The World Economy Is Up! No, Down!

How to Choose Where to Take Your Franchise in 2014

Recent world business headlines have swung from euphoria on the growth of the world’s economy to mild panic that the world is falling down. “Global growth is now projected to be slightly higher in 2014, at around 3.7 percent, rising to 3.9 percent in 2015”, according to the World Economic Outlook (WEO) Update: “Is the Tide Rising?”, January 2014. This source goes on to say, “In some economies, there is a need to manage vulnerabilities associated with weakening credit quality and larger capital outflows.”

There is new pessimism about the BRICS countries: Brazil, Russia, India, China and South Africa. Latin America’s growth has fallen from about 6% in 2010 to about 2.5% in 2013. Some sources ask if the BRICS are in a midlife crisis. In fact three of the BRICS – Brazil, India and South Africa – are being called part of the ‘Fragile Five” with the other two countries being Turkey and Indonesia. (Source: World Economic Forum blog by Nouriel Roubini, January 24, 2014.)

There has been a significant fall in currencies of Turkey, Brazil, South Africa, India and Russian against the dollar in recent days. “Argentina woes weigh on EM currencies”, Financial Times, January 24, 2014.

Why are these emerging markets seeing declines? Is this caused by internal economic problems? Not exactly. Russia has seen a dramatic fall in foreign direct investment (FDI) due to rule of law challenges. Brazil has seen a fall in FDI due to protectionist government policies and the extremely difficult requirements to start up new businesses in the country. South Africa has real wage and union challenges, and the central bank controls payment in hard currency. Argentina, Venezuela South, both have huge inflation and a currency that is set against the dollar at an unrealistic level. Turkey is in the 12th year of the AK Party running everything and its leaders are seeing internal problems that are not good for FDI.

China seems to be cooling off in the manufacturing sector, which means less imports of commodities from various BRICS countries. But there is evidence that the central government is working hard to turn a government sector economy into a consumer driven economy. China remains a great market to sell into. Consumer wages are increasing dramatically, as is the discretionary income of the middle class consumer. India, despite the pending elections and bureaucracy, remains a country with over 250 million middle class consumers who desire western products and services and can pay for them. But it is absolutely critical to chose the country licensees extremely carefully.

But there is general agreement that what we are seeing today is not a repeat of the 1997 Asian currency crisis. The large emerging markets are much more diverse today and their middle class consumer base is dramatically higher than is was 17 years ago. Brazil, China, India and Indonesia are now ‘Engines’ of consumer spending, not tied completely to commodity export income or the economies of the first world. With a combined middle and upper class population of more than 600 million, these countries generate a high level of consumer spending internally

So, what do franchisors seeking to sell into the BRICS+ do? I submit that you do research to find out the real cause of problems in the emerging markets and focus your efforts in 2014 on those that are least likely to interfere in their economy and most likely to welcome FDI without protectionist policies. Watch for projections of 4% or more real annual Gross Domestic Product (GDP) growth – follow ‘The Economist” magazine’s weekly analysis. The World Bank sees real economic growth and new investment when the GDP growth rate is 4% or more in a country.

http://www.imf.org/external/pubs/ft/weo/2014/update/01/index.htm

http://www.voxeu.org/article/overstated-pessimism-over-latin-america

http://forumblog.org/2014/01/brics-midlife-crisis/

http://www.economist.com/news/economic-indicators/21595021-output-prices-and-jobs

http://www.cnbc.com/id/101364841

Bill’s Fall 2013 Asia Pacific Trip

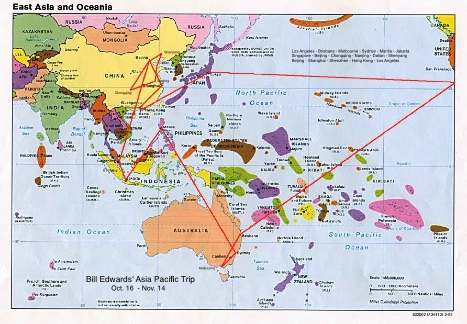

From mid-October through mid-November I traveled approximately 20,000 air miles (see map) visiting 5 countries and 13 cites in Australia, Philippines, Indonesia, Singapore, China and Japan. The purpose of this trip was to meet with companies who were interested in acquiring licenses for U.S. franchise brands our company represents.

Australia had just gone through a national election that saw the pro-business party sweep into power. Everyone was very excited about the potential for growth over the next couple of years. The Philippines is seeing high growth and strongly desires U.S. brands, especially in the food sector. Indonesia continues to see good consumer spending growth despite some nationalistic moves by the government ahead of major elections in 2014. Singapore has recovered from the recession but is having some challenges with imported labor. All of these remain good places to take established U.S. franchise brands.

Singapore’s immigration challenges are interesting. For decades Singapore welcomed immigrants to help grow the economy to one of the most advanced in the world. Low wage workers are needed but citizens are becoming nervous about the influx of migrant workers. (Source: Stratford, ‘Singapore’s Immigration Dilemma’, 12/12/2013)

China is experiencing huge changes in 2013 associated with the once-a-decade Beijing government leadership changes. My trip to China this time was focused more on “2nd tier” cities such as Chongqing, Nanjing, Dalian and Shenyang. While these are cities with large populations – Chongqing officially has over 30 million people – they are often considered second class to Beijing, Shanghai, Guangzhou and Shenzhen. The 2nd tier cities are where the central government is focusing investment to raise the standard of living and to keep the population happy.

One of the very interesting trends now in the Philippines, Indonesia and China is the consumer’s focus on food quality and safety. Fast middle class consumer growth has far outstripped the countries ability to produce safe food locally. This seems to be a higher concern than prices. Especially for the new middle class young families with children.

A good sign on this concern is that US-based Smithfield Foods, a huge producer of pork, was recently bought by China’s Shuanghui International. And the UK-based Weetabix cereal was bought in 2012 by China’s Bright Food. (Source: Forbes, ‘Global Small Business Blog’, 12/20/13)

India

Burger King®, Starbuck’s®, TESCO® and Vodaphone® have recently announced major investments in India, shortly after Wal-Mart® decided to end its joint venture in the country. Mixed signals from the Indian government, which often tries to protect the small indigenous business from the entry of modern retail businesses into the market, is cause for some concern by Western companies, including franchises, looking to enter the Indian market. But the large and growing middle class – over 250 million English speaking consumers – want the international businesses which often have better service, prices and quality.

84 Charing Cross Road

This is a 1970 book about the twenty-year correspondence between the author and the chief buyer of Marks & Co, antiquarian booksellers located on a street in central London that was – at the time – world renown as the place to shop for new and old books. Foyles® is the most famous bookstore on this street. My wife, Nancy, and I spent many hours searching for books on this street in the 80s and 90s.

Today 84 Charing Cross Road is a Subway®. Nearby are a TJMaxx® and Chipotle®. There are very few book stores anymore. Rents are the primary cause of this shift.

2014 International Business Predictions

Here are some snippets from various research pieces I have seen recently seen from a wide variety of sources.

MONOCLE magazine publishes an annual soft power survey. They define ‘soft power’ as how well countries project themselves on the global front and influence the world outside the use of military force. Germany is the best of the 30 countries listed and is trending upward. The UK and U.S. are 2 and 3 and trending downward. Japan (5), Australia (7), Canada (9), Italy (10), Singapore (17), Spain (12), China (20), and Mexico (24) are trending upward. Brazil (19), South Korea (14), Turkey (26) and Poland (30) are trending down. Chile joins the list for the first time and Israel drops off the list.

See www.monocle.com for the complete list and details.

THE ECONOMIST magazine recently published its Global Business barometer, which surveyed 1,500 executives who see the business environment much brighter in the Middle East and Africa, Eastern Europe, Asia-Pacific, North and Latin America. The trend has gone from significantly negative in mid-2013 to significantly positive in late 2013. (Source: The Economist; December 2013)

A year-end McKinsey study found that global executives are more optimistic about economies growing, especially in the developed world. Of course, this is a mixed signal as developing countries are seeing more challenges. (Source: McKinsey, ‘Economic Conditions Snapshot’, December 2013)

The Boston Consulting Group released a study that indicates that “. . .despite dreary news of economic slowdowns and market volatility from Brazil to India to Turkey, consumer sentiment in some of the world’s largest rapidly developing economies remains remarkably bullish. Shoppers in key emerging markets feel more financially secure and far more confident about the future than those in developed economies. They also express greater enthusiasm for brands and for consumerism itself.” (Source: Boston Consulting Group, ‘Why Emerging-Market Consumers Remain Bullish’, 11/27/2013)

Frankly, at the end of 2013 it is possible to find optimism and pessimism around the world depending on which survey you read. More are now positive. They were negative in early 2013.

The bottom line is that the global middle class – the consumer class – continues to grow fast. And this group wants the brands, quality, convenience and customer service that U.S. franchises represent.