EGS Biweekly Global Business Newsletter Issue 109, Tuesday, May 28, 2024

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Comments About This 109th Issue: This extended issue covers trend and happenings in Argentina, Australia, China, Europe, Germany, the GCC countries, India, Japan, Singapore, the United Kingdom and the United States. Scroll down to find out how ‘Swiftonomics’ seems to have helped the Singapore economy. Who are the world’s most valuable soccer (football) teams? Should airlines stop meal service when the seatbelt sign is on? Emerging markets are pushing back at China’s subsidized exports. And for us world travelers, what are the most dangerous cities in the world?

Edited and curated by: William (Bill) Edwards, CEO & Global Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA. Contact Bill with any questions, comments and contributions.

Bedwards@edwardsglobal.com, +1 949 375 1896

The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business. Some of the information sources that we provide links to require a paid subscription for our readers to access.

First, A Few Words of Wisdom From Others For These Times

“It is not the strongest or the most intelligent who will survive, but those who can best manage change.” ― Leon C. Megginson

“All failure is failure to adapt, all success is successful adaptation.” ― Max McKeown

“The secret to living well and longer is: eat half, walk double, laugh triple and love without measure.”, Tibetan Proverb

Highlights in issue #109:

- Brand Global News Section: Burger King®, Carl’s Jr®, Dominos®, KFC®, McDonalds® and Wendy’s®

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

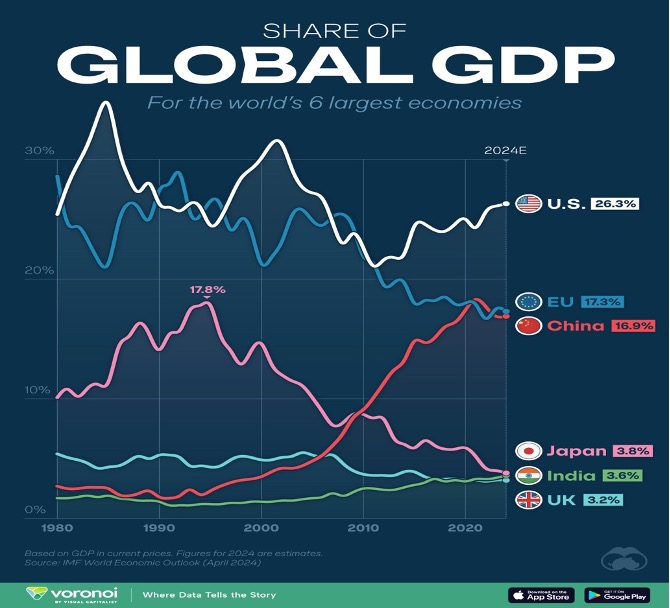

“The Top 6 Economies by Share of Global GDP (1980-2024) – Over time, the distribution of global GDP among the world’s largest economies has shifted dynamically, reflecting changes in economic policies, technological advancements, and demographic trends. To see how this has played out in recent decades, we visualized the world’s top six economies by their share of global GDP from 1980 to 2024. All figures were sourced from the IMF’s World Economic Outlook (April 2024 edition) and are based on using current prices.”, Visual Capitalist, IMF, May 14, 2024

“Google Is About to Change the Whole Internet — Again…The company’s all-in investment in AI. Will search engines be replaced by AI chatbots? In May, the company offered some clarity: ‘In the next era of search, AI will do the work so you don’t have to,’ according to a video announcing that AI Overviews, Google’s new name for AI-generated answers, would soon be showing up at the top of users’ results pages. The popular notion that the AI boom represents a disruptive threat to the internet giants deserves more skepticism than it’s gotten so far — the needs of the tech industry past, present, and future are neatly and logically aligned.”, New Yorker, May 19, 2024

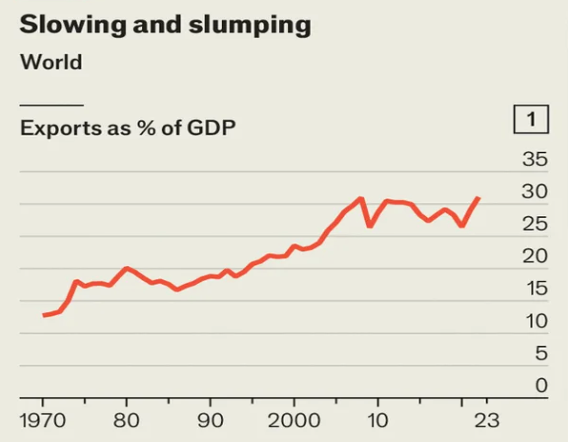

“The world’s economic order is breaking down – Critics will miss globalisation when it is gone. The dysfunction at the WTO (World Trade Organization) is emblematic of a world where the institutions and rules intended to foster international trade and investment are falling into abeyance. Every day brings alarming new headlines. The European Union, although supposedly both more supportive of free trade and more determined to reduce its greenhouse-gas emissions than other economic powers, is on the verge of imposing duties on Chinese electric vehicles. The proliferation of subsidies and sanctions is one of the most obvious signs of the unravelling of the “international rules-based order”, as policy wonks like to call it.”, The Economist, May 9, 2024

“The World’s Most Valuable Soccer Teams 2024 – The average team is now worth $2.3 billion, a 5.1% increase from a year ago—despite headwinds in TV rights across Europe. When Sir Jim Ratcliffe, the billionaire founder and CEO of the Ineos chemical group, bought 27.7% of Manchester United in February for an enterprise value of $6.5 billion, it was the richest price ever paid for sports team in which the buyer also got operating rights. Real Madrid generated the most revenue ($873 million) of any team and has won the Champions League five of the past nine years. Despite the speed bump in European broadcasting revenue, the average soccer team is now worth $2.3 billion, a 5.1% increase from a year ago. Forbes, May 23, 2024

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation, Taxes & Trade Issues

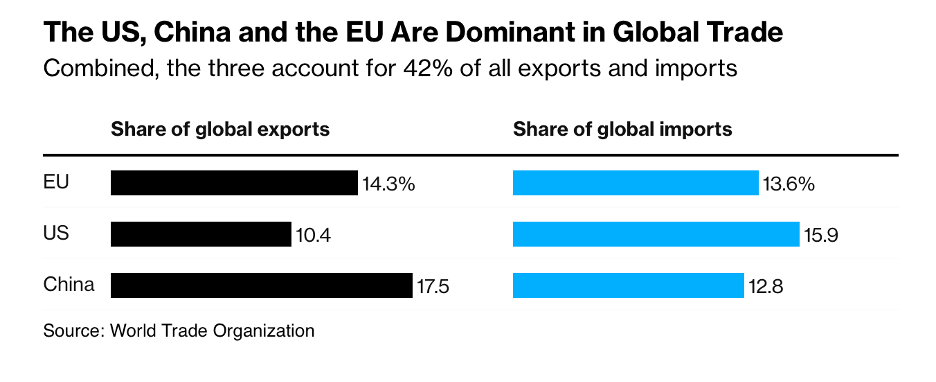

“A New Trade War Offers No Easy Way Back for Old Global Order – Rules-based trade fades as policies cement protectionism. Once a free-market cheerleader, US borrows from China playbook. The world’s three dominant economies are entering a new, combative phase as the US increasingly uses trade weapons borrowed from China’s playbook. That’s threatening to deepen international fractures and to challenge decades of free-market orthodoxy — and it leaves Europe with big decisions to make. The $31 trillion arena of international commerce has withstood a series of shocks in recent years, including the US-China trade war. This time, the linchpin is the European Union — caught between preserving its self-styled role as defender of multilateral rules and fearing the loss of millions of jobs and tens of billions in investment while the US and China wield market-distorting subsidies and tariffs.”, Bloomberg, May 23, 2024

===========================================================================

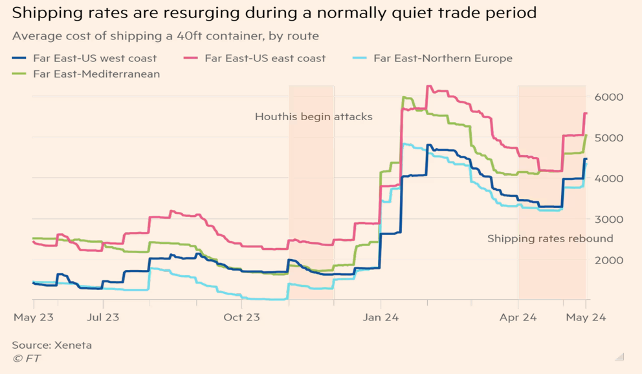

“Shipping rates spike as businesses expect more Red Sea attacks – Companies prepare to ship goods for festive season early as attacks by Yemen’s Houthis force ships to take longer route. The average cost of shipping a 40ft container between the Far East and northern Europe at short notice, the figure that is most sensitive to market prices, hit $4,343 last week, roughly three times higher than the same period last year, according to freight market tracker Xeneta.”, The Financial Times, May 25, 2024

===========================================================================

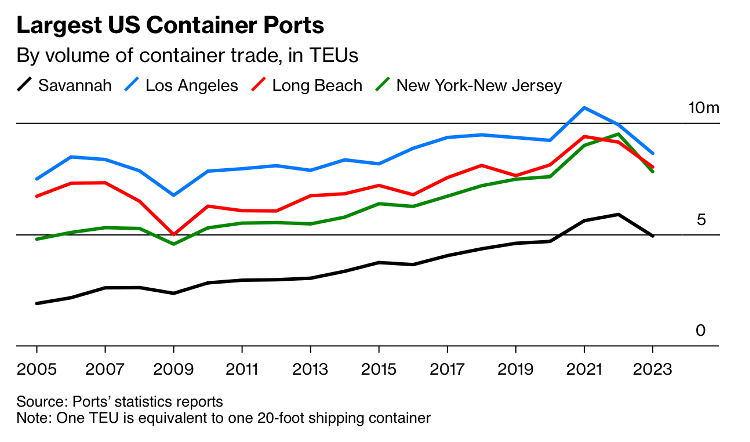

“US East Coast Ports Are Spending Billions to Profit From Asia’s Shifting Exports– Savannah and Brunswick in Georgia are looking to win business away from Pacific Coast rivals. As more export production destined for the US migrates to South Asia from China, the geographic edge is tilting toward the East Coast, which boasts quicker deliveries through the Suez Canal and across the Atlantic from such countries as India and Sri Lanka. Savannah also stands to benefit from a host of domestic factors, including the US population shift to Sun Belt boom states.”, Bloomberg, May 14, 2024

============================================================================

Global & Regional Travel

“Singapore Airlines turbulence: stopping meal service may not reduce risk to passengers, Hong Kong’s Cathay Pacific union says – Paul Weatherilt, chairman of the Hong Kong Aircrew Officers Association, told the Post on Saturday tightening cabin service rules could bring about undesirable results and the best way to prevent injuries during flights was to require passengers to keep their seat belts fastened at all times.

‘I’m not convinced that stopping the [meal] service will necessarily change anything, and I think it is possible that it could have a counterproductive effect,’ he said. Weatherilt said Singapore Airlines’ rule revisions could make cabin crew hesitant to put the seat belt sign on, while meal service might not be halted quickly enough as it took time to retrieve the food carts.”, The South China Morning Post, May 25, 2024

=========================================================================

“Most Dangerous Cities in the World 2024 – You can yield a little less caution in some of the world’s safest countries, such as Iceland, New Zealand, and Portugal. With over 4,416 cities in the world, there are seemingly endless places to travel to and cultures to experience around the world. The world’s 50 most dangerous cities are located in 11 countries: Brazil, Colombia, El Salvador, Guatemala, Honduras, Jamaica, Mexico, Puerto Rico, South Africa, the United States, and Venezuela. Brazil has the most cities on the list with 17, followed by Mexico with 12. Brazil, Mexico, and Venezuela are the only countries with cities in the top ten most dangerous cities. Mexico has five cities, Brazil has three, and Venezuela has two.”, World Population Review, May 2024

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

South Africa

“South African Assets Primed for Post-Election Rally, but Old Challenges Persist – Rally has room to run after poll, Bloomberg survey finds Most investors overweight or neutral on South Africa. There’s a widespread belief among investors that stocks, bonds and the rand will keep soaring after the May 29 election, especially as record-hitting commodity prices boost the exports that South Africa’s economy relies on. In a Bloomberg survey of 26 emerging-market investors, most were overweight or neutral on South Africa, and said they preferred the country over investing in Egypt or Nigeria, Africa’s two other powerhouses.”, Bloomberg, May 23, 2024

============================================================================

Argentina

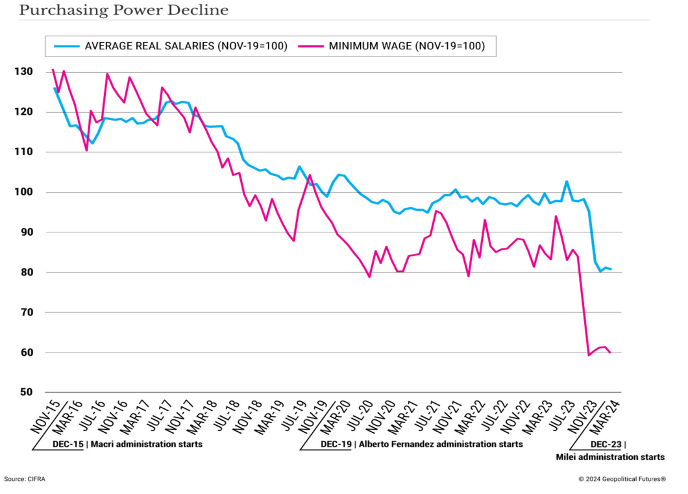

“The State of Argentina’s ‘Transformation’ – Milei’s government has been more pragmatic than it said it would be. One of the public’s biggest complaints is the decline of purchasing power, which owes to inflation brought on by the government’s decision to lift market controls. Private employees fared significantly better than public employees, with respective decreases of 11.2 percent and 21.3 percent. More concerning is that in the past six months, the country’s minimum wage has lost 29 percent of its purchasing power, pushing more people into poverty. Argentina’s Pontifical Catholic University estimates that the poverty rate now stands at 57 percent. While better insulated from economic shock, even the country’s upper class has started to feel the pinch as inflation outpaces favorable exchange rates and a sharp decline in disposable income.”, Geopolitical Futures, May 24, 2024

Australia

“Australian wine pours back into China as tariff-free shipments surge to over US$10 million in April – With import tariffs removed for the first time in three years, shipments of Australian wine to China surged in April, with analysts expecting producers to jump back into the lucrative market “quite quickly”. China imported US$10.4 million of wine from Australia in April, up from US$126,045 a year earlier, representing a roughly eightyfold increase, according to Chinese customs data. Imports by volume, meanwhile, increased more than sevenfold year on year to 462,518 litres (813,918 pints).”, The South China Morning Post, May 23, 2024

============================================================================

China

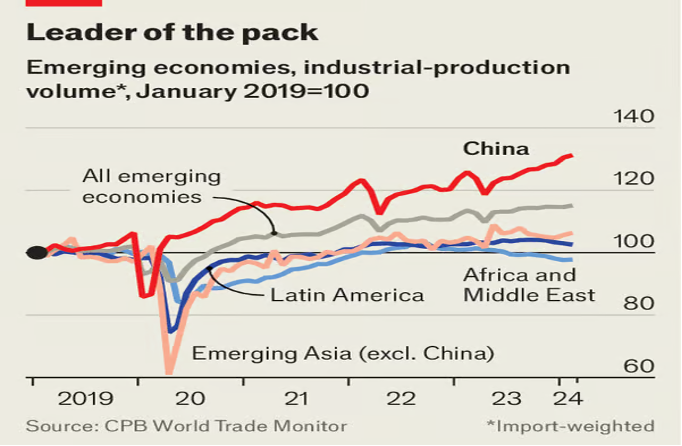

“Brazil, India and Mexico are taking on China’s exports – To avoid an economic shock, they are pursuing a strange mix of free trade and protectionism. ‘The biggest threat of Chinese overcapacity is to developing countries,’ says Jorge Guajardo, Mexico’s former ambassador to China. In his country, which is proud of its car industry, the market share of Chinese-made vehicles has grown from next to nothing in 2016 to a fifth. Emerging economies are thus introducing import restrictions on Chinese goods, while accelerating a push for free trade elsewhere. This emerging-market attempt to lower trade barriers with the West is happening at the same time as they are being raised with China. Officials see this as necessary to protect domestic manufacturers until China’s subsidy wave subsides.”, The Economist, May 24, 2024

============================================================================

“The United States used to have cachet in China. Not anymore. ‘Soft power’ is even more important during times of sharp words and military bluster, but the cultural appeal of American culture and ideas has waned in China. America, which is called “Meiguo” or “beautiful country” in Chinese, was the bastion of wealth and ease. Now, Chinese media and commentators mockingly refer to the United States not as “Meiguo” but as “Meidi” — “the beautiful imperialist.” And Chinese shoppers are more likely to be sipping a drink from Luckin, a Chinese coffee chain, than Starbucks or lining up all night to buy Huawei’s Mate 60 Pro than the latest Apple device. “, The Washington Post, May 25, 2024

Europe

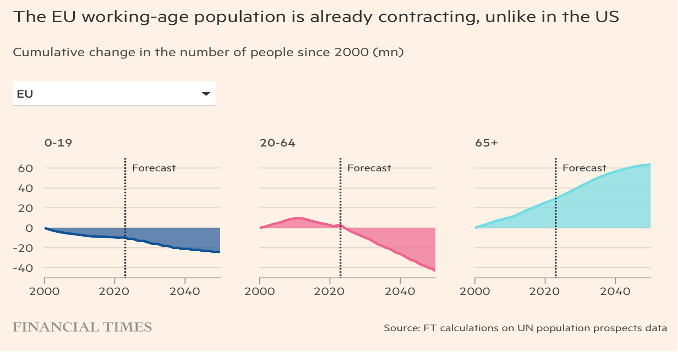

“Has Europe already reached its demographic tipping point? – The EU’s population is shrinking faster than expected, putting strain on government finances and the bloc’s long-term prospects. The EU population rose in the year to January 2023, helped by an influx of displaced persons from Ukraine, after a temporary two-year dip that reflected the impact of the pandemic. Last year, Eurostat forecast that the population would peak at 453mn in 2026. But the 2023 numbers came in below expectations as EU births fell to levels Eurostat had not forecast for another two decades, suggesting the peak may come before 2026. What is becoming clear is that the EU’s long-predicted demographic inversion appears to be coming sooner than many experts predicted.”, The Financial Times, May 23, 2024

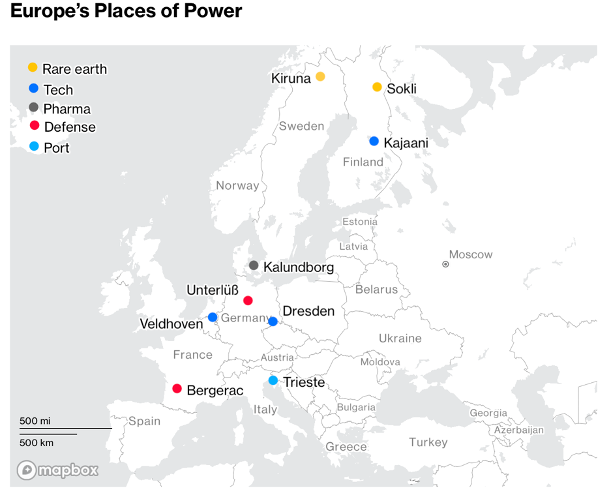

“Europe’s New Power Map, From ASML to the Arctic – Places other than Paris, Brussels and Berlin are wielding economic influence. The power wielded by ASML (the Netherlands) from its campus in Veldhoven is one example of how Europe’s geographyis changing. French munitions factories and Italian shipyards are whirring as the war in Ukraine forces defense matters to front of mind. Chip factories are being built in cities that still bear the scars of World War II. Kalundborg, production hub for Ozempic maker Novo Nordisk A/S, is turning Denmark into a one-company country. Sweden is tapping raw-material deposits essential for the green transition; Finland is converting paper mills into supercomputers.”, Bloomberg, May 14, 2024

Germany

“German economy expands slightly in first quarter of 2024 – The final estimate for Germany’s quarter-on-quarter gross domestic product (GDP) report for Q1 2024 came out on Friday morning. It revealed that GDP grew by 0.2%, according to the Federal Statistical Office. This was a surge from the previous quarter’s -0.5% and in line with analyst estimates. This increase was mainly due to a jump in gross fixed capital formation, which rose to 1.2% in the first quarter of the year, from -2.1% in Q4 2023, primarily driven by advances in construction investment.”, Euronews, May 24, 2024

Gulf Cooperation Council (GCC) Countries

“Industries with huge potential: Saudi and the Gulf – As the world rapidly evolves, the Gulf Cooperation Council (GCC) countries, including Saudi Arabia, the United Arab Emirates, Qatar, Kuwait, Bahrain, and Oman, are actively diversifying their economies and investing in innovative industries poised for growth. From harnessing renewable energy to pioneering artificial intelligence (AI) and architecting awe-inspiring structures, these nations are carving their paths toward a prosperous and sustainable future. Here are some of the industries that are poised to thrive in the future.”, Middle East Sunday Pages, May 19, 2024. Compliments of Corina Goetz

India

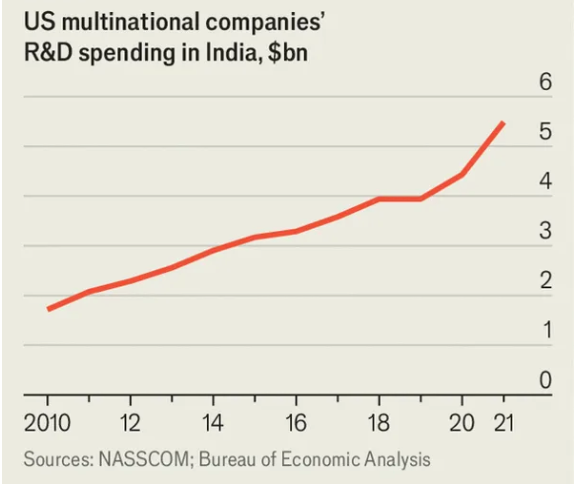

“Global firms are tapping India’s workers like never before – They want their brains more than their brawn. Back in the 1990s global firms such as General Electric, a once-mighty conglomerate, began to rely on Indian workers to perform tedious tasks such as filling in forms and patching software for mainframe computers. More recently, technologies such as cloud computing and video conferencing have made it less cumbersome to tap India’s vast pool of brainy workers. Having learned how to supervise employees remotely through the covid-19 pandemic, plenty of bosses will have now pondered whether some roles could be done from farther afield.”, The Economist, May 23, 2024

Japan

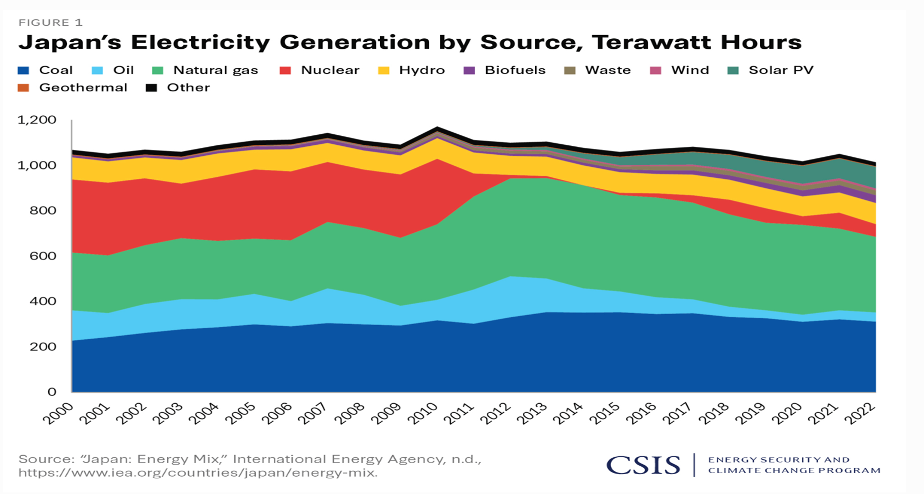

“How Japan Thinks about Energy Security – Energy security is a significant challenge for Japan. As an import-dependent country, Japan has sought to protect itself from fossil fuel supply disruptions and shocks by cultivating strong relationships with exporting countries and investing throughout the energy value chain. When the Biden administration “paused” approvals of new U.S. liquefied natural gas (LNG) export projects, the strongest international reaction was not in Europe—the destination for most U.S. LNG cargoes since 2022—but in Japan. Japanese officials registered concerns about potential restrictions on future gas supply.”, Center for Strategic and International Studies (CSIS), May 22, 2024

=========================================================================

Singapore

“Taylor Swift and Coldplay concerts may have saved Singapore’s economy from shrinking last quarter – ‘Swiftonomics’ could have helped drag Singapore’s economy across the finish line. The Southeast Asian country banked on several high-profile events—most notably concerts by superstar Taylor Swift—to jump-start tourism spending. Some 4.36 million visitors arrived in Singapore in the first three months of the year, according to data from the Singapore Tourism Board. The average hotel occupancy rate for that period was 81.49%, compared with 77.8% for the same period in 2023. Half the audience for both the Coldplay and Taylor Swift concerts came from overseas, according to the Monetary Authority of Singapore.

United Kingdom

“The five key business issues the next government needs to address – Whether Labour or the Conservatives win the election, they will have momentous decisions to take. With Rishi Sunak having fired the starting gun for a snap general election for July 4, business is moving quickly to lobby the political parties on key reforms that boardrooms want from the next government. During the next six weeks of campaigning, leading business groups representing large parts of the economy will promote their own manifestos, having consulted with member companies, including some of the country’s biggest employers. The British Chambers of Commerce, the Federation of Small Businesses, UK Finance and Make UK are all due to publish blueprints.”, The Times of London, May 24, 2024

===========================================================================

United States

“ (U.S.) Consumer Confidence Dips In April – Consumer confidence was down in April. Consumers expressed concerns about the job market, nonessential spending, and their ability to make ends meet, according to the Numerator Consumer Sentiment Tracker that captures more than 6,000 responses a month and provides a comprehensive monthly view of consumer confidence, spending and saving considerations, and future financial outlook. The April Consumer Confidence Score was 56.9 (-0.4 vs. March), which is an average of how consumers feel about the job market, their household finances, and their spending comfort levels.”, Franchising.com, May 25, 2024

============================================================================

“ (U.S.) Small Business Owners Feel Inflationary Pressures – New survey data from Goldman Sachs’ 10,000 Small Businesses Voices finds that business owners across the country are reporting significant inflationary impacts on the costs of doing business. Compared to three months ago, 71% say inflationary pressures have increased on their businesses, and 49% say they’ve had to raise the prices on their goods or services over that period.”, Franchising.com, May 24, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“Burger King-parent RBI completes Carrols acquisition – Company buys largest U.S. franchisee and plans $500M investment in reimaging 600 restaurants. Restaurant Brands International Inc. has completed its acquisition of Carrols Restaurant Group Inc., its largest Burger King franchisee in the United States, for about $1 billion and plans to invest an additional $500 million to reimage 600 Carrols restaurants, the company said Thursday. Toronto, Canada-based Restaurant Brands International, which offered $9.55 a share in the all-cash transaction that was announced in January, said the $500 million reimaging was part of its “Reclaim the Flame” plan, announced in fall 2022.”, Nation’s Restaurant News, May 16, 2024

“Carl’s Jr. to Expand into the U.K. and the Republic of Ireland under a New Master License Agreement with Boparan Restaurant Group – Under this agreement, BRG will open, operate, and franchise restaurants throughout the territory as the exclusive Carl’s Jr. developer. This partnership further solidifies Carl’s Jr.’s European presence which includes nearly 100 restaurants across Spain, France, Denmark, Turkey, and Switzerland.”, PRNewswire, May 22, 2024

“Wendy’s sold to global restaurant management firm Flynn – The New Zealand business of burger restaurant chain Wendy’s has been sold to US franchise operator Flynn Group, marking the company’s first change in ownership in more than three decades. The Lendich family, which has operated the franchise since 1988, put it up for sale in June 2022. The franchise includes 22 restaurants with 12 stores in Auckland, eight in other parts of the North Island, and two on the South Island.”, InsideRetail, May 21, 2024

“Anti-Israel Boycotts Hurting McDonald’s, KFC in Asia, Mideast – McDonald’s saw impact in Middle East, Muslim countries Pakistani can maker to Coca Cola, Pepsi had 11% sales dip. The situation has inflamed tensons in the Middle East that has led to an outpouring of support for Palestinians. Many Muslims in the region changed their consumption habits since the war started, slashing demand for fast food from American retailers. More than 100 KFC outlets in Malaysia were forced to close temporarily. Malaysian operator QSR Brands (M) Holdings Bhd. appealed to its large Muslim consumer base that it has over 18,000 team members in the country, of which, approximately 85% were Muslims.”, Bloomberg, May 24, 2024

“Jubilant FoodWorks Poised for Massive Expansion – Jubilant FoodWorks Ltd (JFL), the master franchisee of Domino’s Pizza in India and several other markets, with a market capitalization of INR 31,517 crore, announced plans on Wednesday to significantly expand its store network. The company aims to increase its Domino’s Pizza outlets from 2,793 to over 5,500 across six global markets in the medium term. JFL operates in India, Turkey, Bangladesh, Sri Lanka, Azerbaijan, and Georgia. Last year, its subsidiary, Jubilant Foodworks (NS:JUBI) Netherlands BV (JFN), acquired DP Eurasia, the master franchisee of Domino’s in Turkey and Georgia, thus expanding JFL’s footprint beyond Asia.”, Investing, May 22, 2024

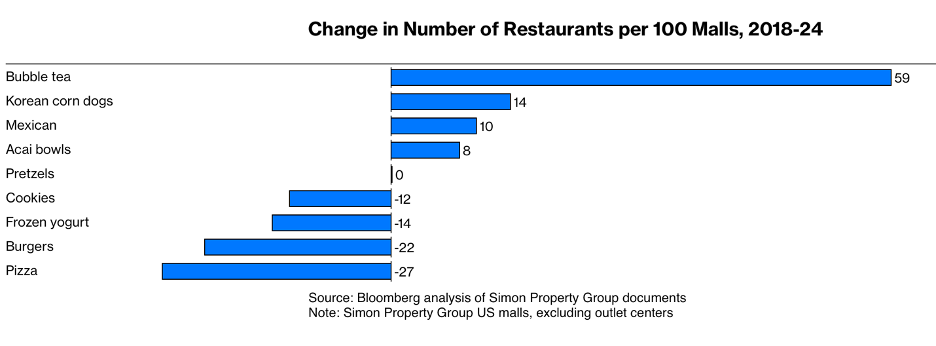

“The Food Court Is Back – Attention, mall shoppers: Restaurants are taking up more retail space. It’s good news for fixtures like Cinnabon and bubble tea shops. Floor space in malls as in-store shopping declines and consumers seek experiences rather than goods, says Emily Arft, an analyst at Green Street, a real estate research firm. Formats are changing: “A lot of landlords are thinking about making a more cohesive retail experience where you have dining throughout, not just in one dedicated center,” Arft says. Still, that’s been good for food court newcomers and stalwarts, including everyone’s favorite auntie.”, Bloomberg, May 17, 2024

To receive our biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing business environment. And our GlobalTeam™ on the ground covering 25+ countries provide us with updates about what is actually happening in their specific countries.

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe, and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant since 2001 taking 40+ franchisors global.

For a complimentary 30-minute consultation on how to take your business global successfully, click on the QR code or contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

And download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 108, Tuesday, May 14, 2024

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

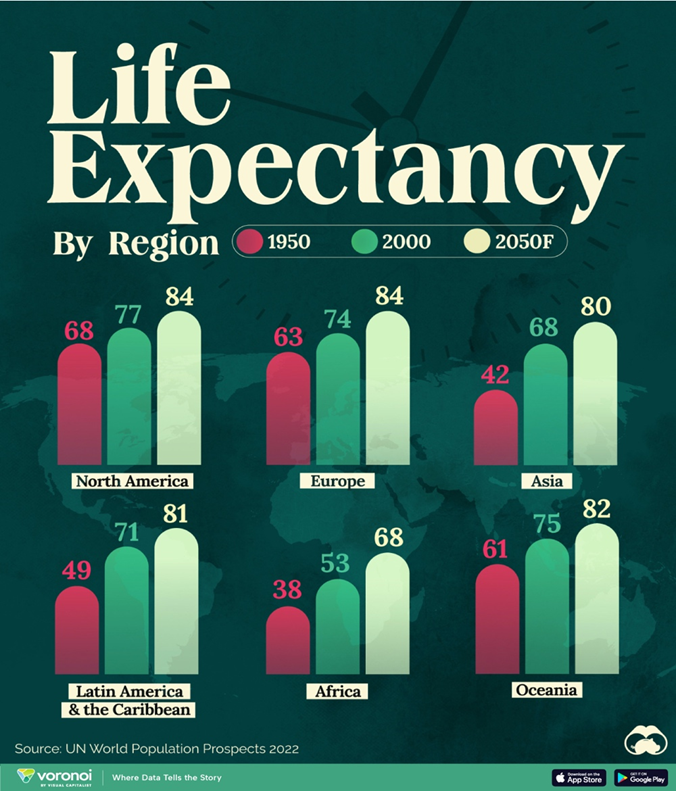

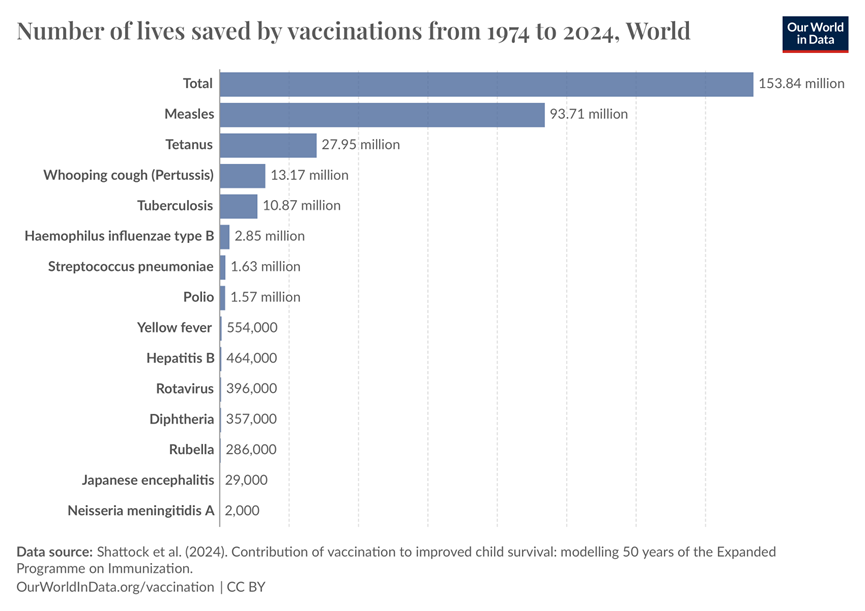

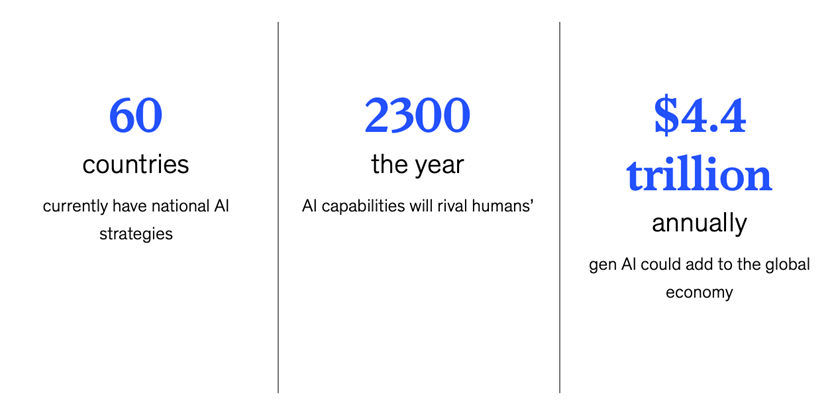

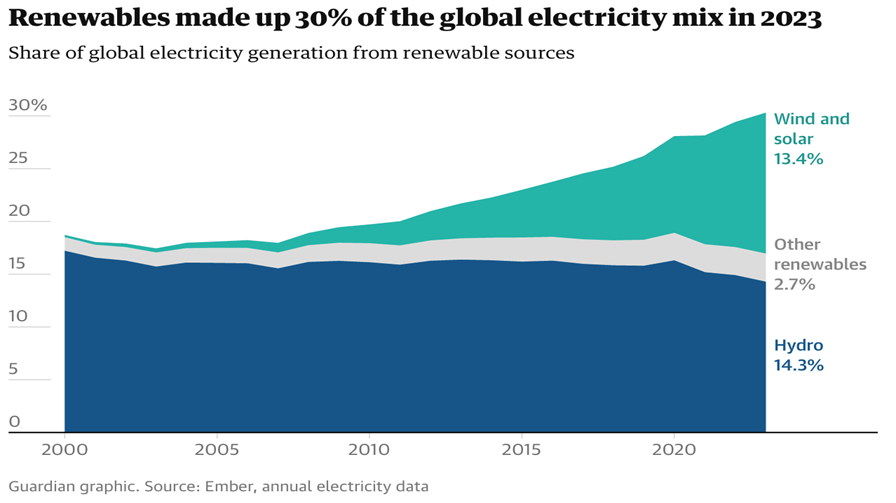

Comments About This 108th Issue: When AI capabilities will rival those of humans. Who walks, drives cars or rides buses around the world. An interesting look at rapidly changing women’s sports in the Middle East. The immense impact of vaccinations on children around the world. Renewables are now 30% of the world’s electricity. Positive news on the economies of Egypt, Indonesia, Turkey, and the United Kingdom. How America’s U.S. stocks have dominated global investing, as measured by market capitalization, for most of the past 125 years. And how life expectancies have changed over time around the world.

Edited and curated by: William (Bill) Edwards, CEO & Global Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA. Contact Bill with any questions, comments and contributions. Bedwards@edwardsglobal.com, +1 949 375 1896

======================================= The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business. Some of the information sources that we provide links to require a paid subscription for our readers to access.

Edited and curated by: William (Bill) Edwards, CEO & Global Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA. Contact Bill with any questions, comments and contributions.

Bedwards@edwardsglobal.com, +1 949 375 1896

The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business. Some of the information sources that we provide links to require a paid subscription for our readers to access.

First, A Few Words of Wisdom From Others For These Times

“I don’t like people who have never fallen or stumbled. Their virtue is lifeless, and it isn’t of much value. Life hasn’t revealed its beauty to them.” Boris Pasternak

“ The best way to predict the future is to create it – Peter Drucker

“Either you run the day, or the day runs you,”, Jim Rohn

Highlights in issue #108:

- Brand Global News Section: Luckin Coffee®, McDonalds®, Nothing Bundt Cakes®, Pret A Manger®, Planet Fitness®, Yum China

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

“Life Expectancy by Region (1950-2050F) – At the beginning of the 19th century, no country had a life expectancy exceeding 40 years, with much of the global population enduring extreme poverty, limited access to medical care, and a lack of sanitation.

By 1950, newborns in Europe, North America, Oceania, Japan, and parts of South America were seeing life expectancies surpassing 60 years, while in other regions, newborns could only anticipate a lifespan of around 30 years. For instance, individuals in Norway had a life expectancy of 72 years, while in Mali, it was merely 26 years. On average, Africa had a life expectancy of only 38 years. Since then, life expectancies have substantially grown worldwide. Notably, between 1950 and 2000, significant progress was observed in Asia and Latin America and the Caribbean.”, Visual Capitalist and the United Nations, May 6, 2024

“Japanese angst as India set to become 4th largest economy – Once an economic powerhouse that was the envy of much of the world, there is deep concern in Tokyo that the economies of China and Germany have already surpassed Japan’s — and that India’s will do so next year. The announcement that in 2025 India will overtake Japan in nominal gross domestic product in dollar terms has shocked Tokyo, which had until 2010 been the undisputed second-largest economy in the world but is now on the brink of slipping to fifth place. In estimates released in late April, the International Monetary Fund (IMF) indicated that India’s nominal GDP will reach $4.34 trillion (€4.03 trillion) in 2025, surpassing Japan’s $4.31 trillion.”, Deutsche Welle, May 10, 2024

“Vaccines have saved 150 million children over the last 50 years – Every ten seconds, one child is saved by a vaccine against a fatal disease. Vaccination against measles has had the biggest impact, saving 94 million lives over the last 50 years — more than 60% of the total. This has been a truly global effort, with more than 5 million children saved in every region, including over 50 million in Africa and 38 million in Southeast Asia. Infant mortality rates have plummeted over the last 50 years. Globally, they’ve fallen by over two-thirds, from around 10% in 1974 to less than 3% today.”, Our World In Data, May 6, 2024

“What’s the future of AI? AI is here to stay. To outcompete in the future, organizations and individuals alike need to get familiar fast. We’re in the midst of a revolution. Just as steam power, mechanized engines, and coal supply chains transformed the world in the 18th century, AI technology is currently changing the face of work, our economies, and society as we know it. We don’t know exactly what the future will look like. But we do know that these seven technologies will play a big role.” McKinsey & Co., April 30, 2024

“Women’s Sports in the Middle East – For centuries, women in the Middle East have faced significant cultural and societal barriers when it comes to participating in sports. However, times are changing, and a growing movement of passionate female athletes, advocates, and organisations are paving the way for greater inclusion and opportunities in the world of sports across the region. In this post we will have a look at how things have changed and how things are improving. With the Olympics around the corner and so many great sports initiatives in the Gulf region, let’s have a look at some of the Women Athletes making waves in the Middle East and North Africa (MENA) region….”, Middle East Sunday Pages, May 12, 2024. Article by Corina Goetz, Middle East Sunday Pages

Global Supply Chain, Energy, Commodities, Inflation, Taxes & Trade Issues

“Renewable energy passes 30% of world’s electricity supply – Report says humans may be on brink of cutting fossil fuel generation, even as demand for electricity rises. Solar was the main supplier of electricity growth, according to Ember, adding more than twice as much new electricity generation as coal in 2023. Solar was the main supplier of electricity growth, according to Ember, adding more than twice as much new electricity generation as coal in 2023. The first comprehensive review of global electricity data covers 80 countries, which represent 92% of the world’s electricity demand, as well as historic data for 215 countries. The surge in clean electricity is expected to power a 2% decrease in global fossil fuel generation in the year ahead, according to Ember.”, The Guardian, May 7, 2024

==================================================================

Global & Regional Travel

“How People Get Around in America, Europe, Asia – This chart highlights the popularity of different transportation types in the Americas, Europe, and Asia, calculated by modal share. Data for this article and visualization is sourced from ‘The ABC of Mobility’, a research paper by Rafael Prieto-Curiel (Complexity Science Hub) and Juan P. Ospina (EAFIT University), accessed through ScienceDirect. The authors gathered their modal share data through travel surveys, which focused on the primary mode of transportation a person employs for each weekday trip. Information from 800 cities across 61 countries was collected for this study.”, Visual Capitalist, May 8, 2024

Country & Regional Updates

China

“The Debate Is Heating Up Over China’s Factory Output – China’s exports rose more than expected in a boost for the economy. A growing number of countries are complaining that China produces too much cheap stuff in its powerhouse factories, and should do something about it soon. They’d better not hold their breath……..China’s economic planning agency had released a detailed rebuttal of claims about “overcapacity,” arguing that Chinese electric cars and solar panels are cheap because their producers are efficient, not because they’re subsidized.”, Bloomberg, May 9, 2024

“EU Firms’ Appetite for China Investment Sinks to Record Low – Companies invest in Asean as China’s appeal fades: survey Overcapacity observed across industries, deflating prices. China is losing its luster as a top country to invest in as firms seek to avoid geopolitical risks and turn to Southeast Asia and Europe, according to a survey by the European Union Chamber of Commerce in China.Only 13% of firms surveyed earlier this year saw the country as a top destination for investments, the lowest level since records began in 2010 and down from 27% in 2021. Companies are now shifting investments to mitigate the impact of “decoupling” between China and other countries as well as to find opportunities elsewhere….”, European Union Chamber of Commerce, may 8, 2024

==================================================================

Egypt

“Fitch revises Egypt’s outlook to positive on reduced external financing risks – In March, the International Monetary Fund approved an expanded financial support of $8 billion for the North African country. The IMF’s loan programme with Egypt should help the country gradually reduce its debt burden, an IMF official said last month. In February, the country also secured a $35 billion real estate investment from the United Arab Emirates to develop its Mediterranean coast stretch. Foreign investors have poured billions of dollars into Egyptian treasury bills since the country announced the IMF loan programme.”, Reuters, May 3, 2024

==================================================================

Indonesia

“Indonesia Economy Expands Steadily at Start of Year, But Challenges Persist – Southeast Asia’s largest economy grew 5.11% on the year in the first quarter. Household consumption and investment, along with government spending, were among the main drivers of growth. Manufacturing—the sector that makes up the biggest share of GDP—grew 4.1% on the year in the first quarter, while the agricultural industry, which accounts for about 12% of GDP, contracted by 3.5%.”, The Wall Street Journal, May 6, 2024

“Indonesia taps influencers to convince people to move to its new, under-construction capital – Social media stars are downplaying fears of deforestation and boredom in Nusantara. Four years after Indonesian President Joko Widodo announced that he would move the nation’s capital from the main island of Java to Borneo, he led a tour of dozens of influencers through Nusantara, the new capital under construction. The influencers, wearing hard hats, stood in front of a giant glass-and-chrome building in the shape of a bird — the mythological garuda or golden eagle — which will be the new presidential palace. On TikTok, Jerhemy Owen told his 3 million followers: “Nusantara will be the smartest and most eco-friendly city in the world! It will be 65% forest and 25% urban area.”, Rest Of World, April 19, 2024

==================================================================

South Korea

“South Korea prepares support package worth over $7 billion for chip industry – South Korea is readying plans for a support package for chip investments and research worth more than 10 trillion won ($7.30 billion), the finance minister said on Sunday, after setting its sights on winning a “war” in the semiconductor industry. Finance Minister Choi Sang-mok said the government would soon announce details of the package, which targets chip materials, equipment makers, and fabless companies throughout the semiconductor supply chain. The program could include offers of policy loans and the setting-up of a new fund financed by state and private financial institutions, Choi told executives of domestic chip equipment makers at a meeting, the finance ministry said in a statement. South Korea is also building a mega chip cluster in Yongin, south of its capital, Seoul, which it touts as the world’s largest such high-tech complex.”, Reuters, May 11, 2024

Turkey

“S&P upgrades Turkey’s credit outlook on rebalanced economic strategy – Ankara is expected to take measures to streamline fiscal, monetary and incomes policies in 2024. The country’s long-term rating was raised one notch up to “B+” from “B”, with a positive outlook, the New York-based ratings agency said on Friday. A “B+” rating, which is “highly speculative”, is four levels below investment grade, according to S&P’s ratings scale. Non-investment grade makes it more difficult for a country to access capital markets and raise funding that it needs when it wants to borrow. S&P expects Ankara will take measures to streamline fiscal, monetary and incomes policies, which would include cuts to current non-wage expenditures in 2024. A return to a more orthodox policy has led S&P to ‘believe the co-ordination between monetary, fiscal, and incomes policy is set to improve, amid external rebalancing.’ ”, The National News, May 4, 2024

United Kingdom

“UK economy ‘going gangbusters’ after coming out of recession with fastest growth in two years, say experts – We’re seeing the fastest growth for two years – the joint highest in the G7. We’ve got inflation down from over 11% to just over 3%. Mortgage rates are down from their peak. Food prices are coming down. And we’ve seen wages growing in real terms for nine months in a row. The numbers on business investment don’t lie either. This follows major investments from the likes of Google, Microsoft, Nissan and Tata Group. It’s a huge vote of confidence in the UK.”, The Sun, May 10, 2024

“Heineken to refresh hundreds of pubs with £39m (US$49m) upgrade – Star Pubs reopenings and revamps expected to create more than 1,000 jobs, with new lighting and sound systems introduced to broaden their appeal. Ninety-four pubs are set for makeovers costing an average of £200,000 (US$250,000). The revamps, which come as pubgoers remain eager to go out despite the cost of living crisis, enable pubs to cater for numerous occasions and maximise events, Heineken said. Updates planned include overhauling cellars with state-of-the-art dispense equipment and launching energy-efficiency measures such as heating controls, insulation and low-energy lighting. Heineken says these changes will cost about £12,500 (US$16,000) per pub but reduce energy use by 15 per cent.”, The Times of London, May 6, 2024

United States

“An American Century (and more) for Stocks – EVERY YEAR, CHINA GETS CLOSER to catching the U.S. as the world’s biggest economy. When it comes to their stock markets, however, there’s no contest. Since 1992, China’s GDP has grown 6.5 times as fast as America’s—but U.S. stock returns have been 3.5 times as high. Indeed, U.S. stocks have dominated global investing, as measured by market capitalization, for most of the past 125 years. For that, you can partly thank New Deal–era regulations that tamed the Wild West of U.S. markets, making them attractive to risk-averse investors worldwide. And compared with China, where state-owned companies drive the economy, the U.S. gets more growth from publicly traded companies. But supremacy can be fleeting. Just ask Japan, whose markets soared in the late 1980s, only to nose-dive amid asset bubbles and massive overborrowing. In other words: Don’t get too cocky, U.S. stock bulls.”, Fortune and UBS, May 12, 2024

==================================================================

“There’s Not Enough Power for America’s High-Tech Ambitions – (The state of)Georgia is a magnet for data centers and other cutting-edge industries, but vast electricity demands are clashing with the newcomers’ green-energy goals. Georgia’s main utility, Georgia Power, has boosted its demand projections sixteen-fold and is pushing ahead on a hotly contested plan to burn more natural gas. Critics warn it will yield higher bills and unnecessary carbon emissions for decades. Some companies are scrambling to secure bespoke renewable-energy deals to power their development. One major source of disruption is data centers. The facilities are ballooning in size as people spend more of their waking hours online and companies digitize everything from factory processes to fast-food drive-throughs.”, The Wall Street Journal, May 12, 2024

==================================================================

Brand & Franchising News

“McDonald’s is betting on its mobile business with new franchisee digital marketing fund – McDonald’s will require its U.S. operators to pay into a new digital marketing fund starting next year, according to a memo viewed by CNBC. The switch is meant to modernize the company’s marketing strategy and widen its competitive advantage as it doubles down on mobile ordering and its digital business. U.S. franchisees will start paying into a digital marketing fund next year as the fast-food giant looks to expand its booming digital business, according to a memo viewed by CNBC on Thursday. The change is meant to modernize the company’s marketing strategy and widen its competitive advantage, according to the memo, which was written by U.S. Customer Experience Officer Tariq Hassan and Chief Information Officer Whitney McGinnis.”, CNBC, May 9, 2024

==================================================================

“Planet Fitness is raising prices even as it warns customers are growing cost-conscious – Planet Fitness said it’s hiking its base-level membership prices for new customers for the first time since 1998, even as the gym operator warns that customers are growing increasingly cost-conscious.Classic card membership will be priced at $15 per month for new members starting this summer. Current members will continue to pay $10 per month “for the duration of their membership,” Planet Fitness said Thursday alongside its quarterly earnings report. The change comes after months of price testing in several markets countrywide.”, CNBC, May 90, 2024

==================================================================

“Luckin Coffee s revenue surged by 40 percent in the first quarter but the ongoing price war is eating away at profits – The price war that has lasted for nearly a year has an increasingly obvious impact on coffee companies. According to the announcement, in the first quarter of 2024, Luckin Coffee opened 2,342 stores, including 2 Singapore stores, bringing the total number of Luckin Coffee stores to 18,590, including 12,199 self-operated stores and 6,391 jointly operated stores……. According to the announcement, in the first quarter of 2024, Luckin Coffee opened 2,342 stores, including 2 Singapore stores, bringing the total number of Luckin Coffee stores to 18,590, including 12,199 self-operated stores and 6,391 jointly operated stores.”, Yical News, May 2, 2024. Compliments of Paul Jones, Jones & Co., Toronto

==================================================================

“Edinburgh and Dundee set for six new Pret a Manger outlets as Scottish franchisee expands – The new store openings are expected to create at least 150 jobs. Two Scottish cities are set for three new Pret a Manger sandwich and snack outlets apiece after a franchise funding deal was agreed. Glasgow-based Joup Group has received a seven-figure financing package from HSBC UK to acquire three existing stores and open the six new ones – three in Edinburgh and three in Dundee. Joup Group already owns six Domino’s pizza franchises across Dundee and Angus.”, The Scotsman, May 10, 2024

“Cake Company Seeks $240 Million Selling Franchise-Backed Bonds – Nothing Bundt Cakes has added nearly 200 stores since 2021 Whole business securitizations already outpaced 2023’s totals. The Texas-based cake maker is borrowing in the whole-business asset-backed securities market for the third time after its initial foray in 2021, when it sold $355 million in bonds. This time, proceeds from the bond sale led by Barclays Plc will be used to refinance all of the company’s 2023-1 Class A notes and possibly to fund a payout to shareholders, according to a person familiar with the matter.”, Bloomberg, May 10, 2024

==================================================================

“Yum China had a good start in the first quarter it has more than 15 000 stores and capital expenditures for mini stores in small towns are as low as 500 000 yuan (US$69,000). This quarter, Yum China added a net of 378 stores , passing the 15,000-store milestone . The total number of stores reached 15,022, including 10,603 KFC stores and 3,425 Pizza Hut stores. It is expected that by 2026, the total number of stores will reach 15,020,000 homes (in China).”, Caijing, April 30, 2024. Compliments of Paul Jones, Jones & Co., Toronto

==================================================================

To receive our biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing business environment. And our GlobalTeam™ on the ground covering 25+ countries provide us with updates about what is actually happening in their specific countries.

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe, and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant since 2001 taking 40+ franchisors global.

For a complimentary 30-minute consultation on how to take your business global successfully, click on the QR code or contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

And download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking