EGS Biweekly Global Business Newsletter Issue 85, Tuesday, June 27, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Introduction: In this issue, global inflation is mixed, China is sputtering, there is too much wine in Europe (?), Japan is seeing lots of foreign investment, the United Kingdom will soon charge to enter, global employee engagement reached a record high in 2022, Outback Steakhouse takes over Brazil and Canada is using mass immigration to grow.

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

NOTE: Some of the sources that we provide links to require a paid subscription to access. We subscribe to 40 international information sources to keep our readers up to date on the world’s business.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here:

First, A Few Words of Wisdom From Others

Change before you have to.”, Jack Welch.

“The greatest danger in times of turbulence is not the turbulence – it is to act with yesterday’s logic.”, Peter Drucker

“Whosoever desires constant success must change his conduct with the times.”, Niccolo Machiavelli

Highlights in issue #85:

- Brand Global News Section: 16 Handles®, Burger Fi®, Burger King®, Long John Silver’s®, Outback Steakhouse® and Studio Pilates®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data and Studies

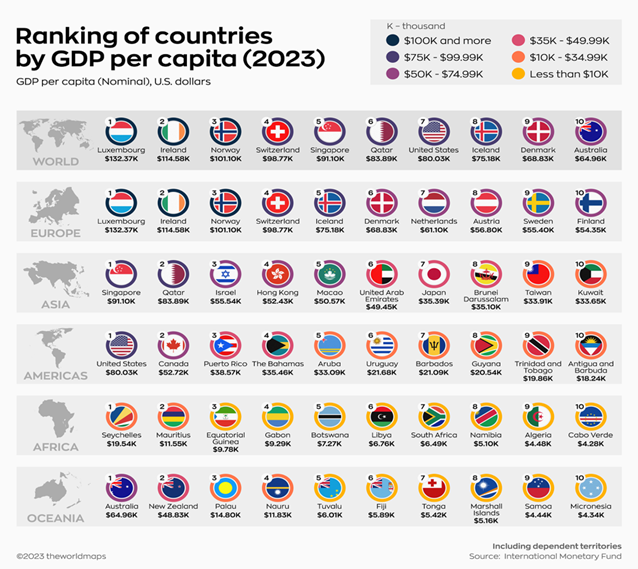

“Top 10 Countries By GDP Per Capita, by Region – GDP per capita attempts to level the playing field by dividing a country’s economic output by its population, effectively giving the average GDP per person. A higher per capita GDP generally corresponds to higher income, consumption levels, and standards of living. The simplicity of this metric also makes it useful for economists and policymakers to communicate levels of economic well-being to the public. The above graphic from the WORLDMAPS ranks the top 10 countries by per capita GDP in different regions, using data from the International Monetary Fund (IMF).”, Visual Capitalist / Worldmaps, June 22, 2023

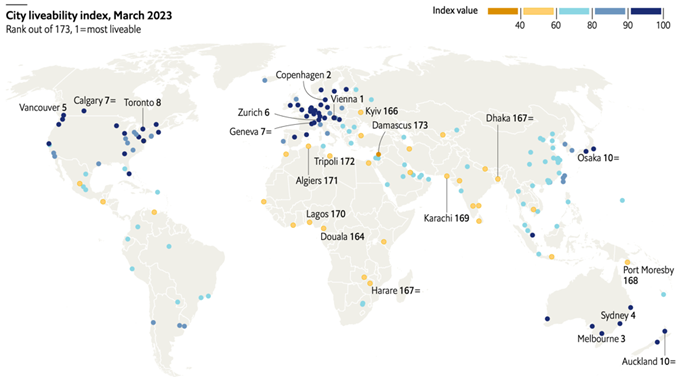

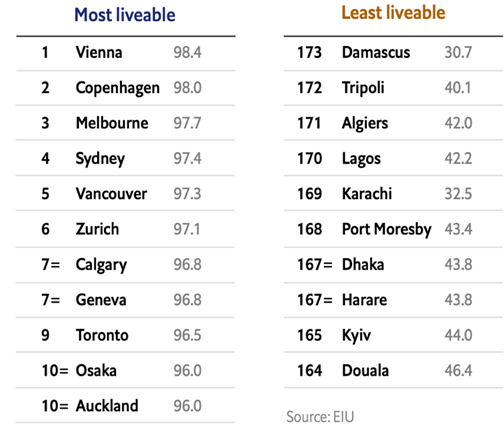

“The world’s most liveable cities in 2023 – Living conditions in cities across the world have fully recovered from the deterioration caused by the covid-19 pandemic, eiu’s latest liveability index shows. It rates living conditions in 173 cities across five categories: stability, health care, culture and environment, education and infrastructure. Cities in the Asia-Pacific region have rebounded the most. The index also suggests that life in cities is a bit better than at any time in the past 15 years.”, The Economist Intelligence Unit, June 21, 2023

“State of the Global Workplace: 2023 Report – Employee engagement reached a record high in 2022. After dropping in 2020 during the pandemic, employee engagement is on the rise again, reaching a record-high 23%. This means more workers found their work meaningful and felt connected to their team, manager and employer. That’s good news for global productivity and GDP growth.”, Gallup, June 2023

“The world’s regulatory superpower is taking on a regulatory nightmare: artificial intelligence – The European Parliament, the legislative branch of the European Union (EU), passed a draft law on Wednesday intended to restrict and add transparency requirements to the use of artificial intelligence (AI) in the twenty-seven-member bloc. In the AI Act, lawmakers zeroed in on concerns about biometric surveillance and disclosures for generative AI such as ChatGPT. The legislation is not final. But it could have far-reaching implications since the EU’s large size and single market can affect business decisions for companies based elsewhere—a phenomenon known as “the Brussels effect.”, The Atlantic Council, June 13, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

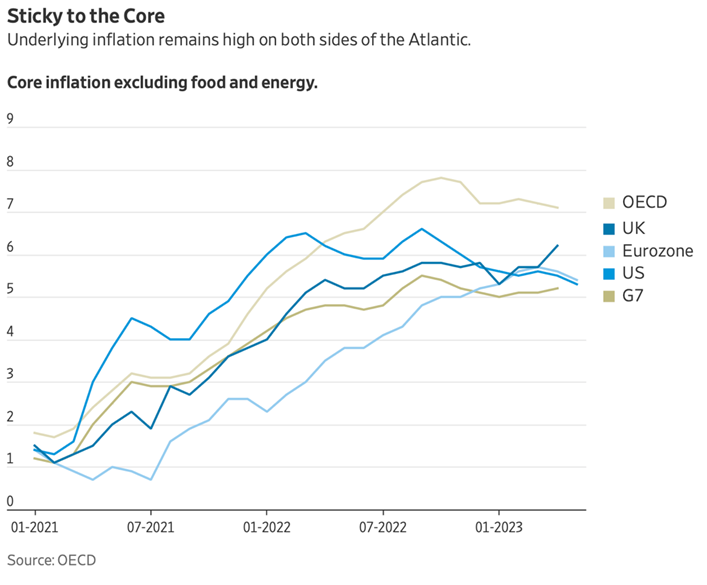

“Why Inflation Around the World Just Won’t Go Away – Roughly a year into their campaign against high inflation, policy makers are some way from being able to declare victory. Roughly a year into their campaign against high inflation, policy makers are some way from being able to declare victory. In the U.S. and Europe, underlying inflation is still around 5% or higher even as last year’s heady increases in energy and food prices fade from view. On both sides of the Atlantic, wage growth has stabilized at high levels and shows few signs of steady declines.”, The Wall Street Journal, June 19, 2023

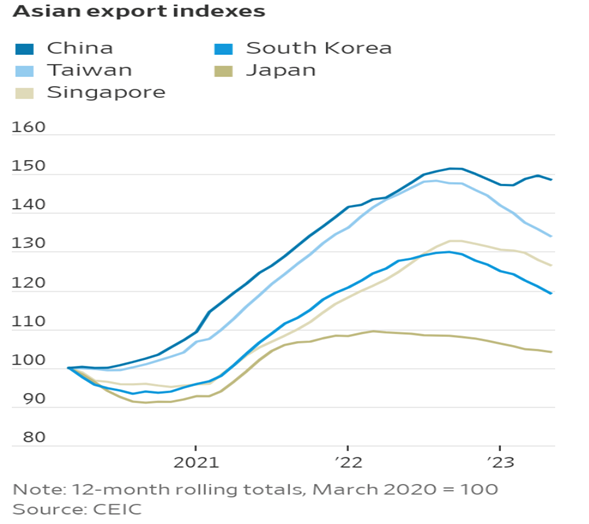

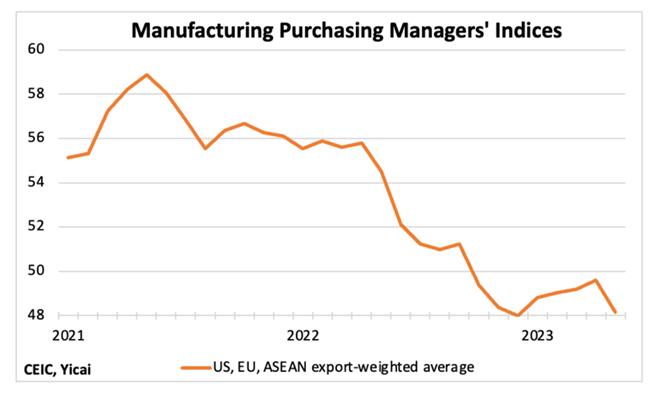

“Trade Woes in Asia Bring Inflation Relief to U.S. Consumers – But slowing exports to Western nations won’t alone stem rapidly rising prices. Sinking global trade is pummeling Asian exports, bringing some relief on inflation to U.S. and other Western consumers. But easing prices for home furnishings, electronics and other manufactured goods don’t signal high inflation will soon be defeated. Wage growth and services price gains are still elevated. And central banks in the U.S. and Europe are warning they aren’t finished raising interest rates in their fight to cool inflation.”, The Wall Street Journal, June 24, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel Updates

“The U.K. Will Officially Charge Travelers for Entry Starting This Fall — Here’s How Much: What to know about the U.K.’s Electronic Travel Authorisation visa waiver, which will go into effect in November. The fee, which will be rolled out this fall, will cost travelers £10 ($12.59) per applicant. When it is fully implemented, all foreign visitors without a visa (including those from the United States) will be required to apply for the ETA online in advance of their trip.”, Travel and Leisure, June 15, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Australia

“Investors sitting on record $1 trillion cash despite super rebound – Savers have turned away from the volatility of stock markets to the security of term deposits and nervous retirees are drawing down lump sums. Savers have shunned their super funds and deposited a record $1 trillion in term deposits amid growing economic and stock market concerns, despite fund performance rebounding during the past 12 months.”, Australia Financial Review, June 23, 2023

Brazil

“Why beef-loving Brazil is so obsessed with an American steakhouse chain – SÃO PAULO – Deep in the urban sprawl of the Western Hemisphere’s largest city, nestled within a thicket of highways, there is a low-slung shopping mall that boasts an attraction not rivaled anywhere in the United States. The giant Outback Steakhouse. Named the world’s largest Outback in 2018 — and the world’s most lucrative before that — its dimensions and legend since then have only grown. The restaurant is now nearly twice the size of the biggest Outbacks in the United States, where the faux-Australian chain was founded.”, The Washington Post, June 20, 2023

Canada

“Mass Immigration Experiment Gives Canada an Edge in Global Race for Labor – The country’s population growth is among the fastest in the world, bolstering the economy while creating strains in big cities. At a time industrialized countries around the world are confronting declining birth rates and aging workforces, Canada is at the forefront of betting on immigration to stave off economic decline. A country about as populous as California has added more than all the residents in San Francisco in a year. Last week, Canada surpassed 40 million people for the first time ever — with growth only expected to continue at a rapid pace as it welcomes more immigrant workers, refugees and foreign students across its borders.”, Bloomberg, June 18, 2023

“Manufacturer 3M Canada doubles down on remote work in an effort to access broader talent pool – While major employers across North America have spent much of the past year trying to persuade their employees to return to the office more often, the global manufacturing giant 3M Co. is doing just the opposite. The company is making its fully remote-work policy a permanent feature of employment, specifically because it will allow 3M to access a broader global pool of talent, not confined by geographical boundaries. ‘We realized over the pandemic that remote work was an absolutely critical part of being able to meet our hiring needs for knowledge workers,’ said Penny Wise, president and managing director of 3M Canada. ‘So we’re embracing that. It is our comparative advantage.’”, The Globe and Mail, June 17, 2023

China

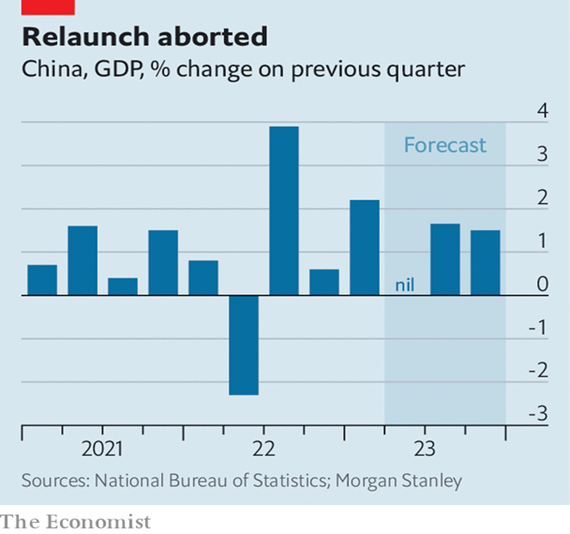

“Is China’s Recovery Sputtering? Like April’s numbers, the economic data released by the National Bureau of Statistics (NBS) for May were disappointing. For both industrial value added and retail sales, the outcomes the NBS reported were weaker than the predictions of the Chief Economists surveyed by the Yicai Research Institute. There were two areas of weakness. First, it appears that low commodity prices are making it unprofitable for China’s upstream industries to produce. Manufacturers of mid-stream goods have increasingly turned to cheaper imports instead of domestic products. Purchases of foreign coal, crude oil and various ores are all up sharply this year. The second area of weakness was in high-tech consumer products like mobile phones, laptops and tablets. Many of these products are exported and in the cases of mobile phones and laptops, the decline in exports was significantly larger than that of production, suggesting that weak foreign demand for these goods played an outsized role in their reduced production.”, YiCai Global, June 21, 2023

“China’s economy is on course for a “double dip” – The post-covid economy was meant to roar. But it is faltering again. Early this year, for example, China’s economy grew faster than expected, thanks to the country’s abrupt exit from covid-19 controls. Then, in April and May, the opposite happened: the economy recovered more slowly than hoped. Figures for retail sales, investment and property sales all fell short of expectations. The unemployment rate among China’s urban youth passed 20%, the highest since data were first recorded in 2018. Some now think the economy might not grow at all in the second quarter, compared with the first. By China’s standards this would be a “double dip”, says Ting Lu of Nomura, a bank.”, The Economist, June 18, 2023

European Union

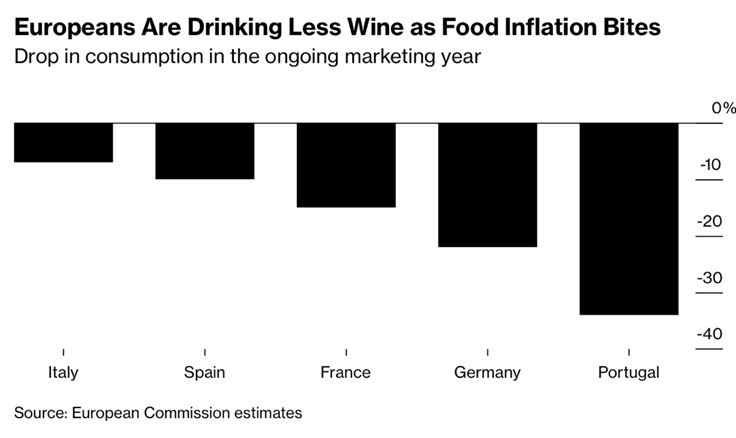

“There’s Too Much Wine in Europe as Drinkers Shun High Prices – Market faces large harvest plus lower consumption and exports. Government set to boost support measures to curb the buildup. High inflation and sliding exports, coupled with a strong 2022 harvest, have fueled a buildup in the bloc, the European Commission said Tuesday. That’s created a “serious loss of income,” especially for rosé and red wine producers in France, Spain and Portugal. The government is boosting support measures for the industry to curb the glut. That includes letting growers distill wine for alcohol — only meant for non-food purposes — and compensating them based on a share of recent market prices.”, Bloomberg, June 23, 2023

India

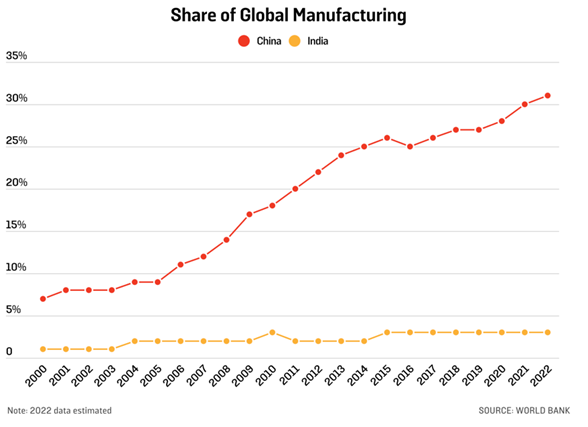

“Will India Surpass China to Become the Next Superpower? Four inconvenient truths make this scenario unlikely. When India overtook China in April to become the world’s most populous nation, observers wondered: Will New Delhi surpass Beijing to become the next global superpower? India’s birth rate is almost twice that of China. And India has outpaced China in economic growth for the past two years—its GDP grew 6.1 percent last quarter, compared with China’s 4.5 percent. At first glance, the statistics seem promising.

Japan

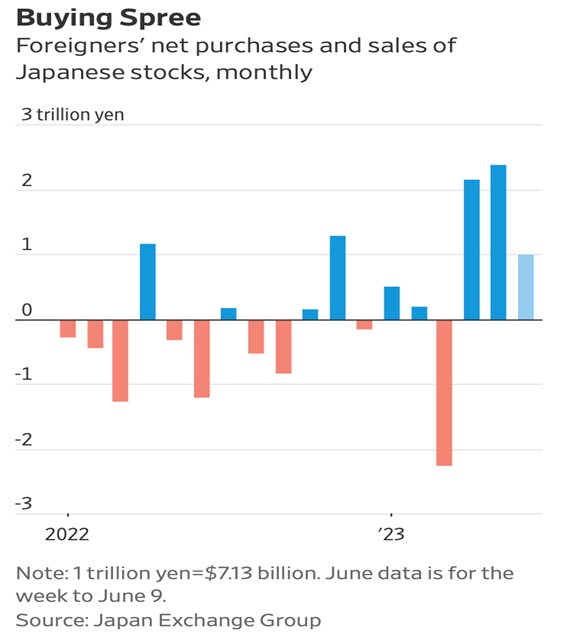

“Global Investors Are Flooding Into Japan. That Is Making Some People Nervous. Foreign investors have bought a net $39 billion of Japanese stocks since the start of April. That has helped the benchmark Nikkei 225 index rise almost 30% this year, bringing it back to levels it last traded at over 30 years ago. The country’s economy expanded faster than the U.S. in the first quarter, its stock exchange is pushing companies to improve their valuations and its central bank is committed to low interest rates, making it cheap for investors to take out loans to buy shares. And Warren Buffett has given the market a vote of confidence, saying in March that his conglomerate held more shares in Japan than anywhere outside the U.S.”, The Wall Street Journal, June 21, 2023

United Kingdom

“Stubborn UK inflation piles pressure on Bank of England to raise rates – May figure of 8.7% higher than expected after prices rise across range of goods and services. The Institute for Fiscal Studies think-tank said interest rate increases over the past year were already on track to absorb 8.3 per cent of mortgage holders’ disposable income — a figure that rises to 20 per cent for 1.4mn people. ‘We have an inflation problem that is not associated with economic growth,’ said Lyn Graham-Taylor, a senior rates strategist for Rabobank. ‘The market is saying that the Bank of England will have to push the UK economy into recession to get on top of this problem.’”, The Financial Times, June 21, 2023

“Surprise rise in retail sales thanks to bank holidays and sun – The Office for National Statistics says retail sales volumes grew by 0.3% in May, far better than the 0.2% decline forecast by economists, as warm weather and bank holidays boosted sales of outdoor goods and summer clothes. Garden centres and DIY shops also benefitted. More was spent on takeaways and fast food during the month as people celebrated the coronation and the usual May bank holiday. But food store sales fell as supermarkets increased prices, the ONS said. Food inflation has risen nearly 20% in the year up to April.”, Sky News, June 23, 2023

United States

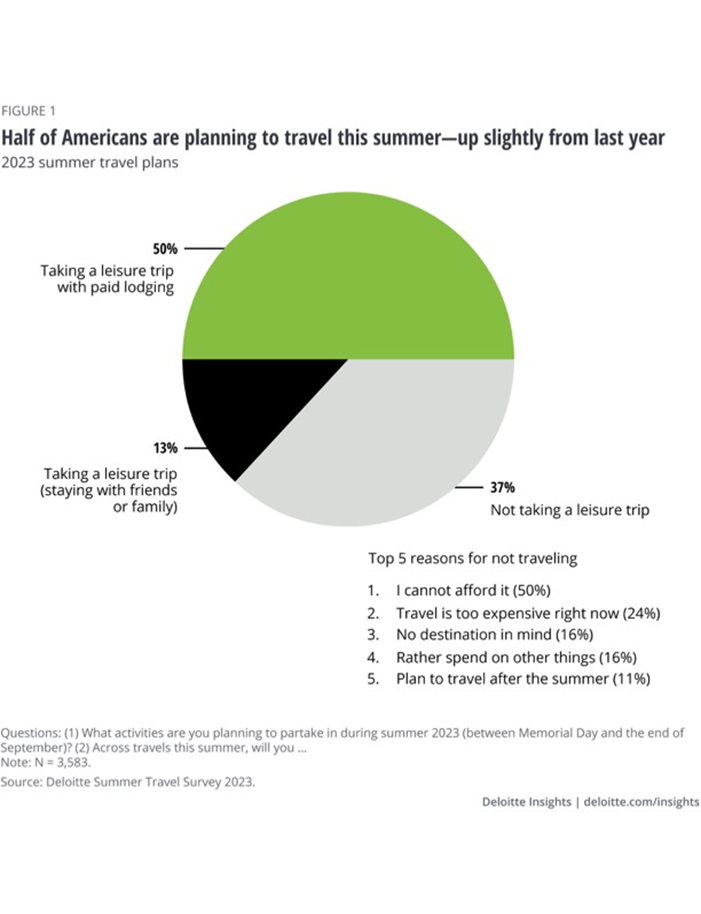

“The experience economy endures: 2023 Deloitte summer travel survey – Signs point to a busy season, as pricing pressure does not seem to deter Americans from enjoying their vacations. Half of Americans say they will take a leisure vacation (involving a stay in paid lodging; see figure 1) this summer, up from 46% in 2022. And they are doing so with enthusiasm, taking more international flights and adding an average of one trip to their calendar. Concerns, however, persist—50% of nontravelers say they will stay home due to financial worries.”, Deloitte, May 2023

Vietnam

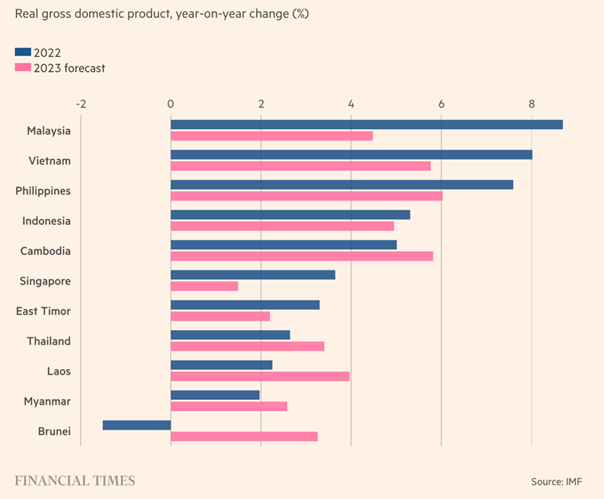

“Vietnam must take ‘aggressive’ action to meet growth goals, says finance minister – Export-driven manufacturing hub has been hit hard by drop in demand amid global economic slowdown. Vietnam was one of Asia’s fastest-developing economies last year, expanding more than 8 per cent, its highest growth rate since 1997. But growth slowed in the first quarter of 2023 to 3.3 per cent, down from 5.9 per cent in the fourth quarter of last year, as a grim global economic picture and high inflation cut into demand for the country’s exports.”, The Financial Times, June 24, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“Australia’s $172 billion franchising industry thriving in the regions due to internal migration – A recently released report has shed light on the changing demographics of Australia’s ….. franchising industry. According to the report, the franchising industry has undergone a significant transformation in adapting to the technological advancements of the modern era and a notable shift in the industry’s mindset has been showcased in the report, moving away from a singular focus on franchise sales towards a growth mindset that places emphasis on innovation, integration of advanced systems and a deep understanding of the Australian market. The report also highlights that over the past 15 years, there has been a notable migration of people from capital cities to regional areas in Australia, according to the Regional Australia Institute.”, Smart Company, June 14, 2023

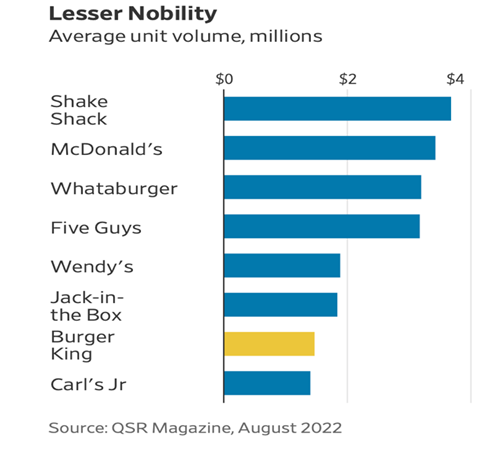

“Could BurgerFi Be the Next Shake Shack Arising? BurgerFi is a growing upscale fast-casual burger restaurant selling 100% hormone-free, never frozen, 100% Angus beef chargrilled burgers. The company has a combined company owned and franchised 172 locations and plans to open 15 to 20 locations in 2023. Upscale fast-casual burger restaurant chain BurgerFi International Inc. shares have been staging an impressive rally rising 39% year-to-date.”, Market Beat, June 19, 2023

“Fixing Burger King’s Royal Mess – Struggling fast-food chain’s turnaround will take time to pay off. Burger King, the longtime No. 2 U.S. burger chain, looked even more like a pretender to the throne after slipping to third place in 2020 behind Wendy’s by revenue. But market share was the least of its concerns after the pandemic roiled the restaurant industry. Its franchisees have seen revenue and profitability sag, and two of its largest owners have been forced into bankruptcy recently with another failing to pay royalties. Now the chain is nine months into a mission to “reclaim the flame”—a tough-love approach to beef up its best operators and encourage weaker ones to cut back.”, The Wall Street Journal, June 20, 2023

“Franchisee Takes Over 16 Handles And Aims To Reinvigorate It – Neil Hershman, an experienced franchisee of 16 Handles, a New York City-based frozen yogurt chain, owns seven of its 30 all-franchised units. In August 2022, he and Danny Duncan, a noted You Tuber and influencer with over 1.5 billion views on his channel, acquired 16 Handles from its long-time founder. Their goal is to reinvigorate it, boost sales, and open more franchised units. Who knows better how a franchise operates, and what is holding it back, than one of its own franchisees? And Hershman, who is 28-years old, based in New York City, and a former analyst at a hedge fund, is also a franchisee of other brands since he also operates three Dippin’ Dots, an ice cream store.”, Forbes, June 26, 2023

“Studio Pilates International Set To Launch First UK Studio in Exeter in early June – Having conquered the Australian, New Zealand and US markets, the brand is now set to take on the UK, with locations in South London, Dublin and Exeter expected to be open by late Spring.”, Franchising.com, June 14, 2023

“US chain Long John Silver’s opens first restaurant in Indonesia – Long John Silver’s, the US-based seafood restaurant, has opened a global flagship store in Gading Serpong, Indonesia, and signalled plans to expand further in the country. The flagship store is the brand’s first location in Indonesia under a new partnership with local franchisee, Cipta Putra Nusantara, which plans a second flagship outlet in the last quarter of this year and a longer-term target of more than 50 restaurants in the market. ‘We have seen great success establishing brand recognition and customer satisfaction in Singapore, which encouraged us to look at neighbouring markets for expansion opportunities,’ said Nate Fowler, Long John Silver’s brand president.”, Inside retail Asia, June 14, 2023. Compliments of Paul Jones, Jones & Co., Toronto

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

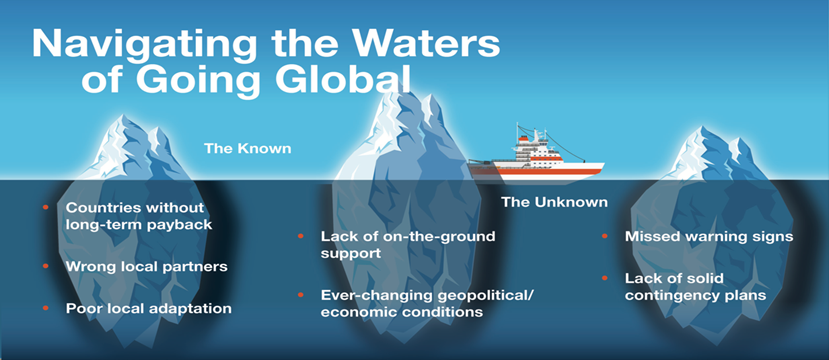

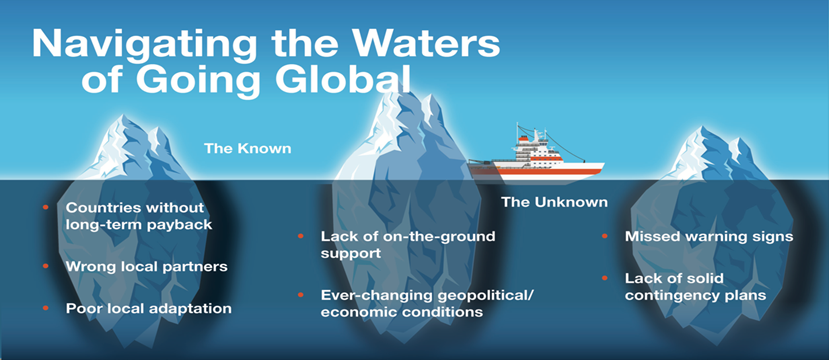

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant taking 40 franchisors global.

For a complimentary 30 minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 84, Tuesday, June 13, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Introduction: In this issue, the state of economic freedom around the world in 2023, inflation continues to ‘cool’, international firms are cutting their office space needs, 5 lessons COVID taught businesses, lower global birth rates, Europe’s economy slows, what the Chinese consumer is spending on and worker productivity in Latin America

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

NOTE: Some of the sources that we provide links to require a paid subscription to access. We subscribe to 40 international information sources to keep our readers up to date on the world’s business.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here:

First, A Few Words of Wisdom From Others

“Change is the law of life. And those who look only to the past or present are certain to miss the future.”, John F. Kennedy

“Life is not about how fast you run or how high you climb, but how well you bounce.”, Vivian Komori

“Opportunities don’t happen. You create them.”, Chris Grosser

Highlights in issue #84:

- Brand Global News Section: Luckin Coffee®, Pizza Hut®, Starbucks®, Subway® and Sweetgreen®’

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data and Studies

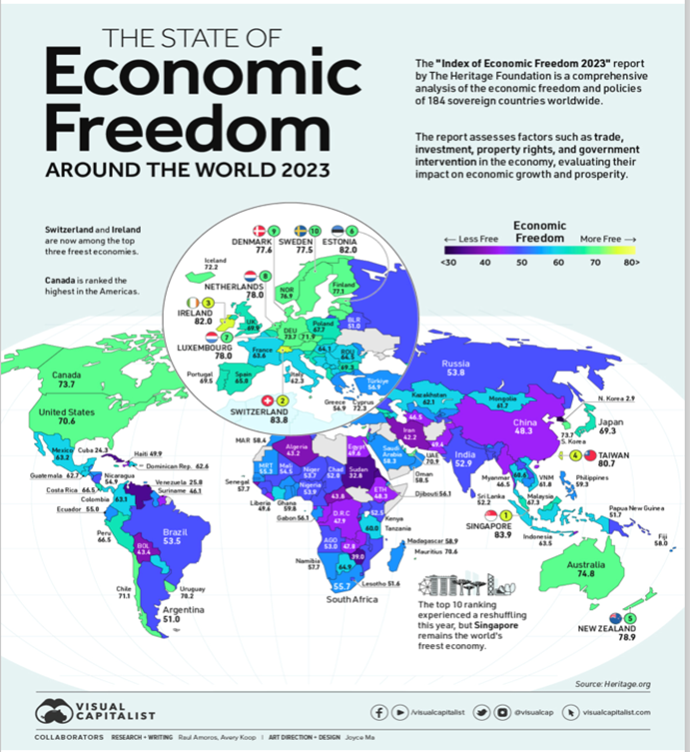

“The State of Economic Freedom in 2023 – The concept of economic freedom serves as a vital framework for evaluating the extent to which individuals and businesses have the freedom to make economic decisions. In countries with low economic freedom, governments exert coercion and constraints on liberties, restricting choice for individuals and businesses, which can ultimately hinder prosperity. The map above uses the annual Index of Economic Freedom from the Heritage Foundation to showcase the level of economic freedom in every country worldwide on a scale of 0-100, looking at factors like property rights, tax burdens, labor freedom, and so on. The ranking categorizing scores of 80+ as free economies, 70-79.9 as mostly free, 60-69.9 as moderately free, 50-59.9 as mostly unfree, and 0-49.9 as repressed.”, Visual Capitalist / Index Of Economic Freedom, June 6, 2023

“World Bank Brightens View of Global Growth This Year, Downgrades 2024 – Bank warns of risks to poorer nations from rising interest rates. The World Bank sees better global economic growth than previously estimated in 2023, thanks to resilient U.S. consumer spending and China’s faster-than-expected reopening in the early part of the year. The bank still expects slowing growth in the second half of this year and a muted expansion into next year, according to its forecast released Tuesday. It warned that stubbornly high inflation and interest-rate increases are weighing on economic activity around the world, particularly in developing countries.”, The Wall Street Journal, June 6, 2023

“These are the top 10 countries where small businesses are flourishing globally – E-commerce company Shopify partnered with Deloitte to create a database that measures the top countries and U.S. states where entrepreneurship is flourishing. To calculate this, they measured the impact of entrepreneurs on GDP, jobs supported, exports, and business activity. According to the index, the top 10 countries where entrepreneurship is thriving are:

United States

Lithuania

Romania

United Kingdom

Czech Republic

Australia

Denmark

China

Hong Kong

Japan

Fast Company, May 16, 2023

“Half of big international firms to cut office space in next three years – Survey of 350 businesses shows 56% favour hybrid working. The survey of 350 businesses by property consultants Knight Frank and commercial real estate firm Cresa found that 50% the largest businesses they questioned – those with more than 50,000 employees – expect to shrink their global workspaces, although most are only planning to reduce by between 10% and 20%. However, this contrasts with the expectations of smaller firms surveyed – those with up to 10,000 employees – just over half (55%) of whom said they were expecting to increase their global office space.”, The Guardian, June 6, 2023

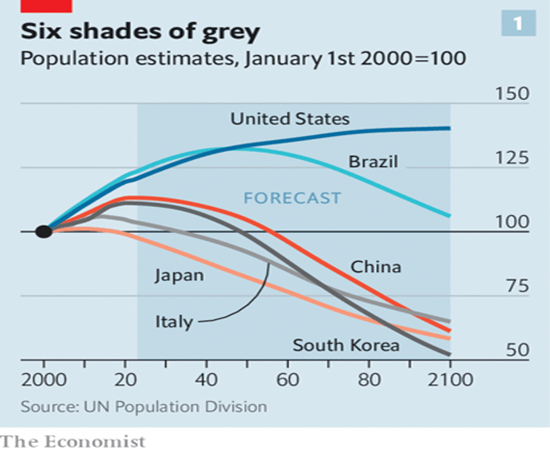

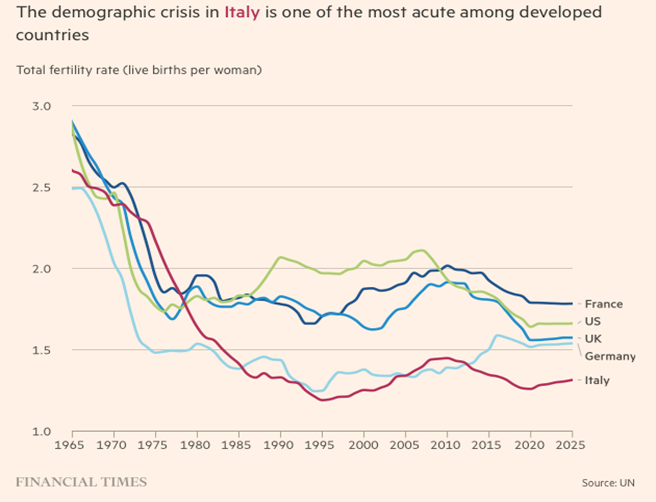

“It’s not just a fiscal fiasco: greying economies also innovate less – That compounds the problems of shrinking workforces and rising bills for health care and pensions. Italy and Japan, in particular, are the poster pensioners for demographic decline and its economic consequences. In both countries the fertility rate (the number of children a typical woman will have over her lifetime) fell below 2.1 in the 1970s. That level is known as the replacement rate, since it keeps a population stable over time. Anything lower will eventually lead to a declining population.”, The Economist, May 30, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

“Today’s supply chain disruptions reaffirm the importance of a multilateral trading system based on WTO rules – Economic security has come to the forefront of policy discussions, as a series of crises—most recently the COVID-19 pandemic and the war in Ukraine—have disrupted global supply chains. Governments around the world are looking for ways to make their countries less vulnerable to such disruptions, especially now that rising geopolitical tensions add new uncertainty. In this regard, reshoring and friend-shoring have become popular policy prescriptions, and talk of global fragmentation abounds.”, International Monetary Fund, June 2023

“These Are the World’s 20 Most Expensive Cities for Expats in 2023 – New York has leapfrogged Hong Kong as the world’s most expensive city to live in as an expat, while skyrocketing rents saw Singapore crash into the top five, according to a new study. Soaring inflation and rising accommodation costs were cited as reasons for New York topping ECA International’s Cost of Living Rankings for 2023, while Geneva and London remained in third and fourth places. These are the world’s top 20 most expensive places for expats to live (with the 2022 rankings in parentheses):

New York, US (2022 ranking: 2)

Hong Kong, China (1)

Geneva, Switzerland (3)

London, UK (4)

Singapore (13)

Zurich, Switzerland (7)

San Francisco, US (11)

Tel Aviv, Israel (6)

Seoul, South Korea (10)

Tokyo, Japan (5)

Bern, Switzerland (16)

Dubai, UAE (23)

Shanghai, China (8)

Guangzhou, China (9)

Los Angeles, US (21)

Shenzhen, China (12)

Beijing, China (14)

Copenhagen, Denmark (18)

Abu Dhabi, UAE (22)

Chicago, US (25)

Bloomberg, June 6, 2023

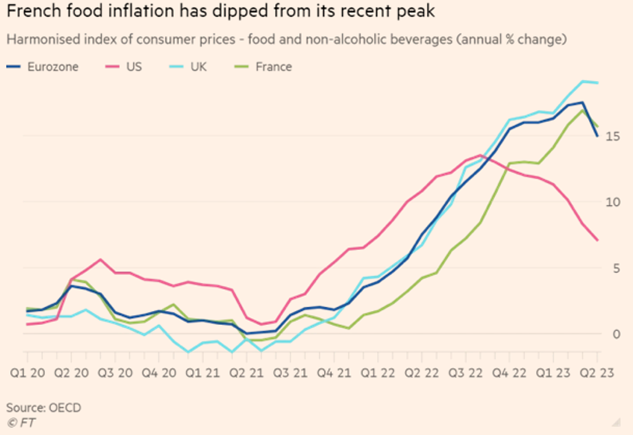

“Food producers agree to cut prices in France after government pressure – Finance minister Bruno Le Maire says 75 groups will make reductions in line with falling wholesale costs. French food prices rose 14.1 per cent in the year to May, close to the eurozone average, and have overtaken energy as the region’s biggest driver of inflation, raising alarm among politicians and consumer groups. Some French food prices have risen faster: olive oil prices are up a quarter and eggs cost a fifth more.”, The Financial Times, June 9, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel Updates

“Heathrow strikes: security staff announce summer of walkouts – More than 2,000 staff who scan bags and frisk passengers at the UK’s biggest airport will walk out for all but two of the busiest weekends of the year, the Unite union said yesterday. The 31 days of strike action, between June 24 and August 27, will affect passengers flying from terminals 3 and 5, the two busiest departure points. It raises the prospect of long delays for security screening during the school summer holidays and the August bank holiday weekend.”, The Times of London, June 8, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Africa

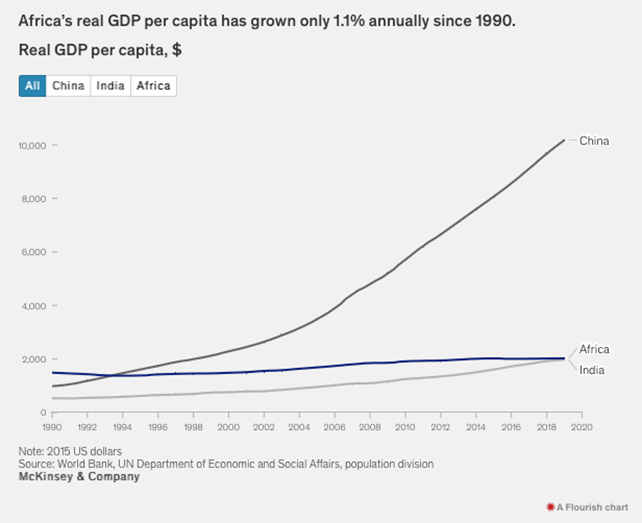

“Reimagining economic growth in Africa: Turning diversity into opportunity – Africa’s economy downshifted over the last decade, yet half of its people live in countries that have thrived on the continent. Africa has the human capital and natural resources to accelerate productivity and reimagine its economic growth, which is, more than ever, vital for the welfare of the world.”, McKinsey & Co., June 5, 2023

Australia

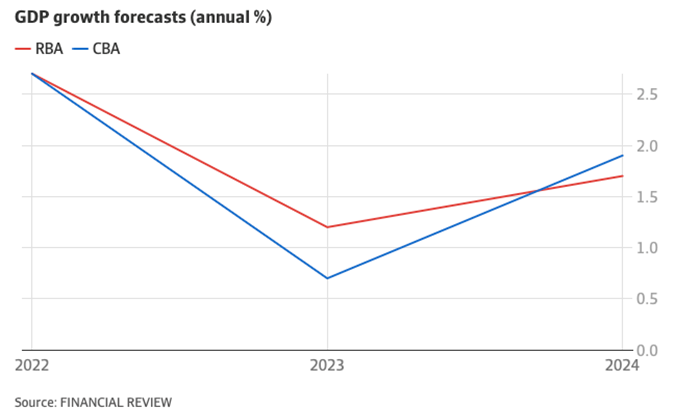

“CBA cuts growth forecasts, places odds of recession at 50pc – Economists are warning of the serious risk of recession this year after sticky inflation and concerns about wages fuelling price pressures forced the Reserve Bank of Australia to lift interest rates and flag more rises to come. Commonwealth Bank of Australia and HSBC economists now both put the odds of a recession at 50 per cent, after cutting their economic growth forecast in response to the RBA raising the cash rate a quarter percentage point to 4.1 per cent on Tuesday.”, Australia Financial Review, June 9, 2023

Canada

“Canada lost 17,000 jobs in May, bringing interest rate hike into question – The drop was driven largely by a fall in youth employment, as 77,000 people between the ages of 15 and 24 lost their jobs. The lacklustre jobs report raised questions over whether the Bank of Canada may have acted too quickly in raising interest rates Wednesday, some economists suggested.”, The Toronto Star, June 9, 2023

“Complexities of international sanctions – Canada is increasingly using international trade sanctions. These sanctions target foreign individuals and entities, and compliance has become increasingly complex and important for companies operating abroad. What happens when you have been added to a sanctions list and want to be removed? We consider below two recent cases on this topic.”, Dentons, June 7, 2023

China

“China’s Services Sector Continues to Rebound Faster Than Industrial Sector – The combined profits of major state-owned industrial companies declined 17.9% year-on-year in the first four months, the National Bureau of Statistics (NBS) reported May 27. Over the same period, total profits of state-owned enterprises (SOEs) in all sectors climbed 15.1%, the Ministry of Finance said the following day. Since the beginning of 2023, the year-on-year growth of the service production index published by the NBS has been consistently higher than increases in industrial value added.”, Caixing Global, May 31, 2023

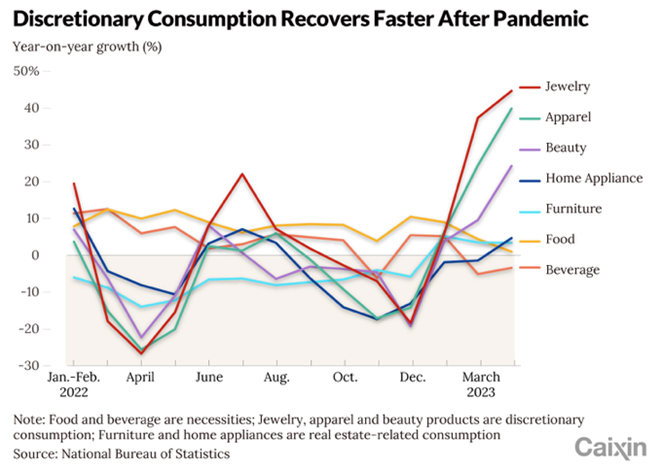

“Where Are Chinese Consumers Willing to Spend? Chinese consumers are resuming spending on travel and dining out but are not buying necessities and other consumer goods as much as before the pandemic. Spending on services was the main driving force for the first-quarter rebound in consumption. Retail sales of consumer goods in the first quarter rose 5.8% year-on-year, significantly rebounding from a decline of 2.7% in the fourth quarter of 2022, data from the National Bureau of Statistics (NBS) showed. Per capita spending on services grew 6.2% year-on-year in the period, faster than overall consumption growth, a report by KPMG showed.”, Caixing Global, June 8, 2023

“U.S. Business Interest In China Is Slowly Recovering, Ex-American Diplomat Says – Strained relations between Washington and Beijing appear to be stabilizing, a shift that is stirring renewed business interest in China among U.S. companies, a former long-term U.S. diplomat who is the current chairman of the American Chamber of Commerce in Shanghai told Forbes on Tuesday. ‘There are some positive signs in the relationship, particularly the high-level contact among the two countries’ economic officials,’ said Sean Stein in Beijing via Zoom. That advance, however, is constrained by continuing concerns about security issues and the economic outlook, he added.”, Forbes, June 7, 2023

European Union

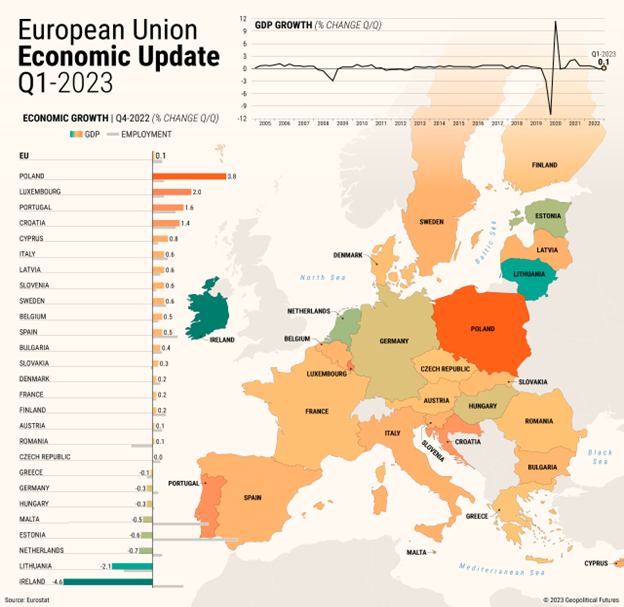

“Europe’s Economy at a Standstill – Ukraine and uncertainty about prices remain the major obstacles to EU growth. The European Union as a whole achieved slight economic growth in the first quarter of the year, but weaknesses abound……Poland recorded 3.8 percent growth compared with final quarter of 2022, powered by household consumption and exports. The war and uncertainty about prices remain the major obstacles to European growth. On the other hand, employment is still rising and energy prices have returned to Earth.”, Geopolitical Futures, June 9, 2023

Latin America

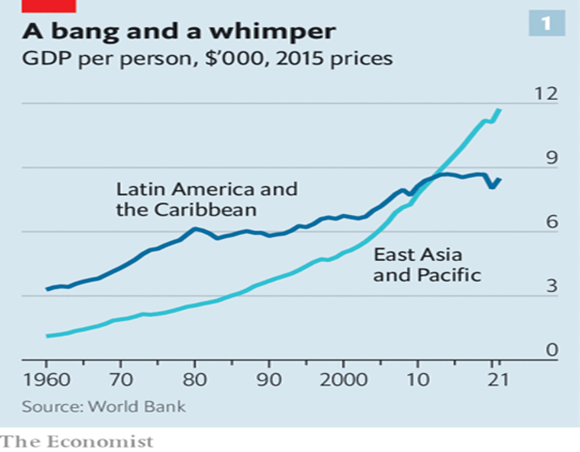

“Why are Latin American workers so strikingly unproductive? Blame education, corruption and a huge shadow economy. In 1962 Latin America’s income per person was three times that of East Asia. By 2012 both regions had the same level. By 2022 East Asia’s was roughly 40% higher than Latin America’s (see chart 1). When the differences in purchasing power are taken into account, Latin Americans’ gdp per person has been stuck at little more than a quarter of that of their neighbours in the United States for the last three decades. According to the World Bank, between 2010 and 2020 Latin America was the world’s slowest-growing regional economy.”, The Economist, June 8, 2023

India

“India Inflation Cools to 25 Month Low of 4.25% in May – India’s retail inflation cooled faster-than-expected in May, providing relief to policymakers even as risks from an uneven monsoon remain. Food prices, which make for about half of the index, rose 2.91%, while fuel and light prices gained 4.64%. Clothing and footwear prices increased 6.64% and housing prices rose 4.84%. Core inflation, which strips volatile food and fuel prices from the headline, moderated to 5.11%, from 5.30% in April.”, Bloomberg, June 12, 2023

Italy

“Baby bust: Italy faces a ‘demographic winter’ – Alarmed by the falling birth rate, the government is trying to entice women into having children. But many are sceptical of the approach. Low birth rates — and greying populations — are a concern for many advanced economies, including European nations and Japan as well as China, now confronting the fallout from its draconian one-child policy. Challenges of older populations include pressure on state pension schemes; strained national healthcare systems; potential hits to sovereign credit ratings; and pervasive labour shortages as employers struggle to find manpower, including care for the elderly. Italy’s demographic crisis, though, is among Europe’s most acute — the result of decades of economic stagnation and political indifference to women’s aspirations.”, The Financial Review, June 7, 2023

United Arab Emirates

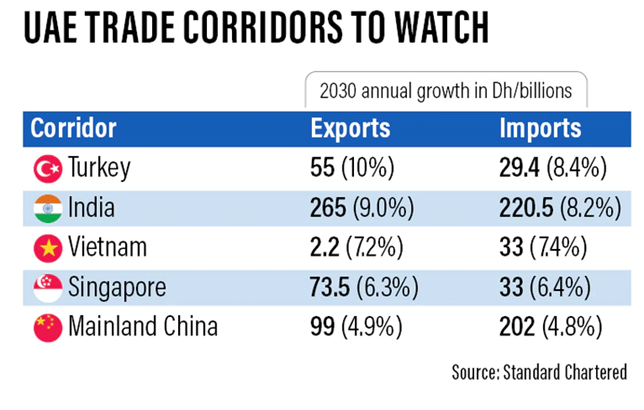

“UAE exports forecast to reach $545bn by 2030, Standard Chartered says – The Emirates’ progressive policies are supporting trade growth, with India to remain largest partner. The country’s exports are projected to increase by 5.5 per cent annually, with metals and minerals (accounting for 73 per cent of exports by 2030) and plastics and rubbers set to drive growth, Standard Chartered said in a report on Thursday.”, The National News, June 1, 2023

United Kingdom

“Britain to steer clear of recession – Britain will avoid a recession this year, according to new forecasts, as energy prices retreat and supply chain disruption abates. Economists warned that companies and consumers were still in for a tough year, however, with stubborn levels of inflation raising the risk of more pain for borrowers while the Bank of England battles to reduce it. KPMG no longer expects a recession in the UK this year, forecasting that gross domestic product will rise by 0.3 per cent.”, The Times of London, June 12, 2023

“Regional workers back in the office four days a week – Office occupancy outside London is back to 93 per cent of pre-pandemic levels, with workers turning up for an average of four days a week. The latest survey from Regional Reit, the owner of 154 largely office properties, found that 65 out of 100 desks were occupied during business hours compared with 70 out of 100 before Covid. Stephen Inglis, chief executive of the company’s asset manager, London & Scottish Property Investment Management, said he was seeing “a steadily improving environment with more people back in the office”. He said the finding that regional workers were back for an average of 4.2 days a week came as a pleasant surprise for his business. “I was expecting three to four days”, he said.”, The Times Of London, June 7, 2023

United States

“The Global Brands Coming to a (U.S.) Shopping Mall Near You – Some retailers now view U.S. expansion as the surest way to boost revenue amid a shaky global economy. American consumers have long been renowned for their spending power. Now global retailers want a bigger slice of the action. Once wary of America, foreign fashion brands such as Mango, Uniqlo and Zara are joining retail giants including Lego and IKEA in pursuing major U.S. expansions. Executives say they are encouraged by the country’s upbeat economic prospects relative to other parts of the world, and a growing sense that American shoppers have become more receptive to new brands.”, The Wall Street Journal, June 7, 2023

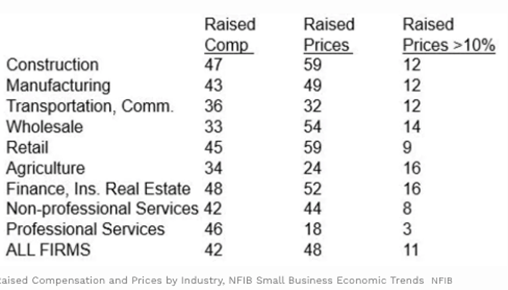

“Who Is Raising Wages On (U.S.) Main Street? The share of firms raising worker compensation reached record-high levels in the past few years, reaching 51% in June 2022. The most difficult cost to cut is compensation. It is also the largest cost for most small employer firms. When the costs of non-compensation inputs fall, the benefit drops to the bottom line and can be passed on to customers by reducing selling prices. Competition is the force that gets this to happen. But when those cost inputs fall because of a slowing economy, wages generally stay the same; they are commitments made to individuals.”, Forbes, June 9, 2023

Vietnam

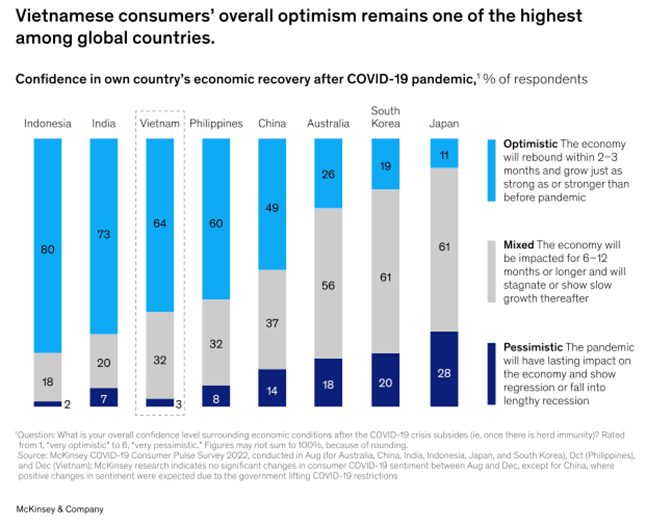

“Vietnamese consumers are coming of age in 2023: How businesses can stay ahead – For the past few years, the middle class in Vietnam has been on the rise, spreading out geographically and growing increasingly diverse.1 Consumers are growing in number and becoming more demanding and discerning. It is estimated that more than half of the Vietnamese population will enter the global middle class by 2035, creating more disposable income and fueling consumption.”, McKinsey & Co., May 26, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“What Covid Has Taught Us: 5 pandemic lessons for franchising – March marked the third anniversary of the global Covid-19 pandemic, and while many of us are keen to move forward, it’s important for businesses to reflect on the takeaways and build on lessons learned through our shared, global experiences.”, Franchising.com article by Catherine Monson, June 7, 2023

“Sweetgreen Stores Are Expected To Be Completely Automated In 5 Years – Dubbed the “Infinite Kitchen,” the chain has been testing a 100% robotic production line that assembles all of Sweetgreen’s orders from start to finish. Prep is still human-orchestrated, as employees make the ingredients, but robots are assembling those ingredients in the bowls. The first Infinite Kitchen prototype opened less than a month ago in Naperville, Illinois, and if it’s any indication of what’s to come, Sweetgreen is thrilled. So far, it isn’t affecting the overall customer experience, and it’s reportedly saving the chain big money.”, Tasting Table, June 10, 2023

“Starbucks says on track to meet 9000 store goal on Chinese mainland – Starbucks’ new global CEO Laxman Narasimhan on Tuesday highlighted China’s huge market potential and suggested the company’s goal of opening 9,000 stores on the Chinese mainland by 2025 remained unchanged. China’s per capita coffee consumption is increasing but still lags far behind Japan and the United States, thus leaving much room for business growth, Narasimhan said during his visit to Shanghai, home to more than 1,000 Starbucks stores, which is more than any other city in the world. The US coffee giant opened its first store on the Chinese mainland in 1999. As of April 2, it had operated over 6,200 stores across 244 cities on the Chinese mainland.”, Shine.con, May 30, 2023. Compliments of Paul Jones, Jones & Co., Toronto

“Starbucks’ China rival Luckin Coffee opens 10,000th shop amid fight for expected 1 trillion yuan market. Luckin Coffee opened 1,137 stores in the first quarter, beating Starbucks, which opened 153 and trails the domestic chain by more than 3,700 locations. Luckin recorded first-quarter revenue of 44.4 billion yuan (US$6.2 billion), with a net profit of 564.8 million yuan. The company, which was formerly listed on the Nasdaq before a scandal forced it to delist, accomplished the 10,000-store milestone within six years. It had already surpassed Starbucks in terms of total stores in China in 2021.”, South China Morning Post, June 7, 2023

“Pizza Hut Australia Purchased by US Group That Owns Taco Bell, Wendy’s Locations – Flynn Restaurant Group expects to gain $300 million in sales The deal marks the company’s first international acquisition. The San Francisco-based group already owns 945 Pizza Huts in its home market. The acquisition will give Flynn about 2,600 locations across the two countries and boost annual sales to roughly $4.5 billion from $4.2 billion. Flynn says it is the largest franchise operator in the world, with a portfolio of restaurants that includes Applebee’s, Taco Bell, Panera Bread, Arby’s and Wendy’s locations in 44 US states.”, Bloomberg, June 7, 2023

“Subway threatens to yank run-down stores from franchisees as company searches for buyer – Subway has ordered some franchisees to spend as much as $100,000 on remodeling their sandwich shops as the company scrambles to sell itself — and is threatening to take away their stores if they don’t comply, The Post has learned. The struggling fast-food giant — which has faced a lackluster response as it attempts to auction the chain for $10 billion, according to sources — is meanwhile demanding that some franchisees make major investments to upgrade their shops in a matter of months, sources said.”, The New York Post, June 11, 2023

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant taking 40 franchisors global.

For a complimentary 30 minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking