EGS Biweekly Global Business Newsletter Issue 84, Tuesday, June 13, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Introduction: In this issue, the state of economic freedom around the world in 2023, inflation continues to ‘cool’, international firms are cutting their office space needs, 5 lessons COVID taught businesses, lower global birth rates, Europe’s economy slows, what the Chinese consumer is spending on and worker productivity in Latin America

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

NOTE: Some of the sources that we provide links to require a paid subscription to access. We subscribe to 40 international information sources to keep our readers up to date on the world’s business.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here:

First, A Few Words of Wisdom From Others

“Change is the law of life. And those who look only to the past or present are certain to miss the future.”, John F. Kennedy

“Life is not about how fast you run or how high you climb, but how well you bounce.”, Vivian Komori

“Opportunities don’t happen. You create them.”, Chris Grosser

Highlights in issue #84:

- Brand Global News Section: Luckin Coffee®, Pizza Hut®, Starbucks®, Subway® and Sweetgreen®’

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data and Studies

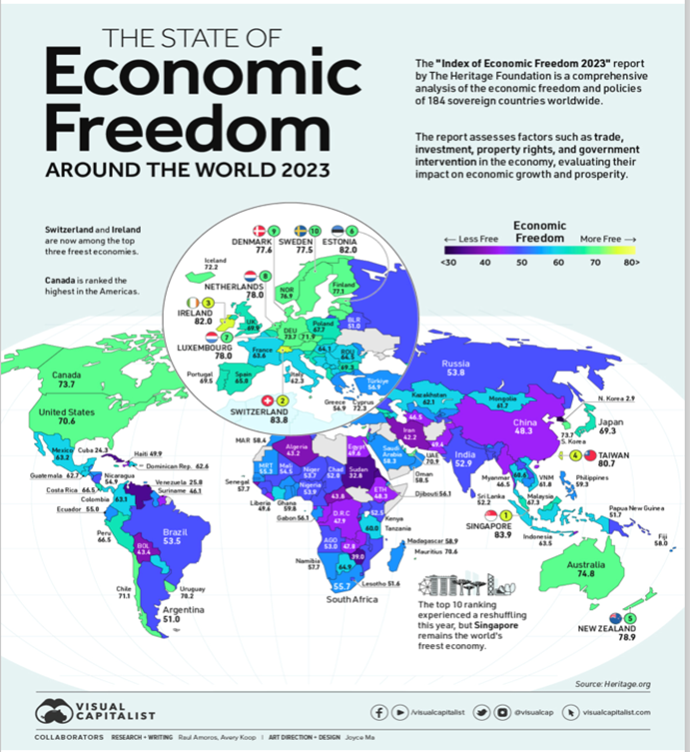

“The State of Economic Freedom in 2023 – The concept of economic freedom serves as a vital framework for evaluating the extent to which individuals and businesses have the freedom to make economic decisions. In countries with low economic freedom, governments exert coercion and constraints on liberties, restricting choice for individuals and businesses, which can ultimately hinder prosperity. The map above uses the annual Index of Economic Freedom from the Heritage Foundation to showcase the level of economic freedom in every country worldwide on a scale of 0-100, looking at factors like property rights, tax burdens, labor freedom, and so on. The ranking categorizing scores of 80+ as free economies, 70-79.9 as mostly free, 60-69.9 as moderately free, 50-59.9 as mostly unfree, and 0-49.9 as repressed.”, Visual Capitalist / Index Of Economic Freedom, June 6, 2023

“World Bank Brightens View of Global Growth This Year, Downgrades 2024 – Bank warns of risks to poorer nations from rising interest rates. The World Bank sees better global economic growth than previously estimated in 2023, thanks to resilient U.S. consumer spending and China’s faster-than-expected reopening in the early part of the year. The bank still expects slowing growth in the second half of this year and a muted expansion into next year, according to its forecast released Tuesday. It warned that stubbornly high inflation and interest-rate increases are weighing on economic activity around the world, particularly in developing countries.”, The Wall Street Journal, June 6, 2023

“These are the top 10 countries where small businesses are flourishing globally – E-commerce company Shopify partnered with Deloitte to create a database that measures the top countries and U.S. states where entrepreneurship is flourishing. To calculate this, they measured the impact of entrepreneurs on GDP, jobs supported, exports, and business activity. According to the index, the top 10 countries where entrepreneurship is thriving are:

United States

Lithuania

Romania

United Kingdom

Czech Republic

Australia

Denmark

China

Hong Kong

Japan

Fast Company, May 16, 2023

“Half of big international firms to cut office space in next three years – Survey of 350 businesses shows 56% favour hybrid working. The survey of 350 businesses by property consultants Knight Frank and commercial real estate firm Cresa found that 50% the largest businesses they questioned – those with more than 50,000 employees – expect to shrink their global workspaces, although most are only planning to reduce by between 10% and 20%. However, this contrasts with the expectations of smaller firms surveyed – those with up to 10,000 employees – just over half (55%) of whom said they were expecting to increase their global office space.”, The Guardian, June 6, 2023

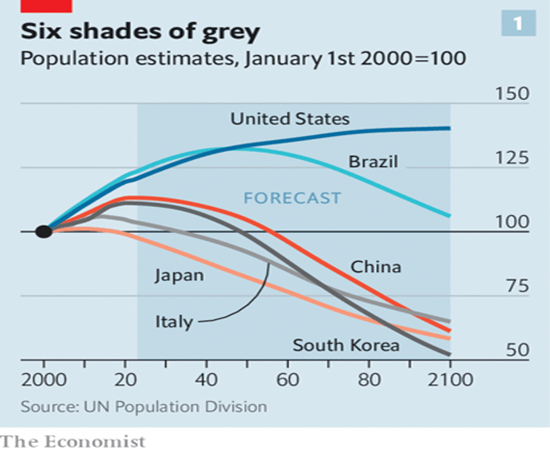

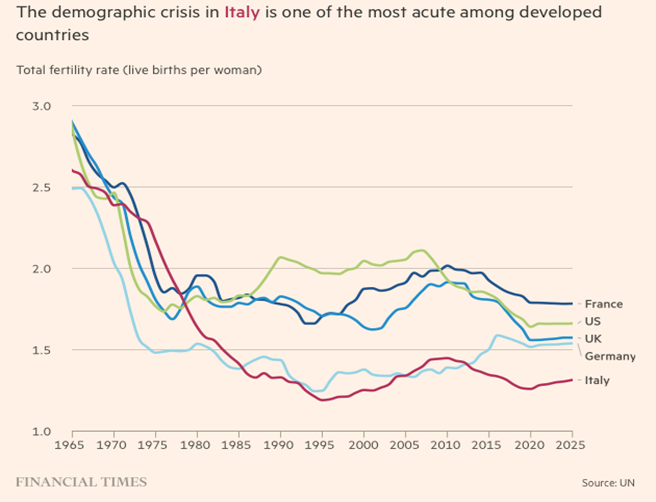

“It’s not just a fiscal fiasco: greying economies also innovate less – That compounds the problems of shrinking workforces and rising bills for health care and pensions. Italy and Japan, in particular, are the poster pensioners for demographic decline and its economic consequences. In both countries the fertility rate (the number of children a typical woman will have over her lifetime) fell below 2.1 in the 1970s. That level is known as the replacement rate, since it keeps a population stable over time. Anything lower will eventually lead to a declining population.”, The Economist, May 30, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

“Today’s supply chain disruptions reaffirm the importance of a multilateral trading system based on WTO rules – Economic security has come to the forefront of policy discussions, as a series of crises—most recently the COVID-19 pandemic and the war in Ukraine—have disrupted global supply chains. Governments around the world are looking for ways to make their countries less vulnerable to such disruptions, especially now that rising geopolitical tensions add new uncertainty. In this regard, reshoring and friend-shoring have become popular policy prescriptions, and talk of global fragmentation abounds.”, International Monetary Fund, June 2023

“These Are the World’s 20 Most Expensive Cities for Expats in 2023 – New York has leapfrogged Hong Kong as the world’s most expensive city to live in as an expat, while skyrocketing rents saw Singapore crash into the top five, according to a new study. Soaring inflation and rising accommodation costs were cited as reasons for New York topping ECA International’s Cost of Living Rankings for 2023, while Geneva and London remained in third and fourth places. These are the world’s top 20 most expensive places for expats to live (with the 2022 rankings in parentheses):

New York, US (2022 ranking: 2)

Hong Kong, China (1)

Geneva, Switzerland (3)

London, UK (4)

Singapore (13)

Zurich, Switzerland (7)

San Francisco, US (11)

Tel Aviv, Israel (6)

Seoul, South Korea (10)

Tokyo, Japan (5)

Bern, Switzerland (16)

Dubai, UAE (23)

Shanghai, China (8)

Guangzhou, China (9)

Los Angeles, US (21)

Shenzhen, China (12)

Beijing, China (14)

Copenhagen, Denmark (18)

Abu Dhabi, UAE (22)

Chicago, US (25)

Bloomberg, June 6, 2023

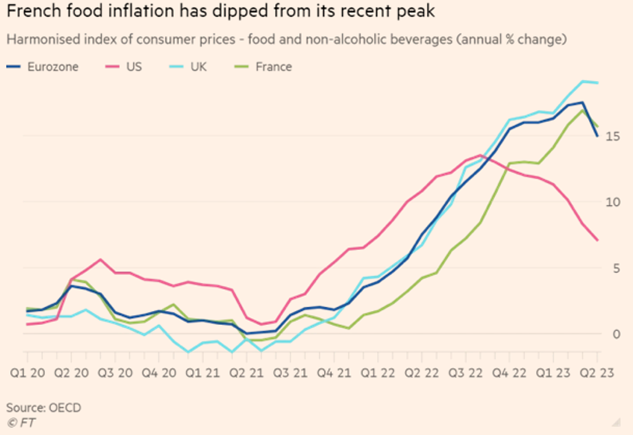

“Food producers agree to cut prices in France after government pressure – Finance minister Bruno Le Maire says 75 groups will make reductions in line with falling wholesale costs. French food prices rose 14.1 per cent in the year to May, close to the eurozone average, and have overtaken energy as the region’s biggest driver of inflation, raising alarm among politicians and consumer groups. Some French food prices have risen faster: olive oil prices are up a quarter and eggs cost a fifth more.”, The Financial Times, June 9, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel Updates

“Heathrow strikes: security staff announce summer of walkouts – More than 2,000 staff who scan bags and frisk passengers at the UK’s biggest airport will walk out for all but two of the busiest weekends of the year, the Unite union said yesterday. The 31 days of strike action, between June 24 and August 27, will affect passengers flying from terminals 3 and 5, the two busiest departure points. It raises the prospect of long delays for security screening during the school summer holidays and the August bank holiday weekend.”, The Times of London, June 8, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Africa

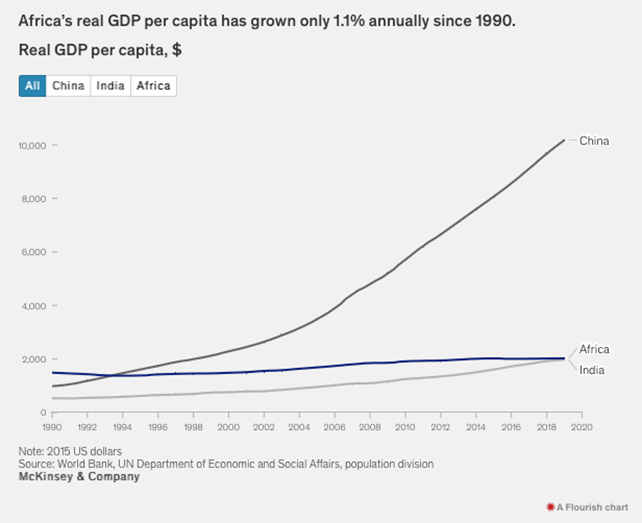

“Reimagining economic growth in Africa: Turning diversity into opportunity – Africa’s economy downshifted over the last decade, yet half of its people live in countries that have thrived on the continent. Africa has the human capital and natural resources to accelerate productivity and reimagine its economic growth, which is, more than ever, vital for the welfare of the world.”, McKinsey & Co., June 5, 2023

Australia

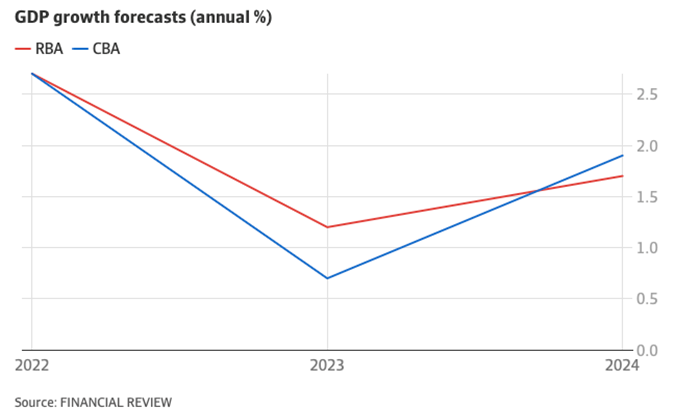

“CBA cuts growth forecasts, places odds of recession at 50pc – Economists are warning of the serious risk of recession this year after sticky inflation and concerns about wages fuelling price pressures forced the Reserve Bank of Australia to lift interest rates and flag more rises to come. Commonwealth Bank of Australia and HSBC economists now both put the odds of a recession at 50 per cent, after cutting their economic growth forecast in response to the RBA raising the cash rate a quarter percentage point to 4.1 per cent on Tuesday.”, Australia Financial Review, June 9, 2023

Canada

“Canada lost 17,000 jobs in May, bringing interest rate hike into question – The drop was driven largely by a fall in youth employment, as 77,000 people between the ages of 15 and 24 lost their jobs. The lacklustre jobs report raised questions over whether the Bank of Canada may have acted too quickly in raising interest rates Wednesday, some economists suggested.”, The Toronto Star, June 9, 2023

“Complexities of international sanctions – Canada is increasingly using international trade sanctions. These sanctions target foreign individuals and entities, and compliance has become increasingly complex and important for companies operating abroad. What happens when you have been added to a sanctions list and want to be removed? We consider below two recent cases on this topic.”, Dentons, June 7, 2023

China

“China’s Services Sector Continues to Rebound Faster Than Industrial Sector – The combined profits of major state-owned industrial companies declined 17.9% year-on-year in the first four months, the National Bureau of Statistics (NBS) reported May 27. Over the same period, total profits of state-owned enterprises (SOEs) in all sectors climbed 15.1%, the Ministry of Finance said the following day. Since the beginning of 2023, the year-on-year growth of the service production index published by the NBS has been consistently higher than increases in industrial value added.”, Caixing Global, May 31, 2023

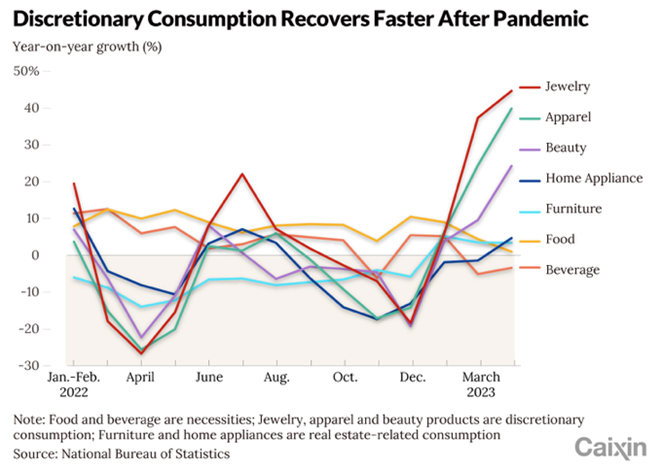

“Where Are Chinese Consumers Willing to Spend? Chinese consumers are resuming spending on travel and dining out but are not buying necessities and other consumer goods as much as before the pandemic. Spending on services was the main driving force for the first-quarter rebound in consumption. Retail sales of consumer goods in the first quarter rose 5.8% year-on-year, significantly rebounding from a decline of 2.7% in the fourth quarter of 2022, data from the National Bureau of Statistics (NBS) showed. Per capita spending on services grew 6.2% year-on-year in the period, faster than overall consumption growth, a report by KPMG showed.”, Caixing Global, June 8, 2023

“U.S. Business Interest In China Is Slowly Recovering, Ex-American Diplomat Says – Strained relations between Washington and Beijing appear to be stabilizing, a shift that is stirring renewed business interest in China among U.S. companies, a former long-term U.S. diplomat who is the current chairman of the American Chamber of Commerce in Shanghai told Forbes on Tuesday. ‘There are some positive signs in the relationship, particularly the high-level contact among the two countries’ economic officials,’ said Sean Stein in Beijing via Zoom. That advance, however, is constrained by continuing concerns about security issues and the economic outlook, he added.”, Forbes, June 7, 2023

European Union

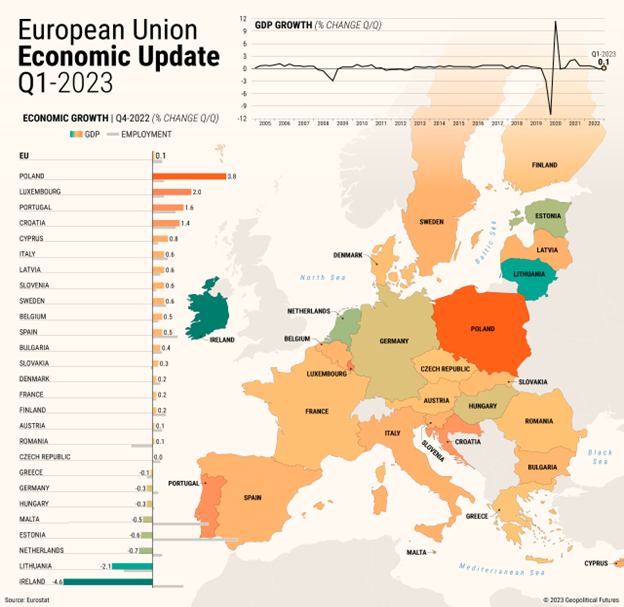

“Europe’s Economy at a Standstill – Ukraine and uncertainty about prices remain the major obstacles to EU growth. The European Union as a whole achieved slight economic growth in the first quarter of the year, but weaknesses abound……Poland recorded 3.8 percent growth compared with final quarter of 2022, powered by household consumption and exports. The war and uncertainty about prices remain the major obstacles to European growth. On the other hand, employment is still rising and energy prices have returned to Earth.”, Geopolitical Futures, June 9, 2023

Latin America

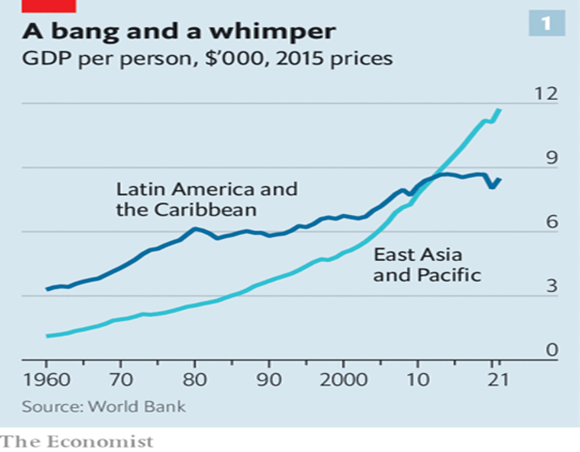

“Why are Latin American workers so strikingly unproductive? Blame education, corruption and a huge shadow economy. In 1962 Latin America’s income per person was three times that of East Asia. By 2012 both regions had the same level. By 2022 East Asia’s was roughly 40% higher than Latin America’s (see chart 1). When the differences in purchasing power are taken into account, Latin Americans’ gdp per person has been stuck at little more than a quarter of that of their neighbours in the United States for the last three decades. According to the World Bank, between 2010 and 2020 Latin America was the world’s slowest-growing regional economy.”, The Economist, June 8, 2023

India

“India Inflation Cools to 25 Month Low of 4.25% in May – India’s retail inflation cooled faster-than-expected in May, providing relief to policymakers even as risks from an uneven monsoon remain. Food prices, which make for about half of the index, rose 2.91%, while fuel and light prices gained 4.64%. Clothing and footwear prices increased 6.64% and housing prices rose 4.84%. Core inflation, which strips volatile food and fuel prices from the headline, moderated to 5.11%, from 5.30% in April.”, Bloomberg, June 12, 2023

Italy

“Baby bust: Italy faces a ‘demographic winter’ – Alarmed by the falling birth rate, the government is trying to entice women into having children. But many are sceptical of the approach. Low birth rates — and greying populations — are a concern for many advanced economies, including European nations and Japan as well as China, now confronting the fallout from its draconian one-child policy. Challenges of older populations include pressure on state pension schemes; strained national healthcare systems; potential hits to sovereign credit ratings; and pervasive labour shortages as employers struggle to find manpower, including care for the elderly. Italy’s demographic crisis, though, is among Europe’s most acute — the result of decades of economic stagnation and political indifference to women’s aspirations.”, The Financial Review, June 7, 2023

United Arab Emirates

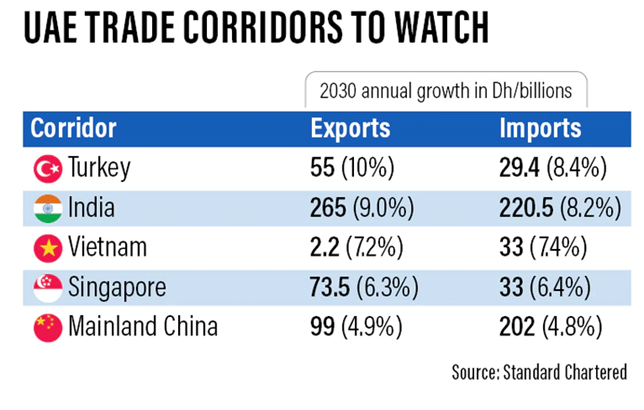

“UAE exports forecast to reach $545bn by 2030, Standard Chartered says – The Emirates’ progressive policies are supporting trade growth, with India to remain largest partner. The country’s exports are projected to increase by 5.5 per cent annually, with metals and minerals (accounting for 73 per cent of exports by 2030) and plastics and rubbers set to drive growth, Standard Chartered said in a report on Thursday.”, The National News, June 1, 2023

United Kingdom

“Britain to steer clear of recession – Britain will avoid a recession this year, according to new forecasts, as energy prices retreat and supply chain disruption abates. Economists warned that companies and consumers were still in for a tough year, however, with stubborn levels of inflation raising the risk of more pain for borrowers while the Bank of England battles to reduce it. KPMG no longer expects a recession in the UK this year, forecasting that gross domestic product will rise by 0.3 per cent.”, The Times of London, June 12, 2023

“Regional workers back in the office four days a week – Office occupancy outside London is back to 93 per cent of pre-pandemic levels, with workers turning up for an average of four days a week. The latest survey from Regional Reit, the owner of 154 largely office properties, found that 65 out of 100 desks were occupied during business hours compared with 70 out of 100 before Covid. Stephen Inglis, chief executive of the company’s asset manager, London & Scottish Property Investment Management, said he was seeing “a steadily improving environment with more people back in the office”. He said the finding that regional workers were back for an average of 4.2 days a week came as a pleasant surprise for his business. “I was expecting three to four days”, he said.”, The Times Of London, June 7, 2023

United States

“The Global Brands Coming to a (U.S.) Shopping Mall Near You – Some retailers now view U.S. expansion as the surest way to boost revenue amid a shaky global economy. American consumers have long been renowned for their spending power. Now global retailers want a bigger slice of the action. Once wary of America, foreign fashion brands such as Mango, Uniqlo and Zara are joining retail giants including Lego and IKEA in pursuing major U.S. expansions. Executives say they are encouraged by the country’s upbeat economic prospects relative to other parts of the world, and a growing sense that American shoppers have become more receptive to new brands.”, The Wall Street Journal, June 7, 2023

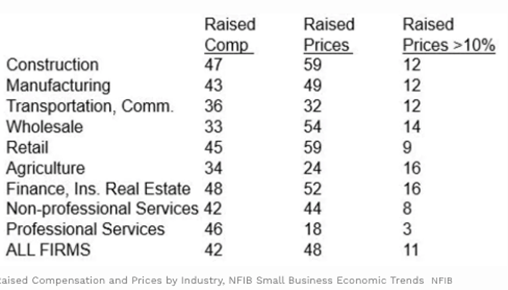

“Who Is Raising Wages On (U.S.) Main Street? The share of firms raising worker compensation reached record-high levels in the past few years, reaching 51% in June 2022. The most difficult cost to cut is compensation. It is also the largest cost for most small employer firms. When the costs of non-compensation inputs fall, the benefit drops to the bottom line and can be passed on to customers by reducing selling prices. Competition is the force that gets this to happen. But when those cost inputs fall because of a slowing economy, wages generally stay the same; they are commitments made to individuals.”, Forbes, June 9, 2023

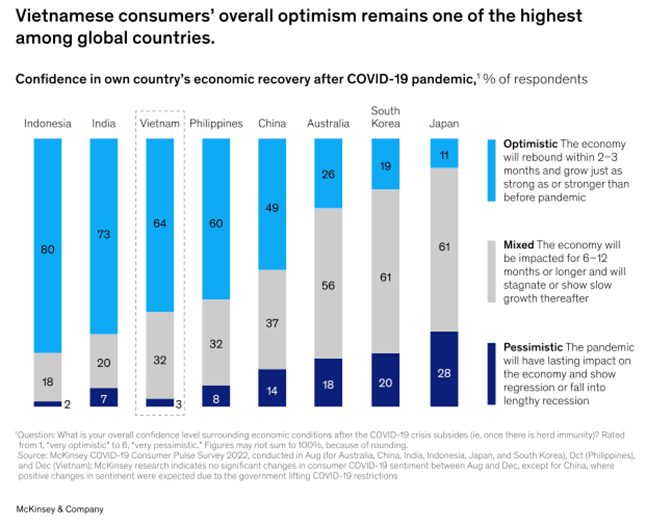

Vietnam

“Vietnamese consumers are coming of age in 2023: How businesses can stay ahead – For the past few years, the middle class in Vietnam has been on the rise, spreading out geographically and growing increasingly diverse.1 Consumers are growing in number and becoming more demanding and discerning. It is estimated that more than half of the Vietnamese population will enter the global middle class by 2035, creating more disposable income and fueling consumption.”, McKinsey & Co., May 26, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“What Covid Has Taught Us: 5 pandemic lessons for franchising – March marked the third anniversary of the global Covid-19 pandemic, and while many of us are keen to move forward, it’s important for businesses to reflect on the takeaways and build on lessons learned through our shared, global experiences.”, Franchising.com article by Catherine Monson, June 7, 2023

“Sweetgreen Stores Are Expected To Be Completely Automated In 5 Years – Dubbed the “Infinite Kitchen,” the chain has been testing a 100% robotic production line that assembles all of Sweetgreen’s orders from start to finish. Prep is still human-orchestrated, as employees make the ingredients, but robots are assembling those ingredients in the bowls. The first Infinite Kitchen prototype opened less than a month ago in Naperville, Illinois, and if it’s any indication of what’s to come, Sweetgreen is thrilled. So far, it isn’t affecting the overall customer experience, and it’s reportedly saving the chain big money.”, Tasting Table, June 10, 2023

“Starbucks says on track to meet 9000 store goal on Chinese mainland – Starbucks’ new global CEO Laxman Narasimhan on Tuesday highlighted China’s huge market potential and suggested the company’s goal of opening 9,000 stores on the Chinese mainland by 2025 remained unchanged. China’s per capita coffee consumption is increasing but still lags far behind Japan and the United States, thus leaving much room for business growth, Narasimhan said during his visit to Shanghai, home to more than 1,000 Starbucks stores, which is more than any other city in the world. The US coffee giant opened its first store on the Chinese mainland in 1999. As of April 2, it had operated over 6,200 stores across 244 cities on the Chinese mainland.”, Shine.con, May 30, 2023. Compliments of Paul Jones, Jones & Co., Toronto

“Starbucks’ China rival Luckin Coffee opens 10,000th shop amid fight for expected 1 trillion yuan market. Luckin Coffee opened 1,137 stores in the first quarter, beating Starbucks, which opened 153 and trails the domestic chain by more than 3,700 locations. Luckin recorded first-quarter revenue of 44.4 billion yuan (US$6.2 billion), with a net profit of 564.8 million yuan. The company, which was formerly listed on the Nasdaq before a scandal forced it to delist, accomplished the 10,000-store milestone within six years. It had already surpassed Starbucks in terms of total stores in China in 2021.”, South China Morning Post, June 7, 2023

“Pizza Hut Australia Purchased by US Group That Owns Taco Bell, Wendy’s Locations – Flynn Restaurant Group expects to gain $300 million in sales The deal marks the company’s first international acquisition. The San Francisco-based group already owns 945 Pizza Huts in its home market. The acquisition will give Flynn about 2,600 locations across the two countries and boost annual sales to roughly $4.5 billion from $4.2 billion. Flynn says it is the largest franchise operator in the world, with a portfolio of restaurants that includes Applebee’s, Taco Bell, Panera Bread, Arby’s and Wendy’s locations in 44 US states.”, Bloomberg, June 7, 2023

“Subway threatens to yank run-down stores from franchisees as company searches for buyer – Subway has ordered some franchisees to spend as much as $100,000 on remodeling their sandwich shops as the company scrambles to sell itself — and is threatening to take away their stores if they don’t comply, The Post has learned. The struggling fast-food giant — which has faced a lackluster response as it attempts to auction the chain for $10 billion, according to sources — is meanwhile demanding that some franchisees make major investments to upgrade their shops in a matter of months, sources said.”, The New York Post, June 11, 2023

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

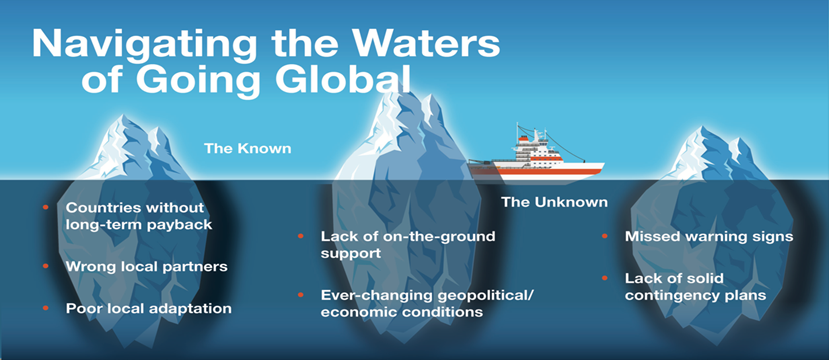

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant taking 40 franchisors global.

For a complimentary 30 minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link: