EGS Biweekly Global Business Newsletter Issue 107, Tuesday, April 30, 2024

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Comments About This 107th Issue: AI tools, global patents and developments around the world. Political stability in Italy. Global coal production continues to rise. International business travel is definitely back. And business news from Argentina, Canada, China, Italy, Mexico, New Zealand, Turkey, the United Kingdom and the USA.

Edited and curated by: William (Bill) Edwards, CEO & Global Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA. Contact Bill with any questions, comments and contributions.

Bedwards@edwardsglobal.com, +1 949 375 1896

The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business. Some of the information sources that we provide links to require a paid subscription for our readers to access.

First, A Few Words of Wisdom From Others For These Times

“The greatest enemy of knowledge is not ignorance, it is the illusion of knowledge”, Stephen Hawking and Daniel J. Boorstin

“We make a living by what we get. We make a life by what we give.”, Winston Churchill. Compliments of Neil Sahota

“You are never too old to set another goal or to dream a new dream.” — C.S. Lewis

Highlights in issue #107:

- Brand Global News Section: Red Lobster®, Snap Fitness® and Tropical Smoothie®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

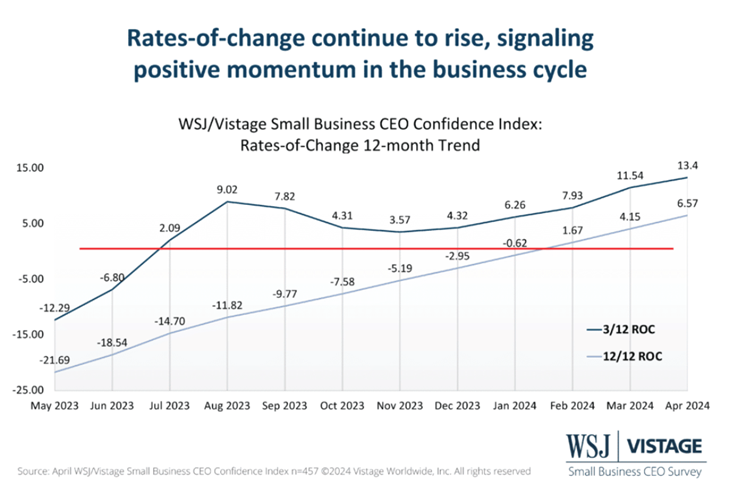

“Vistage U.S. Small Business Index – Each month, we share the insights of small businesses with the understanding that the sentiment captured in the WSJ/Vistage Small Business CEO Confidence Index predicts economic changes. This month, we see a slight decline in the overall Index, but the trend remains above last year.”, Vistage, April 24, 2024

“I Tried These AI-Based Productivity Tools. Here’s What Happened – Hoping to make life easier, I tested six AI-powered tools meant to help me write better and work smarter. Every writer I know is talking about AI tools and whether they’re ethical to use. But what’s just as interesting to me is why we’re so enamored with them even if they produce outrageous or below-average results. Why do we chase the shiny new thing even if it’s not better, faster, or cheaper? This year my LinkedIn feed has been full of posts touting the best new AI tools for doing absolutely everything, and I’ve already fallen for too many new thing even if it’s not better, faster, or cheaper?”, Wired magazine, April 2024

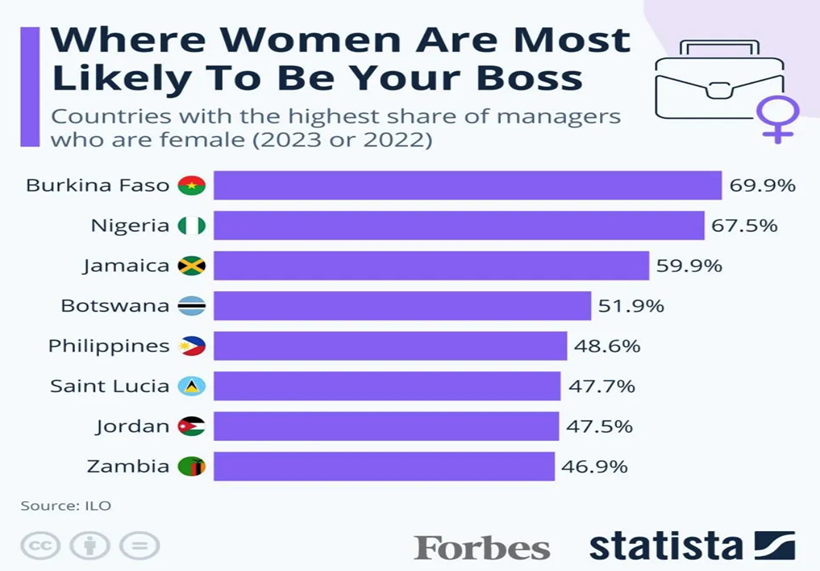

“Where Women Are Most Likely To Be Your Boss – The latest data from 2022 and 2023 shows that in Burkina Faso and Nigeria, between 67% and 70% of all managers are women. Jamaica and Botswana are the only other countries with available data listing more female than male managers, at around 60% and 52%, respectively. More countries with a high share of women in managerial positions are the Philippines and Caribbean island nation Saint Lucia as well as Jordan and Zambia. The share of female managers is also high in Eastern Europe at almost 42% as of 2022, North America at around 40%, Southeast Asia at around 39% and Northern Europe at approximately 38%. The MENA region had the lowest share of managers who are women at just over 15%. Yet, Jordan is featured among the countries with the most female managers, again due to female-centric fields.”, Forbes, April 23, 2024

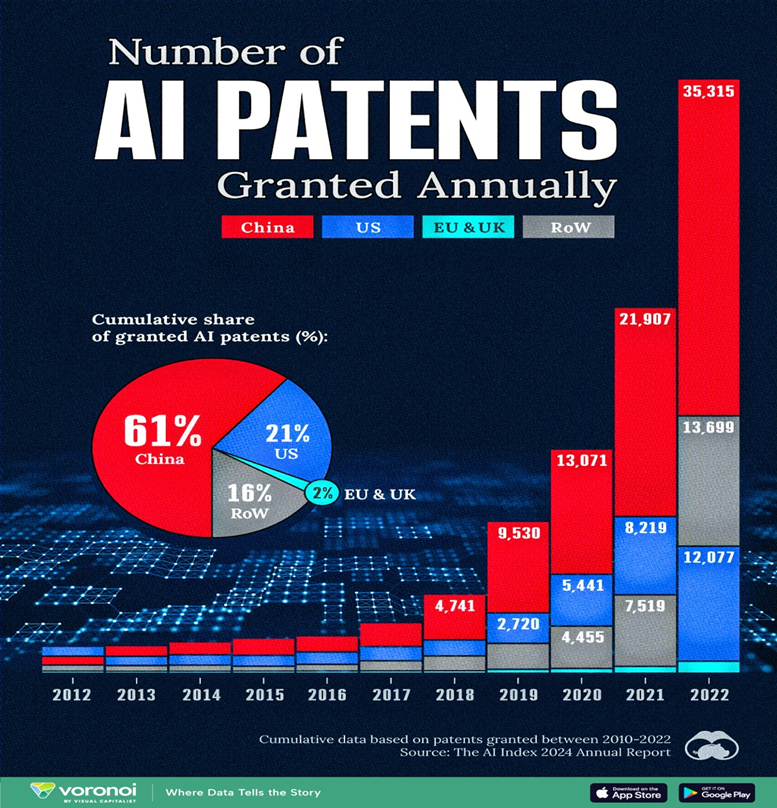

“AI Patents By Country – This infographic shows the number of AI-related patents granted each year from 2010 to 2022 (latest data available). These figures come from the Center for Security and Emerging Technology (CSET), accessed via Stanford University’s 2024 AI Index Report. From this data, we can see that China first overtook the U.S. in 2013. Since then, the country has seen enormous growth in the number of AI patents granted each year. In 2022, China was granted more patents than every other country combined. While this suggests that the country is very active in researching the field of artificial intelligence, it doesn’t necessarily mean that China is the farthest in terms of capability.”, Visual Capitalist, April 24, 2024

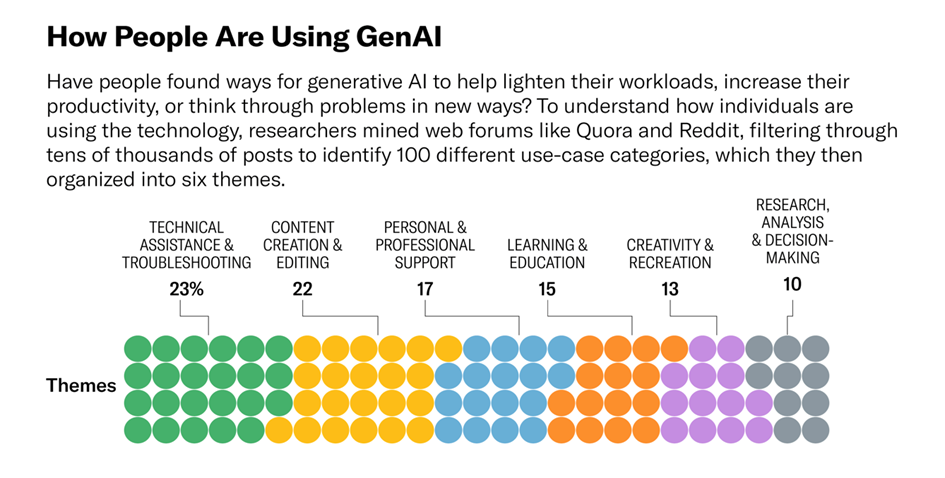

“How People Are Really Using GenAI – There are many use cases for generative AI, spanning a vast number of areas of domestic and work life. Looking through thousands of comments on sites such as Reddit and Quora, the author’s team found that the use of this technology is as wide-ranging as the problems we encounter in our lives. The 100 categories they identified can be divided into six top-level themes, which give an immediate sense of what generative AI is being used for: Technical Assistance & Troubleshooting (23%), Content Creation & Editing (22%), Personal & Professional Support (17%), Learning & Education (15%), Creativity & Recreation (13%), Research, Analysis & Decision Making (10%).” Harvard Business Review, March 19, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation, Taxes & Trade Issues

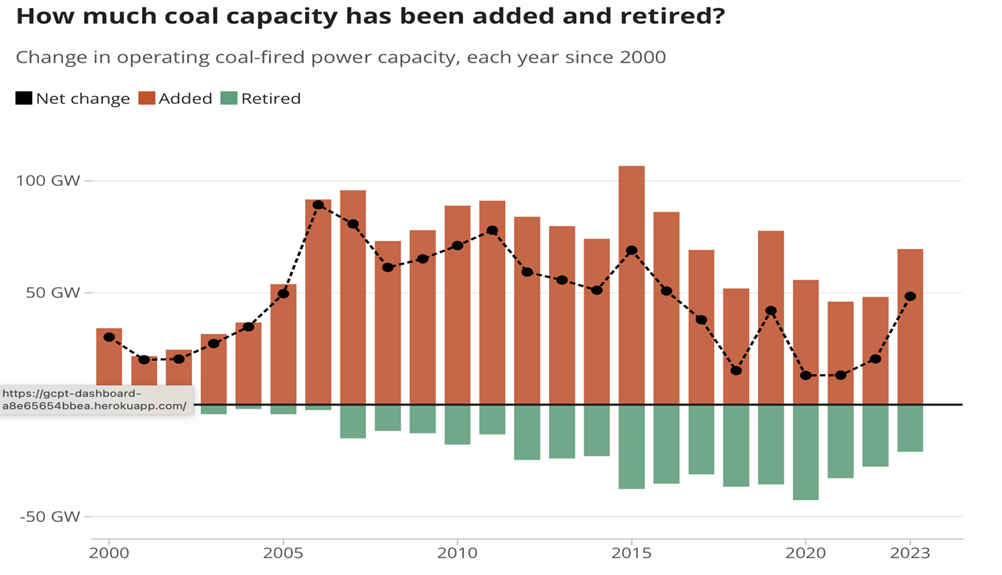

“Global operating coal power capacity increased 2% in 2023 and 11% since 2015. 2,130 gigawatts (GW) operating coal power capacity. An increase of 217 GW coal power capacity since 2015. And 578 GW new coal power capacity currently under development.”, Global Energy Monitor, January 2024

“Asia Has a Strong Dollar Problem Stretching Far Beyond Japan – Strong dollar means Asian central banks likely to delay easing Swaps suggest dovish bets for Korea, Malaysia scaled back. Investors are looking for the next policy domino to fall in Asia amid an escalating campaign against a resurgent dollar, after Indonesia used a surprise interest rate hike to defend the rupiah. The currencies of Japan, South Korea, Thailand, Taiwan, Malaysia, the Philippines and India are all trading within sight of multi-year lows, raising the odds for local authorities to take firmer action to stem the slide. Won and ringgit swaps, for example, are already pricing in a less dovish stance by the two local central banks.”, Bloomberg, April 24, 2024

“Suez trade plunges after war forces ships to reroute – Containers’ trip round Cape of Good Hope adds 20 days to journey. A substantial share of containers pass through the Red Sea, carrying everything from commodities to consumer goods. An escalation in tensions in the region prompted carriers to reroute their vessels around the Cape of Good Hope. The ONS said there had been an annual 57 per cent increase in the number of ships passing through the alternative and longer trade route……the average price of a container has leapt to $2,719 in April from $1,390 in early October, although that is down from a recent peak of nearly $4,000 in January and nowhere near the levels hit in the aftermath of the pandemic.”, The Times of London, April 25

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel

“Hilton Sees Full Corporate Travel Rebound in Hotel Stays in 2024 – Hilton has ridden high on a surging wave of vacationers. But executives at the hotel giant now see the return of corporate trips and conferences as powering the next phase of its growth. Executives predicted Wednesday that occupancy by corporate road warriors and conference-goers would fully recover to pre-pandemic levels soon. ‘By the end of the year from a demand point of view, we think there’s an awfully good chance that BT [business travel] will get there, too,’ said Christopher Nassetta, president and CEO. ‘Just given continued growth in the big corporates and very resilient SMB [small-and-medium-sized] businesses.’”, Skift, April 24, 2024

“Welcome Back, Road Warriors: Business Travel Returns – Airlines, hotels say work trips are rebounding to near prepandemic levels—‘they’re hungry to meet in person’. Videoconferencing hasn’t made in-person meetings obsolete. Scattered workforces have in some cases resulted in more trips, not fewer. Companies are sending employees back on the road again, driving business travel closer to prepandemic levels. The banks, tech companies and consultants who are among the travel industry’s most lucrative customers are hitting the road again. Airlines reported big increases in revenues from corporate accounts in the first quarter, with Delta and United both reporting a 14% bump from a year ago.”, The Wall Street Journal, April 28, 2024

“India’s Hotel Boom: Latest Investments from Marriott, Hilton and Other Chains – The world’s biggest hotel chains are doubling down on India, betting that the country’s rising affluence will fuel a surge in travel demand for years to come. In the past six weeks, all the global hotel groups — including Marriott International and Hilton Worldwide — have unveiled ambitious expansion plans in India. They see a golden opportunity to establish a bigger foothold on the subcontinent in what may become the world’s third-largest economy as soon as 2027.”, Skift, April 27, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Africa

“For Multinationals, Africa’s Allure Is Fading – After decades of optimism about the region, global giants such as Bayer, Nestlé and Unilever are cutting back. Drawn by rapid growth, youthful populations and increasing wealth, legions of top multinationals rushed into Africa in recent decades. But lately, the difficulties of doing business there—cratering currencies, overweening bureaucracies, unreliable power and congested ports—have dimmed the allure. ‘It doesn’t justify the effort,’ says Kuseni Dlamini, a former chairman of Walmart Inc.’s African unit who now heads the American Chamber of Commerce in South Africa.”, Bloomberg, April 16, 2024

Argentina

“Argentina President Announces First Quarterly Fiscal Surplus in 16 Years – Argentina reached a fiscal surplus of 0.2% of gross domestic product due to severe spending cuts and the halting of public works, marking the country’s first quarterly fiscal surplus since 2008. Since taking office in December 2023, Milei’s government has focused on spending cuts and freezes to reduce the country’s very high inflation rates. While the plan is working, inflation is falling at the cost of a severe reduction in Argentines’ purchasing power, leading to a contraction in economic activity.”, Stratfor Worldview, April 23, 2024

Canada

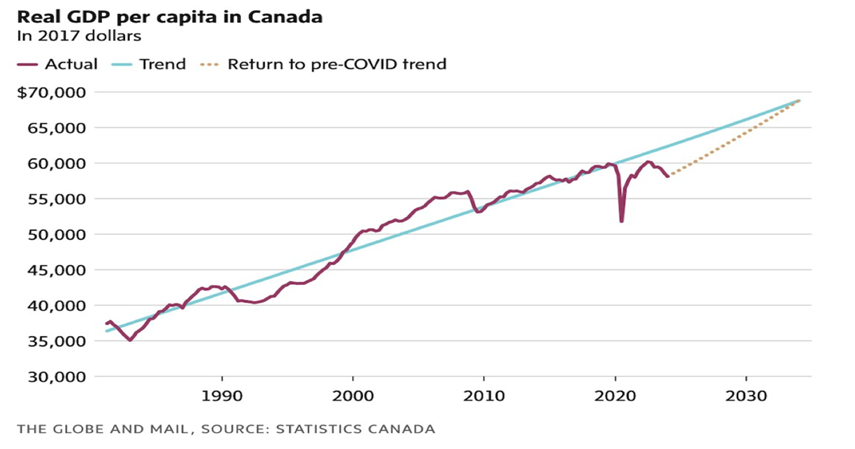

“Canada’s per capita output drops 7% below trend – To return to trend over the next decade, real gross domestic product per capita would need to grow at an average annual rate of 1.7 per cent – similar to the robust expansion in the United States in recent years. Real GDP per capita has fallen to levels seen in 2017. For decades, Canada has struggled with lacklustre capital investment. A Statscan report published in February noted that investment per worker in 2021 was 20 per cent lower than in 2006.”, The Globe and Mail, April 24, 2024

China

“China’s consumers seek security in ‘the only safe asset’ as gold purchases remain strong – Consumers in China bought 308.9 tonnes (10.9 million ounces) of gold in the first quarter, representing a 5.9 per cent increase compared with the same period in 2023, according to data released by the China Gold Association on Friday. ‘Gold represents the only safe asset for [Chinese consumers] to protect their wealth against domestic inflation, asset price declines as well as against geopolitical risks,’ said Chen Zhiwu, the chair professor of finance at the University of Hong Kong. ‘I expect Chinese household demand for gold to rise more in the future. And the Chinese central bank will also continue to purchase more gold to prepare for more geopolitical turmoil ahead.’”, The South China Morning Post, April 29, 2024

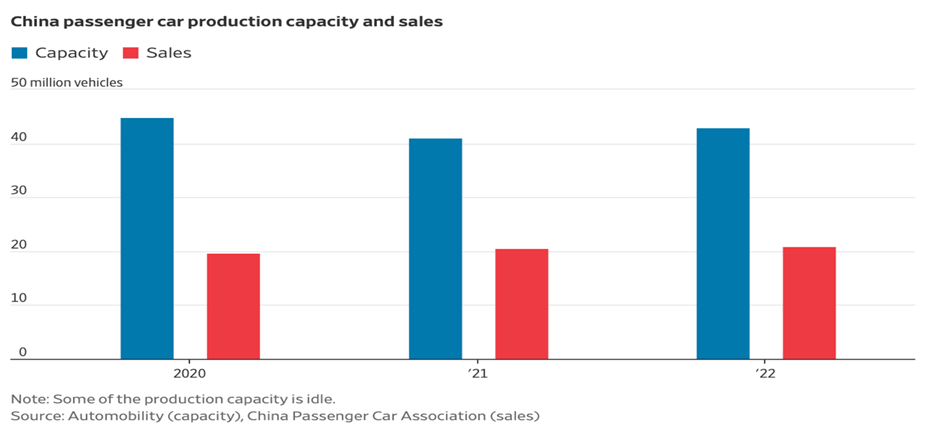

“Why China Keeps Making More Cars Than It Needs – China has the capacity to produce roughly two times as many cars as it sells at home each year. Despite overcapacity, government officials keep supporting automakers. China has a long history of auto overcapacity, with more than 100 domestic brands churning out more vehicles than the country’s drivers buy each year. China currently has the capacity to produce some 40 million vehicles a year, though it sells only around 22 million cars domestically, according to capacity data from Shanghai-based strategy firm Automobility and sales figures from the China Passenger Car Association.”, The Wall Street Journal, April 28, 2024

Italy

“Political stability gives Italy a chance to step into the spotlight – Historically, Italy’s political scene has been highly mercurial. But is it possible that politics in Rome is, dare it be said, boring now? Not exactly. Still, today’s political dynamics in Italy are not what international observers, or even Italians, may be used to. True, the country’s economic prospects remain weak, but Italy is living through a period of relative political stability under the government of Prime Minister Giorgia Meloni. This stability makes Italy well placed to push forward its foreign policy priorities and leadership.”, The Atlantic Council, April 24, 2024

Mexico

“Why tech firms are investing in Mexico – As the US seeks to decrease its dependence on China, investments in Mexico are making the country a hot destination for AI hardware. Amidst an ongoing chip war between the US and China, investments in Mexico are making the country a hot destination for hardware manufacturing in the AI space. At the request of AI companies in the US, Taiwan-based companies are ramping up production efforts in Mexico….A 2020 free-trade agreement between the US, Mexico, and Canada has brought in billions from manufacturing companies “aiming to move operations from China to Mexico.”, IT Brew, April 24, 2024

Turkey

“Turkey’s ‘Orthodox’ Pivot Makes Lira a Favorite for HSBC – Turkey’s return to a more conventional approach to monetary policy is boosting investor confidence, setting the stage for capital inflows and underpinning HSBC Holdings Plc’s bullish stance on the nation’s assets. Raising the benchmark interest rate and “normalizing” monetary policy have been at the center of a policy overhaul. Officials have previously said they see Turkish headline inflation peaking at around 75% in the coming months.”, Bloomberg, April 24, 2024

United Kingdom

“Canary Wharf dangles £150m to convince Morgan Stanley to stay put – After exits of high-profile companies, owner of financial district agreed to pay towards refurbishment costs to keep US bank as a tenant. In return, the US bank has removed a break clause, in effect committing to its European headquarters until 2038; its lease had originally been due to expire in 2028. Canary Wharf has become a poster child for the turmoil in the office market, which has been hit hard by rises in interest rates and fears over the impact of flexible working. The decisions of both HSBC and law firm Clifford Chance to ditch their offices at Canary Wharf for buildings in the City have handed more negotiating power to the estate’s remaining tenants.”, The Times of London, April 27, 2024

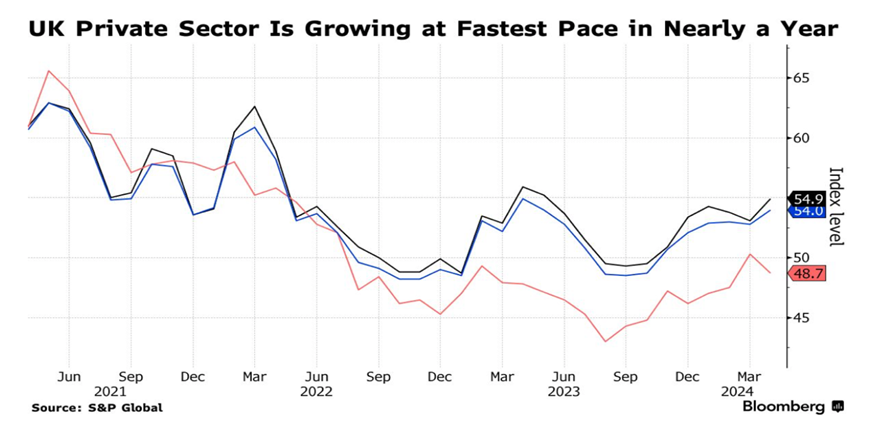

“UK Recovery Gains Pace as PMI Beats Forecast – PMI composite gauge rises to 11-month high of 54 in April Pound rises as traders reduce wagers on scope for rate cuts. The UK economy’s recovery from recession unexpectedly gathered pace at the start of the second quarter as private-sector firms reported the strongest growth in almost a year.

S&P Global’s purchasing managers’ index rose to a stronger-than-expected 54 in April, an 11-month high and a jump from 52.8 the previous month. The pound rose. Firms responded by boosting hiring by the most for nine months. They also reported the strongest cost pressures in 11 months, particularly from staff wages after a near 10% in the minimum wage took effect in April.”, Bloomberg, April 23, 2024

United States

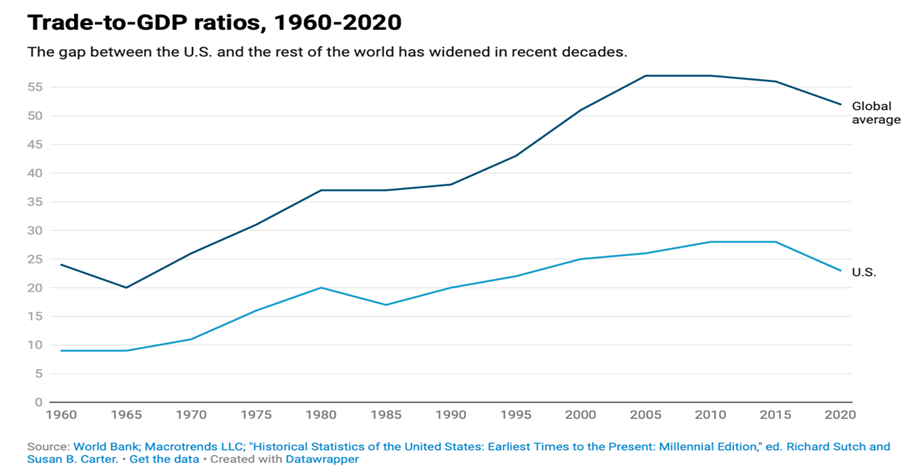

“The US is one of the least trade-oriented countries in the world – despite laying the groundwork for today’s globalized system – In 2022, the U.S. trade-to-GDP ratio was 27%, according to the World Bank. That means the total value of U.S. imports and exports of goods and services combined equaled 27% of the country’s GDP. That’s far below the global average of 63%. In fact, of the 193 countries examined by the World Bank, only two were less involved in international trade than the U.S. Those were Nigeria, at 26%, and Sudan at 3%. Most world economic powers scored considerably higher, with Germany at 100%, France at 73%, the U.K. at 70%, India at 49%, and China at 38%.”, The Conversation, April 25, 2024

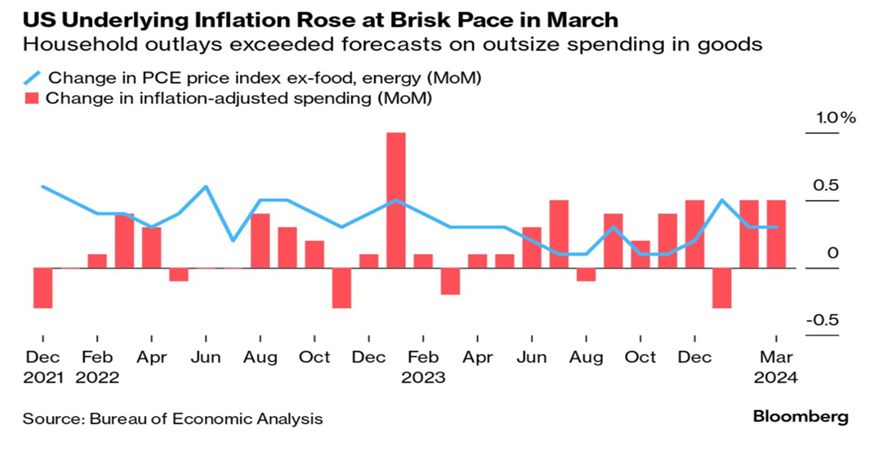

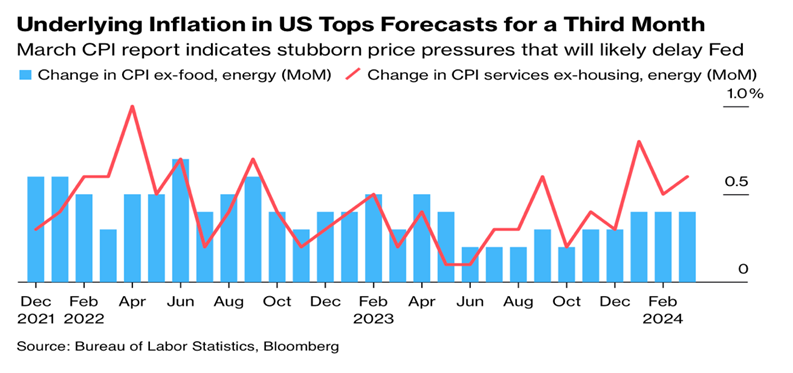

“US Goes From Soft Landing Back to Sticky Inflation – While the economy is still humming along by most metrics, gross domestic product slowed in the first quarter and the Federal Reserve’s preferred gauge of underlying inflation—the core personal consumption expenditures price index—rose in March (though in line with expectations). The Fed’s expected delay in cutting rates is rippling across world economies and markets—from equities to bonds and forex.”, Bloomberg, April 27, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“Blackstone to buy Tropical Smoothie Cafe in $2B deal – Levine Leichtman agrees to sell Atlanta-based 1,400-unit fast-casual brand. Blackstone said the deal for Atlanta-based fast-casual Tropical Smoothie Café LLC would be ‘the first transaction from Blackstone’s most recent vintage of its flagship private-equity vehicle’. Tropical Smoothie Cafe was founded in Destin, Fla., in 1997, and has grown to more than 1,400 locations in 44 states. It added 175 new restaurants in 2023, with 70% of those from existing franchisees, Blackstone said.”, Nation’s Restaurant News, April 24, 2024

“Fair deal for franchisees as Government announces visa changes – A change to the Accredited Employer Work Visa (AEWV) scheme announced today will mean the special franchisee accreditation category will be disestablished. Franchisees will be able to apply to bring in workers from overseas through the standard, high-volume, or triangular employment accreditation. The change, effective immediately, means that franchisees will no longer pay more for accreditation under the AEWV scheme. The previous scheme, introduced in July 2022, meant that franchisees had to pay up to five times the cost to employ the same employees as independently-owned businesses.”, Franchise New Zealand, April 7, 2024

“The bounceback is always stronger than the setback – Recent data at Snap Fitness 24/7 show that membership numbers are up across the globe. Over the past two years we’ve seen membership numbers rise by an average of 22% across our global footprint of Snap Fitness locations. It seems the entire industry is experiencing a boom. A new report from Deloitte and EuropeActive has revealed that revenue and membership numbers topped pre-pandemic numbers for European operators in 2023. The numbers speak for themselves, with fitness memberships up to almost 68 million in 2023 compared to 62.9 million in 2022, and operators experiencing a 14% rise in revenue as a result.”, LinkedIn post, April 29, 2024

“Red Lobster seeks a buyer as it looks to avoid bankruptcy filing – The company has considered filing for bankruptcy to help it restructure its debt and get out of a number of costly and lengthy leases, but it’s also sought a buyer in recent months, people familiar with the matter told CNBC. For the past decade amidst ownership changes, Red Lobster has taken on debt and entered into a number of long-term leases across its 700-plus locations, which have weighed on its balance sheet.”, CNBC, April 25, 2024

To receive our biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing business environment. And our GlobalTeam™ on the ground covering 25+ countries provide us with updates about what is actually happening in their specific countries.

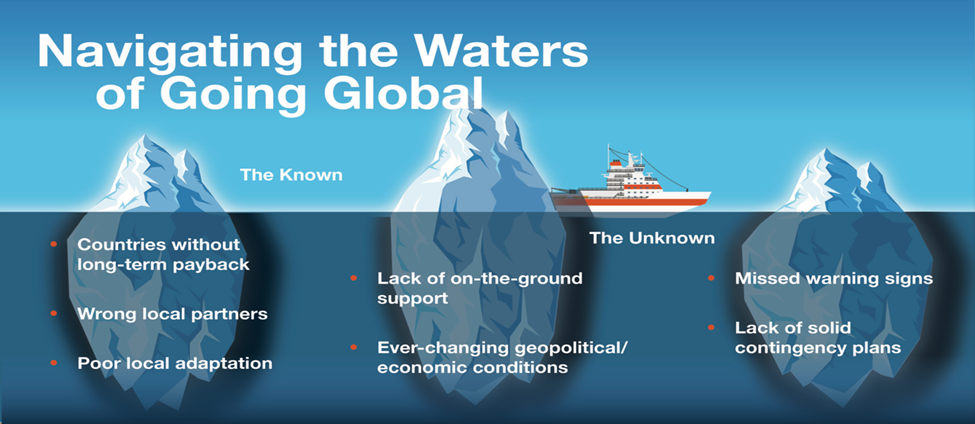

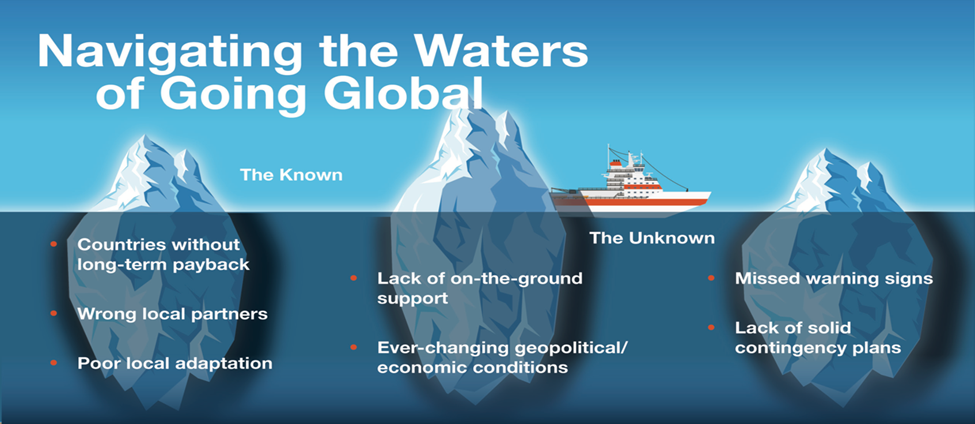

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant since 2001 taking 40+ franchisors global.

For a complimentary 30-minute consultation on how to take your business global successfully, click on the QR code or contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

And download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 106, Tuesday, April 16, 2024

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

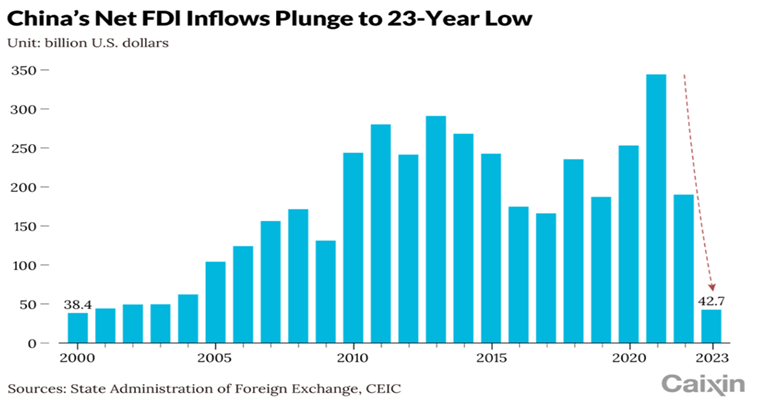

Some Introductory Comments For This 106th Issue: A definition of artificial intelligence (AI). Brazil will require bank statement to get a visa next year. An awesome quote from Yoda! The size of the rapidly growing global senior population. China’s Foreign Direct Investment is drying up. Global tourism continues to recover, but….Who runs the ‘Global South’? U.S. consumers are growing pessimistic about their economy while U.S. CEO are more optimistic (??). Private equity investment is about to massively change the U.S. franchise industry.

Edited and curated by: William (Bill) Edwards, CEO & Global Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA. Contact Bill with any questions, comments and contributions.

Bedwards@edwardsglobal.com, +1 949 375 1896

The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business.

Some of the information sources that we provide links to require a paid subscription for our readers to access. This means that some of the links to articles may not work if the reader does not have a subscription to that service. We maintain a paid subscription to ~30 information sources to be able to bring the reader the latest in global business trends.

First, A Few Words of Wisdom From Others For These Times

“Do or Do Not, There Is No Try.” – Yoda

“Do not squander time for that is the stuff life is made of.” – Benjamin Franklin

“The way to get started is to quit talking and begin doing.” – Walt Disney

Highlights in issue #106:

- Brand Global News Section: Body Fit®, Body Shop®, Jessey Mikes®, Little Chef® and Subway®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

Global Smartphone Market Share: Apple Steals the Crown by Less than 1%. Apple and Samsung nearly tied. The two companies are the dominant names in the global market, holding a 20.1% and 19.4% market share. In terms of growth from 2022, though, Apple managed +3.7%, while Samsung shrank by -13.6%. Chinese firms round out the top five.”, Visual Capitalist and International Data Corporation’s (IDC), April 10, 2024

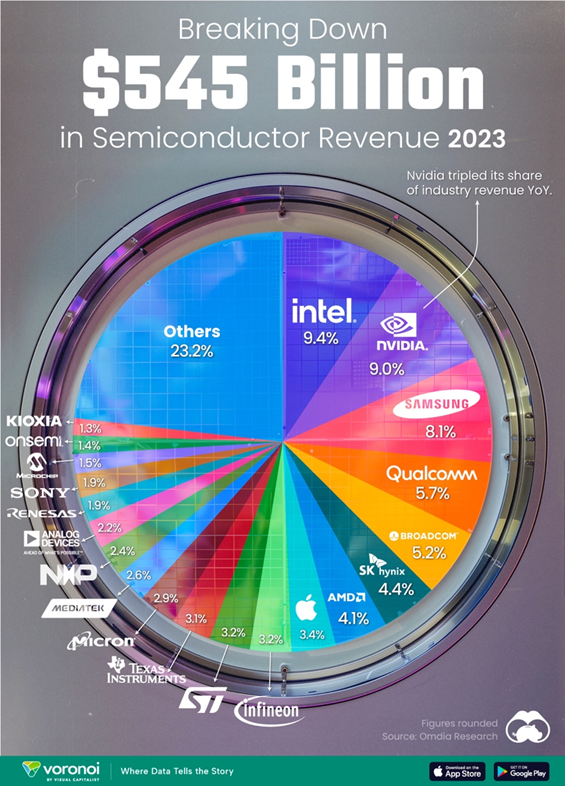

“Semiconductor Companies by Industry Revenue Share – Did you know that some computer chips are now retailing for the price of a new BMW? As computers invade nearly every sphere of life, so too have the chips that power them, raising the revenues of the businesses dedicated to designing them. But how did various chipmakers measure against each other last year? We rank the biggest semiconductor companies by their percentage share of the industry’s revenues in 2023, using data from Omdia research.”, Visual Capitalist and Omdia Research, April 9, 2024

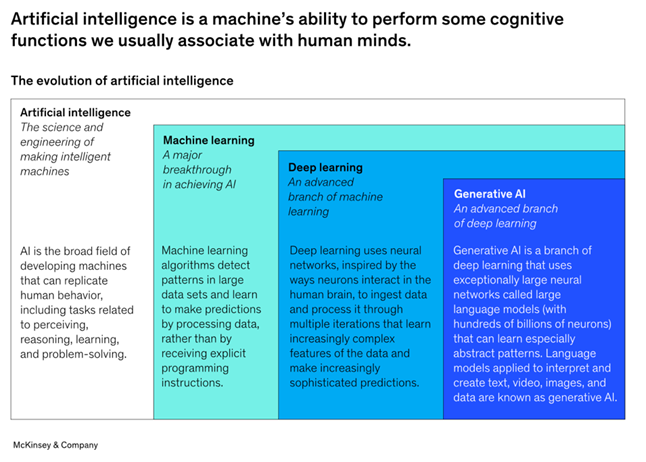

“What is AI (artificial intelligence)? – Artificial intelligence is a machine’s ability to perform some cognitive functions we usually associate with human minds. AI is a machine’s ability to perform the cognitive functions we associate with human minds, such as perceiving, reasoning, learning, interacting with the environment, problem-solving, and even exercising creativity. Machine learning is a form of artificial intelligence that can adapt to a wide range of inputs, including large sets of historical data, synthesized data, or human inputs.”, McKinsey & Co., April 3, 2024

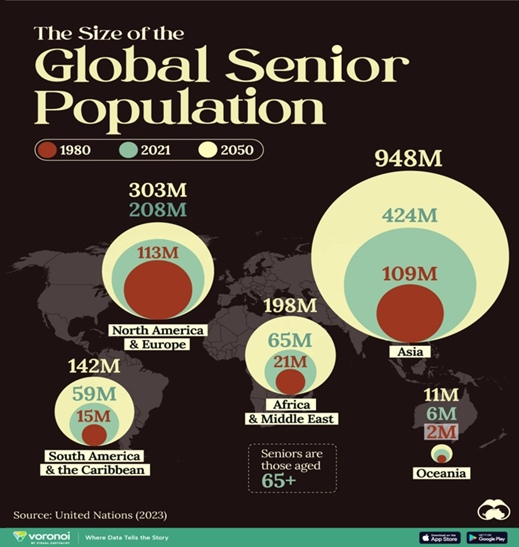

“Visualizing the Size of the Global Senior Population – The growth of the senior population is a consequence of the demographic transition towards longer and healthier lives. Population aging, however, can pose economic and social challenges. The data is from the World Social Report 2023 by the United Nations. Currently, population aging is most advanced in Europe, Northern America, Australia, New Zealand, and parts (of) Eastern and Southeastern Asia.”, Visual Capitalist and United Nations, April 4, 2024

“Economic conditions outlook, March 2024 – Executives’ latest views on the global economy and their countries’ economies lean much more positive than they did at the end of 2023. In the latest McKinsey Global Survey on economic conditions, the outlook on domestic conditions in most regions has become more hopeful, despite ongoing shared concerns about geopolitical instability and conflicts. In a year brimming with national elections, respondents increasingly see transitions of political leadership as a primary hazard to the global economy, particularly in Asia–Pacific, Europe, and North America. Furthermore, respondents now view policy and regulatory changes as a top threat to their companies’ performance, and they offer more muted optimism than in December about their companies’ prospects.”, McKinsey & Co., March 29, 2024

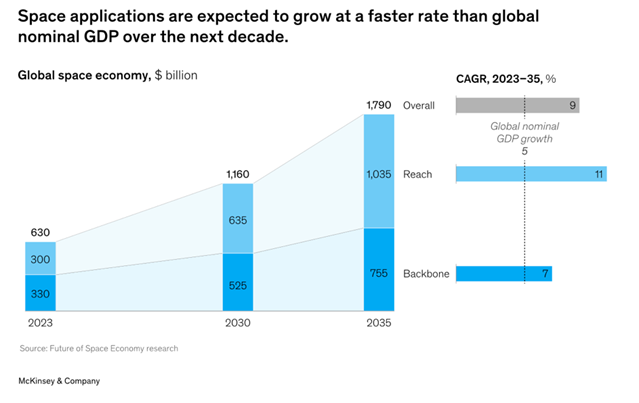

“Space: The $1.8 trillion opportunity for global economic growth – The space industry is approaching the next frontier, with each week bringing news of a major development somewhere in the world. Be it a test of a new rocket system, the launch of an innovative satellite, or a robotic exploration mission safely landing on the moon, activity in space is accelerating. We estimate that the global space economy will be worth $1.8 trillion by 2035 (accounting for inflation), up from $630 billion in 2023.”, McKinsey & Co., April 8, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation, Taxes & Trade Issues

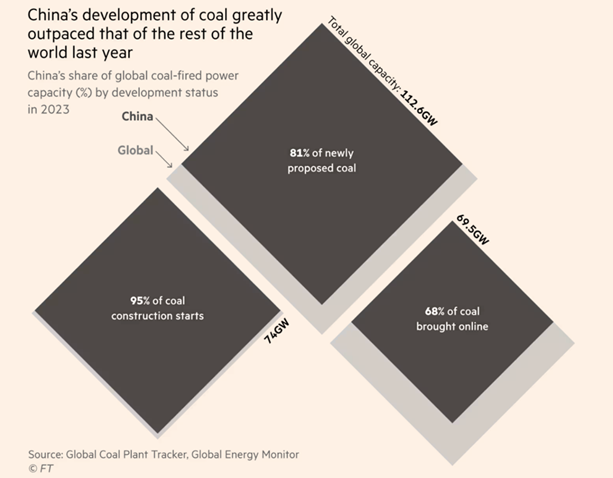

“World coal capacity growth jeopardises peak emissions forecasts – Global fleet increases in 2023 as China brings on new plants and the pace of closures slows in EU and US. The global coal fleet grew by 2 per cent last year, mainly driven by new capacity additions in China and a slow down of closures in the EU and the US, the latest data shows. The new data found that coal capacity outside of China increased for the first time since 2019, according to the non-profit research group Global Energy Monitor, as less coal power was retired than in any single year of the past decade. Outside of China, new coal power was brought online in Indonesia, India, Vietnam, Japan, Bangladesh, Pakistan, South Korea, Greece, and Zimbabwe.”, The Financial Times, April 11, 2024

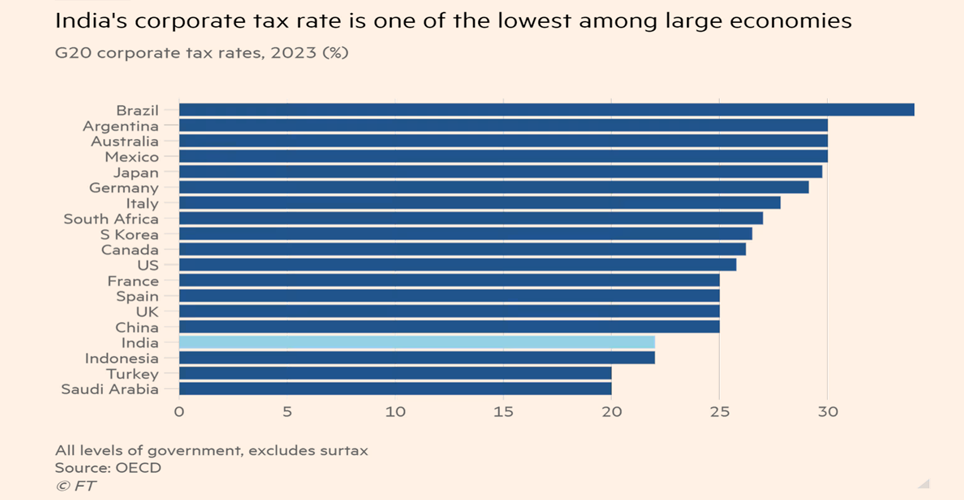

“Businesses bank on Narendra Modi election win to ease India’s bottlenecks – World’s most populous country is emerging as key market for investors but many companies remain tangled in red tape. But in private many businesses still complain about India’s complex tax regulation, difficulties in acquiring land, rigid labour laws, weak intellectual property enforcement and clogged courts. It takes almost four years to enforce contracts in business disputes, among the slowest globally, according to the World Bank. “Is the country better managed than it was decades ago? Undoubtedly so,” said a London-based executive with business in India. “Modi is a great marketer, but the ease of doing business is still not that easy at all.”, The Financial Times, April 15, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel

“Travel and Tourism Industry Poised to Break Records This Year – The World Travel & Tourism Council (WTTC) is predicting that 2024 will be a record-breaking year for the global travel industry, with an all-time high in global economic contribution and employment. The industry is expected to generate one in every 10 dollars worldwide, contributing $11.1 trillion to the global economy, according to WTTC’s 2024 Economic Impact Research. That’s $770 billion higher than its previous record.”, Travel Pulse, April 4, 2024

“This country will require Americans to show their bank statements to visit – If you want to travel to Brazil next year, you’ll need to share your bank statements with the South American nation first. Travelers from the U.S., Canada, and Australia will need to obtain a visa before entering the country, beginning April 10, 2025, according to a Brazilian government-authorized website. To complete the visa application, visitors must provide proof of income for travel by showing their last three checking or savings account statements or their six previous pay stubs.”, The Hill, April 14, 2024

“The World’s Top Flight Routes, by Revenue – In 2024, a record 4.7 billion people are projected to travel by air—200 million more than in 2019. While revenues surged to an estimated $896 billion globally last year, airlines face extremely slim margins. On average, they made just $5.44 in net profit per passenger in 2023. Today, the industry faces pressures from high interest rates, supply chain woes, and steep infrastructure costs. This graphic shows the highest earning flight routes worldwide, based on data from OAG.”, Visual Capitalist and OAG, April 9, 2024

“Global tourism is recovering, but for Asia it’s a mixed bag at best – Talk to the UN world tourism organisation – since January rebranded as UN Tourism – and the message is that international tourism is well on the road to recovery from the Covid-19 pandemic. But talk to tourism officials in Hong Kong, South Korea, mainland China or Thailand and the story is: not so fast. According to the UN’s Tourism Recovery Tracker, global tourism last year recovered to within 12 per cent of the pre-Covid level, and is forecast to fully recover this year. In Europe, by far the world’s largest tourism market, it is a story of strong recovery. Across Asia, the story is anaemic at best. And it is a story of new tourism markets and travel patterns, with much excitement focused on Saudi Arabia, the United Arab Emirates (UAE) and other Gulf economies.”, South China Morning Post, April 6, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Australia

“RBA won’t cut interest rates until 2025 – Australia is expected to be almost the last major advanced economy to deliver an interest rate cut, after hot US inflation caused professional investors to push out bets for a local monetary easing until early next year. The deferral of an expected rate reduction until February is later than the Albanese government had hoped as a federal election approaches.”, Australian Financial Review, April 12, 2024

Canada

“Canada Unveils Billions for Artificial Intelligence – Canadian Prime Minister Justin Trudeau on Sunday said his government would spend nearly $2 billion to help fuel growth in the country’s domestic artificial-intelligence sector, the latest in a series of multibillion-dollar announcements the Canadian leader has vowed won’t stoke a fresh round of inflation…..Trudeau said Canada would spend C$2.4 billion that would, among other things, help build data centers and servers and ensure access to the computer power required to conduct research in the AI field. A report from consulting firm Deloitte & Touche’s Canadian unit said venture-capital investment in Canada’s AI sector reached C$8.6 billion in 2023, adding Canada ranks third among Group of Seven countries in terms of per capita venture-capital AI investments, trailing the U.S. and U.K.”, The Wall Street Journal, April 7, 2024

China

“China Regrets Fitch’s Downward Revision of Its Outlook – The revision from stable to negative — regarding the rating outlook on China as a long-term foreign-currency debt issuer — was based on rising risks to the country’s public finances amid economic uncertainties and ‘a transition away from property-reliant growth to what the government views as a more sustainable growth model,’ Fitch said in a Tuesday commentary. ‘Wide fiscal deficits and rising government debt in recent years have eroded fiscal buffers from a ratings perspective,’ Fitch said. It maintained an ‘A+’ rating for China as a long-term debt issuer.”, Caixin Global, April 10, 2024

“China’s Mammoth Effort to Help Foreigners Spend, Spend, Spend – Regulators have been pushing banks and nonbank payment platforms, such as Alipay, owned by Ant Group Co. Ltd., and WeChat Pay, operated by Tencent Holdings Ltd.’s Tenpay Payment Technology Co. Ltd., to improve services for international visitors and make it easier for them to spend money. The campaign is part of a broader strategy to boost China’s attraction as a destination for overseas visitors and reverse a slump in foreign investment.”, Caixin Global, April 9, 2024

Southern Europe

“Southern Europe is the continent’s new economic growth engine – Southern European economies that were long sneered at by their richer northern neighbors have turned the tables as they cement their role as growth drivers in the sputtering euro area.Business surveys by S&P Global released this week showed Spain and Italy beat economists’ expectations with faster expansion in March. A manufacturing gauge for Greece indicated a similar trend. A tourism surge since the pandemic, booming exports, and lower energy prices thanks to renewables and limited reliance on Russian gas, have given so-called periphery countries on the Mediterranean the edge in the euro area. But the region’s relatively strong growth is mainly due to the fact that after many years, southern European countries have ‘corrected their imbalances, so now they are developing at a healthy rate without macroeconomic imbalances.’”, Fortune, April 9, 2024

Global South

“Who’s the big boss of the global south? In a dog-eat-dog world, competition is fierce. The simplest working definition (of Global South) is that it refers to most, but not quite all, non-Western countries. Its use also denotes how emerging economies want more power over global affairs and often have a critical view of Western policy. Narendra Modi has suggested India could be its “voice”. Luiz Inácio Lula da Silva (known as Lula), the president of Brazil, reckons his country could be, too. Our conclusion is, counterintuitively, that America still has more influence than any other country over the global south, but that within the grouping itself China has become the most powerful member—giving Mr Xi the strongest claim to leadership.”, The Economist, April 8, 2024

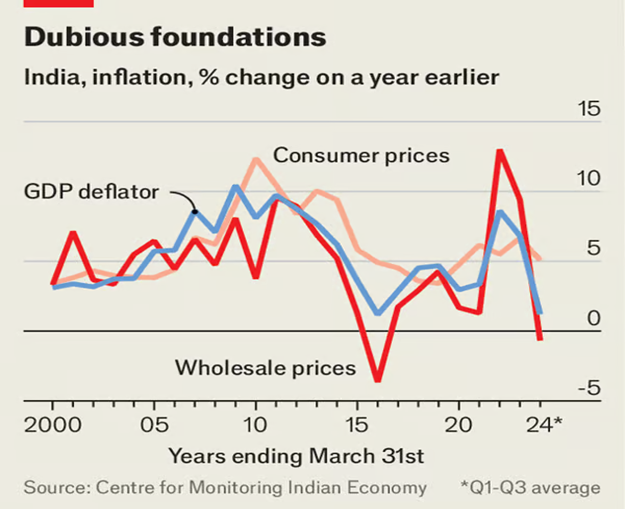

India

“How fast is India’s economy really growing? – Statisticians take the country’s figures with a pinch of salt. Today India again appears to be at the start of an upswing. In the year to the fourth quarter of 2023, GDP growth roared at 8.4%. But such figures tend to be treated with a pinch of salt. Economists inside and outside the government are debating just how fast the economy is growing—a question that has particular piquancy ahead of a general election that begins on April 19th. Since December 2019, real GDP has grown by 4.2% at an average annual rate, meaning that India, like many other countries, has not recovered to its pre-pandemic trend. Corporate and foreign investment remain weak.”, The Economist, April 11, 2024

United States

“US Inflation Refuses to Bend, Fanning Fears It Will Stick – Consumer prices rose in March amid stronger services inflation. Report reorders bets on Fed easing, dashing hopes for June cut. A key US price gauge topped forecasts for a third straight month on gains in rents and transportation costs, spurring concerns that inflation is becoming entrenched and likely further delaying Federal Reserve interest-rate cuts., Bloomberg, April 10, 2024

“Consumers are getting more pessimistic as inflation refuses to fall – Consumer sentiment about the U.S. economy has ticked down but remains near a recent high, with Americans’ outlook largely unchanged this year.The University of Michigan’s consumer sentiment index, released Friday in a preliminary version, slipped to 77.9 this month, down from March’s figure of 79.4. Sentiment is about halfway between its all-time low, reached in June 2022 when inflation peaked, and its pre-pandemic averages. The survey has been conducted since 1980. ‘Consumers are reserving judgment about the economy in light of the upcoming election, which, in the view of many consumers, could have a substantial impact on the trajectory of the economy,’ said Joanne Hsu, director of the consumer survey.”, Fortune, April 12, 2024

“87% of CEOs confident in the U.S. economy, says KPMG – After years of uncertainty facing the economy, from the pandemic to supply-chain challenges to multiple wars, America’s CEOs feel confident in the country’s economy. And chief executives are basking in the sunshine, overjoyed to be out from under the black clouds of economic uncertainty. The survey featured responses from 100 CEOs from companies with at least $500 million in revenue and 70% of which had at least $1 billion.”, Fortune, April 11, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“Body Fit Training Opens Studio in Spain – Body Fit Training (BFT) announced today the opening of its 300th global studio in Barcelona, Spain. The Barcelona studio opening expands the brand’s presence in countries around the world, including its birthplace of Australia, along with New Zealand, Singapore, the U.K., the U.S., and Hong Kong, among others, as the demand for group strength training workouts continues to surge.”, Franchising.com, April 4, 2024

“Little Chefs: What happened to roadside diner chain – With 439 restaurants on major routes across the UK, Little Chef once enjoyed a near monopoly on roadside dining. So, why did the restaurant chain disappear? Little Chef was started in 1958 by catering boss Peter Merchant and caravan manufacturer Sam Alper. The business’ decline was “gradual” according to Becky Parr-Phillips who started working for Little Chef as a waitress in the 1990s, rising through the managerial ranks to become head of operations around 15 years later. The owners were keen to reduce costs and maximise profits as the chain still enjoyed something of a monopoly on roadside dining. ‘There were closures, the prices were hiked, you know the guests did start to call it Little Thief rather than Little Chef’, says Becky.”, BBC News, April 12, 2024

“The Future of The Body Shop and its International Franchisee Network – In February of this year, skincare and cosmetics retailer The Body Shop began appointing administrators across its operations in the UK and certain European territories. The Body Shop Canada and USA have since followed suit. While the future of one of the UK’s most well-known high street brands remains uncertain, we consider what went wrong, what impact this may have on The Body Shop’s international franchise network and intellectual property rights portfolio, and the potential impacts on the Asia-Pacific market….In mainland China, The Body Shop is still selling through cross-border e-commerce platforms but does not have any bricks and mortar stores.”, Bird & Bird, April 10, 2024. Compliments of Paul Jones, Jones & Co., Toronto

“The Franchise Industry is on The Verge of Massive Change With Private Equity’s Potential $8 Billion Acquisition of Jersey Mike’s. Two iconic brands, Subway and Jersey Mike’s, may sell to private equity after years of being closely held. Heavyweight PE firms are an increasing force within the franchising sector, marking a strategic shift and altering the industry landscape. Private equity has successfully cherry-picked most top franchise brands with enough scale to attract professional investors. Jersey Mike’s and Subway are two high-profile holdouts.” Entrepreneur, April 11, 2024

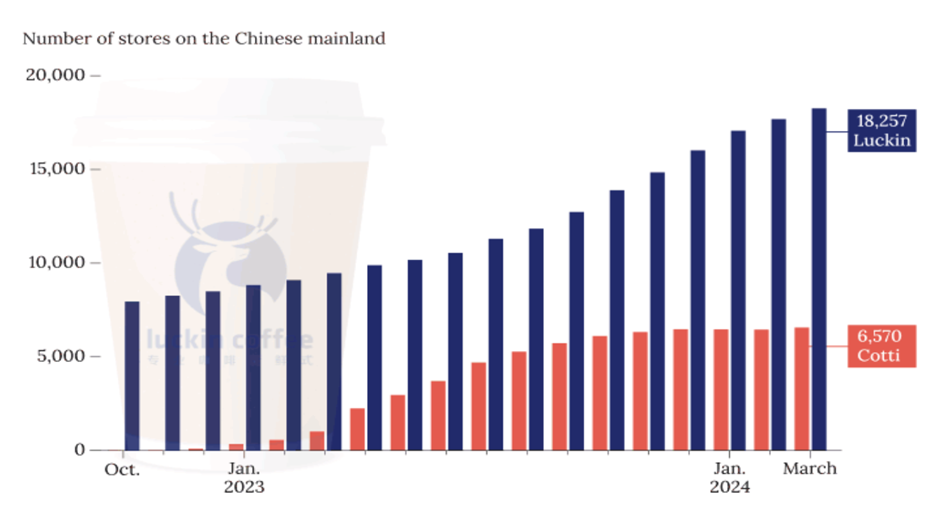

“Luckin Challenger Pushes China’s Coffee Price War Toward Boiling Point – China’s coffee market is in the midst of a price war, and it’s showing no sign of abating as the country’s leading affordable brand Luckin Coffee Inc. faces down challenger Cotti Coffee, the upstart launched by Luckin’s disgraced co-founders Lu Zhengyao and Qian Zhiya. Forced out of Luckin for their role in perpetrating a $300 million fraud, Lu and Qian returned in late 2022 with a new venture and promptly went to battle with their former brainchild. They adopted the same low-price strategy, at one point undercutting Luckin’s best discount. As of early March, Luckin had opened over 17,800 stores in China — significantly outstripping Starbucks’ 7,770 locations and Cotti’s close to 6,800, according to food and beverage industry information provider Canyan Data.”, Caixin Global, April 2, 2024. Compliments of Paul Jones, Jones & Co., Toronto

To receive our biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. And our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant since 2001 taking 40+ franchisors global.

For a complimentary 30-minute consultation on how to take your business global successfully, click on the QR code or contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

And download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 105, Tuesday, April 2, 2024

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Introduction: Coca-Cola worldwide comsumption. Consumer sentiment is rising, inflation is falling, countries in Latin America are dropping interest rates, the first-ever call on a mobile phone was made 50 years ago. ‘Friendshoring’ is growing away from China. But China does finally remove the Australian wine boycott. China relaxes control of the flow of data in and out of country due to business pressure. And we look at the 12 most spoken languages in the world.

This year chocolate easter eggs were subject to ‘shrinkflation’. Egypt got another financial bailout. Starbucks® is now the second largest food brand in the world after McDonalds®, taking over from Subway®. Big tech increasingly has challenges finding energy to power their data centers. Global beer consumption explained. And AI data centers are spurring the use of more natural gas.

Edited and curated by: William (Bill) Edwards, CEO & Global Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA

Bedwards@edwardsglobal.com, +1 949 375 1896

The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business.

Some of the information sources that we provide links to require a paid subscription for our readers to access. This means that some of the links to articles may not work if the reader does not have a subscription to that service. We maintain a paid subscription to ~30 information sources to be able to bring the reader the latest in global business trends.

First, A Few Words of Wisdom From Others For These Times

“Your time on earth is limited. Don’t try to ‘age with grace’, age with mischief, audacity, and a good story to tell.”, Compliments of Doug Bruhnke, Founder of the Global Chamber

“The secret of change is to focus all your energy not on fighting the old but on building the new.”, Socrates, father of Western philosophy

“Ideas are easy. Implementation is hard.”, Guy Kawasaki

Highlights in issue #105:

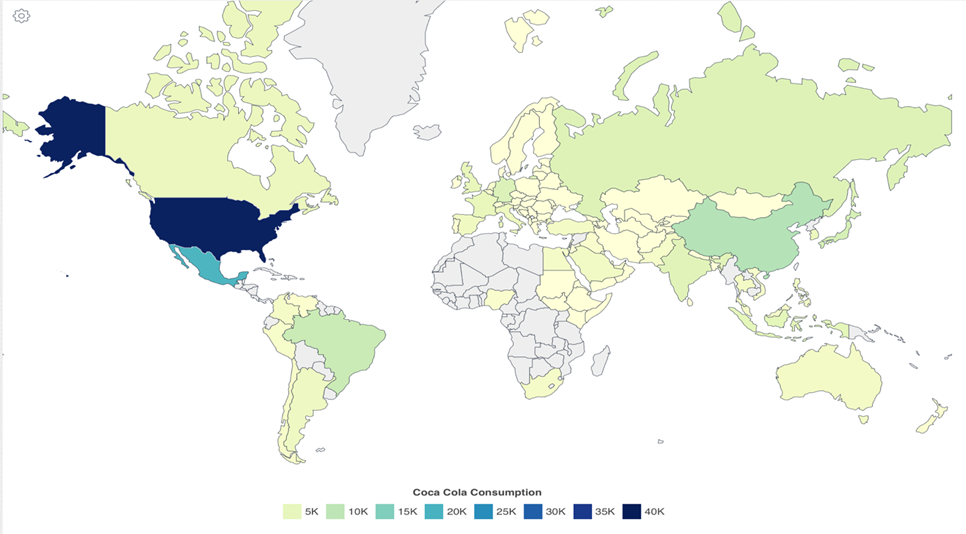

Coca Cola Consumption by Country 2024

China Loosens Cross-Border Data Rules on Business Pressure

U.S. Economic Growth Remains Robust, No Matter How You Slice It

Mexico becomes the latest major Latin American economy to cut rates

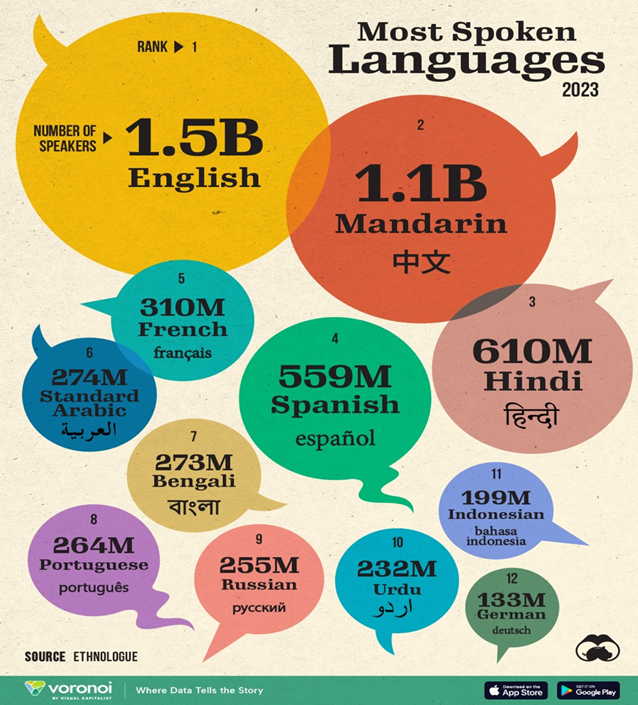

The 12 Most Spoken Languages In the World

Brand Global News Section: Anytime Fitness®, Dominos®, Olive Garden®, Orangetheory Fitness®, McDonalds®, and Starbucks®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

“Coca Cola Consumption by Country 2024 – In 1971, the Coca-Cola Company released a TV commercial that promoted quite lofty goals for a soft-drink company. At a tense time globally, “I’d Like to Teach the World to Sing” invited everyone on our planet to put aside their differences and come together to enjoy friendly music and a friendly beverage. Looking at total consumption figures by country, the number varies from year to year, but Mexico holds the honor as of 2023, with an average of 634 8-ounce servings consumed per year by the 128 million residents, slightly down from 665 reported in 2016.

With three exceptions – Cuba, North Korea, and Russia — Coca-Cola is everywhere.”, Our World In Data, March 2024

“The 12 Most Spoken Languages In the World – The top languages spoken in the world reflect economic trends, populated countries, and even colonial history. These are the most spoken languages around the world as of 2023. These figures come from Ethnologue, which publishes a list of the largest languages every year. English was born in the United Kingdom but today belongs to the modern world as the main international language of business and politics. That’s why it’s not very surprising to find English as the world’s most spoken language, with 1.5 billion speakers as of 2023.”, Visual Capitalist and Ethnologue, February 29, 2024

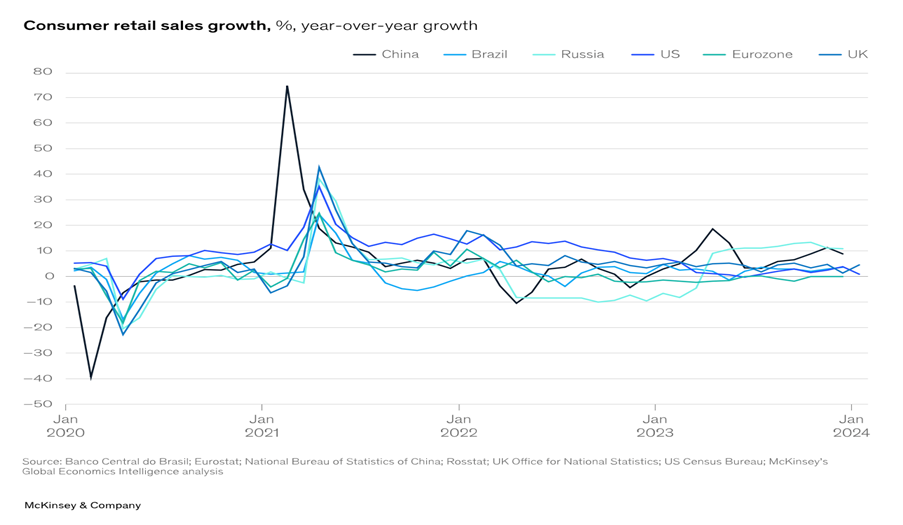

“(Global) Consumers Remain Upbeat – (In February 2024)Global economic uncertainty elevated but consumers upbeat; China faces deflation, real estate problems, and FDI decline; EU growth stagnant; high US interest rates affecting households and companies. Consumers remain upbeat as retail sales in the main economies show steady growth, despite elevated prices (Exhibit 1). Growing sentiment in the US saw the Consumer Confidence Index (Conference Board) rise to 114.8 in January, up from a revised 108.0 in December. By contrast, consumer confidence in Brazil dropped to its lowest level since May 2023 but is still 5.0 points higher than in January 2023. Automobile sales in India (which are a proxy for consumer sales) grew by 37.3% to 393,074 units (286,390 in December). Passenger vehicles saw their highest-ever sales in January, posting a growth of around 14% compared with the previous year. Meanwhile, official news from China was that consumption during the 2024 Spring Festival holiday underwent a notable increase.”, McKinsey & Co., March 20, 2024

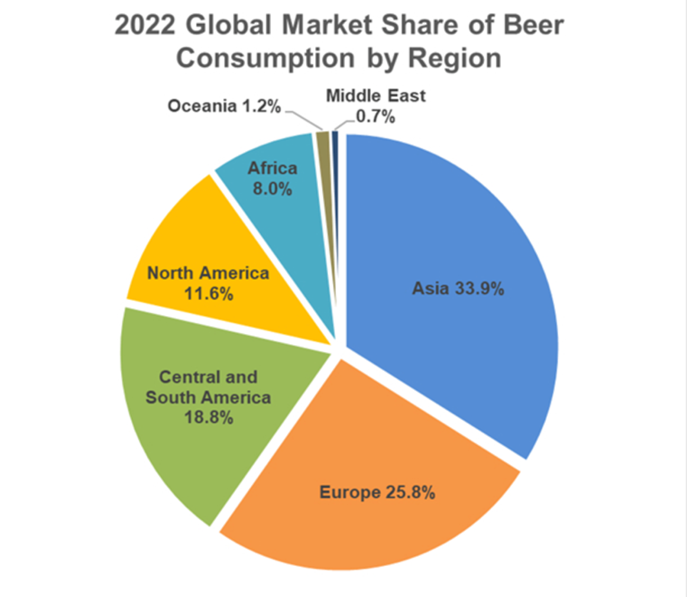

“Global Beer Consumption by Country in 2022 – Global beer consumption exceeded 2019, showing a return to scale to pre-COVID levels despite unstable global conditions. China was the largest overall consumer for the 20th straight year, with Asia the leading region. The Czech Republic remained the top per-capita consumer for the 30th consecutive year.”, Kirin Holdings, December 22, 2023

“Replicating the Mobile Revolution – On April 3, 1973, Martin Cooper, an engineer from Motorola, made the first-ever call on a mobile phone to another engineer at a telecommunications rival company. Fifty years later, the mobile phone is arguably the most transformational invention in recent human history. In just 50 years, the number of people using the device went from zero to more than 7.1 billion as of 2021. Over 91 percent of the world owns a mobile phone, and 90 percent of the world is covered by a commercial wireless signal.”, The Center for Strategic & International Studies, March 19, 2024

“10 Conflicts to Watch in 2024 – More leaders are pursuing their ends militarily. More believe they can get away with it. 2024 begins with wars burning in Gaza, Sudan and Ukraine and peacemaking in crisis. Worldwide, diplomatic efforts to end fighting are failing. Gaza, Wider Middle East War, Sudan, Ukraine, Myanmar, Ethiopia, The Sahel, Haiti, Armenia-Azerbaijan and U.S.-China are the conflicts to watch this year.”, The International Crisis Group, January 1, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

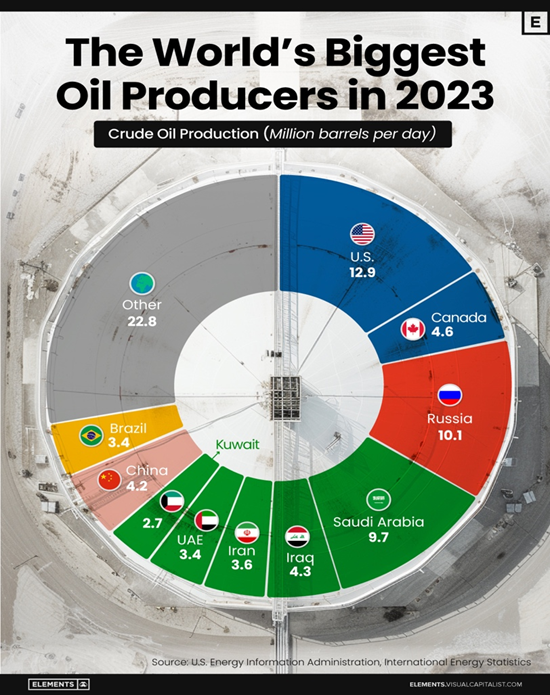

“Three Countries Accounted for One-Third of Global Oil Production in 2023 – Despite efforts to decarbonize the global economy, oil still remains one of the world’s most important resources. It’s also produced by a fairly limited group of countries, which can be a source of economic and political leverage. This graphic illustrates global crude oil production in 2023, measured in million barrels per day, sourced from the U.S. Energy Information Administration (EIA). In 2023, the United States, Russia, and Saudi Arabia collectively contributed 32.8 million barrels per day to global oil production. In 2024, analysts forecast that the U.S. will maintain its position as the top oil producer.”, Visual Capitalist and the U.S. Energy Information Administration (EIA), March 26, 2024

“Big Tech’s Latest Obsession Is Finding Enough Energy – The AI boom is fueling an insatiable appetite for electricity, which is creating risks to the grid and the transition to cleaner energy sources. It isn’t clear just how much electricity will be required to power an exponential increase in data centers worldwide. But most everyone agreed the data centers needed to advance AI will require so much power they could strain the power grid and stymie the transition to cleaner energy sources. After a long period of stagnant demand for electricity, utilities are dialing up forecasts by astonishing amounts. The five-year projection of U.S. electricity demand growth has doubled from a year ago, according to a report from consulting firm Grid Strategies.”, The Wall Street Journal, March 24, 2024

“AI revolution will be boon for natural gas, say fossil fuel bosses – Data centres’ need for reliable power supply set to soar. A surge in demand for electricity to feed data centres and to power an artificial intelligence revolution will usher in a golden era for natural gas, producers say. AI’s soaring energy needs will rise well beyond what renewable energy and batteries can deliver, executives argue, making more planet-warming fossil fuel supplies crucial even as governments vow to slash their use.”, The Financial Times, April 1, 2024

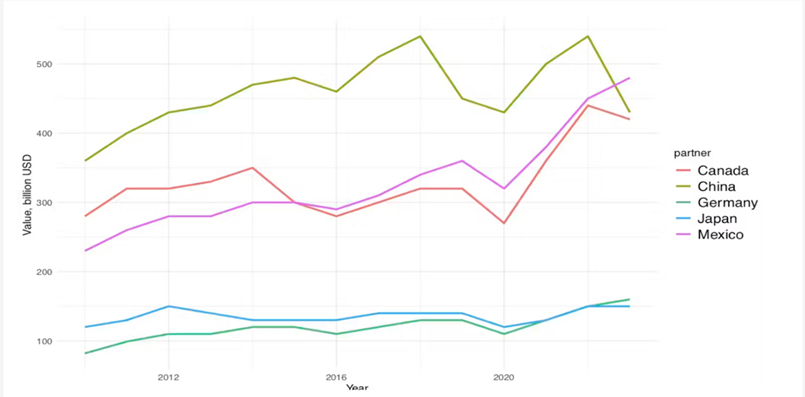

“Friend-shoring having the desired anti-China effect – Biden’s drive to trade more with allies and less with rivals has seen Canada and Mexico supplant China as America’s largest trading partners. One of the most high-profile results of a friend-shoring policy is that Canada and Mexico have recently replaced China as America’s largest trading partners by total trade, while Mexico has overtaken China as America’s top importer.”, AsiaTimes, March 21, 2024

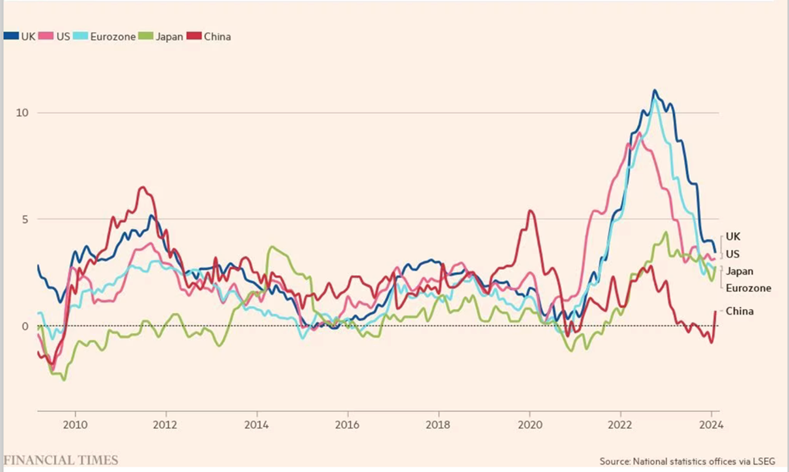

“Which country will be last to escape inflation? A new dividing line in the global fight. In January prices across the rich world rose by 5.7% year on year, down from a peak in late 2022 of 10.7%. This conceals wide variation, however. Some countries have slain the inflation beast. Others are still in the fight of their lives. Countries in the eu and Asia perform well; in the English-speaking world, inflation is taking longer to fade. Australia tops the ranking. Britain and Canada are not far behind. America is doing better, but even there inflation remains entrenched.”, The Economist, March 27, 2024

“‘Shrinkflation’ is coming for your Easter egg – Higher prices for smaller products are drawing the ire of politicians on both sides of the Atlantic. Last year, a Maltesers truffles luxury Easter egg could be snapped up in Waitrose for £8. Now it costs £13, according to UK consumer group Which? A Terry’s chocolate orange Easter egg with mini eggs has shrunk by 30g and a large Mars milk chocolate egg has dropped from 252g to 201g. It’s not just Easter eggs that are getting smaller and more expensive. So-called shrinkflation is hitting economies and consumers across the world and drawing the ire of politicians on both sides of the Atlantic.”, The Financial Times, March 28, 2024

“Global inflation and interest rates tracker – Inflationary pressures are beginning to wane but not all central banks have taken action yet. Central banks around the world are expected to lower borrowing costs as global inflation eases from the multi-decade highs reached in many countries over the past two years.”, The Financial Times, March 28, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Australia

“China removes punishing tariffs on Australian wine trade – China is removing punishing tariffs on Australian wine imposed more than three years ago, restrictions that have all but destroyed a $1.2 billion export market for hundreds of local wineries. The Chinese Ministry of Commerce, late on Thursday, said the tariffs would be removed on Friday. They were imposed in late 2020.”, The Australian Financial Review, March 28, 2024

China

“China Loosens Cross-Border Data Rules on Business Pressure – More information will be exempt, top internet regulator says Foreign businesses have complained about the data rules. China relaxed rules governing cross-border data flows, addressing a key concern of foreign businesses that had complained previous regulations were disrupting their operations. Data collected in international trade, cross-border travel, manufacturing, academic research, and marketing that don’t contain either personal information or “important” information will be exempt from security evaluations when transfered out of the country, China’s top internet regulator said in a statement Friday.”, Bloomberg, March 22, 2024

“Tim Cook opens Asia s biggest Apple Store – People flocked to the Jing’an Temple area in Shanghai for the opening of Asia’s biggest Apple Store on Thursday night, and to see Apple’s chief executive Tim Cook. Shanghai now has eight Apple Stores, compared to six in Hong Kong and five in Beijing. New York city has seven. Since its first store in Shanghai – Apple Pudong – opened in July 2010, more than 163 million people have visited Apple’s seven retail locations in the city.”, Shine.cn, March 21, 2024. Compliments of Paul Jones, Jones & Co., Toronto

Egypt

“After pushing its economy to the brink, Egypt gets a bail-out – But a record-setting investment from the UAE will not fix its chronic problems. On February 23rd Egypt and the United Arab Emirates (UAE) signed a $35bn deal to develop Ras el-Hekma, a wedge of land jutting off Egypt’s Mediterranean coast. Within weeks of the announcement, the IMF more than doubled the $3bn loan it promised Egypt in December 2022, to $8bn. The European Union (EU) announced a €7.4bn ($8bn) aid package, and the World Bank stumped up another $6bn. All told, Egypt hauled in more than $50bn, a sum that dwarfs the central bank’s $35bn in foreign reserves.”, The Economist, March 27, 2024

Japan

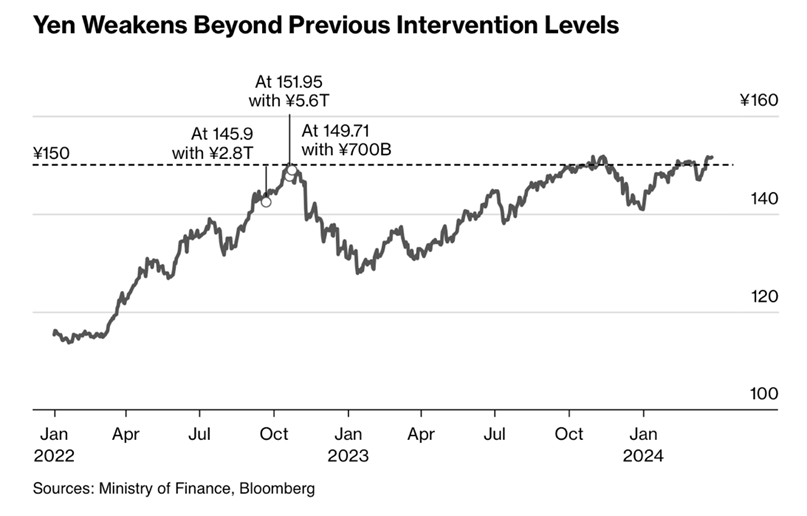

“Japan Steps Closer to Intervention as Yen Hits Lowest Since 1990 – Finance Minister Suzuki ramps up forex intervention threat. Yen may quicken drop if 152 barrier broken, say traders. The yen dipped to 151.97 versus the dollar early on Wednesday in Tokyo, before recovering after comments from Finance Minister Shunichi Suzuki, and his top currency official Masato Kanda indicating that Japan was ready to act.

South Korea

“South Korea prepares financial support for small businesses, builders – The government, together with commercial banks, plans to provide 40.6 trillion won ($30.3 billion) of financial support for small and medium-sized companies through loan guarantees and lower interest rates from April, the Financial Services Commission (FSC) said in a statement. The ministry in charge of financial policies also said it would continue to expand its joint scheme with commercial banks that returns interest income to small businesses and self-employed people who have taken out loans.”, Reuters, March 26, 2024

Mexico

“Mexico becomes the latest major Latin American economy to cut rates – Region has already begun unwinding its response to soaring inflation that has affected monetary policy around the world. The decision by the Bank of Mexico on Thursday to cut rates by 25 basis points to 11 per cent comes as most central banks in developed countries have yet to loosen monetary policy. Latin American central bankers’ swift response to soaring inflation after the coronavirus pandemic has transformed their credibility as they emerge from the most serious wave of price pressures in decades.”, The Financial Times, March 21, 2024

United Kingdom

“UK inflation falls to 3.4% as Bank of England mulls interest rate cut – Inflation slid faster than expected to its lowest level in two and a half years in February, strengthening hopes that the Bank of England will cut interest rates in the coming months, official figures showed. Inflation is now running at its slowest pace since September 2021. City analysts and the Bank of England had anticipated the rate to decline to 3.5 per cent. Inflation peaked at 11.1 per cent in October 2022, lifted by higher energy prices after Russia’s invasion of Ukraine.”, The Times of London, March 21, 2024

“UK Restaurants and Bars Cut Hours as Costs Soar by £3.4 Billion – Hospitality sector is facing higher wages and business rates Sites are reducing shifts and opening hours to cope with costs. Restaurants and bars across Britain are having to slash staff working hours to cushion the blow of a £3.4 billion ($4.3 billion) spike in annual costs, according to the head of the sector’s trade body. Kate Nicholls, chief executive officer of UKHospitality, said sites were also cutting back their opening hours to deal with a ‘tsunami of costs.’”, Bloomberg, April 1, 2024

“Domestic energy production falls to lowest level on record – Britain imported a net 41.1 per cent of its energy last year, up from 37.3 per cent in 2022, primarily from Norway and America. North Sea oil production last year fell to the weakest level since records began in 1948 and gas output was the second lowest, according to figures from the Department for Energy Security and Net Zero. A rise in wind, solar and hydroelectric output failed to offset the fall in more carbon-intensive fuels, which meant that total UK energy production was 9 per cent lower than in 2022 and down by more than two thirds on 1999, when domestic production peaked. Maintenance outages and plant closures meant that nuclear output was also at a fresh low.”, The Times of London, March 29, 2024

United States

“U.S. Economic Growth Remains Robust, No Matter How You Slice It – The Bureau of Economic Analysis said real gross domestic product grew 3.4% in the last three months of 2023, an upward revision from its previous estimate of 3.2%. That was driven by the fact that government spending, particularly at the local and state level, was higher than originally estimated. After trailing GDP dramatically throughout 2023, real gross domestic income jumped by 4.8% in the fourth quarter. It was the first quarter that GDI outpaced GDP growth since the third quarter of 2022.”, Barrons, March 28, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“Anytime Fitness to Expand into United Arab Emirates – High-profile financier Mark Mobius leads an investment group that will bring Anytime Fitness® to the United Arab Emirates, according to a news release from the gym brand’s parent, Self Esteem Brands. The umbrella franchisor owns a portfolio of diverse health and wellness brands. With the expansion into the UAE, Self Esteem Brands will have Anytime Fitness clubs operating 24/7/365 in more than 40 countries and territories around the world. Anytime Fitness is a fast-growing brand that serves nearly 5 million members at more than 5,200 clubs globally.”, FranchiseWire, March 24, 2024

“3 Important Considerations in Adapting Your Restaurant Menu for Global Success – If you want to expand your restaurant franchise and reach a global audience, you must adapt your menu accordingly. Updating your menu items when you open locations in other countries is essential for your restaurant’s long-term stability and success. Recognize cultural sensitivities. Evaluate profit margins and cost considerations. Retain brand consistency while adapting.”, Franchising.com, March 29, 2024

“International Growth Session Highlights from the 2024 Multi-Unit Franchising Conference – A high-level panel discussion at last week’s 2024 Multi-Unit Franchising Conference (“How Franchise Brands Grow Outside Their Home Country”) provided advice—both encouraging and cautionary—for franchise brand attendees looking to expand outside of their national borders. Whether U.S. brands eyeing overseas growth, or international brands looking to expand into the U.S., the expert panel had something for everyone. Franchising, March 27, 2024

“Domino’s China Franchisee Expands in Smaller Cities For Growth – The Chinese franchisee of Domino’s Pizza Inc. is accelerating store expansions as consumers outside the country’s top cities show a bigger appetite for western food.The pizza chain wants to tap demand for fast food among residents in less prominent Chinese cities and towns that aspire to the lifestyle of glitzy megacities, Aileen Wang, chief executive officer of DPC Dash Ltd, also known as Domino’s Pizza China, told Bloomberg in an interview in Shanghai Thursday. Bloomberg, March 28, 2024

“Quebec franchisees sue Tim Hortons, claiming declining profits – Nearly a dozen Quebec franchisees are suing Tim Hortons QSR-T, claiming their profits have declined by millions of dollars in recent years. The store owners say the gap has narrowed between their own costs for supplies and menu prices, both of which are controlled by the company. Tim Hortons currently has more than 3,900 locations in Canada, approximately 615 of which are in Quebec. The company has acknowledged that franchisee profits fell during that time: The average Tim Hortons location made $320,000 in earnings before interest, taxes, depreciation and amortization (EBITDA) in 2018, a number that declined to $220,000 by 2022.”, The Globe and Mail, March 29, 2024

“Olive Garden’s earnings just pulled back the curtain on the economy: The rich are dining out while the poor are falling back. ‘We’re clearly seeing consumer behavior shifts,’ Darden CEO Rick Cardenas said in a third-quarter earnings call on Thursday. ‘Transactions from incomes below $75,000 were much lower than last year. And at every brand, transactions fell from incomes below $50,000.’ Meanwhile, transactions for higher-income individuals were higher than last year, according to the earnings call, so households earning at least $150,000 were dining out more.”, Fortune, March 22, 2024

“Second-biggest restaurant chain in the world behind McDonald’s will surprise you – The burger chain is the biggest-restaurant chain in the world by unit, according to a Restaurant Business report, a publication focused on the foodservice industry. Hot on the heels in the No. 2 slot this year is a newcomer. For the first time, coffee giant Starbucks pushed past Subway to become the second-largest restaurant chain in the world. The Seattle-based coffee brand added 3,000 new locations in 2023, bringing the total number globally to 38,587, according to data from Technomic, an industry research and consulting firm. Starbucks operates 2,000 more locations than Subway, which once was the largest chain in the world by total unit count.”, Penn Live, March 23, 2024

“Orangetheory Fitness and Self Esteem Brands Announce Intent to Merge as Equals, Creating a New Company Representing One of the Largest Footprints of Fitness, Health and Wellness Services……the new company will represent $3.5 billion in systemwide sales and approximately 7,000 franchise locations across 50 countries and territories on all seven continents. The merger will result in significant international scale for the new company, with continued investments in leading-edge data and analytics, technology, products and services that help franchisees across its brands outpace growing consumer demands for holistic health and wellness services.”, PR Newswire, February 29, 2024

“18 International Starbucks Bakery Items You Need To Know About……the drink selection — and even more noticeably, the bakery options — tend to differ drastically at Starbucks locations outside the U.S. This makes sense, of course. The retailer operates stores in a staggering 80 countries as of March 2024, after all, and has made a conscious effort to adapt to the local culinary culture in each market. Here are 18 international Starbucks bakery items you need to know about.”, The Tasting Table, March 23, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive our biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. And our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant since 2001 taking 40+ franchisors global.

For a complimentary 30-minute consultation on how to take your business global successfully, click on the QR code or contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

And download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking