Biweekly Global Business Newsletter Issue 113, Tuesday, July 23, 2024

Commentary about the 113th Issue: Average salaries in 30 countries. Regenerative AI and the world’s software market. Microsoft orders all China staff to use iPhones. U.S. fast food chains raise prices more then 50% in the last ten years. Canada set to be the fastest growing G7 country in 2025. How to stay healthy at 35,000 feet.Commentary about the 113th Issue: Average salaries in 30 countries. Regenerative AI and the world’s software market. Microsoft orders all China staff to use iPhones. U.S. fast food chains raise prices more than 50% in the last ten years.

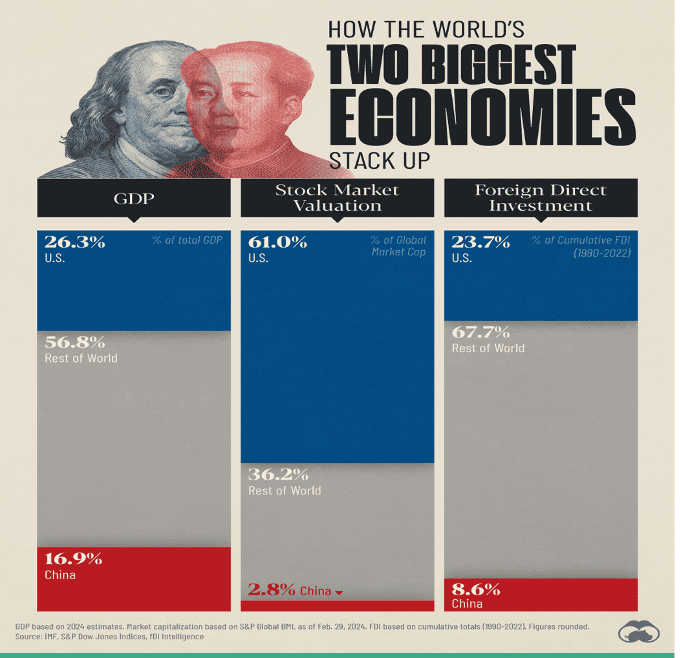

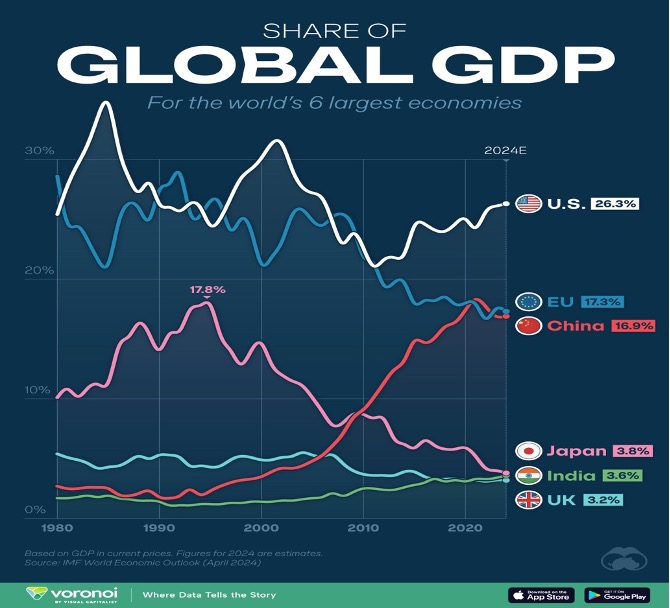

How to stay healthy at 35,000 feet. Saudi Arabia allows first sale of alcohol (really!). U.S. must add 290 terawatt hours of electricity by 2030. Olive Garden® parent buys Chuy’s®. McDonald s plans to have more than 10,000 restaurants in mainland China by 2028. Fossil fuels made up 81% of global energy consumption in 2023. India projects growth of 6.5%-7% vs 8.2% last year. And the United States and China combine for a massive 43.2% share of the global economy.

Edited and curated by: William (Bill) Edwards, CEO & Global Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA. Contact Bill with any questions, comments and contributions.

Bedwards@edwardsglobal.com, +1 949 375 1896

===============================================================================================

The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business. Some of the information sources that we provide links to require a paid subscription for our readers to access.

=============================================================================================

First, A Few Words of Wisdom From Others For These Times

“Train people well enough so they can leave, treat them well enough so they don’t want to.”, Richard Branson, business magnate and founder of Virgin Group

“Get the right people. Then no matter what all else you might do wrong after that, the people will save you. That’s what management is all about.”, Tom DeMarco, software engineer

“Of all the things I’ve done, the most vital is coordinating the talents of those who work for us and pointing them toward a certain goal.”, Walt Disney

==========================================================================================

Highlights in issue #113:

- Average Annual Salaries by Country

- Economic conditions outlook, June 2024

- Microsoft Orders China Staff to Use iPhones for Work and Drop Android

- Inflation Across U.S. Fast Food Chains (2014-2024)

- Small Businesses Still Struggling

- Staying Healthy at 35,000 Feet

- Brand Global News Section: Chuy’s®, Dominos®, Herbalife®, McDonalds®, Olive Garden® and Sol Bowl®

============================================================================================

Interesting Data, Articles and Studies

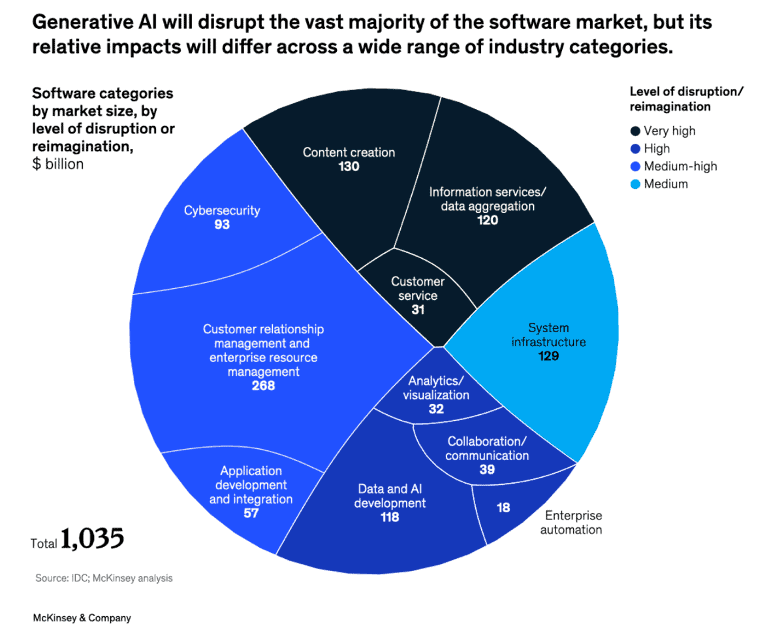

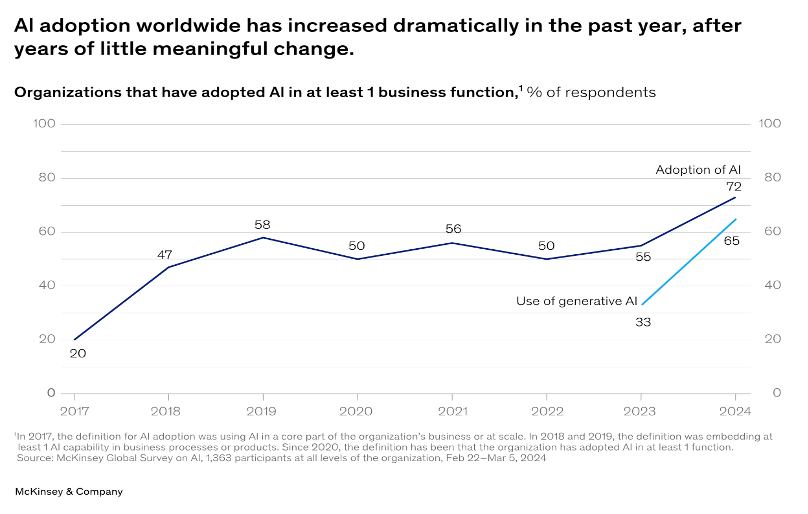

“Software’s byte of the gen AI apple – Generative AI’s (gen AI’s) quick adoption over the past year suggests that the global software sector will undergo a major change, senior partner Jeremy Schneider and coauthors note. But based on a McKinsey survey of software leaders and executives, it is anticipated that gen AI will affect each software category to a different degree. Content creation is one of three areas expected to see a very high level of disruption, while system infrastructure is on the other end of the disruption spectrum. Overall, gen AI could spark almost $300 billion in new software spending over the next few years.”, McKinsey & Co., July 9, 2024

=============================================================================================

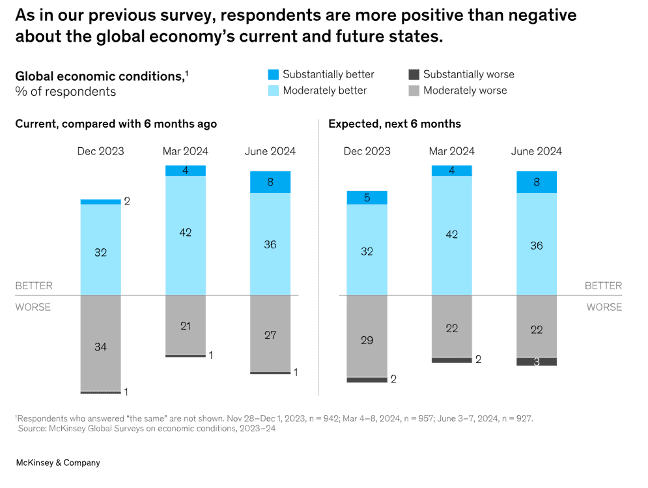

“Economic conditions outlook, June 2024 – Executives’ views on the world economy remain more positive than negative, though they believe a recession is increasingly likely. In their own economies, concerns over unemployment are growing. So far in 2024, survey respondents seem more sanguine about the economy than they were for much of 2023. In our newest McKinsey Global Survey on economic conditions,1 respondents tend to say that conditions in their countries and globally are improving rather than declining and will continue to improve in the months ahead. Yet they also foresee a few clouds gathering on the horizon.”, McKinsey & Co., June 27, 2024

==================================================================================================

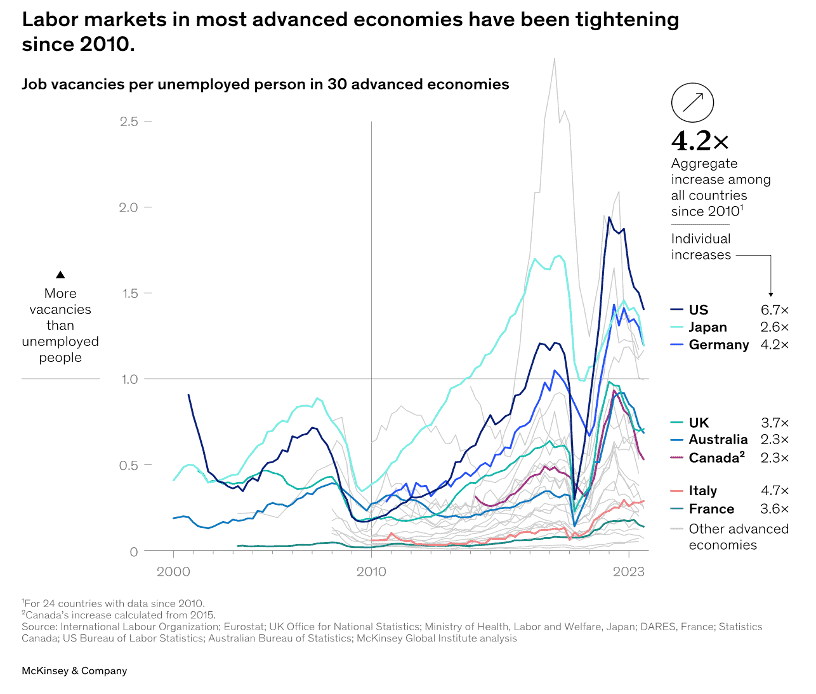

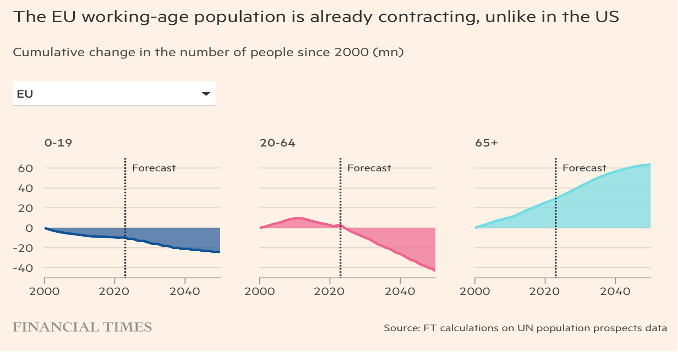

“Help wanted: Charting the challenge of tight labor markets in advanced economies – Labor markets in advanced economies today are among the tightest in two decades, not merely a pandemic-induced blip but rather a long-term trend that may continue as workforces age. Tightness means forgone economic output. We estimate that GDP in 2023 could have been 0.5 percent to 1.5 percent higher across these economies if employers had been able to fill their excess job vacancies. Companies and economies will need to boost productivity and find new ways to expand the workforce. Otherwise, they will struggle to exceed—or even match—the relatively muted economic growth of the past decade.”, McKinsey & Co., June 28, 2024

===============================================================================================

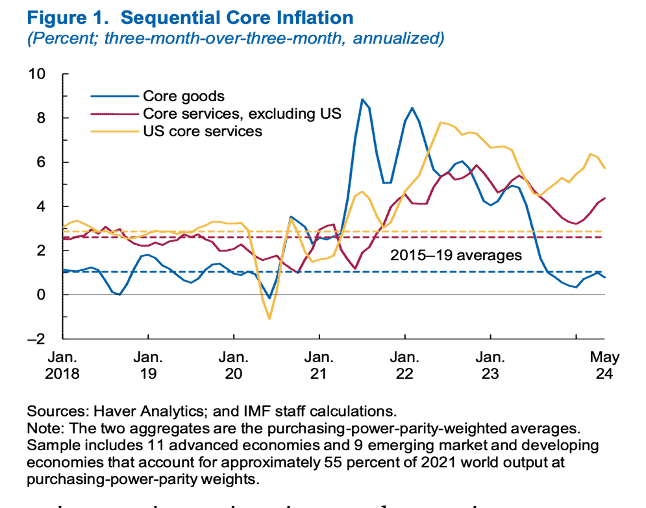

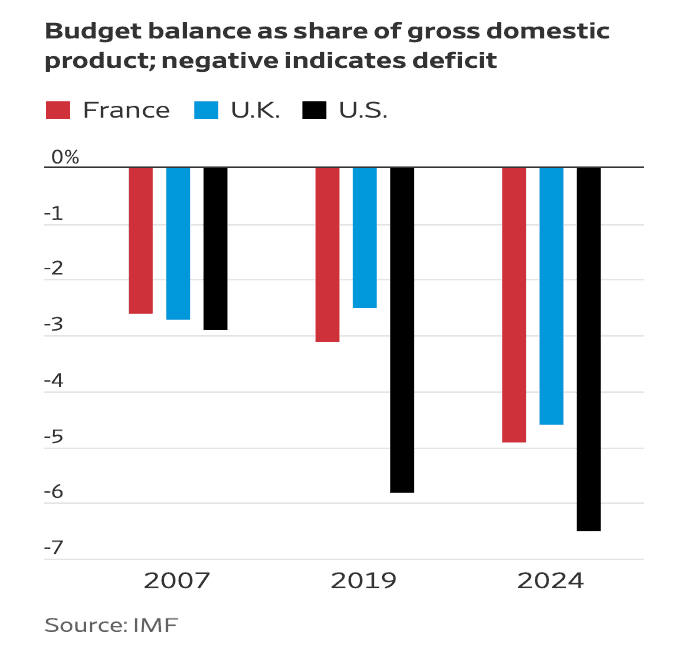

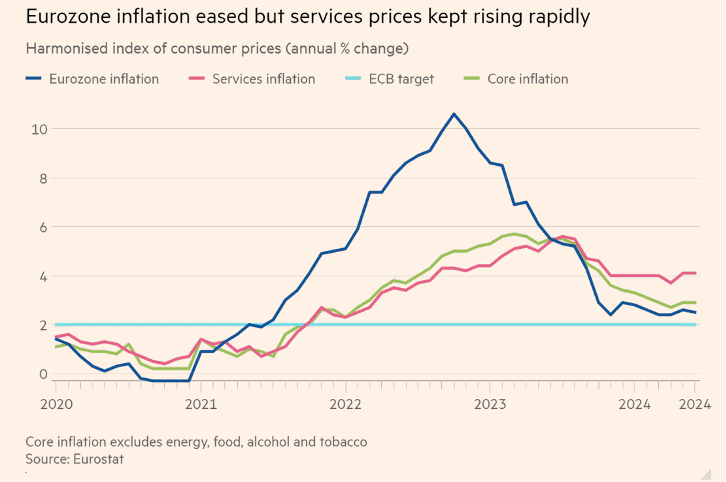

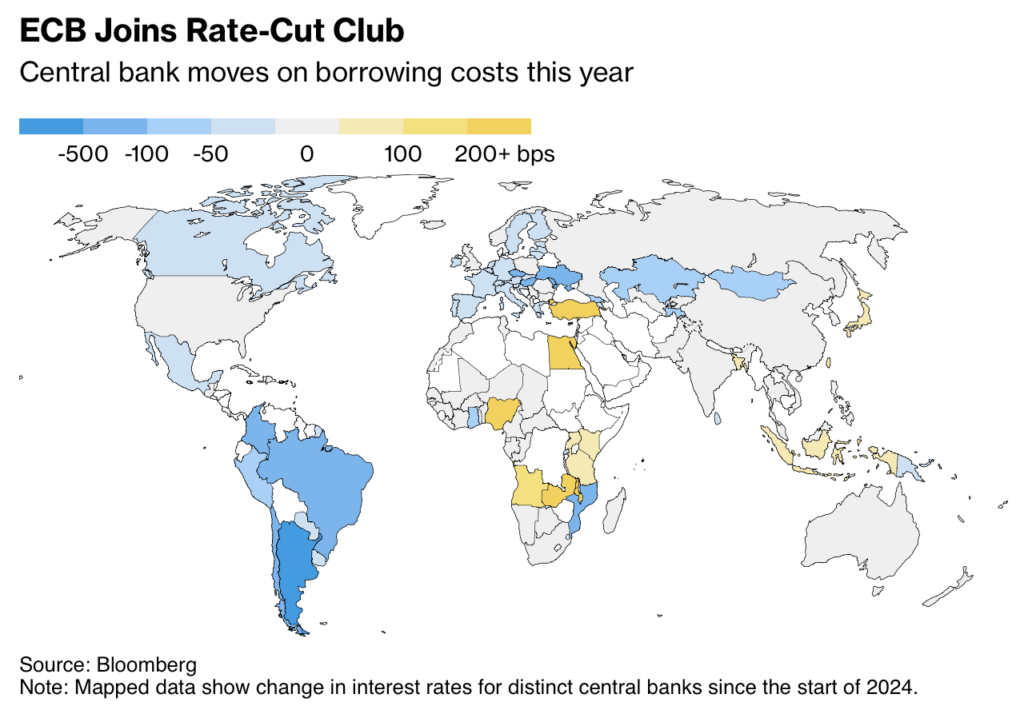

“WORLD ECONOMIC OUTLOOK UPDATE – Global growth is projected to be in line with the April 2024 World Economic Outlook (WEO) forecast, at 3.2 percent in 2024 and 3.3 percent in 2025. However, varied momentum in activity at the turn of the year has somewhat narrowed the output divergence across economies as cyclical factors wane and activity becomes better aligned with its potential. Services price inflation is holding up progress on disinflation, which is complicating monetary policy normalization. Upside risks to inflation have thus increased, raising the prospect of higher-for-even-longer interest rates, in the context of escalating trade tensions and increased policy uncertainty. To manage these risks and preserve growth, the policy mix should be sequenced carefully to achieve price stability and replenish diminished buffers.”, International Monetary Fund, July 2024

===========================================================================================

Global Supply Chain, Energy, Commodities, Inflation, Taxes & Trade Issues

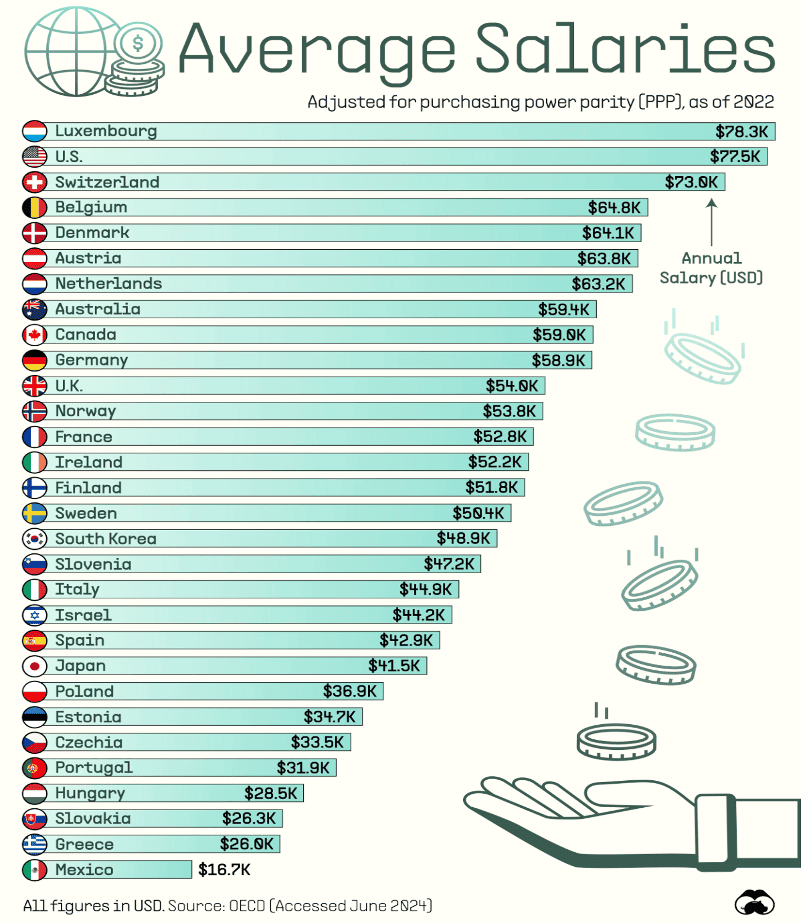

“Average Annual Salaries by Country – There are many reasons for why salaries vary between countries: economic development, cost of living, labor laws, and a variety of other factors. Because of these variables, it can be difficult to gauge the general level of income around the world. With this in mind, we’ve visualized the average annual salaries of 30 OECD countries, adjusted for purchasing power parity (PPP). This means that the values listed have taken into account the differences in cost of living and inflation between countries. This data was sourced from the OECD (Organisation for Economic Co-operation and Development), an international organization that promotes policies to improve economic and social well-being. It has 38 member countries, though in this instance, data for all of them was not available.”, OECD & Visual Capitalist, July 17, 2024

==================================================================================================

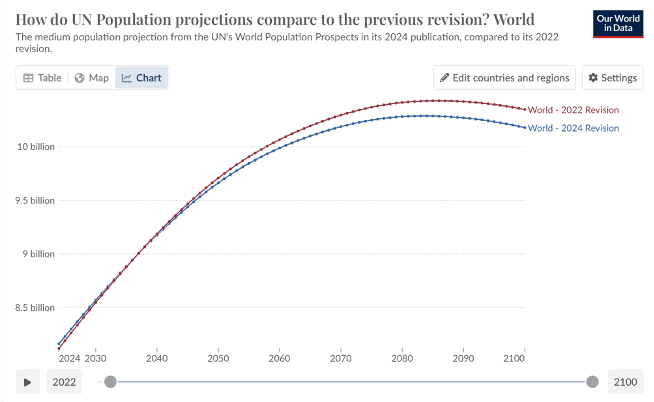

“The world population is projected to peak slightly earlier than in previous projections – The United Nations doesn’t only publish historical estimates of how population and demographic trends have changed in the past; it also makes projections for what the future might look like. To be clear, these are projections, not predictions of changes in the future. In its 2022 publication, the UN estimated that, in its medium scenario, the global population would peak in 2086 at around 10.4 billion people. This year’s edition brings this peak forward slightly to 2084, with the population topping at just under 10.3 billion.”. Our World In Data, July 11, 2024

==================================================================================================

Global Supply Chain, Energy, Commodities, Inflation, Taxes & Trade Issues

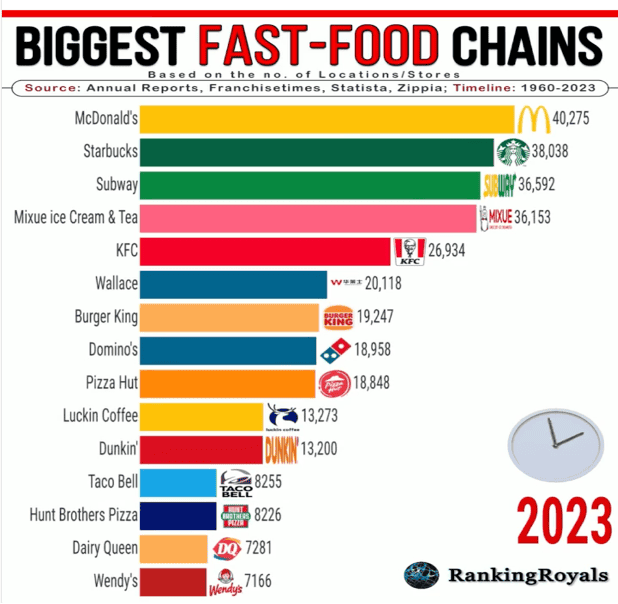

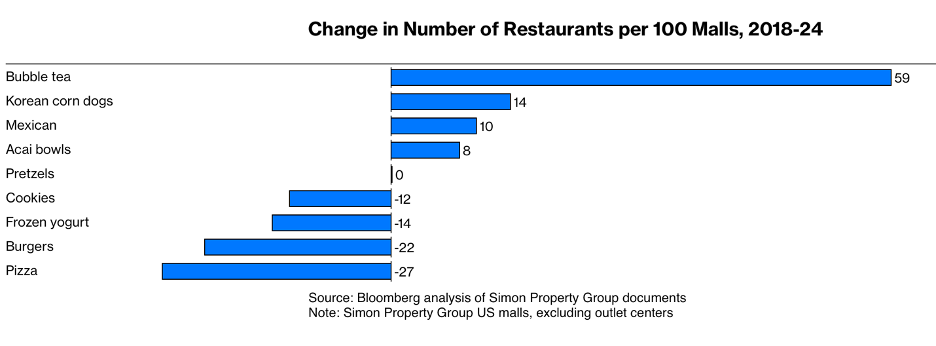

“Inflation Across U.S. Fast Food Chains (2014-2024) – Fast food joints were once the go-to option for quick, cost-friendly meals, but now, they’re starting to pinch the budget.

Inflation has hit fast food chains hard in the past decade, with many restaurants seeing an average price increase on menu items of more than 50%. This graphic visualizes the average price increase of 10 core menu items from select American fast food chains, as well as the change in the consumer price index (U.S. city average) for food away from home, from 2014 to 2024.”, FianceBuzz and the Federal Reserve, July 12, 2024

=============================================================================================

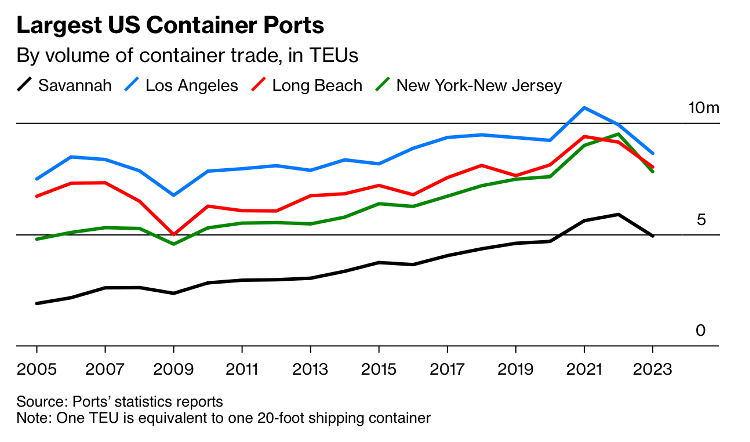

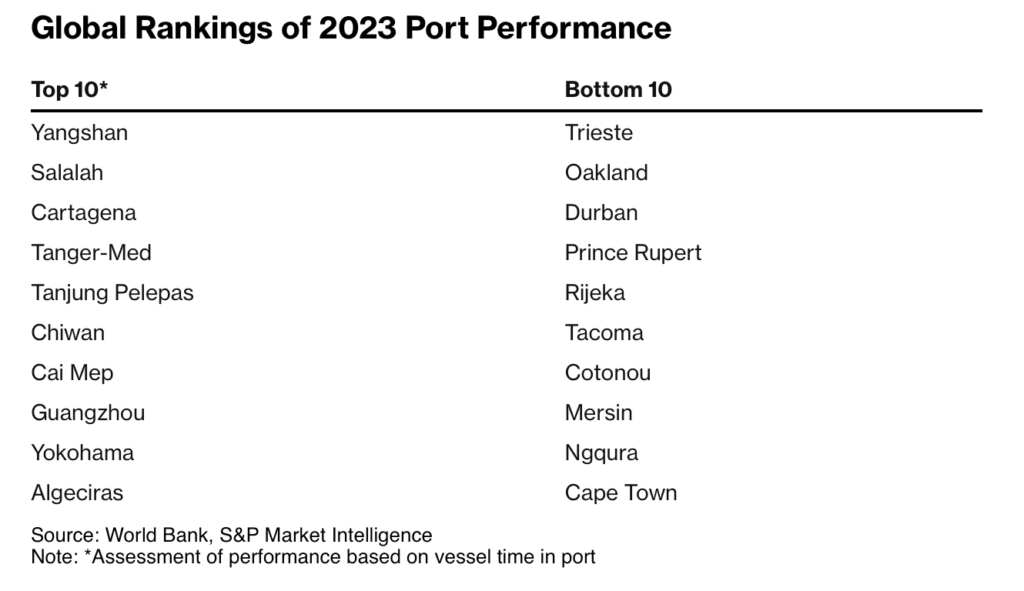

“New Labor Unrest Hits U.S. Ports – The peak shipping season is getting underway with another threat of labor disruption at American ports. The union representing about 45,000 workers at ports from Maine to Texas and the seaport employers are in a standoff with no negotiations on the calendar and the current longshore contract due to expire in a little over two months. German port workers are considering a “final offer” from employers after staging several walkouts in recent weeks. (Maritime Executive). A vote at a Coventory warehouse to force Amazon to recognize a union for the first time in the U.K. fell just short of a majority. (Financial Times).”, The Wall Street Journal, July 2024

=============================================================================================

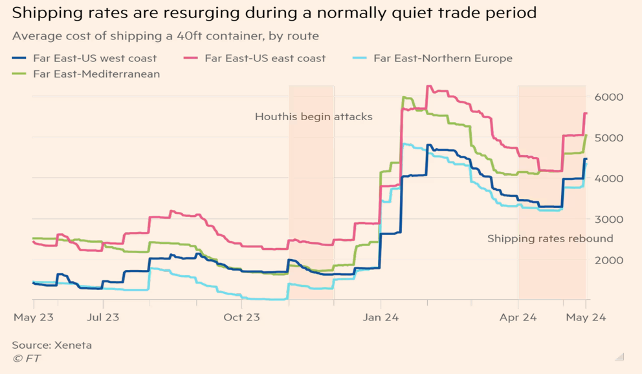

“Maersk says Red Sea shipping disruption having global effects – DENMARK’S AP Moller-Maersk said on Wednesday (Jul 17) that disruption to its container shipping via the Red Sea had extended beyond trade routes in the far east of Europe to its entire global network. Shipping groups have diverted vessels around Africa’s Cape of Good Hope since December to avoid attacks by Iran-aligned Houthi militants in the Red Sea, with the longer voyage times pushing freight rates higher. “Ports across Asia, including Singapore, Australia, and Shanghai, are experiencing delays as ships reroute and schedules are disrupted, caused by ripple effects from the Red Sea,” it said in a statement.”, The Business Times, July 17, 2024

=================================================================================================

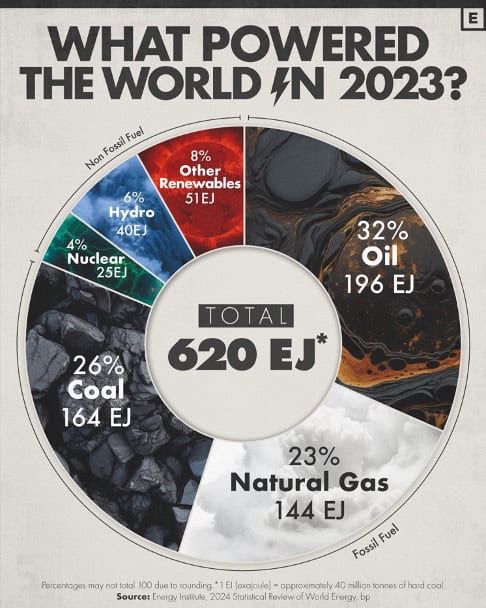

“2024 Statistical Review of World Energy – What Powered the World in 2023 – Fossil fuels continue to power the world. While a lot of spotlight in the energy industry is on the clean energy transition to renewable sources, fossil fuels continue to reign supreme when it comes to the world’s production and consumption of energy. Global production and consumption of coal, oil, and natural gas all increased in 2023, and as a result fossil fuels made up 81% of global energy consumption as shown above.”, Visual Capitalist & Energy Institute, July 2024

==================================================================================================

Global & Regional Travel & Living

“Staying Healthy at 35,000 Feet – With the summer travel season in full swing, board-certified infectious disease physician Carl Abraham, M.D., assistant professor at the College of Osteopathic Medicine’s Jonesboro location (NYITCOM-Arkansas), arms passengers with information to stay healthy at 35,000 feet. Abraham notes that some people may be surprised about the risk of germ spread on most airplanes. ‘Disinfecting touched objects, like seatbelts or trays, won’t hurt, although airlines are supposed to make sure areas are cleaned thoroughly between flights,’ he adds. But, the real hotspot might be the airplane lavatory.”, New York Tech news, July 2, 2024

==========================================================================================

===========================================================================================

Book Review – New Section

“The Fast Future Blur: Discover Transformative Interconnections Shaping the Future – Fast Future Blur provides invaluable insights and strategic frameworks to navigate the complexity of our current period of rapid and radical transformation (‘Fast Future’ phase). Focused on the interconnected nature of the evolution underway, the book serves as an eye-opener for business leaders, providing guidance in understanding this dynamic and complex landscape. Fast Future Blur delves into 12 key areas of change, including platform businesses, regenerative innovation, artificial intelligence, the future of healthcare, the future of work, the future of mobility, blockchain, metaverse, virtual & augmented reality, leadership, agility, fintech, and the impact from 6 inter-connections. With compelling, powerful, and timely insights from the Fast Future Executive faculty ― a global consortium of experts and industry leaders, many of whom are associated with the World Economic Forum, top business and technology schools and leading global companies.”, Amazon, July 2024

Editor’s Note: I attended a session of The Fast Future Blur 2024 Summit on June 11th at the Executive Next Practices event at the University of California, Irvine, Beall Center for Innovation. We had 19 speakers from the Fast Future Executive faculty who came in from around the world. Wow!

==============================================================================================

Book Review – New Section

“The Fast Future Blur: Discover Transformative Interconnections Shaping the Future – Fast Future Blur provides invaluable insights and strategic frameworks to navigate the complexity of our current period of rapid and radical transformation (‘Fast Future’ phase). Focused on the interconnected nature of the evolution underway, the book serves as an eye-opener for business leaders, providing guidance in understanding this dynamic and complex landscape. Fast Future Blur delves into 12 key areas of change, including platform businesses, regenerative innovation, artificial intelligence, the future of healthcare, the future of work, the future of mobility, blockchain, metaverse, virtual & augmented reality, leadership, agility, fintech, and the impact from 6 inter-connections. With compelling, powerful, and timely insights from the Fast Future Executive faculty ― a global consortium of experts and industry leaders, many of whom are associated with the World Economic Forum, top business and technology schools and leading global companies.”, Amazon, July 2024

Editor’s Note: I attended a session of The Fast Future Blur 2024 Summit on June 11th at the Executive Next Practices event at the University of California, Irvine, Beall Center for Innovation. We had 19 speakers from the Fast Future Executive faculty who came in from around the world. Wow!

==================================================================================================

Country & Regional Updates

Canada

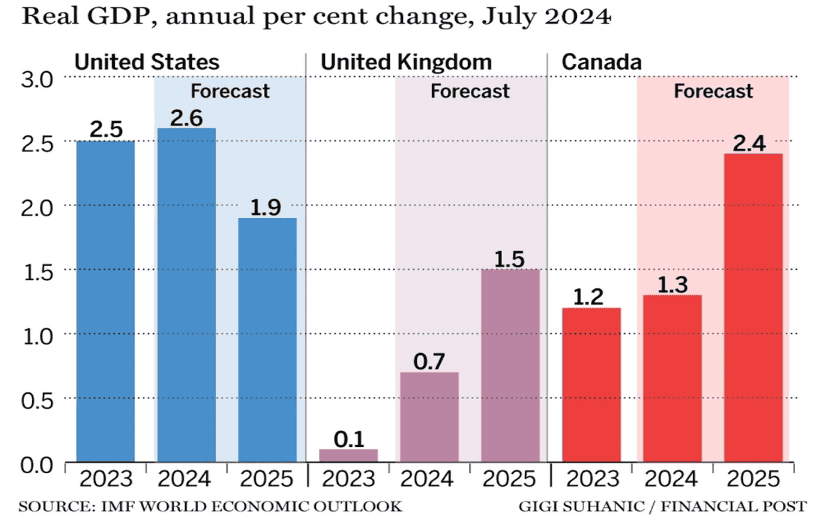

“Canada set to be fastest growing economy in G7 in 2025, IMF forecasts – Latest outlook puts this country ahead of United States and United Kingdom. The IMF predicts the global economy is headed toward a “soft landing,” but warns risks remain for the inflation outlook, especially in advanced economies. ‘The good news is that, as headline shocks receded, inflation came down without a recession’, wrote Pierre-Olivier Gourinchas, economic counsellor and the director of research at the IMF, in a blog post accompanying the release. “The bad news is that energy and food price inflation are now almost back to pre-pandemic levels in many countries, while overall inflation is not.”, International Monetary Fund, July 2024

=============================================================================================

China

“Microsoft Orders China Staff to Use iPhones for Work and Drop Android – Company will block corporate access from Android in China Microsoft has been tightening cybersecurity following attacks. Microsoft has been ramping up security worldwide after incurring repeat attacks from state-sponsored hackers. Microsoft Corp. told employees in China that starting in September they’ll only be able to use iPhones for work, effectively cutting off Android-powered devices from the workplace. The US company will soon require employees based there to use Apple Inc. devices to verify their identities when logging in, according to an internal memo reviewed by Bloomberg News.”, Bloomberg, July 8, 2024

=============================================================================================

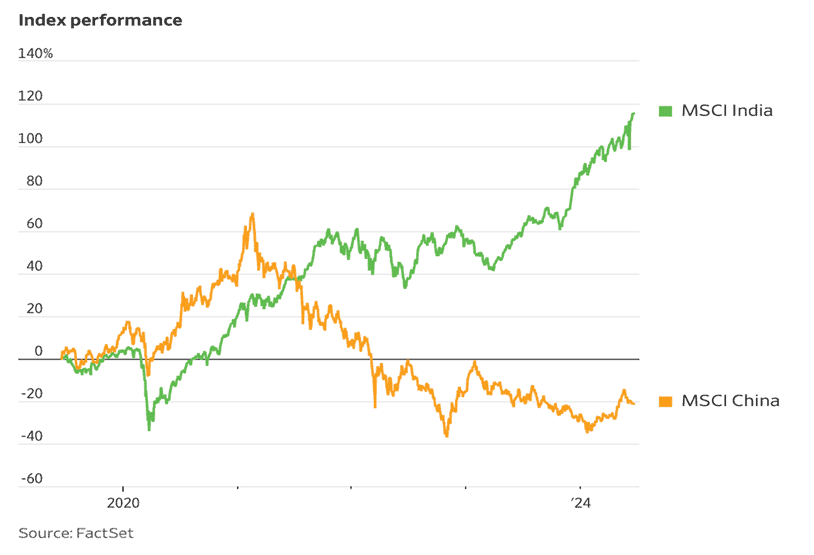

“Comparing the Economies of U.S. and China in 3 Key Metrics – Starting with GDP, we used 2024 estimates from the latest edition of the IMF’s World Economic Outlook (April 2024). Based on these figures, the United States and China combine for a massive 43.2% share of the global economy. It’s also interesting to note that America’s share of global GDP has actually been increasing in recent years, from a low of 21.1% in 2011. This is partly due to its relatively strong recovery from the COVID-19 pandemic. The U.S. dominates when it comes to stock market valuation, accounting for 61% of the global total as of Feb. 29, 2024.”, Visual Capitalist & International Monetary Fund, June 3, 2024

==============================================================================================

India

“India Sets Subdued Economic Growth Forecast as Risks Mount – Government projects growth of 6.5%-7% vs 8.2% last year Finance minister to give annual budget speech on Tuesday. India’s government set a fairly conservative economic growth forecast for the current fiscal year, concerned about mounting global risks. The economy will likely expand 6.5%-7% in the year through March 2025, the Ministry of Finance said its Economic Survey report released Monday. That compares with 8.2% in the past financial year and the central bank’s projection of 7.2% for the current year. Modi must also balance demands from his coalition allies to spend billions of dollars in their states, with pressure from credit rating companies to curb government debt.”, Bloomberg, July 22, 2024

==================================================================================================

Japan

“More than 40% of Japanese companies have no plan to make use of AI – The survey, conducted for Reuters by Nikkei Research, pitched a range of questions to 506 companies over July 3-12 with roughly 250 firms responding, on condition of anonymity. About 24% of respondents said they have already introduced AI in their businesses and 35% are planning to do so, while the remaining 41% have no such plans, illustrating varying degrees of embracing the technological innovation in corporate Japan. Asked for objectives when adopting AI in a question allowing multiple answers, 60% of respondents said they were trying to cope with a shortage of workers, while 53% aimed to cut labour costs and 36% cited acceleration in research and development.”, Reuter, July 17, 2024

============================================================================================

Saudi Arabia

“Saudi Arabia takes first step towards relaxing alcohol laws – Saudi Arabia has opened an off-licence in the diplomatic quarter of its capital, Riyadh, which is the kingdom’s first commercial outlet for the sale of alcohol beverages since a ban on the public sale and consumption of alcohol was imposed in 1952. We expect further relaxation of alcohol laws, together with the implementation of other social reforms and initiatives, in the years ahead as the government pushes ahead with its transformative Vision 2030 development plan, which includes the creation of a tourism offering that boasts major hotels, resorts, entertainment venues, sporting locations and (currently alcohol-free) restaurants and bars.”, Economist Intelligence Unit, February 23, 2024

===================================================================================================

“One crucial piece of advise for business in Saudi – Landing that lucrative contract or big deal in Saudi Arabia requires much more than an impressive pitch deck and competitive pricing. One of the most crucial pieces of advice for doing business in the Kingdom is this: take the time to deeply understand the culture and build strong relationships before ever pitching your products or services. Why is this so important? Saudi Arabian culture places an extremely high value on personal connections, trust, and commitment. Saudis want to work with those they know and have established a bond with. Attempting to jump straight into business negotiations without first investing in relationship building is a surefire way to be met with skepticism and difficulty gaining traction.”, Middle East Sunday Pages by Corina Goetz, July 21, 2024

=======================================================================================

Southeast Asia

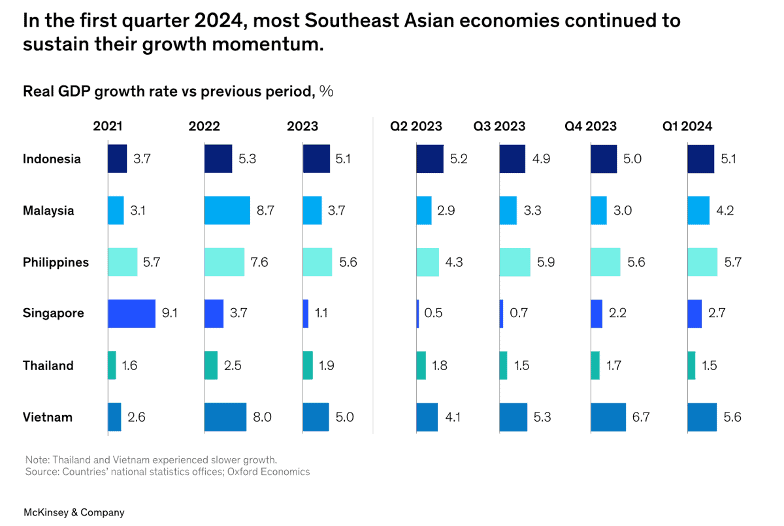

“Southeast Asia’s economies continue to sustain their growth momentum in the first quarter 2024. GDP grew in all economies, with growth in Indonesia, Malaysia, the Philippines, and Singapore increasing during this period, while Thailand and Vietnam recorded slower growth. Southeast Asia’s economies continue to sustain their growth momentum in the first quarter 2024. GDP grew in all economies, with growth in Indonesia, Malaysia, the Philippines, and Singapore increasing during this period, while Thailand and Vietnam recorded slower growth.”, McKinsey & Co., June, 2024

============================================================================================

Turkey

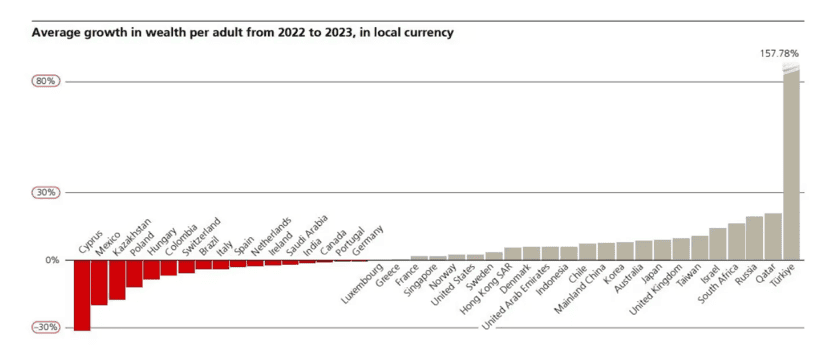

This country has seen its wealth growth explode since 2008. It’s not the U.S. – Individual wealth has been soaring since 2008 in places some might find surprising, such as Turkey. That’s according to UBS’s 2024 Global Wealth Report, released on Wednesday. The report shows that globally, people have been getting progressively wealthier, with dramatic rises in some places. This chart shows average wealth growth from 2022 to 2023 in local currencies. On this metric, Turkey has surged above the rest at more than 157% (in dollar terms, that growth is 63%).”, MarketWatch, July 10, 2024

==========================================================================================

United States

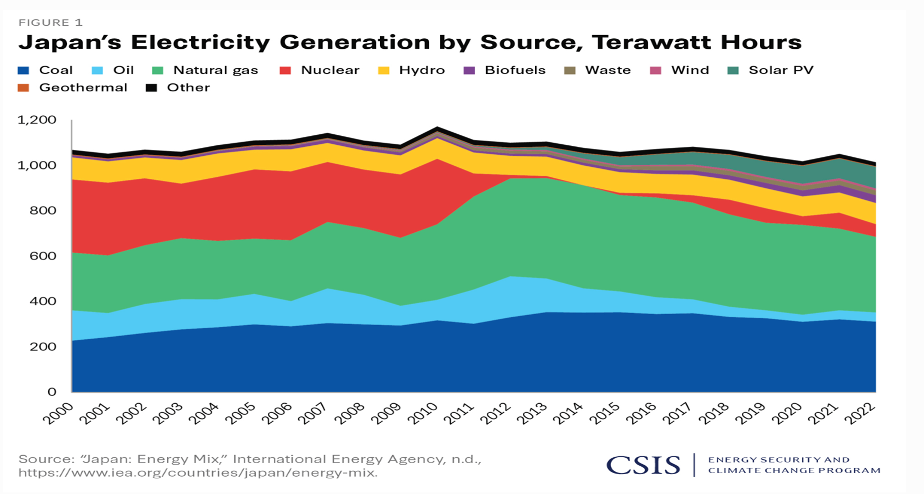

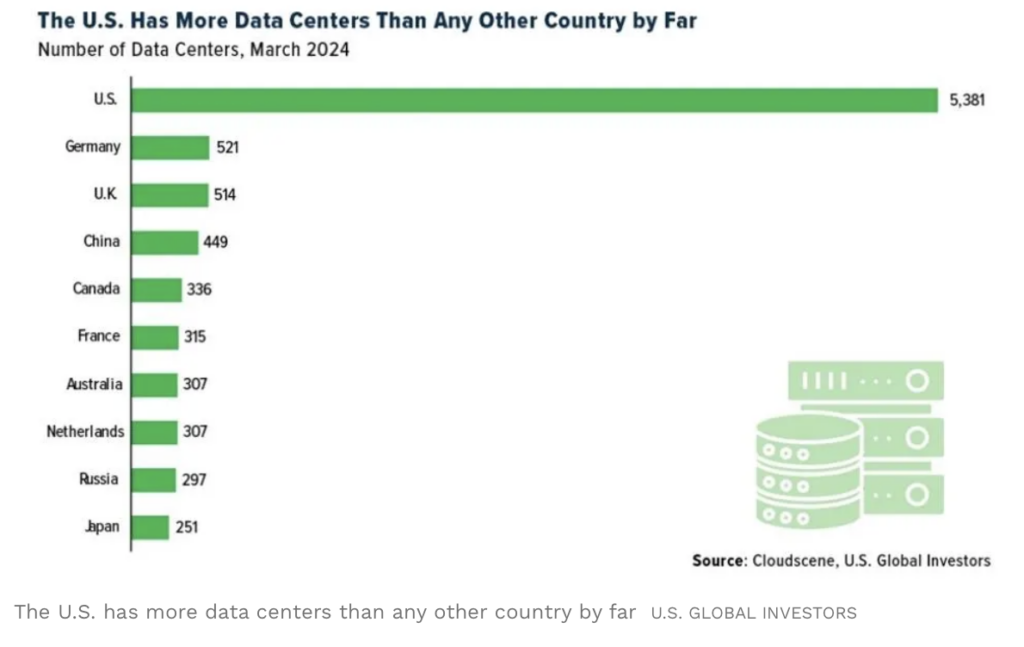

“U.S. will fall behind in the AI race without natural gas, Williams Companies CEO says – ‘The only way we’re going to be able to keep up with the kind of power demand and the electrification that’s already afoot is natural gas,’ Williams Companies CEO Alan Armstrong said in an interview Thursday. ‘If we deny ourselves that we’re going to fall behind in the AI race.’ The tech sector’s expansion of data centers to support AI and the adoption of electric vehicles is projected to add 290 terawatt hours of electricity demand by the end of the decade in the U.S., according to a recent report by the energy consulting firm Rystad. This load growth is equivalent to the entire electricity demand of Turkey, the world’s 18th largest economy.”, CNBC, July 19, 2024

============================================================================================

“Small Businesses Still Struggling – Small business (SMB) owners continue to face economic headwinds, including rent delinquency and revenue loss and stress around high interest rates and spiking labor costs. That’s according to Alignable’s June Revenue & Rent Report. The report was based on 3,690 responses to a poll of randomly selected small business owners in June. It also drew information from past survey responses. 72% of SMBs are earning less now monthly than pre-Covid, a slight increase from May’s 71%, breaking a 2024 record. Post-pandemic businesses are also struggling with 72% earning less than last year. Cumulative inflation—35% of SMB owners cite this as their top worry, up from 33% in May. Rising labor costs—79% of SMB employers are paying more for labor, up nine percentage points from May. Cash crisis—38% of SMBs have one month or less of cash on hand.”, Franchising.com, July 18, 2024

================================================================================================

Brand & Franchising News

“Olive Garden parent Darden Restaurants is buying Chuy’s for $605M – It will be the second acquisition for Darden in as many years and brings Mexican cuisine to its portfolio for the first time. Chuy’s has 101 restaurants and specializes in Tex-Mex cuisine. Darden Restaurants, the parent of Olive Garden, LongHorn Steakhouse and other casual-dining brands, is acquiring Chuy’s Tex-Mex for $605 million in cash, the company announced Wednesday. The 101-unit, Austin-based Chuy’s is known for its scratch-made Tex-Mex cuisine and the funky, eclectic atmosphere of its restaurants.”, Restaurant Business, July 17, 2024

===============================================================================================

“China Isn’t Done Tormenting Nike or Starbucks – Global Brands Hit Local Competition. China has become a more challenging market for global consumer brands like Nike and Starbucks, and investors are beginning to rethink the value of their Chinese business, according to a new report from TD Cowen analysts. Chinese consumers still like global brands like Nike, Adidas, Skechers andLululemon, which each generate a midteen share of their sales from China. But investors are beginning to discount the cash flows that companies generate from China as domestic competition and geopolitical risks intensify, TD Cowen analyst John Kernan, who co-wrote the report, tells Barron’s. Shares of some of these companies have already taken a hit as China’s economic recovery has sputtered, making consumers reluctant to spend as the property market—a major store of household wealth—is still struggling.”, Barron’s, July 18, 2024

================================================================================================

“Aussie boxing franchise UBX to enter United Arab Emirates – Brisbane-based boxing franchise UBX has announced its eighth international expansion with 18 locations planned in the United Arab Emirates (UAE), adding to an existing 100-plus gyms globally and hot on the heels of its recent campaign launch “Boxing is for Everyone” with adidas.

The company has appointed Mohsan Bari as the master franchisor for UBX UAE with initial sites being sourced in Dubai and Abu Dhabi. ‘In recent years, the Middle East has become a hotspot for combat sports, and the UAE’s enthusiasm for boxing makes it the perfect next step for UBX as interest in the sport is followed by participation,’ says UBX co-founder and managing director Tim West.”, Business New Australia, July 17, 2024

===============================================================================================

“Domino’s to shutter 100 stores – The board of Domino’s Pizza Enterprises (Australia) waited until after the market closed yesterday to announce store closures in two of its largest markets, Japan and France, which will almost entirely offset the net effect of planned store growth globally over the course of FY25.”, Business News Australia, July 18, 2024

============================================================================================

“Herbalife expects China to become its largest market – China is expected to double the size of Herbalife’s India market in about five years, which is currently its largest in terms of sales, Herbalife President Stephan Gratziani said in Shanghai. The United States-based nutrition product manufacturer is confident in the Chinese market given the growth potential in the country’s health and well-being sector. ‘In 5-7 years, China is expected to double the size of our India market, which is currently its largest market in terms of sales followed by the US and Mexico,’ Gratziani said in a recent interview. Currently, Herballife service providers operate about 3,200 community health-care and nutritional advisory clubs in China, and the number could grow significantly in the coming years given the potential, especially in lower tier cities.”, Shine, July 17, 2024. Compliments of Paul Jones, Jones & Co., Toronto

================================================================================================

“McDonald s plans to have more than 10,000 restaurants in mainland China by 2028 with more than 60 percent of employees born after 1995 – McDonald’s entered the Chinese mainland market in 1990. In 2017, McDonald’s China became McDonald’s largest international franchise market in the world, and CITIC Consortium became the controlling shareholder. Before the “Golden Arches” era, McDonald’s focused more on market development in first- and second-tier cities. Now, about 50% of McDonald’s restaurants are located in third-, fourth- and fifth-tier cities.”, Yicai, July 17, 2024

================================================================================================

“Piccolo Me parent plans 100 stores for Sol Bowl acquisition – Piccolo Me parent company FABE (Food and Beverage Enterprises) has added Sydney-based Sol Bowl to its portfolio of food brands. FABE has big goals for its newest addition: 100 stores, international expansion and co-branding with Piccolo Me. There are another five Sol Bowl sites planned for New South Wales and ACT before FABE takes the brand interstate. Sol Bowl founder Lilly Semaan launched the healthy-fast-food business as Soul Bowl in Parramatta in 2017. She has since refined the branding and added locations in Baulkham Hills and Rosehill.”, Inside Retail (Australia), July 17, 2024

=========================================================================================

To receive our biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing business environment. And our GlobalTeam™ on the ground covering 25+ countries provide us with updates about what is actually happening in their specific countries. We do not get involved in or report on politics!

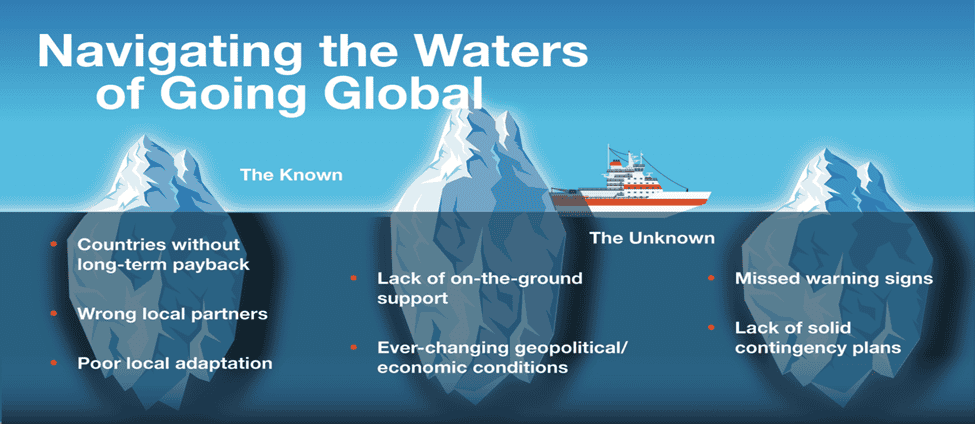

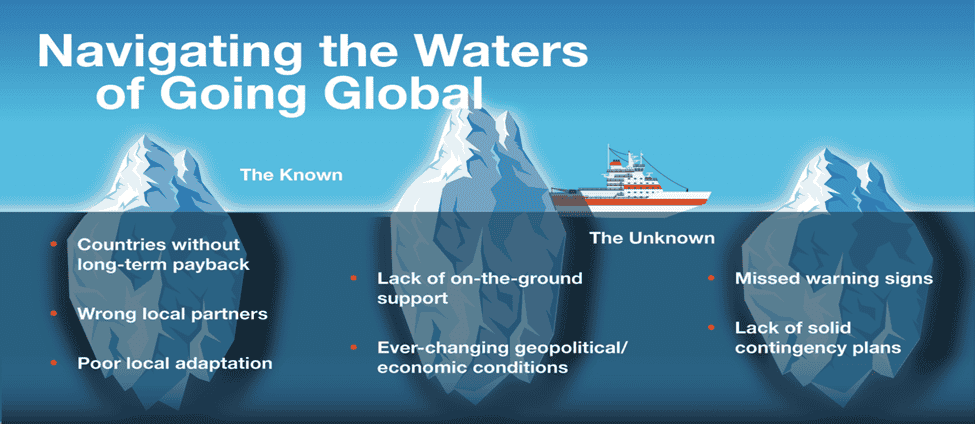

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe, and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant since 2001 taking 40+ franchisors global.

For a complimentary 30-minute consultation on how to take your business into new countries and make money doing it. For a complimentary call with Bill Edwards click on the QR code or contact Bill at bedwards@edwardsglobal.com and +1 949 375 1896

And download our latest chart ranking 40+ countries as places to do business, used by many companies for strategic planning, at this link:

Our latest GlobalVue™ 40 country ranking

Biweekly Global Business Newsletter Issue 112, Tuesday, July 9, 2024

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

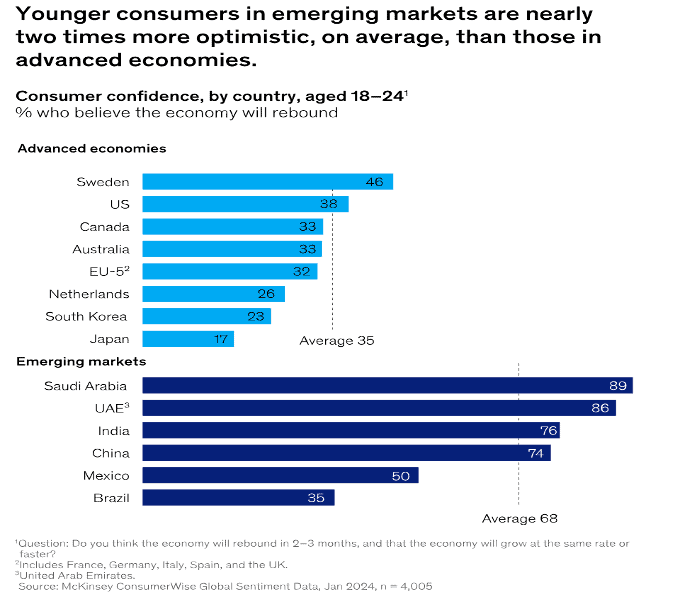

Commentary about the 112th Issue: The world’s most livable cities, the countries preferred by expats, the world’s richest countries, the corporate tax rates for the G20 countries (the USA is near the bottom!) and European’s are the happiest in the world. Which young consumers are the most optimistic in the world. Greece starts 6 day work weeks. Pan Am Airlines is making another comeback. The young and rich in China are trying to leave. And we are adding a book review to each newsletter going forward.

Edited and curated by: William (Bill) Edwards, CEO & Global Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA. Contact Bill with any questions, comments and contributions.

Bedwards@edwardsglobal.com, +1 949 375 1896

===================================================================

The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business. Some of the information sources that we provide links to require a paid subscription for our readers to access.

===================================================================

First, A Few Words of Wisdom From Others For These Times

“For the only way in which a durable peace can be created is by world-wide restoration of economic activity and international trade.”, James Forrestal

“Laws are like sausages, it is better not to see them being made.”, Otto von Bismarck

“If you don’t know where you are going, you might wind up someplace else.”, Yogi Berra

===================================================================

Highlights in issue #112:

- Brand Global News Section: Burritobar®, Little Caesars®, Mod Pizza® and Tim Hortons®

===================================================================

Interesting Data, Articles and Studies

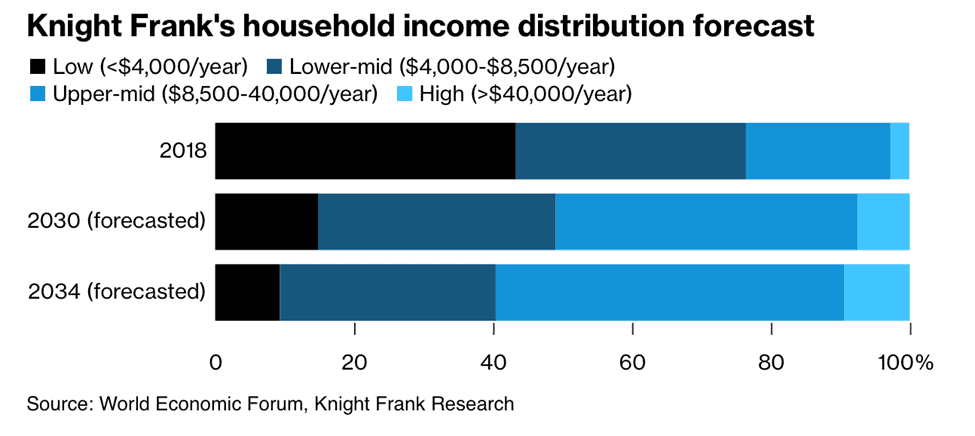

“State of the Consumer 2024: What’s now and what’s next – Amid massive shifts in the consumer landscape, companies can’t afford to rely on yesterday’s consumer insights. Here are nine trends that merit close attention. Middle-income consumers are feeling the squeeze and worrying about inflation but aren’t holding back on splurges. Rather than sticking to tight budgets in retirement, aging consumers are splurging too. Speaking of older shoppers, it turns out that the brand loyalty they’ve long been known for is a thing of the past. And young consumers in Asia and the Middle East are more likely than those in Western markets to switch to higher-priced brands.”, McKinsey, June 10, 2024

===================================================================

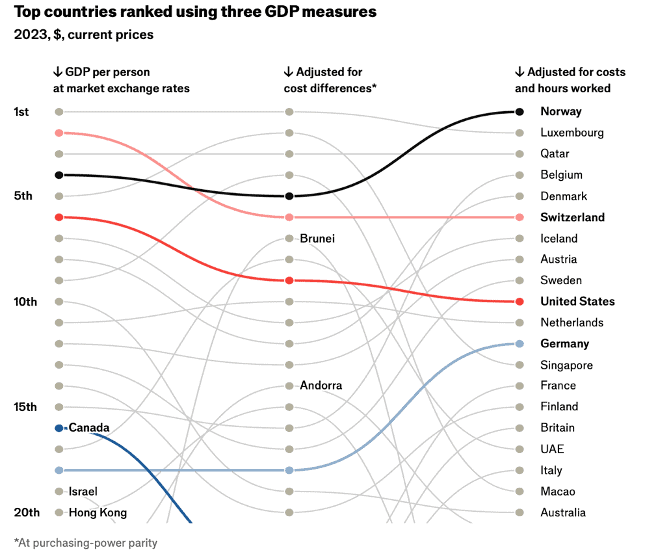

“The world’s richest countries in 2024 – Sorting Countries into rich and poor can be difficult. Measures such as GDP are affected by population size (more people generally mean more output). But adjusting for population alone is not enough. Dollar income per person does not account for differences in prices between countries (a Big Mac, for example, will set you back more in some places than in others, even after converting into dollars). Nor does it account for productivity (overall output per hour worked). To get a fuller picture, The Economist therefore ranks countries by three measures: dollar income per person, income adjusted for local prices (known as purchasing-power parity, or PPP) and income per hour worked. Take America first. Its GDP has been the largest at market exchange rates for over a century. But by income per person it falls to sixth, behind Luxembourg (first) and Switzerland (second). The results for China—the world’s second-largest economy in nominal terms—are even starker: it falls to 69th by GDP per person, 75th at local prices and 97th after accounting for hours worked.”, The Economist, July 4, 2024

===================================================================

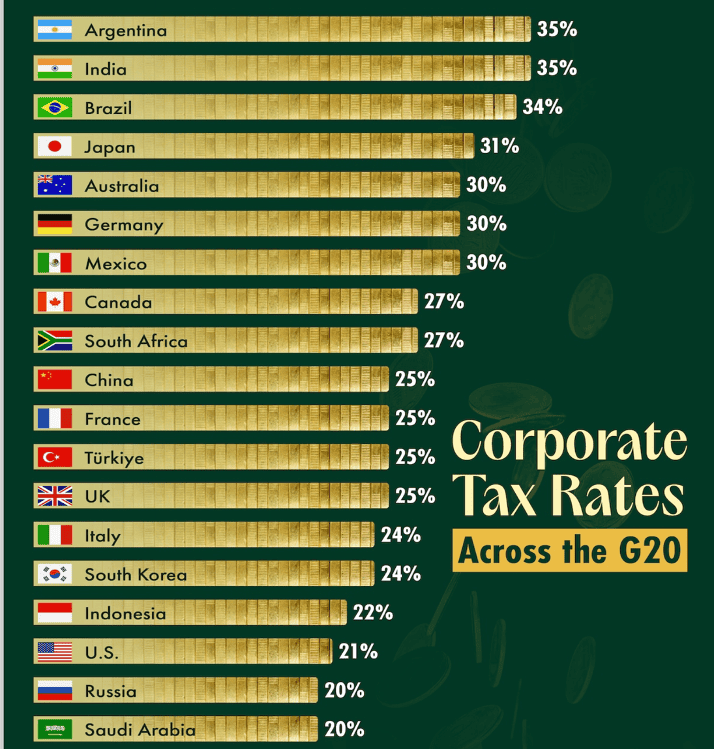

“Which Countries Have the Highest Corporate Tax Rates in the G20?– In the wake of the 1999 Asian financial crisis, government representatives from the 20 largest economies in the world decided to informally gather to coordinate policy on trade. Thus began the G20. Together the bloc accounts for more than 85% of the world economy and has been credited with unified policy action in response to world events. However, despite this shared affiliation, this group is still made of fundamentally different economies with varied policies towards their business entities.”, Visual Capitalist, June 26, 2024

===================================================================

“Top 10 most expensive cities for expats in 2024 – Hong Kong retained its pole position as the world’s most expensive city for expats in 2024, according to Mercer. Asia’s biggest financial hubs have once again clinched the top spots for being the costliest cities for international workers to live in, according to Mercer. Hong Kong was ranked as the most expensive city for expats to live in, followed by Singapore and Zurich, according to the Cost of Living City Ranking 2024. Cities in Switzerland — Zurich, Geneva, Basel and Bern — snagged four out of 10 spots. New York City ranked No. 7. The top five spots had no change from the year before, but London climbed 9 positions from No. 17 to 8. The survey compared the costs of more than 200 items in each of the 226 cities studied — including the price of housing, transportation, food, clothing, household goods and entertainment. New York City was used as the benchmark and currency fluctuations were measured against the U.S. dollar.”, June 18, CNBC

===================================================================

Global Supply Chain, Energy, Commodities, Inflation, Taxes & Trade Issues

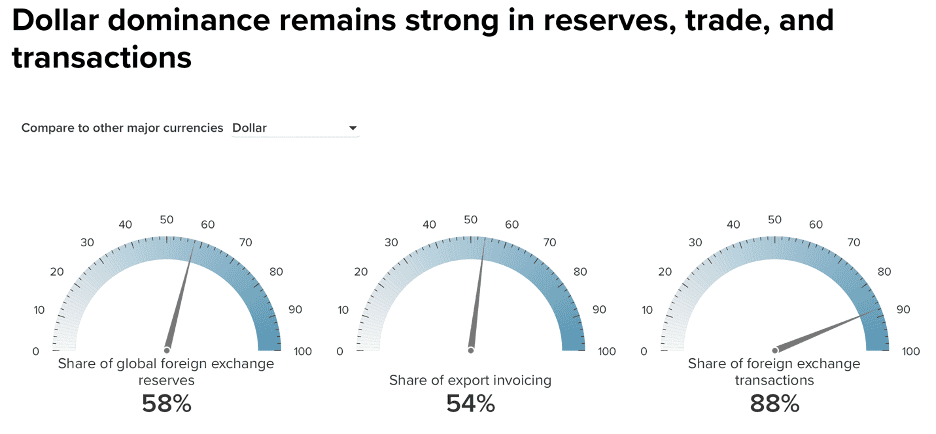

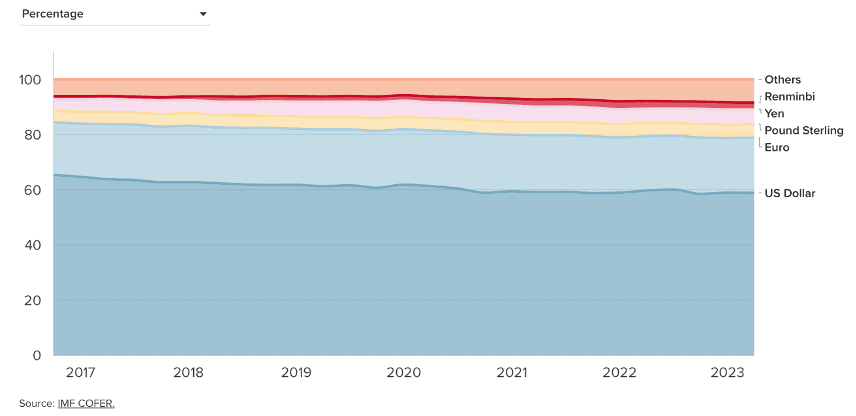

“Dollar Dominance Monitor – The US dollar has served as the world’s leading reserve currency since World War II. Today, the dollar represents 58 percent of the value of foreign reserve holdings worldwide. The euro, the second-most-used currency, comprises only 20 percent of foreign reserve holdings. Over the past twenty-four months, the members of BRICS (a grouping of Brazil, Russia, India, China, and South Africa that recently added Egypt, Ethiopia, Iran, and the United Arab Emirates; Saudi Arabia is considering joining) have been actively promoting the use of national currencies in trade and transactions. During this same time, China has been expanding its alternative payment system to its trading partners and seeking to increase international usage of the renminbi. But in recent years, and especially since Russia’s invasion of Ukraine and the Group of Seven (G7)’s subsequent escalation in the use of financial sanctions, some countries have been signaling their intention to diversify away from dollars.”, Atlantic Council, July 7, 2024

===================================================================

Global & Regional Travel & Living

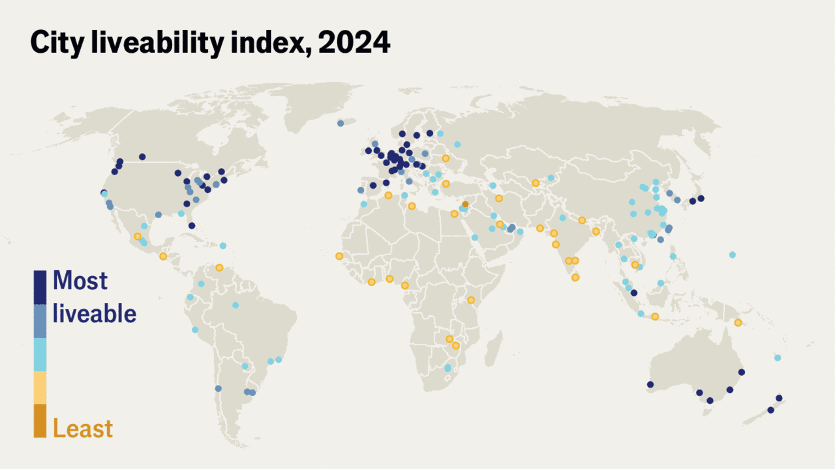

“The world’s most liveable cities – Which city is the most liveable in the world? Hint: it’s the historic capital of the Babenberg dynasty and the birthplace of the snow globe. This week EIU (Economist Intelligence Unit), our sister company, crowned it the world’s most liveable city for a third consecutive year. EIU’s index measures liveability using criteria like good schools, access to health care and so on. These are all relevant factors if you’re considering a move. But if you ask me, some important qualities of a city can’t be easily quantified. The general buzz and unpredictability can be what makes it exciting. “, The Economist (LinkedIn post), July 3, 2024

===================================================================

“Dream of moving abroad? This Central American destination is the No. 1 country for expats – Panama was named the No. 1 country for expats out of 53 countries in this year’s report, which surveyed more than 12,500 people in February about how satisfied they feel with their lives in a foreign country. The InterNations report ranked 53 global countries across five indices: quality of life, ease of settling in, working abroad, personal finance and an “expat essentials” index, which covers housing, administration, language and digital life. These are the top 10 countries for expats to live and work abroad, according to InterNations data: Panama, Mexico, Indonesia, Spain, Colombia, Thailand, Brazil, Vietnam, Philippines and the United Arab Emirates. (The USA ranks 35th).”, CNBC Make It, July 4, 2024

===================================================================

“Marriott International opens its 100th Sheraton Hotel in China – Marriott International is accelerating investment in China’s booming hospitality industry with the announcement of more than 40 new upper upscale hotels by the end of 2025. Sheraton Hotels & Resorts, part of Marriott Bonvoy’s global portfolio of more than 30 hotel brands, announced the opening of Sheraton Lanzhou Anning in Lanzhou, northwest China’s Gansu Province, on Monday, which marks the 100th Sheraton Hotel in China, where the brand made its market debut 50 years ago. Marriott International operates nearly 270 upper upscale hotels in China at present.”, Shine, July 3, 2024. Compliments of Paul Jones, Jones & Co., Toronto

===================================================================

“New Pan Am Soars, Reviving The Golden Age Of Air Travel – Under new ownership, Pan American World Airways has announced the first in a series of planned themed journeys that harken back to its heyday. For decades, the Pan Am brand and its distinctive blue and white logo symbolized the excitement and elegance of air travel’s golden age. Even after the airline ceased operations in 1991, memories of its attentive service, gourmet meals, impeccably dressed crew, and spacious seating endure. Now, Pan Am is ready to take flight once more. Its inaugural journey will be a 12-day commemorative voyage limited to 50 guests. Craig Carter, CEO of Pan American World Airways and owner of Pan Am Brands, will host the trip, which will fly round-trip to Europe from New York City with stops in Bermuda, Lisbon, Marseille, London, and Foynes in Ireland.”, Forbes, July 7, 2024

===================================================================

Book Review – New Section

“’No One Left: Why the World Needs More Children’ by Paul Morland – A population calamity is unfolding before our eyes. It started in parts of the developed world and is spreading to the four corners of the globe. There are just too few babies being born for humanity to replace itself. Leading demographer Paul Morland argues that the consequences of this promise to be calamitous. Labour shortages, pensions crises, ballooning debt: what is currently happening in South Korea – which faces population decline of more than 85% within just two generations – threatens to engulf us all, and sooner than we think. In the developed world we may be able temporarily to stave off the worst of its effects with immigration, but many countries, including those the immigrants come from, will get old before they get rich. ‘No One Left’ charts this future, explains its causes and suggests what might be done.”, Hachelle Australia, July 4, 2024

===================================================================

Country & Regional Updates

Canada

“For the first time in more than 150 years, Alberta’s electricity is coal free – At 10:57 p.m. on Sunday, June 16, Alberta’s last coal plant went offline. An official announcement shortly followed, quietly signalling the end of coal-fired electricity in Alberta. Coal accounted for 80 per cent of Alberta’s electricity grid in the early 2000s and it still amounted to 60 per cent just 10 years ago. Rapidly growing, low-cost renewable energy further supported the phase-out, along with companies investing in gas-fired electricity. All these actions accelerated the transition away from coal at a faster rate than anticipated.”, The Globe and Mail, July 6, 2024

===================================================================

China

“Decathlon, Lululemon and other sportswear brands accelerate store openings and adjust China store strategies – Sports fashion brands are considering opening larger stores or upgrading services as brand upgrading strategies. Since the beginning of this year, many sports and fashion brands such as Decathlon, lululemon, Zara, and Arc’teryx have opened large stores or upgraded store services, such as creating sports communities, in order to enhance user experience and improve brand positioning. On June 27, yoga wear brand Lululemon opened its first store in North China in Beijing Sanlitun Taikoo Li. The brand’s store in this business district was originally very small and located on the underground floor of the shopping mall. After the upgrade, it became a large street-side store covering three floors.”, Caixin, July 5, 2024. Compliments of Paul Jones, Jones & Co., Toronto

===================================================================

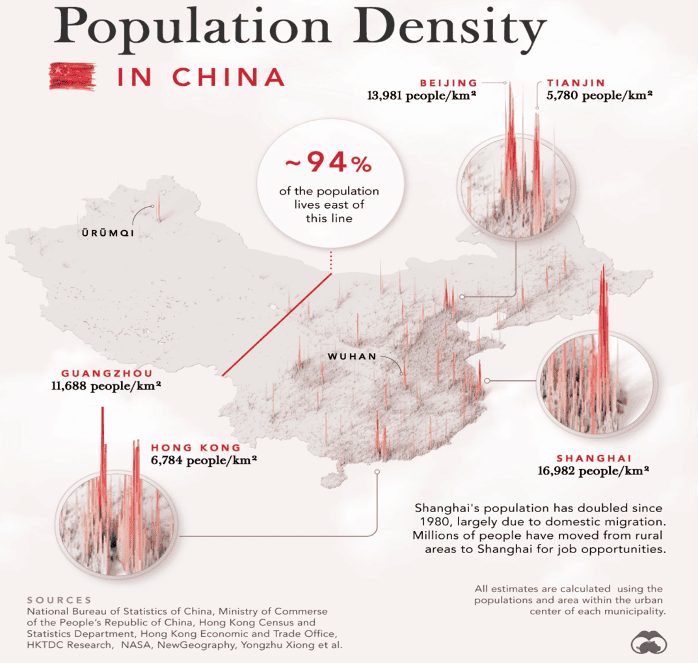

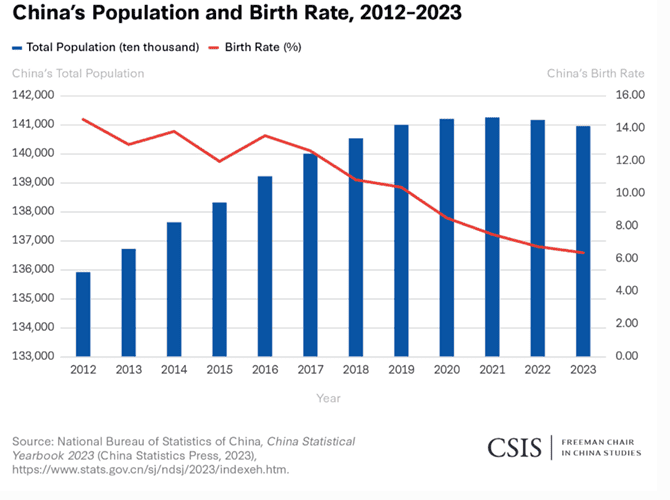

“China’s Population Density Visualized Using a 3D Map– For seven decades, China’s population was the world’s largest until India took that particular crown in 2023. Still, 1.4 billion people live in the country that stretches across 3.7 million square miles (9.6 million km²). However, as seen in the map above, 94% of the Chinese population lives east of the Heihe-Tengchong line, which is only 43% of the country’s area. Here are all of China’s cities with at least one million residents, from the 2020 census. Clearly noticeable are the provinces they are found in—on the eastern edge of the country, matching the population spikes seen above.”, Visual Capitalist, July 3, 2024

===================================================================

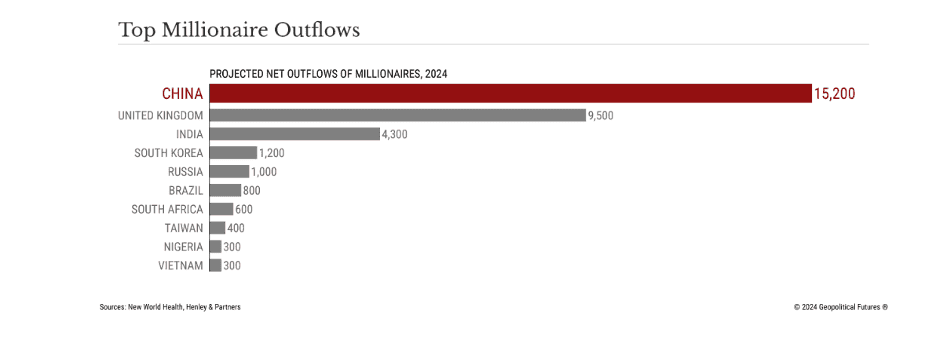

“Young, Rich and Restless in China – Economic conditions and draconian regulatory campaigns have led to record breaking levels of emigration. China is at the top of the list, having already seen an exodus of millionaires thanks to the COVID-19 pandemic and its economic discontents – not to mention President Xi Jinping’s anti-corruption campaign. All told, H&P estimates that China is set to lose some 15,200 of its most wealthy people this year, up from 13,800 the year before. (According to one estimate, there were in 2023 roughly 1.7 million people in China with personal wealth worth over 10 million yuan, or $1.4 million.) Importantly, young Chinese are starting to follow suit.”, Geopolitical Futures, June 28, 2024

===================================================================

Egypt

“Cairo Inks $72.4 Billion in Agreements and MOUs at Egypt-EU Investment Conference – Following the expanded agreement between Cairo and the International Monetary Fund (IMF), in which Egypt has largely aligned with IMF recommendations, investor confidence in Egypt has increased and will continue to draw in similar agreements and MOUs. Gaining additional investment is essential for boosting private sector growth and expanding jobs in Egypt. The Egypt-EU Investment Conference follows a March 2024 agreement between the European Union and Egypt in which they agreed to a financing package worth 7.4 billion euros ($8.1 billion) between 2024 and 2027 to support Egypt’s economic reforms, boost energy exports from Egypt to Europe and curb irregular migration through Egypt.”, Worldview Stratfor, July 1, 2024

===================================================================

European Countries

“Europeans feel the happiest and most respected in the world. Will the threat of an aging population change everything? When it comes to a life well-lived, there’s no beating Europe. For years, its countries have ranked among the highest in many lifestyle metrics. In 2024 and for the six years prior, Finland has held the crown as world’s happiest country, according to the World Happiness Report. Its other European peers followed—such as Denmark, Iceland, and the Netherlands. There’s more—Europeans felt respected and well-rested at varying degrees, pointing to an overall higher living standard and stronger social networks around people, according to Gallup’s Global Emotions Report. That scale varied from country to country—for instance, 97% of Portuguese respondents said they felt respected, while that figure dropped to 58% in Romania. Meanwhile, 75% of those in Ireland felt well-rested compared to just 53% in Greece.”, Fortune, July 5, 2024

===================================================================

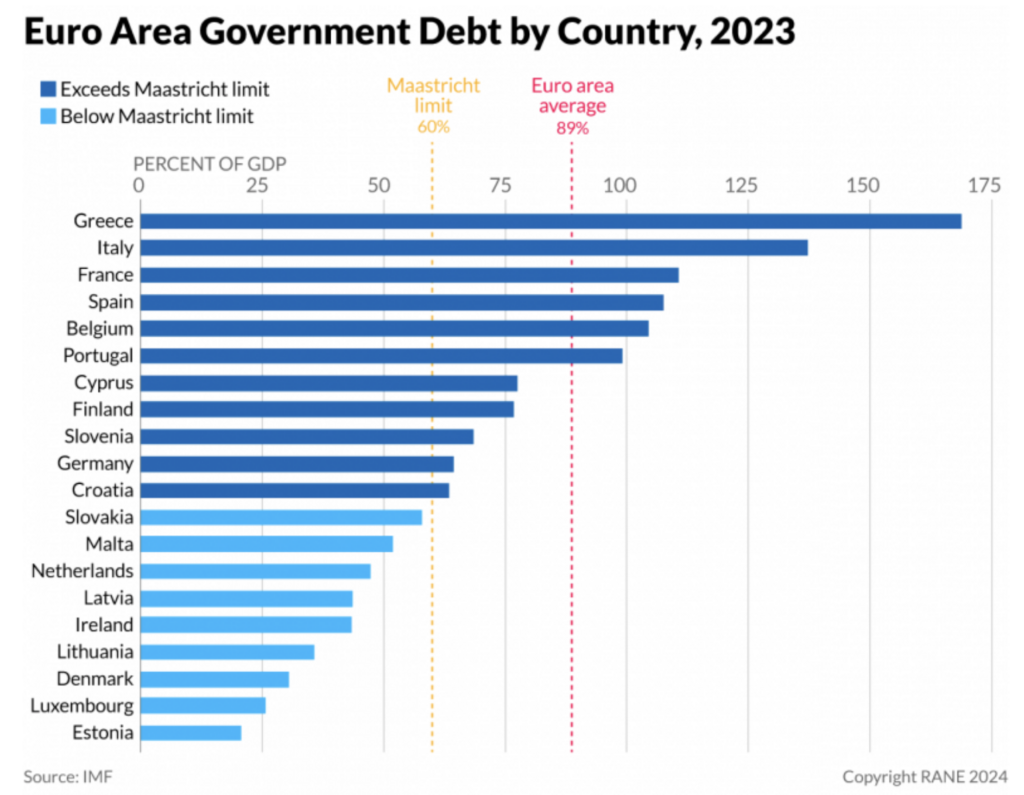

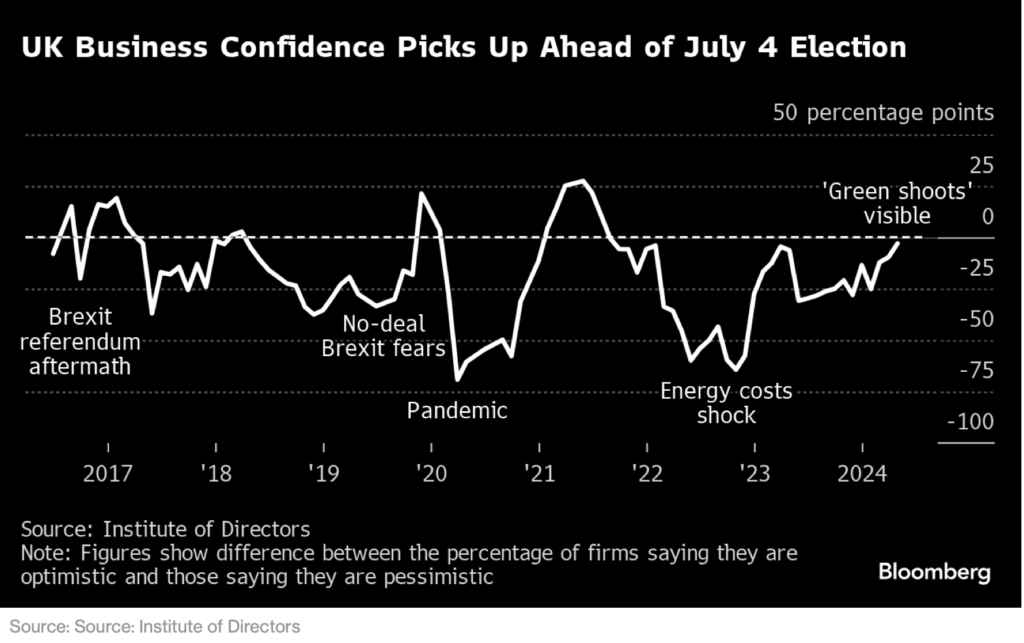

“Crushing Debts Await Europe’s New Leaders – Planned largess by election winners in Britain and France is on a collision course with soaring debts and deficits. Public debt is close to multidecade highs on both sides of the English Channel, where voters this week were electing new parliaments. In both France and the U.K., government spending and budget deficits as a share of gross domestic product are significantly above prepandemic levels. Economic growth remains lackluster, borrowing costs have surged, and demands on the public purse are rising, from defense to old-age pensions. All that means fiscal restraint—less spending or higher taxes—will be necessary, economists say. But politicians haven’t prepared electorates for that. On the contrary, they have signaled bold new spending plans.”, The Wall Street Journal, July 7, 2024

===================================================================

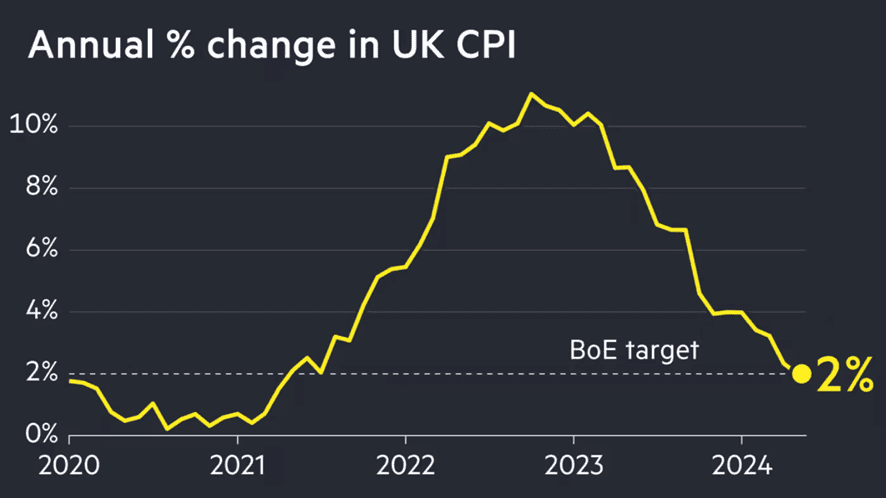

“Eurozone inflation slows to 2.5% – Lower rises in energy and fresh food costs are offset by persistently high services prices. Please use the sharing tools found via the share button at the top or side of articles. The figure for the year to June marked a slowdown from 2.6 per cent in the previous month. It was in line with economists’ forecast of 2.5 per cent in a Reuters poll. Please use the sharing tools found via the share button at the top or side of articles. Economists said the figures made it likely that the ECB would keep its benchmark deposit rate at 3.75 per cent at its next meeting on July 18 and further reductions in borrowing costs could hinge on how quickly services inflation comes down.”, The Financial Times, July 2, 2024

===================================================================

Greece

“Greece starts six-day working week for some industries – New legislation, which came into effect at the start of July, allows employees to work up to 48 hours in a week as opposed to 40. It only applies to businesses which operate on a 24-hour basis and is optional for workers, who get paid an extra 40% for the overtime they do. However, the move by the Greek government is at odds with workplace culture elsewhere in Europe and the US, where four-day working patterns are becoming more common.”, BBC, July 3, 2024

===================================================================

India

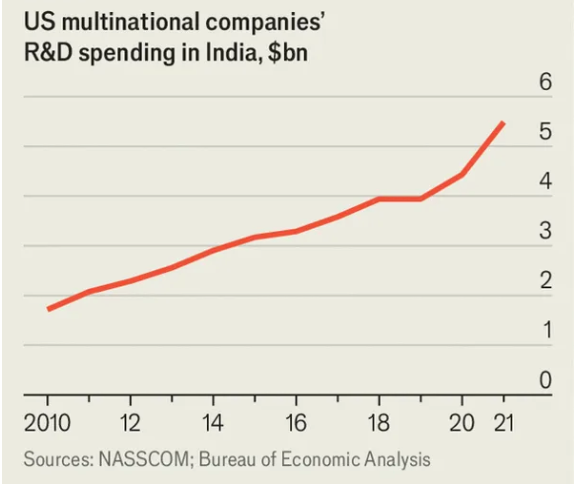

“Accenture taps Indian talent to take on the Big Four in consulting – Amid a downturn in the sector, using highly qualified Indian staff for complex tech work allows the consultancy to cut its prices when pitching to clients. There was a time when companies outsourced only their simpler work to India, but now Accenture is using the growing number of people there with MBAs and PhDs to do its highest-level advisory work for British and European clients. The consultancy is turning to top-ranking workers in India so it can cut its prices when pitching to clients, especially for IT-based work. In some cases, where the firm is bidding to transform or upgrade companies’ IT systems, up to 95 per cent of the skilled consultancy teams are based in India.”, The Times of London, June 23, 2024

===================================================================

“India’s big fat wedding industry is a US$130 billion gold mine for the economy – While many Indian weddings are elaborate affairs, there has been a notable shift in the scale of such ceremonies in recent years, according to industry observers. More couples are opting for intimate affairs that involve increased spending per guest. The sector is worth US$130 billion annually and is an immense driver of economic activity, according to a recent market report by the brokerage and investment research firm Jefferies. India holds more wedding ceremonies each year than any other country, with between 8 million and 10 million – or nearly 25 per cent of the global total. In comparison, about 2 million weddings and 8 million weddings take place annually in the United States and China, respectively. The value of India’s wedding industry is about twice that in the US, according to the report.”, The South Morning Post, July 6, 2024

===================================================================

Indonesia

“‘Not enough jobs’: Indonesia’s 10 million Gen Z face looming unemployment crisis – With so many young Indonesians neither working nor studying, experts warn of a demographic challenges in the coming years……..according to a recently released report by Statistics Indonesia (BPS), unemployment among those aged 20 to 24 had been on the rise in recent years, climbing from 12.86 per cent in 2015 to 17.02 per cent in 2022. This figure is significantly higher than the country’s average unemployment rate, which in February 2023 stood at 5.45 per cent, meaning that unemployment is particularly high for the younger age bracket. Jakarta is hoping to reach the status of a developed country in the next two decades, under its “Golden Indonesia 2045” vision, and the government is counting on young people to drive economic growth.”, (Edited for length), The South Morning Post, July 5, 2024

===================================================================

The Philippines

“Philippines overtakes China and Indonesia to be most dependent on coal-generated power – The Philippines’ dependency on coal-fired power surged 62% last year, overtaking China, Indonesia and Poland, according to London-based energy think-tank Ember. The Philippines was also the most coal-dependent country in Southeast Asia in 2023, as adoption of renewable electricity generation remained low. The share of electricity generated from coal in the country climbed to 61.9% last year compared to 59.1% in 2022. ‘Indonesia and the Philippines are the two most coal dependent countries in Southeast Asia and their reliance on coal is growing fast,’ the report said, adding that the Southeast Asian region saw a 2% uptick in coal reliance from 31% in 2022 to 33% last year.”, CNBC, July 3, 2024

===================================================================

South Korea

“South Korea Hikes Growth Forecast Sharply as Demand for AI Booms – South Korea revised its economic growth forecast sharply higher as booming global demand for artificial intelligence drives its semiconductor exports to record levels. The government sees gross domestic product expanding 2.6% this year, an upward revision from its previous forecast of 2.2%, according to a statement Wednesday from the Finance Ministry. The inflation forecast has been kept unchanged at 2.6%, matching an estimate by the Bank of Korea. The pick-up in economic projections underscores optimism about an economy that has bounced back from last year’s slump in semiconductor demand even as interest rates have stayed elevated.”, Bloomberg, July 2, 2024

===================================================================

Turkey

“Turkish inflation cools for first time in 8 months – Consumer prices increased 71.6 per cent in June from the same month in the previous year, a slower rate than expected and down from a nearly two-year high of 75.5 per cent in May, according to official data. The decline in inflation is one of the strongest signs to date that Turkey’s pivot away from unconventional monetary policy following President Recep Tayyip Erdoğan’s re-election in May last year is starting to bear fruit. The centrepiece of the new programme, which is slowly drawing back foreign investors who deserted the market in recent years, has been huge increases in borrowing costs. The central bank raised its main interest rate from 8.5 per cent in June last year to 50 per cent by March in an attempt to stomp out runaway price growth.”, The Financial Times, July 3, 2024

===================================================================

United Kingdom

“U.K. tech overtakes China, cementing its position as the world’s second-largest ecosystem by funding – China may be the world’s second-largest economy, but when it comes to startup funding, the U.K. is punching above its weight. Startups in the U.K. raised $6.7 billion in funding during the first half of 2024, helping dethrone China and propelling the U.K. to second place globally for funds raised, according to a new report. While the overall U.K. figure was down 2% year on year, according to data from global market intelligence platform Tracxn, it remained more robust than that of China, whose funding sat at $6.1 billion in H1 2024, helping the U.K. move into the No. 2 spot globally.”, Fortune, July 5, 2024

===================================================================

United States

“Empty Offices Risk Wiping Out $250 Billion in Commercial Property Value – US office vacancy rate is forecast to hit a peak of 24% by 2026. Nearly one-quarter of all US office space will be vacant by 2026 as working from home persists, slicing commercial-property values by as much as $250 billion, according to a report from Moody’s. Office-vacancy rates are expected to rise to 24% from 19.8% in the first quarter of this year in the US, reducing revenue for office landlords by between $8 billion and $10 billion when combined with the impact of lower rents and lease turnovers, the authors of the report said.”, Bloomberg, June 27, 2024

===================================================================

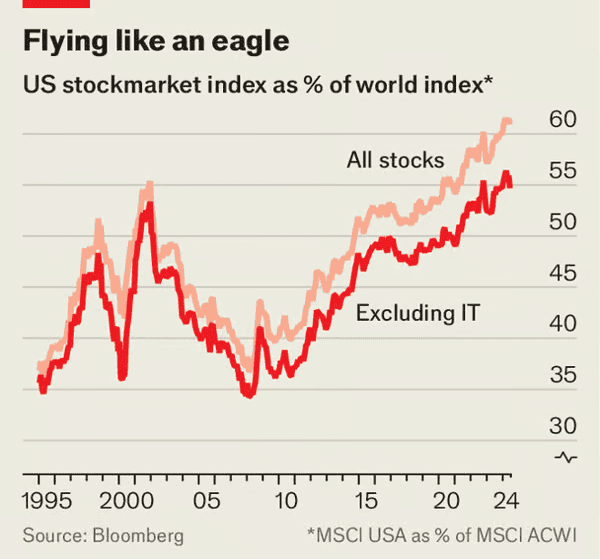

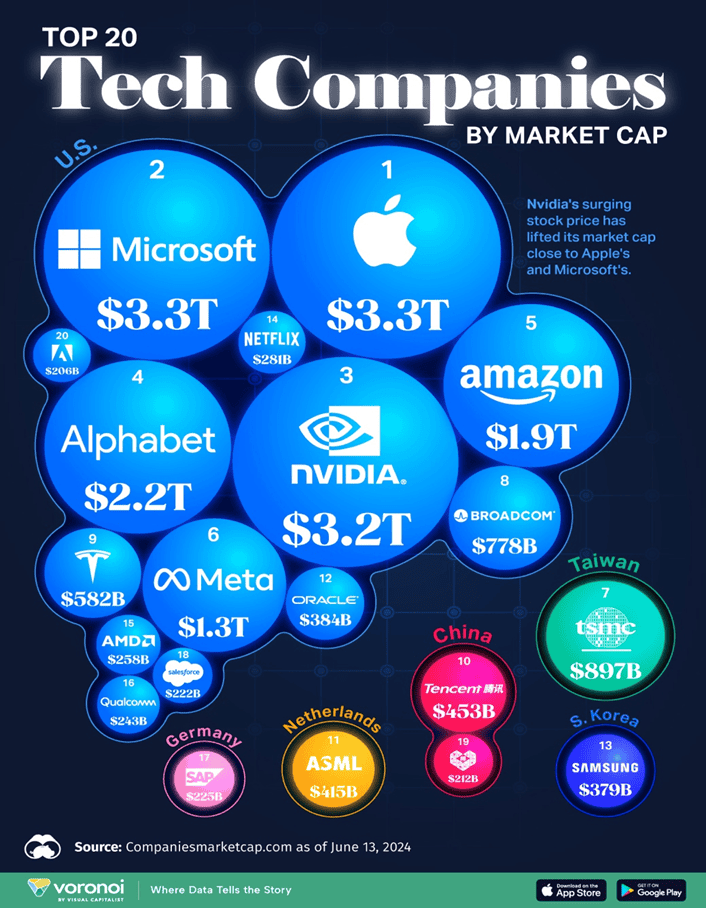

“American stocks are consuming global markets– That does not necessarily spell trouble. America’s share of the world’s stockmarket capitalisation has climbed pretty consistently over the past decade and a half, and sharply this year. It now stands at 61%. That is astonishing dominance for a country which accounts for just over a quarter of global gdp. The extent of market concentration is all the more extreme given what is happening within the American stockmarket itself. Just three companies—Apple, Microsoft and Nvidia—make up a tenth of the market value of global stocks.”, The Economist, June 27, 2024

===================================================================

Brand & Franchising News

“Leveraging AI in franchising: opportunities and legal considerations – In the context of franchising, AI presents opportunities to streamline operations, automate tasks and promote data-driven decision-making. The following are examples of several current and potential use cases of AI in franchising: Automation, Supply chain, Customer support and Personalized marketing. Franchisees are increasingly leveraging AI to tailor marketing strategies, optimize product assortments and create targeted promotions that would improve consumer conversion rates and bolster the bottom-line profitability of the franchise system.”, Osler law firm. July 5, 2024

===================================================================

“63 years of progress distilled into one eye-opening video – What fascinated me was observing the constant churn. Brands rose, fell, and then completely disappeared over the decades, a harsh reality of how brutal the food industry can be. But among this sea of change, a few exceptional companies thrived and fought their way to the top. That meteoric rise wasn’t pure luck – it was the result of a laser focus on quality, an uncanny ability to tap into evolving customer tastes, and treating their people as the cornerstone of their success. Today, let’s recognise that an unwavering drive for excellence and a willingness to adapt can transform even the simplest ideas into enduring legacies.”, From a LinkedIn post by Akshay Jatia, with the video by Justin Fischer, July 2, 2024.

===================================================================

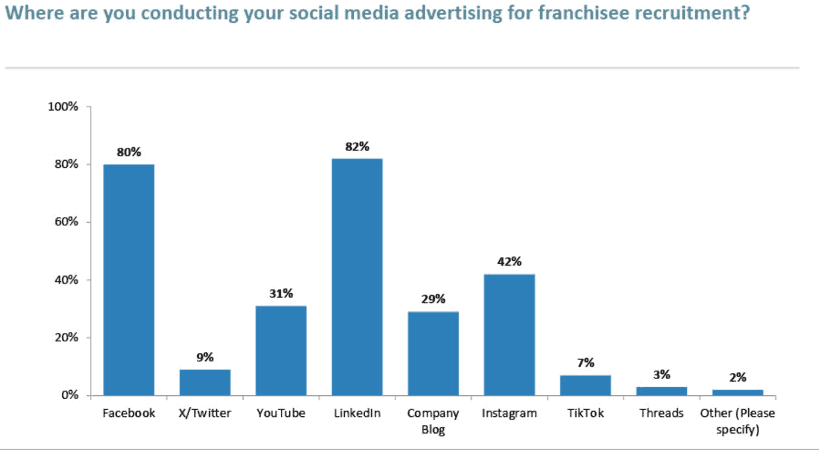

“2024 AFDR Data – The Use of Social Media with (U.S.) Franchise Recruitment – Franchise Update Media has been researching franchise lead generation and franchisee recruitment processes for more than a decade. An annual in-depth online survey queries franchise development professionals about a number of issues related to their lead generation and recruitment strategies. All the responses are collected, aggregated, and analyzed to produce a detailed look into the recruitment and development practices, budgets, spending allocations, and strategies of a wide cross-section of franchisors. The results are presented each year in the Annual Franchise Development Report (AFDR), which can be ordered online at afdr.franchiseupdate.com. The 2024 AFDR report is a valuable resource that can provide crucial insights on franchise development lead generation and recruitment best practices. It’s the kind of information that can help brands assess what they are doing right, and what needs improvement.”, Franchising.com, July 8, 2024

===================================================================

“Fast-Growing (Canadian) Burrito Chain Plans to Open 750 Restaurants In the U.S. – Burritobar, a Toronto-based Tex-Mex chain that offers classics like burritos, tacos, and bowls, just announced a franchise agreement with U.S. partners in New Jersey, planning for 93 new franchised restaurants across the state within the next two decades. The new agreement follows similar franchise plans in Michigan, Florida, Virginia, Maryland, Tennessee, Iowa, Nebraska, North Texas, Illinois, and Ohio, totaling 750 Burritobar restaurants planned for opening in the United States in the near future. Known as BarBurrito in Canada, the chain first opened in Toronto in 2015, quickly becoming a go-to for fast-casual Tex-Mex food across Canada. With 325 restaurants, the brand is Canada’s fastest-growing Mexican food franchise. In 2020, BarBurrito changed its name to Burritobar for its debut in the American market, with new franchise agreements opening two locations in Michigan and one in Delaware.”, Eat This, Not That!, July 5, 2024

===================================================================

“National pizza chain based in the Northwest reportedly on brink of bankruptcy– A national fast-casual pizza chain is exploring a potential bankruptcy filing as the company looks for a buyer, according to several report…..people familiar with MOD Pizza say the Seattle chain with 512 locations across the country has hired legal and financial advisers to work on a possible sale of the business or bankruptcy filing. ‘We’re working diligently to improve our capital structure and are exploring all options to do so. Since this is an ongoing process, it would be inappropriate to speculate about an outcome,’ a MOD representative shared with Nation’s Restaurant News in a statement. MOD was founded in 2008 as part of a wave of build-your-own pizza places. It currently has 32 locations in Oregon.”, Oregon Live, July 6, 2024

===================================================================

“Q&A with Little Caesars International Franchisee Leo Gonzalez – Was the process of acquiring a franchise in another country more difficult than in the United States? No, it wasn’t more difficult to build a franchise in Mexico. It’s actually easier to find the space to build out new franchise locations and also more cost effective. Mexico has a lot more space to franchise with restaurants that are bigger in size. About 65% of our Little Caesars there are free-standing with drive-thrus. These tend to do well with our guests and provide the convenient dining experience the brand is known for at all hours of the day.”, Franchising.com, July 2024

===================================================================

“Tim Hortons’ parent company inks two deals to bolster presence in China – Restaurant Brands International says it’s spending up to $45 million on two deals intended to boost its presence in China and spur growth in what the company sees as a promising market. The parent company behind Tim Hortons, Burger King, Popeyes Louisiana Kitchen and Firehouse Subs says the first deal will see it acquire Popeyes China from Tims China, which operates Tim Hortons franchises in the country. RBI values the purchase at $15 million, noting Popeyes China has opened 14 restaurants in Shanghai since initially launching in August 2023.”, CTV, July 2, 2024

===================================================================

To receive our biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing business environment. And our GlobalTeam™ on the ground covering 25+ countries provide us with updates about what is actually happening in their specific countries. We do not get involved in or report on politics!

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe, and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant since 2001 taking 40+ franchisors global.

For a complimentary 30-minute consultation on how to take your business into new countries and make money doing it, click on the QR code for a complimentary call with Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

And download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

Biweekly Global Business Newsletter Issue 111, Tuesday, June 25, 2024

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Commentary about the 111th Issue: The USA now gets a third of all global capital flows while China inbound investment craters. Birth rates in rich countries halve to hit record low. Norway discovers a huge source of rare minerals. The Philippines becomes the world’s hottest luxury housing market. The new owner of the chicken Big Mac trademark will expand into Europe. Southeast Asia is the go to place for companies leaving China. Managers around the world are learning Gen Z is different. Starbucks® and Hilton® ‘marry’. The top 20 tech companies control almost 20% of the world’s stock market value. India will need 100 million new homes in the next decade. India’s stock market out grows China. And KFC® is selling panini sandwiches, wagyu burgers and hot bagels in their new ‘healthy’ brand in Shanghai.

Edited and curated by: William (Bill) Edwards, CEO & Global Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA. Contact Bill with any questions, comments and contributions.

Bedwards@edwardsglobal.com, +1 949 375 1896

===================================================================

The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business. Some of the information sources that we provide links to require a paid subscription for our readers to access.

===================================================================

First, A Few Words of Wisdom From Others For These Times

“The biggest threat to your organization is the lack of imagination in your leadership” Hari Abburi .

“One day you will wake up and there won’t be any more time to do the things you’ve always wanted. Do it now.”, Paul Coelho

“Only those who will risk going too far can possibly find out how far one can go.”, T. S. Eliot

Highlights in issue #111:

- We’re in a new era’ of supply chain disruption, HSBC analyst says

- Southeast Asia is a top choice for firms diversifying supply chains amid U.S.-China tensions

Brand Global News Section: Guzman y Gomez®, Hilton®, KFC®, Mathnasium®, McDonalds®, Quiznos®, Starbucks® and Supermac®

==================================================================

Interesting Data, Articles and Studies

“The 20 Biggest Tech Companies by Market Cap – The world’s 20 biggest tech companies are worth over $20 trillion in total. To put this in perspective, this is nearly 18% of the stock market value globally. This graphic shows which companies top the ranks, using data from Companiesmarketcap.com. Market capitalization (market cap) measures what a company is worth by taking the current share price and multiplying it by the number of shares outstanding. Here are the biggest tech companies according to their market cap on June 13, 2024. It’s clear from the biggest tech companies that involvement in AI can contribute to investor confidence. Among S&P 500 companies, AI has certainly become a focus topic. In fact, 199 companies cited the term “AI” during their first quarter earnings calls, the highest on record. The companies who mentioned AI the most were Meta (95 times), Nvidia (86 times), and Microsoft (74 times).”, Visual Capitalist, June 17, 2024

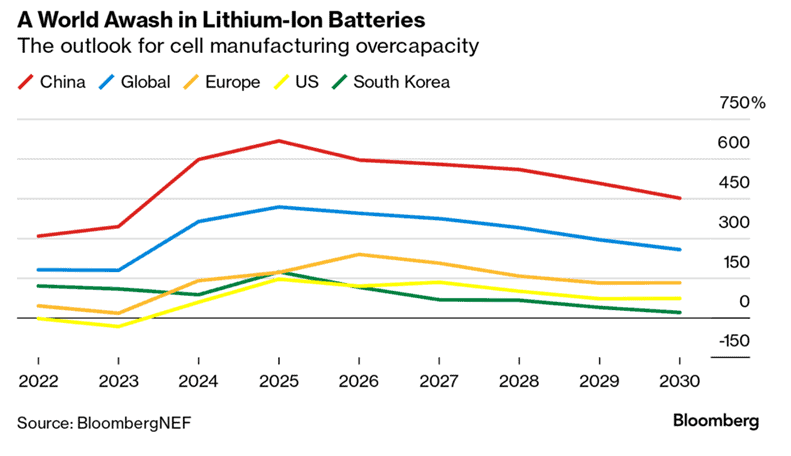

“Europe’s EV Battery Plans Are Getting Crushed by China, US – As electric-vehicle sales slow, companies including Volkswagen, Stellantis and Mercedes-Benz are scaling back or refocusing battery projects. Chinese manufacturers are slashing costs and the US is drawing away investment with lucrative subsidies. China already has excess battery-making capacity, can make cells at a fraction of the cost it takes in Europe, and has a head start on the next generation of cell technology.”, Bloomberg, June 20, 2024

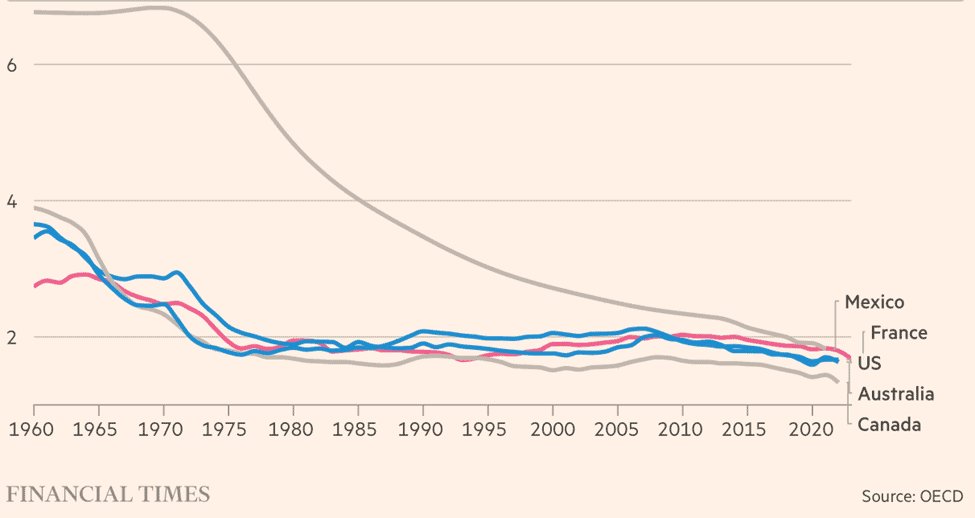

==================================================================

Number of Children Per Woman

“Birth rates in rich countries halve to hit record low – Steep decline in fertility will ‘change face of societies’ and affect growth prospects, says OECD Steep decline in fertility will ‘change face of societies’ and affect growth prospects, says OECD. The average number of children per woman across the 38 most industrialised countries has fallen from 3.3 in 1960 to 1.5 in 2022, according to a study by the OECD published on Thursday. The fertility rate is now well below the “replacement level” of 2.1 children per woman — at which a country’s population is considered to be stable without immigration…”, The Financial Times, June 20, 2024

==================================================================

“Top 10 most expensive cities for expats in 2024 – Hong Kong retained its pole position as the world’s most expensive city for expats in 2024, according to Mercer. Asia’s biggest financial hubs have once again clinched the top spots for being the costliest cities for international workers to live in, according to Mercer. Hong Kong was ranked as the most expensive city for expats to live in, followed by Singapore and Zurich, according to the Cost of Living City Ranking 2024. Cities in Switzerland — Zurich, Geneva, Basel and Bern — snagged four out of 10 spots. New York City ranked No. 7. The top five spots had no change from the year before, but London climbed 9 positions from No. 17 to 8. The survey compared the costs of more than 200 items in each of the 226 cities studied — including the price of housing, transportation, food, clothing, household goods and entertainment. New York City was used as the benchmark and currency fluctuations were measured against the U.S. dollar.”, June 18, CNBC

==================================================================

Global Supply Chain, Energy, Commodities, Inflation, Taxes & Trade Issues

“This Mexican Port Is Angling to Be a Nearshoring Gateway – The Guaymas Port in Mexico is looking to reposition itself as a transport hub that officials say will accelerate nearshoring in the region. Sonora Governor Alfonso Durazo announced this week that the port in the northwest region of Mexico would be revamped under a deal signed with the Port of Antwerp-Bruges International in Belgium and backed by a $220 million investment from the federal government. Ford Motor is one of the first companies looking to take advantage. The carmaker will kick off a pilot out of Guaymas starting this week— some 2,000 cars will make their way out of the port to Chile by the end of the year. Ford estimates that switching to exporting from Guaymas will reduce highway transport by 3,300 kilometers (2,050 miles) per vehicle.”, Bloomberg, June 19, 2024

==================================================================

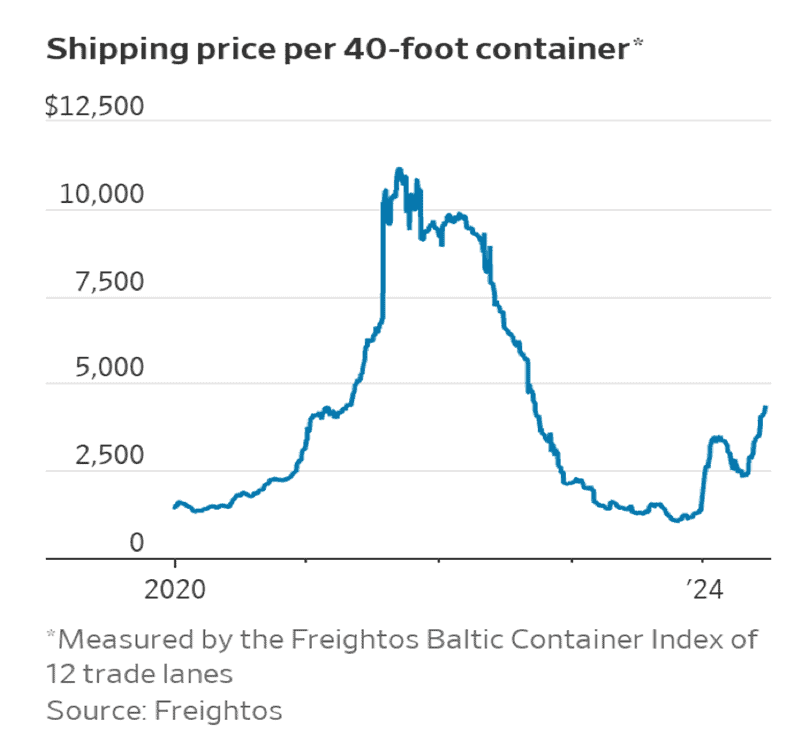

“Ocean Shipping Prices Are Pushing Toward Pandemic-Era Highs as Congestion Swells – Disruptions from the diversions around the Red Sea violence are backing up vessels with the peak shipping season still looming. The Port of Singapore, a global hub for container lines, has been swamped, leading to long wait times for a berth and increased shipping costs. Ship backups that plagued seaports during the Covid pandemic are making a comeback, as vessel diversions because of attacks in the Red Sea trigger gridlock and soaring costs at the start of the peak shipping season. Flotillas of containerships and bulk carriers are growing off the coasts of Singapore, Malaysia, South Korea and China while ports in Spain and other parts of Europe look to dig out from container piles. Houthi rebel attacks on commercial shipping in the Red Sea, which have effectively closed the Suez Canal since the end of last year, are being felt at faraway ports as the disruptions extend voyage times, throw ships off schedule and strand sea containers. T he average worldwide cost of shipping a 40-foot container hit $4,119 the week ending June 14, according to Freightos, more than triple the cost in June last year and the highest rate since September 2022.”, The Wall Street Journal, June 24, 2024

==================================================================

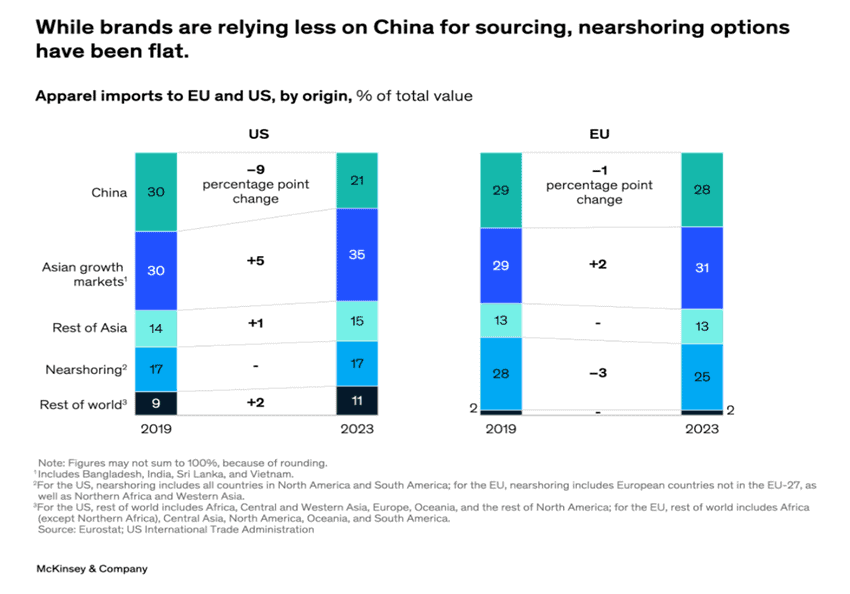

“Is nearshoring in fashion? Nearshoring—locating production close to consumer markets—has been a top priority for US and European apparel executives since 2016, according to McKinsey surveys. But in practice, nearshoring has remained flat, senior partner Karl-Hendrik Magnus and colleagues find. Although apparel companies are shifting sourcing away from China, production has moved primarily to other Asian countries.”, McKinsey & Co., June 12, 2924

==================================================================

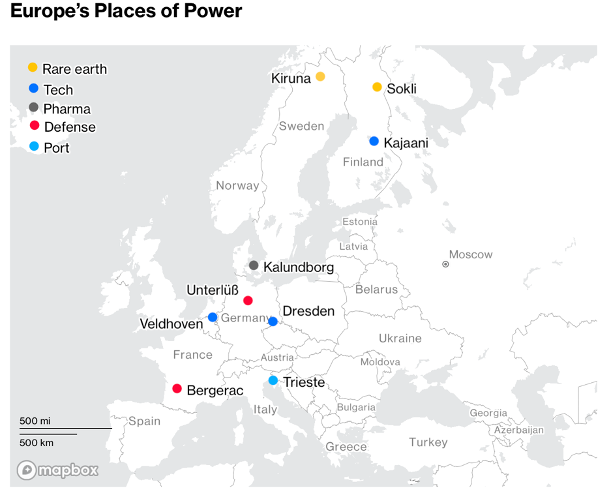

“Norway just loosened China’s stranglehold on rare minerals critical to the global economy—and it’s a huge win for Europe and the U.S. Norway just struck a gold mine. Well, a rare mineral mine – The Norwegian mining company, Rare Earths Norway, just uncovered the largest deposit of rare earth elements in Europe. The discovery has major implications not just for the company, which is certainly poised for a windfall, but for global geopolitics. Norway’s discovery would finally make Europe a player in the industry. In January, the Norwegian parliament voted 80–20 to allow offshore, deep-sea mining of rare minerals in remote waters to the north of the country. Norway, which is already a major producer of oil and natural gas, would become the first country to allow its seabed to be mined for rare minerals.”, Fortune, June 11, 2024

“We’re in a new era’ of supply chain disruption, HSBC analyst says – After a series of COVID-19 pandemic disruptions, ongoing geopolitical conflicts, and now a historic year in which more than 60 countries are holding elections, supply chain managers face a growing number of challenges. ‘I would actually say that we’re in a new era,’ HSBC Americas head of global trade solutions Marissa Adams told Yahoo Finance in a video interview. ‘I don’t think that there is a normalization anymore. I think that what companies are now facing is that supply chain disruption is the new norm.’ Supply chain disruptions have always been a part of global trade, even dating back to the Silk Road, which connected trade routes in Europe, the Middle East, and Asia. However, companies in the current market are more exposed to unexpected global events, which impacts their ability to trade effectively.”, Yahoo Finance, June 16, 2024

==================================================================

Global & Regional Travel

“Thailand is still attracting fewer visitors than before COVID – But its tourism sector is thriving thanks to AI, savvy marketing, and Season 3 of ‘White Lotus’. “There are three reasons for the slow recovery,” says Bill Barnett, founder and managing director of C9 Hotelworks, a Phuket-based hospitality consultancy: “China, China, and China.” The country was the largest source of tourists for Thailand in 2019, sending 11 million. But just 3.5 million Chinese visited in 2023, mostly because of China’s gloomy economy. Hotels have also cut costs by choosing not to restore positions slashed during COVID. They’ve automated repetitive tasks like check-ins. Chatbots can answer many guest inquiries, and existing staff have learned to multitask.”, Fortune, June 17, 2024

Country & Regional Updates

BRICS Countries

“Malaysia, Thailand Declare Intentions to Join BRICS Ahead of Russia Summit – (Malaysia) Prime Minister Anwar Ibrahim declared his intention to apply to the bloc after it doubled in size this year by luring Global South nations — partly by offering access to financing but also by providing a political venue independent of Washington’s influence.