EGS Biweekly Global Business Newsletter Issue 85, Tuesday, June 27, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Introduction: In this issue, global inflation is mixed, China is sputtering, there is too much wine in Europe (?), Japan is seeing lots of foreign investment, the United Kingdom will soon charge to enter, global employee engagement reached a record high in 2022, Outback Steakhouse takes over Brazil and Canada is using mass immigration to grow.

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

NOTE: Some of the sources that we provide links to require a paid subscription to access. We subscribe to 40 international information sources to keep our readers up to date on the world’s business.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here:

First, A Few Words of Wisdom From Others

Change before you have to.”, Jack Welch.

“The greatest danger in times of turbulence is not the turbulence – it is to act with yesterday’s logic.”, Peter Drucker

“Whosoever desires constant success must change his conduct with the times.”, Niccolo Machiavelli

Highlights in issue #85:

- Brand Global News Section: 16 Handles®, Burger Fi®, Burger King®, Long John Silver’s®, Outback Steakhouse® and Studio Pilates®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data and Studies

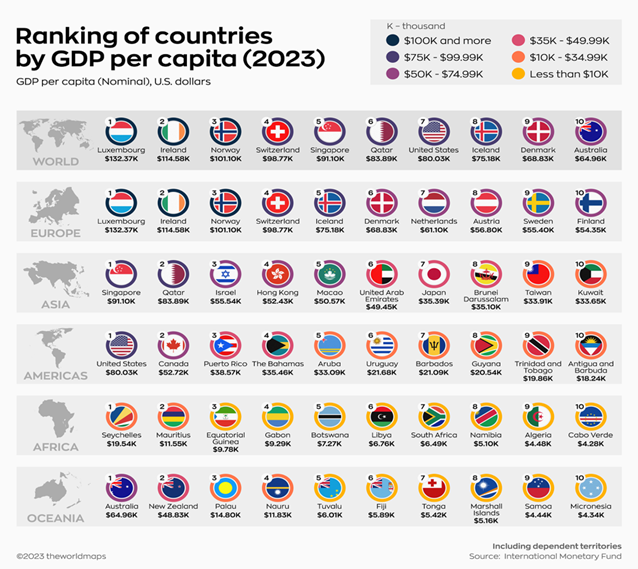

“Top 10 Countries By GDP Per Capita, by Region – GDP per capita attempts to level the playing field by dividing a country’s economic output by its population, effectively giving the average GDP per person. A higher per capita GDP generally corresponds to higher income, consumption levels, and standards of living. The simplicity of this metric also makes it useful for economists and policymakers to communicate levels of economic well-being to the public. The above graphic from the WORLDMAPS ranks the top 10 countries by per capita GDP in different regions, using data from the International Monetary Fund (IMF).”, Visual Capitalist / Worldmaps, June 22, 2023

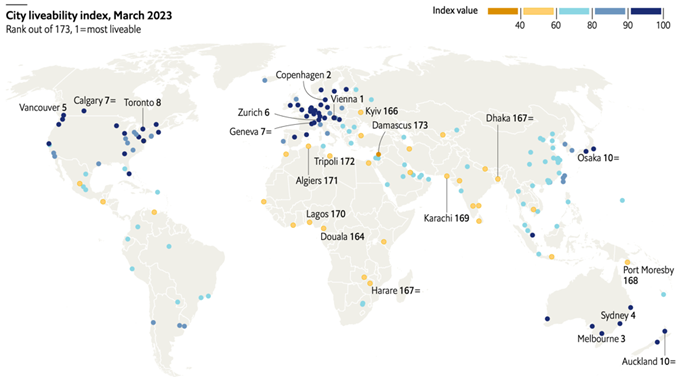

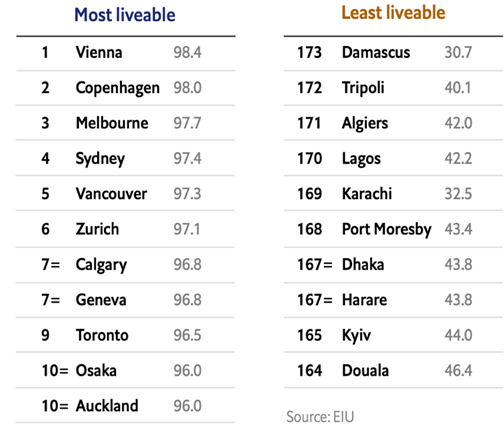

“The world’s most liveable cities in 2023 – Living conditions in cities across the world have fully recovered from the deterioration caused by the covid-19 pandemic, eiu’s latest liveability index shows. It rates living conditions in 173 cities across five categories: stability, health care, culture and environment, education and infrastructure. Cities in the Asia-Pacific region have rebounded the most. The index also suggests that life in cities is a bit better than at any time in the past 15 years.”, The Economist Intelligence Unit, June 21, 2023

“State of the Global Workplace: 2023 Report – Employee engagement reached a record high in 2022. After dropping in 2020 during the pandemic, employee engagement is on the rise again, reaching a record-high 23%. This means more workers found their work meaningful and felt connected to their team, manager and employer. That’s good news for global productivity and GDP growth.”, Gallup, June 2023

“The world’s regulatory superpower is taking on a regulatory nightmare: artificial intelligence – The European Parliament, the legislative branch of the European Union (EU), passed a draft law on Wednesday intended to restrict and add transparency requirements to the use of artificial intelligence (AI) in the twenty-seven-member bloc. In the AI Act, lawmakers zeroed in on concerns about biometric surveillance and disclosures for generative AI such as ChatGPT. The legislation is not final. But it could have far-reaching implications since the EU’s large size and single market can affect business decisions for companies based elsewhere—a phenomenon known as “the Brussels effect.”, The Atlantic Council, June 13, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

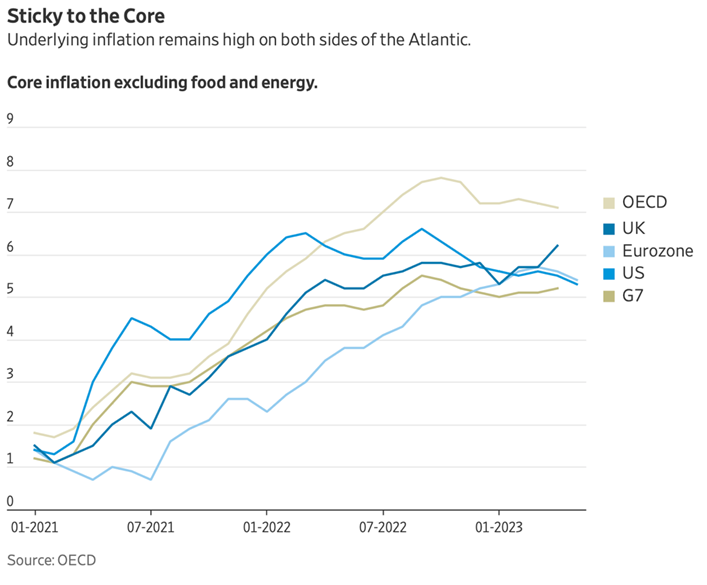

“Why Inflation Around the World Just Won’t Go Away – Roughly a year into their campaign against high inflation, policy makers are some way from being able to declare victory. Roughly a year into their campaign against high inflation, policy makers are some way from being able to declare victory. In the U.S. and Europe, underlying inflation is still around 5% or higher even as last year’s heady increases in energy and food prices fade from view. On both sides of the Atlantic, wage growth has stabilized at high levels and shows few signs of steady declines.”, The Wall Street Journal, June 19, 2023

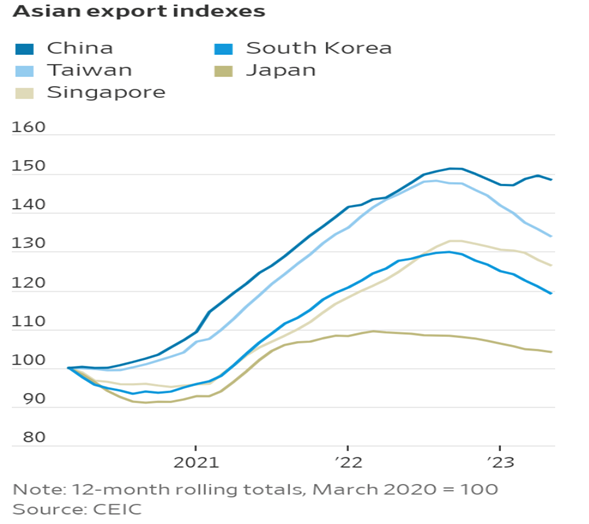

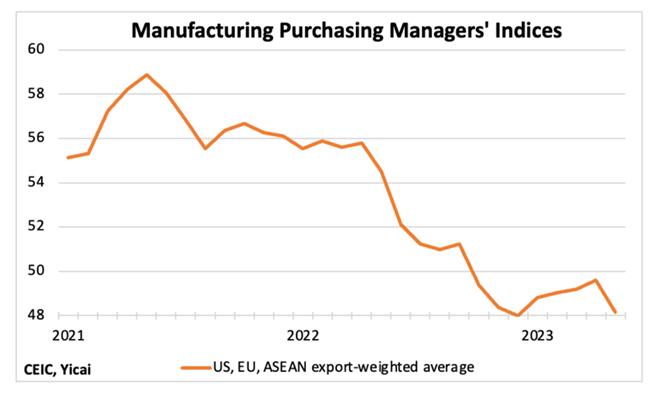

“Trade Woes in Asia Bring Inflation Relief to U.S. Consumers – But slowing exports to Western nations won’t alone stem rapidly rising prices. Sinking global trade is pummeling Asian exports, bringing some relief on inflation to U.S. and other Western consumers. But easing prices for home furnishings, electronics and other manufactured goods don’t signal high inflation will soon be defeated. Wage growth and services price gains are still elevated. And central banks in the U.S. and Europe are warning they aren’t finished raising interest rates in their fight to cool inflation.”, The Wall Street Journal, June 24, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel Updates

“The U.K. Will Officially Charge Travelers for Entry Starting This Fall — Here’s How Much: What to know about the U.K.’s Electronic Travel Authorisation visa waiver, which will go into effect in November. The fee, which will be rolled out this fall, will cost travelers £10 ($12.59) per applicant. When it is fully implemented, all foreign visitors without a visa (including those from the United States) will be required to apply for the ETA online in advance of their trip.”, Travel and Leisure, June 15, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Australia

“Investors sitting on record $1 trillion cash despite super rebound – Savers have turned away from the volatility of stock markets to the security of term deposits and nervous retirees are drawing down lump sums. Savers have shunned their super funds and deposited a record $1 trillion in term deposits amid growing economic and stock market concerns, despite fund performance rebounding during the past 12 months.”, Australia Financial Review, June 23, 2023

Brazil

“Why beef-loving Brazil is so obsessed with an American steakhouse chain – SÃO PAULO – Deep in the urban sprawl of the Western Hemisphere’s largest city, nestled within a thicket of highways, there is a low-slung shopping mall that boasts an attraction not rivaled anywhere in the United States. The giant Outback Steakhouse. Named the world’s largest Outback in 2018 — and the world’s most lucrative before that — its dimensions and legend since then have only grown. The restaurant is now nearly twice the size of the biggest Outbacks in the United States, where the faux-Australian chain was founded.”, The Washington Post, June 20, 2023

Canada

“Mass Immigration Experiment Gives Canada an Edge in Global Race for Labor – The country’s population growth is among the fastest in the world, bolstering the economy while creating strains in big cities. At a time industrialized countries around the world are confronting declining birth rates and aging workforces, Canada is at the forefront of betting on immigration to stave off economic decline. A country about as populous as California has added more than all the residents in San Francisco in a year. Last week, Canada surpassed 40 million people for the first time ever — with growth only expected to continue at a rapid pace as it welcomes more immigrant workers, refugees and foreign students across its borders.”, Bloomberg, June 18, 2023

“Manufacturer 3M Canada doubles down on remote work in an effort to access broader talent pool – While major employers across North America have spent much of the past year trying to persuade their employees to return to the office more often, the global manufacturing giant 3M Co. is doing just the opposite. The company is making its fully remote-work policy a permanent feature of employment, specifically because it will allow 3M to access a broader global pool of talent, not confined by geographical boundaries. ‘We realized over the pandemic that remote work was an absolutely critical part of being able to meet our hiring needs for knowledge workers,’ said Penny Wise, president and managing director of 3M Canada. ‘So we’re embracing that. It is our comparative advantage.’”, The Globe and Mail, June 17, 2023

China

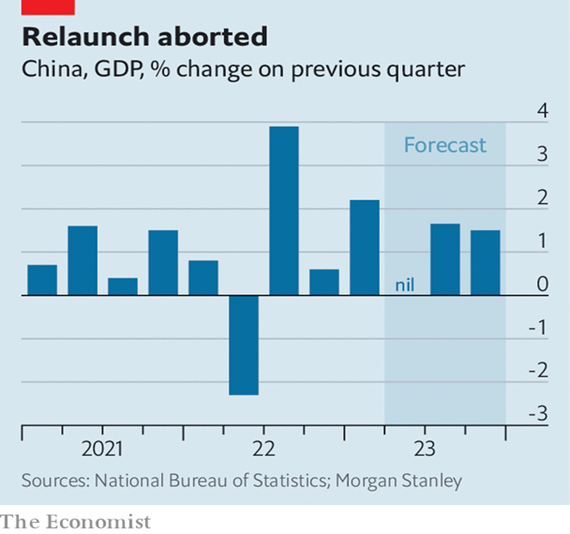

“Is China’s Recovery Sputtering? Like April’s numbers, the economic data released by the National Bureau of Statistics (NBS) for May were disappointing. For both industrial value added and retail sales, the outcomes the NBS reported were weaker than the predictions of the Chief Economists surveyed by the Yicai Research Institute. There were two areas of weakness. First, it appears that low commodity prices are making it unprofitable for China’s upstream industries to produce. Manufacturers of mid-stream goods have increasingly turned to cheaper imports instead of domestic products. Purchases of foreign coal, crude oil and various ores are all up sharply this year. The second area of weakness was in high-tech consumer products like mobile phones, laptops and tablets. Many of these products are exported and in the cases of mobile phones and laptops, the decline in exports was significantly larger than that of production, suggesting that weak foreign demand for these goods played an outsized role in their reduced production.”, YiCai Global, June 21, 2023

“China’s economy is on course for a “double dip” – The post-covid economy was meant to roar. But it is faltering again. Early this year, for example, China’s economy grew faster than expected, thanks to the country’s abrupt exit from covid-19 controls. Then, in April and May, the opposite happened: the economy recovered more slowly than hoped. Figures for retail sales, investment and property sales all fell short of expectations. The unemployment rate among China’s urban youth passed 20%, the highest since data were first recorded in 2018. Some now think the economy might not grow at all in the second quarter, compared with the first. By China’s standards this would be a “double dip”, says Ting Lu of Nomura, a bank.”, The Economist, June 18, 2023

European Union

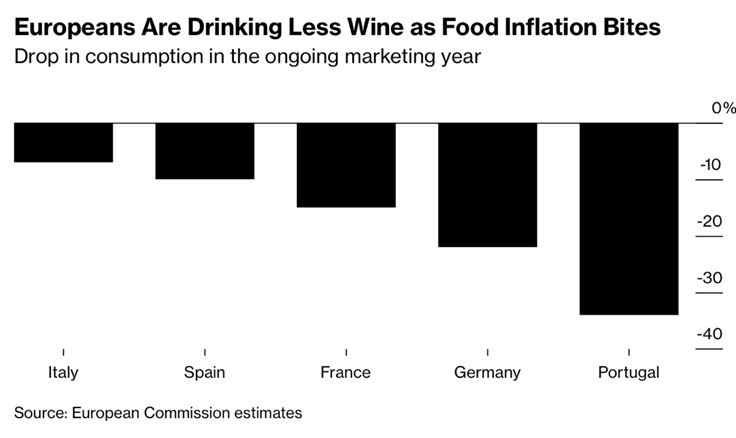

“There’s Too Much Wine in Europe as Drinkers Shun High Prices – Market faces large harvest plus lower consumption and exports. Government set to boost support measures to curb the buildup. High inflation and sliding exports, coupled with a strong 2022 harvest, have fueled a buildup in the bloc, the European Commission said Tuesday. That’s created a “serious loss of income,” especially for rosé and red wine producers in France, Spain and Portugal. The government is boosting support measures for the industry to curb the glut. That includes letting growers distill wine for alcohol — only meant for non-food purposes — and compensating them based on a share of recent market prices.”, Bloomberg, June 23, 2023

India

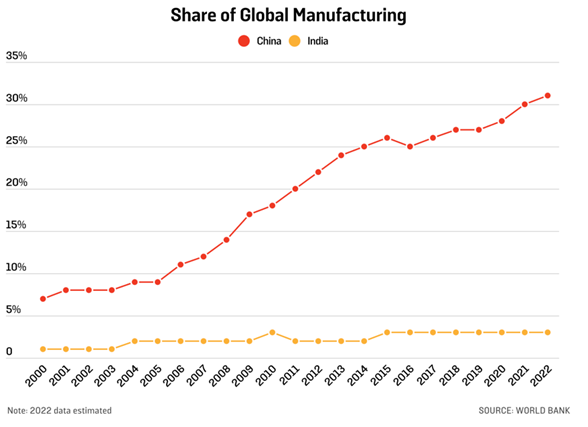

“Will India Surpass China to Become the Next Superpower? Four inconvenient truths make this scenario unlikely. When India overtook China in April to become the world’s most populous nation, observers wondered: Will New Delhi surpass Beijing to become the next global superpower? India’s birth rate is almost twice that of China. And India has outpaced China in economic growth for the past two years—its GDP grew 6.1 percent last quarter, compared with China’s 4.5 percent. At first glance, the statistics seem promising.

Japan

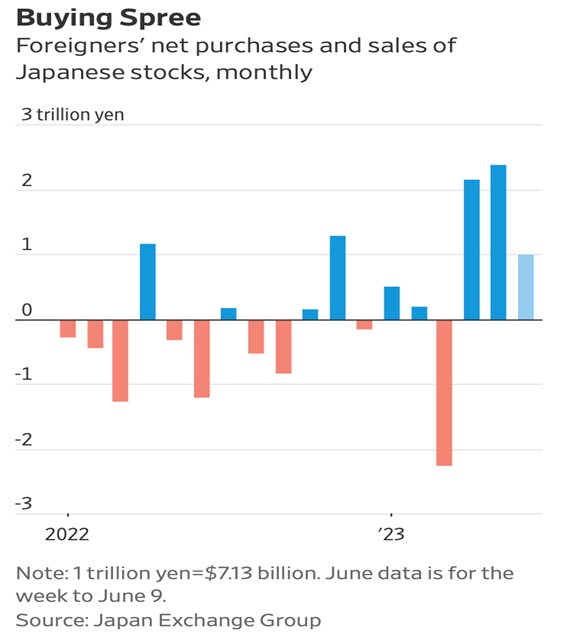

“Global Investors Are Flooding Into Japan. That Is Making Some People Nervous. Foreign investors have bought a net $39 billion of Japanese stocks since the start of April. That has helped the benchmark Nikkei 225 index rise almost 30% this year, bringing it back to levels it last traded at over 30 years ago. The country’s economy expanded faster than the U.S. in the first quarter, its stock exchange is pushing companies to improve their valuations and its central bank is committed to low interest rates, making it cheap for investors to take out loans to buy shares. And Warren Buffett has given the market a vote of confidence, saying in March that his conglomerate held more shares in Japan than anywhere outside the U.S.”, The Wall Street Journal, June 21, 2023

United Kingdom

“Stubborn UK inflation piles pressure on Bank of England to raise rates – May figure of 8.7% higher than expected after prices rise across range of goods and services. The Institute for Fiscal Studies think-tank said interest rate increases over the past year were already on track to absorb 8.3 per cent of mortgage holders’ disposable income — a figure that rises to 20 per cent for 1.4mn people. ‘We have an inflation problem that is not associated with economic growth,’ said Lyn Graham-Taylor, a senior rates strategist for Rabobank. ‘The market is saying that the Bank of England will have to push the UK economy into recession to get on top of this problem.’”, The Financial Times, June 21, 2023

“Surprise rise in retail sales thanks to bank holidays and sun – The Office for National Statistics says retail sales volumes grew by 0.3% in May, far better than the 0.2% decline forecast by economists, as warm weather and bank holidays boosted sales of outdoor goods and summer clothes. Garden centres and DIY shops also benefitted. More was spent on takeaways and fast food during the month as people celebrated the coronation and the usual May bank holiday. But food store sales fell as supermarkets increased prices, the ONS said. Food inflation has risen nearly 20% in the year up to April.”, Sky News, June 23, 2023

United States

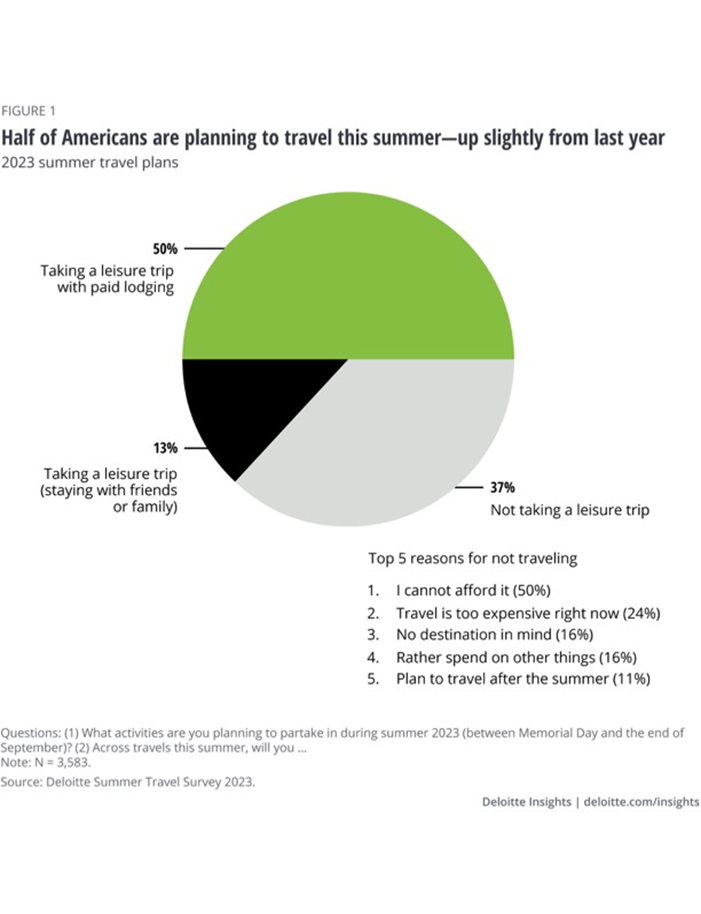

“The experience economy endures: 2023 Deloitte summer travel survey – Signs point to a busy season, as pricing pressure does not seem to deter Americans from enjoying their vacations. Half of Americans say they will take a leisure vacation (involving a stay in paid lodging; see figure 1) this summer, up from 46% in 2022. And they are doing so with enthusiasm, taking more international flights and adding an average of one trip to their calendar. Concerns, however, persist—50% of nontravelers say they will stay home due to financial worries.”, Deloitte, May 2023

Vietnam

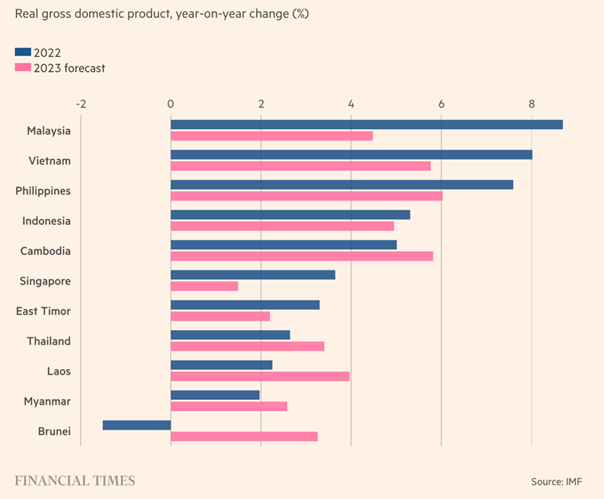

“Vietnam must take ‘aggressive’ action to meet growth goals, says finance minister – Export-driven manufacturing hub has been hit hard by drop in demand amid global economic slowdown. Vietnam was one of Asia’s fastest-developing economies last year, expanding more than 8 per cent, its highest growth rate since 1997. But growth slowed in the first quarter of 2023 to 3.3 per cent, down from 5.9 per cent in the fourth quarter of last year, as a grim global economic picture and high inflation cut into demand for the country’s exports.”, The Financial Times, June 24, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“Australia’s $172 billion franchising industry thriving in the regions due to internal migration – A recently released report has shed light on the changing demographics of Australia’s ….. franchising industry. According to the report, the franchising industry has undergone a significant transformation in adapting to the technological advancements of the modern era and a notable shift in the industry’s mindset has been showcased in the report, moving away from a singular focus on franchise sales towards a growth mindset that places emphasis on innovation, integration of advanced systems and a deep understanding of the Australian market. The report also highlights that over the past 15 years, there has been a notable migration of people from capital cities to regional areas in Australia, according to the Regional Australia Institute.”, Smart Company, June 14, 2023

“Could BurgerFi Be the Next Shake Shack Arising? BurgerFi is a growing upscale fast-casual burger restaurant selling 100% hormone-free, never frozen, 100% Angus beef chargrilled burgers. The company has a combined company owned and franchised 172 locations and plans to open 15 to 20 locations in 2023. Upscale fast-casual burger restaurant chain BurgerFi International Inc. shares have been staging an impressive rally rising 39% year-to-date.”, Market Beat, June 19, 2023

“Fixing Burger King’s Royal Mess – Struggling fast-food chain’s turnaround will take time to pay off. Burger King, the longtime No. 2 U.S. burger chain, looked even more like a pretender to the throne after slipping to third place in 2020 behind Wendy’s by revenue. But market share was the least of its concerns after the pandemic roiled the restaurant industry. Its franchisees have seen revenue and profitability sag, and two of its largest owners have been forced into bankruptcy recently with another failing to pay royalties. Now the chain is nine months into a mission to “reclaim the flame”—a tough-love approach to beef up its best operators and encourage weaker ones to cut back.”, The Wall Street Journal, June 20, 2023

“Franchisee Takes Over 16 Handles And Aims To Reinvigorate It – Neil Hershman, an experienced franchisee of 16 Handles, a New York City-based frozen yogurt chain, owns seven of its 30 all-franchised units. In August 2022, he and Danny Duncan, a noted You Tuber and influencer with over 1.5 billion views on his channel, acquired 16 Handles from its long-time founder. Their goal is to reinvigorate it, boost sales, and open more franchised units. Who knows better how a franchise operates, and what is holding it back, than one of its own franchisees? And Hershman, who is 28-years old, based in New York City, and a former analyst at a hedge fund, is also a franchisee of other brands since he also operates three Dippin’ Dots, an ice cream store.”, Forbes, June 26, 2023

“Studio Pilates International Set To Launch First UK Studio in Exeter in early June – Having conquered the Australian, New Zealand and US markets, the brand is now set to take on the UK, with locations in South London, Dublin and Exeter expected to be open by late Spring.”, Franchising.com, June 14, 2023

“US chain Long John Silver’s opens first restaurant in Indonesia – Long John Silver’s, the US-based seafood restaurant, has opened a global flagship store in Gading Serpong, Indonesia, and signalled plans to expand further in the country. The flagship store is the brand’s first location in Indonesia under a new partnership with local franchisee, Cipta Putra Nusantara, which plans a second flagship outlet in the last quarter of this year and a longer-term target of more than 50 restaurants in the market. ‘We have seen great success establishing brand recognition and customer satisfaction in Singapore, which encouraged us to look at neighbouring markets for expansion opportunities,’ said Nate Fowler, Long John Silver’s brand president.”, Inside retail Asia, June 14, 2023. Compliments of Paul Jones, Jones & Co., Toronto

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

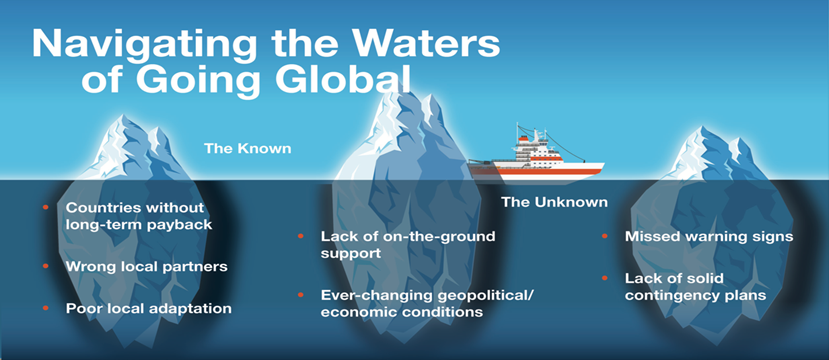

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant taking 40 franchisors global.

For a complimentary 30 minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link: