EGS Biweekly Global Business Newsletter Issue 68, Tuesday, November 1, 2022

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

In this issue, the sudden reversal of the global chip shortage, global consumer spending declines, air fares are high, natural gas prices decline, fossil fuel demand might peak this decade, Euromonitor makes its 2023 economic predictions and McKinsey says we may be seeing a ‘New Dawn’ for global economies.

To receive this biweekly newsletter that is read by 1,450 people in 20 countries, click here : https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others

“It always seems impossible until it’s done.”, Nelson Mandela

“Victory is sweetest when you’ve known defeat.”, Malcolm S. Forbes

“Fortune befriends the bold.”, Emily Dickinson

Highlights in issue #68:

- A New Era Dawns – McKinsey & Co.

- Brand Global News Section: Dominos® Pizza China, Guzman y Gomez®, Happy Joe’s Pizza & Ice Cream®, KFC®, Xponential Fitness®

NOTE: Bolded headlines in this newsletter are live links where the article is available without a subscription.

Interesting Data and Studies

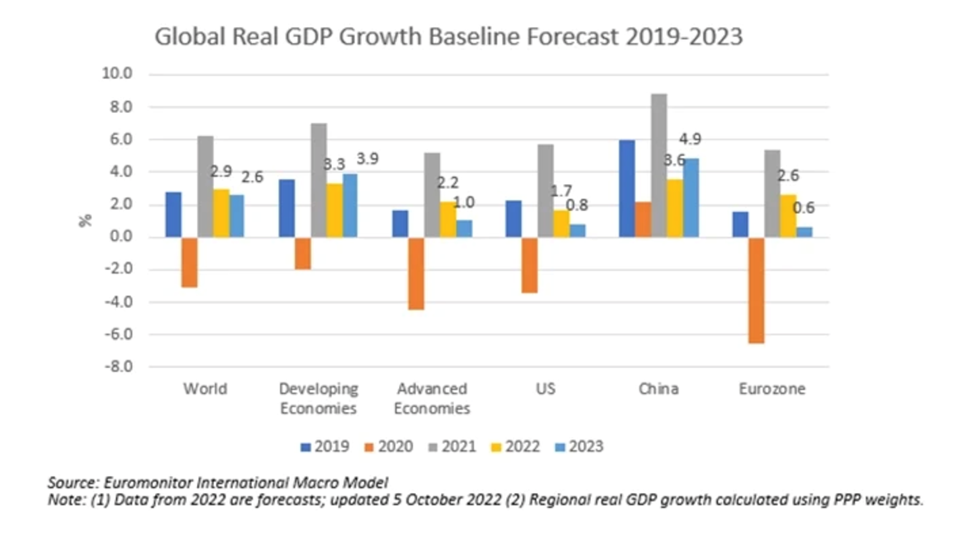

“Euromonitor’s Q4 Global Economic Forecast Predicts Worsening Conditions – Global real GDP growth is expected to decline from 6.2% in 2021 to 2.9% in 2022 and 2.6% in 2023, 0.1 and 0.3 percentage points lower than our predictions made in Q3 2022, respectively. Global inflation will peak at 9.0% in 2022 before it recedes somewhat in 2023.”, Euromonitor, October 24, 2022

“A New Era Dawns – With a growing US-China rift, pandemic-induced supply-chain breakdown and war-induced energy crisis unfolding alongside demographic aging, it’s arguably a cliché to say humanity is entering a new era. That said, a paper from the McKinsey Global Institute details a compelling case for why the world is likely going through something akin to major step changes of the 20th century, including World War II, the 1970s oil crisis and the breakup of the Soviet empire in 1989-92, which powerfully shaped socio-economic outcomes in following decades.”, Bloomberg and McKinsey & Co., October 26, 2022

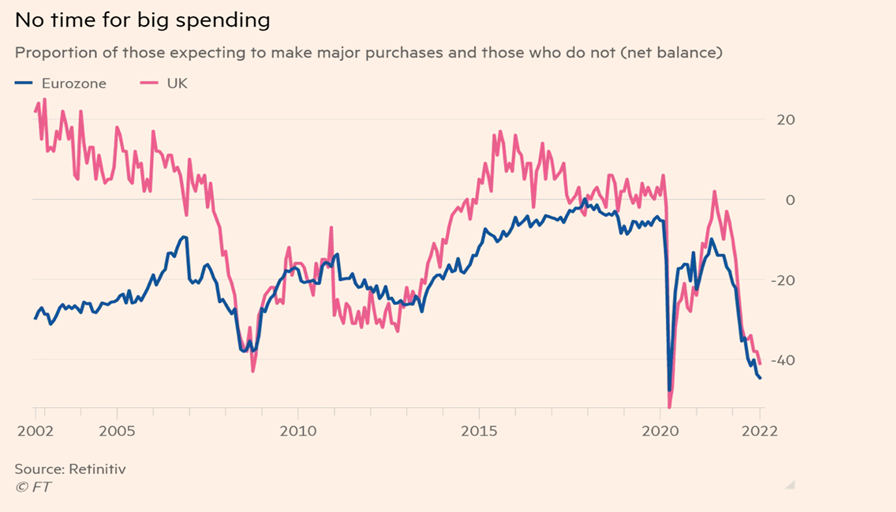

“European consumers cut back on discretionary spending – Shoppers postpone big purchases and reduce leisure outlays as cost of living crisis bites. European consumers’ intentions of spending on major goods, such as cars and houses, are at their lowest levels for two decades, excluding the early months of the pandemic.”, The Financial Times, October 29, 2022

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

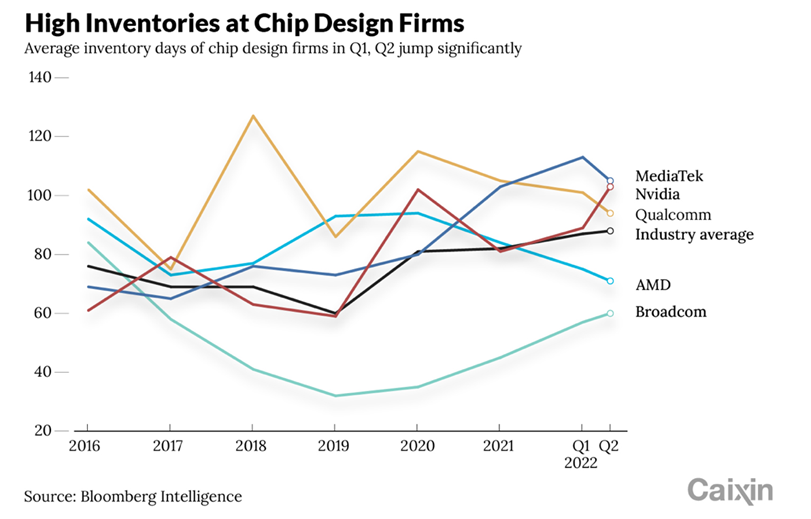

“The Sudden Reversal of the Global Chip Shortage – Remember the global semiconductor shortage a few months ago? It’s over. Now quickly shrinking demand for consumer electronics is causing canceled orders and unsold stockpiles at makers of integrated circuits including Taiwan Semiconductor Manufacturing Co. (TSMC), Advanced Micro Devices Inc. (AMD) and Nvidia. It’s a stark contrast with the disruptions that chip shortages caused for makers of autos, smartphones, computers and other goods relying on the advanced electronic devices.”, Caixin Global, October 20, 2022

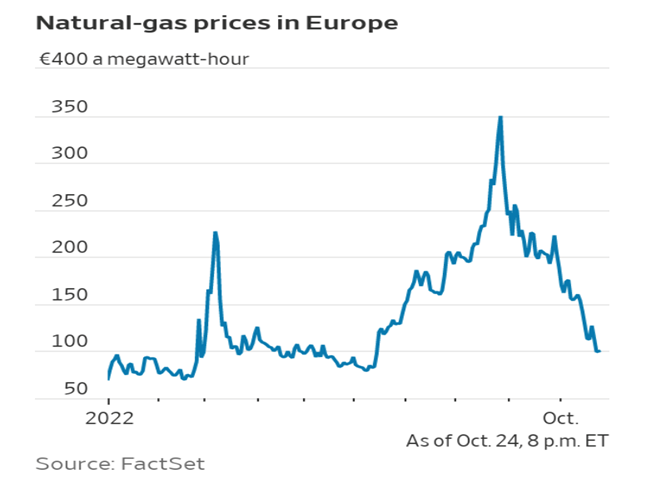

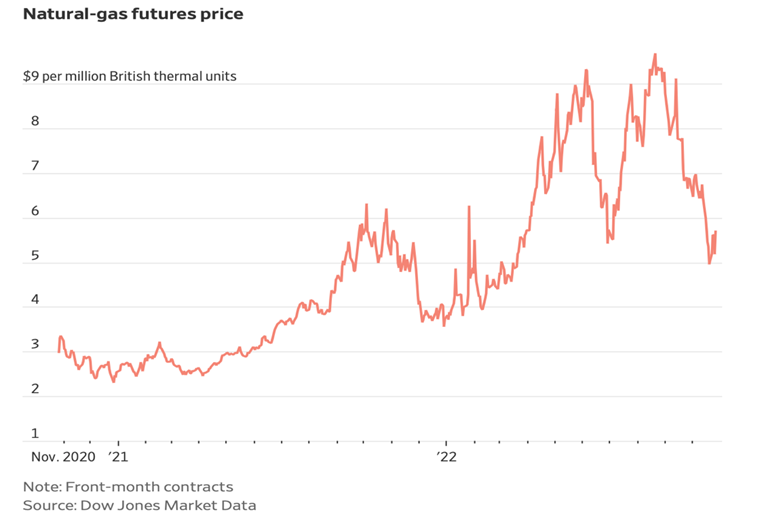

“Europe, Once Fearing Gas Rationing This Winter, Has a Glut – Prices for natural gas have tumbled more than 70% from their late-August high, thanks in part to a burst of warm weather. The comfortable position Europe finds itself in could be temporary. Starting next week, seasonal forecasts will be able to show with some accuracy how winter weather will affect storage.”, The Wall Street Journal, October 26, 2022

“(US) Natural-Gas Prices Have Plunged Into Autumn – A big driver of inflation is down about 40% in two months as U.S. inventories have swelled since air-conditioning season ended. The decline is due to warm autumn weather, record domestic production and gas-storage facilities that have filled up fast since the end of air-conditioning season. Now, one of the big drivers of inflation costs roughly the same as it did a year ago.”, The Wall Street Journal, October 30, 2022

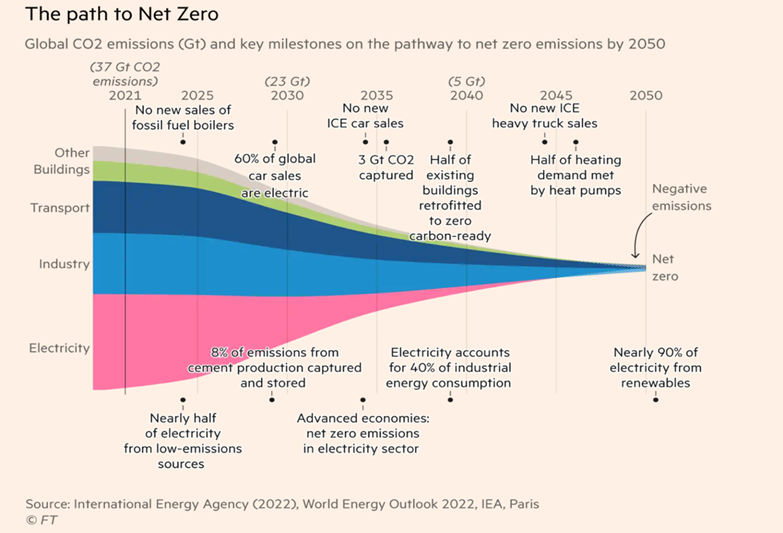

“IEA forecasts fossil fuel demand will peak this decade – World is approaching a ‘pivotal moment’ and ‘golden age of gas’ is coming to an end. The International Energy Agency has said Russia’s invasion of Ukraine will accelerate a peak in the world’s consumption of fossil fuels, with gas demand now expected to join oil and coal in topping out near the end of this decade.”, The Financial Times, October 27, 2022

Global & Regional Travel Updates

“Why Airfares Have Risen Five Times Faster Than The Overall Inflation Rate – Airline ticket prices have climbed much faster than overall inflation during the pandemic recovery due to several factors. The industry ground to a virtual standstill in the earliest days of the pandemic and recovery was initially slow. Russia’s war in Ukraine has driven up fuel costs substantially and, in recent months, an extraordinarily strong rebound in travel demand has collided with massive challenges to supply, including labor shortages, aircraft delivery delays and other issues.”, Forbes, October 14, 2022

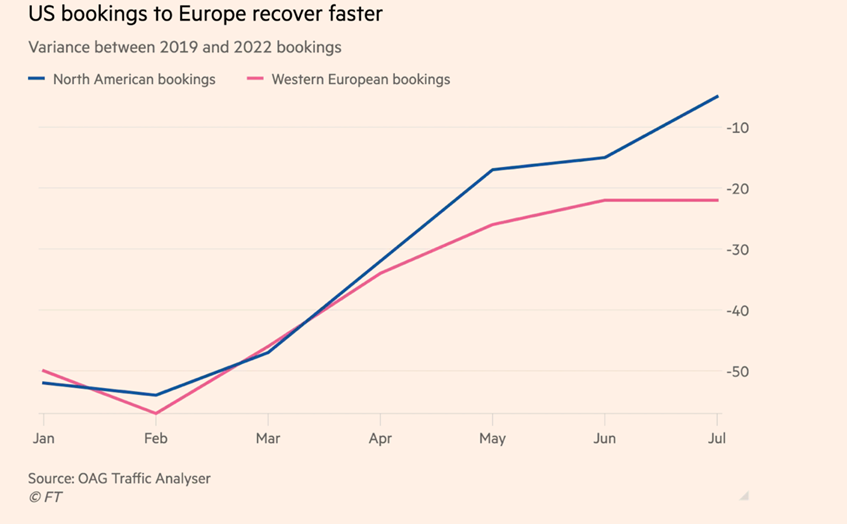

“Transatlantic travel soars as Americans make most of strong dollar – Virgin boss says UK holidays are ‘on sale’ for US tourists. Transatlantic travel is booming, driving airline revenue as Americans armed with a strong US dollar fly to Europe and the UK.”, The Financial Times, October 22, 2022

Country & Regional Updates

Southeast Asia

“Southeast Asia’s top digital economies expected to hit $200 billion in 2022 – The milestone comes three years ahead of earlier projections and is a 20% increase from last year’s $161 billion in gross merchandize value (GMV). An earlier report in 2016 estimated the internet economy in the region’s six major countries will close in on $200 billion in GMV by 2025. The six major economies covered in the report are: Indonesia, Malaysia, the Philippines, Singapore, Thailand, and Vietnam.”, CNBC, October 26, 2022

Australia

“Australia to cut economic growth forecasts on lower consumer spending – Australia’s economic growth is expected to slow sharply next financial year as rising inflation curbs household consumption, according to new forecasts to be unveiled by Treasurer Jim Chalmers in Tuesday’s budget. Budget papers are set to show gross domestic product (GDP) for fiscal 2023-2024 will be downgraded to 1.5% from the 2.5% forecast in April. GDP is also due to be downgraded to 3.25% from 3.5% for 2022-2023, according to draft figures from the Treasury.”, Reuters, October 24, 2022

Brazil

“Lula wins Brazil presidential election in historic comeback – Lula won 50.83 per cent of the vote versus 49.17 for Bolsonaro after a cliffhanger three-hour count, followed by millions across the country on television and online.’, The Financial Times, October 31, 2022

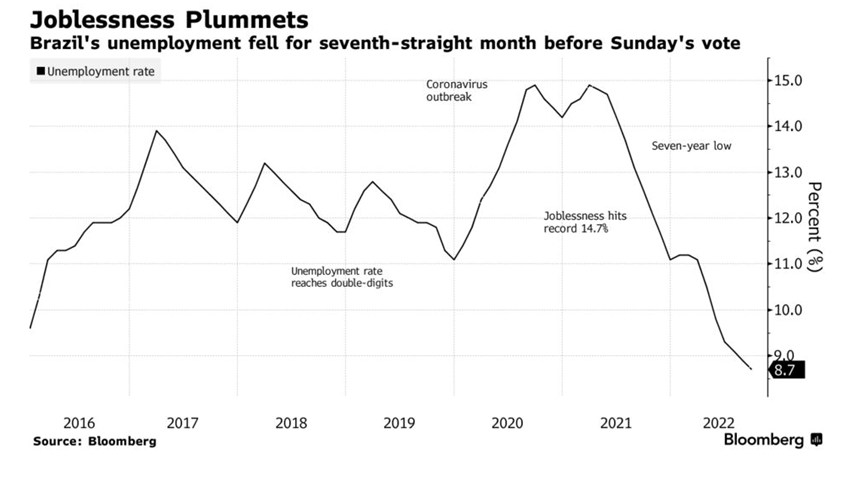

“Brazil Unemployment Hits New Seven-Year Low Before Presidential Runoff Vote – Jobless rate at 8.7% in three months through Sept.; est. 8.7% Brazilians head to the polls on Sunday with Lula leading polls. Brazil’s unemployment rate declined for the seventh-straight month to the lowest level since 2015, signaling the job market continued to improve ahead of Sunday’s presidential runoff.”, Bloomberg, October 27, 2022

Canada

“Bank of Canada raises interest rate for sixth time in a row, but signals campaign nearing end – The central bank raised its benchmark rate by 0.5 percentage points, its sixth consecutive hike since March. The move was smaller than financial markets were expecting, but still brings the policy rate to 3.75 per cent, its highest level since early 2008. Bank Governor Tiff Macklem told a news conference that further rate hikes are needed to get inflation, currently running near a four-decade high, under control.”, The Globe and Mail, October 27, 2022

China

“US companies’ sales forecasts drop to 10-year low in AmCham Shanghai’s 2022 poll, as zero-Covid rules upend operations – The number of companies expecting annual revenue growth plunged by 29 percentage points to 47 per cent this year, from 82.2 per cent in 2021. The annual AmCham Shanghai survey, featuring 307 respondents this year, was a stark contrast to the optimism found in the 2021 poll.”, South China Morning Post, October 28, 2022

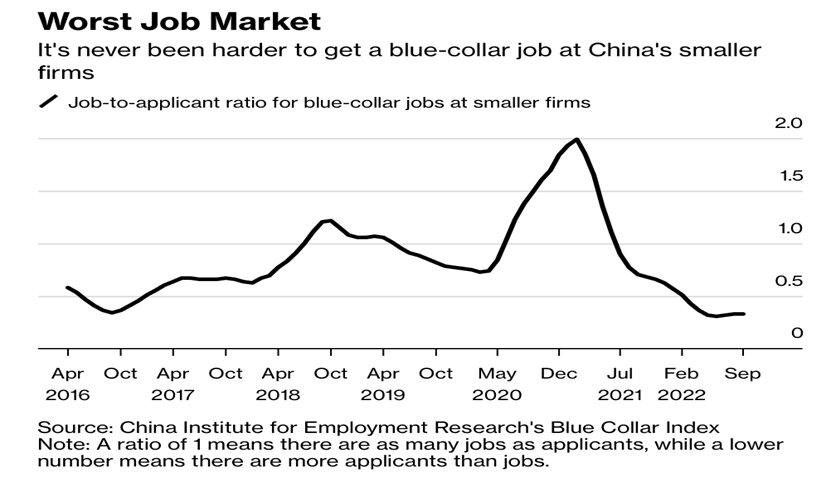

“Hiring at China’s Small Firms Fails to Pick Up from Record Low – Situation for blue-collar jobs near the worst since 2016. Jobs that declined most are related to property, construction. The ‘Blue Collar’ Job Index for small and medium-sized businesses, which are mostly in manufacturing and services, showed little improvement in the third quarter after hitting an all-time low of 0.3 in June, according to the Beijing-based China Institute for Employment Research. That means there’s more than three times as many applicants as there are jobs available.”, Bloomberg, October 27, 2022

India

“India economic outlook, October 2022 – India will likely post a 6.8%–7.1% growth during FY22–23, provided global uncertainties and inflation don’t weigh on domestic demand and investment sentiment in the near term. The purchasing managers’ index (PMI) suggests that economic activity stayed strong in July and August. Input cost inflation also fell to the lowest in 2022 due to falling commodity prices, including the lower prices of aluminum and steel.”, Deloitte, October 21, 2022

Japan

“Japan unleashes $200bn stimulus – The Japanese government on Friday unveiled Y29.1tn ($197bn) in fresh spending to ease the impact on consumers of soaring commodity prices and a falling yen, while the Bank of Japan stuck by its ultra-loose policy. Japan’s inflation rate, at 3 per cent in September, is much lower than price rises in the US and Europe.”, The Financial Times, October 28, 2022

Spain

“Economic Slowdown Starts to Weigh on Spain’s Stellar Job Market – Spain created fewer jobs in third quarter that during the same periods in the two previous years, a first sign that the job market is cooling after an impressive post-pandemic recovery. Unemployment rose slightly to 12.7% in the July to September period, according to data released by the statistics institute on Thursday.”, Bloomberg, October 27, 2022

United Kingdom

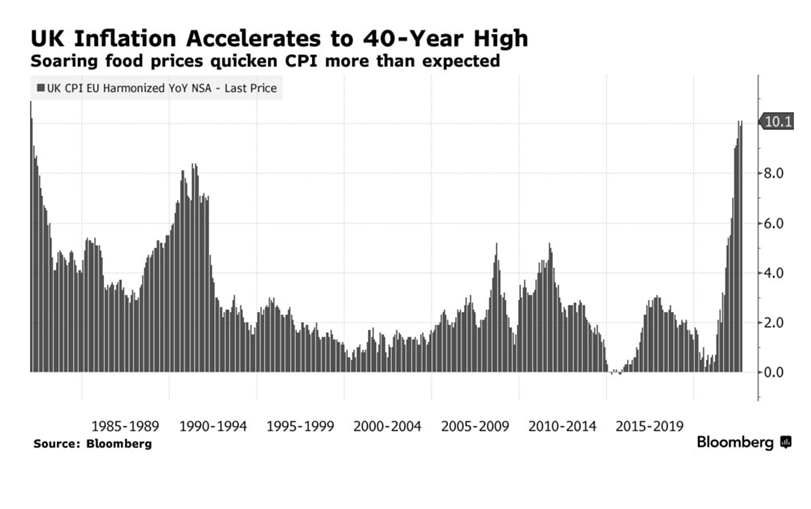

“UK Inflation May Hit 15% Without Further Energy Support – Backtracking on aid plan exposes households to surge in prices Government’s fiscal plan will have a big impact on economy. “The key question for the 2023 inflation outlook now relates to the energy price guarantee,” said James Smith, an economist at ING, who estimated that Hunt’s decision could add up to 3 percentage points to the headline inflation rate from April onwards.”, Bloomberg, October 20, 2022

United States

“Americans in Gallup poll say holiday spending will rise to 2019 level – The Gallup poll released Thursday shows Americans plan to spend an average of $932 on gifts this season, close to the $942 that the survey giant recorded in 2019. Pollsters found 37 percent of Americans plan to spend at least $1,000 on Christmas gifts this year, while 20 percent plan to spend between $500 and $999. Only 3 percent said they plan to spend less than $100, in line with previous years.”, The Hill, October 27, 2022

“U.S. economy grows in third quarter, reversing a six-month slump – Latest GDP report shows the economy expanded at an annual rate of 2.6 percent, even though many signs point to slowdown. Even though consumers bought fewer goods, they continued to spend on health care, which helped lift the reading on GDP, which sums up goods and services produced in the U.S. economy. The biggest boost, though, came from a narrowing trade deficit, with American retailers importing fewer items and exporting more goods as well as services, such as travel.”, The Washington Post, October 27, 2022

Brand News

“Three year revenue nearly doubled Domino s Pizza China s replicable economic model to build a broad moat – As the exclusive master franchisee of the world-renowned pizza brand Domino’s Pizza in Mainland China, Hong Kong Special Administrative Region of China and Macau Special Administrative Region of China, Domino’s Pizza China’s growth rate is impressive: as of June 30, 2022, it has 12 These cities quickly exceeded 500 directly-operated stores, while the number of stores in 2019 was 268.”, EEO.com.cn, October 21, 2022. Compliments of Paul Jones, Jones & Co., Toronto

“This Aussie food business is valued at A$1.5b as sport stars, super giant invest – Superannuation giant Aware Super and a syndicate of elite Australian athletes have backed Mexican food chain Guzman y Gomez in a share sale which values the company at $1.5 billion. Guzman y Gomez founder Steven Marks said the investments were a testament of the group’s recent past performance and plans for the future. “We’re well positioned to build and bring even more [Guzman y Gomez eateries] to life here in Australia and globally,” he said.”, Brisbane Times, October 19, 2022. Compliments of Jason Gehrke, The Franchise Advisory Centre, Brisbane

“Happy Joe’s to Increase Footprint by Over 50% with Monumental Master Franchise Agreement – Happy Joe’s CEO Tom Sacco announced this year that the popular family-centric concept has signed a master franchise agreement with H.J. Happy Joe’s for Restaurants L.L.C. to grow the brand abroad and open multiple new restaurants throughout the Middle East and North Africa. Led by Master Franchisee Ahmed Elbatran, the group will develop or sub-franchise at least 25 Happy Joe’s restaurants across Bahrain, Egypt, Jordan, Kuwait, Morocco, Qatar, Saudi Arabia and the U.A.E. over the next 10 years.”, Franchising.com, October 29, 2022

“Xponential Fitness Signs Master Franchise Agreement in Kuwait – Xponential Fitness, Inc. announced today it has signed a Master Franchise Agreement in Kuwait for its brands Rumble, Club Pilates, StretchLab and CycleBar. The deal, signed with Kuwait Real Estate Company, Aqarat, will result in the opening of a minimum of eight studios early in the initial 10-year term of the agreement. The Master Franchisee for Xponential in Kuwait is the publicly traded real estate development company, Aqarat, a prominent developer and manager of commercial, residential and hospitality properties in Kuwait and the Middle East, as well as Europe and the United States.”, Franchising.com, October 29, 2022

“KFC Owner Yum Exits Russia, Sells Business to Local Franchisee – Yum! Brands Inc., owner of the KFC fast-food chain, is exiting Russia and selling the business there to Smart Service Ltd., which is operated by one of the company’s existing KFC franchisees there. The new owner will be responsible for rebranding the restaurants to non-Yum concepts and retaining the company’s employees, the company said in a statement Monday. Yum said that after the transaction, it will cease having any corporate presence in Russia.”, Bloomberg, October 25, 2022

Articles & Studies For Today And Tomorrow

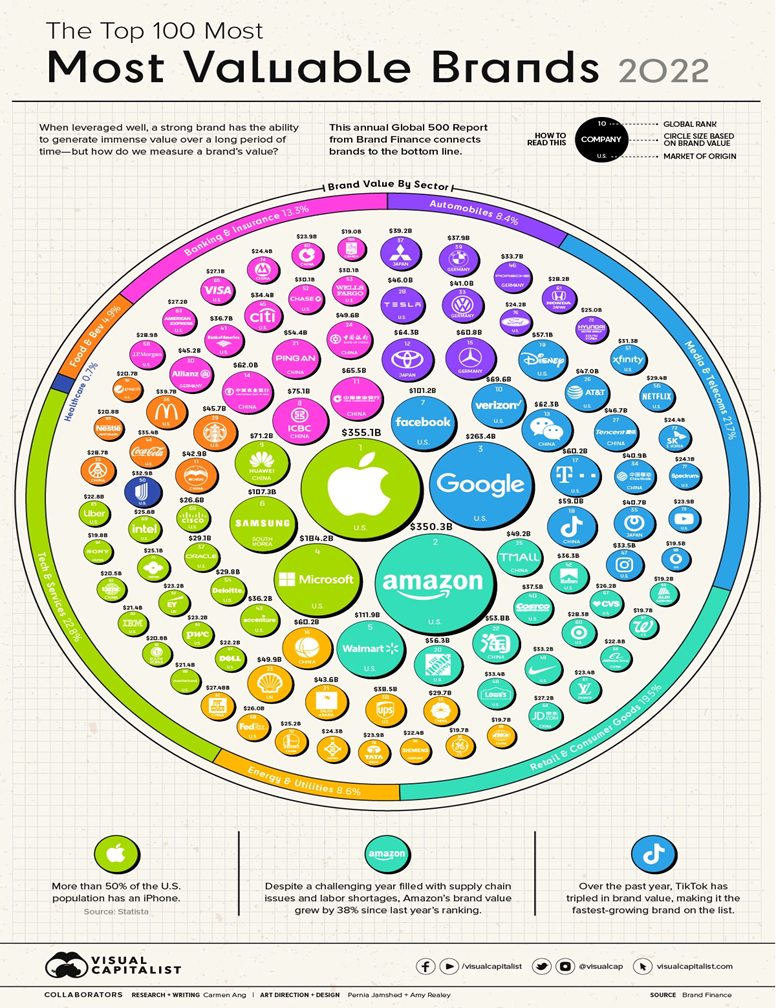

“The Top 100 Most Valuable Brands in 2022 – Given the allusive nature of brands, determining a brand’s financial value is a difficult task. Despite a brand’s intangibility, it’s hard to deny just how effective a strong one can be at boosting a company’s bottom line. With this in mind, Brand Finance takes on the challenge of identifying the world’s most valuable brands in the world in its annual Global 500 Report. The graphic above, using data from the latest edition of the report, highlights the top 100 most valuable brands in 2022.”, Visual Capitalist / Brand Finance, October 27, 2022

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ covering 25+ countries provides us with updates about what is happening in their specific countries.

To sign up for our biweekly newsletter click here: https://bit.ly/geowizardsignup

William (Bill) Edwards has a four-decade career successfully accelerating the international growth of more than 40 brands worldwide. He has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East and has lived in China, the Czech Republic, Hong Kong, Indonesia, Iran and Turkey. Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. EGS has twice received the U.S. President’s Award for Export Excellence. For advice on doing business successfully across 40+ countries, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 67, Tuesday, October 17, 2022

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Our latest GlobalVue™ country ranking chart is out with changes. How global opinion of China has changed in recent years. The latest global economic growth forecast and the rise of global uncertainty. Germany and Singapore are to pay bills for consumers, France is running out of gas and Hong Kong is giving away 500,000 free air tickets once they fully reopen to travelers.

To receive this biweekly newsletter that is read by 1,450 people in 20 countries, click here : https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others

“ I look to the future because that’s where I’m going to spend the rest of my life.:, George Burns

“However difficult life may seem, there is always something you can do and succeed at.”, Stephen Hawking

“It is better to fail in originality than to succeed in imitation.”, Herman Melville

Highlights in issue #67:

- Brand Global News Section: BurgerFuel®, Chick-Fil-A®, Chipolte®, F45®, McDonalds®, Qdoba® and Starbucks®

NOTE: Bolded headlines in this newsletter are live links where the article is available without a subscription.

Interesting Data and Studies

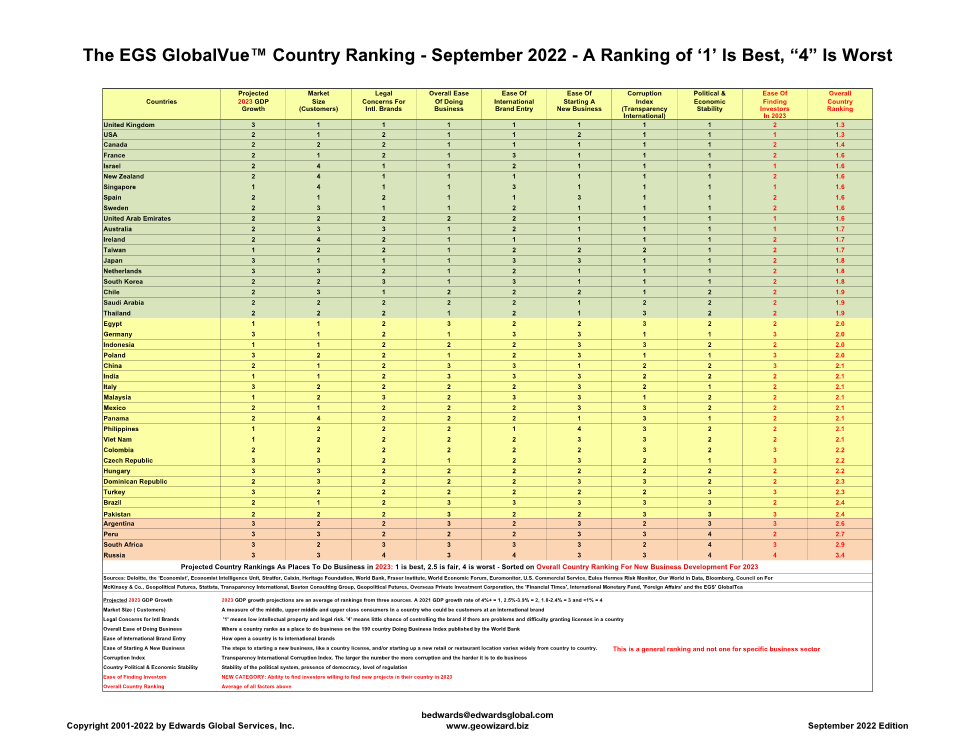

The latest quarterly EGS GlobalVue™ country ranking report is out and has a few key changes. We dropped the COVID recovery category and add a section for the ease of finding investors in a country. In September’s EGS GlobalVue™ report, Australia, China, Indonesia, Saudi Arabia, Singapore, South Korea, Thailand and United Arab Emirates climbed in rankings while the Czech Republic, Germany, Hungary, Italy, Mexico and the Philippines dropped down since the Q2 report was released in June of 2022.

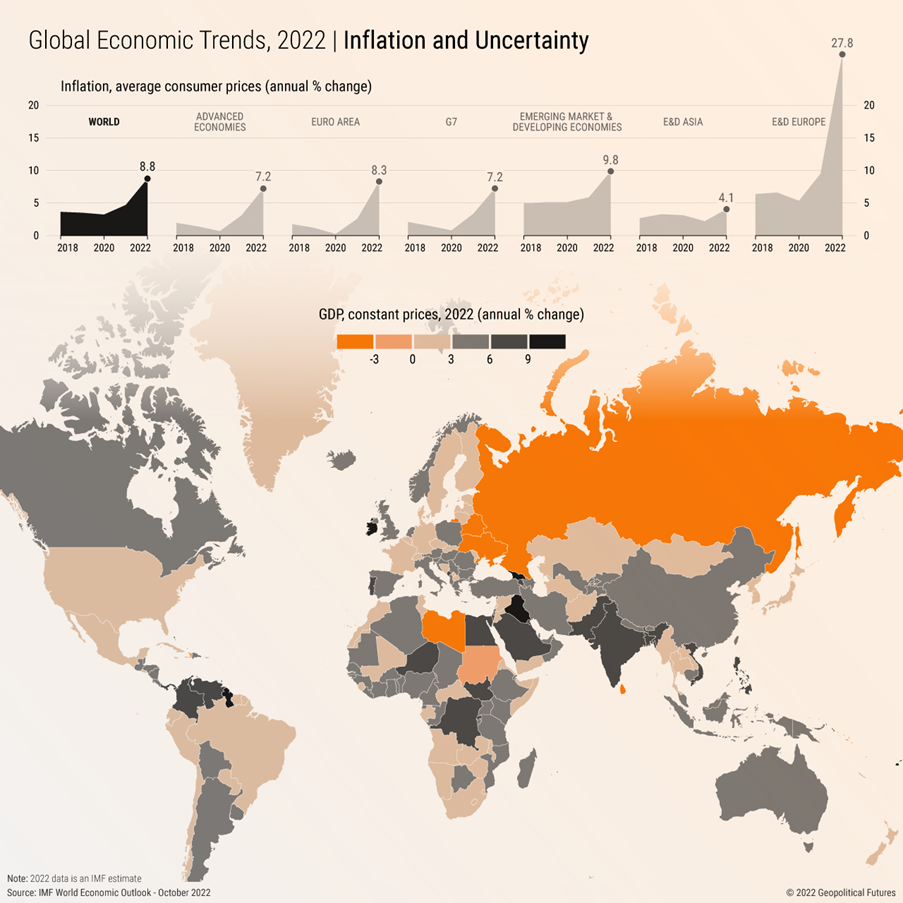

“The Latest Global Growth Forecast – In its new report on the outlook for the global economy, the International Monetary Fund confirmed a slowdown for 2022 and was pessimistic about 2023. In identifying the causes of the gloomier forecast, the IMF highlighted Russia’s war in Ukraine, pandemic-related supply disruptions and high inflation expectations.”, Geopolitical Futures, October 14, 2022. Compliments of William (Bill) Ellermeyer, Ellermeyer Connect

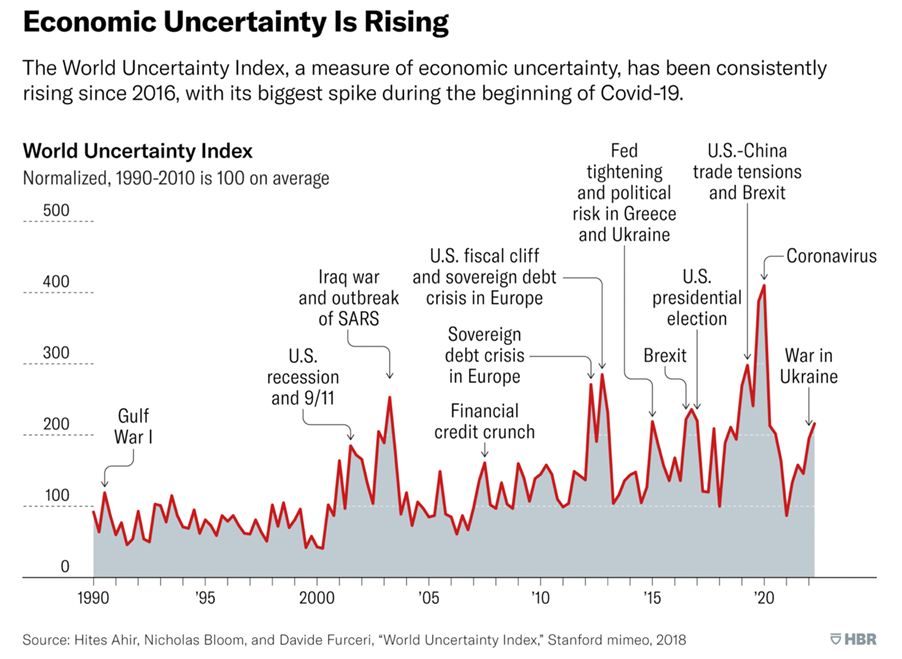

“Visualizing the Rise of Global Economic Uncertainty – Over the last six years, companies have had to grapple with five major “uncertainty shocks”: First it was Brexit in 2016, followed by the U.S. presidential election, China-U.S. trade-tensions, the Covid-19 pandemic, and in 2022 the Ukraine war.”:, Harvard Business Review, September 29, 2022

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

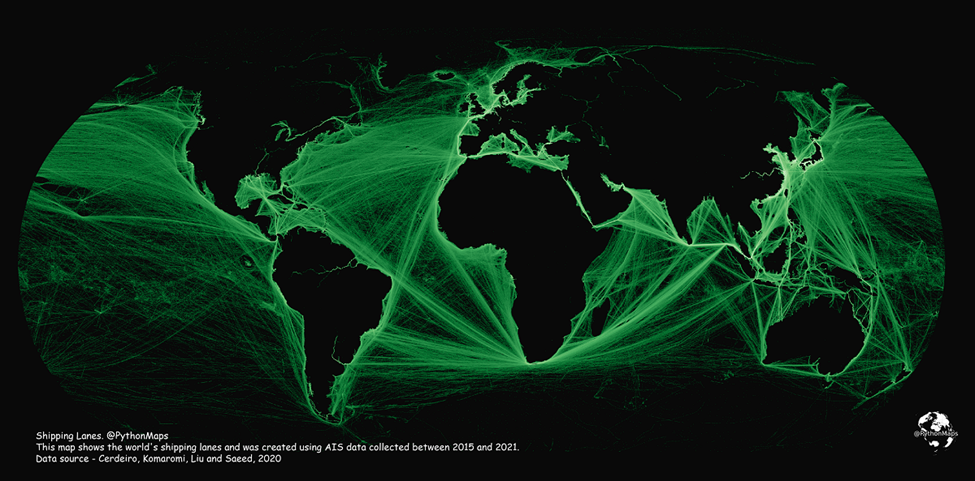

“Mapping Shipping Lanes: Maritime Traffic Around the World – Each year, thousands of ships travel across the globe, transporting everything from passengers to consumer goods like wheat and oil. But just how busy are global maritime routes, and where are the world’s major shipping lanes? This map by Adam Symington paints a macro picture of the world’s maritime traffic by highlighting marine traffic density around the world. It uses data from the International Monetary Fund (IMF) in partnership with The World Bank, as part of IMF’s World Seaborne Trade Monitoring System. Data …….includes five different types of ships: commercial ships, fishing ships, oil & gas, passenger ships, and leisure vessels.”, Visual Capitalist / Adam Symington, June 20, 2022

Global & Regional Travel Updates

“Hong Kong to give away 500,000 airline tickets next year as part of global campaign to revive tourism – Head of Tourism Board says plan is part of global promotion next year once Hong Kong removes all epidemic curbs for arrivals. The free plane tickets are not all for inbound tourists. Some of them will be given to outbound travellers, while some will be distributed via travel agents.”, South China Morning Post, October 6, 2022

“International Flights Continue Returning to China – Chinese authorities are releasing the controls on international flights, and such action has attracted dozens of carriers to resume and open new routes in and out of China. In May, China reduced the mandatory quarantine period from 14+ days to 7 days. Since Aug, the Chinese authority changed the fusing mechanism for international flights, from the original absolute confirmed Covid-19 cases to a percentage of all passengers on a flight.”, Airline Geeks, October 13, 2022

Country & Regional Updates

Argentina

“What Is the Value of an Argentine Peso? It Depends on What You’re Buying – Government adds new currency rules, multiplying existing rates Goal is to avoid devaluation even if it faces IMF opposition. In Argentina, where about a dozen different exchange rates overlap, the government is creating ever more rules about who can access dollars and for what, making an already vexing system more complicated in a bid to delay a devaluation.”, Bloomberg, October 12, 2022

Canada

“Canada’s oil sands firms to invest $24-billion on emissions projects – Canadian oil sands companies plan to spend more than $24-billion on emissions-reduction projects by 2030, as they accelerate their bid to get production to net zero by 2050. The investment by members of the Pathways Alliance – a group that covers about 95 per cent of oil sands production – includes $16.5-billion for a massive carbon capture and storage (CCS) network in northern Alberta. Another $7.6-billion will be spent on advancing other emissions-reduction technologies….”, The Globe and Mail, October 14, 2022

China

“How Global Public Opinion of China Has Shifted in the Xi Era – The Chinese Communist Party is preparing for its 20th National Congress, an event likely to result in an unprecedented third term for President Xi Jinping. Since Xi took office in 2013, opinion of China in the U.S. and other advanced economies has turned precipitously more negative. How did it get to be this way?”, Pew Research Center, October, 2022

“China’s economic crisis, led by a faltering property sector, looms over Xi Jinping’s expected third term – On Sunday, a collection of 2,300 delegates from the Communist Party of China will convene for a weeklong conference to choose China’s next leader. The victor is almost certain to be current President and General Secretary Xi Jinping, who would be the first to serve more than two terms as the Party’s leader since Mao Zedong.”, Fortune, October 15, 2022

France

“Heading to France? It’s running out of gas – For the past two weeks, French trade union General Confederation of Labour has been locked in a bitter standoff with fuel giants TotalEnergies and Esso-ExxonMobil in a dispute over pay for its members. Dozens of workers at several oil refineries owned by the multinationals walked out, blockaded several refineries and stymied gasoline supplies; as a result, more than a quarter of gas stations are now out of at least one type of fuel and 19% are completely dry.”, The Points Guy, October 13, 2022

Germany

“Germany to pay December gas bills for households and businesses – Under the scheme, the one-off full reimbursement in December would be followed up next spring with a more differentiated subsidy scheme designed to cap bills but still incentivise people to save energy. From March 2023 to the end of April 2024, private households would pay €0.12 (£0.11) per kilowatt hour for the first 80% of last year’s use of gas. Industry, meanwhile, would from 1 January 2023 until end of April 2024 pay €0.07 per kilowatt hour for the first 70% of last year’s use.”, The Guardian, October 10, 2022

India

“India festival spending booms despite inflation worries, global slowdown – Indian consumers are lapping up everything from cars, houses and television sets to travel and jewellery in the festive season that began last month, according to early data, giving a fillip to growth prospects despite economic gloom elsewhere in the world. Online and offline sales during the Hindu festival period starting in the last week of September and lasting until early November are estimated to cross $27 billion, almost double the amount in the same pre-COVID period in 2019, and nearly 25% higher than last year, according to industry estimates.”, Reuters, October 14, 2022

Japan

“Japan Eager to Welcome Tourists From Abroad Amid Cheap Yen – Individual travelers will be able to visit Japan without visas beginning on Tuesday, just like in pre-COVID-19 times, and electronics stores, airlines and various tourists spots have big hopes for a revival of their businesses. Japan kept its borders closed to most foreign travelers during much of the pandemic. Only packaged tours have been allowed since June. Meanwhile, the yen has weakened sharply against the dollar, giving some visitors much heftier buying power and making Japan nearly irresistible to bargain hunters.”, Bloomberg, October 10, 2022

Pakistan

“Pakistan keeps policy rate at 15%, projects high inflation, weak growth – Pakistan’s central bank kept its key policy rate unchanged at 15% on Monday, days after the South Asian country’s credit rating was downgraded in the face of an economic meltdown exacerbated by devastating floods. Pakistan is in the middle of a balance of payment crisis, with foreign reserves falling to barely one month’s worth of imports, a situation which has been aggravated by a devalued currency and consumer prices rising 27%.”, Reuters, October 10, 2022

Russia

“Russia’s Rank As U.S. Trade Partner At 30-Year Low – Russia now ranks as the United States’ 39th most important trade partner, on track to finish lower than any year since 1992, shortly after it emerged from the dissolution of the Soviet Union. It was the United States’ 40th most important trade partner that year. Russian trade is down more than $10.7 billion from the same eight months of 2021, according to the U.S. Census Bureau data released last week. That’s more than six times the decrease of any country in the world.”, Forbes, October 11, 2022

Singapore

“Singapore Unveils New $1.05 Billion Inflation-Relief Package – Singapore Friday unveiled a new S$1.5 billion ($1.05 billion) plan to support lower- and middle-income households, as the economy contends with the fastest inflation in 14 years. The new package, together with earlier rounds of relief measures this year, will fully cover the increase in cost of living for lower-income households on average, and more than half of the increase in living costs for middle-income households, the Ministry of Finance said in a statement.”, Bloomberg, October 14, 2022

United Kingdom

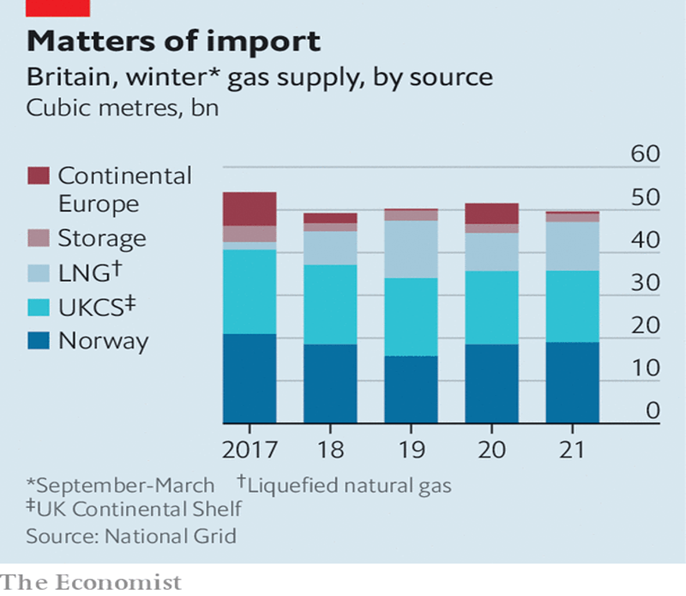

“The threat of energy blackouts in Britain forces a rethink on gas storage – As Europe builds up stocks for the winter, Britain has only meagre capacity. Storage facilities in the European Union are capable of meeting more than 20% of the annual demand for gas; an EU target compelling members to fill storage to 80% by November has been met. Britain’s current storage is around 2% of annual demand. Since some remaining facilities can be emptied and filled multiple times during winter, National Grid says that what remains could satisfy up to 4% of winter demand.”, The Economist, October 7, 2022

“Three-Quarters of UK Business Struck by Labour Shortages – Businesses hit by labour shortages have urged the Government to relax immigration policies to help temporarily fill roles, a new survey has found. Three-quarters of businesses said they have experienced difficulties filling vacancies and a shortage of workers, according to the Confederation of British Industry’s (CBI) employment trends survey with recruitment agency Pertemps Network Group, conducted in August.”, Bloomberg, October 10, 2022

United States

“US Small-Business Optimism Improves for a Third Straight Month – NFIB’s September index ticked up to 92.1 on sales expectations Smaller share of owners said they raised selling prices. Optimism among US small businesses edged up in September as firms grew less downbeat about the outlook for sales, while a smaller share said they raised prices. The National Federation of Independent Business overall optimism index rose 0.3 point to 92.1 last month, the group said in a report Tuesday. Five of the gauge’s 10 components increased. Despite rising for a third-straight month, the measure is historically low.”, Bloomberg, October 11, 2022

“Americans began new businesses at record pace in 2021 – Americans applied last year to start a record 5.4 million new businesses, with Hispanic Americans applying at the fastest rate in more than a decade and 23% faster than pre-pandemic levels, the White House touted in April. But inflation surged to the highest level in a generation and remains the single most important problem for 29% of small businesses surveyed in August by the National Federation of Independent Business.”, USA Today, October 7, 2022

“Online (U.S.) holiday shopping sales to reach $209.7B this year – Cyber Week is projected to drive $34.8 billion in online sales. According to Adobe, the projected total for online shopping sales during the 2022 holiday season spanning Nov. 1 to Dec. 31 would constitute a 2.5% increase from 2021, when shoppers spent $204.5 billion online. Nearly half of the projected $209.7 billion in online spending is expected to come from electronics ($49.8 billion), apparel ($40.7 billion) and groceries ($13.3 billion).”, Fox Business, October 10, 2022

Brand News

“(U.S.) Teenage Consumers Prefer Chick-Fil-A, Starbucks And Chipotle – Piper Sandler’s 44th semi-annual Taking Stock With Teens survey didn’t yield many surprises in terms of restaurant preferences. The survey, which highlights discretionary spending trends and brand preferences of those averaging 15.8 years old, shows that Chick-fil-A remains the No. 1 restaurant for the demographic, with 18% share. It is followed closely by Starbucks at 17% and Chipotle at 13%. Chick-fil-A and Starbucks are consistent favorites for teens, according to the survey, which is notable as the spending power of Gen Z continues to increase. A Bloomberg report from 2021 shows this demographic has about $360 billion in disposable income, or more than double what was estimated three years ago.”, Forbes, October 14, 2022

“Fast-Food Restaurants Use Robots as Frequent Fryers – Several restaurants – including a San Diego Jack in the Box and a CaliBurger on the West Coast – have robot fry cooks. The Flippy 2 robot from Miso Robotics Inc. in Pasadena, Calif., has automated the process of deep-frying potatoes, onions and other foods, Reuters reported. Cameras and artificial intelligence control the Flippy 2 robot, having it pull French fries out of a freezer, place them in hot oil and then put the cooked potatoes on a tray.”, FranchiseWire, October 6, 2022

“BurgerFuel launches rescued bread-based beer – Bread into beer into buns: BurgerFuel, in collaboration with Citizen Collective, is launching a craft beer made from rescued surplus bread….. the BurgerFuel franchise has teamed up with Citizen, the innovators behind an award-winning circular solution to ‘rescue & upcycle’ unsold fresh supermarket bread to create a craft beer designed to address needless food waste.”, Franchise New Zealand, October 5, 2022. Compliments of Jason Gehrke, The Franchise Advisory, Brisbane

“Mark Wahlberg-backed F45 faces takeover bid – F45 confirmed this week that it had received an unsolicited proposal from its largest shareholder and lender, Kennedy Lewis Investment Management (“KLIM”), to acquire all the shares not already owned by KLIM ‘or other stockholders participating in the proposed transaction’. While F45 is more expensive than a traditional full-service gym, its group exercise classes are cheaper than hiring your own personal trainer. Australia has more than 800 franchises.”, Brisbane Times, October 5, 2022. Compliments of Jason Gehrke, The Franchise Advisory, Brisbane

“McDonald s has reopened five more restaurants in Kyiv (Ukraine) addresses – The McDonald’s restaurant chain announced the opening of restaurant halls in Kyiv at a number of addresses – customers were warned about the possibility of long queues. McDonald’s announced that on September 20 they will begin the phased opening of restaurants in Ukraine with the launch of McDelivery. The first establishments on the left bank of Kyiv – near the “Kharkivska” and “Poznyaki” metro stations, as well as “Darnytsia” – became operational.”, ePravda, October 13, 2022. Compliments of Paul Jones, Jones & Co., Toronto

“QDOBA, the #1 Mexican Fast Casual Franchise, is Getting Innovative – QDOBA’s 730-plus unit chain has an appetite for growth and a healthy development pipeline. The Mexican Fast Casual restaurant takes pride in its culture of communication and strong franchisee relationships. This year, the growing franchise has placed an emphasis on rolling out innovative menu items and a digital strategy to create convenience and accessibility for its customers.”, Franchising.com, October 14, 2022

Articles & Studies For Today And Tomorrow

“How Global Businesses Can Ensure Quality Support for Customers Across Different Time Zones – When running a global business, you will naturally have clientele located in countries in different time zones. As such, everyone needs to get the same consistent experience and levels of support. Contacting customer service is never something someone wants to do — rather, it usually only happens when there’s a problem. As a global player, you need to think about how you will serve your customers from the very start, as not doing so will adversely impact those not in your locality. In order to truly operate on the worldwide stage, the delivery of round-the-clock support is essential, meaning that it should be a central component of your strategy.”, Entrepreneur, October 14, 2022

“World’s 20 wealthiest cities, ranked: New York, Tokyo and San Francisco are home to more millionaires and billionaires than anywhere – but Dubai, Mumbai and Shenzhen are catching up fast. The Henley Global Citizens Report places London fourth and Singapore fifth on its ranking of resident UHNWIs, with Beijing at ninth – just ahead of Shanghai. Top-placed New York is home to 59 billionaires and the world’s most expensive residential real estate – Hong Kong slips down to 12th behind Los Angeles, Chicago and Houston. A decade ago, Hong Kong was Asia-Pacific’s second wealthiest city after Tokyo, but has since been overtaken by Singapore, Beijing, Shanghai and Sydney.”, South China Morning Post, October 8, 2o22

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ covering 40 countries provides us with updates about what is happening in their specific countries.

To sign up for our biweekly newsletter click here: https://bit.ly/geowizardsignup

William (Bill) Edwards has a four-decade career successfully accelerating the international growth of more than 40 brands worldwide. He has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East and has lived in China, the Czech Republic, Hong Kong, Indonesia, Iran and Turkey. Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. EGS has twice received the U.S. President’s Award for Export Excellence. For advice on doing business successfully across 40+ countries, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 66, Tuesday, October 4, 2022

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

We say goodbye to Queen Elizabeth II. Chinese consumers get frugal, China’s energy imports decline and Starbucks will add 3,000 more stores in China. The war weighs down European Union country economies. And a new study says 90% of franchised businesses in the USA are negatively impacted by inflation.

To receive this biweekly newsletter that is read by 1,450 people in 20 countries, click here : https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others

“Some people dream of success, while other people get up. Every morning and make it happen.”, Wayne Huizenga

“Success is walking from failure to failure with no loss of enthusiasm.”, Winston Churchill

“Remain a lifelong student. Don’t lose that curiosity.”, Indra Nooyi

HiiHighlights in issue #66:

- Brand Global News Section: Chipolte®, Dave & Buster’s®, Pokeworks®, Tommy Car Wash Systems®, Tous les Jours® and Wayback Burgers®

NOTE: Bolded headlines in this newsletter are live links where the article is freely available

Interesting Data and Studies

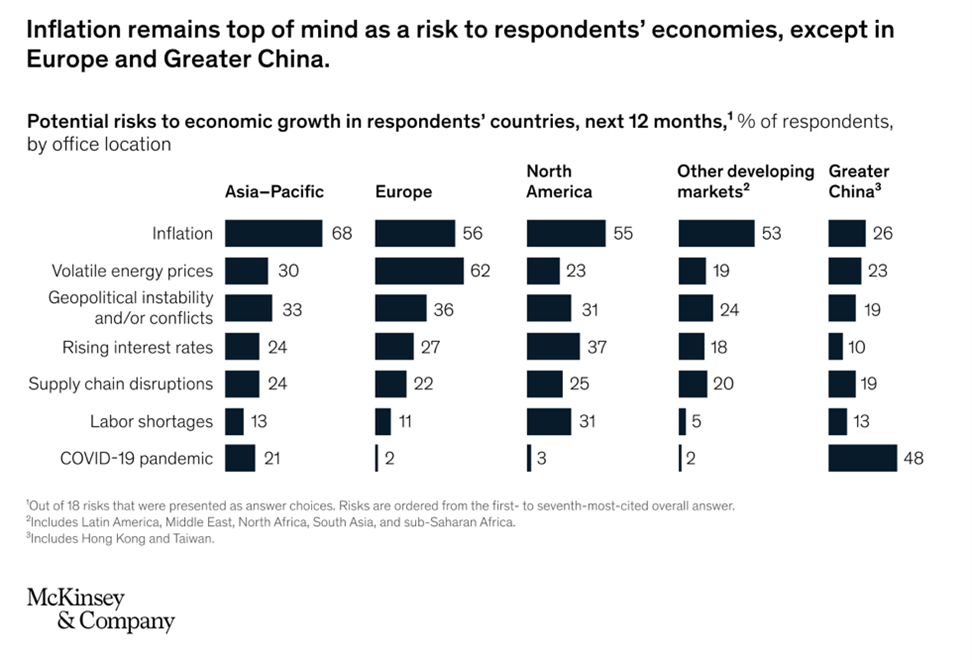

“Economic conditions outlook, September 2022 – In stormy weather, survey respondents maintain realism about the global economy. While geopolitical conflicts and inflation remain top of mind, concerns about energy volatility predominate in Europe. In September, respondents in most regions cite inflation as the main risk to growth in their home economies for the second quarter, according to the latest McKinsey Global Survey on economic conditions.1 Geopolitical instability and conflicts remain a top concern as well, most often cited as the greatest risk to global growth over the next 12 months.”, McKinsey & Co., September 29, 2022

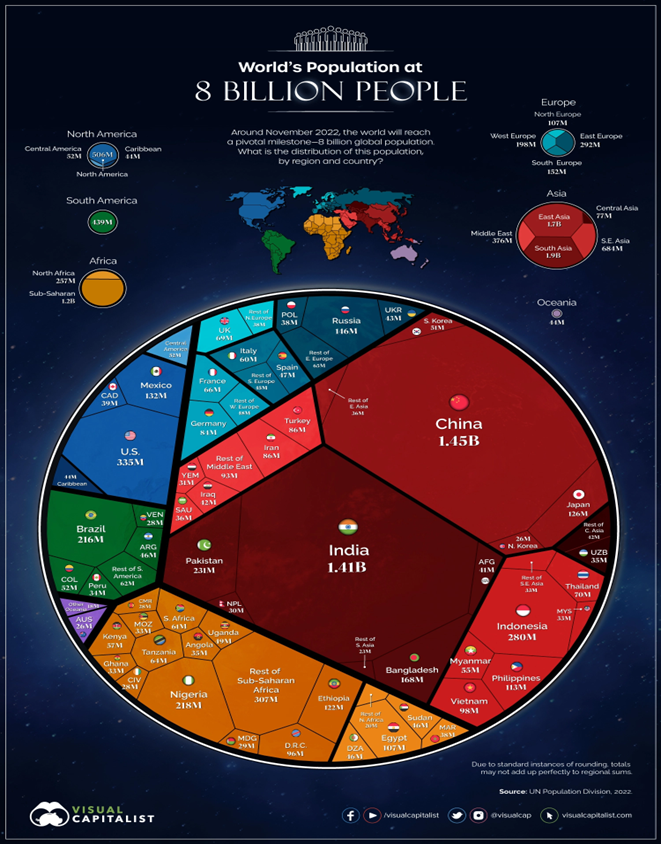

“The World’s Population at 8 Billion – At some point in late 2022, the eight billionth human being will enter the world, ushering in a new milestone for humanity.In just 48 years, the world population has doubled in size, jumping from four to eight billion. Of course, humans are not equally spread throughout the planet, and countries take all shapes and sizes. The visualizations in this article aim to build context on how the eight billion people are distributed around the world.”, Visual Capitalist / UN Population Division 2022

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

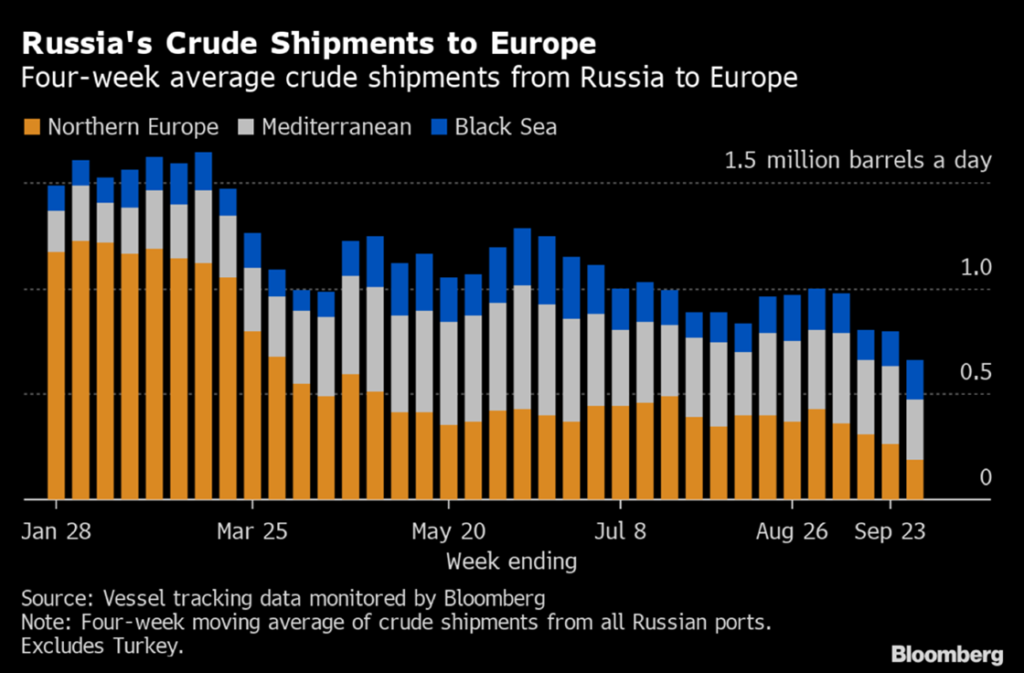

“Europe Turns Its Back on Russian Crude as Sanctions Draw Closer – Shipments to Europe are down 60%. The European market for Russia’s seaborne crude is drying up as sanctions draw nearer, and the country’s Asian customers aren’t picking up the slack like they once were. With just over two months until a European Union ban on seaborne crude imports comes into effect, shipments to the bloc plus the UK are down by about 60% from where they were before Moscow’s troops invaded Ukraine.”, Bloomberg, October 3, 2022

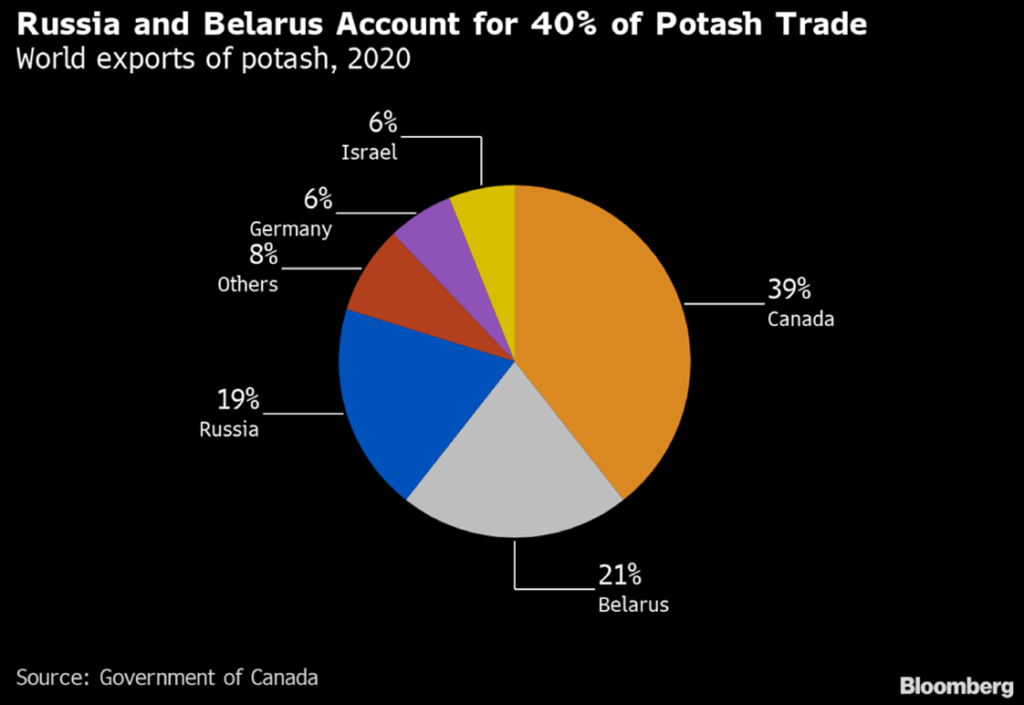

“India’s Potash Demand Languishes as World Reels From High Prices – Supplies from Russia, Belarus have been cut off amid sanctions Price talks will begin soon with companies in Russia, Canada – India, one of the world’s biggest potash importers, is facing demand destruction due to high prices and the loss of critical supplies from Belarus and Russia. Potash consumption will probably fall to 3 million tons in the year through March 2023 from 5 million a year earlier……Farmers have been using less of it to grow crops like rice, wheat and sugar.”, Bloomberg, September 27, 2022

“Oil Heads for First Quarterly Loss Since 2020. OPEC Expected to Cut Output. Crude oil prices are set for a quarterly loss for the first time in more than two years as global economic concerns outweigh the prospect of lower production. Brent crude , the international benchmark, was down 1.0% at $86.30 in morning trading and down 21% over the last three months. West Texas Intermediate , the U.S. standard, was down 0.9% at $80.50, down 24% over a three-month period. The last time the price of oil fell over a quarter was March 2020, although prices remain substantially elevated since their pandemic-driven lows. The potential for output cuts from the Organization of Petroleum Exporting Countries and its allies at their upcoming October meeting could support oil prices.”, Barron’s, September 30, 2022

Global & Regional Travel Updates

“Hong Kong-Los Angeles Business Class Fares Hit $13,000 in Rush to Fly – Travel to and from Hong Kong is easier now that hotel quarantine has ended. It is also more expensive. A business class ticket between Hong Kong and Los Angeles leaving Friday and returning on Oct. 7 cost HK$102,270 ($13,029) Monday with Cathay Pacific Airways Ltd., the only carrier offering the nonstop service in the wake of the pandemic. That’s more than double the HK$44,499 fare for the same flight next year.”, Bloomberg, September 26, 2022

Country & Regional Updates

Australia

“More than one in three Aussies would quit if they couldn’t work from home – Researchers from the National Bureau of Economic Research in the US found Australians worked an average of two days a week at home at the time of the surveys, higher than the survey average across 27 countries of 1.5 days. They found Australian employers on average wanted workers to have just one day working from home, while employees on average would like to work remotely two days a week. And if their employer required them to return to the office full-time, 35 per cent of Australians said they would quit or immediately start looking for a new job that allows working from home.”, Brisbane Times, September 18, 2022

Canada

“Canadian economy is slowing, but still eking out growth – Real (inflation-adjusted) gross domestic product rose 0.1 per cent in July, stronger than a previous estimate of a 0.1-per-cent drop, Statistics Canada said in a report on Thursday. In a preliminary estimate, the agency said growth was essentially unchanged in August……GDP is on track to grow at an annualized pace of about 1 per cent in the third quarter. That is considerably slower than growth of 3.1 per cent in the first quarter and 3.3 per cent in the second, along with the Bank of Canada’s forecast of 2-per-cent growth.”, The Globe & Mail, September 29, 2022

“COVID-19 air travel restrictions lifted in Canada – All COVID-19 restrictions for air travel are officially gone as of Oct. 1, with ArriveCan no longer being used for public health checks. Masks are now optional on flights.”, Global News, October 1, 2022

China

“Microsoft plans 1 000 new jobs in China despite slowing economy and widespread tech layoffs – The US technology giant says it will grow its workforce in China to over 10,000 next year, up from roughly 9,000 currently. Microsoft’s announcement comes amid a spate of lay-offs among some of the largest technology companies operating in China.”, South China Morning Post, September 22, 2022. Compliments of Paul Jones, Jones & Co., Toronto

“Starbucks opens 6 000th store in Chinese mainland – Starbucks Tuesday celebrated its 6,000th store in the Chinese mainland, located in downtown Shanghai. Shanghai thus became the first city in the world to have 1,000 Starbucks stores. In 2018, Starbucks announced it would have 6,000 stores on the Chinese mainland by the end of its fiscal year in September 2022. Starbucks opened its first store on the Chinese mainland in January 1999 in Beijing.”, Shine.cn, September 27, 2022. Compliments of Paul Jones, Jones & Co., Toronto

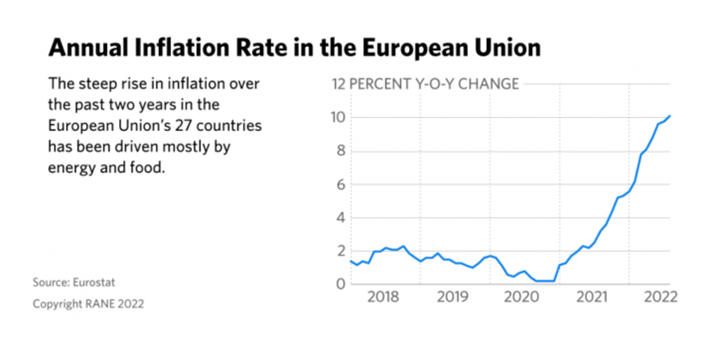

European Union

“A Slowing Economy Raises Social and Political Risks – A combination of high inflation, high energy prices, lingering geopolitical uncertainty and monetary tightening will slow economic activity in Europe during the quarter and increase social and political risks. Inflation will remain high in Europe, driven primarily by pervasively high energy prices.”, RANE/Worldview, September 28, 2022

Germany

“Berlin Introduces Debt-Financed Natural Gas Price Cap – The German government set out a 200 billion euro ($196 billion) debt-financed special fund to implement a natural gas price cap aimed at shielding German consumers and energy companies from soaring gas prices, Politico reported Sept. 29. Under the plan, which will run until March 2024, the government will use the fund to pay natural gas importers the difference between the cap and what importers pay for gas on the global market.”, RANE/Worldview, October 3, 2022

“New German COVID-19 rules come into force as infections rise in colder months – Germany has modified rules on mask-wearing and hygiene as it prepares for a rise in COVID-19 cases. But not all restrictions have been tightened — and not everyone is satisfied. Health Minister Karl Lauterbach called the new rules strict compared with other European countries but said Germany was being “not smarter but more cautious” in its approach.”, Deutsche Welle, October 1, 2022

India

“India Jobless Rate Drops to Four-Year Low Before Festival Season – India’s unemployment rate dropped to the lowest in more than four years in September, buoyed by a strong rise in new jobs, according to a private research firm. The jobless rate sharply fell to 6.43%, data from the Centre for Monitoring Indian Economy Pvt. showed. The reading is the lowest since August 2018 and compares with a one-year high of 8.3% in August.”, Bloomberg, October 3, 2022

Middle East

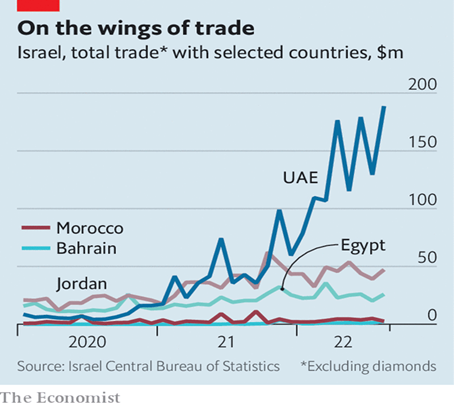

“Trade and security ties are knitting Israel into its region – Former enemies drawing closer, offering hope of a more stable and prosperous Middle East. For the first time since its creation in 1948, Israel has a warm peace with an Arab country, not just the formal, often frosty ones with Egypt and Jordan, its immediate neighbours. The accords are underpinning a realignment of trade, diplomacy and security arrangements in the Gulf. They are largely economic, built on the hope that trade can bring peace and restore the Middle East to its historic role as the crossroads of the world’s trade, linking Asia and Europe through the Silk Road and Africa through the Incense Road.”, The Economist, September 22, 2022

Pakistan

“How worried should we be about Pakistan’s economy? Concerns are rising again over the health of Pakistan’s economy as foreign reserves run low, the local currency weakens and inflation stands at decades-high levels despite the resumption of an International Monetary Fund funding programme in August. But then Pakistan was hit by major floods in late August that killed more than 1,500 people and caused billions of dollars worth of damage, heaping even more pressure on its finances. The biggest worries centre around Pakistan’s ability to pay for imports such as energy and food and to meet sovereign debt obligations abroad.”, Reuters, September 30, 2022

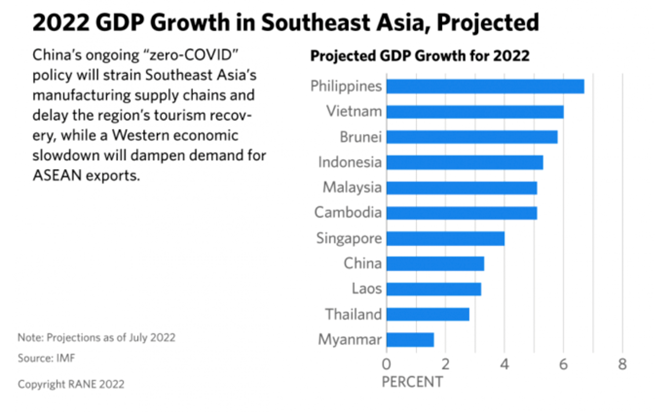

South East Asia

“Southeast Asian Economic Recovery Will Lag – Continued Chinese lockdowns and weaker consumer demand in the West will strain budgets and limit economic growth in Southeast Asia…… monetary policy tightening and looming recessions in the United States and the European Union will reduce demand, which will negatively impact Southeast Asian exports.”, RANE/Worldview, September 28, 2022

Thailand

“Thailand to Eliminate All Pandemic-related Travel Restrictions This Week – Thailand will drop the last of its remaining pandemic-related travel rules this week as the country ends its nationwide COVID-19 Emergency Decree. Starting Oct. 1, the Southeast Asian country will no longer require travelers to show proof of vaccination or proof of a negative test to enter.”, Travel & Leisure, September 26, 2022

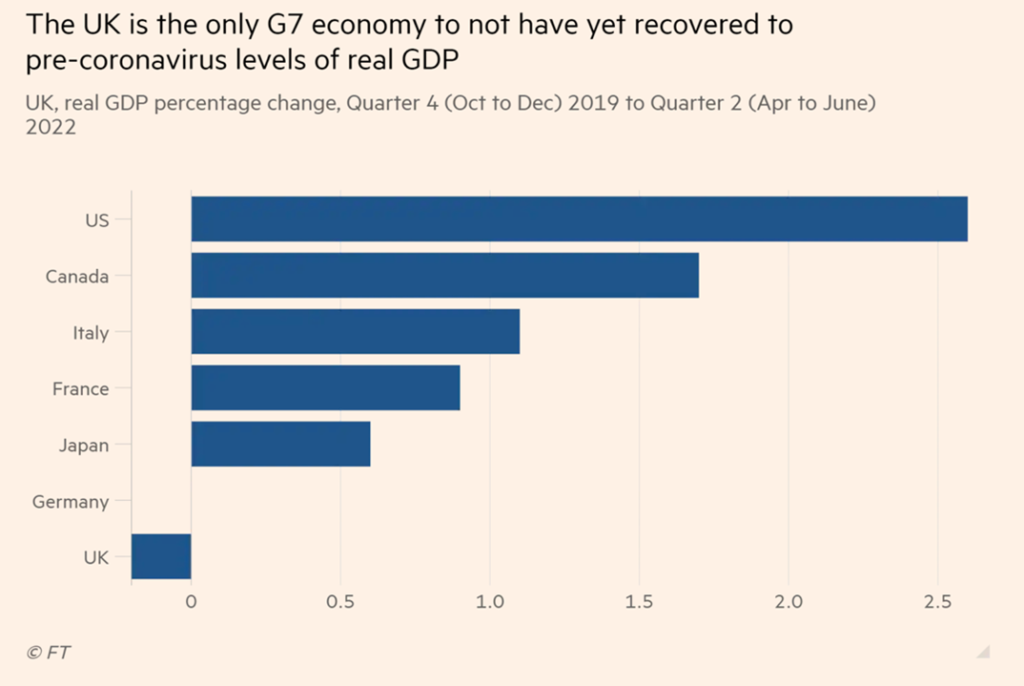

United Kingdom

“UK remains only G7 economy to languish below pre-pandemic levels – GDP stuck 0.2% below final quarter of 2019, but latest growth data now positive. Office for National Statistics figures released on Friday showed that UK gross domestic product for the three months to June this year remained 0.2 per cent below the level it reached in the final quarter of 2019. By contrast with the UK’s failure to return to pre-pandemic levels, the eurozone economy reached 1.8 per cent above 2019 levels in the second quarter. The US had recovered to pre-pandemic levels by the start of last year.”, The Financial Times, September 30, 2022

“Why ‘digital literacy’ is now a workplace non-negotiable – Digital literacy used to mean being able to send an email or type using a word-processing programme. It was a skill largely required of knowledge workers – people who might use specific software at work, and need to be fluent in how to use it accordingly. Now, digital literacy means having the skills to thrive in a society where communication and access to information are increasingly done via digital technologies, such as online platforms and mobile devices. Today, digital literacy is no longer a functional proposition, it’s a mindset. In the modern workplace, there is a greater expectation for employees to nimbly adopt whatever technology comes with their job as well as adapt to ever-changing tools and approaches.”, BBC News, September 25, 2022

United States

“Vast Majority Of Manufacturers Plan Price Increases In 2023 – The poll of 150 manufacturing CEOs surveyed in late August found that nearly half of companies (45%) had passed on the costs of inflation to customers today, while 38% said they had avoided doing so and 17% said their companies absorbed the costs despite the financial hit. Those price increases had an impact. More than half (55%) said they had lost customers over the past year due to price increases, while nearly one in five (19%) have cut their workforce to keep costs in line.”, Forbes, September 28, 2020

“US Business Equipment Orders Rise by Most Since Start of Year – Capital goods orders ex-defense, aircraft rose 1.3% in August Overall durable goods bookings fell on softer plane orders. Orders for business equipment at US factories rose in August by the most since the start of the year, reflecting broad advances across categories, including machinery and computers, even as interest rates rise. The value of core capital goods orders, a proxy for investment in equipment that excludes aircraft and military hardware, increased 1.3% last month.”, Bloomberg, September 27, 2022

Brand News

“Franchise Times Top 500 Ranks the Largest Brands in Franchising – With many of the measures meant to slow down the coronavirus pandemic coming to an end and a sense of normalcy returning, 2021 marked a rebound year for hundreds of franchises. Those comebacks are reflected across the Franchise Times Top 500, the annual ranking of the largest U.S.-based franchise systems by worldwide sales.”, Franchise Times,

“Chipotle is moving its tortilla robot to a real restaurant – Chipotle’s tortilla-making robot will soon help out in a restaurant you can visit. The chain has unveiled a slew of technology updates that include moving the Miso Robotics-made Chippy robot to a real restaurant. The machine will start cooking tortilla chips in a Fountain Valley, California location in October. The chain is also piloting AI that tells kitchen staff what to cook.”, Engadget, September 27, 2022

“Dave and Buster’s to Open 11 Units Across KSA, UAE, and Egypt – Announces international franchise partnership with Abdul Mohsen Al Hokair Holding Group. The Brand will begin its expansion with sites in the Kingdom of Saudi Arabia, followed by the United Arab Emirates and Egypt.”, Company press releases, September 14, 2022

“Pokeworks Continues Global Growth with Talabat Partnership in the Middle East – In the first phase, Pokeworks expects to open 10 delivery-only locations in the UAE, Kuwait, and Bahrain over the next 3 years, starting with Dubai in 2023. Talabat is part of Germany’s Delivery Hero, which operates a network of online food delivery companies worldwide.”, September 30, 2022

“Tommy Car Wash Systems and Tommy’s Express Car Wash set their Sights on Development in Canada – U.S.-based car wash franchise, Tommy’s Express, announced earlier this year it will break ground on its first international franchise location in Ontario, Canada in Q4 2022. As front runners in the car wash industry, the brand is continuing to focus on expansion in Canada by exhibiting at the Convenience U CARWACS Show taking place September 13th – 14th at the Toronto Congress Centre.”, Franchising.com, September 13, 2022

“French-Asian Bakery Tous les Jours Makes U.S. Franchise Push – Tous les Jours means “every day” in French, and the French-Asian bakery-café chain hopes to make its artisan pastries, gourmet cakes and freshly baked bread an everyday habit in its push in the United States. With more than 70 cafes stateside, 1,631 worldwide and $697 million in system sales in 2021, Tous les Jours debuts on the Franchise Times Top 500 this year at No. 122. Franchise Times, September 2022

“Wayback Burgers Signs New Master Franchisee in the Dominican Republic – Wayback Burgers has announced a new master franchise agreement with Farhiell Exil to bring the U.S. burger concept to the Caribbean. Under the agreement, Exil will open eight Wayback restaurants across the Dominican Republic within the next 8 years. The first opening is planned for Santo Domingo, the nation’s capital, in early 2023.”, Franchising.com, September 27, 2022

Articles & Studies For Today And Tomorrow

“Unit-Level Economics for Franchise Businesses – After working with more than 900 franchise brands, we’ve (FranConnect) found that a common practice is working together with their franchisees to improve their unit-level economics – not only their top-level sales but also their bottom line. If you’re not doing this today, you will have trouble selling franchises in the future. Unit-level economics is a means by which franchisors and franchisees identify, measure, track, and manage the performance of their businesses at individual unit levels.”, FranConnect on Franchising.com, September 30, 2022

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ covering 40 countries provides us with updates about what is happening in their specific countries.

To sign up for our biweekly newsletter click here: https://bit.ly/geowizardsignup

William (Bill) Edwards has a four-decade career successfully accelerating the international growth of more than 40 brands worldwide. He has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East and has lived in China, the Czech Republic, Hong Kong, Indonesia, Iran and Turkey. Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. EGS has twice received the U.S. President’s Award for Export Excellence. For advice on doing business successfully across 40+ countries, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking