Biweekly Global Business Newsletter Issue 122, Tuesday, November 26 , 2024

Almost 100% of Gen Zers Surveyed Admitted to Using AI Tools at Work

Increasing energy demands, the world’s largest exporter, USA companies are accelerating commodity purchases ahead of expected January tariffs, what region has the most copper reserves, and which country imports far more copper than it produces. Almost 100% of Gen Z uses A.I. Who are the world’s biggest exporters and where is the world’s wealth? There has been an astounding 34% increase in the cost of opening a new business since 2019. A great new book on the Road to

Entrepreneurship was just published. Jersey Mikes® sells to Blackstone for U$8 billion and YUM China is focused on 20,000 locations in that country.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business. Some of the information sources that we provide links to require a paid subscription for our readers to access.

You will see small ads in each edition for carefully vetted companies that serve international businesses. Please click on the ads or use the QR code to see what each of our carefully chosen advertisers can do to make doing global business easier. Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Bedwards@edwardsglobal.com https://www.linkedin.com/in/williamedwards/ +1 949 375 1896

==============================================================================================

First, A Few Words of Wisdom From Others For These Times

“A problem well stated is a problem half-solved.”, Charles F. Kettering. Compliments of Beth Adkisson, Vistage Master Chair

“Whenever you find yourself on the side of the majority, it is time to pause and reflect.” – Mark Twain

“If one does not know to which port one is sailing, no wind is favorable.” – Lucius Annaeus Seneca

v+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Highlights in issue #122:

- Brand Global News Section: YUM China, Jersey Mike’s®, KFC® and Taco Bell®

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

B2B Payments Platform For Global Businesses

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

“The World’s 30 Largest Exporters – As protectionism continues to rise around the world, global trade flows are adapting. Despite facing a wave of tariffs, China’s goods exports show resilience. In 2023, China’s export volumes neared all-time highs as the price of its manufactured exports fell 10%, on average. Overall, the world’s largest exporter delivered $500 billion in goods to America last year, but this could drastically change under the Trump administration. Last year, global exports of goods totaled $23.8 trillion, declining by 5% compared to 2022. Overall, the dollar value of exports dropped across 20 of the top 30 largest exporters in the world as the number of trade restrictions rose to almost 3,000 worldwide—approximately fivefold levels seen in 2015. Visual Capitalist & the World Trade Organization, November 21, 2024

============================================================================================

“Almost 100% of Gen Zers Surveyed Admitted to Using AI Tools at Work – Here’s Why They Say It Is a ‘Catalyst’ for Their Careers. Despite most of Gen Z thinking that their jobs could be replaced with AI in the next decade, the vast majority are still using AI to help complete office tasks — and they’re open about it. A new survey released on Monday from Google assessed the AI habits of 1,005 full-time U.S.-based knowledge workers aged 22 to 39. Google called the group “young leaders” because they’re currently in leadership positions or aspire to hold one at work. The survey found that 93% of Gen Z respondents from 22 to 27 years old are using two or more AI tools like ChatGPT or Google Gemini AI per week. In comparison, 79% of millennials ages 28 to 39 indicate that they’re doing the same.”, Entrepreneur magazine, November 25, 2024

===============================================================================================

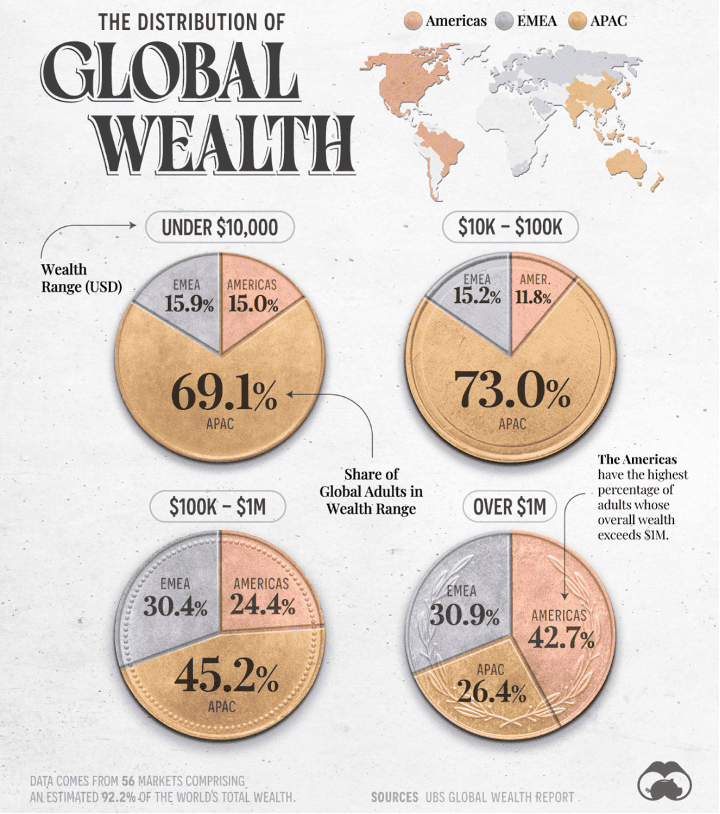

“Global Wealth Distribution by Region in 2023 – Wealth distribution varies significantly across the world’s regions, reflecting the economic disparities shaped by differences in development, resource availability, and financial access. The data comes from the UBS Global Wealth Report 2024 and encompasses 56 markets representing an estimated 92.2% of total global wealth. The UBS report’s data does not include a majority of African countries. The majority of adults in the lowest wealth bracket (under $10K) are concentrated in the Asia-Pacific (APAC) region, where nearly 70% of people in this wealth bracket being from the region. On the other end, the highest wealth bracket (over $1M) is dominated by the Americas along with the grouped region of Europe, the Middle East, and Africa (EMEA). Visual Capitalist and the UBS Global Wealth Report, November 12, 2024

===========================================================================================

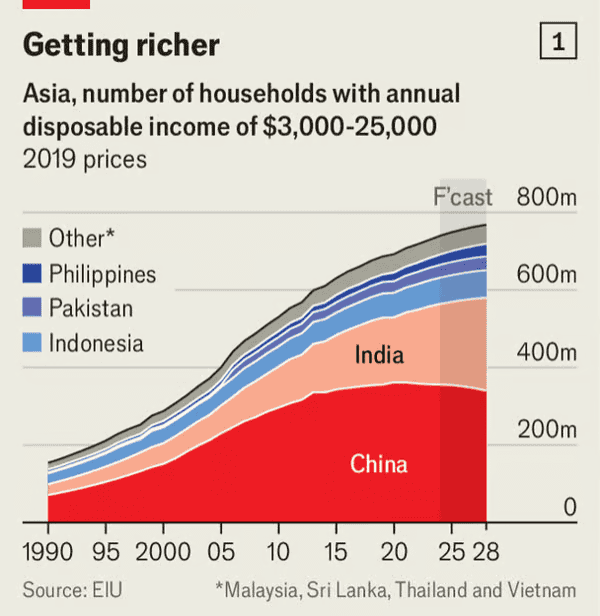

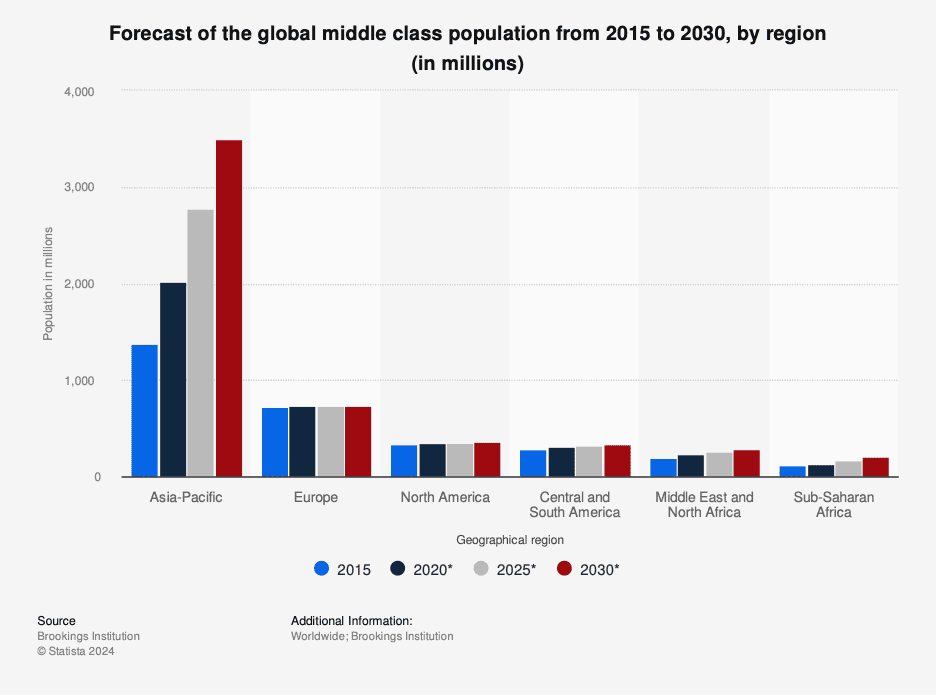

“The surprising stagnation of Asia’s middle classes – It could shake up everything from profits to politics. In August Indonesia’s statistician-in-chief, appeared in parliament with bad news. The country’s middle class had shrunk. Between 2021 and 2024, 6m Indonesians had fallen into the “aspiring middle class”, an official euphemism for being a stone’s throw away from poverty. The middle-class share of the population had fallen to 17% from 22% before the pandemic. Asked about the grim trend the next day, Joko Widodo, then the president, deflected: ‘This issue exists in almost all countries.’ Between 1991 and 2014, the average annual growth rate in the number of Asian middle-class households was 6%, according to our analysis. In the past decade, it has slowed to 2%. In a few countries, including China, it has shrunk. Exclude India, where the middle class is still growing, and Asia’s middle classes have stagnated. At stake are the futures of 2.7bn people in the middle class, or 72% of the population of developing Asia.”, The Economist, November 21, 20242024

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Simple, secure currency transfers

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation, Taxes & Trade Issues

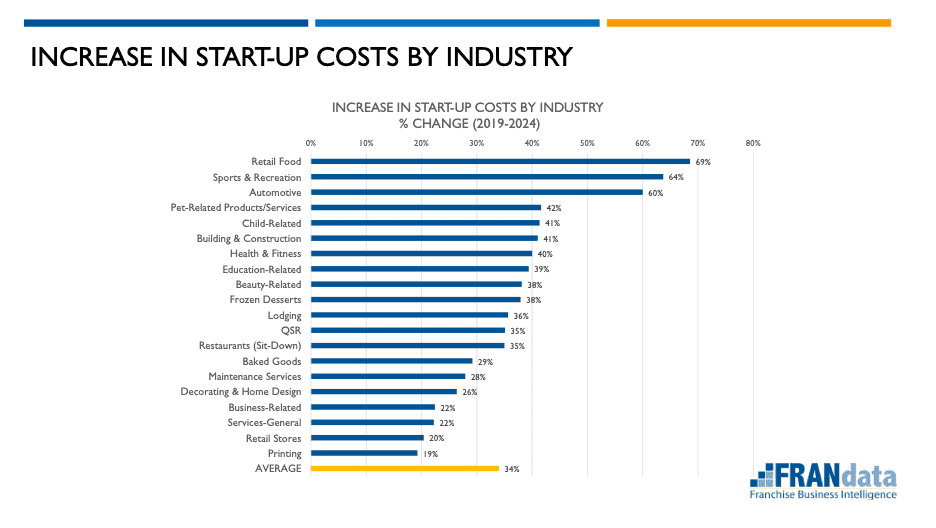

“Increase In Start-up Costs By Industry – At last week’s fall advisory board meeting of the Titus Center for Franchising at Palm Beach Atlantic University Edith Wiseman, President at FRANdata, presented this slide which shows the increase in cost to start-up a single franchise unit in various industries over the past 5 years. The average single unit start-up cost increased 34% from 2019 until this year.

=================================================================================================

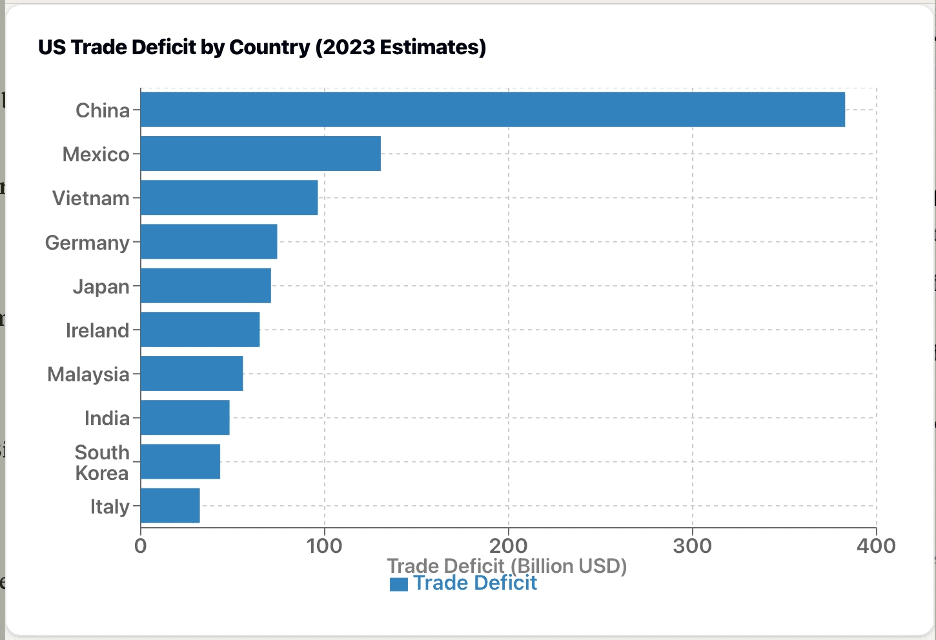

US Trade Deficits By Country – This chart visualizes the estimated US trade deficits with its top 10 trading partners in 2023. China remains the country with the largest trade deficit for the United States, at approximately $382.9 billion. Mexico is the second-largest deficit country, with around $130.5 billion. These are estimated figures based on recent economic reports. The data represents the difference between imports and exports. The data for this chart is extracted from McKinsey & Co., International Monetary Fund (IMF), the World Economic Forum, the Financial Times and the Economist, November 2024

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

“Emerging energy demands – Global energy demand has taken off once again after a dip in 2020. It is projected to grow 11 percent by 2050 if momentum continues at its current pace. Most of the energy demand growth is expected in emerging economies such as the Association of Southeast Asian Nations (ASEAN), India, and the Middle East, senior partner Alessandro Agosta and colleagues note. ASEAN countries in particular are expected to propel this growth, which may reshape global energy trade flows.” McKinsey & Co., November 15, 2024

=================================================================================================

Book Review

The Road to Entrepreneurship Starts With Why: Drastic Steps to Success by Toni Harris Taylor, Azaniah Israel, Carol Schillne, Gloria Solomon, Jeanna Bumpas, Lea Rutherford, Lisa McClease Kelly, Melanie Cotten, Pankaj Kumar , Patrika Romano and Keith Gerson. This just published book is an empowering anthology that challenges aspiring entrepreneurs to dig deep and uncover their true motivations. This book is more than a guide; it’s a collection of powerful stories from individuals who have faced significant hurdles yet persevered, driven by a clear sense of purpose—their “Why.”

The premise is simple yet profound: understanding why you want to be an entrepreneur is crucial to navigating the highs and lows of the journey. Each chapter introduces a different voice, offering insights into the contributors’ personal struggles and triumphs. From overcoming financial obstacles to embracing bold, life-changing decisions, the contributors reveal the drastic steps they took to achieve success. Their authenticity makes this book relatable, and their stories are a testament to resilience and the transformative power of self-awareness.

Taylor’s editorial touch ensures the lessons are practical, not just motivational. She provides actionable advice, encouraging readers to connect their business goals with their passions and core values. The book also emphasizes the importance of community, mentorship, and embracing risks—valuable themes for any entrepreneur.

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Keith Gerson and Bill Edwards Join Forces To Offer Trusted Suppliers To The Franchise Community

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

China

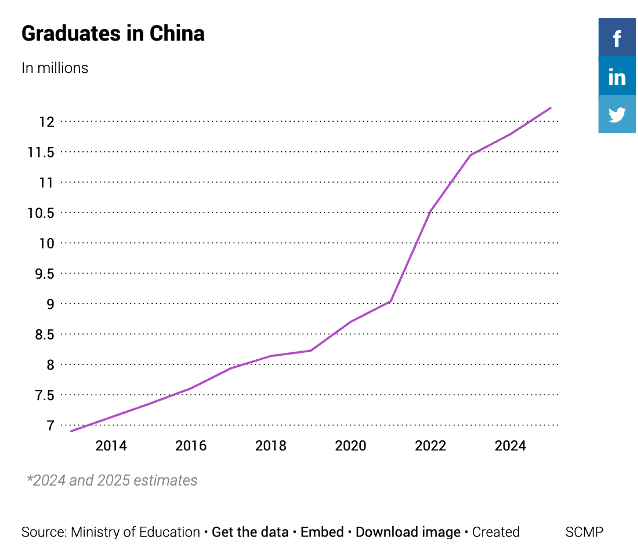

“China’s job market braces for record number of fresh graduates next year – Ministry estimates that number of university graduates next year will hit a record 12.22 million. This year, as an estimated 11.79 million graduates flooded the job market, the unemployment rate for 16- to 24-year-olds, excluding students, rose in July and August, when it reached 18.8 per cent, the highest level since the data was revised last year.”, South China Morning Post, November 14, 2024

==============================================================================================

“Mondelēz International increases investment in China – Snack giant expands into baking market. As the world’s largest manufacturer of baked goods and chocolate products, Mondelēz International has many well-known brands, including “Oreo”, “Xuanmai”, “Qiduoduo”, “Taiping” and “Toblerone” chocolate, which are well-known to Chinese consumers. With rising raw material prices, inflationary pressure and reduced consumer spending, Mondelēz is facing a new transformation cycle. Mondelēz China President François Frédéric said: “The Chinese market is the strategic growth engine of Mondelēz worldwide. China has a huge middle class, the number of which is still expanding, and the pace of urbanization is accelerating, which is a huge opportunity for every foreign-invested enterprise. This huge investment is the best reflection of this and means that Mondelēz’s development in China has entered a new stage.”, eeo.com.cn, November 19, 2024. Translation and article provided by Paul Jones, Jones & Co., Toronto

==============================================================================================

Euro Zone

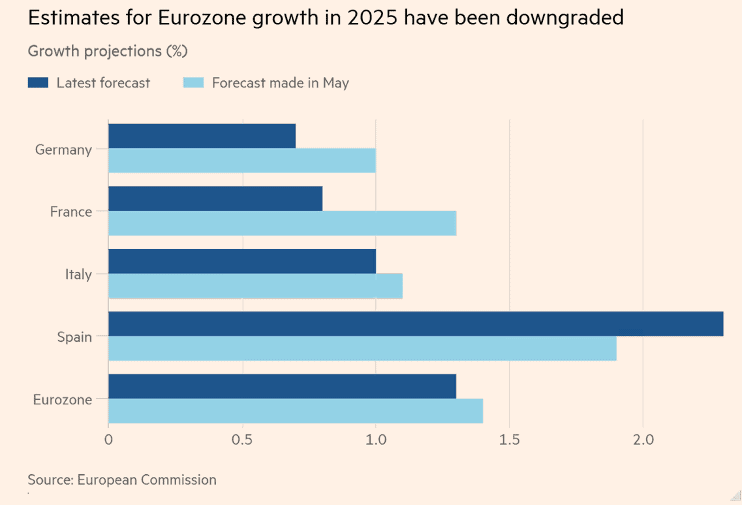

“Eurozone growth gap to widen with US, as Brussels cuts forecasts – Germany’s economic struggles weigh down region as US continues to outpace Europe. The Eurozone economy is set to fall further behind the US, the European Commission said on Friday, as it downgraded its 2025 growth forecast for the region to 1.3 per cent. While Germany, France and Italy are all expected to grow less in 2025 than was anticipated by the commission in May, Spain’s projections were upgraded. It is expected to remain the fastest-growing large EU economy for the second consecutive year after a strong 2024.”, The Financial Times, November 15, 2024

==========================================================================================

India

“India’s economy will soon overtake Japan’s – Will that cause an “India shock” for the world economy? China overtook Japan in 2010 to become the world’s second largest economy, a title Japan had held for almost 40 years. Will the world see such a rise again? India hopes so. In 2025 it could overtake Japan to become the second-biggest economy in Asia and the fourth largest in the world (behind America, China and Germany). India’s population is already bigger than China’s and its economy is likely to grow significantly faster in the next few years. India’s leaders want its GDP to reach $5trn by 2028 and its exports of goods and services to reach $1trn apiece by 2030.”, The Economist, November 20, 2024

==================================================================

“Unilever to Double Down on India Under New Strategic Shift – CEO Hein Schumacher said India is the best opportunity for Unilever over the next couple of years and will be the key for all its group businesses. He added that India’s gross domestic product per capita is estimated to grow to about 4,500 euros ($4,713) by 2033, representing an 85% increase in 10 years.”, The Wall Street Journal, November 22, 2024

===============================================================================================

Latin America

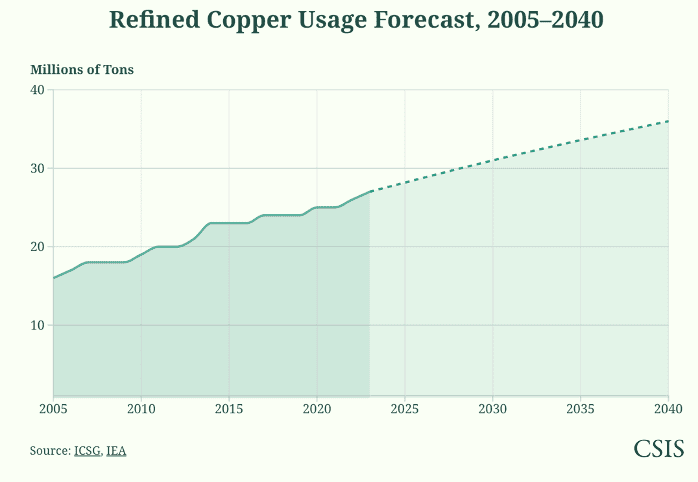

“The World’s Copper Stronghold – Copper is vital to U.S. national, economic, and energy security. Everything—from clean energy technologies, electronics, and automotives, to power transmission infrastructure, data centers, and defense systems—depends on copper. However, the United States only mines 5 percent of the world’s copper. Latin America, which cumulatively mines nearly half (46 percent) of the world’s raw copper—the largest share of any global region—holds significant potential as a sourcing partner. Chile and Peru have the two largest copper reserves globally. To meet the Biden administration’s net-zero carbon emissions targets, American annual copper supply will need to double by 2035. Infrastructure for artificial intelligence and data centers could require a projected additional 2.6 million tons of copper. By 2030, the International Energy Agency predicts that the total copper production from existing mines and mines under construction will only meet 80 percent of the world’s copper needs.”, Center for Strategic and International Studies, November 13, 2024

============================================================================================

United States

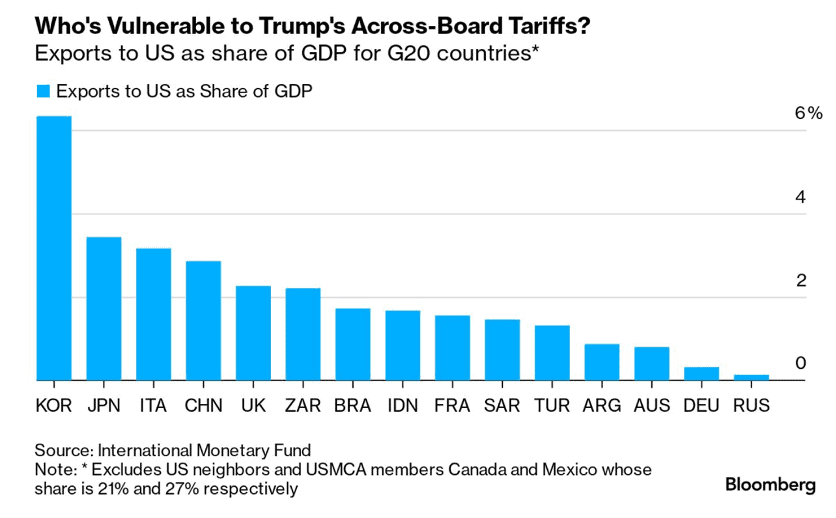

“American Companies Are Stocking Up to Get Ahead of Trump’s China Tariffs – Businesses plan to stockpile, raise prices and accelerate shift to manufacturing elsewhere. American businesses are dusting off a playbook they used during Trump’s first term: stocking up on imported goods before tariffs are enacted. They are also considering how to cope with the levies if and when enacted—whether they will be able to raise prices and whether they will need to find alternatives to their Chinese manufacturers. Already, exports from China surged last month, which some economists think could have been driven at least in part by front-loading amid uncertainty around election results. Outbound shipments from China rose nearly 13% in October from a year earlier, well above consensus expectations and up sharply from 2.4% growth in September. Chinese exports growth should remain strong through the next few months because of front-loading, Wall Street economists said.”, Wall Street Journal, November 29, 2024

==============================================================================================

Vietnam

“Under Trump Tariffs, ‘Made In Vietnam’ Will Be The New ‘Made In China’ – For decades, the Southeast Asian nation has opened its doors to major firms like Apple, Samsung and Intel. Now it’s poised to do even bigger business. ‘If previously it was made in China, now it’s going to be made in Vietnam,’ Jason Miller, a professor of supply chain management at Michigan State University, told Forbes. ‘That production is not coming back to America.’ Vietnam has a number of advantages over other regional rivals like India. First, as a single-party authoritarian state, Vietnam can and does set new business-friendly policy quickly. Additionally, the country is geographically well-positioned: it already has three of the world’s top 50 busiest ports, and is next-door to China, making trade and logistics between the two countries easier. Critically, Vietnam also has a free-trade agreement with the European Union – the only other regional country besides Singapore to have one.”, Forbes, November 20, 2024

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Taking Brands Global Successfully For 5 Decades

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“He Bought a Sub Shop as a Teen. Now He’s Selling Jersey Mike’s for $8 Billion – Peter Cancro started slinging subs at his local shop at 14. Now he’s selling the national chain he built to Blackstone. ‘We’re not a chain. We’re the mom-and-pop shop in every town,’ Cancro said in an interview last year. Cancro declined to comment for this article through a spokeswoman.

Cancro kept the formula simple: meat and cheese sliced right in front of a customer, fresh dressings and a large amount of food for the money. Another key ingredient: Franchisees are tasked with keeping deep ties in the communities in which they operate. Jersey Mike’s did $3.3 billion in U.S. sales across 2,680 locations last year, its revenue growing 25% from 2022 levels, according to Technomic. Cancro had long contemplated what’s next for his business. During the interview last year, he said he could consider Jersey Mike’s going public but had no specific plans. He was most focused on growth, with a target of reaching 10,000 sub shops in the U.S. one day.

Blackstone has spent the past three years getting Cancro comfortable with a deal, people familiar with the talks said. Cancro wasn’t going to hand over control to someone who didn’t understand his vision and Jersey Mike’s focus on fresh ingredients and ample portions that customers have grown to love and expect, the people said.”, The Wall Street Journal, November 22, 2024

================================================================================================

“Yum China targets 20 000 stores – accelerated franchising – Yum China, operator of KFC, Pizza Hut, Taco Bell and Lavazza, reported robust third quarter results, aiming to operate 20,000 stores by 2026 and vowing to strengthen franchising efforts. The company said its strategic focus on operational efficiency and innovation has yielded impressive results, with a total store count reaching 15,861, including 11,283 KFC and 3,606 Pizza Hut locations. In the third quarter alone, the company opened 438 new stores, with franchisees contributing 145 new stores, accounting for around a third of the total. Customer loyalty has been a cornerstone for Yum China, with the total membership of KFC and Pizza Hut surpassing 510 million. Member sales now account for about 64 percent of system-wide sales for both brands combined.”, China Daily, November 19, 2024

===========================================================================================

“Q&A: offer and sale of franchises in Chile – Franchising is very widespread in Chile and most of the biggest international brands are already in the country due to its franchising development. The main sectors are clothing, food and beverages, convenience stores, drug stores, car rental, dry cleaning, language academies and real estate brokers, etc. In general, Chile has a business-friendly environment, as it has been recognised in various rankings and studies, such as the business environment ranking developed by the Economic Intelligence Unit, which ranks Chile 30th worldwide and as the most prominent country in Latin America. there are no specific regulatory barriers and the relation between franchisor and franchisee will be ruled mainly by what they have freely agreed.”, Porzio Rios Garcia, Lexology, July, 2024

=============================================================================================

“Jollibee parent fully acquires Hong Kong’s Michelin-rated Tim Ho Wan dim sum chain – Jollibee Food Corporation buys remaining 8 per cent stake in company for S$20.2 million. Jollibee Food Corporation, which runs fast-food chains across Asia, owned 92 per cent of the dim sum company in January, and the latest deal gives it full ownership. Tim Ho Wan runs about 80 stores in 11 markets including Singapore, Shanghai, Beijing, Melbourne, Tokyo, Macau, South Korea and Manila. The deal comes at a time when Hong Kong’s food and beverage industry faces an uphill battle to retain customers, with many residents crossing the border to mainland China for leisure. Consumption has also slowed on the mainland, with Beijing rolling out a raft of stimulus measures in a bid to electrify the economy.”, South China Morning Post, November 6, 2024

==============================================================================================

To receive this biweekly newsletter in your email every other Tuesday, click here https://insider.edwardsglobal.com

===========================================================================================

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing business environment. And our GlobalTeam™ on the ground covering 25+ countries provide us with updates about what is actually happening in their specific countries. We do not get involved in or report on politics!

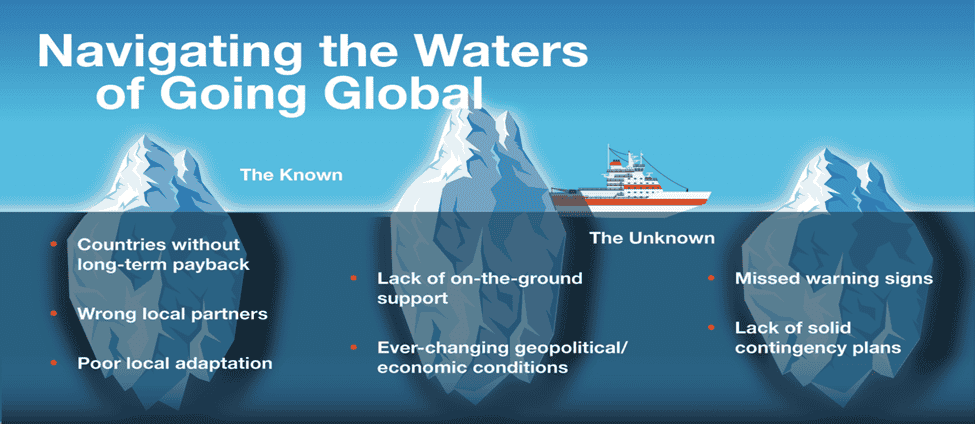

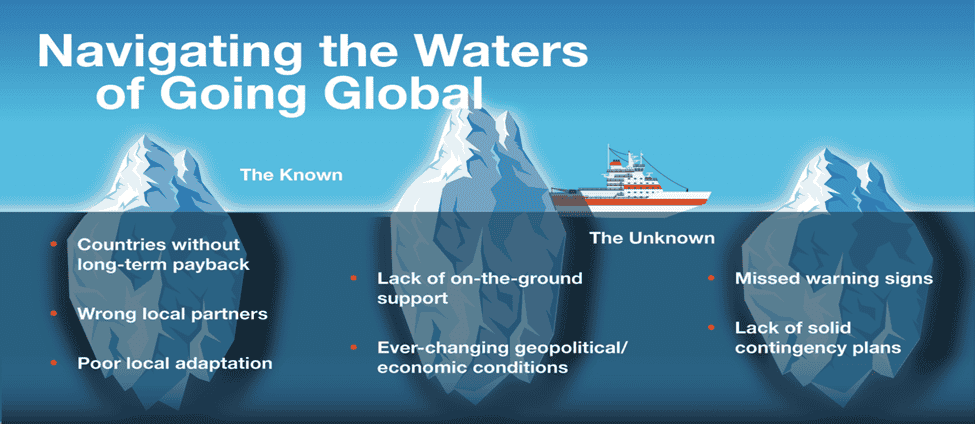

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe, and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant since 2001 taking 40+ franchisors global.

| To receive this biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com +++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++ |

Our latest GlobalVue™ 40 country ranking

For a complimentary 30-minute consultation on how to take your business into new countries and make money doing it. For a complimentary call with Bill Edwards click on the QR code or contact Bill at bedwards@edwardsglobal.com and +1 949 375 1896

Biweekly Global Business Newsletter Issue 121, Tuesday, November 12 , 2024

The World’s Elections Have Consequences

This edition is primarily focused to the projected impact on doing business around the world post USA national election last week. The new USA administration that will take office on January 20th has said that it will take a different economic, political, diplomatic and business approach here at home and in other countries than the current administration that has been in office and in charge of economic and foreign policy for the past almost 4 years. In this edition we look at what numerous reports say will be the business policies that those of us who do business in other countries will need to factor into our plans in order to be successful going forward.

On other matters, Starbucks® is putting into place an innovate supply chain strategy. McKinsey looks at how countries compare in productivity. Consumer anger over high prices piles pressure on politicians. The top 10 countries by value of all their natural resources. The global economy is returning to normalcy (??). Wynn is bulding a casino in the United Arab Emirates!! And the surprise rich country with the worst mobile-phone service!

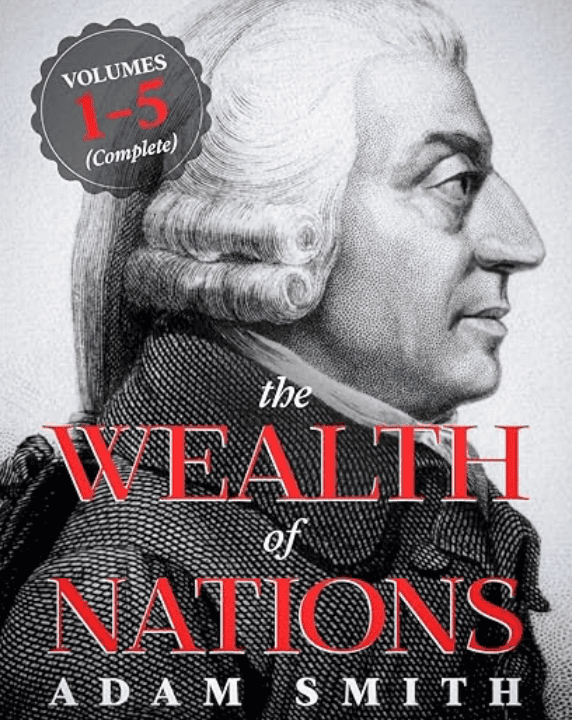

This Edition’s Book Review: Adam Smith’s “The Wealth of Nations”, written 250 years ago, is still hugely relevant in global business today. Smith’s concept of the “invisible hand” explains how, when people act in their self-interest, markets naturally move toward efficiency, creating a win-win for society. It’s the foundation of how free-market economies work – basically, capitalism as we know it today.

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Edited and curated by: William (Bill) Edwards, CEO & Global Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA. Contact Bill with any questions, comments and we welcome contributions.

The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business. Some of the information sources that we provide links to require a paid subscription for our readers to access.

Editor’s Note: You will see small ads in each edition for carefully vetted companies that serve international businesses. These small, focused, vetted ads are in place of charging subscriptions to our readers. Please click on the ads or use the QR code to see what each of our carefully chosen advertisers can do to make doing global business easier.

Bedwards@edwardsglobal.com https://www.linkedin.com/in/williamedwards/ +1 949 375 1896

==============================================================================================

First, A Few Words of Wisdom From Others For These Times

“I’ve learned that people will forget what you said, people will forget what you did, but people will never forget how you made them feel.” – Maya Angelou

“Everything is going to be fine in the end. If it’s not fine, it’s not the end.”, Attributed to Oscar Wilde

“When you have eliminated the impossible, whatever remains, however improbable, must be the truth”, Sherlock Holmes+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Highlights in issue #121:

- Brand Global News Section: Jolibee®, Starbucks®, Wendys® and Wingstop®

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

B2B Payments Platform For Global Businesses

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Special Section: Elections Have Consequences

As my readers here in the USA and in other countries are aware, there was an election here in the USA last week. The surprise result will significantly impact the way we do business going forward not just in the USA but around the world. I have spoken to the Global Chamber and will give a webinar on the impact of the USA election on global business. What follows is a projection based on numerous articles and reports. This is NOT a political summary.

What happens in the USA has an impact in Asia, Latin America, Europe and the Middle East. The change in government direction here at home will make it easier to do business in some countries and more difficult in others. It is expected that the new USA administration will impose tariffs on products and services coming into the USA as soon as January. Other countries can be expected to add tariffs to what they export to the USA. This will hurt USA exports as it will cost more to buy them in other countries.

Overall, there have been major national elections in 71 countries in 2024 covering 50% of the world’s population and over 50% of the world’s Gross Domestic Product. Businesses across the world are now trying to figure out what the new political and economic environment will be in 2025 as a result of all these elections. Political stability may change substantially in countries the new USA administration target for tariffs and sanctions. Other examples of business changes that can and will come from national elections are taxes going up or down, more or less regulations, changes in currency export policy, tariffs in both directions and labor costs to name but a few. The ‘Financial Times’ reports that most ruling parties in countries around the world lost a share of control as a result of votes in their countries this year.

Donald Trump’s return to the U.S. presidency is set to disrupt trans-Atlantic relations, likely escalating trade tensions, weakening already limited cooperation on climate and tech policy, and straining EU unity on defense and support for Ukraine. The key is to figure out what impact on doing business in European Union countries if the Ukraine war is solved or of it expands due to the new USA President’s foreign policy after January 20thwhen he takes over.

For example, it is expected on January 20th when the new USA administration takes over among the first executive orders will be the reimposition of oil sanctions on Iran that could result in their daily production dropping from 4 million barrels a day to 2 million barrels or less a day. This will have an impact on the worldwide price of oil and will cost China about 40% more to pay for their oil imports as they have been getting very cheap oil from Iran the past two years.

With the U.S. increasing tariffs on imports, particularly from countries like China, businesses may face rising costs on goods and raw materials. This could prompt companies to rethink their supply chains and even relocate production closer to their primary markets to avoid steep tariffs and trade barriers.

As the U.S. enacts new tech, data privacy, and energy policies, other nations are likely to follow suit with similar but distinct regulations. This means foreign companies will need to navigate a patchwork of rules, especially in industries like telecommunications, software, and cloud services, where data privacy and localization are crucial. Managing compliance across different countries may become more challenging and costly as each region enforces its own version of these standards.

The U.S. trade policies could also encourage allies to strengthen or create new regional trade agreements, such as within the EU or ASEAN. For foreign companies, this will mean continuing to shift their supply chains toward countries with more stable trade relationships, gradually moving operations away from traditional manufacturing hubs (China). The added uncertainty from tariffs, regulatory shifts, and currency fluctuations may further disrupt financial stability for businesses, potentially requiring them to hedge their bets by diversifying investments and managing risk more proactively.

Furthermore, as immigration restrictions tighten, global talent mobility may become limited. Foreign companies that depend on specialized talent across borders might turn to remote work or emphasize developing local talent pools, impacting operational efficiency.

We believe that the global business landscape will likely experience increased volatility and complexity in the coming years. Companies that can adapt by revising strategies, maintaining flexible supply chains, and keeping compliance agile will be best positioned to navigate the challenges and opportunities ahead. Time to update that Going Global’ strategic business plan!

Here are a number of articles from information sources both here in the USA and in other countries.

The Impact of the U.S. Elections on Trade and International Supply Chains

The likely winners and losers in Trump presidency

Trump re-election entrenches global instability

Wall Street girds for Trump 2.0: Tariffs, tax cuts and volatility

So, what does a Trump presidency mean for markets?

China Nears Record $1 Trillion Trade Surplus as Trump Returns

Here’s what’s at stake in the Middle East under Trump’s second term

Trump’s Return Looks to Upend US Foreign Policy Once Again

Welcome to Trump’s world – His sweeping victory will shake up everything

What Trump’s Win Means for the Economy

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

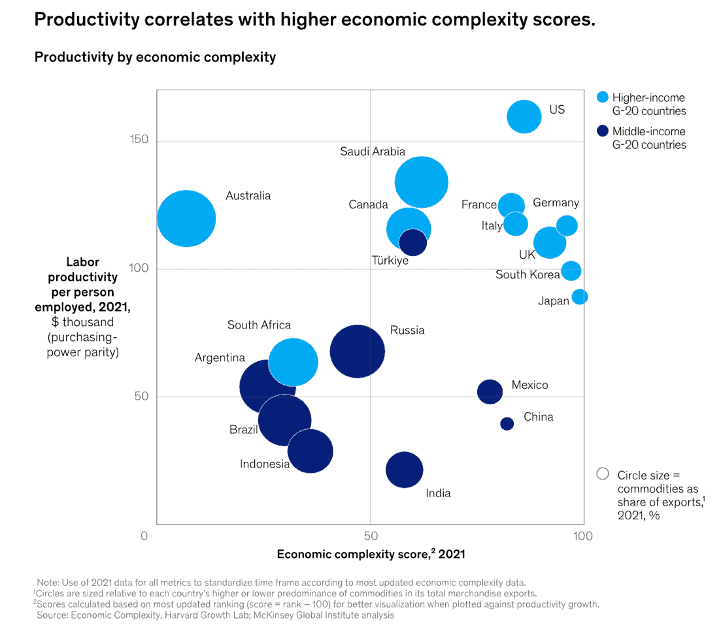

“Economically complex, highly productive – Countries with higher economic complexity scores—a calculation based on the diversity and complexity of a country’s exports—tend to have greater labor productivity. This may suggest a potential link between a nation’s economic structure and its overall productivity levels, McKinsey global managing partner Bob Sternfels and senior partner Tracy Francis and coauthors explain. Higher-income G-20 countries shifted from agrarian to industrial and service-based economies, resulting in higher economic complexity scores. Conversely, many middle-income economies tend to have relatively low economic complexity due to their reliance on commodities.”, McKinsey & Co., November 7, 2024

============================================================================================

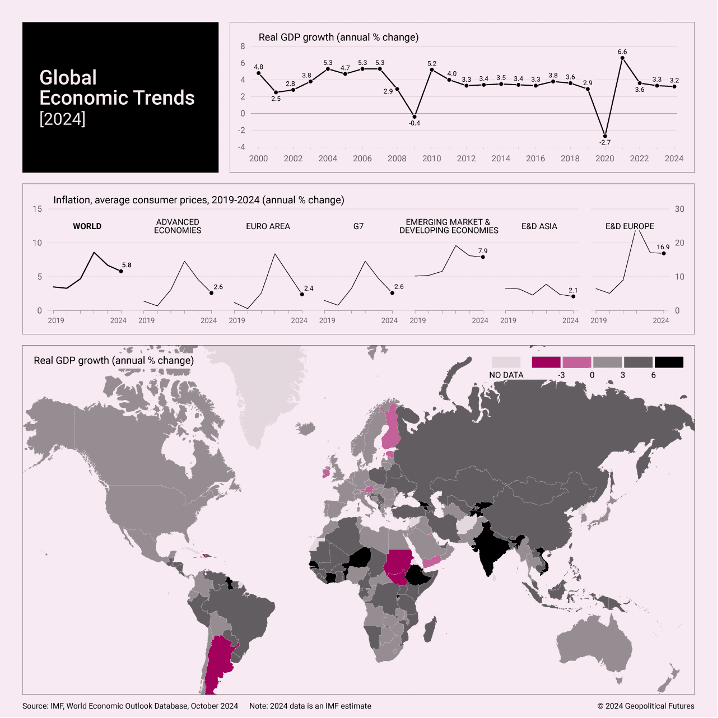

“The Global Economy’s Return to Normalcy – Economists are now focused on implementing the next phase of recovery. International Monetary Fund data shows the global economy has stabilized since the pandemic shock four and a half years ago. Inflation has largely eased, though rates remain higher in developing and emerging markets than in advanced economies. Global gross domestic product held steady, bolstered by economic growth in the U.S. and Asia, while projections for commodity-dependent economies in the Middle East, Central Asia and sub-Saharan Africa have been revised downward. Economists are now focused on implementing the next phase of recovery, which demands tighter fiscal policies and structural reforms to boost productivity and sustain growth. They also urged governments to address demographic challenges affecting labor forces. Each of these steps risks fueling renewed political and social pressures.”, Geopolitical Futures, November 8, 2024

Editor’s Note: This analysis is dated three days after the USA election but does not mention the election impact.

===========================================================================================

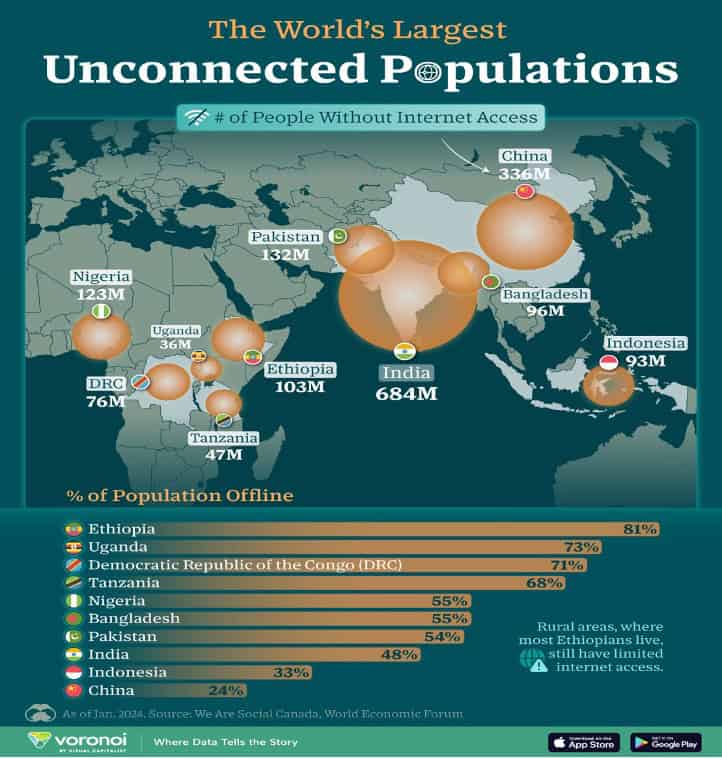

“The World’s Largest Unconnected Populations – The internet has become essential for humanity, with most of the population spending hours online each day. Yet, over 2.5 billion people worldwide still lack internet access. This graphic illustrates the countries with the largest unconnected populations in absolute terms, according to We Are Social as of January 2024. Asia and Africa Have the Largest Unconnected Populations. All 10 countries on the list are located in Africa or Asia. India has the largest unconnected population, with over 684 million individuals offline, representing 47.6% of its population. China has the second-largest unconnected population, at 336 million, though its percentage of offline individuals is relatively lower, at 23.6%.”, Visual Capitalist, Social Canada and World Economic Forum, November 8, 2024

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Simple, secure currency transfers

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

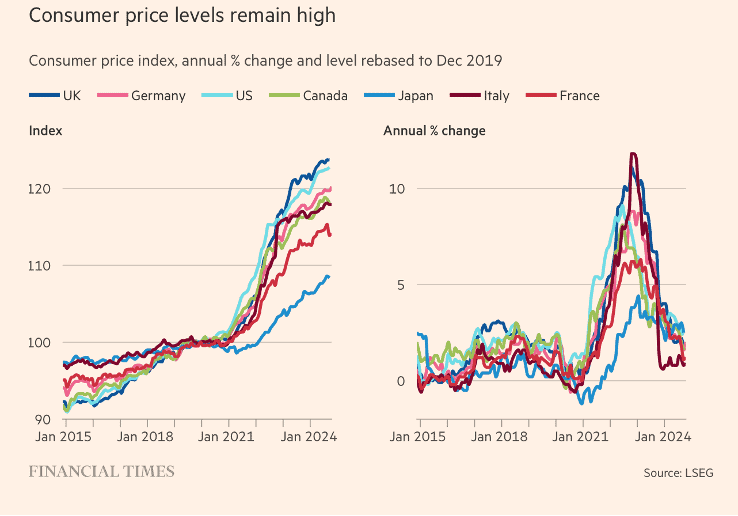

“Consumer anger over high prices piles pressure on politicians – Post-Covid inflation rise leaves toxic legacy for governments across rich economies. Discontent over the economy was a key motivator for Republican voters in last week’s US election, exit polling suggested — contributing to vice-president Kamala Harris’s defeat at the hands of Donald Trump. Incumbents in countries including the UK and Japan have also suffered in elections this year, partly because of anger at high living costs. Polling suggests the legacy of inflation will also play a role in national elections next year, including in Germany and Canada.”, The Financial Times, November 10, 2024

=============================================================================================

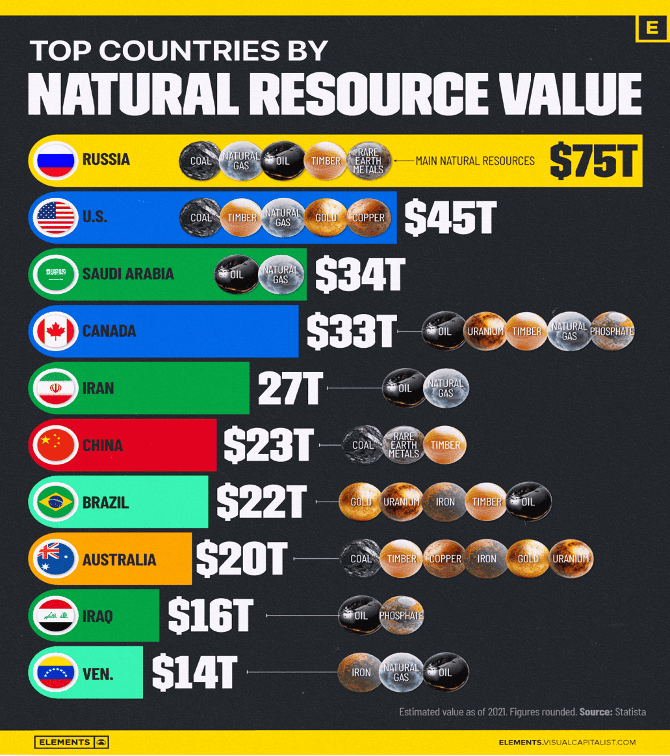

“Top 10 Countries by Value of All Their Natural Resources – Natural resources are the backbone of modern manufacturing, necessary to produce everything around us. According to 2021 data from Statista, 10 countries dominate the global natural resource landscape, each holding vast reserves critical for various industries. Russia leads the pack with natural resources valued at $75 trillion, largely consisting of coal, natural gas, oil, and rare earth metals. At the end of 2018, Russia’s Ministry of Natural Resources and the Environment valued the country’s mineral reserves at approximately $1.44 trillion. In terms of global share, Russia is unmatched in natural gas, holding the world’s largest proven reserves at 1.32 quadrillion cubic feet as of 2020—nearly 20% of the global total. Russia also ranks as a gold powerhouse.”, Visual Capitalist and Statista, November 7, 2024

=================================================================================================

“Forecast of the global middle class population from 2015 to 2030, by region – By 2030, the middle-class population in Asia-Pacific is expected to increase from 1.38 billion people in 2015 to 3.49 billion people. In comparison, the middle-class population of sub-Saharan Africa is expected to increase from 114 million in 2015 to 212 million in 2030. China accounted for over half of the global population for middle-class wealth in 2017. The United States had the highest number of individuals belonging to the top one percent of wealth holders.”, Statista and the Brookings Institute, November 2024

Editor’s Note: This confirms what we have seen in the literature over the past few years for the Asia Pacific region. For example. as of 2024, Indonesia’s middle class comprises approximately 47.85 million individuals, accounting for about 17.1% of the population. (Channel News Asia) The Indonesian government has set an ambitious target to elevate the middle-class population to 80% by 2045, coinciding with the nation’s centennial. (Jakarta Globe).

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Book Review

Adam Smith’s “The Wealth of Nations”, written 250 years ago, is still hugely relevant in global business today. Smith’s concept of the “invisible hand” explains how, when people act in their self-interest, markets naturally move toward efficiency, creating a win-win for society. It’s the foundation of how free-market economies work – basically, capitalism as we know it today.

Smith’s emphasis on the division of labor, where everyone does what they’re best at, set the stage for modern business structure and supply chains. Think about how today’s companies operate: specialized tasks lead to more productivity and competitive edge, just as Smith predicted.

Smith also argued against the old idea that nations get rich by hoarding gold and controlling colonies. Instead, he said wealth comes from productivity, not stockpiling resources. This thinking led to today’s liberal trade policies, encouraging open markets and fewer barriers. So, when companies source globally and countries trade based on their unique strengths, they’re following Smith’s playbook.

While he was all about free markets, he knew that governments need to provide public goods, enforce laws, and keep things fair. Today’s mixed economies still use that balance, allowing free markets to grow while governments step in when needed for the public good.

Overall, The Wealth of Nations is still the backbone of modern economic thought, guiding how businesses and nations operate in a connected world.introduced principles that continue to influence economics and public policy today.

This book is a unique way to understand globalization’s impact on everyday goods, showing how something as simple as a T-shirt reflects the vast, interconnected web of today’s economy.

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Keith Gerson and Bill Edwards Join Forces To Offer Trusted Suppliers To The Franchise Community

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Canada

“Port of Montreal Employers Move to Lock Out Dockworkers After Final Offer Rejected – The dispute exacerbates the disruption to trade in Canada as a lockout at ports along the West Coast continues. The movement of cargo through Canada’s second-largest seaport halted late Sunday after dockworkers at the Port of Montreal rejected a revised pay offer from employers, heightening stresses on trade as talks aimed at reopening ports on the country’s West Coast faltered.”, The Wall Street Journal, November 10, 2024

=============================================================================================

China

“Din Tai Fung, a Taiwan-based restaurant chain, will close several of its mainland China stores as customers lose appetite for pricier meals – The chain’s announcement it would close all its shops in northern China – no alternate Beijing locations for the Yin family – marks the end of a 20-year engagement between the wildly popular restaurant and a consumer base once flush with discretionary income and hungry for new places to spend it. Data from Chinese food and beverage platform Hongcan 18 showed 1.36 million restaurants severed their licences in 2023, more than double the 519,000 closures reported in 2022.”, South China Morning Post, September 4, 2024

==============================================================================================

“China sharpens edge in global trade with zero-tariff deal for developing world – China will eliminate tariffs for goods from countries classified as the world’s least developed starting in December, a move expected to lower shipping costs from parts of Africa and Asia and give Beijing more sway in global trade. The zero-tariff treatment for the group of mostly small, non-industrialised countries poses little threat to China’s manufacturing-intensive economy, analysts said, and gives Beijing an edge in emerging markets as the US and Europe attempt to stem the flow of Chinese goods into their own backyards. The scheme will cover all countries the United Nations considers “least developed” that have diplomatic ties to China….”, South China Morning Post, October 30, 2024

==============================================================================================

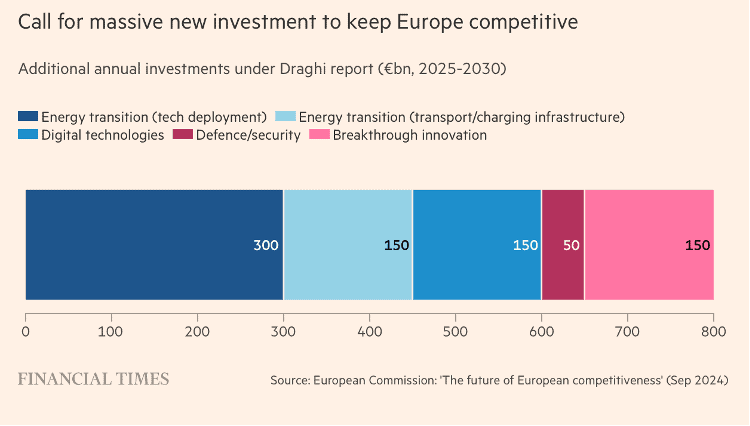

Europe & European Union Countries

“Can Europe’s unity survive as its sense of crisis grows? – The EU needs investment to boost growth and competitiveness, but the debate over who pays has echoes of the financial crisis. The sense of crisis grew on Wednesday after Trump was re-elected US president. Analysts at Goldman Sachs believe his pledges to impose tariffs on US imports from Europe and demand that the continent spend more on its own defence will further curtail economic growth in the EU. Trump has also pledged to roll back swaths of environmental legislation, which EU officials fear will leave European businesses at a further competitive disadvantage. ‘You cannot pay for competitiveness. You have to create the conditions for it,’ says a senior EU diplomat present in Budapest. ‘[And] where is this new money supposed to come from? Borrow against future generations? Or expect other member states to pay for you?’”, The Financial Times, November 7, 2024

==========================================================================================

United Arab Emirates

“Inside Wynn Resorts’ $3.9 Billion Gamble On The UAE – With its first casino resort set to open in 2027, a little-known emirate is suddenly an unlikely hot gaming market. Here’s how the U.S. casino giant made a high-stakes bet on its future—and left Abu Dhabi, Dubai and other casino operators in the dust. Wynn Resorts CEOCraig Billings raised eyebrows a year ago when he told investors that the United Arab Emirates was the “the most exciting new market opening in decades.” Outside of Egypt and Lebanon, casinos are practically nonexistent in the Middle East, since majority Muslim countries typically ban gambling. Even more intriguing: At the time Billings was enthusing about the UAE’s gaming future, the kingdom had exactly zero casinos.”, Forbes, November 10, 2024

===============================================================================================

United Kingdom

“The rich country with the worst mobile-phone service – 5G networks are fast. Their roll-out is not. Britian has long been a pioneer in telecoms. In 1837 it built the world’s first commercial telegraph; the first transatlantic call was placed from London in 1927; in 1992 a British programmer sent the world’s first text message to a mobile phone. Today it lags rather than leads. A new “core network” using stand-alone technology will need to be installed to get the full benefits of 5G. Last year just 2,000 of the country’s 81,000 mobile base stations were broadcasting stand-alone 5G. In laboratory environments the next generation of mobile networks has reportedly notched up speeds 100 times faster than 5G. Britain is anything but that.”, The Economist, November 11, 2024

============================================================================================

United States

“2024 Election Analysis – After an unprecedented campaign cycle that cost nearly $16 billion, 158 million Americans went to the polls to elect our next set of leaders up and down the ballot. While it may take time to sort out the remaining House and Senate races that will determine the full balance of power in Congress, one thing is certain, President-elect Donald Trump and the new 119th Congress will be met in January with an enormous inbox of global threats and challenges, with escalating threats from foreign rivals, wars raging in Ukraine and the Middle East, and cascading humanitarian crises.

USGLC organized over 1,000 local leaders across the nation – business leaders, veterans, mayors, farmers, community and faith-based leaders to engage hundreds of candidates running for the House and Senate. Some candidates were already well-versed on foreign policy – from their own military service, missionary work, or international business experience – but for many, this was one of their few, if not their only, in-depth discussion about foreign policy and how global diplomacy and development impacts our communities here at home.”, U.S. Global Leadership Coalition (USGLC), November 9, 2024Editor’s Note: This is a very detailed analysis of the USA election with several key ‘election takeaways’.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Taking Brands Global Successfully For 5 Decades

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“Starbucks ramps up supply chain investments for climate resilience – Starbucks, which sources 3% of the world’s coffee, is ramping up investments in its supply chain as experts expect hotter temperatures and changing climates to dramatically transform production and shrink the amount of land suitable for growing in half by 2050. The company is buying two innovation farms in Central America to advance research to protect its coffee supply. The coffee giant said it plans additional farm investments in Africa and Asia as it looks to build an innovation network across the world’s largest growing regions. New innovation farms in Asia and other areas of the world will enable new research tailored to specific geographies and allow Starbucks to scale solutions across the “Coffee Belt” growing regions.”, Supply Chain Dive, October 31, 2024

================================================================================================

“Wingstop unit growth spikes with strong performance – With same-store sales at the chicken-wing chain up nearly 21% in third quarter, almost all from traffic, it’s no surprise franchisees want to open more restaurants. Wingstop on Wednesday reported yet another outstanding performance in the third quarter with domestic same-store sales up nearly 21%. The 20.9% increase, which was almost entirely driven by transactions yet again, wasn’t quite the comparable sales of 28.7% in the second quarter this year, which disappointed Wall Street watchers who were expecting even better sales, sending the stock price tumbling immediately after the report. Still, the chain’s two-year comparable sales topped 36%, and the company still expects to reach 20% same-store sales growth for the year, which far surpasses most public restaurant companies. The shops in the United Kingdom are averaging annual per shop sales of US$3,000,000.”, Restaurant Business Online, October 30, 2024

===========================================================================================

“Wendy’s Bets on Palantir AI to Keep Up With $1 Frosty Demand – Program could eventually place orders without human help. Supply chain executive: This will ‘change the way we work’. AI is making inroads in a restaurant industry grappling with increased costs for labor and ingredients after years of high inflation. That’s pushed a sector already operating on tight margins to look even closer at managing expenses. Wendy’s supply chain co-op, an independent group that purchases on behalf of the chain’s restaurants, is betting Palantir’s system will do just that for the burger brand’s 6,000 US locations. Normally, stores keep extra inventory just in case, and that’s become more expensive thanks to inflation.”, Bloomberg, November 7, 2024

=============================================================================================

“Jollibee parent fully acquires Hong Kong’s Michelin-rated Tim Ho Wan dim sum chain – Jollibee Food Corporation buys remaining 8 per cent stake in company for S$20.2 million. Jollibee Food Corporation, which runs fast-food chains across Asia, owned 92 per cent of the dim sum company in January, and the latest deal gives it full ownership. Tim Ho Wan runs about 80 stores in 11 markets including Singapore, Shanghai, Beijing, Melbourne, Tokyo, Macau, South Korea and Manila. The deal comes at a time when Hong Kong’s food and beverage industry faces an uphill battle to retain customers, with many residents crossing the border to mainland China for leisure. Consumption has also slowed on the mainland, with Beijing rolling out a raft of stimulus measures in a bid to electrify the economy.”, South China Morning Post, November 6, 2024

==============================================================================================

To receive this biweekly newsletter in your email every other Tuesday, click here https://insider.edwardsglobal.com

===========================================================================================

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing business environment. And our GlobalTeam™ on the ground covering 25+ countries provide us with updates about what is actually happening in their specific countries. We do not get involved in or report on politics!

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe, and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant since 2001 taking 40+ franchisors global.

| To receive this biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com +++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++ |

Our latest GlobalVue™ 40 country ranking

For a complimentary 30-minute consultation on how to take your business into new countries and make money doing it. For a complimentary call with Bill Edwards click on the QR code or contact Bill at bedwards@edwardsglobal.com and +1 949 375 1896