Biweekly Global Business Newsletter Issue 131, Tuesday, April 1, 2025

Happiest Countries, Global Uncertainty and TGI Friday’s Is Back!

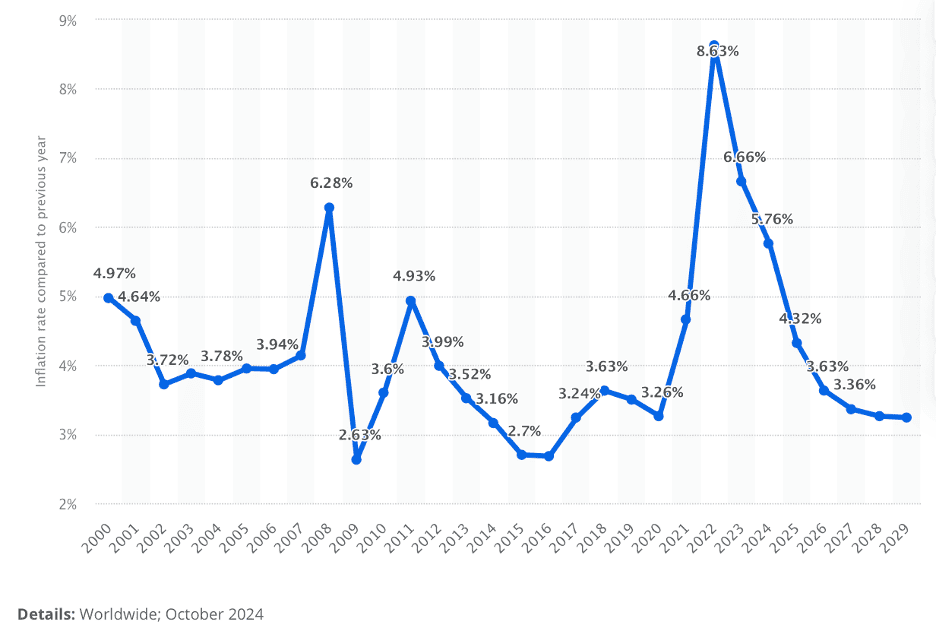

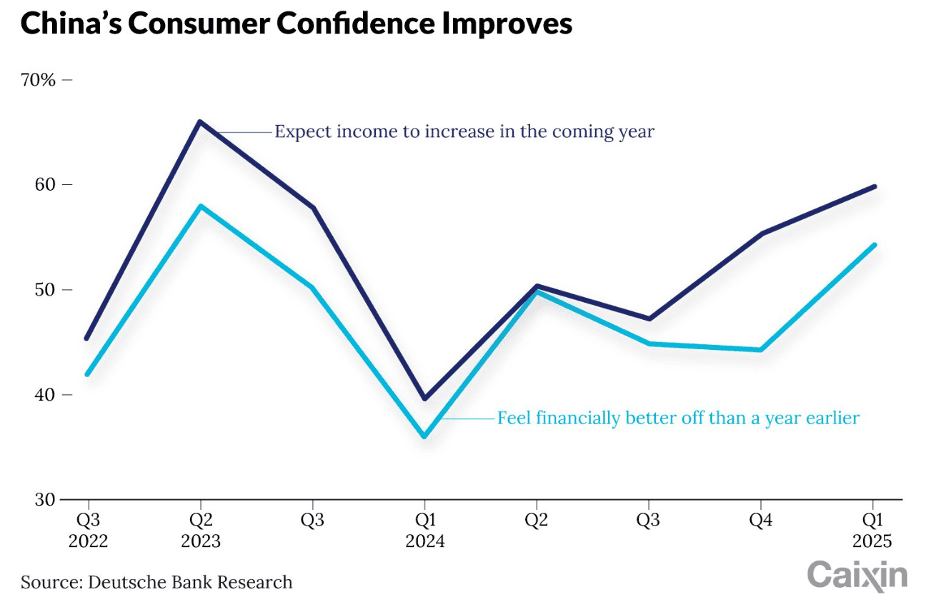

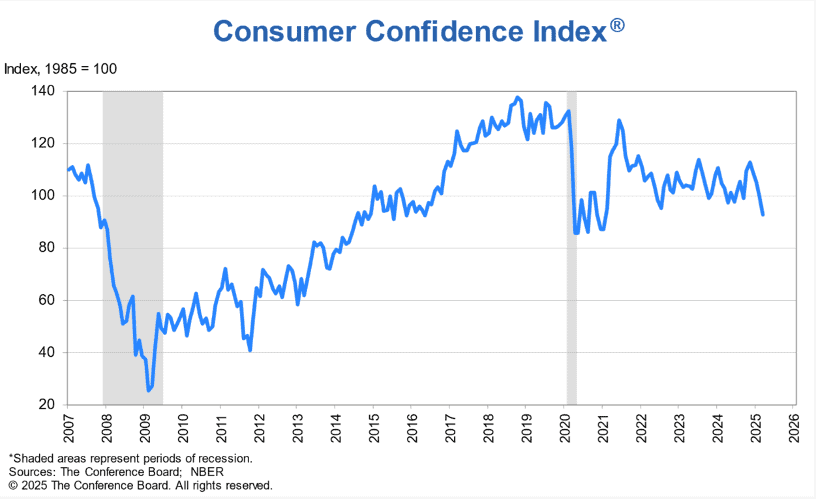

Commentary about the 131th Issue: This is one of our biggest newsletters to date as there is lots of ‘stuff’ going on around the world today! As we approach ‘T-Day” on April 2nd (maybe) in the USA, other countries are pushing back against doing business with US companies and brands. America accounts for just 13 percent of global goods imports — down from close to 20 percent two decades ago. Global inflation is projected to drop from over 5% in 2024 to just over 3% by 2029. Walmart, the US’s 10th most valuable company is a full $300 billion more valuable than Tencent, China’s most valuable company. Chinese consumer confidence is up while consumer confidence tumbled this month partially due to concern about the impact tariffs will have on prices at stores. Going forward, it is predicted that economic growth will depend on electricity, not oil as the supply and price of electricity become as politically potent as that of gasoline. And several high tourist countries are putting ‘overtourism’ policies in place. Oh, and you can see the predictions for all 12 zodiac signs in the Year of the Snake!!!!!!

One More Thing: The “Opportunities don’t happen. You create them” quote in this issue by Chris Grosser is especially relevant for entrepreneurs and franchise leaders expanding into new international markets like the companies Edwards Global Services, Inc. helps Go Global successfully with their brands.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

But First……The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business.

PLEASE NOTE: Some of the information sources that we provide links to in our newsletter require a paid subscription to directly access them. Clicking on a link may not give the reader access to the content.

Edited and curated by: William (Bill) Edwards, CEO & Global Business Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA. Contact Bill with questions, comments and contributions. Bedwards@edwardsglobal.com, +1 949 375 1896

Link to our current and past newsletters: https://edwardsglobal.com/geowizard/

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

First, A Few Words of Wisdom From Others For These Times

“Tough times never last, but tough people do.”, Robert H. Schuller

“Believe you can and you’re halfway there.”, Theodore Roosevelt

“Opportunities don’t happen. You create them.”, Chris Grosser.

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Highlights in issue #131:

McDonald’s passes Starbucks as the world’s most valuable restaurant brand

The World’s Happiest Countries Over Time (2019–2024)

Is Year of the Snake’s month 3 lucky for you?

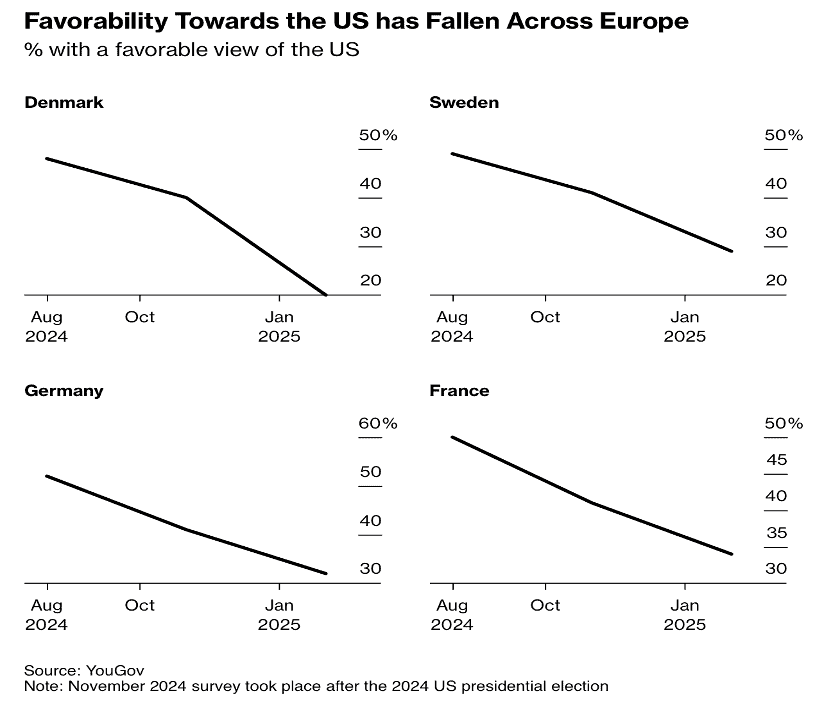

Anti-American Sentiment Rises in Europe as Trump Fuels Anger

US Consumer Confidence tumbled again in March

Destinations Making Changes to Combat Overtourism

Brand Global News Section: Chagee®, Dave’s Hot Chicken®, Haidilao®, Off Burger®, McDonalds® and TGI Fridays®

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

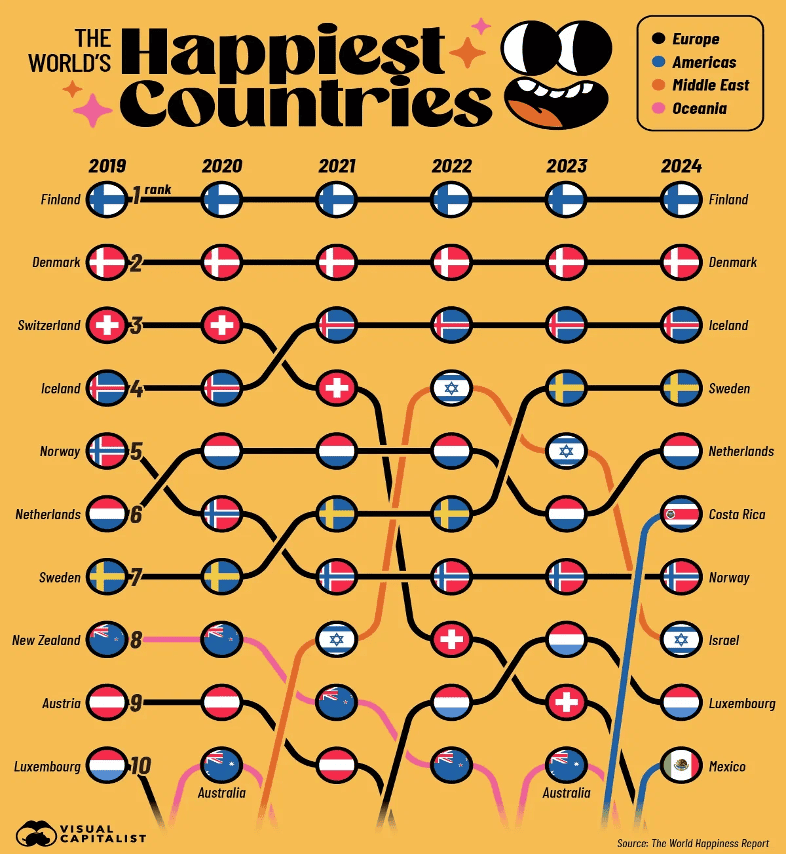

“The World’s Happiest Countries Over Time (2019–2024) – The World Happiness Report is an annual publication that ranks global happiness based on life evaluations, social support, freedom, GDP per capita, and other well-being indicators, using data from the Gallup World Poll and additional sources. Finland and Denmark have been the world’s two happiest countries for six years in a row, respectively. Overall, Nordic countries have consistently been among the top 10, with Iceland and Sweden climbing up the rankings. Costa Rica has seen a steady climb from the 15th spot in 2019 to 6th in 2024. Meanwhile, Switzerland dropped from 3rd to 13th over the same period. Among the top 10, Mexico has seen the biggest jump from 25th in 2023 to number 10 in 2024. Israel has seen a turbulent shift in happiness rankings, rising from 14th in 2019 to 4th in 2022, before dropping to 8th in 2024. However, it remains among the happiest countries in the world.”, Visual Capitalist & World Happiness Report, March 28, 2025

Editor’s Note: Canada ranks 18th, The United Kingdom 23rd and the United States 24th.

============================================================================================

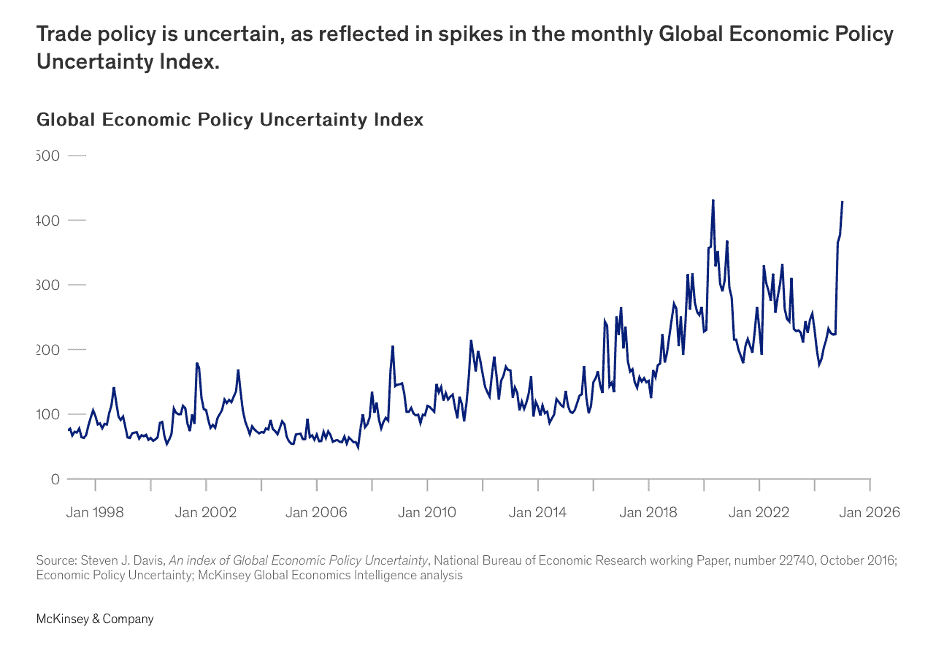

“Global Economics Intelligence executive summary – Geopolitical and trade uncertainty stayed elevated in February, with inflation back in focus as consumers and producers expect higher prices; industry sentiment is still positive despite slow growth. Trade policy is notably uncertain, with both the monthly Global Economic Policy Uncertainty Index and the Trade Policy Uncertainty Index spiking. Across economies, consumer confidence has dipped as inflation expectations have risen. The US consumer confidence index (Conference Board) declined in January to 104.1, from a revised 109.5 in December. In Brazil, consumer confidence has been lingering below the neutral 100 mark and fell to 86.2 in January (91.3 in December) to reach its lowest level since February 2023, with elevated borrowing costs a likely factor in denting confidence.”, McKinsey & Co., March 21, 2025

=============================================================================================

“10 Largest Companies in the U.S., Europe, and China – This chart ranks the 10 largest companies in the U.S., EU (including the UK), and China by their market capitalizations. Data is……current up to February 10th, 2025. The top nine American companies by market cap are all worth more than a trillion dollars. And the 10th largest—Walmart—is a full $300 billion more valuable than Tencent, China’s most valuable company.”, Visual Capitalist & Companiesmarketcap.com & Yahoo Finance, February 24, 2025

=============================================================================================

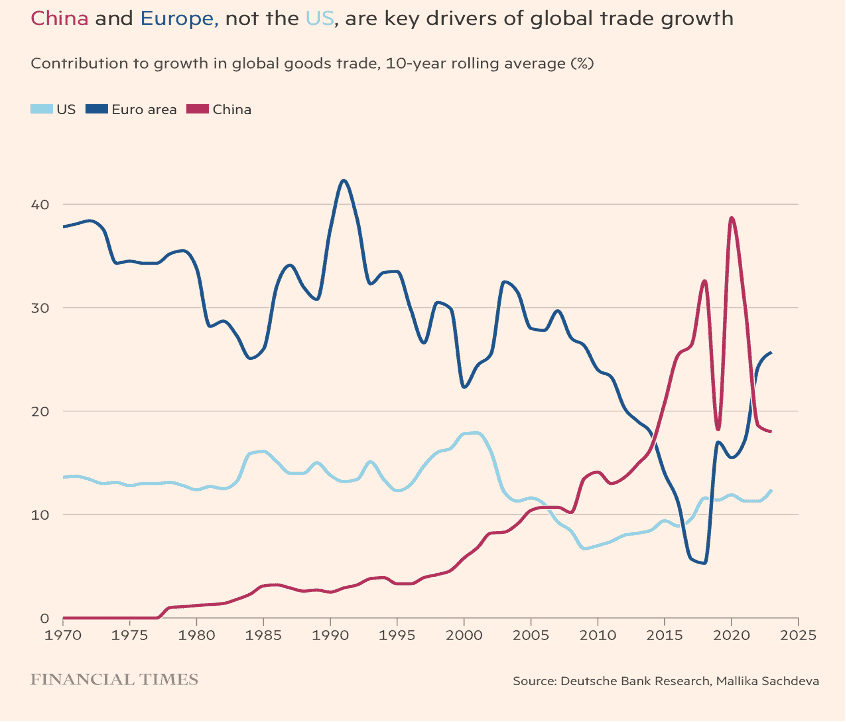

“Globalisation will triumph over Donald Trump – Economic incentives outweigh politics in the long run. Fear of a deglobalising world is high. With the global goods trade slowing and national security doctrine in vogue, many worry that Trump’s tariffs could be the straw that breaks globalisation’s back……….the importance of the US to global trade can be overstated, since it is the world’s largest economy. America accounts for just 13 per cent of global goods imports — down from close to one-fifth two decades ago. That makes it the largest importer and a notable influence on trade patterns, but not sufficient to reverse globalisation on its own. The US isn’t the main driver of global trade growth. Europe — and more recently China — are bigger contributors. ‘As the US retreats from the global stage, other governments will want to lean in to offset potential sales and import losses with new deals,’ said Scott Lincicome, a vice-president at the Cato Institute.”, The Financial Times, March 29, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation, Taxes & Trade Issues

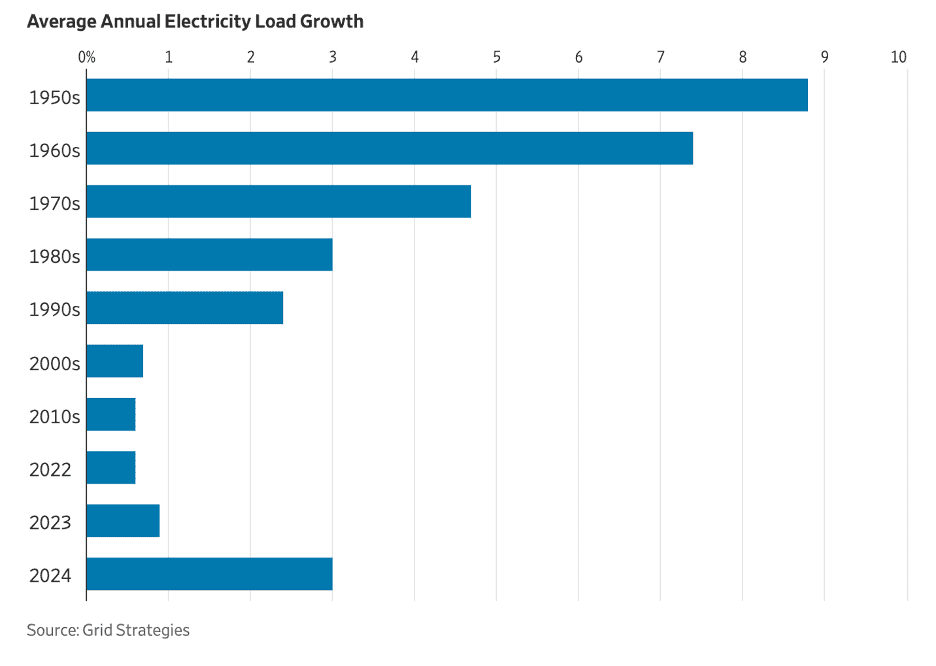

“Economic Growth Now Depends on Electricity, Not Oil – Americans have long equated energy security with oil. The country wanted as much as possible because of the havoc an interruption to supply—from wars, disasters and political convulsions—can cause. In coming years, though, energy security will mean electricity. Power demand, stagnant for decades, is now growing rapidly, for data centers to run artificial intelligence and other digital services and, in time, transportation and buildings. An economy dependent on electricity will be different from one dependent on oil. It will require mammoth investment in generation, distribution and transmission. It will challenge regulators and political leaders, as the supply and price of electricity become as politically potent as that of gasoline.”, The Wall Street Journal, March 29, 2025

=============================================================================================

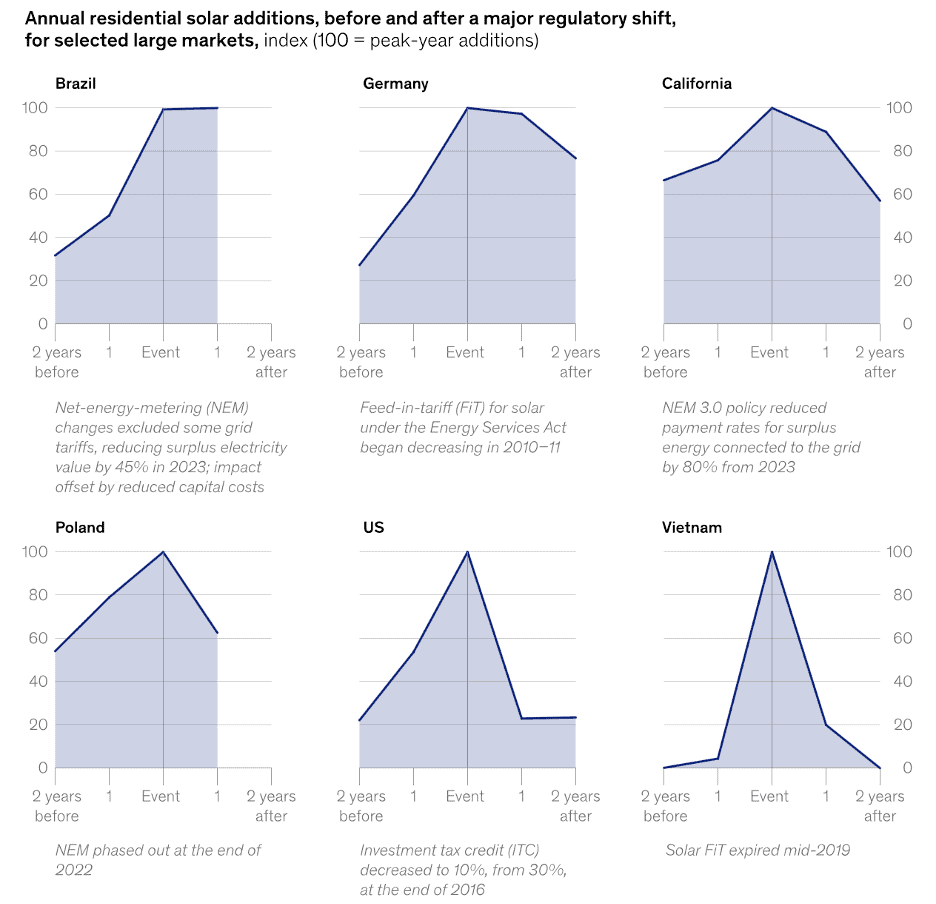

“Solar installation swings with policy shifts – Regulatory changes significantly affect residential solar projects. Policy shifts, such as the addition or removal of compensation mechanisms like net-energy metering or feed-in tariffs, can cause dramatic year-over-year increases or decreases in the installation of residential solar projects in markets worldwide…..Significant policy changes can bring dramatic swings in year over year solar installation.”, McKinsey & Co., March 11, 2025

============================================================================================

“Global inflation rate from 2000 to 2022, with forecasts until 2029 – Inflation is generally defined as the continued increase in the average prices of goods and services in a given region. Following the extremely high global inflation experienced in the 1980s and 1990s, global inflation has been relatively stable since the turn of the millennium, usually hovering between three and five percent per year. There was a sharp increase in 2008 due to the global financial crisis now known as the Great Recession, but inflation was fairly stable throughout the 2010s, before the current inflation crisis began in 2021.”, Adapted from Statista, published by Aaron O’Neill, January 10, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel News

“Destinations Making Changes to Combat Overtourism – Overtourism is a big theme in the travel world, and it has been growing since the pandemic. Destinations that received large numbers of tourists enjoyed a well-deserved break from the congestion during lockdowns and travel bans. Then, they suddenly experienced large waves of tourists returning once the world reopened. Amsterdam is one of the significant destinations creating the most laws restricting or curbing overtourism in recent years. Barcelona hopes to ban short-term rentals by 2028. Alicante is banning new short-term rentals for the next two years. The Czech Republic cracked down on unregistered short-term vacation rentals in major cities like Prague in September 2024. Venice implemented a day trip tax for travelers who don’t stay the night during high-tourist days and later added a size limit for tour groups, so groups can only be 25 people maximum. Rome is also considering restricting access to the Trevi Fountain due to large crowds.”, Travel Pulse, March 21, 2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Book Review

“The Measure of Progress: Counting What Really Matters” by Diane Coyle, critically examines the adequacy of traditional economic metrics in capturing the complexities of today’s digital and global economy. Coyle argues that economic indicators developed in the mid-20th century, such as Gross Domestic Product (GDP), are outdated and insufficient for assessing contemporary economic realities. She contends that these metrics fail to account for factors like environmental sustainability, digital innovation, and intangible assets, which are increasingly central to economic progress. The book advocates for a new statistical framework that better reflects the current economic landscape.

In regard to doing global business, Coyle’s insights underscore the necessity of adopting more comprehensive and nuanced measures of economic performance. Relying solely on traditional metrics like GDP can lead to misinformed strategies and policies that overlook critical elements such as digital transformation, environmental impact, and social well-being. Embracing a broader set of indicators can enhance decision-making processes, promote sustainable practices, and provide a more accurate assessment of market potentials and risks.

Five Key Takeaways

Limitations of Traditional Metrics: Standard economic measures like GDP are inadequate for capturing the full scope of modern economic activities and challenges.

Need for a New Framework: There is a pressing need to develop and implement statistical frameworks that incorporate contemporary factors such as digital assets, environmental costs, and intangible values.

Importance of Comprehensive Data: Accurate and inclusive data collection is essential for understanding and responding to current economic dynamics effectively.

Policy Implications: Policymakers must recognize the shortcomings of existing economic indicators and work towards integrating more holistic measures to guide economic policies.

Adaptation to Modern Challenges: The evolving nature of the global economy, marked by digitalization and environmental concerns, necessitates a reevaluation of how progress is measured to ensure sustainable and equitable growth.

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The Accredited Franchise Supplier certification

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Argentina

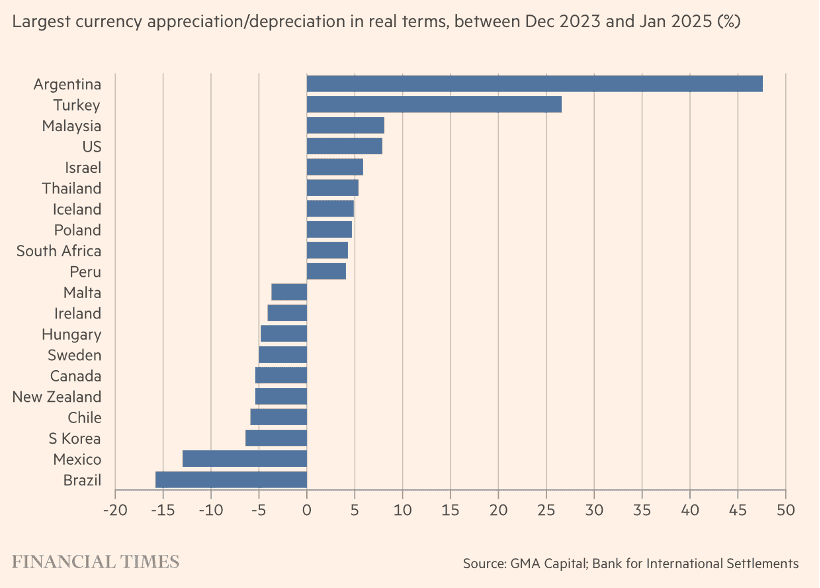

“Argentines snap up foreign goods as Javier Milei strengthens peso – Chinese solar panels and Uruguayan butter arrive as president tackles inflation by easing import restrictions. Argentina’s peso has strengthened more in real terms than any other currency since December 2023. As Argentina recovered from a recession that depressed imports and Milei began opening up the protectionist economy, the country’s inbound trade surged 30 per cent in the past six months compared with the previous period on a seasonally adjusted basis, according to the national statistics agency. Italian pasta, Brazilian bread and Uruguayan butter have become increasingly visible on supermarket shelves after retailers almost doubled food imports in the first two months of 2025 from a year earlier. Solar-cell imports grew tenfold, while farmers quadrupled overseas tractor purchases.”, The Financial Times, March 22, 2025

==============================================================================================

Australia

“Industrial Relations Reforms Causing (Australian) Small Business Headaches – Australian businesses are feeling the squeeze from ongoing industrial relations (IR) changes, with new research revealing that nearly two-thirds of business owners believe the reforms have made running their business harder. The survey by Small Business Loans Australia, found that a large number of businesses have been negatively impacted by the government’s IR reforms. Wage increases, limits on fixed-term contracts, multi-employer bargaining, and changes designed to improve worker protections are damaging small businesses. 64 per cent of businesses say IR changes have made running their business harder. Minimum wage increases have had the most negative impact on more than a quarter of businesses. Half of large businesses are struggling with multi-employer bargaining. The most common pain point was the 2022 increase to the minimum wage, which saw pay packets rise by 5.2 per cent. More than a quarter (28 per cent) of business owners identified this change as a major burden.”, Business Builders, March 20, 2025

===============================================================================================

Canada

“Canada’s corrugated industry works to untangle from U.S. as tariffs loom – It can take less than 24 hours for a shipment of 3.5 tonne paper rolls to travel from a mill in Washington State to corrugated sheet manufacturer CanCorr in Surrey, B.C. But in the past two months, Baha Naemi, co-founder and managing partner of CanCorr, has paused orders from the U.S., instead waiting at least 10 days for the same shipment to arrive from Eastern Canada. Or even longer from Europe. It’s no secret that he’s losing money over the decision, but he says it’s worth it to send a message to his U.S. counterparts and smooth out any kinks in a changing supply chain. ‘We all agree that Canada needs to become self-reliant, whether it’s in the packaging industry or any other industry,’ Mr. Naemi said.”, The Globe and Mail, March 26, 2025

===============================================================================================

China

“Chinese Consumers Are More Confident and Willing to Spend, Survey Shows – Confidence among consumers in China’s large and midsize cities is returning and willingness to spend is increasing, with more people feeling financially better off and expecting higher incomes this year, a new survey shows, suggesting government stimulus measures that started in September are having an impact. However, while attitudes on income and spending have improved, more survey respondents said prices have been rising over the past few months and sentiment toward the property market remains weak….The survey was conducted during the first quarter among individuals aged 18 to 65 in first- and second-tier cities.”, Caixin Global, March 20, 2025

==============================================================================================

“Is Year of the Snake’s month 3 lucky for you? Predictions for all 12 zodiac signs – Work pressures increase for many Chinese zodiac signs in the third lunar month of the Year of the Snake, which starts on March 29, while budgeting and windfalls are common themes as well. Health seems stable for most signs, with a couple of outliers who must watch out for accidents and take preventive measures. Read on to discover feng shui master Andrew Kwan’s predictions about what your Chinese zodiac sign brings.” South China Morning Post, March 29, 2025

===============================================================================================

Europe

“Anti-American Sentiment Rises in Europe as Trump Fuels Anger – Trump’s threats to impose punitive tariffs on Europe, seize territories and pull military support in the region — including his handling of the war in Ukraine — have irked European consumers, fueling campaigns to boycott US products. There’s currently no country in Europe where more than half of the population has a positive attitude toward the US, according to a YouGov poll published March 4. Facebook groups urging the boycott of US goods have sprung up and amassed thousands of followers.”, Bloomberg, March 30, 2025

=============================================================================================

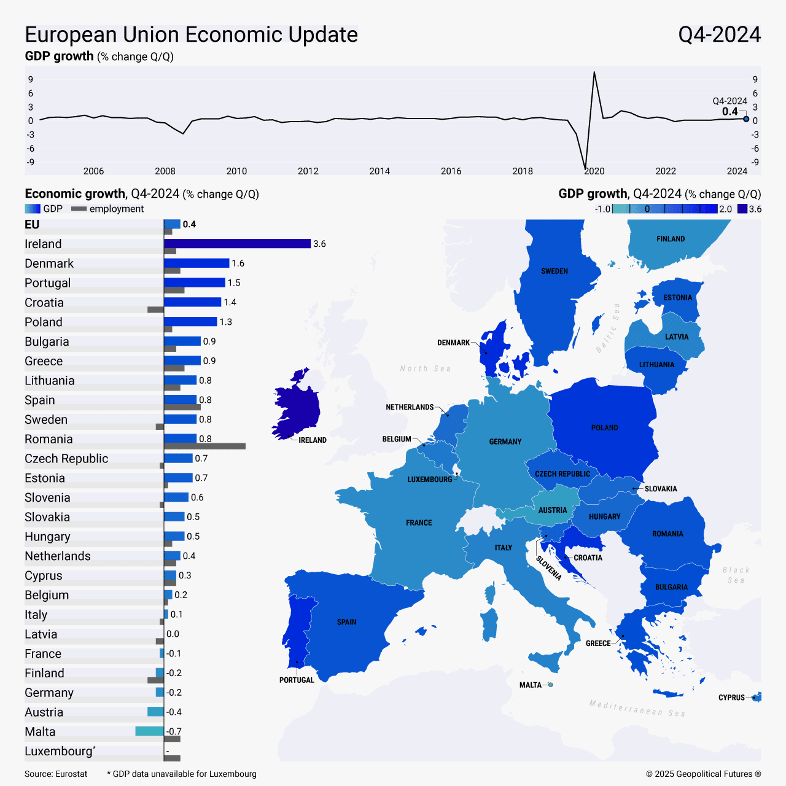

Germany

“Germany Weighs Down European Growth – Germany’s economic trajectory remains Europe’s central challenge. The euro area posted modest economic growth in the last quarter of 2024, with seasonally adjusted gross domestic product rising 0.2 percent from the previous quarter. The broader EU outpaced it slightly, growing by 0.4 percent. Employment also increased, up 0.1 percent in the euro area and 0.3 percent in the EU. Germany, however, remains a weak link. Its GDP contracted by 0.2 percent in the fourth quarter, reversing the 0.1 percent growth in the previous quarter. The primary driver was a sharp 2.2 percent drop in exports – the steepest decline since mid-2020.”, Geopolitical Futures, March 28, 2025

==============================================================================================

India

“US officials begin trade talks in Delhi as tariff deadline nears – A US delegation, led by Assistant Trade Representative for South and Central Asia Brendan Lynch, arrived in the city on Tuesday for the talks. ‘This visit reflects the United States’ continued commitment to advancing a productive and balanced trade relationship with India,’ a US Embassy statement said. The countries have been engaged in hectic negotiations since Trump came into office. Trump and Modi had set a target to more than double it to $500bn (£400bn). The two sides also committed to negotiating the first phase of a trade agreement by autumn 2025. India’s average tariffs of around 12% are also significantly higher than the US’s 2%.”, BBC News, March 25, 2025

==============================================================================================

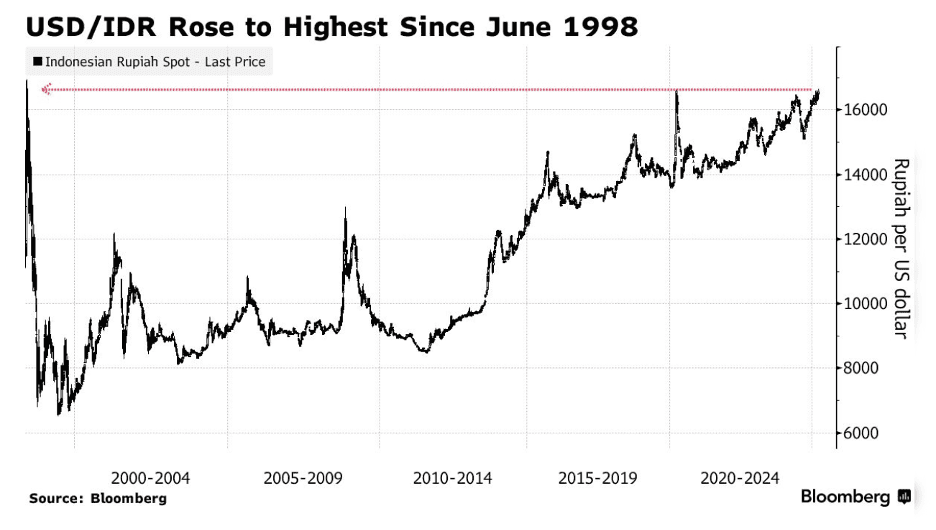

Indonesia

“Indonesian Rupiah Tumbles to Lowest Since Asian Financial Crisis – The currency has slumped more than 3% this year, making it one of the worst performers in emerging markets. The rupiah’s weakening is mainly due to global uncertainties, including Donald Trump’s tariffs and a potentially more hawkish Federal Reserve…… Indonesia, one of the region’s favorite markets just a year ago, has quickly lost its appeal with global investors as concerns grow over the sustainability of the nation’s economic policies.”, Bloomberg, March 25, 2025

==============================================================================================

The Philippines

“Philippine Finance Chief Sees 7% Growth Despite Political Noise – The Philippine economy can grow as much as 7% this year, aided by interest-rate cuts that will support investment and consumption, according to Finance Secretary Ralph Recto who also brushed aside concerns over political stability. The Philippine currency has risen 1.6% in the past month, the best performance among Asia’s most-active currencies. The Philippines, one of Asia’s growth stars, could see its economic momentum slow amid elevated borrowing costs, sluggish stock market and mounting political risks.”, Bloomberg, March 18, 2025

===============================================================================================

United States

“US Consumer Confidence tumbled again in March – Consumers’ expectations for the future at a 12-year low. The Conference Board Consumer Confidence Index® fell by 7.2 points in March to 92.9 (1985=100). The Present Situation Index—based on consumers’ assessment of current business and labor market conditions—decreased 3.6 points to 134.5. The Expectations Index—based on consumers’ short-term outlook for income, business, and labor market conditions—dropped 9.6 points to 65.2, the lowest level in 12 years and well below the threshold of 80 that usually signals a recession ahead. The cutoff date for preliminary results was March 19, 2025. ‘Consumer confidence declined for a fourth consecutive month in March, falling below the relatively narrow range that had prevailed since 2022,’ said Stephanie Guichard, Senior Economist, Global Indicators at The Conference Board.”, The Conference Board, March 25, 2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Taking Brands Global Successfully For 5 Decades

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Brand & Franchise Sector News

McDonald’s passes Starbucks as the world’s most valuable restaurant brand – Chick-fil-A has jumped into the top 10 with a 43% increase in brand value, according to valuation consultancy Brand Finance. After a challenging 2024 that included four straight quarters of same-store sales declines, Starbucks is no longer the world’s most valuable restaurant brand, according to a new “Restaurants 25 2025” report from valuation consultancy Brand Finance. The coffee giant has ceded the top spot to McDonald’s, which experienced a 7% increase in value to $40.5 billion. It’s the first time McDonald’s has held the top spot since 2016.”, Nation’s Restaurant News, March 24, 2025

Editor’s Note: Here are the top 10 most valuable food & beverage brands in 2025: McDonald’s®, Starbucks®, KFC®, Subway®, Taco Bell®, Tim Horton’s®, Dominos®, Chick fil A®, Wendy’s® and Pizza Hut®.

===============================================================================================

‘Hot Chicken’ Is On The Menu With Dave’s Billion Dollar Buyout – Dave’s Hot Chicken has signed a deal with Roark Capital to sell its trendy fried chicken franchise to the Atlanta-based private equity firm for a cool $1 billion. Dave’s is a fast-casual restaurant chain with a colorful, artsy, graffiti aesthetic that started as a pop-up in Los Angeles in 2017 and has grown like wildfire (too soon?) with nearly 300 locations around the country and annual sales reaching $1 billion. Roark Capital, a private equity fund with $37 billion in assets under management, is no stranger to food and franchises, and owns iconic brands such as Dunkin’ Donuts, Baskin Robbins, Subway, Buffalo Wild Wings, Jimmy John’s, Jamba Juice, Auntie Anne’s Pretzels, Cinnabon, Moe’s Southwest Grill and Sonic (among others).”, Forbes, March 21, 2025

============================================================================================

“Chinese tea chain Chagee reveals revenue surge in US IPO filing – Net revenue nearly tripled to US$1.71 billion in 2024, company says as it prepares for Nasdaq listing. Founded in 2017, Chagee is a premium tea brand. As of December 31, its network comprised 6,440 teahouses, including 6,284 in mainland China, the company said. Chagee’s net revenue jumped to 12.41 billion yuan (US$1.71 billion) in 2024, from 4.64 billion yuan a year ago. Net income increased 213 per cent to 2.51 billion yuan over the same period. The Chinese tea chain plans to use the offering’s proceeds to expand its network in China and abroad, along with other corporate purposes.”, South China Morning Post, March 25, 2025. Compliments of Paul Jones, Jones & Co., Toronto

===============================================================================================

“TGI Fridays CEO says the brand is ready to grow again post-bankruptcy – Ray Blanchette returned to the restaurant chain earlier this year and will help lead future growth, menu innovation and franchising. ‘Over the past decade, our business, and the category-at-large, has faced challenges,’ Blanchette said. ‘Yet, the essence of Fridays — our culture, values, and people — remains strong……With 391 locations across 41 countries, making the right strategic decisions to secure our brand’s future for me is more than a job — it’s a calling……… With TGI Fridays now operating under a debt-free structure, franchisees fully own and manage their locations, allowing them to focus on what matters most — delivering exceptional guest experiences.’”, Restaurant Dive, March 25, 2025

===============================================================================================

“Odd Burger halts US expansion plans over US Canada political tensions – The Ontario-based vegan burger restaurant said its U.S. development is being put on pause ‘given the global tariff uncertainty’. This is a swift turnaround from the burger chain’s U.S. expansion plan funded by a $2 million private placement announced two weeks ago. Instead, Odd Burger is planning to use the private investment funds to invest in its Canadian manufacturing and franchise operations. With U.S. tariffs on Canadian imports set to go into effect on April 2, Odd Burger stated that it wants to help Canadian companies transition from U.S.-based vegan products to Canadian companies selling plant-based products, like Odd Burger.”, Nation’s Restaurant News, March 24, 2025. Compliments of Paul Jones, Jones & Co., Toronto

==============================================================================================

“Haidilao’s core operating profit increased by 18 7 percent last year – It will strategically seek to acquire high-quality assets. On March 25, Haidilao released its 2024 financial report. It disclosed that the company’s revenue last year was 42.755 billion yuan, up 3.1% year-on-year; net profit was 4.700 billion yuan, up 4.6% year-on-year. The core operating profit was 6.230 billion yuan, up 18.7% year-on-year. By the end of 2024, Haidilao will operate 1,368 restaurants, including 1,332 self-operated restaurants in mainland China, 23 in Hong Kong, Macao and Taiwan, and 13 franchised restaurants. Haidilao maintains a relatively steady pace of expansion while continuing to adjust and optimize its stores. In 2024, Haidilao received a total of 415 million customers, with an average daily customer flow of over 1.1 million, an increase of 4.5% over the previous year, and an average turnover rate of 4.1 times per day.”, Caijing, March 25, 2025. Compliments of Paul Jones, Jones & Co., Toronto

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive our biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing business environment. And our GlobalTeam™ on the ground covering 25+ countries provide us with updates about what is actually happening in their specific countries. We do not get involved in or report on politics!

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe, and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant since 2001 taking 40+ companies global.

| To receive this biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com +++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++ |

Our latest GlobalVue™ 40 country ranking

For a complimentary 30-minute consultation on how to take your business into new countries and make money doing it. For a complimentary call with Bill Edwards click on the QR code or contact Bill at bedwards@edwardsglobal.com and +1 949 375 1896