Biweekly Global Business Newsletter Issue 140, Tuesday, August 5, 2025

“Resilience is the new currency of global business.”

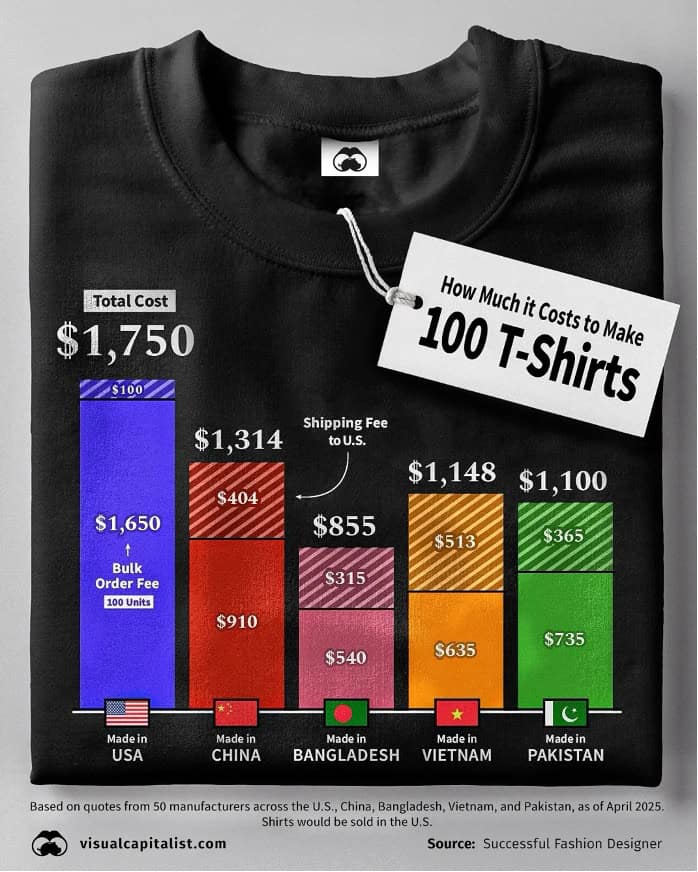

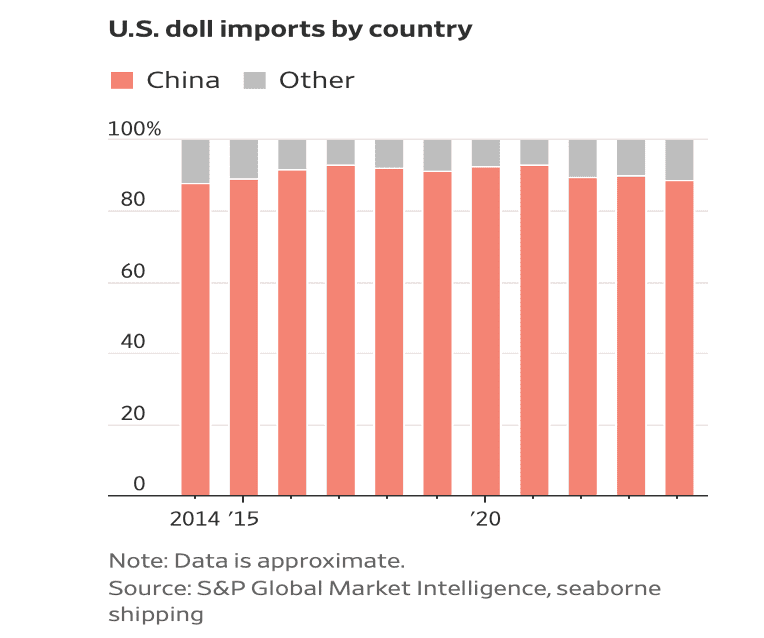

Welcome to the 140th Edition of the Global Business Update – Global volatility has eased but rising tariff tensions are reshaping the international business landscape. President Trump’s sweeping new tariff orders—targeting imports from over 70 countries—are sparking concern across industries. U.S. consumers are reacting strongly: 86% express concern about tariffs, with 77% fearing a recession and 43% anticipating higher prices or product shortages. While intended to bolster U.S. manufacturing, economists warn these actions could trigger renewed inflation and suppress demand.

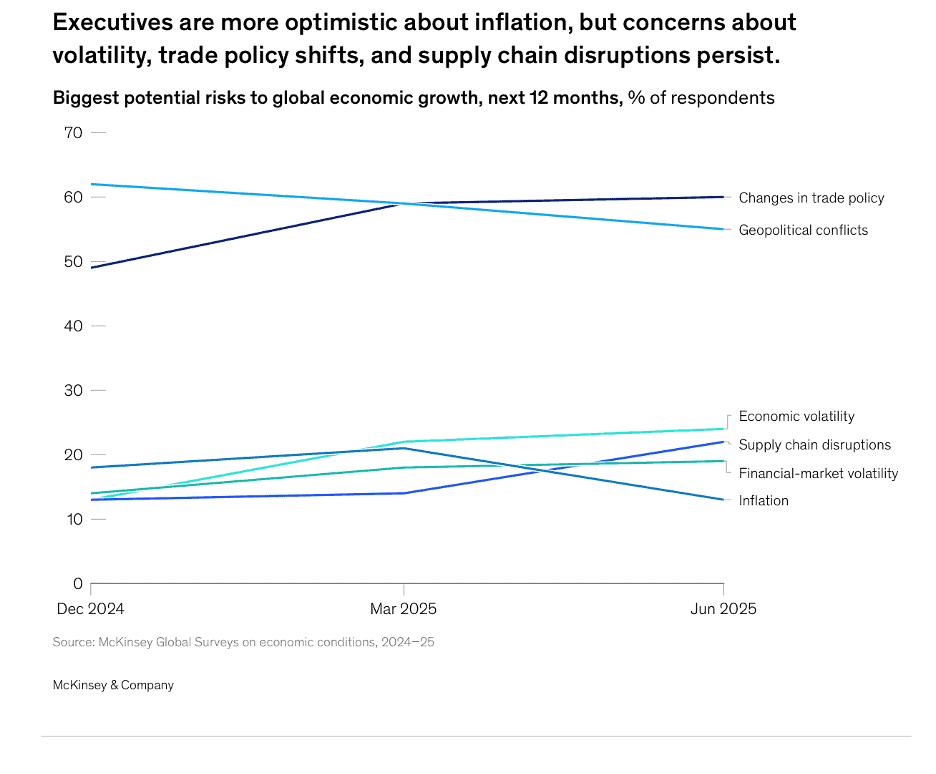

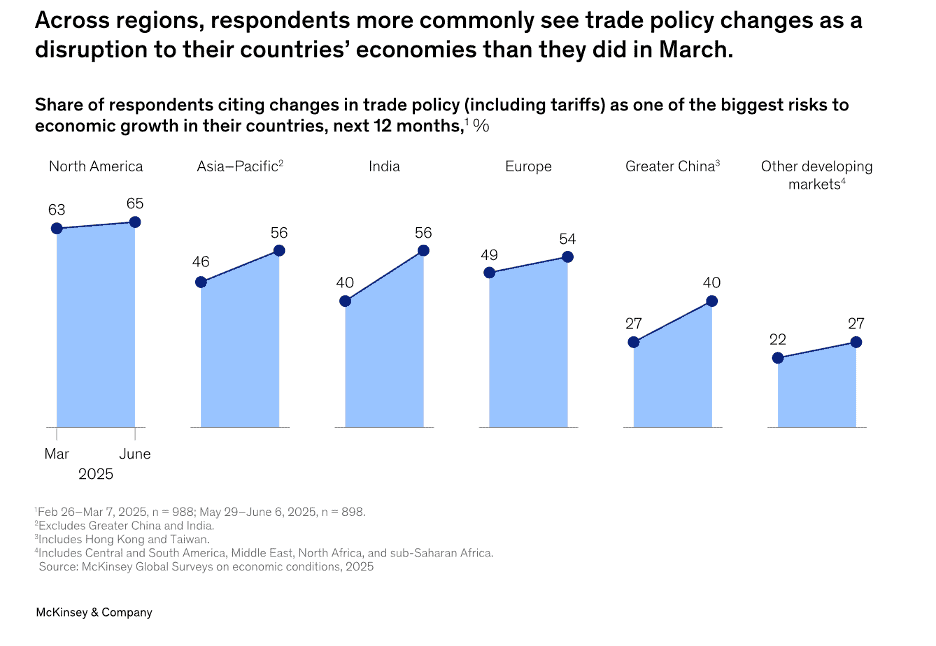

Trade policy uncertainty is now the top disruptor to global growth, according to McKinsey’s latest economic survey. Surprisingly, most executives are not prioritizing trade strategy responses; instead, AI investment remains their central focus. McDonald’s, for example, is rolling out AI-driven order systems globally after testing success in India.

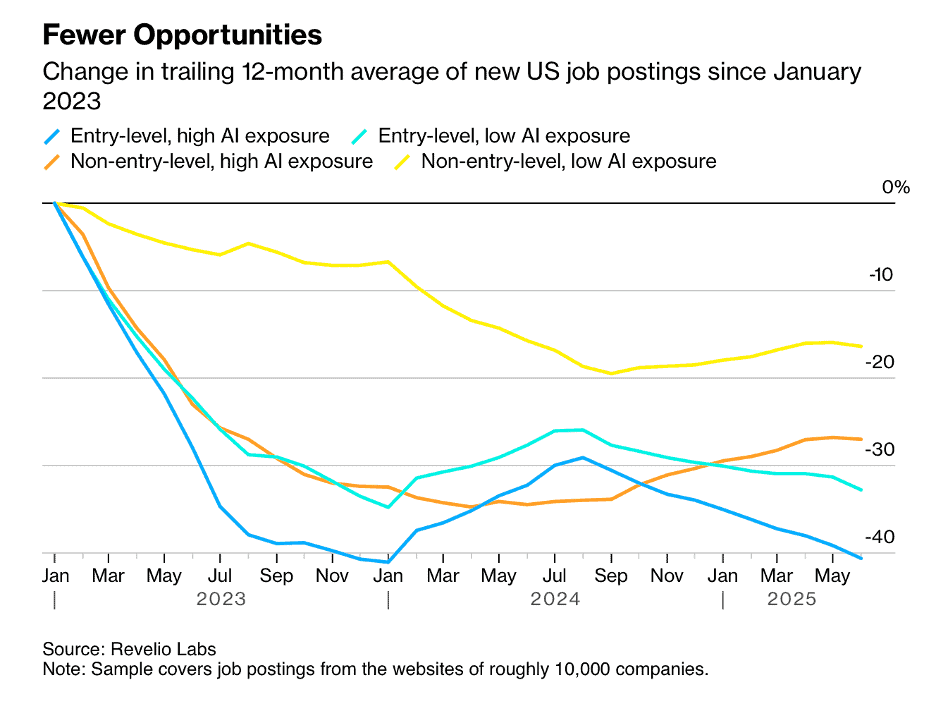

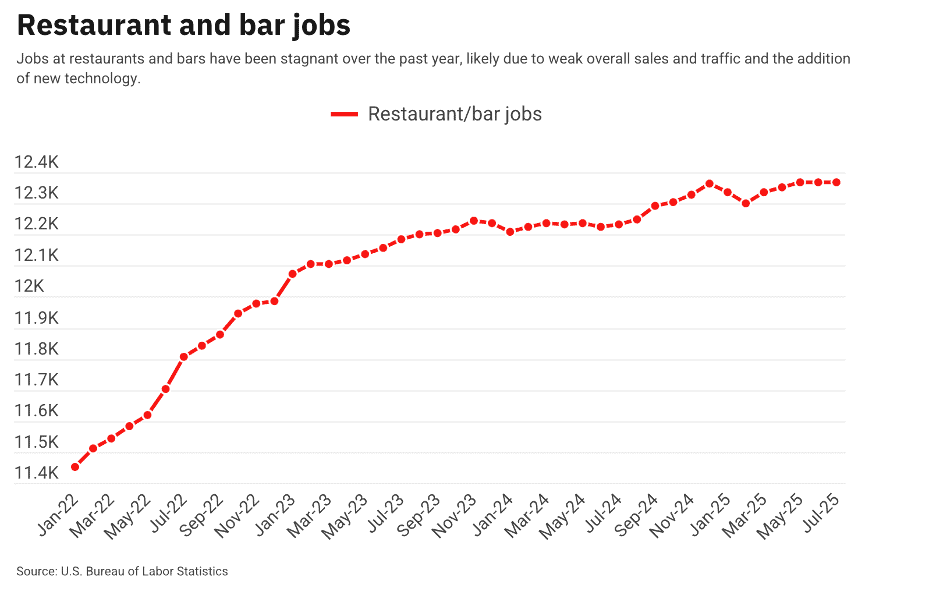

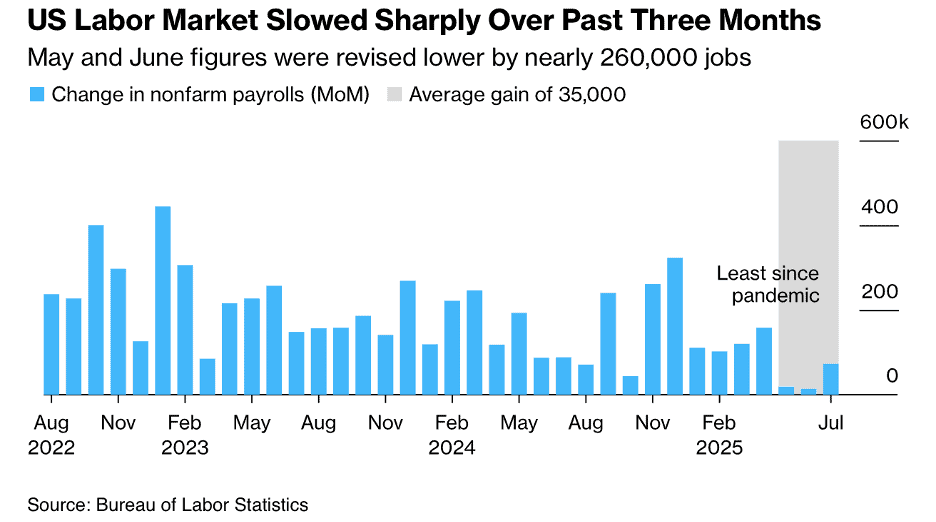

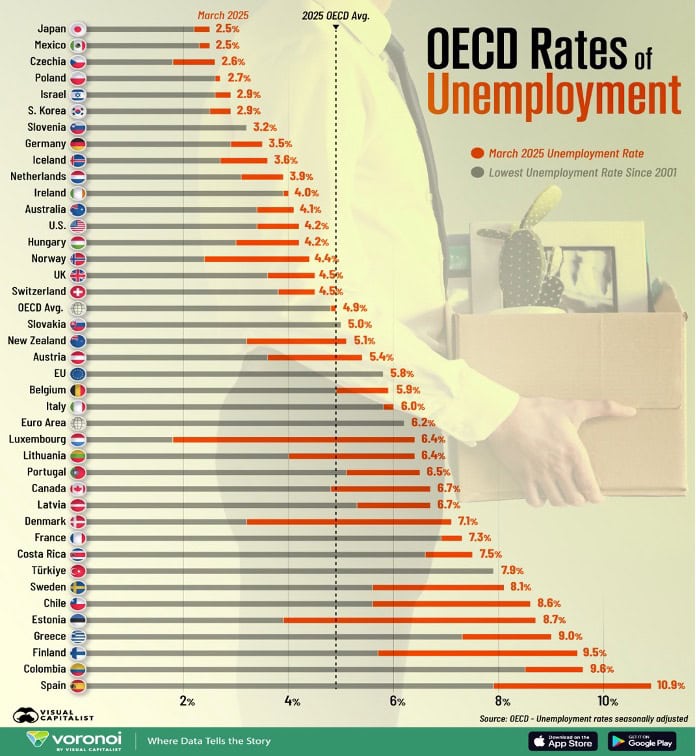

Despite modest economic stabilization, the U.S. labor market has weakened, particularly in hospitality and entry-level tech jobs—partly due to automation pressures.

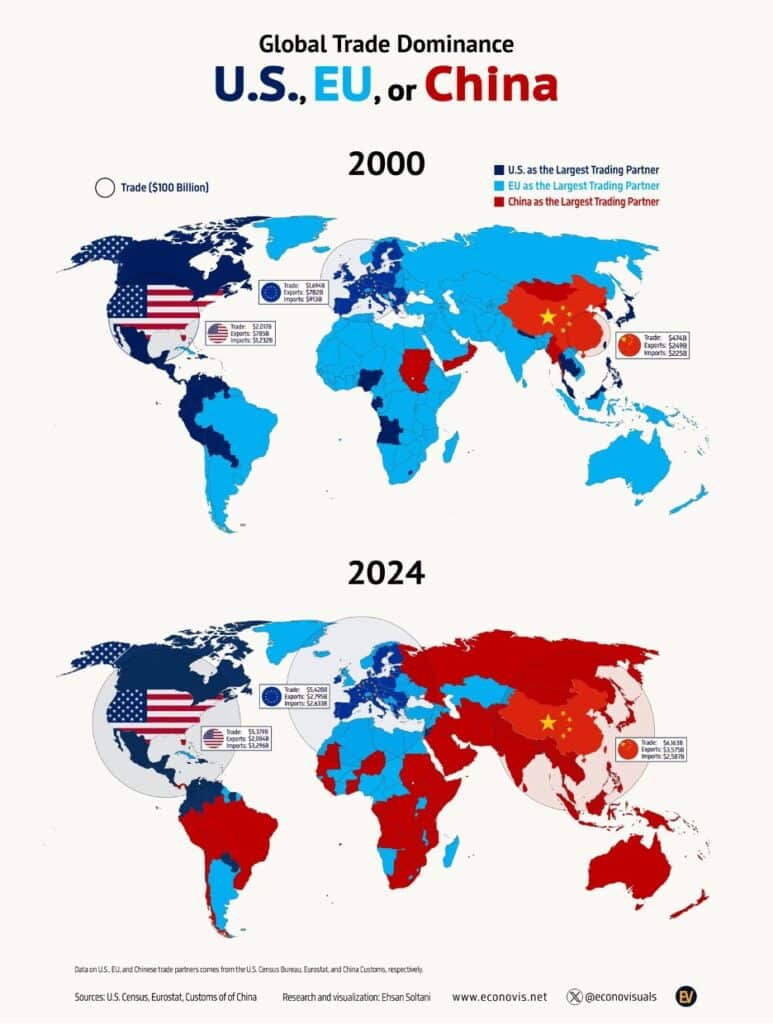

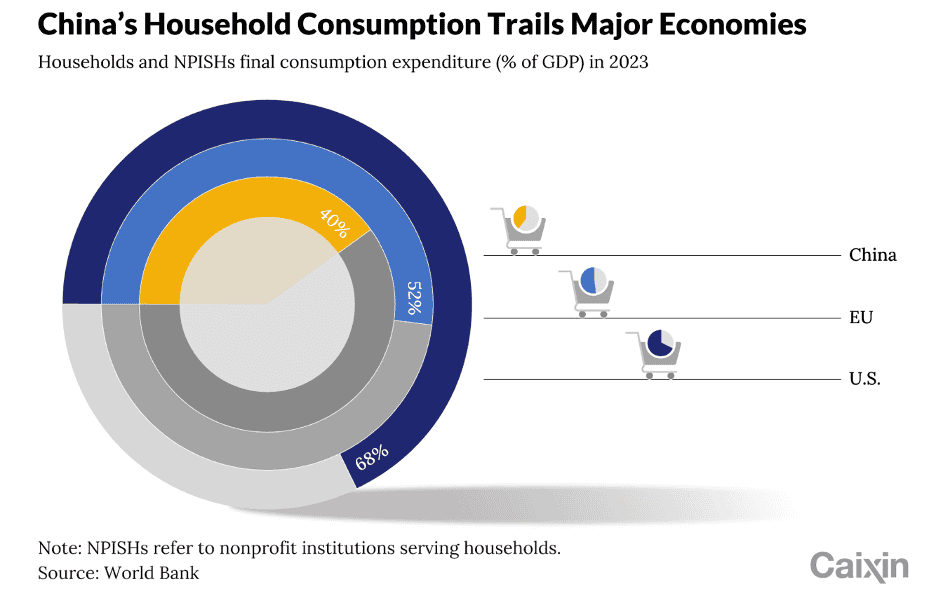

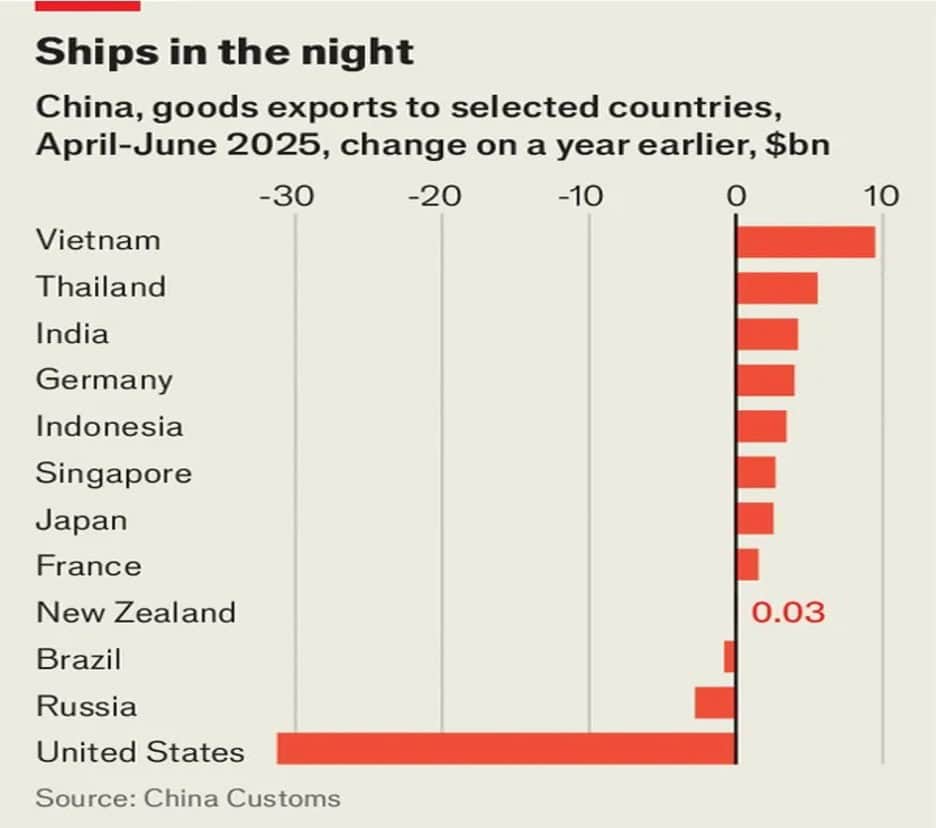

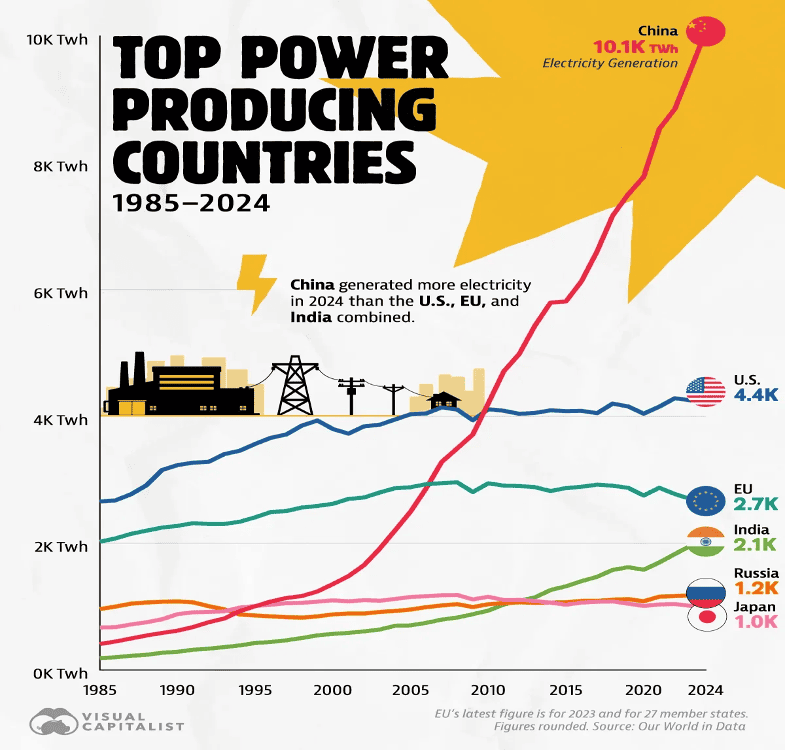

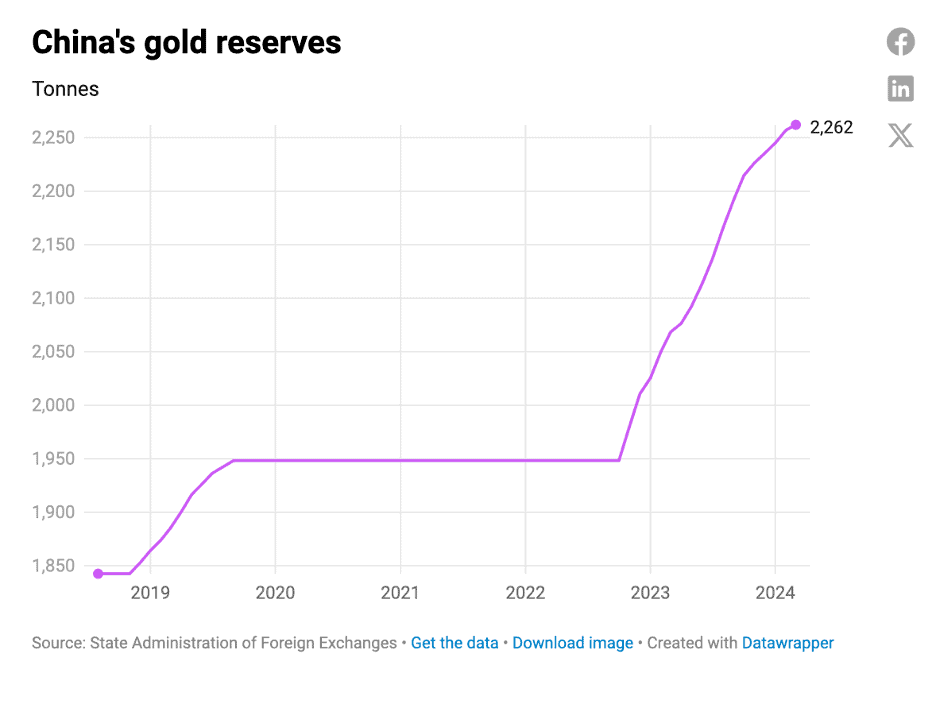

On the international stage, China’s trade dominance continues to grow, while its domestic consumption debate intensifies. The EU and U.S. remain large trading blocs but are now navigating more protectionist climates. Africa’s booming e-commerce sector shows promise, though limited credit access poses challenges.

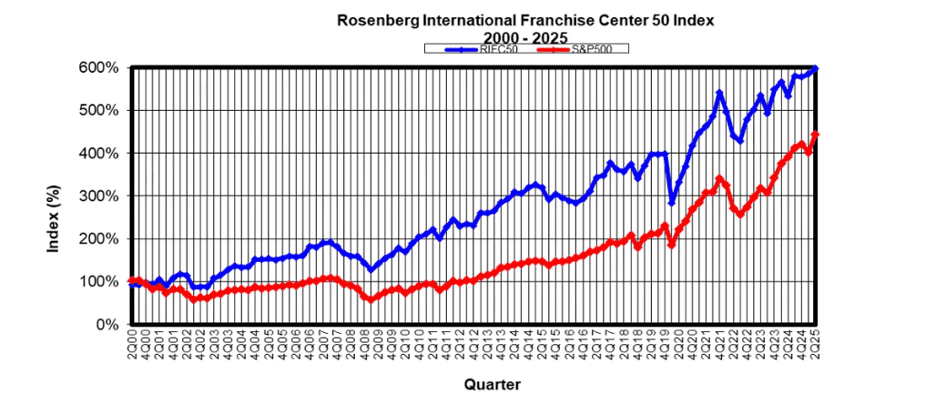

The global franchise sector continues to show resilience amid global headwinds. McDonald’s is selling off the real estate for several restaurants in Hong Kong. Wendy’s is expanding into Italy and Armenia, adding up to 190 new units. Marco’s Pizza celebrates milestones in Mexico and Puerto Rico, reinforcing its international growth. Reborn Coffee signed a master franchise deal with Dubai’s Arjomand Group, aiming to scale in Europe and the Middle East. The RIFC 50 Index rose 2.2% in Q2, led by strong gains from Avis and Hertz. Krispy Kreme, however, dropped sharply. Asia Pacific remains a franchising hotbed, with demand driven by health-conscious brands and digital convenience across F&B segments.

This issue’s book is Resurgent: How established organizations can fight back and thrive in an age of digital transformation by Julian Birkinshaw and John Fallon. In Resurgent, business strategist Julian Birkinshaw and former Pearson CEO John Fallon dismantle the myth that only startups and disruptors succeed in volatile times. Drawing from two decades of data across global corporations, they reveal how established companies not only survive—but often thrive—amid technological, economic, and geopolitical upheaval.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business. We do not get involved with or report on politics!

PLEASE NOTE: Some of the information sources that we provide links to in our newsletter require a paid subscription to directly access them. Clicking on a link may not give the reader access to the content.

Edited and curated by: William (Bill) Edwards, CEO & Global Business Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA. Contact Bill with questions, comments and contributions. Bedwards@edwardsglobal.com, +1 949 375 1896

Link to our current and past newsletters: https://edwardsglobal.com/geowizard/

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

First, A Few Words of Wisdom From Others For These Times

“Think globally, but act with surgical local precision.”, Amara Li, Asia Market Strategist

“AI is your compass, but culture is still your map.”, Ravi Menon, Global Innovation Consultant

“Resilience is the new currency of global business.”, Leila Morgan, CEO, Borderless Ventures

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Highlights in issue #140:

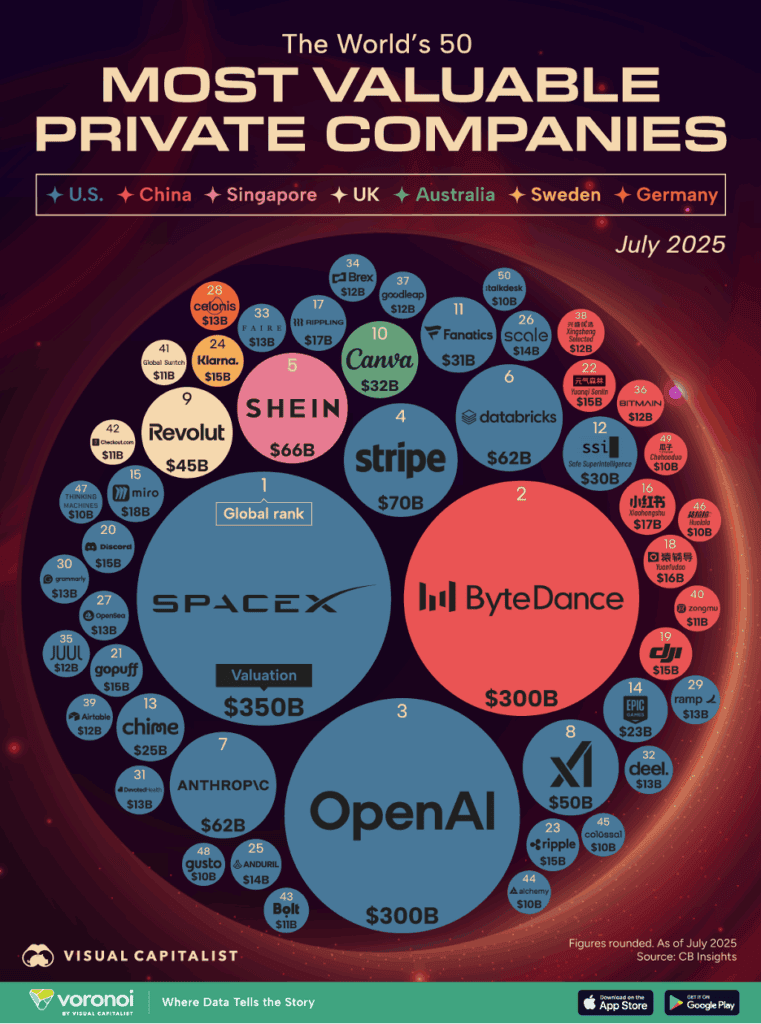

The World’s 50 Most Valuable Private Companies in 2025

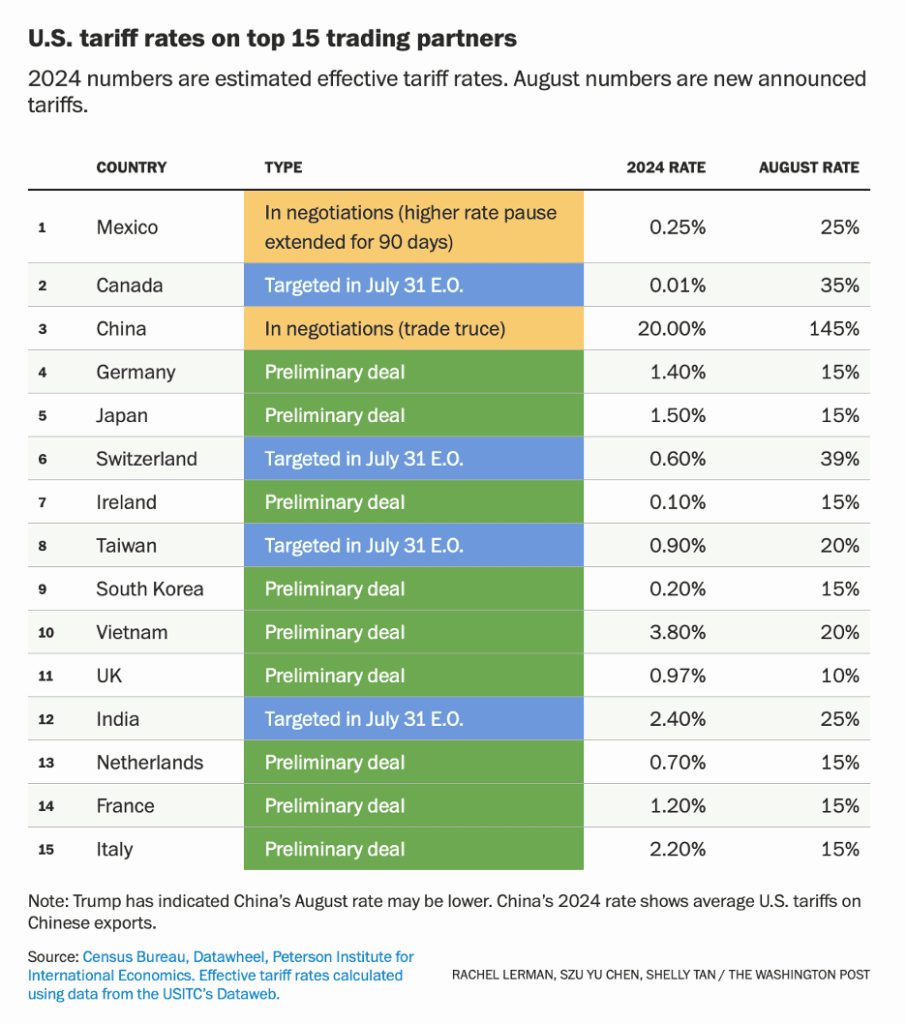

Trump’s new tariffs will hit these major trading partners

86% of (U.S.) Consumers Express Concerns About Tariffs

Global Trade Dominance: U.S., EU, or China (2000 vs. 2024)

The Consumption Conundrum Dividing China’s Economists –

Brand Global News Section: Marco’s Pizza®, McDonald’s®, Reborn Coffee®, Starbucks® and Wendy’s®

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

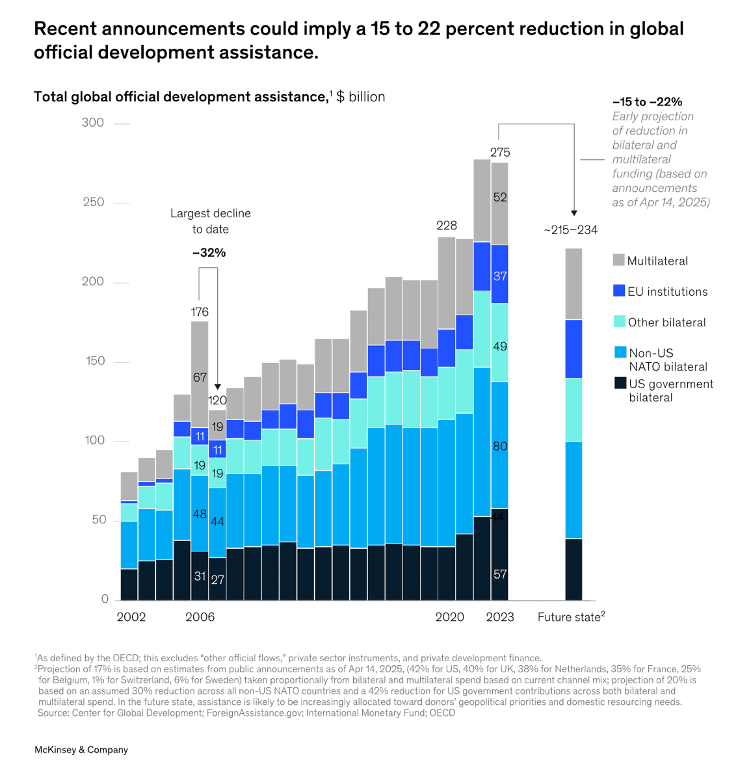

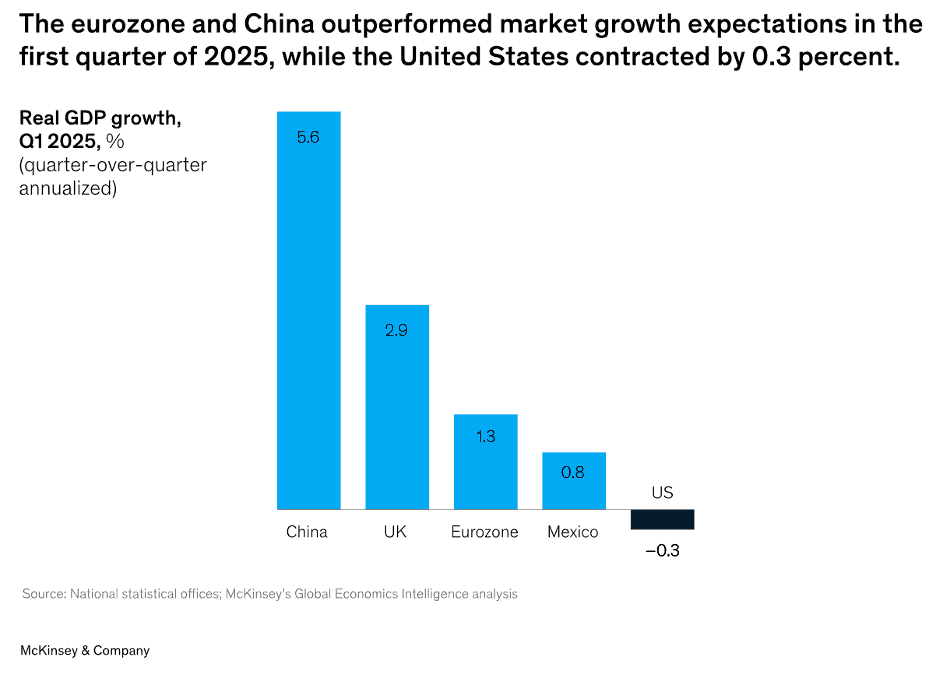

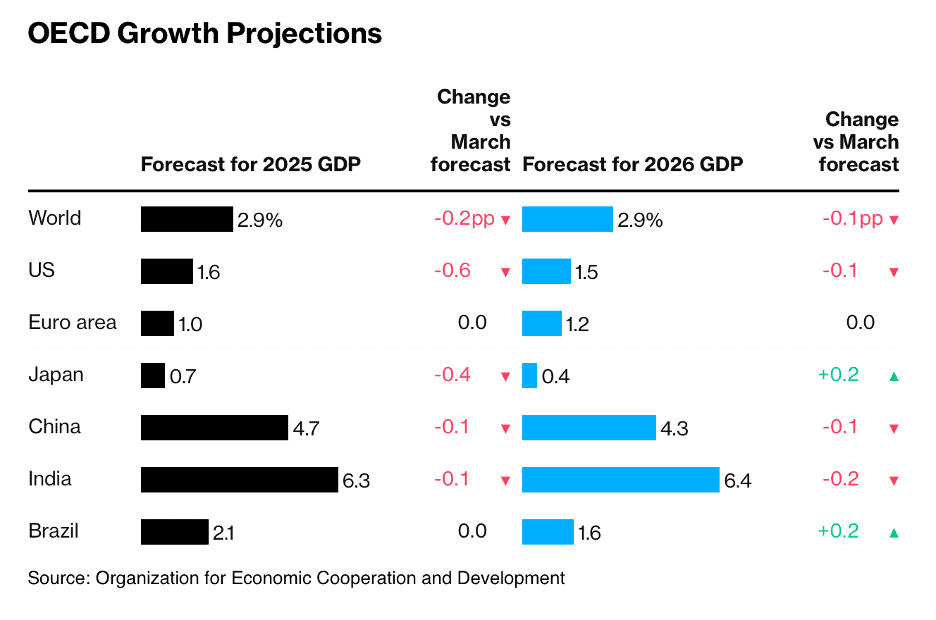

“Global Economics Intelligence executive summary, June 2025 – Overall economic volatility has subsided, but consumer confidence is deteriorating and demand remains fragile, despite inflation decelerating across most countries. Businesses are keeping a close watch on potential trade disruptions. Indeed, the perceived risk from shifts in trade continues to grow, according to the latest McKinsey Global Survey on economic conditions. Respondents cite changes in trade policy or relationships as the top growth disruptor in the global economy, their home economies, and for their companies (Exhibit 1). Interestingly, the survey found that responding to changes in trade dynamics isn’t the priority focus among business leaders in any industry: The largest group of respondents points to leaders prioritizing AI investments.”, McKinsey, July 30, 2025

==================================================================================================

“The World’s 50 Most Valuable Private Companies in 2025 – 31 of the 50 most valuable private companies are based in the United States. AI-focused companies such as OpenAI, Anthropic, xAI, and Safe Superintelligence are among the most highly valued. China has 8 entries, including ByteDance, Xiaohongshu, DJI, and Yuanfudao, showing strong representation in consumer tech and hardware. While public markets get most of the spotlight, private companies are quietly building massive valuations and shaping the future of industries. This visualization ranks the world’s 50 most valuable private companies in 2025, highlighting emerging powerhouses from different countries and sectors. The data for this visualization comes from CB Insights. It ranks private companies globally by their most recent reported valuations.”, Visual Capitalist and CB Insights, July 31, 2025

============================================================================================

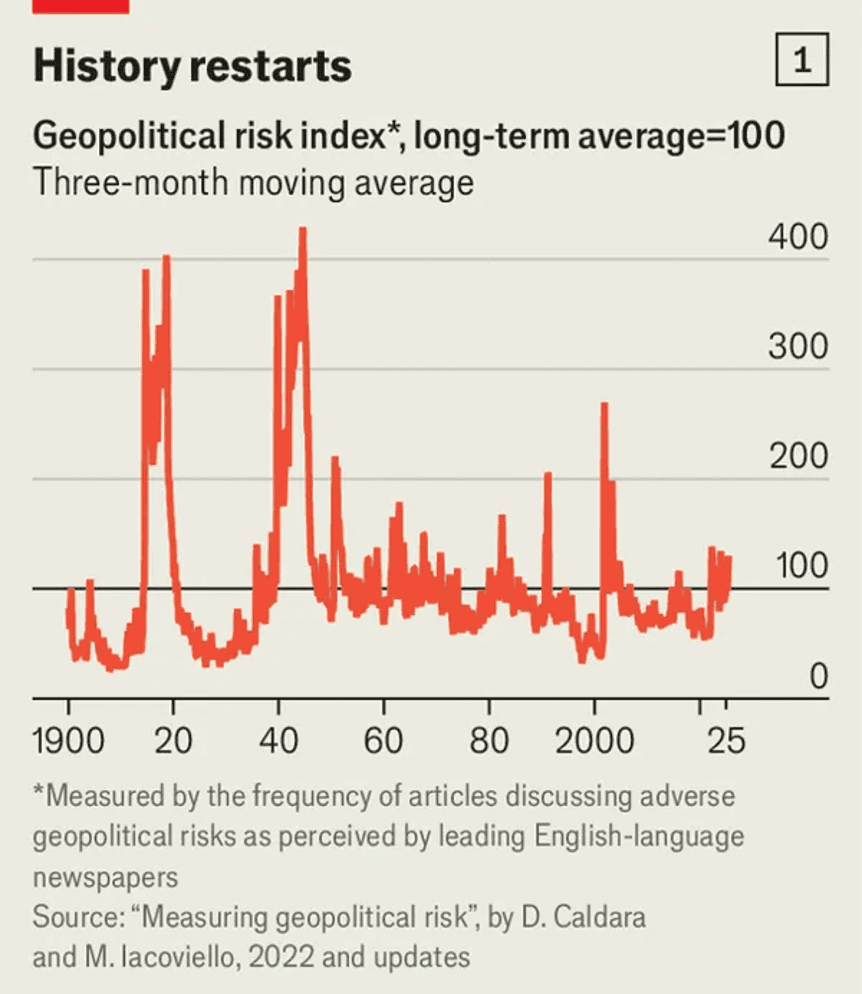

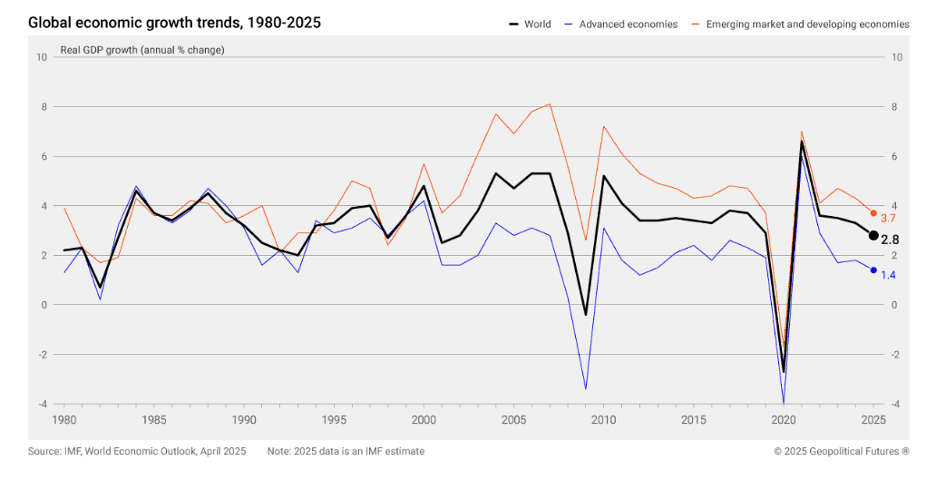

“War, geopolitics, energy crisis: how the economy evades every disaster – Although today’s dangers are not in the same league as a world war, they are significant. Pundits talk of a “polycrisis” running from the covid-19 pandemic, land war in Europe and the worst energy shock since the 1970s to stubborn inflation, banking scares, a Chinese property bust and trade war. One measure of global risk is 30% higher than its long-term average (see chart 1). Consumer-confidence surveys suggest that households are unusually pessimistic about the state of the economy, both in America and elsewhere.”, The Economist, July 15, 2025

============================================================================================

“McDonald’s plans AI expansion to streamline customer orders, executive says – Fast-food giant to roll out AI tech that will catch order errors, forecast sales. The fast-food giant currently uses AI to verify orders at 400 restaurants in India, allowing the chain to catch and correct errors before food is handed to customers, according to the outlet. McDonald’s is planning to roll out the new system globally in two years, Head of Global Business Services Operations Deshant Kaila said, Reuters reported. Fox Business, August 1, 2025

===============================================================================================

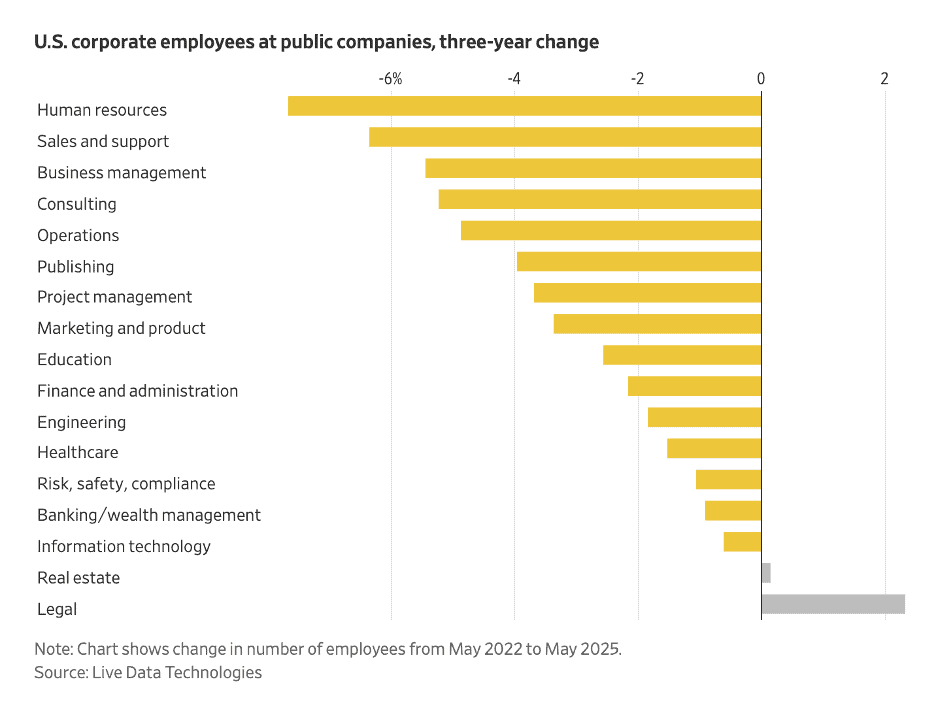

“Is AI Killing Entry-Level Jobs? Here’s What We Know – Job postings have plunged and unemployment is up for young people, yet new research suggests an emerging paradox in which AI may expand access in some fields. AI’s arrival is adding to the anxiety of graduates scrambling to land their first job interviews. It may also be making them less likely to secure one: The US unemployment rate for college-educated people age 22 through 27 reached 5.8% in March, according to the Federal Reserve Bank of New York—the highest level in four years and significantly above the national average. Many people blame AI. Researchers at job site Indeed found that postings for junior roles in the tech industry fell 36% from 2020 to 2025.”, Bloomberg, July 31, 2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation, Taxes & Trade Issues

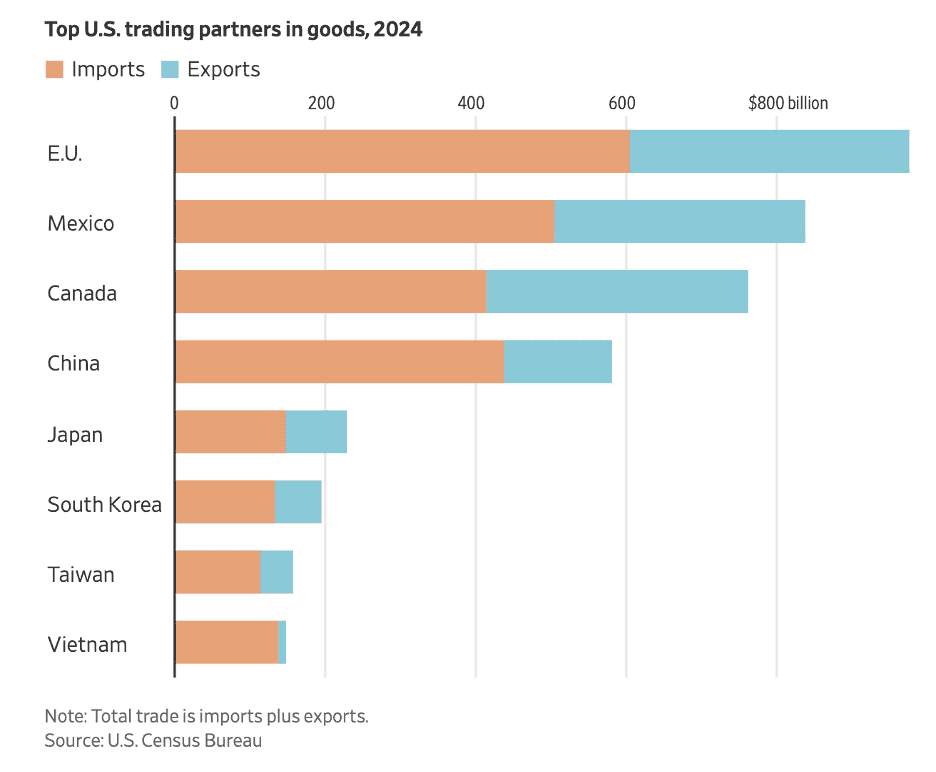

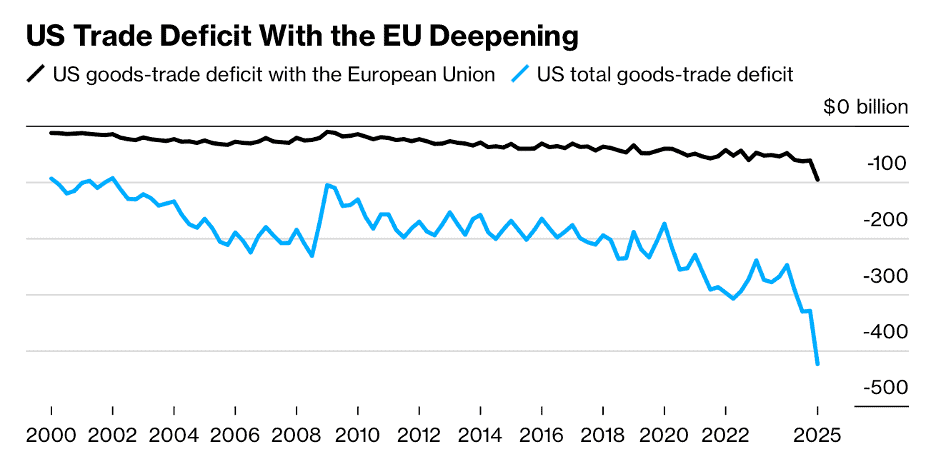

“Trade Between the U.S. and EU Is Massive. We Break It Down. After steeper threat, deal sets 15% baseline tariff on largest U.S. trading partner. While Mexico ranks as the largest single-country U.S. trading partner, the EU as a 27-nation bloc is larger, and EU trade policy is handled centrally. In 2024, the U.S. imported about $606 billion in goods from the EU and exported around $370 billion. This kind of imbalance is a major sticking point for Trump as he tries to use tariffs to revamp U.S. manufacturing. Europe is a big buyer of U.S. oil, gas, cars, airplanes—and human blood products like plasma. The U.S. shipped $32.3 billion worth of airplanes and airplane parts, plus $12.4 billion worth of vehicles to the EU. Many of the cars shipped across the Atlantic are European brands, like BMWs and Mercedes made in American factories. The U.S. sent $5.2 billion in blood products to the EU last year.”, The Wall Street Journal, July 29, 2025

============================================================================================

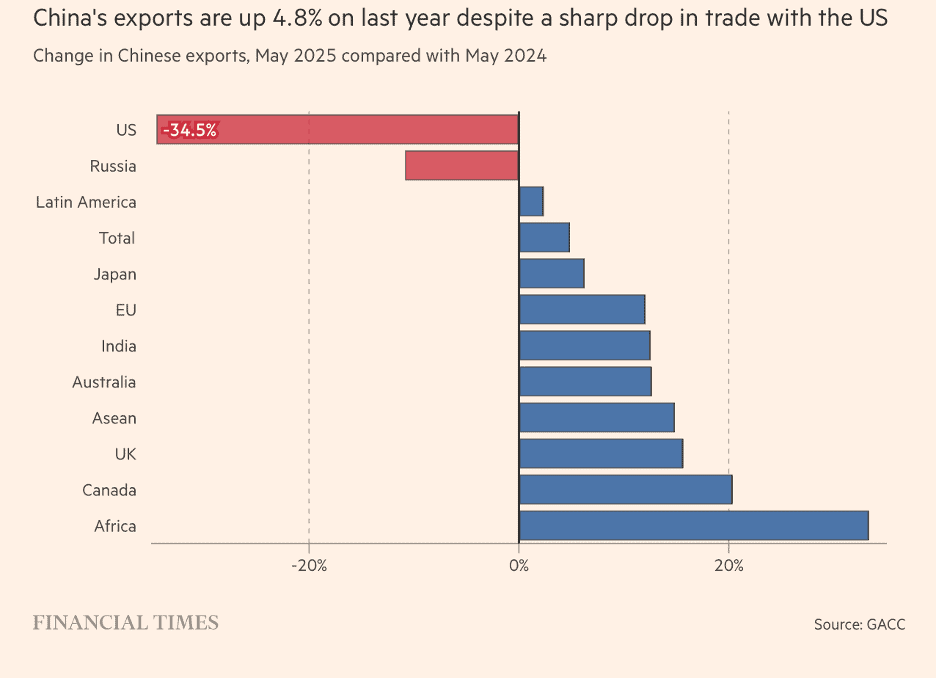

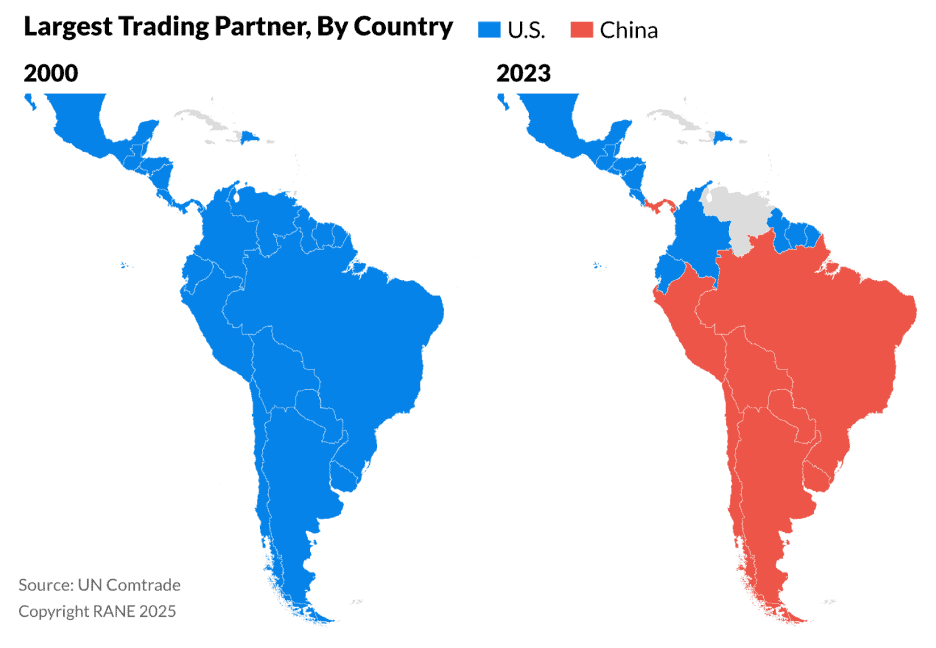

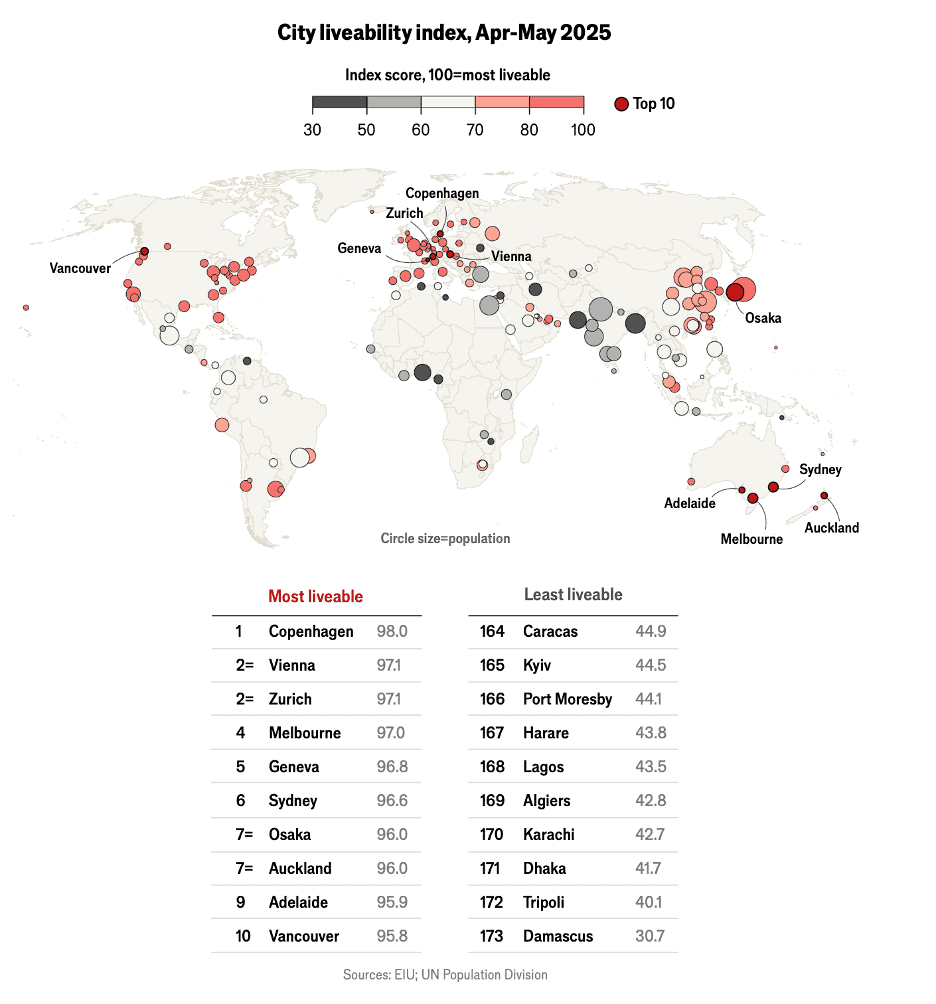

“Global Trade Dominance: U.S., EU, or China (2000 vs. 2024) – In 2000, the U.S. was the top trading partner for most of the Americas, several major Asia-Pacific economies, and parts of Africa. The EU dominated trade with much of Europe, large parts of Africa and Asia, and significant portions of South America. China was the largest partner for only a few smaller economies, including Myanmar, Mongolia, North Korea, Oman, Sudan, and Yemen. By 2024, China’s trade footprint expanded dramatically, becoming the largest trading partner for nearly all of Asia, much of Africa, and the majority of South America. The U.S. maintained dominance in North America and select countries in South America. The EU remained the leading partner for much of Europe, North Africa, and nearby regions, but its global reach diminished relative to China’s. China’s total trade surged from $474 billion in 2000 to $6.2 trillion in 2024, overtaking both the U.S. and EU to become the world’s leading trading power.”, Visual Capitalist and various other sources, July 7, 2024

================================================================================================

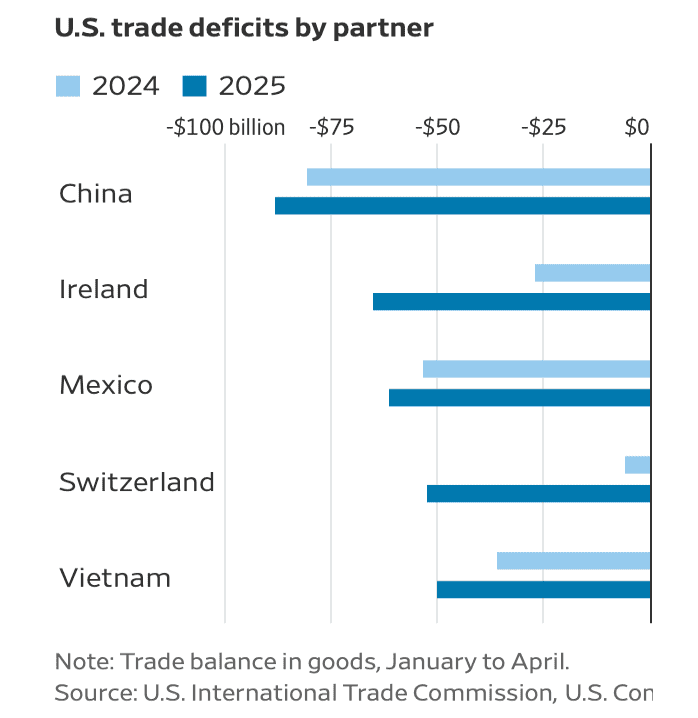

“Trump’s new tariffs will hit these major trading partners – Here’s how Canada, Mexico, China and other countries fare under President Donald Trump’s plan to rebalance global trade. In a pair of executive orders, President Donald Trump has raised tariffs on merchandise from about 70 countries, most of them set to fall into place in a week. Trump has argued that his high-risk trade strategy will rebalance a global system that he said has been tilted against the United States — even as some economists warn that it could lead to renewed inflation and recession.”, Washington Post, July 31, 2025

================================================================================================

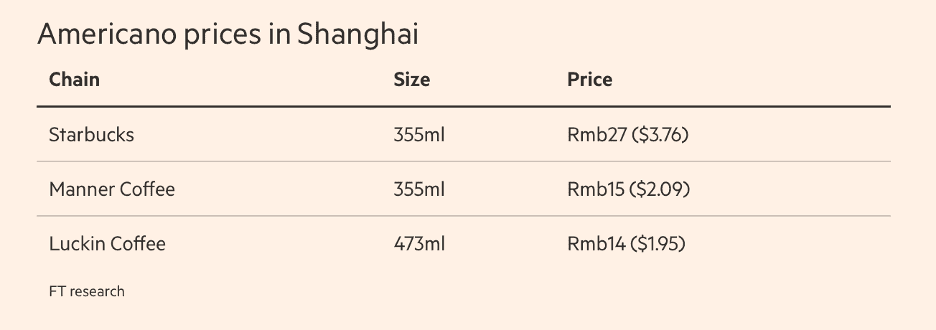

“10 Most Expensive Countries in the World to Grab a Cappuccino – How much is too much for coffee? According to Deutsche Bank’s 2025 “Mapping the World’s Prices” report, the cheapest cup of cappuccino in the world is in Cairo, Egypt, at just $1.57. While Zurich in Switzerland tops the chart at a steep $6.77 per cup.”, Conde Nast Traveler, August 1,2 2025

===============================================================================================

“86% of (U.S.) Consumers Express Concerns About Tariffs – 7% are worried about general inflation, 47% are worried about higher prices on nonessential items, and 43% of U.S. consumers are concerned about the limited availability of certain products. 77% of respondents are concerned about the possibility of a recession in the coming year. 71% of consumers say they are aware of new or proposed tariffs on goods imported into the U.S. 43% oppose tariffs, 29% support, and 28% feel neutral. 27% of U.S. consumers say tariffs will have a positive impact on the nation’s economy, 58% believe they will have a negative effect.”, Franchising.com, July 30th. From an article by M. Scott Morris

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

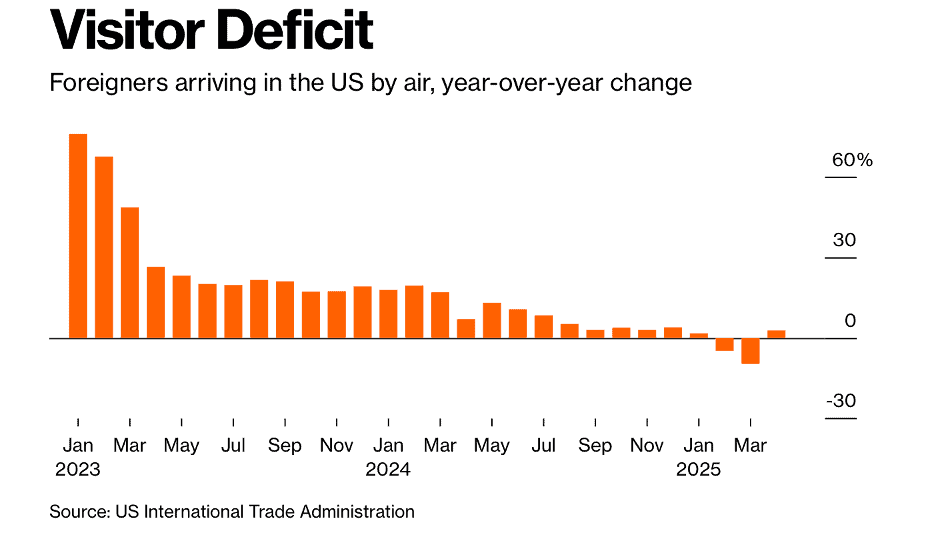

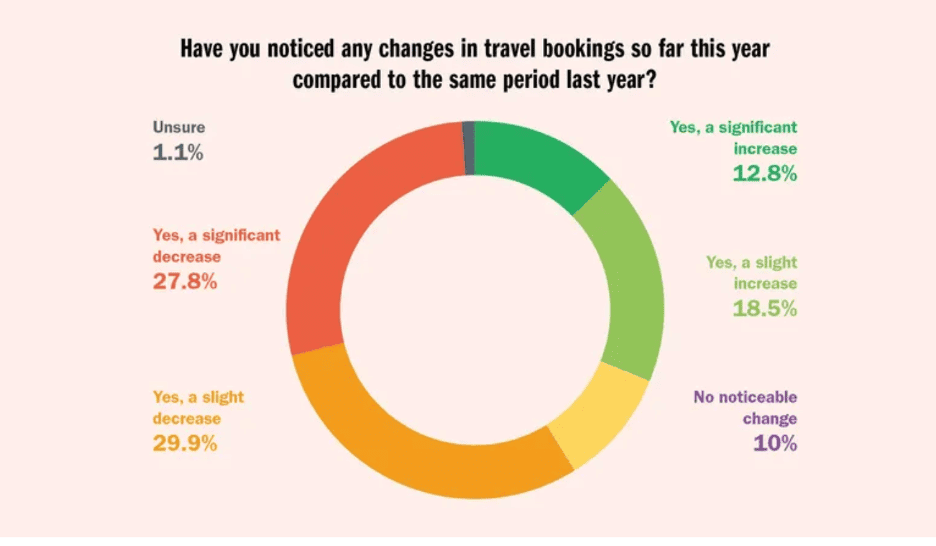

Global & Regional Travel News

“A New Tourist Visa Will Make Travel Much Easier Among 6 Gulf Countries – Set to launch by early 2026, the new multicountry visa was modeled after Europe’s Schengen visa system. In a sweeping move set to transform travel in the Middle East, six Gulf countries have announced plans to implement a unified tourist visa, allowing visitors to move freely across Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates under a single entry permit. Called the Gulf Cooperation Council (GCC) Grand Tours Visa (or the GCC Unified Visa), the long-anticipated initiative, modeled on Europe’s Schengen visa system, is expected to launch by the end of 2025 or early 2026. GCC officials say the visa will simplify travel and encourage longer, multicountry trips throughout the region.”, AFAR, July 28, 2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Book Review

Resurgent: How established organizations can fight back and thrive in an age of digital transformation by Julian Birkinshaw and John Fallon. In Resurgent, business strategist Julian Birkinshaw and former Pearson CEO John Fallon dismantle the myth that only startups and disruptors succeed in volatile times. Drawing from two decades of data across global corporations, they reveal how established companies not only survive—but often thrive—amid technological, economic, and geopolitical upheaval.

Rather than chasing radical reinvention, the authors argue, resilient incumbents succeed through strategic adaptation, cultural consistency, and thoughtful long-term investments. Through case studies from industries like media, education, aviation, and healthcare, Resurgent shows how companies like Microsoft, Pearson, and Schneider Electric reinvented their trajectories without losing their identity.

This book is especially timely for 2025’s global leaders managing through tariff uncertainty, AI disruption, and market fragmentation. It offers a pragmatic, evidence-backed alternative to short-termism: recommit to purpose, empower people, and evolve decisively.

Five Key Takeaways:

Survival isn’t about speed—it’s about strategic clarity and durability.

Don’t abandon your core business; evolve it with conviction.

Reinvention can be incremental yet powerful – consistency builds trust across markets.

Empower local leadership in global operations to respond with agility.

Enduring companies balance purpose and performance, even under pressure.

Resurgent is a must-read for executives facing today’s complex global environment. It’s a thoughtful counterpoint to the “disrupt or die” narrative—grounded in experience, not hype.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

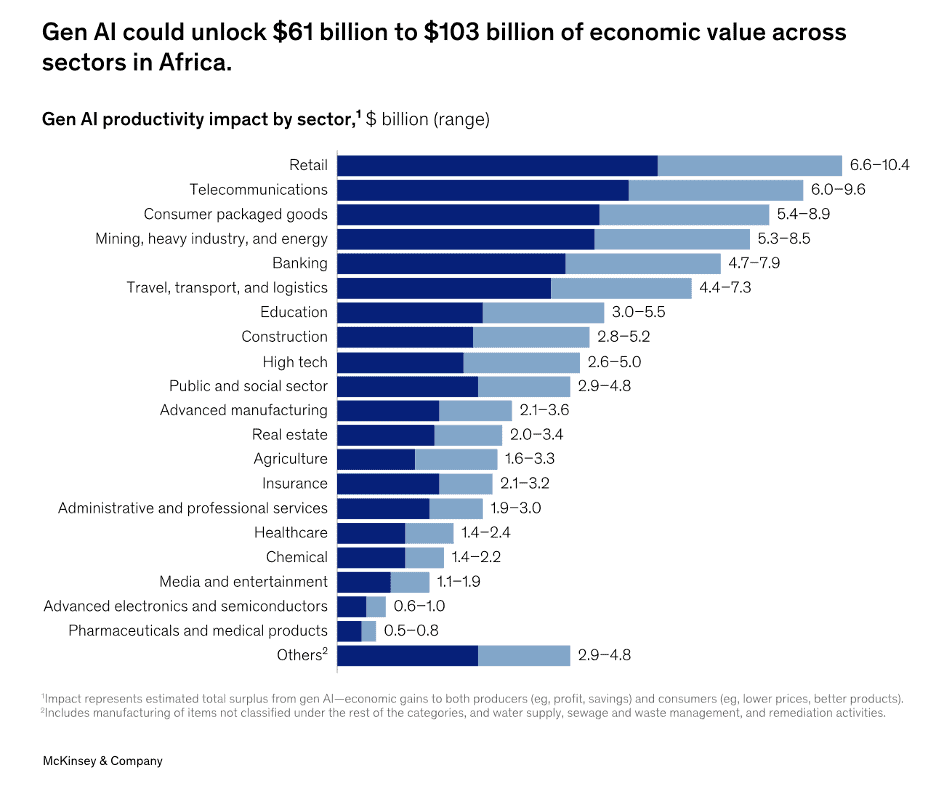

Africa

“How to unlock e-commerce in Africa – Small and medium-sized businesses need better credit access. Africa’s e-commerce sector is experiencing a renaissance. In 2025, Africa’s retail e-commerce is expected to reach over $39 billion, and $55 billion by 2029. This growth is driven by ambitious brands, from contemporary fashion labels to innovative lifestyle businesses, capturing both local and international demand. These businesses are leveraging digital commerce and modern payment rails to reach more customers than ever before. E-commerce is also emerging as a critical lever to help businesses recover from economic shocks and unlock the trade potential of the African Continental Free Trade Area (AfCFTA). Yet one critical barrier threatens to limit their growth: access to affordable, flexible credit. The financing shortfall for sub-Saharan Africa exceeds $331 billion, with medium-sized consumer-facing businesses among the hardest hit. As Africa’s middle class expands, with roughly 212 million people projected to reach middle income status by 2030 and consumer spending expected to hit $2 trillion in 2025—the demand for e-commerce will surge. However, tight credit access could block supply-side growth.”, Fast Company, August 1, 2025

=============================================================================================

Asia

“The global crypto wave is catching on in Asia as businesses warm up to stablecoins – Unlike conventional bank transfers that take days and incur steep processing fees, stablecoin transactions are nearly instantaneous and also cheaper. Singapore and Hong Kong were among the top three markets for stablecoin flows, just following the U.S. Businesses across Asia are increasingly warming up to stablecoins for cross-border transactions — a trend set to accelerate further as Hong Kong moves to legalize the use of digital tokens, experts told CNBC. From online travel agencies and luxury goods resellers to high-end hotels, companies are embracing stablecoin for payments, citing both speed and cost-efficiency compared to the traditional financial system. Stablecoins are cryptocurrencies usually pegged to sovereign currencies or even gold, making them more stable compared to other crypto assets.”, CNBC, August 1, 2025

============================================================================================

Canada

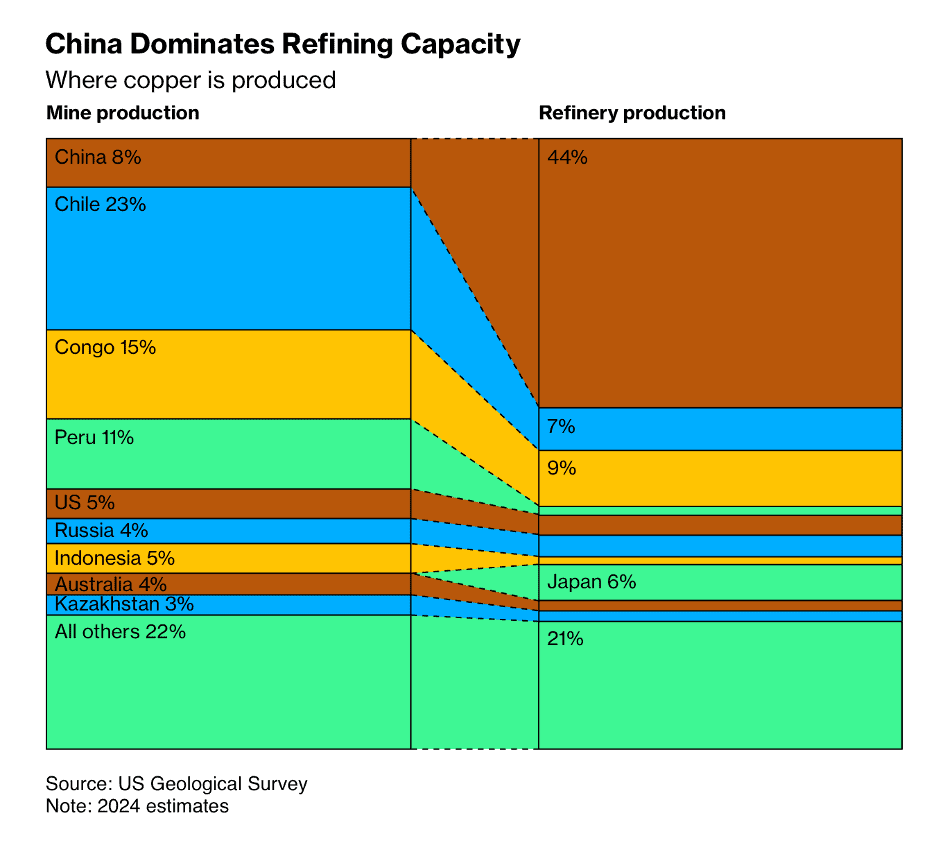

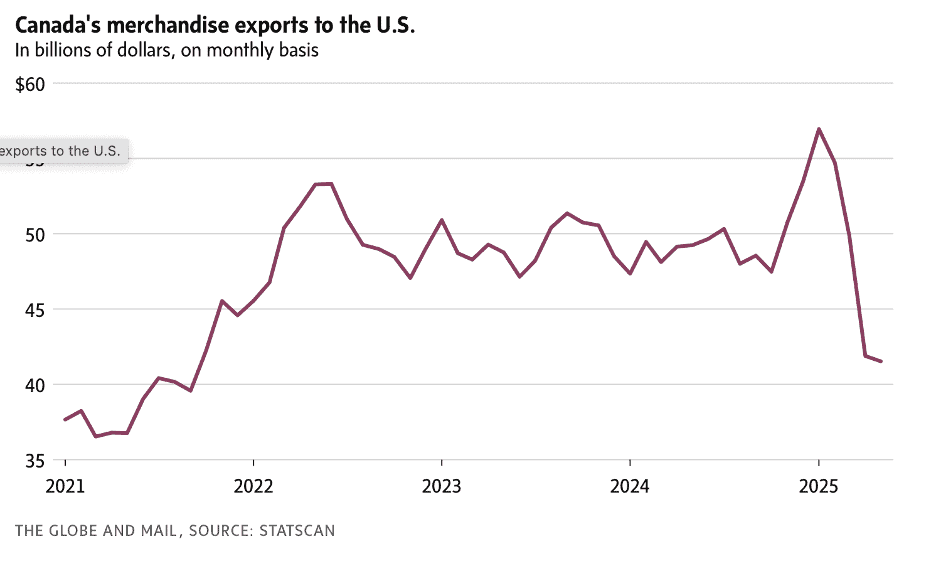

“Canadian producers relieved as Trump’s 50% tariff on imported copper spares key products – The White House said it will slap the duty on copper pipes, wires, rods, sheets and tubes as well as derivative products such as pipe fittings, cables and electrical components. However, copper concentrate and anodes and cathodes, semi-processed materials that companies in Canada produce and export in large volumes, as well as copper scrap, are exempt for the time being, it said.”, The Globe and Mail, July 30, 2025

=============================================================================================

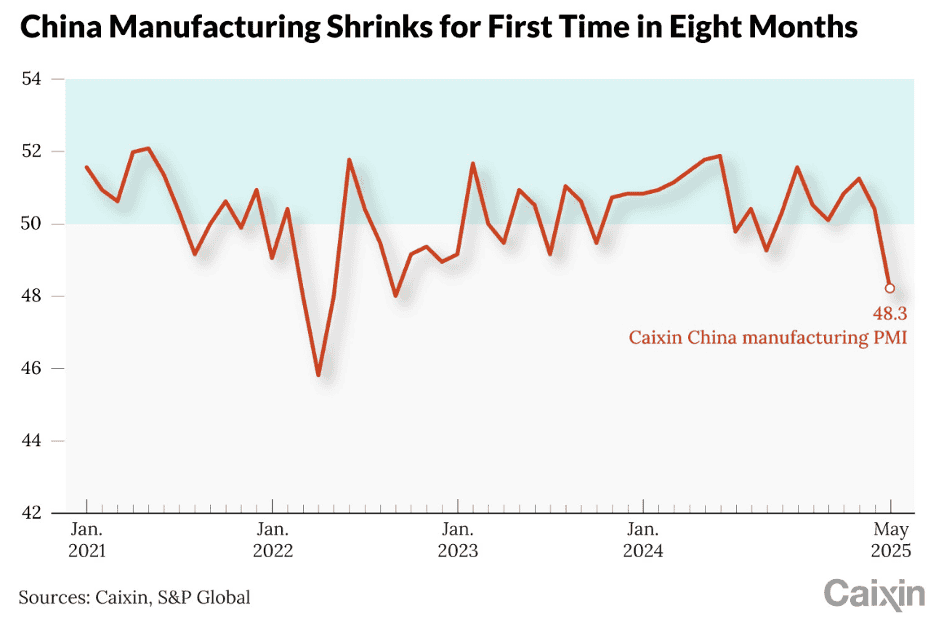

China

“The Consumption Conundrum Dividing China’s Economists – Household consumption — or rather the lack of it — has been at the center of the policymaking debate in China for several years, and top officials from President Xi Jinping down have become increasingly vocal about the need to increase domestic demand amid growing headwinds facing the world’s second-largest economy. As the government and its advisers prepare to put together the 15th Five-Year Plan to guide the country’s economic and social development through 2030, a contentious debate has erupted over the true strength of the Chinese consumer and what policies are needed to get them to spend more. The dispute is pitting influential economists against each other. One side argues that China’s consumption power is significantly underestimated by traditional monetary metrics, which don’t take price differences and currency valuations into account.”, Caixin Global, July 15, 2025

===============================================================================================

United Kingdom

“HSBC tells managing directors to return to office four days a week – London-listed bank’s senior managers must ‘set the tone from the top’ by being present from October, following a trend in the banking sector. It is the latest example of a big UK company pushing for higher office attendance amid concerns over productivity since pandemic-era lockdowns caused a surge in remote working. The likes of JP Morgan, Tesco, John Lewis and Uber have all introduced policies to compel employees to show up more. HSBC’s memo defines in-office work as work in the bank’s offices or with customers, Bloomberg reported. It includes visiting stakeholders and attending conferences, offsite meetings or the equivalent.”, The Times of London, July 29, 2025

===========================================================================================

United States

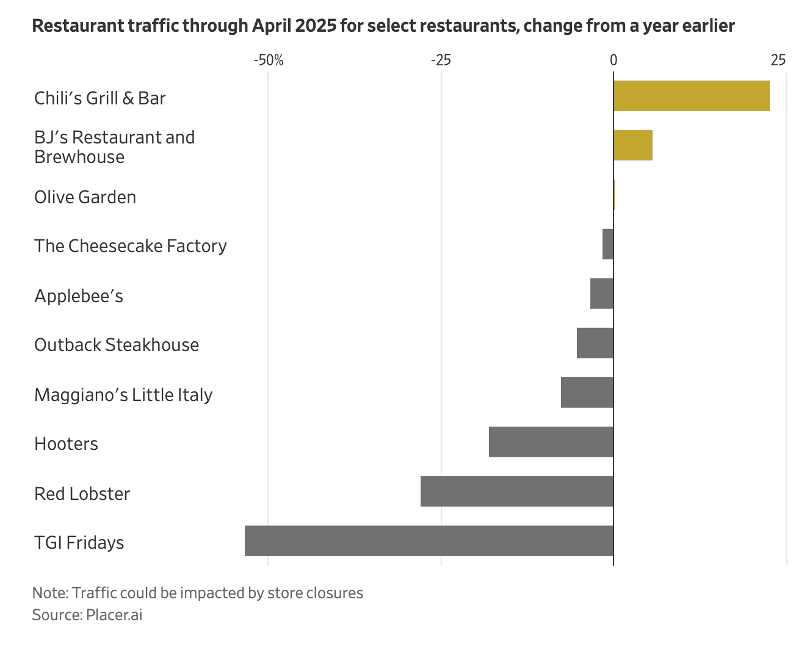

“The (U.S.) labor market has slowed to a crawl – Restaurant job growth has flattened in recent months while employment throughout the economy has slowed this year, according to new federal data. Restaurant and bar employment was flat in July, down 300 jobs, according to the U.S. Bureau of Labor Statistics. The industry has added just 100 jobs over the past two months, continuing a period of year-long, tepid employment growth.

The overall economic picture is not much better. The economy added 73,000 jobs, under expectations, but prior months’ jobs estimates were revised downward significantly. May’s job growth was revised downward to 19,000 from 144,000, for instance. June’s was revised to 14,000 from 147,000, according to the Labor Department.”, Restaurant Business, August 1, 2025

==============================================================================================

“Charting the Global Economy: US Job Market Wavers in Cue for Fed – The US labor market is wavering after a slowdown in economic growth during the first half of the year — implications of heightened uncertainty tied to trade policy. Signs of a sluggish job market and the risk of a reacceleration in inflation due to higher import duties are dueling forces dividing Federal Reserve officials over the path of interest rates. In the wake of a weak jobs report on Friday, Treasury yields declined on bets the Fed will lower interest rates as soon as September after keeping them unchanged this week.”, Bloomberg, August 2, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The Accredited Franchise Supplier certification

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Brand & Franchise Sector News

“McDonald’s seeks US 153 million for 8 Hong Kong retail properties in rare asset sale – Fast-food chain to sell assets in Tsim Sha Tsui, Causeway Bay, Mong Kok, Kennedy Town, Tai Kok Tsui, Yuen Long, Tsuen Wan and Tsz Wan Shan. McDonald’s Corp is selling eight retail properties in Hong Kong with an estimated market value of HK$1.2 billion (US$153 million), giving investors a rare opportunity to own fully tenanted assets, as the world’s biggest fast-food chain reviews its real estate portfolio in the city. McDonald’s said it would continue to operate its restaurants in the eight locations on long-term leases. Some of the properties would be sold with additional tenancies involving 7-Eleven convenience stores and independent pharmacies, it added.”, South China Morning Post, July 28, 2025. Compliments of Paul Jones, Jones & Co., Toronto

==============================================================================================

“Starbucks Says Over 20 Firms Interested in Buying China Business Plans to Retain Significant Stake – On July 29 local time, during the earnings call for Q3 FY2025 (calendar Q2), Starbucks CEO Brian Niccol stated that the company has been actively looking for a strategic partner that shares its values to capture future growth opportunities in China. More than 20 interested parties have shown strong interest, and Starbucks is currently evaluating its options. Niccol candidly noted that the ideal partner would help Starbucks operate more efficiently in China. “This isn’t about capital — it’s about ensuring that the Starbucks brand remains in a position of strength. I believe there are still thousands more Starbucks stores to come in the China market,” he said.”, Caixin, July 29, 2025. Compliments of Paul Jones, Jones & Co., July 29, 2025

=============================================================================================

“RIFC 50 Index – The RIFC 50 Index, initially published in 2002 by the Rosenberg International Franchise Center (RIFC), is the first stock index to track the financial market performance of the US franchising sector. It is published quarterly. The RIFC 50 Index gained 2.2 percent in market value in 2Q 2025, with 32 Index components posting positive returns, with 22 garnering double digit returns. Car rental franchisors Avis Budget Group (CAR) and Hertz Global (HTZ) had very strong performances, up +123 percent and +74.8 percent, respectively. Krispy Kreme Donuts (DNUT) had the Index’ weakest performance in 2Q 2025, shedding 40.3 percent of its market value. Year to date, the RIFC 50 Index is up 3.3 percent while over 1-year, 5-years, and 10-years, the RIFC 50 Index returned +11.9%, +80.0%, and 87.0% respectively. Since its inception in 2000, it has gained 497.5%.” The Rosenberg International Franchise Center, Peter Paul College of Business and Economics, University of New Hampshire, July 2025. Compliments of E. Hachemi Aliouche, Ph.D., Director – Rosenberg International Franchise Center, Rosenberg Chair in Franchising, University of New Hampshire

==============================================================================================

“Reborn Coffee signs $1.7m franchise deal – The US specialty coffee group has inked licensing deals for over 100 stores across a dozen international markets, with its latest agreement focused on kickstarting outlet growth in Europe and the Middle East. US specialty coffee group Reborn Coffee has signed a master franchise agreement with Dubai-based Arjomand Group to open stores across Europe and the Middle East. The coffee chain, which has 11 stores in the US and a single international site in Kuala Lumpur, Malaysia, has previously announced agreements to open outlets in the UAE, the Czech Republic, Austria and Italy. However, first stores in Dubai and Prague, which were scheduled to open in June 2025, are yet to materialise. Reborn also has multiple franchise deals in place to launch in China, alongside partnerships in South Korea, Singapore, Thailand and Turkey – which could add over 100 stores to its international footprint, if fully realised.”, World Coffee Portal, July 21, 2025

==================================================================================================

“Wendy’s Announces New Development Agreements for 190 New Restaurants Across Italy and Armenia. Momentum builds behind global expansion strategy as brand aims to accelerate global net unit growth to achieve 2,000 international restaurants by 2028. The Wendy’s Company announced today the finalization of two new franchise agreements that will add up to 190 new Wendy’s® restaurants across Italy and Armenia, marking a significant step forward in advancing the brand’s strategic priority to accelerate global net unit growth. These commitments support Wendy’s goal to achieve 70 percent of its unit growth outside the United States, with the Company expecting to reach 2,000 international restaurants by 2028.”, Wendy’s, July 29, 2025

===============================================================================================

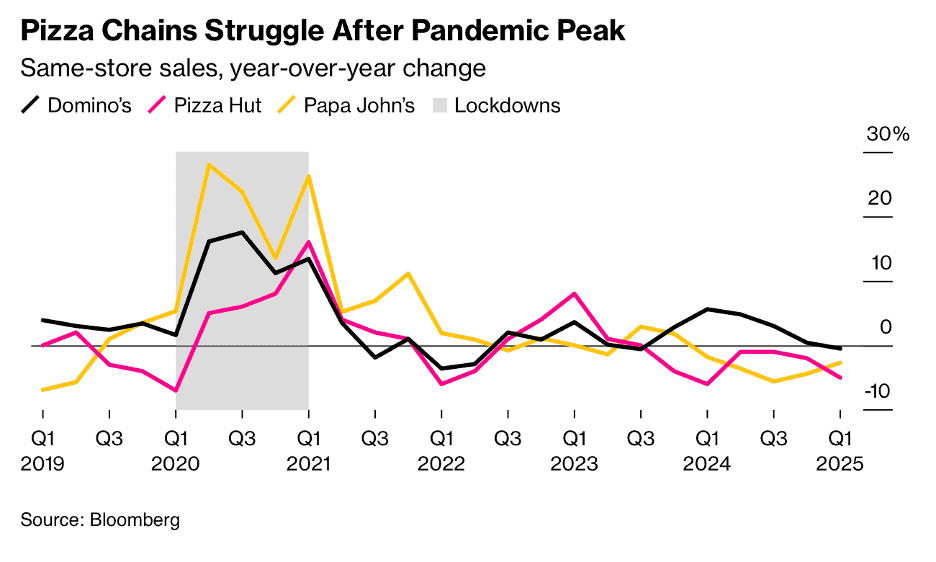

“Marco’s Pizza Celebrates Key International Milestones in Mexico and Puerto Rico – Marco’s Pizza, one of the nation’s fastest-growing pizza brands, celebrates major milestones in its international expansion strategy – marking one year since opening its first location in Mexico and ten years of operations in Puerto Rico. These anniversaries underscore the brand’s robust global appeal and continued investment in international development. Marco’s entrance into Mexico began in 2024 through a 50-unit master franchise agreement with Grupo Pizza Amantes SA de CV, a seasoned group of operators with decades of experience in the restaurant and hospitality industry.”, Franchising.com, July 22, 2205

==============================================================================================

“Trends shaping the next phase of growth in Asia Pacific’s franchise boom – F&B remains the most franchised sector in Asia Pacific. Brands in quick service restaurants, coffee chains and casual dining continue to expand rapidly, especially in Southeast Asia and China. Tech continues to shape how franchises operate as touchless payment systems, loyalty apps or app-based ordering become the norm. The booming health and wellness focus offers prime opportunities as brands focused on health-conscious lifestyle concepts are rapidly gaining traction across Asia Pacific. Consumers, especially younger demographics, are actively choosing brands that demonstrate environmental responsibility.”, Baker McKenzie, July 25, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive our biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing business environment. And our GlobalTeam™ on the ground covering 25+ countries provide us with updates about what is actually happening in their specific countries. We do not get involved in or report on politics!

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe, and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant since 2001 taking 40+ companies global.

| To receive this biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com +++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++ |

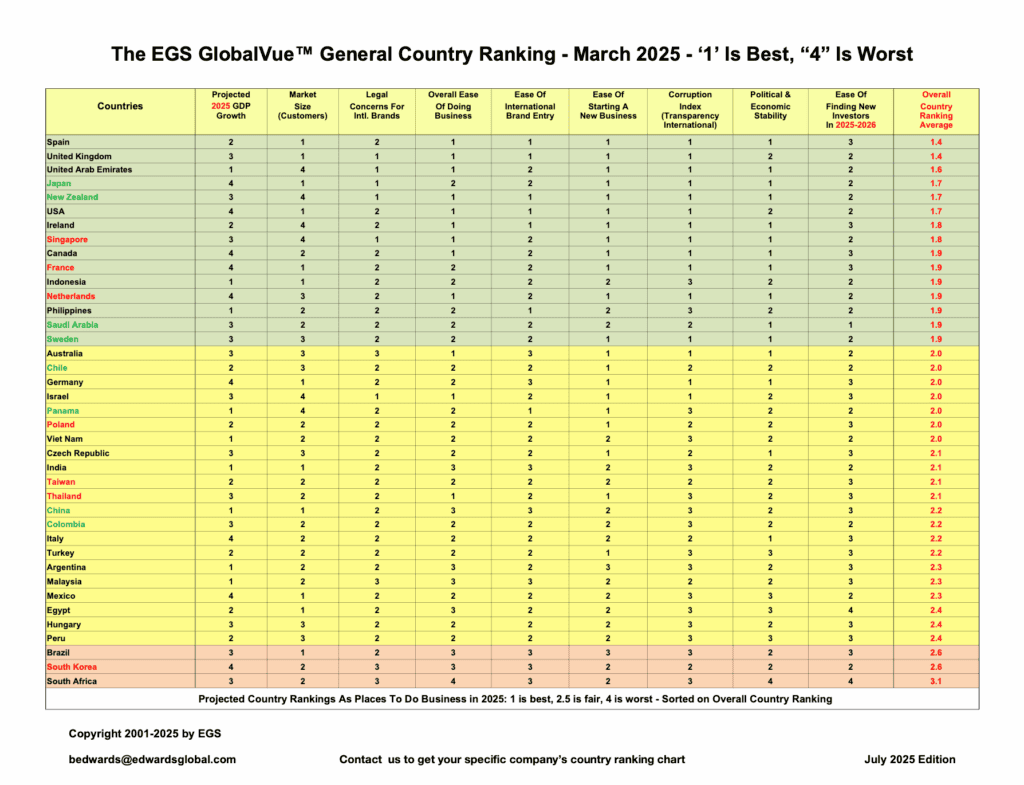

Our latest GlobalVue™ 40 country ranking

For a complimentary 30-minute consultation on how to take your business into new countries and make money doing it. For a complimentary call with Bill Edwards click on the QR code or contact Bill at bedwards@edwardsglobal.com and +1 949 375 1896

Biweekly Global Business Newsletter Issue 139, Tuesday, July 22, 2025

“I will either find a way, or make one”, Hannibal

Welcome to the 139th Edition of the Global Business Update – As always, our goal is to keep you informed, inspired, and strategically positioned for what lies ahead on global trends. This edition is longer than most as there is just lots of global business news to make our 4,600 subscribers aware of!

This edition spans critical business, economic, and geopolitical developments from around the world—curated to help global executives stay ahead of the curve.

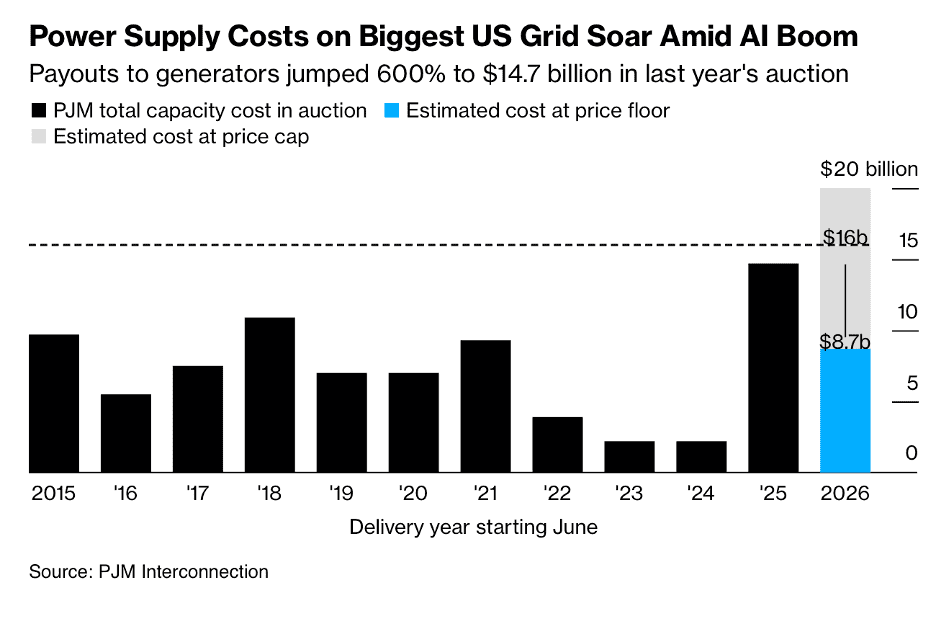

Artificial intelligence continues to dominate headlines and reshape industries. ChatGPT now surpasses 500 million monthly users, as companies increasingly integrate generative AI into operations. Yet this digital transformation brings new ethical and operational complexities. Meanwhile, China’s biotech sector is rapidly evolving, positioning itself as a global competitor in pharmaceutical R&D and innovation. And the growing cost of power supplies for AI.

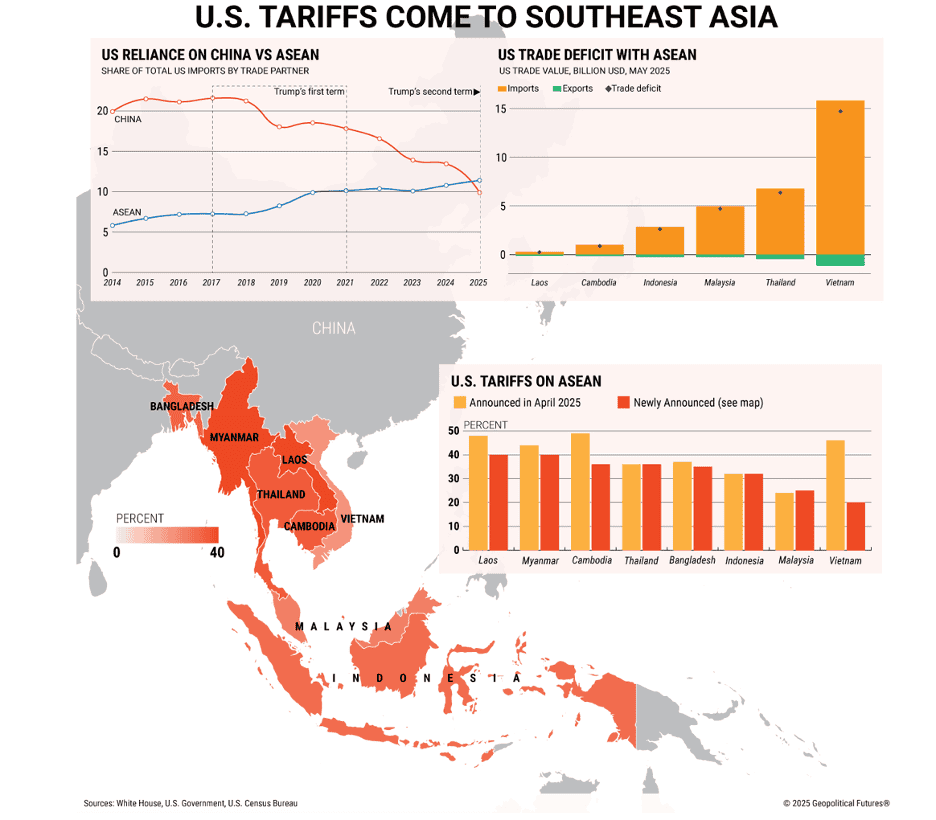

Economic resilience is also in focus. Argentina, despite its well-documented volatility, received a modest credit upgrade, reflecting recent reforms. At the same time, U.S. investors are increasingly looking abroad, as foreign stock markets outperform the S&P 500. Trade relations, however, remain tense. The U.S. has imposed new tariffs targeting Southeast Asia, even as countries like Indonesia navigate the disruption through last-minute deals.

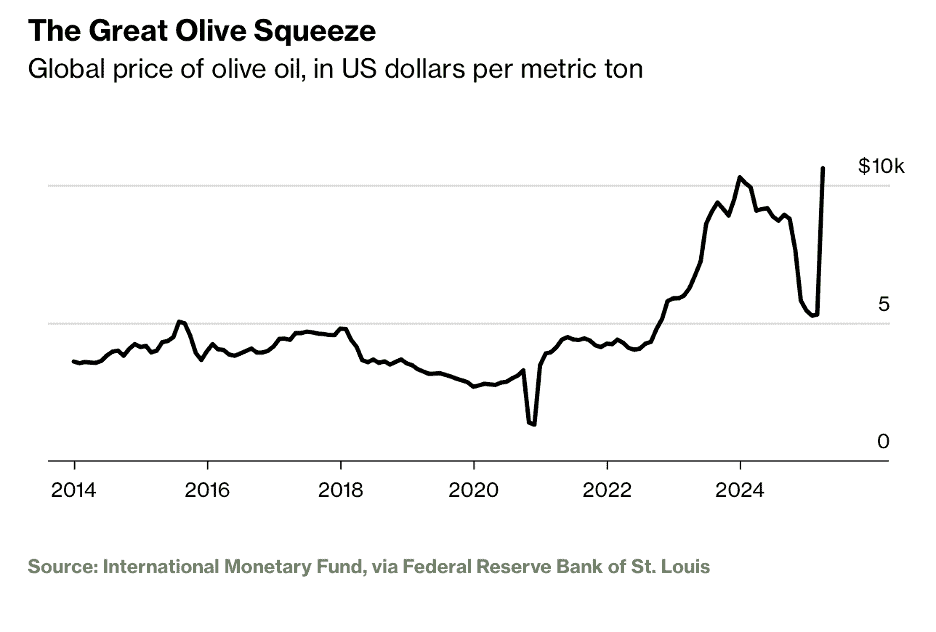

On the consumer front, lifestyle shifts, and global pressures are front and center. Olive oil prices are skyrocketing due to climate-driven supply shortages, while the race for ultra-long-haul flights raises fresh concerns about traveler fatigue. Countries like New Zealand, Ireland, and Australia are recognized for offering the best work-life balance—an increasingly valuable benchmark in talent attraction and retention.

In the world of franchising, Taco Bell is making headlines for its global growth strategy. Auntie Anne’s launches in Australia, and World Gym has entered Brazil through a new master franchise agreement. We also take a closer look at franchise development in the Gulf region, where ambitious growth strategies are met with distinct cultural and regulatory considerations. Updates from China and the UK include key legal and operational shifts impacting both inbound and outbound franchise strategies. KFC’s new CEO is already making global waves.

This issue’s book is Nexus: A Brief History of Information Networks from the Stone Age to AI by Yuval Noah Harari which explores how the evolution of information-sharing systems—from cave paintings to artificial intelligence—has shaped human history, economics, and power. Harari contends that the true engine of civilization is not tools or resources, but our growing ability to collect, store, transmit, and act on information at scale. Harari’s Nexus is a timely call to rethink strategy, ethics, and innovation in the age of intelligent systems.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business. We do not get involved with or report on politics!

PLEASE NOTE: Some of the information sources that we provide links to in our newsletter require a paid subscription to directly access them. Clicking on a link may not give the reader access to the content.

Edited and curated by: William (Bill) Edwards, CEO & Global Business Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA. Contact Bill with questions, comments and contributions. Bedwards@edwardsglobal.com, +1 949 375 1896

Link to our current and past newsletters: https://edwardsglobal.com/geowizard/

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

First, A Few Words of Wisdom From Others For These Times

“I will either find a way, or make one”, Hannibal

“You can’t build a reputation on what you are going to do.”, Henry Ford

“The secret of change is to focus all of your energy not on fighting the old, but on building the new.”, Socrates

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Highlights in issue #139:

The World’s Top Countries by Natural Gas Reserves

The Best Countries for Life-Work Balance in 2025

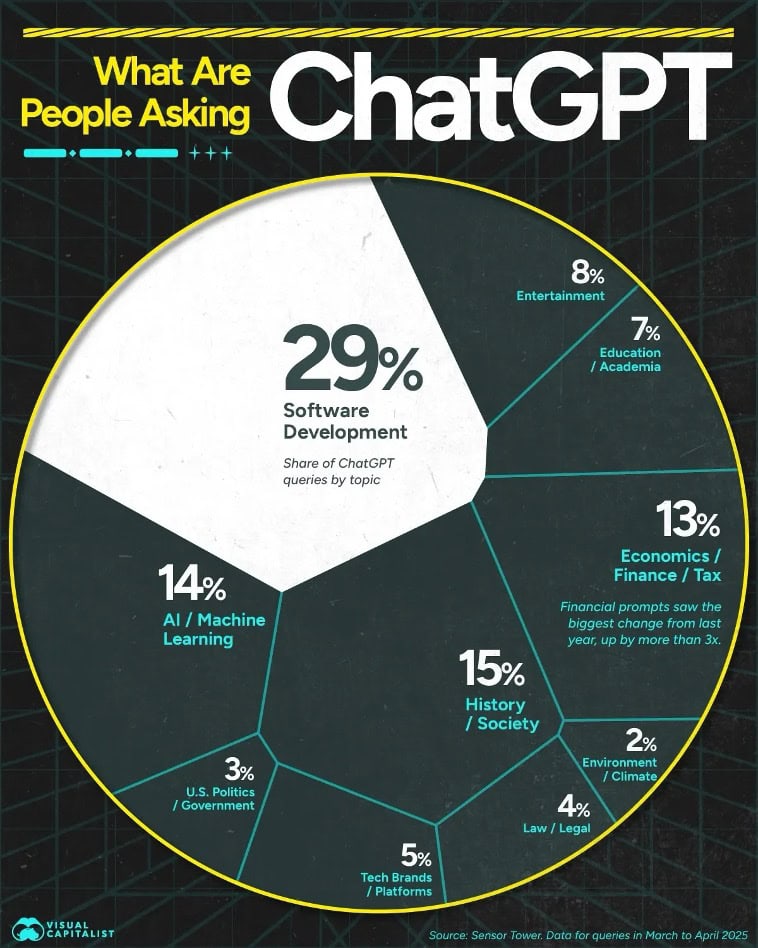

What Are People Asking ChatGPT?

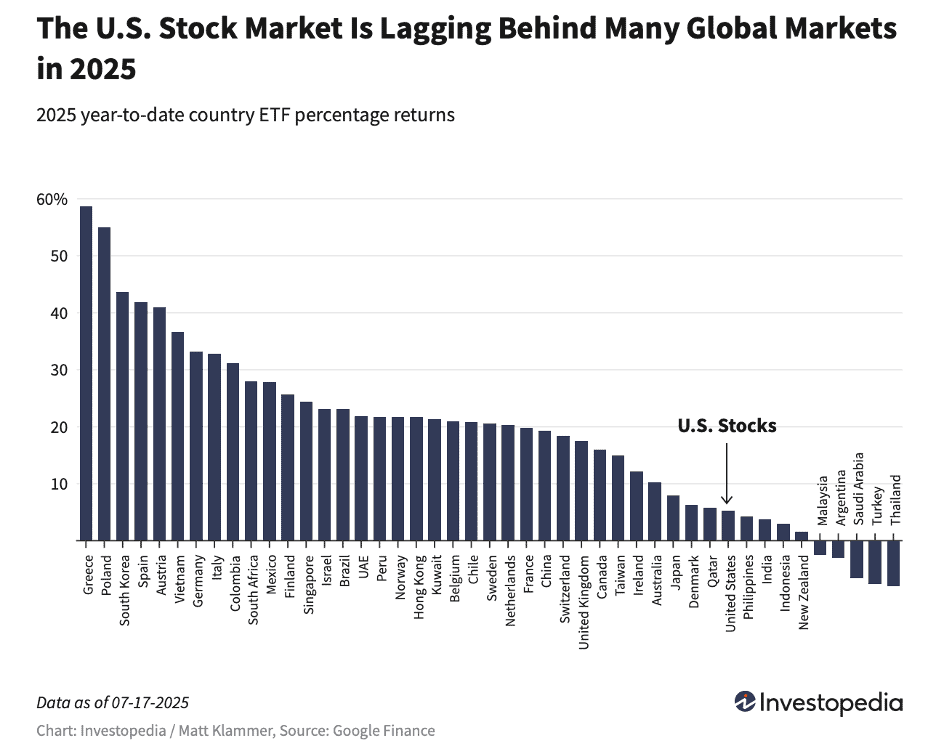

Global Stock Markets Are Eating the U.S. Market’s Lunch

Why olive oil is suddenly more expensive than ever

US firms say China market critical despite fraying relations other issues

Brand Global News Section: Auntie Anne’s®, KFC®, Taco Bell®, Planet Fitness® and World Gym®

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Please sign up for this amazing future looking August 6th event at the Beall Center for Innovation and Entrepreneurship at the University of California, Irvine at this link: www.enpinstitute.com/events

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

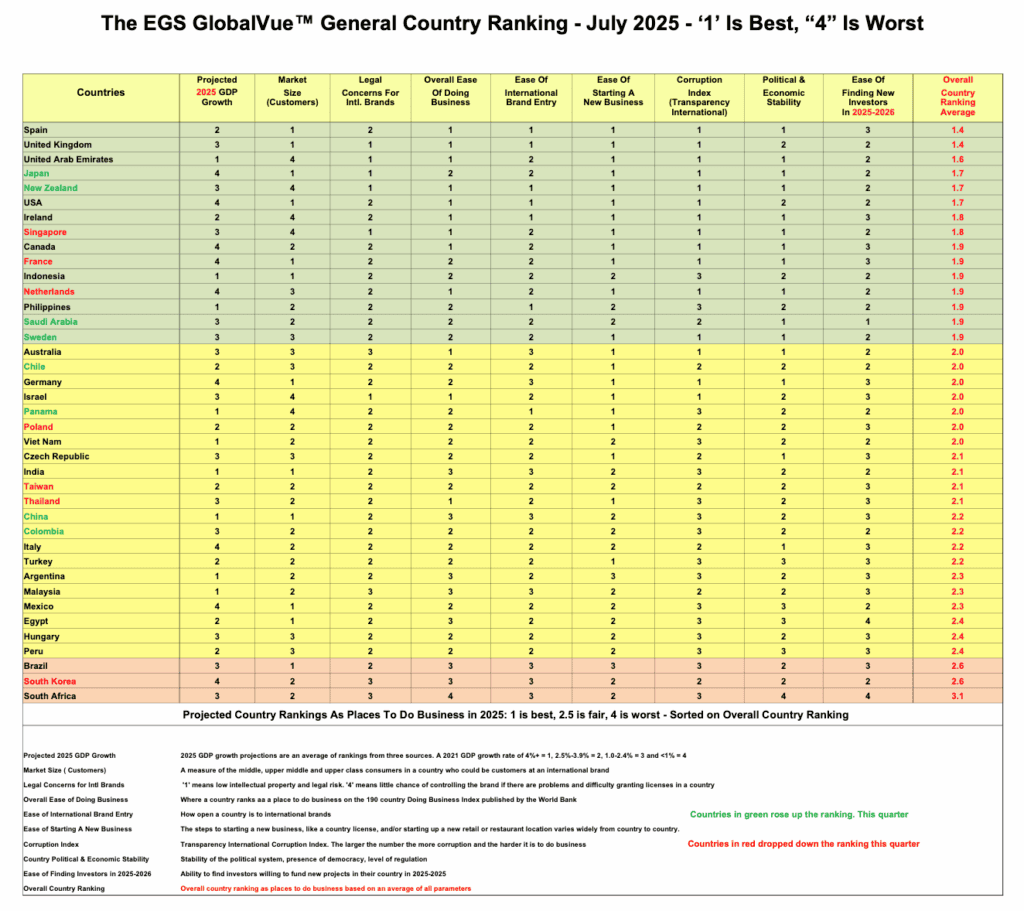

Interesting Data, Articles and Studies

GlobalVue™ Country Ranking July 2025 – The latest version of the Edwards Global Services, Inc. quarterly country ranking as places to do business has just been published. Several countries moved up the ranking in the last quarter due to improved GDP growth projections for 2025, improved investor interest in new projects or changes in country political and/or economic stability. Several countries went down in the ranking for the same reasons. The GlobalVue™ ranking has been published quarterly since 2001 and is used by companies to plan and evaluate their international expansion.

==================================================================================================

“What Are People Asking ChatGPT? In under two years, ChatGPT has gained 500 million monthly active users (MAUs). Software development queries are the top prompt category, with a 29% share, although it has fallen from 44% in April 2024. History and society is the second-most popular category, at 15% of prompts, up from 13% in April 2024 according to analysis from Sensor Towe. As adoption rises, daily app user time spent has surged 98% between April 2024 and April 2025. In April, ChatGPT’s top three referral sites were YouTube, Wikipedia, and the National Library of Medicine.”, Visual Capitalist and Sensor Towe, July 4, 2025

============================================================================================

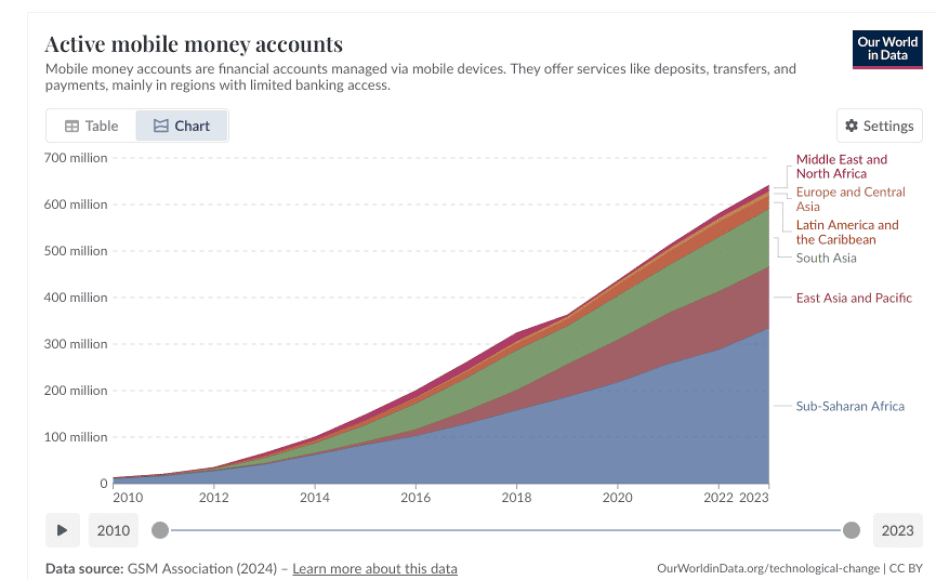

“There are now more than half a billion mobile money accounts in the world, mostly in Africa — here’s why this matters – Mobile money allows people without banks to securely transfer funds via text message, and its adoption is growing rapidly. By the end of today, you’ll probably have used your bank account — maybe to buy groceries, pay rent, or send money to a friend. Even better, to receive your salary. It’s something many of us take for granted. However, for more than a billion people globally, transactions only happen with cash.That means carrying around physical notes and coins, traveling long distances just to send or receive money, and facing the constant risk of losing it or having it stolen. The absence of formal banking services adds yet another hurdle for people trying to escape poverty. But in recent years, “mobile money” has transformed how many people access financial services.”, Our World In Data, July 6, 2025

============================================================================================

“The Best Countries for Life-Work Balance in 2025 – Top-ranked countries like New Zealand and Ireland offer generous paid maternity leave (26 weeks) and high statutory annual leave (30+ days), supporting strong work-life balance. Most countries with universal healthcare also provide extensive sick pay (80–100%) and maternity benefits, reinforcing social safety nets for workers. The study evaluated paid leave, sick pay, maternity benefits, minimum wage, healthcare, happiness, work hours, LGBTQ+ rights, and safety, weighted to produce an overall score out of 100. Data was collected and analyzed in April 2025.”, Global Work-Life Index 2025, July 4, 2025

============================================================================

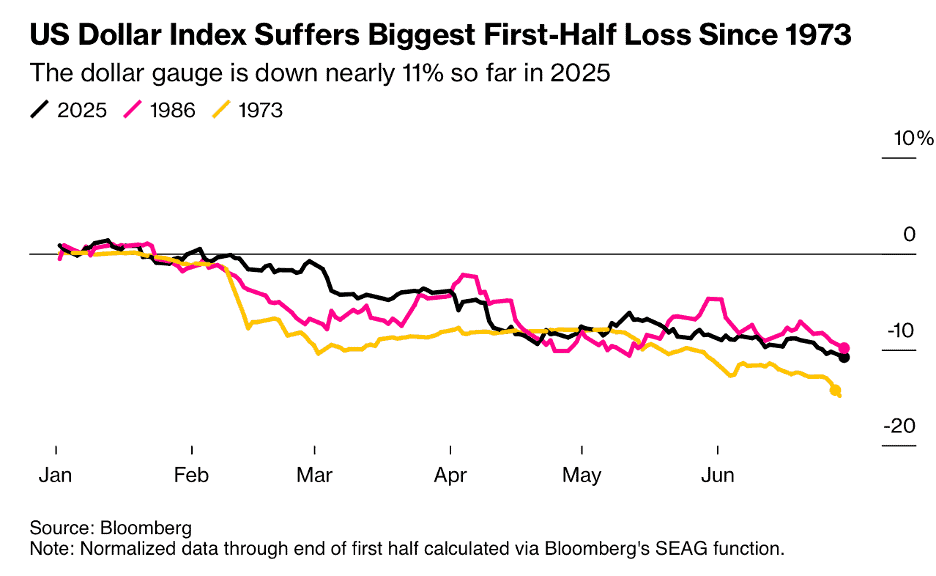

“Global Stock Markets Are Eating the U.S. Market’s Lunch. Here’s Why—and How You Can Invest Internationally – Although the U.S. stock market has historically outperformed its international peers since the end of the Great Recession, cheaper valuations abroad, the U.S.’s higher-for-longer interest rate policy, and the appeal created by the weaker U.S. dollar are pushing some investors to look overseas. Global stocks are outperforming U.S. equities in 2025—a rare occasion, historically. Key factors contributing to the U.S. market’s underperformance are interest rate policy divergence, dollar weakness, and relative valuation gaps.”, Investopedia, July 18, 2025

==========================================================================================

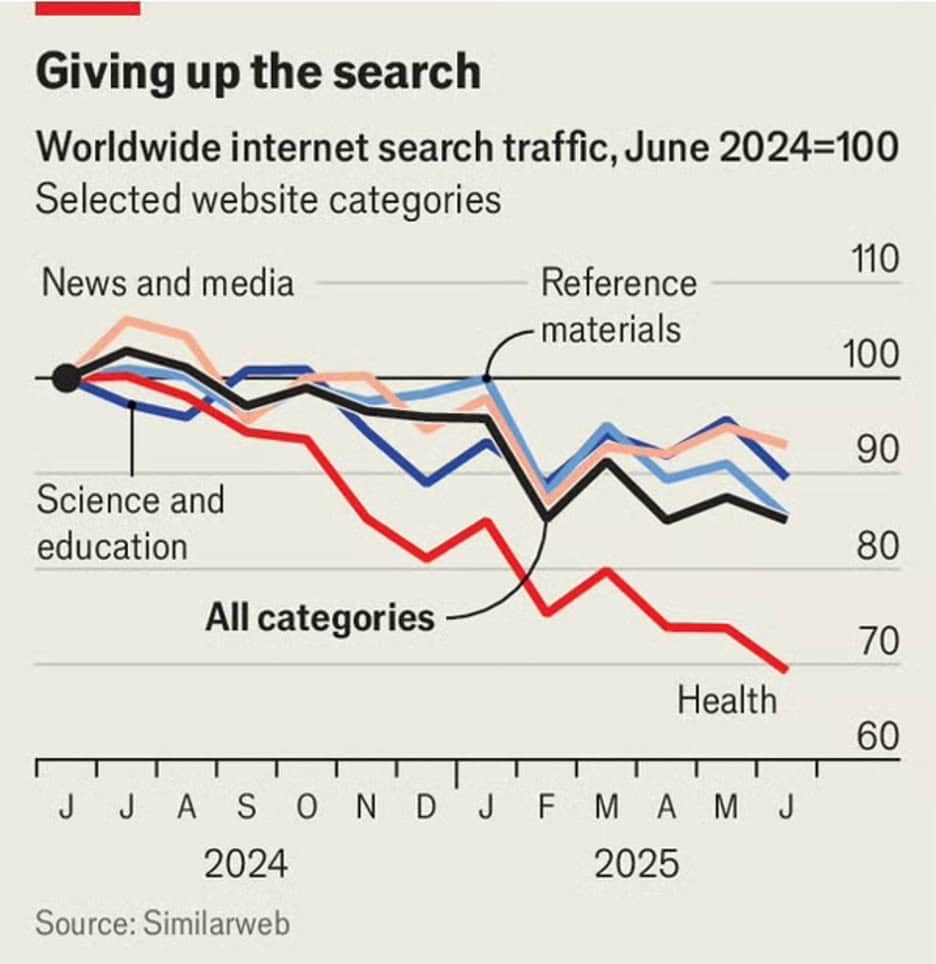

“AI is killing the web. Can anything save it? The rise of ChatGPT and its rivals is undermining the economic bargain of the internet. As users pose their queries to chatbots rather than conventional search engines, they are given answers, rather than links to follow. The result is that “content” publishers, from news providers and online forums to reference sites such as Wikipedia, are seeing alarming drops in their traffic. As Openai and other upstarts have soared, Google, which has about 90% of the conventional search market in America, has added ai features to its own search engine in a bid to keep up.”, The Economist, July 14, 2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation, Taxes & Trade Issues

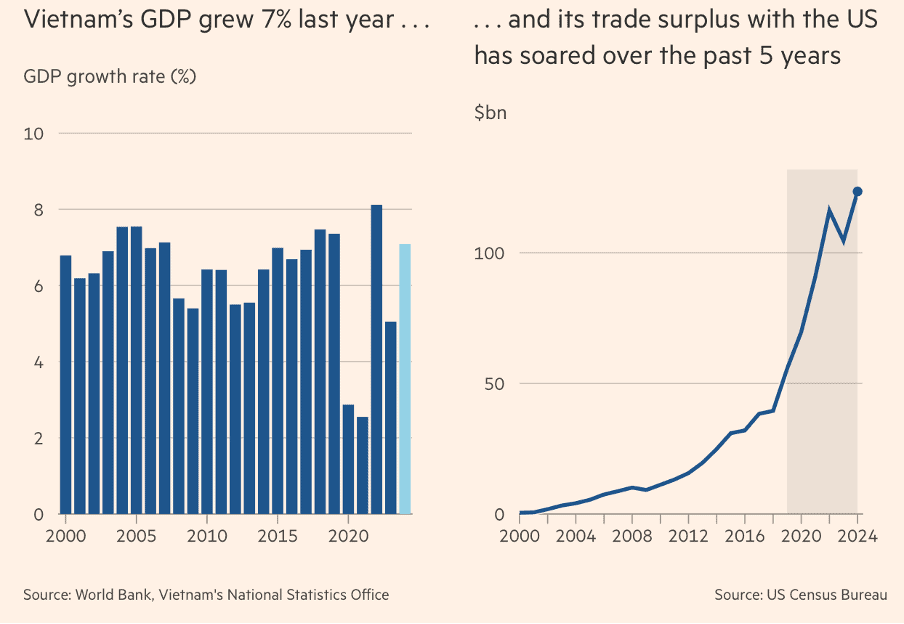

“Tariffs Target Southeast Asia – The region now accounts for more U.S. imports than China. Since 2016, the share of U.S. imports from China has fallen by nearly half, while imports from the Association of Southeast Asian Nations have nearly doubled. The United States now imports more from Southeast Asia than it does from China. The new tariffs are aimed at reducing these growing imbalances. The new tariff package targets ASEAN countries not only for their trade deficit but also for their role in transshipping Chinese goods. Vietnam, now America’s largest ASEAN trade partner, faces a 20 percent tariff on its exports and a 40 percent tariff on goods rerouted from higher-tariff countries like China.”, Geopolitical Futures, July 11, 2025

============================================================================================

role in the global energy mix, used widely for electricity generation, heating, and as industrial feedstock. This graphic visualizes the top 10 countries with the largest proven natural gas reserves in the world. Countries are organized and colored by region, Reserves indicates that these stores of natural gas are economically viable to extract at the current market price. Data comes from the Oil & Gas Journal via the U.S. Energy Information Administration.”, Visual Capitalist, July 9, 2025

================================================================================================

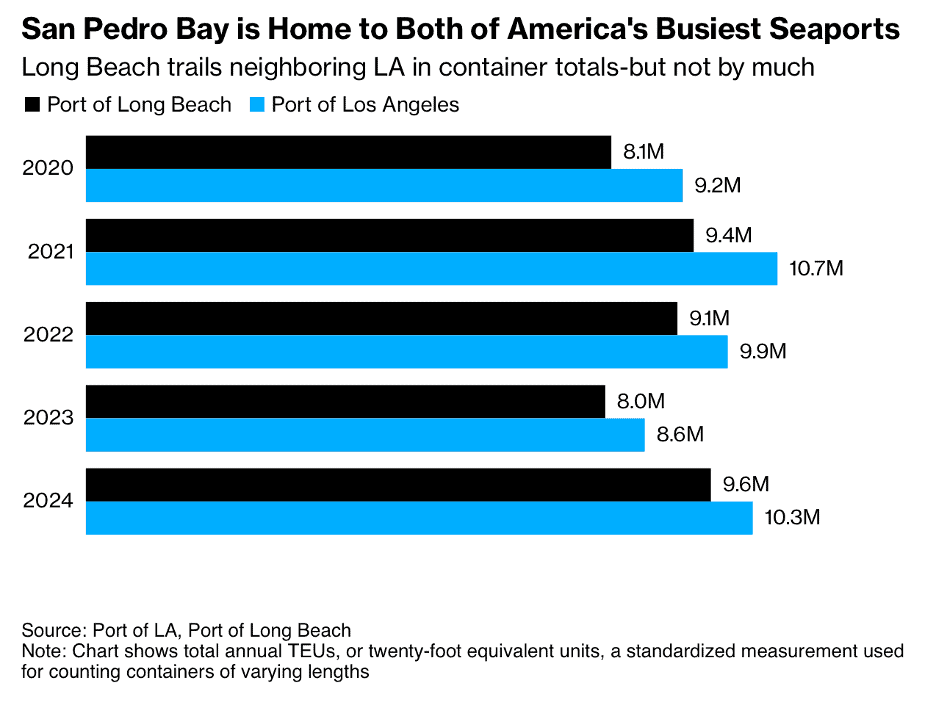

“How the Port of Long Beach Plans to Finally Overtake Rival LA – LA has long enjoyed the title of the country’s busiest seaport, with Long Beach almost always in second place. LA’s reign looks shaky, however, thanks to just 19 acres of new land added to one Long Beach terminal. With the expansion, annual capacity at ITS will jump about 50% to 2.3 million TEUs, according to CEO Kim Holtermand. The extra 900,000 TEUs is likely be enough to surpass LA, which last year processed 10.3 million containers. (Long Beach, despite having its best year on record, handled 9.6 million.)”, Bloomberg, July 17, 2025

================================================================================================

“Why olive oil is suddenly more expensive than ever – Olives were a low-stress crop for millennia, but Greece shows how climate change has made the harvest much less predictable—and growing regions more desperate. Olives have been a hardy staple for thousands of years throughout the Mediterranean because the trees thrive in dry climates. But these days olive growers in Spain, Italy and Greece—the world’s top three producers—are struggling to keep their groves from getting too dry. Bloomberg, June 30, 2025

===============================================================================================

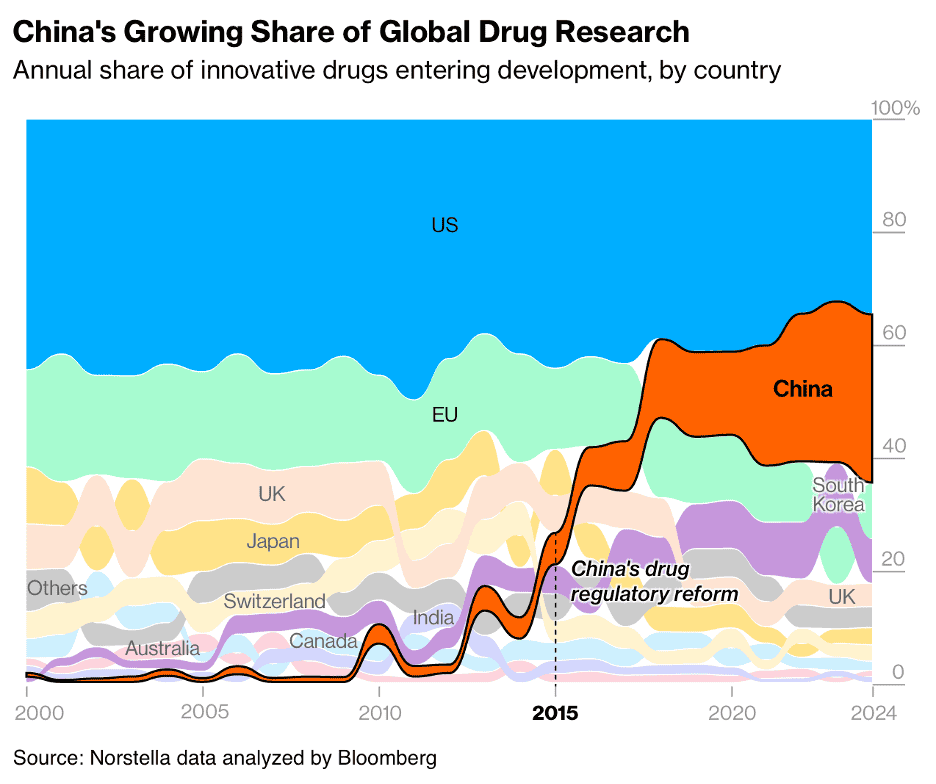

“China Biotech’s Stunning Advance Is Changing the World’s Drug Pipeline – Chinese biotech’s advance has been as ferocious as the nation’s breakthrough efforts in AI and EVs, eclipsing the EU and catching up to the US. The number of novel drugs in China — for cancer, weight-loss and more — entering into development ballooned to over 1,250 last year, far surpassing the European Union and nearly catching up to the US’s count of about 1,440, an exclusive Bloomberg News analysis showed. The world’s strictest regulatory agencies, including the US Food and Drug Administration and the European Medicines Agency, increasingly view Chinese drugs as generally promising enough to justify devoting extra resources to speed up their review, handing them coveted industry designations such as priority review, breakthrough therapy designation or fast track status.”, Bloomberg, July 13, 2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel News

“Delta moves toward eliminating set prices in favor of AI that determines how much you personally will pay for a ticket – Delta has a long-term strategy to boost its profitability by moving away from set fares and toward individualized pricing using AI. The pilot program, which uses AI for 3% of fares, has so far been “amazingly favorable,” the airline said. Privacy advocates fear this will lead to price-gouging, with one consumer advocate comparing the tactic to “hacking our brains.” Fresh off a victory lap after a better-than-expected earnings report, Delta Air Lines is leaning into AI as a way to boost its profit margins further by maximizing what individual passengers pay for fares. By the end of the year, Delta plans for 20% of its ticket prices to be individually determined using AI, president Glen Hauenstein told investors last week. Currently, about 3% of the airline’s flight prices are AI-determined, triple the portion from nine months ago.”, Fortune, July 16, 2025

==============================================================================================

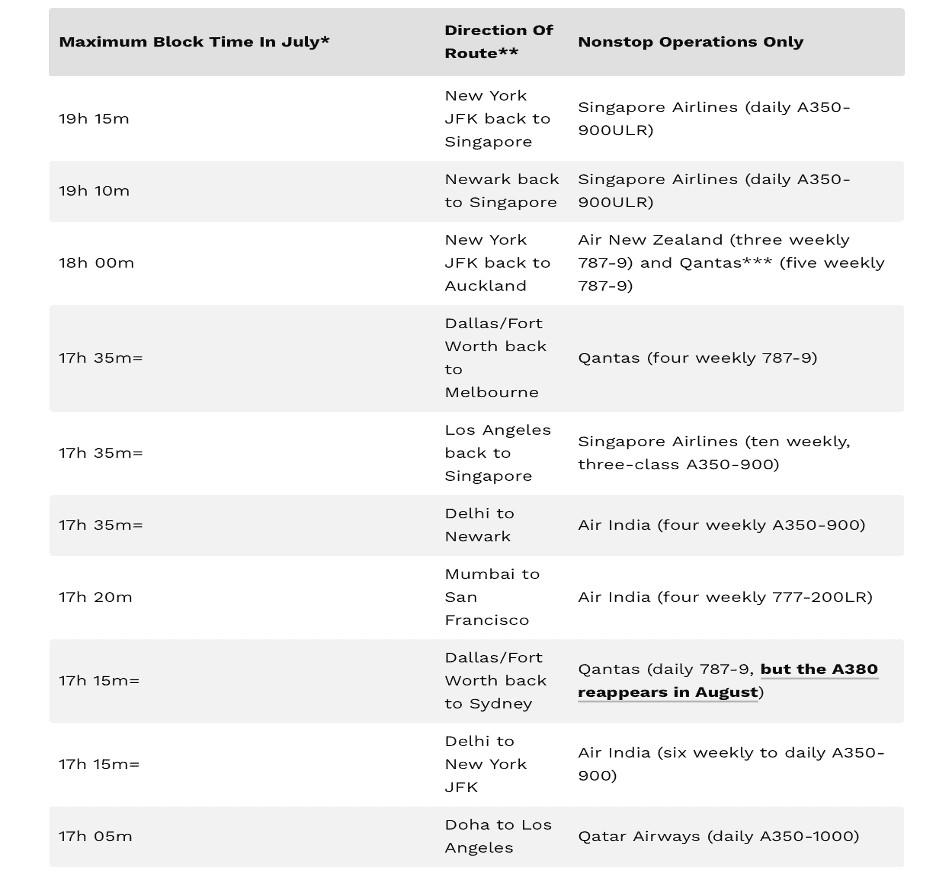

“Up To 19h 15m: The US’s 10 Longest Nonstop Flights – Some of the world’s longest nonstop flights involve the US, a handful of which are ultra-long-haul. While definitions vary, this is usually taken to mean flights that take more than 16 hours. Inevitably, some services are operated by the niche Airbus A350-900ULR and the Boeing 777-200LR. They are, of course, designed for such missions, although both types are necessarily deeply unpopular. However, other equipment, including the A350-1000 and 787-9, both famed for their long ranges and economics, are also deployed. Unsurprisingly, Singapore Airlines from New York JFK Airport (the US’s leading widebody airport) back to Singapore is number one. It is the world’s longest nonstop scheduled passenger flight. Famously, it uses the 161-seat A350-900ULR, with 67 seats in business class and 94 in premium economy. To help with appeal, comfort, fares, and yields, regular economy is unavailable on the very expensive-to-operate route.”, Simple Flying, July 15, 2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Book Review

Nexus: A Brief History of Information Networks from the Stone Age to AI by Yuval Noah Harari explores how the evolution of information-sharing systems—from cave paintings to artificial intelligence—has shaped human history, economics, and power. Harari contends that the true engine of civilization is not tools or resources, but our growing ability to collect, store, transmit, and act on information at scale. From oral traditions to writing, from the printing press to global internet platforms, each leap in information processing has transformed how societies—and businesses—function. Harari weaves historical analysis with future-facing insights, arguing that today’s AI revolution represents a fundamental shift in decision-making power, organizational design, and global coordination.

Harari’s Nexus is a timely call to rethink strategy, ethics, and innovation in the age of intelligent systems.

Five Takeaways for Global Business Leaders:

Information is infrastructure: As important as capital or labor—invest in your organization’s ability to manage and interpret data.

Adaptability trumps legacy: Every major network shift (e.g., writing, printing, AI) favors the flexible over the entrenched.

AI will redefine leadership: Delegating judgment to algorithms challenges traditional authority and requires new ethical frameworks.

Global networks are fragile and powerful: Interconnectedness enables scale—but also systemic risk.

Narratives still matter: Despite technology, human belief systems and trust networks remain vital for aligning teams and markets.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Argentina

“Moody’s Raises Argentina’s Rating On Macroeconomic Reforms – The ratings agency upped Argentina’s long-term foreign currency sovereign credit ratings and local currency issuer ratings to Caa1 from Caa3. Moody’s Ratings has upgraded Argentina’s credit ratings due to macroeconomic reforms that are stabilizing and disinflationary. Argentina’s long-term foreign currency sovereign credit ratings were raised to Caa1 from Caa3. Reforms, including reduced spending, have spurred investment, wage increases and credit availability; however, structural issues persist. The economy returned to year-over-year growth in the fourth quarter of 2024 for the first time in six quarters, Moody’s said. The ratings agency said Argentina’s weak external buffers and structural barriers to investment still prevent the country’s rating from rising beyond Caa1.”, The Wall Street Journal, July 17, 2025

===========================================================================================

China

“China’s exporters shrug off the trade war—for now – How long can they continue to do so? In the first half of the year, exports grew at the same pace as they did in 2024, helping to keep China’s gdp growth on track to meet its annual target. For now, China’s exporters appear to have shrugged off trade tensions with America. But that might not last much longer. America accounted for about 15% of China’s exports last year, but just 12% in the first half of 2025. Over that period China’s exports to South-East Asia, in particular, have risen rapidly. Shipments to Vietnam, Thailand and Indonesia increased by 20%, 22% and 15% year on year respectively.”, The Economist, July 17, 2025

===============================================================================================

“US firms say China market critical despite fraying relations other issues – Industry group president, in interview with Post, calls for talks to address issues beyond tariffs, export controls. A new survey of American companies operating in China has indicated that most of them consider the country’s market critical despite fraying bilateral relations, tariffs, economic weakness and lost market share. Nearly all respondents participating in an annual US-China Business Council survey said they cannot remain globally competitive without their business in the world’s second-largest economy, according to a report about the survey published by the advocacy group on Wednesday. This is despite the fact that a growing number of US firms report dropping sales, reputational damage and pressure on profitability in the face of growing geopolitical tensions and trade issues and stricter investment restrictions. Moreover, although leaving China is not viable for many American firms, the group said that fewer than half of survey respondents are optimistic about the future, given persistent concerns over tariffs, China’s deflation and insufficient demand and policy uncertainty. The survey covered about 130 of the group’s 270 member firms, most of which are large corporations that have been in China for over 20 years, and was conducted between March and May.”, South China Morning Post, July 17, 2025. Compliments of Paul Jones, Jones & Co., Toronto

Indonesia

“To Avoid Steeper Tariffs, Indonesia Reaches High-Stakes Trade Deal With the U.S. – Under the deal, most Indonesian exports to the United States will be subject to a 19% tariff, significantly lower than the 32% rate Trump had threatened to impose on Aug. 1. In exchange, the United States will receive what Trump called ”full and total” market access to the Indonesian economy, including exemptions from non-tariff barriers for U.S. goods. As part of the negotiated terms, Indonesia also committed to buy over $34 billion worth of U.S. imports, including $15 billion in energy purchases from firms such as ExxonMobil and Chevron, $4.5 billion in agricultural goods from suppliers such as Cargill and ADM, and a procurement agreement for 50 Boeing jets. Indonesia is the largest economy in Southeast Asia and the 15th-largest exporter to the United States.”, RANE Worldwide, July 17, 2025

===========================================================================================

New Zealand

“10 reasons New Zealand is the best country on Earth – New Zealand, Aotearoa, is back on top of the world. After being knocked off the premier spot of the podium by South Africa in 2023, the Land of the Long White Cloud has once again been voted the best country in the world by our readers. Yet while other countries have become less welcoming, more violent, too hot, or too polluted, New Zealand has simply continued to offer a safe and friendly welcome to visitors who come for its mountains, forests, geysers, wineries, city harbours, and beaches – to be thrilled, awed, relaxed, and awakened. Which is why we go on holiday, after all.”, The Telegraph, July 11, 2025

=============================================================================================

United Kingdom

“FINDING YOUR WAY – The Trade and Investment Guide to the UK – This guide is provided by the British American Business which is the leading transatlantic trade association incorporating the British-American Chamber of Commerce in the US and the American Chamber of Commerce in the UK.”, July 2025. Compliments of the British American Business Council of Orange County

===========================================================================================

United States

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The Accredited Franchise Supplier certification

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Brand & Franchise Sector News

“How Taco Bell plans to accelerate its international momentum – The brand’s global marketing plan includes some playful lessons on how to eat a taco. During its Consumer Day in New York City in March, executives shared aspirations to nearly triple Taco Bell’s international footprint by 2030 with a goal of reaching 3,000 restaurants outside of the United States. That plan includes entry into nine new countries, including France, Greece, and South Africa, as well as accelerated growth in the United Kingdom, Spain, Australia, and India. For the brand piece, the team is connecting more with local cultures through initiatives like “encore hours” in the U.K., which allows restaurants to stay open late near music venues. It is also engaging in a bit of an educational campaign that teaches consumers the right way to eat a taco — head tilt and all, or “tiltvertising,” as it’s been called.”, Nation’s Restaurant News, July 8, 2025

============================================================================================

“American pretzel franchise Auntie Anne’s set to open across Australia – American franchise pretzel brand, Auntie Anne’s, is launching its first store at Sydney’s Westfield Parramatta on July 26. The brand has been brought to Australia by business partners Yu-Jin Lee and Johann Wong, with the intention of sharing Auntie Anne’s pretzels with a brand new audience. Lee and Wong have plans to open 60 stores across Australia over the next few years. ‘Australia represents a key milestone in our international growth strategy, and Yu-Jin and Johann with their passion, vision, and commitment to quality are exactly what we look for in franchise leaders,’ said Steven Yang, senior VP of Apac at GoTo Foods International.”, Inside Retail, July 16, 2025

=============================================================================================

“Inside Scott Mezvinsky’s First 100 Days as KFC CEO – The global chicken giant has plans to modernize and accelerate while leaning on the people and culture that’s defined it for 73 years. One thing that separates KFC from other brands, he says, is it doesn’t merely have talent and capable leaders—it boasts them across the globe in 14 or 15 business units. Leading KFC demands understanding market-to-market strengths and potential, and deciphering how some countries can inform others, or which ones must be treated differently. Opening lines of communication and consistent, solid relationships with franchisees is one of those things, Mezvinsky says, critical to KFC’s success and why it’s managed to spread so fast globally. The chain opened 2,892 gross new restaurants across 97 countries in 2024, including 1,100 in Q4 alone. That number was 528 through 52 countries in Q1 2025.”, QSR Magazine, July 9, 2025

==============================================================================================

“Restaurant Franchising in the Gulf: Navigating Opportunities and Strategic Decisions – The Gulf Cooperation Council (GCC)—comprising Saudi Arabia, the UAE, Qatar, Kuwait, Bahrain, and Oman—continues to solidify its reputation as a hotspot for restaurant franchising. For U.S. brands seeking international expansion, the region offers high disposable incomes, a digitally savvy and youthful population, and a strong appetite for global and premium dining experiences. But behind the headlines lies a landscape that demands strategic planning, legal awareness, and the right local partnerships. Partnering with a single operator across multiple countries offers unified branding, centralized supply chain control, and operational efficiency, to name a few benefits.”, Franchising.com, July 11, 2025. This article is by Rebecca Viani who is partner with WhiteSpace Partners,

===============================================================================================

“The franchisor-franchisee relationship in China – In China, the Franchising Regulation and the Measures for Information Disclosure are the two major regulations governing the ongoing relationship between franchisor and franchisee. The Ministry of Commerce of the People’s Republic of China (MOFCOM) and its local counterparts are the government authorities in charge of the administration of franchise activities. From a regulatory standpoint there are some minor differences in how foreign franchisors are handled.”, Lexology, July 1, 2025

==============================================================================================

“World Gym International Signs Master Franchise Agreement for Brazil – World Gym International (WGI) has entered into a Master Franchise Agreement (MFA) with Flag Holding LTDA. Flag Holding is led by CEO Flavia Almeida, co-owner and operator of 17 World Gym locations in Goiás and the Federal District of Brasília. Since opening the first World Gym in Brasília in 2012, Almeida has established the brand, offering a large selection of strength and cardio equipment. The MFA grants Flag Holding LTDA exclusive rights to expand World Gym into Brazil’s other states.”, Franchising.com, June 26, 2025

===============================================================================================

“Planet Fitness Has Right Tools to Continue Growing – The low-cost gym giant is coming off four consecutive months of higher foot traffic despite raising its signature membership price to $15 from $10. Wall Street is positive on Planet Fitness due to increased foot traffic, despite raising membership prices. Analysts believe Planet Fitness can grow by opening locations and by leaning into its “Judgment Free Zone” mantra. Planet Fitness is attracting new gym-goers and is adding strength equipment to appeal to experienced members. As of March 31, Planet Fitness had about 20.6 million members and more than 2,700 locations. A large part of its growth story—as well as the fitness industry at large—is centered on Gen Z, which analysts say is the fastest-growing demographic of gym-goers.”, The Wall Street Journal, July 21, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive our biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing business environment. And our GlobalTeam™ on the ground covering 25+ countries provide us with updates about what is actually happening in their specific countries. We do not get involved in or report on politics!

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe, and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant since 2001 taking 40+ companies global.

| To receive this biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com +++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++ |

Our latest GlobalVue™ 40 country ranking

For a complimentary 30-minute consultation on how to take your business into new countries and make money doing it. For a complimentary call with Bill Edwards click on the QR code or contact Bill at bedwards@edwardsglobal.com and +1 949 375 1896

Biweekly Global Business Newsletter Issue 138, Tuesday, July 8, 2025

“Alone we can do so little; together we can do so much.”

Helen Keller

Welcome to the 138th edition of the Global Business Update, where we track the signals that matter for international business leaders, investors, and expansion-focused companies. As this edition goes to press on July 7th, the US has imposed new tariffs on several countries and moved the day when new deals need to be done to August 1. This edition features the newly released Q3 2025 GlobalVue™ Country Ranking, our proprietary index that evaluates the world’s top markets for international business expansion. Several countries climbed the list this quarter thanks to improved GDP outlooks, rising investor confidence, and political stabilization. Others dropped due to growing economic headwinds, policy uncertainty, or waning capital flows. We also highlight shifting executive sentiment in the face of global trade realignment. McKinsey’s latest global survey shows that trade policy uncertainty has overtaken inflation as the primary concern for business leaders, prompting many to pause or rethink international investments. In this edition you will also find:

A deep dive into Asia’s demographic epicenter—the Yuxi Circle—home to over half the world’s population

An update on AI-driven disruption, from Salesforce’s internal automation to Yum China’s operational overhaul

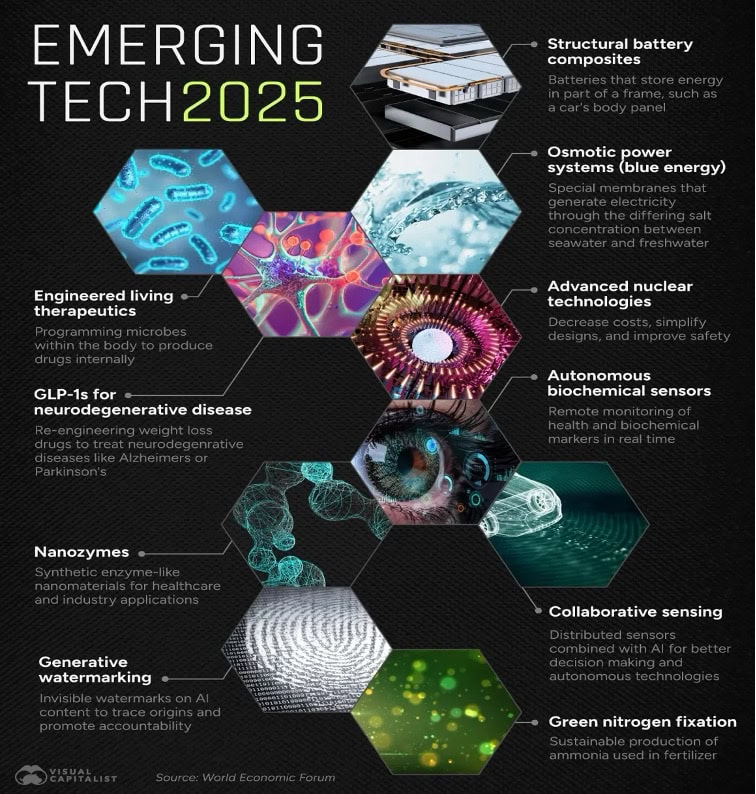

The World Economic Forum’s Top 10 Emerging Technologies of 2025, from structural battery composites to GLP-1s for neurodegenerative diseases

Geopolitical and economic shifts including NATO’s expanded defense spending targets, Canada’s first LNG exports to Asia, and Vietnam’s new U.S. trade deal

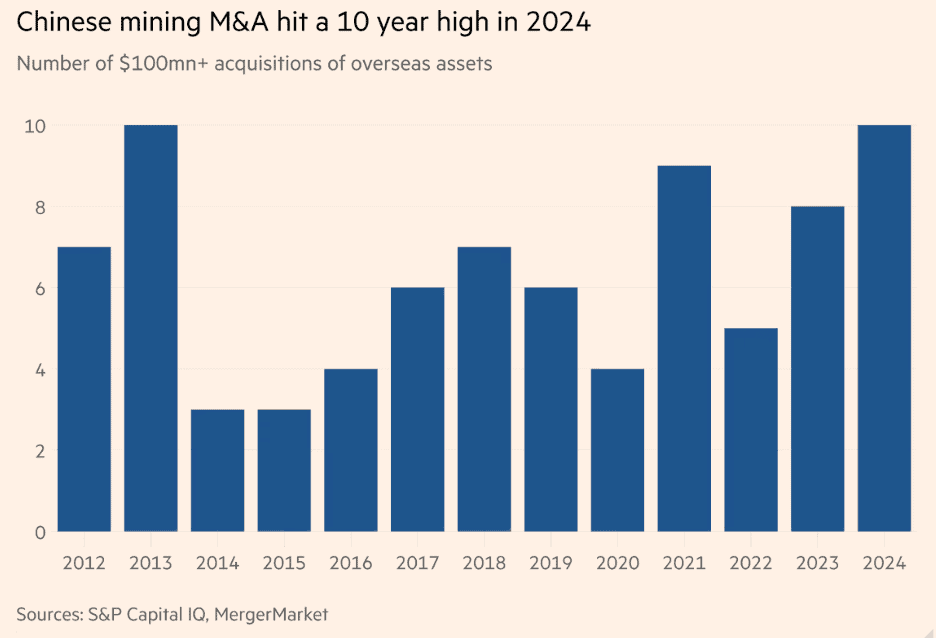

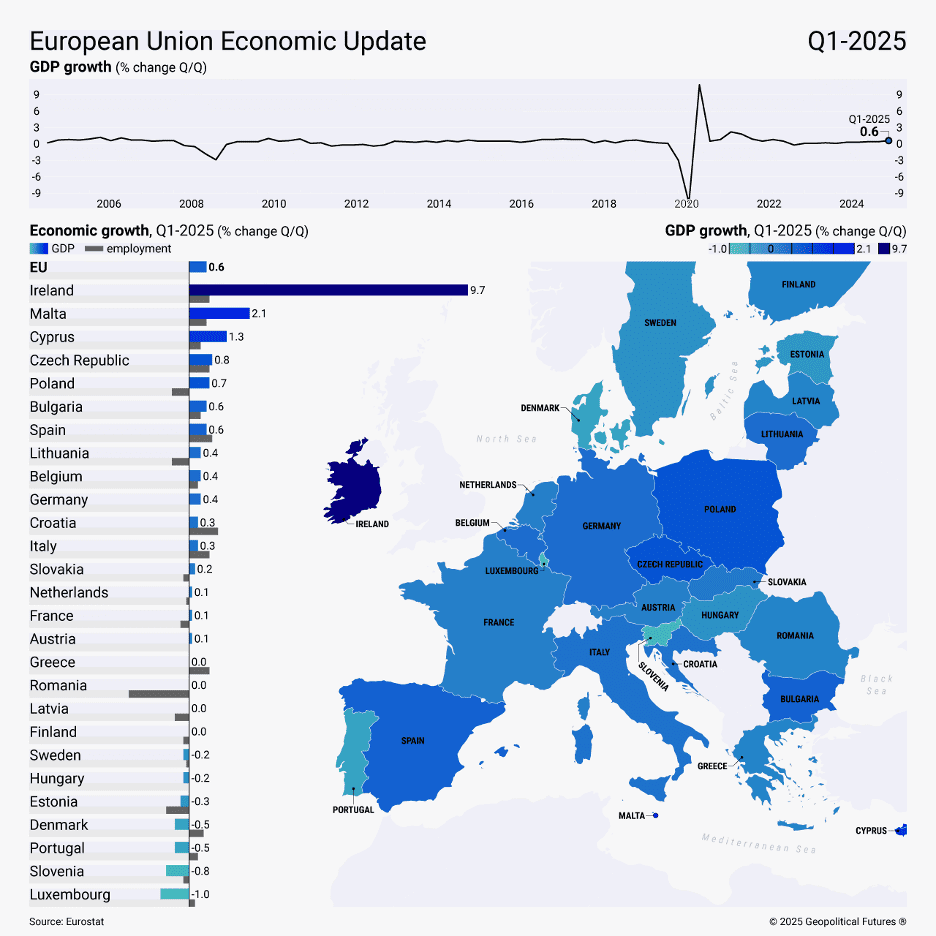

Regional snapshots on CEO confidence, Eurozone GDP growth, Chinese outbound mining deals, and the global trade/tariff reset under the Trump administration

And how YUM China embraces AI to boost efficiency and profitability.

From logistics and labor to policy and platforms, today’s cross-border challenges are more dynamic than ever.

This issue’s book is The Thinking Machine by Stephen Witt, How Nvidia, Jensen Huang, and a Bold Bet on AI Changed the Global Tech Landscape. In June 2024, Nvidia became the most valuable company in the world—a stunning milestone for a business that began in a California Denny’s three decades earlier. The Thinking Machine tells the inside story of how Nvidia transitioned from designing video game chips to powering the AI revolution—and in the process, redefined the future of computing. This is the story of the company that is inventing the future.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

But First……The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business. We do not get involved with or report on politics!

PLEASE NOTE: Some of the information sources that we provide links to in our newsletter require a paid subscription to directly access them. Clicking on a link may not give the reader access to the content.

Edited and curated by: William (Bill) Edwards, CEO & Global Business Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA. Contact Bill with questions, comments and contributions. Bedwards@edwardsglobal.com, +1 949 375 1896

Link to our current and past newsletters: https://edwardsglobal.com/geowizard/

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

First, A Few Words of Wisdom From Others For These Times

“People do business with people they know and like.”, Mary Thompson, CEO, BNI Worldwide

“Do not go where the path may lead, go instead where there is no path and leave a trail.”, Ralph Waldo Emerson

“Business opportunities are like buses, there’s always another one coming.”, Richard Branson

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Highlights in issue #138:

GlobalVue™ Country Ranking July 2025

Economic conditions outlook, June 2025

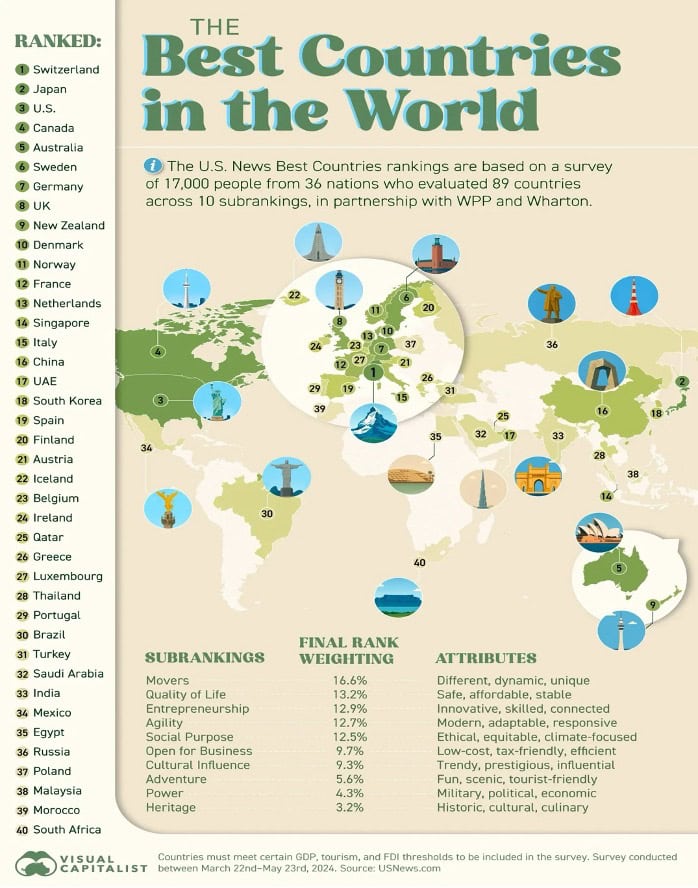

The 40 Best Countries in the World, As Determined by the People

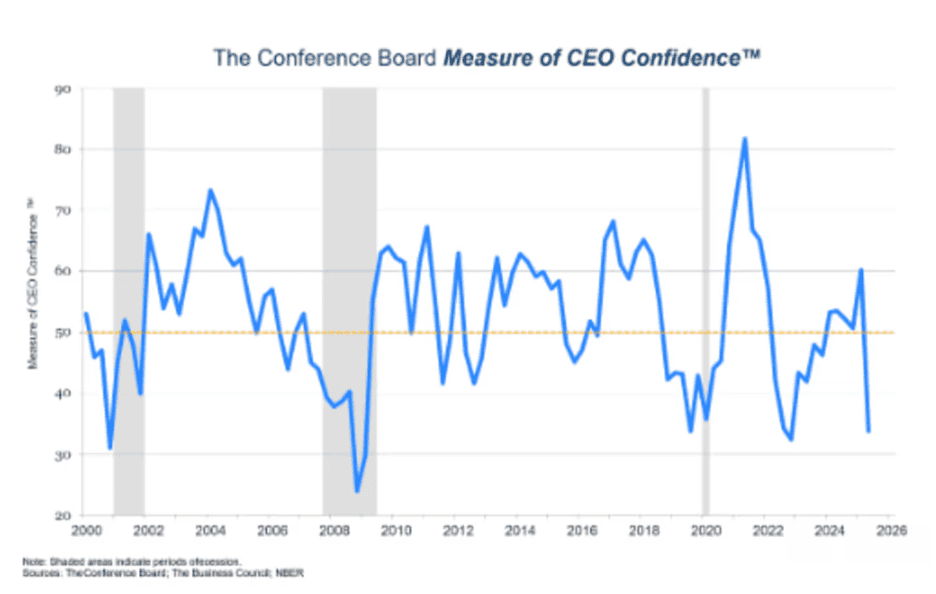

CEO confidence registers sharpest fall-off in a half-century

The Yuxi Circle: The World’s Most Densely Populated Area

Dollar Index Slumps 10.8% in Biggest First-Half Loss Since 1973

The Top 10 Emerging Technologies of 2025

Unlocking M&A Success in the Franchise Industry

Brand Global News Section: Burger King®, Firehouse Subs®, McDonald’s, Tim Hortons®, Popeyes®, and YUM China

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Please sign up for this amazing future looking August 6th event at the Beall Center for Innovation and Entrepreneurship at the University of California, Irvine at this link: www.enpinstitute.com/events

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

GlobalVue™ Country Ranking July 2025 – The latest version of the Edwards Global Services, Inc. quarterly country ranking as places to do business has just been published. Several countries moved up the ranking in the last quarter due to improved GDP growth projections for 2025, improved investor interest in new projects or changes in country political and/or economic stability. Several countries went down in the ranking for the same reasons. The GlobalVue™ ranking has been published quarterly since 2001 and is used by companies to plan and evaluate their international expansion.

==================================================================================================

“Economic conditions outlook, June 2025 – Surveyed executives increasingly point to changes to trade policy and relationships as a disruptive force they expect to affect the world economy, their countries, and their companies. The perceived risk from shifts in trade continues to grow, according to the results from our latest McKinsey Global Survey on economic conditions.1Respondents to this quarter’s survey—which was in the field at the end of May through the first week in June—cite changes in trade policy or relationships as the top disruption to growth in the world economy, in their home economies, and even for their companies. Companies have already made changes as a result. Meanwhile, respondents’ long-standing focus on inflation is fading. Respondents continue to report less positivity about the state of today’s economy, though their views on near-term economic prospects are more upbeat now than in March.”, McKinsey & Co., June 30, 2025

============================================================================================

“The 40 Best Countries in the World, As Determined by the People – Switzerland is the best country in the world according to a global survey conducted in 2024. Respondents ranked it highly for business (#2), quality of life (#3), social purpose (#7), and cultural influence (#8) U.S. News designed its “Best Countries” ranking around 73 attributes grouped into 10 thematic subrankings, such as Quality of Life, Power, Entrepreneurship, etc. The attributes reflect public perceptions, not hard data. To gather this, the survey is distributed globally to about 17,000 respondents, including business leaders, informed elites, and general citizens. Each participant is shown a random subset of countries (that must meet GDP, tourism, and FDI thresholds) and asked to rate how strongly they associate those countries with each of the 73 attributes.”, USNews.com, July 5, 2025

============================================================================================

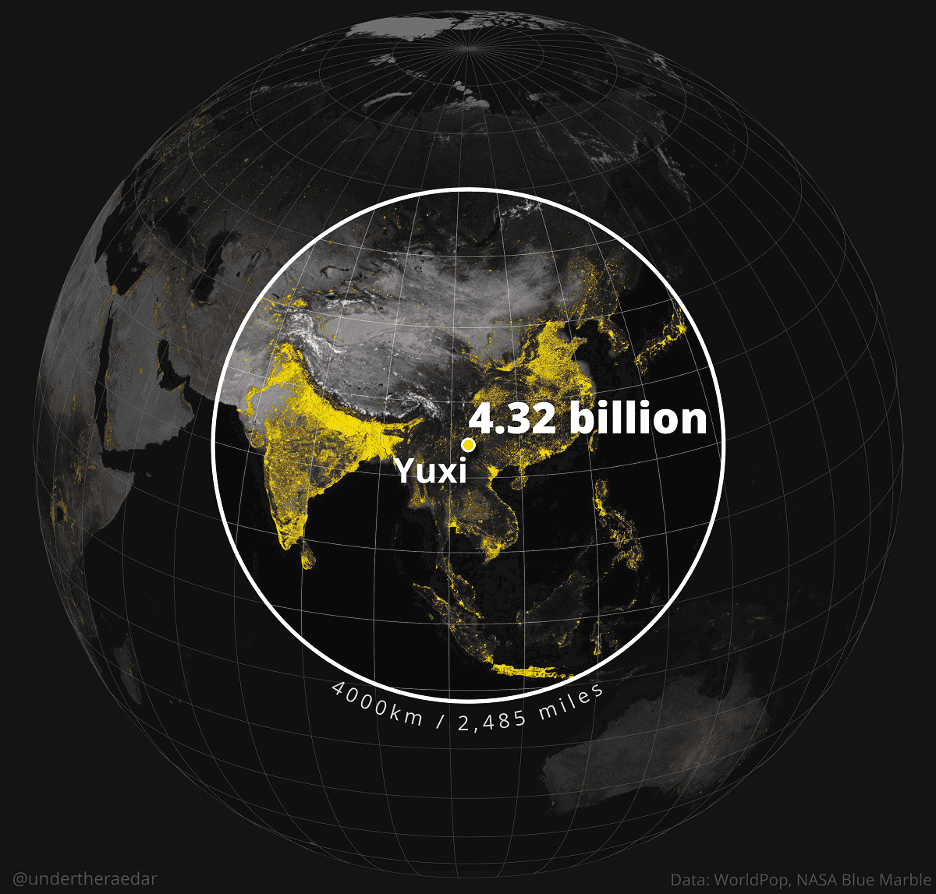

The Yuxi Circle: The World’s Most Densely Populated Area – If you wanted to capture over 55% of the global population inside a circle with a 4,000km radius, which city would you place at its epicenter? In 2013, a post appeared on Reddit marking a circular area of the globe with “more people living inside this circle than outside of it.” The circle had a radius of 4,000 km (just under 2,500 miles) and was named the Valeriepieris circle after author Ken Myers’ username. Acknowledging that the Valeriepieris circle is not actually a circle (it was drawn on a two-dimensional map rather than a globe) and is based on data that has become outdated, mapmaker Alasdair Rae went digging and discovered what he calls The Yuxi Circle, the world’s most densely populated area.”, Visual Capitalist, April 8, 2022. This was contributed by Mark Kasperowicz, Managing Partner, Digital Azimuth

============================================================================

“The Top 10 Emerging Technologies of 2025 – Now in its 13th edition, the World Economic Forum’s report on the leading innovations that stand to shape tech, health care, and industry covers a wide scope of technologies still in their nascent phase. GLP-1s for neurodegenerative diseases, for instance, have the possibility to meaningfully help patients with Alzheimers and Parkinson’s as GLP-1s have aided in weight loss therapies. Meanwhile, structural battery composites are able to store electricity in a car’s frame or a plane’s structure—in turn reducing their overall weight.”, World Economic Forum, July 3, 2025

============================================================================================

“Salesforce CEO Says 30% of Internal Work Is Being Handled by AI – Tech leaders, including those at Microsoft and Alphabet, are highlighting AI’s potential to replace human workers, with Salesforce saying its internal AI use has allowed it to hire fewer people. Salesforce is developing an AI product that can handle tasks like customer service without human supervision, which has reached 93% accuracy, including for large customers like Walt Disney Co. Executives at Microsoft Corp. and Alphabet Inc. have said that AI is producing about 30% of new computer software code on some projects.”, Bloomberg, June 26, 2025

==========================================================================================

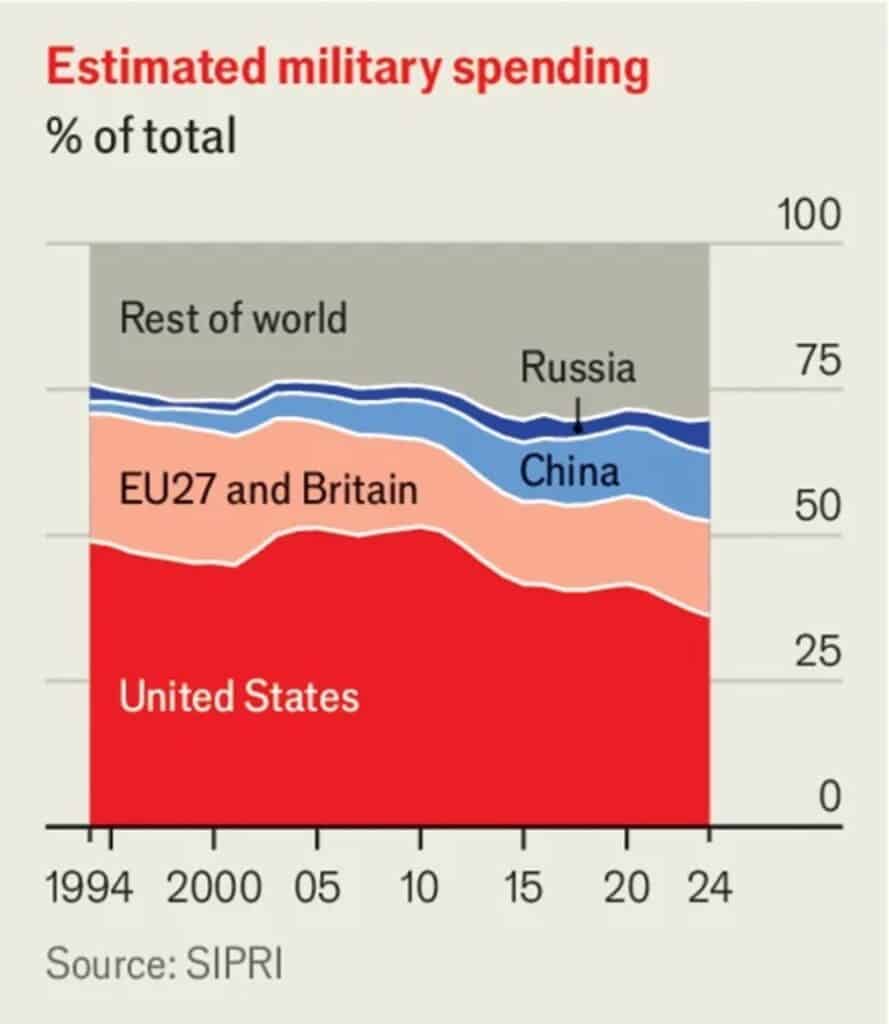

“How the defence bonanza will reshape the global economy – As they spend big, politicians must resist using one pot of money to achieve many goals. or the first time in decades, the rich world is embarking on mass rearmament. Wars in Ukraine and the Middle East, the threat of conflict over Taiwan and President Donald Trump’s impulsive approach to alliances have all made bolstering national defence an urgent priority. On June 25th members of nato agreed to raise their target for military spending to 3.5% of gdp and allocated an extra 1.5% to security-related items (Spain insisted on a loophole). If they achieve that target in 2035, they will be spending $800bn more every year, in real terms, than they did before Russia invaded Ukraine.”, The Economist, June 26, 2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation, Taxes & Trade Issues

“Donald Trump renews threat to hit trading partners with steep tariffs – White House extends deadline for ‘reciprocal’ levies from July 9 to August 1. Donald Trump has revived his threat to hit major trading partners with steep “reciprocal” tariffs even as he granted a three-week reprieve for countries to negotiate trade deals with the US. The president on Monday sent letters to Japan and South Korea, both among the US’s biggest trading counterparts, saying the country would impose 25 per cent levies beginning on August 1. South Africa would be hit with 30 per cent tariffs, Trump said, while also announcing big levies on several other countries.”, The Financial Times, July 7, 2025

============================================================================================

“The US Has More Copper Than China But No Way to Refine All of It – The industry will need to overcome high energy and labor costs, environmental regulations and a glut of cheap Chinese competition to make US copper smelting great again. The process has become almost prohibitively expensive in the US because of regulation, energy costs, labor and a glut of cheap Chinese competition. Freeport-McMoRan Inc.’s only US copper smelter—a hulking metal-processing facility at the edge of an old Arizona mining town—spits neon flames from its furnace like an industrial volcano. Freeport’s US operations cost about three times more than the company’s operations outside the country. Instead of processing copper in the US, many miners now turn abroad—where there’s more than enough capacity—to transform the raw materials they pull from the ground.”, Bloomberg, June 20, 2025

================================================================================================

“How trade tensions are really affecting the global economy – Companies are not yet rushing to relocate production to the US, but investment and dealmaking have already slowed. US tariff revenue surged almost fourfold from a year earlier to a record $24.2bn in May, while imports from China fell 43 per cent from the same month in 2024. But with policymaking so evidently at the caprice of Trump himself, it has become incredibly challenging for businesses to make long-term decisions about supply chains, according to Neil Shearing, chief economist at Capital Economics, a research company. ‘Relocating plants is an eight- to 10-year decision, but when you can’t predict what is happening next week, let alone next year or in five years, mitigation of the status quo is the likely strategy,’ he says. Now, as countries clamour to strike fresh deals with Trump before the July 9 deadline, deep unease still lingers through global boardrooms and supply chains. Many companies are resorting to holding strategies.”, The Financial Times, July 4, 2025

================================================================================================

“LNG Canada starts exports to Asia and explores pathways to expansion – A ship has left B.C. for Asia with the first load of liquefied natural gas from the new LNG Canada terminal, ushering a new era in energy exports at a time when Canada seeks to diversify markets away from the United States. The cost of building the first phase of the project has been pegged at $48.3-billion, including the $18-billion Kitimat terminal, the $14.5-billion Coastal GasLink pipeline and other infrastructure, as well as annual budgets for drilling in the North Montney region of northeastern B.C. Once the Kitimat terminal’s first phase is in full swing, there will be about 170 vessels a year transporting LNG to Asian markets.”, The Globe and Mail, June 30, 2025

=================================================================================================