EGS Biweekly Global Business Newsletter Issue 82, Tuesday, May 16, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Introduction: In this issue, Artificial Intelligence apps are impacting all aspects of business but in different ways in different countries. Airports are fuller than 2019. Inflation continues its slow decline from on high. ‘Hybrid’ workers have a better life, apparently. McDonalds® find a way to become accepted in France while Starbucks® opens in Rome.

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here:

First, A Few Words of Wisdom From Others

“It is not the strongest or the most intelligent who will survive, but those who can best manage change.”, Leon C. Megginson

“All failure is failure to adapt, all success is successful adaptation.”,

Max McKeown

“Honesty is the best policy in international relations, interpersonal relations, labor, business, education, family and crime control because truth is the only thing that works and the only foundation on which lasting relations can build.”, Ramsey Clark

Highlights in issue #82:

- Brand Global News Section: Burger King®, Carl’s Jr.® & Hardees®, Dominos®, McDonalds® and Tim Horton’s®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data and Studies

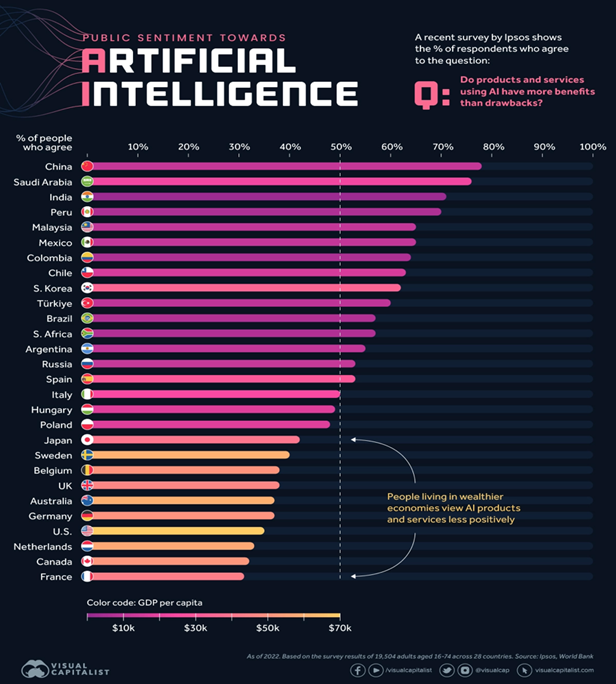

“Visualizing Global Attitudes Towards AI – Artificial intelligence (AI) is one of the fastest growing and most disruptive technologies in the world today. Because it has the potential to drastically impact society, it’s important to measure how people are feeling towards it. This infographic visualizes survey data from market research firm, Ipsos, to see how attitudes towards AI varies by country. By including each country’s GDP per capita, we can see that wealthier populations are more skeptical about products and services that use the technology. This data is based on a 28-country survey of 19,504 adults aged 18 to 74. Polling took place between November and December 2021, and the results were published in January 2022.”, Visual Capitalist, May 9, 2023

“The jobs AI won’t take yet – A March 2023 report from Goldman Sachs estimated that AI capable of content generation could do a quarter of all the work currently done by humans. Across the European Union and US, the report further notes, 300 million jobs could be lost to automation. Thankfully, it’s not all bad news. The experts issue their warnings with a caveat: there are still things AI isn’t capable of – tasks that involve distinctly human qualities, like emotional intelligence and outside-the-box thinking. And moving into roles that centre those skills could help lessen the chances of being replaced.”, BBC New, May 8, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

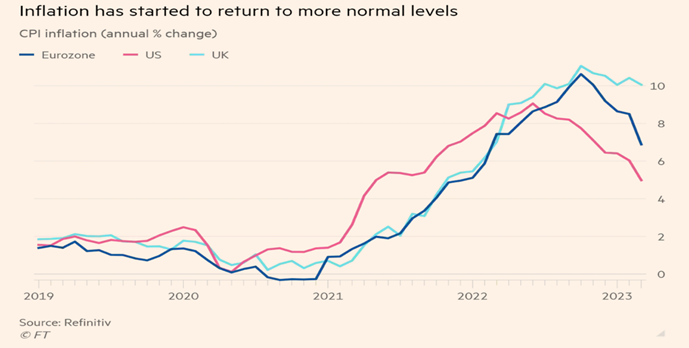

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

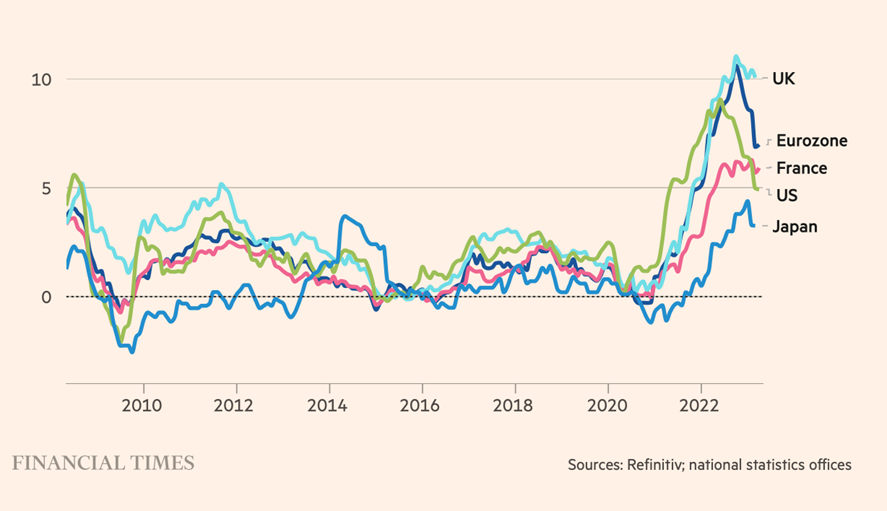

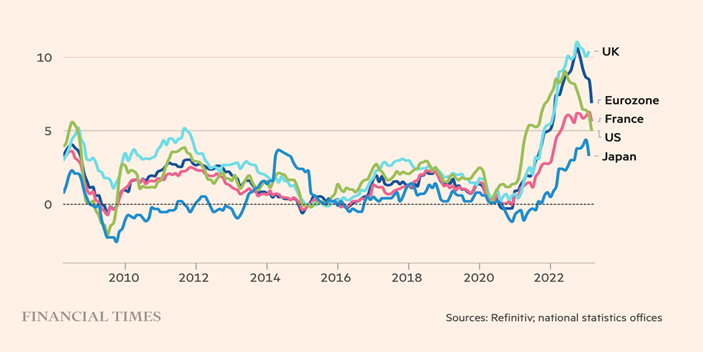

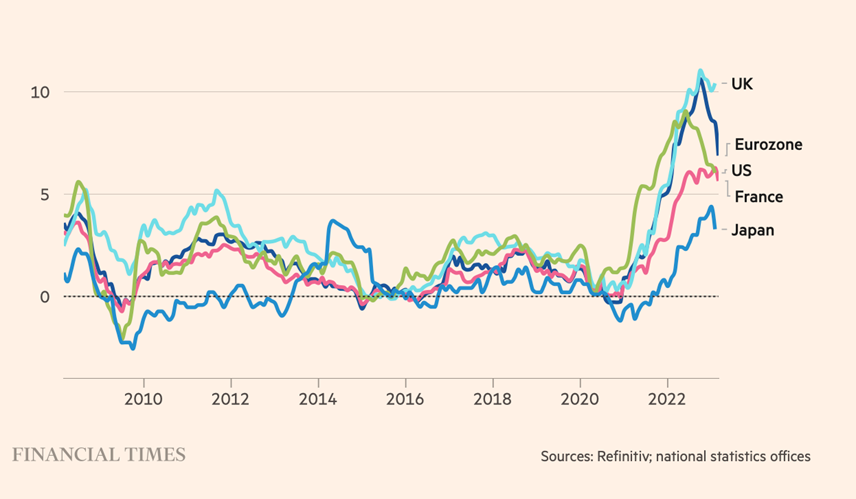

“Global inflation tracker – Inflation has started to show signs of easing from the multi-decade highs reached in many countries following Russia’s full-scale invasion of Ukraine. The latest figures for most of the world’s largest economies still make for worrying reading, with price pressures remaining high as the war in Ukraine continues to keep energy and food prices elevated. But in some countries pressures have eased and energy and food wholesale prices have declined. Economist and investors also expect inflationary levels to stabilise in the next few years.”, The Financial Times, May 10, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel Updates

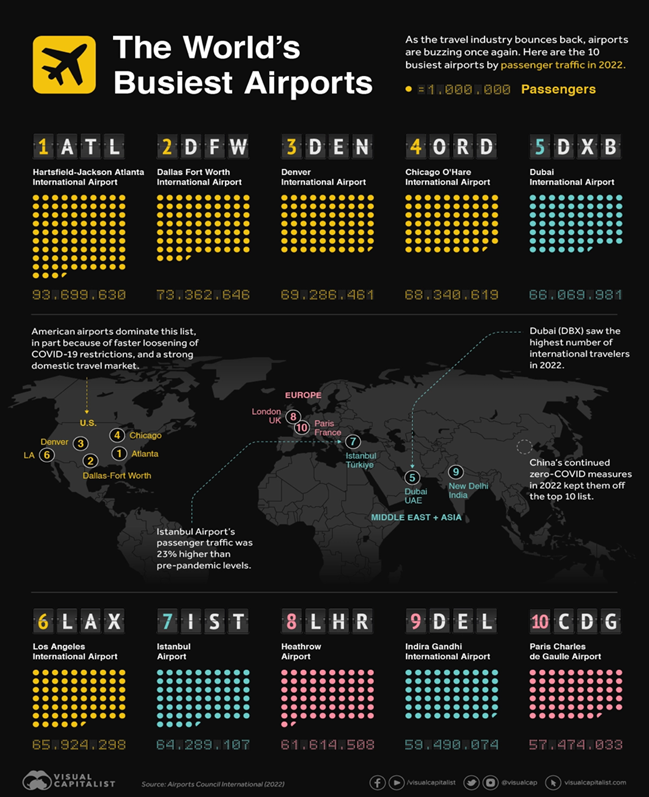

“The World’s Busiest Airports, by Passenger Count – The infographic above uses data from Airports Council International (ACI) to rank the top 10 busiest airports in the world, looking at total passengers enplaned and deplaned, with passengers in transit counted once. In 2022, worldwide passenger traffic came near to 7 billion, an increase of almost 54% from 2021, and a 74% recovery from pre-pandemic levels.”, Visual Capitalist, May 8, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Canada

“Hybrid workers are eating healthier, sleeping and exercising more, survey finds – A recent report by IWG, a global operator of flexible workspaces, found these workers eat healthier, exercise more and drink less alcohol, too. The company’s survey of 2,000 workers in Canada shows: More than 70 per cent of hybrid workers now cook and eat healthier meals; Workers enjoy an extra 73 hours of sleep a year; Exercise over 40 minutes per week longer compared to before the pandemic; More than a quarter (27 per cent) said they have decreased their alcohol consumption. Overall, 82 per cent of respondents believe hybrid working has improved their quality of life and 66 per cent reported improved mental health and well-being.” The Globe and Mail, May 14, 2023

China

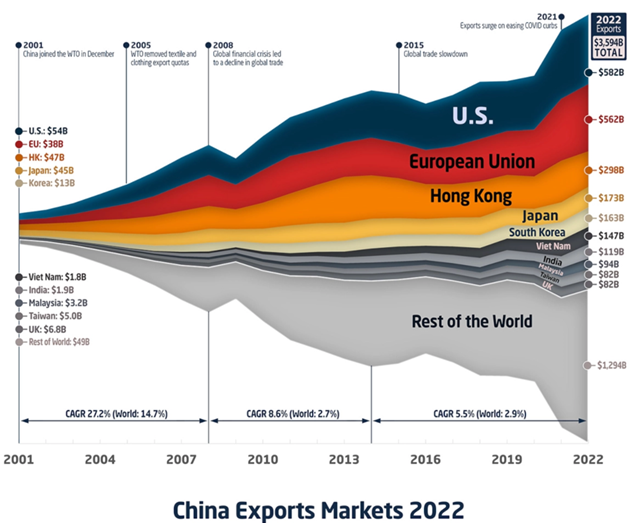

“Charting and Mapping China’s Exports Since 2001 – In 2001, when China joined the World Trade Organization, the value of its merchandise exports stood at $266 billion. Over the next seven years, the country’s exports grew uninterrupted until the 2008 financial crisis caused a sharp decline in global trade. This cycle would repeat again with consecutive growth until 2015 (another global trade slowdown), followed by slowed growth until 2020 (the onset of the COVID-19 pandemic). But merchandise exports skyrocketed by 30% in 2021, and by the end of 2022 had grown to an estimated $3.6 trillion per year. That means China’s exports alone are bigger than the entire economies of countries like the UK, India, and France.”, Visual Capitalist, May 2, 2023

“China’s data-security laws rattle Western business executives – Authorities go after foreign companies for hazily defined data transgressions. Chinese firms that sell information about the Chinese economy and companies are being forced by their domestic overseers to curtail their operations abroad. Firms supplying Chinese corporate records, such as Qichacha, are no longer permitted to do so outside China. To the dismay of academics around the world, cnki, a digital subscription platform for Chinese research papers, suddenly became inaccessible to accounts outside the country in March. In just the past few months many of the links that have helped the world understand China have been severed.”, The Economist, May 4, 2023

Greece

“Once Europe’s Headache, Greece Finds Its Feet – Ahead of elections, doubts on country’s euro membership have gone away. Greece’s economy nearly broke the euro last decade. Now it is one of the fastest-growing in Europe’s common-currency zone. Nobody frets about Grexit any more in Greece’s once-again bustling capital city. In streets that were previously blighted by closed storefronts, locals complain about rising rents and the spread of Airbnb apartments.”, The Wall Street Journal, May 13, 2023

India

“Slowest India Inflation in 18 Months Boosts Rate Hold Calls – Consumer prices rose 4.70% in April versus 4.76% estimate within target band will give RBI room to support growth. A third straight month of cooling prices brings the marker closer to the mid-point of the Reserve Bank of India’s 2%-6% target.”, Bloomberg, May 11, 2023

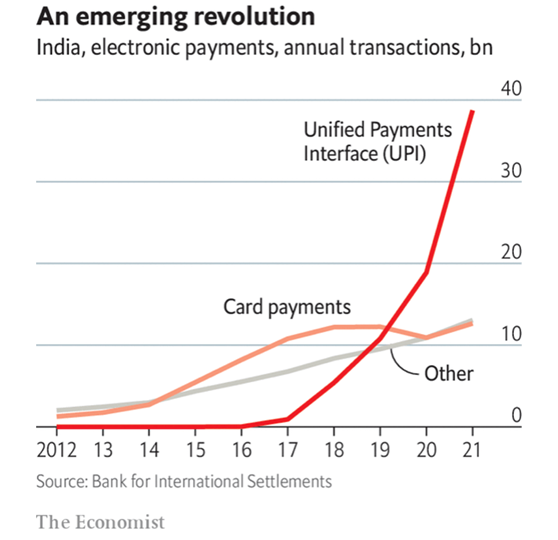

“A digital payments revolution in India – How emerging economies from India to Brazil built alternative payments models. The Unified Payments Interface (upi) is a platform that allows free and fast account-to-account transfers using fintech apps such as PhonePe or Google Pay. Unlike AliPay in China, it is open, so users are not locked into a single company and can take their financial history to competitors, notes Praveena Rai, the chief operating officer of the National Payments Corporation of India (npci), which manages the platform. And it is facilitated by qr codes or easy-to-remember virtual ids.”, The Economist, May 15, 2023

Indonesia

“Indonesia emerges as world’s second-largest cobalt producer – Fast-growing supply depresses prices but raises fears about China’s control of market. The south-east Asian country generated 9,500 tonnes of cobalt last year — 5 per cent of the global supply — up from minimal volumes before 2021, according to an annual market report by the Cobalt Institute, an industry group. That means it has overtaken established producers Australia and the Philippines.” , The Financial Times, May 9, 2023

Italy

“Starbucks moves into central Rome as Italy surrenders to Frappuccino – Starbucks has advanced its stealthy conquest of Italy by opening its first café in central Rome, close to the city’s parliament, allowing Italian MPs the chance to pop out for a frappuccino during recess. Long considered off limits by the Seattle coffee giant, Italy is fast surrendering to the company’s large pots of milky, frothy, fruit-flavoured coffee, with 25 stores now open and more to come. ‘Italy is not easy, but people are appreciating the coffee,’ said Vincenzo Catrambone, the chain’s Italy general manager.”, The Times Of London, May 11, 2023

The Philippines

“Cooling Philippine Inflation Boosts Odds of Rate Pause – Month-on-month consumer price index fell 0.2%, same as March Central bank says risks to CPI outlook ‘tilted heavily’ upside. Philippines’ overall inflation cooled for a third straight month in April from a year ago and was below all analysts estimates, supporting the case for a pause in monetary policy tightening.”, Bloomberg, May 4, 2023

United Kingdom

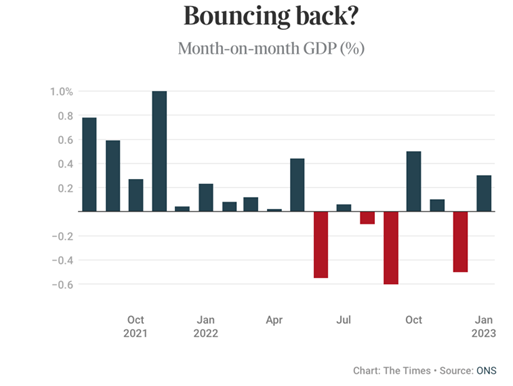

“Bank of England boosts forecasts for UK growth – The upgrade is the largest in the monetary policy committee’s 26-year history and contrasts with dire warnings last autumn that the UK was heading for the longest recession in half a century. The outlook has shifted so much because global wholesale gas prices have fallen below their levels before the Ukraine war and household spending has been boosted by government support measures. Unemployment also remains low. The Bank warned inflation would fall more slowly than previously projected, dropping to 5 per cent at the end of 2023, compared with February estimates of 3.9 per cent.”, The Times of London, May 12, 2023

“Mortgage lenders offer 100% loans for first time since 2008 – This will be the first 100 per cent mortgage available since the last financial crisis. The deal will be fixed for over two years to guard against the risk of borrowers ending up in negative equity. Some banks, including Barclays, Lloyds and some smaller building societies, are willing to lend up to 100 per cent of a property’s value but only if the borrower’s family put down a deposit of up to 20 per cent.”, The Times of London, May 8, 2023

United States

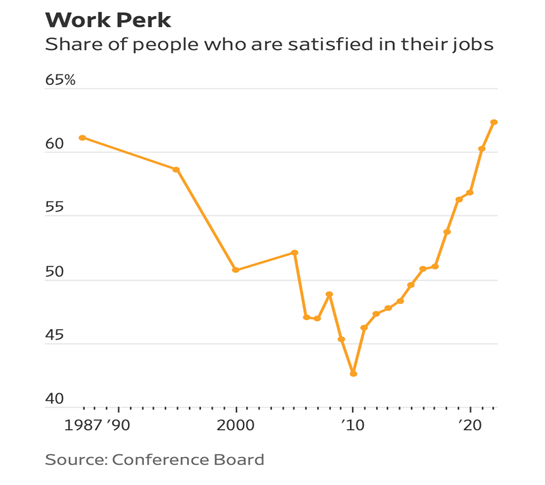

“(U.S) Workers Are Happier Than They’ve Been in Decades – Labor shortages and shifting expectations lead to improvement for millions, survey shows. Job satisfaction hit a 36-year high in 2022, reflecting two effects of the tight pandemic labor market: The quality of jobs improved as wages and work flexibility increased, and workers moved into positions that were a better fit. Last year, 62.3% of U.S. workers said they were satisfied with their jobs, according to new data from the Conference Board, up from 60.2% in 2021 and 56.8% in 2020. The business-research organization polled workers on 26 aspects of work, and found that people were most content with their commutes, their co-workers, the physical environment of their workplace and job security.”, The Wall Street Journal, May 11, 2023

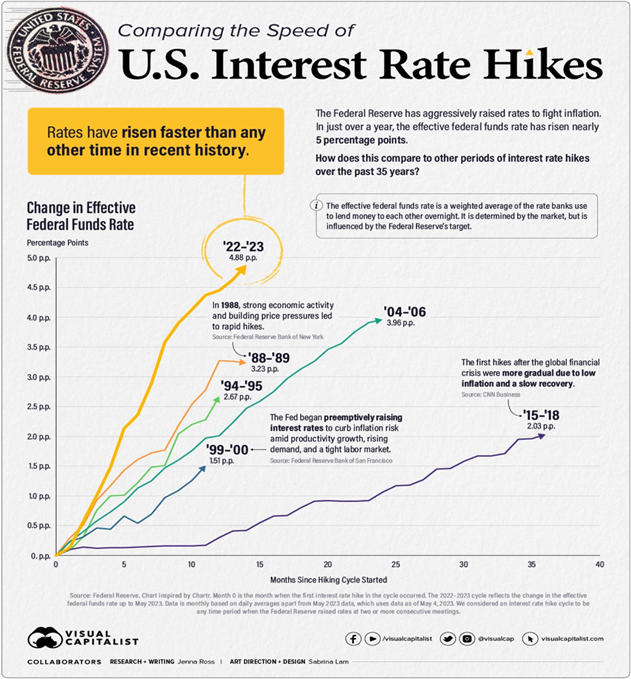

“Comparing the Speed of Interest Rate Hikes (1988-2023) – After the latest rate hike on May 3rd, U.S. interest rates have reached levels not seen since 2007. The Federal Reserve has been aggressive with its interest rate hikes as it tries to combat sticky inflation. In fact, rates have risen nearly five percentage points (p.p.) in just 14 months. In this graphic— inspired by a chart from Chartr —we compare both the speed and severity of current interest rate hikes to other periods of monetary tightening over the past 35 years.”, Visual Capitalist, May 7, 2023

“SBA Research Sheds New Light on Small Business Exporters – The U.S. Small Business Administration (SBA) released new findings from a commissioned study on the Total Addressable Market (TAM) of small business exporters in America. Among the key findings from the study is new data, based on recent business surveys, that places the number of exporting small businesses at 1.3 million – an almost fivefold increase over the estimates previously published by the federal government. Furthermore, the research places the potential market size, or total addressable market, at over 2.6 million small businesses, representing 42 percent of all small employer businesses.”, U.S. SBA press release, March 14, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“This Fast-Food Chain (Burger KING®) Is Shutting Down Up to 400 Restaurants – The affected restaurants will close by the end of 2023. By the end of 2023, Burger King will shut down hundreds of its nearly 7,000 restaurants across the country. Up to 400 Burger King locations will close by the end of 2023, in addition to 124 locations that have shut down this year already.”, Taste Of Home, May 11, 2023

“Carl’s Jr. and Hardee’s to roll out A.I. drive-thru ordering nationwide – CKE Restaurants, the parent of Carl’s Jr. and Hardee’s, has partnered with Presto and OpenCity, which both have the ability to launch at the company’s locations nationwide. Presto Voice is already used at Del Taco and Checkers & Rally’s restaurants, while OpenCity’s Tori has been used by a Popeyes franchisee. Additionally, Valyant AI has a deal with CKE to use its voice-ordering tech at 32 locations, with the ability to expand to another 21 restaurants in the coming months.”, CNBC, May 4, 2023

“Domino’s Pizza eyes 420 more stores in China after Hong Kong IPO – DPC Dash entered the cities of Qingdao, Changzhou, and Wenzhou last Saturday, taking the store count to 638 as of April 30. ‘The recent listing was a great achievement for DPC Dash as well as for our global franchisor, Domino’s Pizza,’ said Frank Paul Krasovec, director and chairman at DPC Dash. ‘With the newly raised proceeds, we aim to aggressively expand across the greater China region and to bring our comprehensive product offerings to hundreds of millions of potential Chinese consumers.’”, Inside Retail Asia, May 5, 2023

“Tim Hortons to enter South Korea this year – Canadian coffee chain Tim Hortons is set to expand into South Korea this year through a master franchise agreement with local quick-service restaurant firm BKR. ‘South Korea is one of the world’s largest and fastest-growing coffee markets,’ said David Shear, president international of Restaurant Brands International. According to the Korea Agro-Fisheries & Food Trade Corporation, the number of coffee shops in the country reached its peak last year with about 99,000 stores, increasing 17.4 per cent year on year.”, Inside Retail, May 11, 2023. Compliments of Paul Jones, Jones & Co., Toronto

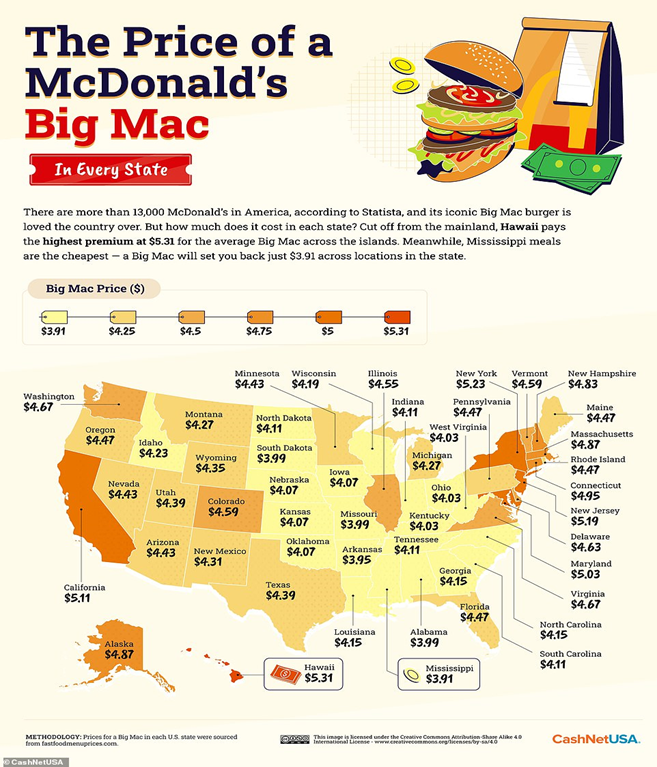

“The Genius Way McDonald’s Held Its Own In France – One of McDonald’s’ earliest targets, however, was also one of its trickiest: France. Unsurprisingly, one of the culinary capitals of the world took some convincing to get on board with McDonald’s hegemony. Shockingly, though, it’s now quite popular there, all because McDonald’s eventually embraced French culture. McDonald’s didn’t have success in France until the turn of the millennium, when executives decided to really lean into McDonald’s becoming French.”, The Daily Meal, May 10, 2023

“NZ attractive to international franchise brands – The latest quarterly GlobalVue™ chart from Edwards Global Services (EGS) once again ranks New Zealand in the top 10 countries in the world for franchises to consider when expanding internationally. In fact, New Zealand comes in equal third, just behind the USA and the United Kingdom, and on a par with Spain, the United Arab Emirates, Canada and Israel, and marginally ahead of Australia, France and Saudi Arabia. The long-running ranking chart from the US franchise consultants is significant because it reflects conditions in 40 countries on an international basis, regardless of short-term media stories.”, Franchise New Zealand, May 9, 2023. Compliments of Simon Lord, Publisher, Franchise New Zealand, Auckland

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

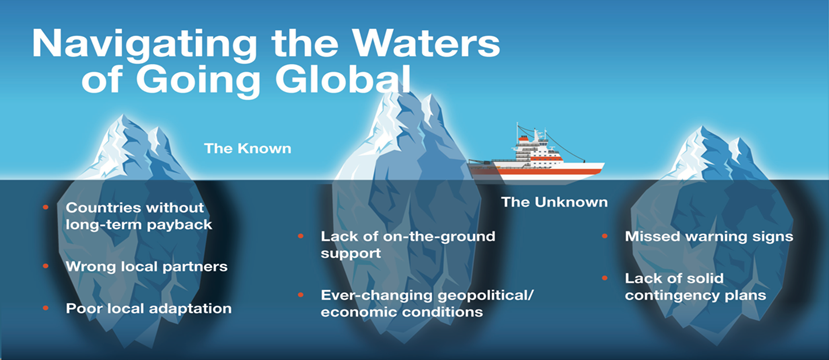

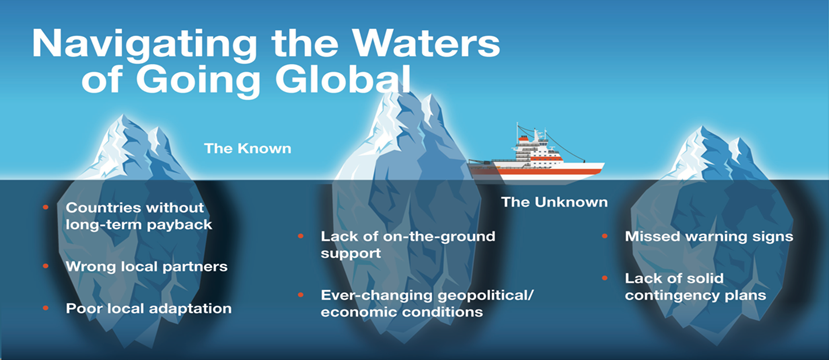

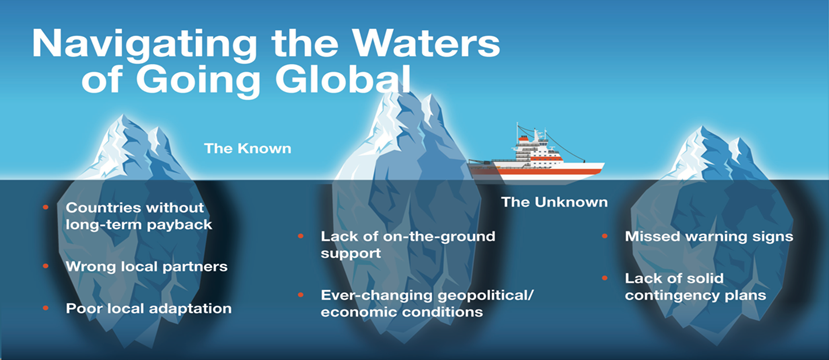

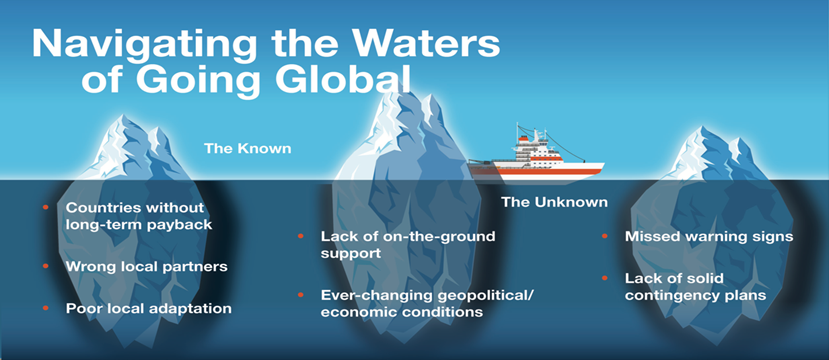

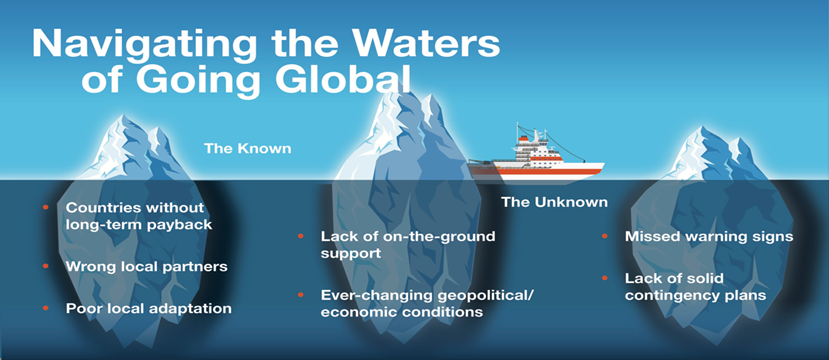

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global.

With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant taking 40 franchisors global.

For a complimentary 30 minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 81, Tuesday, May 2, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Introduction: In this issue, inflation continues to fall for most developed economies. AI may give as many jobs as it takes away….over time. The numbers for China seem mixed. European consumer trends report. Some developing countries try to move away from the US$. And we track the interesting growth of gold production over 200 years.

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here:

First, A Few Words of Wisdom From Others

“To be successful, you must act big, think big and talk big.”, Aristotle Onassis

“Whenever you see a successful business, someone once made a courageous decision.”, Peter F. Drucker

The secret of getting ahead is getting started.”, Mark Twain

Highlights in issue #81:

- Brand Global News Section: Anytime Fitness®, Johnny Rockets, McDonalds®, Popeyes®, Shake Shack® and Subway®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data and Studies

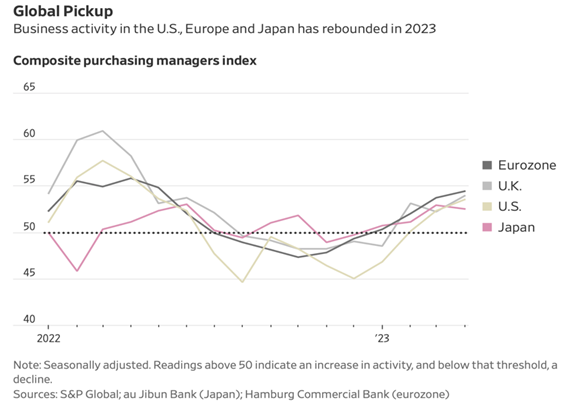

“Global Economy Gets Boost but Inflation Worries Linger – U.S., European business activity accelerated in April, but price pressures picked up as central banks consider additional interest-rate increases. U.S. and European business activity rose in April at the fastest pace in about a year, a boost for the global economy but a potentially complicating factor for central banks working to reduce high inflation. Demand for services drove the growth, according to surveys by data firm S&P Global covering U.S., eurozone and U.K. businesses. That kept pressure on price increases in regions where inflation last year reached its highest level in decades.”, Wall Street Journal, April 21, 2023

“What is generative AI? Generative artificial intelligence (AI) describes algorithms (such as ChatGPT) that can be used to create new content, including audio, code, images, text, simulations, and videos. Recent breakthroughs in the field have the potential to drastically change the way we approach content creation. While many have reacted to ChatGPT (and AI and machine learning more broadly) with fear, machine learning clearly has the potential for good.”, McKinsey, January 19, 2023

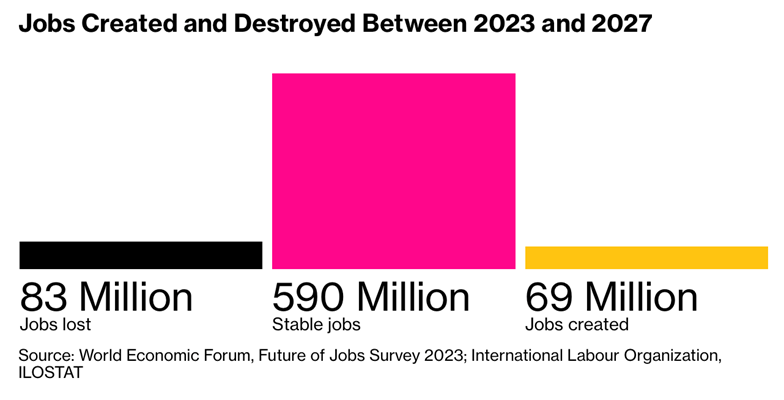

“Tech, AI Driving Job Changes for Nearly a Quarter of All Workers – Technology may eliminate 26 million jobs over next five years. Green transition will provide opportunities for job creation. Over the next five years, nearly a quarter of all jobs will change as a result of AI, digitization and other economic developments like the green energy transition and supply chain re-shoring, according to a report published by the World Economic Forum in Geneva on Monday. While the study expects AI to result in “significant labor-market disruption,” the net impact of most technologies will be positive over the next five years as big data analytics, management technologies and cybersecurity become the biggest drivers of employment growth.”, Bloomberg, April 30, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

“The ECB’s inflation dilemma: can Lagarde silence her critics again? – The Financial Times has spoken to a dozen current and former members of the ECB’s rate-setting governing council in the past few weeks as well as several economists, financiers and analysts who follow the central bank closely. Most of them praise Lagarde for rebuilding unity among ECB monetary policymakers and preventing recent economic shocks from spiralling into a financial crisis. But critics complain she lacks economic expertise, was late to react to soaring inflation and should communicate more clearly.”, The Financial Times, April 30, 2023

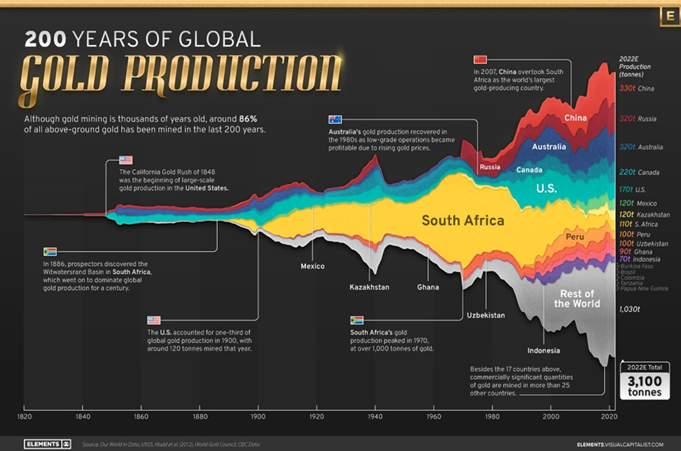

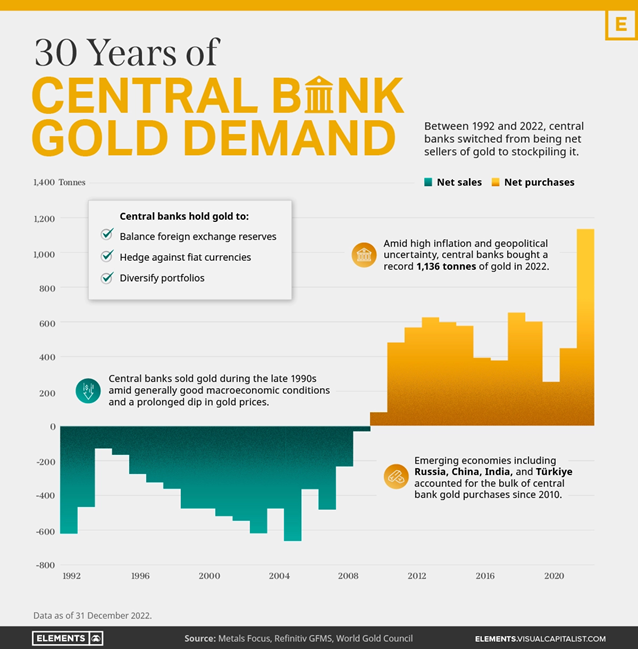

“Visualizing Global Gold Production Over 200 Years – Although the practice of gold mining has been around for thousands of years, it’s estimated that roughly 86% of all above-ground gold was extracted in the last 200 years. With modern mining techniques making large-scale production possible, global gold production has grown exponentially since the 1800s. The above infographic uses data from Our World in Data to visualize global gold production by country from 1820 to 2022, showing how gold mining has evolved to become increasingly global over time.”, Visual Capitalist / Our World In Data, April 26, 2023

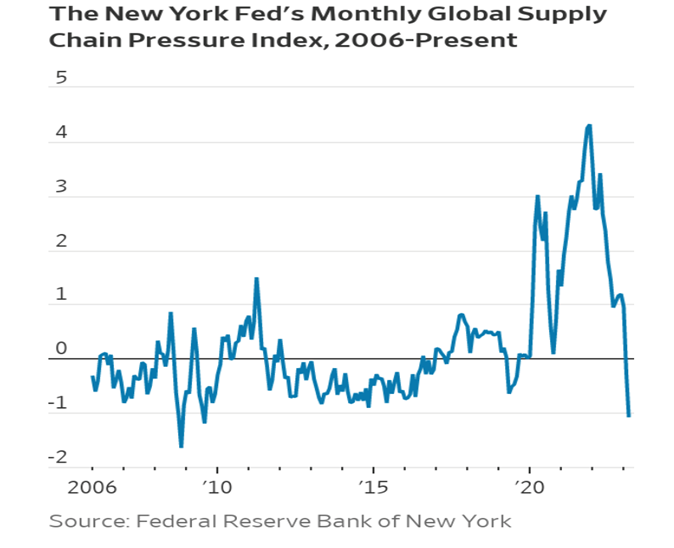

“Here’s How Supply Chains Are Being Reshaped for a New Era of Global Trade –

Nearshoring. Automation. Supplier diversification. Sustainability. Companies are adapting their operations to changing market pressures and geopolitics. When a measure of strains on global supply chains fell earlier this year to levels last seen before the Covid-19 pandemic, it signaled to some that the product shortages, port bottlenecks and shipping disruptions of the past three years were over and that a new era of stability was on the horizon.”, The Wall Street Journal, April 24, 2023

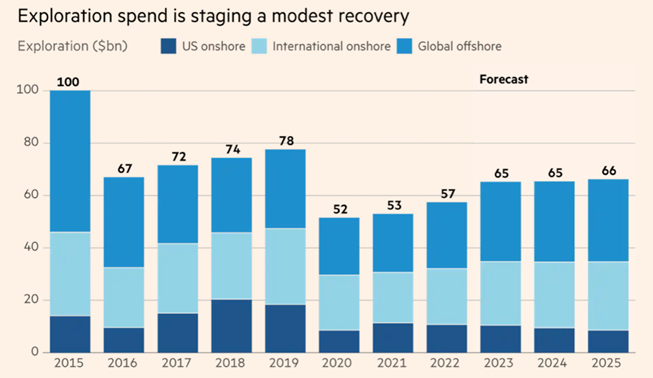

“Oil exploration: modest revival leaves majors ahead by a whisker – Total spend on exploration is set to rise to $65bn in 2023, from $57.5bn last year. It takes a brave oil and gas major to wager on wildcat wells, as risky drilling is termed. Most have taken an axe to budgets, believing the energy transition will stem demand for fossil fuels. Now there are inklings of excitement in exploration. That is good news for the likes of Shell, TotalEnergies and drilling services groups. But investors yearning for the return of roustabout rock ‘n’ roll in London stocks will be disappointed.”, The Financial Times, April 24, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel Updates

“American Airlines Sees Topping Profit Forecast as Global Demand Grows – Airline is boosting capacity for international flights. Ease of Covid restrictions is boon for overseas travel. The company, like its largest rivals, is seeing a rebound in flights outside the US after travelers pulled back on those trips last year when many Covid-related restrictions were still in place. The airline is devoting 80% of its capacity growth this quarter to long-haul international routes.”, Bloomberg, April 27, 2023

“These Airlines Are Using AI to Make Long-haul Flights More Efficient – The goal is to cut down on delays and cancellations. Airlines like Air New Zealand and Qantas are using AI-powered software to determine fuel-efficient routes in efforts to prevent having to stop to refuel, Bloomberg reported. (The former launched a 17.5-hour flight from New York City to Auckland, New Zealand. The latter plans to launch the longest flights in the world between Sydney to New York and London with its Project Sunrise.) The software, which is designed to get better the more it’s used, warns pilots about bad weather, helps them catch a tailwind, and more.”, Travel & Leisure magazine, April 24, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Canada

“Small businesses expect to grow in next 6 months despite economic challenges – 62% of small and medium-sized businesses anticipate growth. Business leaders of Canadian small and medium-sized companies are optimistic about the future, with 62 per cent expecting to grow in the next six months, according to a new report by Zoho Corp. More specifically, 38.2 per cent expect growth of one to 10 per cent, 15.4 per cent estimate growth of 10 to 20 per cent and 8.5 per cent forecast growth of above 20 per cent, the Zoho Canada SMB Outlook Report, which surveyed 1,016 Canadian business leaders in March, showed. However, 31.2 per cent are expecting zero growth and only 7.8 per cent are expecting declines.”, The Financial Post, April 21, 2023

China

“US firms’ confidence in China’s economy is rising, but so are fears over bilateral tensions – AmCham China poll finds a sharp increase in negative sentiment regarding the impact of souring relations between the world’s two largest economies. However, more business executives are visiting China, and more foreigners say they would consider moving to China. A total of 59 per cent of 109 respondents had a positive outlook on China’s economic recovery in AmCham’s latest “flash survey” conducted from April 18-20, marking a significant increase from 33 per cent in the previous survey results released in March after 319 respondents were polled in October, November and February. Yet, pessimistic views on bilateral relations have worsened, rising across the two surveys from 73 per cent to 87 per cent.”, South China Morning Post, April 26, 2023. Compliments of Paul Jones, Jones & Co., Toronto

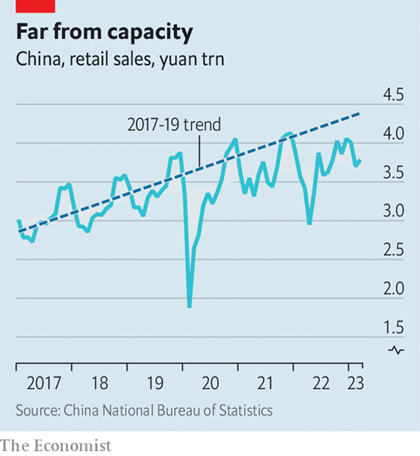

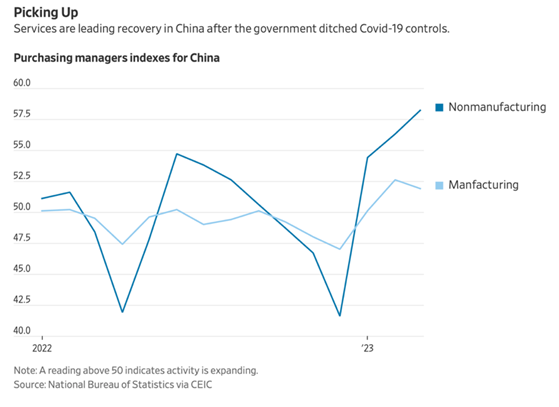

“If China’s growth is so strong, why is inflation so weak? This newspaper described China’s reopening as the biggest economic event of the year. So why has it had such a small effect on prices? Some suspect the recovery is weaker than the official statistics portray. Analysts at China Beige Book, which relies on independent surveys to track the country’s economy, told clients they were “snickering” at official figures showing that retail sales surged by 10.6% in March compared with the previous year.”, The Economist, April 27, 2023

Eurozone

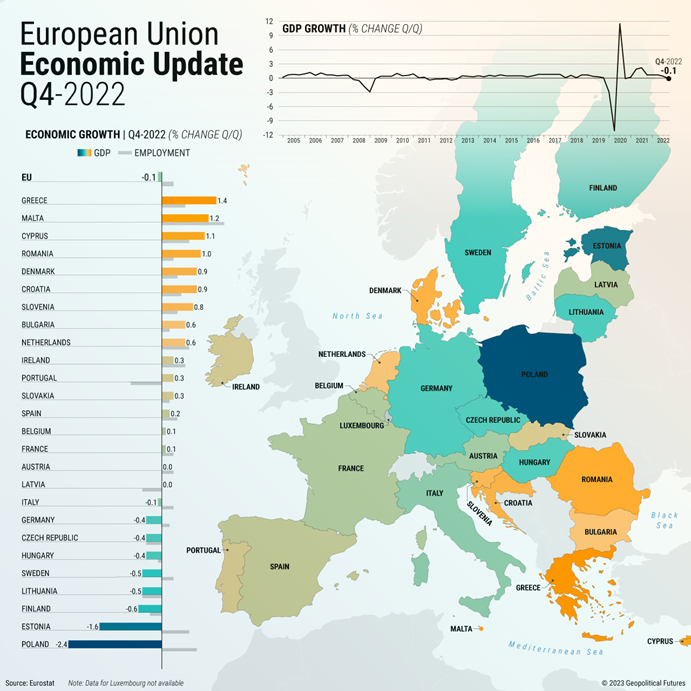

“Eurozone returns to weak growth in first quarter – GDP fails to hit expectations as German stagnation weighs on outlook. The eurozone economy returned to growth in the first three months of the year as output expanded by 0.1 per cent. But the figure undershot economists’ expectations of stronger growth as stagnation in Germany, the region’s largest economy, offset expansions elsewhere in the bloc. The eurozone’s economy is now 1.3 per cent larger than in the first quarter of 2022. That compares with US growth of 1.6 per cent over the same period and a 4.5 per cent expansion of the Chinese economy in the same period.”, The Financial Times, April 28, 2023

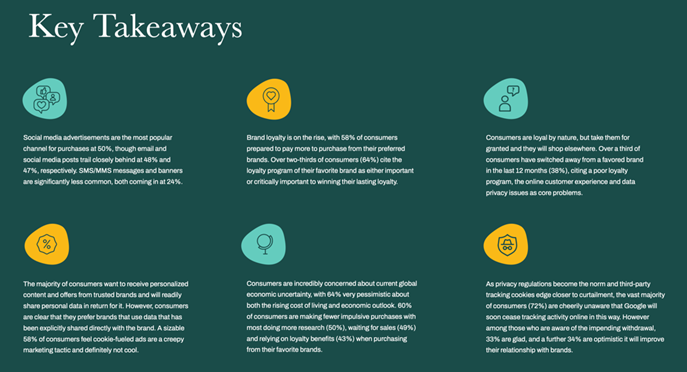

“2023 European Consumer Trends & Attitudes – Are European consumers different from consumers elsewhere in the world? Marigold, in conjunction with Econsultancy, asked 7,392 consumers across Europe (U.K., Germany, France, Spain, Denmark, Sweden, and the Benelux region) for their thoughts on 2023. Here’s some of what they found, all reported in the Europe Consumer Trends Index 2023. The 41-page report focuses on European consumer attitudes and trends in six areas: messaging, brand loyalty, privacy and personalization, the rising cost of living, and consumer sentiment by industry.”, Euroconsultancy, April 2023. Compliments of Eddy Goldberg, Franchising.com

India

“India Pushes Rupee Settlements With Trade Partners Amid Dollar Shortages. – New Delhi is boosting its efforts to expand the use of the Indian rupee (INR) in international trade, as it seeks to increase exports to nations facing a shortage of the U.S. dollar. The United Arab Emirates, a rising economy in the Middle East, is now set to join 18 other countries that are settling cross-border trade transactions with the rupee. India’s push to advance rupee transactions in global trade follows in the lines of similar efforts by other countries, notably China and Russia, to ditch the dollar as the world looks warily at the weaponization of the greenback by the United States.”, International Business Times, May 1, 2023

Japan

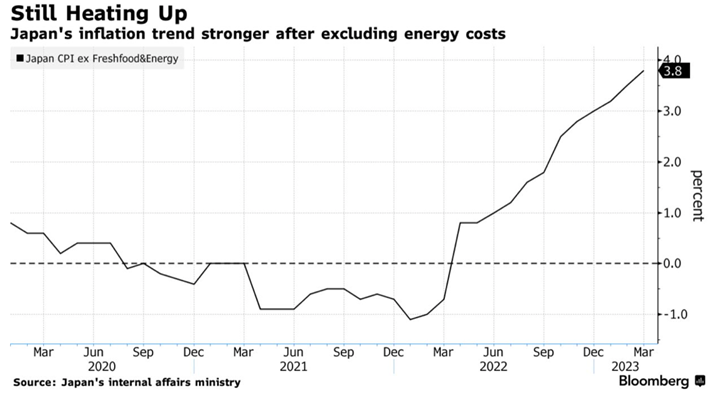

“Japan Inflation Outpaces Forecasts Again as BOJ Prepares to Meet – Gauge of underlying price trend at strongest since 1981. Consumer prices excluding fresh food rose 3.1% in March from a year ago, matching the pace of the previous month, the internal affairs ministry said Friday. Economists had expected the inflation measure to ease to 3%. A separate gauge of price growth that excludes both energy and fresh food also proved stronger than expected, climbing to 3.8% for its highest reading since 1981.”, Bloomberg, April 20, 2023

Spain

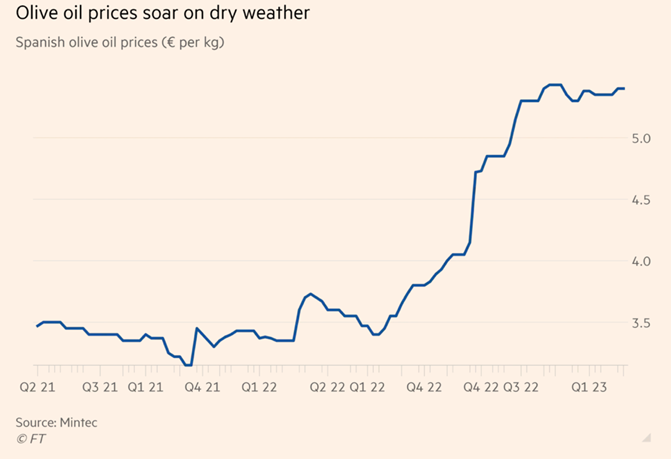

“No rain in Spain pushes olive oil prices to record levels – Continuing drought conditions leave traders and analysts worried about this year’s output. Olive oil prices have surged almost 60 per cent since June to roughly €5.4 per kilogramme, on the back of a severe drought in Europe that last year ruined olive crops across the continent. Spain, the largest olive oil producer, was hit particularly hard. The country’s farmers typically produce half of the world’s olive oil, though annual supplies have roughly halved to about 780,000 tonnes in the past 12 months.”, The Financial Times, April 23, 2023

United Kingdom

“Demand for services pushes private sector to 12-month high – The flash composite purchasing managers’ index (PMI), which is compiled by the Chartered Institute of Procurement and Supply and S&P Global, jumped by more than expected to hit 53.9 on the index this month, up from 52.2 in March. City economists had predicted that it would stay at 52.2. It is the third consecutive month in which there has been a rise in business activity, adding to signs that the wider economy is holding up despite the cost of living squeeze on households.”, The Times of London, April 21, 2023

United States

“US manufacturing contracts again in April, but pace slows – Manufacturing PMI rises to 47.1 in April New orders improve moderately; prices paid pick up. U.S. manufacturing pulled off a three-year low in April as new orders improved slightly and employment rebounded, but activity remained depressed amid higher borrowing costs and tighter credit, which have raised the risk of a recession this year.Despite the weakness in factory activity and demand for goods reported by the Institute for Supply Management (ISM) on Monday, there was a build-up of inflation pressures last month.”, Reuters, May 1, 2023

“US growth slowed sharply in first quarter as Fed pushed rates higher – GDP climbed 1.1% on annualised basis as consumers spent heavily in face of elevated inflation. The world’s largest economy grew 1.1 per cent on an annualised basis between January and March, according to preliminary data released by the commerce department on Thursday. The figures marked an abrupt deceleration from the 2.6 per cent pace registered in the final three months of 2022 and came in well below economists’ expectations of a 2 per cent increase.”, The Financial Times, April 27, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“Information statement for prospective franchisees – The Australian government has released a new version of the ‘Information statement for prospective franchisees. This document must be given to potential franchisees by a franchisor if they express an interest in a franchise. It must be given as soon as practicable, but not later than 7 days after interest is expressed. The information statement must be given to the potential franchisee before giving them any other documents. It is part of Australia’s Franchising Code of Conduct and is a legal requirement for every foreign or local franchisor to comply with if offering franchises in Australia.”, Australian Competition and Consumer Commission, April 2023. Compliments of Rod Young, Chairman, DC Strategy, Sydney

“Anytime Fitness has signed a master franchise deal for Austria with Manfred Mitterlehner, the fitness and personal training operator of Austria-based Mitterlehner Fitness. He will continue to operate Mitterlehner Training Physio brand locations separately and independently. Within the next 12 months, however, he will convert 9 existing Mitterlehner Fitness Clubs across Austria to Anytime Fitness clubs. He also plans to open two new Anytime Fitness clubs in Vöcklamarkt and Andorf in this autumn. With this deal, parent company Self Esteem Brands will have Anytime Fitness clubs operating in 40 countries and territories.”, Franchising.com, April 27, 2023

“Johnny Rockets Touches Down in India at Kempegowda International Airport – Classic Burger Chain Broadens International Presence with Newest Bengaluru Location. FAT Brands Inc. announces a new location in India at the Kempegowda International Airport in partnership with HMSHost. Located in Bengaluru, the capital city of Karnataka, the new Johnny Rockets serves the classic fare that put the brand on the map over 35 years ago, including juicy, made-to-order burgers and hand-spun shakes. ‘Expanding Johnny Rockets’ presence in non-traditional venues continues to be a key growth objective for the brand,’ said Jake Berchtold, COO of FAT Brands’ Fast Casual Division. ‘Strategically, we are pleased to spearhead this type of expansion in a country like India, where we see significant opportunity to build our footprint.’”, Franchising.com, April 27, 2023

“McDonald’s Restaurant Revamp Is Paying Off, CEO Says – Net income rises 63% in first quarter. McDonald’s Corp.’s efforts to improve operations across its U.S. restaurants are making orders faster and more accurate, its chief executive said, as the burger giant pursues a broader restructuring. McDonald’s said that restaurant staffing levels are improving, and that the chain is continuing to draw business from rival fast-food restaurants despite raising menu prices.”, The Wall Street Journal, April 25, 2023

“Popeyes (China) spreads its wings for a new operator – Tims China announced it would acquire the exclusive rights to develop and sub-franchise the fried chicken brand earlier this year. Tims China completed a transaction on March 30 to become the exclusive operator and developer of the Popeyes brand on the Chinese mainland. Under the transaction, Popeyes China would bring US$30 million in cash to Tims China and the latter will earmark an additional US$60 million to develop its Popeyes China business over the coming years.”, Shina.cn, April 24, 2023

“‘Too Many Seats, Too Few Butts’ Mean Changes at Your Favorite Restaurant – As eating out is replaced by ordering out, restaurant real estate gets a radical makeover. For most people, a meal at an upscale chain is about the ambience as much as the food. A surprisingly high 18% of sales at American fine dining establishments last year, surveyed by consulting firm Technomic, were to people for whom there is no place like home—except maybe their car. At the other end of the quality and price spectrum–fast food–about 60% of meals already were consumed off-premises in 2019. That rose to about three-fourths in the final quarter of 2022.”, The Wall Street Journal, April 29, 2023

“Restaurant Earnings Have Been Strong. Why Some Operators See Trouble Ahead – Menu prices are up across the board—but if the current spate of restaurant earnings are anything to go by, that hasn’t ruined people’s appetites for dining out. This week, McDonald’s, Domino’s Pizza, and Chipotle Mexican Grill all released first-quarter results—and beat analysts’ estimates. ‘Our base case does not include a recession, or certainly not a meaningful recession’, said John Hartung, Chipotle’s chief financial and administrative officer, in a call with analysts. BofA’s economics team has a different view, arguing that the report’s strength was thanks to a series of one-off boosts to spending, including an unseasonably warm January and an 8.7% increase to Social Security benefits. “The handoff to 2Q spending is soft and the outlook for the consumer over the rest of 2023 is murky,” the team wrote.”, Barron’s, April 28, 2023

“Shake Shack to Open in Israel in 2024 – Shake Shack will partner with Harel Wizel and Yarzin Sella Group to bring Shake Shack to Israel. Harel Wizel is the CEO of Fox Group, a fashion and lifestyle retail group with more than 1,000 global stores. Yarzin Sella Group is one of Israel’s leading culinary groups that owns and manages more than 30 restaurant concepts, and operates high-end corporate dining services in more than seven countries.” QSR Magazine, April 19, 2023

“Subway shed more U.S. sandwich shops in 2022 – Subway, which is exploring a potential $10 billion sale, further shrank last year in the United States as franchisees closed 2.7% of the brand’s sandwich shops, squeezing its royalties and fees. The chain shed another net 571 locations in 2022 after even steeper closings in previous years in the United States, its largest global market, according to the latest disclosure document it provides to franchisees who are interested in buying locations.”, Reuters, May 1, 2023

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global.

With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant taking 40 franchisors global.

For a complimentary 30 minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 80, Tuesday, April 18, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Introduction: In this issue, are we approaching the end of the central bank interest rate increases? There is a natural gas surplus due to increased U.S. LNG shipments and conservation post Ukraine invasion. Delta has already sold 75% of its seats for summer travel. Inflation continues to fall except for sugar. And the global future lies with electric cars ready or not!

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here:

First, A Few Words of Wisdom From Others

“Europe was created by history. America was created by philosophy.”, Margaret Thatcher

“To understand Europe, you have to be a genius – or French.”, Madeleine Albright

“You can’t go back and change the beginning, but you can start where you are and change the ending.”, C. S. Lewis

Highlights in issue #80:

- Brand Global News Section: Burger King®, Chick-Fil-A®, Papa Johns® and Subway

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data and Studies

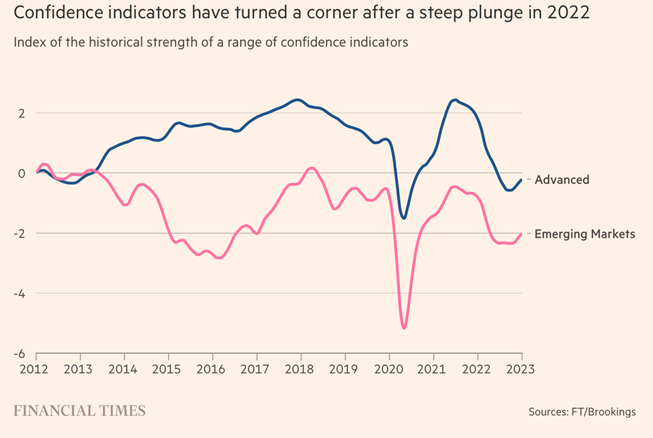

“Global economy fends off geopolitical and banking threats – China, US, eurozone, India and UK well-placed to avoid slowdown going into IMF-World Bank spring meetings. The world’s leading economies are showing surprising resilience despite facing a perilous moment, according to research for the Financial Times that suggests the global economy may avoid a sharp slowdown this year. China, the US, the eurozone, India and the UK are all growing faster than had been expected late last year, the latest edition of the twice-yearly Brookings-FT tracking index found, with consumer and business confidence rising after a rocky end to 2022.”, The Financial Times, April 9, 2023

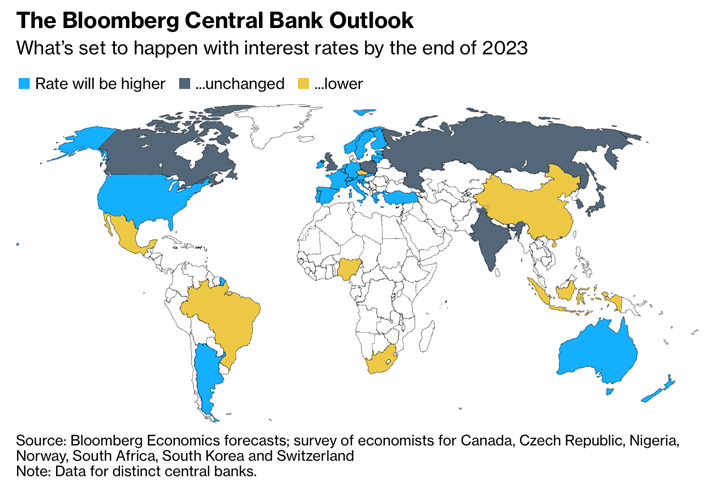

“End May Be in Sight for Global Rate-Hike Cycle as Fed Nears Peak – Quarterly outlook on what to expect from monetary policy. One more Fed hike and a pause could herald pivot by peers. Most global central banks may be either close to a peak or already done with interest-rate hiking, auguring a hiatus before possible monetary loosening comes into view.”, Bloomberg, April 9, 2023

“Intelligence for Sanctions Compliance – International sanctions and trade restrictions are growing in scope and complexity, not least in response to Russia’s invasion of Ukraine. Compliance with such laws can require insights into third-parties that cannot be achieved with automated screening or desktop research. For situations of heightened risk, an investigative approach that goes beyond the public record is recommended.”, Enquirisk, April 10, 2023

Editor’s Note: this site and company offer unusual insight into the all-important but often murky area of sanctions that companies need to know about when doing business on a global basis

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

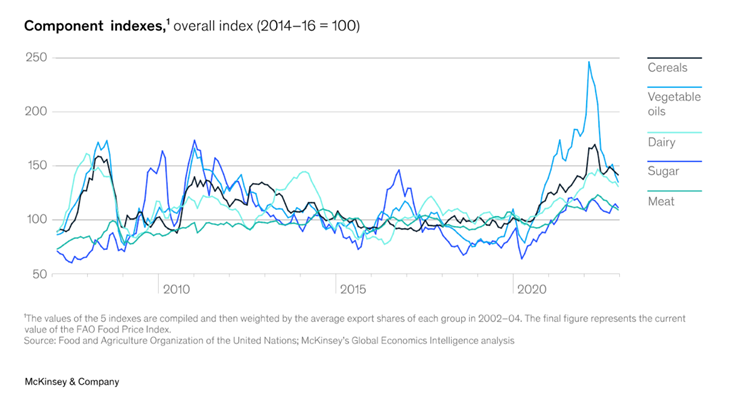

“Global inflation tracker – Inflation has started to show signs of easing from the multi-decade highs reached in many countries following Russia’s full-scale invasion of Ukraine. The latest figures for most of the world’s largest economies still make for worrying reading, with price pressures remaining high as the war in Ukraine continues to keep energy and food prices elevated. But in some countries pressures have eased and energy and food wholesale prices have declined. Economist and investors also expect inflationary levels to stabilise in the next few years.”, The Financial Times, April 12, 2023

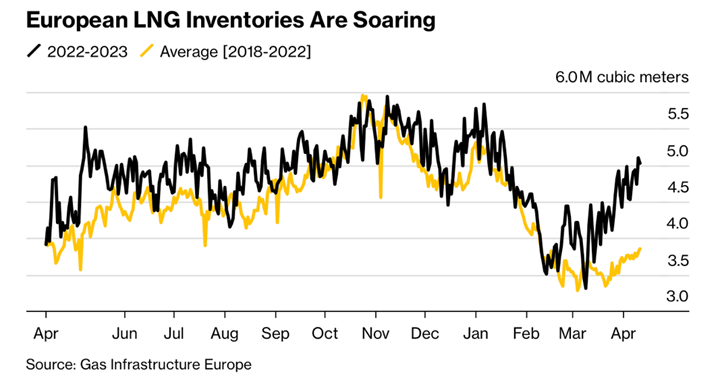

“World Gas Supply Shifts From Shortage to Glut With Demand Muted – Europe is reaching storage milestones weeks earlier than usual. Analysts uncertain over how long gas supply glut will last. The world is becoming awash with natural gas, pushing prices lower and creating an overabundance of the fuel in both Europe and Asia — at least for the next few weeks…… inventories are filling up from South Korea to Spain, a result of mostly mild winter weather and efforts to reduce consumption. Tankers filled with liquefied natural gas — a stopgap in replacing lost Russian pipeline flows — now often struggle to find a home, spending weeks idling at sea.”, Bloomberg, April 15, 2023

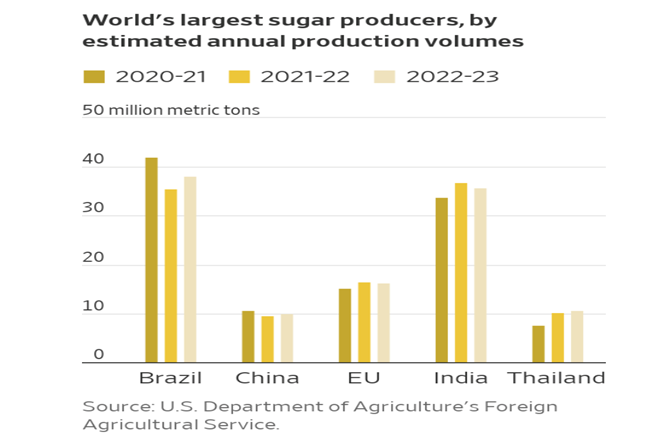

“Sugar Prices Bubble Up to Highest Since 2012 – The surge could lead to costlier sweet foods and drinks. Bad weather in India, China and Thailand has hit sugar production in all three countries, just as China’s economy has begun to reopen following the end of coronavirus lockdowns. Winners from the rally include Brazilian farmers, who are on track for a solid crop. Losers could include both food companies and consumers.”, The Wall Street Journal, April 14, 2023

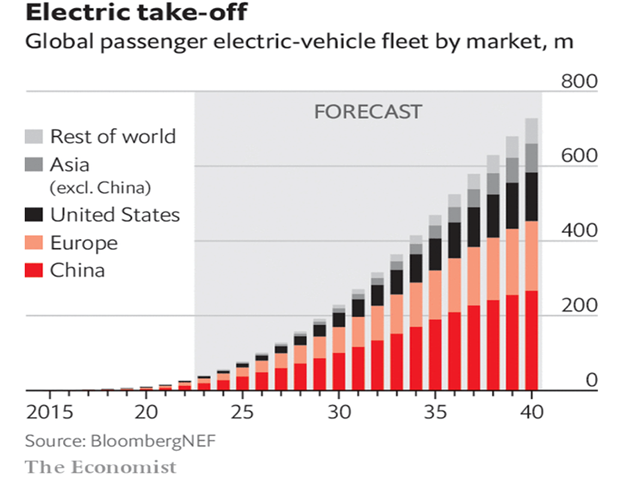

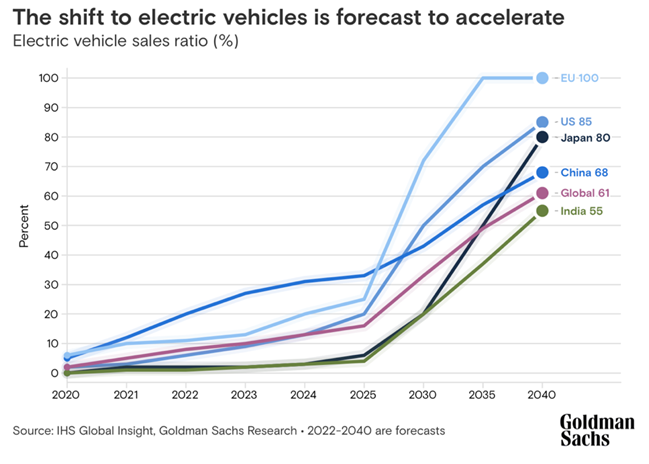

“The future lies with electric vehicles – The car industry is electrifying rapidly and irrevocably. A draft law approved by the European Union in February may mean a total ban on new ice cars by 2035 (though Germany has won an exception for cars using carbon-neutral synthetic fuels). Governments and cities are cracking down on carbon and other emissions that affect local air quality. China is demanding that 20% of cars must be (electric) by 2025.”, The Economist, April 14, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel Updates

“Delta’s International Flights Are Already 75% Booked for Summer Travel – Want to fly Delta this summer? The increased demand follows a record March in which consumer demand ‘was well ahead of pre-pandemic levels,’ Delta president Glen Hauenstein said in an earnings call this week reviewed by Travel + Leisure. As a result, Delta is growing its international capacity this summer, and flying its largest-ever Transatlantic summer schedule (including new flights to London, increased service to Paris, and beyond).”, Travel & Leisure, April 14, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Australia

“May rate rise on the cards after strong jobs numbers – Overall consumer spending appears to be coming off the boil following 10 Reserve Bank interest rate increases and the inflationary squeeze on household incomes. But the 53,000-strong job surge in March, reported yesterday, brings a May rate rise back onto the table, reported Michael Read, following the central bank’s pause this month. If so, that would come exactly a week before the May 9 federal budget. Amid the loss of tech and consulting jobs, the red-hot labour market has been one of the big surprises of the pandemic recovery.”, Australia Financial Review, April 13, 2023

Canada

“Companies turn to baristas, free food and socializing to lure employees back to the office – Manulife’s chief executive Roy Gori says a complete overhaul of the company’s nearly 100-year-old office building, as well as pro-actively listening to employee feedback on their hybrid arrangement, has already paid off. ‘We’re not seeing any decrease in productivity,’ Mr. Gori says over lunch in the company’s renovated second floor cafeteria. “If anything, I think we’re going to see – and probably already are seeing – productivity improve because people are now being more purposeful with their time.”, The Globe And Mail, April 11, 2023

China

“Chinese Exports Surge as Trade With Russia and Southeast Asia Jumps – Shipments to Russia more than doubled in March from a year earlier. Outbound shipments from China soared 14.8% in March from a year earlier, data from China’s customs bureau showed Thursday, reversing the 6.8% decline recorded during the first two months of 2023 and ending a nearly half-year string of such drops stretching back to October.”, The Wall Street Journal, April 13, 2023

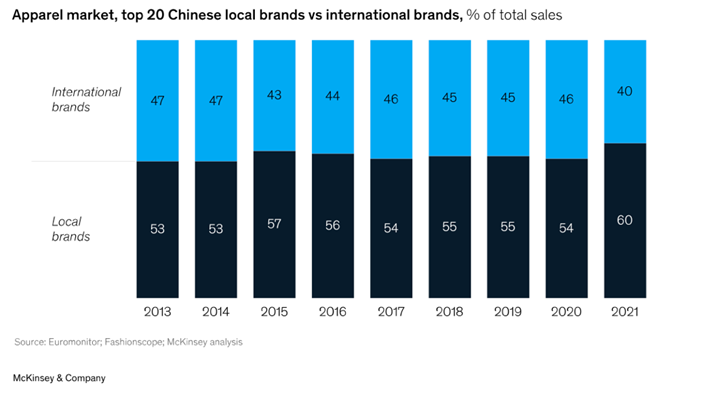

“Winning in China Top priorities for global apparel and fashion brands – The apparel, fashion, and luxury market in China continues to be one of the largest and most dynamic in the world. After a difficult 2022, the industry is likely to resume double-digit growth, fueled in part by a rising middle class. However, for multinational companies, doing business in China is getting harder. According to the National Bureau of Statistics, the China Consumer Confidence Index fell by 28 percent from October 2021 to October 2022, dampening consumer spending.2 Chinese champions are increasingly outpacing their global peers, and many are adopting a more agile operating model and supply chain to enable greater responsiveness to changing consumer preferences.”, McKinsey, March 30, 2023. Compliments of Paul Jones, Jones & Co., Toronto

India

“India’s plan to export its wildly successful digital payments system – After starting cross-border payments with Singapore, India is now setting up more international partnerships. The country’s biometric ID system, Aadhaar, already has takers in developing countries in Africa and Southeast Asia that are seeking digital sovereignty. With wider adoption of its unified payments interface, India’s digital stack is now positioned as a ‘benign’ alternative to international networks like Swift.”, Rest Of World, April 10, 2023

Japan

“Japan to Drop COVID-19 Testing, Vaccination Protocols Next Month — What to Know: ‘All border measures to prevent the spread of COVID-19 will be lifted on May 8, 2023,’ the Japan National Tourism Organization announced. Currently, all travelers heading to Japan are required to show either proof of three doses of a COVID-19 vaccine or proof of a negative test conducted within 72 hours of departure, according to the Japan National Tourism Organization.”, Travel & Leisure, April 7, 2023

Turkey

“Turkey to make inaugural deliveries from big Black Sea gas discovery – Turkish Petroleum, the state oil and gas company, will on Thursday flip the switch on the Sakarya gasfield development, roughly three years after making the find, according to its chief executive, Melih Han Bilgin.”, The Financial Times, April 16, 2023

United Kingdom

“Big firms a lot more confident about the future – Confidence among finance chiefs at the UK’s biggest companies has seen its sharpest rise since 2020. The Deloitte survey of chief financial officers showed sentiment rebounded as their concerns about energy prices and Brexit problems eased. There were 25% more chief financial officers feeling better about the future than worse, compared to 17% more feeling the opposite three months ago. Not since the Covid vaccine rollout has there been such a swing in confidence.”, BBC News, April 16, 2023

“No recession — but growth to be subdued, forecasters warn – The forecasting group expects the gross domestic product (GDP) measure of output to rise by 0.2 per cent. This reflects a significant upgrade from the 0.7 per cent decline expected in its January forecast. Output is then expected to rise by 1.9 per cent next year and 2.3 per cent in 2025. Inflation will begin to decline quickly because prices this year are compared with already high prices last year, and household bills are set to drop from July once households benefit from the sharp decline in natural gas prices over winter, the EY Item Club said.”, The Times of London, April 17, 2023

United States

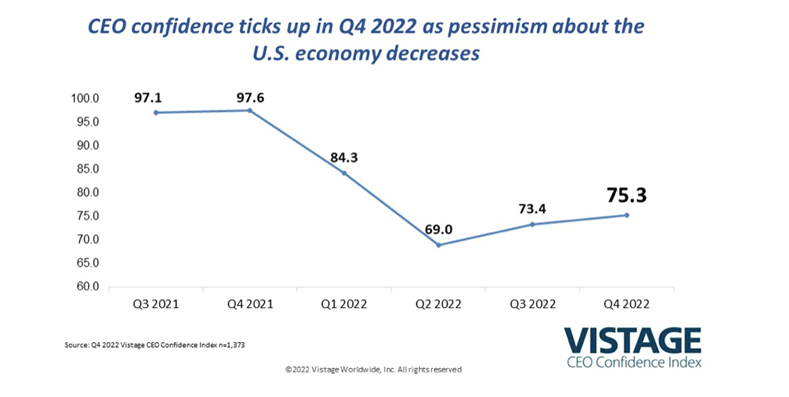

“The Q4 2022 Vistage CEO Confidence Index rose 1.9 points in Q4 to reach 75.3, which is the fourth lowest reading since the Great Recession. Looking across the six core components of the Index, the shifts in CEOs’ responses between improved, stayed the same and worsened largely offset each other. While plans for increased hiring in the year ahead rose, that improving sentiment was tempered by confidence in the economy remaining near historic lows.”, Vistage, January 5, 2023

“Homebuilder sentiment jumps to highest level since September – Confidence among builders in the U.S. housing market increased more than expected in April as declining mortgage rates and low inventory helped drive demand higher for new homes. The National Association of Home Builders/Wells Fargo Housing Market Index, which measures the pulse of the single-family housing market, rose one point to 45, the highest reading since September.”, Fox Business, April 17, 2023

“Small businesses are less optimistic about the future, survey finds – The National Federation of Independent Businesses released survey results showing their small business optimism index decreased in March, ‘marking the 15th consecutive month below the 49-year average of 98.’ “Small business owners are cynical about future economic conditions,” NFIB Chief Economist Bill Dunkelberg said. ‘Hiring plans fell to their lowest level since May 2020, but strong consumer spending has kept Main Street alive and supported strong labor demand.’”, Washington Examiner, April 12, 2023

Brand & Franchising News

“Burger King is selling more Whoppers than ever before in early days of its U.S. turnaround – Seven months after Burger King unveiled a strategy to revive its U.S. business, the chain is selling more Whoppers than ever before. Burger King U.S. President Tom Curtis told CNBC that preliminary improvements to restaurant operations and new marketing campaigns are already boosting sales and customer satisfaction, although it’s still early innings.”, CNBC, April 5, 2023

“Chick-fil-A Has the Country’s ‘Slowest Drive-Thru,’ But It’s Still Bringing in Major Profits – The chicken chain brought in $18.8 billion in U.S. sales last year, marking consistent upward growth since 2019, according to the brand’s Franchise Disclosure Document released earlier this week. But Chick-fil-A also ranked last for speed of service, according to The 2022 QSR Drive-Thru Report, with the average transaction taking 325.47 seconds (for reference, Taco Bell ranked number one at 221.99 seconds).”, Entrepreneur magazine, April 7, 2023

“Papa Johns Plots Global Domination – QSR Magazine reports that Papa Johns has announced, in partnership with PJP Investments Group, plans to open a whopping 650 new restaurants in India by 2033. That’s a lot of stores. According to Papa Johns’ filings, as of 2019 the chain consisted of 3,142 locations in the United States and 5,395 restaurants worldwide. The new locations in India would account for 11% of all Papa Johns units—which is wild, considering the restaurant operates in 49 other countries.”, The Takeout, April 4, 2023

“Subway Sale Process Heats Up as Bidders Head to Second Round – The first pool of bids were lodged in March, and several interested parties have already been thrown out by the company’s advisers for offering too little, the people said. Subway is aiming for a valuation of $10 billion or more. More than 10 possible suitors, including some big names in private equity, are conducting due diligence that should draw to a close by the end of this month, the people added. Final bids will likely be due around then and a buyer could emerge by the end of May, the people said.”, The Wall Street Journal, April 13, 2023

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global.

With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant taking 40 franchisors global.

For a complimentary 30 minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 79, Tuesday, April 4, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Introduction: In this issue, inflation falling around the world, AI spreading, EV adoption spreading, oil rising again, Middle East IPOs are up, UK house prices are down and post pandemic western food & beverage brands are once again on the rise in China as Chinese consumers are heading back to stores and restaurants.

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here:

https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others

“Take risks. Failure is a stepping stone to success.”, Arianna Huffington, co-founder of The Huffington Post

“If you always do what you’ve always done, you’ll always get what you’ve always got.”, Henry Ford, founder of the Ford Motor Company

“The road to success is always under construction.” , Lily Tomlin, actress and comedian

This issue’s quotes are compliments of Zyro.com

Highlights in issue #79:

- Brand Global News Section: BurgerFi®, Dominos®, Haidilao®, KX Pilates®, Popeyes® and Starbucks® China

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data and Studies

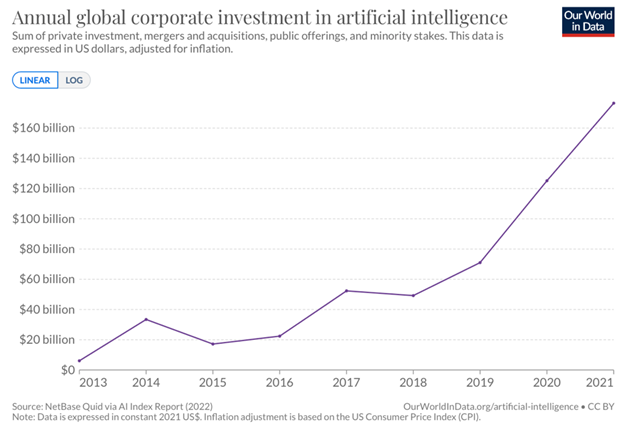

“Artificial intelligence has advanced despite having few resources dedicated to its development – now investments have increased substantially. In the past, relatively few researchers were working on AI technology and there was little commercial interest and funding. Now, the available resources have increased substantially. We should expect that the field continues to advance rapidly.”, Our World In Data, March 29, 2023

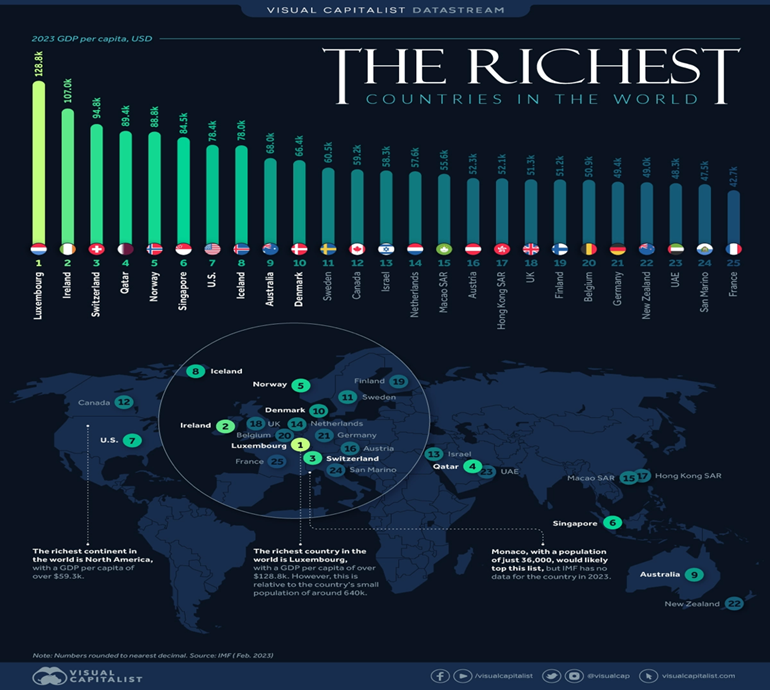

“The World’s 25 Richest Countries by GDP per Capita – Measuring GDP per capita is a common measure of the economic wealth on a per person basis. This article sorts countries according to the latest International Monetary Fund (IMF) projections on GDP per capita for 2023. Currently this metric is at $13,920 globally in 2023, up from $13,400 in 2022 and $11,160 in 2020, all nominal figures, not accounting for inflation.”, Visual Capitalist, March 29, 2023

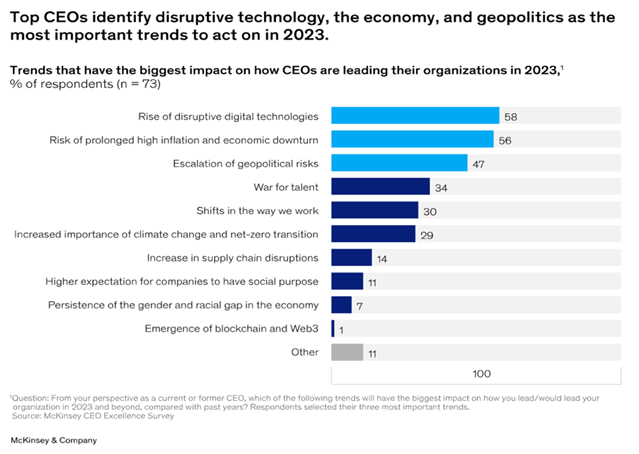

“Actions the best CEOs are taking in 2023 – Corporate leaders are addressing the risks while finding the opportunities in digital disruption, the economy, and geopolitical uncertainties. the torrent of trends, ideas, and information that leaders now face makes knowing what matters more difficult than ever…….McKinsey conducted its latest CEO Excellence Survey, to take the pulse of leading CEOs’ evolving priorities and the actions they’re taking in response. We started by asking a group of the world’s top-performing CEOs which trends will have the biggest impact on how they lead their business in 2023 compared with past years. Their answers suggest that three “true signals” matter most: digital disruption, the economy, and geopolitics.” McKinsey, March 15, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

“Global inflation tracker – Inflation has started to show signs of easing from the multi-decade highs reached in many countries following Russia’s full-scale invasion of Ukraine. High inflation remains geographically broad-based, even if it is lower in many parts of Asia.”, The Financial Times, March 31, 2023

“Oil Prices Jump as Saudi-Led Group Plans Output Cuts – Potential U.S. recession and China’s demand will help determine whether crude pushes even higher. Tallying up Sunday’s commitments by Saudi Arabia, Iraq and others, OPEC producers say they will cut daily output by more than 1.1 million barrels from May, according to Natasha Kaneva, head of commodities research at JPMorgan Chase.”, The Wall Street Journal, April 3, 2023

“Electric vehicles are forecast to be half of global car sales by 2035 – EV sales will soar to about 73 million units in 2040, up from around 2 million in 2020, according to forecasts by Goldman Sachs Research. The percentage of EVs in worldwide car sales, meanwhile, is expected to rise to 61% from 2% during that span. The share of EV sales is anticipated to be well over 80% in many developed countries.”, Goldman Sachs, February 10, 2023

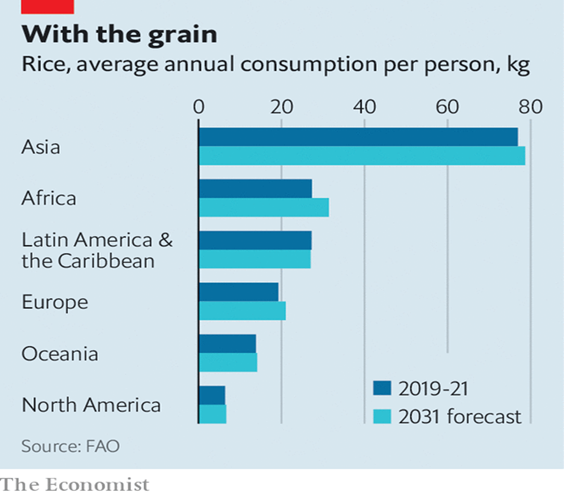

“The global rice crisis – Rice feeds more than half the world—but also fuels diabetes and climate change. Asia accounts for 90% of the world’s rice production and almost as much of its consumption. Asians get more than a quarter of their daily calories from rice. The un estimates that the average Asian consumes 77kg of rice a year—more than the average African, European and American combined. Hundreds of millions of Asian farmers depend on growing the crop, many with only tiny patches of land. Yet the world’s rice bowl is cracking.”, The Economist, March 28, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel Updates

“Flights at Cathay Pacific budget carrier HK Express ‘back to pre-pandemic levels by Friday – Airline seeks 500 staff as it ramps up services. Low-cost carrier took delivery of the first of 16 narrow-body Airbus A321neo aircraft on Wednesday… the carrier’s service frequency would return to pre-pandemic levels by the end of the month with more than 400 flights per week and 500 by the summer to around 22 destinations. HK Express is looking to expand network and aims to hire 180 pilots and more than 300 cabin crew by the end of the year.”, South China Morning Post, March 29, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Argentina

“IMF approves next tranche of emergency loans to Argentina – The $5.4 billion set for disbursement brings the total lent to the Latin American country under the Extended Fund Facility to $28.9 billion. Argentina is the target of the IMF’s largest assistance program. The International Monetary Fund’s executive board approved late on Friday the disbursement of $5.4 billion (approximately €4.97 billion) to Argentina, as part of a $44 billion loan program to the Latin American nation struggling with an ailing economy.”, Deutsche Welle, March 31, 2023

Canada

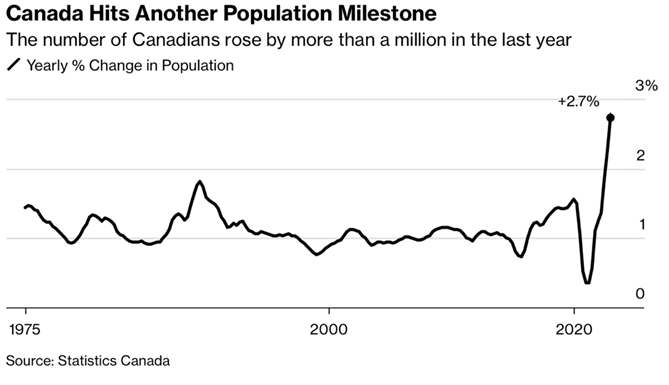

“Canada’s Population Grows by Over 1 Million for First Time – Annual expansion of 2.7% is fastest among advanced economies. Rush of newcomers strains housing market, health-care system. International migration accounted for 95.9% of the growth — a testament to Canada’s decision to counter the economic drag of an aging populace by throwing its doors open to newcomers.”, Bloomberg, March 27, 2023

China

“China’s Consumers Extend Economic Rebound From Pandemic – A gauge of activity in China’s services sector reached its highest level in more than a decade in March, a sign that Chinese consumers are heading back to stores and restaurants, powering an economic recovery following the end of almost three years of strict Covid-19 controls.”, The Wall Street Journal, Mach 31, 2023

Eurozone & European Union Countries

“Eurozone inflation lower than expected, as energy costs drop – Inflation in the Eurozone slowed sharply to 6.9% in an unexpected turnaround after months of steady increases. The 20 countries that make up the Eurozone recorded slowed inflation rates, although food prices rose with energy prices falling official, European Union’s statistics agency revealed on Friday. -Consumer prices in the Eurozone rose by 6.9% in March, but that represented a decrease from 8.5% in February, the data showed.”, Deutsche Welle, March 31, 2023

India

“From fast food to autos, India’s digitally connected users lure investors – China saw a jump in consumption from 2006 when, as per World Bank data, its per capita gross domestic product (GDP) crossed $2,000. India crossed that threshold in 2021, according to the bank’s latest available data, which could put it on a similar growth trajectory even though weak job growth and income inequalities in the country pose a risk to this outcome.

With the cheapest mobile data rates in the world, thanks to intense competition among telecoms providers, and the explosive growth of social media and personal entertainment, Indian consumers are going digital at a breakneck pace.”, Reuters, April 2, 2023

“India Offers Rupee Trade Option to Nations Facing Dollar Crunch – New Delhi has been pushing to internationalize the rupee Central bank unveiled plans for rupee settlement last year. India will offer its currency as an alternative for trade to countries that are facing a shortage of dollars in the wake of the sharpest tightening in monetary policy by the US Federal Reserve in decades. Facilitating the rupee trade for countries facing currency risk will help “disaster proof” them, Commerce Secretary Sunil Barthwal said during an announcement on India’s foreign trade policy Friday in New Delhi.”, Bloomberg, March 31, 2023

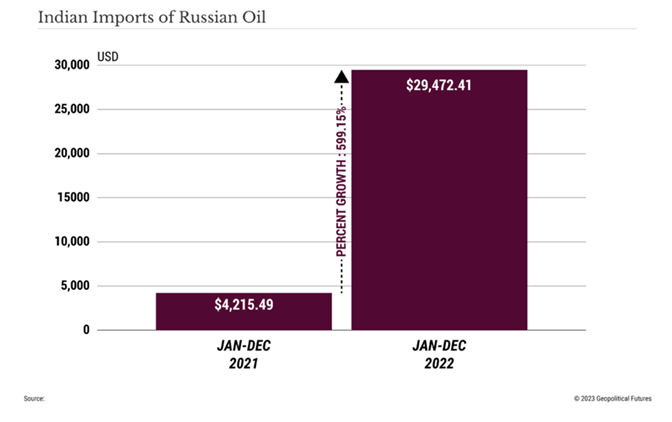

“India’s Emerging Foreign Policy – India’s economic rise has validated its historical efforts to maintain a diverse set of foreign relations. Russia’s war in Ukraine is both an opportunity and a challenge for New Delhi’s foreign policy approach. While managing pressures from Western governments to help isolate Moscow, the Indians have also been trying to assert themselves on the world stage. The South Asian powerhouse will not content itself with being merely an ally of the West and instead will maintain its policy independence, with implications for the U.S.-Chinese rivalry.”, Geopolitical Futures, March 29, 2023

Indonesia

“Nickel Revolution Has Indonesia Chasing Battery Riches Tinged With Risk – A wave of new supply from the Southeast Asian nation, key for climate goals, is challenging metal markets and a pristine environment. Within two years, Indonesia could supply 65% of the world’s nickel, up from 30% in 2020, Macquarie Group Ltd. estimates. With so much metal outside the London Metal Exchange and the Shanghai exchange, Indonesia threatens to upend even nickel pricing benchmarks.”, Bloomberg, March 28, 2023

Italy

“ChatGPT banned in Italy over privacy, data collection concerns – Calls have grown in the United States to stop development of the AI technology. The Italian Data Protection Authority said it is blocking OpenAI from processing the data from American users, and has opened an investigation into the organization. The order lasts until OpenAI respects the EU’s privacy law, the General Data Protection Regulation (GDPR).”, Fox Business, March 29, 2023

Japan

“Tokyo Inflation Slows Ahead of BOJ Leadership Change to Ueda – Production, retail sales improve in more positive sign Labor market worsens slightly in challenge for wages outlook. Consumer prices excluding fresh food in the capital rose 3.2% from a year ago, following a sharp deceleration in the previous month that was mainly driven by government subsidies for electricity costs, according to the ministry of internal affairs Friday.”, Bloomberg, March 30, 2023

South Korea

“Five trends that will define South Korean grocery in 2023 – South Korean consumers are increasingly shifting from cooking from scratch to eating out or more conveniently. What does “convenience” mean? According to our 2021 South Korea grocery survey,1 45 percent of consumers prefer prepackaged and partially cooked fresh meals that require some preparation (compared with 34 percent of the world), and 41 percent order prepared foods for delivery (versus 24 percent of the world).”, McKinsey, March 22, 2023

Mexico

“Mexico Sees Inflation Slowing to 4% in 2024 as Economy Grows 3% – Finance Ministry released preliminary budget plan for 2024 The country’s economy expected to grow 3% this year and next. Inflation in Latin America’s second-largest economy is expected to slow to 5% by the close of this year and reach 4% by the end of 2024, from the most recent level of 7.12% in early March.”, Bloomberg, March 31, 2023

Middle East Region

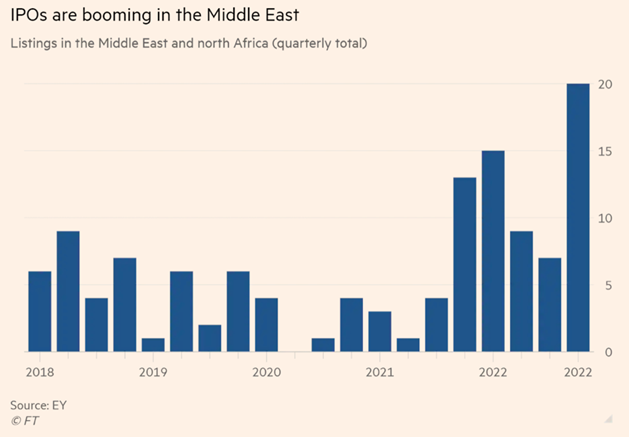

“Middle East on ‘radar’ of global investors as it enjoys IPO boom – Frenzy of activity across the region contrasts sharply with Europe’s moribund market. The 51 IPOs across the Middle East and north Africa last year was a record, according to EY. They raised $22bn, a 179 per cent increase on 2021, the advisory firm said, adding that this year’s market looked “healthy”. Financial regulatory reform, a privatisation push amid political stability and oil and gas prices that have risen significantly from their Covid-19 pandemic lows are driving both the IPO frenzy and private deals, bankers said.”, The Financial Times, March 27, 2023

United Kingdom

“Joining this trade partnership opens up a world of opportunity – The UK’s accession to the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) is a significant milestone for UK trade. This landmark deal will help the UK enhance its trading links in the Asia-Pacific region and strengthen its ties with some of the fastest-growing markets in the world. It is a marker of the UK’s strong position on the global stage that we are the first country from outside the Pacific Rim to join this bloc — and our presence will enhance its total value from 13 per cent of global GDP to 15 per cent, making it worth £11 trillion.”, The Times of London, April 1, 2023

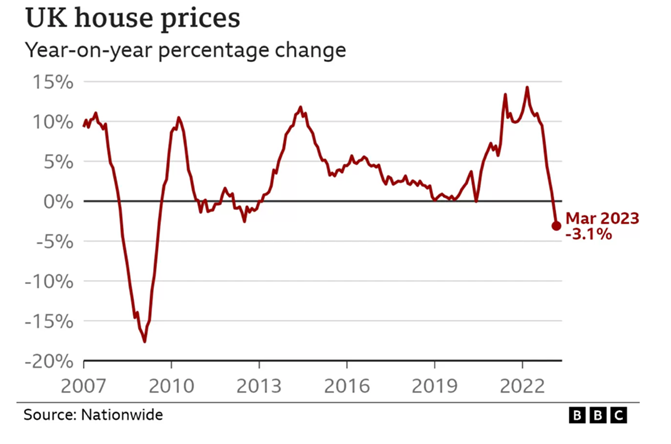

“House prices see biggest annual fall since 2009 – House prices fell in March at their fastest annual pace for 14 years, according to the latest figures from the Nationwide. The lender said prices were down 3.1% compared with a year earlier, the largest annual decline since July 2009. The Nationwide said the housing market reached a “turning point” last year, after the financial market turbulence which followed the mini-budget. Since then, “activity has remained subdued”, it added.”, BBC News, March 31, 2023

“Businesses in battle to find skilled staff – Most British businesses are struggling to plug gaps in their workforces amid a shortage of skilled talent. About 80 per cent of companies reported difficulty filling jobs, according to the latest talent shortage survey by ManpowerGroup, the American recruitment giant. That marks the highest percentage since 2006, while the proportion of businesses reporting difficulties with recruitment has jumped from 13 per cent a decade ago.”, The Sunday Times of London, March 27, 2023

United States

“Remote work gains momentum despite return-to-office mandates from high-profile CEOs – In some major US cities, the number of job postings for remote-friendly roles is hitting record levels — and trending up. That’s the latest finding of researchers including Stanford University’s Nicholas Bloom who’ve been gathering data on remote work since the early days of the pandemic. Data from security firm Kastle Systems show that office occupancy in major US cities is only about half of the pre-Covid level.”, Fortune, March 25, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“2023 Franchising Economic Outlook Predicts Industry Will Stay Strong – Despite economic uneasiness from ongoing inflation, labor shortages and supply chain problems, the franchise industry remained healthy last year and most sectors are expected to grow steadily in 2023, according to the 2023 Franchising Economic Outlook Report by FRANdata. In 2022, total franchised units grew 2% to a total of 790,492. The report projects that franchisee-owned businesses will increase by 15,000 units, to a total of roughly 805,000 this year. Franchising will grow by about 254,000 jobs, a 3% increase over 2022.”, FranchiseWire, March 22, 2023

“Study Finds 2 Out of 3 Restaurant Franchise Operators Feel Optimistic – Yet another survey has confirmed that restaurant operators are most concerned about inflation as they operate in 2023. But TD Bank’s Restaurant Franchise Finance Group’s new survey also finds people in the restaurant industry optimistic about the future and finding opportunities to invest. The poll surveyed 300 restaurant franchise operators and other finance professionals at the 2022 Restaurant Finance and Development Conference in Las Vegas, Nevada, to identify restaurant franchise finance trends.”, Franchising.com, March 30, 2023

“The Franchise in Spain 2023 Report Shows Post-Pandemic Resilience – The data shows that the turnover (revenue) figure grew by 2.9%, from €26,154 million at the end of 2019 to €26,929 million at year-end 2022. In 2022 franchising in Spain provided jobs for 303,595 people, compared with 294,231 employed in 2019, an increase of 3.18%. The number of networks that make up the country’s franchise system fell slightly, from 1,381 at the end of 2019 to 1,375 at year-end 2022, a decline of 0.5%. The number of open establishments also fell slightly (0.7%), from 77,819 operational premises at the end of 2019 to 77,426 at the end of 2022. Of Spain’s 1,375 franchise networks, 1,137 (82.6% ) are of national origin. The remaining 238 brands (17.4%) come from a total of 24 countries.”, Franchising.com, March 28, 2023

“BurgerFi Predicts Growth Despite Financial Woes And Closures – BurgerFi closed 15 stores in 2022 and 17 in 2021, on top of many other pandemic-related closures in 2020 (via QSR Magazine). As of 2022, the chain has 114 total remaining stores, all located exclusively in the U.S., 11 of which it opened in 2022. The chain cited the previous store closures as the result of staffing shortages, lack of capital, and inadequate operational knowledge. Looking forward, BurgerFi expects to opens 15 to 20 stores in 2023, including airport restaurants…..”, Tasting Table, March 25, 2023

“Chinese top hotpot chain’s overseas unit sees profit this year – The overseas unit of China’s biggest hotpot chain Haidilao expects to return to profit this year, after posting almost 80% year-on-year growth in revenue for 2022 late on Thursday. Originally founded in Sichuan Province of China in 1994, Haidilao now operates more than 1,300 stores across China……Haidilao currently has 114 stores overseas, including a new store opened in Dubai this month, its first venture into the Middle East market.”, Reuters, March 30, 2023

“Domino’s (China) Pizza Franchiser DPC Dash Looks to Tap Hong Kong IPO Market – The pizza chain operator has set a price range of HK$41.4 to HK$55.0 a share. The latest offering is higher than its earlier plan to raise up to HK$567.50 million. The Shanghai-headquartered company began managing Domino’s Pizza outlets in China in 2010, and now operates more than 450 of the restaurants in Beijing, Shanghai and eight other cities across the country.”, The Wall Street Journal, March 15, 2023

“KX Pilates (Australia) eyes global expansion as it celebrates 100 studios – Founded by fitness entrepreneur Aaron Smith, KX Pilates opened its first studio in Melbourne in 2010 and now spans across 100 studios in Australia and the broader Asia Pacific region, including New Zealand, Indonesia, China and Taiwan, and is soon to launch in Singapore. It counts six international studios and 94 Australian-based studios in its franchised network, with Noosa taking the title as the 100th location. In 2023, a further 15 new studios are on the cards, and 2024 is forecasted to be bigger than ever for the global business.”, Smart Company AU, March 14, 2023. Compliments of Jason Gehrke, Franchise Advisory Centre, Brisbane

“Popeyes to Accelerate Growth in China – Roughly $90 million is being poured into growth and development efforts. Tims China, the master franchisee rapidly growing Tim Hortons across mainland China, Hong Kong, and Macau, announced Thursday that it will spearhead growth for Popeyes as well. The company purchased PLKC International (Popeyes China), which holds exclusive rights to develop and sub-franchise Popeyes in mainland China and Macau.”, QSR Magazine. March 31, 2023. Compliments of Paul Jones, Jones & Co., Toronto

“Starbucks braced for price war in China as rivals pile into coffee market – Chains backed by private equity bet consumers will turn social pastime into daily routine. The US chain plans to open a store in China every nine hours to reach 9,000 locations by 2025, up from just over 6,000 currently. As with many consumer brands in China, Starbucks’s expectations of a big rebound rest on projections for a huge market opportunity, but they are tempered by increased competition from international and domestic rivals and often fickle consumer habits.”, The Financial Times, March 22, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

William “Bill” Edwards: Global Advisor – Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global.