EGS Biweekly Global Business Newsletter Issue 32, Monday, June 14, 2021

By William (Bill) Edwards, CEO of Edwards Global Services, Inc. (EGS)

“It’s choice, not chance that determines your destiny”, Jean Nidetch, compliments of Rafik Farouk on LinkedIn

“The ones who are crazy enough to think they can. Change the world are the ones who do.”, Steve Jobs

“Today is your opportunity to build the tomorrow you want.”, Ken Poirot

Highlights in issue #32:

- OECD: Global prospects are improving but performance diverges strongly across countries

- COVID-19’s Impact on Employment Worldwide

- Report Says Half Of Small Businesses Unable To Fill Job Openings

- CDC Travel Guidelines Relax for More than 100 Countries

- Worldwide food costs hit decade high

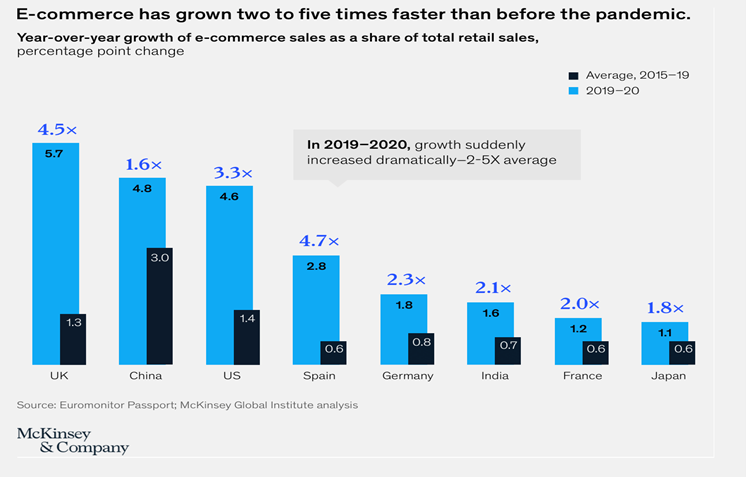

- E-commerce has grown two to five times faster than before the pandemic and Pandemic drove small businesses online — and they’re staying

- Brand News Section: Capriotti’s Sandwich Shop®, Chuck E. Cheese®, Del Taco®, Denny’s®, Hilton®, Jack in the Box®, Krispy Kreme®, Nathan’s Famous, Pizza In®, Urban Air Adventure Parks®, Wendy’s®

First, a few Personal Comments

This issue covers 18 countries, highlights global employment issues, international travel as well as updates the level of vaccinations that are collectively leading to businesses reopening and high GDP growth in many countries.

Our Mission and Information Sources

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel.

We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covers 43 countries and provides us with updates about what is happening in their specific countries. Please feel free to send us your input and sources of information. Our contact information is at the bottom of this newsletter.

Interesting Data and Studies

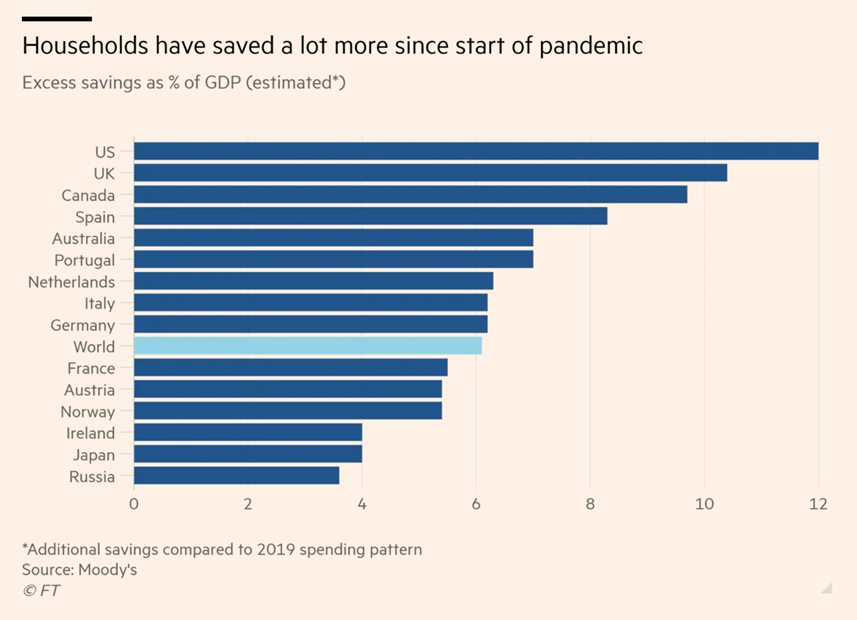

“World Bank boosts growth forecasts as U.S. stimulus, vaccines stoke demand – The World Bank on Tuesday raised its global growth forecast to 5.6% for 2021, marking the strongest recovery from a recession since 1940 due to U.S. stimulus spending and faster growth in China but held back by “highly unequal” access to COVID-19 vaccines.”, June 8, 2021

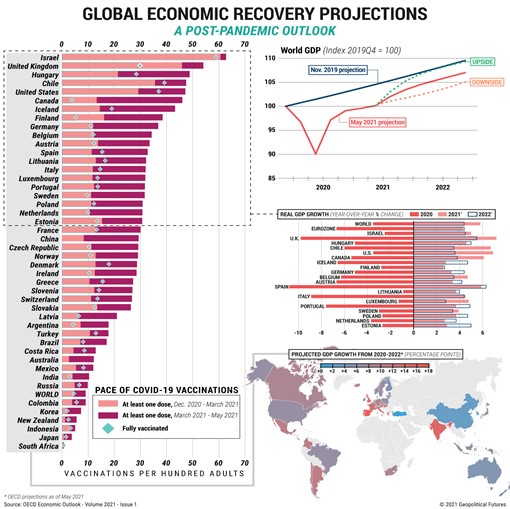

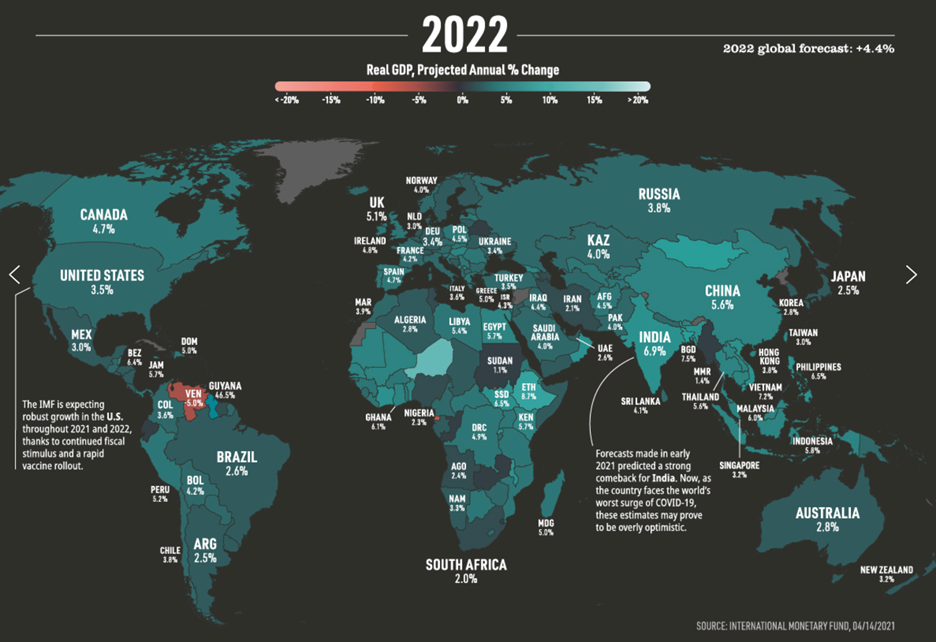

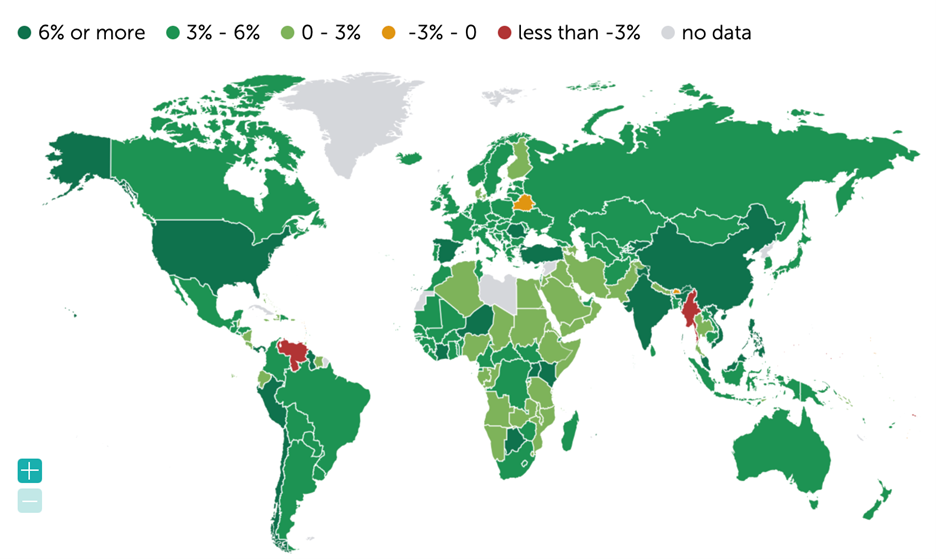

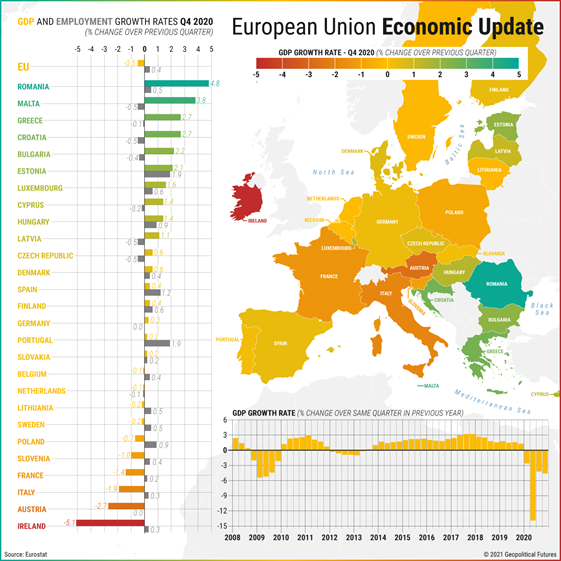

“As the number of vaccinated people increases, so does optimism about the economic recovery. But despite the general positive trends, the defining characteristic of the recovery will be its unevenness. The success or failure of the recovery in a given country depends on the government’s vaccination program and public health policies, according to the Organization for Economic Cooperation and Development.”, Geoploitical Futures, June 4, 2021

“OECD: Global prospects are improving but performance diverges strongly across countries – Prospects for the world economy have brightened but this is no ordinary recovery. It is likely to remain uneven and dependent on the effectiveness of vaccination programmes and public health policies. Some countries are recovering much faster than others. Korea and the United States are reaching pre-pandemic per capita income levels after about 18 months. Much of Europe is expected to take nearly 3 years to recover. In Mexico and South Africa, it could take between 3 and 5 years.”, OECD, June 2021

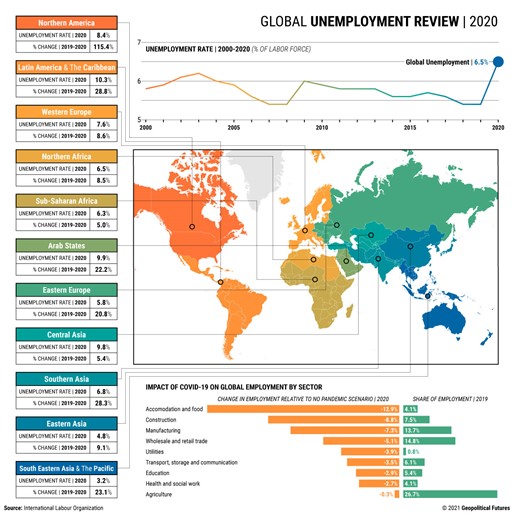

“COVID-19’s Impact on Employment Worldwide – In 2020, some 114 million workers around the world lost their jobs or withdrew from the labor force. An estimated 30 million jobs were never created because of the disruption caused by the pandemic. It will take months or, in some sectors or locations, years for the labor force to recover. The International Labor Organization projects a shortfall of 23 million jobs even through 2022.”, Geopolitical Futures, June 11, 2021

“Worldwide food costs hit decade high – A UN index of food prices “has reached its highest since September 2011, climbing almost 5% last month,” reports Bloomberg. Another tracker of ‘prices from grains to sugar and coffee is up 70% in the past year.’”, Axios, June 4, 2021

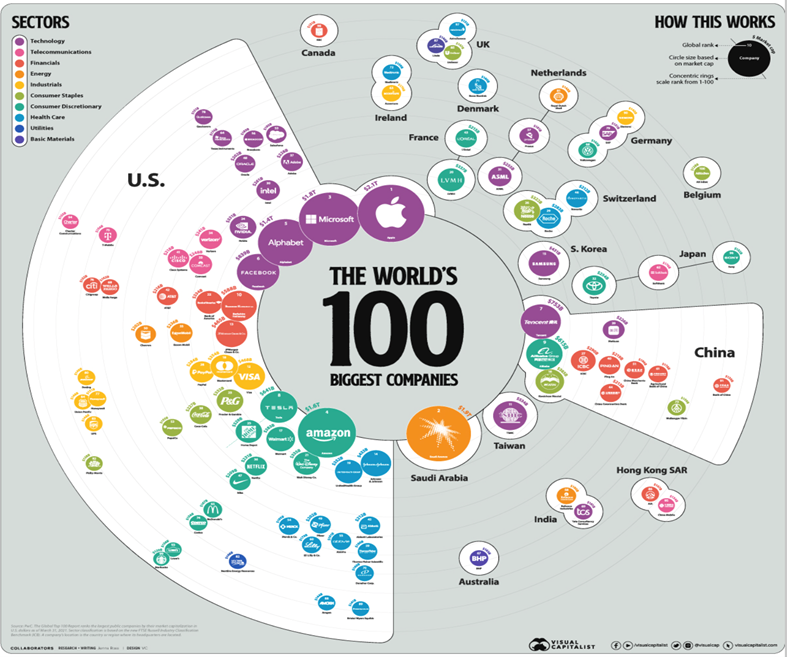

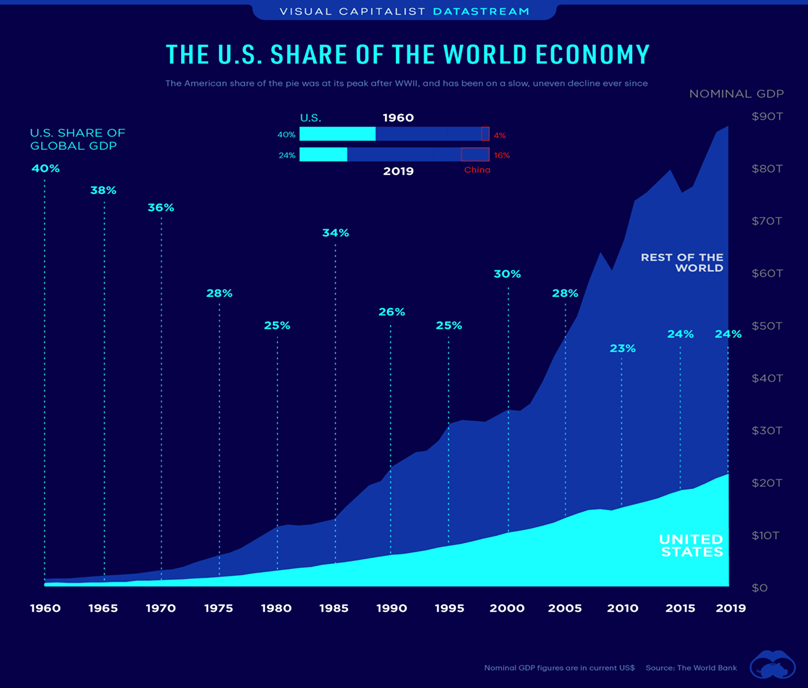

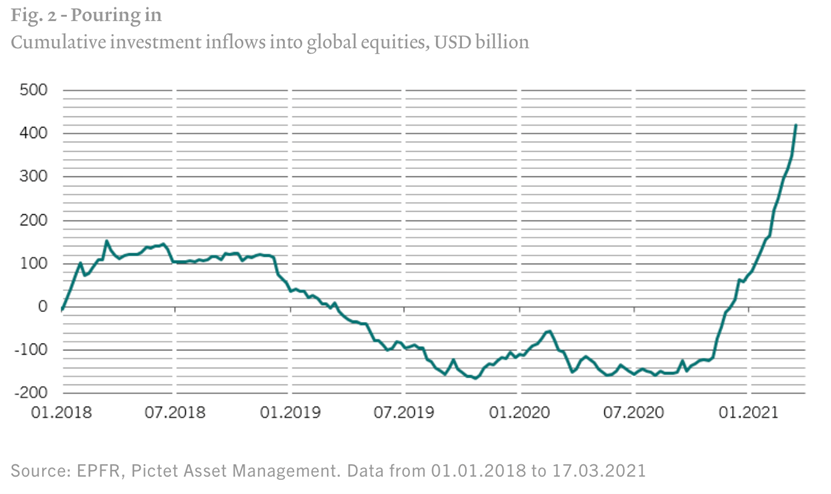

“PwC ranked the largest publicly-traded companies by their market capitalization in U.S. dollars – The 100 biggest companies in the world were worth a record-breaking $31.7 trillion as of March 31 2021, up 48% year-over-year. As a point of comparison, the combined GDP of the U.S. and China was $35.7 trillion in 2020.”, Visual Capitalist, June 10, 2021

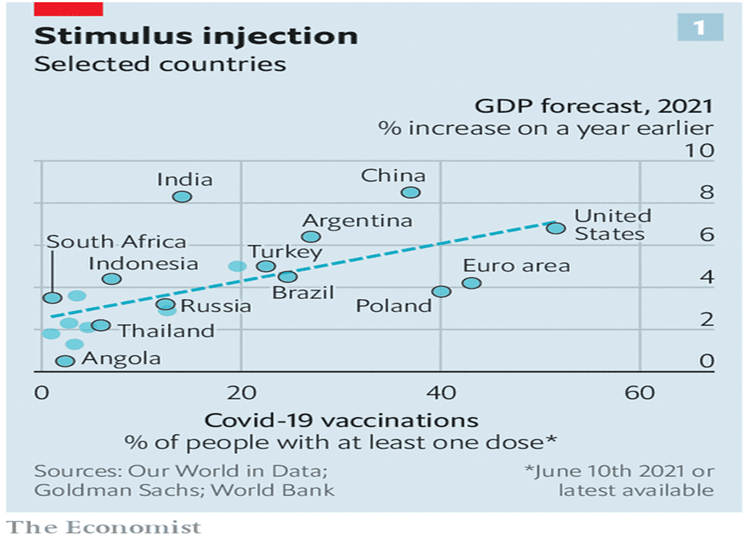

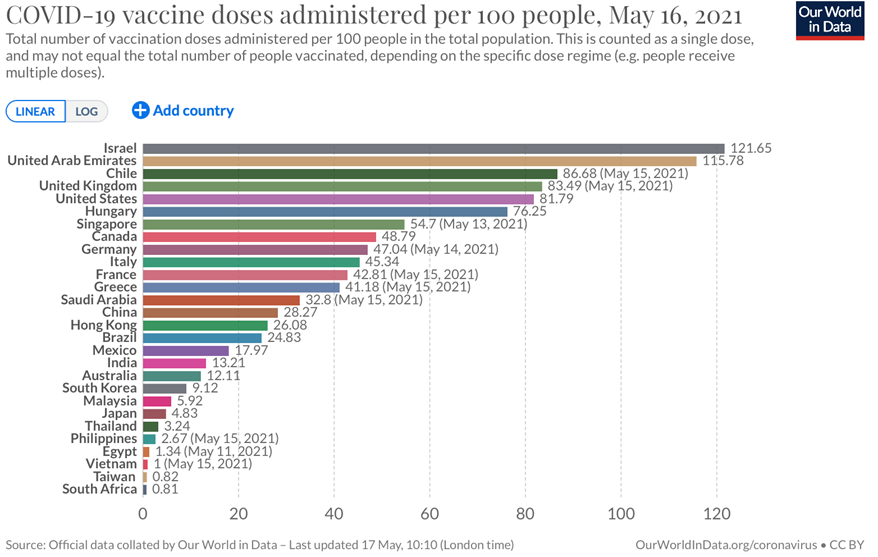

Global Vaccine Update

“Uneven vaccination rates are creating a new economic divide – The global economy should grow briskly this year: by 5.6%, according to the World Bank, which updated its forecasts this month. But where vaccination has lagged, especially in the poorest countries, some economies seem to be going directly the other way.”, The Economist, June 13, 2011

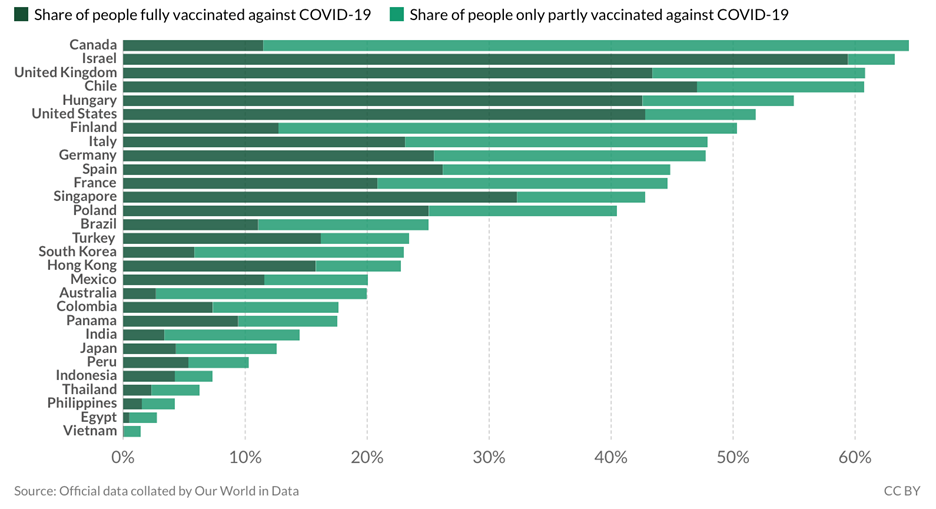

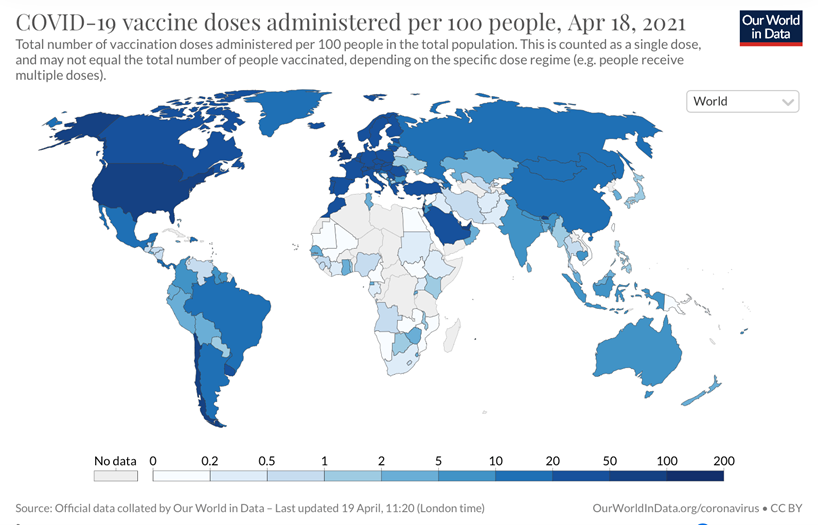

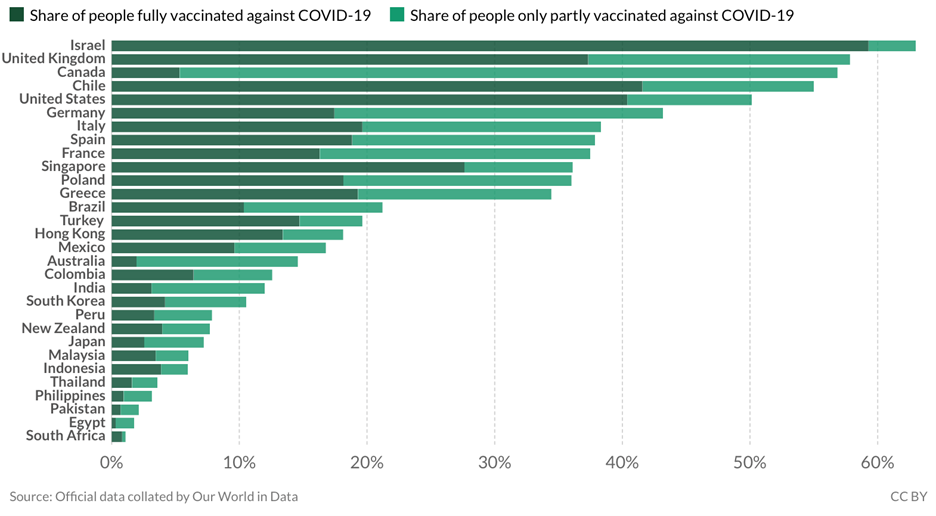

“Share of people partially or fully vaccinated against COVID-19. 12.5% of the world population has received at least one dose of a COVID-19 vaccine. 2.4 billion doses have been administered globally, and 33.3 million are now administered each day. Only 0.8% of people in low-income countries have received at least one dose.”, Our World in Data, June 12, 2021.

“Growth Projections After the Pandemic – Getting shots in arms gives the economy a shot in the arm. The success or failure of the recovery in a given country depends on the government’s vaccination program and public health policies, according to the Organization for Economic Cooperation and Development. Other key factors include the degree of state support for businesses and workers as well as the country’s dependence

“Canada Set to Ease Quarantine Rules for Vaccinated Travelers – The government is crafting plans to loosen the current 14-day isolation period for border-crossers who’ve had two vaccine doses, said the people, speaking on condition they not be identified. Travelers entering Canada would still be tested for the virus and may be required to quarantine for a shorter period.”, Bloomberg, June 8, 2021

“Mexico, Brazil: Vaccine Progress and Resilience – In Brazil and Mexico the vaccine rollout will likely pick up pace in the rest of the year, but to receive a vaccine some eligible people will have to wait until 2022 (H1 2022 in Brazil and H2 2022 in Mexico). However, the economies have proved resilient as they adapted better than expected to restrictions.”, Continuum Economics, May 27, 2021

Global, Regional & Local Travel Updates

“(U.S.) TSA screened more than 2 million flyers for the first time since March 2020 – The Transportation Security Administration (TSA) said it screened 2,028,961 travelers, the highest number since Sunday, March 8, when 2,119,867 passed through checkpoints at U.S. airports.”, The Points Guy, June 14, 2021

“(U.K.) June 21 easing of Covid lockdown rules delayed by four weeks – A government source said that (Prime Minister Boris) Johnson views a delay as the “final stretch”. He has repeatedly argued that the end of lockdown restrictions must be ‘irreversible’.”, The Times of London, June 14, 2021

“CDC Travel Guidelines Relax for More than 100 Countries – On Monday the U.S. Centers for Disease Control and Prevention (CDC) revised its coronavirus travel guidelines for over 100 countries “to better differentiate countries with severe outbreak situations from countries with sustained, but controlled, COVID-19 spread,” the agency said on its website. The new CDC travel guidelines now include specific recommendations for both vaccinated and unvaccinated travelers.”, CNN Traveler, June 9, 2021

“Americans May Be Able to Obtain the EU’s Digital COVID Certificate for Travel – The European Union’s COVID-19 digital certificate could be extended to non-EU citizens, including from the United States, an EU Commission spokesperson said in an interview this week.”, Travel And Leisure, June 3, 2021

“Air Canada Launches COVID-tested Flights Between Canada and Italy – Air Canada’s COVID-tested flights to Italy are scheduled to take off starting July 2. Travelers will need to provide proof of a negative COVID-19 test taken within 48 hours of their departure from Canada. They’ll also have to take another test upon landing in Italy, but will not be required to isolate or participate in health monitoring programs if they test negative.”, Travel And Leisure, June 3, 2021

“Iberia Restores Latin American Services as Spain Reopens to More Tourists – Iberia’s 2021 summer flight program will total more than 90 flights per week to Latin America. The schedule includes 18 destinations in 16 countries.”, Airline Geeks, June 9, 2021

“Thai Airways (TG) will commence direct flights from Phuket to Zurich, Paris, Copenhagen, London, and Frankfurt, starting July 2, 2021, as the country prepares to revive its tourism. The decision came right after the government confirmed to reopen Phuket to fully vaccinated tourists. The airline, through its wholly-owned subsidiary – Thai Smile, has increased its frequency on the Hong Kong (HKG) – Phuket route to four weekly flights starting 02 July as well. The flag carrier also plans two routes from Asian cities – Seoul (ICN) and Taipei (TPE) — to Phuket from July, while a route to Tokyo still awaits confirmation.”, Airways Magazine, June 8, 2021

Country & Regional Updates

Canada

“Ontario patios, retail to open Friday as province speeds up COVID-19 reopening plan – The staged reopening plan was originally scheduled to kick in next Monday. But the province says it has exceeded its goal for administering first doses of COVID-19 vaccinations, while new cases and hospitalization continue to drop. The changes, approved in a Monday morning cabinet meeting, take effect Friday at 12:01 a.m.”, The Globe And Mail, June 7, 2021

“‘This is 100 per cent the worst thing we’ve ever seen’: How Canadian companies are adjusting to supply chain chaos – Today, unrelenting demand from cash-flush shoppers for certain goods, restocking by companies scrambling to satisfy them as regions emerge from lockdowns, and ever-changing COVID-19 protocols – resulting in more checks and labour shortages at each step of the transportation chain – have created an unprecedented slowdown of goods that is testing the global economy and its distribution networks.”, The Global and Mail, June 14, 2021

China

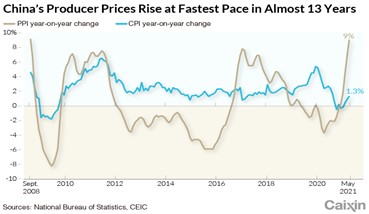

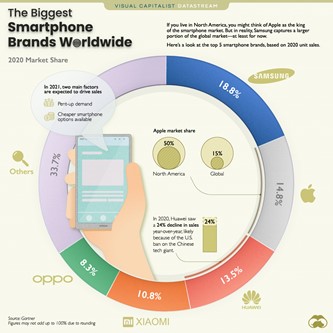

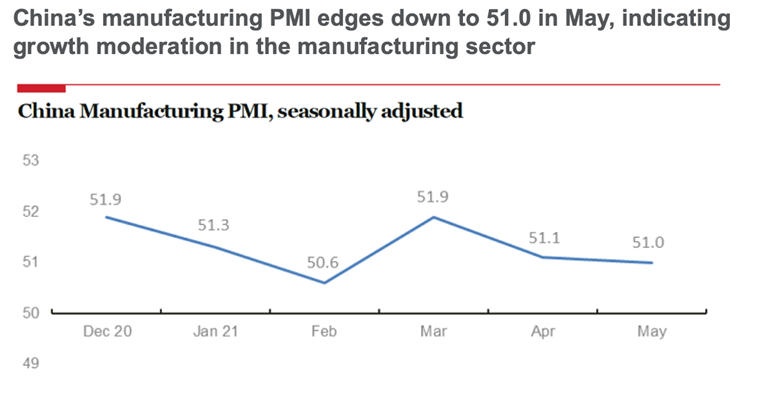

“China’s Factory Inflation Jumps Most in Almost 13 Years as Commodity Prices Surge – Surging commodity prices fueled inflation in China in May, with factory-gate prices jumping the most in almost 13 years and consumer prices accelerating at the fastest pace since September, government data released Wednesday show.”, Caixing Global, June 9, 2021

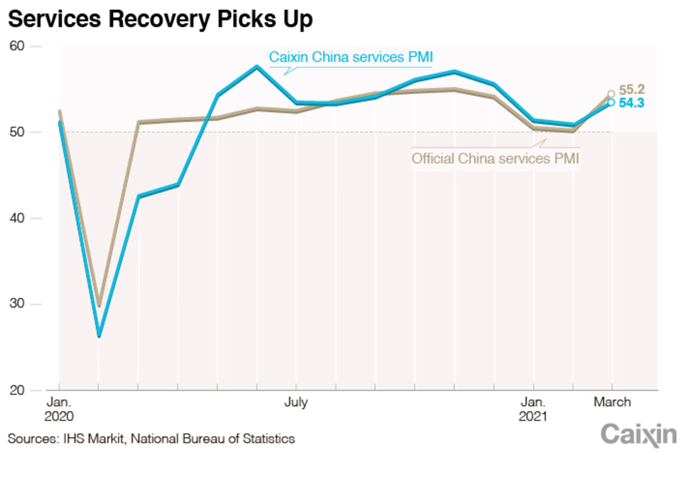

“China’s Manufacturing Expands at Fastest Pace in Five Months, The Caixin China General Manufacturing Purchasing Managers’ Index (PMI), which gives an independent snapshot of the country’s manufacturing sector, rose slightly to 52 in May from 51.9 the previous month, according to a report released Tuesday.”, Caixing Global, June 01, 2021

“China’s Services Expansion Slows, The Caixin China General Services Business Activity Index, which gives an independent snapshot of operating conditions in the services sector, fell to 55.1 in May from 56.3 the previous month.”, Caixing Global, June 3, 2021

Colombia

“Colombia to restart large events as COVID-19 deaths climb past 90,000 – Colombia on Thursday approved the reopening of most large events it had banned to contain the pandemic, even with intensive care units likely to be full until the end of June and more than 90,000 dead from COVID-19.”, Reuters, June 3, 2021

India

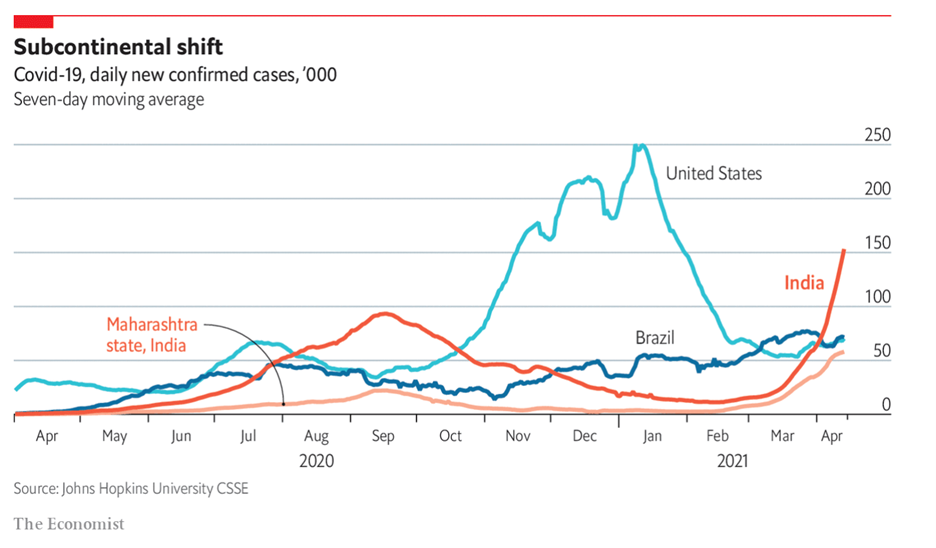

“New Delhi and Mumbai loosen lockdowns as India’s Covid-19 crisis eases in cities – India’s capital New Delhi and financial hub Mumbai began a gradual easing of restrictions on Monday as coronavirus infections in the country fell to a two-month low.”, France 24, June 7, 2021

New Zealand

“The world’s most livable cities in 2021 – Auckland came out on top on The Economist Intelligence Unit’s Global Liveability Index of 140 cities around the world thanks to its success in containing the pandemic quickly, enabling restrictions to be lifted early on.”, CNN, June 9, 2021

Philippines

“World Bank slashes GDP growth forecasts for the Philippines – The World Bank has slashed its Philippine growth projection for this year due to a deeper-than-expected contraction in the first quarter and the reimposition of stricter quarantine measures in the capital region to contain a surge in COVID-19 cases. While growth in the Philippines remains on track for recovery, the bounce back this year will likely be lower than previously expected at 4.7%…”, Reuters. June 7, 2021

Russia

“Every third coffee (in Russia) comes from McDonald’s – The CEO of the chain in Russia spoke about the food preferences of Russians. The coronavirus pandemic has made adjustments even in the preferences of Russians in the food they order at McDonald’s . Mark Karena , general director of McDonald’s in Russia , told Lente.ru how the network will develop in Russia, what they will do with security and what new products to expect in the menu.”, Lente.ru, June 7, 2021. Website translated compliments of Paul Jones, Jones & Co., Toronto

“Russia raises key rate to 5.5%, flags more hikes to curb inflation – After slashing the rate to a record low of 4.25% last year during the COVID-19 pandemic, the central bank has now raised it three times in 2021 to slow inflation that shot above its target in November and is on track to accelerate further. ‘Our main task is to normalise the price growth rates,’ Governor Elvira Nabiullina said.”, Reuters, June 11, 2021

Singapore

“Singapore to start easing Covid restrictions as daily infections fall – Starting Monday, Singapore will allow social gatherings of five people — an increase from the current two-person limit. Limits on event attendees and operating capacity at venues such as public libraries and museums will also be relaxed, the government said.”, CNBC, June 11, 2021

United Kingdom

“Housing boom drives biggest rise in construction for seven years – The IHS Markit/CIPS construction purchasing managers’ index rose from 61.6 to 64.2, its highest level since September 2014 and above economists’ forecasts of 62.3.”, The Sunday Times of London, June 5, 2021

“New car sales rose sharply in May, the first full month that showrooms have been open this year. Registrations rose to 156,737, up from the 20,247 in the same month last year when dealerships were closed. Mike Hawes, chief executive of the Society of Motor Manufacturers and Traders (SMMT), said: ‘With dealerships back open and a brighter, sunnier, economic outlook, May’s registrations are as good as could reasonably be expected.’”, The Times of London, June 4, 2021

United States

“US inflation hits 5% for first time since 2008 – Policymakers continue to insist that inflation’s ascent will be transitory as Covid-19 restrictions are loosened, but apprehension that a sustained rise would inevitably twist their arms — leading them to tighten the monetary policy that has helped to fuel markets’ record run during the pandemic — has rattled equities and bonds in recent months.”, The Times of London, June 4, 2021

“Small business optimism slips on hiring, inflation worries – U.S. small-business confidence edged lower last month, the first decline in four months, as a nationwide labor shortage and inflation worries weighed on business owners’ economic outlook, according to a survey released on Tuesday. The National Federation of Independent Business (NFIB) Optimism Index fell 0.2 point to a reading of 99.6 in May after three straight monthly increases.”, Reuters, June 8, 2021

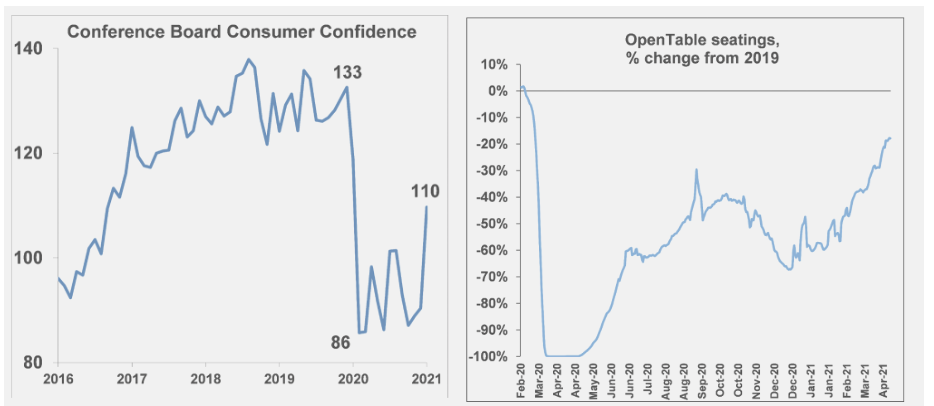

“The (U.S.) restaurant industry achieved stronger two-year sales for the second consecutive month in April. Same-store sales growth was 6.8% on a two-year basis in April, an improvement of 4.6 percentage points from the 2.3% two-year growth reported for March. This is optimistic news for the industry as April became the best month for restaurants based on sales growth in over three years.”, Nation’s Restaurant News, May 19, 2021

“Report Says Half Of Small Businesses Unable To Fill Job Openings – A record-high 48% of small business owners in May reported unfilled job openings (seasonally adjusted). That makes May the fourth month in a row of record-high readings for unfilled job openings and is 26 points higher than the 48-year historical reading of 22%. ‘Small business owners are struggling at record levels trying to get workers back in open positions,’ said NFIB Chief Economist Bill Dunkelberg.”, Franchising.com, June 10, 2021

Brand News

“Chuck E. Cheese expanding franchise footprint to Europe – Chuck. E Cheese, the family entertainment restaurant franchisor with 556 franchised locations open in 47 states and 17 countries, has signed an agreement with EWAS Management Solutions to bring the brand to Romania for the first time.”, Global Franchise, June 11, 2021

“’Ahora en Denny’s Vista Hermosa estamos atendiendo 24 horas,’ read one social media post announcing the newest Denny’s restaurant on Vista Hermosa Boulevard in Guatemala City is open and serving 24 hours a day. That 24/7 presence is central to the identity of Denny’s in Guatemala and elsewhere in Central America, where the brand now has 11 locations after franchisee Grupo Comidas opened its third in Guatemala in February.”, Franchise Times, May 27, 2021

“Krispy Kreme goes public with IPO filing, looking to raise $100 million. The JAB Holding brand will be trading on the Nasdaq under the ticker symbol ‘DNUT’. The company made $321.8 million in revenue for the first quarter of 2021, ended April 4, up 23% from $261.2 million the same quarter the year prior. The filing also noted that Krispy Kreme achieved its highest level of sales — $1.1 billion — in the company’s history in 2020 during the COVID-19 pandemic.”, Nation’s Restaurant News, June 1, 2021

“How Hilton’s CEO moved the company forward by focusing on the past – Though the COVID-19 pandemic is expected to result in more deaths globally in 2021 than in 2020, summer travel bookings are on the rise. Many people around the world—and nearly 52% of American adults—are fully vaccinated, and polls show that people are excited to get back out into the world.”, Fortune, June 3, 2021

“Jack In The Box Jumps Into The Virtual Restaurant Space With Jason Derulo Collaboration – The chain today announced a partnership with award-winning singer/songwriter Jason Derulo to launch the One in a Milli Virtual Restaurant out of 10 Los Angeles Jack in the Box locations.”, Forbes, June 14, 2021

“Nathan’s Famous is relaunching Arthur Treacher’s as ghost kitchens. Nathan’s is adding the famous fried seafood restaurant to its portfolio and helping to evolve their menu. Nathan’s Famous is bringing back the iconic 1970s quick-service brand.”, Nation’s Restaurant News, May 27, 2021

“Covid Accelerates Franchising’s Adoption of Marketing Technologies, Part 1 – Del Taco®, Capriotti’s Sandwich Shop®, Pizza In®.”, Franchising.com, June 9, 2021

“How Data Transformed Urban Air From A Trampoline Park To Adventure Park – When Michael Browning started Urban Air, the business was a trampoline park for kids like many others in the industry. But with a background in data science and analytics, Browning was able to see the opportunity to create a more innovative model that was centered around the needs of parents and kids both.”, Forbes, June 8, 2021

“Brits Queue Up for New Wendy’s as American Fast Food Invades U.K. – Brands with expansion plans benefit from glut of available sites. Wendy’s Co. is returning to the U.K. two decades after it left, part of an American fast-food-chain invasion that has been a rare bright spot for restaurant property owners during the pandemic.”, The Wall Street Journal, June 8, 2021

Articles & Studies About Doing Business Going Forward

“Global trade set for strong 2021 rebound after proving resilient during pandemic – Global trade was more resilient during the pandemic than expected and will rebound strongly in 2021, according to the Dubai Multi Commodities Centre, though the recovery will be uneven and dependent on the roll out of vaccines and easing geopolitical tensions. However, the future of global trade is dependent on the global vaccine drive and governments’ ability to respond quickly to new waves and variants of Covid-19, according to DMCC’s The Future of Trade report.”, The National News, June 9, 2021

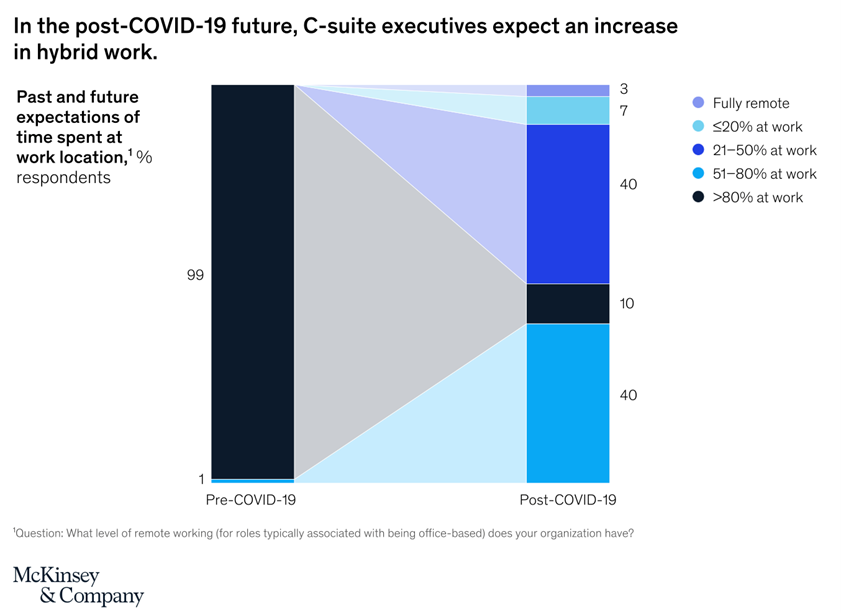

“What’s next for consumers, workers, and companies in the post-COVID-19 recovery – COVID-19 changed how we live and work in ways that will alter our behavior long after the pandemic subsides. Companies moved rapidly to deploy digital and automation technologies, dramatically accelerating trends that were unfolding at a much slower pace before the crisis. Work went remote, shopping, entertainment, and even medicine went online, and businesses everywhere scrambled to deploy digital systems to accommodate the shifts.”, McKinsey, May 18, 2021

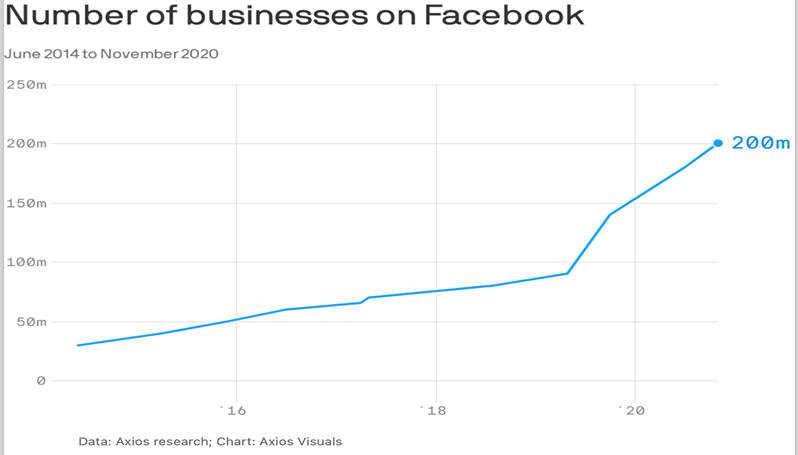

“Pandemic drove small businesses online — and they’re staying – Small businesses are the engines of the economy. While many did not survive the last 15 months, new businesses have popped up and found ways to find customers in the new, all-online-all-the-time environment.”, Axios, June 4, 2021

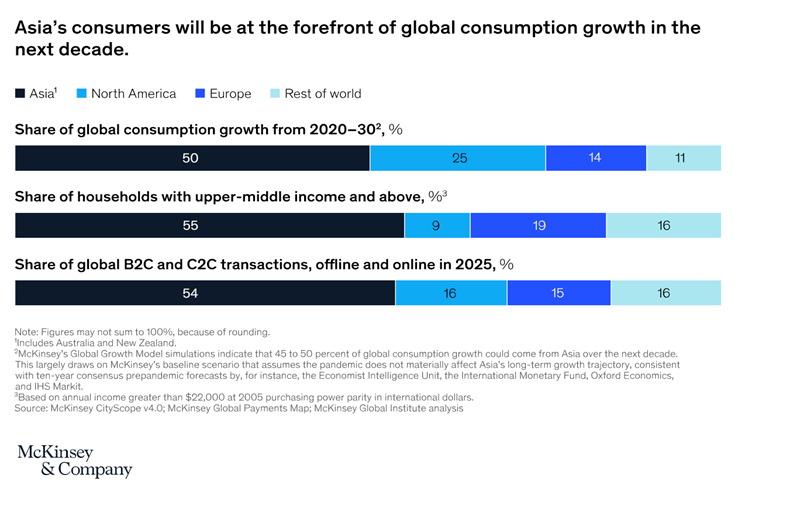

“Understanding who we have become – Change accelerates under pressure, as illustrated by the last year and a quarter. This week, McKinsey drilled into numerous changes that have reset the context for companies, employees, and societies. McKinsey experts analyzed changes to consumer profiles in Asia, the consequences of women’s exodus from the workforce, and why more than 70 HR leaders believe this is a new era for their profession.”, McKinsey, June 9, 2021

We accelerate successful global development for our Clients

Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. Our U.S. based executive team has experience living and working in many countries. Our Associate network on the ground overseas covers 40+ countries. EGS has twice received the U.S. President’s Award for Export Excellence.

Find out more about how we help companies Going Global successfully at:

Download our latest 40 country ranking chart at this link:

William (Bill) Edwards, CFE, is CEO and Global Advisor of Edwards Global Services (EGS). He has 46 years of international operations, development, executive and entrepreneurial experience and has lived in 7 countries. With experience in the franchise, oil and gas, information technology and management consulting sectors, he has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East. Mr. Edwards advises a wide range of companies on early to long term global development of their brands.

My latest article: “LEADERSHIP – We Spoke to William (Bill) Edwards of Edwards Global Services on Being an Effective Leader During Turbulent Times.”, Authority magazine, April 22, 2021

For truly global market research, operations and development support across 40 countries, contact Mr. Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

View a brief video on Bill’s background and focus: imparting global wisdom

https://calendly.com/geowizard/30min Click here to schedule a call with Bill Edwards to discuss how to succeed in developing your company around the world.

EGS Biweekly Global Business Newsletter Issue 31, Monday, June 1, 2021

By William (Bill) Edwards, CEO of Edwards Global Services, Inc. (EGS)

“It’s choice, not chance that determines your destiny.”, Jean Nidetch, compliments of Rafik Farouk on LinkedIn

“The ones who are crazy enough to think they can. Change the world are the ones who do.”, Steve Jobs

“Today is your opportunity to build the tomorrow you want.”, Ken Poirot

Highlights in issue #31:

- Brand News Section: Hyatt®, IHOP®, KFC®, McDonald’s®, Panera®, Popeyes®, YUM Brands®

First, a few Personal Comments

Just a typical day for a world coming out of COVID-19.

Incentives to get vaccinated and to come back to work, very high consumer product demand, supply chain disruptions, staffing shortages, European stocks end week at record high, record iron ore prices, tin prices hit 10 year high, Italian economic sentiment index up 11 points to 115.8 in May, labor shortages hit German reopening, foreign investment firms cleared to offer wealth management services in China, US air passenger level back to March 2020 level, hybrid office and home working plans announced, US CDC clears cruise ships to resume sailing out of US ports.

Our Mission and Information Sources

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel.

We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covers 43 countries and provides us with updates about what is happening in their specific countries. Please feel free to send us your input and sources of information. Our contact information is at the bottom of this newsletter.

Interesting Data and Studies

“Most companies expected employees to come into the office before the pandemic. Now more accustomed to working via video calls, most C-suite executives expect a hybrid work model to be the norm in the future.”, McKinsey, May 27, 2021

“Supply chain worries loom over global economy – Cycles of shortages may lead to speculative binges and then deeper recessions spurred by inventory liquidation. At the moment, people across the globe are experiencing many more idiosyncratic shortages, from oxygen in Indian hospitals to gasoline on the US East Coast to automobile semiconductors pretty much everywhere.”, The Financial Times, May 14, 2021

“Global economy will return to pre-pandemic level by 2022, says OECD – The Paris-based organisation said global output would rise 5.8 per cent this year, a significant upgrade from the forecast of 4.2 per cent made in December. Growth of 4.4 per cent the following year would bring most of the world back to pre-pandemic levels of activity, it added. However, the OECD also warned that the recovery would be uneven and living standards in many developed economies will still fall well short of the levels expected before the pandemic.”, The Financial Times, May 31, 2021

“What the soaring cost of breakfast may signal for global food price inflation – The prices of raw materials that go into morning staples have surged since the start of the pandemic. Prices for bulk contracts of coffee, milk, sugar, wheat, oats and orange juice have jumped 28 per cent on average from 2019 levels, according to trading on US futures markets, where companies lock in supplies or hedge their exposure to commodities costs. For meat-eaters, adding pork to that list pushes the average price rise to 32 per cent.”, The Financial Times, May 27, 2021

“10 Ways to Cash In on the Shortage of Just About Everything – America’s chicken-sandwich war has the combatants scrambling for supplies. Breast prices have doubled this year. Chick-fil-A has run low on sauce. Burger King has had pickle problems—jars, not cucumbers, are hard to come by. An isolated supply squeeze? Anyone who is building or remodeling a home, or buying or renting a car, or stocking up on pool chlorine or dog food, knows better. In the land of plenty, there suddenly seems to be an everything shortage.”, Barron’s, May 28, 2021

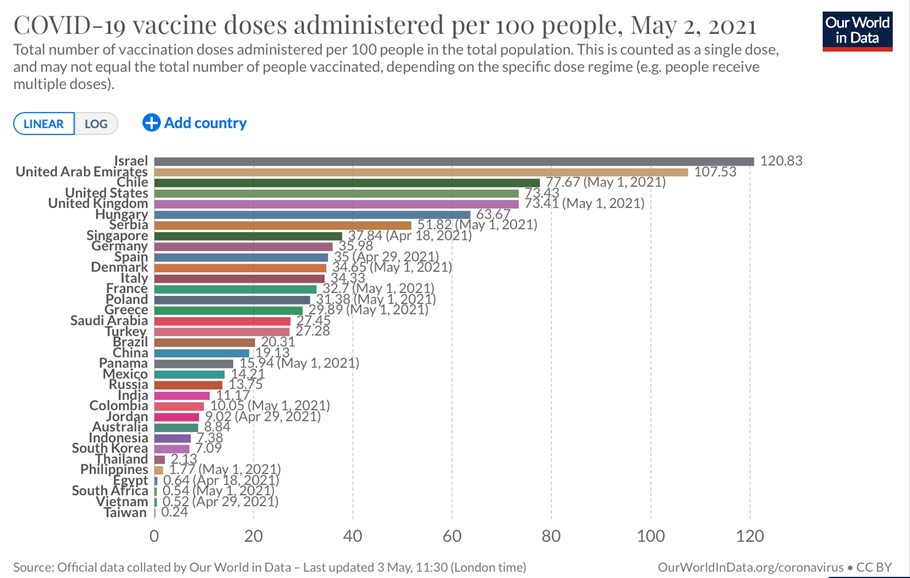

Global Vaccine Update

The more a country is vaccinated, the more open business seems to be. Israel, the United Kingdom and USA are largely open. Europe is seeing an encouraging ramp up in vaccinations. Much of the Asia Pacific region have been slow to vaccinate for various reasons. China says it is vaccinating 14 million people a day.

“Share of people partially or fully vaccinated against COVID-19. This data is only available for countries which report the breakdown of doses administered by first and second doses.”, Our World in Data, May 30, 2021. (Note: China does not report partly vaccinated people.)

“Airlines Encourage Staff to Vaccinate – After being hit by the coronavirus for more than a year, airlines are telling their staff to be vaccinated against Covid-19. Delta Air Lines has announced that newly-hired staff have to be vaccinated. Earlier, Cathay Pacific Airways encouraged its staff to get vaccinated.”, Airline Geeks, May 18, 2021

“Latin America poised to benefit as U.S. raises exports of COVID-19 shots – Latin America is poised to receive millions of U.S.-made COVID-19 shots in the coming weeks as the United States emerges as a top exporter of vaccines against the novel coronavirus.” Reuters, May 20, 2021

“Delhi announces ‘very slow’ easing of lockdown – Indian authorities Friday announced a “very very slow” easing of the lockdown in the capital New Delhi as coronavirus infections fall in major cities after weeks of lockdown.”, Asia Times, May 28, 2021

“EU Negotiators Reach Deal on COVID-19 Travel Certificates – Negotiators from the European Parliament and European Council reached an agreement to create an EU-wide COVID-19 certificate designed to facilitate travel and revive tourism, Euractiv reported May 20. The pass will allow authorities to determine whether travelers have been vaccinated, recently tested or have antibodies from a previous COVID-19 infection, based on records from their home country.”, Stratfor, May 21, 2021

Global and Regional Travel Updates

“EU executive urges reopening in summer to vaccinated tourists – The European Commission proposed on Monday that vaccinated people should be exempt from testing or quarantines when travelling from one EU country to another, and urged a gradual easing of travel measures as COVID-19 inoculations accelerate.”, Reuters, May 31, 2021

“Dubai targets over 5.5 million overseas tourists this year – Dubai expects to attract over 5.5 million overseas visitors this year, hopeful that new markets can help make up for the loss of visitors from key places where travel is restricted.”, Reuters, May 18, 2021

“U.S. Airline Flyers Creep Up Toward 2 Million in Travel Rebound – U.S. airlines carried the most passengers in almost 15 months on Friday, rebounding from the pandemic as travelers took advantage of relaxed restrictions and expanding vaccinations to take off for Memorial Day weekend. The Transportation Security Administration reported that it screened almost 1.96 million people at airports, compared with 1.85 million on Thursday. That’s the most since March 7, 2020, when the Covid-19 pandemic was in its early stages.”, Bloomberg, May 29, 2021

“Americans Can Travel to Spain Starting June 7 – Spain’s borders will reopen to vaccinated travelers, including Americans, from outside the European Union on June 7. Travelers who have been fully vaccinated with an approved vaccine are allowed to enter Spain, no matter their origin country, Reuters reported Friday.”, Travel and Leisure, May 21, 2021

“Mexico eyes easing U.S. border curbs from June 22, depending on COVID – Mexico and the United States are discussing relaxing curbs on non-essential land border crossings from June 22, depending on the spread of COVID-19 and how many people in both countries have been vaccinated, Mexico’s foreign ministry said on Tuesday.”, Reuters, May 18, 2021

“Hawaii Lifts Outdoor Mask Mandate – Visitors can now enjoy Hawaii’s beaches, hiking trails, and majestic outdoor vistas mask-free, regardless of their vaccination status. The state lifted its outdoor mask mandate on Tuesday and has paved the way for its world-famous surfing competitions to restart in June.”, Travel and Leisure, May 26, 2021

“Celebrity Cruises Will Be the First (USA) Line to Sail With Ticketed Passengers in June – The cruise line’s Celebrity Edge ship will make its grand re-debut from Ft. Lauderdale on June 26, as the Centers for Disease Control and Prevention’s guidelines allow ships to either complete a series of test cruises or agree to have 98% of crew and 95% of passengers onboard vaccinated.”, Travel and Leisure, May 27, 2021

“Canada Urged to Relax Entry Rules for Fully Vaccinated Travelers – A Canadian advisory body said Justin Trudeau’s government should relax its stringent border rules for vaccinated travelers and drop a requirement that international air passengers quarantine in a hotel when they arrive.”, Bloomberg, May 27, 2021

“Qantas offers unlimited flights for a year as incentive to get COVID-19 jab – Company announces plans to offer 10 ‘mega prizes’ of unlimited flights for one year for vaccinated customers.”, Fox Business, May 31, 2021

“Delta says domestic travel demand recovered, hits pre-pandemic levels – United and Delta said bookings have recovered better than expected. Delta Air Lines announced that bookings for domestic travel this summer have fully recovered and will even surpass pre-pandemic levels further into the season.”, Fox Business, May 27, 2021

“How To Travel To France This Summer, What’s Open And What To Expect – The country is widely believed to be opening on 9 June to international travelers for non-essential travel…..If the country opens on 9 June, it is not a given that it will be open to everyone.”, Forbes, May 26, 2021

Country & Regional Updates

China

“Manufacturing production expands at a faster pace – The output index rises from 52.2 in April to 52.7 in May. The new export orders index drops by 2.1 pts and returns to the contractionary zone, indicating a fall in external demand. The input prices index rises to a 10-year high, suggesting severe cost pressures on manufacturers.”, Fung Business Intelligence, May 31, 2021

“China’s Census 2021: 5 Takeaways for Foreign Investors – China’s census 2021 data reveal anticipated trends, such as slowing population growth…..China’s demographic profile is distinct from any other country due to its historically rapid economic development and unique population management strategies. A combination of factors that include population size, education trends, and accumulation of personal wealth make China an unmatched consumption market.”, AmCham China, May 27, 2021

“Goldman Forms Wealth Venture With China’s Largest Bank – Goldman Sachs Group Inc. received approval from Chinese regulators to set up a wealth management joint venture in the world’s second-largest economy to go after an asset pool it estimated will surpass $70 trillion by the end of this decade.”, Caixing Global, May 26, 2021

Egypt

“Egypt lifts coronavirus restrictions from June 1 – Egypt will lift restrictions imposed to curb the spread of the coronavirus, including easing the early closure of shops and restaurants, from Tuesday, the cabinet said.”, Reuters, May 30, 2021

France

“COVID-weary French cafes, stores impatient for new lockdown easing – From Wednesday, non-essential retail outlets will be able to reopen to customers for the first time in six weeks as France gradually winds down its third national lockdown in little more than a year.”, Reuters, May 18, 2021

Germany

“Supply bottlenecks could delay German recovery, institute warns – According to the report by the respected German Economic Institute, reported by Handelsblatt newspaper on Wednesday, 40% of industry groups surveyed reported severe short-term supply disruption. A further third were seeing more modest disruption.”, Reuters, May 18, 2021

Ireland

“Ireland’s PM sets out roadmap for easing restrictions – including return of foreign travel – Micheal Martin says the end of the pandemic is “within our grasp”, urging people to ‘remain vigilant against the terrible virus’. The Irish government has set out its plans for re-opening the country over the summer – including the adoption of a COVID-19 certificate so that people can travel abroad more freely.”, Sky News, May 28, 2021

Japan

“Covid drags down Japan’s first-quarter growth – Output in Asia’s largest rich economy dropped 1.3%, more than analysts expected. Japan’s economic output fell 1.3 per cent in the first quarter of 2021, a drop of 5.1 per cent at an annualised rate, as a renewed Covid-19 state of emergency bit into consumer spending., The Financial Times, May 17, 2021

“IOC reassures anxious Japan that Olympics will be safe – The International Olympic Committee (IOC) reassured an anxious Japan on Wednesday that the Tokyo Olympics would be safe for athletes as well as the host community, amid mounting opposition to the Games and fears it will fuel a spike in COVID-19 cases.”, Reuters, May 18, 2021

United Kingdom

“Crowds hit the beach on the hottest day of the year – Britons flocked to parks and beaches across the country on Bank Holiday Monday to enjoy the hottest day of the year.”, The Times of London, May 31, 2021

“UK set for stronger post-Covid recovery, says OECD – The Organisation for Economic Co-operation and Development says the UK is likely to grow 7.2% in 2021, up from its March projection of 5.1%. The UK’s growth is set to be the fastest among the large rich countries, the OECD says.”, BBC News, May 31, 2021

United States

“U.S. core capital goods orders, shipments increase strongly in April – New orders for key U.S.-made capital goods increased more than expected in April and shipments rose solidly, suggesting strong momentum in business spending on equipment growth persisted early in the second quarter. Economists polled by Reuters had forecast core capital goods orders rising 1.0%. Orders shot up 14.7% year-on-year in April.”, Reuters, May 27, 2021

“California theme parks cleared to return to full capacity in June – The revised guidance will run from June 15 through Oct. 1 and will be reassessed and updated on Sept. 1 as needed.”, Fox Business, May 23, 2021

“Staffing Shortages Pose a Threat to Hotels’ Budding Recovery – Hotels say they are struggling to hire enough housekeepers, kitchen staff and other hourly workers—including those laid off early in the pandemic. Travelers this summer could notice something they may not have seen before: The person who checked them in is the same person who helps clean their room.”, The Wall Street Journal, May 18, 2021

Vietnam

“Vietnam to test all 9 million residents in largest city – Vietnam will test all residents of Ho Chi Minh City — the country’s economic hub and largest city. Vietnam’s government also said on Monday that it would suspend incoming international flights to the capital, Hanoi. Ho Chi Minh City took a similar step for its airport late last week.”, DW, May 31, 2021

Brand News

“Hyatt CEO: The pandemic taught us that experimentation is good for business – While some organizations were stopped in their tracks by the onset of the pandemic, those that welcomed experimentation were a step ahead in their ability to manage through it.”, Fortune, May 30, 2021

“IHOP to launch new restaurant, Flip’d by IHOP, after rethinking pilot during pandemic – After pausing the launch because of the coronavirus pandemic, IHOP plans to open its first Flip’d by IHOP location this summer. Flip’d is a fast-casual spinoff of the pancake chain, with a menu formulated to appeal to on-the-go consumers.”, CNBC, May 20, 2021

“KFC sees potential to triple in size, predicting “Buckets of Growth” in the long-term – In a Yum brands global investor day, KFC also unveiled driver tracking system technology and augmented reality training. This growth trajectory could yield more than the projected 4% annual unit growth for Yum. According to Yum investor day, 90% of the company’s growth in the last five years has been from overseas markets, with 70% of growth coming from outside of the US and China. Much of the unit growth has also been in emerging markets like India.”, Nation’s Restaurant News, May 25, 2021

“Want an iPhone with that? McDonald’s tries to lure staff – In Illinois, a branch of McDonald’s has begun offering a free iPhone to employees who stay for more than six months. Another, in Florida, has offered people $50 to attend an interview. The giveaways come as restaurants dealing with a rush of diners struggle to find the employees to serve them.”, The Times of London, May 25, 2021

“Panera Bread’s new café redesign features a double drive-thru and a new brand logo – The next generation Panera Bread store design will feature a double drive-thru with a pickup lane, contactless ordering and dine-in, and a new look on the inside.”, Nation’s Restaurant News, May 20, 2021

“Popeyes (US) to Develop its Brand in Saudi Arabia – Popeyes and Gulf First Fast Food Company (“Gulf First”) are excited to announce a plan to develop and grow the Popeyes brand in the Kingdom of Saudi Arabia. Gulf First entered into an exclusive Master Franchise and Development Agreement for the territory.”, Compliments of World Franchise Associates, April 28, 2021

“’A new era of convenience’: how delivery platforms are doubling down on new verticals, wider coverage to capitalise on projected growth….With consumers still spending on delivery even as in-store dining slowly returns, technology platforms say they are looking to take it a step further by adding new ways and times for both chain and customer to engage within the channel.”, QSR Media Australia, May 10, 2021. Compliments of Jason Gehrke, Franchise Advisory Centre, Brisbane

“Yum! Brands buys Australian tech startup Dragontail – Yum! Brands’ acquisition of Dragontail will take the startup’s emerging technologies in-house in addition to its kitchen order management and delivery software.”, Inside FMCG (Australia), May 27, 2021. Compliments of Jason Gehrke, Franchise Advisory Centre, Brisbane

Articles & Studies About Doing Business Going Forward

“Franchise Businesses Sell At Higher Price Point – When it comes to resale value, franchises beat non-franchise businesses, according to a new study from Palm Beach Atlantic University’s (PBA) Rinker School of Business. After examining 2,159 business resales over a ten year period, the researchers found that franchise businesses sold at a 1.5 times higher price than non-franchise businesses.”, Franchising.com, May 26, 2021

“What’s next for consumers, workers, and companies in the post-COVID-19 recovery – COVID-19 changed how we live and work in ways that will alter our behavior long after the pandemic subsides.”, McKinsey, May 18, 2021

“Retailers as ‘experience designers – Only if retailers stop thinking like retailers will they truly innovate. So says Brian Solis, a self-described “digital anthropologist and futurist” who joined Salesforce.com in March 2020 as its global innovation evangelist. The author of several books including X: The Experience When Business Meets Design (John Wiley & Sons, 2015), Solis recently shared his views on the future of shopping with McKinsey’s Cindy Van Horne.”, McKinsey, Match 31, 2021

We accelerate successful global development for our Clients

Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. Our U.S. based executive team has experience living and working in many countries. Our Associate network on the ground overseas covers 40+ countries. Edwards Global Services, Inc. (EGS) has twice received the U.S. President’s Award for Export Excellence.

Find out more about how we help companies Going Global successfully at:

Download our latest 40 country ranking chart at this link:

William (Bill) Edwards, CFE, is CEO and Global Advisor of Edwards Global Services (EGS). He has 46 years of international operations, development, executive and entrepreneurial experience and has lived in 7 countries. With experience in the franchise, oil and gas, information technology and management consulting sectors, he has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East. Mr. Edwards advises a wide range of companies on early to long term global development of their brands.

My latest article: “LEADERSHIP – We Spoke to William (Bill) Edwards of Edwards Global Services on Being an Effective Leader During Turbulent Times.”, Authority magazine, April 22, 2021

For truly global market research, operations and development support across 40 countries, contact Mr. Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

https://calendly.com/geowizard/30min Click here to schedule a call with Bill Edwards to discuss how to succeed in developing your company around the world.

EGS Biweekly Global Business Newsletter Issue 30, Monday, May 17, 2021

By William (Bill) Edwards, CEO of Edwards Global Services, Inc. (EGS)

“Never doubt that a small group of thoughtful, committed citizens can change the world. Indeed, it is the only thing that ever has.” – Margaret Mead, compliments of Christie Brockhage on LinkedIn

“To be yourself in a world that is constantly trying to make you something else is the greatest accomplishment.” – Ralph Waldo Emerson, compliments of Larry Putterman on LinkedIn

“When I was young, I used to admire intelligent people; as I grow older, I admire kind people.”, Abraham Joshua Heschel

Highlights in issue #30:

- In our latest McKinsey Global Survey on the economy, executives’ views are as decidedly positive as they were in March—even as the pandemic continues to dwarf other risks to growth.

- Optimism rises among (U.S) small business owners even as many struggle to hire

- IBM Surveys 15,000 Globally on Life After the Covid-19 Vaccine

- Rethinking Post-Pandemic Business Travel to China

- The EU’s Economy Bounces Back

- Carl’s Jr. Parent CKE Restaurants Evolves Into A ‘Global Operation’ With 1,000th International Milestone

- Brand News Section: Applebee’s®, Burger King®, CKE Restaurants, IHOP®, Maggiano’s Little Italy® (Brinker), McDonalds®

First, a few Personal Comments

International travel capacity continues to increase with many countries opening to tourists. My first international trip this year is now scheduled to Europe to meet with candidates in September. Then to Asia in late November. Progress! There is slow, but consistent vaccination progress across the world with a few developed countries lagging behind. Surveys of global executives show continuing optimism for 2021 and 2022.

On the other hand, India remains a huge problem as does development ion new vaccine strains. Brands continue the immense innovation we have seen for over a year as customers are slowing coming back to retail locations. Demand for consumer products outstrips the ability of brands to get supplies. Inflation is a natural outcome of this challenge.

Our Information Sources

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel.

We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covers 43 countries and provides us with updates about what is happening in their specific countries. Please feel free to send us your input and sources of information. Our contact information is at the bottom of this newsletter.

Interesting Data and Studies

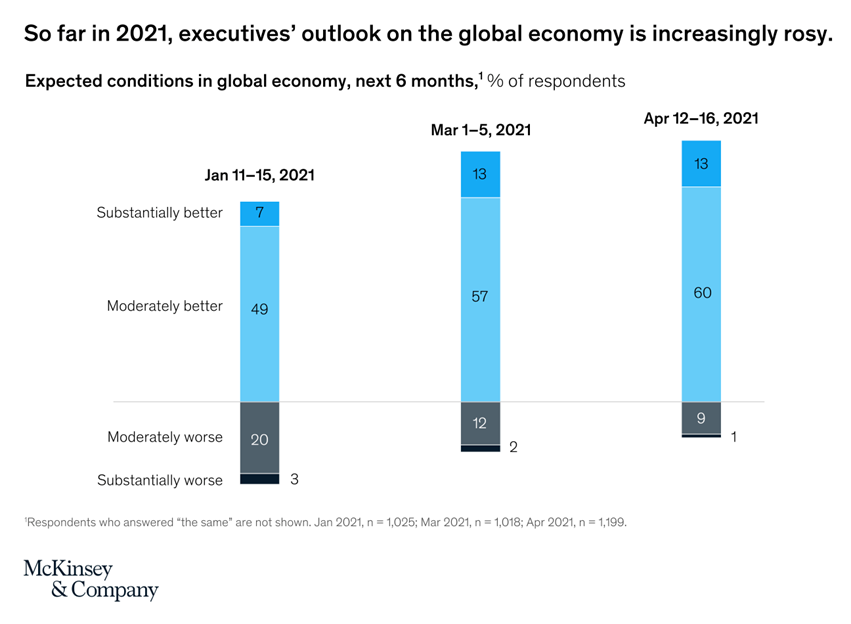

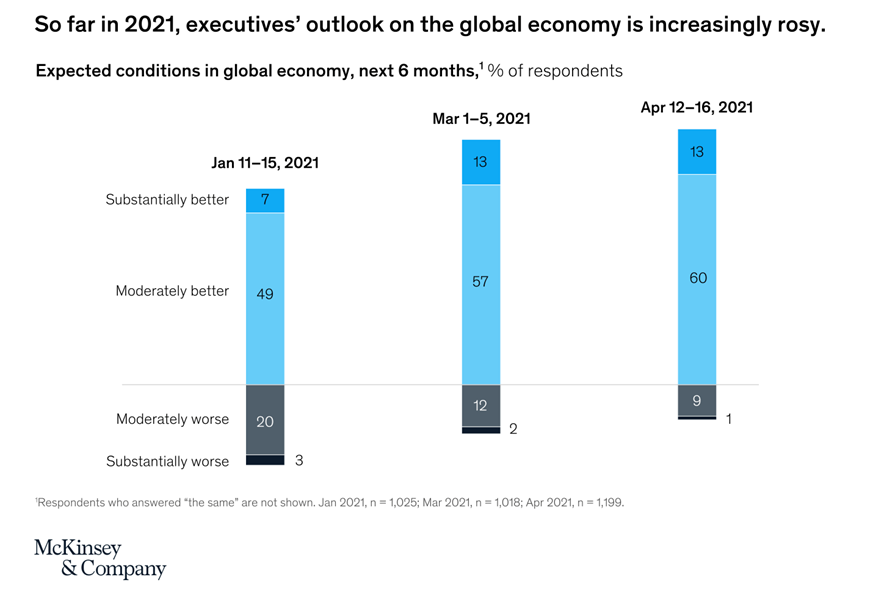

“In our latest McKinsey Global Survey on the economy, executives’ views are as decidedly positive as they were in March—even as the pandemic continues to dwarf other risks to growth. Globally, 73 percent of all respondents believe that conditions in the world economy will improve in the next six months. It’s the largest share to say so all year, while the share of executives expecting worsening conditions has shrunk by more than half in the past three months: 10 percent say so now, down from 23 percent in January”, McKinsey, April 30, 2021

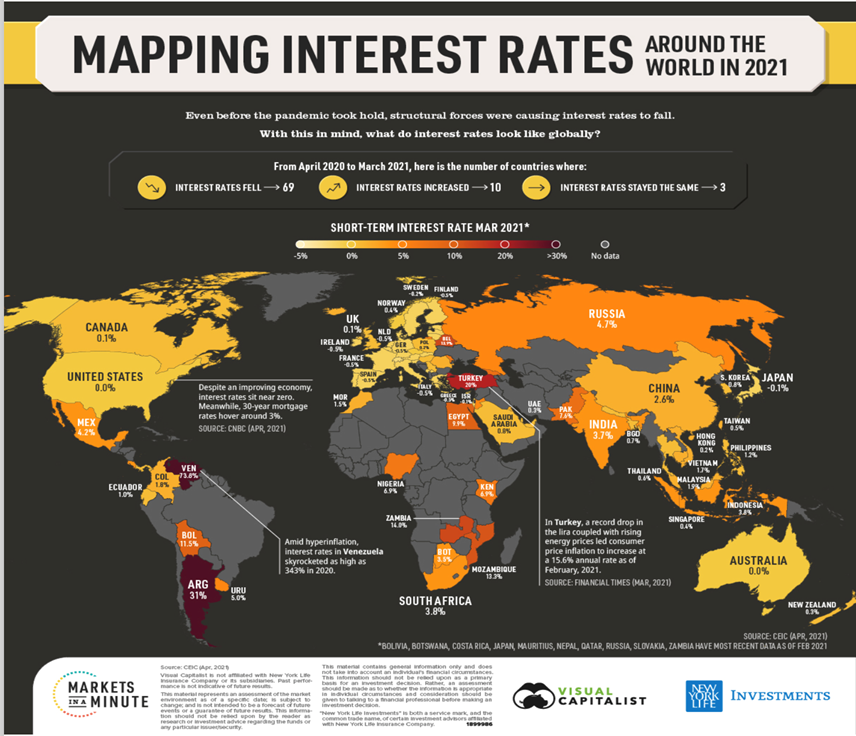

“Visualizing Interest Rates by Country in 2021 – Going as far back as the 14th century, pandemics have been found to have a negative effect on interest rates. History shows that this effect is even greater than that of financial crises. Across a study of 19 pandemics since the mid-1300s, real interest rates fell an average of 1.5 percentage points lower in the following two decades than they would have otherwise. And yet, even before COVID-19, structural forces, such as rising debt, were causing interest rates to fall.”, Visual Capitalist, May 2021

“Axios Harris Poll 100: Pfizer, Moderna reputations soar post-vaccine – Moderna and Pfizer shot up the ranks this year in the Axios/Harris 100, our annual survey of corporate reputations. Moderna is Americans’ third-favorite company this year, and Pfizer came in at seventh — up from No. 61 a year ago.”, Axios, May 13, 2021

“The best countries for digital nomads – Iceland, Barbados, Latvia and the Cayman Islands are just some of the countries actively inviting remote workers and entrepreneurs to work from their shores. With tourism revenue down, many countries are scrambling to lure ‘digital nomads’ to their shores to explore exciting new places and build their networks.”, Regus, May 12, 2021

Global Vaccine Update

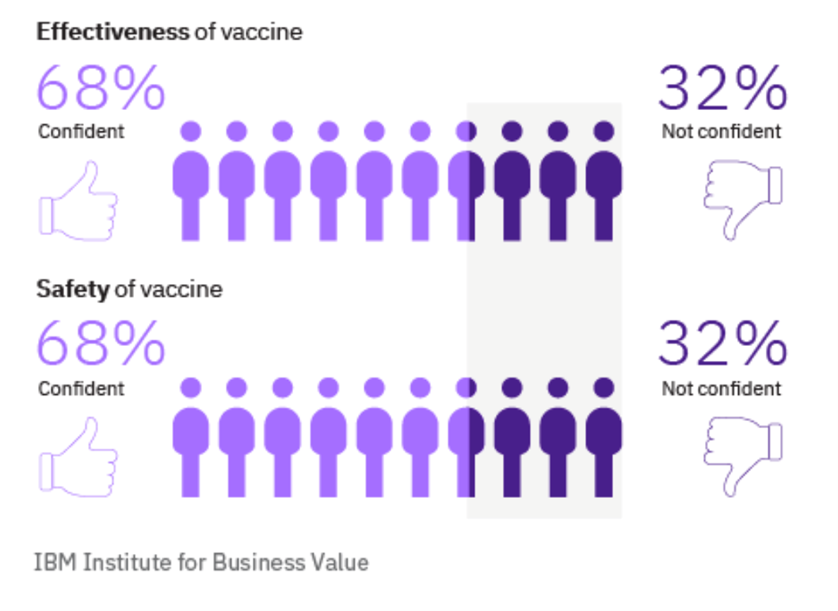

“IBM Surveys 15,000 Globally on Life After the Covid-19 Vaccine – The survey found that, overall, most respondents were confident in the safety, effectiveness, and distribution of the vaccines. One reason cited is that greater transparency helped drive consumer confidence. More than half of respondents said they expect the vaccine to keep them protected even as variants appear.”, Franchising.com and IBM.com, May 10, 2021

“Forget vaccine jabs—next-generation COVID-19 pills and nasal sprays are on their way – Even as the world tries to inject billions of people’s arms to fight against COVID-19, the next generation of coronavirus vaccines could make some of that massively complicated rollout unnecessary—perhaps as early as next spring. Instead of vials shipped around the world, and having to be stored at sub-zero temperatures, the new drugs would look more like this: blister-pack tablets and nasal sprays.”, Fortune, May 4, 2021

“This map shows the number of COVID-19 vaccination doses administered per 100 people within a given population. Note that this is counted as a single dose, and may not equal the total number of people vaccinated, depending on the specific dose regime as several available COVID vaccines require multiple doses.”, Our World in Data, May 17, 2021

Global and Regional Travel Updates

“Rethinking Post-Pandemic Business Travel to China – As the prospect of renewed international travel returns over the course of 2021, companies and individuals find themselves at a potential inflection point when it comes to travel to China.”, Stratfor, May 12, 2021

“U.S./U.K. Travel Ban: Airlines Beg To Restart Flights, Worried That June Decision Is Too Late – The news on the reopening of the U.K./U.S. border is gradually becoming more promising–the U.S. has downgraded the U.K. from a Level 4: ‘Do Not Travel’ to a Level 3: ‘Reconsider Travel’ and the U.K. is reopening its borders to some countries on 17 May. However, industry professionals are begging the countries to make a decision before it becomes too late to really profit from the summer travel season.”, Forbes, May 14, 2021

“EU Travel: An Explainer On What You Need To Visit–Testing, Vaccinations, Digital Green Certificates – The list of dates when European countries have or are expecting to relax borders is growing and now is the time that most people are locking down summer travel plans……Here’s an explainer on what has been announced so far in regard to traveling internationally to a country in the EU over the summer in terms of what you need to have to travel.”, Forbes, May 16, 2021

“Germany Will Allow Vaccinated Travelers to Skip Quarantine and Testing – The German government plans to allow visitors who have been vaccinated against or recovered from COVID-19 to skip mandatory testing and quarantines.”, Travel and Leisure, May 12, 2021

“Delta will require COVID-19 vaccine for new employees – ‘Any person joining Delta in the future, future employees, we’re going to mandate they be vaccinated before they can sign up with the company,’ Chief Executive Ed Bastian told CNN in an interview late Thursday.”, Reuters, May 14, 2021

“Italy is reopening to all Americans aboard Delta’s COVID-tested flights – The country, which is in the process of reopening, is ready to welcome all travelers, but only if they’re flying on a COVID-tested flight from the U.S., Canada, Japan and the United Arab Emirates. The policy change is effective from May 16 through July 30, per the Italian health ministry.”, The Points Guy, May 14, 2021

“Qantas’ International Flight Resumption Delayed – The Australian Federal Government has revised its options on a significant border re-opening, delaying it to the middle of 2022 in view of its vaccine program completion by end of 2021. As a consequence, QF is revising its plans for the resumption of international flights from the end of October to late December 2021.”, Airways Magazine, May 13, 2021

“BA reveals how airports will look ahead of return of holidays – Online check-in systems, virtual queuing schemes and even a virus-busting UV robot are among a raft of new measures lined up at Heathrow Airport ahead of the lifting of restrictions on non-essential travel next week. Britons will be given the green light to legally leave the UK on Monday when the Government finally opens the airport gates for holidays and trips abroad.”, The London Daily Mail, May 13, 2021

“Singapore Announces Lockdown-Like Restrictions As Local Covid Cases Flare Up – Singapore has currently detected 11 active clusters of Covid-19 cases according to the Straits Times and 46 of the country’s current active cases are linked to the city’s Changi Airport. The government is concerned that there may be several hidden cases that have not been detected yet and those could lead to a spread in the larger community.”, Forbes, May 14, 2021

“No alternative to vaccine passports, says Dubai airport boss – Dubai Airports chief executive Paul Griffiths told the BBC: ‘I don’t think there is an alternative.’”, BBC News, May 15, 2021

“The Road Ahead: How COVID-19 has changed the way we travel – Americans are poised to begin traveling again. But how we travel and where we go will not be the same. As vaccinations roll out across the United States and other parts of the world, Americans are poised to begin traveling again. But, as we explore in this package, how we travel and where we go will not be the same. And the places we visit will be inexorably altered.”, Fast Company, May 10, 2021

“Hong Kong-Singapore travel bubble postponed for a second time – ‘In light of the recent increase in unlinked community cases, Singapore is unable to meet the criteria to start the Singapore-Hong Kong ATB,’ Singapore’s Ministry of Transport said in a statement. But both sides remained committed to launching the bubble safely, it said. The Hong Kong government said another announcement would come on or before June 13.”, Reuters, May 17, 2021

Country & Regional Updates

Australia

“Covid-19 jab to be given to every Australian by end of year, Peter Dutton says – The defence minister told the Today show on Friday the only adults who would not be vaccinated by Christmas would be the ones who did not want the vaccine.“, The London Daily Mail, May 13, 2021

“Australia sticks by plan to re-open border in mid-2022 – ‘All the way through we will be guided by the medical advice,” Prime Minister Scott Morrison said at a televised briefing. “We will be guided by the economic advice.’”, Reuters, May 15, 2021

China

“China’s Services Activity Expands at Fastest Pace in Five Months, Caixin PMI Shows – The Caixin China General Services Business Activity Index, which gives an independent snapshot of operating conditions in the services sector, rose to 56.3 in April from 54.3 the previous month.”, Caixing Global, May 7, 2021

“China’s Labor Day Tourism Rebounds to Near Pre-Covid Levels – As many as 230 million domestic trips were made during the five-day holiday that ended 0n May 5, an increase of 119.7% from a year ago…..”, Caixing Global, May 6, 2021

“China’s factory output slows as bottlenecks crimp production – Factory output grew 9.8% in April from a year ago, in line with forecasts but slower than the 14.1% surge in March, National Bureau of Statistics data showed on Monday. Retail sales, meanwhile, rose 17.7%, much weaker than a forecast 24.9% uptick and the 34.2% surge in March.”, Reuters, May 16, 2021

European Union

“The EU’s Economy Bounces Back – GDP growth will accelerate in the European Union in the coming months, but risks connected to high debt and deficit levels, along with uncertainty about the future of the economy, will persist. On May 12, the European Commission predicted that the bloc’s GDP will expand by 4.2% in 2021, up from its previous 3.7% growth forecast.”, Stratfor, May 12, 2021

“Europe looks hopefully past infection rates to reopen economies – Over little more than a week, France lifted its travel ban, Spain allowed its six-month old “state of alert” to lapse and Germany eased lockdown. Italy has also steadily loosened restrictions over the past month, with people anticipating returning soon to gyms and indoor pools.”, The Financial Times, May 16, 2021

India

“India: Individual States Look to Import Foreign Vaccines – The governments of the Indian states of Maharashtra, Odisha, Karnataka, Uttar Pradesh and Telangana, among others, have placed global tenders for COVID-19 vaccines as domestic supplies fail to meet growing demand, Asian Age reported May 12.”, Stratfor, May 12, 2021

Italy

“Come visit Italy, Draghi says after G20 tourism meeting – Prime Minister Mario Draghi urged foreigners on Tuesday to book their summer holidays in Italy, saying it was set to introduce travel passes from the middle of May, sooner than much of the rest of Europe.”, Reuters, May 4, 2021

Mexico

“Heading to Mexico? These Are the COVID Restrictions in Place – From Tulum to Oaxaca, here’s what to expect if you’re visiting Mexico, from pre-departure requirements to what’s open on the ground.”, CNN Traveler, May 13, 2021

New Zealand

“New Zealand PM sets out plans to re-connect with post-pandemic world – New Zealand Prime Minister Jacinda Ardern said on Thursday her government will explore more travel “bubbles” and lead trade delegations later this year to re-connect with a post-pandemic world after more than a year of border closures.”, Reuters, May 12, 2021

Oman

“Oman ends coronavirus night curfew, orders overnight trading ban – Oman will end a nightly curfew on Saturday designed to curb the spread of COVID-19, but shops and commercial activities will be banned from 8pm until 4am, the Supreme Committee for Combating Coronavirus said.”, Reuters, May 13, 2021

Portugal

“Portugal opens borders to British tourists for travel from Monday – Portugal, whose economy heavily depends on tourism, made the move despite an EU ban on non-essential travel from countries outside the bloc. It said that tourists from Britain will have to present evidence of a negative PCR Covid test taken 72 hours before they depart.”, The London Times, May 7, 2021

“Portugal’s hotels see huge spike in booking requests after UK gives green light on international travel – The U.K. government said on Friday that from May 17 travelers from England will not need to quarantine when returning from Portugal. They will have to take a Covid PCR test within two days of their arrival in the U.K.— but this is a much simpler process compared to the rules applied to other destinations.”, CNBC, May 13, 2021

Singapore

“Singapore Announces Lockdown-Like Restrictions As Local Covid Cases Flare Up – Singapore has currently detected 11 active clusters of Covid-19 cases according to the Straits Times and 46 of the country’s current active cases are linked to the city’s Changi Airport.”, Forbes, May 14, 2021

Spain

“Vaccination, Improved External Environment Reduce Economic Risks for Spanish Economy, Central Bank Says – An acceleration in the vaccination pace in Europe and the improvement of economic prospects abroad reduce the risks for the outlook of the Spanish economy, according to the annual report of the central bank of Spain published on Thursday.”, The Wall Street Journal, May 13, 2021

Turkey

“Pandemic tourism in Turkey – Turks are stuck indoors. Foreigners have the country to themselves. As of May 15th, travellers from more than a dozen countries, including Britain, will no longer be required to produce a negative covid-19 test on arrival in Turkey.”, The Economist, May 15, 2021

United Kingdom

“UK economy set to grow at fastest rate in more than 70 years – The economy is expected to expand by 7.25% this year, with extra government spending helping to limit job losses. However, it follows a contraction of 9.9% in 2020, the biggest in 300 years. Andrew Bailey, the governor of the Bank of England, said the recovery was “strong” but likened it to ‘more of a bounce back’ than a boom.”, BBC News

“Pubs and restaurants welcome you in from the cold from May 17 – The prime minister will formally announce this afternoon that England will move to stage three of its road map out of lockdown, with mixing allowed indoors in groups of six from Monday. Pubs and restaurants will be allowed to serve inside again.”, The Times of London, May 10, 2021

United States

“Optimism rises among (U.S) small business owners even as many struggle to hire – The NFIB Small Business Optimism Index increased 1.6 points in April, to 99.8, from a month before. The index is up from a reading of 95 in January, but down from 104 in the fall. The reading is about 2 points above the historical average.”, Axios, May 12, 2021

“Vaccinated Americans are raring to travel, survey shows, and are booking up summer vacations – 97% of users surveyed by TripIt, the travel management platform, said they plan to travel in 2021, with more than half planning to fly somewhere within the United States by June.”, The Points Guy, May 12, 2021

“More than a dozen Las Vegas casinos cleared to operate at 100% capacity – Three of the biggest casino operators in Nevada — MGM Resorts International, Caesars Entertainment and Station Casinos — were all approved to return to full casino capacity with no social distancing restrictions. The news, announced Wednesday, means 24 casinos across the valley can now immediately resume operating at 100% capacity.”, The Points Guy, May 13, 2021

“CDC advances plan for resumption of U.S. passenger cruise operations – On Wednesday, it announced two new phases and said operators now have all necessary requirements needed ‘to start simulated voyages before resuming restricted passenger voyages and apply for a COVID-19 conditional sailing certificate to begin sailing with restricted passenger voyages.’ The CDC said on April 28 it was “committed” to the resumption of cruise industry passenger operations by mid-summer as it issued some clarifications of its earlier order.”, Reuters, May 5, 2021

Brand News

“Carl’s Jr. Parent CKE Restaurants Evolves Into A ‘Global Operation’ With 1,000th International Milestone – In total, Carl’s Jr. and Hardee’s have more than 3,900 restaurants in 44 U.S. states and 40 countries and U.S. territories. The company will enter Peru this year, making it 41 countries…..about 60% of CKE’s development from the past 10 years has come from international markets.”, Forbes, May 20, 2021

“Maggiano’s Little Italy is #1 – Italian Chain Restaurants Ranked From Worst To Best. It doesn’t come as a surprise that one out of every eight restaurants in the United States serves Italian food, which means there are approximately 100,000 Italian restaurants in the country.”, Mashed, April 16, 2021

“Applebee’s And IHOP Are ‘All In’ On Ghost Kitchens And Virtual Brands – Consider the company’s off-premise numbers, indicating that both Applebee’s and IHOP are now a balanced dine-in and off-premise business. Applebee’s off-premise sales are nearly 37% of the sales mix, with delivery accounting for 14.7% and takeout accounting for 22%. IHOP’s off-premise sales are more than 33%, with delivery at 16.4% and takeout at 16.9%.”, Forbes, May 6, 2021

“Burger King (UK) launches first ever ‘dark kitchen’ as home delivery surges – The fast food chain is currently trialing the initiative at a kitchen in Kentish Town, London. If successful, the kitchen could mean that Burger King can serve roughly 400,000 customers in the north London area.”, The Independent, May 17, 2021

“McDonald’s eyes 100 more restaurants over next three years as part of $600m investment plan. A majority of new restaurants will include a drive-thru, McDelivery and digital ordering. The fast food giant, which currently has 1,007 restaurants and employs over 106,000 people in the country (Australia).” QSR Media Australia, May 1, 2021. Compliments of Jason Gehrke, ‘Franchise News’

Articles & Studies About Doing Business Going Forward

“Celebrating Small Businesses—The R&D Of The U.S. Economy – Name a large successful firm that didn’t start off as a small innovative enterprise, there aren’t any. Walmart, Amazon, Microsoft, McDonald’s etc.—their stories are inspirational and there are a million such stories of a different scale and flavor that populate Main Street across the country and employ about half our workforce. Entrepreneurs are free to try out their ideas. The market picks the winners, the losers go on to try other ideas.”, Forbes, May 4, 2021

“Restaurants Plan for Post-Covid Renewal: Smaller Menus, Merch Stores, Healthcare for Workers. The pandemic provided a window of experimentation. Here’s what chefs, restaurateurs and industry experts think will stick. For many restaurant owners, pandemic-related labor shortages laid bare what was no longer working in an industry defined by its unrelenting work culture, and provided a window for experimentation. Many restaurants reopened post-lockdown with permanently revised pay structures and operations, as well as new standards to address burnout.”, The Wall Street Journal, May 6, 2021

“10 Marketing Predictions for a New Decade – ‘What do the next 5 years have in store? Will buyers continue to crave more choice and personalization? Will technologies like AI and machine learning present new ways to market? Or will forward-looking businesses reinvent marketing in ways we haven’t even thought of yet?’”., Franchising.com. May 13, 2021

We accelerate successful global development for our Clients

Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. Our U.S. based executive team has experience living and working in many countries. Our Associate network on the ground overseas covers 40+ countries.

Edwards Global Services, Inc. (EGS) has twice received the U.S. President’s Award for Export Excellence.

Find out more about how we help companies Going Global successfully at:

Download our latest 40 country ranking chart at this link:

William (Bill) Edwards, CFE, is CEO and Global Advisor of Edwards Global Services (EGS). He has 46 years of international operations, development, executive and entrepreneurial experience and has lived in 7 countries. With experience in the franchise, oil and gas, information technology and management consulting sectors, he has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East. Mr. Edwards advises a wide range of companies on early to long term global development of their brands.

My latest article: “LEADERSHIP – We Spoke to William (Bill) Edwards of Edwards Global Services on Being an Effective Leader During Turbulent Times.”, Authority magazine, April 22, 2021

For truly global market research, operations and development support across 40 countries, contact Mr. Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

https://calendly.com/geowizard/30min Click here to schedule a call with Bill Edwards to discuss how to succeed in developing your company around the world.

EGS Biweekly Global Business Newsletter Issue 29, Monday, May 3, 2021

By William (Bill) Edwards, CEO of Edwards Global Services, Inc. (EGS)

““A smooth sea never made a skilled sailor.”, Breton proverb

“We must accept finite disappointment, but we must never lose infinite hope”, Dr. Martin Luther King

“You cannot go back and change the beginning, but you can start where you are and change the ending.”, C.S. Lewis

Highlights in issue #29:

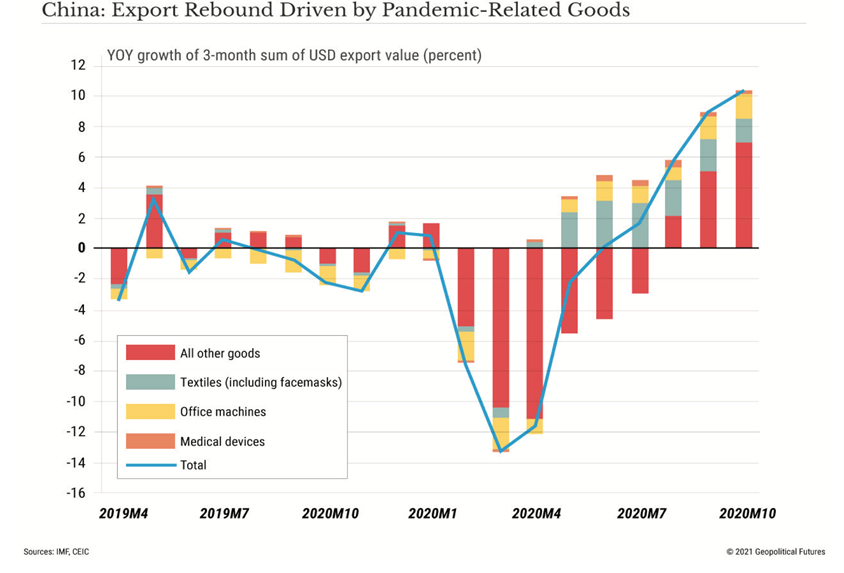

- China’s Economy After the Pandemic – Major study by Geopolitical Futures

- “Trade: The Path to Recovery and Growth in 2021: May 18-20 World Trade Week event with 3+ speakers from around the world

- The Brian Connors Report – A comprehensive look at our economy today and for the future

- Brand News Section: Dominos®, Dunkin®, Hooters®, McDonald’s®, Nathan’s Famous®, Popeyes®, Retail Zoo (Australia) and Taco Bell®

Our Information Sources

Our biweekly newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel.

We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covers 43 countries and provides us with updates about what is happening in their specific countries.

Please feel free to send us your input and sources of information. Our contact information is at the bottom of this newsletter.

First, a few Personal Comments

This issue is longer than most due to lots of positive news from around the world about vaccine penetration and businesses reopening.

The Alliance Risk Barometer says the rollout of coronavirus vaccines provides hope that the worst effects of the pandemic will subside in 2021. While we do see reopening of businesses in Italy, Greater Madrid, Hungary, Italy, the United Kingdom and the USA, COVID-19 cases remain high in Brazil and especially in India. International travel, key to new business development, remains low but there are signs that by September this will also increase dramatically open up the world to faster economic recovery.

Your newsletter editor, Bill Edwards, is moderating sessions on export resources for small businesses in the USA and Ambassador’s Craig Allen’s keynote speech entitled, “Navigating in Uncharted Waters, Exports to China in 2021’, during the Orange County World Trade Week event on May 18-20, 2021. Register to join us as 30+ global trade experts share their knowledge on global trade going forward at https://bit.ly/2S97HZn

Global Vaccine Update

“This map shows the number of COVID-19 vaccination doses administered per 100 people within a given population. Note that this is counted as a single dose, and may not equal the total number of people vaccinated, depending on the specific dose regime as several available COVID vaccines require multiple doses.”, Our World in Data, May 2, 2021

“EU Commissioner Breton confident of 70% inoculation goal by mid-July – The European Union will be able to produce enough vaccines to achieve its target for immunity of its adult population by the middle of July, the EU executive’s vaccine task force chief said in an interview with a Greek newspaper published on Sunday.”, Reuters, April 25, 2021

“Vaccine Passports: Just The Ticket Or A Ticket To Nowhere?”, Forbes, April 30, 2021

May 18-20, 2021 World Trade Week Event Announcement

“Trade: The Path to Recovery and Growth in 2021: This year’s 3-day Orange County World Trade Week event will have more than 30 global business and trade leaders from every region of the world and will cover 9 major business sectors showing us how best to go forward to further success. To register for this event, visit:https://bit.ly/2S97HZn

Interesting Data and Studies

“Global GDP Forecasts for 2021 and 2022: In its April 2021 report, the International Monetary Fund (IMF) projected a strong recovery in 2021 and 2022 thanks to the ongoing fiscal support, vaccine rollouts, and a general adaptation to pandemic life”, Visual Capitalist, April 29, 2021

“The coronavirus effect on global economic sentiment – Though the pandemic overshadows other risks to growth, optimism about the economy persists and company prospects continue to brighten, especially on the hiring front.”, McKinsey & Co., April 30, 2021

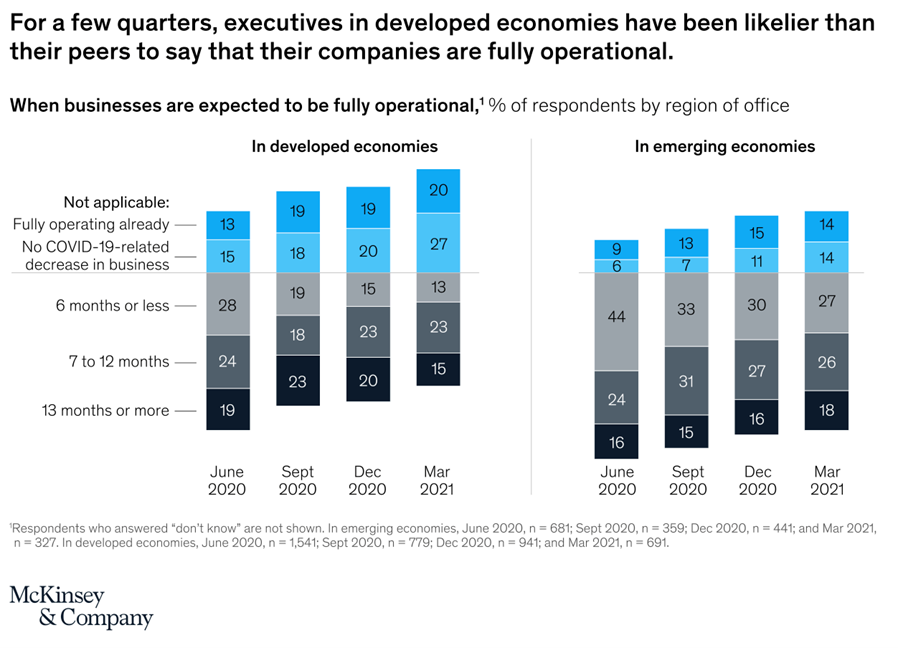

“Open for business? Developed economies are more likely to say ‘yes.’ Less than half of businesses are fully operational, according to our latest McKinsey Global Survey. Developed economies are out in front, perhaps because of their greater access to COVID-19 vaccines.”, McKinsey & Co., April 27, 2021

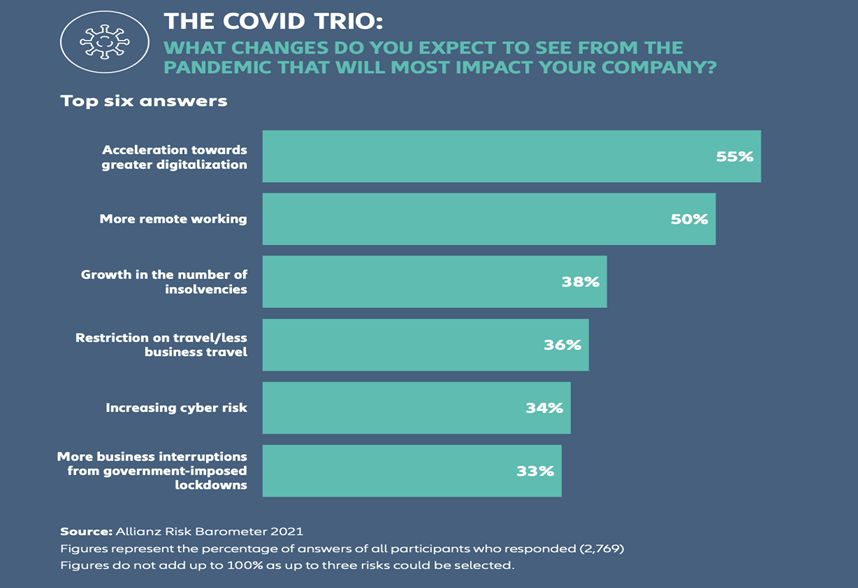

“ALLIANZ RISK BAROMETER IDENTIFYING THE MAJOR BUSINESS RISKS FOR 2021 – The most important corporate perils for the next 12 months and beyond, based on the insight of 2,769 risk management experts from 92 countries and territories. The rollout of coronavirus vaccines provides some hope that the worst effects of the pandemic will subside in 2021, although measures to contain the virus are expected to remain in place for some time yet. However, the economic, political and societal consequences of the pandemic are likely to be a source of heightened business interruption risk in the years ahead.”, Alliance Risk Barometer, May 2021

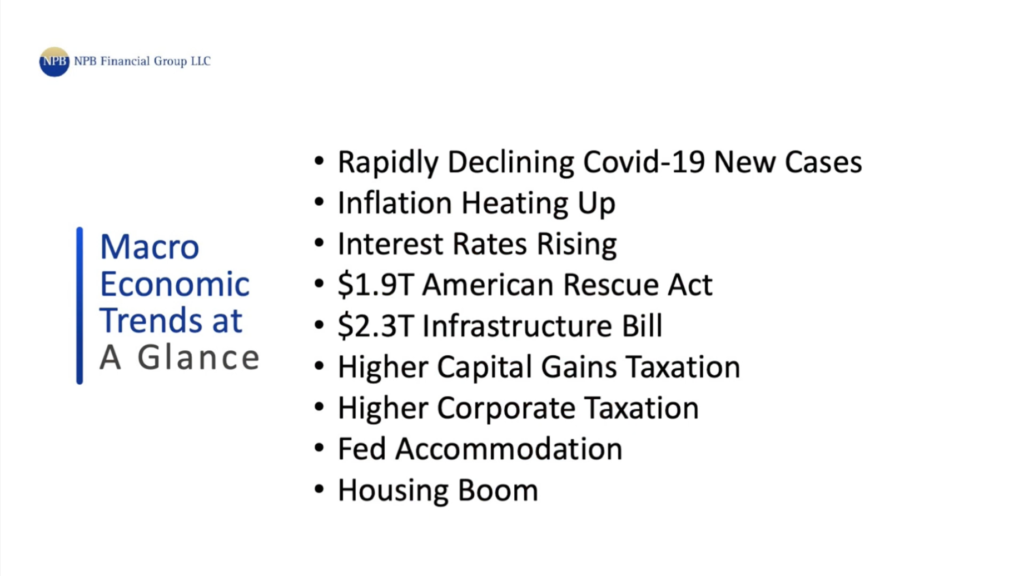

”The Brian Connors Report – NPB Financial Group LLC – The Conners Report talks with industry thought leaders on the key economic, market, business, and disruptive technologies that face business leaders today. He searches for breakthrough ideas and megatrends that will provoke you to take action today so we will be relevant tomorrow, hosted by Brian Conners, a Certified Financial Planner (CFP) and Wealth Management Specialist., April 30, 2021

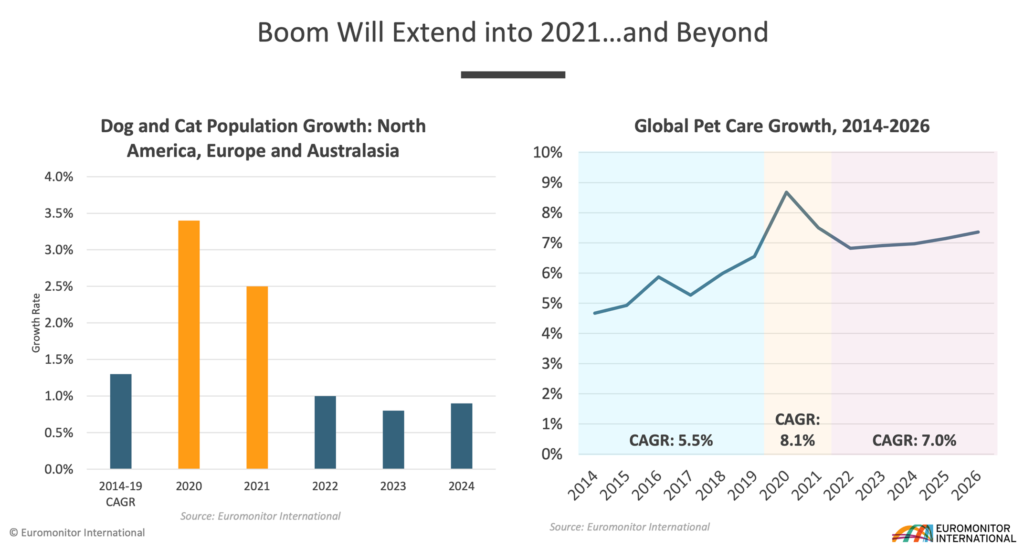

Pet Care Outlook Study – Which Trends Will Outlast the Pandemic? “2020 was an Exceptional Year for Pet Care; Revitalized pet population growth in developed markets; A major pivot in ownership to higher income households; and More bonding time and deeper humanization trends. Strong Growth Outlook for 2021: Workplace and mobility patterns continuing into 2021; More clarity around the long- term future of remote work; and Elevated population base in higher-income households”, Euromonitor International

“On-demand pay a growing benefit – and concern – for small businesses – We think of payday as a rigid date, but ‘pay on the day’ is becoming more popular. Here’s how to navigate on-demand benefits.”, The London Guardian, May 2, 2021

A Bit of Fun In These Otherwise Serious Times

“McKinsey for Kids: A tiger’s tale about what nature is really worth. In this edition of McKinsey for Kids, let’s explore mangrove forests—which have unique trees that grow near tropical-ocean coastlines—and why protecting them can help tigers and other endangered species, as well as all of us.”, McKinsey & Co., April 29, 2021

“This Is Not a Joke: The Cost of Being Humorless – Humor has tremendous benefits for physical health, mental well-being, and your bottom line. A 15-year longitudinal (Norwegian) study of more than 50,000 Norwegians found that women with a strong sense of humor had a 73% lower risk of dying from heart disease and an 83% lower risk of dying from infection.”, Stanford Business, January 28, 2021

Global and Regional Travel Updates

“Want to travel to Europe this summer? Here’s what you need to know – The European Union is reportedly planning to reopen to fully vaccinated American tourists this summer. While details remain murky, it’s an encouraging sign for Americans who are eager to venture abroad and return to some of their favorite destinations in Europe.”, The Points Guy, April 26, 2021

“Guangzhou Topples Atlanta as World’s Busiest – Traffic at Guangzhou Baiyun International Airport (CAN) surpassed Atlanta Hartsfield-Jackson Airport (ATL) by 1.1 million passengers in 2020.”, Airways Magazine, April 23, 2021

“Disneyland reopens for first time in 13 months as US hits another major vaccine milestone. Visitors cheered and screamed as the Southern California theme park opened its gates for the first time in 13 months. And according to the Centers for Disease Control and Prevention (CDC), 39% of the nation’s adult population has now been fully vaccinated – totalling more than 100 million people. More than 55% of adults have received at least one dose.”, Sky News, April 30, 2021

“CDC ‘committed’ to U.S. cruise industry resuming operations by mid-summer – ‘If a ship attests that 98% of its crew and 95% of its passengers are fully vaccinated,’ the agency told the industry in a letter released publicly, that ship may skip simulated voyages and move directly to open water sailing.”, Reuters, April 28, 2021

“Hopes rise for overseas travel to dozens of green list countries – Hopes of a summer holiday in Europe were boosted yesterday with the possibility of non-essential travel to destinations such as Portugal and Malta as soon as mid-May….Meanwhile, France announced that Britons will be able to travel there from the start of June provided they have proof of being vaccinated.”, The Times of London, April 30, 2011

“The gateway to the rest of world? Why Singapore is ready to open a travel bubble with Australia as soon as the government gives the green light. Singapore – which has very low levels of Covid-19 – is already open to Australians . Morrison government is in talks with ministers about a two-way travel bubble. No timeframe has been set but Singapore is keen to welcome Aussies asap.”, The London Daily Mail, April 28, 2021