Biweekly Global Business Newsletter Issue 149, Tuesday, December 9, 2025

“The future of trade will belong to the economiesthat move the fastest, not the largest.”

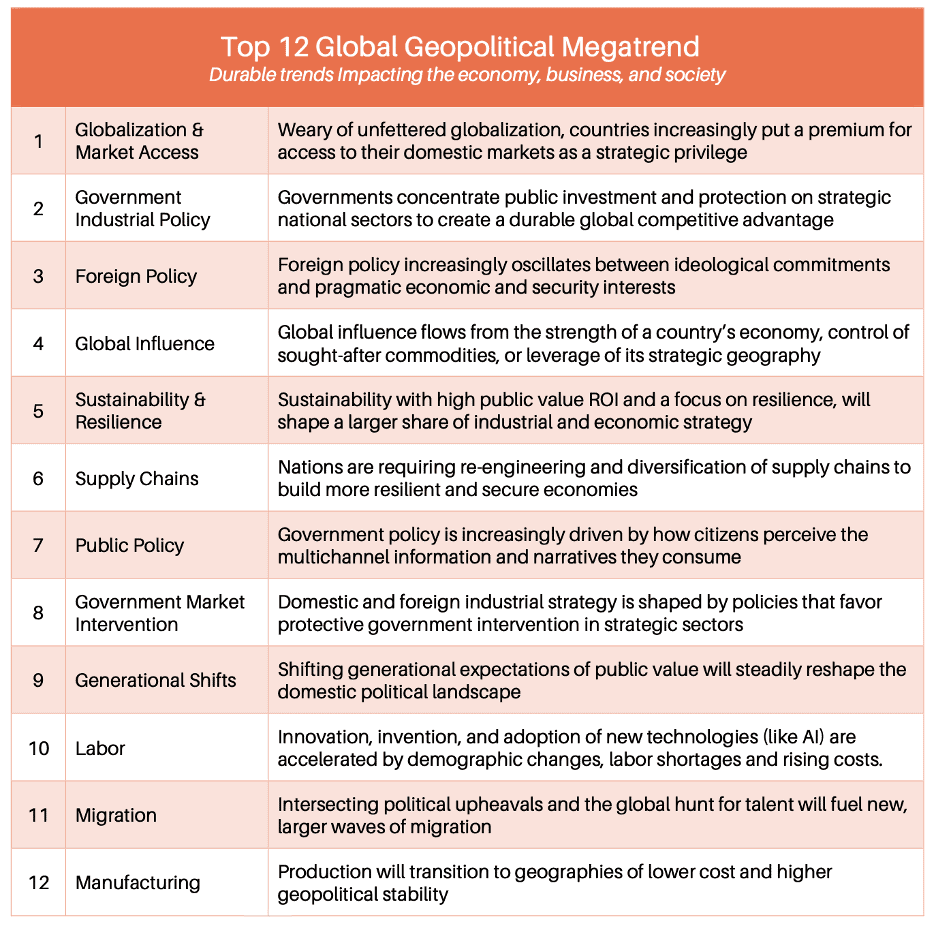

Welcome to the 149th Edition of the Global Business Update – The final weeks of 2025 bring a world economy marked by uneven momentum, persistent uncertainty, and several deep structural shifts reshaping global business. A new report on Geopolitical Megatrends highlights the accelerating forces now moving beneath the surface of daily events — durable, long-term transformations at the intersection of geography, economics, technology, and power.

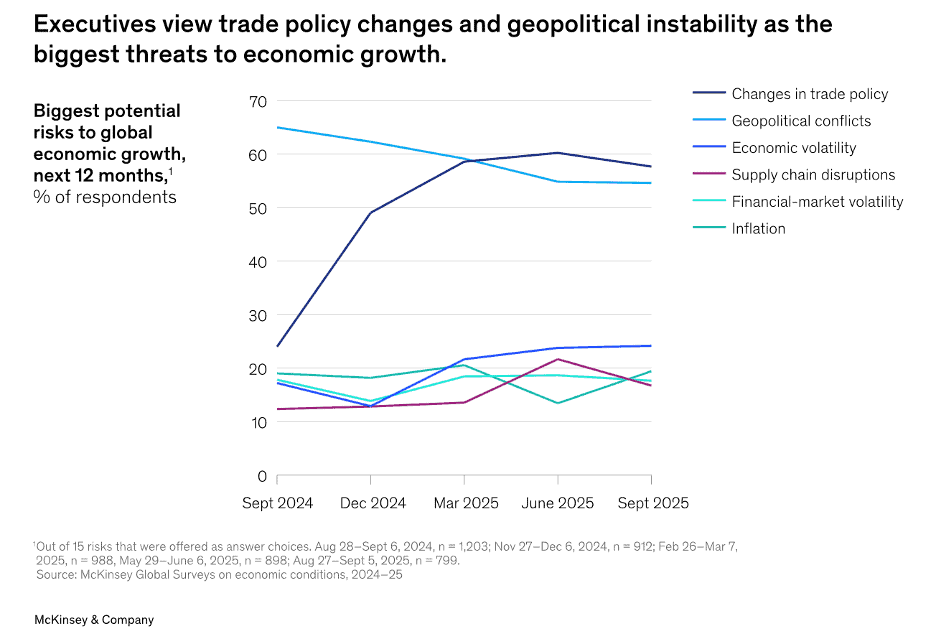

Growth remains mixed across major markets as inflation edges higher in many developed economies and policy uncertainty continues to influence investment decisions. The U.S. government shutdown, U.S.–China tariff dynamics, and energy-driven inflation shifts in Europe all contribute to a business environment defined by volatility rather than stability. The upcoming 2026 review of the USMCA USA-Mexico-Canada trade agreement is already prompting vigorous debate on the future of North American integration.

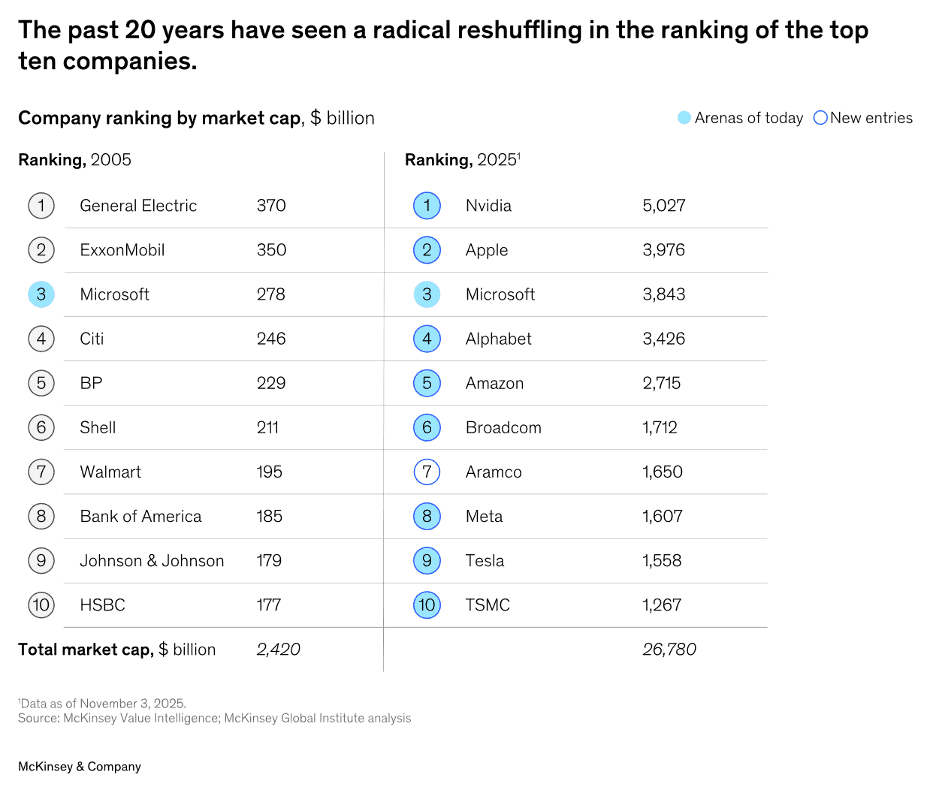

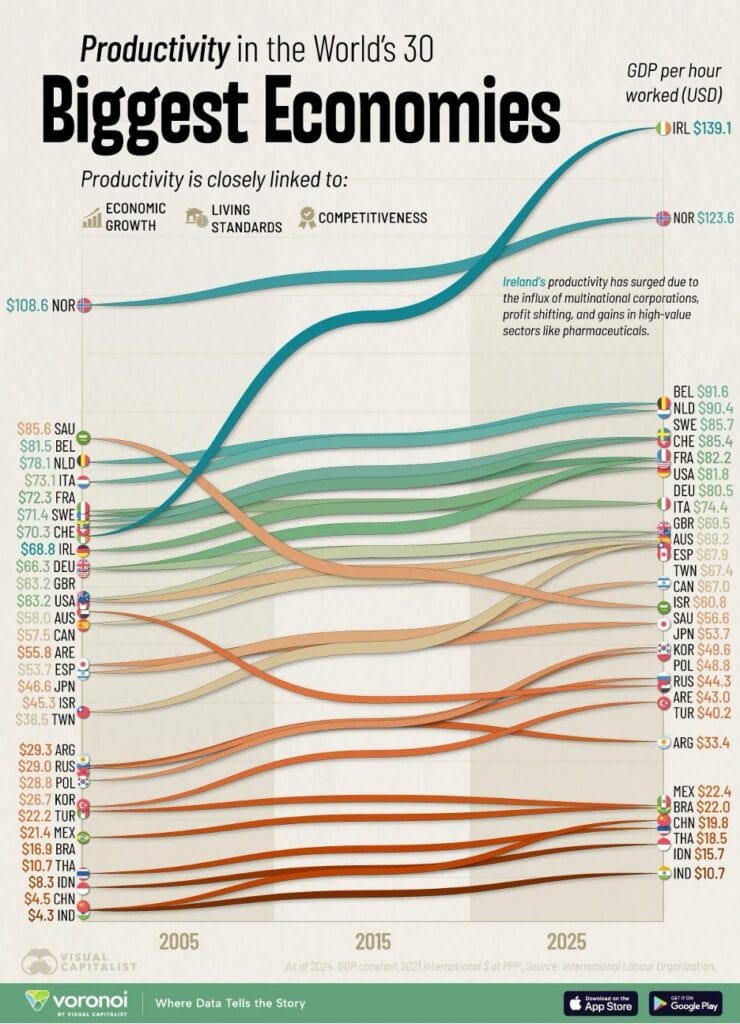

McKinsey’s analysis of “business arenas” underscores how quickly competitive landscapes are shifting: only one company appears on both the 2005 and 2025 lists of the world’s most valuable firms. Productivity trends tell a similar story, with China’s long surge moderating, Ireland’s tax-driven distortions widening, and Saudi Arabia grappling with a slow transition away from hydrocarbons.

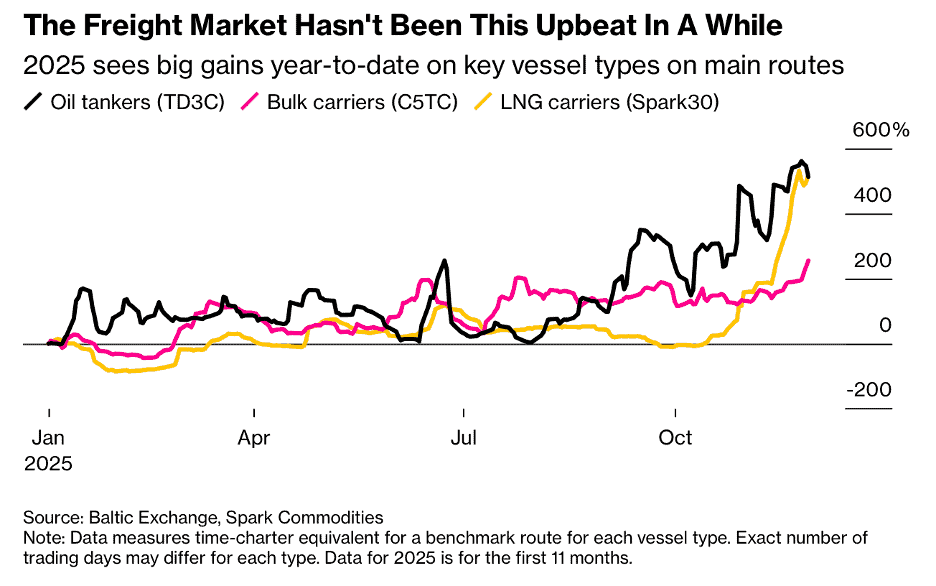

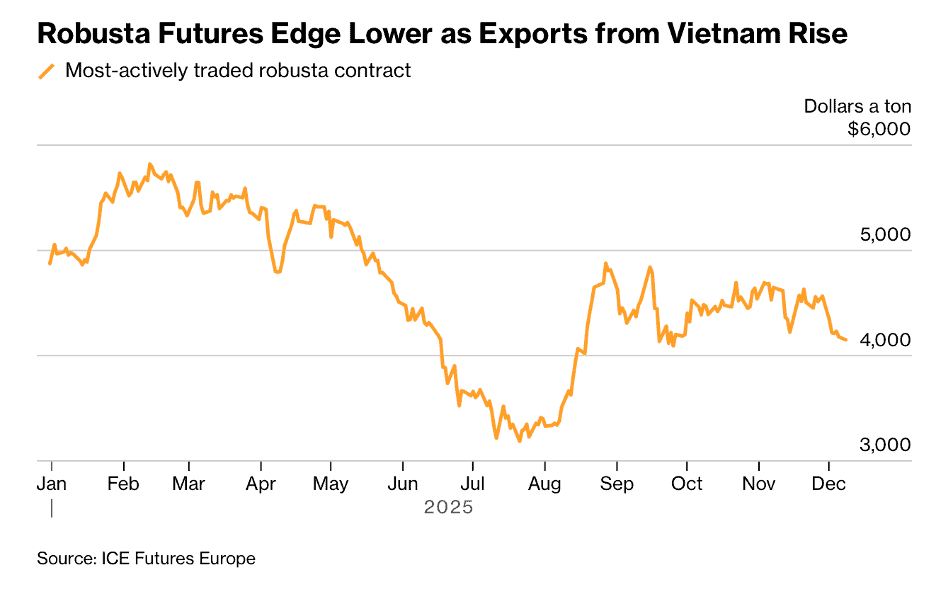

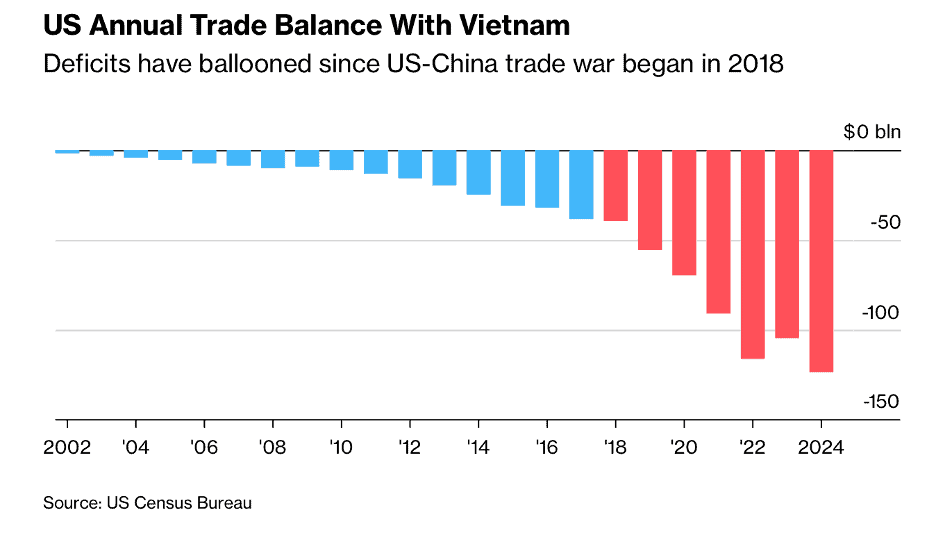

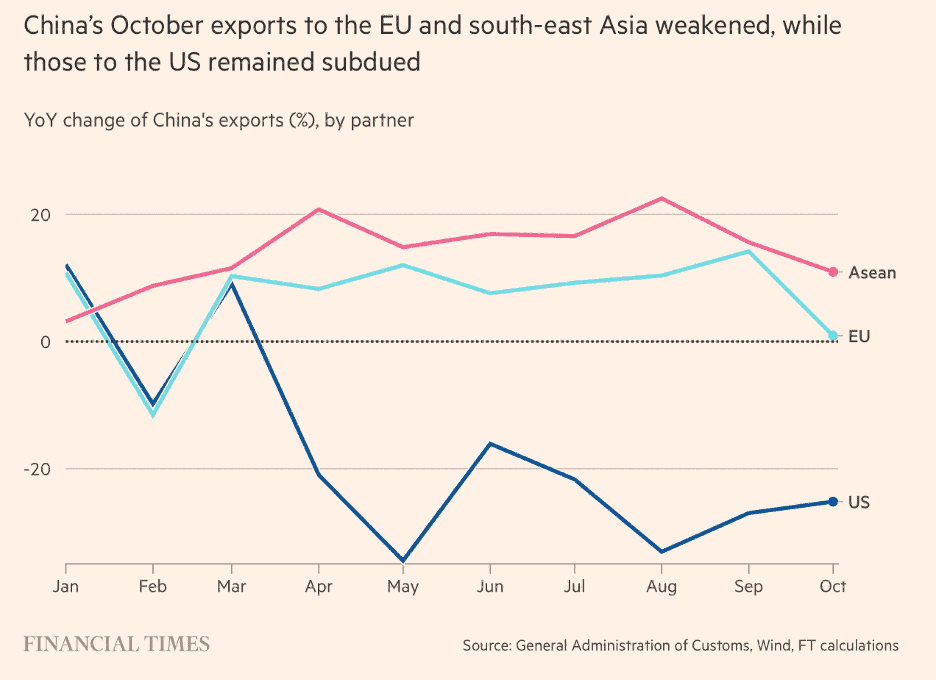

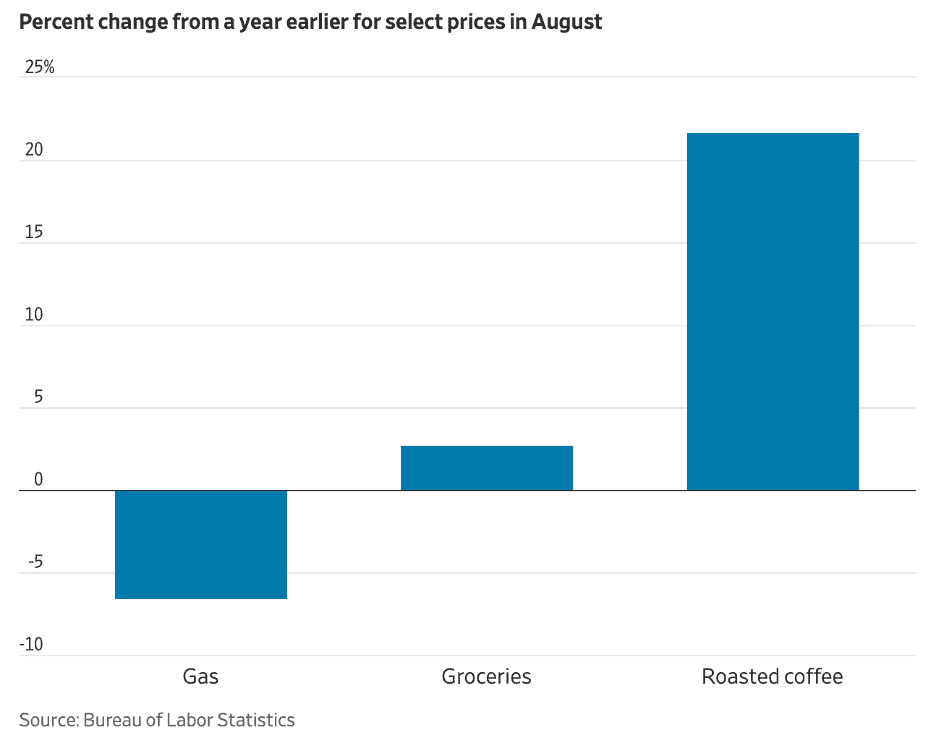

Global freight rates have spiked sharply amid geopolitical disruptions, China is deepening export ties with Southeast Asia in response to U.S. tariffs, and Vietnam has emerged as a major U.S. supplier despite rising trade frictions. But coffee prices are starting to come down!

This edition’s book review highlights a “Borderless Business: How Smart Entrepreneurs Expand Globally”, by Dr Raymond Hopkins, who draws on 30+ years of hands-on experience in global contracting and international trade to deliver a practical, actionable playbook for entrepreneurs seeking to grow beyond their home markets. Rather than selling theory, Hopkins offers real-world frameworks grounded in decades of negotiating complex contracts, managing supply chains, and adapting to diverse regulatory, cultural and economic environments.

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive our biweekly newsletter by email every other Tuesday, click here https://insider.edwardsglobal.com

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business. We do not get involved with or report on politics!

PLEASE NOTE: Some of the information sources that we provide links to in our newsletter require a paid subscription to directly access them. Clicking on a link may not give the reader access to the content.

Edited and curated by: William (Bill) Edwards, CEO & Global Business Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA. Contact Bill with questions, comments and contributions. Bedwards@edwardsglobal.com, +1 949 375 1896

Link to our current and past newsletters: https://edwardsglobal.com/geowizard/

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

First, A Few Words of Wisdom From Others For These Times

“The future of trade will belong to the economies that move the fastest, not the largest.”, 2025 Global Competitiveness Forum

“A leader is one who knows the way, goes the way, and shows the way.”, John C. Maxwell.

“Treat people well, it’s the only investment that never loses value.”, Justin Wright

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Highlights in issue #149:

Top 12 Geopolitical Megatrends Insights for Businesses & Governments Leaders

Productivity of the World’s Largest 30 Economies (2005-2025)

Robusta Coffee Falls on Ample Supply From Top Grower Vietnam

Costco Joins Companies Suing for Refunds If Trump’s Tariffs Fall

2026 Travel Trends – An evolving travel and loyalty industry

Franchise Global News Section: Chick-fil-a®, Denny’s® and Wingstop®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

“Top 12 Geopolitical Megatrends Insights for Businesses & Governments Leaders – We live in an age defined not by calm progress, but by constant motion, churn, and noise. Information is everywhere. Scarce is wisdom and judgement. The ability to pull insight from complexity in our environment is now one of the essential skills of leadership. When John Naisbitt first used the word “megatrends,” he named the powerful forces moving beneath daily events. Today those forces are faster, more tightly linked, and harder to ignore. The twelve megatrends in this report are durable, structural shifts at the intersection of geography, economics, and power.”, Report and analysis by Dr. John Pournoor, Government Analytica®.

=============================================================================================

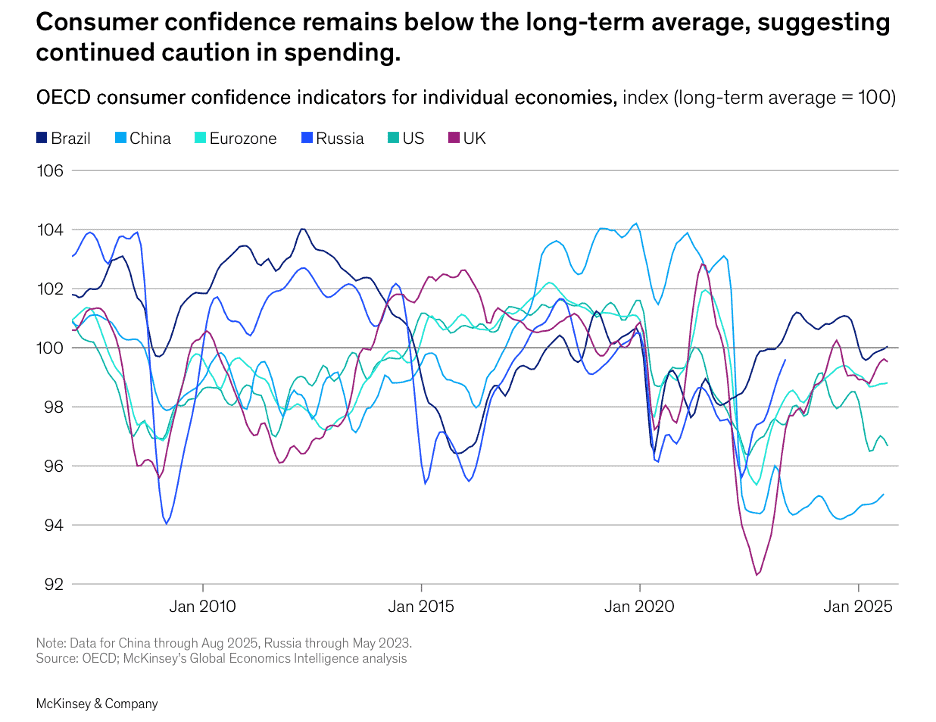

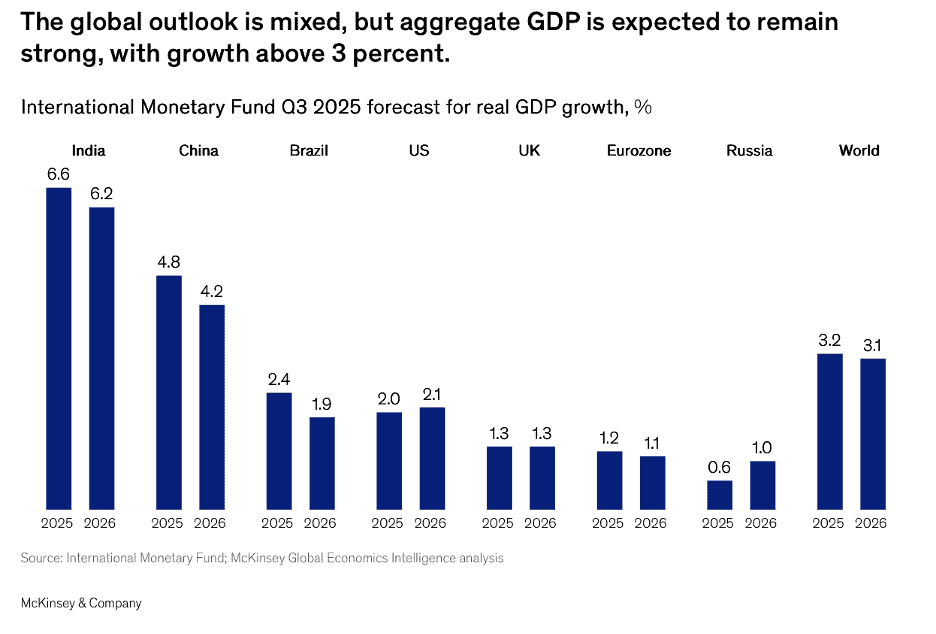

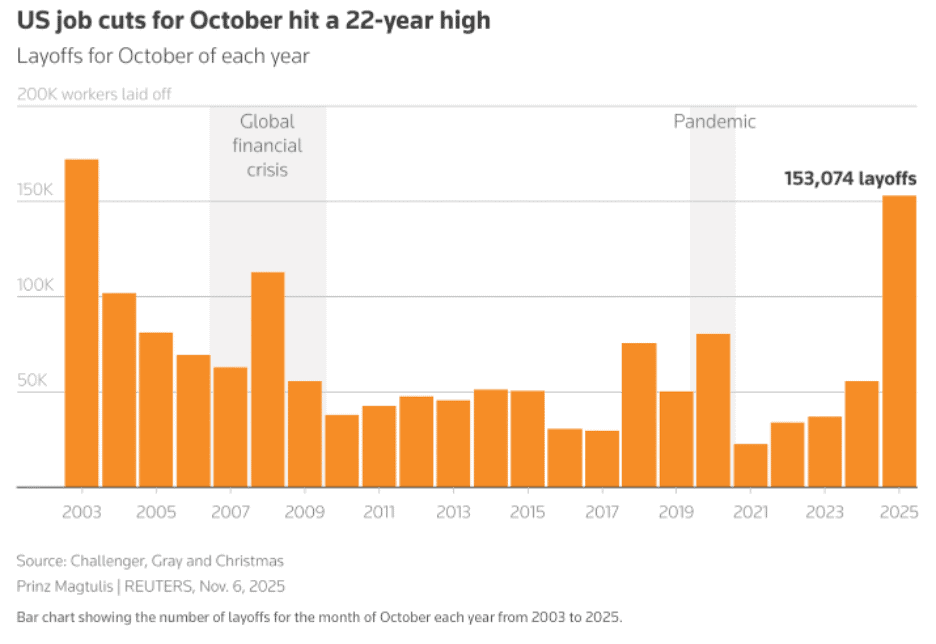

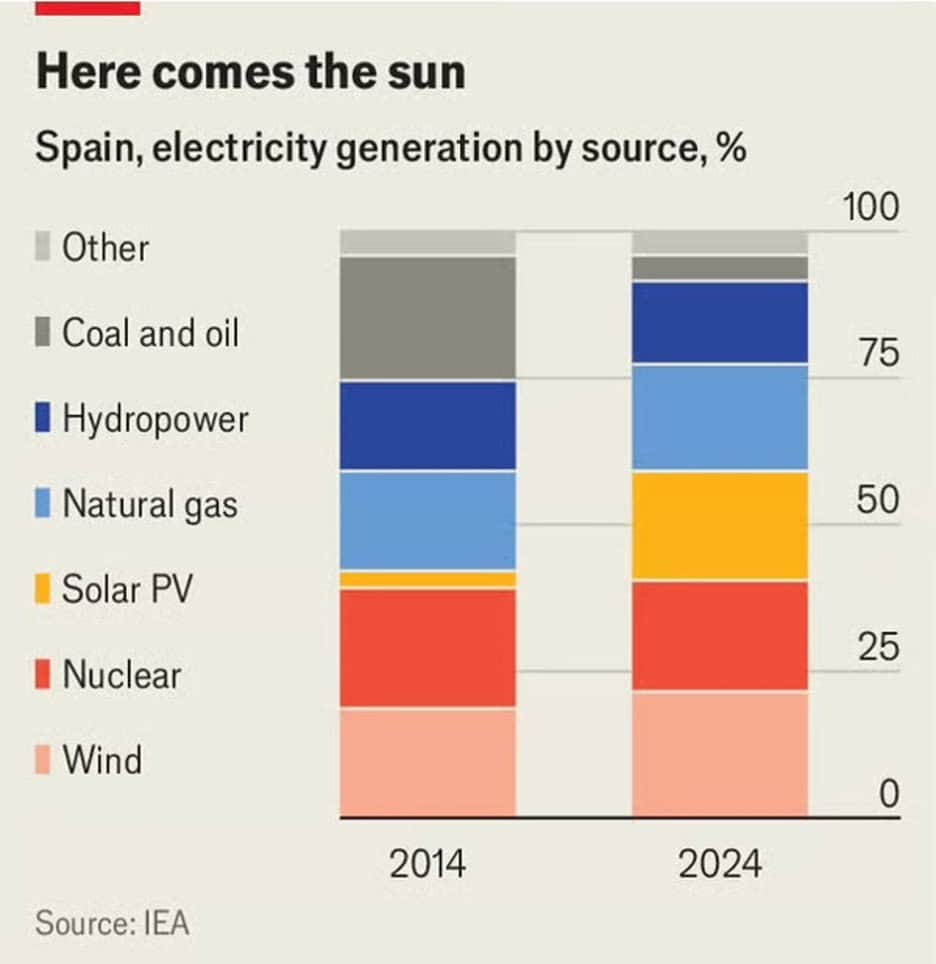

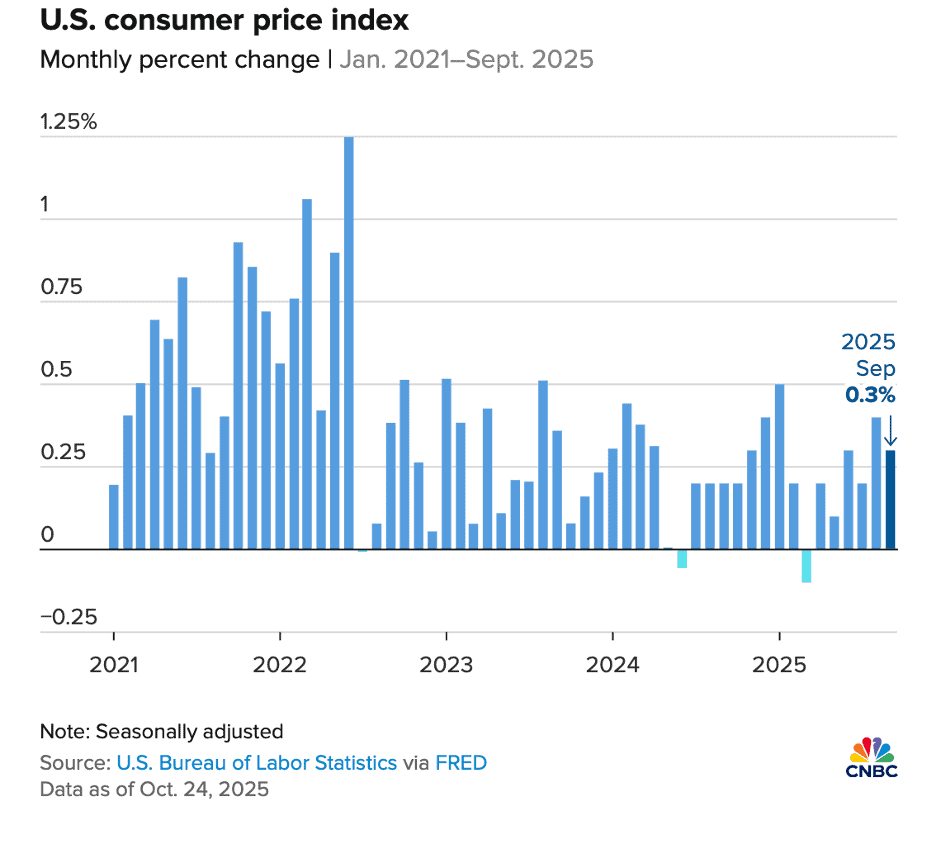

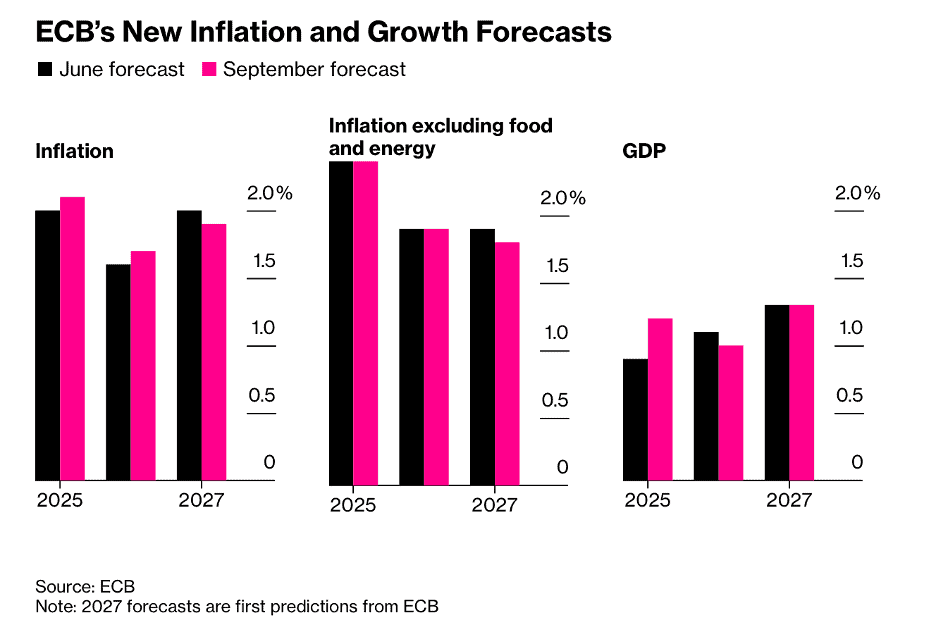

“Global Economics Intelligence executive summary, October 2025 – Global growth remains uneven amid policy uncertainty and trade realignments. US government shutdown adds downside risk, while US–China tariff talks and gradually easing inflation offer some optimism. Inflation among developed economies continues to accelerate and is moving away from the targets set by most central banks. In the US, the consumer price index (CPI) rose 3.0% for the 12 months ending September, after increasing 2.9% over the 12 months ending August. Core inflation was slightly up, to 3.0% (annualized). In the eurozone, headline inflation ticked up to 2.2% in September, but the rise was entirely driven by a smaller annual decline in energy prices. Core inflation remained stable at 2.3% for the fourth consecutive month. In the UK, it’s a different story: inflation remains elevated. Headline CPI inflation reached 3.8% in September, one of the highest rates among developed economies, largely driven by transportation and hotels/recreation prices.”, McKinsey & Co., November 25, 2025

===============================================================================================

“The power of arenas – Arenas are industries that transform the business landscape. The industrial landscape has shifted dramatically over the past 20 years. Just look at the top ten most valuable companies in 2005 and 2025. Only one company appears on both lists. And the rest of the 2025 leaders are worth about ten times more than the 2005 leaders they replaced.”, McKinsey & Co., November 20, 2025

=============================================================================================

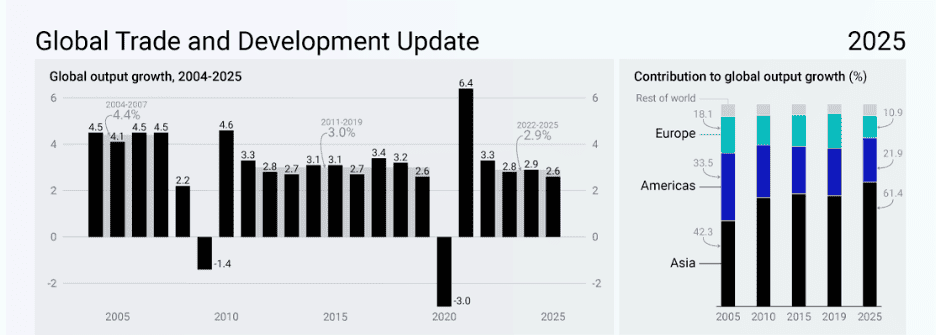

“Global Growth Continues Its Descent – A U.S. import surge lifted world trade at the start of the year, but it’s over now. According to the latest U.N. Trade and Development Report, global economic sentiment remains negative. Output growth is still slowing, and the dominant trend is prolonged uncertainty as economies struggle to adjust to shifting external conditions. It also underscores a widening gap between global trade and global finance, a sign of deeper structural imbalances.”, Geopolitical Futures, December 5, 2025

============================================================================================

“Productivity of the World’s Largest 30 Economies (2005-2025) – China’s productivity has surged by about 340% since 2005, driven by rapid industrial upgrades and investment in technology. However, growth has slowed in recent years. Ireland’s productivity appears high due to a tax system that lets global tech and pharma firms book profits and intellectual property earnings in the country, even though most of the money goes back to their parent companies. Saudi Arabia’s productivity has declined over the past two decades, mainly due to lower oil prices in the mid-2010s and OPEC+ production cuts that limited output. Non-oil sectors are growing, but the economy still depends heavily on hydrocarbons.”, International Labour Organization, November 27, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation, Taxes, Tariffs & Trade Issues

“The Debate Over a USMCA Overhaul in 2026 Kicks Off in Washington – The deal Trump negotiated in his first term comes up for review in 2026 and a contentious debate is under way. Policy leaders and business groups began a three-day hearing to air their concerns about the $2 trillion deal on Wednesday in Washington, kicking off a mandated review period ahead of July 1. ‘Mexico and Canada, together, are now America’s largest customers, largest investors and most important suppliers all in one,’ said former Ways & Means Chair Kevin Brady, who is set to testify Thursday. ‘Our argument is going to be: No trade agreement is ever perfect, especially one with such large economies so closely integrated,’ Brady said Wednesday. ‘The review is an opportunity to continue to strengthen the agreement, to look for ways to improve it.’”, Bloomberg, December 4, 2025

=================================================================================================

“Costco Joins Companies Suing for Refunds If Trump’s Tariffs Fall – Costco Wholesale Corp. is suing the Trump administration to ensure eligibility for refunds if the US Supreme Court strikes down the president’s global tariffs policy. The company filed a complaint in the US Court of International Trade due to uncertainty that refunds will be guaranteed for all businesses that have been paying duties if the Supreme Court declares the tariffs unlawful. Costco argues that it needs a court intervention immediately because Customs and Border Protection denied its request to extend the schedule for finalizing tariff determinations under Trump’s use of the International Emergency Economic Powers Act.”, Bloomberg, December 1, 2025

===============================================================================================

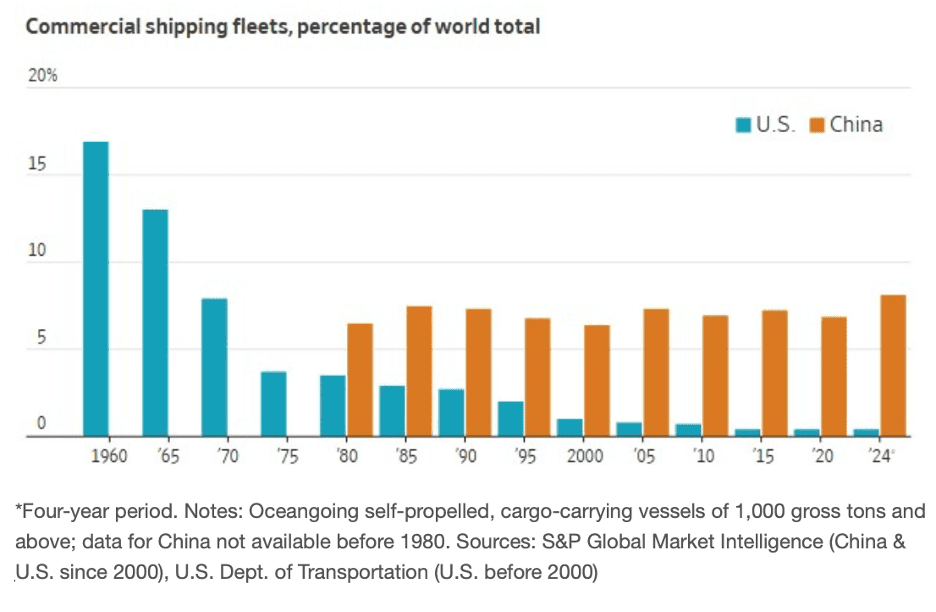

“U.S. Jobs at Sea Go Begging – Very little cargo currently moves on American-flagged ships, partly because of staffing, and shipping companies, which are generally required to hire Americans, say they are starved of crews. Yet, despite high pay and generous perks, maritime jobs go begging, the WSJ’s Daniel Michaels writes. The U.S. employs an estimated 10,000 commercial sailors, a number that has fallen sharply over recent decades as America outsourced much of its shipping demands to China and other countries. Shipping companies have begun offering fat signing bonuses. To retain hires, they are lifting salaries while improving onboard gyms, connectivity and cuisine. As AI threatens more office jobs, hands-on work like sailing is increasingly appealing, especially to the mechanically inclined, though many young people aren’t aware that the jobs exist.”, The Wall Street Journal, December 2025

============================================================================================

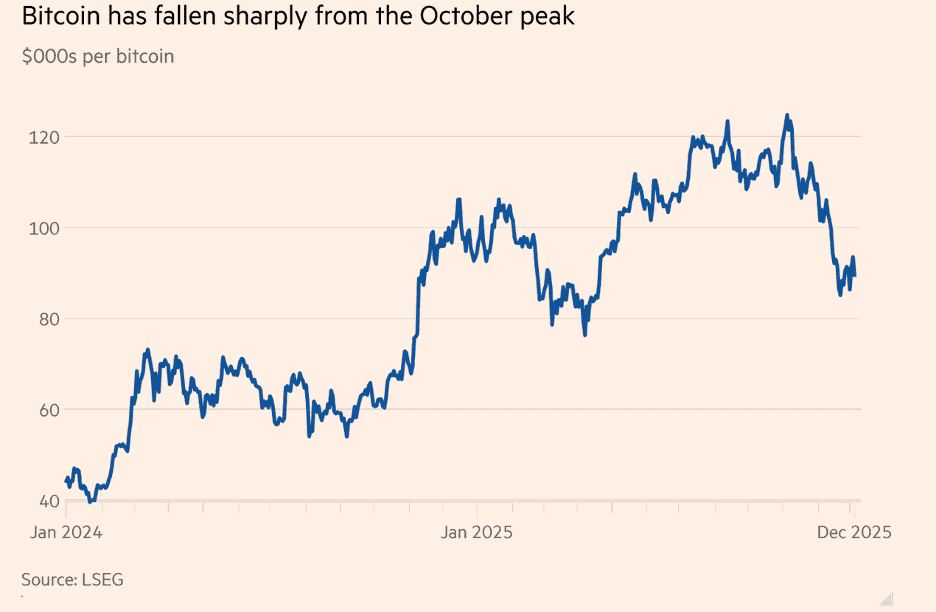

“Crypto’s rocky year – The industry was hugely optimistic when Donald Trump returned to the White House. But bitcoin has fallen by a quarter in two months. Explanations for the sell-off — more than $1tn has been erased from the combined capitalisation of about 18,000 digital tokens over the past two months — range from uncertainty surrounding the path of US interest rates to concerns about lofty tech stock valuations that have spilled over into other risky assets. ‘Unlike prior crashes, driven primarily by retail speculation, this year’s downturn has occurred amid substantial institutional participation,’ said Deutsche Bank analysts Marion Laboure and Camilla Siazon.”, The Financial Times, December 5, 2025

=============================================================================================

“Ship Rates Spiking 467% Marks Upended Trade Across Commodities – Conflicts, sanctions, and swelling output upending global supply lines. Daily earnings to transport crude have seen the biggest jump this year, while rates to ship liquefied natural gas and commodities such as iron ore have increased more than fourfold and twofold, respectively. Shipping executives expect tightness in the market to continue at least through early next year, with vessels spending more time at sea transporting cargo and contributing to the spike in freight costs. For crude tankers, rates rallied following a ramp-up in Middle Eastern production, along with higher Asian demand for their barrels after US sanctions on two Russian oil giants. Meanwhile, the cost to ship LNG from the US to Europe recently climbed to the highest level in two years as new projects in North America tied up more vessels to deliver the fuel. More broadly, hostilities around key routes have contributed to an overall increase in costs.”, Bloomberg, December 3, 2025

============================================================================================

“Robusta Coffee Falls on Ample Supply From Top Grower Vietnam – The market has been pressured recently by expectation that Vietnam will deliver its biggest crop in four years despite heavy rains. The country’s November coffee exports were seen climbing almost 40% from a year earlier to 88,000 tons, according to the National Statistics Office. Shipments for the January-November period were up 15%.”, Bloomberg, December 8, 2025

==============================================================================================

“Navigating Non-Tariff Barriers and Global Trade Challenges – The Global Chamber® Export-Import Forum, moderated by Anita Rodal, featured Bill Edwards, CEO and Global Trade Advisor at Edwards Global Services (Your newsletter Editor!!!), in a dynamic and highly informative discussion on international trade challenges and non-tariff barriers (NTBs) that impact businesses especially small to medium-sized enterprises (SMEs). Bill emphasized that while tariffs are often discussed in trade policy, non-tariff barriers — including certification requirements, labeling regulations, customs procedures, and shifting political environments — often create even greater obstacles for small exporters. ‘About half of all non-tariff barriers serve legitimate public purposes,’ Bill explained, ‘But the other half can act as discriminatory trade barriers — depending on market.’”, Global Chamber, October 23rd. Please go to this link for the YouTube webinar:

https://www.youtube.com/watch?v=i7_pH5kSF6Q

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel News

“2026 Travel Trends – An evolving travel and loyalty industry – New technology, a changing economic landscape, shifting consumer behaviors and fierce brand competition: Travel and loyalty look markedly different today than 10 years ago — and the evolution of the industry doesn’t show signs of slowing down. That’s why it’s more important than ever that savvy travelers stay updated on changing government and industry policies. It also remains vital to be flexible when planning travel and to take advantage of all the tools that can help improve the experience (without breaking the bank). Here are the top trends TPG experts are seeing across the industry — and what they mean for travelers in 2026.”, The Points Guy, December 2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Book Review

“Borderless Business: How Smart Entrepreneurs Expand Globally”, Dr Raymond Hopkins. In “Borderless Business”, Dr. Raymond Hopkins draws on 30+ years of hands-on experience in global contracting and international trade to deliver a practical, actionable playbook for entrepreneurs seeking to grow beyond their home markets.

Rather than selling theory, Hopkins offers real-world frameworks grounded in decades of negotiating complex contracts, managing supply chains, and adapting to diverse regulatory, cultural and economic environments.

Through detailed guidance on market evaluation, entry strategy, product and pricing adaptation, compliance, logistics, and global partnerships — as well as the integration of technology and AI — the book shows how nimble companies can transform from domestic players into global competitors.

Whether you’re a startup ready to export or an established business seeking international scale, Hopkins argues that borderless business is not optional — it’s the modern path to resilience, growth, and long-term competitiveness.

Five Key Takeaways for Global Business Leaders

Global expansion must be intentional and strategic — not accidental. Success starts with rigorous market evaluation and selection, not a “spray and pray” approach.

Entry strategy matters. Exporting, licensing, joint-ventures or direct investment — the right model depends on the product, market conditions, and long-term vision.

Adaptation is essential. Products, pricing, positioning — all must be tailored to local market needs and expectations rather than simply transplanted from home markets.

Technology (including AI) is now a core enabler of borderless growth. From supply-chain optimization to compliance, digital tools reduce friction for companies scaling globally.

Risk, compliance, and cultural awareness can make or break expansion. Success requires navigating regulation, logistics, partnerships, and relationships — not just chasing opportunity.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Canada

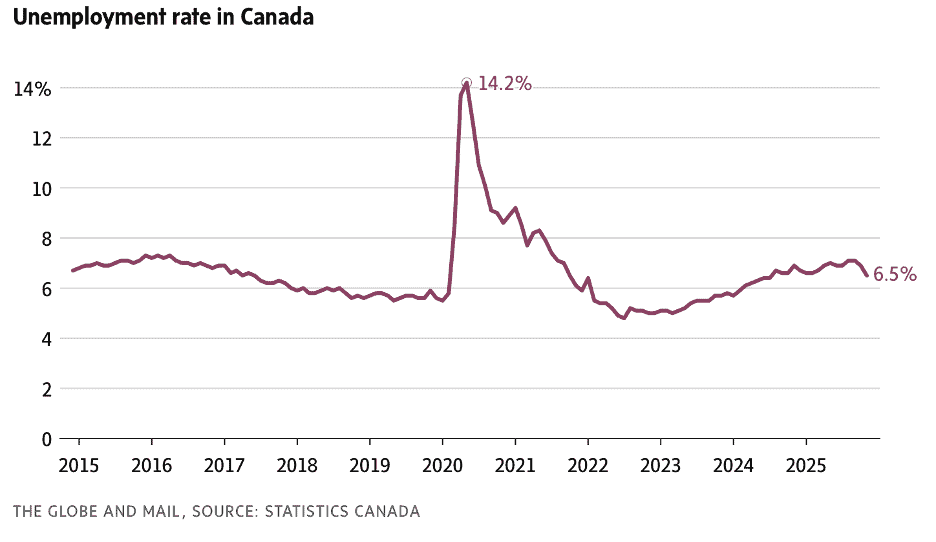

“Canada’s jobless rate falls to 6.5% driven by rise in part-time, youth employment – Canadian employment surged in November for the third consecutive month as young people picked up tens of thousands of positions, with the results easily outperforming tepid predictions from economists. The country’s unemployment rate fell to 6.5 per cent in November from 6.9 per cent in October, Statistics Canada reported Friday in its Labour Force Survey. The decrease was fuelled by growth in part-time jobs, and a corresponding decline in the youth unemployment rate, which reached a four-year peak in September of this year. Over all, the economy added 54,000 jobs in November, bringing the cumulative increase in jobs for September through November to 181,000.”, The Globe and Mail, December 5, 2025

===========================================================================================

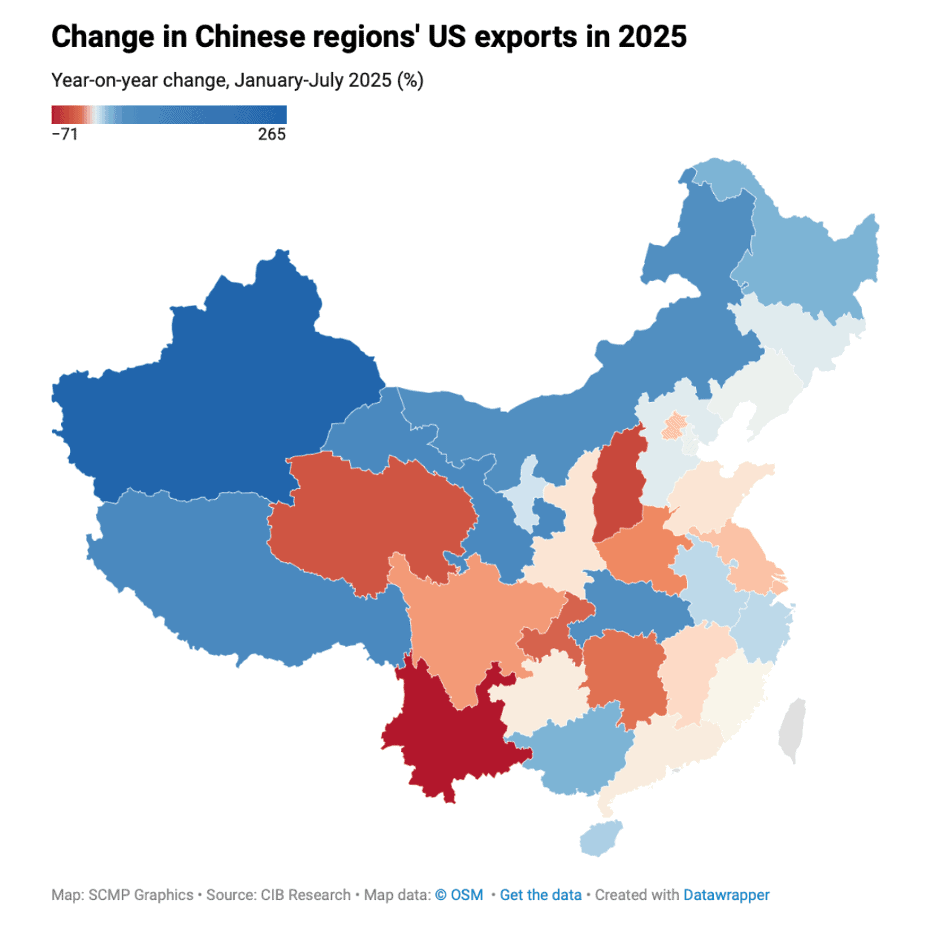

China

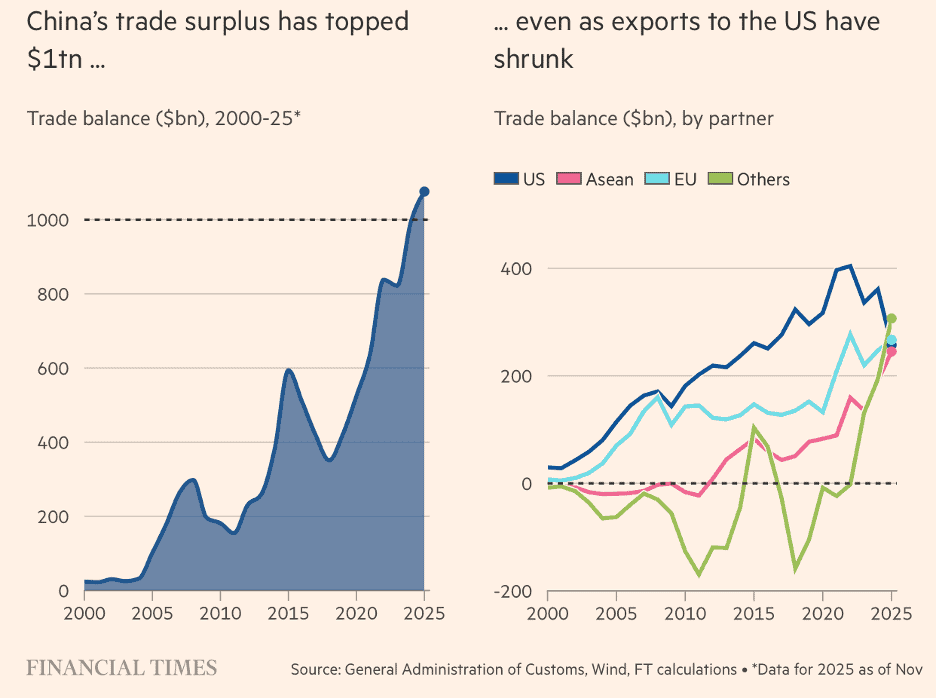

“China’s trade surplus tops US$1tn for first time – Exports soar despite tensions between Washington and Beijing. China’s trade surplus in goods has surpassed $1tn this year for the first time, as exports boomed despite US President Donald Trump’s tariff war. In the first 11 months of this year, China’s trade surplus in dollar terms was $1.076tn, according to data released on Monday by the country’s customs administration, which covers goods but not services. China’s trade surplus in goods for the full year in 2024 was just shy of $1tn.”, The Financial Times, December 8, 2025

=============================================================================================

Eurozone Countries

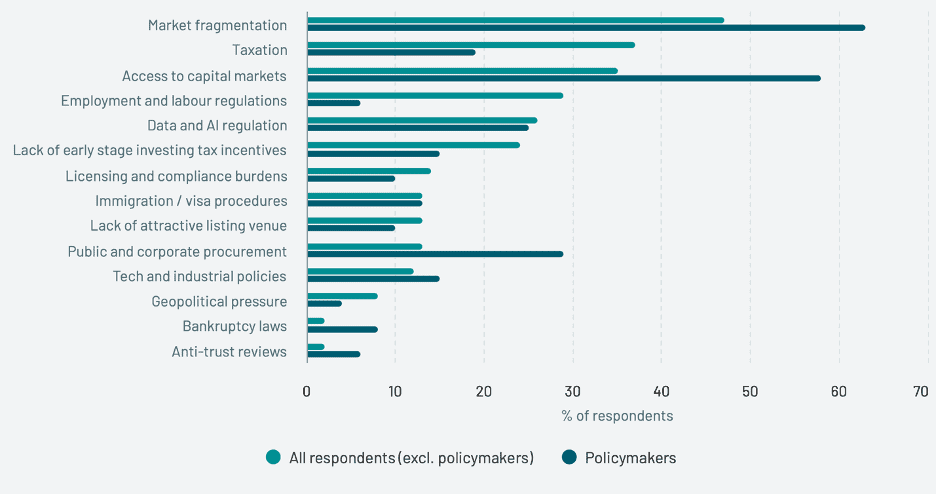

“State of European TECH 25 – The continent’s tech ecosystem has reached a certain level of maturity, but long-term competitiveness depends on whether it can turn its promise into global strategic assets. Europe effectively stands at a crossroads. We don’t lack talent or innovation — what Europe does lack is alignment between ambition and commitment. The policy barriers holding the ecosystem back. It’s overwhelmingly clear what the (European) ecosystem needs. Fifty percent are calling for the end of the market fragmentation, unencumbered access to capital markets, and changes to taxation. Policymakers themselves are indexing strongly on the top two — but show less appetite to reform taxation and employment and labour regulations, even though nearly one in three respondents overall rank these as a high priority.”, Atomico, December 2025

============================================================================================

Malaysia

“Anwar to Cut Small Business Costs After Poor Poll, Bernama Says – Malaysian Prime Minister Anwar Ibrahim announced measures to help reduce cost burdens for small and medium enterprises. Anwar has raised the threshold to exempt businesses from an e-invoicing initiative by the Inland Revenue Board to 1 million ringgit (US$243,267) in annual revenue from 500,000 ringgit, Bernama said. He also doubled government funds to expedite tax refunds to small businesses, to 4 billion ringgit from 2 billion ringgit, according to the report.”, Bloomberg, December 6, 2025

===========================================================================================

United States

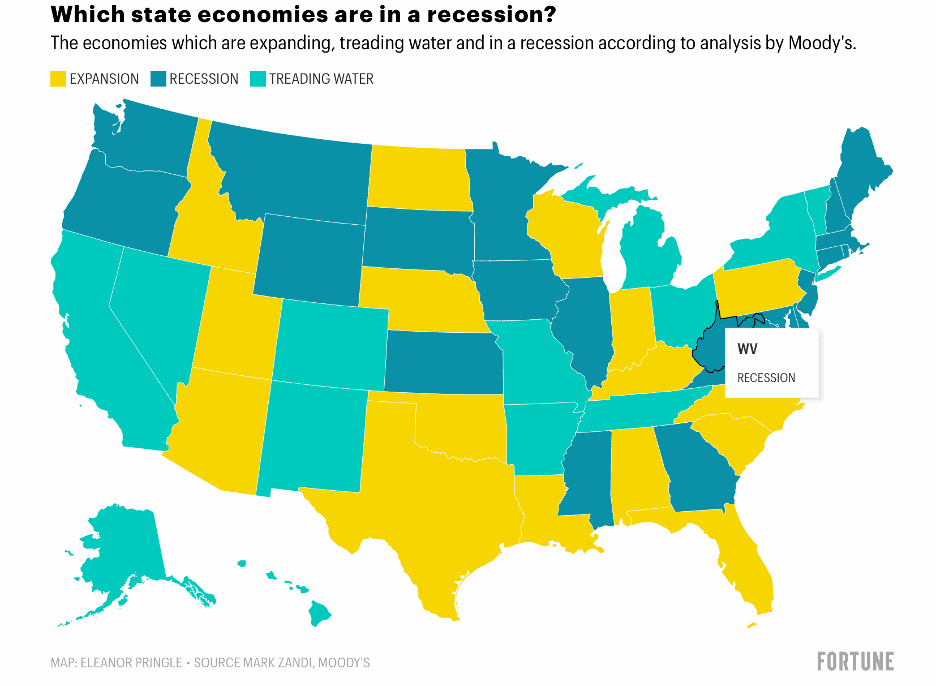

“U.S. Manufacturing Contracts for Ninth Straight Month – Tariffs, which have increased costs for sourcing materials, continue to weigh on U.S. producers. U.S. manufacturing activity contracted for the ninth consecutive month in November, with the ISM’s PMI at 48.2, down from 48.7 in October. Manufacturers attribute the decline largely to tariffs, which have increased costs for sourcing materials and created uncertainty regarding duty levels. A separate S&P Global survey showed manufacturing PMI at 52.2, a slight decrease from 52.5 in October, with slowed demand growth, especially in export markets. ‘It really is all about tariffs,’ said ISM Chair Susan Spence. ‘We do not see anything on the horizon that’s going to turn this ship.’”, The Wall Street Journal, December 1, 2025

=============================================================================================

Vietnam

“Vietnam’s US Exports Jump, Surplus Rises Despite Tariffs – The Southeast Asian nation, which ships everything from footwear to furniture to America, reported a trade surplus with the US of $121.6 billion in the first 11 months of 2025, up 27.5% from a year earlier, according to data released by the National Statistics Office in Hanoi Saturday. Exports to the US climbed to $138.6 billion in the first 11 months, that’s up 27.3% from a year prior, data from the statistics office showed. Vietnam has repeatedly promised to buy more big-ticket American items in a bid to reduce its ballooning trade imbalance with the US, which last year was the third-largest behind only China and Mexico.”, Bloomberg, December 5, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The Accredited Franchise Supplier certification

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Brand & Franchise Sector News

“Wingstop hits 3,000th restaurant milestone – The company has expanded its global footprint by 50% in the past two years. The company said it is growing at a record pace, opening nearly 800 restaurants and expanding its global footprint by 50% in the past two years. During its most recent quarter, Wingstop opened 114 restaurants. Wingstop has also recently entered six new markets, including Australia, Bahrain, Kuwait, Puerto Rico, Saudi Arabia, and The Netherlands, giving it a presence in 47 U.S. states and 15 countries. The chain is expecting to enter Thailand, Italy, and Ireland soon as well.”, National Restaurant news, November 26, 2025

==================================================================

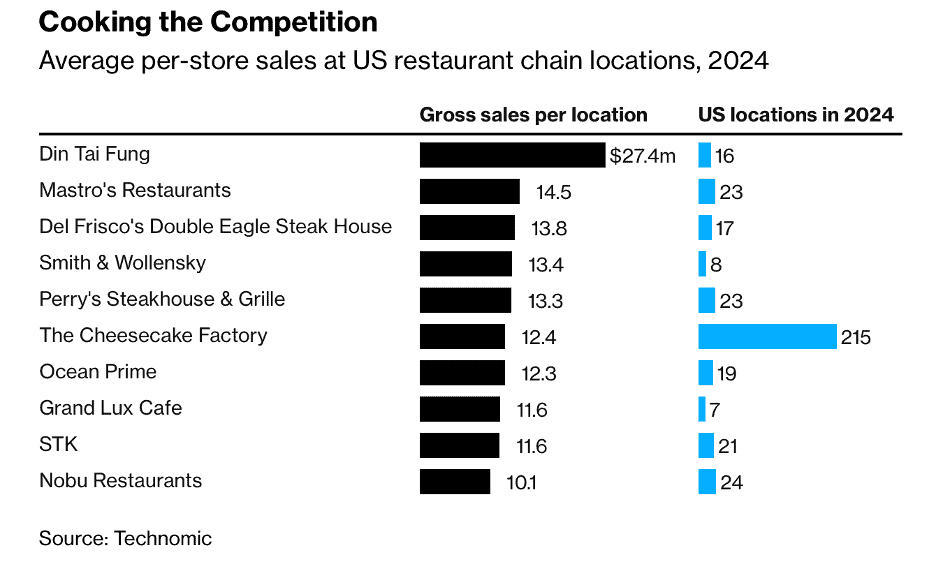

“Get Ready, America: Here Come China’s Food and Drink Chains – China’s fast-food and beverage brands have an opportunity to expand in the United States and escape cutthroat competition at home. The economic relationship between the United States and China is as fraught as it has been in recent memory, but that has not stopped a wave of Chinese food and beverage chains from moving aggressively into the United States for the first time. Chinese tea shops in New York and Los Angeles are offering consumers drinks topped with a milk or cheese foam. Fried chicken sandwich joints are trying to lure diners in California with affordable fast food. Restaurant and drink brands, some with thousands of stores in China, are taking root in American cities to escape punishing competition at home.”, The New York Times, December 1, 2025. Compliments of Paul Jones, Jones & Co., Toronto

==============================================================================================

“Restaurant Brands International: International Business Still Shines; Shares Fairly Valued – While the restaurant backdrop remains sour, RBI’s growth story remains intact. A strong suite of global brands, stepped-up investment, and a well-capitalized franchise base have propelled global system sales growth to 8% over the last three years, outpacing the global industry’s 5.5% rate.”, Morningstar, November 28, 2025

============================================================================================

“10 Up-And-Coming Chain Restaurants We’ll See Everywhere In 2026 – These booming restaurant chains — from coffee shops to smoothie cafes and more — are thankfully nowhere near suddenly shutting down or facing financial woes, unlike other popular chains that faced bankruptcy in 2025. In fact, the following spots will probably be popping up in your neighborhood by next Christmas.”, Tasting Table, November 29, 2025

=============================================================================================

“Can Denny’s bounce back from the doldrums? As private-equity investors spend $620M to buy the brand and take it private, a lot is riding on the deal – For decades, Denny’s was the iconic U.S. diner destination — the go-to spot for cheap coffee, late-night meals and highway-side comfort. But that’s all changed in the past few years. While the helpings are still generous, the once-ubiquitous chain has been shrinking as Denny’s struggles with rising menu prices, declining customer traffic and a wave of restaurant closures. Now Denny’s is being sold to a consortium of private-equity and franchise investors in a $620-million deal that will take the brand private.”, Moneywise, November 29, 2025

=============================================================================================

“Chick-fil-A is making a major change to 425 restaurants nationwide – Chick-fil-A’s big shift for hundreds of restaurants nationwide will reshape its business forever. Chick-fil-A is converting its licensed locations, found on college campuses, in hospitals, and at theme parks (excluding airports), to its owner-operator model. Under this franchise system, operators run the restaurant, manage daily operations, and share profits with the company, while Chick-fil-A retains ownership of the business assets.”, The Street, December 5, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive our biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing business environment. And our GlobalTeam™ on the ground covering 25+ countries provide us with updates about what is actually happening in their specific countries. We do not get involved in or report on politics!

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

William “Bill” Edwards: CEO & Global Trade Advisor “Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global”. With five decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe, and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service global management consultant since 2001 helping 40+ franchisors expand into new countries. Bill knows how to turn the challenges in taking a brand global into opportunities.

For a complimentary 30-minute consultation on how to take your business into new countries successfully. For a complimentary call with Bill Edwards click on the QR code or contact Bill at bedwards@edwardsglobal.com and +1 949 375 1896

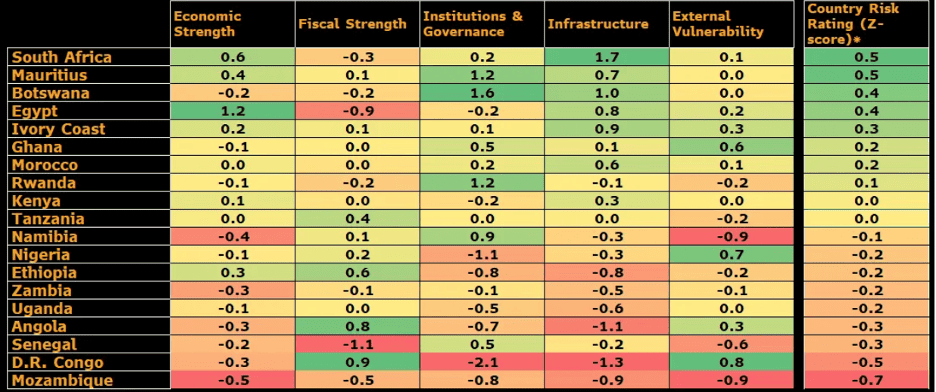

And download our latest chart ranking 40+ countries as places to do business, used by many companies for strategic planning, at this link:

Our latest GlobalVue™ 40 country ranking

Biweekly Global Business Newsletter Issue 148, Tuesday, November 25, 2025

“We are entering an age of protracted geopolitical competition that will reshape the world economy.”

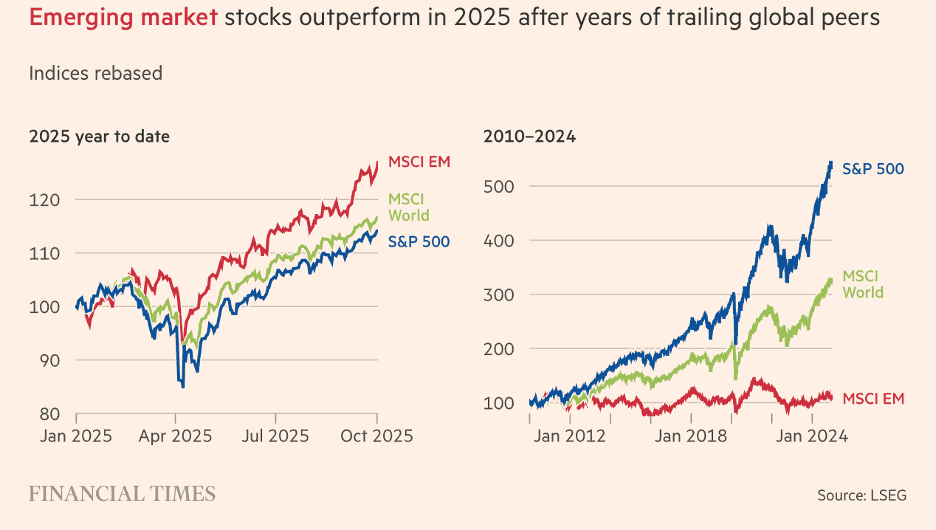

Welcome to the 148th Edition of the Global Business Update – Global business conditions are increasingly shaped by powerful and sometimes conflicting forces—from accelerating AI investment to persistent economic uncertainty and shifting trade dynamics.

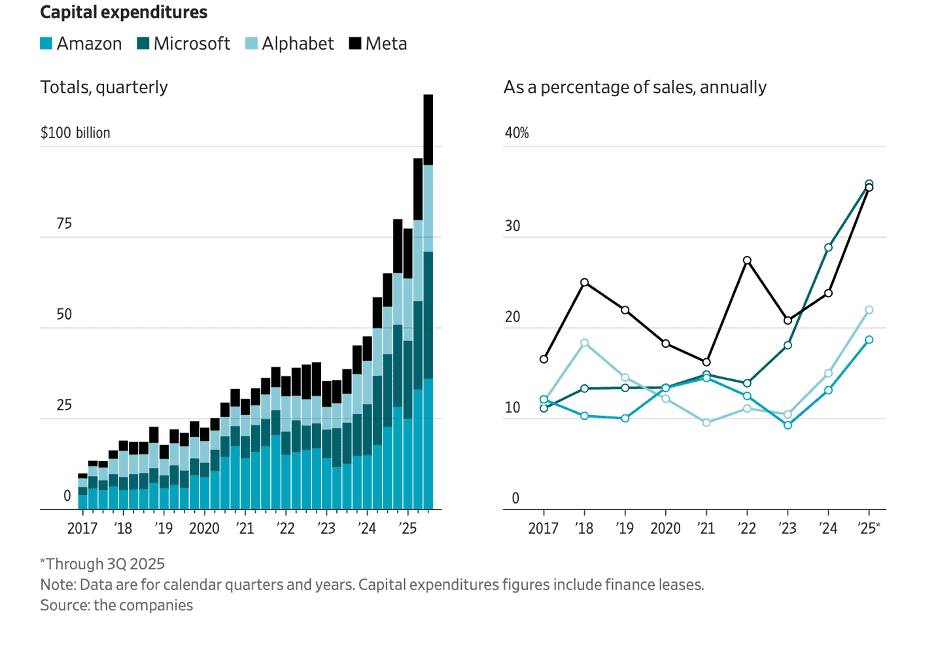

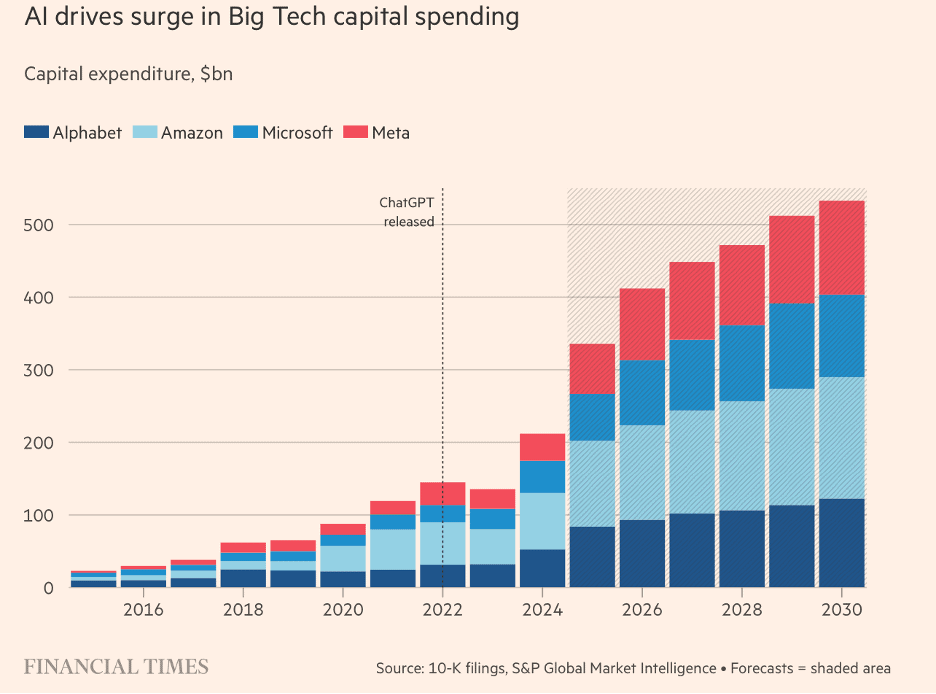

AI continues its breakneck expansion. Major tech companies report record capital spending, driving unprecedented demand for the physical backbone of data centers—chips, servers, transformers, and energy infrastructure.

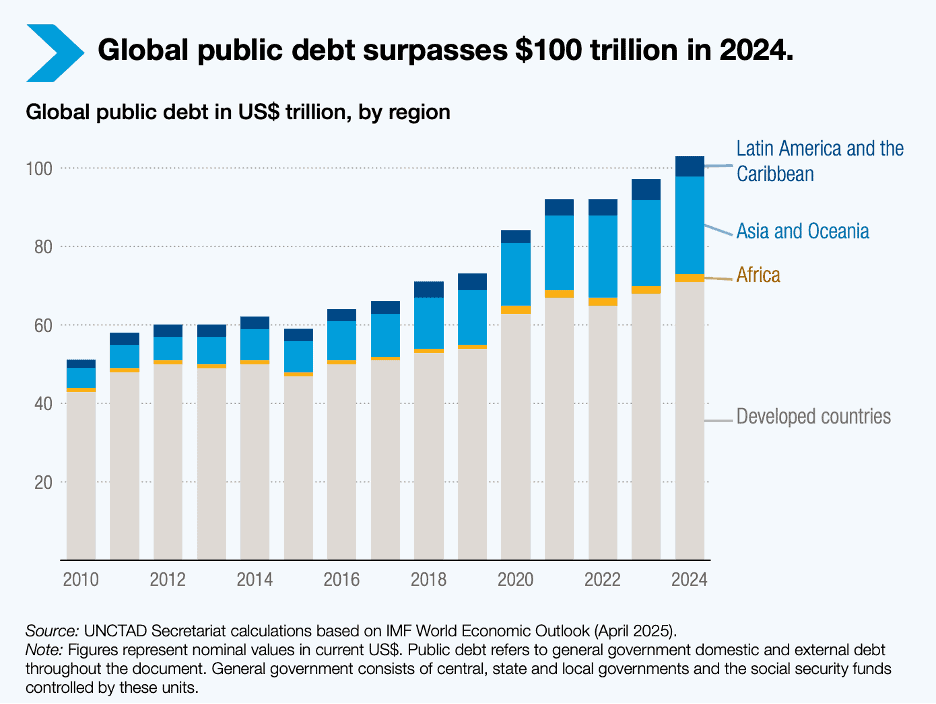

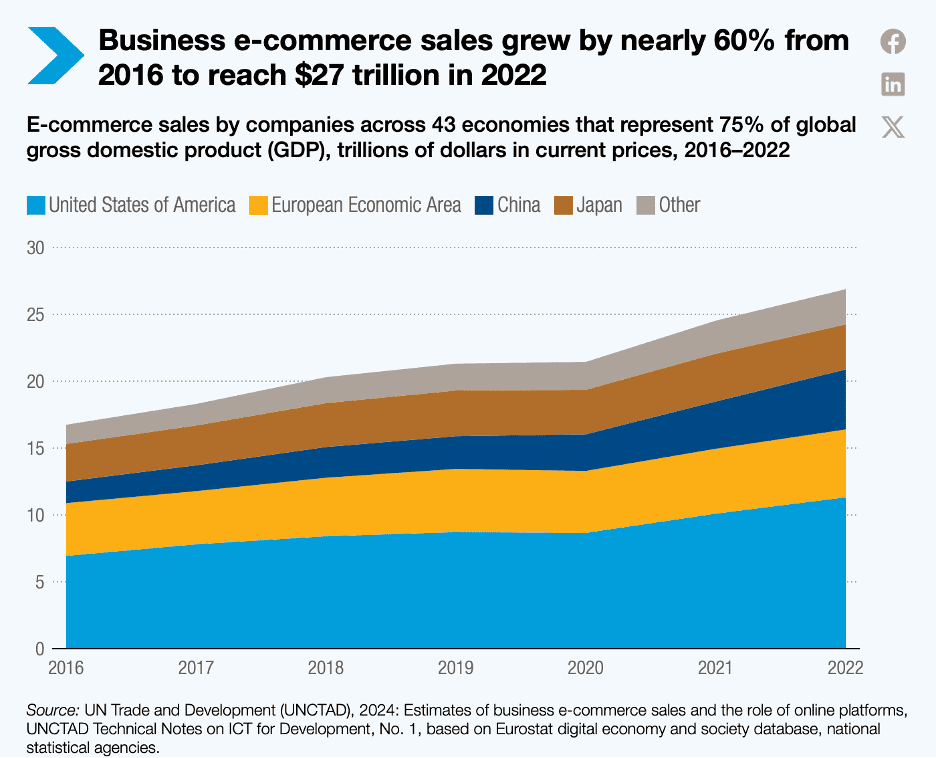

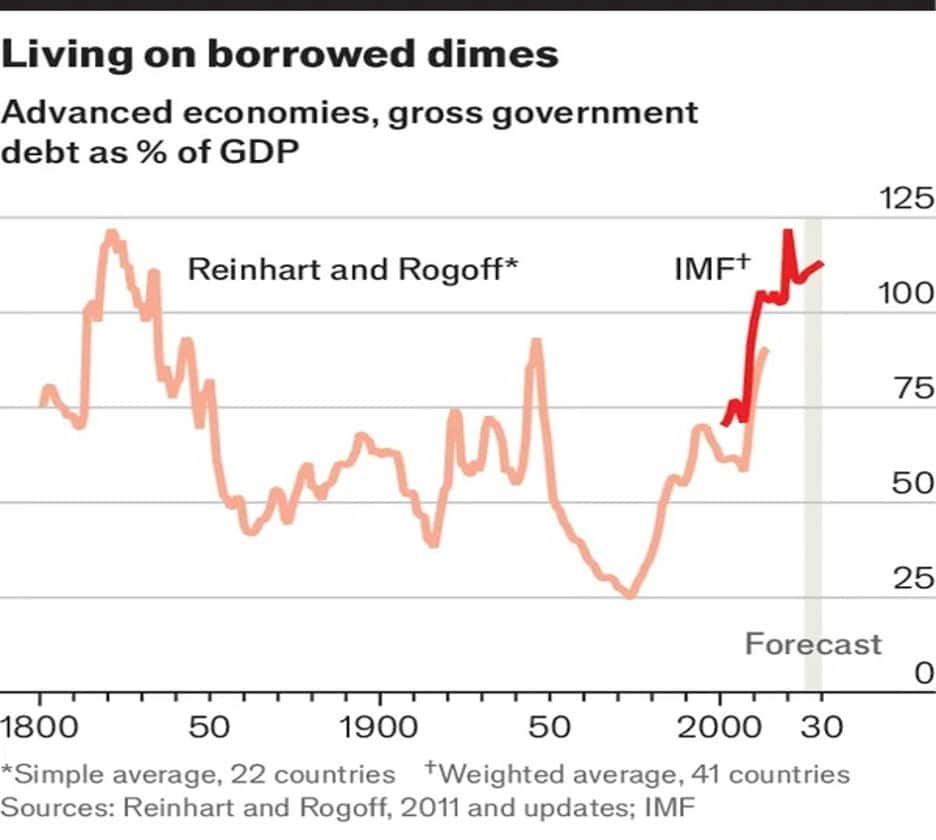

Macroeconomic stresses remain significant. Global public debt has climbed to $102 trillion, with developing nations’ debt burdens rising twice as fast as those of advanced economies. Meanwhile, the booming digital economy is becoming increasingly concentrated among a handful of technologically dominant countries, leaving many others confined to the role of data suppliers rather than value creators.

Trade and tariff volatility continue to influence global supply chains, prices, and investment decisions. With U.S. tariff policy in flux and key court decisions underway, businesses face ongoing uncertainty.

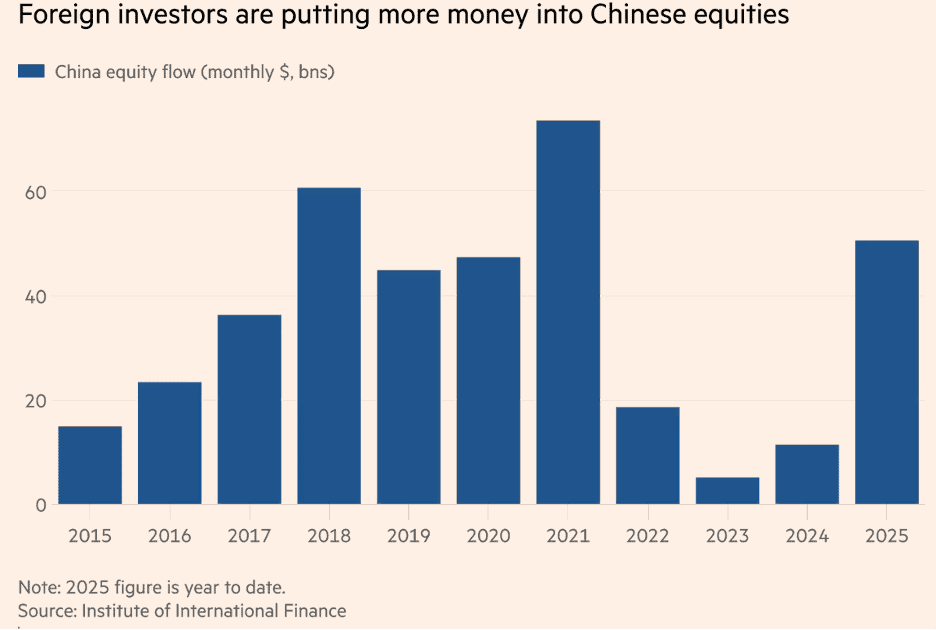

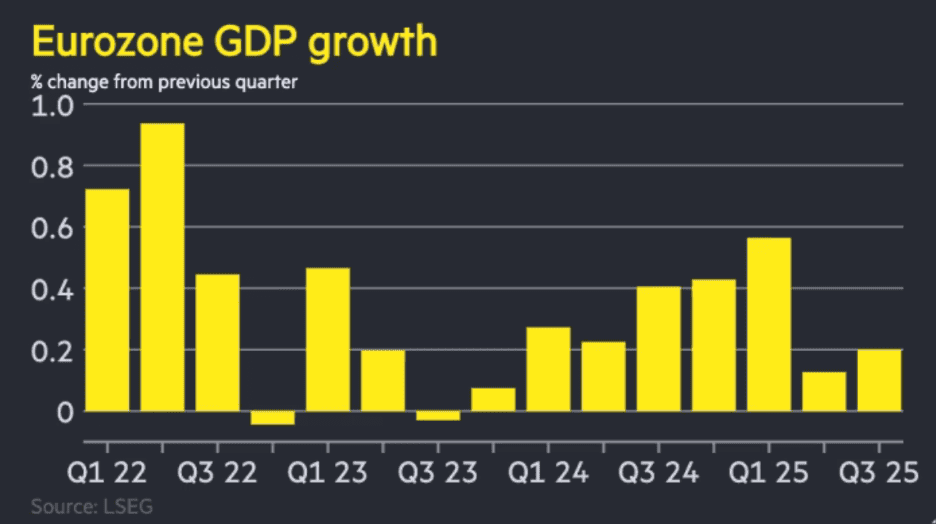

Economic performance varies widely. Europe shows modest resilience, the U.K. slows following supply disruptions, Mexico risks recession, and China sees its strongest foreign equity inflows in four years. Additional trends—from Bolivia’s return to credit markets to demographic shifts in New Zealand’s business-buying landscape—underscore the rapid changes underway.

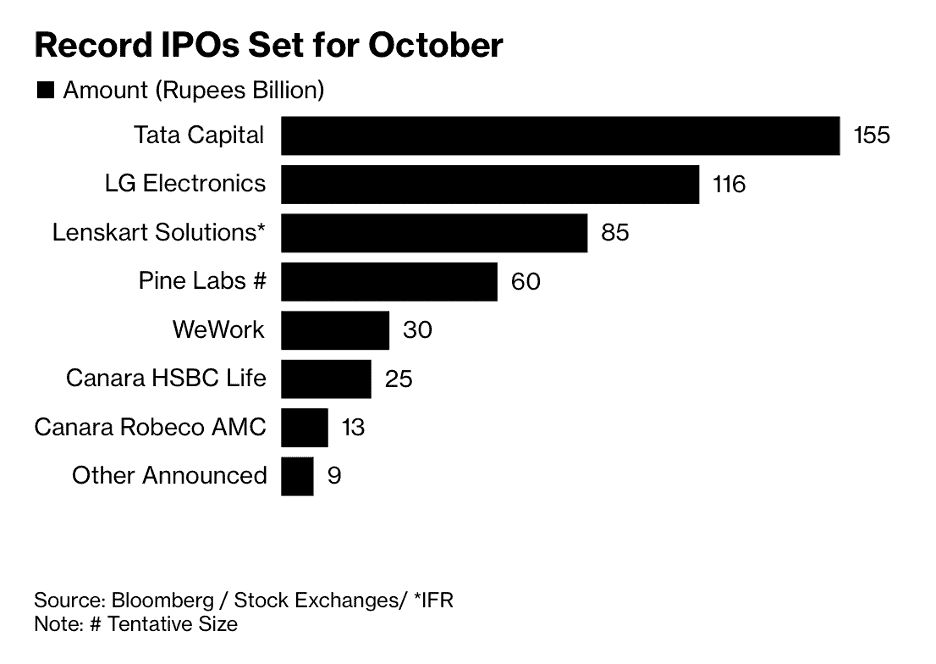

In global franchise sector news, analysts expect 2026 to bring strong M&A and IPO activity in the restaurant sector, with high-performing concepts seeking capital and distressed brands looking for turnaround investment. Emerging restaurant chains are also evaluating when they are ready to expand internationally. Europe and the U.K. remain top destinations for U.S. franchisors, who must adapt to shifting labor markets, the gig economy, and evolving real estate conditions.

Krispy Kreme has entered Spain and plans additional locations across Brazil and Uzbekistan, while Anytime Fitness has opened its first club in Dubai, extending its footprint to 49 countries. Captain D’s has debuted in the U.K., and Great American Cookies and Marble Slab Creamery will launch 10 co-branded stores in Iraq. Meanwhile, chicken chains—especially KFC—see global demand rising sharply, fueled by consumer preference and ease of cross-border adoption.

This edition’s book review highlights a CEO for All Seasons by Carolyn Dewar, Scott Keller, Vikram Malhotraand Kurt Strovink is one of the most relevant leadership books of 2025, offering a fresh and timely look at what it means to lead in an era defined by volatility, artificial intelligence, geopolitical uncertainty, and shifting workforce expectations. Rather than presenting a one-size-fits-all leadership formula, the book argues that today’s most effective executives are “seasonal CEOs”—leaders who can shift styles, mindsets, and strategies depending on market conditions, cultural context, and organizational stage.

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive our biweekly newsletter by email every other Tuesday, click here https://insider.edwardsglobal.com

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business. We do not get involved with or report on politics!

PLEASE NOTE: Some of the information sources that we provide links to in our newsletter require a paid subscription to directly access them. Clicking on a link may not give the reader access to the content.

Edited and curated by: William (Bill) Edwards, CEO & Global Business Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA. Contact Bill with questions, comments and contributions. Bedwards@edwardsglobal.com, +1 949 375 1896

Link to our current and past newsletters: https://edwardsglobal.com/geowizard/

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

First, A Few Words of Wisdom From Others For These Times

“We are entering an age of protracted geopolitical competition that will reshape the world economy.”, Dr. Hal Brands, Bloomberg Opinion

“Leadership is the capacity to translate vision into reality.” — Warren Bennis

“A thankful heart is not only the greatest virtue, but the parent of all other virtues.”, Marcus Tullius Cicero. This week is Thanksgiving here in the USA

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Highlights in issue #148:

Global Supply Chain, Energy, Commodities, Inflation, Taxes, Tariffs & Trade Issues

US Consumer Sentiment Nears Record Low

Euro Zone Set for Moderate Growth After Resilience in 2025

Digital economy: A new frontier for trade, sustainability and inclusion

Franchise Global News Section: Anytime Fitness®, Captain D’s®, Great American Cookies®, Krispy Kreme®, KFC®, Luckin Coffee® and Marble Slab®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

“When AI Hype Meets AI Reality – Record capital expenditures and data-center planning run up against the ground truths of physical infrastructure. The rate at which tech companies and startups are investing in AI shows no signs of slowing. In their latest financial reports, all of the big spenders revealed that their current investments had grown significantly, and projected that this trend would continue. All this investment has translated into record spending on the stuff that goes into data centers—aka “AI supercomputers”—all those chips, servers, HVAC systems, transformers, gas turbines, power lines and power plants.”, The Wall Street Journal, November 14, 2025

=============================================================================================

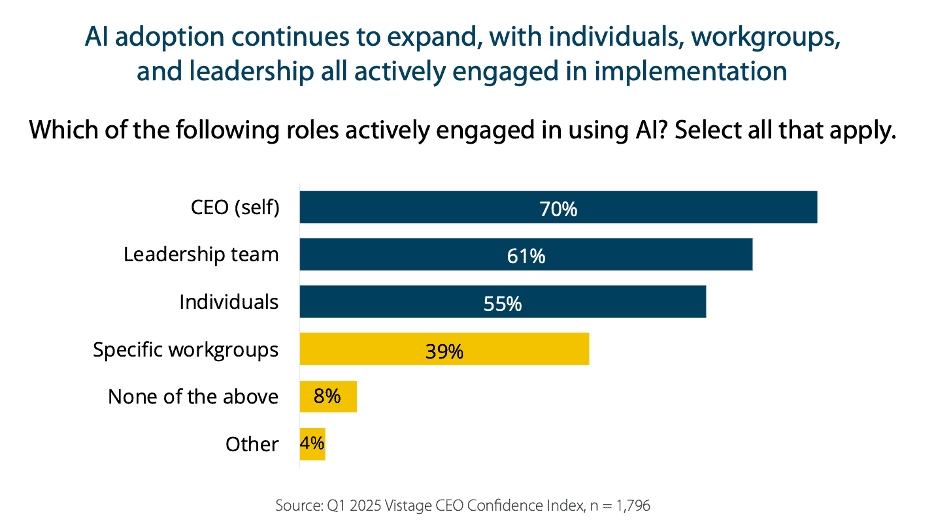

“Vistage Digital Engagement – A predictor of productivity – Generative artificial intelligence (Gen Al) is accelerating disruption at an unprecedented pace. Its rapid evolution and transformative capabilities are redefining the way businesses operate, innovate, and compete. While we are only beginning to grasp the full scope of its potential, Gen Al is already delivering immediate and profound gains in productivity – ushering in a new era of possibility for leaders ready to embrace it. Despite its technological wonderment, humans will determine the speed of Gen Al’s impact and adoption. Today’s digitally engaged workers will lead the charge, pushing the organization into the future.”, Vistage, November 2025

===============================================================================================

“A World of Debt – REPORT 2025 – Public debt can be vital for development. Governments use it to finance expenditures, protect and invest in their people and pave the way to a better future. However, when public debt grows excessively or its costs outweigh its benefits, it becomes a heavy burden. This is precisely what is happening across the developing world today. Global public debt reached a record high of $102 trillion in 2024. Although public debt in developing countries accounted for less than one third of the total – $31 trillion – it has grown twice as fast as in developed economies since 2010.”, UN Trade & Development, 4th Quarter 2025

=============================================================================================

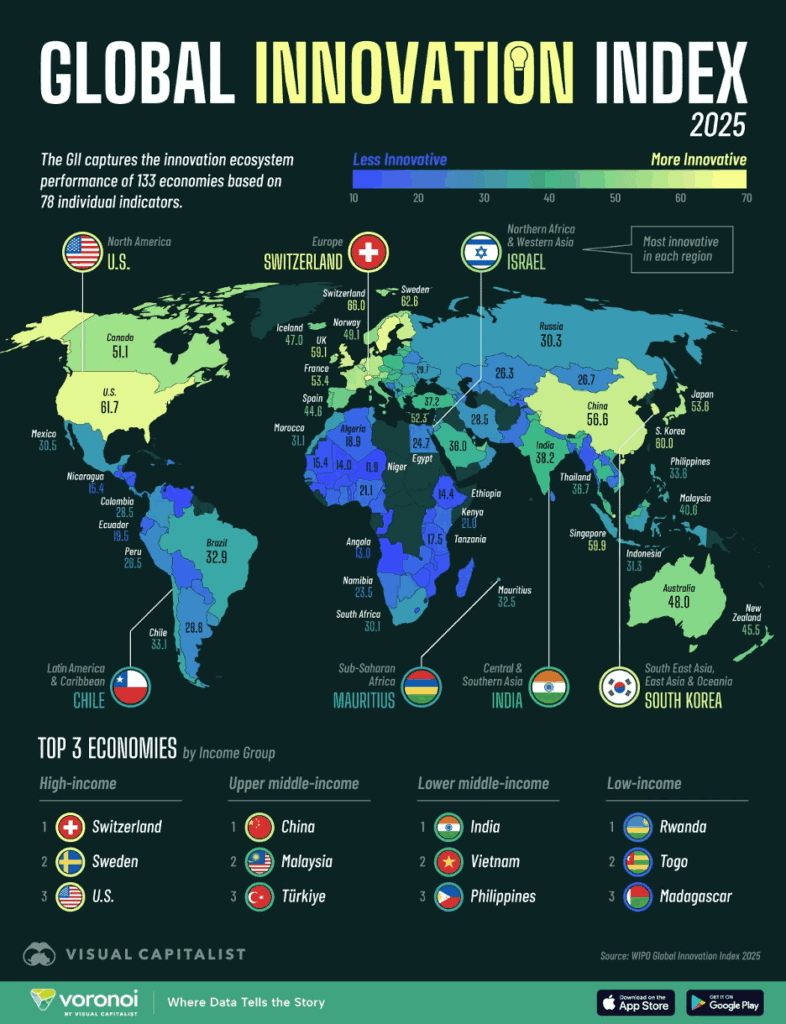

“Digital economy: A new frontier for trade, sustainability and inclusion – The digital economy marks the newest chapter in the long-running story of trade, driven in part by technological advances like artificial intelligence (AI) – a market projected to reach $5 trillion by 2033. The digital economy is booming but highly concentrated in a handful of countries, leaving the rest of the world, including many least developed countries, often relegated to the role of mere data providers.”, UN Trade & Development, September 30, 2025

============================================================================================

Global Supply Chain, Energy, Commodities, Inflation, Taxes, Tariffs & Trade Issues

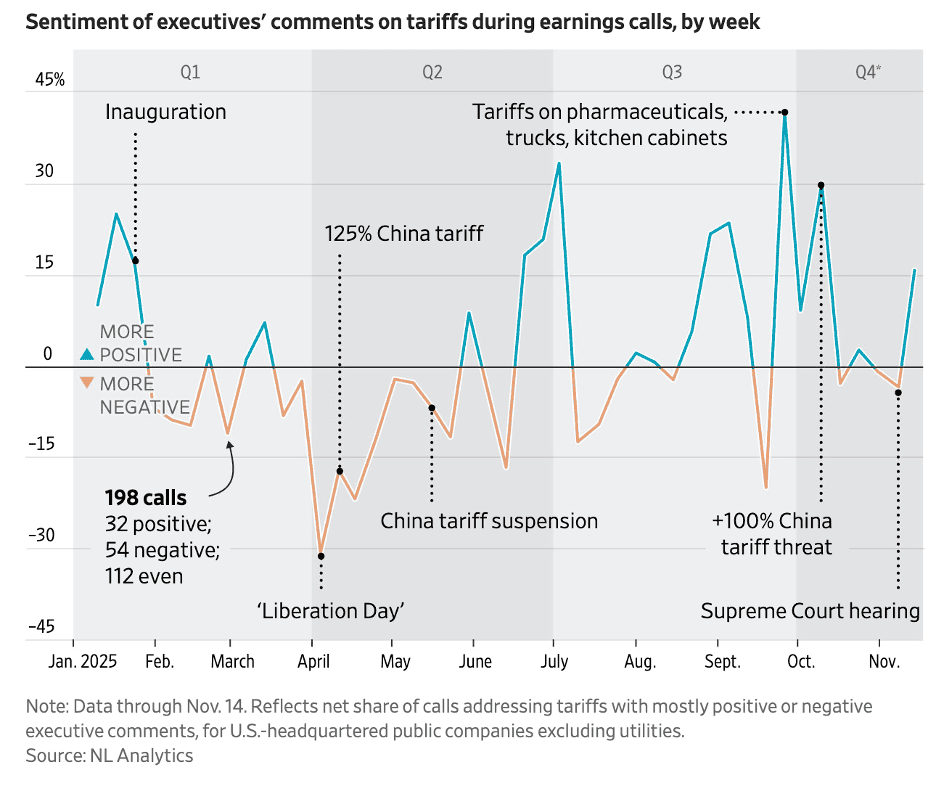

“We Analyzed 5,000 Calls to Find Out What CEOs Really Think About Tariffs – Trump’s trade war is a pain, but less so than many executives expected. Business leaders are sounding less gloomy about tariffs, which are coming up less often in earnings calls. Businesses are mitigating tariff costs by securing exemptions, raising prices, cutting spending and rearranging supply chains. Companies have passed about two-thirds of tariff costs to customers, a decrease from nearly 100% in Trump’s first term.”, The Wall Street Journal, November 24, 2025

============================================================================================

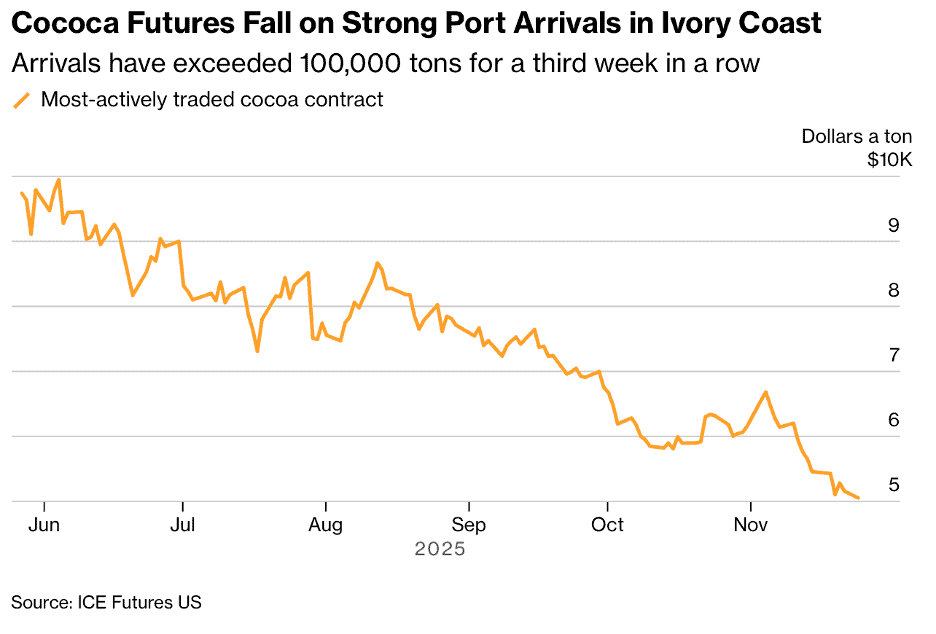

“Cocoa Extends Slump to 21-Month Low on Robust Ivorian Supplies – Prices dropped as much as 2.7% on Monday, and are down about 60% from a record high set in December on forecasts for a bigger global surplus driven by better production and weakening demand. Traders are keeping a close eye on supplies from West Africa as farms continue to recover from poor harvests that caused prices to soar to an all-time high.”, Bloomberg, November 24, 2025

=============================================================================================

“Global Supply Chain, Energy, Commodities, Inflation, Taxes, Tariffs & Trade Issues – Here’s what’s going on with Trump’s tariffs, prices and the Supreme Court. This is everything you need to know about where tariffs stand, and where they’re going. The levies that importers pay to bring in specific products fromforeign countries have evolved so many times that American shoppers could be forgiven for not knowing what is on, what is off, and what is on the table. Add in a pair of Supreme Court cases, tumultuous trade negotiations with longtime allies and national security concerns and it’s enough to make anyone need a field guide. This is what to know about tariffs currently in place, those threatened by court cases and how consumers are being hit.”, The Washington Post, November 16, 2025

============================================================================================

“Navigating Non-Tariff Barriers and Global Trade Challenges – The Global Chamber® Export-Import Forum, moderated by Anita Rodal, featured Bill Edwards, CEO and Global Trade Advisor at Edwards Global Services (Your newsletter Editor!!!), in a dynamic and highly informative discussion on international trade challenges and non-tariff barriers (NTBs) that impact businesses especially small to medium-sized enterprises (SMEs). Bill emphasized that while tariffs are often discussed in trade policy, non-tariff barriers — including certification requirements, labeling regulations, customs procedures, and shifting political environments — often create even greater obstacles for small exporters. ‘About half of all non-tariff barriers serve legitimate public purposes,’ Bill explained, ‘But the other half can act as discriminatory trade barriers — depending on market.’”, Global Chamber, October 23rd. Please go to this link for the YouTube webinar:

https://www.youtube.com/watch?v=i7_pH5kSF6Q

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel News

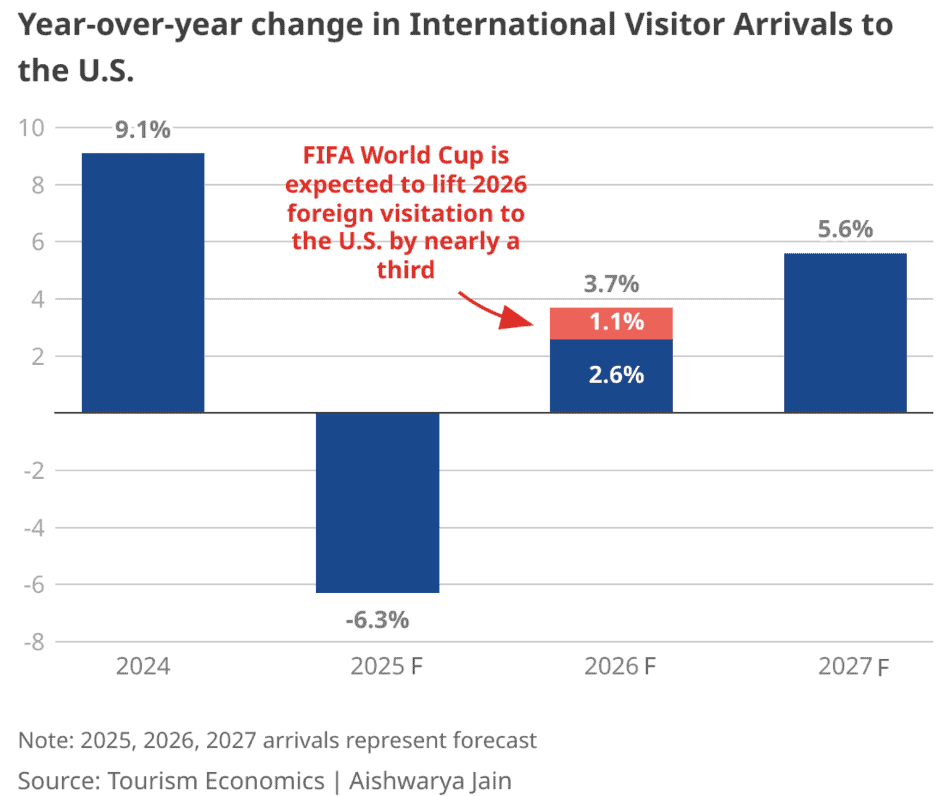

“US tourism expected to score big with FIFA World Cup – International tourism to the U.S. could get a much-needed boost from the 2026 FIFA World Cup after a sluggish 2025, when visitors stayed away amid unease over President Donald Trump’s trade policies and concerns about tougher border scrutiny. Foreign visitation to the U.S. was down 4% year to date through July, according to visa data from the National Travel and Tourism Office. Travel data company Tourism Economics projects a full-year decline of about 6.3% in 2025. The World Cup, which will take place from June 11 to July 19, could account for roughly one in three additional foreign visitors to the U.S. in 2026, Tourism Economics estimates.”, Reuters, November 19, 2025

=============================================================================================

‘World’s Safest Airline’: Air New Zealand Wins Big At World Travel Awards – Air New Zealand is flying high after collecting several industry awards these past few weeks, including the world’s safest airline, best airline in the South Pacific, and innovation of the year, and Australia’s most trusted airline. The airline has been acknowledged not only for its innovative designs but also for its continued commitment to sustainability. Air NZ was named by the World Travel Awards 2025 as Oceania’s leading airline, beating other carriers such as Fiji Airways and Qantas.”, Simply Flying, November 21, 2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Book Review

A CEO for All Seasons by Carolyn Dewar, Scott Keller, Vikram Malhotra and Kurt Strovink is one of the most relevant leadership books of 2025, offering a fresh and timely look at what it means to lead in an era defined by volatility, artificial intelligence, geopolitical uncertainty, and shifting workforce expectations. Rather than presenting a one-size-fits-all leadership formula, the book argues that today’s most effective executives are “seasonal CEOs”—leaders who can shift styles, mindsets, and strategies depending on market conditions, cultural context, and organizational stage.

The author blends real-world case studies, global business examples, and insights from executives across multiple continents. What stands out most is the book’s emphasis on adaptability—not as a buzzword, but as a disciplined practice. The writing is clear, contemporary, and highly actionable for CEOs, founders, and senior executives navigating global growth.

Top 5 Takeaways for Global Businesspeople

1. Leadership must be climate-adaptive, not personality-fixed. Great CEOs today flex between being a visionary, operator, crisis manager, diplomat, or culture-builder depending on what the moment requires.

2. Global markets require cultural seasonality. What motivates teams in Los Angeles may not work in Dubai, Tokyo, or São Paulo. Leaders must shift communication, incentives, and decision-making norms to match local cultures.

3. AI fluency is no longer optional. The book makes a compelling case that CEOs who don’t embrace AI as a co-executive—not just a tool—will fall behind. Decision cycles must be faster, data-driven, and augmented by automation.

4. Trust is the new global currency. In fragmented geopolitical environments, stakeholders choose brands—and partners—they trust. Transparency and consistency matter more than ever.

5. Resilience must be built, not assumed. The strongest organizations develop systems for resilience: diversified supply chains, cross-trained teams, scenario-planning, and disciplined cash management.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Bolivia

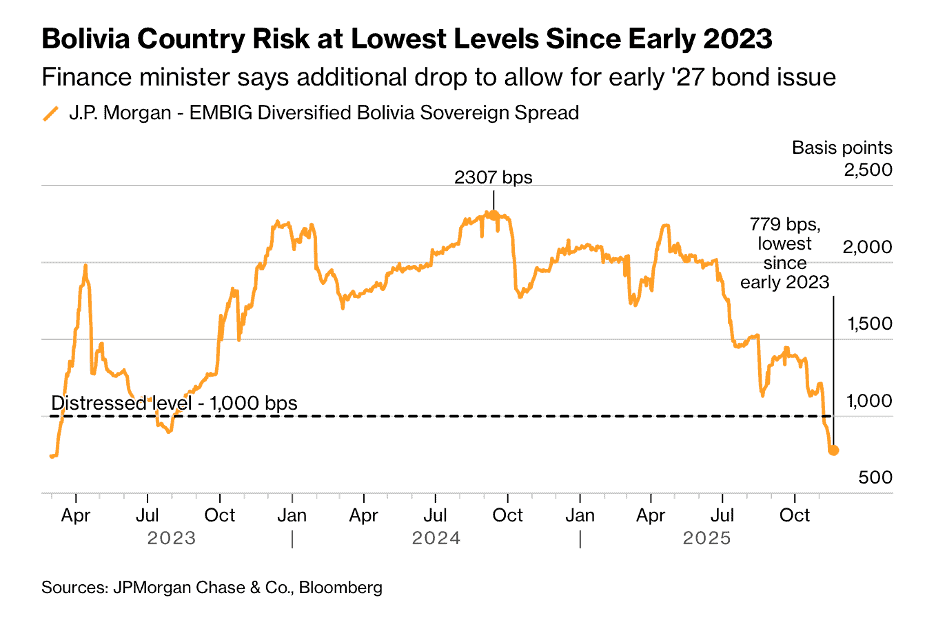

“Bolivia Charts Return to International Credit Market by 2027 – Bolivia’s new government expects to secure up to $5 billion in multilateral loans next year and return to international credit markets in late 2026 or early 2027, Finance Minister José Gabriel Espinoza said. Around half of the loans under discussion are aimed at boosting private-sector transport, energy and infrastructure projects, Espinoza said. The Paz administration plans to cut costly fuel subsidies and transfer fuel distribution to the private sector to make it more efficient, while keeping state-owned YPFB in charge of supplying remote places.”, Bloomberg, November 20, 2025

===========================================================================================

China

“Foreign investors return to China’s stock market – DeepSeek AI breakthrough spurs biggest overseas inflows in four years. Foreign purchases of Chinese equities have hit their highest level in four years, in a sign global investors are reassessing a market that until recently was considered “uninvestable”. Offshore inflows into China stocks from January to October this year totalled $50.6bn, up from $11.4bn in 2024….”, The Financial Times, November 15, 2025

=============================================================================================

Eurozone Countries

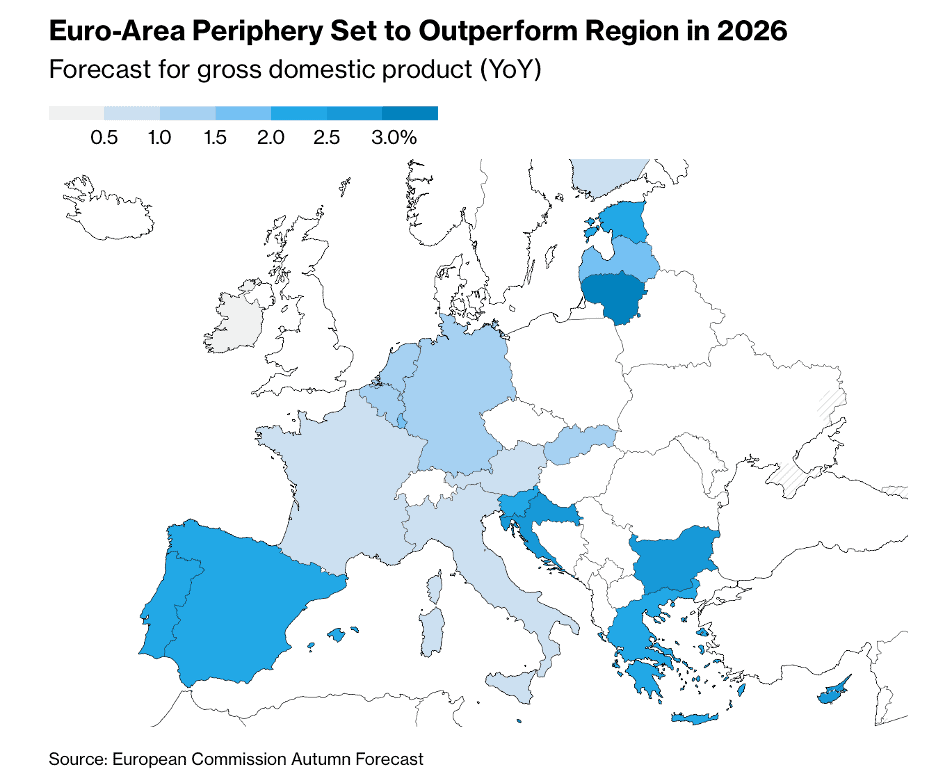

“Euro Zone Set for Moderate Growth After Resilience in 2025 – The European Commission says the euro-area economy will maintain its moderate expansion after weathering Donald Trump’s tariff turmoil better than expected. Output will rise, with the commission predicting an upgrade for this year compared with May’s prediction, and a small downgrade for 2026, and inflation is seen at 2.1% in 2025. The commission sees recent outperformance driven by a pre-tariff surge in exports and investments, and says higher spending by governments, private consumption and a tight labor market should underpin expansion.”, Bloomberg, November 17, 2025

============================================================================================

Mexico

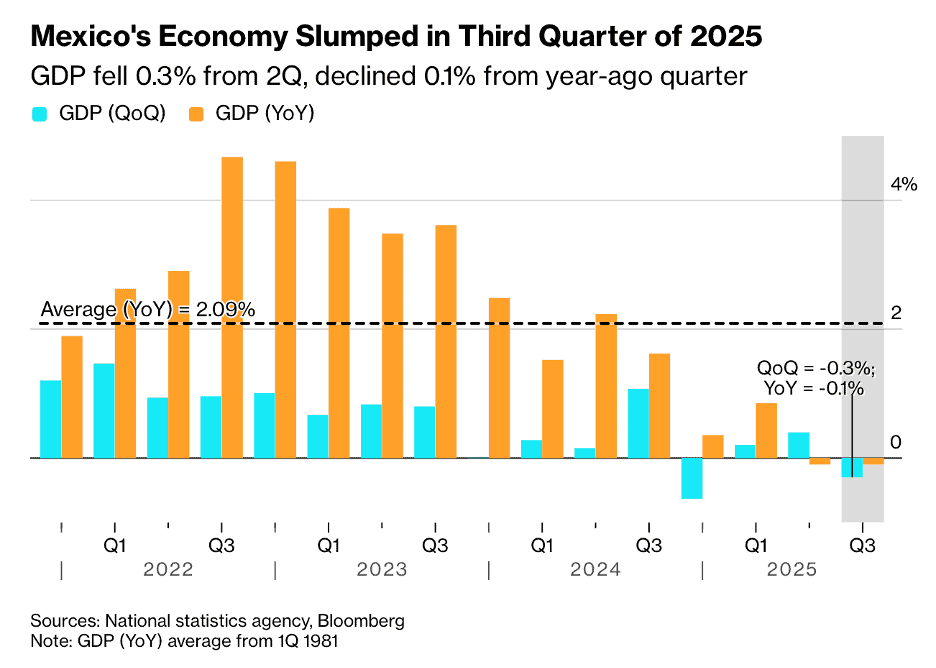

“Mexico Economy Dipped Last Quarter, Fueling Recession Fears – Mexico’s economy shrunk in the third quarter due in large part to trade uncertainty stoked by US President Donald Trump. Gross domestic product fell 0.3% in the July-to-September period compared to the prior three months, and declined 0.1% from a year ago. If Mexico’s economy were to suffer a contraction in the fourth quarter, it would tip into a technical recession, according to analysts. The national statistics institute also revised second-quarter figures downward, saying the economy fell 0.1% versus the same period the previous year, compared to the initial report of no change.”, Bloomberg, November 21, 2025

============================================================================================

New Zealand

“New Trends Emerging in New Zealand Business Sales Market – Younger, more diverse buyers are increasingly entering the market as older owners step aside. New research from The ABC Business September 2025 Quarterly Market Intelligence Report shows a shift in who is buying and selling businesses in New Zealand. The report reveals that 65% of business sellers are now over 46, while more than half of buyers are younger than that. Many sellers are leaving their businesses for retirement or lifestyle changes, creating opportunities for a new generation of entrepreneurs to take the reins.

Diversity among buyers is also on the rise. While more than 70% of sellers identify as NZ European, over 40% of buyers come from Indian, Chinese, or other non-European backgrounds. Migration trends are playing a role, with many newcomers seeing small business ownership as a pathway to stability and financial growth.”, Franchise New Zealand magazine, November 20, 2025

=============================================================================================

United Kingdom

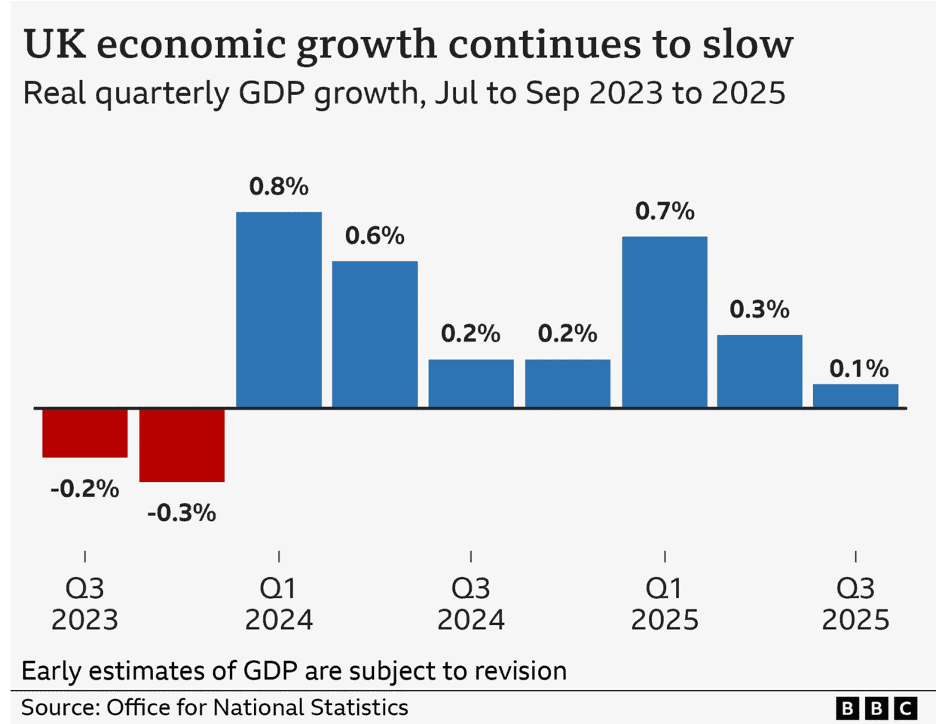

“UK growth slows after big fall in car production – Growth in the UK economy slowed to 0.1% in the July-to-September period, official figures show, as car production slumped. The Office for National Statistics said there had been a “marked” fall in car production in September as a result of the cyber-attack on Jaguar Land Rover. But even when this is taken out, other sectors of the economy showed weak growth.”, BBC, November 13, 2025

===========================================================================================

United States

“US Economy 2026 Outlook From Economists – Modest growth with easing inflation and policy shifts. Economists expect the U.S. economy to navigate 2026 with modest growth, cooling but still above-target inflation, and a gradual easing of interest rates. Baseline expectations center on real GDP growth in the 1.7% to 1.9% range in 2026 (with some outlooks nearer 2.0%), inflation easing toward roughly 2.5% to 3.0%, and a Federal funds rate drifting to around 3.25% to 3.5% by mid-2026. The labor market is set to cool, with unemployment edging toward roughly 4.4% or higher, consumer spending slowing before re-accelerating late in the year, tariffs sustaining price pressures and squeezing margins, AI investment providing a supportive tailwind, and commercial real estate fundamentals gradually improving.”, Grey Journal, November 12, 2025

=============================================================================================

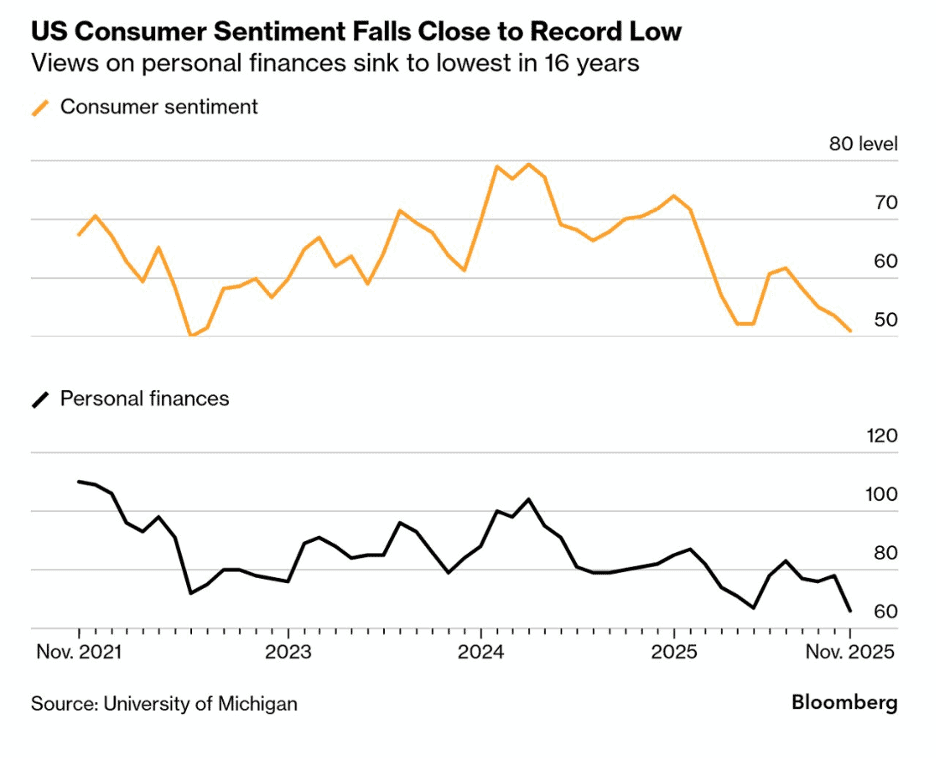

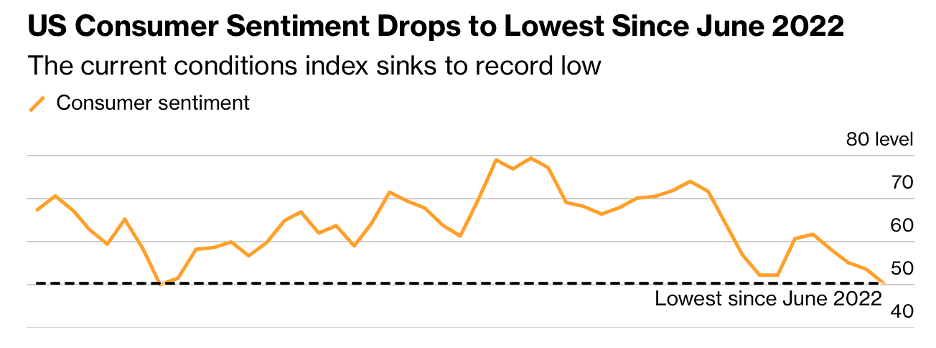

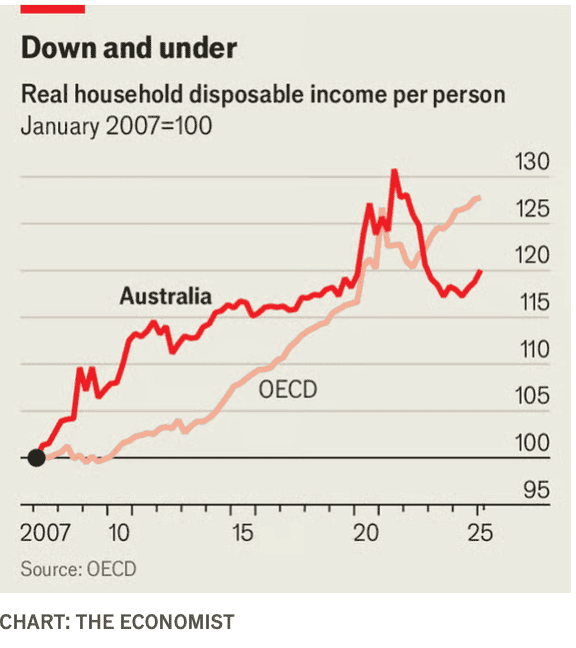

“US Consumer Sentiment Nears Record Low – As far as Americans are concerned, the future of their wallets is looking glum. With inflation having hit 3% and unemployment rising to 4.4%, the third part of the troubled trifecta, US consumer sentiment, has fallen to one of the lowest levels on record. The final November sentiment index dropped to 51 from 53.6 in October, according to the University of Michigan. Views of personal finances were the dimmest since 2009. Data from the survey along with studies by private companies have become more useful of late, as federal agencies once renown for their “gold standard” in economic data have become unreliable.”, Bloomberg, November 21, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The Accredited Franchise Supplier certification

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Brand & Franchise Sector News

“Will restaurants see more M&A and IPO activity next year? Next year may be marked by a high volume of deals for both high-performing growth concepts and distressed assets, as challenger brands look for capital and ailing systems seek turnarounds. Despite consumer pullback and macroeconomic uncertainty, 2025 turned out to be a major year for restaurant deal activity. Looking ahead to 2026, experts at the Restaurant Finance and Development Conference say the pace of deals might continue as high-performing brands seek fresh capital, underperformers look for turnaround sponsors and private equity eyes franchisees.”, Restaurant Dive, November 14, 2025

=============================================================================================

“Is Your Emerging Restaurant Concept Ready to Go Global? Some brands spend decades perfecting their model before opening in a new country. Others find themselves faced with the question much sooner: Are we ready to go global? There’s no single formula for the right time. For some, it’s 30 years in. For others, it’s five. The better question is what signals tell you your brand is mature enough to thrive abroad. Here’s what every emerging restaurant brand should consider before taking the leap.”, Franchising.com, November 14, 2025. This article is authored by Carolyne Canady, the chief development officer with Dave’s Hot Chicken.

============================================================================================

“Breaking Out of the States: Expanding a Franchise into the U.K. and Europe – For decades, the United States has been the birthplace of some of the world’s most recognizable franchises. While America is fertile ground for franchising success, ambitious brands often face a crucial next step: international expansion. Among the most attractive destinations? The United Kingdom and Europe. For many franchises, taking the leap across the pond to establish a presence in the U.K. and Europe has been a strategic move driven by careful research, market evaluation, and an understanding of the growing gig economy and real estate landscape. Here are some of the top lessons franchises need to know before expanding into the U.K. and Europe.”, Franchising.com, November 14, 2025. This article is authored by Brian Kelley, the CEO and President of Phenix Salon Suites.

=============================================================================================

“Luckin Coffee responds to questions about relisting on the US main board – On November 12, according to multiple media reports, Luckin Coffee CEO Guo Jinyi stated at an event in Xiamen that Luckin is actively promoting its relisting on the US main board. Once the listing is completed, it will help make Xiamen a more attractive global business and investment destination. In response, Luckin Coffee officially stated that it will continue to monitor the US capital market, but the company currently has no definite timetable for returning to the main board listing. Luckin Coffee’s primary task at this stage remains implementing its business strategy and focusing on development.”, Security Times Website (China), November 13, 2025. Compliments of Paul Jones, Jones & Co., Toronto

===========================================================================================

“Krispy Kreme® Continues Global Expansion – Iconic doughnut brand opens first shop in Spain with more locations planned through a minority interest joint venture with Glaseados Originales S.L. International expansion continues with new shops in Brazil and first location in Uzbekistan expected to open before the end of 2025.”, Business Wire, October 15, 2025

============================================================================================

“Purpose Brands Announces Grand Opening of First Anytime Fitness Club in Dubai – Coinciding with Dubai Fitness Challenge Wellness Campaign. With the addition of the UAE, Anytime Fitness clubs now operate in 49 countries and territories around the world, with access to all locations a key benefit for the 5 million Anytime Fitness members worldwide. The UAE also marks expansion of the brand across the Middle East, joining Qatar and Kuwait, with additional countries to be announced.”, PR Newswire, October 23, 2025

=============================================================================================

“Captain D’s Splashes Down in the UK in October – Iconic American seafood brand debuts refreshed design and UK-tailored menu at Westwood Cross Shopping Centre. The launch marks the start of an exciting new chapter for Captain D’s as the brand brings its refreshed restaurant design, UK-tailored menu, and international expansion strategy to life. This opening is part of a 20-unit master franchise agreement with local partner CD’s Holdings.”, Franchising.com, October 10, 2025

=============================================================================================

“Great American Cookies and Marble Slab Creamery Build on Global Growth with Development Deal in Iraq – FAT (Fresh. Authentic. Tasty.) Brands Inc., parent company of Great American Cookies, Marble Slab Creamery, and 16 other restaurant concepts, has announced a new development deal to open 10 co-branded Great American Cookies and Marble Slab Creamery stores across Iraq over the next five years in partnership with Eric Wilson, a 27-year U.S. military veteran who served in Iraq.”, FAT Brands, October 22, 2025

===========================================================================================

“KFC is not afraid of growing chicken competition – Company executives believe that increasing competition from other chicken chains can keep them on their toes internationally and help them get better back home in the U.S. More than any other protein, chicken is soaring in restaurants. Burger brands are adding chicken to their menus. New concepts are emerging and exploding all the time. Internationally, U.S. chicken chains are increasingly eyeing international expansion. Chicken sales worldwide grew 9% in 2024, according to Technomic, compared with 1.4% for burgers. Religious groups generally do not have objections to chicken, which makes it a relatively easy cuisine to expand in other markets.”, Restaurant Business, November 19, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive our biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing business environment. And our GlobalTeam™ on the ground covering 25+ countries provide us with updates about what is actually happening in their specific countries. We do not get involved in or report on politics!

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

William “Bill” Edwards: CEO & Global Trade Advisor “Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global”. With five decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe, and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service global management consultant since 2001 helping 40+ franchisors expand into new countries. Bill knows how to turn the challenges in taking a brand global into opportunities.

For a complimentary 30-minute consultation on how to take your business into new countries successfully. For a complimentary call with Bill Edwards click on the QR code or contact Bill at bedwards@edwardsglobal.com and +1 949 375 1896

And download our latest chart ranking 40+ countries as places to do business, used by many companies for strategic planning, at this link:

Our latest GlobalVue™ 40 country ranking

Biweekly Global Business Newsletter Issue 147, Tuesday, November 11, 2025

“If you want to go fast, go alone. If you want to go far, go together.”

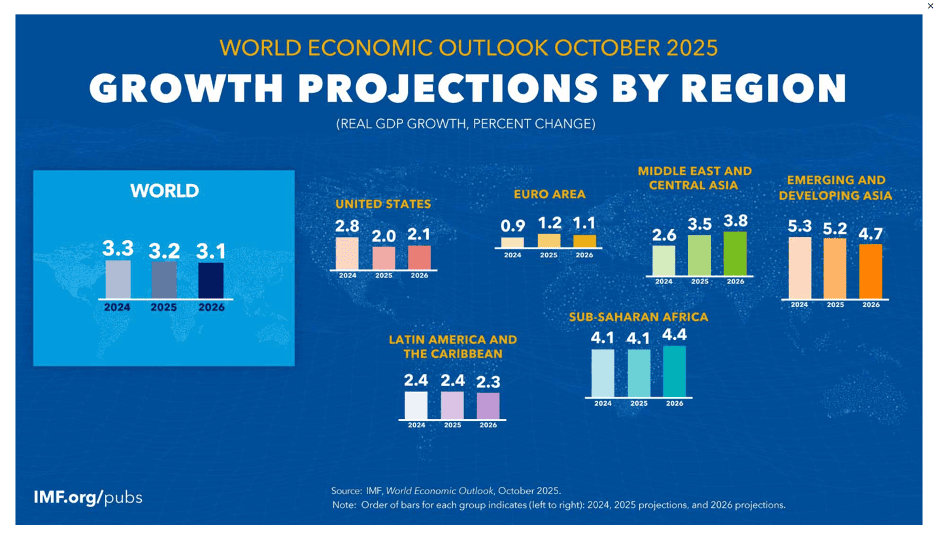

Welcome to the 147th Edition of the Global Business Update – Global economic indicators reveal resilience amid uneven regional recovery. The IMF projects roughly 3 percent growth for 2025-26, with the U.S. constrained by a government shutdown, China’s slowdown deepening, and Europe wrestling with fiscal and political instability.

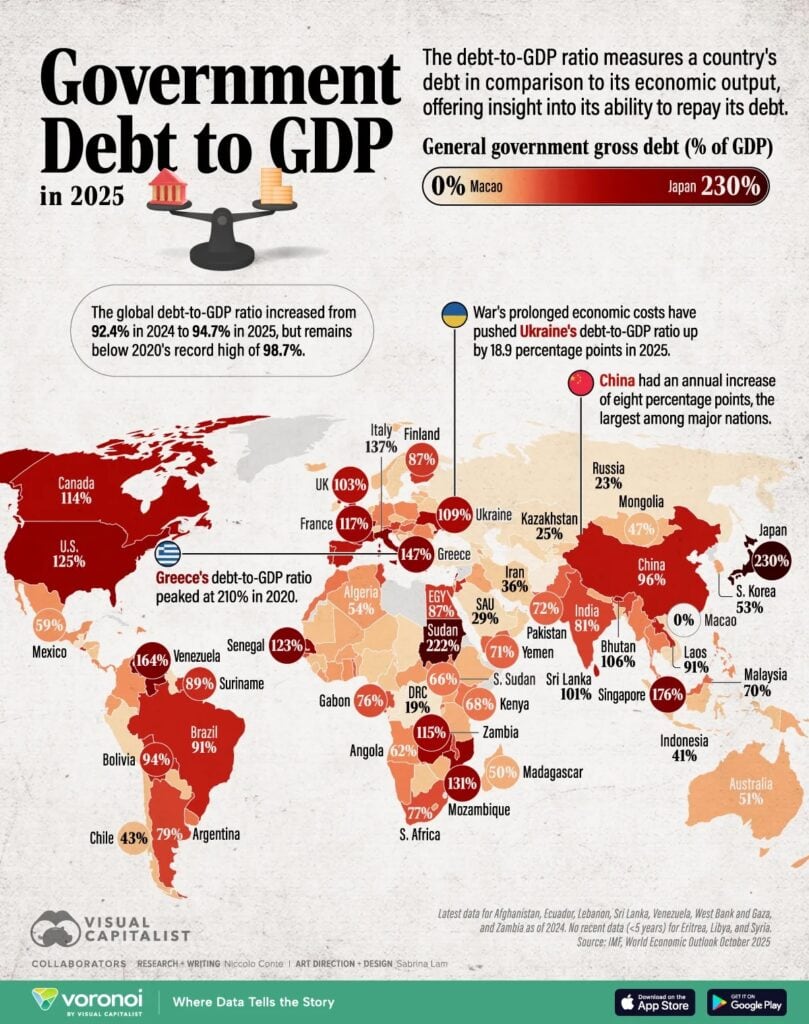

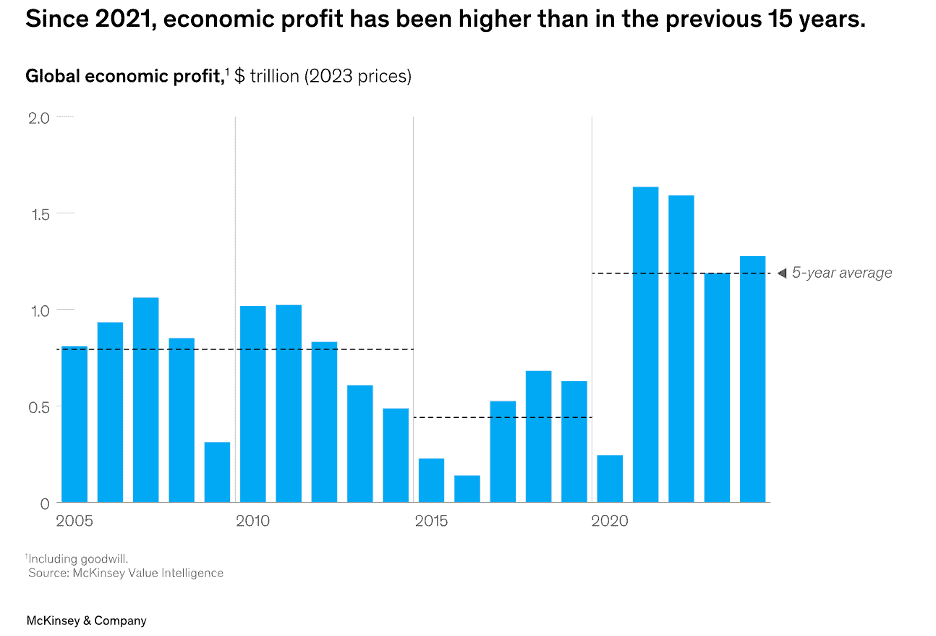

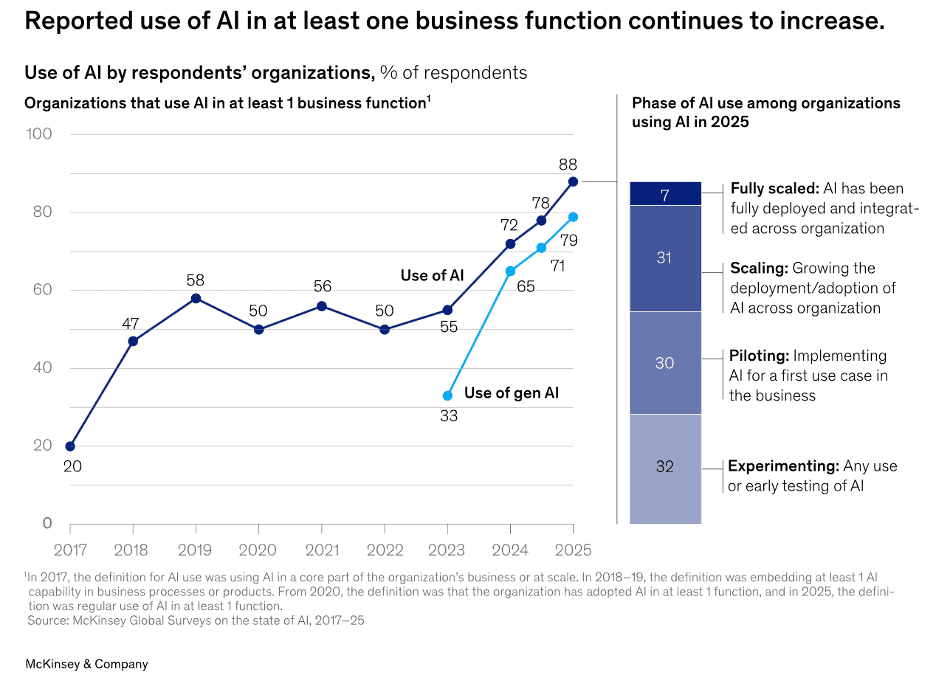

Global debt continues to climb, reaching 94.7 percent of GDP, while McKinsey reports a rebound in worldwide economic profits—driven by technology, energy, and materials sectors. AI adoption remains high, though many firms are still early in scaling enterprise-wide value.

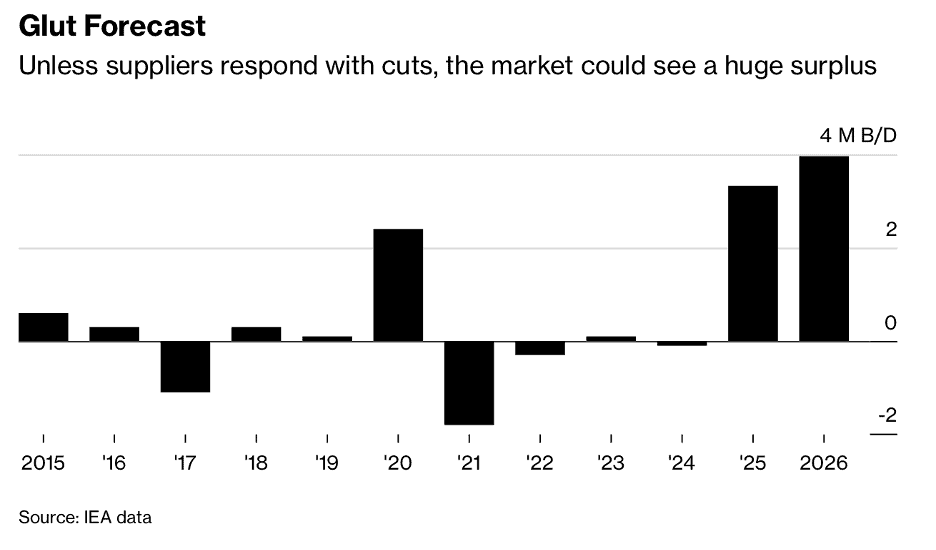

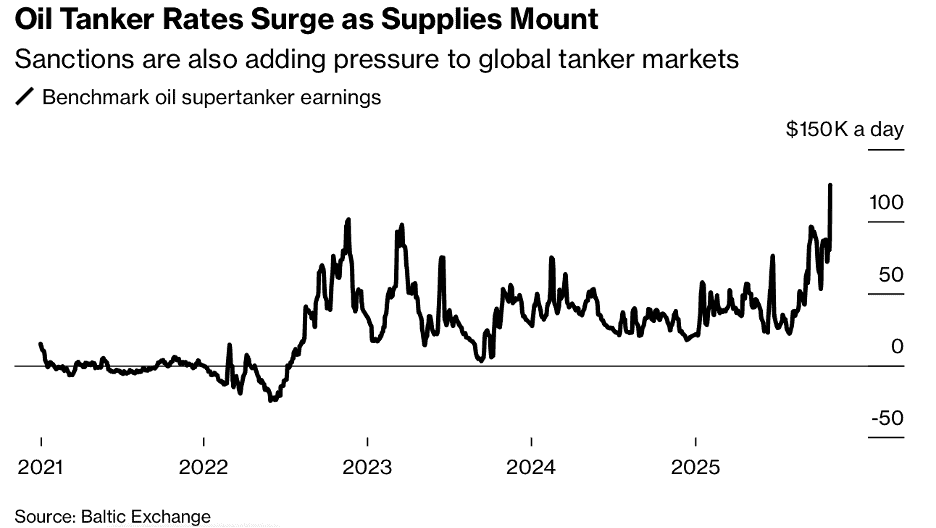

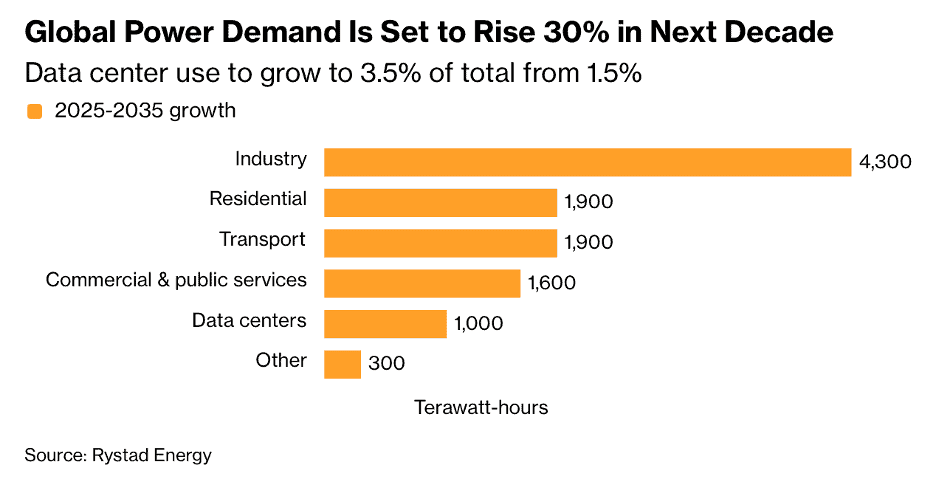

In energy, OPEC+ faces conflicting pressures as surplus risks meet renewed sanctions on Russia; meanwhile, tanker earnings and shipping activity surge. Rystad Energy forecasts a 30 percent rise in global power demand by 2035. Visual Capitalist notes that Greece, China, and Japan now control 40 percent of global shipping capacity.

In trade and geopolitics, your Editor, EGS CEO Bill Edwards, highlighted non-tariff barriers as a growing challenge for SMEs in a webinar at the Global Chamber Export-Import Forum.

Franchise section headlines include the $620 million sale of Denny’s to private equity, Brinker’s strong Chili’s results, Yum China’s record expansion, Starbucks’ China joint venture with Boyu Capital and Burger King China also selling part of its business.

Overall, 2025 continues to be defined by moderate economic optimism, strong energy logistics, accelerating AI transformation, and renewed global franchise activity—tempered by political volatility and consumer caution.

This edition’s book review highlights The Art of Less – How to Focus on What Really Matters at Work by Mats Alvesson and André Spicer argue that many organizations and professionals are burdened by excess — too many meetings, overlapping initiatives, training programs, targets, rules and bureaucratic structures that distract from core work and value creation. They label this burden “organizational sludge” — the accumulation of practices, procedures and policies that consume time and energy yet deliver little meaning or impact.

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive our biweekly newsletter by email every other Tuesday, click here https://insider.edwardsglobal.com

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business. We do not get involved with or report on politics!

PLEASE NOTE: Some of the information sources that we provide links to in our newsletter require a paid subscription to directly access them. Clicking on a link may not give the reader access to the content.

Edited and curated by: William (Bill) Edwards, CEO & Global Business Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA. Contact Bill with questions, comments and contributions. Bedwards@edwardsglobal.com, +1 949 375 1896

Link to our current and past newsletters: https://edwardsglobal.com/geowizard/

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

First, A Few Words of Wisdom From Others For These Times

“If you want to go fast, go alone. If you want to go far, go together.”, African Proverb

“Successful entrepreneurs are givers and not takers of positive energy.” , Anonymous

“You miss 100% of the shots you don’t take.” – Wayne Gretzky

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Highlights in issue #147:

Global Economics Intelligence executive summary, September 2025

The state of AI in 2025: Agents, innovation, and transformation

Government Debt to GDP by Country in 2025

Navigating Non-Tariff Barriers and Global Trade Challenges

US Consumer Sentiment Is at Near-Record Lows

World Power Demand to Rise Almost a Third by 2035

Franchise Global News Section: Burger King®, Chili’s®, Club Pilates®, Denny’s®, Pizza Hut®, Starbucks®, Wendy’s® and YUM China

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

“Global Economics Intelligence executive summary, September 2025 – The global economy is showing resilience, although growth remains uneven across regions. IMF projections indicate global growth of around 3% for 2025 and 2026, but underlying data is mixed. Currently, the United States faces a government shutdown, China’s momentum continues to slow, and Europe is contending with persistent political and fiscal turbulence. Central banks are cautiously pivoting toward easing, yet uncertainty surrounding trade dynamics, tariff policies, and the trajectory of AI markets continues to cloud the outlook.”, McKinsey & Co., October 31, 2025

=============================================================================================

“Government Debt to GDP by Country in 2025 – The global debt-to-GDP ratio rose 2.3 percentage points to 94.7% in 2025, but is still below the pandemic-era peak of 98.7% in 2020. Japan remains the world’s most indebted nation at 230% of GDP, followed by Sudan (222%) and Singapore (176%). Global debt levels continue to rise, with 2025 marking another year of fiscal strain across both advanced and developing economies. This map shows how much each country’s government debt compares to its economic output, measured as debt-to-GDP ratio, offering insight into fiscal resilience and vulnerability worldwide.”, Visual Capitalist & IMF World Economic Outlook, October 27, 2025

=================================================================================================

“Global economic profit bounces back to an all-time high – After years of decline, economic profits rebounded with a vengeance—driven by tech companies, performance in the energy and materials sector, and capital growth in China and North America. When adjusted for inflation, and despite the impact of the COVID-19 pandemic, economic profit between 2020 and 2024 increased to about $1.2 trillion per annum—50 percent above levels between 2005 and 2009. This is a notable shift from the past 15 years, when, as our previous research showed, companies’ aggregate economic profit—or their profit above the total cost of capital—mostly shrank.”, McKinsey & Co., September 4, 2025

===============================================================================================

“The state of AI in 2025: Agents, innovation, and transformation – Three years since the introduction of gen AI tools triggered a new era of artificial intelligence, nearly nine out of ten survey respondents say their organizations are regularly using AI—but the pace of progress remains uneven. Almost all survey respondents say their organizations are using AI, and many have begun to use AI agents. But most are still in the early stages of scaling AI and capturing enterprise-level value. High curiosity in AI agents: Sixty-two percent of survey respondents say their organizations are at least experimenting with AI agents.”, McKinsey & Co., November 5, 2025

============================================================================================

“How Franchises Can Properly Structure AI for Success – A recent study from MIT delivered a sobering finding: 95 percent of AI initiatives fail to generate measurable return on investment. For many brands, this statistic has been a wake-up call. In a recent six-month study, Goldfish Swim School and Heights Wellness Retreat offered two early proof points. Instead of trying to overhaul their entire tech stack, each brand zeroed in on a single, high-impact question: how can they help their franchise business coaches identify underperforming units faster, understand what’s driving the issues, and act on the right next steps? A second factor is human-centered design that integrates AI into existing workflows. Systems that operate in isolation, or attempt to replace human judgment entirely, often struggle to gain adoption.”, Franchising.com, October 22, 2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation, Taxes, Tariffs & Trade Issues

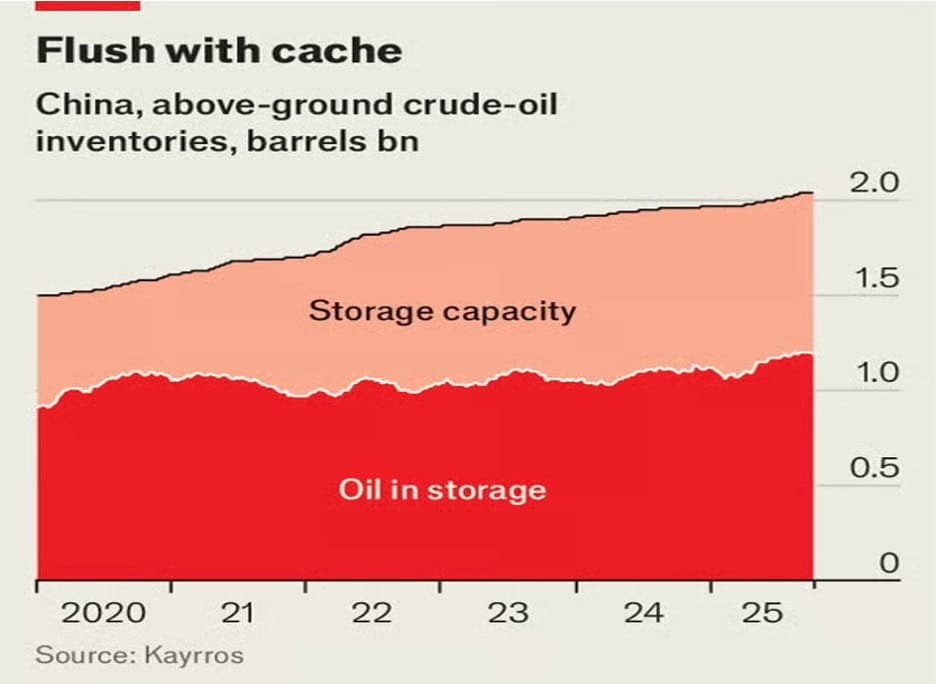

“OPEC+ Balances Oil Risks From Surplus to Sanctions – When OPEC+ meets this weekend, it’ll confront an oil market assailed by hazards on all sides. First, there are growing signs that a long-predicted supply surplus — swollen by the group’s production increases this year — is finally showing up. With Chinese demand cooling, top forecasters are bracing for a record glut in 2026. Then there are new US sanctions that threaten to disrupt exports from OPEC+ co-leader Russia. Finally, there’s the one-year trade truce reached this week between Washington and Beijing, which has allayed some of the concerns over oil demand and buoyed Brent crude futures near $65 a barrel.”, Bloomberg, October 31, 2025

============================================================================================

“Navigating Non-Tariff Barriers and Global Trade Challenges – The Global Chamber® Export-Import Forum, moderated by Anita Rodal, featured Bill Edwards, CEO and Global Trade Advisor at Edwards Global Services (Your newsletter Editor!!!), in a dynamic and highly informative discussion on international trade challenges and non-tariff barriers (NTBs) that impact businesses especially small to medium-sized enterprises (SMEs). The conversation explored regulatory, compliance, and cultural challenges that companies face when entering global markets, and how to navigate these obstacles effectively through market research, local partnerships, and access to international resources. Bill emphasized that while tariffs are often discussed in trade policy, non-tariff barriers — including certification requirements, labeling regulations, customs procedures, and shifting political environments — often create even greater obstacles for small exporters. ‘About half of all non-tariff barriers serve legitimate public purposes,’ Bill explained, ‘But the other half can act as discriminatory trade barriers — depending on market.’”, Global Chamber, October 23rd. Please go to this link for the YouTube webinar:

https://www.youtube.com/watch?v=i7_pH5kSF6Q

================================================================================================

“Oil Supertanker Earnings Soar to $125,000 a Day as Supply Swells – Earnings for ships that can carry two million barrels of crude from the Middle East to China jumped 40% to $125,000 a day, according to the Baltic Exchange. It’s the highest since April 2020, when the global pandemic forced traders to hoard oil at sea. Rates have been steadily rising as global oil supplies climb, with production growing both inside and outside of the OPEC+ alliance.”, Bloomberg, October 29, 2025

==============================================================================================

“Three Nations Control the Global Fleet – The top three ship-owning nations by capacity, Greece, China, and Japan, account for over 40 percent of the world fleet by deadweight tonnage. Measured by vessel count, these three nations control nearly one-third of the global fleet. The combined share of the top 10 ship-owning countries reaches 67.3 percent of global fleet capacity. Much of the capacity owned by these top 10 ship-owning countries is registered under foreign flags.”, Visual Capitalist, October 31, 2025

==============================================================================================

“World Power Demand to Rise Almost a Third by 2035 – Global power demand will continue to grow rapidly over the next decade, jumping about 30% as electric vehicles, data centers and the need to heat and cool buildings increases, although the source of that electricity will shift markedly, according to Rystad Energy. Legacy industrial sectors such as iron and steel, which were also key in seeing electricity consumption double over the past two decades, will be the biggest drivers, the energy research company said in a report. While data centers are becoming a notable source of demand growth, their power usage will remain a relatively small part of the total — at 3.5% in 2035.”, Bloomberg, October 30, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel News

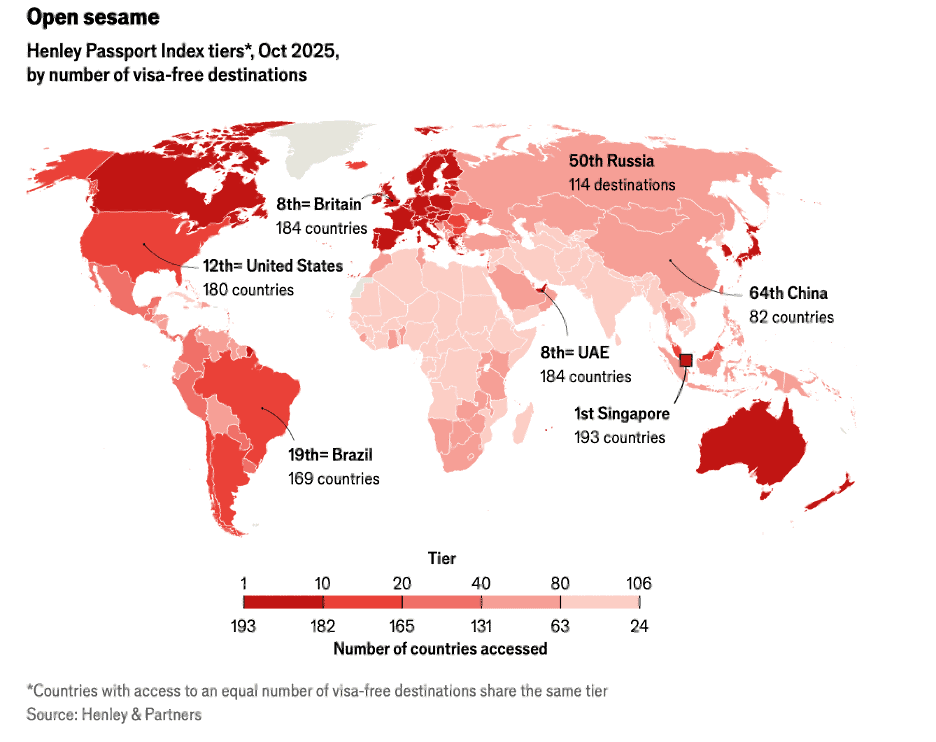

“The world’s most—and least—powerful passports – Americans’ travel documents aren’t as muscular as they used to be. Citizens of some countries can speed through the gates; citizens of others must submit to interrogation and delay. Henley & Partners, a consultancy that helps rich people acquire citizenship in attractive countries, ranks passports by the number of countries their holders can enter without a visa. Its latest assessment of passport power shows that America is sliding down the table. Our map shows how countries compare this year.”, The Economist, October 16, 2025

===============================================================================================

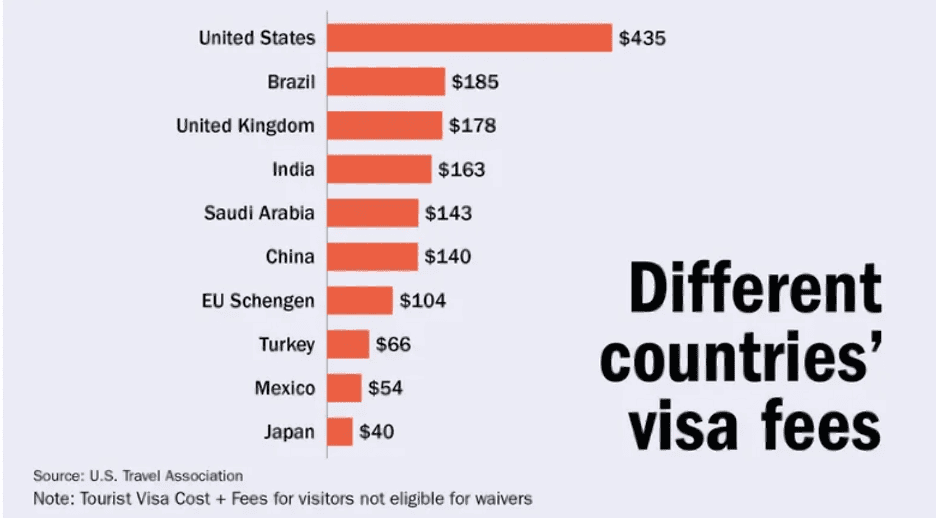

“Visa fees may blunt U.S. travel gains from weakened dollar – According to Morgan Stanley, the value of the U.S. dollar against other currencies dropped about 11% in the first half of 2025, the biggest decline in more than 50 years. Travel industry leaders are hopeful this might convert into more inbound visitation. But for many international visitors, a $250 visa fee introduced this month for visitors from countries that are not part of the Visa Waiver Program, including top markets Mexico, China, India and Brazil, makes visiting the U.S. more expensive. It does not apply to visitors from Canada or countries in the Visa Waiver Program, which includes most of Europe, Australia, Chile, Japan and South Korea.”, Travel Weekly, October 29, 2025.

=============================================================================================

“The world’s best airports for business travellers revealed – The Booking.com for Business study analysed 50 of the world’s busiest airports based on factors such as the number of business class routes and proximity to the local business district. It comes as global business travel spending is forecast to climb to £1.2trillion by the end of 2025, before accelerating with 8.1 per cent growth in 2026. With a score of 9.55, Dubai International Airport holds the coveted top position in the Business Travel Airport Index. Singapore Changi Airport takes second place with a Business Travel Airport Index score of 9.01.”, The Daily Mail, November 5, 2025

Editor’s Note: Airports in both the United Kingdom and the United States did not make the top ten in the world for business travelers.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Book Review

In The Art of Less – How to Focus on What Really Matters at Work by Mats Alvesson and André Spicer argue that many organizations and professionals are burdened by excess — too many meetings, overlapping initiatives, training programs, targets, rules and bureaucratic structures that distract from core work and value creation. They label this burden “organizational sludge” — the accumulation of practices, procedures and policies that consume time and energy yet deliver little meaning or impact.

The book explains how sludge arises (from over‑standardization, risk aversion, stakeholder demands and managerial interventions), how it proliferates via a “sludge cycle”, and the ways in which it throttles productivity, stifles innovation and demoralizes employees. In the final section the authors propose a “de‑sludging” agenda: diagnosing what is truly meaningful work, challenging assumptions about mandatory activities, streamlining structures, creating space for judgment and initiative, and instituting “institutional minimalism” — doing fewer things, but doing them better.

For global organizations especially, the book emphasizes that focus, clarity and simplicity become even more critical in complex transnational contexts where cultural, structural and regulatory burdens can multiply. The central message: doing less of the unnecessary enables more of what matters.

Five Key Takeaways for Global Businesspeople

Identify and eradicate “sludge” – In multinational operations you’ll often encounter layers of processes, approvals, trainings or reporting systems that serve local comfort rather than real value. Ask: What practices don’t help but hinder?

Prioritize meaningful work – Especially in global teams with time‑zones and cultural differences, ensure that the tasks people spend most time on align with value‑creation, not just activity.

Empower judgement rather than rigid controls – Standardizing globally can pull you into high sludge. Give local teams discretion so they can focus on what really matters in their context.

Streamline structures and governance – Franchising, licensing, global joint ventures: all benefit from “less but sharper” rules. Avoid duplicative procedures across countries that slow responses and innovation.

Embed minimalism in culture – Build a mindset of “do fewer things, do them better” across your global organization: fewer horizons, fewer KPIs, fewer initiatives but higher impact. A global business that executes fewer priorities well will outperform one stretched thin across many weak ones.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

China