Biweekly Global Business Newsletter Issue 139, Tuesday, July 22, 2025

“I will either find a way, or make one”, Hannibal

Welcome to the 139th Edition of the Global Business Update – As always, our goal is to keep you informed, inspired, and strategically positioned for what lies ahead on global trends. This edition is longer than most as there is just lots of global business news to make our 4,600 subscribers aware of!

This edition spans critical business, economic, and geopolitical developments from around the world—curated to help global executives stay ahead of the curve.

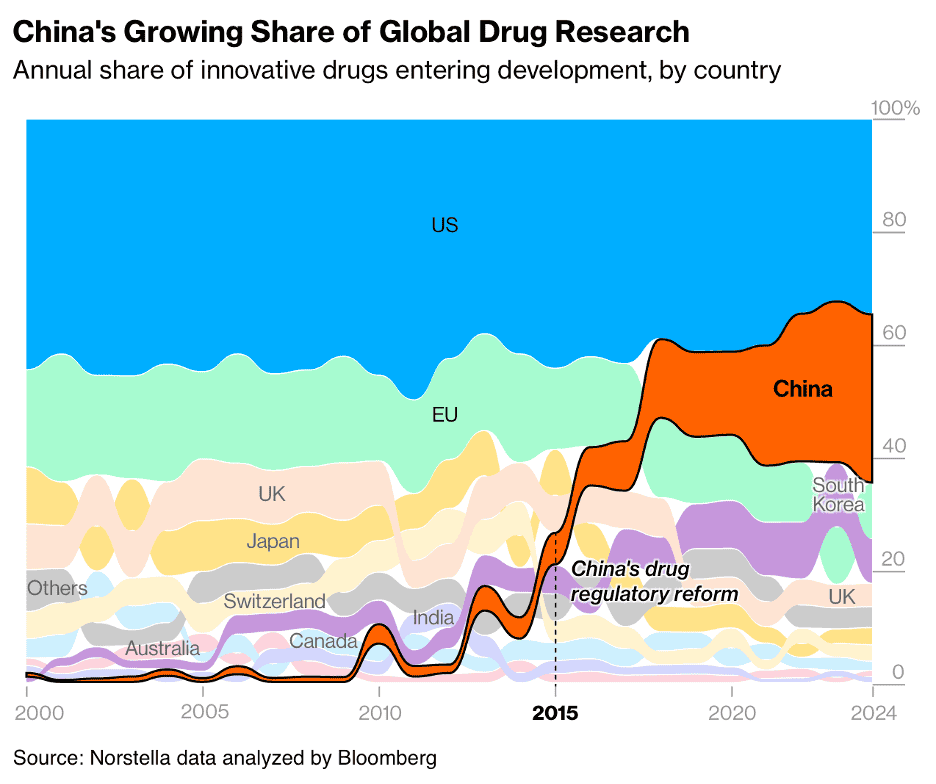

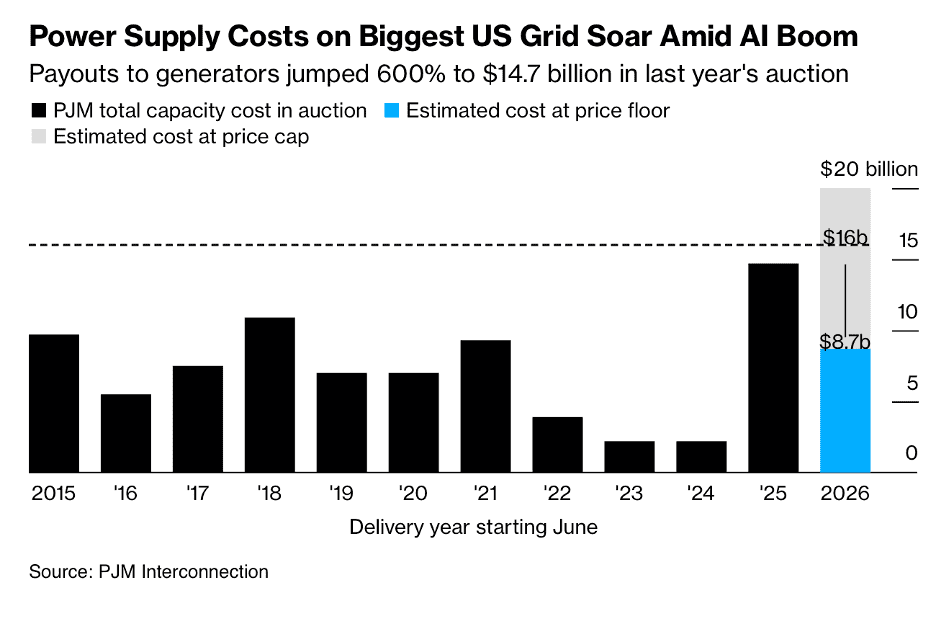

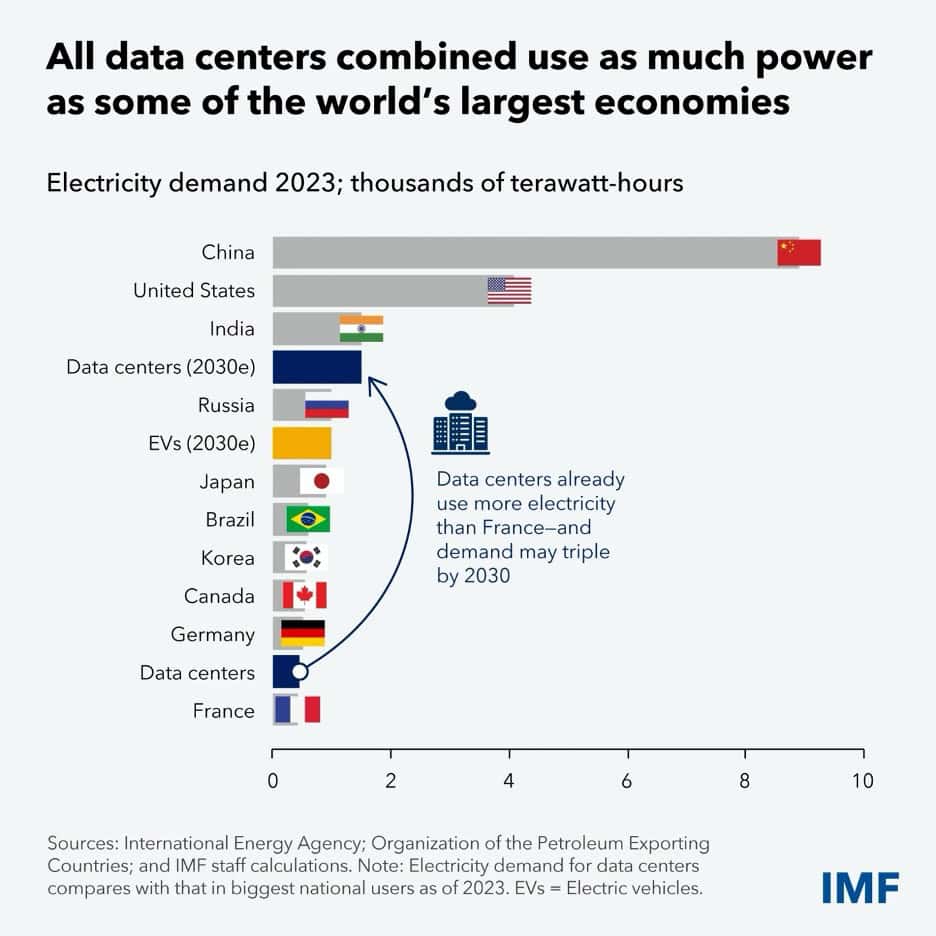

Artificial intelligence continues to dominate headlines and reshape industries. ChatGPT now surpasses 500 million monthly users, as companies increasingly integrate generative AI into operations. Yet this digital transformation brings new ethical and operational complexities. Meanwhile, China’s biotech sector is rapidly evolving, positioning itself as a global competitor in pharmaceutical R&D and innovation. And the growing cost of power supplies for AI.

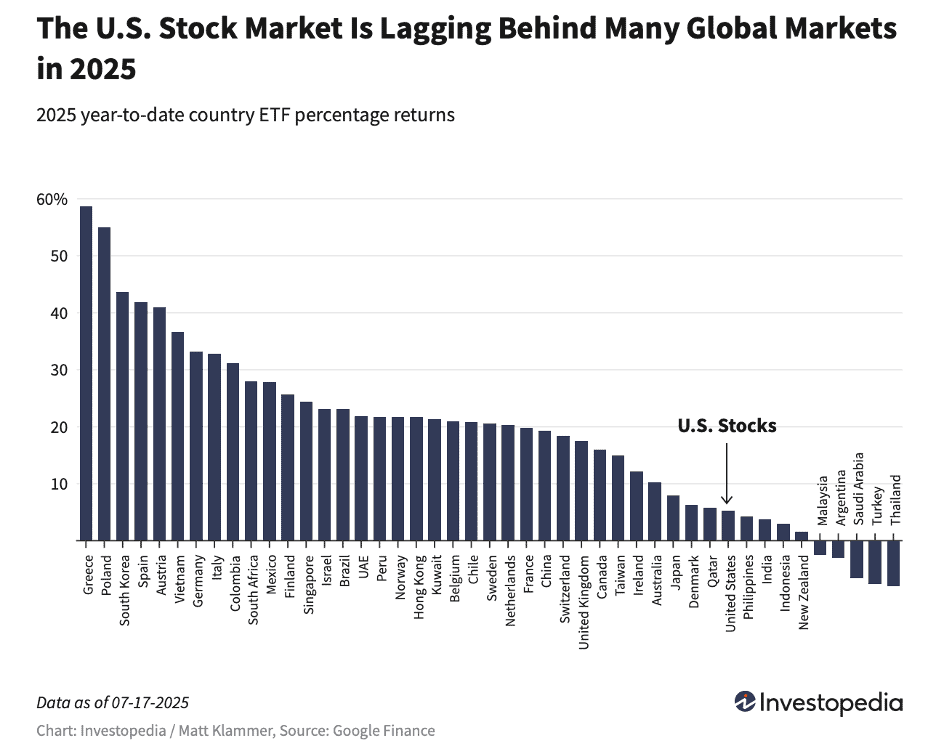

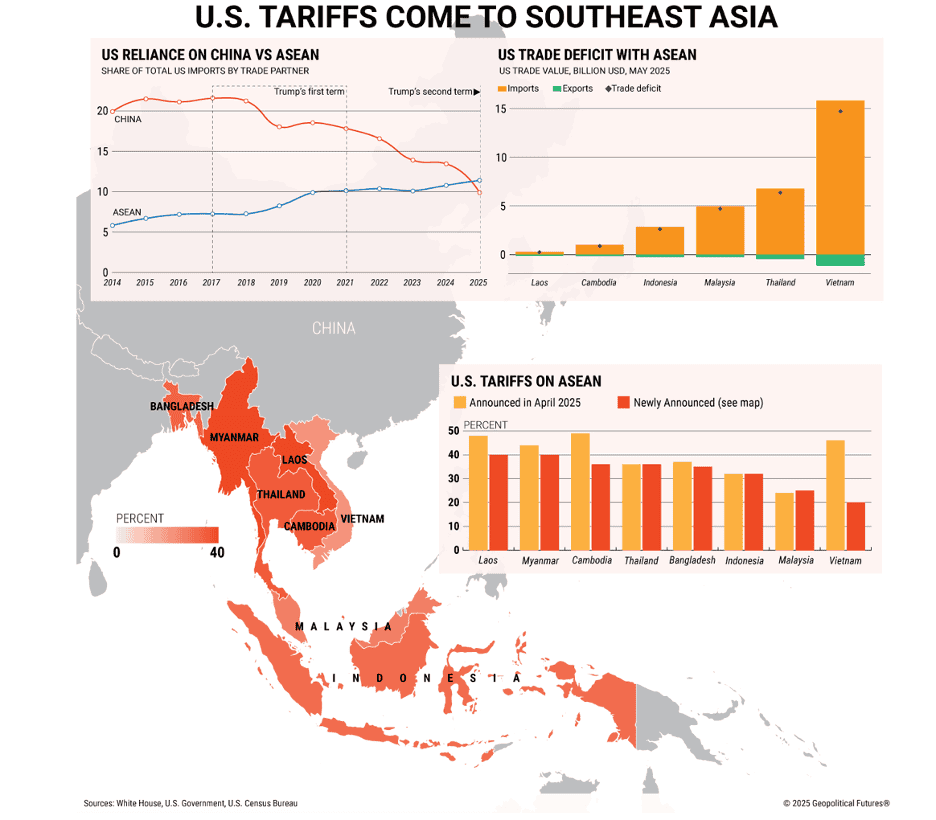

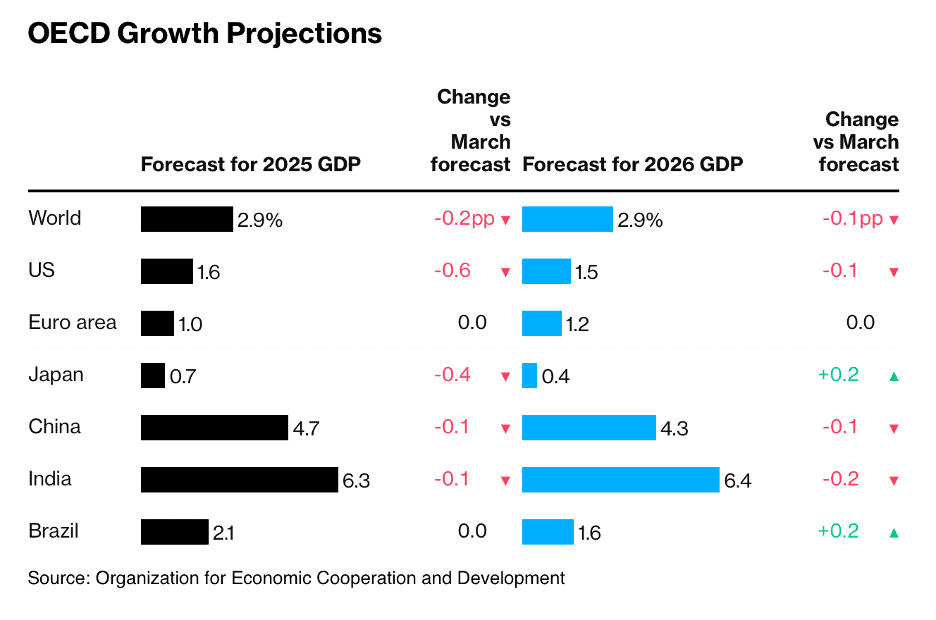

Economic resilience is also in focus. Argentina, despite its well-documented volatility, received a modest credit upgrade, reflecting recent reforms. At the same time, U.S. investors are increasingly looking abroad, as foreign stock markets outperform the S&P 500. Trade relations, however, remain tense. The U.S. has imposed new tariffs targeting Southeast Asia, even as countries like Indonesia navigate the disruption through last-minute deals.

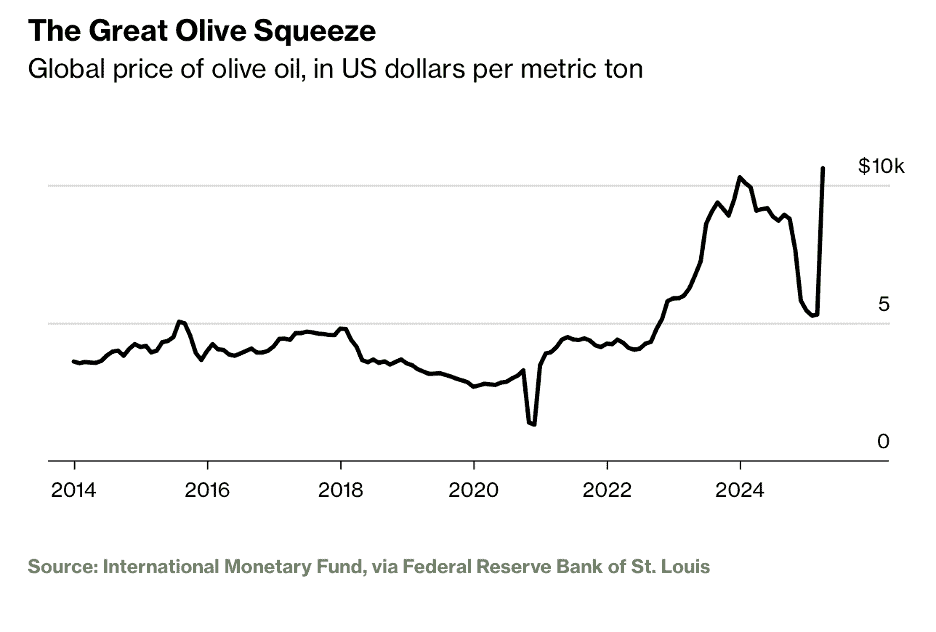

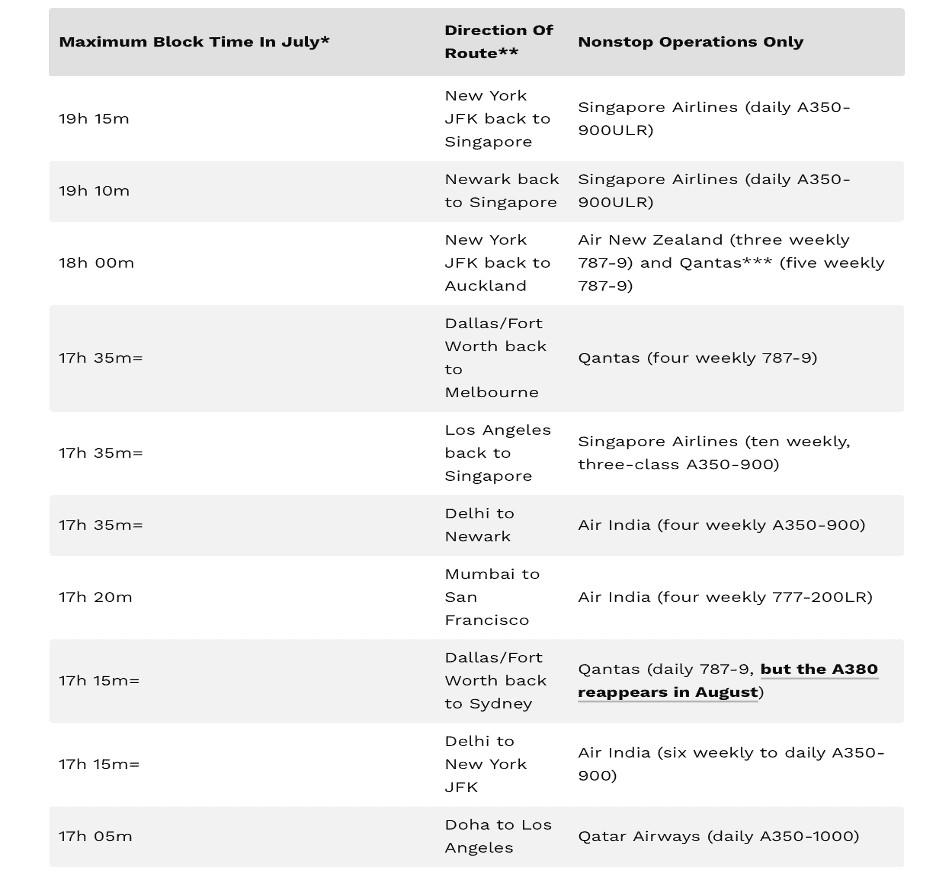

On the consumer front, lifestyle shifts, and global pressures are front and center. Olive oil prices are skyrocketing due to climate-driven supply shortages, while the race for ultra-long-haul flights raises fresh concerns about traveler fatigue. Countries like New Zealand, Ireland, and Australia are recognized for offering the best work-life balance—an increasingly valuable benchmark in talent attraction and retention.

In the world of franchising, Taco Bell is making headlines for its global growth strategy. Auntie Anne’s launches in Australia, and World Gym has entered Brazil through a new master franchise agreement. We also take a closer look at franchise development in the Gulf region, where ambitious growth strategies are met with distinct cultural and regulatory considerations. Updates from China and the UK include key legal and operational shifts impacting both inbound and outbound franchise strategies. KFC’s new CEO is already making global waves.

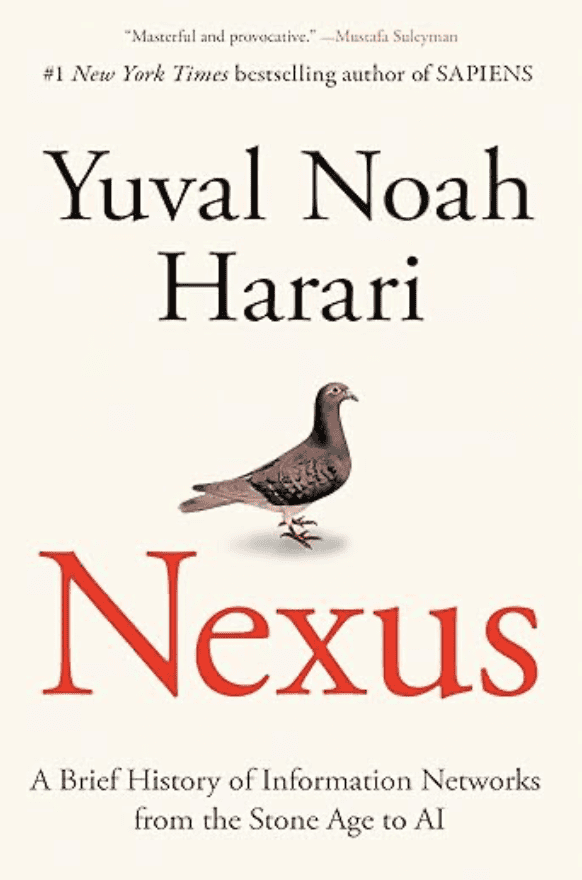

This issue’s book is Nexus: A Brief History of Information Networks from the Stone Age to AI by Yuval Noah Harari which explores how the evolution of information-sharing systems—from cave paintings to artificial intelligence—has shaped human history, economics, and power. Harari contends that the true engine of civilization is not tools or resources, but our growing ability to collect, store, transmit, and act on information at scale. Harari’s Nexus is a timely call to rethink strategy, ethics, and innovation in the age of intelligent systems.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business. We do not get involved with or report on politics!

PLEASE NOTE: Some of the information sources that we provide links to in our newsletter require a paid subscription to directly access them. Clicking on a link may not give the reader access to the content.

Edited and curated by: William (Bill) Edwards, CEO & Global Business Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA. Contact Bill with questions, comments and contributions. Bedwards@edwardsglobal.com, +1 949 375 1896

Link to our current and past newsletters: https://edwardsglobal.com/geowizard/

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

First, A Few Words of Wisdom From Others For These Times

“I will either find a way, or make one”, Hannibal

“You can’t build a reputation on what you are going to do.”, Henry Ford

“The secret of change is to focus all of your energy not on fighting the old, but on building the new.”, Socrates

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Highlights in issue #139:

The World’s Top Countries by Natural Gas Reserves

The Best Countries for Life-Work Balance in 2025

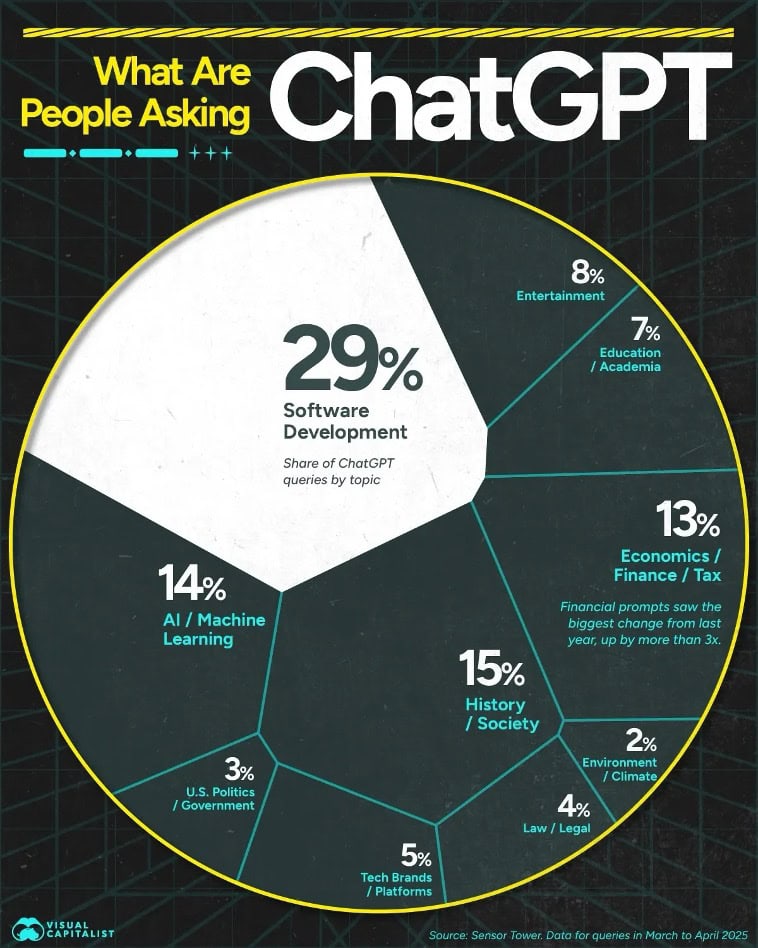

What Are People Asking ChatGPT?

Global Stock Markets Are Eating the U.S. Market’s Lunch

Why olive oil is suddenly more expensive than ever

US firms say China market critical despite fraying relations other issues

Brand Global News Section: Auntie Anne’s®, KFC®, Taco Bell®, Planet Fitness® and World Gym®

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Please sign up for this amazing future looking August 6th event at the Beall Center for Innovation and Entrepreneurship at the University of California, Irvine at this link: www.enpinstitute.com/events

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

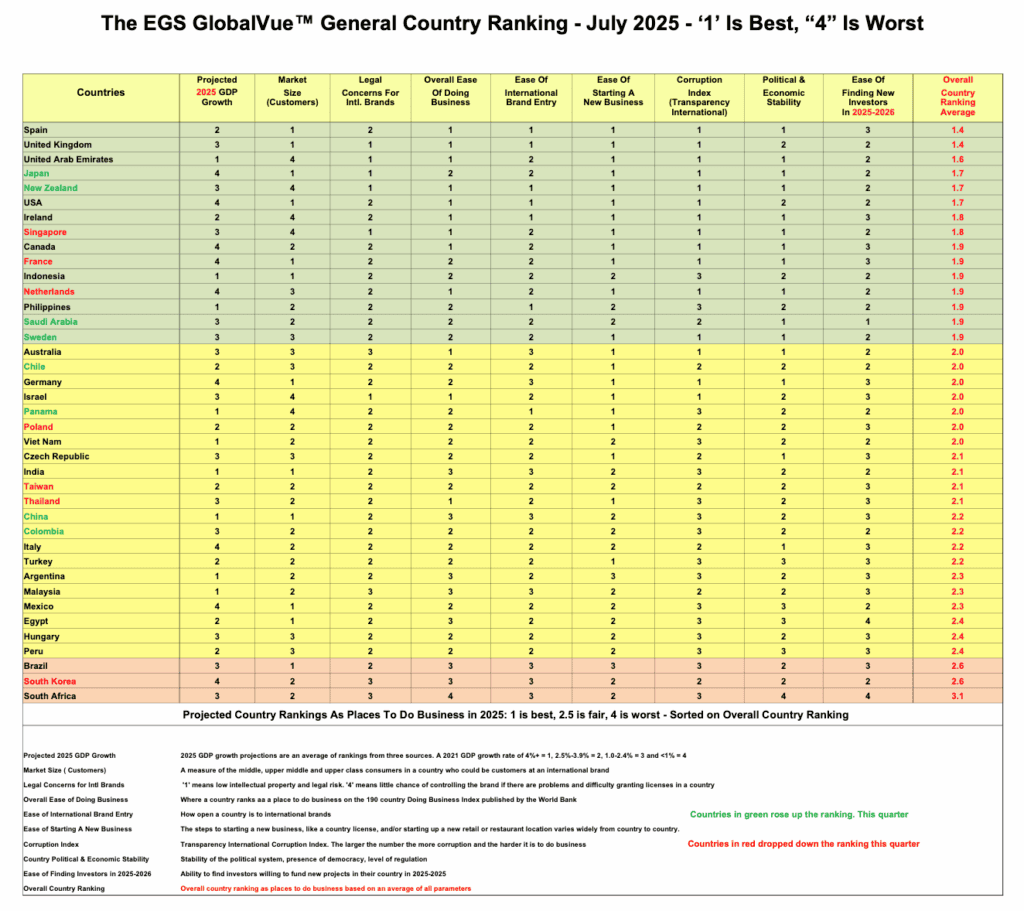

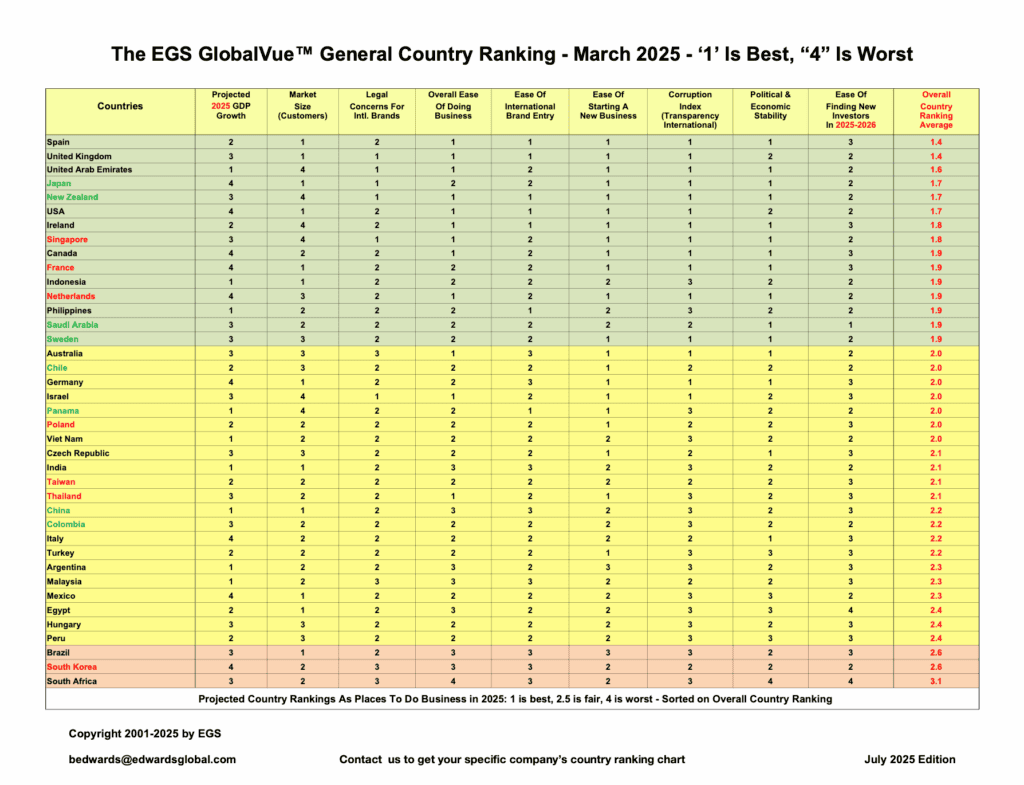

GlobalVue™ Country Ranking July 2025 – The latest version of the Edwards Global Services, Inc. quarterly country ranking as places to do business has just been published. Several countries moved up the ranking in the last quarter due to improved GDP growth projections for 2025, improved investor interest in new projects or changes in country political and/or economic stability. Several countries went down in the ranking for the same reasons. The GlobalVue™ ranking has been published quarterly since 2001 and is used by companies to plan and evaluate their international expansion.

==================================================================================================

“What Are People Asking ChatGPT? In under two years, ChatGPT has gained 500 million monthly active users (MAUs). Software development queries are the top prompt category, with a 29% share, although it has fallen from 44% in April 2024. History and society is the second-most popular category, at 15% of prompts, up from 13% in April 2024 according to analysis from Sensor Towe. As adoption rises, daily app user time spent has surged 98% between April 2024 and April 2025. In April, ChatGPT’s top three referral sites were YouTube, Wikipedia, and the National Library of Medicine.”, Visual Capitalist and Sensor Towe, July 4, 2025

============================================================================================

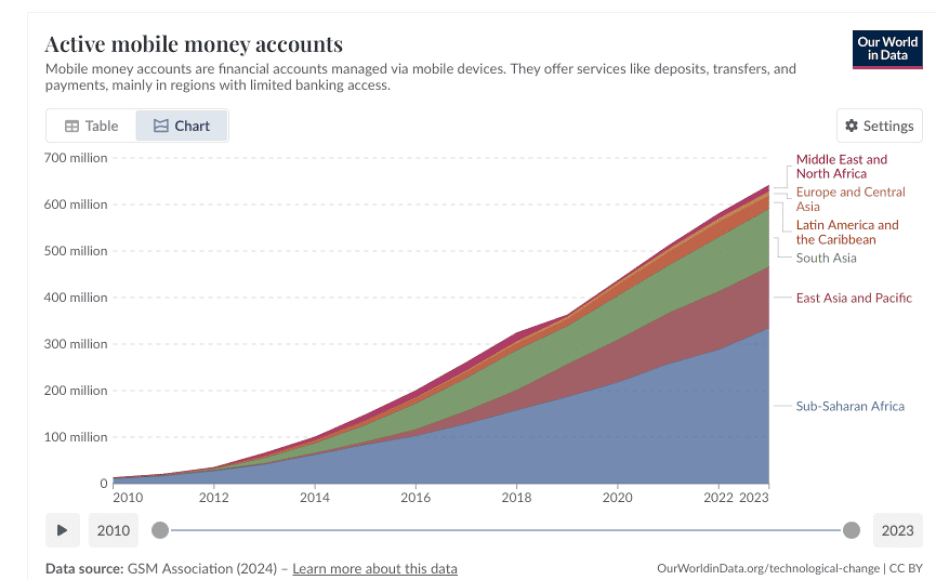

“There are now more than half a billion mobile money accounts in the world, mostly in Africa — here’s why this matters – Mobile money allows people without banks to securely transfer funds via text message, and its adoption is growing rapidly. By the end of today, you’ll probably have used your bank account — maybe to buy groceries, pay rent, or send money to a friend. Even better, to receive your salary. It’s something many of us take for granted. However, for more than a billion people globally, transactions only happen with cash.That means carrying around physical notes and coins, traveling long distances just to send or receive money, and facing the constant risk of losing it or having it stolen. The absence of formal banking services adds yet another hurdle for people trying to escape poverty. But in recent years, “mobile money” has transformed how many people access financial services.”, Our World In Data, July 6, 2025

============================================================================================

“The Best Countries for Life-Work Balance in 2025 – Top-ranked countries like New Zealand and Ireland offer generous paid maternity leave (26 weeks) and high statutory annual leave (30+ days), supporting strong work-life balance. Most countries with universal healthcare also provide extensive sick pay (80–100%) and maternity benefits, reinforcing social safety nets for workers. The study evaluated paid leave, sick pay, maternity benefits, minimum wage, healthcare, happiness, work hours, LGBTQ+ rights, and safety, weighted to produce an overall score out of 100. Data was collected and analyzed in April 2025.”, Global Work-Life Index 2025, July 4, 2025

============================================================================

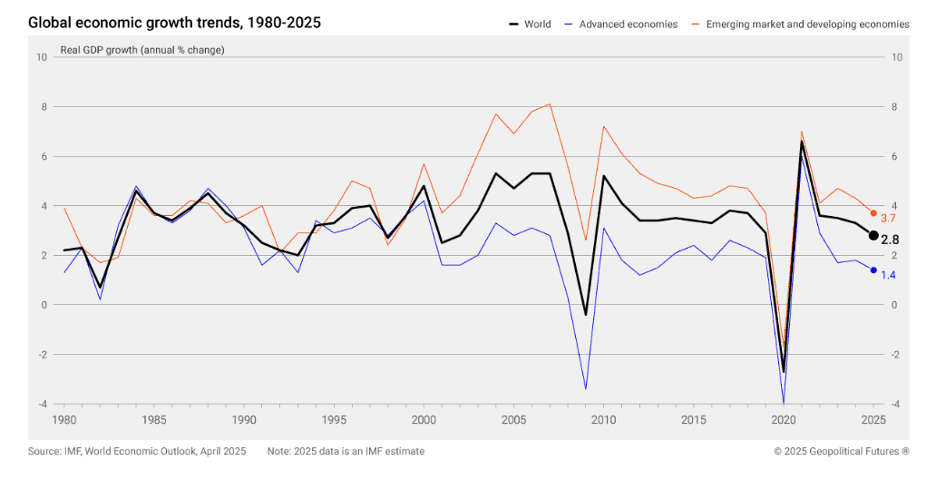

“Global Stock Markets Are Eating the U.S. Market’s Lunch. Here’s Why—and How You Can Invest Internationally – Although the U.S. stock market has historically outperformed its international peers since the end of the Great Recession, cheaper valuations abroad, the U.S.’s higher-for-longer interest rate policy, and the appeal created by the weaker U.S. dollar are pushing some investors to look overseas. Global stocks are outperforming U.S. equities in 2025—a rare occasion, historically. Key factors contributing to the U.S. market’s underperformance are interest rate policy divergence, dollar weakness, and relative valuation gaps.”, Investopedia, July 18, 2025

==========================================================================================

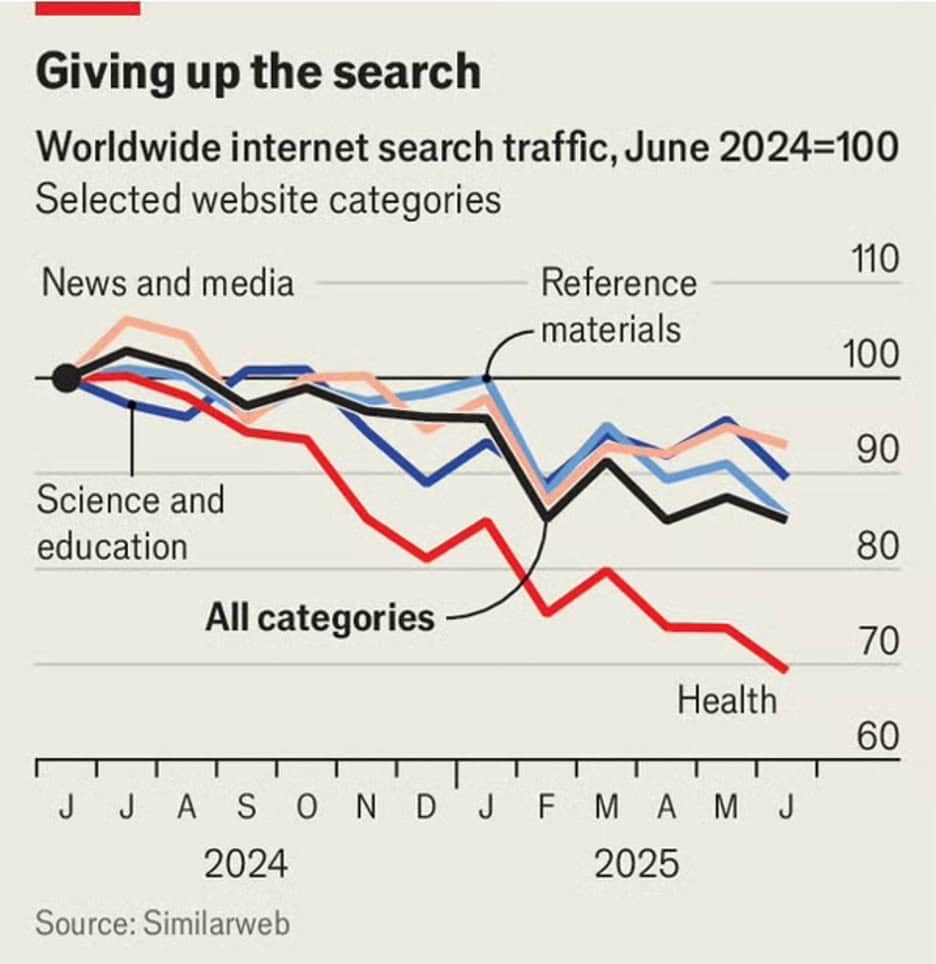

“AI is killing the web. Can anything save it? The rise of ChatGPT and its rivals is undermining the economic bargain of the internet. As users pose their queries to chatbots rather than conventional search engines, they are given answers, rather than links to follow. The result is that “content” publishers, from news providers and online forums to reference sites such as Wikipedia, are seeing alarming drops in their traffic. As Openai and other upstarts have soared, Google, which has about 90% of the conventional search market in America, has added ai features to its own search engine in a bid to keep up.”, The Economist, July 14, 2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

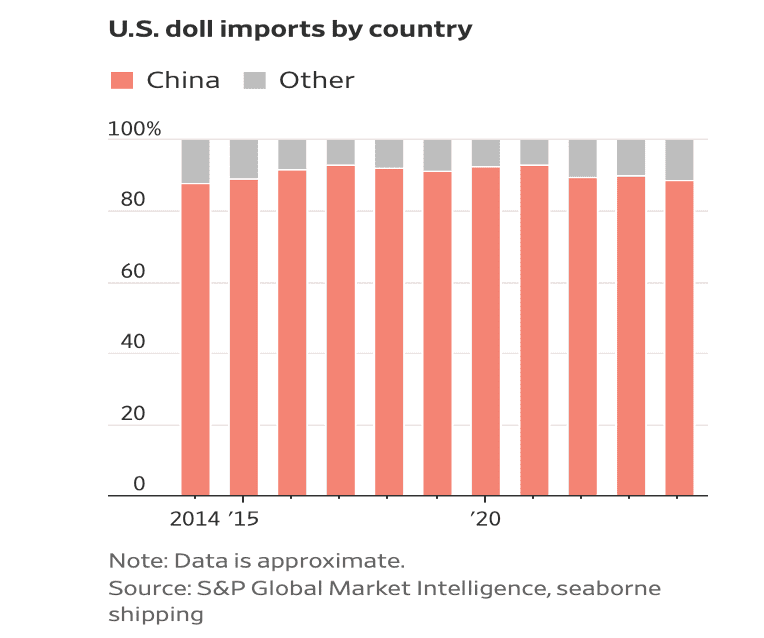

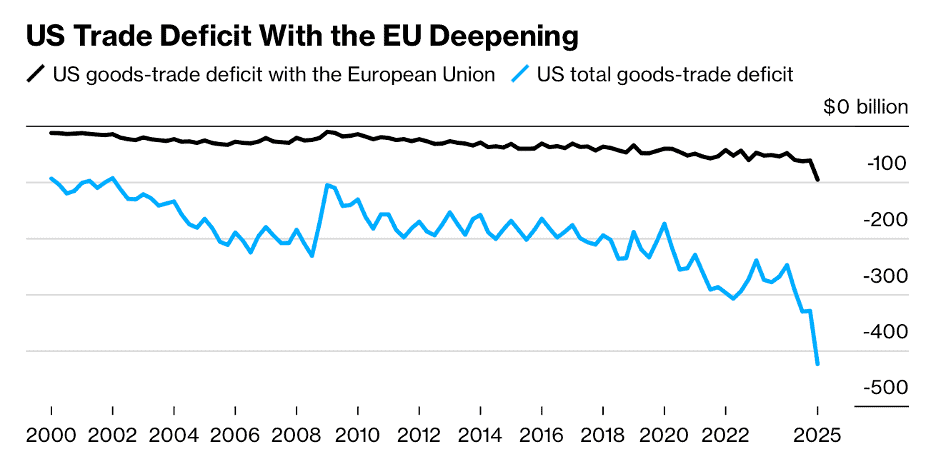

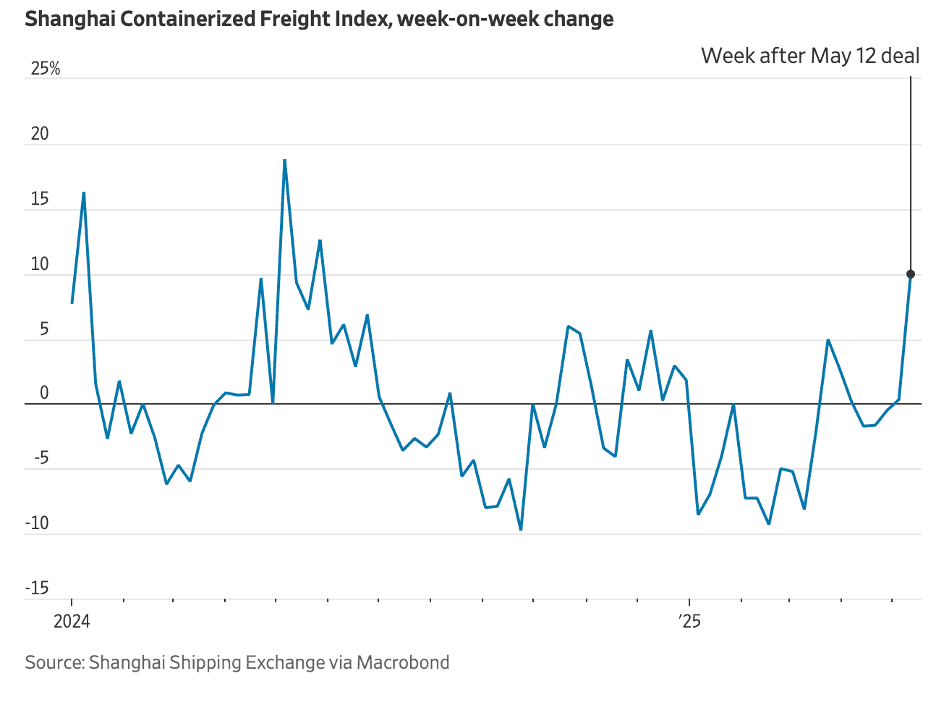

Global Supply Chain, Energy, Commodities, Inflation, Taxes & Trade Issues

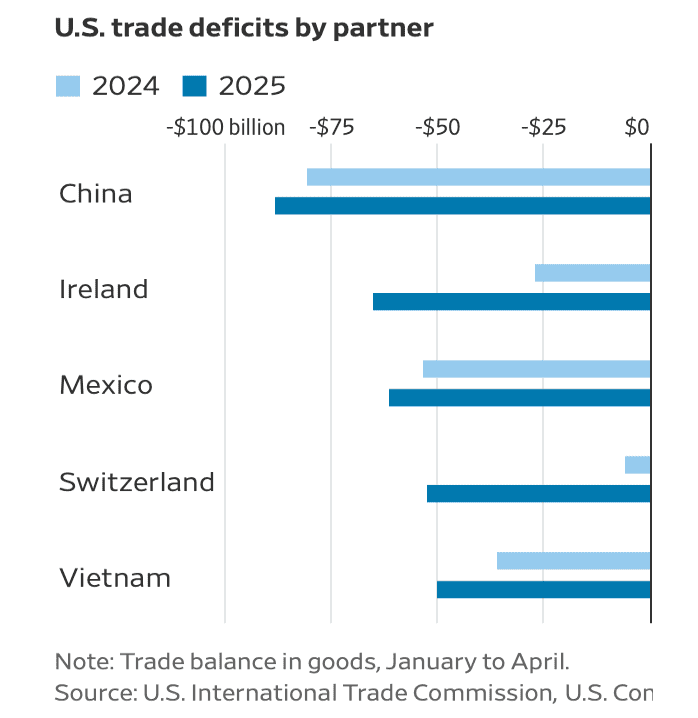

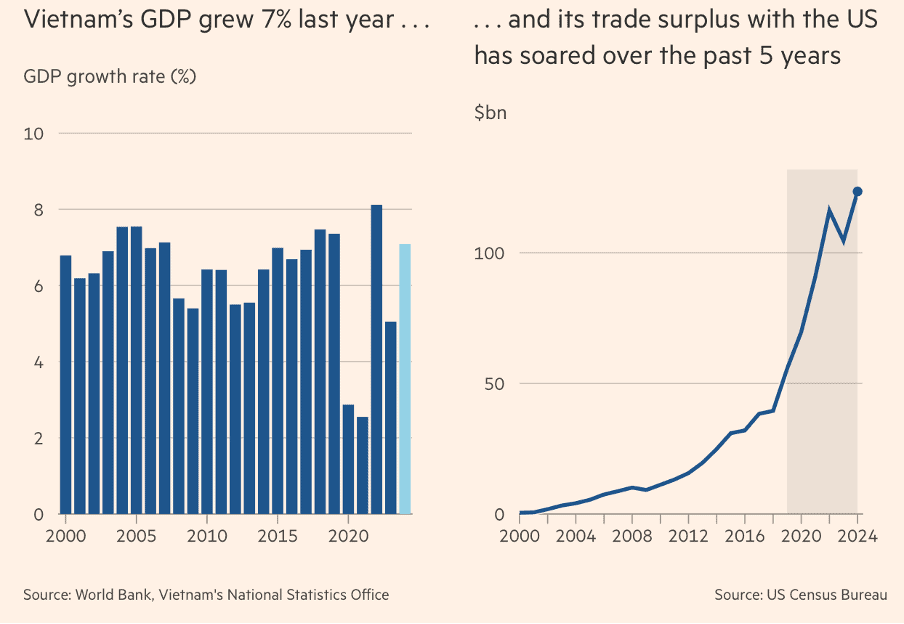

“Tariffs Target Southeast Asia – The region now accounts for more U.S. imports than China. Since 2016, the share of U.S. imports from China has fallen by nearly half, while imports from the Association of Southeast Asian Nations have nearly doubled. The United States now imports more from Southeast Asia than it does from China. The new tariffs are aimed at reducing these growing imbalances. The new tariff package targets ASEAN countries not only for their trade deficit but also for their role in transshipping Chinese goods. Vietnam, now America’s largest ASEAN trade partner, faces a 20 percent tariff on its exports and a 40 percent tariff on goods rerouted from higher-tariff countries like China.”, Geopolitical Futures, July 11, 2025

============================================================================================

role in the global energy mix, used widely for electricity generation, heating, and as industrial feedstock. This graphic visualizes the top 10 countries with the largest proven natural gas reserves in the world. Countries are organized and colored by region, Reserves indicates that these stores of natural gas are economically viable to extract at the current market price. Data comes from the Oil & Gas Journal via the U.S. Energy Information Administration.”, Visual Capitalist, July 9, 2025

================================================================================================

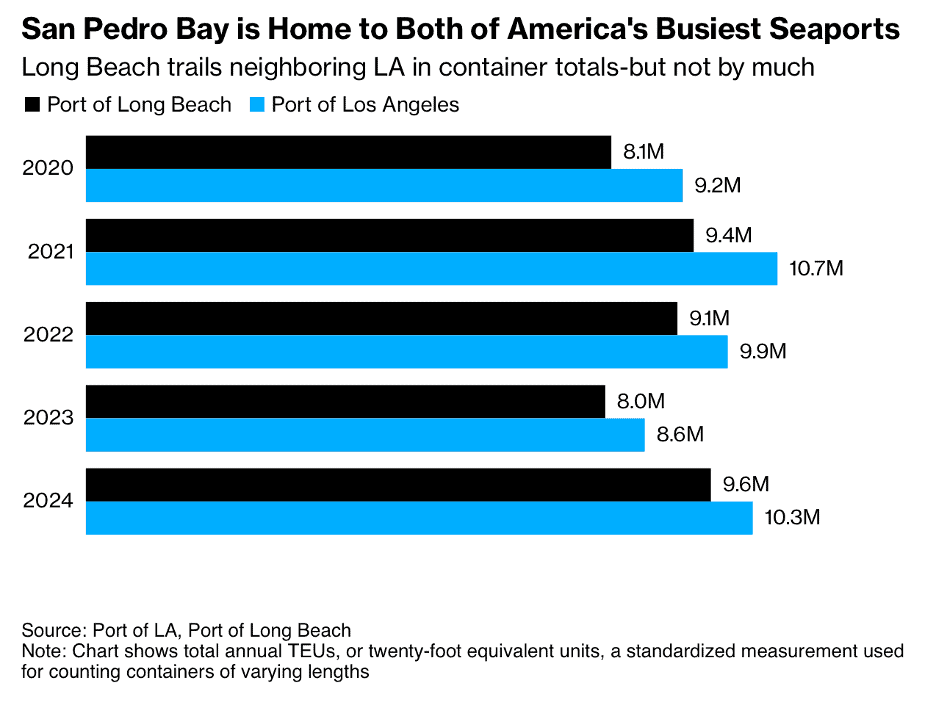

“How the Port of Long Beach Plans to Finally Overtake Rival LA – LA has long enjoyed the title of the country’s busiest seaport, with Long Beach almost always in second place. LA’s reign looks shaky, however, thanks to just 19 acres of new land added to one Long Beach terminal. With the expansion, annual capacity at ITS will jump about 50% to 2.3 million TEUs, according to CEO Kim Holtermand. The extra 900,000 TEUs is likely be enough to surpass LA, which last year processed 10.3 million containers. (Long Beach, despite having its best year on record, handled 9.6 million.)”, Bloomberg, July 17, 2025

================================================================================================

“Why olive oil is suddenly more expensive than ever – Olives were a low-stress crop for millennia, but Greece shows how climate change has made the harvest much less predictable—and growing regions more desperate. Olives have been a hardy staple for thousands of years throughout the Mediterranean because the trees thrive in dry climates. But these days olive growers in Spain, Italy and Greece—the world’s top three producers—are struggling to keep their groves from getting too dry. Bloomberg, June 30, 2025

===============================================================================================

“China Biotech’s Stunning Advance Is Changing the World’s Drug Pipeline – Chinese biotech’s advance has been as ferocious as the nation’s breakthrough efforts in AI and EVs, eclipsing the EU and catching up to the US. The number of novel drugs in China — for cancer, weight-loss and more — entering into development ballooned to over 1,250 last year, far surpassing the European Union and nearly catching up to the US’s count of about 1,440, an exclusive Bloomberg News analysis showed. The world’s strictest regulatory agencies, including the US Food and Drug Administration and the European Medicines Agency, increasingly view Chinese drugs as generally promising enough to justify devoting extra resources to speed up their review, handing them coveted industry designations such as priority review, breakthrough therapy designation or fast track status.”, Bloomberg, July 13, 2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel News

“Delta moves toward eliminating set prices in favor of AI that determines how much you personally will pay for a ticket – Delta has a long-term strategy to boost its profitability by moving away from set fares and toward individualized pricing using AI. The pilot program, which uses AI for 3% of fares, has so far been “amazingly favorable,” the airline said. Privacy advocates fear this will lead to price-gouging, with one consumer advocate comparing the tactic to “hacking our brains.” Fresh off a victory lap after a better-than-expected earnings report, Delta Air Lines is leaning into AI as a way to boost its profit margins further by maximizing what individual passengers pay for fares. By the end of the year, Delta plans for 20% of its ticket prices to be individually determined using AI, president Glen Hauenstein told investors last week. Currently, about 3% of the airline’s flight prices are AI-determined, triple the portion from nine months ago.”, Fortune, July 16, 2025

==============================================================================================

“Up To 19h 15m: The US’s 10 Longest Nonstop Flights – Some of the world’s longest nonstop flights involve the US, a handful of which are ultra-long-haul. While definitions vary, this is usually taken to mean flights that take more than 16 hours. Inevitably, some services are operated by the niche Airbus A350-900ULR and the Boeing 777-200LR. They are, of course, designed for such missions, although both types are necessarily deeply unpopular. However, other equipment, including the A350-1000 and 787-9, both famed for their long ranges and economics, are also deployed. Unsurprisingly, Singapore Airlines from New York JFK Airport (the US’s leading widebody airport) back to Singapore is number one. It is the world’s longest nonstop scheduled passenger flight. Famously, it uses the 161-seat A350-900ULR, with 67 seats in business class and 94 in premium economy. To help with appeal, comfort, fares, and yields, regular economy is unavailable on the very expensive-to-operate route.”, Simple Flying, July 15, 2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Book Review

Nexus: A Brief History of Information Networks from the Stone Age to AI by Yuval Noah Harari explores how the evolution of information-sharing systems—from cave paintings to artificial intelligence—has shaped human history, economics, and power. Harari contends that the true engine of civilization is not tools or resources, but our growing ability to collect, store, transmit, and act on information at scale. From oral traditions to writing, from the printing press to global internet platforms, each leap in information processing has transformed how societies—and businesses—function. Harari weaves historical analysis with future-facing insights, arguing that today’s AI revolution represents a fundamental shift in decision-making power, organizational design, and global coordination.

Harari’s Nexus is a timely call to rethink strategy, ethics, and innovation in the age of intelligent systems.

Five Takeaways for Global Business Leaders:

Information is infrastructure: As important as capital or labor—invest in your organization’s ability to manage and interpret data.

Adaptability trumps legacy: Every major network shift (e.g., writing, printing, AI) favors the flexible over the entrenched.

AI will redefine leadership: Delegating judgment to algorithms challenges traditional authority and requires new ethical frameworks.

Global networks are fragile and powerful: Interconnectedness enables scale—but also systemic risk.

Narratives still matter: Despite technology, human belief systems and trust networks remain vital for aligning teams and markets.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Argentina

“Moody’s Raises Argentina’s Rating On Macroeconomic Reforms – The ratings agency upped Argentina’s long-term foreign currency sovereign credit ratings and local currency issuer ratings to Caa1 from Caa3. Moody’s Ratings has upgraded Argentina’s credit ratings due to macroeconomic reforms that are stabilizing and disinflationary. Argentina’s long-term foreign currency sovereign credit ratings were raised to Caa1 from Caa3. Reforms, including reduced spending, have spurred investment, wage increases and credit availability; however, structural issues persist. The economy returned to year-over-year growth in the fourth quarter of 2024 for the first time in six quarters, Moody’s said. The ratings agency said Argentina’s weak external buffers and structural barriers to investment still prevent the country’s rating from rising beyond Caa1.”, The Wall Street Journal, July 17, 2025

===========================================================================================

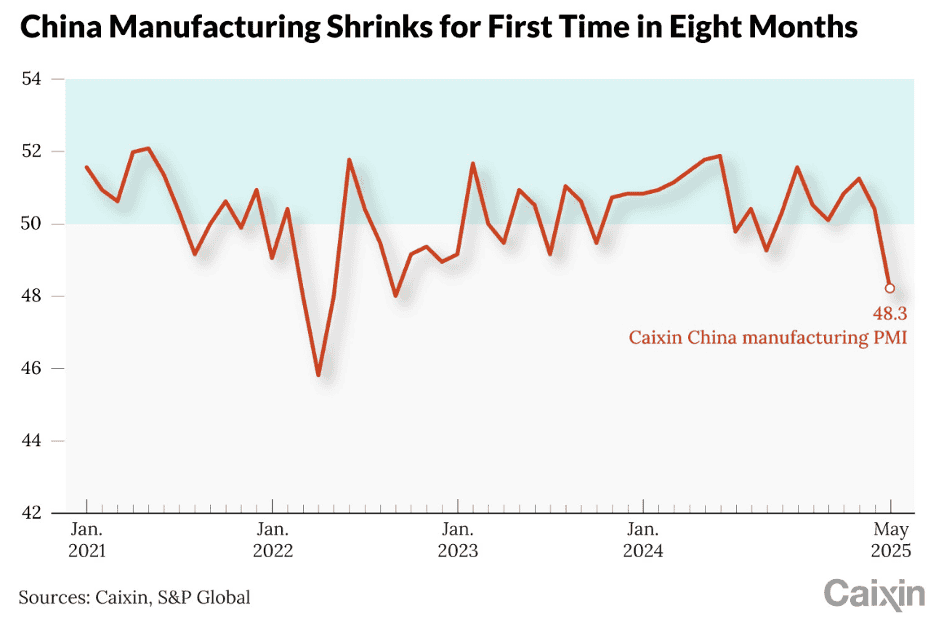

China

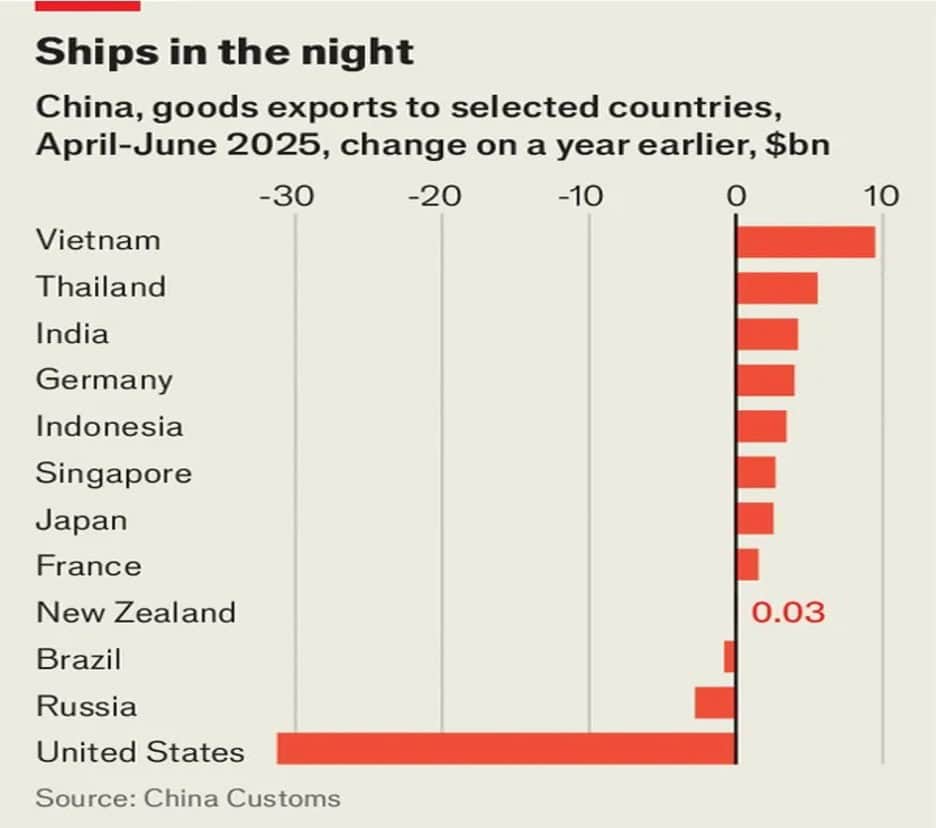

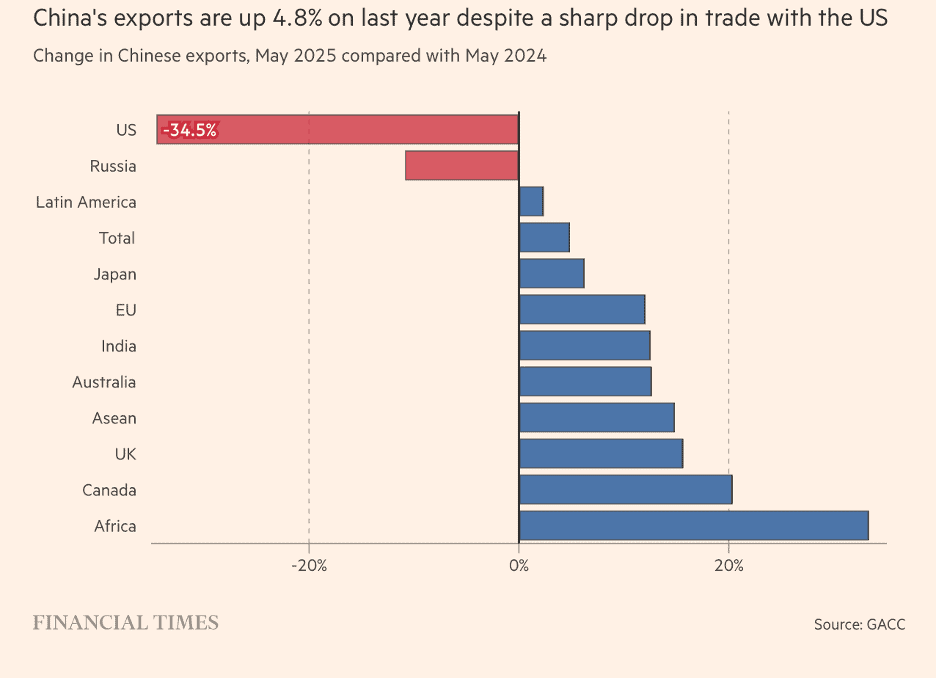

“China’s exporters shrug off the trade war—for now – How long can they continue to do so? In the first half of the year, exports grew at the same pace as they did in 2024, helping to keep China’s gdp growth on track to meet its annual target. For now, China’s exporters appear to have shrugged off trade tensions with America. But that might not last much longer. America accounted for about 15% of China’s exports last year, but just 12% in the first half of 2025. Over that period China’s exports to South-East Asia, in particular, have risen rapidly. Shipments to Vietnam, Thailand and Indonesia increased by 20%, 22% and 15% year on year respectively.”, The Economist, July 17, 2025

===============================================================================================

“US firms say China market critical despite fraying relations other issues – Industry group president, in interview with Post, calls for talks to address issues beyond tariffs, export controls. A new survey of American companies operating in China has indicated that most of them consider the country’s market critical despite fraying bilateral relations, tariffs, economic weakness and lost market share. Nearly all respondents participating in an annual US-China Business Council survey said they cannot remain globally competitive without their business in the world’s second-largest economy, according to a report about the survey published by the advocacy group on Wednesday. This is despite the fact that a growing number of US firms report dropping sales, reputational damage and pressure on profitability in the face of growing geopolitical tensions and trade issues and stricter investment restrictions. Moreover, although leaving China is not viable for many American firms, the group said that fewer than half of survey respondents are optimistic about the future, given persistent concerns over tariffs, China’s deflation and insufficient demand and policy uncertainty. The survey covered about 130 of the group’s 270 member firms, most of which are large corporations that have been in China for over 20 years, and was conducted between March and May.”, South China Morning Post, July 17, 2025. Compliments of Paul Jones, Jones & Co., Toronto

Indonesia

“To Avoid Steeper Tariffs, Indonesia Reaches High-Stakes Trade Deal With the U.S. – Under the deal, most Indonesian exports to the United States will be subject to a 19% tariff, significantly lower than the 32% rate Trump had threatened to impose on Aug. 1. In exchange, the United States will receive what Trump called ”full and total” market access to the Indonesian economy, including exemptions from non-tariff barriers for U.S. goods. As part of the negotiated terms, Indonesia also committed to buy over $34 billion worth of U.S. imports, including $15 billion in energy purchases from firms such as ExxonMobil and Chevron, $4.5 billion in agricultural goods from suppliers such as Cargill and ADM, and a procurement agreement for 50 Boeing jets. Indonesia is the largest economy in Southeast Asia and the 15th-largest exporter to the United States.”, RANE Worldwide, July 17, 2025

===========================================================================================

New Zealand

“10 reasons New Zealand is the best country on Earth – New Zealand, Aotearoa, is back on top of the world. After being knocked off the premier spot of the podium by South Africa in 2023, the Land of the Long White Cloud has once again been voted the best country in the world by our readers. Yet while other countries have become less welcoming, more violent, too hot, or too polluted, New Zealand has simply continued to offer a safe and friendly welcome to visitors who come for its mountains, forests, geysers, wineries, city harbours, and beaches – to be thrilled, awed, relaxed, and awakened. Which is why we go on holiday, after all.”, The Telegraph, July 11, 2025

=============================================================================================

United Kingdom

“FINDING YOUR WAY – The Trade and Investment Guide to the UK – This guide is provided by the British American Business which is the leading transatlantic trade association incorporating the British-American Chamber of Commerce in the US and the American Chamber of Commerce in the UK.”, July 2025. Compliments of the British American Business Council of Orange County

===========================================================================================

United States

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The Accredited Franchise Supplier certification

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Brand & Franchise Sector News

“How Taco Bell plans to accelerate its international momentum – The brand’s global marketing plan includes some playful lessons on how to eat a taco. During its Consumer Day in New York City in March, executives shared aspirations to nearly triple Taco Bell’s international footprint by 2030 with a goal of reaching 3,000 restaurants outside of the United States. That plan includes entry into nine new countries, including France, Greece, and South Africa, as well as accelerated growth in the United Kingdom, Spain, Australia, and India. For the brand piece, the team is connecting more with local cultures through initiatives like “encore hours” in the U.K., which allows restaurants to stay open late near music venues. It is also engaging in a bit of an educational campaign that teaches consumers the right way to eat a taco — head tilt and all, or “tiltvertising,” as it’s been called.”, Nation’s Restaurant News, July 8, 2025

============================================================================================

“American pretzel franchise Auntie Anne’s set to open across Australia – American franchise pretzel brand, Auntie Anne’s, is launching its first store at Sydney’s Westfield Parramatta on July 26. The brand has been brought to Australia by business partners Yu-Jin Lee and Johann Wong, with the intention of sharing Auntie Anne’s pretzels with a brand new audience. Lee and Wong have plans to open 60 stores across Australia over the next few years. ‘Australia represents a key milestone in our international growth strategy, and Yu-Jin and Johann with their passion, vision, and commitment to quality are exactly what we look for in franchise leaders,’ said Steven Yang, senior VP of Apac at GoTo Foods International.”, Inside Retail, July 16, 2025

=============================================================================================

“Inside Scott Mezvinsky’s First 100 Days as KFC CEO – The global chicken giant has plans to modernize and accelerate while leaning on the people and culture that’s defined it for 73 years. One thing that separates KFC from other brands, he says, is it doesn’t merely have talent and capable leaders—it boasts them across the globe in 14 or 15 business units. Leading KFC demands understanding market-to-market strengths and potential, and deciphering how some countries can inform others, or which ones must be treated differently. Opening lines of communication and consistent, solid relationships with franchisees is one of those things, Mezvinsky says, critical to KFC’s success and why it’s managed to spread so fast globally. The chain opened 2,892 gross new restaurants across 97 countries in 2024, including 1,100 in Q4 alone. That number was 528 through 52 countries in Q1 2025.”, QSR Magazine, July 9, 2025

==============================================================================================

“Restaurant Franchising in the Gulf: Navigating Opportunities and Strategic Decisions – The Gulf Cooperation Council (GCC)—comprising Saudi Arabia, the UAE, Qatar, Kuwait, Bahrain, and Oman—continues to solidify its reputation as a hotspot for restaurant franchising. For U.S. brands seeking international expansion, the region offers high disposable incomes, a digitally savvy and youthful population, and a strong appetite for global and premium dining experiences. But behind the headlines lies a landscape that demands strategic planning, legal awareness, and the right local partnerships. Partnering with a single operator across multiple countries offers unified branding, centralized supply chain control, and operational efficiency, to name a few benefits.”, Franchising.com, July 11, 2025. This article is by Rebecca Viani who is partner with WhiteSpace Partners,

===============================================================================================

“The franchisor-franchisee relationship in China – In China, the Franchising Regulation and the Measures for Information Disclosure are the two major regulations governing the ongoing relationship between franchisor and franchisee. The Ministry of Commerce of the People’s Republic of China (MOFCOM) and its local counterparts are the government authorities in charge of the administration of franchise activities. From a regulatory standpoint there are some minor differences in how foreign franchisors are handled.”, Lexology, July 1, 2025

==============================================================================================

“World Gym International Signs Master Franchise Agreement for Brazil – World Gym International (WGI) has entered into a Master Franchise Agreement (MFA) with Flag Holding LTDA. Flag Holding is led by CEO Flavia Almeida, co-owner and operator of 17 World Gym locations in Goiás and the Federal District of Brasília. Since opening the first World Gym in Brasília in 2012, Almeida has established the brand, offering a large selection of strength and cardio equipment. The MFA grants Flag Holding LTDA exclusive rights to expand World Gym into Brazil’s other states.”, Franchising.com, June 26, 2025

===============================================================================================

“Planet Fitness Has Right Tools to Continue Growing – The low-cost gym giant is coming off four consecutive months of higher foot traffic despite raising its signature membership price to $15 from $10. Wall Street is positive on Planet Fitness due to increased foot traffic, despite raising membership prices. Analysts believe Planet Fitness can grow by opening locations and by leaning into its “Judgment Free Zone” mantra. Planet Fitness is attracting new gym-goers and is adding strength equipment to appeal to experienced members. As of March 31, Planet Fitness had about 20.6 million members and more than 2,700 locations. A large part of its growth story—as well as the fitness industry at large—is centered on Gen Z, which analysts say is the fastest-growing demographic of gym-goers.”, The Wall Street Journal, July 21, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive our biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing business environment. And our GlobalTeam™ on the ground covering 25+ countries provide us with updates about what is actually happening in their specific countries. We do not get involved in or report on politics!

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe, and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant since 2001 taking 40+ companies global.

| To receive this biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com +++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++ |

Our latest GlobalVue™ 40 country ranking

For a complimentary 30-minute consultation on how to take your business into new countries and make money doing it. For a complimentary call with Bill Edwards click on the QR code or contact Bill at bedwards@edwardsglobal.com and +1 949 375 1896

Biweekly Global Business Newsletter Issue 138, Tuesday, July 8, 2025

“Alone we can do so little; together we can do so much.”

Helen Keller

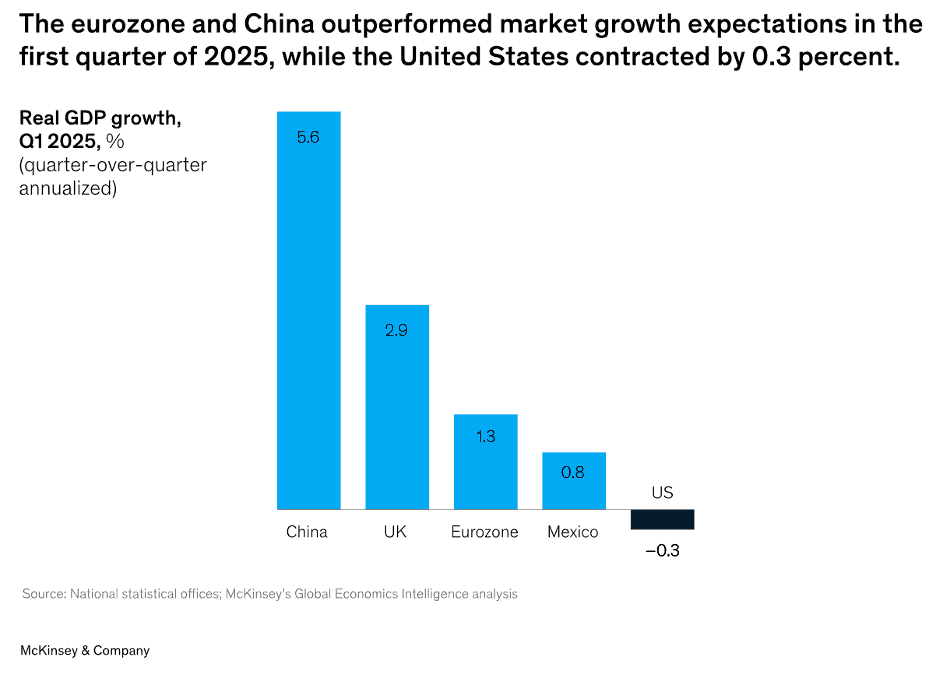

Welcome to the 138th edition of the Global Business Update, where we track the signals that matter for international business leaders, investors, and expansion-focused companies. As this edition goes to press on July 7th, the US has imposed new tariffs on several countries and moved the day when new deals need to be done to August 1. This edition features the newly released Q3 2025 GlobalVue™ Country Ranking, our proprietary index that evaluates the world’s top markets for international business expansion. Several countries climbed the list this quarter thanks to improved GDP outlooks, rising investor confidence, and political stabilization. Others dropped due to growing economic headwinds, policy uncertainty, or waning capital flows. We also highlight shifting executive sentiment in the face of global trade realignment. McKinsey’s latest global survey shows that trade policy uncertainty has overtaken inflation as the primary concern for business leaders, prompting many to pause or rethink international investments. In this edition you will also find:

A deep dive into Asia’s demographic epicenter—the Yuxi Circle—home to over half the world’s population

An update on AI-driven disruption, from Salesforce’s internal automation to Yum China’s operational overhaul

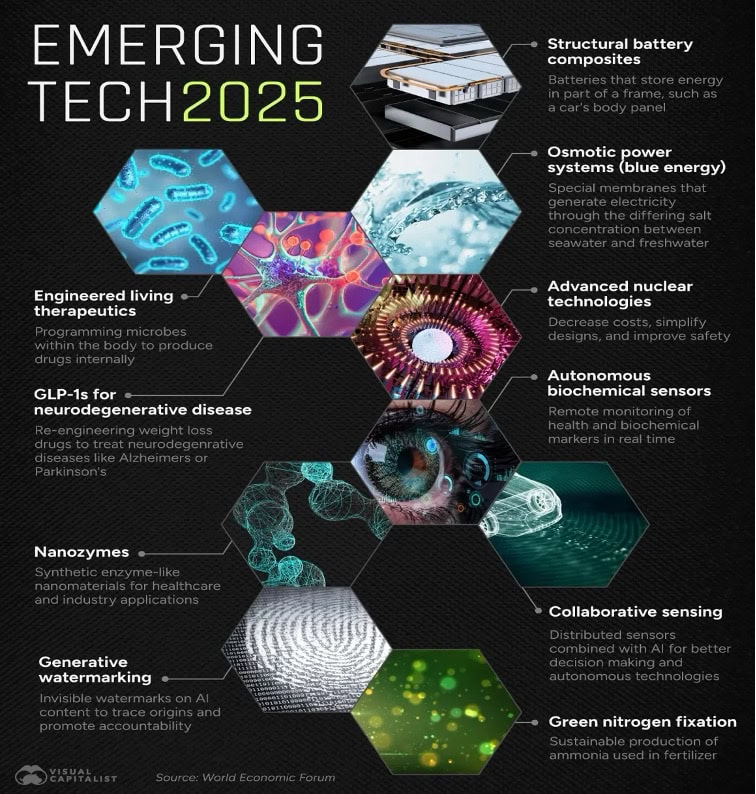

The World Economic Forum’s Top 10 Emerging Technologies of 2025, from structural battery composites to GLP-1s for neurodegenerative diseases

Geopolitical and economic shifts including NATO’s expanded defense spending targets, Canada’s first LNG exports to Asia, and Vietnam’s new U.S. trade deal

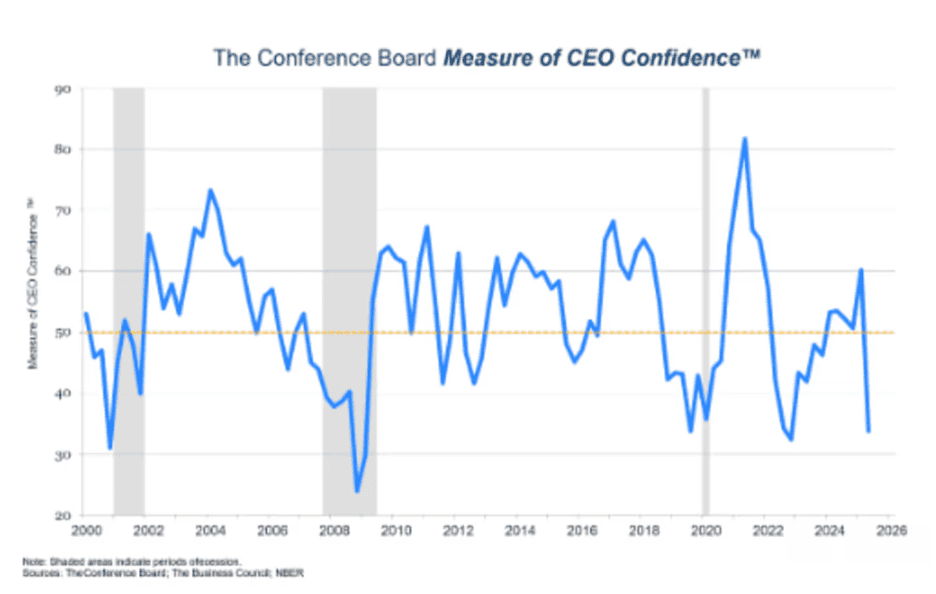

Regional snapshots on CEO confidence, Eurozone GDP growth, Chinese outbound mining deals, and the global trade/tariff reset under the Trump administration

And how YUM China embraces AI to boost efficiency and profitability.

From logistics and labor to policy and platforms, today’s cross-border challenges are more dynamic than ever.

This issue’s book is The Thinking Machine by Stephen Witt, How Nvidia, Jensen Huang, and a Bold Bet on AI Changed the Global Tech Landscape. In June 2024, Nvidia became the most valuable company in the world—a stunning milestone for a business that began in a California Denny’s three decades earlier. The Thinking Machine tells the inside story of how Nvidia transitioned from designing video game chips to powering the AI revolution—and in the process, redefined the future of computing. This is the story of the company that is inventing the future.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

But First……The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business. We do not get involved with or report on politics!

PLEASE NOTE: Some of the information sources that we provide links to in our newsletter require a paid subscription to directly access them. Clicking on a link may not give the reader access to the content.

Edited and curated by: William (Bill) Edwards, CEO & Global Business Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA. Contact Bill with questions, comments and contributions. Bedwards@edwardsglobal.com, +1 949 375 1896

Link to our current and past newsletters: https://edwardsglobal.com/geowizard/

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

First, A Few Words of Wisdom From Others For These Times

“People do business with people they know and like.”, Mary Thompson, CEO, BNI Worldwide

“Do not go where the path may lead, go instead where there is no path and leave a trail.”, Ralph Waldo Emerson

“Business opportunities are like buses, there’s always another one coming.”, Richard Branson

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Highlights in issue #138:

GlobalVue™ Country Ranking July 2025

Economic conditions outlook, June 2025

The 40 Best Countries in the World, As Determined by the People

CEO confidence registers sharpest fall-off in a half-century

The Yuxi Circle: The World’s Most Densely Populated Area

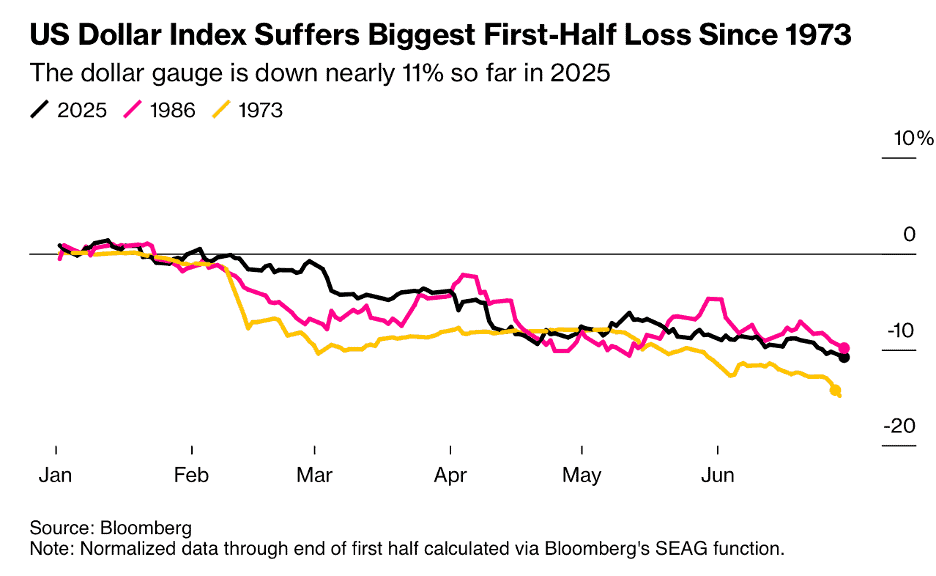

Dollar Index Slumps 10.8% in Biggest First-Half Loss Since 1973

The Top 10 Emerging Technologies of 2025

Unlocking M&A Success in the Franchise Industry

Brand Global News Section: Burger King®, Firehouse Subs®, McDonald’s, Tim Hortons®, Popeyes®, and YUM China

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Please sign up for this amazing future looking August 6th event at the Beall Center for Innovation and Entrepreneurship at the University of California, Irvine at this link: www.enpinstitute.com/events

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

GlobalVue™ Country Ranking July 2025 – The latest version of the Edwards Global Services, Inc. quarterly country ranking as places to do business has just been published. Several countries moved up the ranking in the last quarter due to improved GDP growth projections for 2025, improved investor interest in new projects or changes in country political and/or economic stability. Several countries went down in the ranking for the same reasons. The GlobalVue™ ranking has been published quarterly since 2001 and is used by companies to plan and evaluate their international expansion.

==================================================================================================

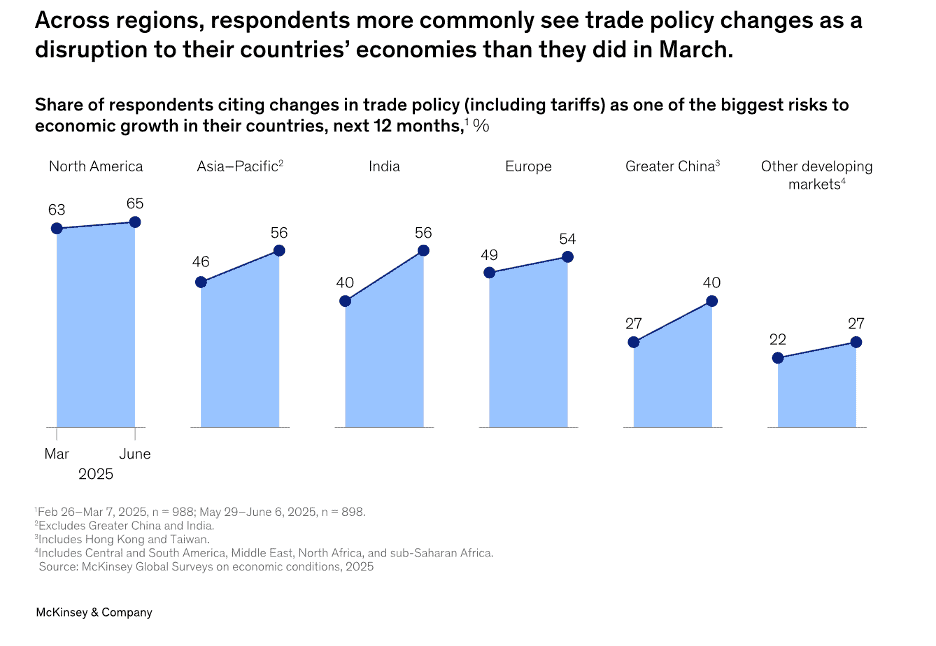

“Economic conditions outlook, June 2025 – Surveyed executives increasingly point to changes to trade policy and relationships as a disruptive force they expect to affect the world economy, their countries, and their companies. The perceived risk from shifts in trade continues to grow, according to the results from our latest McKinsey Global Survey on economic conditions.1Respondents to this quarter’s survey—which was in the field at the end of May through the first week in June—cite changes in trade policy or relationships as the top disruption to growth in the world economy, in their home economies, and even for their companies. Companies have already made changes as a result. Meanwhile, respondents’ long-standing focus on inflation is fading. Respondents continue to report less positivity about the state of today’s economy, though their views on near-term economic prospects are more upbeat now than in March.”, McKinsey & Co., June 30, 2025

============================================================================================

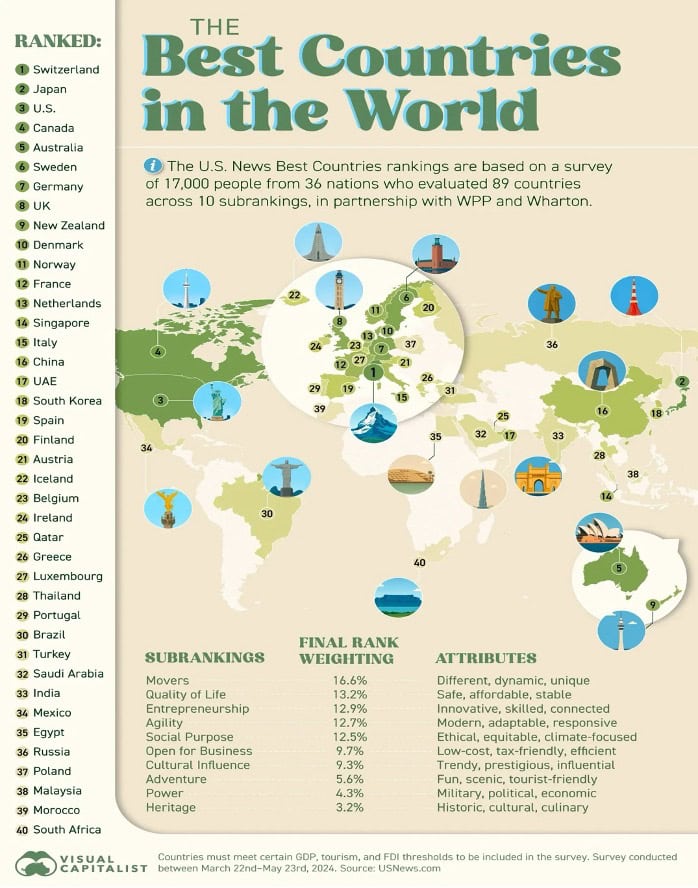

“The 40 Best Countries in the World, As Determined by the People – Switzerland is the best country in the world according to a global survey conducted in 2024. Respondents ranked it highly for business (#2), quality of life (#3), social purpose (#7), and cultural influence (#8) U.S. News designed its “Best Countries” ranking around 73 attributes grouped into 10 thematic subrankings, such as Quality of Life, Power, Entrepreneurship, etc. The attributes reflect public perceptions, not hard data. To gather this, the survey is distributed globally to about 17,000 respondents, including business leaders, informed elites, and general citizens. Each participant is shown a random subset of countries (that must meet GDP, tourism, and FDI thresholds) and asked to rate how strongly they associate those countries with each of the 73 attributes.”, USNews.com, July 5, 2025

============================================================================================

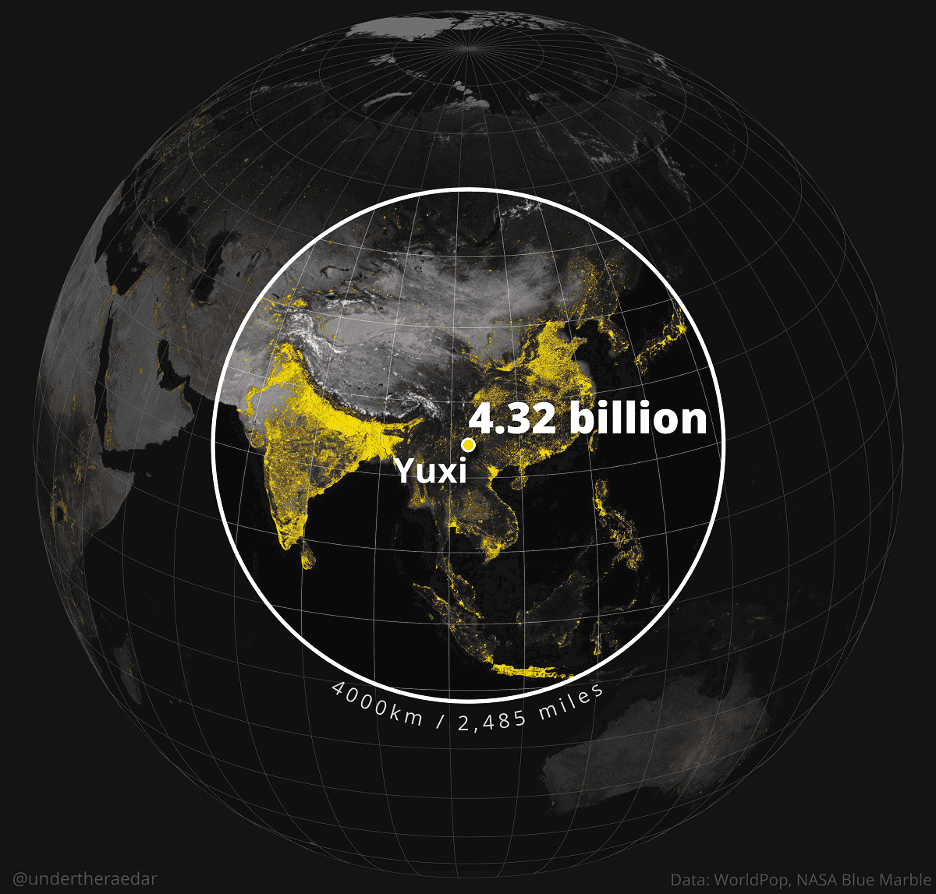

The Yuxi Circle: The World’s Most Densely Populated Area – If you wanted to capture over 55% of the global population inside a circle with a 4,000km radius, which city would you place at its epicenter? In 2013, a post appeared on Reddit marking a circular area of the globe with “more people living inside this circle than outside of it.” The circle had a radius of 4,000 km (just under 2,500 miles) and was named the Valeriepieris circle after author Ken Myers’ username. Acknowledging that the Valeriepieris circle is not actually a circle (it was drawn on a two-dimensional map rather than a globe) and is based on data that has become outdated, mapmaker Alasdair Rae went digging and discovered what he calls The Yuxi Circle, the world’s most densely populated area.”, Visual Capitalist, April 8, 2022. This was contributed by Mark Kasperowicz, Managing Partner, Digital Azimuth

============================================================================

“The Top 10 Emerging Technologies of 2025 – Now in its 13th edition, the World Economic Forum’s report on the leading innovations that stand to shape tech, health care, and industry covers a wide scope of technologies still in their nascent phase. GLP-1s for neurodegenerative diseases, for instance, have the possibility to meaningfully help patients with Alzheimers and Parkinson’s as GLP-1s have aided in weight loss therapies. Meanwhile, structural battery composites are able to store electricity in a car’s frame or a plane’s structure—in turn reducing their overall weight.”, World Economic Forum, July 3, 2025

============================================================================================

“Salesforce CEO Says 30% of Internal Work Is Being Handled by AI – Tech leaders, including those at Microsoft and Alphabet, are highlighting AI’s potential to replace human workers, with Salesforce saying its internal AI use has allowed it to hire fewer people. Salesforce is developing an AI product that can handle tasks like customer service without human supervision, which has reached 93% accuracy, including for large customers like Walt Disney Co. Executives at Microsoft Corp. and Alphabet Inc. have said that AI is producing about 30% of new computer software code on some projects.”, Bloomberg, June 26, 2025

==========================================================================================

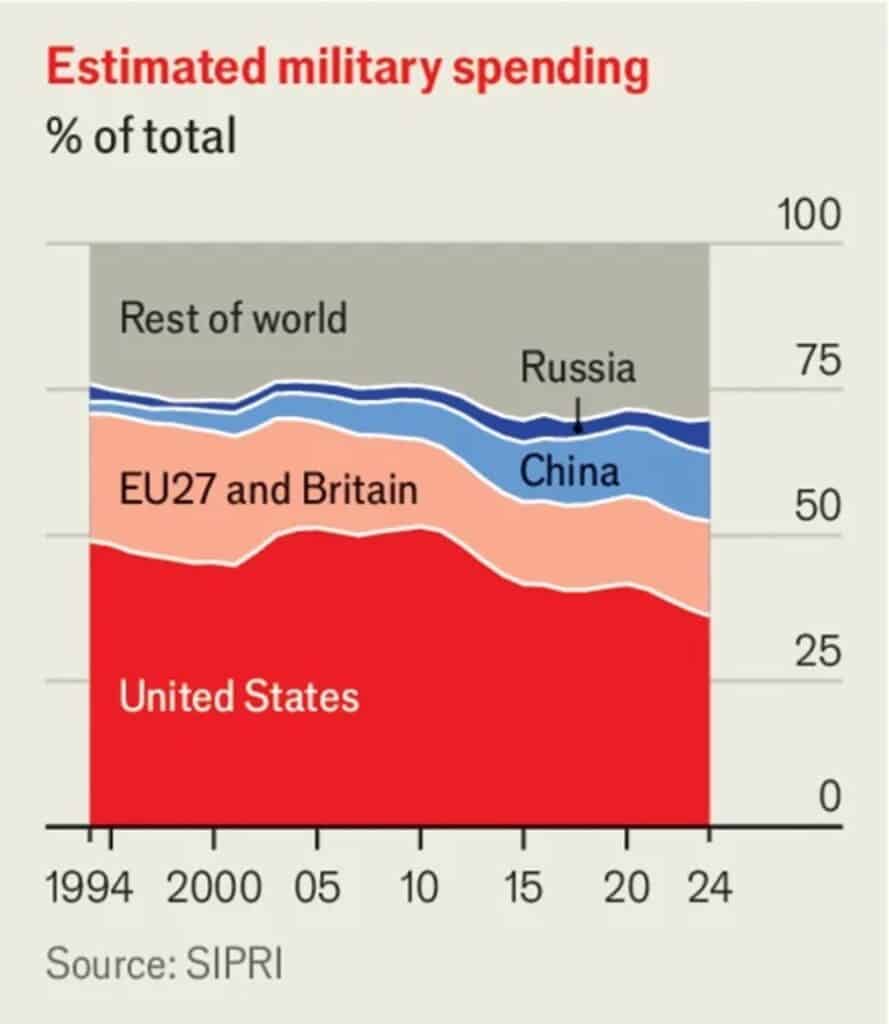

“How the defence bonanza will reshape the global economy – As they spend big, politicians must resist using one pot of money to achieve many goals. or the first time in decades, the rich world is embarking on mass rearmament. Wars in Ukraine and the Middle East, the threat of conflict over Taiwan and President Donald Trump’s impulsive approach to alliances have all made bolstering national defence an urgent priority. On June 25th members of nato agreed to raise their target for military spending to 3.5% of gdp and allocated an extra 1.5% to security-related items (Spain insisted on a loophole). If they achieve that target in 2035, they will be spending $800bn more every year, in real terms, than they did before Russia invaded Ukraine.”, The Economist, June 26, 2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation, Taxes & Trade Issues

“Donald Trump renews threat to hit trading partners with steep tariffs – White House extends deadline for ‘reciprocal’ levies from July 9 to August 1. Donald Trump has revived his threat to hit major trading partners with steep “reciprocal” tariffs even as he granted a three-week reprieve for countries to negotiate trade deals with the US. The president on Monday sent letters to Japan and South Korea, both among the US’s biggest trading counterparts, saying the country would impose 25 per cent levies beginning on August 1. South Africa would be hit with 30 per cent tariffs, Trump said, while also announcing big levies on several other countries.”, The Financial Times, July 7, 2025

============================================================================================

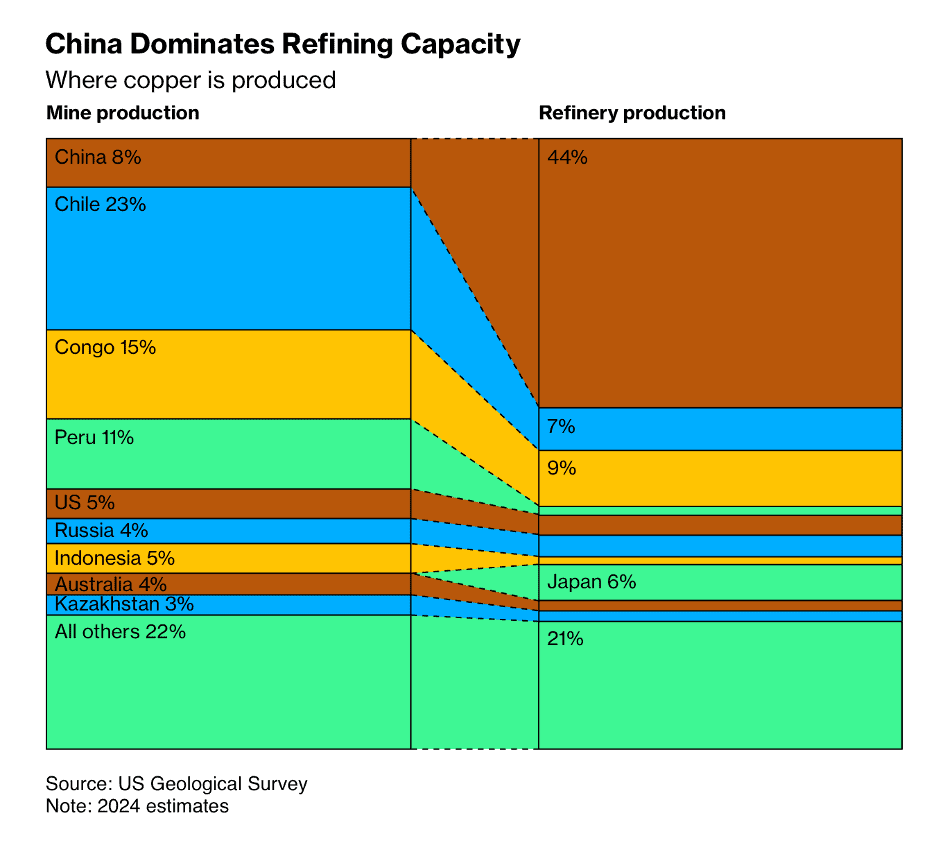

“The US Has More Copper Than China But No Way to Refine All of It – The industry will need to overcome high energy and labor costs, environmental regulations and a glut of cheap Chinese competition to make US copper smelting great again. The process has become almost prohibitively expensive in the US because of regulation, energy costs, labor and a glut of cheap Chinese competition. Freeport-McMoRan Inc.’s only US copper smelter—a hulking metal-processing facility at the edge of an old Arizona mining town—spits neon flames from its furnace like an industrial volcano. Freeport’s US operations cost about three times more than the company’s operations outside the country. Instead of processing copper in the US, many miners now turn abroad—where there’s more than enough capacity—to transform the raw materials they pull from the ground.”, Bloomberg, June 20, 2025

================================================================================================

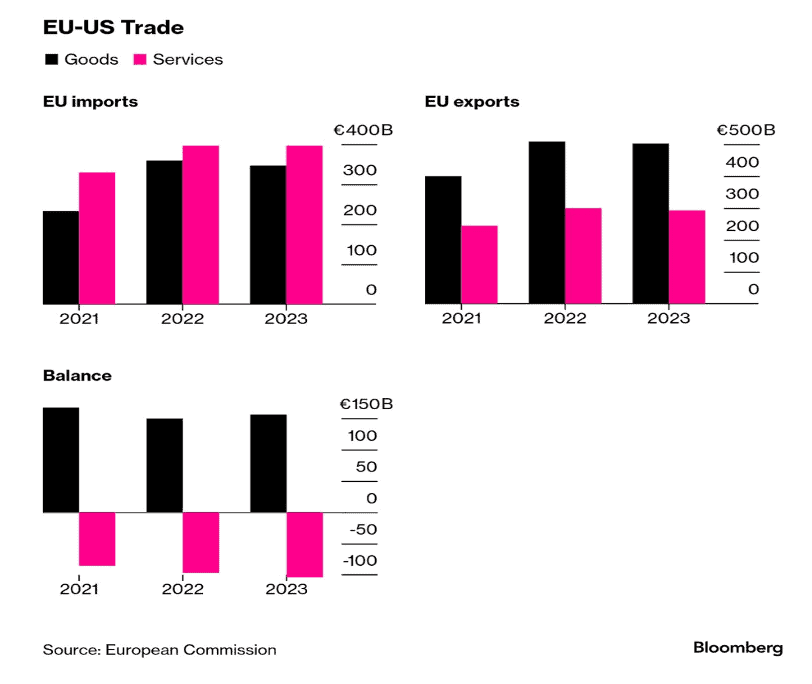

“How trade tensions are really affecting the global economy – Companies are not yet rushing to relocate production to the US, but investment and dealmaking have already slowed. US tariff revenue surged almost fourfold from a year earlier to a record $24.2bn in May, while imports from China fell 43 per cent from the same month in 2024. But with policymaking so evidently at the caprice of Trump himself, it has become incredibly challenging for businesses to make long-term decisions about supply chains, according to Neil Shearing, chief economist at Capital Economics, a research company. ‘Relocating plants is an eight- to 10-year decision, but when you can’t predict what is happening next week, let alone next year or in five years, mitigation of the status quo is the likely strategy,’ he says. Now, as countries clamour to strike fresh deals with Trump before the July 9 deadline, deep unease still lingers through global boardrooms and supply chains. Many companies are resorting to holding strategies.”, The Financial Times, July 4, 2025

================================================================================================

“LNG Canada starts exports to Asia and explores pathways to expansion – A ship has left B.C. for Asia with the first load of liquefied natural gas from the new LNG Canada terminal, ushering a new era in energy exports at a time when Canada seeks to diversify markets away from the United States. The cost of building the first phase of the project has been pegged at $48.3-billion, including the $18-billion Kitimat terminal, the $14.5-billion Coastal GasLink pipeline and other infrastructure, as well as annual budgets for drilling in the North Montney region of northeastern B.C. Once the Kitimat terminal’s first phase is in full swing, there will be about 170 vessels a year transporting LNG to Asian markets.”, The Globe and Mail, June 30, 2025

=================================================================================================

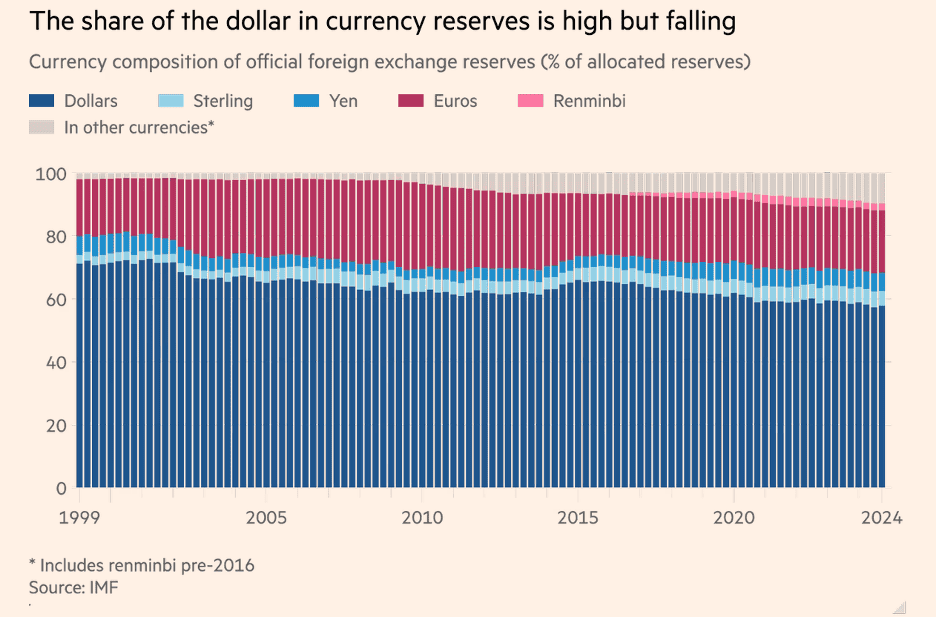

“Dollar Index Slumps 10.8% in Biggest First-Half Loss Since 1973 – The US Dollar Index has fallen about 10.8% year-to-date, compared with a 14.8% slump in the first half of 1973. Uncertainties associated with President Donald Trump’s trade and tariff policies – on top of his push for Federal Reserve rate cuts – have weighed heavily on the currency. The US dollar looks set for more pain after sliding to a new multi-year low, as dovish Federal Reserve pricing, softer economic data, and heightened policy uncertainty all weigh heavily on the greenback.”, Bloomberg, June 30, 2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel News

“America Has Pulled Off the Impossible. It Made Getting a Passport Simple – Washington isn’t known for tech innovation. How did a team of bureaucrats put their stamp on a process that hadn’t changed in 50 years? Now you can submit the application on your computer, upload a photo from your phone and pay with your credit card. No paper is necessary. To get a vital document that will accompany you around the world, you don’t even have to leave your kitchen table. The system has been open to the public for less than a year, but it’s already handling nearly half of all U.S. passport renewals, according to the State Department. And the really wild thing is that people are raving about it. In government surveys, online passport renewal gets positive reviews from 94% of respondents. That’s basically the approval rating of free pizza.”, The Wall Street Journal, July 4, 2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Book Review

In June 2024, Nvidia became the most valuable company in the world—a stunning milestone for a business that began in a California Denny’s three decades earlier. The Thinking Machine tells the inside story of how Nvidia transitioned from designing video game chips to powering the AI revolution—and in the process, redefined the future of computing.

At the center is CEO Jensen Huang, a Taiwanese-born entrepreneur who risked everything on AI long before it was proven. With rare access to Huang, his team, and investors, author Stephen Witt reveals how one leader’s conviction—and a team of brilliant, unconventional engineers—transformed Nvidia into a company that now supplies the supercomputers driving autonomous vehicles, generative content, robotics, and next-generation digital economies.

For global business leaders, this book offers a compelling look at the convergence of technology, geopolitics, and strategy. It highlights the importance of long-term vision, ecosystem thinking, and the ability to seize global opportunities in volatile environments.

As international companies prepare for the AI era, The Thinking Machine provides both inspiration and insight. This is not just the story of Nvidia—it’s the story of the next industrial revolution, unfolding now on a global scale.

This is the story of the company that is inventing the future.

5 Key Takeaways:

Global Vision Wins – Nvidia’s rise hinged on Huang’s ability to anticipate and act on worldwide tech demand, especially in the U.S.–China landscape.

Build the Ecosystem, Not Just the Product – CUDA made Nvidia indispensable globally. Think platforms, not just products.

Geopolitics = Strategy Now – Export bans, Taiwan chip supply, and AI policy show how geopolitics directly impact your business.

Cross-Cultural Grit Matters – Huang’s journey is a model of global resilience, conviction, and culturally aware leadership.

AI Is the New Infrastructure – No matter your sector, understanding how chips power AI is key to future-proofing your business.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Canada

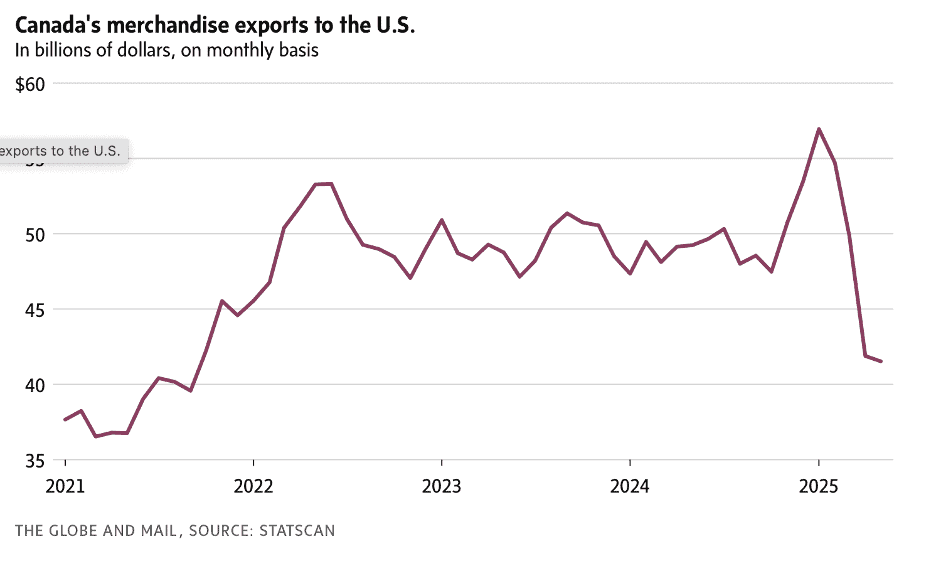

“Canada’s trade deficit narrows in May, exports to U.S. decrease for fourth straight month – Statistics Canada reported on Thursday that the country’s trade deficit, which reflects the difference between its exports and imports, fell to $5.9-billion. Exports to the United States in May slipped by 0.9 per cent, following a whopping 16-per-cent decline in April. It was the fourth consecutive monthly decline as the White House targets some sectors of the Canadian economy with punishing tariffs. This includes levies on steel, aluminum and automobiles, as well as on all goods that don’t comply with the continental free-trade agreement’s rules of origin. Last month, Mr. Trump doubled tariffs on steel and aluminum to 50 per cent.”, The Globe and Mail, July 3, 2025

===============================================================================================

China

“China’s first Legoland opens to tourists in Shanghai – Thousands of local tourists poured into China’s first-ever Legoland as it opened its gates in Shanghai on Saturday, the latest theme park hoping to capitalise on a domestic tourism boom. The Chinese branch of the British-owned theme park franchise is the biggest Legoland in the world. Despite the Chinese economy’s sluggish growth in recent years, domestic tourist spending grew 18.6 percent in the first quarter of this year compared to the previous year, according to statistics. Eager Lego fans rushed into the park as soon as it opened, wearing themed shirts and waving branded flags as they enjoyed the 318,000-square-metre (78.5-acre) compound in scorching temperatures.”, AFP, July 5, 2025

================================================================================================

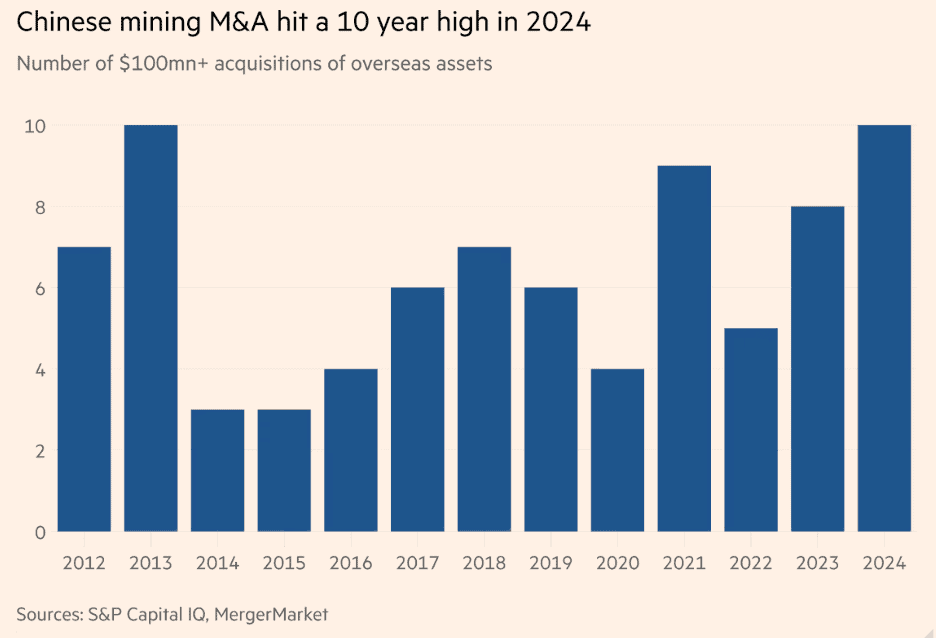

“China snaps up mines around the world in rush to secure resources – Dealmaking hits highest level since 2013 as groups seek raw materials that underpin global economy. Chinese mining acquisitions overseas have hit their highest level in more than a decade as companies race to secure the raw materials that underpin the global economy in the face of mounting geopolitical tension. There were 10 deals worth more than $100mn last year, the highest since 2013 according to an analysis of S&P and Mergermarket data. Separate research by the Griffith Asia Institute found that last year was the most active for Chinese overseas mining investment and construction since at least 2013. The country’s huge demand for raw materials — it is the world’s largest consumer of most minerals — means its mining companies have a long history of investing overseas. Analysts and investors say that the rise in dealmaking partly reflects China’s efforts to get ahead of the deteriorating geopolitical climate, which is making it increasingly unwelcome as an investor in key countries such as Canada and the US.”, The Financial Times, July 5, 2025

=============================================================================================

European Union

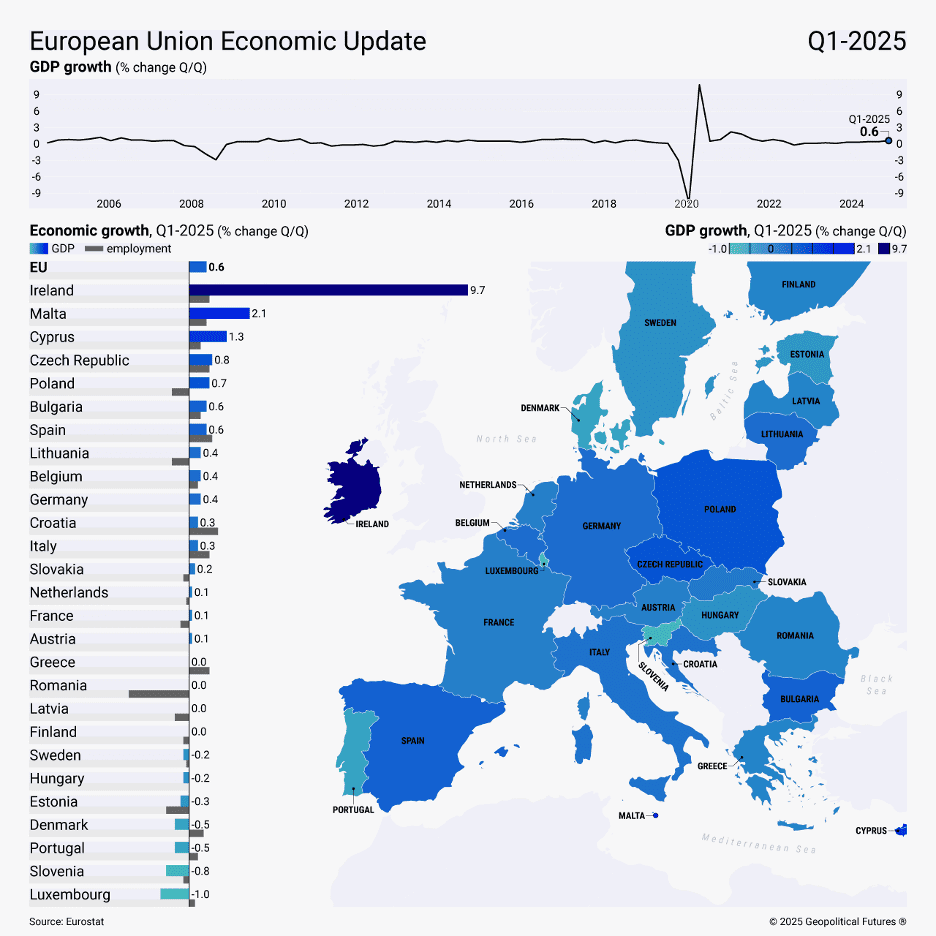

“Cautiously Optimistic EU Economic Data – In the first quarter, the eurozone doubled its growth rate from the previous quarter. In the first quarter of 2025, the eurozone recorded 0.6 percent quarter-on-quarter GDP growth, doubling the 0.3 percent rate seen in the fourth quarter of 2024. Year-over-year, GDP rose by 1.5 percent, up from 1.2 percent in the previous quarter. Household consumption contributed 0.1 percentage points to overall EU growth, while government consumption held steady. Employment in the eurozone rose by 0.2 percent from the previous quarter, supporting the modest expansion.”, Geopolitical Futures, July 4, 2025

===========================================================================================

Latin America

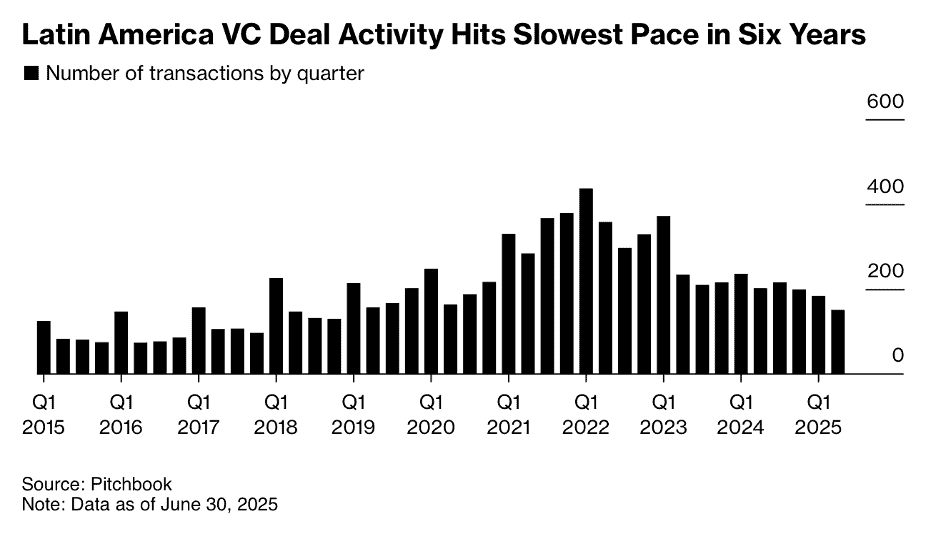

“Latin American VC Activity Slows to Near Pre-Pandemic Lows – Venture capital dealmaking in Latin America has hit the slowest pace in almost seven years, in part due to global economic uncertainty and a pullback from US investors in the region. In the first half of the year, there were 335 transactions totaling $2.9 billion in Latin America, according to PitchBook data released Thursday. If the current pace holds, it could reach levels as low as those in 2016, before a rise in VC activity when the region was experiencing strong economic growth that drew US investors looking for high yields in new markets, Pitchbook analyst Kyle Stanford said in an interview. There were 384 deals in all of 2016, the data shows.”, Bloomberg, July 3, 2025

============================================================================================

Middle East

“Oman vs Qatar: The Gulf’s Quiet Giants with Very Different Etiquette – When Western professionals think about doing business in the Gulf, the spotlight usually shines on the giants: Saudi Arabia and the UAE. These are the high-profile players with ambitious visions, mega-projects, and headline-grabbing reforms. But just offstage, two quieter nations are commanding serious influence in their own, more understated ways: Oman and Qatar. And while both may seem “easier” at first glance — thanks to their soft-spoken reputations — they could not be more different in how they approach business, relationships, and etiquette.”, Middle east Sunday Pages, July 6, 2025. Written by Corina Goetz, Middle East & Saudi Etiquette & Business Specialist

============================================================================================

Singapore

“The little country building the world’s biggest mega-port – and it’s going to cost £10bn – A tiny Asian country will soon be home to the largest port in the world as a £10 billion project gets underway. A 16-mile-long port will become the largest in the world when it is completed in this small Asian country. One of the most ambitious infrastructure projects in the world at the moment. The Tuas Mega Port in Singapore will cost around £10 billion once it opens. The project is already underway and is expected to be completed by the 2040s. The project promises to be a greener and smarter port compared to others around the world. The world’s largest port is currently located in Shanghai, China, but will be outranked once the Tuas Meg Port in Singapore opens fully.”, Express UK, July 6, 2025

============================================================================================

United States

“CEO confidence registers sharpest fall-off in a half-century, new survey finds – Biggest decline since the survey — conducted by the Conference Board in collaboration with the Business Council — started in 1976. Given the commencement of trade hostilities and the huge amount of uncertainty in foreign and economic policy that have characterized the past few months, the lack of top-executive conviction should come as no surprise. Just as damagingly, expectations for the future also deteriorated sharply, with more than half of respondents foreseeing worsening conditions over the rest of the year.”, Market Watch, May 29, 2025

=================================================================================================

Vietnam

“Vietnam’s new US trade deal sparks optimism despite tariff challenges – Under the new deal, US goods into Vietnam will not be taxed while Vietnamese exports will face a 20 per cent US tariff. The Vietnam Stock Index reached its highest level since April 2022, indicating confidence that export stability had been achieved. On the face of it, the deal is highly unbalanced, with US exports to Vietnam enjoying tariff-free market access, while Vietnamese exports in the other direction now face a 20 per cent rate, slightly over twice last year’s average rate of 9.4 per cent. Furthermore, the new rate is vastly lower than the 46 per cent that Trump unveiled in April against Vietnamese goods.”, South China Morning Post, July 6, 2025.

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The Accredited Franchise Supplier certification

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Brand & Franchise Sector News

“Unlocking M&A Success in the Franchise Industry – Being prepared is the true competitive advantage. After a quieter period, mergers and acquisitions (M&A) in the franchise and restaurant industries are showing renewed momentum. Though deal volumes have not yet returned to pre-pandemic levels, strategic buyers, private equity firms, and multi-unit operators are reengaging the market with a pragmatic mindset. Today’s franchise M&A environment demands more than capital—it requires detailed planning, robust diligence, cultural alignment, and strategic discipline. ranchise transactions are inherently complex. Buyers must evaluate more than just financial performance—they need to understand franchise agreements, unit-level economics, development obligations, and the strength of franchisor-franchisee relationships.”, QSR Magazine, June 27, 2025

===============================================================================================

“KFC, Pizza Hut operator Yum China embraces AI to boost efficiency, profitability – Digital ordering accounted for about 90 per cent of Yum China’s sales in 2024, backed by its 540 million ‘membership’ consumers. The firm, which introduced its Q-Smart AI-powered assistant in June, was expected to help reduce waste, improve quality and save labour costs, chief technology officer (CTO) Leila Zhang said in an interview. The AI-powered system could help with staff scheduling, inventory replenishment and meal preparation, she added. ‘When we think about AI and robotics, one of our primary considerations is to empower our restaurant managers,’ she said. ‘We develop systems and AI-powered digital tools to allow them to work more efficiently, freeing up more of their time so they can focus on delivering exceptional customer service.’”, South China Morning Post, July 6, 2025

================================================================================================

“The Fast Food Giant Behind Burger King Also Owns 3 Other Iconic Chains – Restaurant Brands International came about from the unique merger of Burger King and Tim Hortons in 2014. The two companies were brought together by an outside owner named 3G Capital, based in Brazil, and the deal was partially funded by famous investor Warren Buffett. Burger King, Tim Hortons, Popeyes, and Firehouse Subs are all owned by Restaurant Brands International. While all four of these chains are owned by this single conglomerate based in Toronto, Restaurant Brands International does still operate them as independent businesses in each’s home country.”, The Tasting Table, June 18, 2025

==============================================================================================

“The Star Ingredient McDonald’s Leaves Off The Menu In India – With tens of thousands of McDonald’s locations worldwide in over 100 countries, exploring the overseas offerings at the ubiquitous burger chain can be an amazing view into local cultures. Many of these products combine classic McDonald’s items with local flavors, like a bacon McMuffin that uses halloumi cheese in Cyprus, or a burger with bulgogi sauce in Korea. Some are entirely unique to different nations, like McD’s version of the porridge dish bubur ayam in Indonesia and Malaysia. But one of the things that stands out about McDonald’s international menu items in India is that you can’t get a hamburger at all. That’s right. Beef patties are nowhere to be found in any Indian McDonald’s. This stems from the country’s dietary culture.”, The Tasting Table, June 25, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive our biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing business environment. And our GlobalTeam™ on the ground covering 25+ countries provide us with updates about what is actually happening in their specific countries. We do not get involved in or report on politics!

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe, and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant since 2001 taking 40+ companies global.

| To receive this biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com +++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++ |

Our latest GlobalVue™ 40 country ranking

For a complimentary 30-minute consultation on how to take your business into new countries and make money doing it. For a complimentary call with Bill Edwards click on the QR code or contact Bill at bedwards@edwardsglobal.com and +1 949 375 1896

Biweekly Global Business Newsletter Issue 137, Tuesday, June 24, 2025

“Think global, act local.”, Patrick Geddes

Welcome to Edition #137 of the Edwards Biweekly Global Business Update, your trusted biweekly briefing on the complex and fast-moving developments shaping global trade, investment, and franchising. This edition provides curated insights across several sectors—from energy strategy shifts in Canada to etiquette nuances in the Gulf—and is designed to help executives anticipate risks and spot new global opportunities.

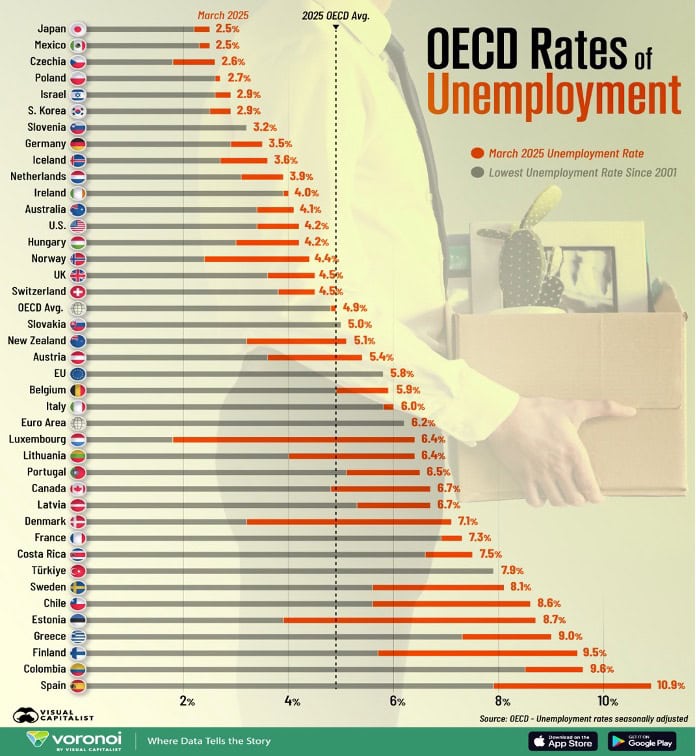

This issue captures a world in continuing flux. The OECD has revised its inflation forecasts upward for 2025 and 2026, highlighting how persistent trade barriers and geopolitical instability are reshaping economic expectations. At the same time, global unemployment trends paint a mixed picture—some nations are hitting record lows, while others like Spain are now struggling with double-digit jobless rates.

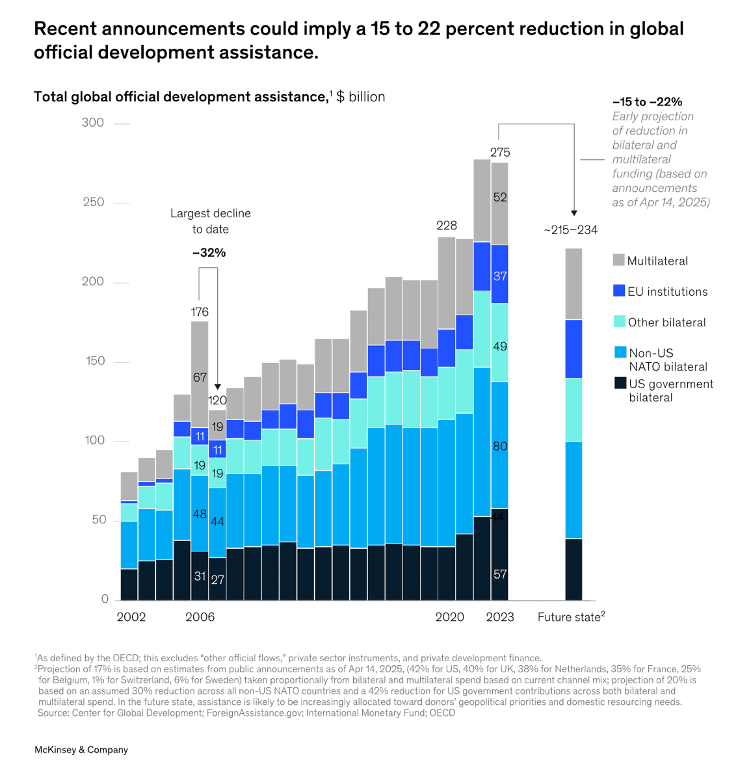

In the realm of global aid, major donor countries are pulling back. With official development assistance projected to drop by up to $60 billion, there’s growing concern over the future of global health, education, and infrastructure initiatives. Meanwhile, cities once known for stability—like Vienna—have seen their reputations shaken, underscoring how safety and security increasingly influence global livability and business decisions.

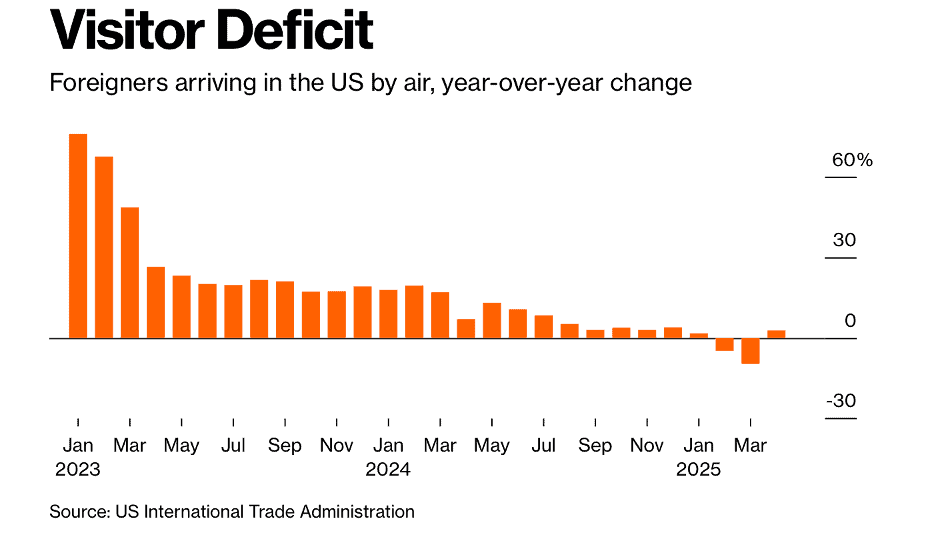

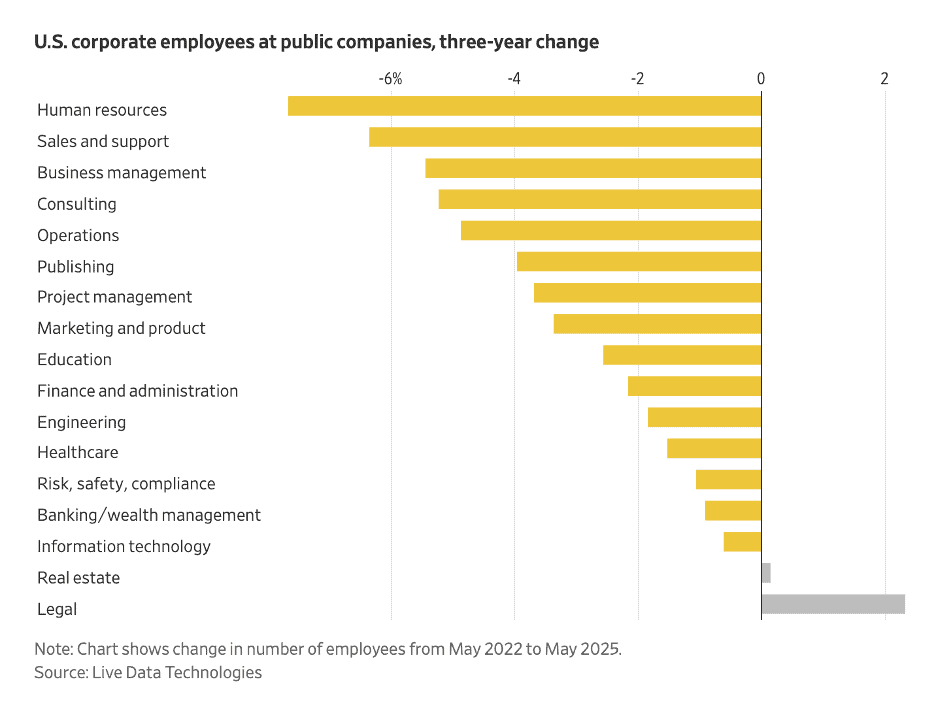

Trade and tourism are also under pressure. President Trump’s second-term policies, including new travel bans and protectionist tariffs, may have wiped out $12.5 billion in U.S. tourism revenue this year and triggered retaliatory moves in regions like Southeast Asia. Meanwhile the biggest companies across America are cutting their workforces.

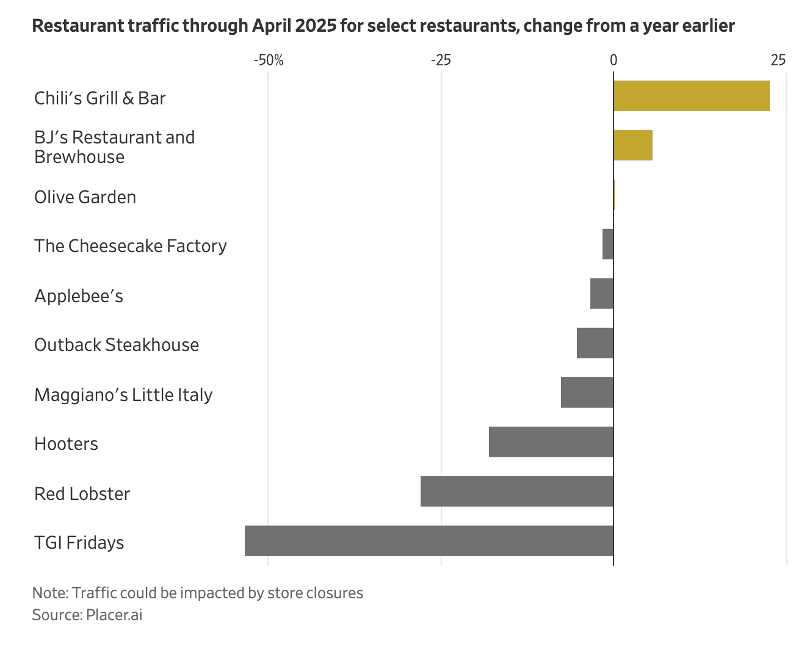

On the franchise front, innovation continues. From Yum China’s rollout of an AI assistant for KFC store managers to U.S. Congressional recognition of June 11 as the first-ever World Franchise Day, we see both technological and political forces validating the growing relevance and success of the franchise model worldwide. And some casual-dining franchise chains are staging a comeback.

In this issue’s book, Marketcrafters: The 100-Year Struggle to Shape the American Economy, Chris Hughes, Co-Founder of Facebook, presents a compelling historical narrative that challenges the myth of the “free market” as a natural phenomenon. Instead, he argues that markets are deliberately created and continuously shaped by policymakers, economists, and corporate interests—a process he calls “marketcraft.” Covering a century of U.S. economic history, from New Deal reforms to Big Tech’s modern dominance, Hughes reveals how intentional rule-making has defined winners and losers in the American economy.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

But First……The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business.

PLEASE NOTE: Some of the information sources that we provide links to in our newsletter require a paid subscription to directly access them. Clicking on a link may not give the reader access to the content.

Edited and curated by: William (Bill) Edwards, CEO & Global Business Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA. Contact Bill with questions, comments and contributions. Bedwards@edwardsglobal.com, +1 949 375 1896

Link to our current and past newsletters: https://edwardsglobal.com/geowizard/

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

First, A Few Words of Wisdom From Others For These Times

“Choose lazy people to do difficult jobs, they always find ways to do it easily.”, Bill Gates

“The future belongs to those who believe in the beauty of their dreams.”, Eleanor Roosevelt

“We must ensure that the global market is embedded in broadly shared values and practices that reflect global social needs, and that all the world’s people share the benefits of globalization.”, Kofi Annan

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Highlights in issue #137:

Global Inflation Projections in 2025 and 2026

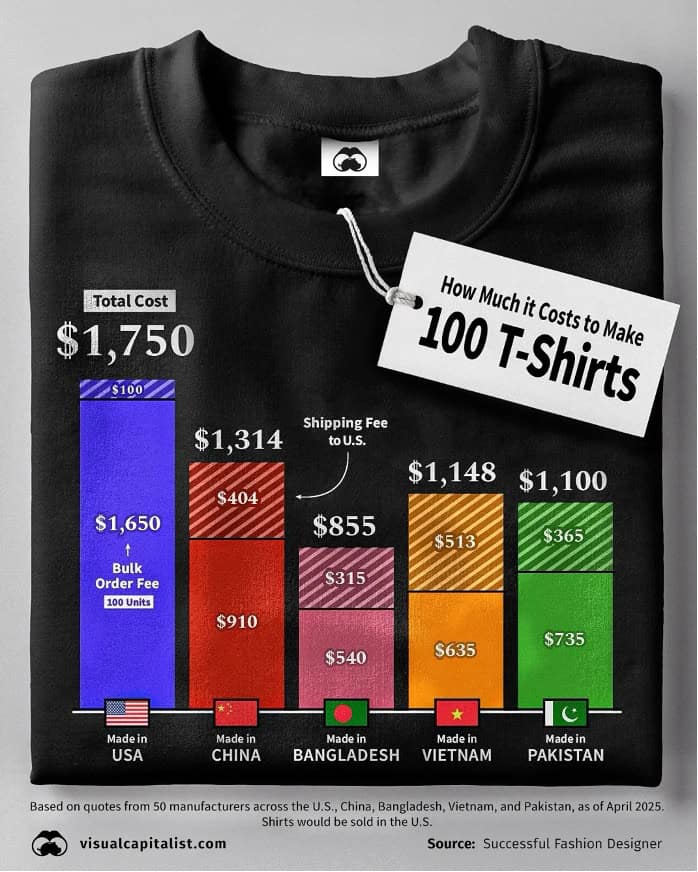

How Much it Costs to Make 100 T-Shirts

Yum China is testing an AI assistant for store managers

Unemployment Rates in OECD Countries in 2025

How Weight-Loss Drugs Blew Out the U.S. Trade Deficit

Trump’s $12 Billion Tourism Wipeout

Brand Global News Section: Chili’s®, Honeymoon Dessert® and YUM China

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Please sign up for this amazing future looking August 6th event at the Beall Center for Innovation and Entrepreneurship at the University of California, Irvine at this kink: www.enpinstitute.com/events

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

“Global Inflation Projections in 2025 and 2026 – Average headline inflation across the OECD is projected to be 4.2% in 2025, and 3.2% in 2026. The OECD’s previous inflation projections have been revised upwards due to escalating trade barriers. After a global spike in inflation following the COVID-19 pandemic and Russia’s invasion of Ukraine, central banks have worked to cool price growth. This visualization shows the OECD’s latest inflation projections through 2026, highlighting where price pressures are easing—and where they are still stubbornly high.”, OECD Economic Outlook, June 2025

==================================================================================================

“Global aid at a crossroads – Global aid faces a pivotal moment. After years of official development assistance increasing, major foreign donors have announced significant reductions. As a result, a 15 to 22 percent reduction in funds is expected, for an estimated loss of $41 billion to $60 billion, according to McKinsey & Co. Senior Partner Tania Holt and coauthors. Stakeholders can consider several levers to combat these challenges, including mobilizing additional resources and reprioritizing investments and programs.”, McKinsey & Co., June 11, 2025

============================================================================================

“Unemployment Rates in OECD Countries in 2025 – Japan and Mexico have the lowest unemployment rates at 2.5%. Spain’s unemployment rate of 10.9% is the highest of all OECD countries. Unemployment rates in Türkiye, Slovenia, and Slovakia are at their lowest levels since 2001. As of March 2025, the average unemployment rate across OECD countries stood at 4.9%, nearly in line with its lowest level since 2001. However, behind that average lies a wide spectrum, ranging from countries at near-record unemployment lows to others grappling with high joblessness.”, OECD & Visual Capitalist, June 20, 2025

============================================================================================

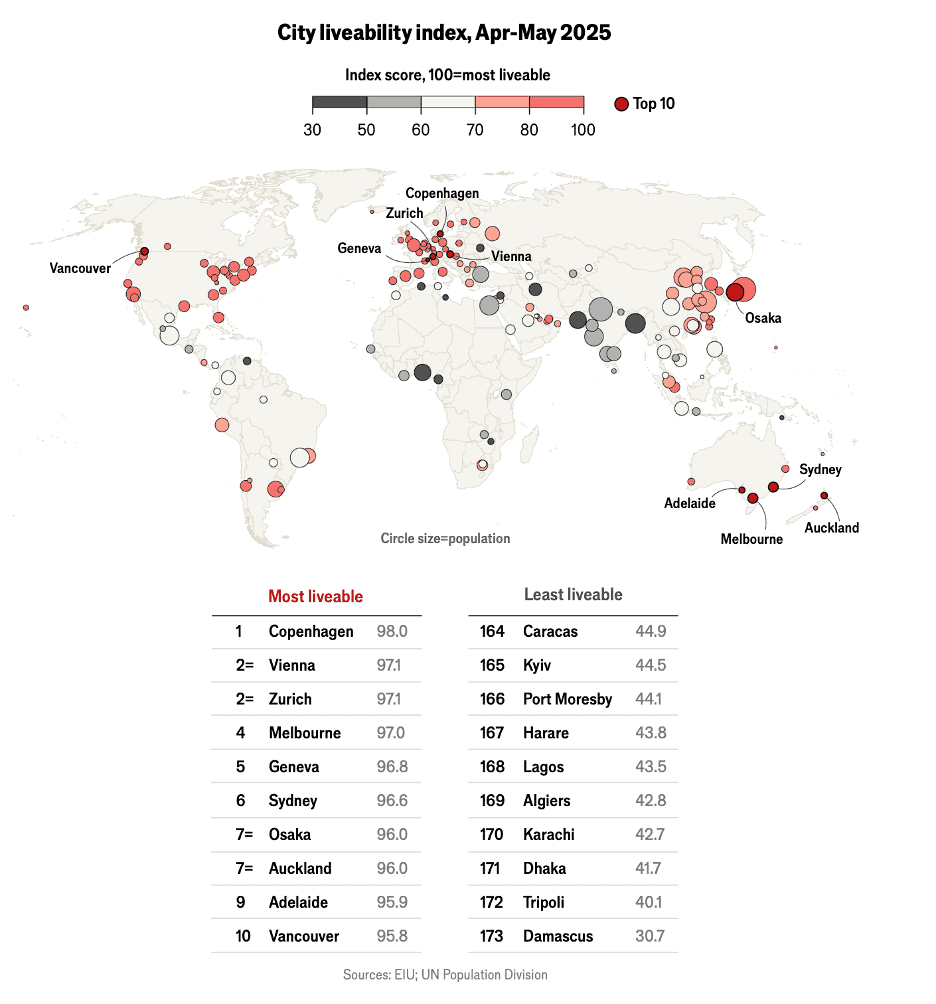

“The world’s most liveable cities in 2025 – Vienna has lost its crown. Instability threatens living standards everywhere. Vienna is a case in point. The Austrian capital was the world’s most liveable city from 2022 to 2024. But this year it lost its place because two foiled terrorist attacks—on a Taylor Swift concert and on a train station—brought down its stability score, which quantifies the threat of military conflict, civil unrest and terrorism. Smaller places generally do well on the index. Only three cities in the top 20 have more than 6m residents. London and New York are in 54th and 69th place respectively.”, The Economist, June 16, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation, Taxes & Trade Issues

“How Much it Costs to Make 100 T-Shirts – This graphic breaks down the cost to produce 100 T-shirts from manufacturers in various countries. Bangladesh offers the lowest total cost and cost per shirt. Shipping costs significantly impact the total cost, with locations like Ho Chi Minh and Guangdong showing higher shipping fees. Manufacturing in the USA is the most expensive option, with the highest bulk order fee and cost per shirt, despite lower shipping costs. Based on quotes from 50 manufacturers across the U.S., China, Bangladesh, Vietnam, and Pakistan, as of April 2025.”, Successful Fashion Designer, June 9, 2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel News

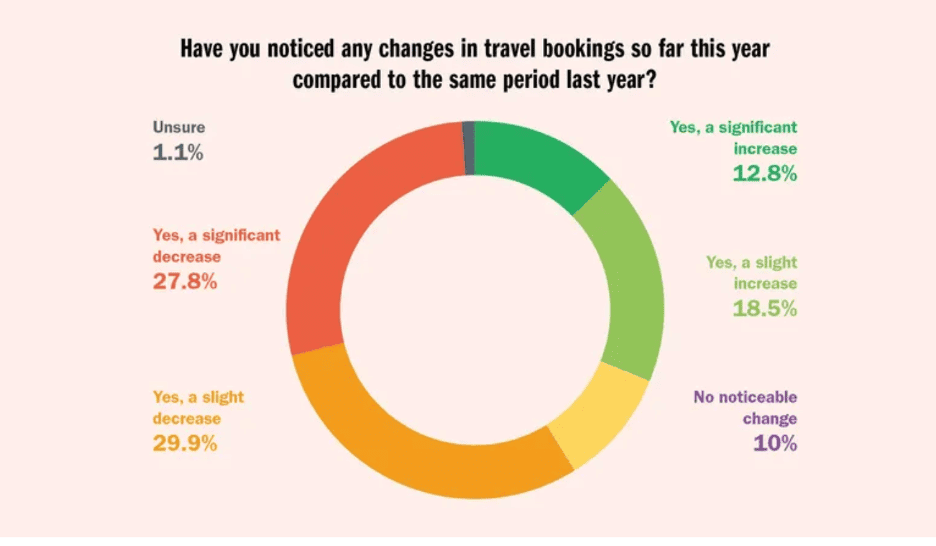

“Trump’s $12 Billion Tourism Wipeout – Four months into the president’s second term, his policies are upending tourism worldwide. Nine charts show the toll on global travel. US President Donald Trump’s “America First” policies have cut into travel worldwide. The simmering trade war, the crackdown at the border and the rollback of LGBTQ rights—capped by a ban on visitors from a dozen countries announced on June 4—have led to tens of thousands of canceled trips. With travelers choosing alternate destinations, the American economy will lose out on $12.5 billion this year, according to the World Travel & Tourism Council—which will widen the trade deficit, because economists count spending by visitors to the country as an export.”, Bloomberg, June 5, 2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Book Review

In Marketcrafters: The 100-Year Struggle to Shape the American Economy, Chris Hughes presents a compelling historical narrative that challenges the myth of the “free market” as a natural phenomenon. Instead, he argues that markets are deliberately created and continuously shaped by policymakers, economists, and corporate interests—a process he calls “marketcraft.” Covering a century of U.S. economic history, from New Deal reforms to Big Tech’s modern dominance, Hughes reveals how intentional rule-making has defined winners and losers in the American economy.

Hughes draws from his background in politics and technology to show how power, not just policy, influences economic outcomes. The book is rigorously researched yet highly readable, offering both historical insight and a call to action for more democratic participation in market design. For global business leaders, Marketcrafters is a timely reminder that markets are not immutable—they’re built, and they can be rebuilt for broader prosperity.

Top 5 Takeaways for Global Businesspeople

Markets Are Engineered, Not Natural – Policies, institutions, and legal frameworks actively shape economic systems.

Power Determines Outcomes – Market structures often reflect the interests of those with influence, not pure efficiency.

Globalization is a Policy Choice – Trade liberalization, labor flows, and tech regulation are outcomes of crafted decisions, not inevitabilities.

Economic Fairness Requires Deliberate Design – Equity and competition don’t emerge on their own—they must be built into market rules.

Business Leaders Are Market Participants and Market Shapers – Executives must recognize their role in shaping fair and functional systems, not just operating within them.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Canada

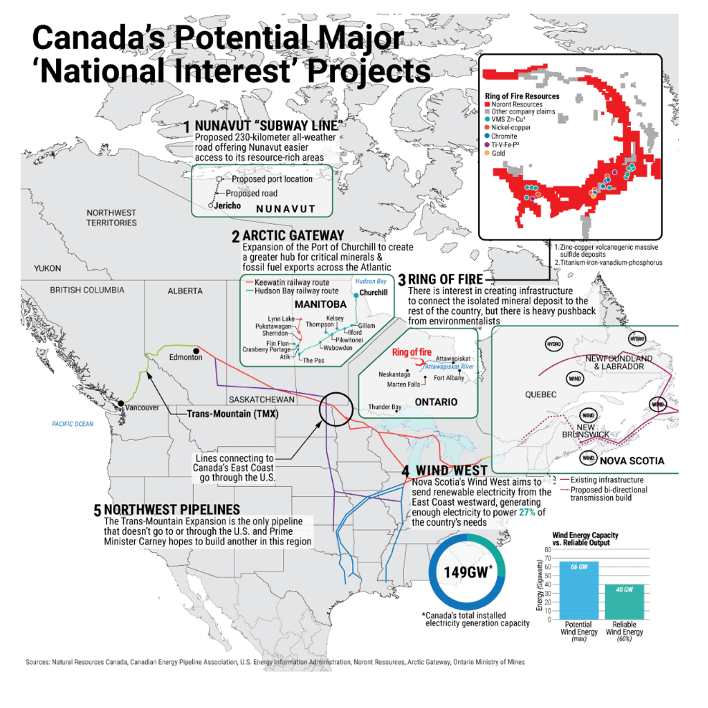

“Strategic Projects Under Consideration in Canada – Ottawa has ambitions to become an energy superpower. The Canadian government is making a strong push to improve the country’s strategic independence. The government of Prime Minister Mark Carney has rallied provincial and business leaders to fast-track infrastructure projects that will make Canada more self-reliant, improve national security and support long-term economic growth. The country wants to become an energy superpower (both for internal consumption and export), improve its export infrastructure, build a strong Arctic presence and boost development of critical mineral resources. Tensions with the U.S. are accelerating these efforts, but the projects address longstanding needs that will persist long after the Trump administration.”, Geopolitical Futures, June 13, 2025

===============================================================================================

China

“China’s Top 100 Chain Stores in 2024 Released – Based on the results of the 2024 industry basic situation survey, the China Chain Store & Franchise Association (CCFA) released the “Top 100 Chinese Chains in 2024”. In 2024, the sales volume of the top 100 chain enterprises will be 2.13 trillion yuan, and the total number of stores will be 257,200, an increase of 4.9% and 13.5% respectively over the previous year’s top 100 chain enterprises. Among the top 100 chain enterprises, there are 46 comprehensive retailers, 23 supermarkets, 13 convenience stores, and 18 specialty stores. Among them, comprehensive retail enterprises face the greatest growth pressure, with 19 enterprises experiencing year-on-year sales growth, and 9 enterprises achieving year-on-year double growth in sales and number of stores.”, China Chain Store & Franchise Association, June 18, 2025. Compliments of Paul Jones, Jones & Co., Toronto

================================================================================================

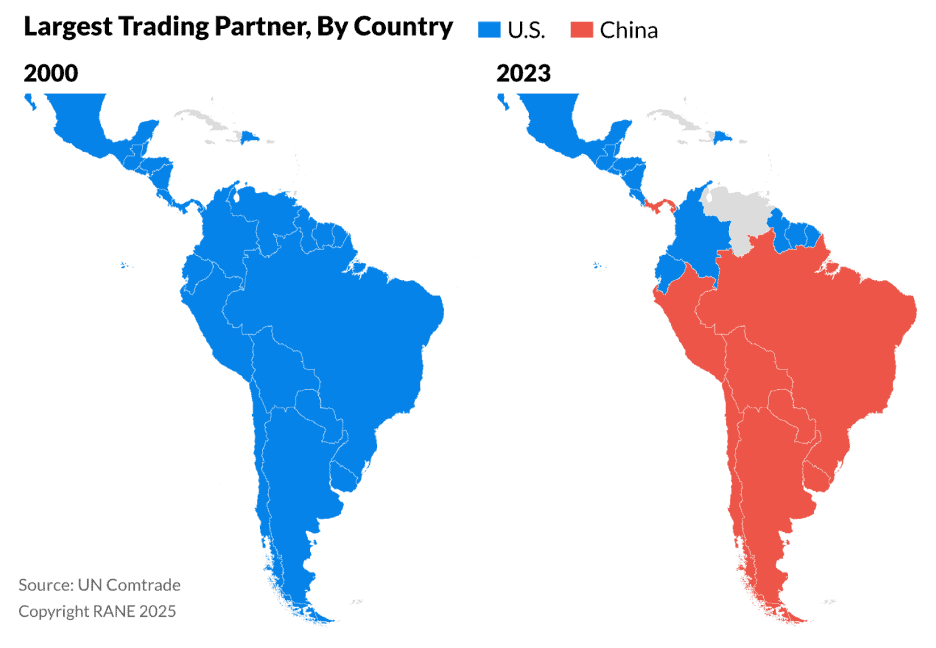

“Despite Stronger Trade Ties, China’s Influence in Latin America Will Remain Limited – In 2000, the United States was the main trade partner of countries across the Western Hemisphere. However, China soon became the largest trading partner of most regional countries, especially in South America, after joining the World Trade Organization in 2001 and expanding commerce with the region. In the coming years, China will diversify and expand trade and investment in Latin America and the Caribbean amid U.S. protectionism, but Beijing’s influence will likely remain limited due to its declining financial capacity and the region’s enduring ties with the West.”, RANE Worldview, June 11, 2025