Global Business Predictions for 2019

Despite global trade fears, new investment projects and new business development around world in 2019 will continue to be tied to a country’s Gross Domestic Product (GDP) growth. Generally, the higher the annual GDP growth rate in country, the more new investment is being made in an economy.

While the International Monetary Fund (IMF) believes global growth will slow a bit to about 3.7% in 2019, there remain several countries where the annual GDP growth rate will exceed 5%, including China, India, Indonesia, the Philippines and Vietnam. These high annual GDP growth countries have rapidly growing middle classes that need high growth rates to ensure there are sufficient jobs for the young consumer.

Argentina – “IMF support and fiscal reforms have pleased financial markets, but high interest rates are slowing domestic consumption and the economy is expected to have GDP growth of less than 2% in 2019. The second half of 2019 will be the time to begin looking at this market again.” Robert Jones, Chief International Officer, EGS

Brazil – Although the recent election of new President Jair Bolsonaro is somewhat of a wild card, he is expected to push fiscal reforms during his first year signaling a very positive message to the market, attracting domestic and foreign investors. Pro-business policies are expected to stimulate the economy and generate 2.4% GDP growth in 2019, creating new opportunities for foreign brands.

Canada – A GDP growth rate of 1.7% due to lower oil prices, new employment laws and regulations plus high business taxes will keep new brand investment and development down in this country in 2019.

Chile – Continued strong domestic demand and solid fiscal discipline should result in a GDP growth rate of 3.4% in 2019, making Chile a solid prospect for foreign brands.

China – Trade tensions with the U.S. and EU, as well as Chinese government controls and barriers, have increased the foreign investment difficulty factor in this market. GDP is expected to slow to 6.3% in 2019 as the government attempts to establish a more sustainable level of growth for the long-term. This ‘low’ GDP growth relative to recent years may be tied to lower consumer spending for the first time in almost 30 years

India – Although higher oil costs are a drag on the economy, GDP growth is expected to exceed 7% in 2019. This is slightly down form 2018. If the government implements regulatory and economic reforms, which it has announced it will do, the business climate could improve for foreign companies in 2019.

Indonesia – Strong domestic demand is expected to sustain a GDP growth rate of 5.2% in 2019. Foreign brand investment will continue due to the rapidly growing middle class consumer base. The presidential election needs watching for its impact on consumer confidence.

Italy – A higher fiscal deficit and disagreement with the EU regarding the new government’s budget have resulted in an estimated GDP of 1.2% in 2019; however, American brands are popular in this market and there is a demand despite the economy’s challenges.

Japan – Manufacturing has recently slowed somewhat and varying oil prices are a negative, but increasing domestic demand should maintain a GDP growth rate of 1.1% in 2019. This relatively low annual GDP growth rate is still good for this economy

Middle East – “The Middle East (Saudi Arabia, United Arab Emirates, Kuwait, Qatar, Oman and Bahrain), has experienced an economic contraction over the past several years with lower oil prices. Nevertheless, the restaurant segment continues to be strong. Retail is highly competitive and the B2B and B2C sectors offer limited opportunity for compelling new investment opportunities.” Paul Cairnie, CEO, World Franchise Associates.

Peru – Consumer spending is up, the government is pro-business growth, and increased export growth supports a prediction of 4% GDP growth for 2019, providing a solid opportunity for new investors.

Philippines – With an expected GDP growth rate of 6% in 2019, a fast-growing middle class consumer base, and a robust new investment environment, this country will continue to see continued new international brand entry this coming year.

Poland – Although the country’s very strong growth is expected to moderate somewhat in 2019, the current estimate of 3.6% is one of the European Union’s highest economic growth rates. This market offers solid opportunities for foreign franchisors, but market analysis and selection of the correct partner are keys for success.

Saudi Arabia – The 2019 GDP growth rate is expected to be an anemic 2% in 2019. Low oil prices, little new local investment plus fallout from recent legal issues, mean little new foreign investment in 2019.

Singapore – Weaker manufacturing will be offset by stronger consumer demand, with a 2.9% GDP growth rate estimated for 2019. Anti-immigrant legislation has made finding service workers difficult and choice retail space is priced at a premium.

South Africa – With a new government, the country could have an estimated GDP growth rate of 1.7% due to a program of fiscal stimulus. But security and rule of law challenges remain in a country with a huge middle class consumer upside.

Spain – Although 2019 annual GDP growth is expected to slow down from 2.7% in 2018, the pace of new development should continue to be high, especially in the food and beverage sector, in 2019. Retail rents are the price level before the 2008 recession.

Thailand – “As a center for global tourism, Thailand supports more international brands than its own population could support. It is also an excellent showcase of brands and proof-of-concept for the region. The Thai international brand market is crowded and tightly focused on selected urban areas. But there is a subset of strong, risk tolerant and qualified investors willing to invest in well-established American brands.” Greg Wong, Senior Commercial Officer, U.S. Commercial Service, Bangkok.

United Kingdom – “The United Kingdom is open for business, but until the details of what Brexit is going to look like have been confirmed, there will continue to be uncertainty in the marketplace. There are, however, still many good opportunities for the brave!” Iain Martin, The Franchising Centre, London.

Vietnam – This market continues to have strong retail sales and has benefitted from factories relocating from China. GDP growth of 6.6% is expected in 2019. American brands are highly desired in this market.

Projected 2019 GDP growth rates for this article are from the ‘Economist’ magazine.

William Edwards is CEO of Edwards Global Services (EGS). Contact him at bedwards@edwardsglobal.com or on +1 949 224 3896. With 45 years’ experience as a leader in international operations, business development and franchising, William “Bill” Edwards helps clients worldwide navigate the complex and often turbulent global business landscape. EGS provides a complete International Operations and Development Solution for Franchisors. From the initial global market research and country prioritization, to developing new international markets and providing operational support around the world, EGS offers the complete solution based on:

- Experience as Franchisors, International Licensees, Franchisees and Consultants working with 30+ U.S. franchise brands across 40 countries

- Knowledge across Food & Beverage, Retail and Service sectors and diverse cultures

- An operations and development team in over 40 countries experienced in finding,

- qualifying, signing, starting up, growing and fixing intentional licensees

- Trademarked processes and services based on decades of problem-solving experience

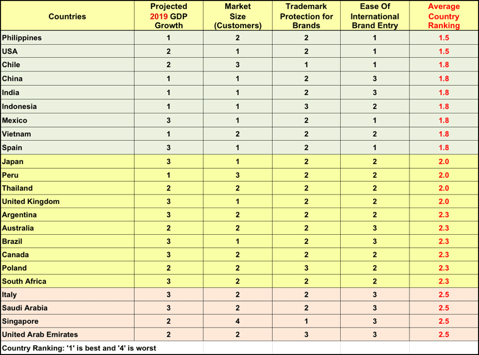

The EGS GlobalVue™ Country Ranking for Selected Countries in 2019

This blog is adapted from an article to appear this month in ‘Franchise Update’ magazine.

Ranking Countries as Places to Franchise Into – A Few Parameters

To enter a country, a franchisor has to find a licensee, secure trademarks, sign an international license agreement, train the new licensee, travel to their country and provide on-going support in order for the licensee to start-up and grow properly to produce royalties. Therefore, the biggest challenge a franchisor has in taking their brand global is choosing the right countries that will give them the best Return On Investment (ROI).

Some of the most important parameters the franchisor needs to know are: (1) the size of the consumer market that can afford their product or service in a country; (2) the legal environment and whether it will allow them to maintain control of their brand if a problem occurs; (3) how easy is it for a foreign company/brand to enter a country and what barriers to entry exist; (4) how easy is it to open a new business in a country keeping in mind that franchises are usually new business; and (5) what is the political and economic stability – or instability – of a country.

EGS has been evaluating and ranking countries as places to franchise on a quarterly basis since the founding of our company in 2001. We developed a tool for this – GlobalVue™. The latest issue – 2nd quarter 2014 – can be downloaded at the following link: http://edwardsglobal.com/index.php/globalvue/

EGS uses more than 25 information sources to establish and monitor these key parameters. Plus, EGS has associates under contract in 32 countries that keep us up to date on their countries. This is not a one-time evaluation, but a constant research project.

Things can change quickly in a country, taking it from being open to foreign brands and lots of local company investment to a downward market where new entries will fail. And economic parameters in a country can also begin to change for the better, which makes for opportunity for those franchises who are monitoring the world consistently.

Market size for your franchised products or services is key. Lots of people in a country does not automatically make for lots of consumers who can afford to buy your franchised products or services. Take Indonesia with a population of 240 million and a strong desire for US franchises. The consumer base for most US franchises is the middle and upper class, which is about 20% of this number. Still a significant potential market!

A few years ago the World Bank studied the occurrence of new investment by companies in a country. This is a very important parameter for franchisors because we need new investment happening to find licensees who will invest in our brands. The World Bank found that countries with annual Gross Domestic Product (GDP) growth of 4% or more are seeing new investment. 2-4% growth was ‘okay’. Less than 2% annual growth resulted in little new business creation. This makes sense and should be considered by franchisors looking at new countries to enter. If businesses are investing then we generally find consumers are also spending. This, or course, results in sales at businesses and royalties for franchisors.

Three years ago, Ireland was near the top of countries to franchise into. Today, unfortunately, their GDP growth rate is near zero and they are trying to recover from almost 20% unemployment. But Ireland is very receptive to US franchises and will come back in the future. So, it is important to keep up with global trends in order to focus your annual marketing on the countries most likely to give you a good ROI.

Another big challenge is how corrupt a country is because this directly impacts your licensee’s ability to do business and make a profit. And US companies are held responsible for how their licensees do business in their country under the U.S.’s Foreign Corrupt Practices Act of 1977.

Here are links for information on particular parameters mentioned in this blog posting.

(1) Political and economic stability can be research through these free online resources:

(2) The ease of starting a new business in a country is usually tied to the economic freedom to open a new business in a country.

www.freetheworld.com/release.html

www.heritage.org/index

www.fraserinstitute.org/programs-initiatives/economic-freedom.aspx

(3) Legal concerns are important to evaluate so you will know how easy or difficult it is to franchise in a country and whether you can protect your brand in the case of a problem.

www.franchise.org/IndustrySecondary.aspx?id=45874

(4) Corruption in a country impacts the ability of a business (franchise) to succeed. One of the best sources of information on country corruption can be found at the Transparency International website and on their Corruption Perception Index that measures more than 50 local parameters.

www.cpi.transparency.org/cpi2013/