EGS Biweekly Global Business Newsletter Issue 23, Monday, February 8, 2021

By William (Bill) Edwards, CEO of Edwards Global Services, Inc. (EGS)

“Success isn’t always about greatness. It’s about consistency. Consistent hard work leads to success. Greatness will come.”, Dwayne Johnson

“Success is the sum of small efforts, repeated day in & out.”, R. Colier

“So often in life things that you regard as an impediment turn out to be great good fortune.”, Ruth Bader Ginsburg

Introduction

Our biweekly newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment and travel.

HiiHighlights in issue #23:

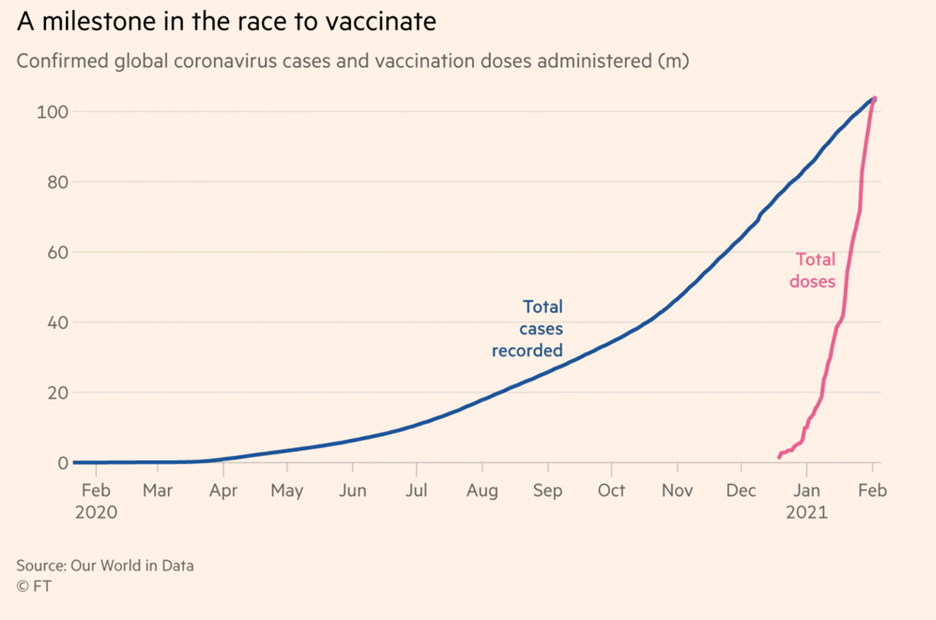

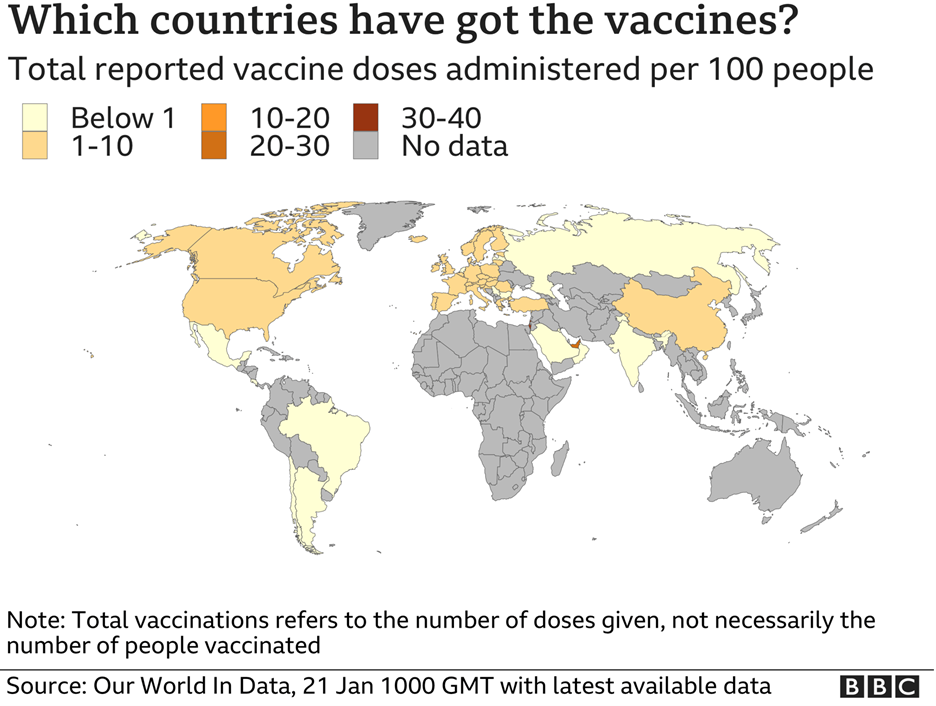

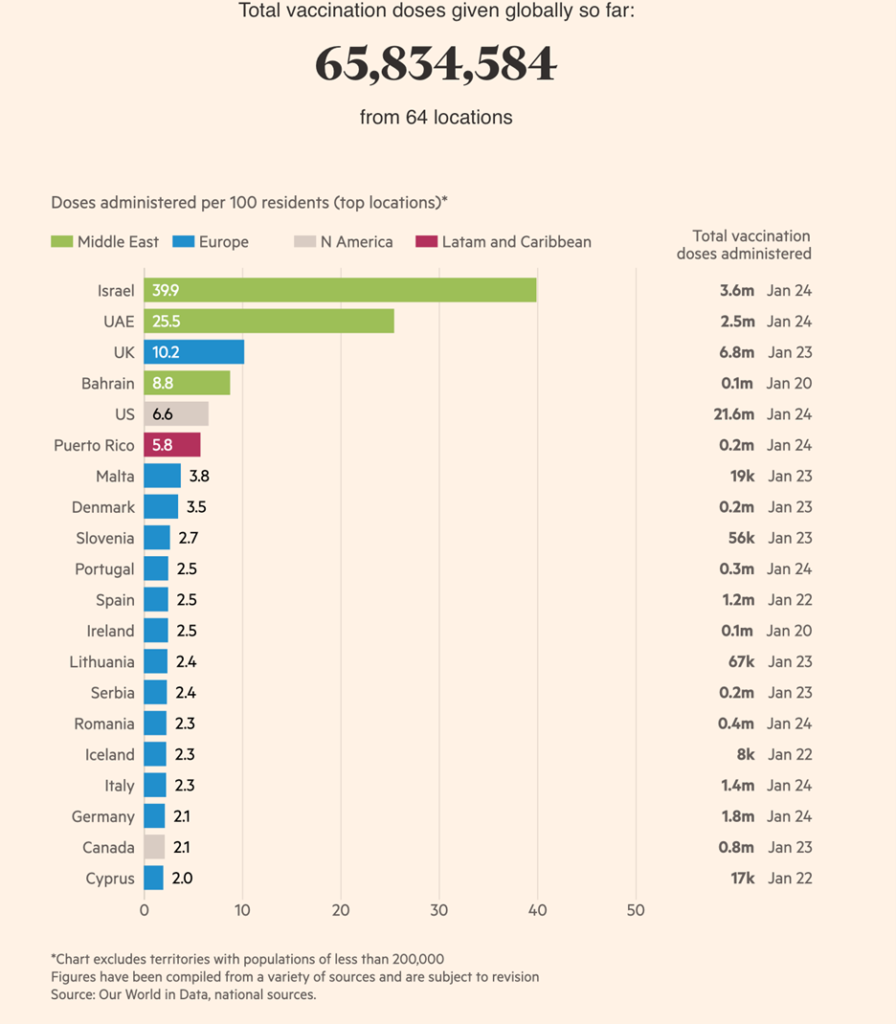

- Vaccine milestone as global Covid jabs pass number of confirmed cases

- Daily cases of COVID-19 are currently falling across most of the world, and deaths….are also beginning to decrease

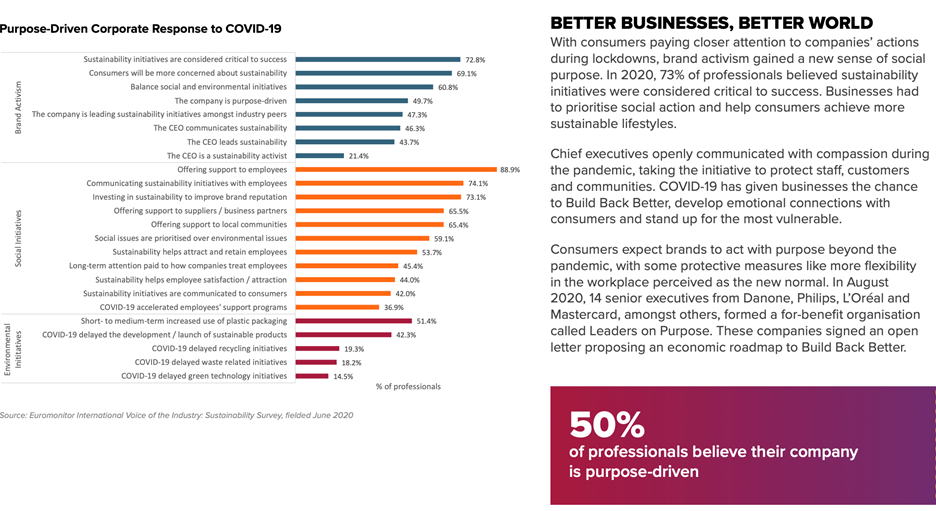

- Which Covid-Related Consumer Marketing Changes Will Last Beyond the Pandemic? In the Articles and Charts section

- Work-from-home isn’t going away: Only 4% of CEOs plan to add office space. In the Articles and Charts section

- Lots of positive brand recovery news in the Brands section

- A global risk assessment in the Articles and Charts section

We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covers 43 countries and provides us with updates about what is happening in their specific countries.

Please feel free to send us your input and sources of information. Our contact information is at the bottom of this newsletter.

First, a few Personal Comments

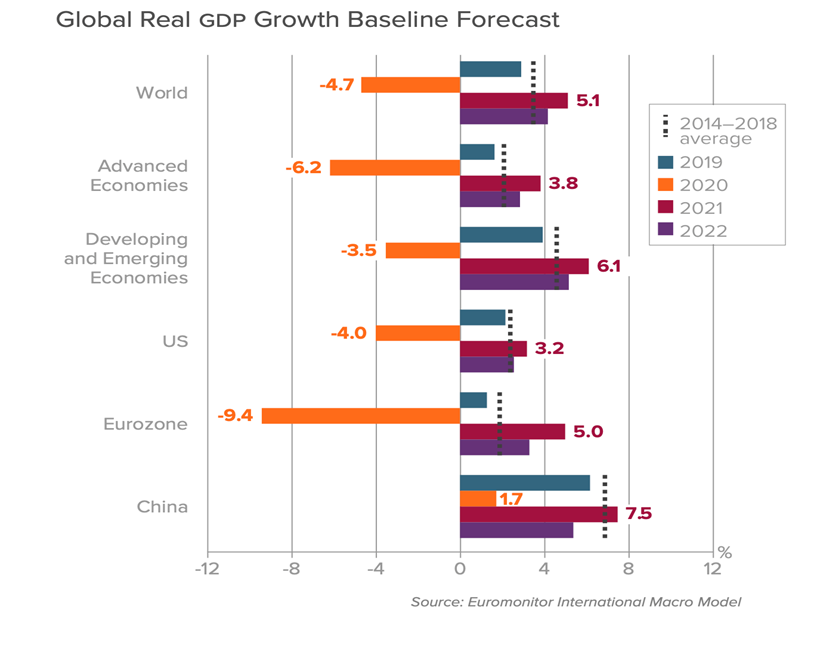

The big news today is the growing initial vaccinations in many key business countries along with an apparent broad decline in the number of new cases. Business leaders are cautiously optimistic about the recovery of business in 2021. The International Monetary Fund recently projected the global economy will grow 5.5% in 2021 versus a -3.5% in 2020. The 2nd half of 2021 may see post-COVID-19 travel passports.

Vaccine Updates from Around the World

“Vaccine milestone as global Covid jabs pass number of confirmed cases: FT tracker shows rapid growth in doses administered around world — but warnings come of long road ahead.”, The Financial Times, February 3, 2021

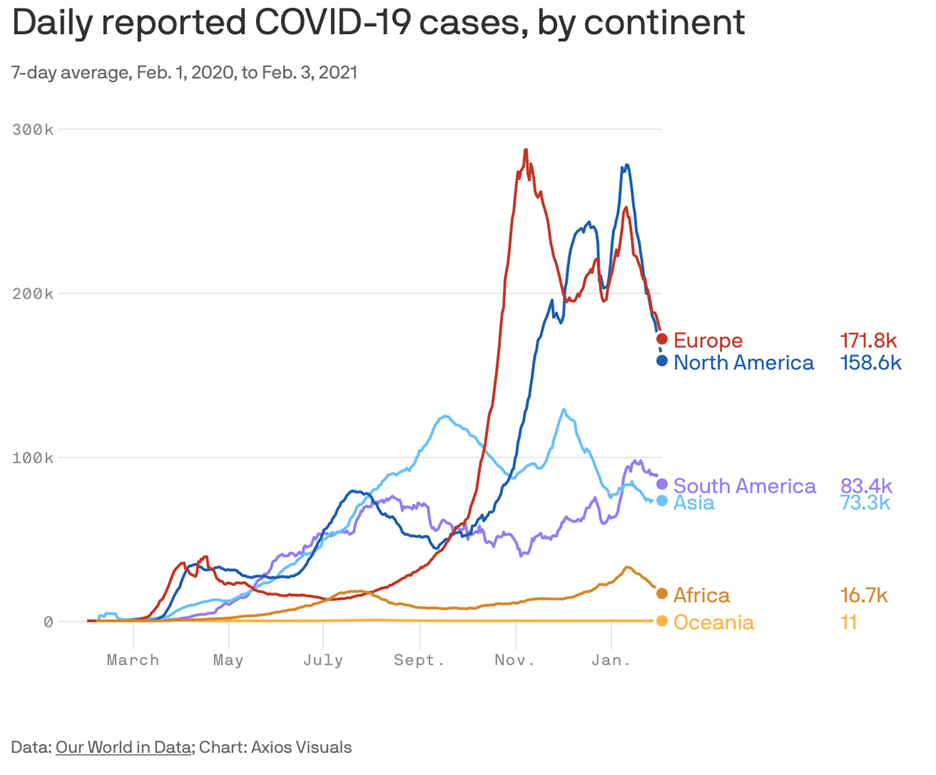

“Daily cases of COVID-19 are currently falling across most of the world, and deaths — which had been climbing globally until late January — are also beginning to decrease…..this is the first time since the pandemic began where cases are falling in basically every region of the world at the same time. On a global level, virtually the only number that is rising is vaccine doses administered. And in some places — south Asia for example — there’s growing confidence that the worst of the pandemic may be over even before vaccines become widely available.”, Axios, February 5, 2021

Please see specific country vaccine news in the country section below.

Interesting Data and Studies

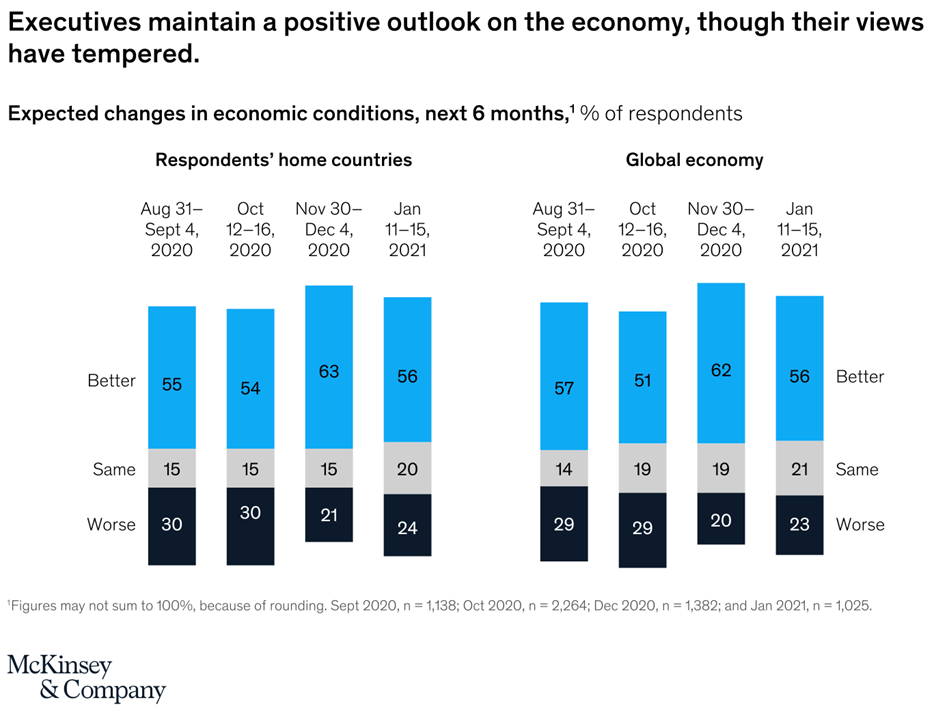

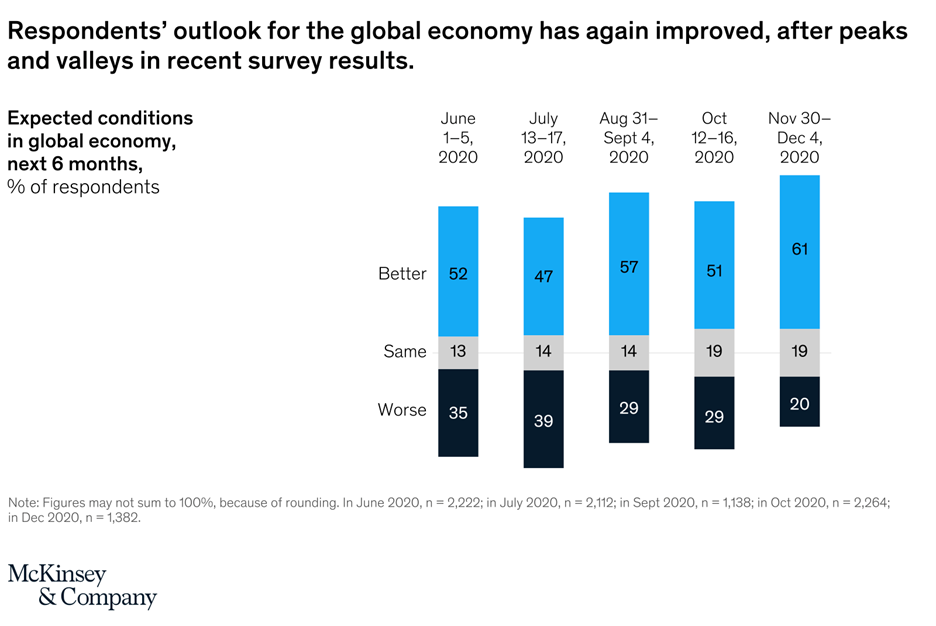

“In our newest McKinsey Global Survey of more than a thousand executives from all industries, the outlook is still positive, though not quite as strong as in early December 2020. Majorities of executives continue to believe that conditions in their home economies and in the global economy will improve over the next six months.”, McKinsey & Co., February 2, 2021

“Carlsberg predicts surge in demand similar to Jazz Age boom: World’s third-largest brewer expects ‘normal summer’ as lockdowns lift. Carlsberg is expecting a surge in demand this summer similar to a boom seen a century ago as more people are vaccinated and lockdowns lift, according to the Danish brewer’s chief executive.”, The Financial Times, February 7, 2021

Global and Regional Travel Updates

“Where Can I Travel Internationally and Do I Need the Covid-19 Vaccine? Covid restrictions for international trips are more complicated than ever. Before you dust off your passport, a few words of caution. THE COVID-19 VACCINES have arrived. Does this mean we’ll soon be free to roam the world, guilt- and hassle-free? The short answer is no. While an inoculation protects you from getting sick, it’s not yet known whether the vaccines will prevent an asymptomatic person from passing the virus to others.”, The Wall Street Journal, February 4, 2021

“Healthy Passport Apps Under Development in Travel Industry: Travel technology companies are developing health passport apps to allow travelers to verify test results or vaccinations for international flights……SITA, a travel technology firm with its U.S. offices in Atlanta, said Thursday it has started trials of technology enabling airlines and passengers to share COVID-19 test results or vaccination history with authorities to meet government requirements. It has tested it with travelers to the United Arab Emirates and plans for a trial at Milan, Italy’s Malpensa Airport.”, The Atlanta Journal-Constitution, February 6, 2021

“The future of business travel: Digital nomads and “bleisure” define the new high-tech take on work trips: The coronavirus pandemic served as a temporary kill shot to the business travel industry. A tech-savvy and adaptable hospitality industry is rising from these ashes in the remote work era.”, Tech Republic, January 29, 2021

“Delta Air Lines Launches First Domestic Digital ID Test: As the COVID-19 pandemic changes the way people travel by air, possibly forever, growing attention is being paid to systems and procedures aimed at eliminating opportunities for close personal contact and the exchange of objects and papers that can lead to disease transmission.”, Airline Geeks, February 1, 2021

“Delta and Alitalia To Codeshare on COVID-Tested Flights: That gives customers the ability to produce a negative COVID-19 test before flying to avoid quarantine in either country. Effective immediately, travelers can book to fly on Alitalia’s dedicated COVID-tested service from New York’s John F. Kennedy International and Delta’s COVID-tested service from Atlanta’s Hartsfield Jackson International Airport with both flying to Rome’s Fiumicino Airport.”, Travel Pulse, February 2, 2021

“Delta Plans to Bring 400 Grounded Pilots Back to Active Flying Status by Summer: Earlier this month, Delta’s senior vice president of flight operations John Laughter detailed in a memo to staff that the airline plans to return 400 pilots to regular flying status by summer 2021, so they are ready to fly again by summer 2022, according to a report from CNBC. ‘As we looked at ways to better position ourselves to support the projected recovery, we saw an opportunity to build back additional pilot staffing in advance of summer 2022 by bringing 400 affected pilots back to active flying status by this summer,’ Laughter said in his staff note, per the publication.”, People, January 28, 2021

“Copa Will Become the First American Carrier to Have IATA Travel Pass: The International Air Transport Association (IATA) is partnering with the Panamanian government and Copa Airlines to trial the IATA Travel Pass – a mobile app to help passengers easily and securely manage their travel in line with government requirements for COVID-19 testing or vaccine information.

“Australian PM’s New Hope for Country’s Airlines: Australia’s Prime Minister, Scott Morrison has announced that the country’s international arrival caps would return to a higher rate. However, the PM also argued that for the near future, the hotel quarantine process would proceed as before irrespective of vaccination process.”, Airways Magazine, February 7, 2021

“San Diego Airport rolls out on-site COVID-19 testing: Carbon Health, a major player in COVID-19 testing, will now extend its footprint to the San Diego International Airport (SAN). It’s offering “travel clearance visits” that include a COVID-19 test that is sufficient for domestic travel. San Diego joins other West Coast airports such as Portland, San Jose and Los Angeles that all offer similar testing.”, The Points Guy, February 6, 2021

Australia

“Retail and fast-food workers to receive increase in minimum wage from today: The retail and fast-food award wage is now $21.78 an hour.”, Smart Company Australia, February 1, 2021

“Restaurant owners increasingly optimistic about business this year, Deliveroo report says. 81% of restaurant owners are planning to hire more staff. Restaurant sector confidence has grown going into 2021, with hiring and building out a strong workforce becoming a major focus.”, QSR Media Australia, January 21, 2021

“Temporary restructuring relief for small business directors: The Australian Government introduced insolvency reforms for small businesses that came into effect on 1 January 2021, including temporary restructuring relief. These reforms extend some of the temporary measures introduced in March 2020 in response to the COVID-19 pandemic.”, News Hub Asic Australia, January 18, 2021

The three articles om Australia are compliments of Jason Gehrke, Managing Director of the Franchise Advisory Centre, Brisbane, from their February 5, 2021 franchise newsletter.

Mainland China – Chinese New Year is February 12th

“China Services Activity Expands at Slowest Pace in Nine Months, Caixin PMI Shows: China’s services sector expanded at the slowest pace in nine months in January as growth in total new business and new export business softened, a Caixin-sponsored survey showed Wednesday. The Caixin China General Services Business Activity Index, which gives an independent snapshot of operating conditions in the services sector, fell to 52 in January from 56.3 the previous month.”, Caixin, February 3, 2021

“US fast food giants turn to the taste of Chinese: From Chinese burgers to ice cream doused in chili oil, US fast-food giants are infusing their offerings with a Chinese flair. McDonald’s and KFC have long localized their menus to appeal to the Chinese palate, but their latest takes on traditional dishes and ingredients seem to be causing quite a buzz, and not always the good kind.”, Shine, January 27, 2021. Submitted by Paul Jones, Jones & Co., Toronto

https://www.shine.cn/news/nation/2101273955/

“China wins a boost for international luxury brands: The COVID-19 pandemic has had sweeping repercussions on almost all sectors of the worldwide economy. The fashion industry has been among the hardest hit because it is, in essence, under the non-essential spending category. Yet there is light at the end of the tunnel — for some.”, Shine, February 3, 2021. Submitted by Paul Jones, Jones & Co., Toronto

https://www.shine.cn/feature/lifestyle/2101314114/

“China’s Car Sales Rose 25% in January: It was the strongest growth since September 2016. Retail sales of passenger cars rose 25.7% to 2.16 million vehicles last month compared with the same time a year before, the China Passenger Car Association said Monday, the strongest growth since September 2016.”, The Wall Street Journal, February 8, 2021

Iceland

“Iceland opens up after success of Covid testing regime: ‘Cautious steps’ will see return of personal training in gyms and opening of bars until 10pm. Iceland became one of the first European countries to start opening up society again after the second wave of Covid-19 as it reaped the rewards of having the region’s lowest infection rate.”, The Financial Times, February 8, 2021

Korea

“South Korea eases curfew on businesses outside Seoul: South Korea on Saturday eased curfews on more than half a million restaurants and other businesses outside the capital Seoul, letting them stay open an hour later, amid a public backlash over tight curbs to contain COVID-19.”, Reuters, February 5, 2021

“South Korea Leads World in Innovation as U.S. Exits Top Ten: South Korea returned to first place in the latest Bloomberg Innovation Index, while the U.S. dropped out of a top 10 that features a cluster of European countries. Korea regained the crown from Germany, which dropped to fourth place.”, Bloomberg, February 2, 2021

New Zealand

“’Hard and early’ lockdown was the right economic strategy: Economist. Going “hard and early” with a strict lockdown to stop the spread of Covid-19 has proved to have been the best tactic for the economy, too, Infometrics chief forecaster Gareth Kiernan says. The economics consultancy has updated its forecasts and now expects GDP growth to accelerate to 4.6 per cent in the second half of 2021. Kiernan said the country’s economy had now almost recovered to pre-Covid levels. In the year to December 2019, GDP growth was 2.3 per cent.”, Stuff New Zealand, February 5, 202i, Compliments of Simon Lord. Franchise New Zealand

The Philippines

“This hotel in Metro Manila has multifunctional pods for safe outdoor dining, massage. Sheraton Manila is offering the first-ever luxury outdoor dining pod in the Philippines called “Vubble Pods.”, GMA News Online, January 5, 2021

Singapore

“Singapore approves Moderna’s COVID-19 vaccine in Asia first: Singapore has become the first country in Asia to approve Moderna’s COVID-19 vaccine as it begins rolling out its immunisation programme to the wider population.”, Reuters, February 3, 2021

“Our COVID-19 cases have been low since last fall — here’s what we’re doing right: Dr. Lim Hui Ling, 51, is the medical director for the International Medical Clinic in Singapore. Lim says going through the 2002-2003 SARS pandemic helped prepare her and other healthcare workers to deal with COVID-19. She also credits fellow Singaporeans for helping stop the spread of the virus by willingly wearing masks, social distancing, and using a contact tracing app.”, Business Insider, February 8, 2021

South Africa

“South Africa halts AstraZeneca vaccine rollout: South Africa stopped the distribution of the AstraZeneca-Oxford vaccine on Sunday, after researchers found that the vaccine ‘provides minimal protection’ against infection from the new strain first identified in the country, Reuters reports.”, Axios, February 8, 2021

United Kingdom

“Vaccines minister ‘confident’ everyone over 50 will be offered coronavirus jab by May: Nadhim Zahawi says that at one point on Saturday, the UK was administering COVID-19 jabs at a rate of almost 1,000 per minute. The pace of the vaccine rollout indicates the UK is on track to meet its target of offering a jab to everyone in the top four priority groups – about 15 million people – by the middle of this month.”, Sky News, February 7, 2021

“Scientists raise hopes of March meetings and normal summer: The country could be back to near normal by summer, with people able to meet relatives as early as next month, senior scientists have said.”, The Sunday Times of London, February 5, 2021

“NHS plans for annual coronavirus vaccinations: UK government aims to copy flu prevention programme as model for control of new variants. The NHS is planning a mass campaign of booster jabs against new variants of coronavirus as early as the autumn, in what the vaccines minister suggested would become an annual effort to prevent Covid-19 as the virus keeps mutating.”, The Financial Times, February 7, 2021

“UK applying to join Asia-Pacific free trade pact CPTPP: The UK will apply to join a free trade area with 11 Asia and Pacific nations on Monday, a year after it officially left the EU. Joining the group of “fast-growing nations” will boost UK exports, the government says. The Comprehensive and Progressive Agreement for Trans-Pacific Partnership – or CPTPP – covers a market of around 500 million people.”, BBC News, January 31, 2021

United States

“Johnson & Johnson Asks U.S. Regulators for Emergency Approval of Its Covid-19 Vaccine: The potential third vaccine could jump-start a slower-than-expected vaccination rollout…. J&J’s shot wouldn’t only boost the overall supply of Covid-19 vaccine doses, but also could simplify vaccinations for many because it is given in one dose.”, The Wall Street Journal, February 4, 2021

“Business Travel Deductions in the Post COVID-19 World: Tax expert Bonnie Lee offers some tips on what to claim, what not to claim and what’s changing on 2020 taxes.”, Business Traveler, January 27, 2021

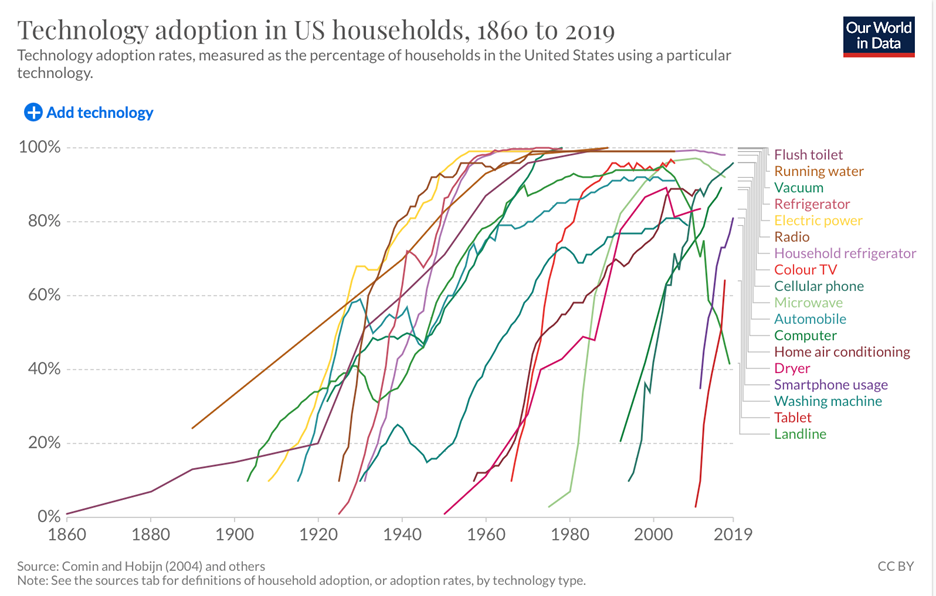

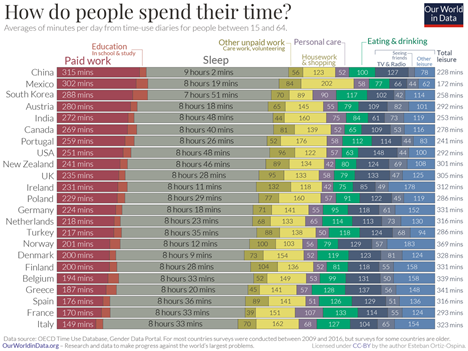

“Technology Adoption: This visualisation details the rates of diffusion and adoption of a range of technologies in the United States, measured as the percentage of US households with access or adoption over time.”, Our World In Data, February 2021

Brand News

“’We’re delivering iconic pizzas and blockbuster moments’: Pizza Hut talks digital. Last year, Pizza Hut decided to launch its first global campaign in 20 years to celebrate the 40th anniversary of its iconic Pan pizza, delivering a digital-first campaign in 55 markets around the world and declaring October ‘Global Pizza Month’. This campaign also saw Pizza Hut use its ‘now that’s delivery’ brand story globally for first time, after seeing how successful the message was in the UK alongside the restaurant chain’s ambassador character, Parker.”, MobileMarketing, February 4, 2021

“What Lies Ahead for Restaurant Franchising: Franchise experts weigh in on the opportunities for the industry in a post-pandemic environment. big reason for many quick serves to be excited is the state of franchising. All signs point to franchises surviving the pandemic better than others, and there is significant potential in franchising moving forward; economic downturns typically lead to more people looking for a second career, and would prefer the safety net of a proven concept.”, QSR Magazine, January 29, 2021

“Chipotle’s Recovery Has Come From Its Digital Business. Here’s How Operations Kept Up. The company announced its Q4 results Tuesday afternoon, which included a comp sales increase of 5.7%, a revenue increase of 11.6% and digital sales growth of 177.2%. This is compared to Q2–in the depths of government-mandated shutdowns and unprecedented consumer anxiety–when comp sales dropped nearly 10%.”, Forbes, February 3, 2021

“This Chicken Chain Is Opening 100 New Locations This Year: Church’s credits its success to strong delivery sales and a mega successful chicken sandwich….. A Southern chain with a fried chicken legacy spanning almost seven decades is planning a major expansion this year as it rides the momentum of the chicken category.”, Eat This, Not That, February 2, 2021

“Everyone Wants Sushi to Go, and It’s Saving Some Restaurants: Eateries and grocers are selling more takeaway sushi during the pandemic, while supermarkets rush to train chefs. Sushi was the most searched takeout cuisine on restaurant-reservation platform Tock during the last three months of 2020.”, The Wall Street Journal, February 6, 2021

“How Two Franchisees Are Affected by Covid, and How They’re Responding: We asked a wide range of multi-unit franchisees about the biggest impacts Covid-19 has had on their business, how they’ve responded, and which changes they think will be permanent. This week we hear from a longtime restaurateur Del Taco operator and a 13-year franchisee of The Learning Experience.”, Franchising. Com. February 8, 2021

Articles and Charts About Doing Business in The Times Of COVID-19 and Beyond

“2021 International Development Goes Online in the Pandemic: 2020 has been a challenging year for the entire global franchise community as the Covid-19 crisis has changed how we seek new international licensees. International travel to countries stopped in May. To meet new licensee candidates, we had to resort to videoconferences. Due diligence on candidates became remote. Discovery days to have candidates meet the franchisor team and see face-to-face the resources the franchisor would provide either did not happen in 2020 or were done virtually.”, Franchising.com article by William Edwards, CEO of Edwards Global Services, Inc. (EGS), February 2021

“Expanding Your Business Internationally in 2021: If you have been thinking about expanding your business internationally, the decision to move overseas is both challenging and rewarding. Whether it has always been part of your long-term business plan or you are responding to a current international opportunity, there are critical considerations you need to make for your project to be successful.”, ArtOne Translations by Olena Polissky, Vancouver, January 29, 2021

“Which Covid-Related Consumer Marketing Changes Will Last Beyond the Pandemic? Looking at what’s changed in 2020 because of Covid – and what changes might be permanent – let’s start with the biggest driver of economic activity: consumers. A majority of the more than 2,000 people surveyed by Jones Lang LaSalle said they want to continue working away from the office at least two days a week; only 26% want to do it full-time after the pandemic passes.”, Franchising.com, Darrell Johnson, CEO of FRANdata, February 2021

“Work-from-home isn’t going away: Only 4% of CEOs plan to add office space: Once the vaccine is fully rolled out, we’ll find out what the future of remote work is. To get a sense of where we’re headed, Fortune conducted a survey of CEOs in collaboration with Deloitte.”, Fortune, February 4, 2021

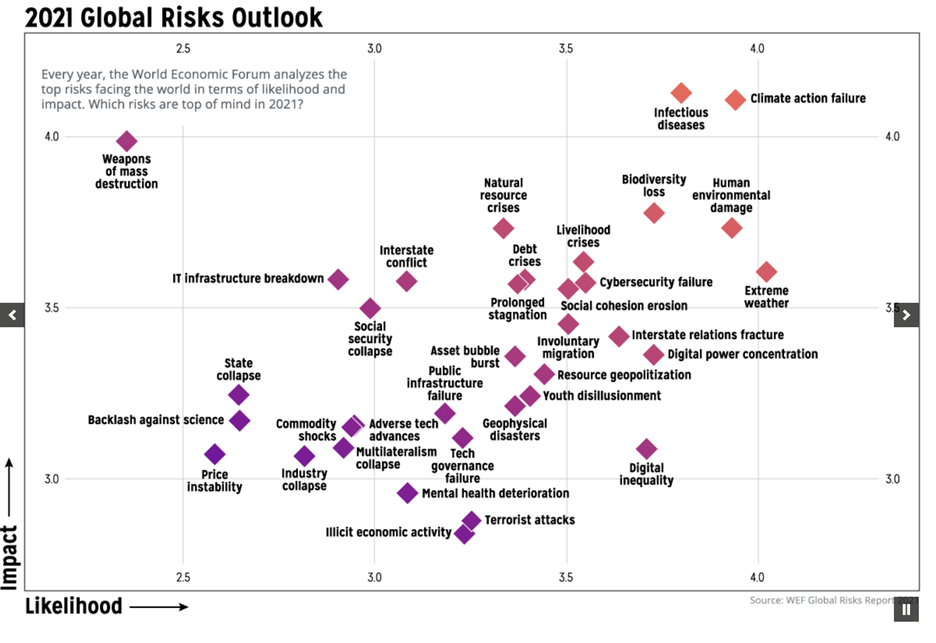

“A Global Risk Assessment of 2021 And Beyond: Risk is all around us. After the events of 2020, it’s not surprising that the level and variety of risks we face have become more pronounced than ever. Every year, the World Economic Forum analyzes the top risks in the world in its Global Risks Report. Risks were identified based on 800+ responses of surveyed leaders across various levels of expertise, organizations, and regional distribution.”, Visual Capitalist, January 25, 2021

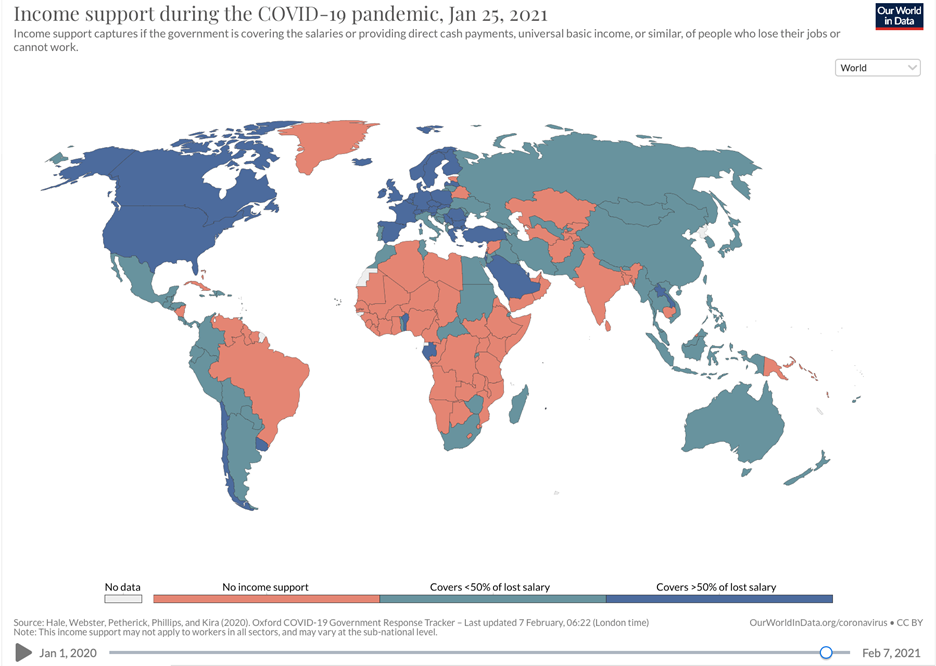

“Mapping Global Income Support During COVID-19: Income loss has impacted many during the COVID-19 pandemic. Unemployment, reduced hours, office closures, and business shutdowns have prompted the need for mass income support. Income support, in this case, is defined as governments broadly covering lost salaries, or providing universal basic income or direct payments to people who have lost their jobs or cannot work. Levels of income support are changing over time.”, Visual Capitalist and Our World In Data, January 26, 2021

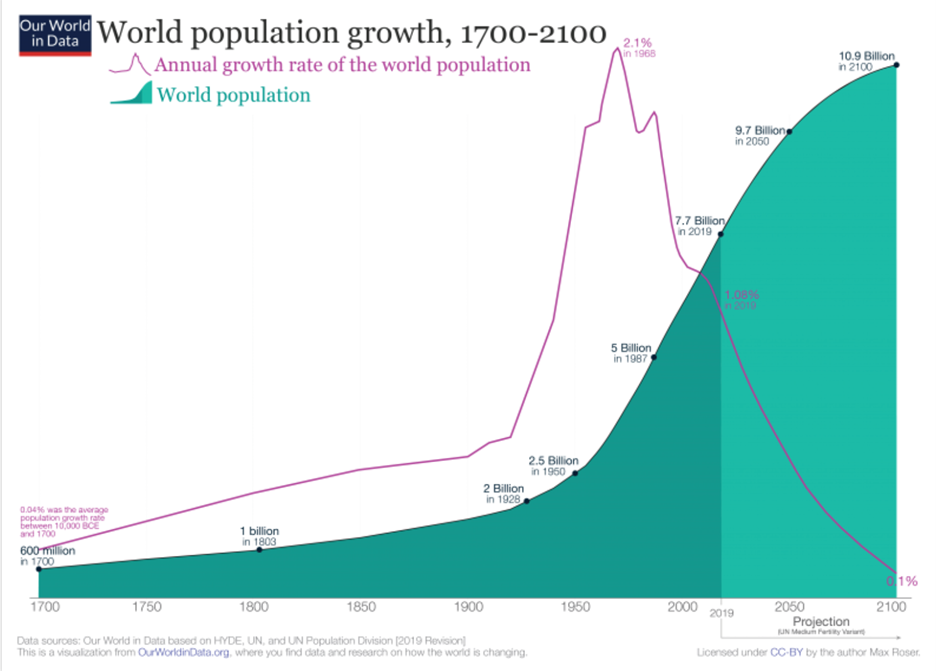

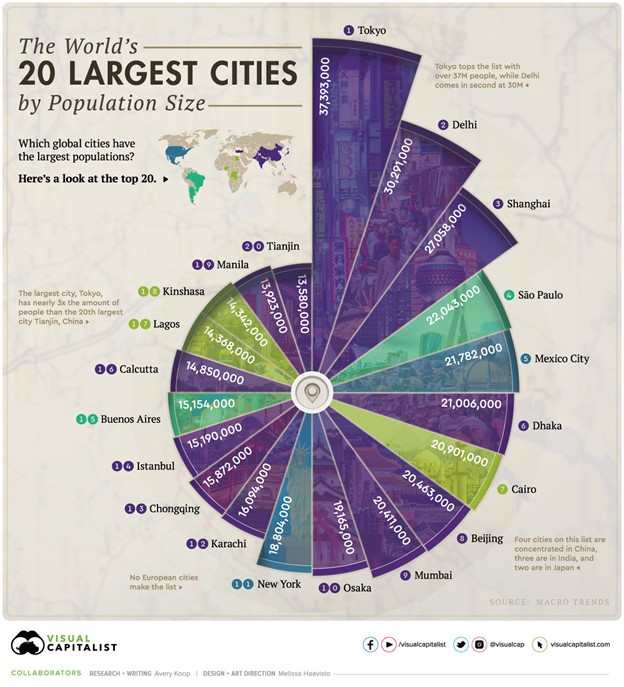

“The UN projects that the global population increases from a population of 7.7 billion in 2019 to 11.2 billion by the end of the century. By that time, the UN projects, fast global population growth will come to an end.”, Our World In Data, November 2019

“Business cards are going online in Asia: But traditionalists miss the feel of paper and ink. Networking is difficult when white-collar workers have fled to home offices, business lunches have been cancelled and conferences have migrated online. Orders for business cards from Vistaprint, a multinational printing company, plummeted by 70% in late March and early April and have yet to recover fully.”, The Economist, February 6, 2021

Who We Are and How We Help Companies ‘Go Global’ Successfully

Edwards Global Services, Inc. (EGS) provides a complete International solution for U.S. businesses Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving. around the world. Our U.S. based executive team has experience living and working in many countries. Our Associate network on the ground overseas covers 40+ countries.

Founded in 2001, Edwards Global Services, Inc. (EGS) takes businesses global and currently has activity in 25 countries. Our Clients are consumer-faced brands. Edwards Global Services, Inc. (EGS) has twice received the U.S. President’s Award for Export Excellence.

Find out more about the services we provide companies Going Global at:

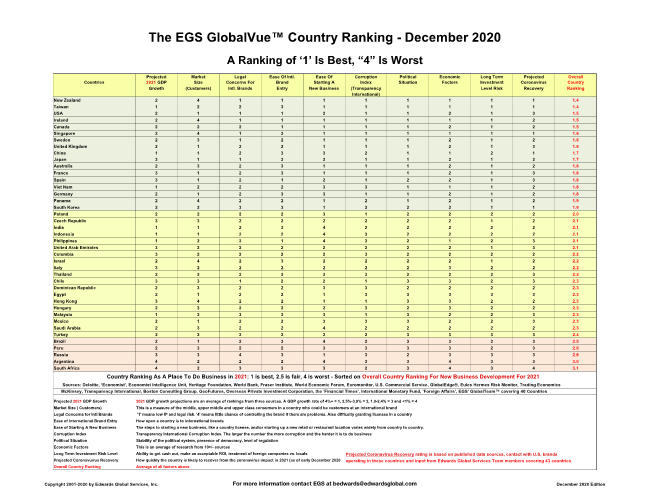

Download our 4th quarter 2020 GlobalVue™ 40 country ranking chart at this link:

William Edwards, CFE, is CEO and Global Advisor of Edwards Global Services (EGS). He has 46 years of international operations, development, executive and entrepreneurial experience and has lived in 7 countries. With experience in the franchise, oil and gas, information technology and management consulting sectors, he has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East. Mr. Edwards advises a wide range of companies on early to long term global development of their brands.

For market research, operations and development support on taking your business global successfully contact Mr. Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

EGS Biweekly Global Business Newsletter Issue 22, Monday, January 25, 2021

By William (Bill) Edwards, CEO of Edwards Global Services, Inc. (EGS)

“The future depends on what we do in the present”, Mahatma Gandhi

“Life is like riding a bicycle. To keep your balance, you must keep moving.”, Albert Einstein

“We must be willing to let go of the life we planned so as to have the life that is waiting for us.”, Joseph Campbell

Introduction

Our biweekly newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment and travel.

Highlights in issue #22:

- Vaccine Updates from Around the World:Ramped up production and better distribution are widely needed

- A new USA administration takes office and starts to define trade policies

- What you need to know about traveling in 2021 from several sources

- The art and science of boarding an airplane in a pandemic

- Health passports for travel are beginning to be available

- 40 Happy Pictures to Take Your Mind Off Things from ‘Readers Digest’

We consistently monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covers 43 countries and provides us with updates about what is happening in their specific countries.

Please feel free to send us your input and sources of information. Our contact information is at the bottom of this newsletter.

First, a few Personal Comments

‘It’s the last mile”, said Honeywell Chief Executive Darius Adamczyk. As you can read below, the challenges currently are producing sufficient vaccine and getting it the last mile to the end user – us humans! But the really good news is that there are a number of apparently effective vaccines available.

As surely the reader knows, the USA has a new President. The expectation is for a calmer, more consistent and less tweet filled 2021.

Vaccine Updates from Around the World

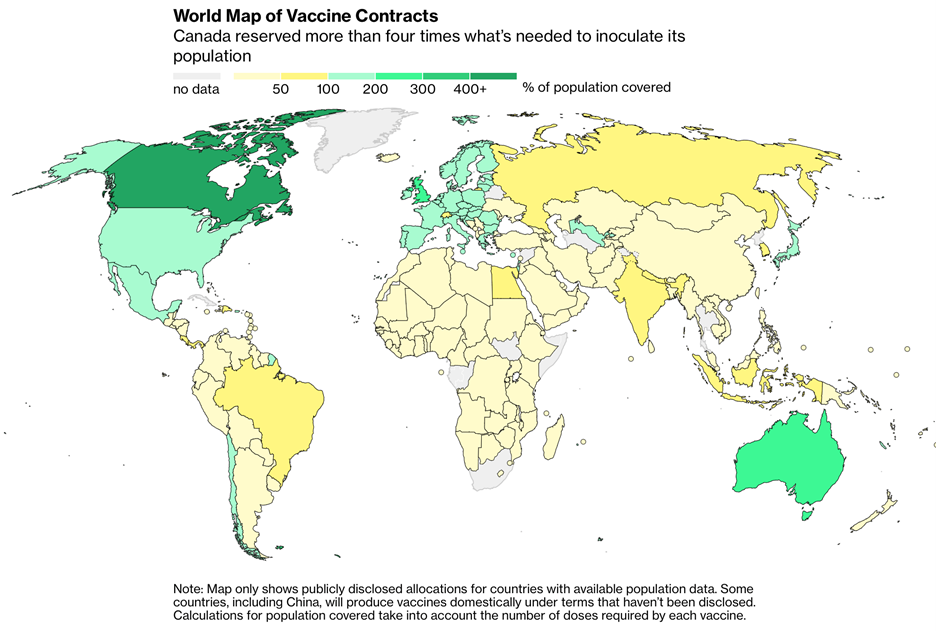

“What to Know About the Global COVID-19 Vaccine Rollout So Far: Several countries stand out for their success in delivering coronavirus vaccinations, while most of the world is struggling to figure out how to get immunizations into more arms.”, The Council on Foreign Affairs, January 25, 2021

“Johnson & Johnson Aims for 100 Million Vaccine Doses by Spring: ‘Johnson & Johnson is making a very large supply, going all out with its production both here in the U.S. and elsewhere around the world, with the goal of having perhaps enough vaccines for 100 million Americans by spring, by this April or so,’ (Dr. Mark) McClellan (A Johnson & Johnson board member) said. 1So that’s going to make a big difference in supply available over the coming weeks and months, if the clinical trial does work out.’, Barron’s, January 22, 2021

“Coronavirus vaccine delays halt Pfizer jabs in parts of Europe: Vaccinations in parts of Europe are being held up and in some cases halted because of a cut in deliveries of the Pfizer-Biontech vaccine. Germany’s most populous state and several regions in Italy have suspended first jabs, while vaccinations for medics in Madrid have been stopped too. The US pharmaceutical firm has had to cut deliveries temporarily while cases in many European countries surge.”, BBC News, January 22, 2021

“Fed-Up Executives Plot a Faster Covid-19 Vaccine Rollout: Honeywell CEO and other leaders say their operational know-how can help jump-start America’s vaccine administration. ‘It’s the last mile,’ Honeywell Chief Executive Darius Adamczyk said of the problems that have plagued the vaccine rollout. “We dramatically need to pick up the pace.”, The Wall Street Journal, January 21, 2021

“Africa’s long wait for the Covid-19 vaccine: Africa will have to wait “weeks if not months” before receiving Covid-19 vaccines approved by the World Health Organization, according to various officials working towards getting doses for the continent. Close to 900 million doses have been secured so far through various initiatives, enough to inoculate about 30% of the continent’s 1.3 billion people this year.”, BBC News, January 22, 2021

Interesting Data and Studies

From “TOP 10 GLOBAL CONSUMER TRENDS 2021’ by Euromonitor International, January 2021

“40 Happy Pictures to Take Your Mind Off Things”: We need a bit of relief these days!

Global and Regional Travel Updates

“Delta CEO: Coronavirus vaccine could restore profitability by summer: Delta Air Lines CEO Ed Bastian told FOX Business Network’s “The Claman Countdown” Thursday that the company could return to profitability in six months’ time as more people receive the vaccine. ‘I think we’ll be profitable this summer,’ he said. ‘That requires that the vaccines become distributed at a higher pace and that we as a country continue to take the necessary steps to combat COVID and put the virus into a contained mode.; Bastian believes the U.S. can approach herd immunity by summer, allowing more people to travel confidently.”, Fox Business, January 14, 2021

“The art and science of boarding an airplane in a pandemic: Researchers and airlines obsessed over efficiency now worry about safety, too….. ‘Airlines are dealing with a very precious balancing act,’ says Martin Rottler, an aviation veteran who now runs his own consultancy. ‘They need to balance efficiency with customer satisfaction, and now they need to add on safety.”, ARS Technica, January 23, 2021

“Your Questions About the COVID-19 Vaccine and Travel, Answered: Experts on what the industry could look like after shots become widely available. While the pandemic likely won’t end until the majority of the world’s population is vaccinated, many of us are looking ahead to a return to travel. But what will that look like after the vaccine widely available?”, Conde Nast Traveler, January 13, 2021

“What You Need to Know for Traveling in 2021: As the pandemic continues, many people are still planning major trips for later this year—here are the factors to consider before booking. Demand is double-barreled. Many travelers rebooked canceled 2020 trips for dates in 2021 and 2022. In addition, there’s massive pent-up demand for travel. But travel has changed. It will require more paperwork, preparation and patience.”, The Wall Street Journal, January 13, 2021

“Etihad, Emirates Launch IATA Travel Pass App: The International Air Transport Association (IATA) today announced partnerships with Etihad Airways (EY) and Emirates (EK) to launch the IATA Travel Pass for guests of two airlines. The IATA Travel Pass is a mobile app that helps passengers easily and securely manage their travel in line with government requirements for COVID-19 tests or vaccines.”, Airways Magazine, January 19, 2021

“Singapore Airlines aims to vaccinate entire workforce, become first fully-vaccinated carrier in the world: Singapore’s Changi Airport opened a vaccination center in Terminal 4. Singapore’s Transport Minister Ong Ye Kung, as well as Singapore Airlines CEO Goh Phong Choon, are currently urging all employees of the country’s national carrier to register for the first dose of their COVID-19 vaccinations, with the goal of completing the vaccination of all front-line workers in the aviation and maritime industries within two months.”, Fox News, January 18, 2021

“American Airlines Passengers Can Soon Upload COVID-19 Test Results to New Health Passport Before Travel: The app will be available to passengers traveling internationally starting Jan. 23.”, Travel and Leisure, January 19, 2021

“EU leaders draw up coronavirus vaccine passports to restart foreign travel: European Union leaders will discuss plans next week for coronavirus vaccination “passports” to allow people who have had the injections to avoid travel restrictions and go on holiday.”, The Times Of London, January 15, 2021

“All UK travel corridors to close on Monday to stop new Covid variants: Everyone travelling to Britain from Monday will have to produce a negative coronavirus test taken within the previous 72 hours and go into immediate isolation for up to ten days.”, The Times of London, January 16, 2021

“Lufthansa’s Boeing 747-8 (and first class) returns to the US in March: The route is set to switch back to the 747-8 on Mar. 30, 2021. This route is currently operated by the airline’s Airbus A350-900…. This marks the return of Lufthansa’s first-class service to the U.S. as well.”, The Points Guy, January 15, 2021

“Qatar Airways: More Capacity on Flights to USA: Qatar Airways (QR) has announced it will add its 12th gateway in the US with four-weekly flights to Atlanta (ATL) starting June 1. The carrier will also significantly increase frequencies, adding an additional 13 weekly flights to operate a total of 83 weekly flights across its 12 gateways.”, Airways. January 22, 2021

“KLM suspending long-haul operations to stem COVID-19 spread: As part of the Dutch government’s bid to crack down on the spread of COVID-19, the airline said that it will suspend 270 weekly flights, according to Reuters. When it takes effect on Jan. 22, the suspended routes will include all intercontinental flights as well as some connections between Amsterdam and other European destinations where crew have to stay overnight.”, The Points Guy, January 21, 2021

“Aeromexico Secures COVID-19 Testing Partnership for U.S.-Bound Travelers: In response to the new COVID-19 testing requirement for international air travelers entering the U.S., Mexico’s largest carrier Aeromexico has reached agreements with two large medical laboratories in Mexico to provide discounted COVID-19 testing and benefits for its travelers in Mexico and those on partner airline Delta Airlines.”, Airline Geeks, January 24, 2021

“Everything You Need to Know Before Traveling to Mexico During the COVID-19 Pandemic: Planning a trip soon? Here’s what you need to know.”, Travel and Leisure, January 21, 2021

“Air Canada Adds Flights to Cairo, Egypt: Air Canada (AC) is launching flights from Montréal (YUL) to Cairo (CAI) in Egypt, which marks a new destination for the airline. According to MEDIAinTORONTO, AC has confirmed the establishment of this new route.”, Airways, January 23, 2021

“Saga Cruises: First To Require Covid-19 Vaccinations, Bookings Surge – The U.K. cruise company, Saga, has become the first tour operator to require passengers to have a Covid-19 vaccination before setting sail. It marks a turning point in international travel, as more and more companies are deliberating how to safely restart travel, and as the clamours for ‘vaccination passports’ or ‘immunity passports’ become louder.”, Forbes, January 23, 2021

Australia

“Iconic fast-food chain Pizza Hut has declared ambitions to unseat rival Domino’s as the nation’s dominant pizza chain, as its private equity owner Allegro Funds explores a possible ASX float of the business.”, Brisbane Times, January 17, 2021

“Fast food giant Five Guys chooses unusual spot to launch its first site in Sydney: Seagrass Boutique Hospitality Group has signed a deal with the Panthers Group to open next door to the Leagues Club and in between a KFC and McDonalds. The Five Guys eatery will also be adjacent to the first Krispy Kreme store in Australia.”, News.com.au, January 19, 2021

The two Australia articles above are supplied compliments of Jason Gehrke, Managing Director, Franchise Advisory Centre, Brisbane

Brazil

“Brazil braced for IPO spree this year after bumper 2020: Bankers says pipeline of companies preparing to hit markets may be ‘biggest ever’. Brazil’s stock market is gearing up for another rush of flotations in 2021, after an army of new investors helped spur the strongest year for initial public offerings in more than a decade.”, The Financial Times, January 20, 2021

Mainland China – Chinese New year is February 12th

“China Trade Surplus Hits Record as Exports Surge More Than Expected: China’s goods trade surplus hit a record high last month while exports rose more than expected, official data showed Thursday, as overseas demand for personal protective and remote work equipment remained strong while the Covid-19 pandemic continued to rage across much of the world. Exports rose 18.1% year-on-year in dollar terms in December, down from 21.1% in the previous month, according to data (link in Chinese) from the General Administration of Customs. Imports increased 6.5% year-on-year in December, faster than the previous month’s 4.5%.”, Caixin Global, January 14, 2021

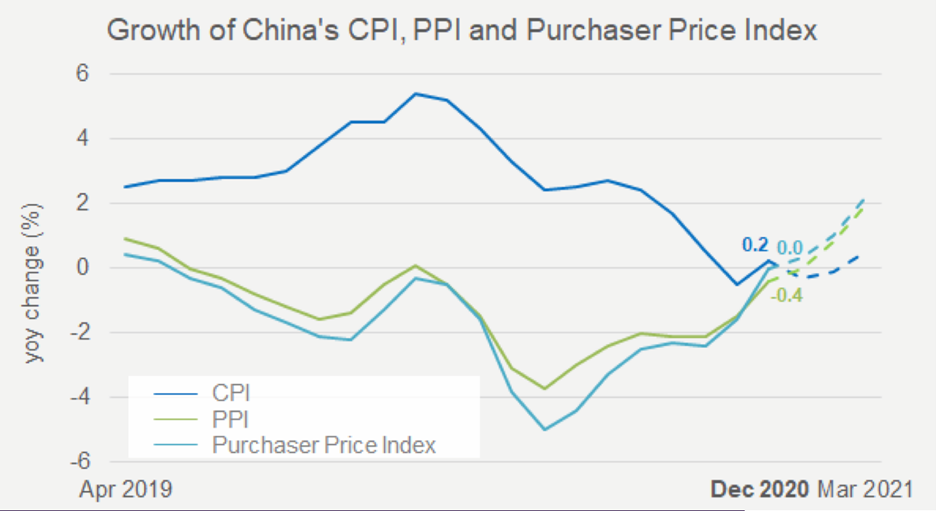

“CPI returns to growth while factory gate deflation continues to ease in December: Year-on-year growth in CPI picked up to 0.2% in December, returning to positive territory. Factory gate deflation eased as the year-on-year growth in PPI improved to minus 0.4% in December. Year-on-year growth rate of the purchaser price index of industrial products improved to 0.0% in December, ending 18 consecutive months of deflation in upstream price.”, FBIC Group, January 18, 2021

“China’s economic centre of gravity is moving south: The country’s dynamic southern provinces now account for two-thirds of output….The south’s share of GDP has risen to 65%, up from 60% five years ago and the highest on record.”, The Economist, January 20, 2021

“Starbucks cultivates growing taste of coffee in China: In 1999, the first Starbucks outlet on the Chinese mainland opened in Beijing, a pioneering move to nurture a taste of coffee in a tea-drinking culture. The company’s initial attempt in the Chinese market failed to generate a profit in the first nine years. “We were not successful in the early years,” acknowledged Howard Schultz, Starbucks Corporation’s chairman emeritus. “It took us several years to get traction and gain success and loyalty,” he said in an interview with China Global Television Network.”, Shine/ Xinhua, January 20, 2021. This articled was submitted by Paul Jones, Jones & Co., Toronto

Mexico

“Cancun Hotels Offer Free Covid Tests And Discounted Quarantine Stays: In Cancun area, hotels are taking the lead in making guests feel comfortable. Posadas Resorts, including The Grand Fiesta Americana and LiveAqua, the Hard Rock Hotel and AMResorts’ many brands are offering free on-site Covid tests.”, Forbes, January 15, 2021

Japan

“Bank of Japan lifts next year’s growth forecast, saves ammunition as virus risks linger: The Bank of Japan kept monetary policy steady on Thursday and upgraded its economic forecast for next fiscal year, but warned of escalating risks to the outlook as new coronavirus emergency measures threatened to derail a fragile recovery.”, Reuters, January 21, 2021

“Japan Denies ‘Categorically Untrue’ Rumors of 2021 Tokyo Olympics Being in Doubt: The Japanese government released a statement Friday saying rumors it’s been decided the Summer Olympics in Tokyo will be canceled because of the COVID-19 pandemic are ‘categorically untrue.’”, Bleacher Report, January 22, 2021

Singapore

“These Singapore hotels are offering health insurance for guests who catch COVID-19: In an effort to ease some of the worries that still come with traveling, one hotel group has announced it will offer health insurance to all of their guests so that their expenses will be covered in case they contract COVID-19 during their stay.”, Lonely Planet, January 20, 2021

United Kingdom

“Trucks sent to Britain return to EU without goods over post-Brexit export fears as UK firms are ‘told to set up hubs across the Channel’ to help avoid disruption: Bosses of firms claim they have been advised to set up subsidiaries in Europe”, The Daily Mail, January 25, 2021

United States

Most of the business related news in the USA since our last biweekly newsletter is focused on the new Biden administration and how they will handle trade issues.

“Biden Team Promises New Look in Trade Policy: A ‘worker-centered’ policy means less focus on opening markets for banks and drug makers. Leading members of the Biden administration are promising a very different approach to international trade. No longer would American negotiators focus on opening markets for financial-service firms, pharmaceutical companies and other companies whose investments abroad don’t directly boost exports or jobs at home.”, The Wall Street Journal, January 24, 2021

Brand News

“How McDonald’s technology investments helped it navigate the pandemic: Chief digital customer engagement officer Lucy Brady talks about outdoor digital menu boards, kiosks and more.”, Nation’s Restaurant News, January 20, 2021

“Chipotle, Just Eat Takeaway CEOs bullish on return to normal: Fast-casual U.S. chain Chipotle Mexican Grill Inc and Dutch delivery company Just Eat Takeaway.com predicted a return to more normal levels of dining out by spring or summer of 2021, they said on Thursday. The two companies, which have both prospered during the coronavirus pandemic, saw little downside to the idea that consumers will want to eat in dining rooms again – instead of grabbing burritos to go or ordering in-home delivery.”, Reuters, January 14, 2021

“Denny’s tests two virtual brands with rollout plans: Family-dining brand says the virtual brands focus on burgers and melts. Denny’s Corp., the family-dining brand, is testing two virtual brands that it plans to expand in 2021 and they “focus on burgers and melts,” the company said Monday. ‘Both concepts have shown promising results in testing and each is expected to be launched in the first half of fiscal 2021 in over half of Denny’s domestic restaurants,’ the company said in a press release before its presentation at the 23rd annual ICR Conference 2021, which was held virtually.”, Nation’s Restaurant News, January 11, 2021

“This Book Is Required Reading For Every Chick-Fil-A Manager: According to Maisie Bolton, a former Chick-fil-A assistant manager, every manager is given a copy of Ken Blanchard’s book, The New One Minute Manager, with the hope that the manager will follow the tips provided within….”, Mashed.com, January 22, 2021

“Stories from the Covid-19 Front Lines: Scott Williams, Batteries Plus CEO: How many locations has your brand reopened? How many closed permanently? ‘All of our stores remain open. In fact, none of our stores had to close as Batteries Plus was deemed an essential business almost immediately. To add to all of this, we were on track to sign for 30 new stores during the course of 2020, with the majority of those signings since March.’”, Franchising.com, January 24, 2021

“How Covid accelerated the rise of ghost kitchens: The Covid pandemic has decimated the restaurant industry and has created huge demand for food deliveries. It’s leading to the accelerated growth of ghost kitchens, or cooking facilities that produce food only for delivery and takeout with no dine-in areas. According to Euromonitor, ghost kitchens could create a $1 trillion global market by 2030.”, CNBC, January 15, 2021

“White Castle celebrates Valentine’s Day with a retro drive-in dining experience: Reservations are now open for ‘Slider Lover’s Point’. For the past 29 years, White Castle has established itself as the dark horse of Valentine’s Day hoopla. Instead of scrapping this year’s festivities due to COVID-19, White Castle is taking it outside and launching “Slider Lover’s Point,” a socially distanced drive-in dining experience that will take over more than 300 parking lots across the country.”, Time Out, January 12, 2021

“Topgolf opens first location in Dubai: Topgolf Entertainment Group has announced the opening of its first location in Dubai, UAE, which marks the fifth country where Topgolf venues now operate. The brand currently has 64 sites in operation, throughout the U.S., U.K., Australia, and Mexico. This news comes shortly after Topgolf announced plans for more venues across Southeast Asia.

Articles and Charts About Doing Business in The Times Of COVID-19 and Beyond

“These are the fastest growing jobs in Southeast Asia, according to LinkedIn: Careers in health care, education and digital services are set to be among the fastest-growing in Southeast Asia this year, according to a new report released Tuesday. LinkedIn’s inaugural “Jobs on the Rise” report points to a surge in demand for medical professionals, teachers and creatives in 2021, as the coronavirus changes the face of the region’s jobs landscape.”, CNBC, January 18, 2021

Who We Are and What We Do for Companies ‘Going Global’

Edwards Global Services, Inc. (EGS) provides a complete International solution for U.S. businesses Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving. around the world. Our U.S. based executive team has experience living and working in many countries. Our Associate network on the ground overseas covers 40+ countries.

Founded in 2001, Edwards Global Services, Inc. (EGS) takes U.S. businesses global and currently has activity in 25 countries. Our Clients are all consumer-faced brands. Edwards Global Services, Inc. (EGS) has twice received the U.S. President’s Award for Export Excellence

Find out more about the services we provide U.S. companies Going Global at:

Download our 4th quarter 2020 GlobalVue™ 40 country ranking chart at this link:

To download our latest published article, “2021 International Outlook – Mixed Prospects Amid Global Uncertainty”, go to this link:

William Edwards, CFE, is CEO and Global Advisor of Edwards Global Services (EGS). He has 46 years of international operations, development, executive and entrepreneurial experience and has lived in 7 countries. With experience in the franchise, oil and gas, information technology and management consulting sectors, he has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East. Mr. Edwards advises a wide range of companies on early to long term global development of their brands.

For market research, operations and development support on taking your business global, contact Mr. Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

EGS Biweekly Global Business Newsletter Issue 21, Monday, January 11, 2021

By William (Bill) Edwards, CEO of Edwards Global Services, Inc. (EGS)

“The goal is not to be perfect by the end. The goal is to be better today.”, Simon Sinek

“You can find inspiration in everything. If you can’t, then you’re not looking properly.”, Paul Smith, fashion designer.

“The secret of getting ahead is getting started”, Mark Twain

Introduction

Our biweekly newsletter focuses on what is happening around the world that impacts new trends, health, consumer spending, business investment and travel.

HiiHighlights in issue #21:

- Vaccine Updates from Around the World: There are 12 vaccines in various stages of approval and distribution around the world with massive logistics challenges

- This issue has links to several surveys that project economic recovery in 2021

- Economic recovery uneven: US Chamber of Commerce, but Chipotle is hiring an additional 15,000 employees

- A significant amount of generally positive travel news

- The Middle East begins to open borders for business

- Consumer spending on app stores over the holidays surpasses $100 billion

- Women Pilots to Make History: Air India’s Longest Nonstop Flight

For our biweekly newsletter, we monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covers 43 countries and provides us with updates about what is happening in their specific countries.

Please feel free to send us your input and sources of information. Our contact information is at the bottom of this newsletter.

First, a few Personal Comments

While shutdowns continue, the vaccine news is positive but with logistics challenges. Our first newsletter edition in 2021 has links to several studies projecting economic, health, travel and business trends for 2021. Asia Pacific region countries generally continue to lead the recovery with a few exceptions. Global retail and hospitality brands continue to innovate to address the new consumer trends as they prepare to come out of the COVID-19 crisis. Let’s start with vaccine news.

Vaccine Updates from Around the World

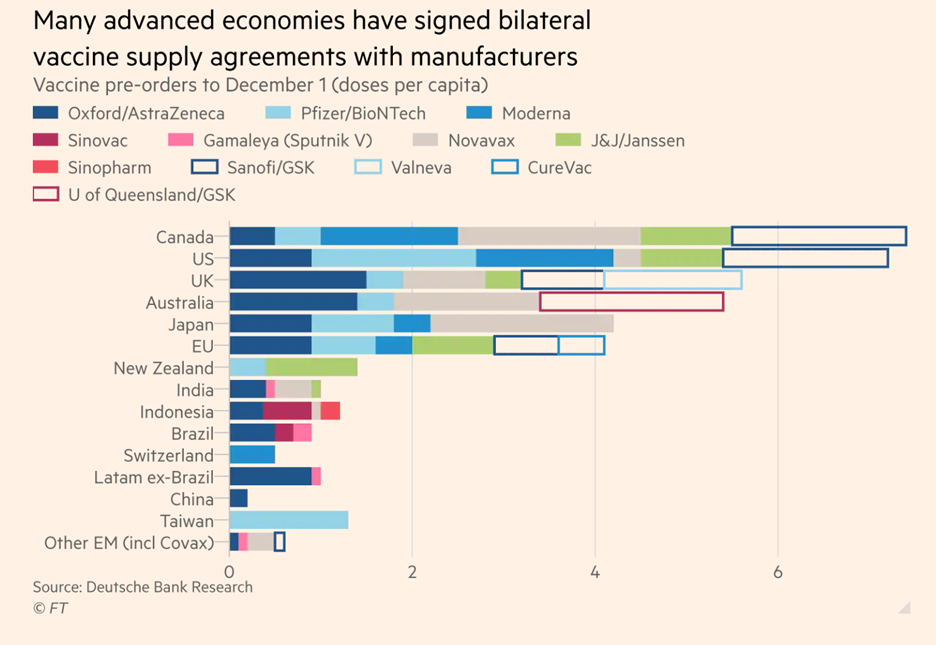

The number of approved vaccines continues to increase, but distribution is still lagging, the Financial Times, December 30, 2020

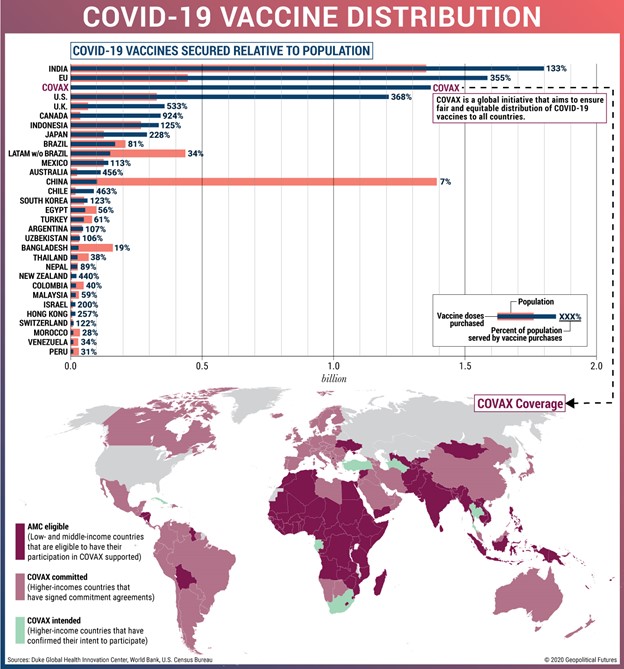

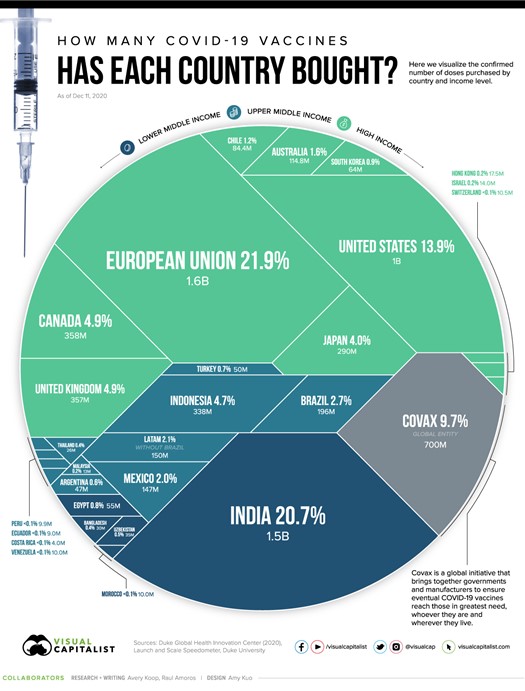

This version gives another look at the vaccines secured to go to various countries, World Bank, December 2020

“BioNTech lifts 2021 COVID-19 vaccine output target to 2 billion doses: Pfizer’s partner BioNTech boosted the 2021 delivery target for their COVID-19 vaccine to 2 billion doses, up from 1.3 billion previously, as they bring new production lines on stream and as more doses can be extracted per vial.”, Reuters, January 11, 2021

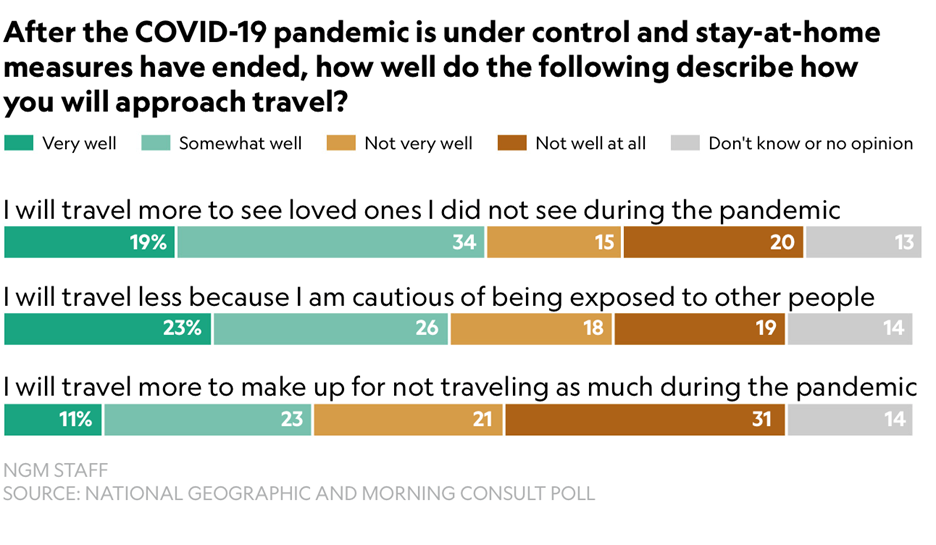

“What vaccines mean for the return of travel: COVID-19 jabs will eventually help tourism start again, but expect a trip full of immunity passports, mouthwash tests, and wary travelers.”, National Geographic, January 2021

“Moderna Raises Covid-19 Vaccine Production Estimate: Biotech company says it will make at least 600 million doses this year, up 100 million from earlier forecast. The Cambridge, Mass., company also said it is making investments and adding staff to make as much as one billion doses this year.”, The Wall Street Journal, January 5, 2021

“EU regulator approves Moderna’s COVID-19 vaccine: The European Medicines Agency on Wednesday recommended Moderna’s coronavirus vaccine for authorization in the European Union’s 27 member states…..This is the second vaccine to be granted approval by the regulator. The European Commission — which has purchased 160 million doses of the Moderna vaccine — is likely to issue final approval this week.”, Axios, January 6, 2021

“Indonesia to ink Pfizer, AstraZeneca vaccine deals as awaits Sinovac clearance: Indonesia is poised to secure coronavirus vaccines from Pfizer and AstraZeneca, the health minister said on Tuesday, as it awaits authorisation to begin its inoculation programme with a third drug, by China’s Sinovac.”, Reuters, December 29, 2020

Interesting Data and Studies

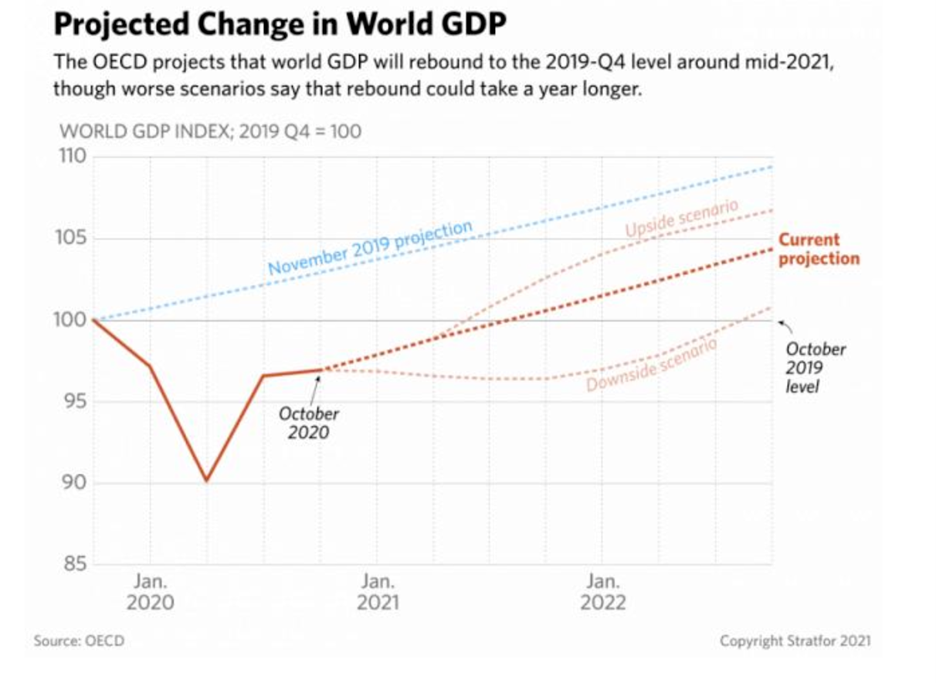

Good news from the OECD via Stratfor Worldview 2021 annual forecast, January 3, 2021

“Manufacturers Overcame Covid-19 Setbacks to End 2020 on High Note: Sector’s strength in U.S., Europe and Asia contrasts with services businesses harmed by pandemic restrictions.”, The Wall Street Journal, January 4, 2021

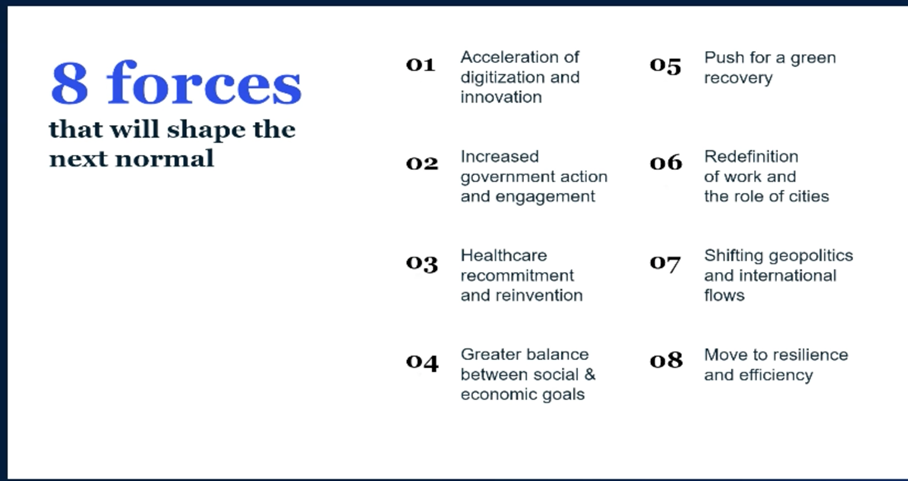

“The next normal arrives: Trends that will define 2021—and beyond: The COVID-19 pandemic has changed the world, and its effects will last. Here are some factors that business leaders should keep in mind as they prepare for the next normal.”, McKinsey & Company, January 4, 2021

“2021 Top Digital Trends and Resolutions: The pandemic forced us all to reconsider how we work and learn, all while the number of cyber threats significantly increased. Accelerated digital transformation became critical for us all to continue to live our lives and do our jobs. As we look ahead to 2021, we wanted to share our insights on some of the biggest digital trends and resolutions.”, Boston Consulting Group, January 2021

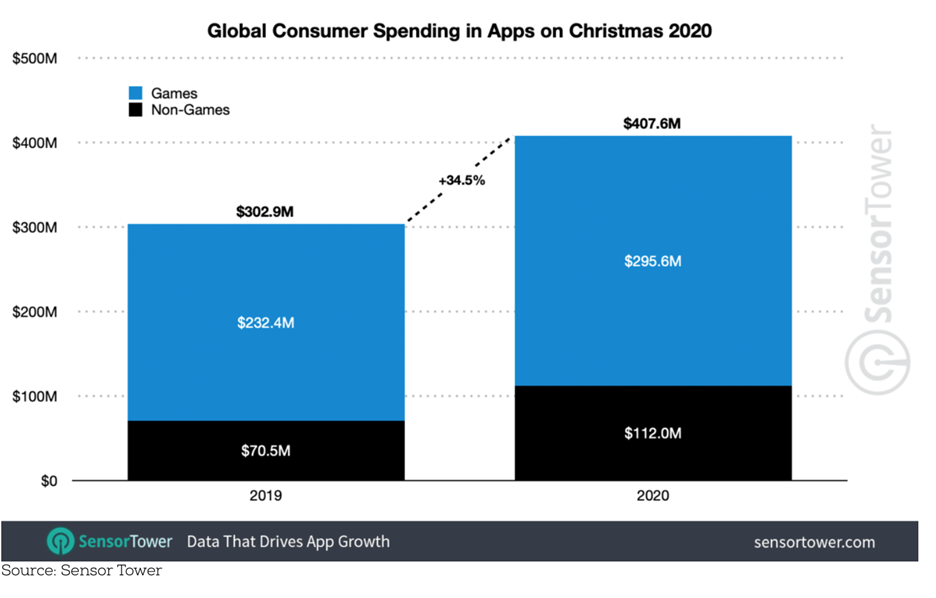

“Consumer spending on app stores surpasses $100 billion for the first time: Reported by Sensor Tower, spending on mobile apps and games has passed $100 billion in a single year for the first time in 2020. On Christmas alone, consumers spent around $407 million across Apple’s App Store and Google’s Play Store.”, iMORE, December 30, 2020

Global and Regional Travel Updates

“Delta CEO Confident There Is a ‘Turning Point’ for Travel This Year: Ed Bastian detailed what 2021 may look like in a published memo to employees. While COVID-19 continues to hinder travelers around the world, Delta Air Lines CEO Ed Bastian wrote in a New Year’s memo to employees that he was confident a “turning point” for the travel industry is ahead.”, Travel and Leisure Magazine, January 5, 2021

“World’s safest airlines named in new ‘Airline Ratings’ report: US carriers Alaska Airlines, Hawaiian Airlines, Southwest, Delta, American and United made the top 20…Qantas topped the annual list from AirlineRatings.com, a ranking which reviews 385 carriers on the following factors: crash and serious incident record; audits from governing and industry bodies; government audits; industry-leading safety initiatives; and fleet age.”, Fax News, January 4, 2021

“What A Survey By Hilton Hotels Reveals About Travel Eagerness: A recent survey from Hilton has found that 95% of Americans are missing travel right now. Though that in itself is not a groundbreaking discovery, the reasons behind this large number is worthy of attention.”, Forbes, December 30, 2020

“LAX begins rapid coronavirus testing for travelers: Fliers who pre-book an appointment at the recently built lab, located across from Terminal 6, will receive results in three to five hours. The lab, located in a shipping container, is processing about 250 to 300 rapid tests a day, with plans to ramp up to 1,000 tests daily. Additional testing sites are at Terminal 2 and Tom Bradley International Terminal, which will provide results in 24 hours.”, The Los Angeles Times, December 31, 2021

“Will you need an immunity passport to fly? How the COVID-19 vaccine will restart travel: TPG spoke to healthcare and travel professionals, as well as travelers, to understand how vaccines (once they become widely available), ongoing COVID-19 testing and potential immunity passports could reshape the travel industry.”, The Points Guy, December 27, 2020

“How Brexit Affects UK Aviation: Brexit is today a reality and major changes will affect tariffs, trade and mobility in the UK for the foreseeable future. Negotiations between the European Union (EU) and the UK regarding new rules have not come to term yet, but there are some that shed a Light on how they will affect the region’s aviation industry.”, Airways Magazine, January 2, 2021

“China Southern Ranks (World’s) Third Largest Airline: China Southern (CZ) ranks third largest airline this winter due to the gradual resumption of air traffic in the country. Since 2019, CZ has gone up by three places, with a 16% increase per year from year to year® domestic flights, not international. As such, China’s total domestic seats are up by 35% this winter, OAG data shows. However, a shadow of its former self, down by 87%. Chinese airlines now account for seven of the world’s top-20 airlines, up from three last (year)., Airways Magazine, January 9, 2021

“Canada announces strict new entry requirements: Canada is announcing strict new entry requirements for all international arrivals. The news comes as a new strain of COVID-19 first identified in the U.K. that spreads even more easily is showing up in more and more countries including Canada.”, The Points Guy, December 31, 2020

“Singapore Airlines resumes UK, Australasia Flights: Singapore Airlines (SQ) has resumed flying to the UK and to Australia and New Zealand under a special agreement. Last month, the government of Singapore banned foreign travelers in the UK from visiting or passing through the city state. Australia and New Zealand remain closed to foreign nationals, but resident citizens can return home by carrying out a 14-day preventive quarantine.”, Airways Magazine, January 6, 2021

“New app can be used as proof you’ve been vaccinated for COVID-19: Your doctor can upload proof of vaccination to software that links to app on your phone.”, WFAA.com, December 29, 2020

“Copa Returns to Its Cabana in Tampa: Copa Airlines (CM) announced today that after a nearly ten-month hiatus due to travel restrictions in the region relating to the COVID-19 pandemic, the carrier is resuming operations from Tampa International Airport (TPA) and Tocumen International Airport (PTY) in Panama.”, Airways, January 10, 2021

Asia Pacific Countries

“HSBC names 2 countries that have tackled the virus and will reap the benefits: Singapore and Vietnam have been successful in controlling Covid in 2020 and are likely to keep the situation contained next year, said HSBC Global Research’s Joseph Incalcaterra. Singapore and Vietnam have been successful in controlling the coronavirus in 2020 and are likely to keep the situation contained next year, an economist said this week.”, CNBC, December 30, 2020

Australia

“McDonald’s Australia reaches 1,000-store milestone with sustainability flagship: The new restaurant features 25 core sustainability initiatives. Located at Melton South, the restaurant is operating fully on renewable energy and features 25 core sustainability initiatives, including Happy Meal toy recycling, carbon neutral McDelivery via Uber Eats and DoorDash, a bespoke PlayPlace made with recycled content, electric vehicle charging stations, and daylight harvesting lighting. An on-site solar system will generate around 42,000kWh per year, the company said., QSR Media Australia, December 11, 2020

“Radical plan to save Australia’s shopping centres: Smashed by online retail and battered by COVID, shopping centres have been all but written off. But one reckons it has the secret to survival – and it involves Ninja Warrior. The firm calls it a “retail-as-a-service concept”. In layman’s terms, it’s a space designed specially for online retailers that enables them to set up shop for a fraction of the price and time it would normally take. Rather than a month to build the interior of a store, Mirvac reckons it can now be done in a single day.”, News.com.au, December 15, 2020

“Mark Wahlberg is Bringing His Wahlburgers Chain to Australia: While in Australia promoting his F45 fitness chain, Wahlberg reportedly took a liking to the scenery. According to The Daily Telegraph, the actor signed a $50 million deal with the owners of the United Cinemas chain to house his restaurants at over 15 locations across Australia.”, Manofmany, January 5, 2021

“Guzman y Gomez ends the year with an $86 million investment: Specialist funds manager Magellan Financial Group has acquired 10 percent of existing shares from (Mexican) restaurant chain Guzman y Gomez, the business announced on Tuesday morning. The deal cost Magellan $86.8 million, leaves TGM Growth Partners and GYG founder and CEO Steven Marks as the chain’s largest shareholders, and will allow Magellan head of governance and advisory Craig Wright to join the board.”, Inside Retail Australia, December 22, 2020

Mainland China – Chinese New year is coming up again soon!

“Apple launches special, limited edition AirPods Pro for Chinese New Year: Since the next year is Year of the Ox in the Chinese calendar, Apple’s new AirPods Pro – noticed by 9to5Mac – have a little image of a cow on the box and engraved on the earbuds’ case. The image is actually a reworked version of the cow face emoji. These limited edition AirPods Pro are only available in certain Asian markets, such as China, Hong Kong, Singapore, Taiwan, and Malaysia.”, Mashable, January 7, 2021

“Chain Favorites Foreign Hotels Expand Against Trend: In the past 2020, foreign hotel giants did not slow down their expansion due to the epidemic. On January 4, a reporter from Beijing Business Daily learned from several hotel groups that last year, InterContinental Group opened nearly 60 hotels, Hilton Group expanded dozens of high-end hotels, and Marriott, the largest hotel group, also opened in China. 36 hotels.”, Beijing Commercial Daily, January 5, 2021. Compliments of Paul Jones, Jones & Co., Toronto

“China’s Factory Outlook Eases With Recovery Still on Track: A gauge of China’s manufacturing industry moderated in December from a three-year high in the previous month, with the economy’s recovery stabilizing as the year comes to a close. The official manufacturing purchasing managers’ index fell to 51.9 from 52.1 in November, the National Bureau of Statistics said Thursday, lower than the median estimate of 52 in a Bloomberg survey of economists. The nonmanufacturing gauge, which reflects activity in the construction and services sectors, dropped to 55.7. Bloomberg via Caixing Global, December 31, 2020

India

“Women Pilots to Make History: Air India’s Longest Nonstop Flight: Four women Pilots will make history today by flying Air India’s (AI) inaugural flight from San Francisco International Airport (SFO) to Kempegowda International Airport (BLR). The 17-hour-long route, covering a distance of 9,942 mi (16,000km), will be Al’s longest nonstop flight. It will take the Pilots directly over the North Pole. Making them the first all-female Crew to operate a flight over that region.”, Airways Magazine, January 8, 2021

Bill Edwards personal comment: 3 years ago, I flew an all-female crew flight between New Delhi and Mumbai

Korea

“South Korea exports post sharpest expansion in 26 months in December but slide 5.4% year-on-year in 2020. South Korea’s exports expanded at their fastest pace in 26 months in December, on robust chip demand and improved global demand, providing additional signals that the recovery is on track despite resurgences in the novel coronavirus.”, Reuters, December 31, 2020

The Middle East

“How the Middle East is defying a Covid downturn: Tarek Fadlallah took his seat among the bankers enjoying after-work drinks on the terrace of the International Financial Centre in Dubai on Wednesday and declared: ‘We’re seeing an economic bounce-back. Everything’s trending in the right direction.’ Fadlallah, who has run Nomura Asset Management across the Middle East for the past six years, can scarcely believe it.”, The Times of London, January 10, 2021

“Saudi Arabia ends entry ban, keeps some coronavirus restrictions: Saudi Arabia said that entry to the kingdom by sea land and air will be resumed starting Sunday after a ban that lasted two weeks amid fears of a new coronavirus variant, the state news agency reported on Sunday. A ministry of interior official said that some restrictions including asking people coming from countries where the new variant spread such as the UK, South Africa and any others, to stay at least 14 days out of these countries before entering the kingdom.”, Reuters, January 2, 2021

“Saudi Arabia to Open Borders with Qatar: Saudi Arabia has agreed to open its air, sea, and land borders with Qatar. The move will help to end a dispute that has lasted more than three years and triggered a crisis in the oil-rich Gulf – setting two US allies against each other. According to The Financial Times, Kuwait mediated the agreement and has said that the borders would be open beginning Monday night.”, Airways, January 4, 2021

Peru

“Peru’s Economy Gets a Wake-Up Call. Will Its Leaders Listen? Peru’s post-pandemic path to economic recovery will primarily require retaining confidence in prudent fiscal management and political stability, as well as addressing the structural issues impeding the country’s long-term financial sustainability.”, Stratfor, January 6, 2021

The Philippines

“Philippines signs deal to secure 30 million doses of COVID-19 vaccine Covovax: distributor: The Philippine government has signed a deal to secure the supply of 30 million doses of the COVID-19 vaccine Covovax from Serum Institute of India (SII), the latter’s local partner said on Sunday.”, Reuters, January 10, 2021

United Kingdom

“No Deal’ Brexit Averted: EU/U.K. Reach Historic Bilateral Trade Deal: The full contours of the Agreement are detailed in a 1,256-page text released by the European Commission on December 25, 2020, and cover a broad array of issues including trade in goods and services, digital trade, intellectual property, public procurement, aviation and road transport, energy, fisheries, social security coordination, law enforcement and judicial cooperation in criminal matters, thematic cooperation and participation in EU programs.”, Faegre Drinker summary, December 30, 2020

“Approval of Oxford vaccine hailed as game-changer in Covid fight: Astrazeneca chief promises 2 million doses a week. The Covid vaccine developed by Oxford University and the drugmaker Astrazeneca has been approved for use in Britain, with government advisers saying that a single shot could achieve 70 percent protection.”, The Times of London, December 30, 2020

“COVID-19: Retail, leisure and hospitality firms to get up to £9,000 to help cope with lockdown: Rishi Sunak said the measures would help businesses get through the months ahead and sustain jobs for when firms reopen. Businesses in the specified sectors across the UK will receive up to £9,000 per property, costing a total £4bn. An estimated 600,000 properties are expected to benefit.”, Sky News, January 5, 2021

“BBC to put lessons on TV during lockdown: BBC TV is to help children keep up with their studies during the latest lockdown by broadcasting lessons on BBC Two and CBBC, as well as online. Schools have been closed to most children across the UK as part of tougher measures to control Covid-19. The BBC will show curriculum-based programmes on TV from Monday. They will include three hours of primary school programming every weekday on CBBC, and at least two hours for secondary pupils on BBC Two.”, BBC News, January 6, 2021

United States

“Prediction Consensus: What the Experts See Coming in 2021: Making predictions is a tricky business at the best of times, but especially so after a year of upheaval. Even so, that didn’t stop people from trying their hand at reading the crystal ball. If anything, the uncertainty creates a stronger temptation for us to try to forecast the year ahead.”, Visual Capitalist, January 5, 2021

“Economic recovery uneven: US Chamber of Commerce – The survey includes responses from thirty-six business leaders across a wide range of industries, from healthcare to finance and energy to entertainment. A new analysis released Monday by the U.S. Chamber of Commerce reveals that the United States’ economic recovery from the coronavirus pandemic continues to be uneven.”, Fox Business, January 11, 2021

“Traveling soon? Here’s where you can quickly get a COVID-19 PCR test for travel.”, The Points Guy, January 7, 2020

Vietnam

“Lowest in 10 years, Vietnam 2020 growth among world’s highest: A 4.48 percent Q4 growth has propelled Vietnam’s annual growth to 2.91 percent for the year, the General Statistics Office said Sunday afternoon. ‘This is the lowest GDP growth level in the 2011-2020 period. However, given the negative impacts of the Covid-19 pandemic, it is considered a success for Vietnam, with the growth rate among the world’s highest,’ Nguyen Thi Huong, head of the GSO, said at a press briefing.”, VF Franchise Consulting, Ho Chi Minh City, December 29, 2020

“Long Thanh International Airport to Break Ground Next Week: The aviation industry in Vietnam is growing fast. With new startups in Vietnam like Vietravel Airlines, Bamboo Airlines, and VietJet Airlines emerging, airports in Vietnam can handle limited passengers. For example, Ho Chi Minh City’s main airport, Tan Son Nhat International Airport, is designed to handle 25 million passengers. However, pre-pandemic in 2019, the airport carried 40.6 million passengers, according to data from the Civil Aviation Authority in Vietnam. The overcapacity at Tan Son Nhat International Airport has necessitated a new airport to be built. The solution to this will break ground on January 5, 2021, which is Long Thanh International Airport.”, Airline Geeks, January 2, 2021

Brand News

“Burger King revamps brand for first time in over 20 years: Burger King has redesigned its brand including its logo, food packaging and restaurants in order to reflect improvements such as eliminating preservatives, the fast food chain announced on Thursday. ‘We’ve been doing a lot in terms of food quality and experience,’ said Fernando Machado, global chief marketing officer of Restaurant Brands International, which owns Burger King.”, Reuters, January 7, 2021

“2021 Will Be “Road To Recovery” For Foodservice Industry Say Reports: Technomic foresees strong to moderate growth—specifically in the U.S. and Canada—over the next 12 months, being led by aggressive strategies. One commonality across regions is the streamlining of menus.”, Franchising.com, December 31, 2020

“Chipotle to hire 15,000 workers in the United States: Chipotle Mexican Grill Inc said on Monday it would hire 15,000 workers in the United States, as the fast-casual burrito chain benefits from strong demand during the COVID-19 pandemic. The move comes about five months after Chipotle said it planned to add 10,000 more people to its more than 85,000-strong workforce. It now employs about 94,000 people, most of them in the United States.”, Reuters, January 11, 2021

Articles and Charts About Doing Business in The Times Of COVID-19 and Beyond

“Change Is Just Beginning: How Leaders Can Focus on Meeting 2021’s Challenges: As this new year begins amid much economic uncertainty, companies that successfully navigated 2020’s turbulence can’t rest. They need engaged, forward-thinking leaders who can keep adjusting and focusing on the right factors in a volatile business environment. We live in a VUCA world, which stands for volatility, uncertainty, complexity, and ambiguity. We need to adjust to how fast things are changing.”, Franchising.com, January 10, 2021

“Demystifying Global Consumer Choice: What really drives consumer choice around the world? An intensive BCG research project offers three key insights…”, Boston Consulting Group, December 15, 2020

“The Serial Innovation Imperative – THE MOST INNOVATIVE COMPANIES 2020: Facing turbulent and fast-changing markets, innovators need a well-tuned innovation system that can spot emerging product, service, and business model opportunities—and then rapidly develop and successfully scale them—over and over again.”, The Boston Consulting Group, January 2021

Who We Are and What We Do for Companies ‘Going Global’

Edwards Global Services, Inc. (EGS) provides a complete International solution for U.S. businesses Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving. around the world. Our U.S. based executive team has experience living and working in many countries. Our Associate network on the ground overseas covers 40+ countries.

Founded in 2001, Edwards Global Services, Inc. (EGS) takes U.S. businesses global and currently has activity in 25 countries. Our Clients are all consumer-faced brands. Edwards Global Services, Inc. (EGS) has twice received the U.S. President’s Award for Export Excellence

Find out more about the services we provide U.S. companies Going Global at:

Download our 4th quarter 2020 GlobalVue™ 40 country ranking chart at this link:

To download our latest published article, “2021 International Outlook – Mixed Prospects Amid Global Uncertainty”, go to this link:

William Edwards, CFE, is CEO and Global Advisor of Edwards Global Services (EGS). He has 46 years of international operations, development, executive and entrepreneurial experience and has lived in 7 countries. With experience in the franchise, oil and gas, information technology and management consulting sectors, he has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East. Mr. Edwards advises a wide range of companies on early to long term global development of their brands.

William Edwards, CFE, is CEO and Global Advisor of Edwards Global Services (EGS). He has 46 years of international operations, development, executive and entrepreneurial experience and has lived in 7 countries. With experience in the franchise, oil and gas, information technology and management consulting sectors, he has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East. Mr. Edwards advises a wide range of companies on early to long term global development of their brands.

For market research, operations and development support on taking your business global, contact Mr. Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

EGS Biweekly Global Business Newsletter Issue 20, Monday, December 28, 2020

By William (Bill) Edwards, CEO of Edwards Global Services, Inc. (EGS)

“It is amazing what you can accomplish if you do not care who gets the credit”, President Harry Truman

“Great minds discuss ideas, average minds discuss events, small minds discuss people”, Eleanor Roosevelt, compliments of Jeff Bevis

“The best way to predict the future is to create it”, Peter Drucker

Introduction

Best wishes to our readers in 20 countries for the holidays and a calmer, healthy and prosperous 2021. Our biweekly newsletter focuses on what is happening around the world that impacts new trends, health, consumer spending, business investment and travel. This is our 20th edition, 40 weeks since the COVID crisis formally hit.

A few highlights in issue #20:

- Three vaccines have now been approved and two are being distributed in the EU, USA and the United Kingdom – a global vaccine update

- The United Kingdom and the European Union have an agreement to part ways as of January 1, 2021

- Nobel Perspectives & Economic Views: Asking the questions that matter. A UBS current knowledge resource

- The Impact of Covid-19 on Global & Local Supply Chains

- McDonald’s China releasing Oreo, Spam burger for limited time…..seriously!

- A bit of fun: Stroll down memory lane with a 1996 instructional video on “How to Internet”

For our biweekly newsletter, we monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covers 43 countries and provides us with updates about what is happening in their specific countries.

Please feel free to send us your input and sources of information. Our contact information is at the bottom of this newsletter.

First, a few Personal Comments

The world is a mixed place at the time of this holiday season report. Multiple vaccines are being deployed. Businesses are open in Asia but not as much in Europe and the USA. Cross border travel and tourism remains constrained, but airlines and governments are seeking ways to get planes flying long hauls once again. Predictions for the world’s economy for 2021 are optimistic. Let’s start with a vaccine update.

A COVID Vaccine Update

“Astra Zeneca’s Soriot says vaccine has a “winning formula’: After the strangest festive period many of us have lived through, there is a rare dose of good news in today’s section – one has the potential to make a lot of difference to all our lives. It’s contained in Sabah Meddings’ interview with Pascal Soriot, the boss of Astra Zeneca. He has won our award for businessperson of the year – thanks to the drugs giant’s work tackling Covid-19. Soriot reveals that its vaccine – which we have bought 100 millions doses of – should work against the new strain of the virus, and that it should be just as effective as the other jabs being developed.”, The Sunday Times of London, December 27, 2020

“’The beginning of the end’: Europe rolls out vaccines to fight pandemic: Europe launched a mass COVID-19 vaccination drive on Sunday with pensioners and medics lining up to get the first shots to see off a pandemic that has crippled economies and claimed more than 1.7 million lives worldwide.”, Reuters, December 27, 2020

“EU Begins Covid-19 Vaccinations After Clearing Pfizer Shot: European Union countries began vaccinating against Covid-19 as members of the 27-nation bloc struggle with a rising death toll from the virus. The coordinated rollout launched on Sunday is getting underway less than a week after the EU cleared a shot developed by Pfizer Inc. and BioNTech SE. Several European countries, including Germany, have imposed tougher restrictions in an effort to contain a winter surge in infections and deaths.”, Bloomberg, December 27, 2020

“The COVID-19 vaccines are here: What comes next? Countries must prepare now for the largest simultaneous public-health initiative ever undertaken”, McKinsey & Co., December 9, 2020

The United Kingdom and the Remaining 27 EU Countries reach an Agreement

“’Parting is such sweet sorrow’: EU and UK clinch narrow Brexit accord: Britain clinched a narrow Brexit trade deal with the European Union on Thursday, just seven days before it exits one of the world’s biggest trading blocs in its most significant global shift since the loss of empire.”, Reuters, December 23, 2020

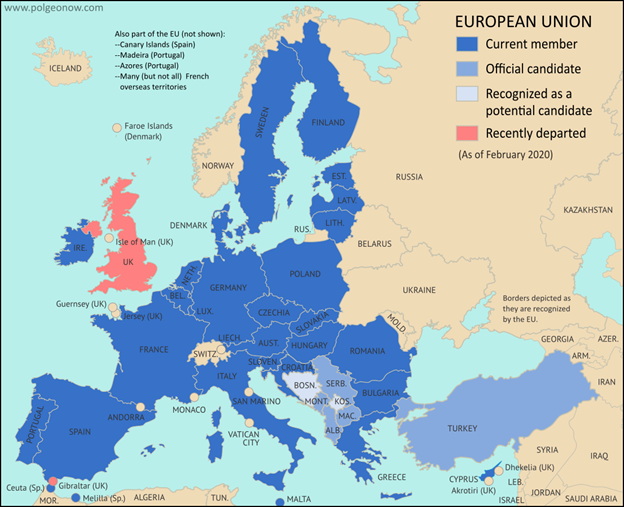

The European Union and the United Kingdom have a final agreement to separate as of January 1, 2021. This is what the regional alliance map looks like post January 1, 2020.

Some Interesting Year End Data

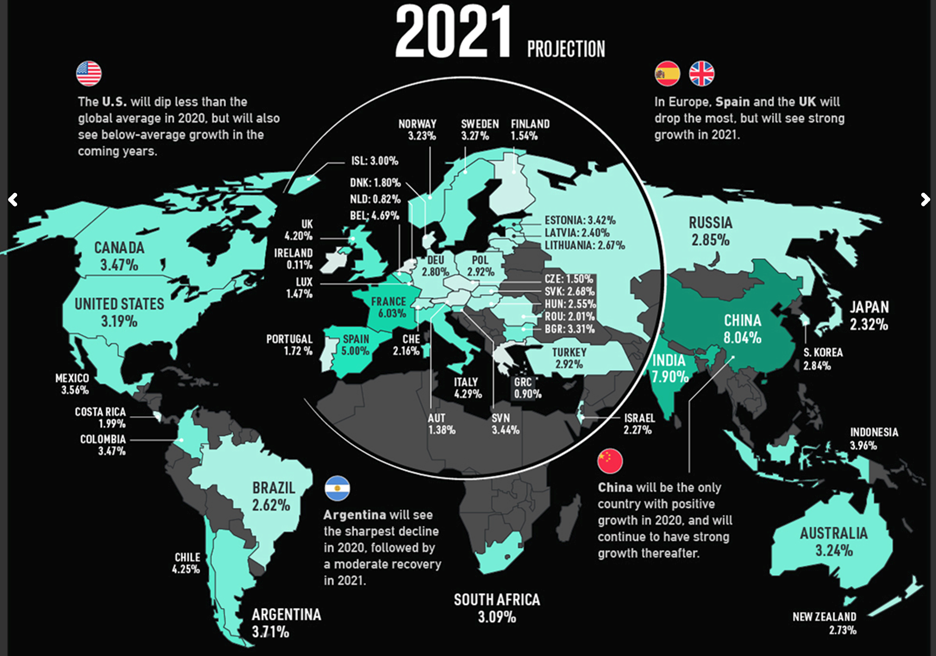

“The Organization for Economic Co-operation and Development (OECD) projects that after a 4.2% drop this year, the global economy will reach pre-pandemic levels in 2021. This chart, which uses data from the OECD, shows which countries will recover the fastest from the global recession in 2020”, Visual Capitalist, December 15, 2020

“Bill Gates: These breakthroughs will make 2021 better than 2020. The latest on the innovations that will let us go back to normal.” GatesNotes, December 22, 2020

“Global cargo logjam deepens, delaying goods bound for retailers, automakers: A surge in demand for furniture, exercise equipment and other goods for shoppers sheltering at home in a worsening COVID-19 pandemic has upended normal trade flows. That has stranded empty cargo containers in the wrong places, spawning bottlenecks that now stretch from factories to seaports.”, Reuters, December 23, 3030

A Bit of Fun in these Times

“Stroll down memory lane with this 1996 instructional video on How to Internet: Everything You Need to Know About… Introduction to the Internet is on the Internet Archive.”, Ars Technica, December 13, 2020

Global and Regional Travel Updates