Biweekly Global Business Newsletter Issue 152, Tuesday, January 20, 2026

“We live in excessively interesting times”

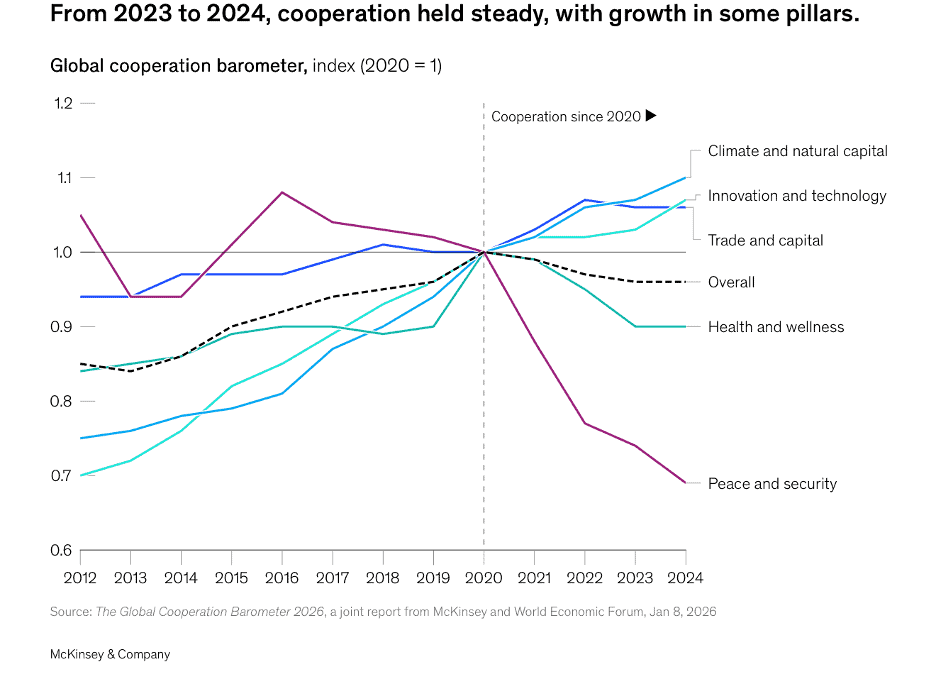

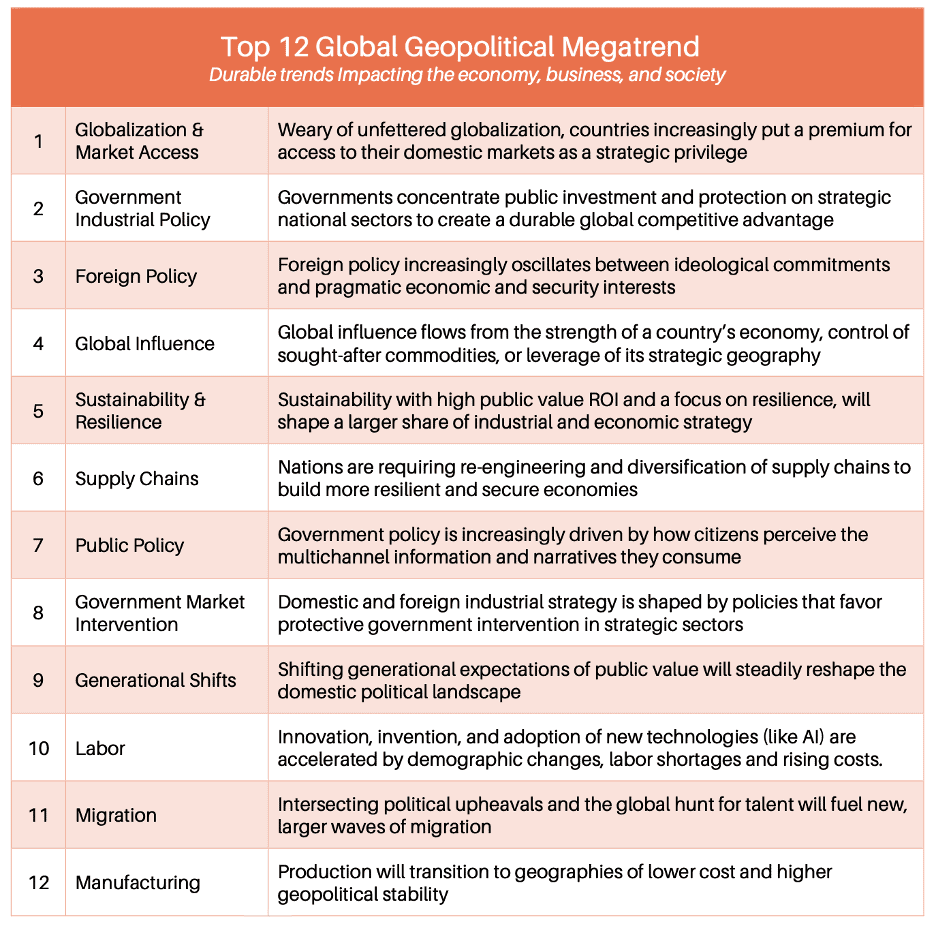

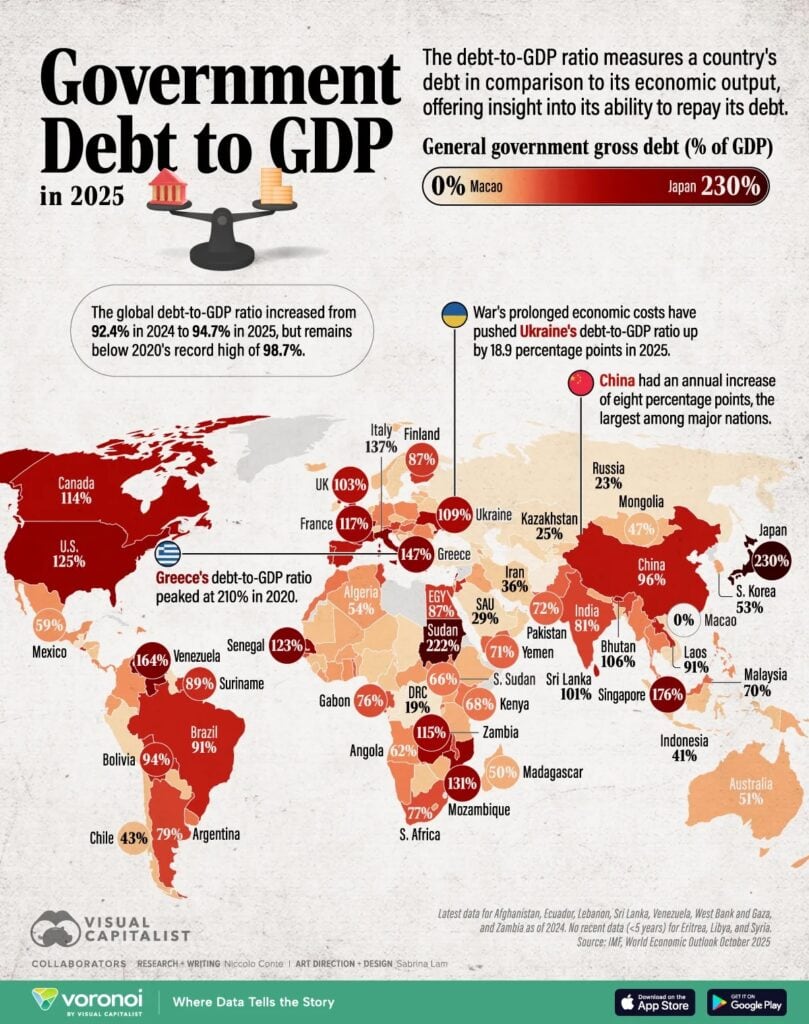

Welcome to the 152nd Edition of the Global Business Update – As 2026 begins, global business is neither unraveling nor stabilizing—it is recalibrating. New research from McKinsey and the World Economic Forum shows that while global cooperation remains intact, its structure is changing. Traditional multilateral frameworks are weakening, replaced by more flexible, issue-specific arrangements around data, services trade, capital flows, and technology. For executives, this means a more fragmented, regional, and less predictable operating environment. This edition has news from Canada, China, the European Union, Malaysia, Taiwan, the United Kingdom, the USA and Vietnam. Silver and copper are making news.

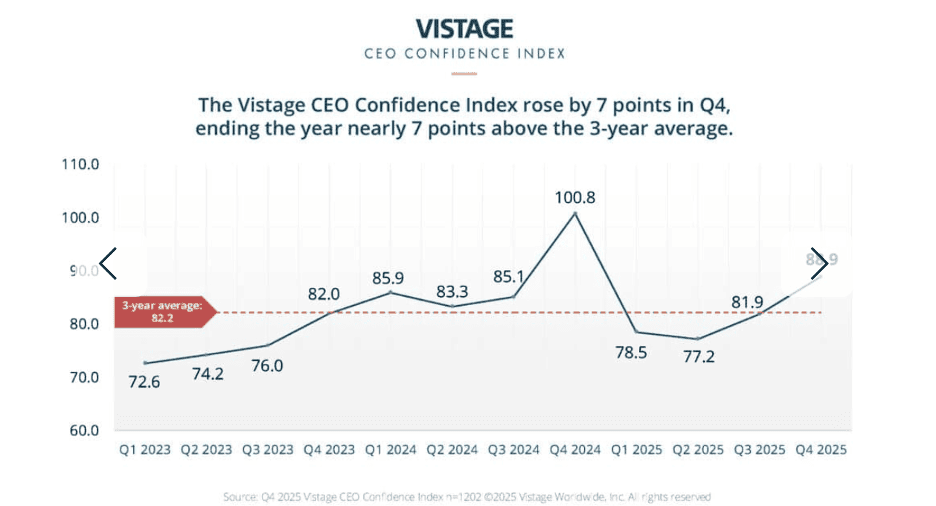

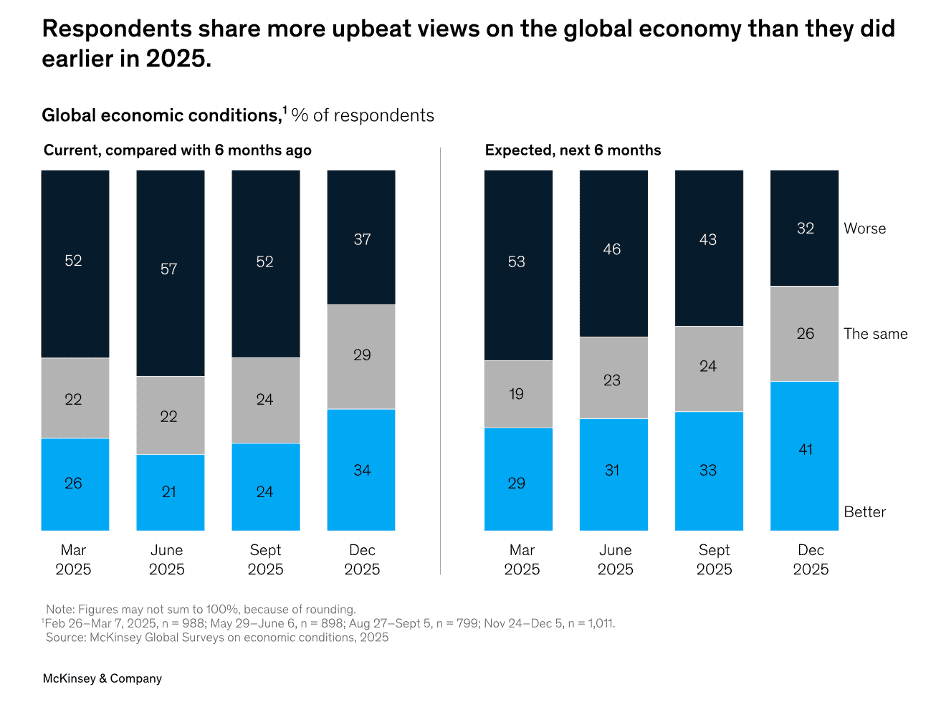

Business confidence is cautiously improving. CEO sentiment has rebounded from early-2025 lows not because uncertainty has eased, but because leaders are learning to operate within it. Trade volatility, shifting tariff regimes, geopolitical friction, and supply-chain reconfiguration are no longer viewed as temporary disruptions—they are now baseline planning assumptions. Layer on the rapid commercialization of AI, uneven technology adoption, and rising economic nationalism, and it is clear that global strategy today requires resilience, flexibility, and deep local insight—not just scale.

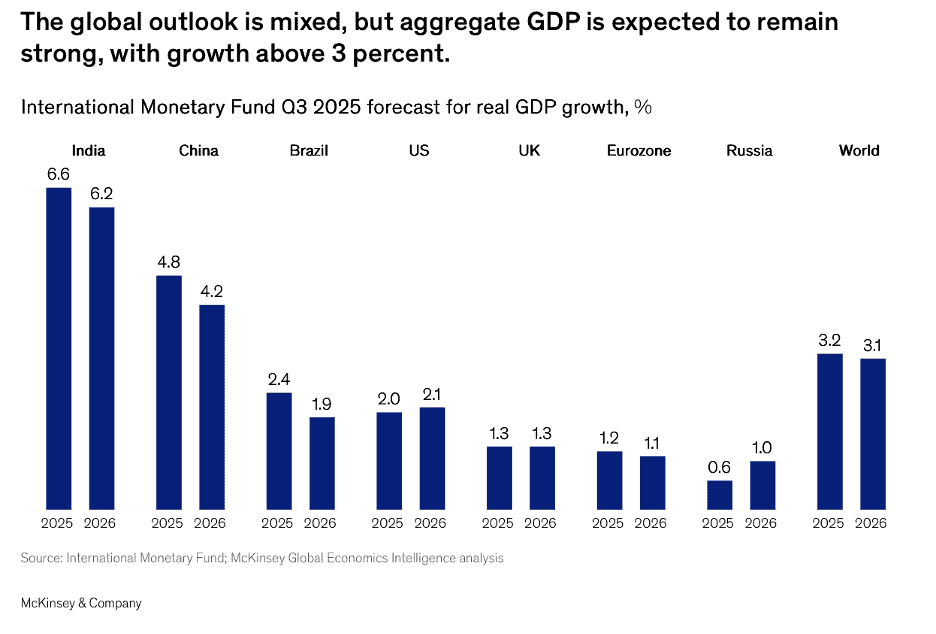

The data in this issue reinforces a consistent message: growth still exists, but it is uneven and increasingly shaped by demographics, consumer behavior, and national policy choices. Markets such as Vietnam, the UAE, and parts of Asia continue to outperform, while others face slower consumption, trade realignment, or rising cost pressures.

Against this backdrop, global franchising remains one of the most effective vehicles for international expansion. Recent deals and development activity confirm that brands with adaptable models, strong local partners, and market-specific strategies are still scaling globally. In this edition we see global development news from Costa Coffee®, Denny’s®, Domino’s Pizza (Australia), Fat Burger®, Jolibee®, Mr. Transmission®, Pollo Tropical®, Raising Canes® and TGI Friday’s®.

This edition’s book review highlightsIn The Triangle of Power: Rebalancing the New World Order, Alexander Stubb avoids simplistic narratives about a new Cold War and instead offers a clear, usable framework for understanding today’s global order. He argues that power is no longer concentrated in a single bloc or defined solely by U.S.–China rivalry. Instead, it is distributed across three interacting forces: the Global West, the Global East, and the Global South.

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive our biweekly newsletter by email every other Tuesday, click here https://insider.edwardsglobal.com

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business. We do not get involved with or report on politics!

PLEASE NOTE: Some of the information sources that we provide links to in our newsletter require a paid subscription to directly access them. Clicking on a link may not give the reader access to the content.

Edited and curated by: William (Bill) Edwards, CEO & Global Business Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA. Contact Bill with questions, comments and contributions. Bedwards@edwardsglobal.com, +1 949 375 1896

Link to our current and past newsletters: https://edwardsglobal.com/geowizard/

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

First, A Few Words of Wisdom From Others For These Times

“We live in excessively interesting times”, Bronwen Maddox, Executive Director, Chatham House

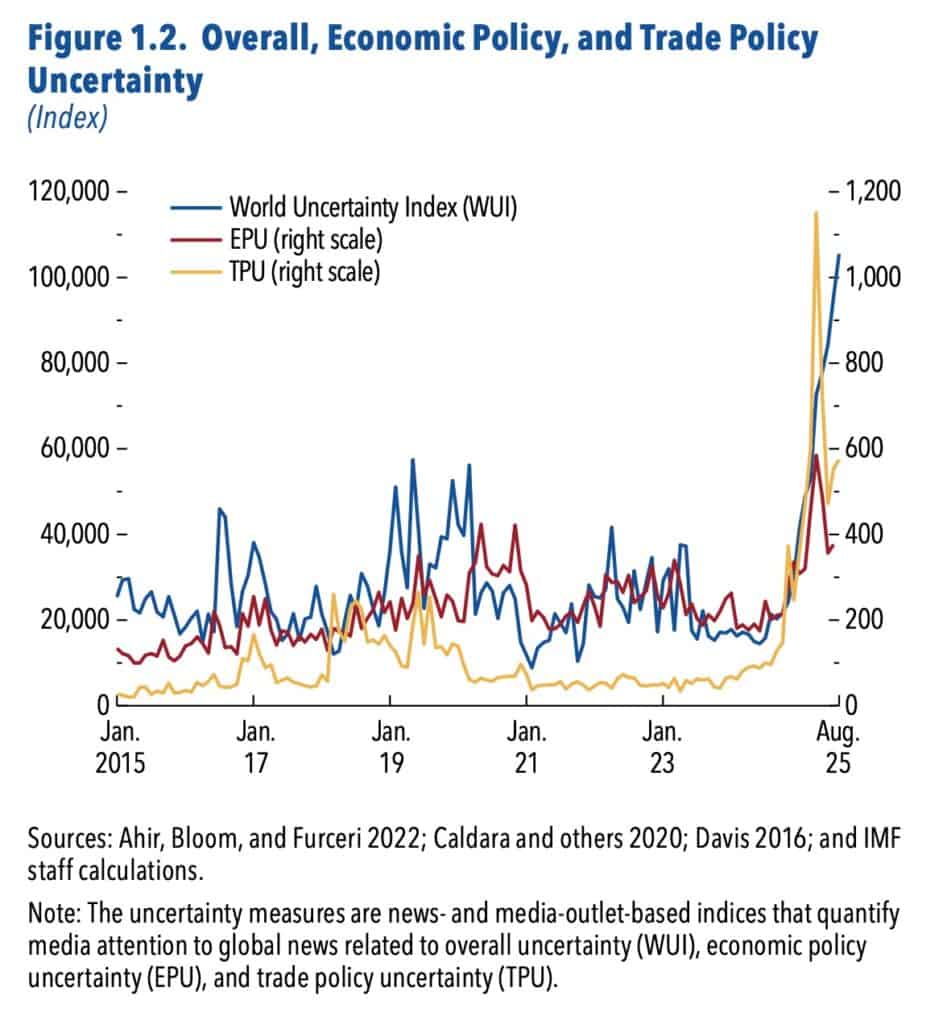

“Uncertainty is bad for business.” — IMF Managing Director Kristalina Georgieva

“Globalization is a fact of economic life.” — Carlos Salinas de Gortari, former President of Mexico

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Highlights in issue #152:

The Global Cooperation Barometer 2026

The Economic Toll of Trump’s Policies Will Soon Be Visible

China’s Slowdown Is Set to Deepen as Pivot to Consumption Stalls

Here are four ways AI and talent trends could reshape jobs by 2030]

Franchise Global News Section: Costa Coffee®, Denny’s®, Domino’s Pizza (Australia), Fat Burger®, Jolibee®, Mr. Transmission®, Pollo Tropical®, Raising Canes® and TGI Friday’s®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

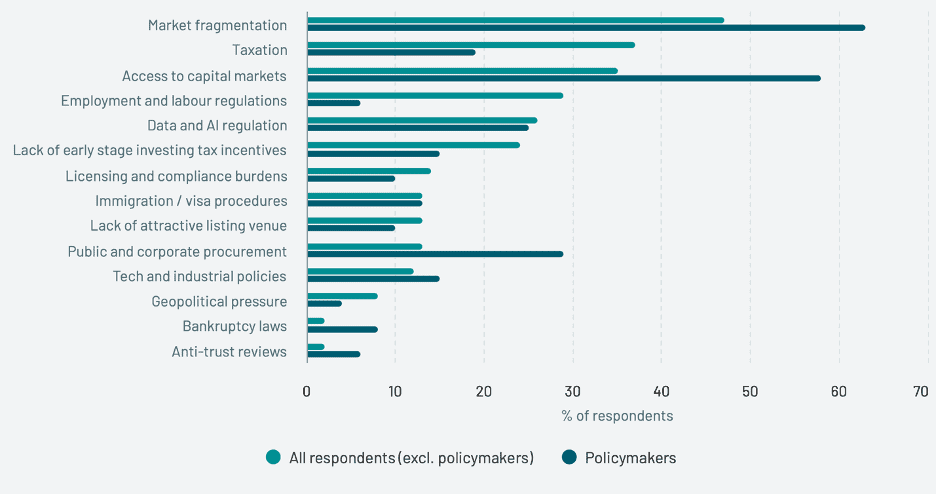

“The Global Cooperation Barometer 2026 – New research from McKinsey and the World Economic Forum finds that global cooperation is holding steady, but its shape is evolving. The 2026 edition of the Global Cooperation Barometer shows that overall cooperation is largely unchanged from previous years, but its composition appears to be changing (exhibit). Metrics relating to multilateralism weakened the most. Metrics in which more flexible and smaller arrangements of cooperation can operate—in data flows, services trade, and select capital flows, for example—have continued to grow, including in 2025.”, McKinsey & Co., January 8, 2026

===============================================================================================

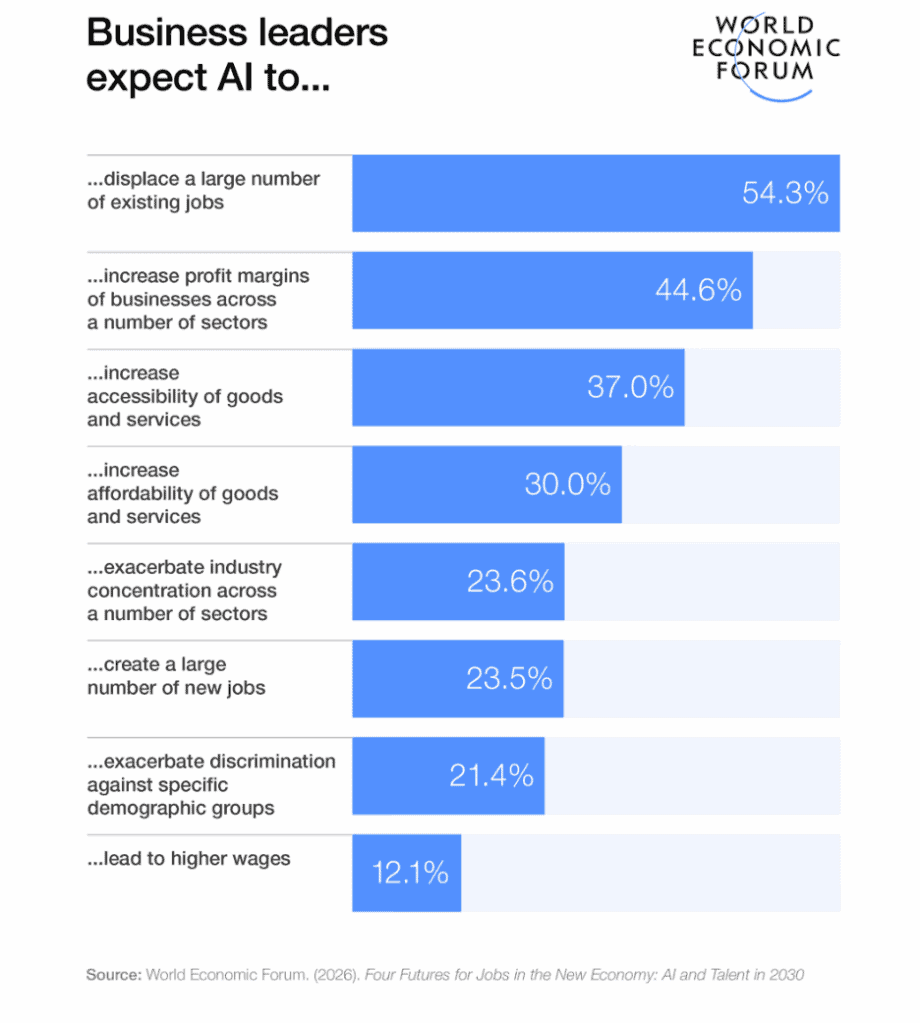

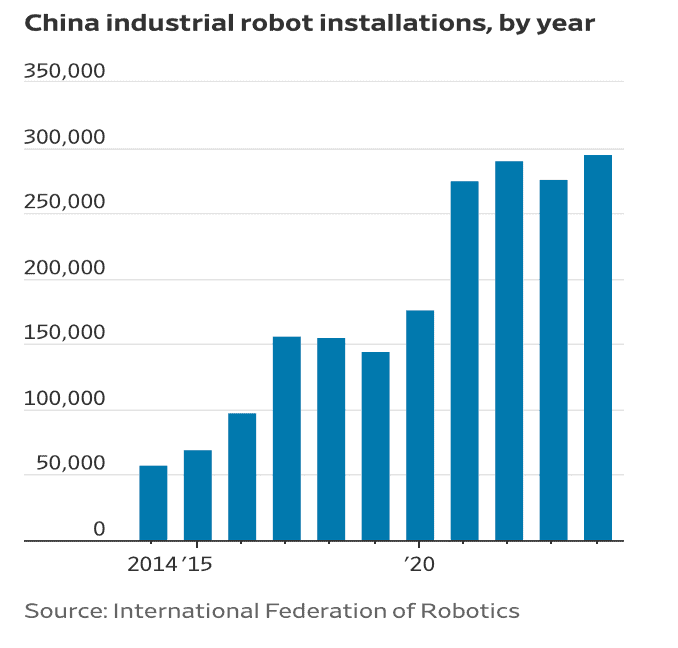

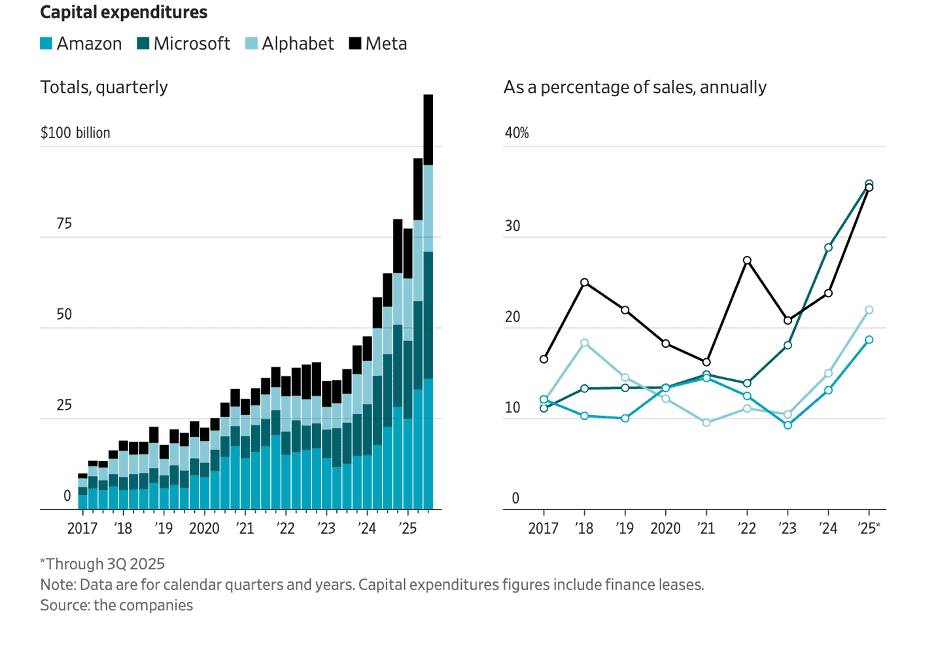

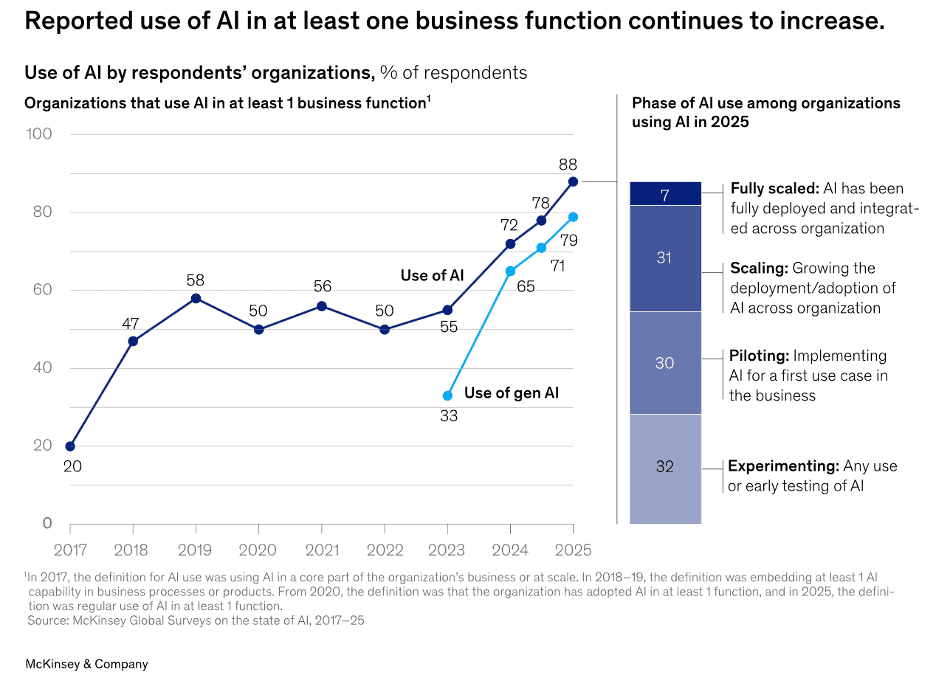

“Here are four ways AI and talent trends could reshape jobs by 2030 – More than two-thirds of chief strategy officers expect the commercialization of AI and emerging technologies to shape business strategies over the next five years. The pace and trajectory of AI advancement has deepened uncertainty about its implications for businesses, workers and the global economy. The second edition in the World Economic Forum’s Scenarios for the Global Economy Dialogue Series explores how AI and talent trends could shape the future of jobs, with varying implications for corporate strategies and investment decisions. Fast-developing technologies such as artificial intelligence, robotics and autonomous systems are redefining how businesses operate, how tasks are performed and what skills are required to stay competitive. As they move from experimentation to workflow integration – including the diffusion of agentic AI – their advancement creates both new growth opportunities and risks.”, World Economic Forum, January 7, 2026

============================================================================================

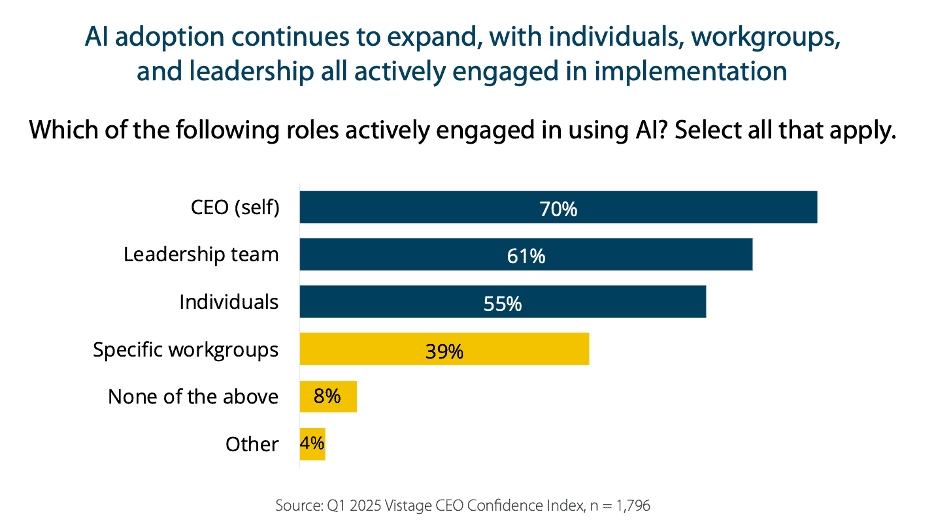

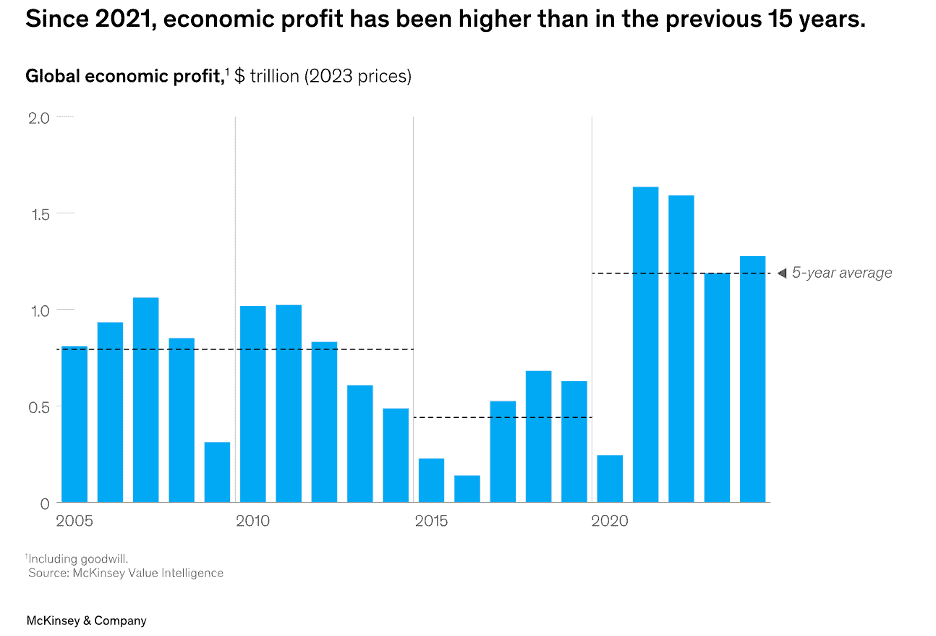

“CEO Confidence Enters 2026 with Measured Optimism – Often, heightened optimism gives way to a phase of adjustment as expectations meet reality. One year ago, CEO confidence surged as post-election optimism fueled expectations of pro-business policies, easing inflation, and lower borrowing costs. That enthusiasm faded quickly. Shifting trade policy, rising costs, and uneven demand made planning difficult, sharply lowering confidence in early 2025 before it gradually stabilized. That context matters as the Q4 2025 Vistage CEO Confidence Index shows a modest but meaningful improvement. Confidence rose to 88.9, an increase of 7 points from last quarter. More notably, this is also nearly 7 points above the 3-year average. This increase does not signal a return to euphoria. Instead, it reflects a growing acceptance of the conditions CEOs expect to face and a clearer view of both risks and opportunities for their business heading into 2026.”, Vistage, January 14, 2026

=============================================================================================

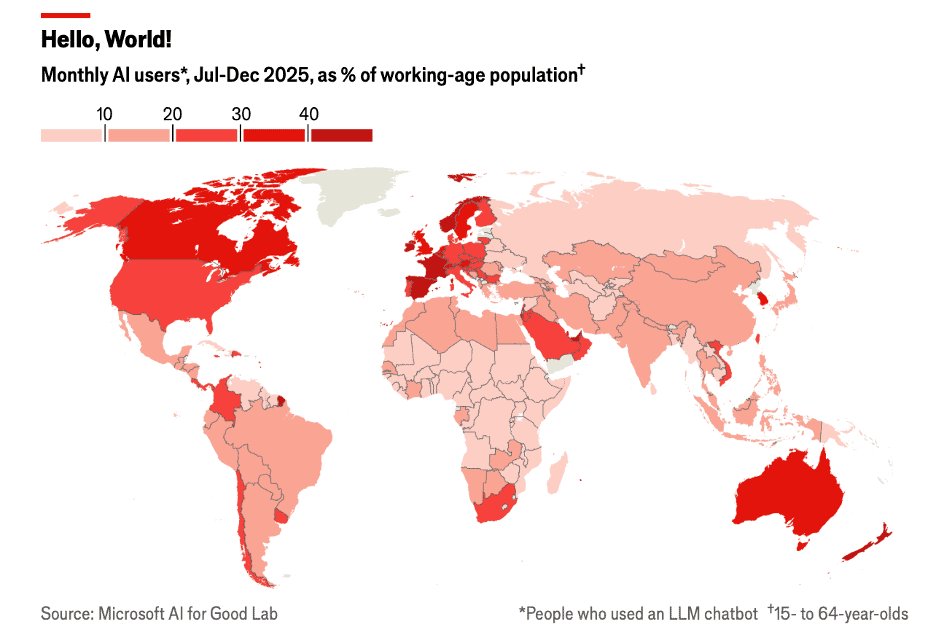

“Which countries are adopting AI the fastest? Rich populations and tech-friendly governments help. Measuring the spread of ai is not straightforward. One method, used by researchers at Microsoft, is to identify the share of people who used Microsoft desktop devices to get access to ai tools—such as Chatgpt, Claude, DeepSeek or Gemini—in a given month. The researchers combined this information with other data, such as Microsoft’s market share and mobile-phone use in a country, to estimate ai usage among the working-age population in 147 economies. Residents of the United Arab Emirates, Singapore, Norway, Ireland and France were the top ai adopters. In both the uae and Singapore more than 60% of the working-age population used ai chatbots. Governments there were quick to promote the technology.”, The Economist, January 12, 2026

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation, Taxes, Tariffs & Trade Issues

“All of the World’s Silver Reserves by Country, in One Visualization – Silver prices surged to new all-time highs in December, extending a powerful end-of-year rally supported by geopolitical uncertainty and a weaker U.S. dollar. Silver futures briefly touched around $80, marking an unprecedented 160% rally in 2025 that outpaced even gold. Against this backdrop, understanding where the world’s silver reserves are concentrated provides crucial context for future supply dynamics. The data for this visualization comes from the U.S. Geological Survey’s Mineral Commodity Summaries (January 2025). It estimates total global silver reserves at about 641,400 metric tons.”, Visual Capitalist and the U.S. Geological Survey, January 6, 2026

============================================================================================

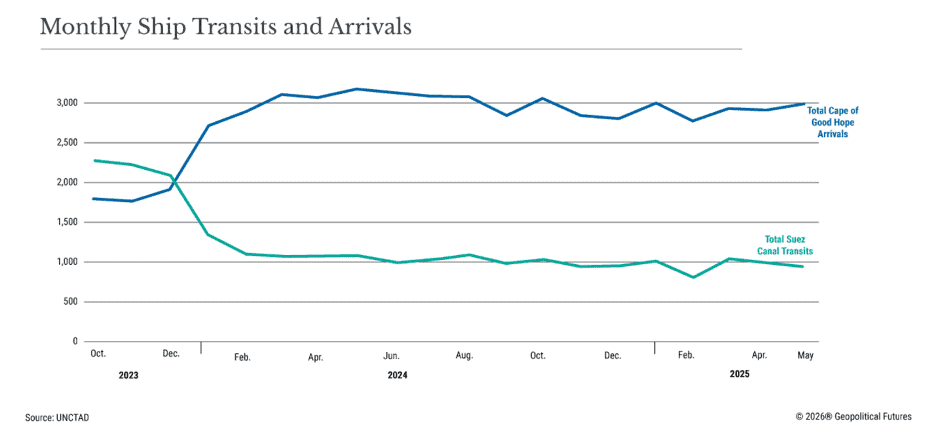

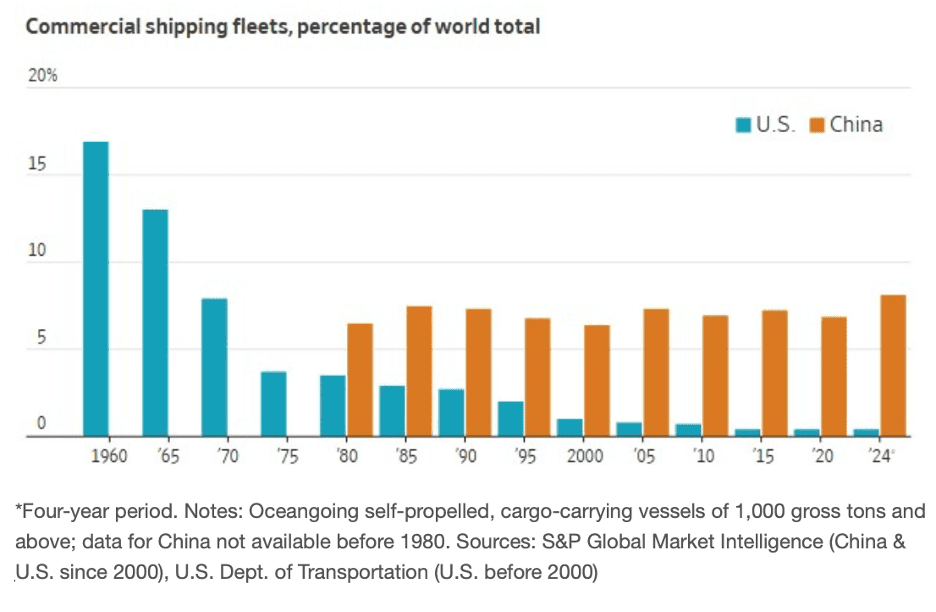

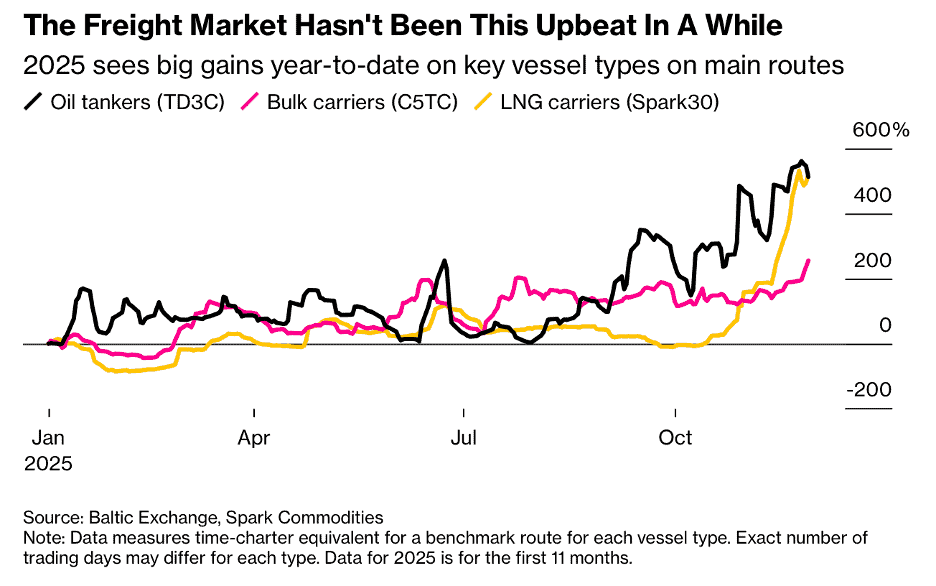

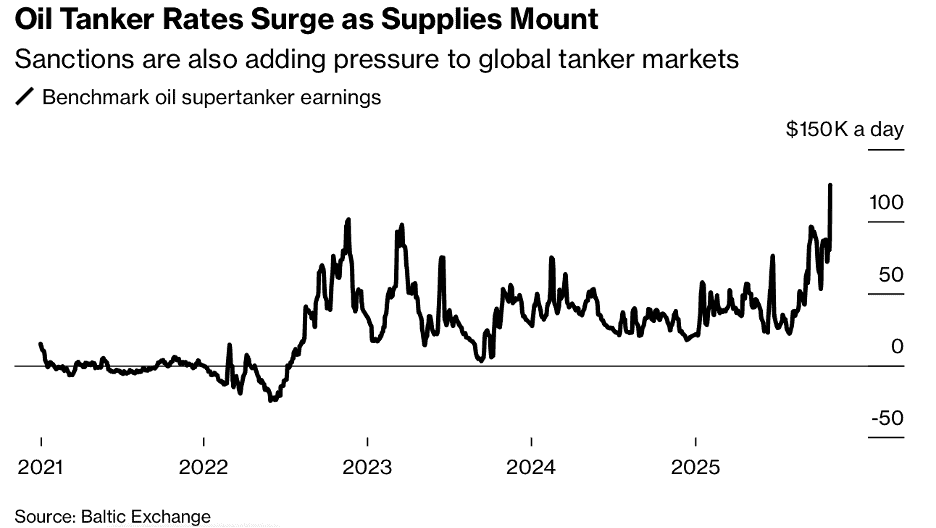

“The New Maritime Operating Environment – Rerouting, rising war-risk premiums and infrastructure surveillance have turned maritime security into a hidden tax on global trade. The prediction that threats to key sea lanes would place global trade under unprecedented pressure proved correct, though the language now needs refinement. The crisis in the Red Sea and Bab el-Mandeb did not dissipate after early disruptions. It instead became the most sustained corridor shock since the pandemic-era supply chain breakdowns. Rerouting around the Cape of Good Hope, higher insurance premiums and uncertainty over Suez transits reshaped Asia-Europe shipping economics throughout 2024 and 2025. Rerouting around the Cape of Good Hope added roughly 30 percent more time (10-12 days) to Asia-Europe journeys and cut effective container capacity by about 9 percent.”, Geopolitical Futures, January 6, 2026

===============================================================================================

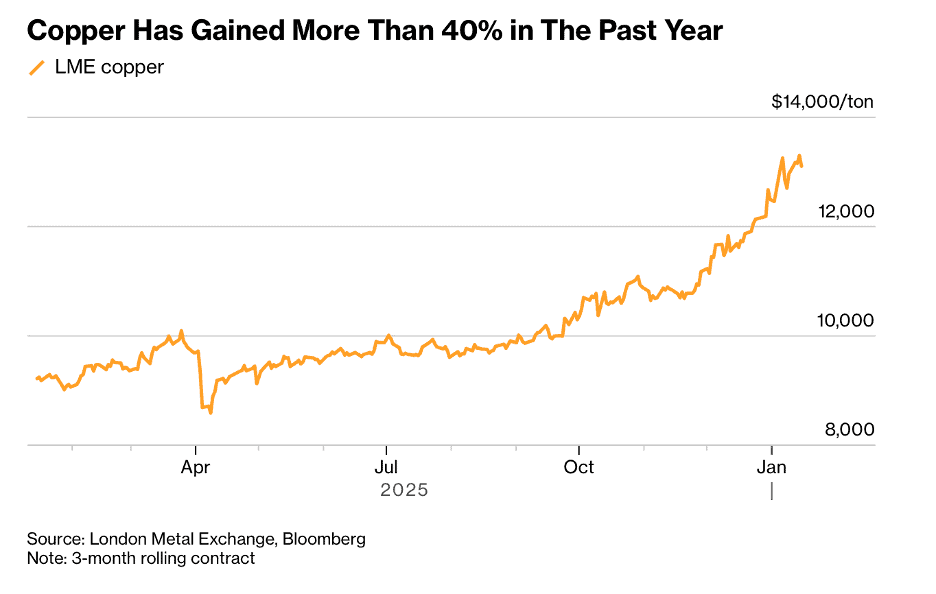

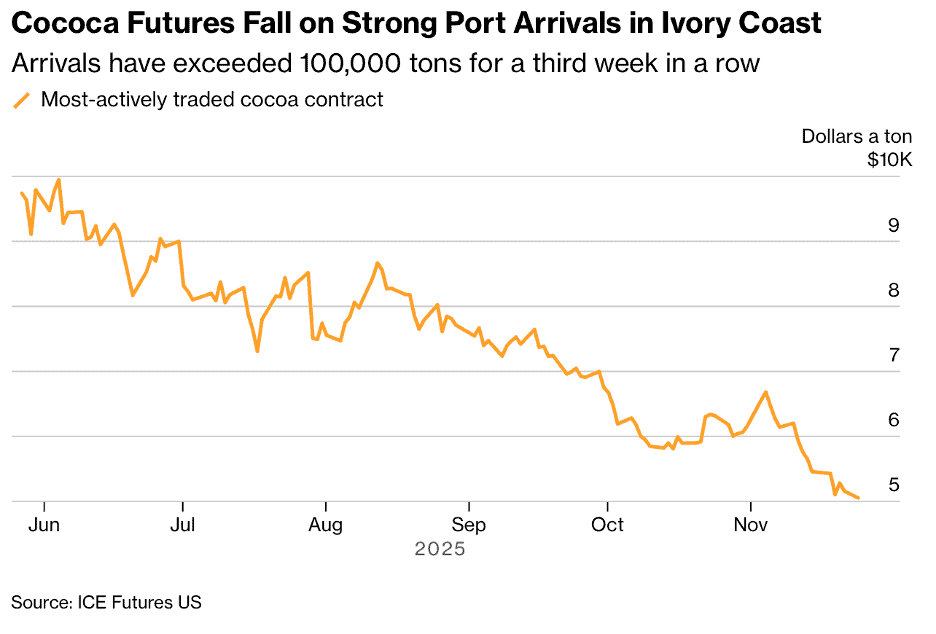

“Copper Drifts Lower as Traders Weigh Rally’s Impact on Demand – Copper eased from an all-time-high, as markets took stock of a record rally that could hit physical demand for the crucial industrial input, and fell 0.6% on the London Metal Exchange on Thursday. Analysts at Goldman Sachs Group Inc. cautioned that the copper price is increasingly vulnerable to a correction and see LME copper falling to $11,000 a ton by year-end, noting that the fundamental physical supply and demand balance had weakened in recent months. Nickel also fell, after surging to the highest level since mid-2024, as top producer Indonesia signaled a potential drop in output, with the country likely to issue quotas for 250 million to 260 million tons of nickel ore this year.”, Bloomberg, January 14, 2026

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

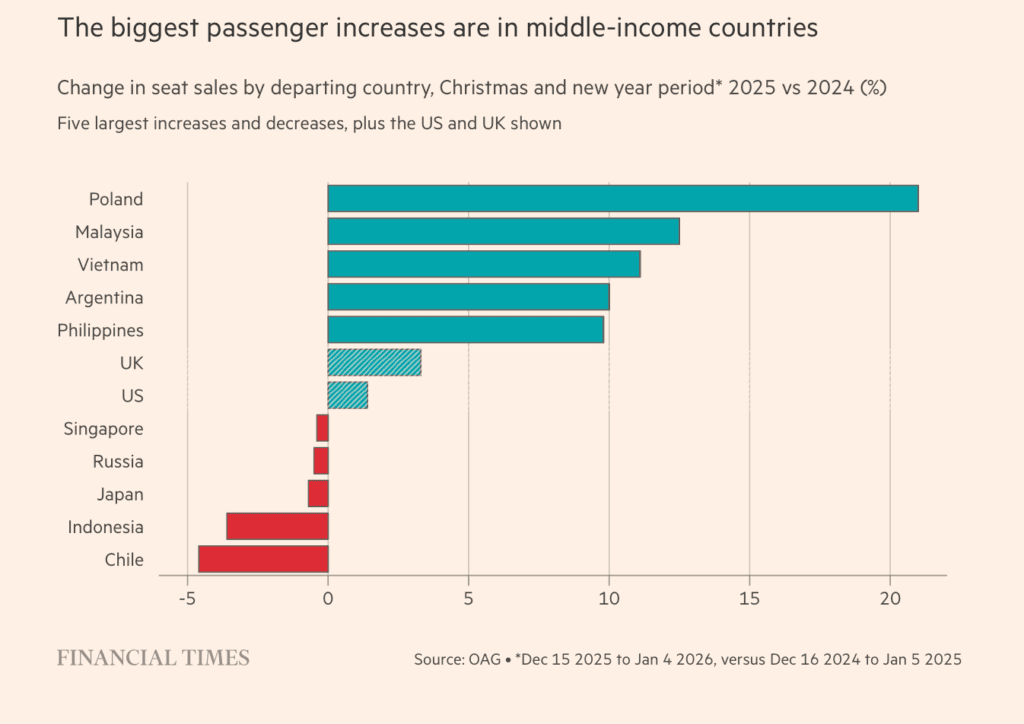

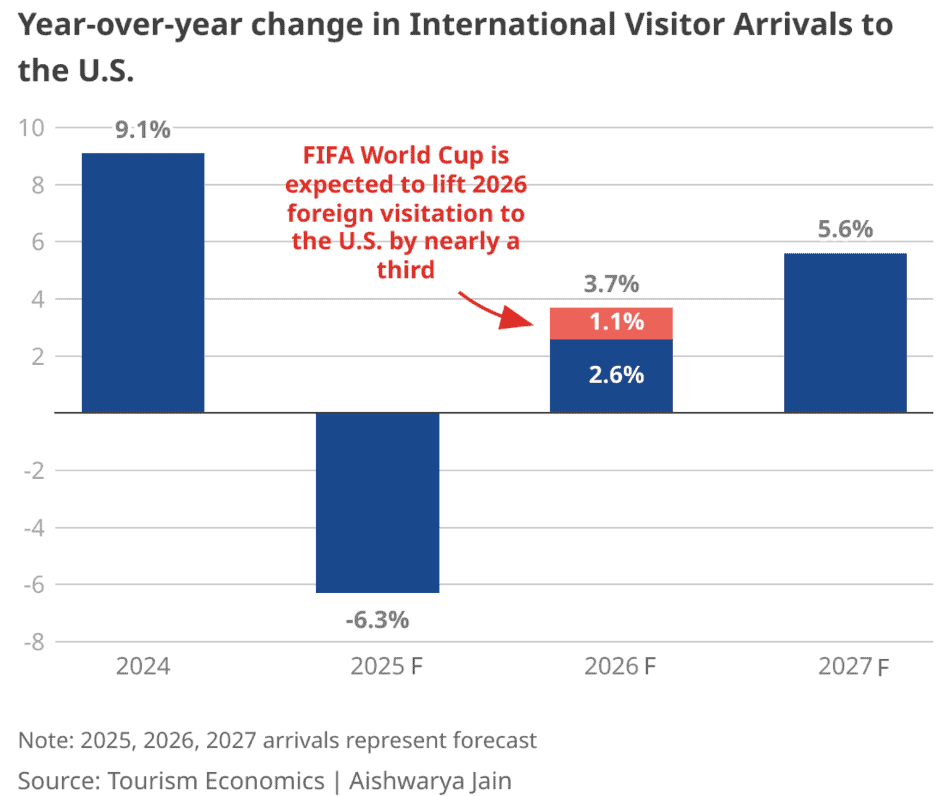

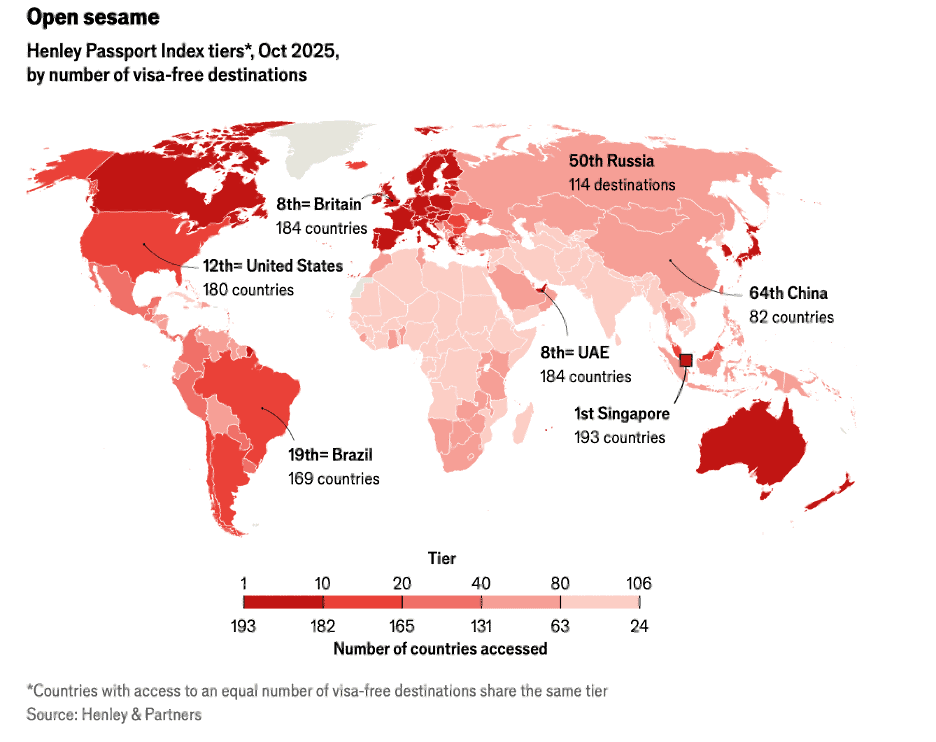

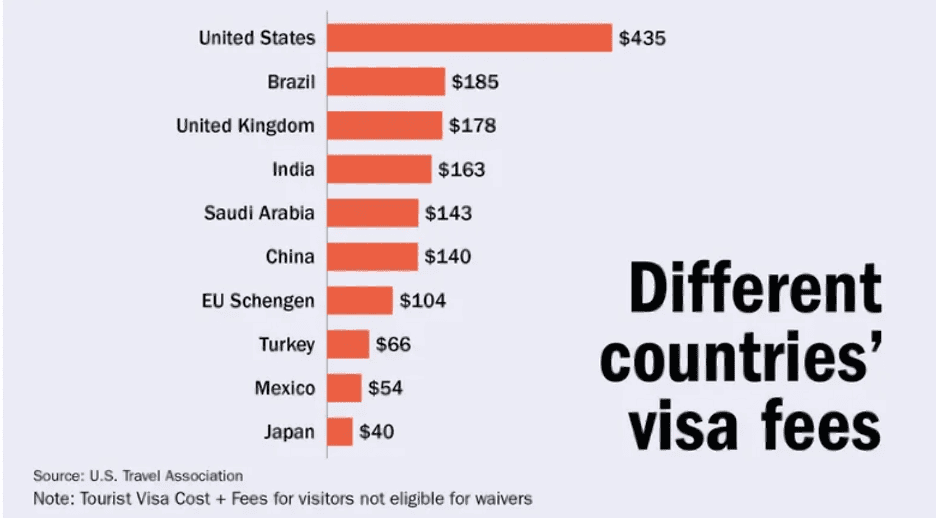

Global & Regional Travel News

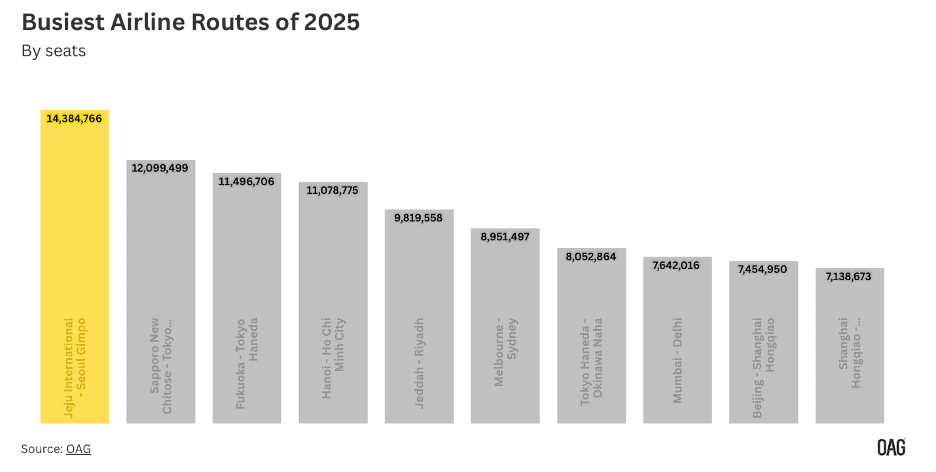

“The Busiest Flight Routes of 2025 – Nine of the Top Ten Busiest Routes operate in the Asia Pacific region. The busiest airline route of 2025 is Jeju (CJU) to Seoul Gimpo (GMP). This route has 14.4 million scheduled seats in 2025, this is equivalent to almost 39,000 daily seats operating on this short sector of just 243 nautical miles. Capacity on the route is 1% above 2024 levels, but remains 17% behind 2019 levels. Seven carriers operate on this very competitive route. Airfares have dropped by 11% year-on year to $44 one-way. The second and third placed busiest routes are both in Japan – which continues to maintain a strong position despite an extensive high speed rail network covering the country. Vietnam’s largest domestic route between Hanoi (HAN) and Ho Chi Minh City (SGN) is the fourth busiest route. The fastest growing route in the top ten is fifth placed Jeddah (JED) to Riyadh (RUH).”, OAG.com, January 2026

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Book Review

In The Triangle of Power: Rebalancing the New World Order, Alexander Stubb avoids simplistic narratives about a new Cold War and instead offers a clear, usable framework for understanding today’s global order. He argues that power is no longer concentrated in a single bloc or defined solely by U.S.–China rivalry. Instead, it is distributed across three interacting forces: the Global West, the Global East, and the Global South.

The Global West continues to dominate in capital markets, institutions, and advanced technology, but faces internal political and demographic constraints. The Global East, led by China, leverages scale, state coordination, and industrial policy to project influence. The Global South has become the decisive swing player — pragmatic, growth-oriented, and increasingly unwilling to align permanently with any single bloc.

For global business leaders, Stubb’s core message is practical rather than ideological: geopolitics has become a permanent operating condition. Market access, supply chains, capital flows, and regulatory environments are now shaped as much by political alignment as by economics. Companies that assume stability, fixed alliances, or frictionless globalization risk strategic blind spots.

The Triangle of Power provides a calm, executive-level roadmap for navigating this multipolar reality — emphasizing diversification, resilience, and geopolitical awareness as essential tools for sustainable global growth in 2026 and beyond.

Five Takeaways for Global Business Leaders

Political literacy is a core leadership skill

The world is multipolar, not bipolar

The Global South is the strategic swing factor

Geopolitics is structural risk, not background noise

Resilience now beats efficiency in global strategy

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Canada

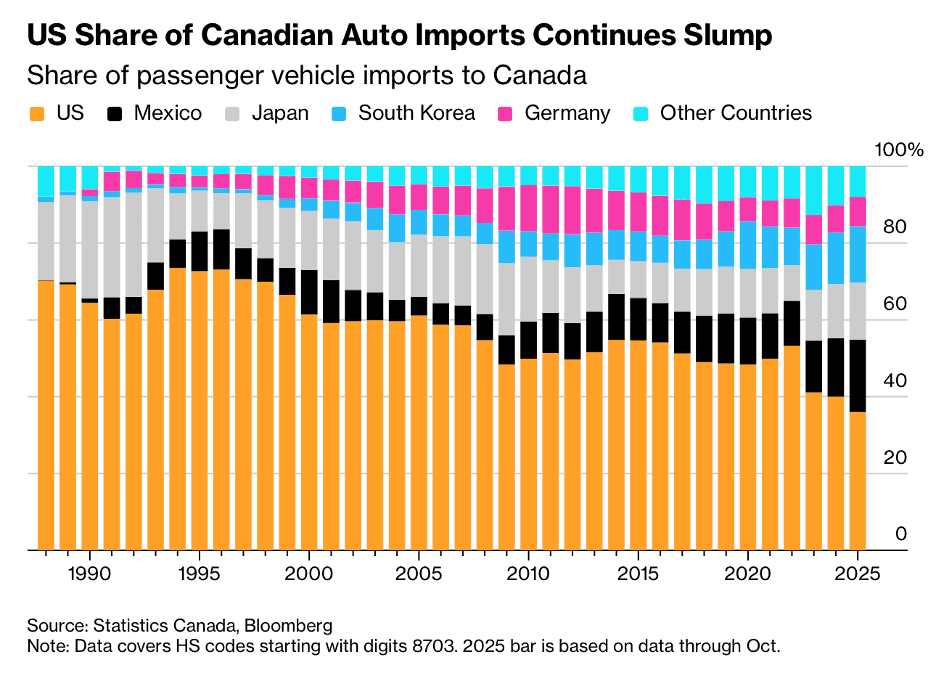

“US Auto Market Share in Canada Hits Record Low on Tariff Turmoil – US factories’ share of the Canadian vehicle market has tumbled to a new low due to automobile tariffs. Just 36% of passenger vehicles imported to Canada were manufactured in the US during the first 10 months of 2025, compared to an average of 49% in the 10 years before that. The trade war has changed the business, with Mexican and South Korean-made vehicles gaining a bigger share of sales at Canadian auto dealers. Canada is the largest buyer of American-made new cars and trucks, by far. But the numbers help illustrate how the trade war started by President Donald Trump’s administration has changed the business. Mexican and South Korean-made vehicles are gaining a bigger share of sales at Canadian auto dealers.”, Bloomberg, January 16, 2026

===============================================================================================

China

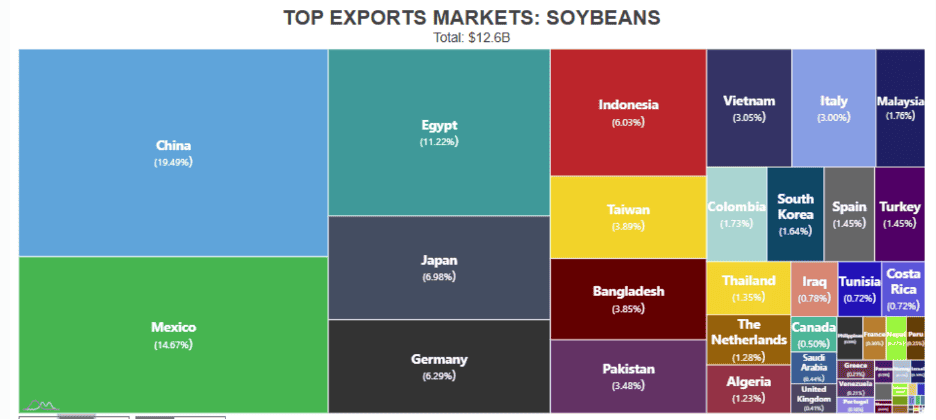

“China Purchased No U.S. Soybeans For An Unprecedented Fifth Straight Month – China was under 20% of all U.S. exports of soybeans through October of 2025, the latest U.S. Census Bureau data available. For 14 of the last 17 years for the same time period, that percentage was above 40%. For the first time in more than two decades, the United States did not export any soybeans in the month of October, the traditional start of the exporting season, to the world’s largest market, China. October was also an unprecedented fifth consecutive month without any U.S. soybean exports to China in at least three decades, according to the latest U.S. Census Bureau data. It matters. U.S. soybean farmers export about 55% of all soybeans they produce, whether as whole bean, which is the most common, or “crushed” into meal form or as oils, a much smaller percentage, according to the U.S. Soybean Export Council.”, Forbes, January 18, 2026

=============================================================================================

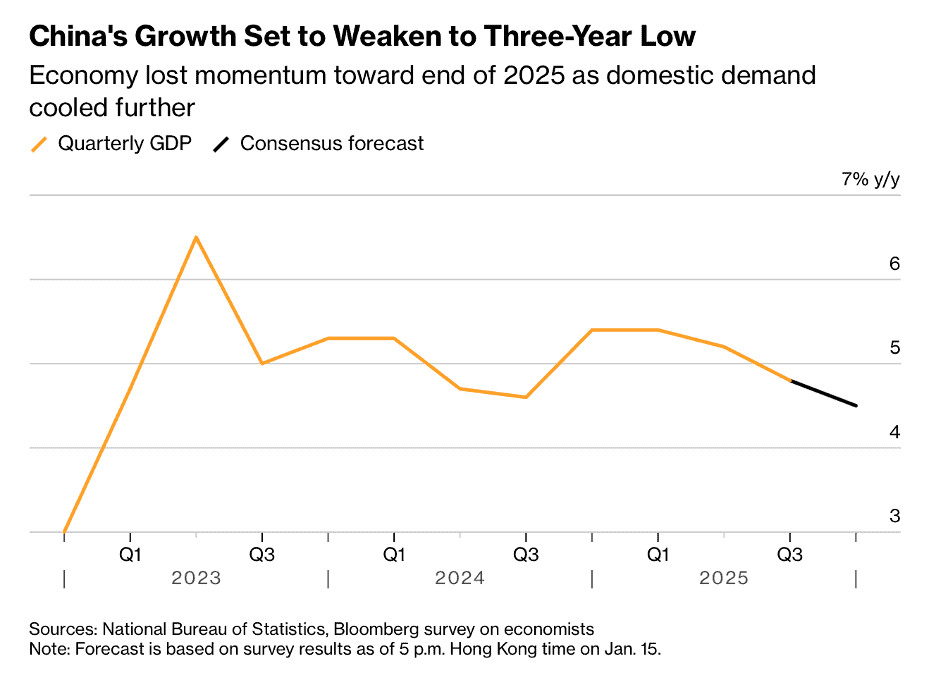

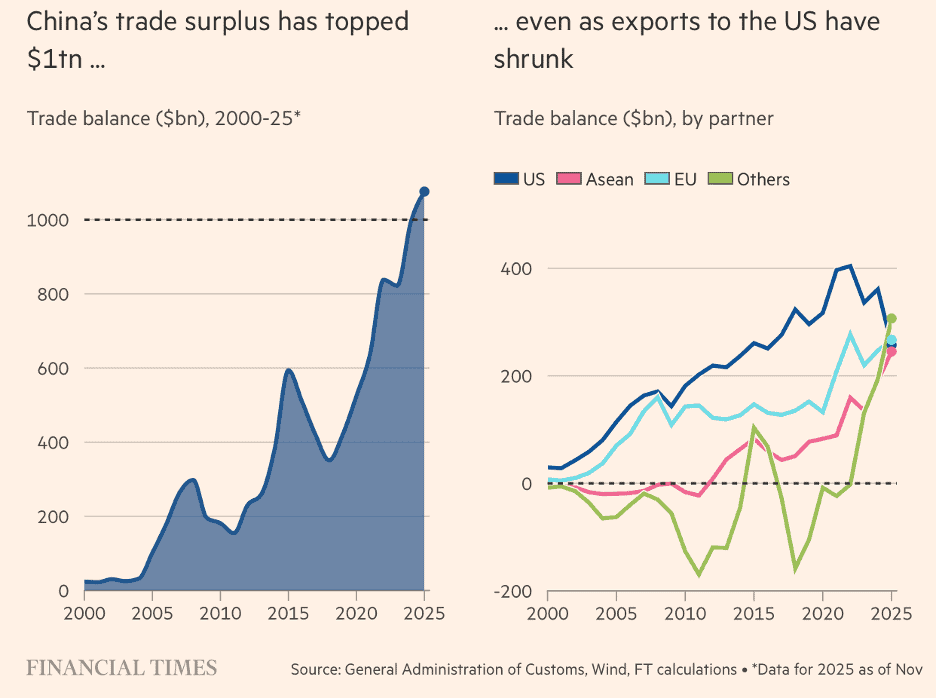

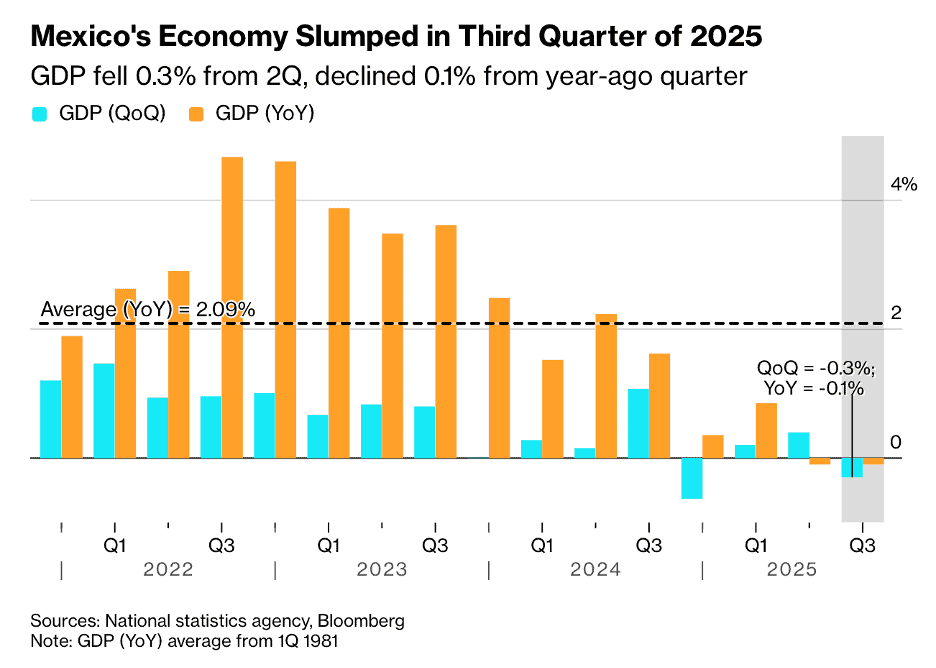

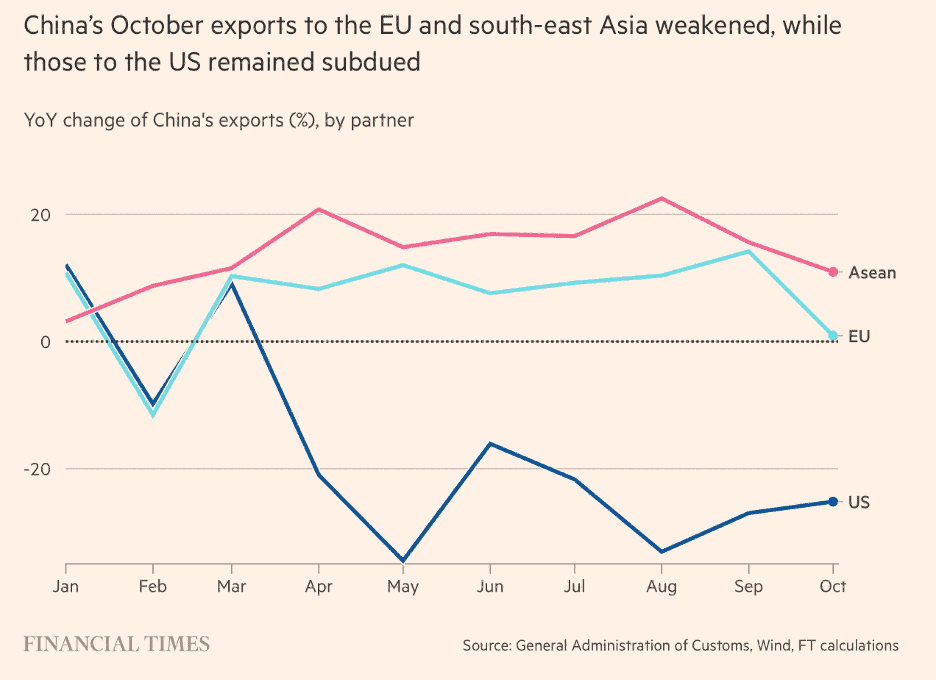

“China’s Slowdown Is Set to Deepen as Pivot to Consumption Stalls – China’s economy likely had its weakest quarterly growth in three years, with a reliance on exports over consumption. Gross domestic product likely gained 4.5% in the fourth quarter from the same period a year prior, according to the median prediction of economists. The uneven growth pattern will likely persist in 2026, buoyed by a positive outlook for exports, with consumption and investment remaining the economy’s weak links.”, Bloomberg, January 15, 2026

=============================================================================================

European Union

“Housing in the EU: Who Owns, Who Rents, and at What Cost – This infographic looks at housing conditions across the EU through three key lenses: the balance between home ownership and renting, the average/median cost of renting and buying per square meter, and the extent of household overcrowding. Together, these indicators help illustrate how affordable, accessible, and adequate housing is across member states. The data reveals strong contrasts. Countries with high levels of home ownership, such as Romania, still face significant overcrowding, highlighting that ownership alone does not guarantee adequate living conditions. Meanwhile, countries like Germany show a very different model, with a large share of renters and relatively stable average rental prices.”, Visual Capitalist, January 7, 2026

=============================================================================================

Malaysia

“In an act of boycott, Malaysia makes its own ‘McDonald’s’ – In Malaysia, customers who have sworn off global restaurant chains in solidarity with Palestine have fuelled a boom in local brands. Malaysia is by no means a make-or-break market for major global brands. The size of the food service industry in the country will almost double to US$27.5 billion (S$35.5 billion) by 2030, said estimates research company Mordor Intelligence. In comparison, in the US, it will surpass US$1.5 trillion. But the loss of its customers still has commercial implications, especially since Malaysia is not the only country rethinking its relationship with global consumer brands. Coca-Cola Icecek, which bottles and sells Coke products in the Middle East, reported a loss of market share in Turkey and Pakistan this summer, following calls to boycott Western companies with perceived links to Israel.”, Straits Times, December 15, 2025

============================================================================================

Taiwan

“US to cut tariffs on Taiwanese goods after investment pledge – The US said it had agreed to cut the tariffs it charges on goods from Taiwan to 15%, in exchange for hundreds of billions of dollars in investment aimed at boosting domestic production of semiconductors. The Commerce Department said the island’s semiconductor and technology enterprises had committed to “new, direct investments” worth at least $250bn (£187bn). The deal also provides carve-outs from tariffs for Taiwanese semiconductor companies investing in the US. As well as the direct investments from companies, the Taiwanese government will provide $250bn in financing to support firms, according to the Commerce Department.”, BBC, January 15, 2026

============================================================================================

United Kingdom

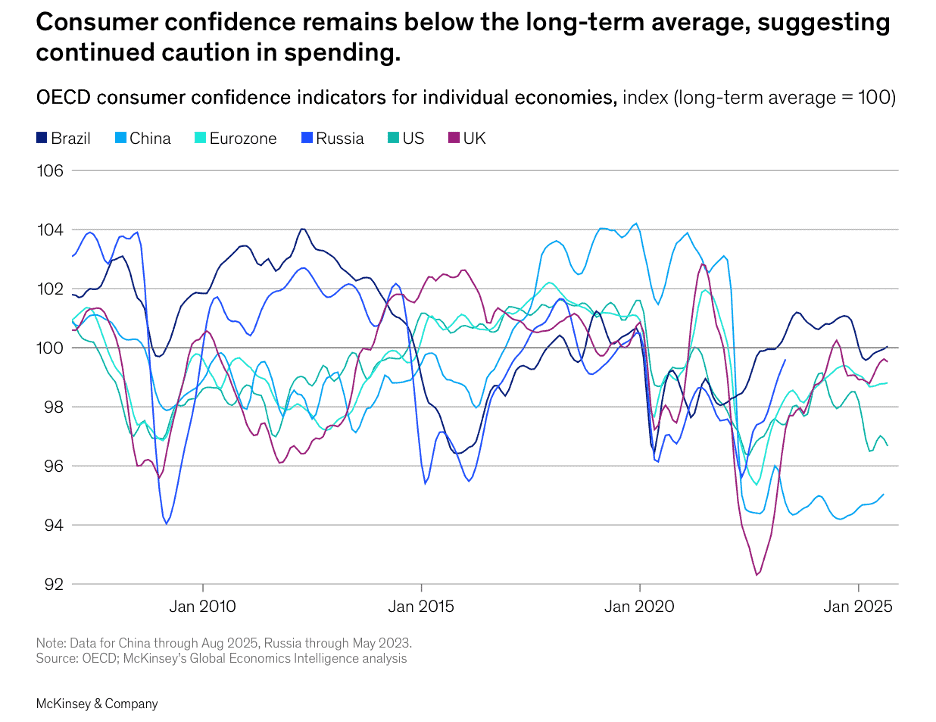

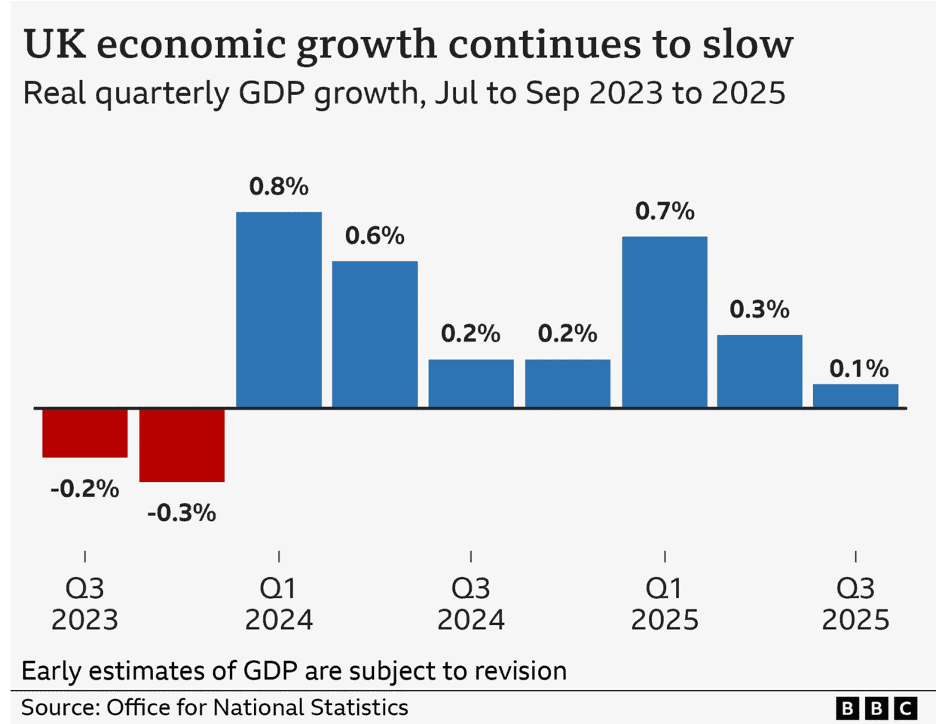

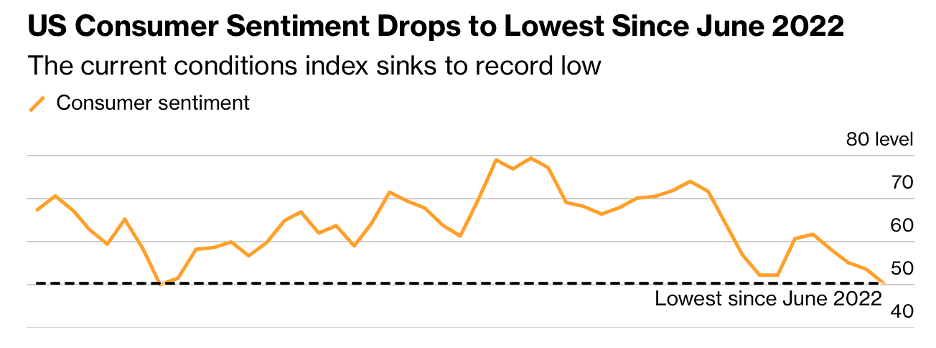

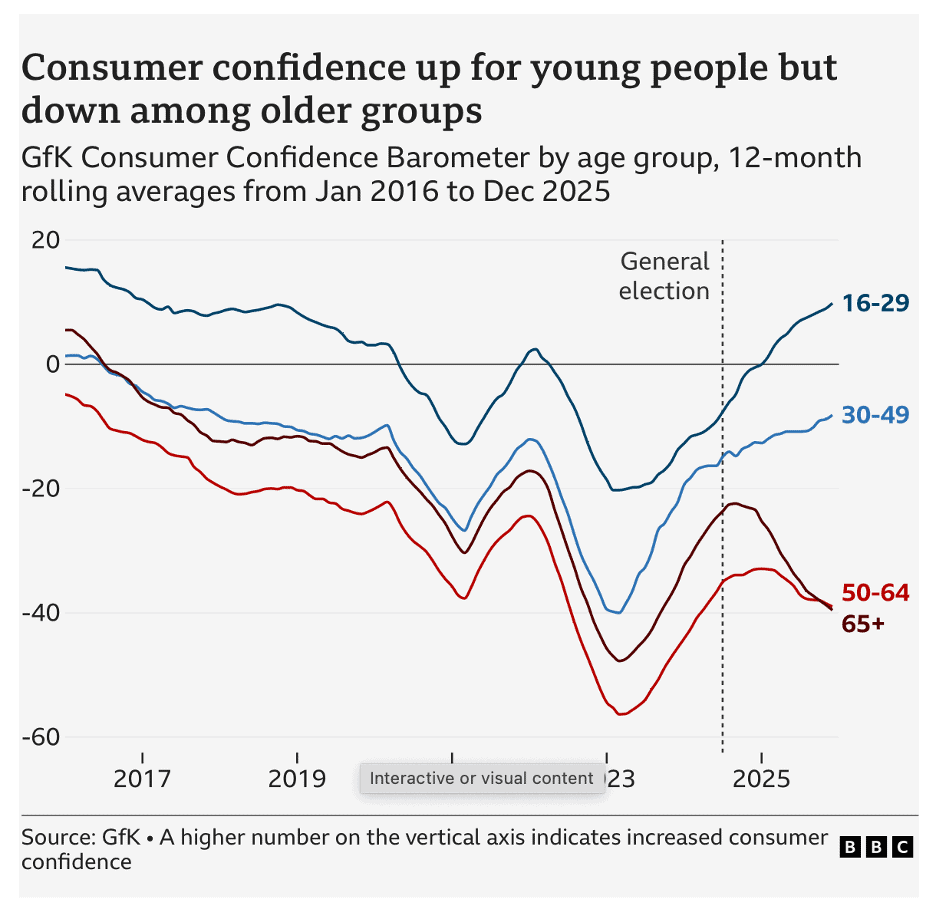

“The one measure that can tell us a lot about the state of the UK economy – There is one chart that might explain quite a lot about both the state of and the prospects for the UK economy. And it might say a fair bit about the political direction of the UK too. It is consumer confidence. These are the long-running surveys that essentially put the nation on the economic psychiatric couch. How do you feel about the economy’s prospects? Are you likely to buy a major piece of equipment? How are your personal finances? Younger people have a generally sunnier starting point but that dims as they age – not a great surprise – and all age groups react to events similarly.”, BBC, January 17, 2026

===========================================================================================

United States

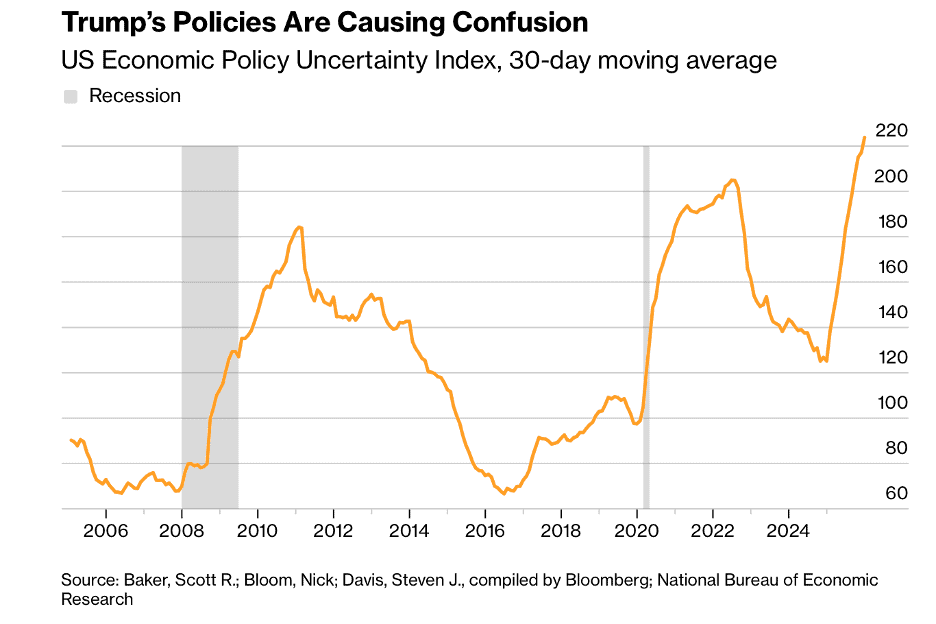

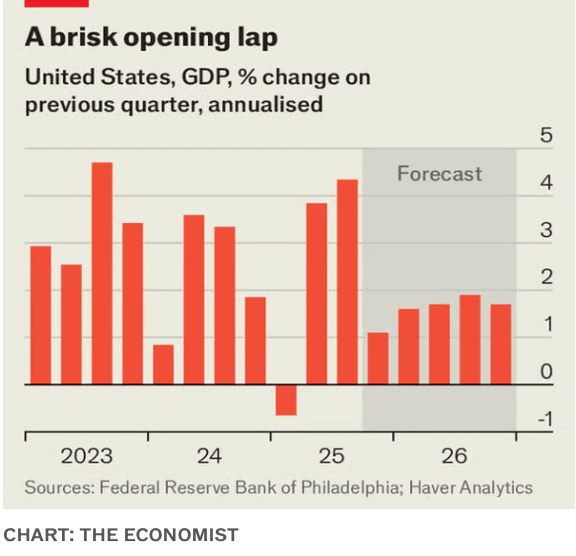

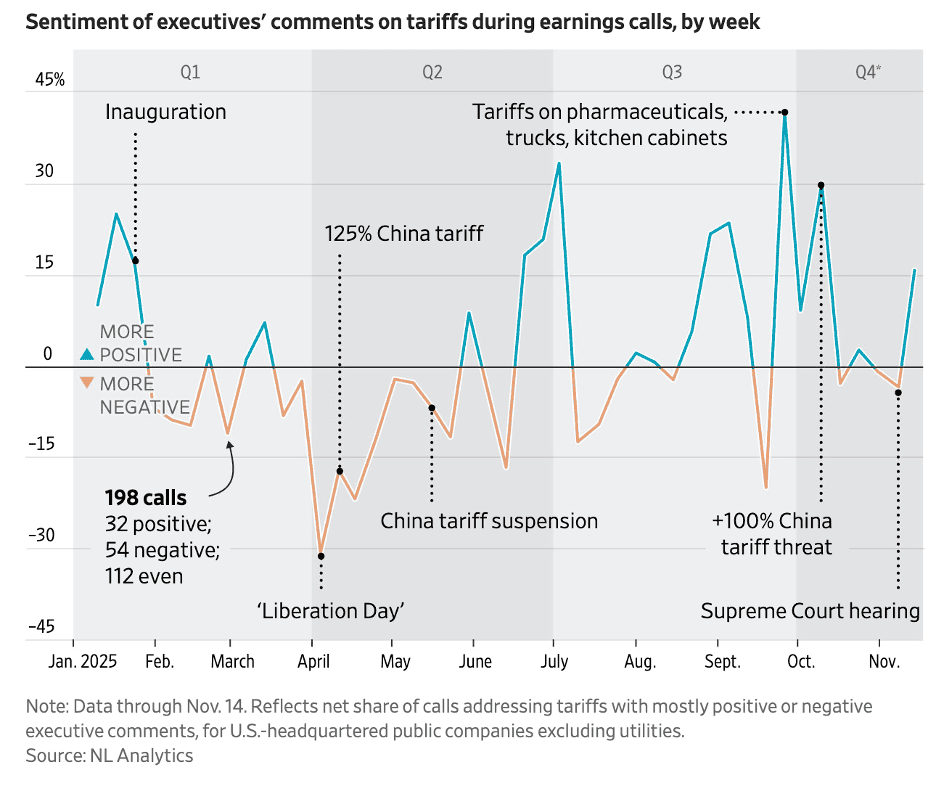

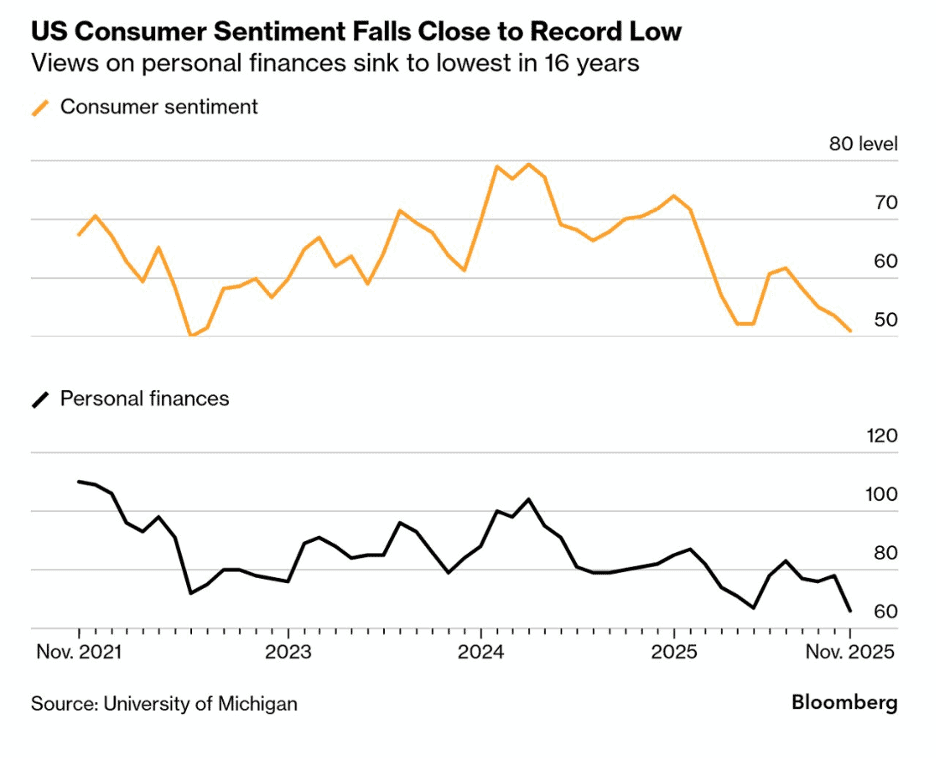

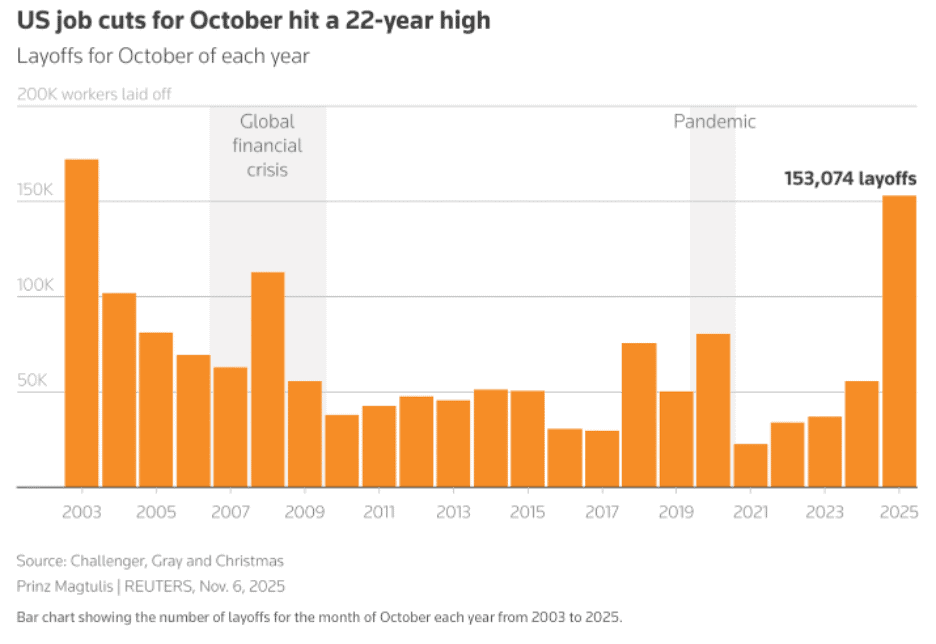

“The Economic Toll of Trump’s Policies Will Soon Be Visible – Mainstream economists have underestimated the cost of all the confusion the administration has unleashed, particularly on trade and immigration. Many forecasters and investors misinterpret the state of the American economy due to a fundamental misunderstanding of how government-induced uncertainty affects it. The effects of President Donald Trump’s trade and immigration policies, such as tariffs and deportations, are expected to become more evident in 2026, leading to stagflationary effects and inflationary pressures. The uncertainty caused by Trump’s policies has delayed decision-making by businesses, households, and investors, but as this uncertainty is resolved, shortages and inflation are expected to rise, potentially forcing employers to raise wages and adding to inflationary pressures.”, Bloomberg, January 13, 2026

============================================================================================

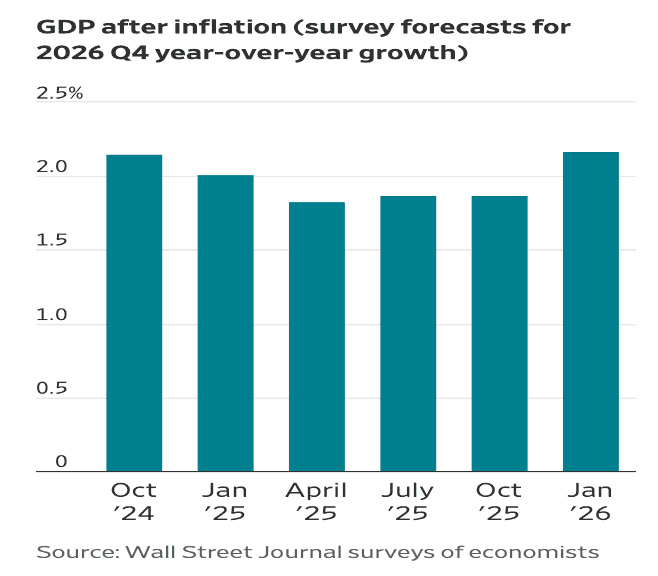

“Economists Shrug Off Trumponomics, Boost 2026 Growth Outlook Back Above 2% – Last year, economists slashed expectations amid tariffs and other Trump policies. The latest survey shows those concerns have largely receded. Economists have learned to stop worrying about Trumponomics. The forecasts are based on 74 surveys from academic and business economists received by the Journal between Jan. 9 and Jan. 15, before Trump’s latest threat to impose tariffs on countries that resist his demands to acquire Greenland. Not every forecaster answered every question. ‘The effective tariff rate will likely peak a little above 13% in the first quarter and that’s almost half the pace of April 2nd—but it’s still more than four times the pace of a year ago,’ said KPMG’s chief economist Diane Swonk. ‘It wasn’t as bad as it could have been.’”, The Wall Street Journal, January 18, 2026

============================================================================================

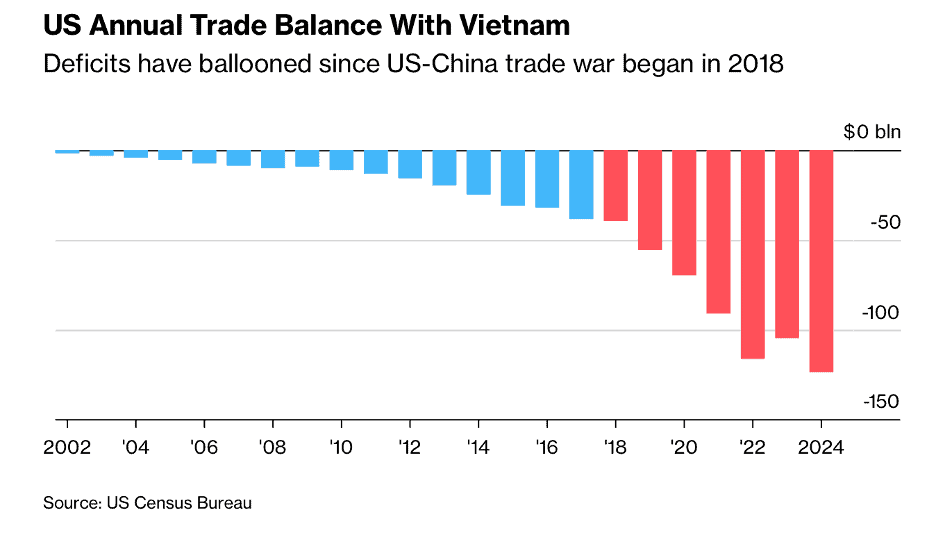

“Vietnam Economy Expands Despite Tariffs, Beating Estimates – Vietnam’s economy grew faster than expected last quarter as manufacturing, investment and trade gained momentum despite President Donald Trump’s tariffs. Gross domestic product expanded 8.46% in the October-December period from a year earlier, beating all estimates in a Bloomberg survey. Vietnam maintained its status as one of the world’s fastest-growing economies, supported by resilient exports and increased public investment, despite facing risks such as liquidity shortages and inflation management.”, Bloomberg, January 5, 2026

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The Accredited Franchise Supplier certification

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Brand & Franchise Sector News

“Pollo Tropical owner hints at long-term IPO plans – Authentic Restaurant Brands, which also owns Primanti Bros, P.J. Whelihan’s and other regional chains, suggested that it could go public in three to five years. It also wants to acquire more brands. While many PE-backed restaurant brands aspire to national growth, ARB is strictly focused on expanding brands within their home markets. When it buys a brand, it keeps management in place and invests in G&A, an area where other firms typically look to cut.”, Restaurant Business, January 14, 2026

==============================================================================================

“Denny’s Corporation Announces Completion of Acquisition by TriArtisan Capital Advisors, Treville Capital Group and Yadav Enterprises – Denny’s Corporation (the “Company” or “Denny’s”) (NASDAQ: DENN), owner and operator of Denny’s Inc. and Keke’s Inc., today announced the successful completion of its previously announced acquisition by TriArtisan Capital Advisors LLC (“TriArtisan”), Treville Capital Group (“Treville”) and Yadav Enterprises, Inc. (“Yadav Enterprises”). The transaction closed following approval by Denny’s stockholders as well as satisfaction of all required regulatory and customary closing conditions. With the support of TriArtisan, Treville and Yadav Enterprises, Denny’s will have enhanced flexibility and resources to invest in its brands, support franchisees and accelerate its growth initiatives.”, Global Newswire, January 16, 2026

==============================================================================================

“Raising Cane’s plans to enter Mexico in 2026 – The fast-growing chain signed a development agreement with Alsea to debut in the market. The agreement with Raising Cane’s includes plans to explore additional opportunities in the region following its debut next year. The chain currently operates more than 950 restaurants across 43 U.S. states and the Middle East and has also recently announced plans to expand into the United Kingdom next year.”, National Restaurant News, December 9, 2026

==============================================================================================

“Moran Family of Brands Goes Global with Acquisition of Mister Transmission – In a milestone moment that reflects the strength and growth of the automotive aftermarket industry, Moran Family of Brands is expanding into Canada with the acquisition of Mister Transmission, creating a unified North American leader in automotive service and repair. Already owning U.S.-based Mr. Transmission, Moran has expanded its portfolio on an international scale to continue meeting the evolving needs of automotive customers.”, PR Newswire, December 8, 2025

============================================================================================

“Fatburger Brings a Taste of Hollywood to Japan with Okinawa Opening – FAT (Fresh. Authentic. Tasty.) Brands Inc. announces the opening of its newest Fatburger location in Okinawa in partnership with Green Micro Factory Inc., marking the brand’s highly anticipated return to Japan.”, Franchising.com, December 16, 2025

===========================================================================================

“Domino’s Pizza (Australia) names fast food veteran Merrill Pereyra as CEO – With more than 30 years of experience in the quick-service restaurant industry, Pereyra has held several regional leadership positions at McDonald’s, and at Domino’s Pizza Indonesia, where he was CEO. He joined QSR Brands, a part of Yum! Brands franchisee for KFC and Pizza Hut as executive director and CEO. In 2019, as MD of Pizza Hut India, Pereyra led a sales turnaround. Inside Retail, January 12, 2026

=============================================================================================

“TGI Fridays targets 1K units, $2B revenue by 2030 – The once-bankrupt chain will focus on global growth, improving franchisee profitability and boosting the guest experience as part of a new strategic vision. TGI Fridays unveiled its “1-2-3 Strategic Vision” on Monday with a plan to target over 1,000 units and $2 billion in annual revenue by 2030, according to a press release. The plan covers four strategic pillars, including activating the brand, growing across markets, improving its franchised system and investing in people and leadership development. Fridays, which has nearly 400 units across more than 40 countries, has signed several development agreements to open over 150 units worldwide, the press release said.”, Restaurant Dive, January 12, 2026

================================================================================================

“Jollibee Looks to Tap Deep US Investor Base for Overseas Unit – Jollibee Foods Corp. plans a US listing to tap into the nation’s deep investor base. The company expects to spin off its international unit and list in the US by late 2027, while its domestic business will remain on the Philippine bourse. Listing in the US will introduce Jollibee to broader research coverage by company analysts, according to Richard Shin, global chief financial officer of Jollibee. The company, which increasingly aims to compete globally with giants such as McDonald’s and Yum! Brands Inc., expects to spin off its international unit and list in the US by late 2027, while its domestic business will remain on the Philippine bourse, among the world’s worst-performing exchanges in the past decade.”, Bloomberg, January 14, 2026

============================================================================================

“Costa (Coffee) sale scrapped, sector cutting emissions and recovering millions, half of pubs closing early et al – Coca-Cola scraps plans to sell Costa after bids fall short: Coca-Cola has ditched plans to sell Costa Coffee after bids from private equity suitors fell short of its expectations. Firms in the latter rounds of negotiations included Asda owner TDR Capital and Bain Capital’s special situations fund, owner of Gail’s and PizzaExpress, the FT reported. Coca-Cola had been seeking about £2bn for Costa, roughly half the £3.9bn it paid to acquire the UK’s largest coffee shop brand from Premier Inn owner Whitbread in 2018. Talks over a deal with TDR would have seen Coca-Cola retain a minority stake in Costa. Private equity firms Apollo, KKR and Centurium Capital, owner of China’s Luckin Coffee brand, were involved at earlier stages of the process, which was handled by Lazard, according to people familiar with the matter.”, Propel UK, January 14, 2026

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive our biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing business environment. And our GlobalTeam™ on the ground covering 25+ countries provide us with updates about what is actually happening in their specific countries. We do not get involved in or report on politics!

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

William “Bill” Edwards: CEO & Global Trade Advisor “Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global”. With five decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe, and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service global management consultant since 2001 helping 40+ franchisors expand into new countries. Bill knows how to turn the challenges in taking a brand global into opportunities.

For a complimentary 30-minute consultation on how to take your business into new countries successfully. For a complimentary call with Bill Edwards click on the QR code or contact Bill at bedwards@edwardsglobal.com and +1 949 375 1896

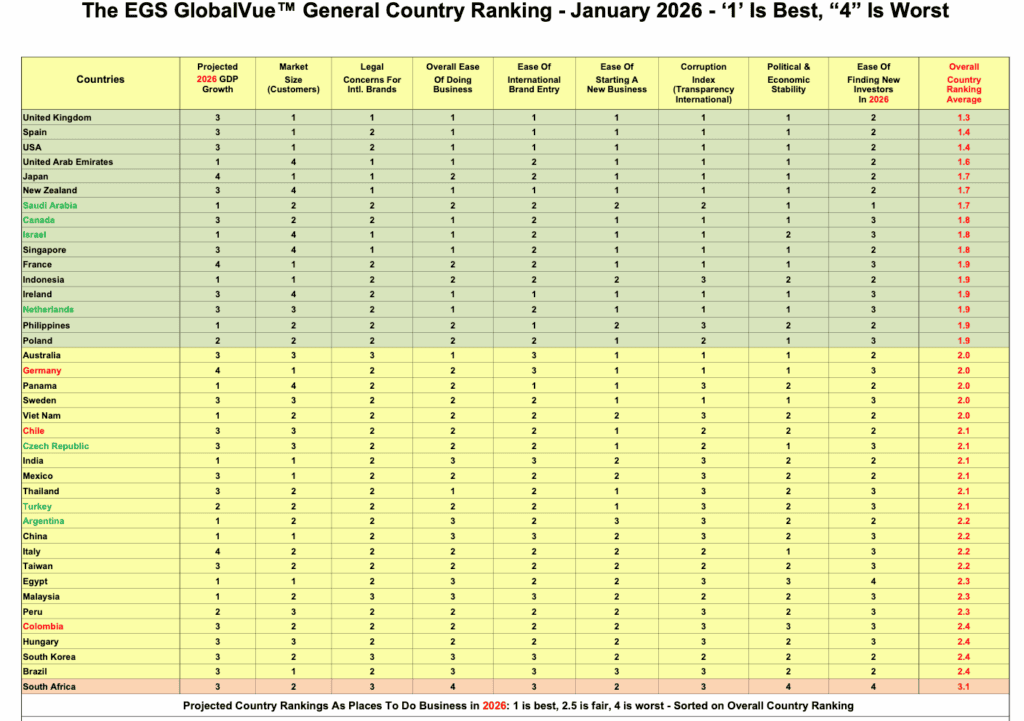

And download our latest chart ranking 40+ countries as places to do business, used by many companies for strategic planning, at this link:

Our latest GlobalVue™ 40 country ranking

Biweekly Global Business Newsletter Issue 151, Tuesday, January 6, 2026

“In the middle of difficulty lies opportunity.”, Albert Einstein

Welcome to the 151st Edition of the Global Business Update – This quote captures the global business mindset needed for 2026. Trade, technology, and geopolitics are no longer separate conversations—they are increasingly the same conversation. This issue highlights how ongoing uncertainty around tariffs and trade rules, uneven economic momentum across regions, and the rapid embedding of artificial intelligence into strategy and workforce planning are reshaping how companies compete and expand.

A consistent message runs through these stories: the winners in 2026 will not be the most aggressive globalizers, but the most disciplined and pragmatic ones—leaders who invest in due diligence, localization, and smart market-entry structures before scaling. The past year reminded many companies that preventable mistakes—weak partner selection, misreading local hiring practices, and underestimating regulatory realities—can quickly turn opportunity into costly detours.

AI adds another layer of complexity. It is becoming both a competitive weapon and a governance challenge as jurisdictions move to regulate its use in hiring, monitoring, and performance management. In 2026, AI will be a performance accelerator—but also a risk factor that requires active management.

The same pragmatism appears in the international franchise stories at the end of this issue: Burger King UK planning 30 new company-owned restaurants a year, franchise operators consolidating for scale in India, and global leaders like McDonald’s and Popeyes proving again that local adaptation—not standardization—drives international success.

2026 will reward adaptability, local insight, and the ability to turn difficulty into advantage.

This edition’s book review highlights Global Value Chains and Geopolitical Uncertainty: Disruption and Transformation edited by Imran Ali, William Ho, and Thanos Papadopoulos, is a timely guide to how global trade and cross-border operations are being reshaped by a new and lasting reality: geopolitical uncertainty has become a permanent operating condition rather than an occasional disruption. The book examines how political tensions, supply shocks, industrial policy, and fast-moving technologies are changing how goods and services move across borders—and what businesses and governments can do to adapt.

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive our biweekly newsletter by email every other Tuesday, click here https://insider.edwardsglobal.com

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business. We do not get involved with or report on politics!

PLEASE NOTE: Some of the information sources that we provide links to in our newsletter require a paid subscription to directly access them. Clicking on a link may not give the reader access to the content.

Edited and curated by: William (Bill) Edwards, CEO & Global Business Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA. Contact Bill with questions, comments and contributions. Bedwards@edwardsglobal.com, +1 949 375 1896

Link to our current and past newsletters: https://edwardsglobal.com/geowizard/

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

First, A Few Words of Wisdom From Others For These Times

“In the middle of difficulty lies opportunity.”, Albert Einstein

“The view you adopt for yourself profoundly affects the way you lead your life.”, Satya Nadella, Chairman and Chief Executive Officer of Microsoft

“Go confidently in the direction of your dreams.”, Henry David Thoreau

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Highlights in issue #151:

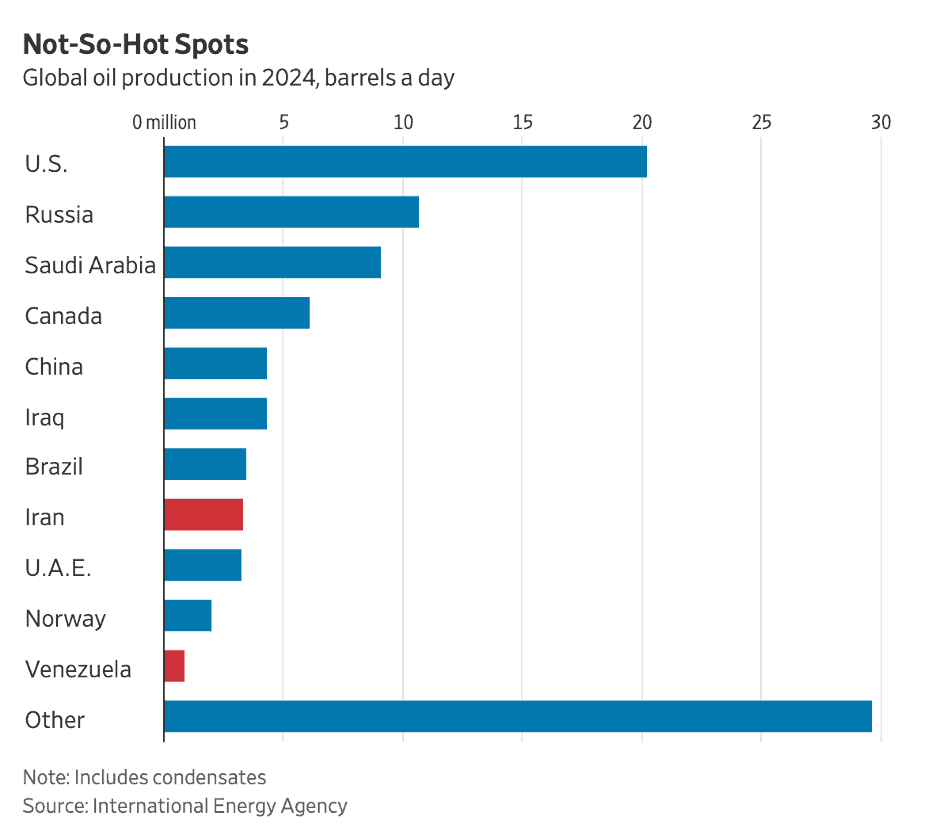

All of the World’s Oil Reserves by Country, in One Visualization

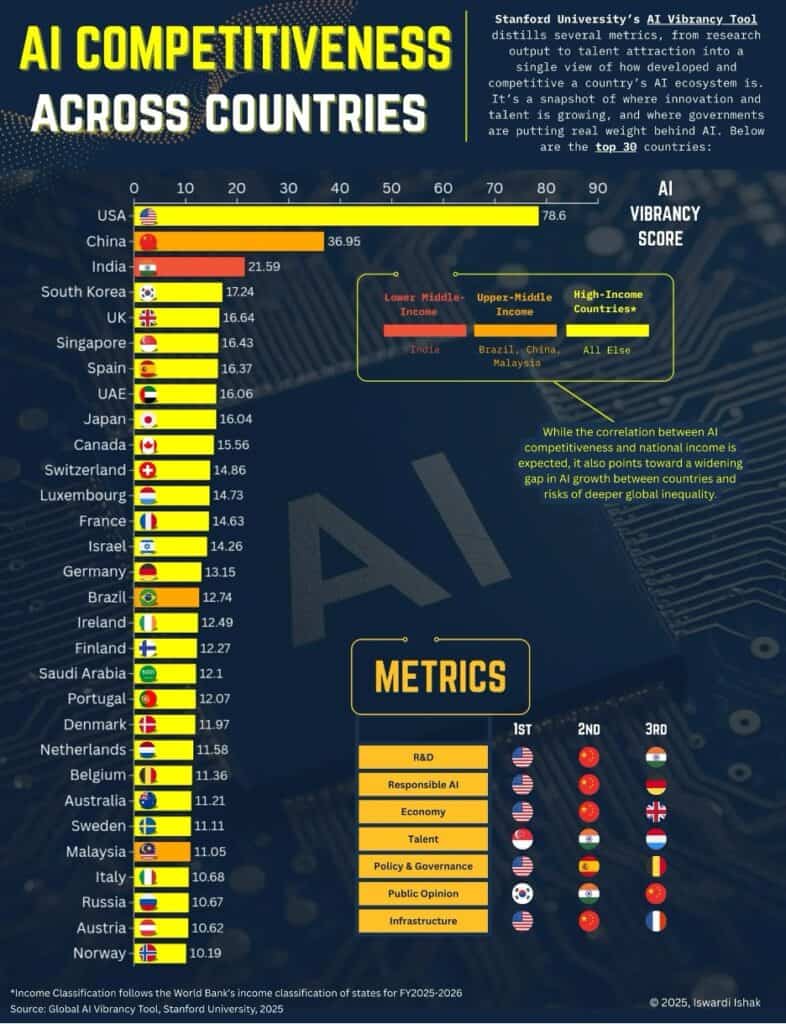

Visualising AI Competitiveness Across Countries

US economy expected to grow faster in 2026 despite stagnant job market

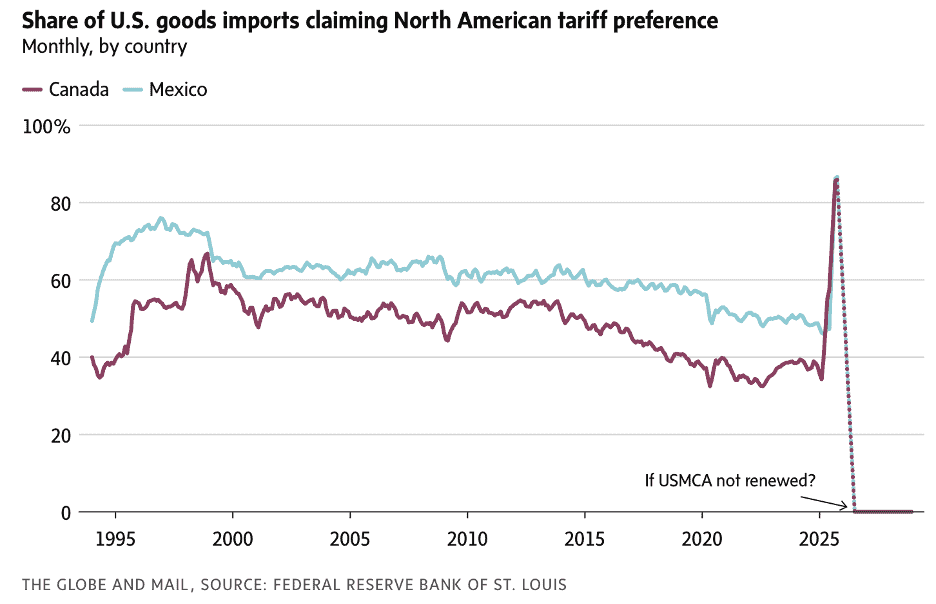

U.S. automakers urge Washington to uphold USMCA

Franchise Global News Section: Burger King®, KFC®, McDonalds®, Pizza Hut®, Popeyes® and Red Lobster®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

The latest GlobalVue™ country ranking chart is out. This chart has been published quarterly since 2001 and compares countries as places to do business. A ranking if ‘1’ is best and a ‘4’ is worst. Information to crate and update this chart is from ~40 global business sources which are monitored almost daily. This version of the GlobalVue™ country ranking is sorted on the overall average of the 9 country ranking parameters as of January 2026.

===============================================================================================

“3 Mistakes Companies Make When Expanding Internationally – Growth blockers can erode the benefits of globalization. Many companies have fallen into the quicksand of jumping into globalization without conducting enough due diligence. An example of a global expansion that went sideways is Home Depot’s failed attempt to gain inroads in China. What went wrong? Consumers in China weren’t motivated to make purchases. Another growth blocker that often surprises businesses is the difference in hiring practices, legal issues, and related expectations around the world. Globalization is worth the effort, but only if you’re dedicated to being pragmatic. Taking a thoughtful and studied upfront approach may delay your break into international markets. Nevertheless, it will prepare you to make your expansion plans work.”, INC. magazine, December 30, 2025

============================================================================================

“These Economists Nailed Their 2025 Forecast: Here’s What They Say About 2026 – Investopedia asked economists at Vanguard to share their predictions for 2026, as their 2025 forecasts are on track to be among the most accurate on Wall Street. The U.S. economy will have solid economic growth, lower unemployment, and slightly lower inflation than in 2026, according to their forecast. Tariffs will continue to push up inflation in 2026, but the economy will likely get a boost from tax cuts, economists said. The year ahead will feature stubborn inflation, an improving job market, and solid economic growth, according to a group of forecasters who nailed their outlook for 2025.”, Investopedia, January 2, 2026

=============================================================================================

“Visualising AI Competitiveness Across Countries – Artificial intelligence is fast becoming a barometer of national technological ambition. Stanford University’s AI Vibrancy Tool, which blends metrics from research and talent to governance and infrastructure, shows a clear hierarchy in global AI competitiveness. The United States retains a commanding lead followed by China and then India. High-income countries dominate the top ranks, reflecting deep investments in R&D, robust university systems and mature digital infrastructure. India is the only lower-middle-income country to break into the top 30, a sign of its expanding research base and large technical workforce. Brazil, China and Malaysia represent the upper-middle tier, each building out their AI capabilities with state-backed initiatives and growing private-sector activity.”, Visual Capitalist, December 12, 2025

==============================================================================================

“Global employment trends and what’s ahead: 2025 in review and 2026 preview – Global employers are preparing for a new era of workforce planning, compliance, and innovation. Economic and geopolitical uncertainty, rapid technological disruption, and fragmented regulation are rewriting the rules of employment worldwide. Geopolitical and economic uncertainty, as well as technological disruption, are impacting workforce strategies and risks. As AI becomes more embedded in the workplace, jurisdictions around the world are enacting laws to regulate its use – particularly in recruitment, performance management, and employee monitoring.”, Lexology, December 15, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation, Taxes, Tariffs & Trade Issues

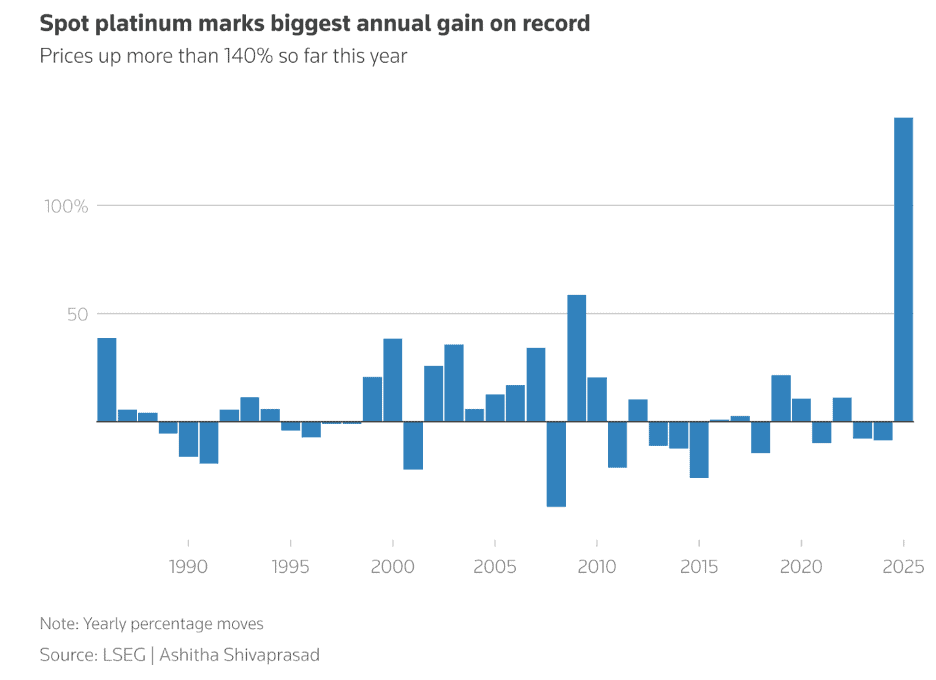

“Platinum set for biggest monthly gain in 39 years on EU auto policy boost – Platinum prices are on track for their strongest monthly rally in nearly four decades in December, fuelled by the EU’s U-turn on its 2035 combustion-engine ban, a tight supply backdrop and rising investment demand for precious metals. Platinum and palladium, both used in autocatalysts that reduce car exhaust emissions, have surged this year as U.S. tariff uncertainty and a rally in gold and silver helped offset long-term headwinds from the rise of electric vehicles. Platinum , also used in other industries such as jewellery, is up 33% so far in December, its biggest jump since 1986, according to LSEG data. After hitting a record high of $2,478.50 per ounce on Monday, the metal is heading for its biggest yearly growth on record of 146%. Its sister metals, palladium and rhodium, are up 80% and 95% respectively so far in 2025.”, Reuters, December 30, 2025

============================================================================================

“U.S. automakers urge Washington to uphold USMCA – The six-year review of the United States-Mexico-Canada Agreement is not scheduled to take place until July, but automakers in the United States are already voicing their support for the continental free trade pact – and calling for the elimination of the Trump tariffs. The agreement, based on the North American Free Trade Agreement that preceded it, has allowed makers of cars and auto parts to boost efficiency and reduce costs by moving production back and forth across borders. The review is happening against a backdrop of trade uncertainty brought about by Mr. Trump, who has imposed tariffs on goods from trading partners – including Canada.”, The Global and Mail, December 26, 2025

===============================================================================================

“All of the World’s Oil Reserves by Country, in One Visualization – Just four countries control more than half of the world’s proven oil reserves. Despite the energy transition, fossil fuels still account for nearly 70% of global energy demand. This visualization ranks countries by the size of their proven oil reserves at the end of 2024. The data for this graphic comes from OPEC’s Annual Statistical Bulletin 2025. Figures represent proven oil reserves as of year-end 2024 and are measured in billions of barrels. The data includes conventional crude oil as well as oil sands.”, Visual Capitalist, December 30, 2025

=============================================================================================

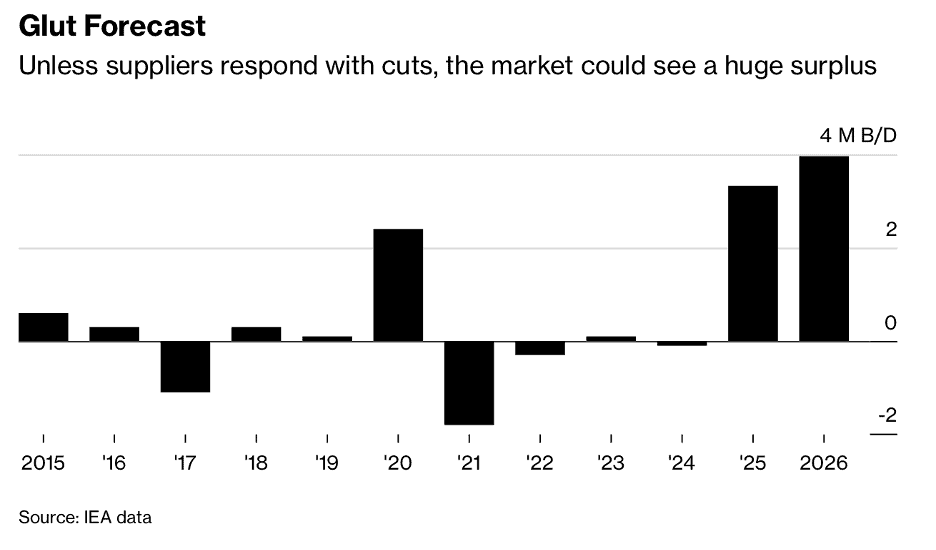

“Not Your Father’s Oil Market: Geopolitical Shocks Lack Impact – Sanctions and fracking have changed the market. The headlines from Venezuela and Iran alone, much less combined, used to be the sort of thing that sent crude prices skyrocketing. Today’s market is different, and that could make a miserable stretch for energy investors even worse. Crude prices have just fallen for an unprecedented third year in a row, and the market remains seriously oversupplied as OPEC unwinds voluntary supply cuts. What is more, there are really two oil markets—the transparent one and the “don’t ask, don’t tell” barrels sold by countries like Russia, Iran and Venezuela operating under sanctions. Many follow convoluted routes via shadow tankers and are snapped up by countries like Turkey, India and China at bargain prices.”, The Wall Street Journal, January 5, 2026

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel News

Global & Regional Travel News

“2026 travel predictions: The unexpected cities about to take off – Unexpected cities set to steal the spotlight in 2026 travel. Global travel search engine, KAYAK, just released its 2026 Travel Trends forecast, analyzing millions of flight searches to uncover the biggest trends shaping travel in 2026. The data is showing that travelers are ready to make 2026 count — uncovering that travel to Eastern Europe is having a “major moment” and that large-scale pop culture, sports and global events are driving interest in unlikely cities.”, The Manual, December 29, 2025

=============================================================================================

“The Future of Travel – A view from the industry – Travelers are showing changes in behavior as we head toward 2026. While they may increasingly be looking to travel abroad, they’re stretching their budgets to make room for richer, more rewarding experiences. ‘What’s exciting about next year is that our data signals traveler demand and spend is set to increase. 84% of the 22,000 people we surveyed globally said they’d travel more in 2026.’ 84% say they’ll go abroad as much – or more – in 2026 vs 2025.”, Skyscanner, December 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Book Review

Global Value Chains and Geopolitical Uncertainty: Disruption and Transformation edited by Imran Ali, William Ho, and Thanos Papadopoulos, is a timely guide to how global trade and cross-border operations are being reshaped by a new and lasting reality: geopolitical uncertainty has become a permanent operating condition rather than an occasional disruption. The book examines how political tensions, supply shocks, industrial policy, and fast-moving technologies are changing how goods and services move across borders—and what businesses and governments can do to adapt.

Rather than arguing that globalization is ending, the volume suggests it is evolving into a more complex form, where resilience depends on diversification, visibility, and flexibility across suppliers, routes, and partners. The authors highlight that decisions once driven mainly by cost and efficiency must now incorporate risk, compliance, geopolitics, and strategic autonomy.

A key strength is its use of recent case-based analysis—showing how firms innovate, adapt, and redesign value chains in response to shifting policies, trade barriers, and technology adoption. The book also explores how digital tools—including automation and AI—are both enabling adaptation and creating new vulnerabilities. Ultimately, the editors frame the future of global value chains as a dynamic balancing act: maintaining competitiveness while navigating an environment where policy, security, and economic objectives increasingly collide.

Five Takeaways for Global Businesspeople

Geopolitical risk is now operational risk—build it into sourcing, pricing, and market-entry decisions.

Diversification beats reshoring as a resilience strategy—multiple regions, suppliers, and logistics options matter.

Expect more government involvement (industrial policy, security-driven regulation, subsidies)—and plan accordingly.

Digital tools (AI/automation) are competitive necessities, but they also introduce new dependencies (chips, energy, talent, governance).

Treat your value chain as a portfolio—measure and actively manage trade-offs between cost, resilience, speed, and compliance.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Australia

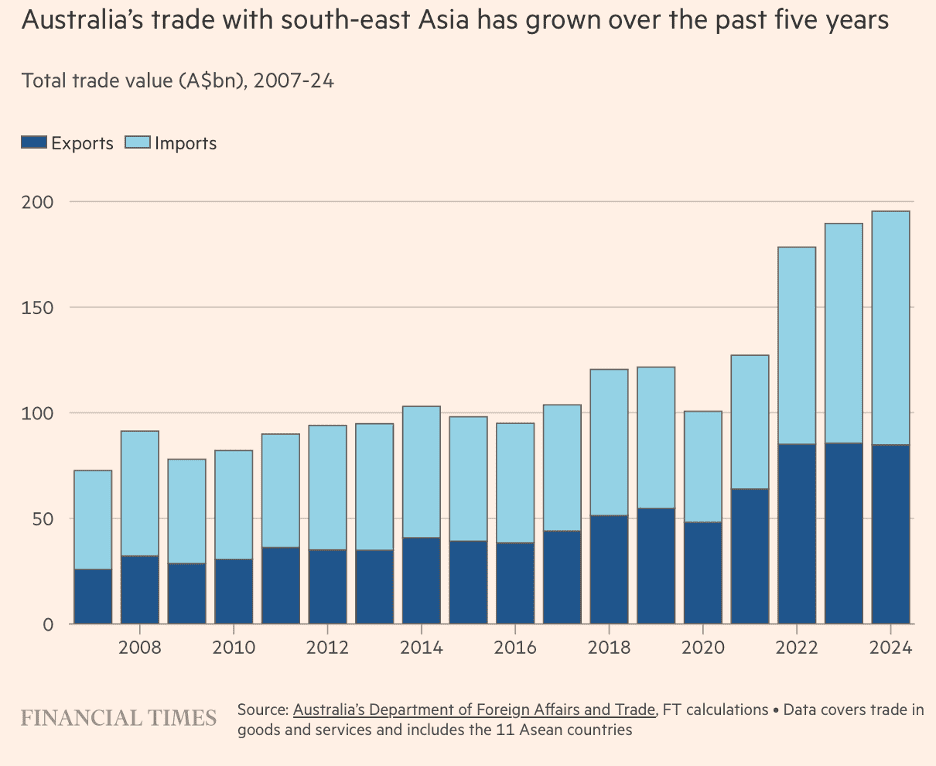

“Australia opens trade frontier on its doorstep as counterweight to China – Canberra pushes to increase business with south-east Asia at a time of heightened trade tensions. South-east Asia was “the fastest growing region in the world”, said Nicholas Moore, the former Macquarie chief executive and Australia’s special envoy to the region. Australian companies and investors who focused on China, the US and Europe risked missing out on the opportunity presented by south-east Asia’s booming middle class and projected GDP growth of between 5 and 6 per cent. ‘There’s a much bigger opportunity to embrace in the region,’ he said, forecasting trade to double over the next 10 years.”, The Financial Times, December 30, 2025

===============================================================================================

China

“Sam’s Club Is Beating Costco at Its Own Game in China – Walmart’s warehouse-club division finds rare success by targeting premium market. Sam’s Club in China has expanded to about 60 stores from 39 three years ago, with some generating over $500 million in annual sales. Walmart’s overall sales in China increased nearly 22% to $6.1 billion in the August-October quarter, making it the company’s fastest-growing international market. Approximately half of Sam’s Club China’s revenue now comes from online shopping, a significant rise from about 4% seven years ago. By contrast, Costco opened its first store in China in 2019 and now has seven locations. The biggest stores each generate more than $500 million in sales annually, according to Walmart.”, The Wall Street Journal, December 28, 2025. Compliments of Paul Jones, Jones & Co., Toronto

=============================================================================================

Canada

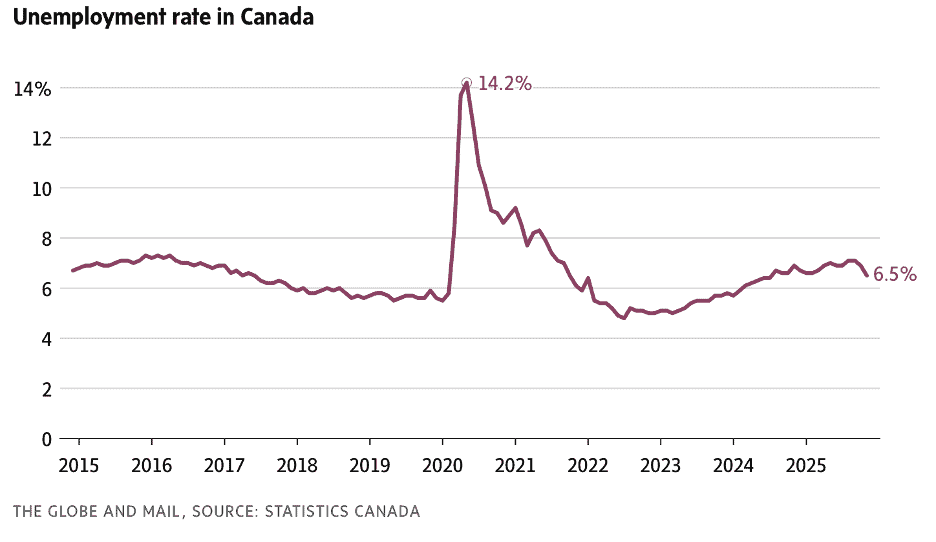

“A tariff road map – The Canada-U.S. trade war is almost a year old – Canada survived Year 1 of the second Trump presidency mostly intact economically, and fully intact sovereignly. What about Year 2? For this series, The Globe asked dozens of economists, analysts and investors to pick a chart they think will be important in 2026. Canadian businesses are also succeeding in rotating their export markets faster than many analysts expected. Tapping into 27 trading partners, Canadian firms have recovered nearly $11-billion of the $18.5-billion loss to the United States. Looking ahead to the (USMCA trade agreement) 2026 renewal, if the U.S. threatens to withdraw – or actually walks away – Canada and Mexico would face another major trade shock, causing more disruption across the North American economy.”, The Global and Mail, January 1, 2026

=============================================================================================

Europe

“Forget affordability. Europe has an availability crisis – Tight regulation is largely to blame. At first glance, Europeans have reason to be concerned about affordability. In fact, the continent’s problem increasingly seems to be not affordability but availability. In its highly regulated markets, prices cannot adjust to balance demand and supply. Rationing is doing the job instead. The share of households paying more than 40% of disposable income on accommodation has, if anything, fallen since 2021. The true difficulty is finding a place at all. When a flat does become available, it can attract hundreds of applications. In health care, another regulated market, a doctor’s appointment can be hard to obtain.”, The Economist, December 30, 2025

============================================================================================

India

“India ‘spreads its bets’ to beat Trump’s 50% tariff as exports rise – With exports hitting a record US$825 billion and a spate of new trade pacts, India is finding success diversifying away from the US. Ever since US President Donald Trump imposed import tariffs of 50 per cent on India last year, among the highest levied by Washington, the South Asian nation has maintained a resolute approach to the punitive levies, even as it has kept the door open to negotiations. After concluding the trade deal with New Zealand last month, Indian Commerce Secretary Rajesh Agrawal said in a social media post that it was the third such arrangement signed last year, following earlier pacts with the United Kingdom and Oman. Analysts predict that an interim trade deal between the US and India is still likely to materialise in the coming months, rather than a full-blown free-trade agreement.”, The South China Morning Post, January 4, 2026

============================================================================================

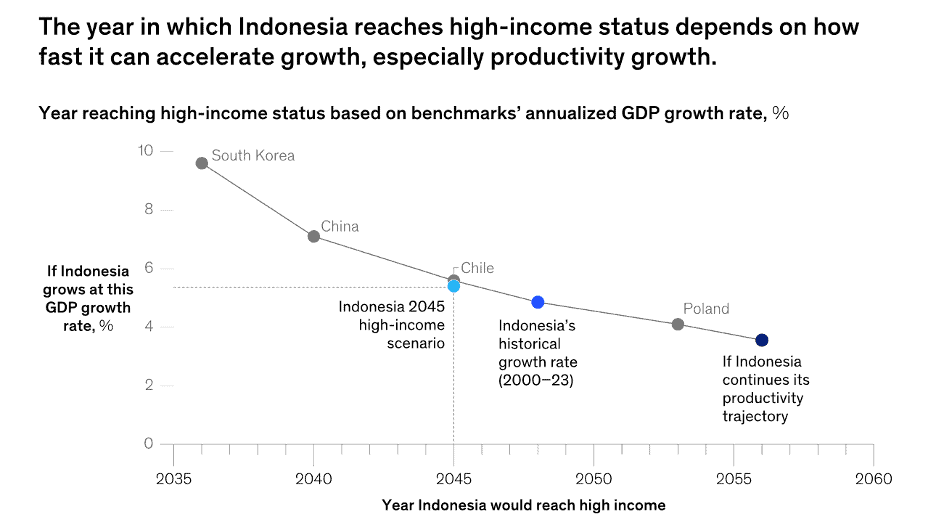

Indonesia

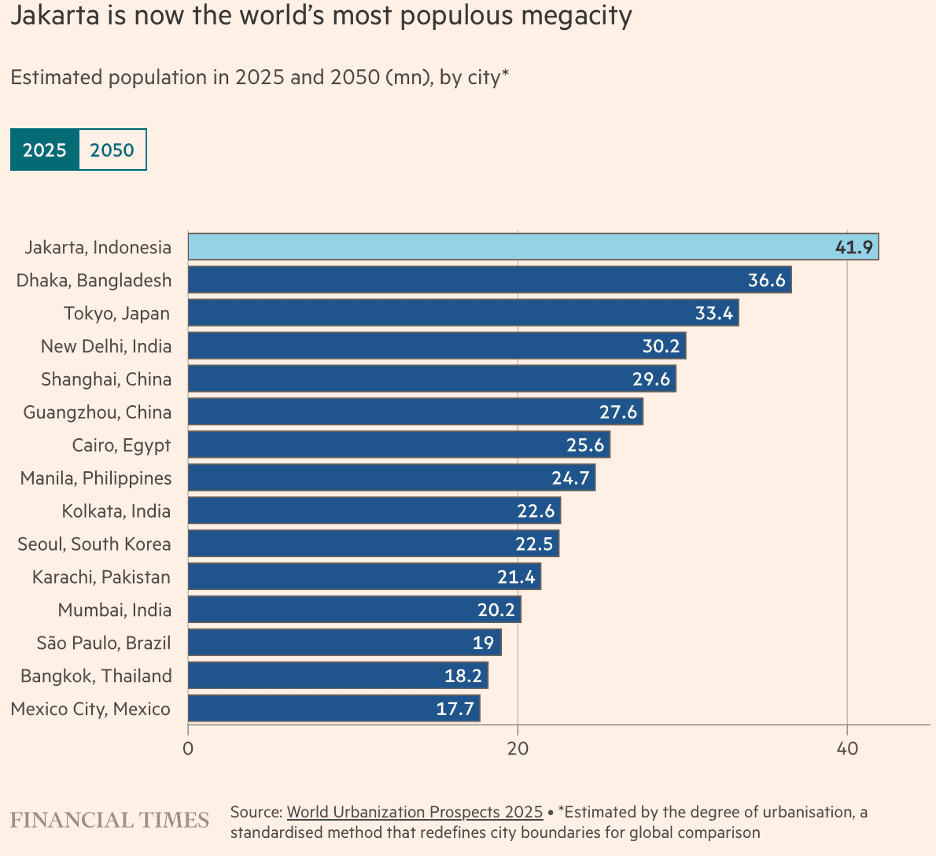

“Move over, Tokyo — the world has a new biggest city – Jakarta and its sprawling environs’ 42mn inhabitants are now the most populous conurbation, according to the UN. Last month, the UN updated its list of the world’s biggest cities after changing its methodology for assessing huge conurbations. It looked beyond Indonesia’s own 11mn reckoning of Jakarta’s population, sweeping into its calculations a much bigger urban area covering sprawling satellite towns such as Bogor…… Jakarta’s problems are reflective of other rapidly growing cities in Asia, which the UN says is now home to about half of the world’s 33 megacities — defined as urban areas with at least 10mn people.”, The Financial Times, December 27, 2025

Editor’s Note: Bill Edwards lived in Jakarta in 1975 and 1976 when the core population was estimated to be 5 million people versus 11 million today. Traffic was bad even then!

===========================================================================================

South-East Asia

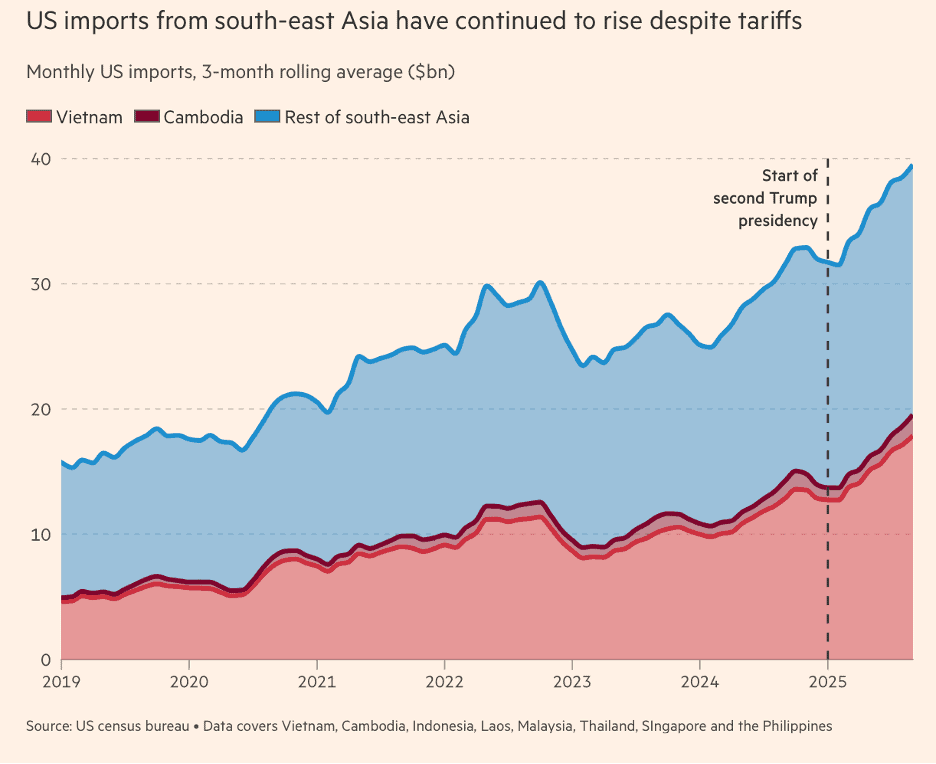

“How south-east Asia is riding out Trump’s tariff storm – Rerouting of goods from China plus US demand for tech products is propping up trade in the region. Goods exports from south-east Asia to the US rose 25 per cent between July and September relative to the same period in 2024 despite the US president’s trade war, according to data from the US Census Bureau. Foreign investments into the region’s main manufacturing economies have also increased, driven by global efforts to diversify supply chains. While Chinese exports to the US were down by 40 per cent in the third quarter of 2025 compared with a year earlier, overall Asian exports to the US have held firm, according to US Census Bureau data.” The Financial Times, January 4, 2026

===========================================================================================

United Kingdom

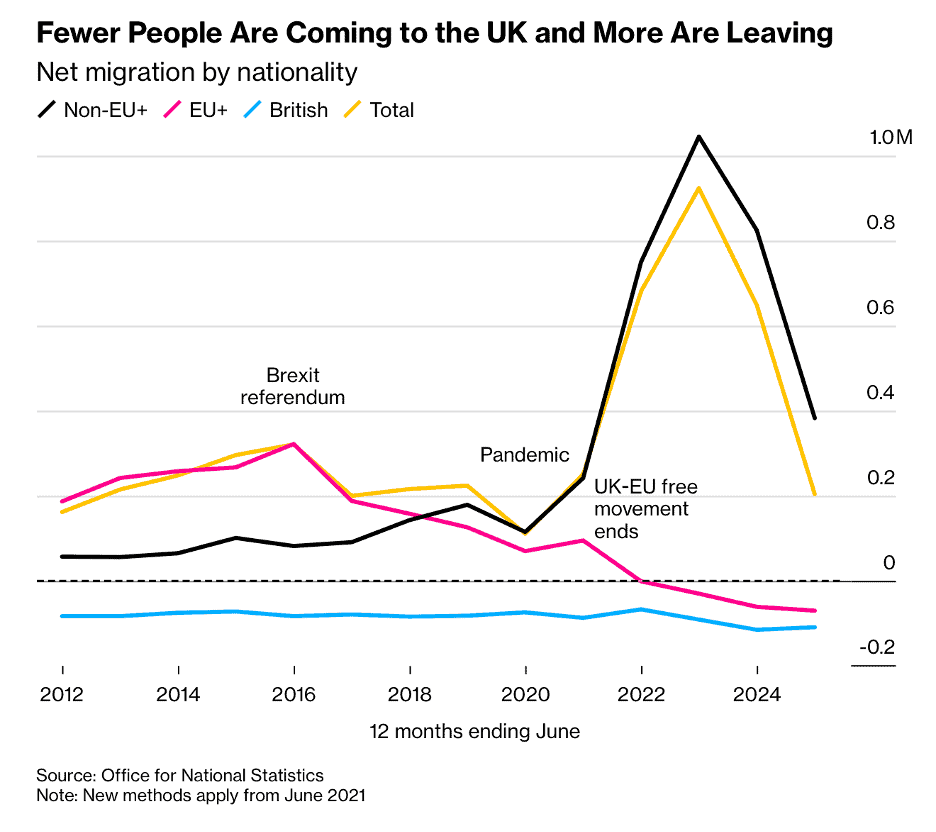

“UK to Pass Population Tipping Point in 2026, Think Tank Says – The number of people who die in Britain this year is set to exceed those born in the country, according to the Resolution Foundation. Britain will see a shortfall in births in 2026, with any population growth from then on set to come from international net migration, the think tank said. The UK’s projected shortfall in births mirrors trends elsewhere in Europe and across the developed world, fueling support for policies to encourage women to have more children. A separate quarterly survey by the British Chambers of Commerce found that confidence has continued to weaken following the November budget to its lowest level in three years, with retail and hospitality the worse affected. The level of tax remains the biggest concern for business, following the £26 billion ($35 billion) payroll levy that came into effect last year and recent increases in business rates.”, Bloomberg, January 4, 2026

============================================================================================

United States

“America’s economy looks set to accelerate – A monetary-fiscal loosening is coming. The effects of the One Big Beautiful Bill Act, a tax-cutting law enacted in July, will soon start to be felt. Americans will receive refunds that reflect retroactive tax cuts on income from 2025. They will also find that levies on monthly earnings have fallen. According to Piper Sandler, an investment bank, these “two years of tax cuts in one” are worth about $191bn. Such tax-cutting should be enough to boost gdp by 0.3%—a reasonable stimulus given the economy probably grew by 1.9% in 2025. For all these reasons a vocal minority of analysts say that 2026 will be a year of strong economic growth. Some expect it to be an international story.”, The Economist, December 30, 2025

============================================================================================

“US economy expected to grow faster in 2026 despite stagnant job market – Goldman Sachs predicts growth acceleration as $100B in tax refunds and reduced tariff drag boost economic momentum. Goldman economists see the U.S. economy growing at a faster rate in 2026 with the firm forecasting 2.6% real GDP growth, above the Bloomberg consensus of 2%. That continues a post-pandemic trend of optimism around the U.S. economy relative to consensus forecasts. The Goldman Sachs economists estimate that consumers will receive an extra $100 billion in tax refunds in the first half of next year, which is equivalent to about 0.4% of annual disposable income. Additionally, they note that OBBBA’s business tax provisions allowing full expensing of plant and equipment spending ‘has already started to boost forward-looking capex indicators.’”, Fox Business, December 29, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The Accredited Franchise Supplier certification

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Brand & Franchise Sector News

“2025 was a year of hope for full-service restaurants – FSRs had plenty to celebrate as consumers rekindled their love for sit-down dining. But there were challenges too, including a steady stream of bankruptcies. In a year in which consumers grew increasingly fed up with inflation, full-service restaurant chains broke through with an appealing proposition: A full meal, a drink or two, plus friendly service, for a reasonable price. But 2025 wasn’t without its warts. A steady drumbeat of full-service bankruptcies continued, and a turnaround at Cracker Barrel came to a screeching halt following its logo blowup.”, Restaurant Business, December 18, 2025

==============================================================================================

“KFC, Pizza Hut India Operators to Merge in $933 Million Deal – Two franchise operators of KFC and Pizza Hut restaurants in India, Devyani International Ltd. and Sapphire Foods India Ltd., have agreed to merge in a share-swap deal worth about $933 million. The deal will create economies of scale, reduce overheads, boost operational efficiencies, and enhance bargaining power with suppliers and vendors, according to the two franchisees. The merged unit will focus on accelerating KFC’s expansion, strengthening Pizza Hut for long-term growth, and scaling emerging brands, and is expected to see potential synergy benefits of as much as 2.25 billion rupees annually from the second full-year of the merged operations.”, Bloomberg, January 1, 2026

===============================================================================================

“Here’s What You’ll Find On Popeyes’ Menus Outside Of The US – Popeyes is the place to patronize when you’re pining for poultry — well, chicken to be exact. The chain was founded in 1972 and has found global success over the decades, with thousands of locations in all corners of the world as of 2025. While the bulk of them are in the U.S., it has seen consistent growth in other parts of the globe. It actually opened the first non-U.S. store way back in 1991 in Malaysia, and now it has more than 1,200 international locations in 35 countries. Who doesn’t love loaded fries? Well, if you head to a Popeyes U.K. location, then make sure to order the cheesy loaded fries straight away. Spaghetti isn’t a dish we’d think Popeyes would serve, and yet you can order it if you head over to the Philippines.”, Tasting Table, December 27, 2025

===============================================================================================

“Red Lobster’s 36-year-old CEO led the company after bankruptcy. Now he’s plotting the ‘greatest comeback in the history of the restaurant industry’ – Red Lobster entered bankruptcy in 2024, but quickly clawed its way out in just about three months. The once-struggling 57-year-old seafood chain had endured an $11 million endless-shrimp fiasco among other mistakes made. But under the leadership of Damola Adamolekun, 36, who was previously the CEO of P.F. Chang’s, Red Lobster has officially turned the ship around. As the company continues to recover from bankruptcy, the chain expects positive net income in fiscal 2026, and adjusted EBIDTA is expected to grow 43% from fiscal 2025 to 2027.”, Fortune, January 2, 2026

==============================================================================================

“McSpaghetti to McAloo Tikki: Inside the world’s local McDonald’s – From paneer wraps in India to ski-through burgers in Sweden, photojournalist Gary He’s new book McAtlas shows that the world’s most global chain is also one of the most local. “McDonald’s has a reputation for cultural imperialism, but that’s not 100% true,” declares photojournalist Gary He. In his new book McAtlas, He challenges assumptions about the global fast-food giant, which operates 42,000 stores in more than 100 countries and serves 65 million people a day. While many believe McDonald’s has homogenised food culture worldwide, He argues the opposite: that the company has thrived by adapting its menu, architecture and brand to local palates and traditions. ‘McDonald’s has succeeded because they have brilliantly incorporated local flavours and ingredients – from the McRaclette in Switzerland to egg bulgogi burgers in South Korea and the Halloumi McMuffin in Jordan,’”, BBC, September 5, 2025

=============================================================================================

“Burger King to open 30 new UK restaurants in 2026 – This will bring the number of Burger King restaurants in the UK to more than 600. Burger King UK has announced ambitious plans to launch 30 new restaurants in 2026 despite facing “softer” consumer confidence and mounting pressure from increased labour costs. The revelation comes as the fast-food giant disclosed stronger revenues amid a ‘challenging’ economic climate. Plans have been unveiled to open approximately 30 restaurants each year from 2026 onwards, with particular emphasis on new company-owned locations.”, Express UK, December 30, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive our biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing business environment. And our GlobalTeam™ on the ground covering 25+ countries provide us with updates about what is actually happening in their specific countries. We do not get involved in or report on politics!

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

William “Bill” Edwards: CEO & Global Trade Advisor “Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global”. With five decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe, and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service global management consultant since 2001 helping 40+ franchisors expand into new countries. Bill knows how to turn the challenges in taking a brand global into opportunities.

For a complimentary 30-minute consultation on how to take your business into new countries successfully. For a complimentary call with Bill Edwards click on the QR code or contact Bill at bedwards@edwardsglobal.com and +1 949 375 1896

And download our latest chart ranking 40+ countries as places to do business, used by many companies for strategic planning, at this link:

Our latest GlobalVue™ 40 country ranking

Biweekly Global Business Newsletter Issue 150, Tuesday, December 23, 2025

“It’s tough to make predictions, especially about the future.”

Welcome to the 150th Edition of the Global Business Update – Reaching the 150th edition of this biweekly newsletter feels is an appropriate moment to look ahead. So, this issue is devoted to 2026 predictions, predictions, predictions and even more predictions – not bold proclamations or crystal-ball certainty, but a disciplined look at how leading institutions believe the global economy may unfold in the year ahead.

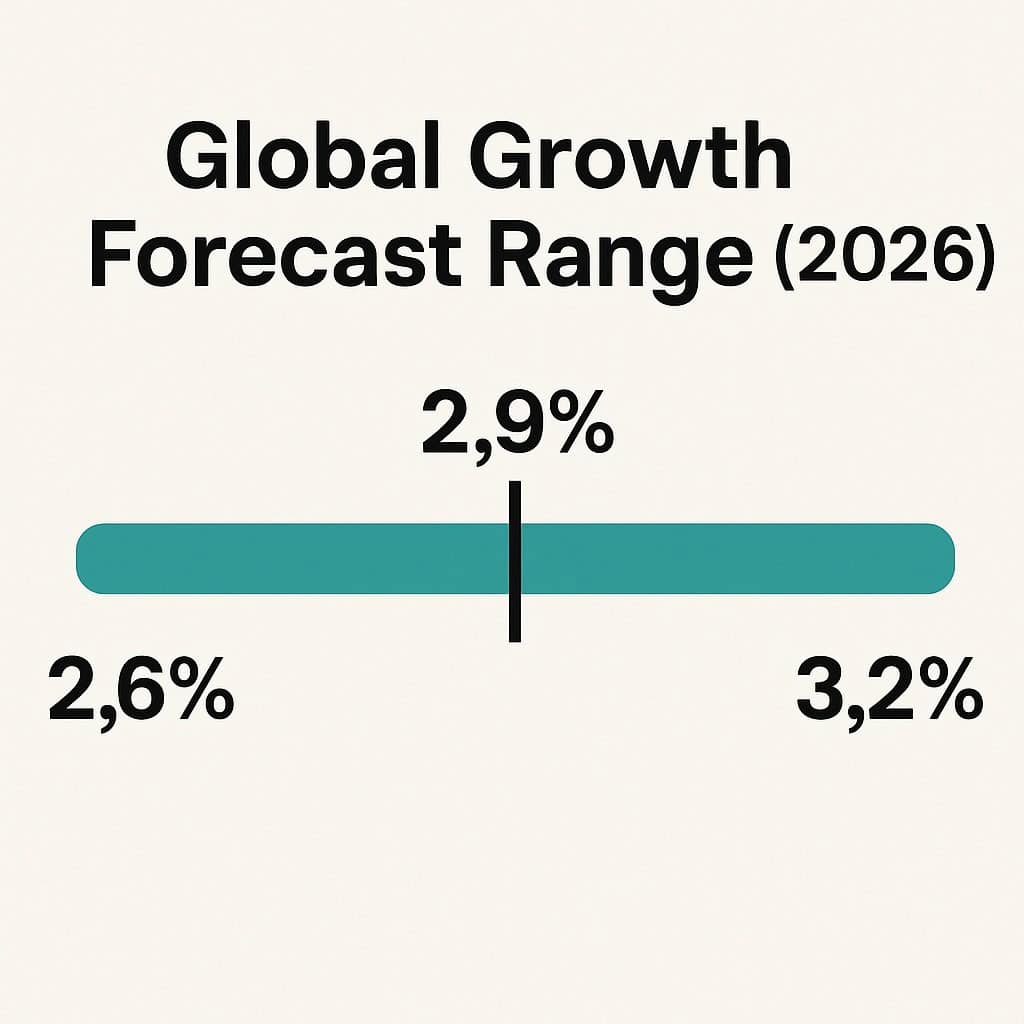

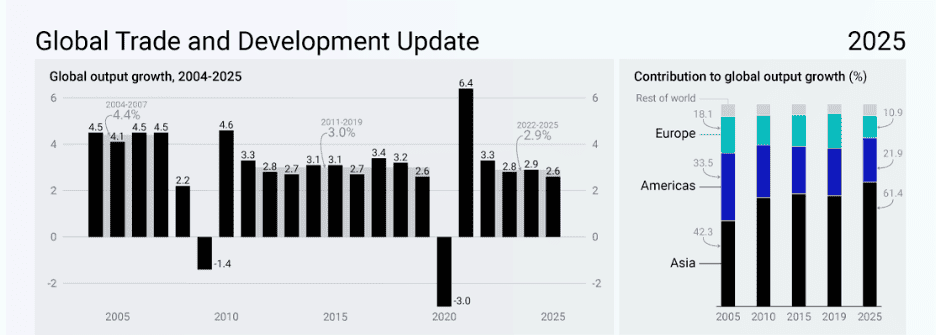

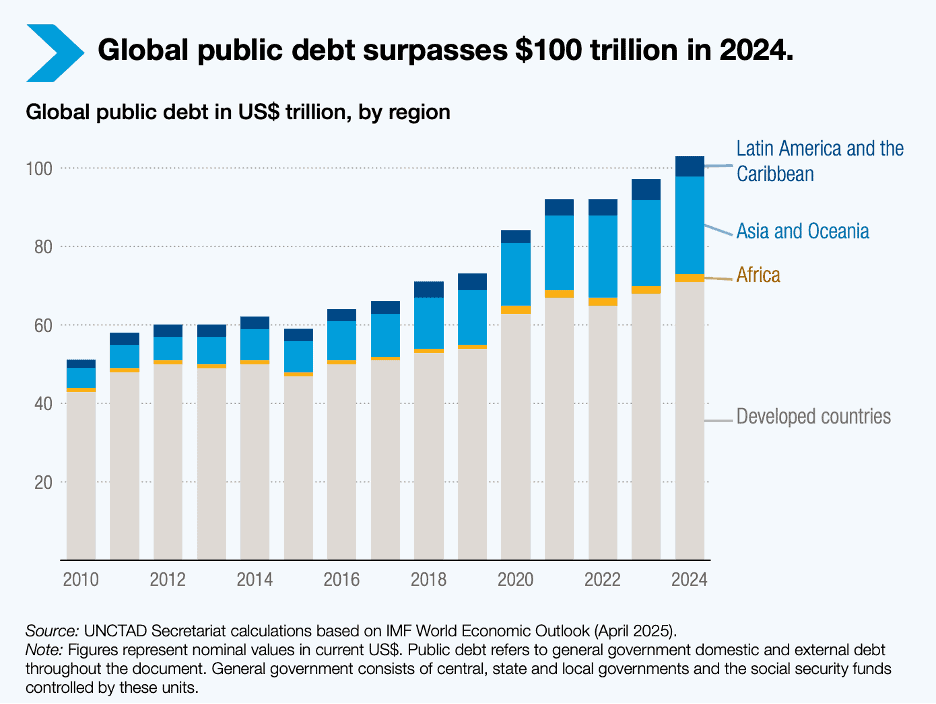

What stands out most from forecasts by the IMF, OECD, Morgan Stanley, Oxford Economics, UNCTAD, the Economist Intelligence Unit, the Financial Times, and others is that projected global GDP growth for 2026 spans from roughly 2.4% at the cautious end to just over 3.2% at the optimistic end. That spread is telling: the global economy is widely viewed as resilient, yet fragile—capable of absorbing shocks, but increasingly vulnerable to policy missteps, geopolitics, and structural constraints.

Advanced economies are expected to grow modestly, while emerging markets—particularly in Asia—continue to shoulder a disproportionate share of global momentum. Trade tensions, tariffs, and political uncertainty remain persistent headwinds, even as private-sector adaptability has repeatedly surprised to the upside.

In 2026, AI is no longer just a technology trend—it becomes a geopolitical and operational risk that global businesses must actively manage. Uneven adoption across countries, AI systems that increasingly act on their own, and competition for chips, energy, and talent push AI governance, workforce redesign, and resilience planning to the center of business strategy.

That same pragmatism is evident in recent global brand and franchise activity. From Western food brands divesting China operations to private-equity buyers, to platform-driven consolidation of mature U.S. brands, to accelerated company-owned expansion in the UK and first-time franchise entries into India, the message is clear: international expansion today is less about exporting formats wholesale and more about finding the right local partners, structures, and ownership models for each market.

This edition’s book review highlightsDesigning Hope: Visions to Shape Our Future, by Futurist Sarah Housley who challenges the prevailing cultural narrative of a dystopian future by urging us to reclaim imagination and optimism about what lies ahead.

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive our biweekly newsletter by email every other Tuesday, click here https://insider.edwardsglobal.com

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business. We do not get involved with or report on politics!

PLEASE NOTE: Some of the information sources that we provide links to in our newsletter require a paid subscription to directly access them. Clicking on a link may not give the reader access to the content.

Edited and curated by: William (Bill) Edwards, CEO & Global Business Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA. Contact Bill with questions, comments and contributions. Bedwards@edwardsglobal.com, +1 949 375 1896

Link to our current and past newsletters: https://edwardsglobal.com/geowizard/

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

First, A Few Words of Wisdom From Others For These Times

Yogi Berra – “It’s tough to make predictions, especially about the future.”

Warren Buffett – “Forecasts may tell you a great deal about the forecaster; they tell you nothing about the future.”

Mark Twain – “Prediction is difficult—particularly when it involves the future.”

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Highlights in issue #150:

Prediction Consensus: What the Experts See Coming in 2026

The Chapman University Economic Forecast

Economic Outlook 2026 – An adaptive economy: tariffs, technology, transformation

BofA Sees Rate Cuts Fueling Latin America Equity Sales in 2026

9 AI Predictions Every Business Leader Should Know For 2026

Franchise Global News Section: Burger King®, California Pizza Kitchen®, Starbucks®, Moe’s Casa Mexicana® and School of Rock®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

Predictions, Predictions, Predictions and more Predictions – The following information is summarized from a variety of global sources that we often use for this newsletter. All this analysis comes from online sources published in December 2025.

Global / Macro Outlooks for 2026

Morgan Stanley — “2026 Economic Outlook: Moderate Growth” projects global GDP growth at **~ 3.2% in 2026** (after ~ 3% in 2025), with resilience from consumption and capital spending.

OECD — According to the December 2025 Economic Outlook: global growth is expected to ease from 3.2% in 2025 to 2.9% in 2026, with a modest rebound to 3.1% in 2027.

UNCTAD — Projects a weaker global performance: **~ 2.6% growth in 2025–26**, down from 2.9% in 2024.

The Conference Board — Their “Global Growth Forecast Update” foresees global real GDP growth around 2.9% in 2026, after 3.1% in 2025.

Oxford Economics — In “Three key trends to watch in the global economy in 2026,” they forecast **~ 2.7% world GDP growth** in 2026, noting growing divergence between regions underneath that aggregate figure.

Alternative Views — Resilience, Disparities & Risks

CaixaBank Research — In its “World economy in 2026: resilience, transition or disruption,” the report argues that despite geopolitical uncertainty and supply-shock risks, the global economy is showing “greater-than-expected resilience,” with ~3% business-cycle speed likely.

S&P Global Ratings — Their “Global Economic Outlook Q1 2026” expects modest global growth (real GDP growth forecast ~2% in 2025 and 2026), but suggests that potential “AI tailwinds” may help avoid deeper slowdown.

RBC Global Asset Management — In its 2026 outlook, estimates U.S. GDP growth of about 2.2% in 2026, positioning it as slightly above the long-term average but below pre-pandemic highs, which may influence global demand dynamics.

Regional Spotlight — What’s Expected in Key Economies

International Monetary Fund (IMF) — In the latest “World Economic Outlook” update: global growth projected at 3.1% in 2026, down from 3.2% in 2025, with advanced economies ~1.5% and emerging economies just above 4%.

S&P Global (regional breakdown) — Their November 2025 update lifts growth forecasts for 2025–27 for several regions, including a positive reassessment for mainland China in 2026.

Invesco — Their “2026 Annual Investment Outlook” argues global capital markets and economic policies are entering a phase of “resilience and rebalancing,” suggesting potential upside for those who navigate carefully.

What This (Probably) Means

There is no single consensus — forecasts for 2026 range widely: from as low as ~2.6% (UNCTAD) to ~3.2% (Morgan Stanley).

Many analyses note structural divergence: developed economies likely remain sluggish, emerging / Asian economies likely carry the bulk of global growth.

Risks and “X-factors” — trade/tariff tensions, geopolitics, policy uncertainty, and uneven recovery from post-pandemic dislocations. And do not fiorget the ‘Oval Office Factor’. On the flip side, AI-driven investment and new capital cycles get cited as potential growth boosters.

The 2026 global growth outlook is described by some firms as “resilient” despite shocks; for others, “fragile,” pointing to downside risks if structural headwinds worsen.

=============================================================================================

What the Economist, EIU & FT say about global growth in 2026

Economist Intelligence Unit (EIU) – In a recent report titled “Global outlook: Looking ahead to 2026”, EIU forecasts global growth to slow to ~ 2.4% in 2026. The report highlights increasing geopolitical risk, policy uncertainty, trade-protectionism and fragility in global trade, which all weigh on global economic growth.

The Economist – The section titled “The World Ahead 2026” outlines broad macroeconomic and structural themes expected in 2026: changes in trade complexity, commodity-price volatility, interest-rate dynamics, etc. However — The Economist does not publish a fixed global-GDP growth rate forecast for 2026 (at least none publicly available in that section). Their outlook is more qualitative than a point-estimate.

Financial Times (FT) – The FT offers analysis and commentary rather than a fixed aggregated global-growth forecast for 2026. For example, in a recent FT article reflecting on the global economy, the authors describe the global economy as “resilient yet fragile,” commenting on headwinds and structural risks. A FT analysis often draws (or critiques) forecasts from organizations such as International Monetary Fund (IMF) or OECD, citing their growth-rate numbers — but FT itself does not always publish its own independent, firm-number 2026 global-GDP forecast in recent public articles.

And what do these normally very astute sources project for their 2026 global GDP growth number?

Economist Intelligence Unit (EIU) — “Global outlook: Looking ahead to 2026” ~ 2.4% global growth in 2026

The Economist — “The World Ahead 2026” Structural / thematic outlook; no fixed GDP number

Financial Times — “The paradox of the resilient, fragile global economy” & related FT commentary Qualitative analysis highlighting risks and structural constraints — no standalone global-growth number

===============================================================================================

And What About AI in 2026? In 2026, AI is no longer just a technology trend—it becomes a geopolitical and operational risk that global businesses must actively manage. Uneven adoption across countries, AI systems that increasingly act on their own, and competition for chips, energy, and talent push AI governance, workforce redesign, and resilience planning to the center of business strategy.

Adoption accelerates—but unevenly: Advanced economies pull further ahead, widening digital and productivity gaps (IMF, OECD).

https://www.imf.org/en/Topics/artificial-intelligence | https://www.oecd.org/digital/artificial-intelligence/

Agentic AI raises governance risk: AI systems increasingly act across workflows, elevating oversight, liability, and control issues (McKinsey, Gartner).

https://www.mckinsey.com/capabilities/quantumblack/our-insights | https://www.gartner.com/en/articles/ai-trends

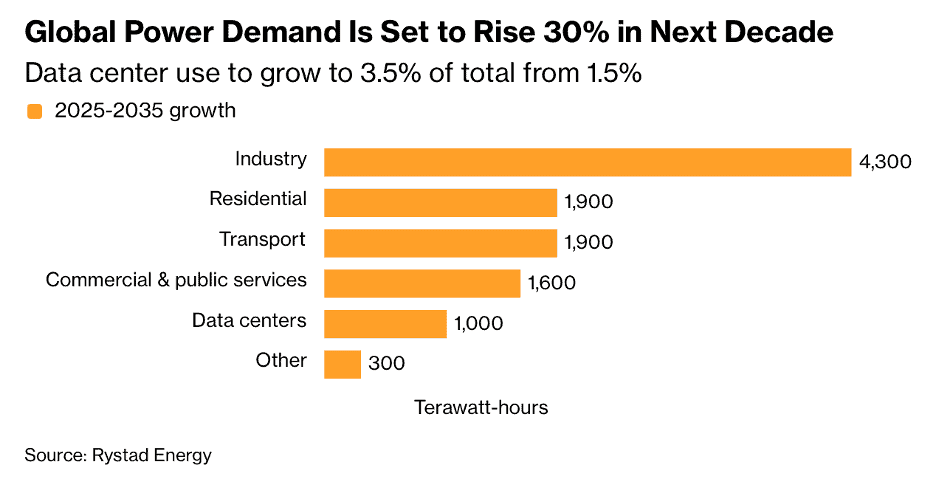

Compute becomes strategic infrastructure: Chips, data centers, and energy shape national competitiveness (WEF).

https://www.weforum.org/topics/artificial-intelligence

Workforce disruption intensifies: Job redesign and AI governance skills become critical (OECD).

https://www.oecd.org/employment/ai-and-work

================================================================================================

“Prediction Consensus: What the Experts See Coming in 2026 – We analyzed over 2,000 predictions from articles, reports, podcasts, and interviews to see what experts are predicting for the coming year. Below, we dig into a few of the top themes. For the seventh straight year, we’ve sifted through the forecast landscape to bring you the Prediction Consensus, a synthesis of what analysts, thought leaders, and industry experts expect for the year ahead. This year, we analyzed over 2,000 individual predictions from a wide variety of sources including Morgan Stanley, Goldman Sachs, the IMF, The Economist, Deloitte, Microsoft, Gartner, and dozens more. By mapping where these forecasts overlap, we’ve distilled the noise into 25 high-conviction themes displayed in our “Bingo Card” format, with the number of dabs reflecting the volume of supporting predictions.”, Visual Capitalist, December 18, 2025

=============================================================================================