EGS Biweekly Global Business Newsletter Issue 28, Monday, April 19, 2021

By William (Bill) Edwards, CEO of Edwards Global Services, Inc. (EGS)

““No one is perfect – that’s why pencils have erasers.”, Wolfgang Riebe, Keynote Speaker/Magician

““Optimism is a happiness magnet. If you stay positive good things and good people will be drawn to you.”, Mary Lou Retton, Olympic Gold Medal Gymnast

“You will either step forward into growth or you will step back into safety”, Abraham Maslow

Introduction

Our biweekly newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment and travel.

Highlights in issue #28:

- Lots of international airline announcements in the Global and Regional Travel Updates section below

Our Information Sources

We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covers 43 countries and provides us with updates about what is happening in their specific countries.

Please feel free to send us your input and sources of information. Our contact information is at the bottom of this newsletter.

First, a few Personal Comments

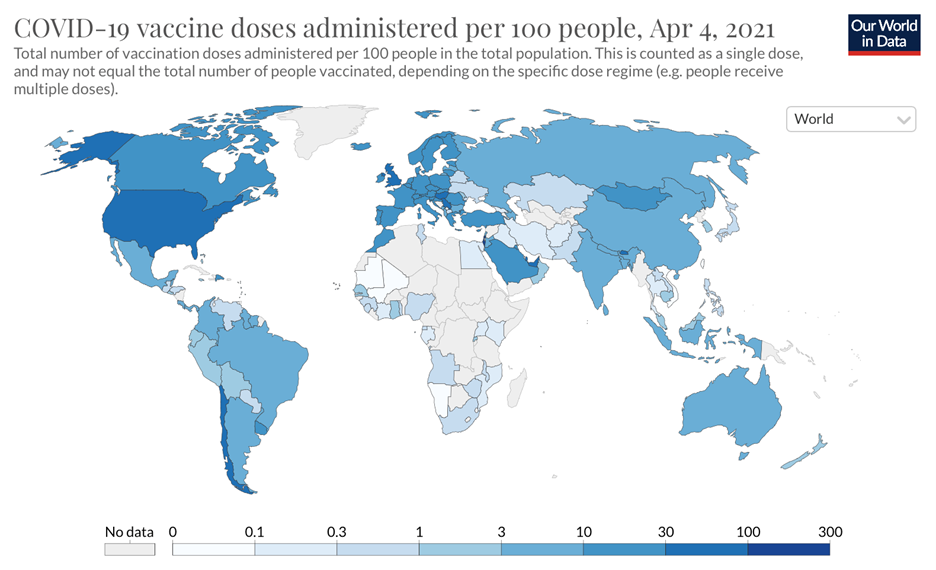

According to Bloomberg, as of April 18th more than 894 million (vaccine) doses have been administered across 155 countries. The latest rate was roughly 16.6 million doses a day. Still too low in the European Union and some parts of the Asia Pacific region. Airlines are increasing northern hemisphere summer schedules. The U.S. and United Kingdom are reopening businesses and consumers are spending. Global savers stockpiled US$5.4 trillion during COVID and are ready to spend.

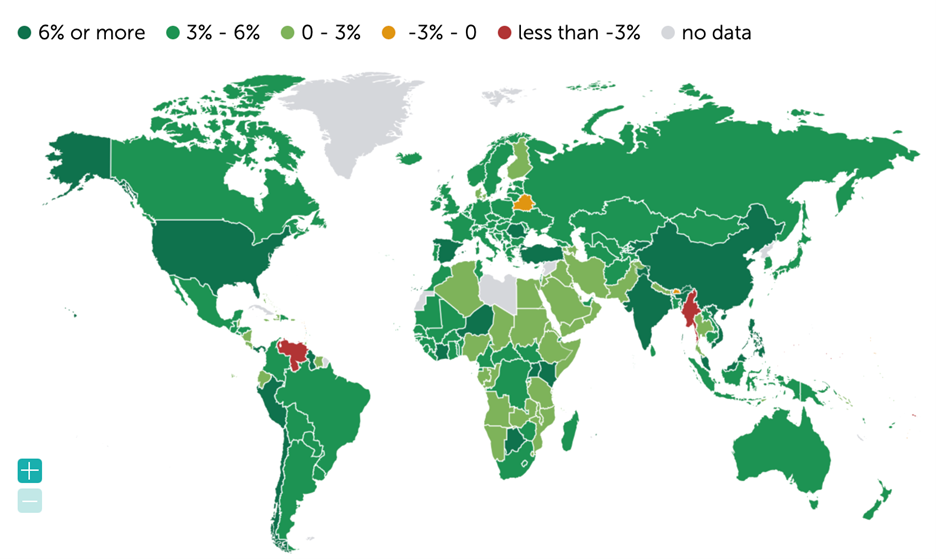

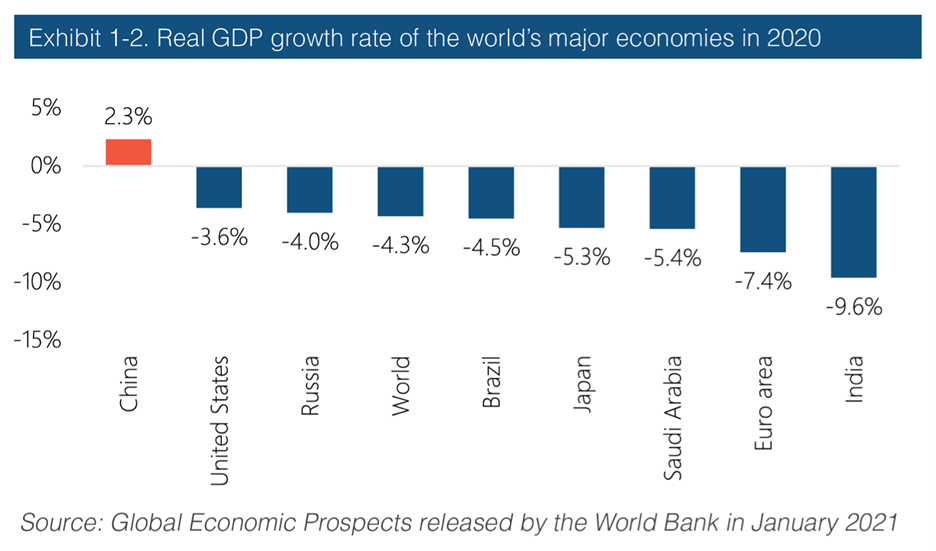

The International Monetary Fund sees global GDP growth this year at over 6%. While the trends are in the right direction, faster vaccine distribution over the next few months is the key to business coming back in 2021.

Global Vaccine Update

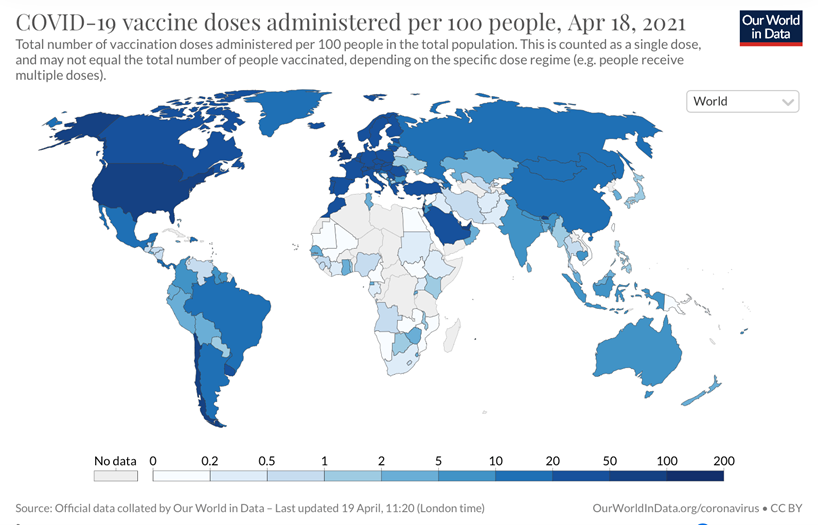

“This map shows the number of COVID-19 vaccination doses administered per 100 people within a given population. Note that this is counted as a single dose, and may not equal the total number of people vaccinated, depending on the specific dose regime as several available COVID vaccines require multiple doses.”, Our World in Data, April 18, 2021

“99.992% of fully vaccinated people have dodged COVID, CDC data shows. No vaccine is 100% effective. But the COVID vaccines seem pretty darn good. The numbers suggest that breakthroughs occur at the teeny rate of less than 0.008 percent of fully vaccinated people—and that over 99.992 percent of those vaccinated have not contracted a SARS-CoV-2 infection.”, ARS Technica, April 15, 2021

Interesting Data and Studies

“Ramadan begins around the world amid Covid restrictions. Millions of Muslims are celebrating the start of Ramadan, a festival that includes a month of fasting and prayer. As Ramadan begins on 13 April, some Muslim communities will find their traditional practises affected by restrictions to stop the spread of coronavirus.”, BBC News, April 13, 2021

“Global growth is projected at 6% in 2021, moderating to 4.4% in 2022. The projections for 2021 and 2022 are stronger than in the October 2020 WEO. The upward revision reflects additional fiscal support in a few large economies, the anticipated vaccine-powered recovery in the second half of 2021, and continued adaptation of economic activity to subdued mobility.” International Monetary Fund, March 23, 2021

“WTO revises global trade forecast higher, as stimulus keeps demand intact and China dominates exports. Global merchandise trade is expected to rise by 8 per cent this year. WTO officials warn that the lopsided distribution of vaccines globally presents the biggest risk to a full recovery in global trade.”, South China Morning Post, March 31, 2021

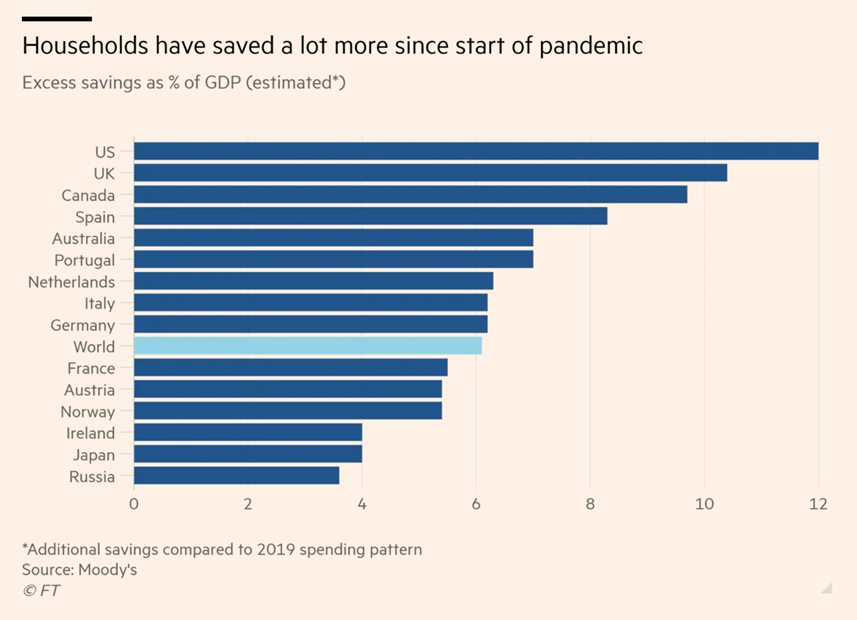

“Global savers’ $5.4tn stockpile offers hope for post-Covid spending. Households amass extra cash equivalent to 6% of world output since pandemic began. Consumers around the world have stockpiled an extra $5.4tn of savings since the coronavirus pandemic began and are becoming increasingly confident about the economic outlook, paving the way for a strong rebound in spending as businesses reopen.

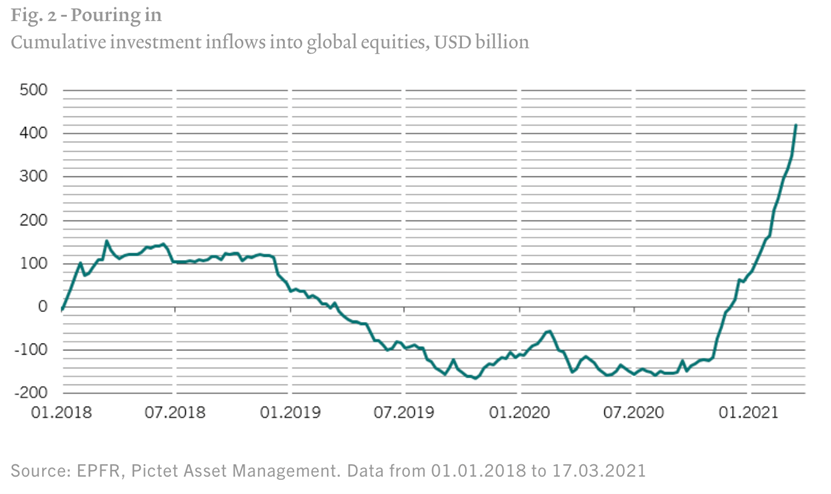

“BAROMETER OF FINANCIAL MARKETS MARCH INVESTMENT OUTLOOK: Let the rally continue. Ample monetary and fiscal stimulus should provide a strong boost to the economy and corporate profits. Which is why we continue to favour cyclical stocks.”, Pictet Asset Management, April 2021

Global and Regional Travel Updates

“Hopes rise for Britain’s summer getaway season. Hopes that the great British getaway would be possible this summer grew on Wednesday, with easyJet (EZJ.L) predicting that most of Europe would be open for travel and British Airways confident on routes to the U.S., despite ongoing uncertainty. Europe’s travel industry, battered by the pandemic, is counting on British holidaymakers to lead a tourism rebound this summer. After one of the world’s fastest vaccination programmes, Britons could be permitted to travel from late May.”, Reuters, April 14, 2021

“Etihad Airways Launches Historic Service From Abu Dhabi To Israel. Etihad Airways, the national airline of the United Arab Emirates, has launched a twice-weekly regular service between Abu Dhabi (AUH) and Tel Aviv (TLV), marking the latest development in the warming relations between the two nations. The Abu Dhabi/Israel flights reflect ‘the growing cooperation between the two nations following the establishment of diplomatic, trade and tourism ties,’ according to an Etihad press release.”, Forbes, April 7, 2021

“Mexican Carriers Start April with Good News. Although Latin America is going through a difficult time due to new outbreaks of COVID-19, positive news has come out in Mexico regarding the development and recovery of its airline sector. Viva Aerobus, Mexico’s ultra-low-cost airline, surpassed one million passengers in March 2021, a growth of 67.7% compared to last February.”, Airline Geeks, April 10, 2021

“Qantas Airways Airbus A380 Fleet Returning to the Skies. ‘All of the A380s, we believe, will be reactivated. QF CEO Alan Joyce said at a CAPA Live virtual conference on Wednesday that the airline had invested a lot of money on them. ‘They’ll be good aircraft once demand is there.’”, Airways Magazine, April 14, 2021

“Airlines are ‘run off their feet’ as thousands of Australians book flights back to New Zealand after travel bubble announcement – but one carrier refuses to take to the skies. Airlines have added hundreds of services between Australia and New Zealand. Qantas, Jetstar and Air New Zealand are among the airlines offering services. But Virgin Australia will not offer flights across to New Zealand before October

“France Set To Ban Short Domestic Flights in Favor of Train Travel. In a dramatic plan to cut airline emissions and help the environment, France is set to ban short domestic flights in favor of train travel if the trip can be taken in two-and-a-half hours or less.”, Travel Pulse, April 13, 2021

“Heathrow warns travelers to brace for up to 6-hour queues. Travelers are already stuck in queues for COVID-19 testing that are several hours long at the moment, and airport officials describe the situation as “untenable.” According to The Times, wait times are “well in excess of two hours and up to six,” and are expected to get worse.”, The Points Guy, April 15, 2021

“Israel to reopen to fully vaccinated tourists from May 23. As of May 23, limited numbers of fully vaccinated tourists will be allowed to enter Israel on a leisure basis in groups. Once the borders have reopened to vaccinated travelers, it will be the first time in more than a year that Israel has reopened to non-citizens. Following an extremely successful vaccination program to date, Israel is ready to welcome back tourists who have been fully vaccinated from COVID-19 this summer.”, The Points Guys, April 13, 2021

“Australia considers staggered reopening of borders. Australia will consider a staggered reopening of its international borders to allow residents who are fully vaccinated against COVID-19 to travel abroad first, Prime Minister Scott Morrison said on Thursday. Australian citizens and permanent residents cannot leave the country due to coronavirus restrictions unless they have an exemption, while returning international travelers have to quarantine in hotels for two weeks at their own expense.”, Reuters, April 15, 2021

“Greece accelerates reopening, plans to welcome tourists back from next week. A Greek official said on Wednesday that the country will reopen to fully vaccinated travelers coming from the United States from next week. Additionally, Americans who have received a negative COVID-19 test will be permitted to enter.”, The Points Guy, April 14, 2021

“Business Travel Is Dead, Long Live Business Travel. It’s unclear whether business travel will make a full comeback to pre-pandemic levels, but two things have happened. First, the past year has permanently changed the way companies think about business travel and how they’ll approach it in the future. Second, technology has a huge role to play not only as a substitute for travel, but as a catalyst for regrowth in the travel industry itself.”, Forbes, April 1, 2021

“China ‘could start easing international travel restrictions by next spring’ if it hits coronavirus vaccination targets. The country aims to inoculate at least 70 per cent of its population by then, which would allow China to start negotiating an end to border restrictions. But Zhang Wenhong, head of Shanghai’s Covid-19 team, warns that it risks falling behind other major economies if take-up rates stay low.”, South China Morning Post, April 6, 2021

Country & Regional Updates

Australia

“Most Australian workers don’t want to return to offices after Covid and businesses say they likely never will – as work-from-home increases productivity. Just 17 per cent of professionals want to come back to the office permanently.”, The London Daily Mail, April 12, 2021

“The Federal government has expanded its guaranteed recovery loan scheme to include SME’s that are eligible flood-affected businesses, according to a government statement. Eligible businesses, including self-employed individuals and non-profit businesses, must have received JobKeeper payments between January 4 and March 28, and/or be located or operating in eligible Local Government Areas (LGAs) impacted by the March floods. Secured and unsecured loans of up to $5 million are available through participating commercial lenders and interest rates are flexible but capped at 7.5%. Loans can be used to support investment and re-finance pre-existing debt, among other things. Loans will be available from 1 April to 31 December 2021.”, Franchise News newsletter, April 15, 2021, Jason Gehrke, Managing Director, the Franchise Advisory Centre, Brisbane

“Australia flags mass inoculation amid COVID-19 vaccine turmoil. The federal government and states will discuss setting up mass vaccination centres from as early as June for people above 50, Prime Minister Scott Morrison said on Wednesday, when the country would have moved to its next immunisation phase.”, Reuters, April 13, 2021

Brazil

“Brazil ‘back to business’ in 2-3 months as vaccinations accelerate, economy minister says. ‘We think that probably two, three months from now Brazil could be back to business. Of course, probably economic activity will take a drop but it will be much, much less than the drop we suffered last year … and much, much shorter,’ (Brazilian Economy Minister Paulo) Guedes said. To achieve that, Brazil must speed up mass vaccination, which Guedes hailed as the country’s most important fiscal policy right now.”, Reuters, April 6, 2021

China

“Chinese Economy Grew More Than 18% in First Quarter. The year-over-year GDP growth rate will almost certainly trend lower in coming quarters. The rate of gross domestic product growth in the first three months of 2021 was sharply higher than the 6.5% year-over-year growth recorded in the final quarter of 2020, though it fell short of the 19.2% growth expected by economists polled by The Wall Street Journal.”, The Wall Street Journal, April 16, 2021

“China factory gate prices rise by most in nearly 3 years as economic recovery quickens. China’s producer price index (PPI) rose 4.4% in annual terms, the National Bureau of Statistics (NBS) said in a statement, far above a 3.5% rise forecast in a Reuters poll and up sharply from a 1.7% increase in February.”, Reuters, April 8, 2021

“China’s imports from US set record in first quarter, but their trade imbalance grows on strong Chinese exports. Analysts tie China’s broader import rise to higher global commodity prices and stronger domestic demand, particularly in construction sector. China’s overall export growth stayed high in first quarter and ‘may now be peaking’, analyst says, as policy support is removed and vaccine roll-outs start to reverse pandemic-induced demand for Chinese goods.”, South China Morning Post, April 13, 2021

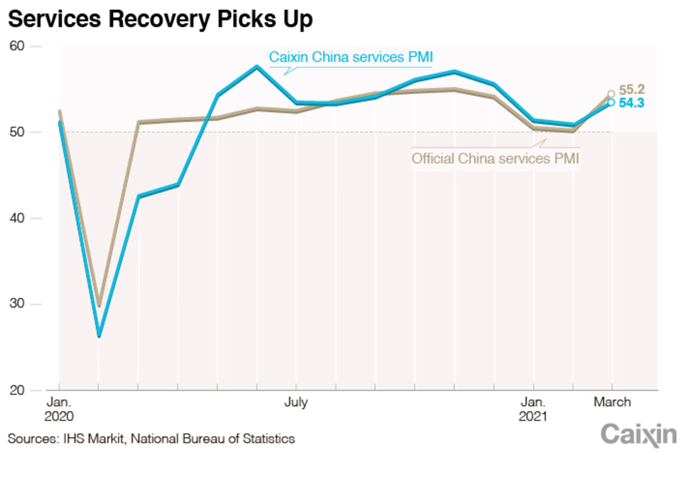

“China Services Expansion Hits Three-Month High, Caixin PMI Shows. The Caixin China General Services Business Activity Index, which gives an independent snapshot of operating conditions in the services sector, rose to 54.3 in March from 51.5 the previous month.”, Caixin Global, April 6, 2021

Czech Republic

“Czechs start to ease lockdown, youngest kids back to schools. The Czech Republic has taken its first steps toward easing a tight lockdown. As the coronavirus pandemic eases up in the Czech Republic, one of the European Union’s hardest-hit countries took its first steps on Monday toward easing of its tight lockdown.”, ABC News, April 12, 2021

European Union

“Europe’s pandemic-stricken economy could return to pre-crisis levels next year, IMF says. European countries have been forced to introduce new restrictions or toughen previous public health measures in recent weeks as Covid infections have surged. There’s uncertainty over how the pandemic will evolve, particularly when it comes to potential new variants and the speed of the vaccination rollout. The IMF said it expected to see high prices in the continent throughout 2021.”, CNBC, April 14, 2021

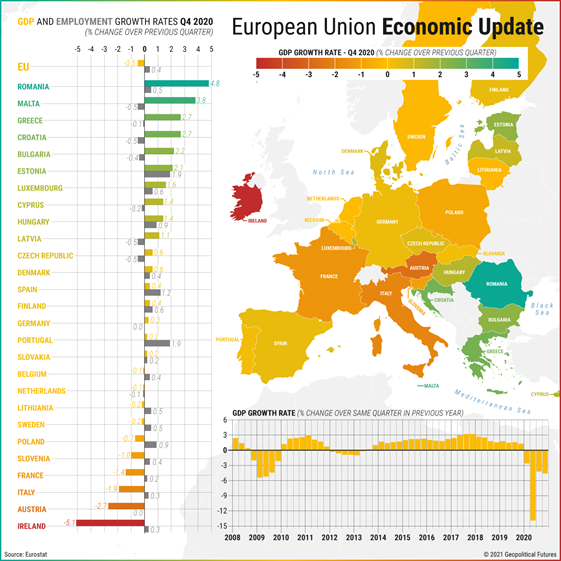

“In its response to the COVID-19 pandemic, the European Union has had some ups and lots of downs – particularly when it comes to vaccine acquisition and distribution. Use of one of the leading vaccines, developed by Oxford University and AstraZeneca, was temporarily suspended and/or restricted over potential health risks, leading some European countries to seek alternatives in Russia or China.”, Geopolitical Futures, April 9, 2021

India

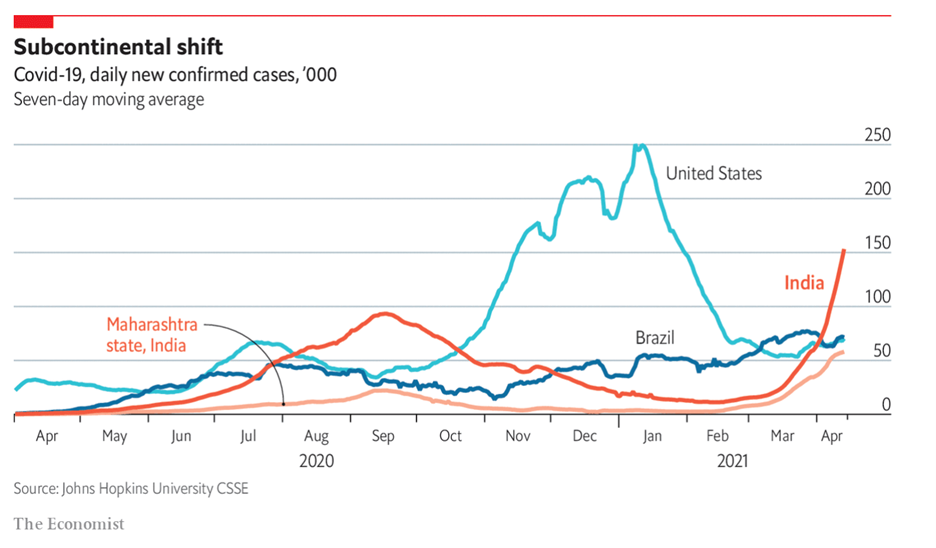

“India is facing a sudden spike in covid-19 cases. Hit with a second wave of infections, the country has become the new coronavirus hotspot. On March 1st, the number of new cases reported was around 12,000. By April 1st it was more than 80,000. On April 13th, it was about 185,000.”, The Economist, April 14, 2021

Singapore

“‘People say they feel safer’ – Singapore now has one-third of global cruise travellers. To date, more than 120,000 residents of Singapore have taken a cruise, and sailings have now been extended until October. The city-state, which contains a population of 5.7 million on an island smaller than New York City, was able to achieve what it has because of its robust health safety framework, Singapore Tourism Board Chief Executive Officer Keith Tan said at a conference.”, The Independent of Dublin, April 18, 2021

“Singapore posts surprise economic growth in first quarter, with GDP expanding 0.2 per cent year on year. The growth was driven by manufacturing, which expanded 7.5 per cent year on year, as well as electronics, precision engineering, chemicals and biomedical sectors.”, South China Morning Post, April 14, 2021

United Arab Emirates

“Rescheduled Dubai Expo hopes to attract 25 million visits. Held every five years, expos see hundreds of countries using pavilions to show off the latest in architecture and technology. Before the pandemic forced the event to be postponed, organisers had expected 25 million visits during the course of the six-month international fair. It will now run from 1 October to 31 March 2022.”, BBC News, April 11, 2021

United Kingdom

“COVID-19: Zoos, pools, theme parks and restaurants on the menu as England’s restrictions ease. Non-essential shops, hairdressers, gyms and outdoor hospitality can be enjoyed again from today. It’s the day millions have been waiting for as coronavirus lockdown restrictions are eased in England.”, SKY News, April 13, 2021

“WH Smith is going places … as long as we’re cleared for take-off……RBC picked WH Smith, the retailer, as a prime beneficiary of the “strong pent-up demand for travel” once the pandemic has passed. “We think WH Smith’s major international markets are providing an encouraging precedent for a recovery in UK travel demand and we expect its relative position to strengthen post the pandemic,” Richard Chamberlain, its retail analyst, said.”, The London Sunday Times, April 17, 2021

“Here’s What Happened in the London Restaurant World This Week…Restaurants, pubs, cafes, and bars reopened outdoors. On Monday 12 April, restaurants, pubs, cafes and bars reopened for outdoor dining — subject to social distancing and the “rule of six” household mixing rules — after their third coronavirus lockdown. In the first week of gardens, terraces, and tables on streets, here’s how it went.”, Eater London, April 16, 2021

“Builders full of joys of spring but prices rise. The March purchasing managers’ index for construction easily beat expectations, jumping to 61.7 from 53.3 in February, its highest reading since September 2014 and above forecasts for 54.6. Readings above 50 indicate growth. Every sector of the industry enjoyed robust growth.”, The Times of London, April 9, 2021

United States

“Disneyland fans waiting hours online for a chance to buy a theme park ticket. Californians trying to get tickets to visit the Happiest Place on Earth after a year-long pandemic shutdown found themselves waiting in line — online — just to get a chance to enter the theme park, where waiting in line is part of the Disney experience.”, San Francisco Chronicle, April 15, 2021

“Small Business Job Openings At Record Level Says New Study. The NFIB’s latest monthly jobs report found 42% of small business owners had job openings they could not fill in the current period – a record reading. The result is based on data from March, and is 20 points higher than the 48-year historical average of 22%. ‘Where small businesses do have open positions, labor quality remains a significant problem for owners nationwide,’ said NFIB Chief Economist Bill Dunkelberg. ‘Small business owners are raising compensation to attract the right employees.’”, Franchising.com, April 12, 2021

“Small Businesses’ Uneven Recovery. A year into the pandemic, owners are still struggling as signs of hope emerge. Because of safety measures to contain the spread of Covid-19, many businesses that depend on gathering people in a physical space, such as gyms, hotels, nail salons, movie theaters, and restaurants, have struggled. Meanwhile, many that don’t depend on people spending time in their space have flourished.”, Bloomberg Businessweek, April 16, 2021

Brand News

“Chicken Sandwiches Take On The World: In the last year, a staggering number of fried chicken sandwiches have made their debut at chain restaurants in the U.S. But it looks like operators around the world are also feeding the craving, according to Technomic’s Global Foodservice Navigator Program. The program’s Spring 2021 report showcases no fewer than eight riffs of the ubiquitous fried chicken sandwich on chain menus in other countries.”, Restaurant Business, April 9, 2021

“Carl’s Jr. Los Angeles Store to Offer All Plant-Based Menu on Earth Day. ‘We are excited to give our fans a fun, delicious way to celebrate Earth Day this year with a full plant-based meat experience at Carl’s Jr.,’ says Patty Trevino, senior vice president of brand marketing at CKE Restaurants. ‘With nearly one-third of consumers identifying as flexitarian, we continue to innovate on new ways for our guests to enjoy our iconic charbroiled burgers with our Beyond Meat partnership.’”, QSR Magazine, April 15, 2021

“Duck Donuts sold to NewSpring Capital affiliate and Betsy Hamm is promoted to CEO. Founder Russ DiGilio, who founded Duck Donuts in 2007 in the town of Duck, N.C., on the state’s Outer Banks, and started franchising in 2013, remains a “significant owner” of the concept and will be a member of the chain’s newly formed board of directors.”, Nation’s Restaurant News, April 13, 2021

“Chick-fil-A tests robot delivery in Southern California. The quick-service chain has partnered with semi-autonomous robot company Kiwibot for robotic deliveries in Santa Monica. Los Angeles-based Kiwibot will be serving Chick-fil-A customers in Santa Monica with the newest version of its robots, which are semi-autonomous — humans operate them remotely, but the rovers are equipped to complete some commands on their own.”, Nation’s Restaurant News, April 15, 2021

“McDonald’s to hire 25,000 staff in Texas this month. Last year, McDonald’s hired around 260,000 restaurant staff in the United States when stores reopened for diners after serving them through delivery, drive-thru and takeaway for weeks due to the COVID-19 pandemic.”, Reuters, April 8, 2021

“StretchLab Signs Master Franchise Agreement for at Least 50 Studios in Australia. The first studio is expected to open in mid-2021 in Perth. StretchLab is one of nine brands owned by U.S. franchisor Xponential Fitness, a curator of leading boutique fitness brands with more than 1,750 studios open worldwide.”, Franchising.com, April 16, 2021

Articles About Doing Business Going Forward

“Digital Transformation in Global Franchising. As we look ahead to a new world of global business, digital business transformation has accelerated and become the way companies will be successful in 2021 and beyond. Franchisors have increased brand innovation and operational efficiency to meet changing customer expectations, reduced product and service costs, made supply chain changes and improved product and service quality.”, Franchising.com, April 2021

“Brave New World of Consumer Marketing Opportunities Dawns as Covid-19 Subsides. Delivery is now a way of life. Businesses will offer people more ways to connect and socialize. Use technology to sell to customers in new ways.”, Franchising.com, April 14, 2021

“The pros and cons of working remotely. Gartner’s recent survey finds that about 70% of employees wish to continue some form of remote work. Twitter and Facebook have already given their employees permission to work remotely on a permanent basis. On the other hand, Goldman Sachs CEO David Solomon calls remote work an “aberration,” urging employees to return to the office to collaborate on ideas.”, Fortune, April 17, 2020

“A new study suggests that “Zoom fatigue” is worse for women than men. The condition will remain a feature of work life, even after employees return to the office. Having endured endless virtual meetings over the past year, many workers are unsurprisingly complaining about “Zoom fatigue”. Videoconferencing can be exhausting.”, The Economist, April 17, 2021

“Senior Care Around the World: Innovation and Bright Ideas from Countries Across the Globe. As the United States grapples with the realities of its large and aging Baby Boom generation, other countries are experiencing similar demographic trends. China, for instance, will have an over-65 population of roughly 500 million people by 2050. The worldwide preponderance of seniors is causing many countries to reassess how they pay for care, manage the needs of those afflicted with dementia, prevent isolation and otherwise show compassion to those who have worked hard throughout their lives and now need support”, Arosa, April 18, 2021

“The post-pandemic office dilemma: Who returns and who works from home? Organizations must decide what happens to the pre-pandemic perks—the gyms, game rooms, and other amenities that defined daily office culture. As we look back on nearly a year of work-from-home data, the results have been overwhelmingly positive—with most remote employees proving to be more productive, while also enjoying the flexibility that can come from a remote setup.”, Fast Company, January 28, 2021

We accelerate global development for our Clients

Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. Our U.S. based executive team has experience living and working in many countries. Our Associate network on the ground overseas covers 40+ countries.

Edwards Global Services, Inc. (EGS) has twice received the U.S. President’s Award for Export Excellence.

Find out more about how we help companies Going Global successfully at:

Download our latest 40 country ranking chart at this link:

William (Bill) Edwards, CFE, is CEO and Global Advisor of Edwards Global Services (EGS). He has 46 years of international operations, development, executive and entrepreneurial experience and has lived in 7 countries. With experience in the franchise, oil and gas, information technology and management consulting sectors, he has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East. Mr. Edwards advises a wide range of companies on early to long term global development of their brands.

For truly global market research, operations and development support across 40 countries, contact Mr. Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

https://calendly.com/geowizard/30min Click here to schedule a call with Bill Edwards to discuss how to succeed in developing your company around the world.

EGS Biweekly Global Business Newsletter Issue 27, Monday, April 5, 2021

By William (Bill) Edwards, CEO of Edwards Global Services, Inc. (EGS)

“Success is the sum of small efforts repeated day in and day out”, Robert Collier

“If I had nine hours to chop down a tree, I’d spend the first six sharpening my axe.”, Abraham Lincoln

“Intelligence is the ability to adapt to change.”, Stephen Hawking

Introduction

Our biweekly newsletter focuses on what is happening around the world that impacts new trends, health, consumer spending, business investment and travel.

Highlights in issue #27:

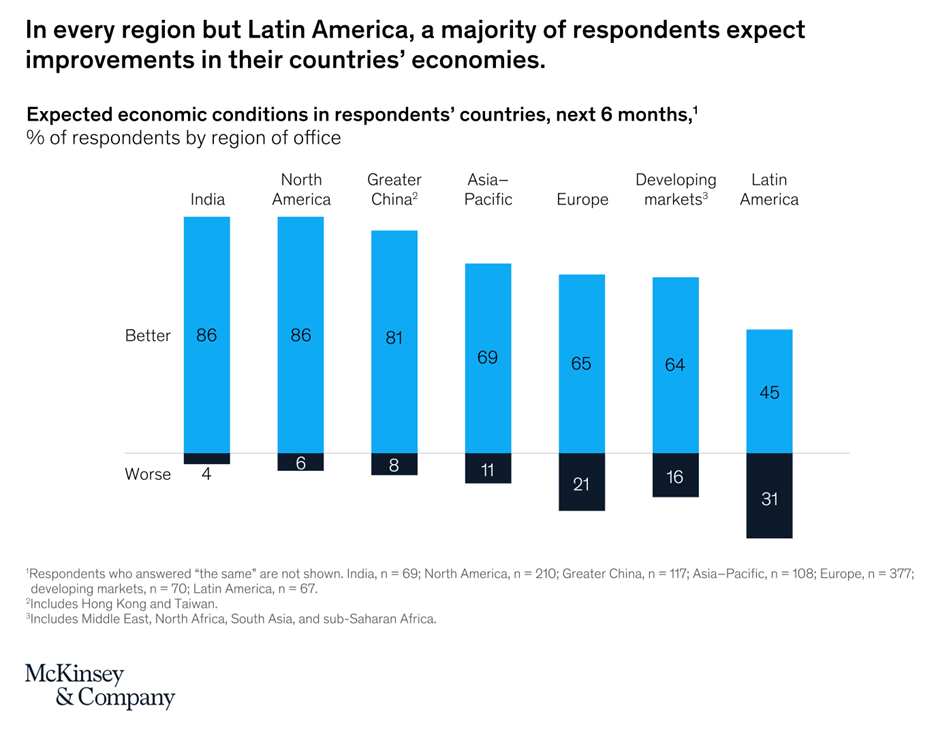

- McKinsey’s latest survey finds greater optimism about the economy and corporate prospects than at any time since the crisis began

- A Vaccine Passport Is the New Golden Ticket as the World Reopens.

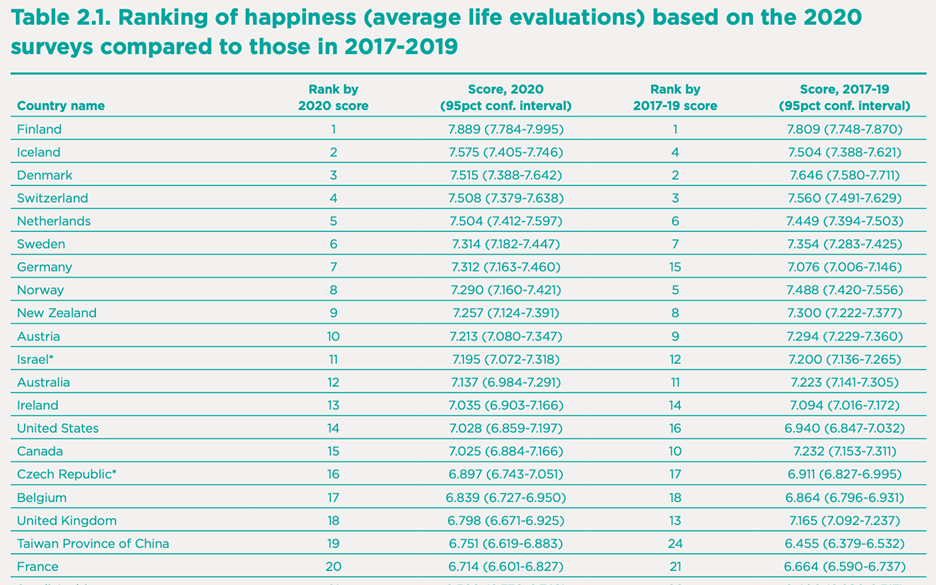

- The World Happiness Report 2021 focuses on the effects of COVID-19 and how people all over the world have fared.

- Consumers can now convert bitcoin or frequent flier miles to cash and reload their Starbucks cards to pay for lattes.

- Asia’s factory recovery picks up but cost pressures grow:

- The robots are coming to small businesses – and for business owners

We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covers 43 countries and provides us with updates about what is happening in their specific countries.

Please feel free to send us your input and sources of information. Our contact information is at the bottom of this newsletter.

First, a few Personal Comments

Since our last biweekly newsletter, the U.S. and The United Kingdom has seen fast growing vaccination rates. The rest of the world, not so much. While the U.S. and the United Kingdom are reopening, the European Union countries are not, partially due to a low vaccination rate. On the positive side, many companies have set new work policies to acknowledge the ability to work productively from home. And several food and beverage brands have announced accelerated growth plans.

Global Vaccine Update

“A Vaccine Passport Is the New Golden Ticket as the World Reopens. Companies and countries that depend on travel or large gatherings are counting on a totally unproven concept.”, Bloomberg, March 25, 2021

“Vaccine Trickle Becomes Torrent as U.S. Eligibility Rules Widen: It’s taking some effort and some patience. But just as eligibility is opening to millions of people across the U.S. after months of cutthroat competition to find Covid-19 shots, vaccines are starting to stream into people’s arms.”, Bloomberg, April 1, 2021

“Even When Covid-19 Vaccines Arrive, EU Struggles to Get Shots in Arms. Despite rising cases, many European countries remain reluctant to overhaul slow and bureaucratic vaccination programs. At the current pace, the EU won’t have vaccinated the majority of adults until well after the summer.”, The Wall Street Journal, March 26, 2021

Interesting Data and Studies

“Our latest survey finds greater optimism about the economy and corporate prospects than at any time since the crisis began—and on a few fronts, more than in the past several years.”, McKinsey, March 31, 2021

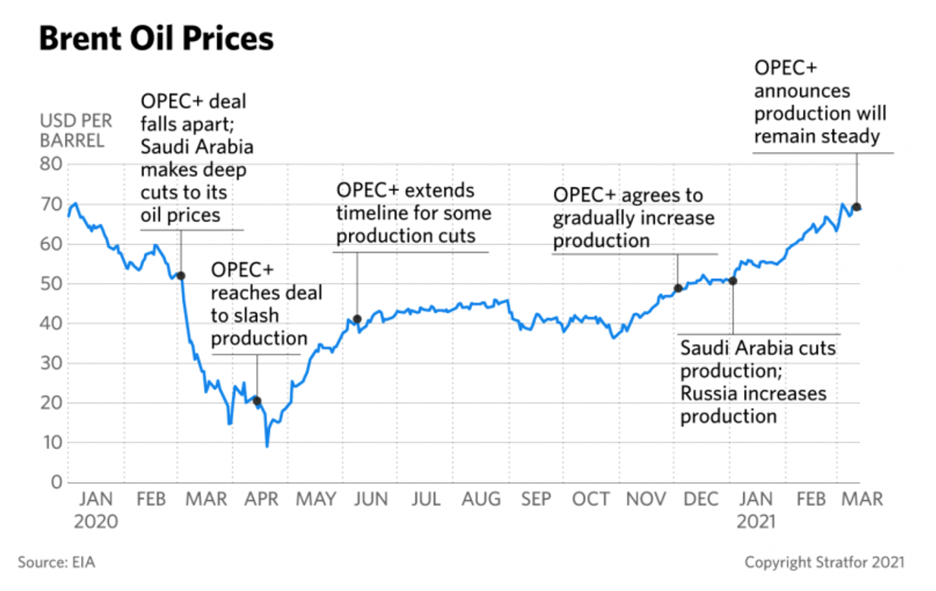

“OPEC+ Reaches Agreement to Slightly Increase Oil Production Starting in May”, Stratfor, April 1, 2021

From a FUNG Business Intelligence report, March 2021

Global and Regional Travel Updates

“American Airlines has inaugurated its first flights between London-Heathrow Airport (LHR) and Seattle-Tacoma International Airport (SEA) – one of American’s hotly awaited new routes ahead of Alaska Airlines joining the oneworld alliance. The flights were delayed due to the pandemic, but the inaugural flight leaving Heathrow for Seattle departed on Tuesday.”, Simple Flying., March 31, 2021

“American Airlines will have most of aircraft taking flight in Q2 as travel demand increases. As of Monday, American Airlines said its seven-day moving average of net bookings is 90% of its 2019 average, with a domestic load factor of 80% during the same time period, according to the filing.”, Fox Business, March 29, 2021

“South American Major Carriers Increase Domestic and International Capacity. Two of South America’s biggest airlines, LATAM, Avianca and Aeroméxico, have announced an increase of its domestic and international routes.”, Airline Geeks, March 25, 2011

“Delta, the last holdout, will start selling flights to 100% on May 1”, The Points Guy, March 31, 2021

“Covid-19 Vaccine Passports Are Coming. What Will That Mean? Scores of plans to verify immunity are in the works. But there are even more questions about how they’ll use data, protect privacy—and who gets certified first.”, Wired, April 2, 2021

“LATAM Announces New Sanitary Measures for Brazil, Chile and Peru; LATAM Airlines announced the entry of new restrictions that South American governments have established for travelers. The measures stated apply to travelers in Brazil, Chile and Peru. These restrictions are for international flights, but there are also requirements for domestic flights.”, Airlines Geeks, April 2, 2021

“Cruise lines want to restart. The CDC has just issued details on how they can do it. Friday, the CDC published detailed requirements for the COVID-19 agreements between cruise lines and U.S. ports they visit, including “worst case scenario” response plans. The agency previously said such agreements would be part of the second phase of its “conditional sail order” but had not released specifics.”, Miami Herald, April 2, 2021

Country & Regional Updates

Asia Pacific

“China, Asia to fill bulk of surging US demand for goods in 2021 as global trade rebounds from coronavirus, WTO says. North America will drive demand in merchandise trade this year, with US imports set to rise by 11.4 per cent after tumbling 6.1 per cent last year, the World Trade Organization (WTO) says. Most demand for imports will be met by producers in China and across Asia, where exports are expected to grow by 8.4 per cent this year.”, South Chinas Morning Post, April 2, 2021

“Asia’s factory recovery picks up but cost pressures grow: Asia’s factories stepped up production in March as a solid recovery in global demand helped manufacturers move past the setbacks of the pandemic, although rising costs are creating new challenges for businesses.”, Reuters, March 31, 2021

Brazil

“Brazil’s unemployment rate rises to 14.2%. Figures from statistics agency IBGE showed that the number of Brazilians officially unemployed in the three months to January rose slightly to 14.3 million from 14.1 million in the three months to October, and up 20% from a year ago.”, Reuters, March 31, 2021

Canada

“Canada’s economy grows for ninth month as pandemic recovery takes hold. January growth jumped on wholesale trade, manufacturing and oil and gas extraction. Retail trade dipped but should recover in February, when restrictions on businesses were lifted, contributing to a likely 0.5% monthly increase.”, Reuters, March 31, 2021

“Air Canada Selling Caribbean/Mexico for May; Restoring Other Routes. They also are restoring flights to Europe, Asia and some U.S. cities in May.”, Travel Pulse, March 22, 2021

China

“China’s Manufacturing Recovery Loses More Momentum: The Caixin China General Manufacturing Purchasing Managers’ Index (PMI), which gives an independent snapshot of the country’s manufacturing sector, dropped to 50.6 in March from 50.9 the previous month.”, Caixin, April 1, 2021

France

“Covid-19: France enters third national lockdown amid ICU surge: All schools and non-essential shops will shut for four weeks, and a curfew will be in place from 19:00 to 06:00. As well as the restrictions that came into force on Saturday, from Tuesday people will also need a valid reason to travel more than 10 km (six miles) from their homes.< BBC, April 3, 2021

India

“India’s second wave hits the whole world through vaccine export curbs. Facing a brutal new wave of coronavirus cases, India on Thursday made anyone over 45 eligible for vaccination. But the scramble to vaccinate as many people as possible has also meant sharply curtailing exports.”, Axios, April 1, 2021

Japan

“Japanese business sentiment rebounds despite Covid-19 woes. Tankan index for big manufacturers beats expectations, offering hope of economic uptick. The Bank of Japan’s Tankan index for large manufacturers rose 15 points to a reading of plus 5, well ahead of analyst expectations that it would remain in negative territory at minus 2.”, The Financial Times, March 31, 2021

“Japan Becomes Latest Country to Issue Digital Vaccine Passport. Vaccinated citizens currently receive a certificate in paper format.”, Travel & Leisure Magazines, March 29, 2021

The Philippines

“Philippines extends coronavirus curbs in Manila, nearby provinces: Restrictions to remain for at least another week as infections surge. Restrictions, which include a ban on non-essential movement, mass gatherings and dining in restaurants, will remain for at least another week”, Nikkei Asia, April 3, 2021

United Kingdom

“UK starts to reopen: Thousands swarm sports clubs and swimming pools as lockdown restriction ease. Golfers hit the fairways at midnight and swimmers completed lengths before dawn as thousands embraced the latest easing of lockdown restrictions..” The Sunday Times of London,. March 29, 2021

“Covid vaccine hesitancy halved in one month. Vaccine hesitancy among people in Britain has halved in one month, official figures show. The Office for National Statistics (ONS) said that the overall positive vaccine sentiment among Britons rose to 94 per cent last month from 78 per cent in December.”, The Times of London, April 1, 2021

“Millions set for switch to working four days a week. More than one million companies in Britain could move to a four-day working week after the pandemic, according to research. Autonomy, a think tank specialising in the future of work, found that a rethink of employment practices could result in a shorter working week for three million people across those companies.”, The Times of London, April 1, 2021

“PwC tells staff to split office and homeworking after Covid. PwC has told its accountants and consultants in the UK that they will spend an average of two to three days a week in the office after the pandemic ends and has promised them a half day on Fridays this summer.”. The Financial Times, March 30, 2021

“Britain’s manufacturers hired more staff as output and orders rose this month in preparation for the end of lockdown restrictions, the latest manufacturing purchasing managers’ index (PMI) showed. The index rose to 58.9 in March, the highest for more than ten years. A figure above 50 indicates growth. Orders were driven by the domestic market as companies prepared for a reopening of non-essential shops and outdoor hospitality on April 12.”, The Tomes of London, April 1, 2021

United States

“A measure of U.S. manufacturing activity soared to its highest level in more than 37 years in March, driven by strong growth in new orders, the clearest sign yet that a much anticipated economic boom was probably underway.”, Reuters, April 1, 2021

“The rise of working from home. The shift to a hybrid world of work will have a big impact on managers. Before the pandemic Americans spent 5% of their working time at home. By spring 2020 the figure was 60%.”, The Economist, April 1, 2021

“Marriott CEO says jobs ‘absolutely’ coming back, company ‘actively hiring’ in select markets. Marriott’s CEO on Sunday downplayed employment concerns and said that the very technology that helped the hotel industry navigate the coronavirus pandemic will help improve the customer experience in the future.., FOX Business, March 28, 2021

“New plan at Disneyland calls for squeezing in more rides, restaurants and shops. Disney announced a plan to add new attractions, shops and restaurants inside Disneyland by redeveloping existing areas of the Anaheim resort.”, The Los Angeles Times, March 25, 2021

“Restaurants struggle to find employees despite declining COVID cases: Some owners of eateries claim stimulus checks remove incentive to work. FOX Business spoke with multiple restaurant owners across the country who say applicants, drawn by the lure of unemployment benefits and stimulus checks, have tapered off over the course of the pandemic and it remains unclear whether that trend will continue.”, Fox Business, April 1, 2021

“Google rejigs remote working as it reopens offices: Google is changing its work-from-home policy as it looks to get more people back into its US offices. The tech firm said employees can work from home overseas for more than 14 days a year if they apply for it.”, BBC, April 1, 2021

“This 210,000-Employee Company Just Banned Zoom on Fridays. Here’s Why You Should, Too. Citi CEO Jane Fraser says working too many hours is taking a toll. It doesn’t help that the pandemic has blurred work-and-home boundaries.”.\, INC. Marah 26, 2021

Brand News

“HOW GOLDEN CORRAL IS ADAPTING TO NEW REALITIES: The pandemic accelerated the buffet chain’s evolution into other service formats. Here are some of the avenues it’s pursuing.”, Restaurant Business, March 26, 2021

“Bennigan’s offers virtual kitchen franchises to hotels: The new virtual kitchen model lets hotels sell food and drinks from Bennigan’s menus for delivery or takeout to both hotel guests and area residents. For hotels with established restaurants, Bennigan’s offers a licensing option to add the Bennigan’s On The Fly menu to their already existing menus.”, Hotel Management, March 29, 2021

“Del Taco franchisees see comp sales increases in final half of 2020. Del Taco Restaurants Inc. said Thursday that the chain’s franchisees saw comp sales increases in the third and fourth quarters of 2020, bringing full-year comp sales growth to 1.4%. Comp sales in the third-quarter were up 6.5%, and for the fourth-quarter, comp sales grew 7.5%.”, Market Watch, April 1, 2021

“Hardee’s and Carl’s Jr. Aiming to Add 2,000 Restaurants. The iconic brands just finished a massive year. Now they’re rolling out a new prototype built for the future.”, QSR Magazine, March 25, 2021

“Boutique Fitness Franchisor Xponential Acquires 9th Brand: Xponential Fitness has acquired boutique boxing concept Rumble to bring its portfolio of fitness brands to nine. Rumble now joins Xponential’s other brands Pure Barre, Club Pilates, CycleBar, YogaSix, StretchLab, Row House, AKT, and STRIDE.”, Franchising.com, April 2, 2021

“Popeyes has announced plans to launch its first location in the U.K. by the end of 2021, Over 350 U.K. sites are planned for the U.S. fried chicken franchise, to open over the next 10 years.”, Global Franchise, April 5, 2021

“How Two Food Franchisees Are Affected by Covid, and How They’re Responding: Luis San Miguel, president and CEO of Fresh Dining Concepts, operates 40 Auntie Anne’s, 2 Cinnabons, 6 co-branded Auntie Anne’s/Cinnabons, and 2 co-branded Auntie Anne’s/Carvels. Robby Basati is the CEO of RoboFran development, a multi-brand organization that operates 15 Mountain Mike’s Pizza; 2 branded gas stations; 1 Neighborhood supermarket; and 8 development agent stores for Mountain Mike’s….Franchising.com, April 2, 2021

“The robots are coming to small businesses – and for business owners: Tight margins and customer demands make new technologies attractive, but are ultimately designed to replace people.” The Guardian, April 1. 2021

Articles About Doing Business Going Forward

“Business priorities in the postpandemic era: This episode of the Inside the Strategy Room podcast features a conversation between Kevin Sneader, McKinsey’s global managing partner, and John Waldron, president and chief operating officer of Goldman Sachs, that took place at our virtual M&A conference in February.”, McKinsey, February 2021

“Consumers can now convert bitcoin or frequent flier miles to cash and reload their Starbucks cards to pay for lattes. Coffee chain goes national with digital wallet platform Bakkt partnership, which allows the conversion of digital assets for payment.”, Nation’s Restaurant News, April 1, 2021

“The World Happiness Report 2021 focuses on the effects of COVID-19 and how people all over the world have fared. Our aim was two-fold, first to focus on the effects of COVID-19 on the structure and quality of people’s lives, and second to describe and evaluate how governments all over the world have dealt with the pandemic. In particular, we try to explain why some countries have done so much better than others.”, March 2021

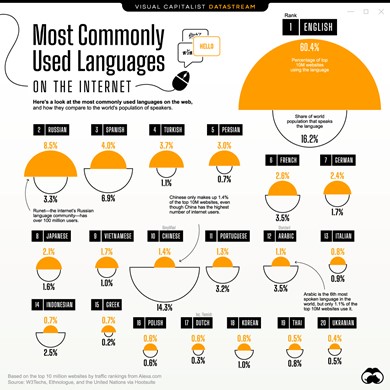

“English is the most common language online, used by 60.4% of the top 10M websites. China has the most internet users in the world but only 1.4% of the top 10M websites use Chinese.”, Visual Capitalist, March 26, 2021

We accelerate global development for our Clients

Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. Our U.S. based executive team has experience living and working in many countries. Our Associate network on the ground overseas covers 40+ countries.

Edwards Global Services, Inc. (EGS) has twice received the U.S. President’s Award for Export Excellence.

Find out more about how we help companies Going Global successfully at:

Download our latest 40 country ranking chart at this link:

William (Bill) Edwards, CFE, is CEO and Global Advisor of Edwards Global Services (EGS). He has 46 years of international operations, development, executive and entrepreneurial experience and has lived in 7 countries. With experience in the franchise, oil and gas, information technology and management consulting sectors, he has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East. Mr. Edwards advises a wide range of companies on early to long term global development of their brands.