EGS Biweekly Global Business Newsletter Issue 29, Monday, May 3, 2021

By William (Bill) Edwards, CEO of Edwards Global Services, Inc. (EGS)

““A smooth sea never made a skilled sailor.”, Breton proverb

“We must accept finite disappointment, but we must never lose infinite hope”, Dr. Martin Luther King

“You cannot go back and change the beginning, but you can start where you are and change the ending.”, C.S. Lewis

Highlights in issue #29:

- China’s Economy After the Pandemic – Major study by Geopolitical Futures

- “Trade: The Path to Recovery and Growth in 2021: May 18-20 World Trade Week event with 3+ speakers from around the world

- The Brian Connors Report – A comprehensive look at our economy today and for the future

- Brand News Section: Dominos®, Dunkin®, Hooters®, McDonald’s®, Nathan’s Famous®, Popeyes®, Retail Zoo (Australia) and Taco Bell®

Our Information Sources

Our biweekly newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel.

We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covers 43 countries and provides us with updates about what is happening in their specific countries.

Please feel free to send us your input and sources of information. Our contact information is at the bottom of this newsletter.

First, a few Personal Comments

This issue is longer than most due to lots of positive news from around the world about vaccine penetration and businesses reopening.

The Alliance Risk Barometer says the rollout of coronavirus vaccines provides hope that the worst effects of the pandemic will subside in 2021. While we do see reopening of businesses in Italy, Greater Madrid, Hungary, Italy, the United Kingdom and the USA, COVID-19 cases remain high in Brazil and especially in India. International travel, key to new business development, remains low but there are signs that by September this will also increase dramatically open up the world to faster economic recovery.

Your newsletter editor, Bill Edwards, is moderating sessions on export resources for small businesses in the USA and Ambassador’s Craig Allen’s keynote speech entitled, “Navigating in Uncharted Waters, Exports to China in 2021’, during the Orange County World Trade Week event on May 18-20, 2021. Register to join us as 30+ global trade experts share their knowledge on global trade going forward at https://bit.ly/2S97HZn

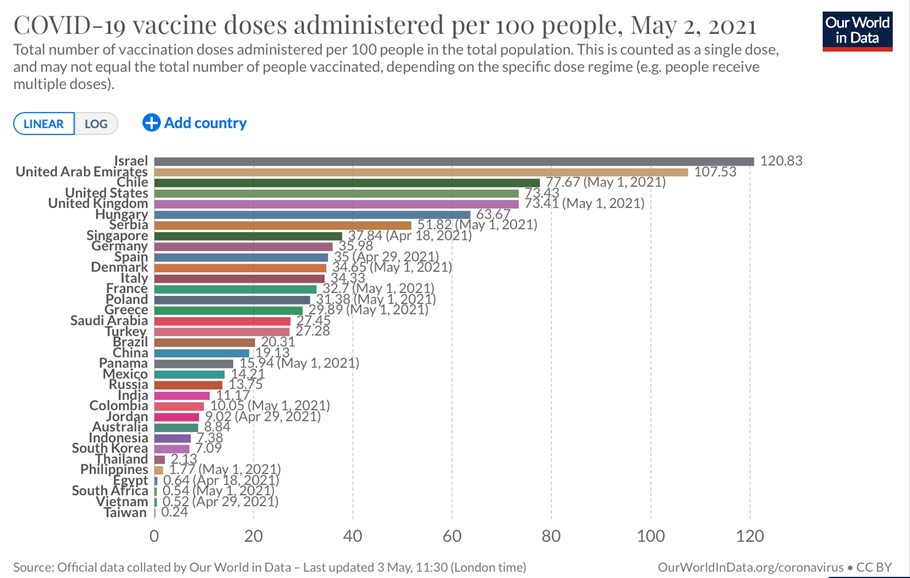

Global Vaccine Update

“This map shows the number of COVID-19 vaccination doses administered per 100 people within a given population. Note that this is counted as a single dose, and may not equal the total number of people vaccinated, depending on the specific dose regime as several available COVID vaccines require multiple doses.”, Our World in Data, May 2, 2021

“EU Commissioner Breton confident of 70% inoculation goal by mid-July – The European Union will be able to produce enough vaccines to achieve its target for immunity of its adult population by the middle of July, the EU executive’s vaccine task force chief said in an interview with a Greek newspaper published on Sunday.”, Reuters, April 25, 2021

“Vaccine Passports: Just The Ticket Or A Ticket To Nowhere?”, Forbes, April 30, 2021

May 18-20, 2021 World Trade Week Event Announcement

“Trade: The Path to Recovery and Growth in 2021: This year’s 3-day Orange County World Trade Week event will have more than 30 global business and trade leaders from every region of the world and will cover 9 major business sectors showing us how best to go forward to further success. To register for this event, visit:https://bit.ly/2S97HZn

Interesting Data and Studies

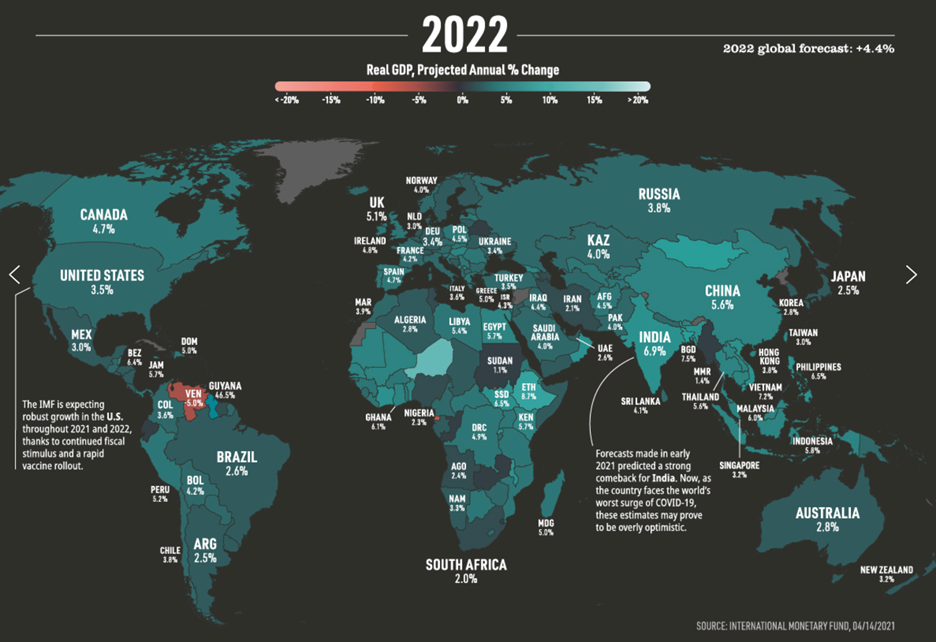

“Global GDP Forecasts for 2021 and 2022: In its April 2021 report, the International Monetary Fund (IMF) projected a strong recovery in 2021 and 2022 thanks to the ongoing fiscal support, vaccine rollouts, and a general adaptation to pandemic life”, Visual Capitalist, April 29, 2021

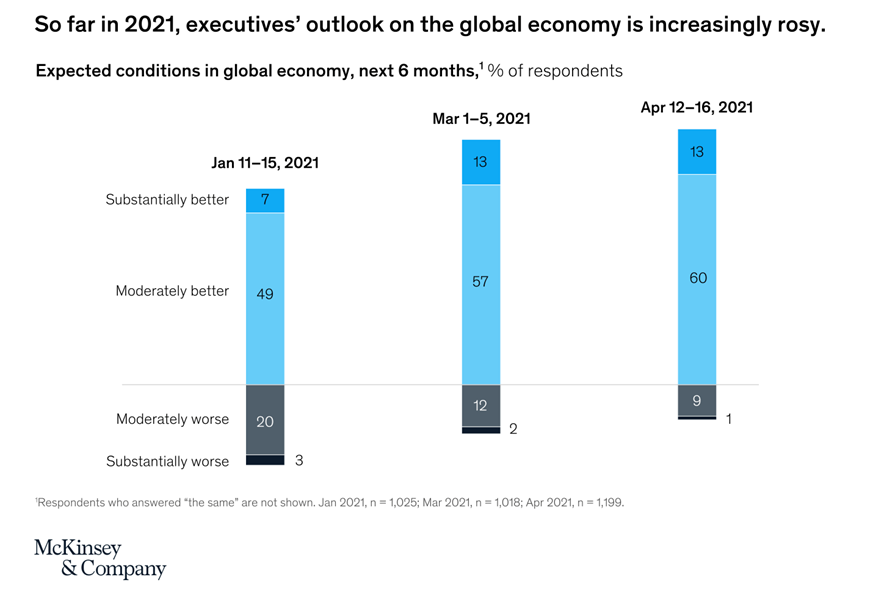

“The coronavirus effect on global economic sentiment – Though the pandemic overshadows other risks to growth, optimism about the economy persists and company prospects continue to brighten, especially on the hiring front.”, McKinsey & Co., April 30, 2021

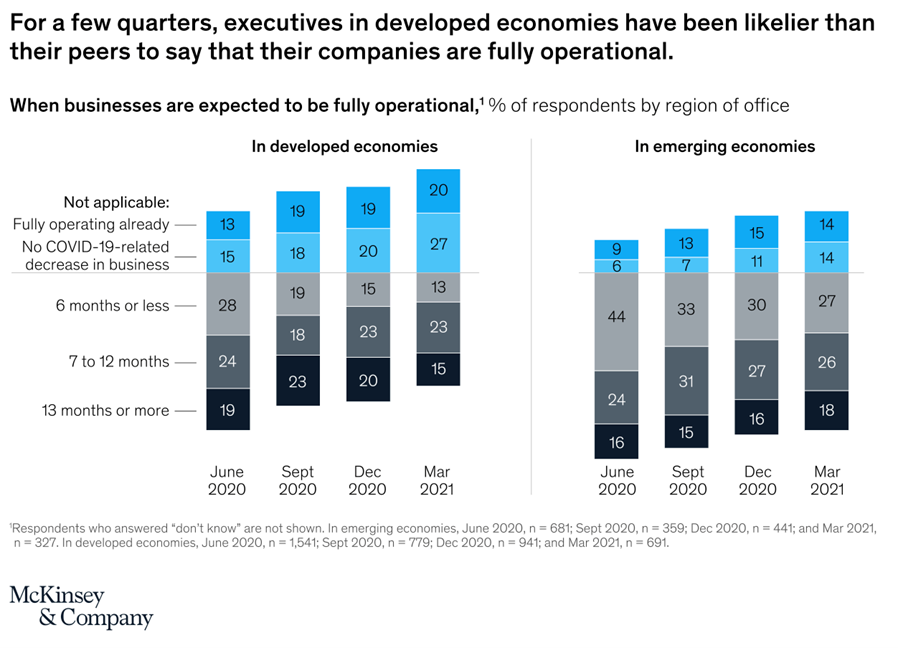

“Open for business? Developed economies are more likely to say ‘yes.’ Less than half of businesses are fully operational, according to our latest McKinsey Global Survey. Developed economies are out in front, perhaps because of their greater access to COVID-19 vaccines.”, McKinsey & Co., April 27, 2021

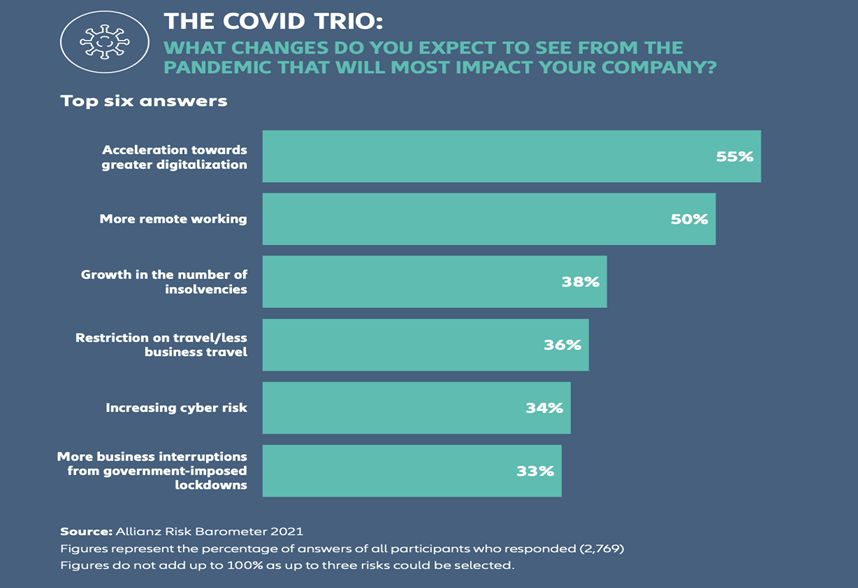

“ALLIANZ RISK BAROMETER IDENTIFYING THE MAJOR BUSINESS RISKS FOR 2021 – The most important corporate perils for the next 12 months and beyond, based on the insight of 2,769 risk management experts from 92 countries and territories. The rollout of coronavirus vaccines provides some hope that the worst effects of the pandemic will subside in 2021, although measures to contain the virus are expected to remain in place for some time yet. However, the economic, political and societal consequences of the pandemic are likely to be a source of heightened business interruption risk in the years ahead.”, Alliance Risk Barometer, May 2021

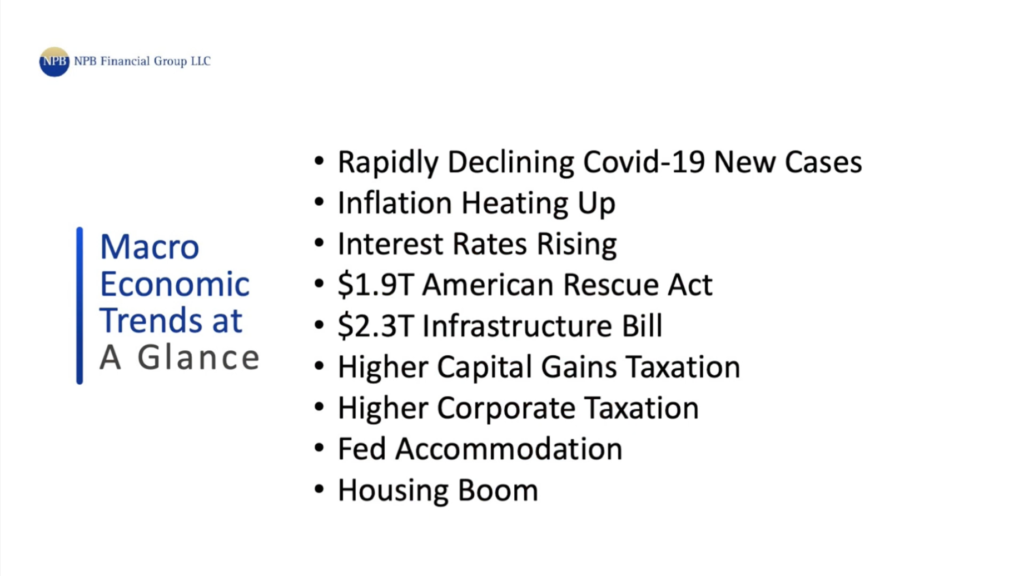

”The Brian Connors Report – NPB Financial Group LLC – The Conners Report talks with industry thought leaders on the key economic, market, business, and disruptive technologies that face business leaders today. He searches for breakthrough ideas and megatrends that will provoke you to take action today so we will be relevant tomorrow, hosted by Brian Conners, a Certified Financial Planner (CFP) and Wealth Management Specialist., April 30, 2021

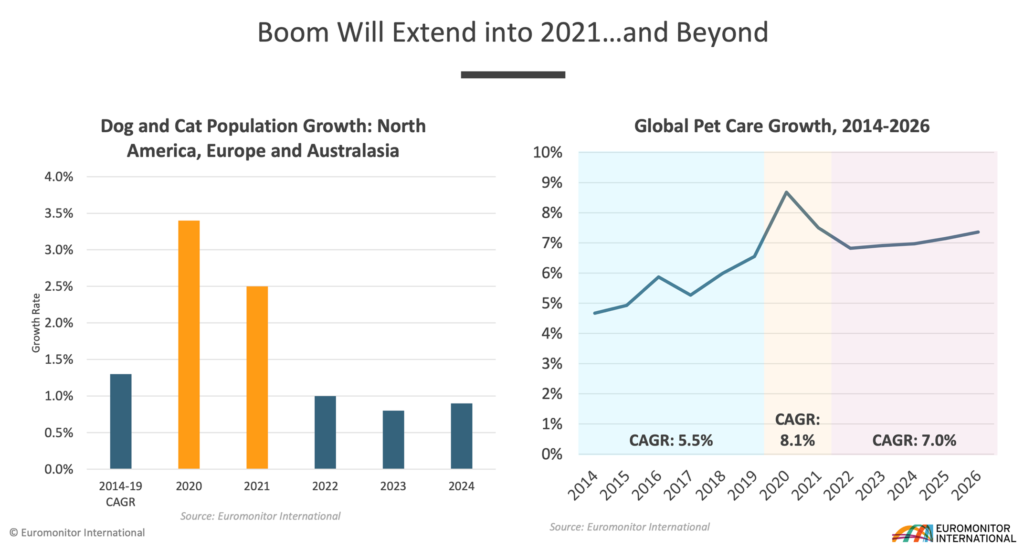

Pet Care Outlook Study – Which Trends Will Outlast the Pandemic? “2020 was an Exceptional Year for Pet Care; Revitalized pet population growth in developed markets; A major pivot in ownership to higher income households; and More bonding time and deeper humanization trends. Strong Growth Outlook for 2021: Workplace and mobility patterns continuing into 2021; More clarity around the long- term future of remote work; and Elevated population base in higher-income households”, Euromonitor International

“On-demand pay a growing benefit – and concern – for small businesses – We think of payday as a rigid date, but ‘pay on the day’ is becoming more popular. Here’s how to navigate on-demand benefits.”, The London Guardian, May 2, 2021

A Bit of Fun In These Otherwise Serious Times

“McKinsey for Kids: A tiger’s tale about what nature is really worth. In this edition of McKinsey for Kids, let’s explore mangrove forests—which have unique trees that grow near tropical-ocean coastlines—and why protecting them can help tigers and other endangered species, as well as all of us.”, McKinsey & Co., April 29, 2021

“This Is Not a Joke: The Cost of Being Humorless – Humor has tremendous benefits for physical health, mental well-being, and your bottom line. A 15-year longitudinal (Norwegian) study of more than 50,000 Norwegians found that women with a strong sense of humor had a 73% lower risk of dying from heart disease and an 83% lower risk of dying from infection.”, Stanford Business, January 28, 2021

Global and Regional Travel Updates

“Want to travel to Europe this summer? Here’s what you need to know – The European Union is reportedly planning to reopen to fully vaccinated American tourists this summer. While details remain murky, it’s an encouraging sign for Americans who are eager to venture abroad and return to some of their favorite destinations in Europe.”, The Points Guy, April 26, 2021

“Guangzhou Topples Atlanta as World’s Busiest – Traffic at Guangzhou Baiyun International Airport (CAN) surpassed Atlanta Hartsfield-Jackson Airport (ATL) by 1.1 million passengers in 2020.”, Airways Magazine, April 23, 2021

“Disneyland reopens for first time in 13 months as US hits another major vaccine milestone. Visitors cheered and screamed as the Southern California theme park opened its gates for the first time in 13 months. And according to the Centers for Disease Control and Prevention (CDC), 39% of the nation’s adult population has now been fully vaccinated – totalling more than 100 million people. More than 55% of adults have received at least one dose.”, Sky News, April 30, 2021

“CDC ‘committed’ to U.S. cruise industry resuming operations by mid-summer – ‘If a ship attests that 98% of its crew and 95% of its passengers are fully vaccinated,’ the agency told the industry in a letter released publicly, that ship may skip simulated voyages and move directly to open water sailing.”, Reuters, April 28, 2021

“Hopes rise for overseas travel to dozens of green list countries – Hopes of a summer holiday in Europe were boosted yesterday with the possibility of non-essential travel to destinations such as Portugal and Malta as soon as mid-May….Meanwhile, France announced that Britons will be able to travel there from the start of June provided they have proof of being vaccinated.”, The Times of London, April 30, 2011

“The gateway to the rest of world? Why Singapore is ready to open a travel bubble with Australia as soon as the government gives the green light. Singapore – which has very low levels of Covid-19 – is already open to Australians . Morrison government is in talks with ministers about a two-way travel bubble. No timeframe has been set but Singapore is keen to welcome Aussies asap.”, The London Daily Mail, April 28, 2021

“Delta Air Lines to Lead Commercial Airline Industry into 5G Era – Together with AT&T Business and Apple, Delta will equip every one of their 19,000+ flight attendants with iPhone 12, enabling them to harness the power of AT&T’s nationwide 5G network to enhance the travel experience for all passengers.”, The Fast Mode, April 30, 2021

“This week, why the future of aviation is looking brighter after a punishing year.”, the Shortlist, McKinsey & Co’., April 30, 2021

Country & Regional Updates

Asia Region

“The best companies to work for in Singapore, Malaysia and the Philippines, according to LinkedIn – Companies that adapted quickly to the pandemic while continuing to offer employees opportunities to advance their careers have ranked top among LinkedIn’s best places to work in Southeast Asia in 2021.”, CNBC, April 30, 2021

China

“Global supply chain continues to shift away from China, but it remains the top sourcing location – American and European companies are gradually reducing their reliance on China, and its popularity as a sourcing market among Western buyers took a hit during the pandemic As a regional alternative to China, Vietnam maintained its popularity during the turbulent 2020, and this year it was named as a top-three sourcing market by a quarter of respondents globally.”, South China Morning Post, April 30, 2021

“Chinese tourists to take 18 million rail trips on May Day – Chinese tourists are expected to make a total of 18.3 million railway passenger trips on the first day of the country’s five-day holiday for international labor day, according to an estimate by the state railway group. Tourists are rushing to travel domestically after the coronavirus has been brought under control in China. The May Day holiday, which runs from May 1 to 5, is the first long break for Chinese tourists since the beginning of the year, when a domestic outbreak of the coronavirus before the Lunar New Year holidays in February cancelled travel plans for many after the government advised people to refrain from traveling.”, ABC News, May 1, 2021

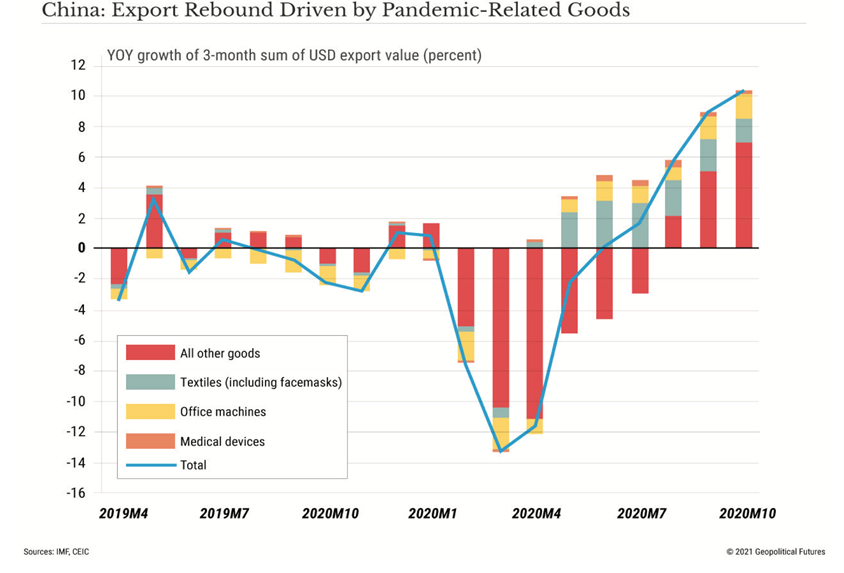

“China’s Economy After the Pandemic – Major study by Geopolitical Futures, April 2021

“China’s manufacturing PMI drops to 51.1 in April, indicating growth moderation in the manufacturing sector – 12 of the 13 sub-indices were lower than their respective levels in the previous month. For example, the new orders index went down by 1.6 pts to 52.0, indicating a slower expansion in the market demand. The new export orders index also declined by 0.8 pts to 50.4.”, Fung Business Intelligence, April 30, 2021

“China’s digital economy surges in 2020 amid pandemic, making up nearly 40 per cent of country’s GDP – China’s digital economy accounted for 38.6 per cent of its GDP last year, up 2.4 percentage points from 2019 – This segment of the country’s economy includes electronics manufacturing, telecommunications, internet and software services.”, South China Morning Post, April 27, 2021

Hungary

“Hungary reopens spas, zoos and gyms to those with proof of vaccination – Spa fans flocked to Budapest’s world-famous thermal baths on Saturday as Hungary relaxed lockdown restrictions for people with government-issued vaccination cards.”, Reuters, May 1, 2021

European Union

“Booming factories and resurgent retail fuel hopes for eurozone recovery. Manufacturing PMI in euro area rose in April to highest level since 1997, says IHS Markit. The eurozone slid into a double-dip recession in the first three months of this year as output dropped 0.6 per cent under the weight of coronavirus lockdown measures, leaving the bloc lagging behind other major economies. But strong manufacturing outlook, detailed in purchasing managers’ index data from IHS Markit on Monday, underlined that trade and consumer demand was recovering fast.”, The Financial Times, May 3, 2021

India

“India warned country is ‘yet to see the worst’ of pandemic amid virus surge – INDIA faces a mounting health crisis amid a surge in coronavirus cases but the country is “yet to see the worst” according to frontline medical workers. Health authorities have recorded 400,000 cases of the virus in a single day.”, Express UK, May 2, 2021

Israel

“Expanding into Israel: what you need to know – If you have not considered expanding your (franchise) brand into Israel, now is the time to do so. One million Israelis are now looking for ways to create new channels of income and franchising will no doubt play a major role in what I believe will be part of our next upcoming financial boom period.”, Global Franchise, May 3, 2021

Italy

“Italy Eases Lockdown Restrictions As COVID-19 Cases Start to Fall – Although restaurants can once again welcome back customers, a 10 p.m. curfew is still in place. After weeks of an almost complete lockdown, coffee bars, restaurants, and cinemas across Italy reopened on Monday as COVID-19 cases fell throughout the country. Fourteen of the country’s regions are now designated “yellow,” or low COVID-19 risk. Another five regions are currently at an orange level. Only one region, Sardinia, remains under red alert, Reuters reported.”, Travel And Leisure, April 26, 2021

New Zealand

“The three reasons Covid couldn’t knock down the Kiwi economy – ASB report – New Zealand’s economy was able to roll with the Covid-19 punches. ASB’s own forecasts were that the economy would shrink by 7 per cent through 2020 and wouldn’t get back to pre-Covid levels until 2023. Instead, New Zealand’s GDP contracted by just 1 per cent over 2020 (close to 3 per cent over the calendar year) and the economy ended with more jobs than it had pre-Covid.”, New Zealand Herald, April 28, 2021. Compliments of Simon Lord, Publisher, Franchise New Zealand media

Singapore

“Singapore: What’s it like in the best place to live during Covid? This week, Singapore topped the Bloomberg Covid Resilience Ranking, knocking out New Zealand which has ruled the chart for months. The list considers factors ranging from Covid case numbers to freedom of movement.”, BBC News, May 3, 2021

United Kingdom

“Britain set for best growth since 1988 – GDP forecast raised to cover spending splurge. The average of growth forecasts collected by the Treasury this month was 5.7 per cent, a big jump from the average of 4.7 per cent in March.”, The London Times, April 22, 2021

“40m people in England live in areas almost free from Covid – Scientists confident lockdown lifting is on track. Seven in ten people live in areas where a maximum of two infections were reported during the most recent week for which data is available.”, The Times of London, April 28, 2021

“Social distancing rules to be scrapped from June 21 – Pubs, restaurants and theatres can open fully from June 21 but mask rules will remain. The “one metre-plus” social distancing rule will be scrapped from June 21 under plans to ensure that all restaurants, pubs, theatres and cinemas can reopen fully, The Times understands.”, The Times of London, May 3, 2021

United States

“US economy grows 6.4 per cent in first quarter as recovery gathers momentum – US economy stood at US$22.05 trillion at the end of March. ‘Amid progress on vaccinations and strong policy support, indicators of economic activity and employment have strengthened,’ says the Fed(eral Reserve).”, South China Morning Post, April 29, 2021

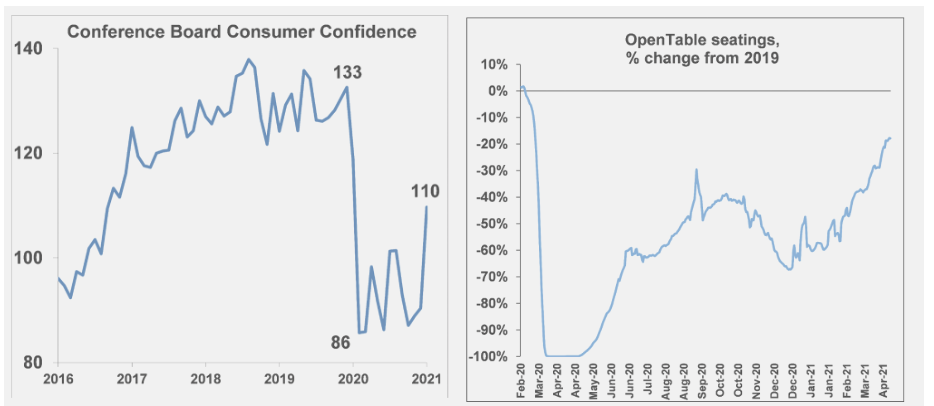

“2021 (US) Economic Outlook: A Very Good Economic Outlook – Consumers Already on a Spree. Manufacturing Activity to Continue Strong. Housing Market Sizzling. Financial Markets Also Signaling Oncoming Surge. Strong Labor Market. Not Everything Is Perfect Though.” Euler Hermes, May 1, 2021

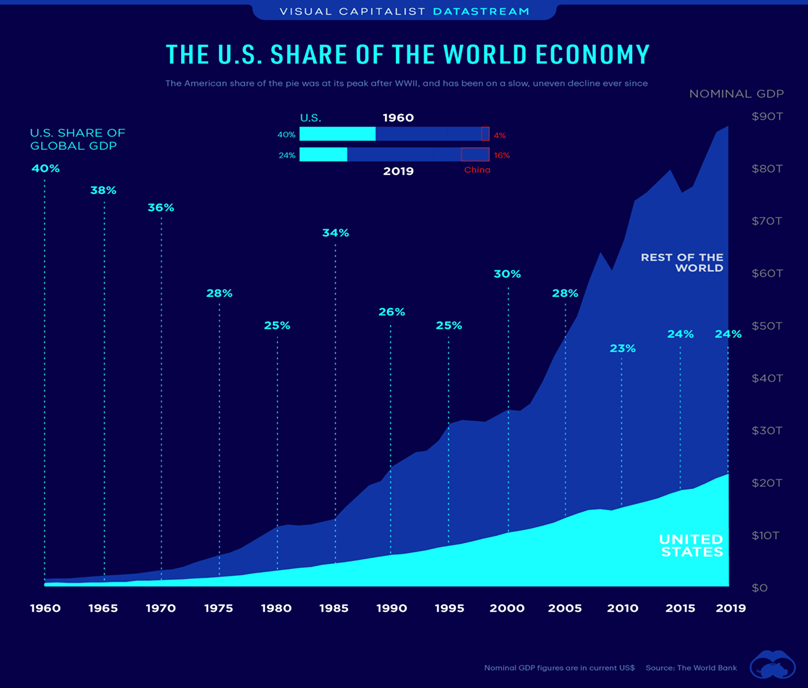

“The U.S. Share of the Global Economy Over Time – The U.S. share of the global economy has nearly halved since 1960. America’s nominal GDP in current U.S. dollars is $21.4 trillion, or about 24% of the share of the global economy….nut the U.S. is the world’s largest economy by nominal GDP, and its influence on the global economy is quite remarkable.”, Visual Capitalist, January 2021

“From Apple to Domino’s Pizza, U.S. Companies Scramble to Meet Surge in Demand. Supply-chain snarls and labor shortages crimp some businesses looking to ride rebound in U.S. economy; ‘caught flat-footed’. Consumers are splurging on cars and furniture—and facing extended waits for delivery. Restaurants and gyms are reopening—and struggling to find workers. Factories and home builders are trying to ramp up—but are short on semiconductors or raw materials.”, The Wall Street Journal, May 2, 2021

Brand News

“Burger King parent aims for international growth – Restaurant Brands International, Inc. is living up to its name. The owner of restaurant chains Burger King, Popeyes and Tim Hortons has international expansion plans for all three brands, with Popeyes leading the way so far in 2021.”, Food Business News, May 3, 2021

“Domino’s (Australia) hiring additional 2,500 staff – The chain previously sought 2,000 workers last year to boost its delivery services. Dominos announced it is hiring an additional 2,500 staff across its 710 stores nationwide. ANZ CEO Nick Knight, who started in the business as an in-store team member, said the company was “privileged to be in a position to hire in the current landscape.”, QSR Media Australia, April 13, 2021

“McDonald’s and Hungry Jacks burger battle – 50 years after the first burger joint opened in Perth, Hungry Jack’s founder Jack Cowin is battling McDonald’s in court.”, ABC News Australia, April 16, 2011

“Dunkin’ is Reopening Thousands of Dining Rooms – Units will reopen indoor dining each week leading into the summer. Overall, more than 2,600 Dunkin’ locations have reopened in-restaurant dining.”, QSR magazine, April 27, 2021

“Hooters Is Opening a New, Fast-Casual Restaurant Chain Spinoff – The Hoots Wings concept curiously does away with what Hooters is known for. In response to customers who miss the Hooters experience because of its food (and critics who felt its values were a little outdated), the 38-year-old company has finally introduced a new restaurant concept that may appeal to customers whose favorite thing about Hooters really is the chicken wings.”, Eat This, Not That!, April 25, 2021

“McDonald’s comes roaring back as restrictions ease – The bounce back for McDonald’s as restrictions were lifted across the U.S. was so strong in the first quarter that the company surpassed sales during the same period even in 2019, long before the pandemic broadsided the country.”, ABC News, April 29, 2021

“NATHAN’S FAMOUS TO ADD 100 UNITS WITH GHOST KITCHEN BRANDS, MANY IN WALMARTS: Nathan’s Famous is adding to its growing network of virtual outposts under a new partnership with Ghost Kitchen Brands that will bring the hot dog chain to 100 nontraditional locations this year. The deal includes 60 U.S. locations and 40 in Canada. Many of them will be inside Walmart stores, Nathan’s said. The off-premise-focused outlets will roughly double Nathan’s virtual footprint in the U.S. and Canada.”, Restaurant Business, April 19, 2021

“Retail Zoo (Australia) is getting a post-pandemic boost from predictive analytics – Retail Zoo chief executive officer Nishad Alani said its domestic business has been able to “fully recover” from COVID-19, confident they are back on a strong growth trajectory that will see them open at least 30 stores on an annual basis. 20 of these will be Boost Juice bars whilst ten will consist of Betty’s Burgers restaurants. A potential one to two Salsa’s Fresh Mex Grill outlets or CIBO Espresso cafes will also be considered.”, QSR Media Australia, April 19, 2021

“Taco Bell launches first-ever global marketing campaign – Taco Bell is giving out free tacos on May 4 across 20 global markets to celebrate what they’re calling the “Taco Moon” phase of the moon. Taco Bell has launched their first global marketing campaign, the Yum Brands company announced Wednesday,…”, Nation’s Restaurant News, April 28, 2021

“Food for Thought: Are Restaurants Becoming Non-Brick-and-Mortar Service Brands? A growing number of established food brands are jumping on the virtual bandwagon. Brands testing the concept of delivery-only host/ghost/virtual kitchens include (among a rapidly growing roster) Fazoli’s, Chili’s, Maggiano’s Little Italy, Applebee’s, Ruby Tuesday, Nathan’s Famous, Just Salad, Sweetgreen, Dickey’s, Smokey Bones, and BurgerFi.”, Franchising.com, April 27, 2021

Articles & Studies About Doing Business Going Forward

“The World Is Entering A Post-Pandemic Future: Here’s What The Latest Consumer Data Says About What’s Next For Retail. With millions of vaccine doses administered and more than 20 percent of the US population fully vaccinated, there is increased optimism that we are on the cusp of entering a post-pandemic future. Like so many industries that experienced massive disruption during the crisis, retail has permanently changed on multiple fronts.”, Fortune, April 29, 2021

“How Private Equity will Transform Franchising – Private equity (PE) firms have been aggressively entering franchising over the last 10 years….As PE firms have gained experience in franchising, how they think about and evaluate franchisor investments have evolved through three distinct paradigms. The latest paradigm is likely to forever transform franchising.”, Joe Mathews, CEO of Franchise Performance Group, April 27, 2021

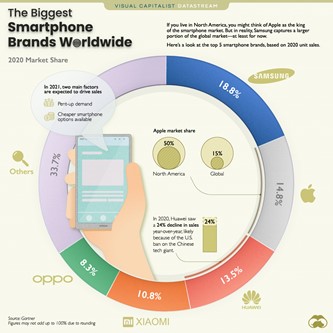

“Top Smartphone Brands, By Global Sales: In 2020, Samsung remained the top smartphone vendor based on units sold. Of the top five brands, Apple and Xiaomi were the only ones that saw sales increase in 2020. China is expected to see the most sales in 2021, but the highest growth areas are projected to be in Western Europe, Latin America, and in more mature markets in the Asia-Pacific.”, Visual Capitalist, April 21, 2021

We accelerate successful global development for our Clients

Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. Our U.S. based executive team has experience living and working in many countries. Our Associate network on the ground overseas covers 40+ countries.

Edwards Global Services, Inc. (EGS) has twice received the U.S. President’s Award for Export Excellence.

Find out more about how we help companies Going Global successfully at:

Download our latest 40 country ranking chart at this link:

William (Bill) Edwards, CFE, is CEO and Global Advisor of Edwards Global Services (EGS). He has 46 years of international operations, development, executive and entrepreneurial experience and has lived in 7 countries. With experience in the franchise, oil and gas, information technology and management consulting sectors, he has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East. Mr. Edwards advises a wide range of companies on early to long term global development of their brands.

My latest article: “LEADERSHIP – We Spoke to William (Bill) Edwards of Edwards Global Services on Being an Effective Leader During Turbulent Times.”, Authority magazine, April 22, 2021

For truly global market research, operations and development support across 40 countries, contact Mr. Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

https://calendly.com/geowizard/30min Click here to schedule a call with Bill Edwards to discuss how to succeed in developing your company around the world.