EGS Biweekly Global Business Newsletter Issue 42, Monday, November 1, 2021

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Trends in this issue:

Inflation, supply chain challenges, increased global vaccination levels, air travel restarts in Asia, trade wars slightly calming, China’s economy slowing, European Union economies accelerating, natural gas prices up and supplies down in the EU and UK and champagnes sales are up just about everywhere!

But First, Some Words of Wisdom

In this issue, we will focus on wisdom from Colin Powell who passed away recently. General Powell was a beacon of wisdom and calm to all of us and will be missed.

“There are no secrets to success. It is the result of preparation, hard work, and learning from failure.”

“Don’t let adverse facts stand in the way of a good decision.”

“Remain calm. Be kind.” (Your Editor’s favorite)

Your Editor’s latest published article

“Rising Through Resilience: William ‘Bill’ Edwards Of Edwards Global Services On The Five Things You Can Do To Become More Resilient.”, Authority Magazine interview with An Interview with Savio P. Clemente, October 19, 2021

Highlights in issue #42:

- Biden Ends Trump-Era Trade War With EU Steel Deal.

- Five windows of opportunity for postpandemic Asia

- Italy’s Lavazza Espresso Brand Takes On Starbucks in China

- Champagne sales are surging close to pre-pandemic highs:

- Thailand to Allow Quarantine-Free Travel From U.S., U.K., China

- Projected 2022 International Franchise Development by Country

- Brand News Section: Buffalo Wild Wings®, Burger King®, Denny’s®, KFC® China, Luckin® (Coffee), NRD Group, Phenix Salon Studios®, Sotheby’s®

Our Mission and Information Sources

Bolded article titles are live links if available without subscription

Our biweekly global business update newsletter focuses on what is happening around the world that impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground in 27 countries covers 43 countries and provides us with updates about what is happening in their specific countries. Please feel free to send us your input and sources of information. Our contact information is at the bottom of this newsletter.

Interesting Data and Studies

“IMF economist expecting inflation pressure through mid-2022 – Gita Gopinath, Chief Economist of the International Monetary Fund (IMF), said on Sunday that inflationary pressure will likely continue into the middle of next year. Gopinath stated that supply chain issues are ongoing as the ‘grip of the pandemic’ continues to hinder global trade, even though pandemic conditions have improved somewhat. ‘The way we see it is that these pressures will remain until sometime in the middle of next year. And then we see us returning to more normal levels of inflation towards the end of next year.’”, The Hill, October 24, 2021

“Biden Ends Trump-Era Trade War With EU Steel Deal. What It Means – At a G-20 summit in Rome over the weekend, the U.S. and the European Union agreed to end a dispute over steel and aluminum tariffs imposed by the Trump administration. Under President Donald Trump, the U.S. placed a 25% tariff on European steel and 10% on aluminum on national security grounds.”, Barron’s, November 1, 2021

“Champagne sales are surging close to pre-pandemic highs: ‘Consumers are ready to celebrate’ – The gradual reopening of global bubbly markets is expected to drive sales to an estimated 305 million bottles worldwide in 2021, according to the General Syndicate of Champagne Winegrowers.”, CNBC, October 22, 2021

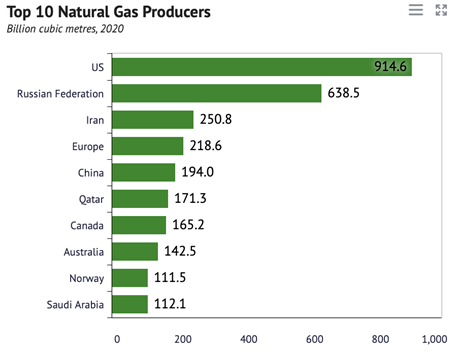

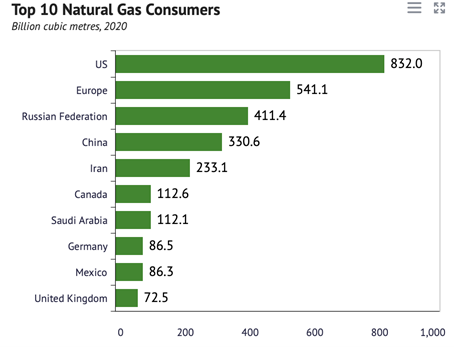

“Natural gas is widely used in energy generation, transportation, commercial, and household sectors, as well as in energy-intensive industries such as chemical, iron and steel manufacturing. The United States, Europe, Russia, and China, the top four natural gas consumers, together accounted for 53% of global consumption in 2019.”, Knoema, October 15, 2021

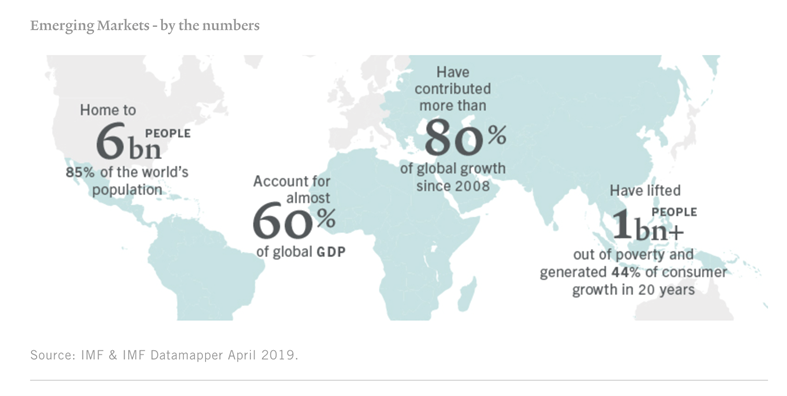

“Emerging markets are the fast-growing economies that drive the world’s growth. When you look at the numbers, their scale and importance are undeniable for investors. Around 70 vastly diverse countries make up the universe of emerging markets1. They have enormous economic potential. But they are also complex and inefficient markets, both for bonds and equities.”, Pictet Asset Management, October 2021

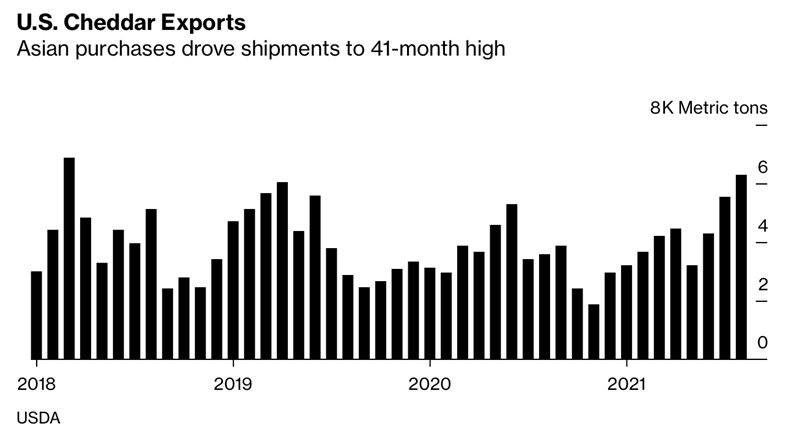

“American Cheese Is Being Devoured in Asia, Export Data Show – U.S. exports of American cheese — including the processed staple coveted for melty grilled cheese sandwiches — are surging as buyers in Asia devour the stuff. Shipments in August increased by 71% from a year earlier to just over 9,000 metric tons, according to data from the U.S. Department of Agriculture. That’s the highest since March 2018.”, Bloomberg, October 22, 2021

Global Supply Chain Update

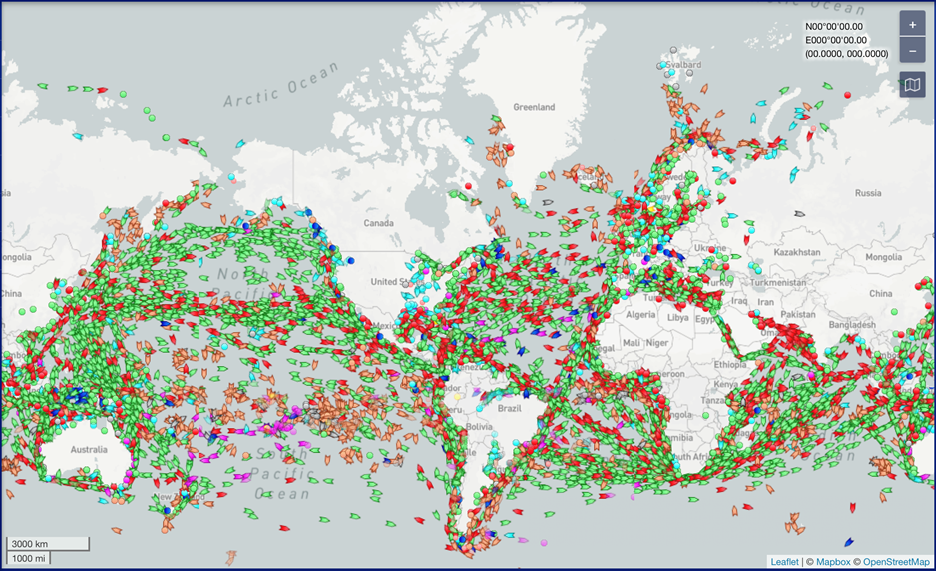

This map shows cargo vessels, tanker and large fishing vessels reporting their positions as of November 1, 2021. Marine Traffic website

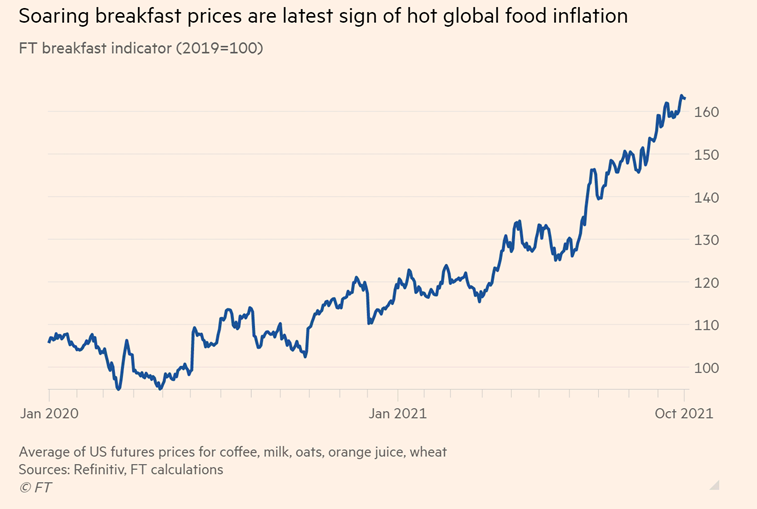

“Cost of breakfast foods hits 10-year high – Bad weather and supply-chain problems push up price of ingredients. The Financial Times breakfast indicator, based on futures prices for coffee, milk, sugar, wheat, oats and orange juice, has shot up 63 per cent since 2019, in a move that has accelerated since this summer.”, The Financial Times, October 29, 2021

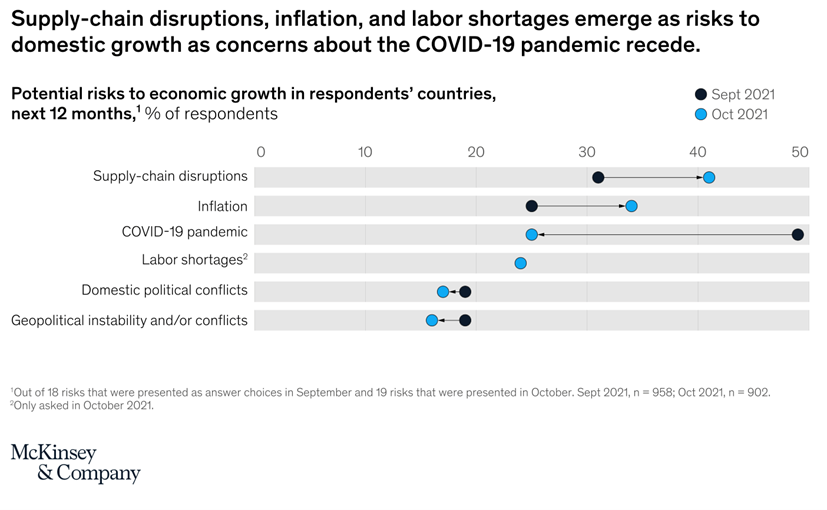

“In a change from the first three quarters in 2021, uncertainty over COVID-19 is no longer a foremost economic concern to executives, according to the latest McKinsey Global Survey.1 When asked about threats to growth in their countries’ economies, executives now cite mounting fallout on the supply chain—which is also the most common risk to company growth—and inflation more often than the pandemic itself.”, McKinsey, October 29, 2021

Global, Regional & Local Travel Updates

“Airlines Are Getting Ready to Fly Into an Uncertain Future – Flights may be creeping toward pre-pandemic levels, but there’s still a China-sized hole in the global tourism market and a pile of debt to manage. After 18 months in which passenger planes were laid up in desert boneyards, converted into makeshift medical-supplies freighters, and even flown on short return hops just to maintain their pilots’ certifications, the machinery of the global aviation industry is gradually creaking back into life.”, Bloomberg, October 27, 2021

“Some of the World’s Last Covid-19 Travel Holdouts Are Reopening – Australia is allowing citizens to travel, while vaccinated tourists from many countries can now enter Thailand without extended quarantines…. n the U.S., the Biden administration plans to lift travel restrictions for international travelers in the coming days. The new policy will affect both air and land-border travelers, who will need to be fully vaccinated.”, The Wall Street Journal, November 1, 2021

“Singapore Storms Back Toward Pre-Virus Levels of Air Traffic – Airlines in Asia are bringing back international capacity as the region gradually follows North America and Europe in reopening borders, led by the city-state of Singapore, whose economy depends on open access. By January, Singapore is poised to reach 84% of the weekly flights to Europe as it had in March last year….”, Bloomberg, October 22, 2021

“Thailand to Allow Quarantine-Free Travel From U.S., U.K., China – Vaccinated travelers from the U.S., U.K. and most of Europe will soon be able to enter Thailand without quarantining, in a further boost to the tourism-dependant economy. They are among 46 countries, also including China, Australia and Singapore, to be added to the quarantine-free travel list from Nov. 1, the government said late Thursday.”, Bloomberg, October 21, 2021

Global Vaccine Update

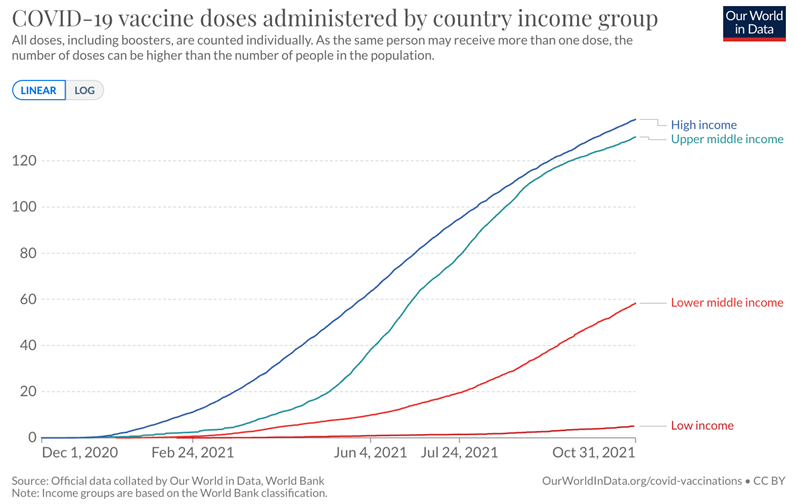

“49.5% of the world population has received at least one dose of a COVID-19 vaccine. 7.07 billion doses have been administered globally, and 26.65 million are now administered each day. Only 3.6% of people in low-income countries have received at least one dose.”, Our World In Data, November 1, 2021

Country & Regional Updates

Asia

“Five windows of opportunity for postpandemic Asia – Although the COVID-19 pandemic has caused hardship, Asia has remained relatively resilient, and opportunities for growth are opening up. In July 2021, the International Monetary Fund (IMF) forecast that Asia would grow at 7.5 percent in 2021 and 6.4 percent in 2022, compared with 6.0 percent and 4.9 percent for the world.”, McKinsey & Co., October 18, 2021

“Why Asia’s CEOs fear inflation as biggest hurdle to coronavirus recovery – Supply-side constraints, loose monetary policy, geopolitical tensions and weakening consumer sentiment are just some of the issues weighing on business leaders’ minds. Asia’s economic vitality means it will remain a leading source of growth in the future, but expect more bumps on the road to recovery.”, South China Morning Post, October 19, 2021

Australia

“Australia reopens its borders as Covid threat recedes – The borders have been closed for almost 600 days. Alan Joyce, head of Qantas, Australia’s national airline, said that international travel in 2022 could be up to three times normal levels owing to pent-up demand. ‘I’m sure there’ll be a lot of visitors around the world that want to come into Australia given how well we’ve handled the pandemic,’ he said. Fewer than 1,500 people have died from coronavirus in Australia.”, The Times of London, November 1, 2021

“Qantas to return all Australia-based staff to work as travel reopens – Asia-Pacific countries ease restrictions on passengers vaccinated against Covid-19. The Australian airline said on Friday 11,000 stood-down workers would return to their jobs in early December, representing half of its Australia-based staff, six months ahead of its original schedule.”, The Financial Times, October 22, 2021

China

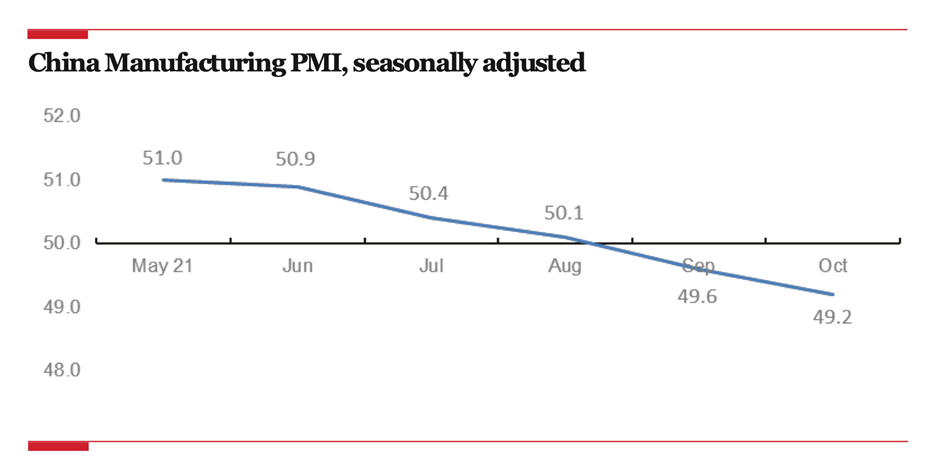

“China’s manufacturing PMI drops to a 20-month low of 49.2 in October, indicating further contraction in the manufacturing sector – The new orders index declines further to 48.8 in October, pointing to contraction in the market demand. The input prices index surges in October, suggesting severe cost pressure on manufacturers.”, FUNG Business Intelligence, October 31, 2021

“China Tightens Scrutiny of Outbound Data Transfers – China’s internet regulator Friday issued draft rules that will impose stricter requirements for data leaving the country as authorities move to tighten oversight of data security. Under rules drafted by the Cyberspace Administration of China (CAC), a national security review will be required for data transfers outside the country involving the personal information of 100,000 individuals or more.”, Caixing Global, October 30, 2021

“AmCham Shanghai today released its annual China Business Report at the PwC Innovation Center, where over 130 members and their guests listened to Jeff Yuan, a PwC partner, introduce the report’s primary findings. Yuan then hosted a panel discussion with four company heads: Colin Block, managing Director of EVAPCO; Anna Pawlak-Kuliga, CEO of Ikea China; Chris Reitermann, Chief Executive of Ogilvy Group Asia; and Tom Tan, President of BorgWarner China.”, AmCham Shanghai, September 22, 2021

Egypt

“Egypt’s new capital city rises in the desert – Is it a vanity project for Egyptian ruler el-Sisi or a necessity to escape the clogged, overcrowded confines of Cairo? Probably both. NAC is to become much more than Egypt’s new capital. It will also attempt to emerge as the country’s, maybe the entire region’s, main business centre and the Middle East’s biggest housing project, with apartments and villas for more than six million people.”, The Globe and Mail, October 25, 2021

European Union

“Eurozone Economy Outpaces U.S., China, but Tougher Times Lie Ahead – Region snapped back strongly in the summer, but supply-chain disruptions now biting into growth. ross domestic product in the 19-nation eurozone grew at a seasonally adjusted annualized rate of 9.1% in the three months through September, roughly in line with the previous quarter, the European Union’s statistics agency said on Friday.”, The Wall Street Journal, October 29, 2021

“Schools reopen in New Delhi as coronavirus cases dip across India – More than four million children are enrolled in public and private schools in the capital. Tens of thousands of pupils returned to schools in New Delhi on Monday after a gap of 19 months amid a drop in coronavirus cases in India. Authorities last week asked schools to run classes but allowed children of parents who did not want to send them to schools to continue with online learning.”, The National News, November 1, 2021

Indonesia

“Indonesian markets boosted by China’s energy crunch – Rupiah rebound leads regional currencies as coal exports lift south-east Asia’s biggest economy. Indonesia’s currency and equities markets are riding high on a global energy crunch as the resource-rich country enjoys record coal prices and surging demand from power-hungry China.”, The Financial Times, October 24, 2021

Japan

“Japanese tourism after Covid-19 looks to build on Tokyo Olympics and Paralympics, but some doubt official strategy. Initiatives include a social networking service campaign in international markets and a long-term strategy designed to encourage tourists to revisit the country. An analyst says a target of 60 million inbound tourists by 2030 may be optimistic, and even if it can be achieved, a focus on quality of visitors is preferable.”, South China Morning Post, October 25, 2021

Malaysia

“Malaysia could reopen to international tourists in November, says tourism minister – Malaysia aims to reopen to international tourists in November, and travelers from neighboring Singapore could be among the first to be allowed into the country, the Malaysian tourism minister told CNBC.”, CNBC, October 21, 2021

United Kingdom

“UK businesses report stronger-than-average growth – CBI – British businesses gained a small amount of momentum and grew at an above-average pace in the three months to the end of October, despite widespread disruption to supply chains, the Confederation of British Industry (CBI) said on Sunday. The CBI’s monthly growth indicator – which pulls together surveys of output from manufacturers, retailers and other services companies – rose slightly to +29 from +27 in September, after hitting its highest since 2014 in August at +34.”, Reuters, October 30, 2021

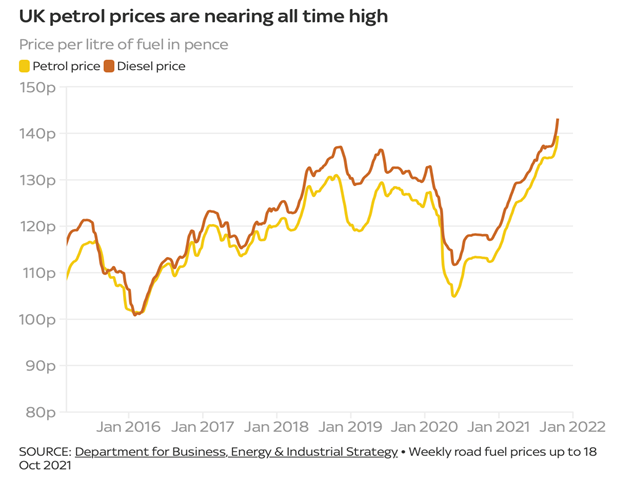

“The cost of petrol is nearing a record high as it is artificially inflated as increases in the wholesale cost of diesel is being “loaded on to petrol”, according to analysis by the AA. The cost reached 142.16p per litre, with the highest price recorded at 142.48p (US$1.95) in April 2012.”, Sky News, October 23, 2021

“Growth spurt points to interest rate rise – The economy regained momentum this month as inflationary pressure rose at its fastest pace in more than 25 years, a respected survey suggests…..Growth was driven by the services sector, which hit a three-month high of 58.”, The Times of London, October 23, 2021

United States

“(US) Supermarkets Play Supply-Chain ‘Whack-a-Mole’ to Keep Products on Shelves – Retailers reroute shipments, expand storage to stay ahead of product shortages; Nutella, Pringles hard to get lately. Supermarket chains are revamping their operations to navigate persistent product shortages, expanding storage space and curbing discounts to make sure they don’t run out.”, The Wall Street Journal, October 31, 2021

Brand News

“Burger King has officially opened a veggie-only restaurant in Madrid, Spain. To promote this rebranded “Vurger King,” the fast food giant remodeled the interior of the restaurant to include a green plant mural and lush hanging plants (via Veg News). For one month only, customers will be able to purchase food items such as a plant-based Whopper, vegan chicken nuggets, and the Long Vegetal. The latter is a menu option featuring “meat” from The Vegetarian Butcher, a Dutch brand that produces high-quality vegetarian meat. Mashed, October 26, 2021

“Buffalo Wild Wings is now testing a robot that can fry chicken wings – The Inspire Brands brand is partnering with Miso Robotics to test Flippy Wings. Flippy Wings is a “robotic chicken wing frying solution” that is designed to help brands maximize chicken wing output even while short-staffed in the kitchen.”, Nation’s Restaurant News, October 21, 2021

“Denny’s Recognized On Newsweek’s List Of The Most Loved Workplaces For 2021 – Denny’s today announced that it has been named one of the Top 100 Most Loved Workplaces for 2021 by Newsweek and Best Practice Institute for its longstanding commitment to employee satisfaction through opportunities for career growth, exceptional healthcare benefits and a love for serving people.”, Cision PR Newswire, October 22, 2201

“KFC Operator Yum China’s Third-Quarter Profit Plunges as Outbreak Curbs Hit Sales – Yum China Holdings Inc., operator of KFC and Pizza Hut restaurants in China, reported a 76% plunge in its third-quarter profit to $104 million, as operations were “significantly impacted” by an outbreak of the delta variant of the coronavirus that began in late July. For the quarter that ended in September 2021, revenue increased 9% to $2.55 billion, while the key metric of same-store sales fell for the first time this year by 7% from a year ago, including a decrease of 8% at KFC chain stores and a 5% drop at Pizza Hut…”, Caixing Global, October 29, 2021. Compliments of Paul Jones, Jones & Co. Toronto

“Italy’s Lavazza Espresso Brand Takes On Starbucks in China – It’s betting a 126-year heritage of offering high-end beans will let it open 1,000 espresso shops in a market the American chain already dominates. Lavazza opened a flagship outpost in Shanghai last year and has since added more coffee shops across the country. With design features including wall murals, traditional mocha machines, and white marble trimmings, the Shanghai store evokes an air of Italian dolce vita that the company hopes will resonate with Chinese consumers eager to embrace European luxury and style.”, Bloomberg, October 27, 2021

“Luckin (China) Says Selling More Coffee for Higher Prices Helped Stem Losses – Scandal-dogged Luckin Coffee Inc. said it managed to pare its losses by over 1 billion yuan during the first half of this year, as it sold more coffee at higher prices, eased off on its previously breakneck expansion and increasingly tapped the franchise model.”, Caixing Global, October 22, 2021

“NRD (Group) creates Experiential Brands platform with Fuzzy’s Taco Shop – Paul Damico, in expanded CEO role, says new division has eye on possible acquisitions…“Experiential Brands will be the holding company and Fuzzy’s Taco Shop will be the first brand we put into that new platform,” Damico said in an interview Tuesday.”, Nation’s Restaurant News, October 26, 2021

“Phenix Salon Suites Inks 75-Unit Deal for the U.K. and Ireland – Phenix Salon Suites opened its first British location in Manchester in early October, marking the start of the company’s strategic global expansion plan, according to company officials. Development group Phenix LTD-UK signed an agreement to open 75 Phenix Salon Suites locations throughout the United Kingdom and the Republic of Ireland.”, Franchising.com, October 22, 2021

“Sotheby’s International Realty Opens Its First Office in Bulgaria – Sotheby’s International Realty announced that Iris Estates has joined its network and will operate as Bulgaria Sotheby’s International Realty. The addition marks the brand’s continued growth in Europe. The brand has nearly 200 affiliated offices in the EMEIA (Europe, Middle East, India, and Africa) region.”, Franchising.com, October 22, 2021

Articles & Studies For Today And Tomorrow

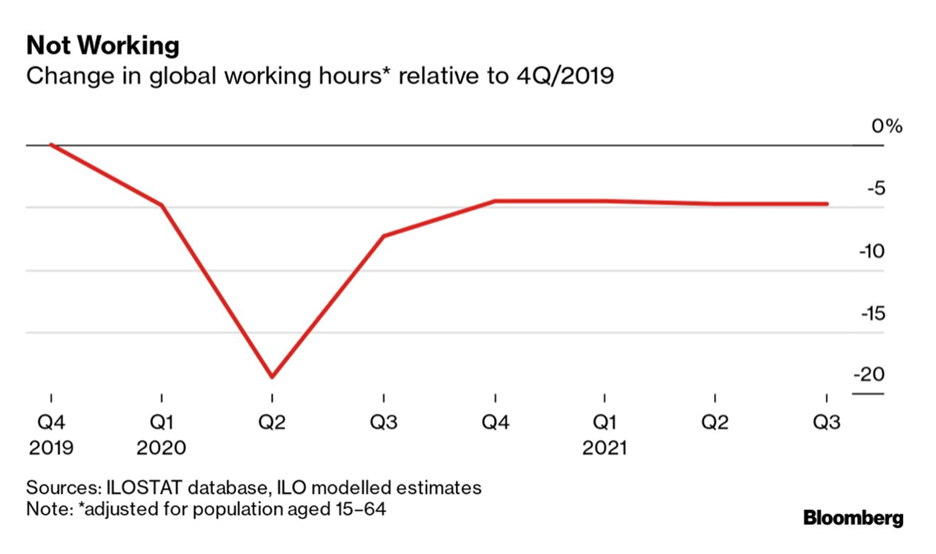

“The number of working hours lost due to the Covid-19 pandemic will be “significantly higher” than projected just a few months ago, with estimates that global hours worked this year will be 4.3% below their pre-pandemic level, the equivalent of 125 million full-time jobs. Africa, the Americas and Arab States were the regions that experienced the biggest declines.”, Bloomberg, October 27, 2021

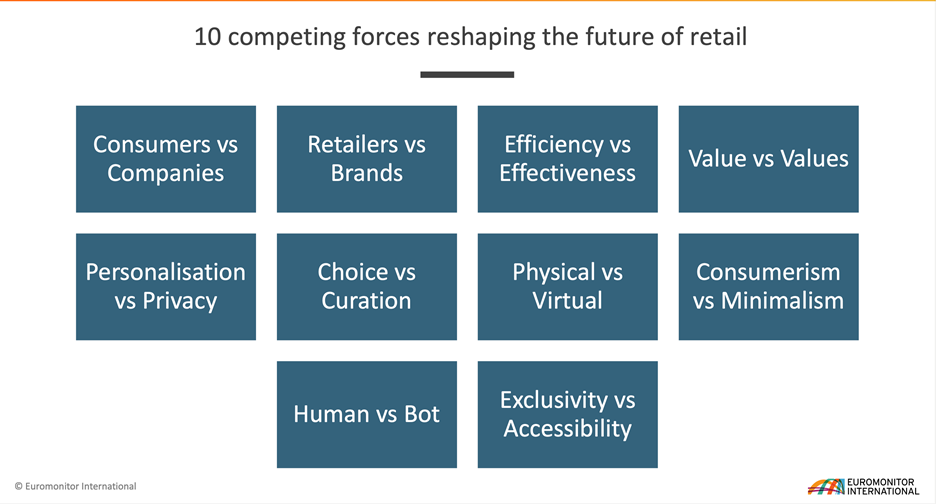

“Commerce 2040 – The Future of the Store in a Digital World”, Euromonitor International, October 2021

“Projected 2022 International Franchise Development by Country – Key to recovering from the pandemic – to the point where local companies in a country will seek new franchise investment – is the level of vaccination in that country. I traveled to Italy, Spain, the Netherlands, and the United Kingdom in September for my first international trip in almost 2 years. These countries are 70% or more fully vaccinated and are learning to live with Covid-19.”, Franchising.com, Late October 2021

William (Bill) Edwards, CFEand CEO and Global Advisor, Edwards Global Services, Inc. (EGS) has 4 decades of international operations, development, executive and entrepreneurial experience and has lived in 7 countries. With experience in the franchise, oil and gas, information technology and management consulting sectors, he has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East. Mr. Edwards advises a wide range of companies on early to long term global development of their brands.

Our Latest GlobalVue™ Country Ranking

Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. Our U.S. based executive team has experience living and working in many countries. Our Associate network on the ground overseas covers 40+ countries. EGS has twice received the U.S. President’s Award for Export Excellence.

For global market research, operations and development support across 40 countries, contact Mr. Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

https://calendly.com/geowizard/30min Click here to schedule a call with Bill Edwards to discuss how to succeed in developing your company around the world.