EGS Biweekly Global Business Newsletter Issue 51, Tuesday, March 8, 2022

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Trends in this issue:

Since living and working in Eastern European countries coming out of decades of communist rule, I have closely watched what Russia does and how it might impact the Czech Republic, Hungary and Poland. In this issue there is a special section on the impact of the war on trade and how the surrounding democratic countries have responded. Actually, most of this issue deals with this immensely important event.

First, A Few Words of Wisdom

“Regimes planted by bayonets do not take root.”, Ronald Regan

“Quality is the best business plan.”, John Lasseter

“Being positive in a negative situation is not naive. It’s leadership.”, Ralph Marston

Highlights in issue #51:

- Brand Global News Section: Burger King®, Jolibee®, KFC, McDonalds’s®, Phenix Salon Suites®, Retail Food Group and Wingstop®

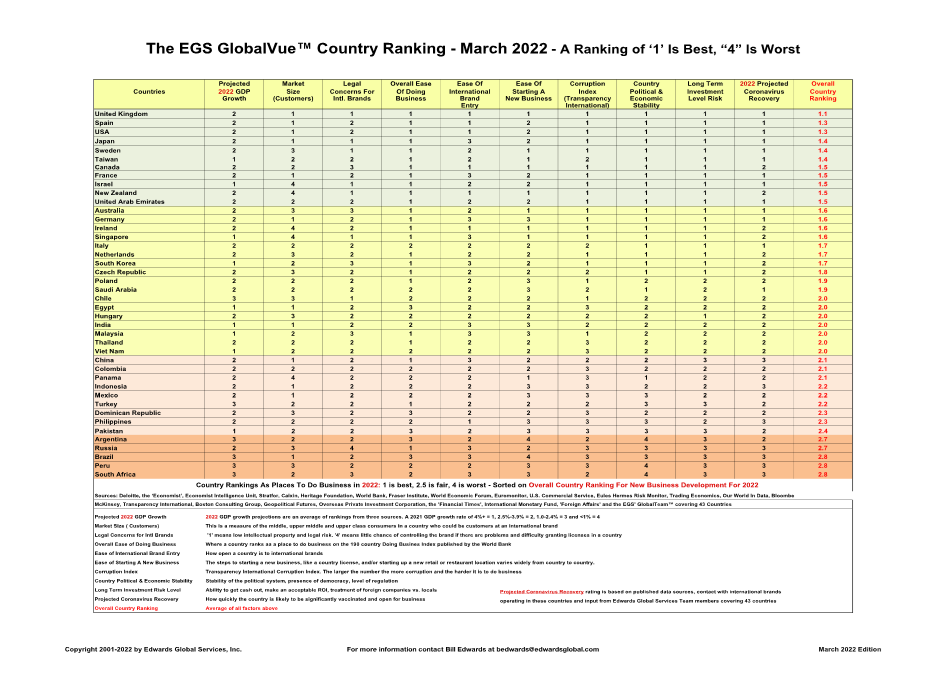

Our latest GlobalVue™ 40 country ranking – Last week we released our quarterly update on how countries rank as places to do business. Our only change would be to give Russia ‘4’ – lowest ranking – for political and economic security.

The Impact of the Ukraine War

“A new Europe is emerging from the tragedy of Ukraine – The war has prompted urgent EU membership applications from countries seeking sanctuary from Russian aggression. Jean Monnet, a founding father of the EU, said that Europe “will be forged in crises”. He is being proved right again. It took the Covid pandemic for the EU to make the giant step of financing a huge recovery plan with common debt. Now a war on the continent has moved the EU to decide, over the course of a weekend, to finance weapons deliveries by member states to a country outside the union, thus turning an economic and political organisation into a security provider. Chancellor Olaf Scholz, then Germany’s finance minister, called the EU recovery fund, agreed in May 2020, “a Hamiltonian moment” for Europe, in reference to Alexander Hamilton’s mutualisation of American war debt in the late 18th century.”, The Financial Times, March 6, 2022

“These Are the Companies Cutting Ties With Russia Over Ukraine – Exits reverse 30 years of investment by foreign businesses Criticism of banks and companies seen doing too little grows. International sanctions, the closure of airspace and transports links due to the war, and the financial restrictions on SWIFT and capital controls have made it difficult if not impossible for many companies to supply parts, make payments and deliver goods to and from Russia. Added to that, the potential international consumer backlash against any company perceived as helping Vladimir Putin’s regime means that the exodus of corporations from Russia has become a stampede.”, Reuters, March 7, 2022

“Businesses worldwide are cutting off Russian trade – ‘The private sector is doing what the U.S. and E.U. were more reticent to do: Punish Russia’s oil and gas sector directly,’ one expert told NBC News. It is an apt metaphor: Russian economic activity has ground to a near halt, stymied by a sudden lack of access to such products and services as software, payment processing and insurance — often-overlooked cogs in the machinery of commerce but vital nevertheless. Transportation, energy and banking are three sectors in which these sudden omissions are likely to cut the deepest, according to experts.”, NBC News, March 5, 2022

“Sainsbury’s renames chicken kievs and pulls Russian-made vodka – UK’s second biggest supermarket switches Soviet-era spelling of capital city to preferred Ukrainian version. Sainsbury’s is changing the name of its chicken kiev to chicken kyiv and is joining Waitrose, Aldi and Morrisons in withdrawing a Russian-made vodka from the shelves in the latest action by British retailers to signal solidarity with the people of Ukraine.

The UK’s second biggest supermarket said the packaging for the poultry dish would change in the next few weeks, switching the Soviet-era name for the country’s capital for the Ukrainian version.”, The Guardian, March 4, 2022

“Russia-Ukraine war: Global shipping titans suspend bookings to, from Russia – Ocean Network Express (ONE), Maersk, MSC and Hapag-Lloyd have suspended operations. Ocean Network Express (ONE), Maersk, MSC and Hapag-Lloyd all suspended operations in the country this week, as Bloomberg first reported. ONE — the world’s sixth-largest container carrier and Asia’s second-largest — announced Tuesday that due to the ongoing conflict, it has suspended bookings to and from Odesa, Ukraine; Novorossiysk, Russia; and St. Petersberg, Russia, effective immediately.”, Fox Business, March 1, 2022

“McDonald’s distributes food, KFC opened kitchens for war – The management of the McDonald’s Ukraine restaurant chain has decided to provide food from restaurants for the needs of Ukrainians during martial law, and KFC has opened kitchens for cooking to hospitals, military and territorial defense.

‘Our restaurants are closed for safety reasons, but we provide food to local councils from restaurants where it is currently safe (as far as possible) for our employees. Local authorities take away products and distribute them where they are most needed,’ the statement said. McDonald’s Ukraine. The KFC restaurant chain has opened its kitchens for cooking for military hospitals, hospitals, territorial defense, military, etc. ‘We appeal to the restaurant business, all over Ukraine, to also join, open their kitchens to cook and deliver food to those who need it most now,’ the statement said.”, Extracted from the Ukrainian ‘Economic Truth’ publication on February 27, 2022. Compliments of Paul Jones, Jones & Co., Toronto.

“Magna to idle Russian operations in response to Ukraine invasion – Magna International Inc., the Canadian auto-parts giant, says it is idling its Russian operations in response to the country’s invasion of Ukraine. Magna, which once boasted of ties to the country’s leadership, had said earlier this week that it was focused on the “business continuity” of its Russian operations, but changed tack on Thursday night.”, The Globe and Mail, March 3, 2022

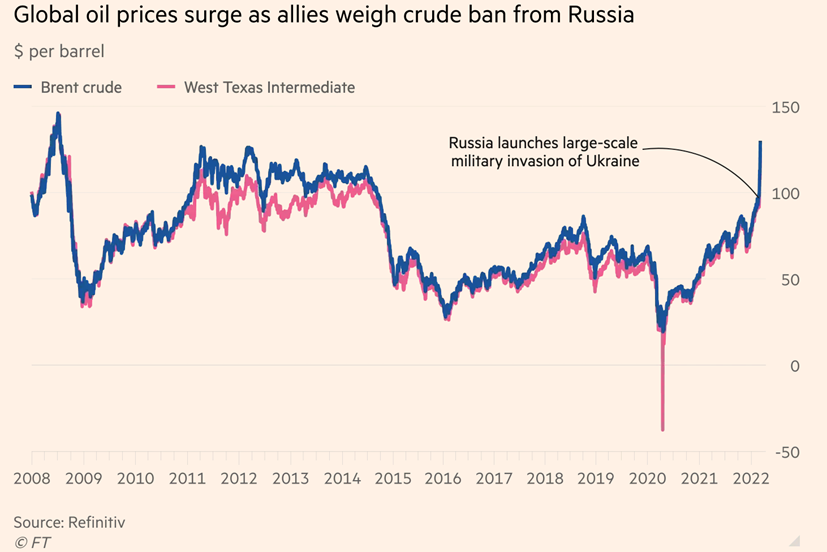

Global Energy

“Oil price rises to highest level since 2008 on talk of Russia oil sanctions – Loss of Russian supplies would remove crucial barrels from an exceptionally tight oil market. The price of Brent oil soared to almost $140 a barrel, its highest price since 2008, in early trading on Monday, after reports that western countries were discussing a possible embargo on crude supplies from Russia, the world’s second-biggest exporter. The price spike came after US secretary of state Antony Blinken said on Sunday that Washington was in “very active discussions” with European allies about a ban on Russian oil exports.”, The Financial Times, March 7, 2022

“Global LNG Supply Will Fall 100 Million Tons Short by Mid-2020s – The gap between supply and demand for liquefied natural gas (LNG) will reach 100 million tons a year globally by the mid-2020s, reflecting increased demand and limited supply growth, global oil and gas giant Shell said Monday in its latest annual LNG outlook report. Global trade in LNG expanded 6% in 2021 to 380 million tons as economies rebounded from the Covid-19 pandemic. Demand is expected to almost double to 700 million tons a year by 2040, Shell said in the report.”, Caixin Global, February 23, 2022

Global Supply Chain & Trade Update

“Ukraine Crisis Creates New Strains On Global Supply Chains – Fragile and sensitive supply chains are facing new challenges in the aftermath of Russia’s invasion of Ukraine. But as bad as things are now, they are likely to get worse for hundreds of thousands of businesses around the world. According to a new report from Dun & Bradstreet, the international domino effect of global dependencies on businesses in the Ukraine region is already being felt.

Why? Because 374,000 businesses worldwide rely on Russian suppliers—90% of these businesses are based in the U.S. About 241,000 businesses rely on Ukrainian suppliers and 93% are based in the U.S., according to Dun & Bradstreet.”, Forbes, March 6, 2022

“Charting the Global Economy: Commodities Fuel Yet More Inflation – Russia’s invasion of Ukraine has sparked a feverish run-up in the prices of just about every commodity — from oil to grains to metals — that will inflict even more financial pain on consumers already struggling with rampant inflation.

Global food prices hit a record last month and consumer price indexes across major economies are on the rise. That’s bad news for households everywhere as wage growth largely lags inflation, underscored by the latest U.S. hourly earnings figures that missed all estimates.”, Bloomberg, March 5, 2022

“Food prices jump 20.7% yr/yr to hit record high in Feb, U.N. agency says – Higher food prices have contributed to a broader surge in inflation as economies recover from the coronavirus crisis and the FAO has warned that the higher costs are putting poorer populations at risk in countries reliant on imports. FAO economist Upali Galketi Aratchilage said concerns over crop conditions and export availabilities provided only a partial explanation to the increase in global food prices.”, Reuters, March 5, 2022

“You Think Groceries Are Expensive in America? Try Shopping in These 6 Countries. American consumers have felt plenty of pain at the supermarket of late, due to the effects of inflation. Overall costs in the U.S. are rising at a 7.5% annual rate. Some food items are going up by as much 20%, according to reports. But shoppers in the U.S. still may not have it as bad as those in Switzerland and South Korea.

In a recent analysis of prices in 36 major nations, the British website Money.co.uk found that those two countries had the highest costs for groceries, based on a fairly standard shopping list that included milk, eggs, cheese, apples, bananas, oranges, tomatoes, onions, lettuce, bread, rice, potatoes, chicken and beef.”, Barron’s, March 1, 2022

Global, Regional & Local Travel Updates

“How Russia’s invasion of Ukraine is changing air travel – The Russian invasion of Ukraine is turning into a seismic event for the aviation industry just as it emerges from the COVID-19 downturn. According to Umang Gupta, managing director at Alton Aviation Consultancy, the typical flight time between Europe and Asia is about 11.8 hours, and 13.5 hours flying the reverse leg.

‘In a best-case scenario, more than two hours of flight time will be added in each direction,” Gupta told Axios. The roundtrip fuel burn would increase by more than 20%, he said, and that’s for the most fuel-efficient wide body aircraft flying today, such as the Boeing 787-9 or Airbus A350-900. At today’s oil prices of around $100/bbl, this will translate into nearly $25,000 of additional expenditure for the airline round trip,’ Gupta said. To cover costs, airlines would need to increase fares by more than $120 for a round trip ticket.”, Axios, March 5, 2022

“Should you change your European travel plans in light of Russia’s invasion of Ukraine? Whether you’re currently booked for a trip to Europe or you’re thinking of booking, there are a handful of rational inferences we can draw from the conflict between Europe and the Kremlin.”, The Points Guy, March 6, 2022

“Many Travel Restrictions Are Being Eased. Here’s The Latest For March 2022 – We’re approaching the start of the spring travel season as the weather starts to warm north of the equator. Additionally, many positive domestic and international travel developments make it easier to pack your bags and hop on a plane. Here is some of the travel news to know about for March 2022, including several restrictions that have been eased.”, Forbes, March 6, 2022

“Asia-Pacific travel faces bumpy recovery – Booking.com exec – Travel in Asia-Pacific is trailing the rest of the world and should expect a bumpy recovery, a Booking.com executive said on Monday, as countries in the region have been slower to open borders than other destinations. With North Asian countries still largely restricting entry and Southeast Asian countries reopening cautiously, the region’s tourism recovery will not be quick, Laura Houldsworth, the online travel agency’s managing director for Asia-Pacific said in an interview.”, Reuters, March 7, 2022

“Indonesia, Malaysia to ease COVID curbs on foreign visitors further – Indonesia is considering a quarantine waiver for foreign visitors to its holiday island of Bali from next week, officials said on Saturday, while neighbour Malaysia announced the removal of curbs on travellers from Thailand and Cambodia.”, Reuters, March 5, 2022

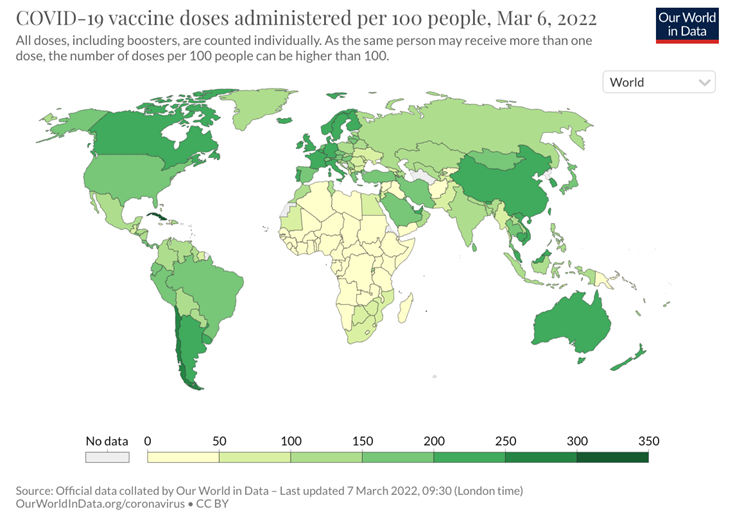

Global COVID & Vaccine Update

“63.3% of the world population has received at least one dose of a COVID-19 vaccine. 10.88 billion doses have been administered globally, and 19.2 million are now administered each day. Only 13.6% of people in low-income countries have received at least one dose., Our World In Data, March 6, 2022

Country & Regional Updates

Asia Pacific Region

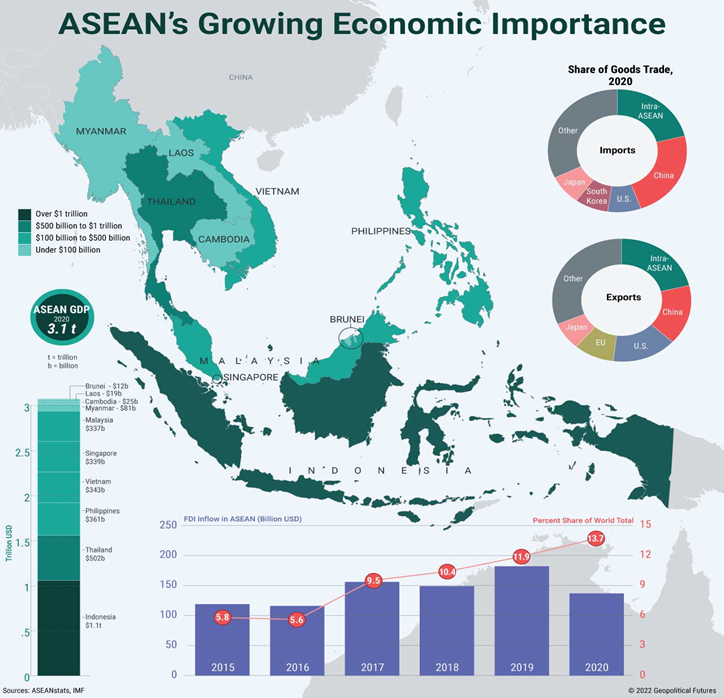

“ASEAN’s Growing Economic Importance – The bloc has one of the largest economies in the world. The Association of Southeast Asian Nations is an increasingly important player in global trade. The 10 members of the grouping together comprise the world’s fifth-largest economy. Its economic resources aren’t quite evenly spread, however. Indonesia has the largest economy among the members, accounting for one-third of its total gross domestic product. It’s followed in a distant second by Thailand and then the Philippines. Still, with its strategic location, ample natural resources and abundant human resources, the region stands out as an attractive destination for foreign direct investment.”, Visual Capitalist and Geopolitical Futures, February 25, 2022

Australia

“Western Australia finally reopens, uniting the country but leaving questions – For months, as waves of the delta and omicron variants led other states and territories to abandon their goal of reaching “zero covid,” Western Australia remained the lone holdout. With almost no local cases but vaccination rates lagging other regions, Premier Mark McGowan kept the border shut. Life inside the state largely went on as normal. ‘The virus is already here and we cannot stop its spread,’ he said last month. ‘Having the border is no longer effective.’”, The Washington Post, March 2, 2022

“Eat your hearts out, McDonald’s Australia is launching a national loyalty program where you can get free food. As if you needed another excuse to cruise through the McDonald’s drive-thru, but now you have one that can financially justify a splurge on a treat from the all the offerings on the coveted McMenu.”

MyMacca’s Rewards, where from Thursday, March 3, customers can earn points with each purchase, which will then earn then even greater rewards. For every $1 spent on eligible food and drink purchases with the MyMacca’s app, customers will earn 100 points.”, The Honey Kitchen, March 1, 2022

China

“China’s Ambitious GDP Goal a Boost to Slowing World Economy – Beijing’s 5.5% target will require modest investment stimulus Focus on curbing debt growth will limit the global impact. Beijing on Saturday announced a gross domestic product growth goal of “about 5.5%” for 2022, at the higher end of many economists’ estimates. If achieved, that would be notably quicker than the 4.8% expansion forecast by the International Monetary Fund and the 5.2% seen by economists.”, Bloomberg, March 6, 2022

“China to meet ‘severe’ commodity price volatility by boosting coal supply, oil and gas exploration – China to focus on increasing coal, oil and gas supply, while strengthening reserves and maintaining stable imports, says economic planner. The coronavirus pandemic, shifting monetary policies of major economies and geopolitical conflict are stoking volatility in commodity prices. China’s top economic planning agency said on Monday it would steady energy supply this year in the face of escalating geopolitical conflicts, such as the Russian invasion of Ukraine that has roiled global oil and gas markets.”, South China Morning Post, March 7, 2022

“China Overhauls $23 Trillion Supply Chain Finance Mechanism – China is about to rein in its booming, 167.23 trillion ($23 trillion) market for commercial acceptance bills, a risky, controversial form of business financing that played a role in the 2019 collapse of Inner Mongolia-based regional lender Baoshang Bank.

Stung by that financial calamity, China’s central bank and top banking regulatory agency are about to overhaul the 25-year-old regulations governing the bills. The rapid growth in their use in recent years and their involvement in fraudulent financing and other violations spurred regulators to close loopholes and tighten supervision of the instruments.”, Caixing Global, February 26, 2022

Japan

“Ukraine crisis may hurt Japan’s economy via fuel spike, says BOJ policymaker – Japan’s consumer inflation could briefly approach the central bank’s elusive 2% target due in part to sharp rises in energy costs triggered by the crisis, Bank of Japan (BOJ) board member Junko Nakagawa said. But such a rise in inflation alone would not be reason to dial back stimulus, Nakagawa said, adding that Japan’s economy was still in the midst of recovering from the pandemic’s wounds.”, Rueters, March 2, 2022

“Japan PM signals more sanctions on Russia, braces for price rises at home – Japan’s prime minister indicated on Thursday that the country will impose more sanctions on Russia including a possible airspace ban, and he promised support for Japanese households and companies over looming price rises. ‘As for additional measures including a ban on Russian airplanes in Japan’s airspace, we need to take appropriate steps while working with the G7 and international community,’ Prime Minister Fumio Kishida told a press conference.”, Reuters, March 3, 2022

Mexico

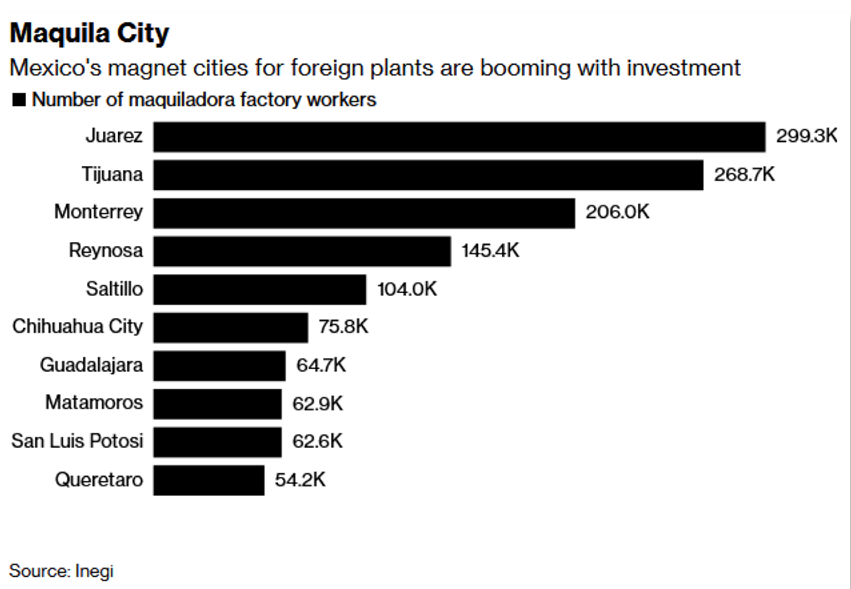

“Mexico’s “magnet cities” are attracting renewed U.S. investment as an alternative to Asian sourcing. Whereas freight from Asia to North America takes roughly 110 days, freight from Mexico takes only five to 10 days. Today, Mexico’s maquiladoras are booming with investment from manufacturers desperate to alleviate supply chain woes.”, Exiger Trends Report, February 2022

Ukraine

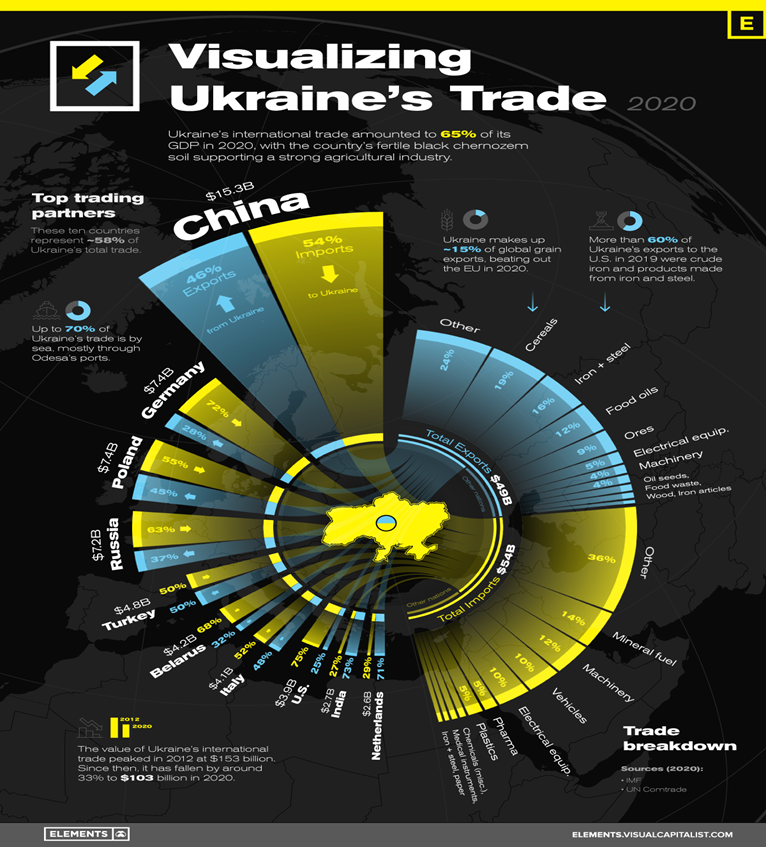

“Visualizing Ukraine’s Top Trading Partners and Products – International trade was equal to 65% of Ukraine’s GDP in 2020, totaling to $102.9 billion of goods exchanged with countries around the world. Ukraine’s largest trading partner in 2020 was China, with the value of trade between the two countries reaching $15.3 billion, more than double the value of any other trading partner.”, Visual Capitalist, March 3, 2022

Brand News

“Burger King shrinks chicken nuggets meal size as inflation eats into margins – The fast-food giant has also removed its popular Whopper as a core discount item. Burger King’s largest franchisee, Carrols Restaurant Group, revealed that the fast-food giant has reduced the number of chicken nuggets in its meals from 10 pieces to eight, in order to ‘limit the impact of higher input costs and help improve restaurant-level profitability.’”, Fix Business, March 1, 2022

“Popular Filipino fast food chain Jollibee finally opens in Vancouver – Anthony Bourdain called Jollibee the “jolliest place on earth” — and one just opened on Granville Street. People from across the Metro lined up for hours on Saturday for a taste of Jollibee, a hugely popular Filipino fast-food chain that just opened in downtown Vancouver. The Granville Street location opened Friday after a two-year delay due to COVID-19.”, Vancouver Sun, February 26, 2022. Compliments of Paul Jones, Jones & Co., Toronto

“KFC Pizza Hut operator Yum China calls time on its struggling East Dawning fast food chain as Covid 19 impact deals fatal blow’. Yum China said its last five outlets of the Chinese-style quick-service restaurant (QSR) brand would cease to operate within 2022. The pandemic was the final straw for the brand, though it had been losing ground for years to the likes of Da Niang Dumpling and Yang’s Dumplings.”, South China Morning Post, March 7, 2022. Compliments of Paul Jones, Jones & Co., Toronto

“Phenix Salon Suites Trailblazes International Growth – Phenix Salon Suites, the leading salon suites brand turned international trailblazer, is continuing its impressive growth spurt.

Since starting to franchise over a decade ago, the brand has continued to reinforce its stellar reputation as the leading salon suite rental franchise. With more than 150 combined licenses sold, Phenix Salon Suites had a monumental year in more ways than one. From opening the first international salon location in Manchester, U.K. to surpassing 300 locations domestically to signing a countrywide development agreement for Sweden, Phenix Salon Suites is experiencing its strongest growth in the company’s history.”, Franchising.com, March 4, 2022

“Higher average spend, overseas growth boost Retail Food Group’s first half – Retail Food Group operates Gloria Jean’s, Donut King, Brumby’s Bakery, Michel’s Patisserie, Crust Gourmet Pizza, Pizza Capers, Cafe2U and The Coffee Guy. It also roasts and wholesales coffee under the Di Bella Coffee brand.”, Inside Retail AU, February 23, 2022

“Wingstop has filed a trademark to sell chicken wings in the metaverse – The chicken-wing chain followed other restaurants, including McDonald’s and Panera Bread, when it filed the trademark applications to the US Patent and Trademark Office on February 25.

The application covers “downloadable virtual goods,” including non-fungible tokens (NFTs) and virtual food and drink. It also includes the creation of an online marketplace where people can trade NFTs, digital assets, and artwork. The multi-class trademark also covers downloadable software for trading cryptocurrency, NFTs, and digital tokens as well as downloadable loyalty and reward cards that the company says can be redeemed for food in both the real and virtual worlds.”, Business Insider, March 3, 2022

Articles & Studies For Today And Tomorrow

“Going International? Taking Your U.S. FDD Abroad – Based on my experience as a master franchisee in five countries, a franchisor executive leading an international operations and development department, and working with more than 40 franchises over the past 20 years in more than 35 countries and cultures, here are the (U.S.) FDD sections I have found international candidates are most interested in, the ones that will most affect their investment decision.”, Franchising.com, March 1, 2022. Your newsletter Editor, William (Bill) Edwards, is the author of this article.

To receive our biweekly newsletter, sign up here: https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ covers 43 countries and provides us with updates about what is happening in their specific countries. Please feel free to send us your input for the biweekly report. bedwards@edwardsglobal.com

To receive our biweekly newsletter click on this link: https://bit.ly/geowizardsignup

William (Bill) Edwards, Your Newsletter Editor, has a four-decade career successfully accelerating the international growth of more than 40 brands. Bill Edwards has a four-decade career successfully accelerating the international growth of more than 40 brands. Bill is known as an international Problem Solver and Advisor. Over the years, Bill has made and/or seen most of the mistakes companies make when going global. In Bill’s role as a Global Advisor to ‘C’ level executives, his objective is to impart the wisdom he has learned over time to help them minimize costly mistakes.

With experience in the franchise, oil and gas, information technology and management consulting sectors, he has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East. He has lived in China, the Czech Republic, Hong Kong, Indonesia, Iran and Turkey and has worked on projects in over 50 countries.

Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. Our U.S. based executive team has experience living and working around the world. Our Team on the ground overseas covers 40+ countries. EGS has twice received the U.S. President’s Award for Export Excellence.

Download our latest chart ranking 40+ countries as places to do business at this link: