EGS Biweekly Global Business Newsletter Issue 57, Tuesday, May 30, 2022

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Shanghai will reopen this week. Is global inflation beginning to slow and maybe even drop slowly? Global travel for the Northern Hemisphere will be beyond 2019 levels. Globalization of trade remains strong. More global brands depart Russia. And those QR codes are for more than just menus

To receive this biweekly newsletter, click on this link:

https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others

“Success isn’t always about greatness. It’s about consistency. Consistent hard work leads to success. Greatness will come.”, Dwayne Johnson

“There is nothing impossible to they who will try.”, Alexander the Great

“No matter what people tell you, words and ideas can change the world.”, Robin Williams

Highlights in issue #57:

- Brand Global News Section: Focus Brands, McDonald’s®, Nike®, Starbucks® and Wendy’s®

Interesting Data and Studies

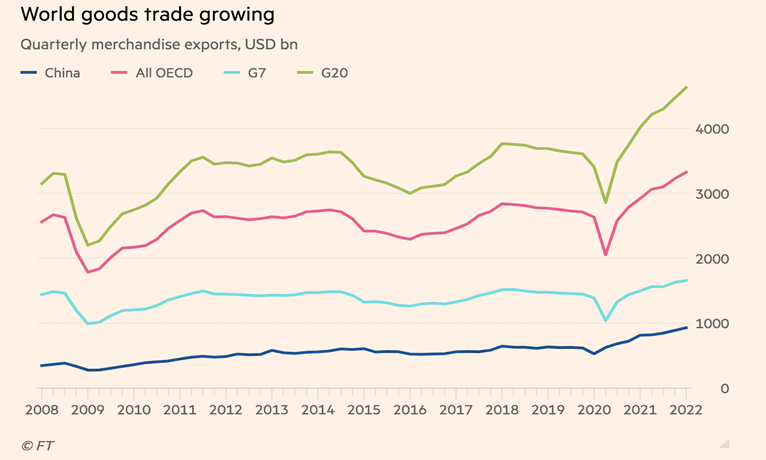

“The death of globalisation has been greatly exaggerated – So far, slowdown in cross-border activity reflects slowdown in growth. The global elite gathered at Davos this week for what by all accounts has been a gloomy affair. Among business leaders the talk is all about globalisation going into reverse. As the chart below shows, until the first quarter of this year merchandise trade gave little indication of deglobalisation for rich countries, China, or the 20 biggest economies (advanced and emerging) taken together. Indeed the IMF’s own research shows that the world now trades more than it had projected three years ago.”, The Financial Times,

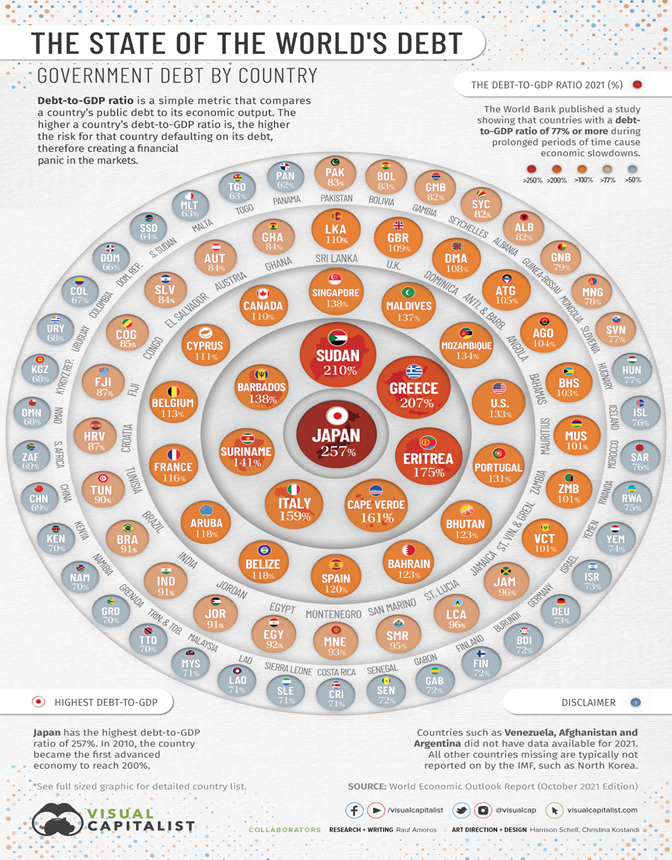

“Visualizing the State of Global Debt, by Country – Since COVID-19 started its spread around the world in 2020, the global economy has been put to the test with supply chain disruptions, price volatility for commodities, challenges in the job market, and declining income from tourism. To analyze the extent of global debt, we’ve compiled debt-to-GDP data by country from the most recent World Economic Outlook report by the IMF.”, Visual Capitalist and International Monetary Fund, February 1, 2022

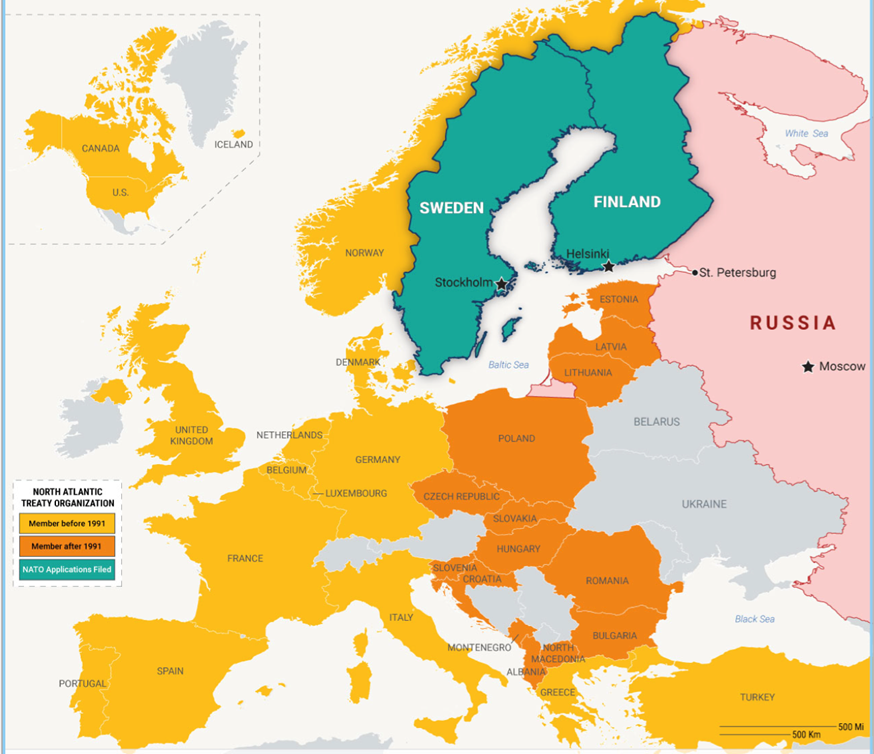

“War in Ukraine Is a Boon for NATO – The trans-Atlantic relationship has found renewed purpose since Russia’s invasion of its neighbor. Most of NATO’s expansion since the end of the Cold War in 1991 occurred from 1999 to 2004 and centered on former Warsaw Pact or Soviet states seeking to anchor themselves in the West and lock in security guarantees against Russia.”, Geopolitical Futures, May 20, 2022

Global Energy

“(UK) EV Rapid Charging Costs Soar 20% in Eight Months – Rapid charging an electric car has become a fifth more expensive in eight months due to soaring energy prices, new figures show. RAC analysis found that the average price of using a public rapid charger in Britain increased from 36.7p per kilowatt hour (kWh) in September last year to 44.6p per kWh this month……The RAC attributed the increase to a 65% spike in the wholesale cost of electricity, which was driven by surging gas prices.”, Bloomberg, May 26, 2022

Global Supply Chain, Commodities & Trade Update

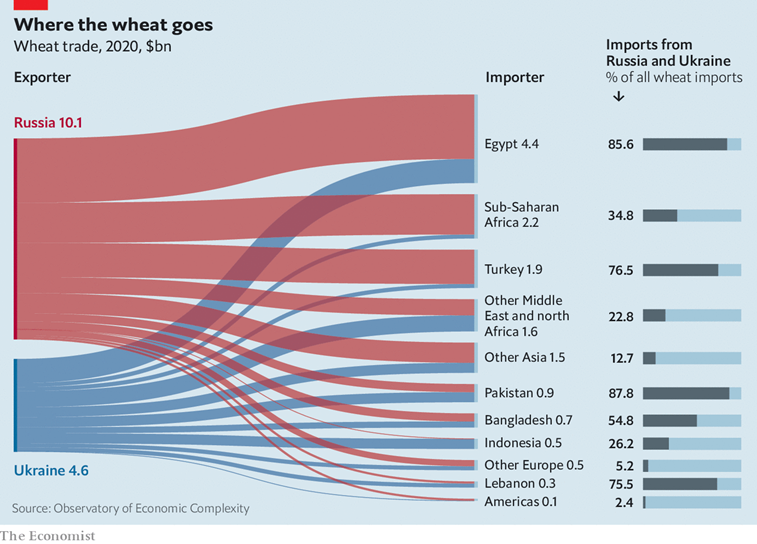

“In 2021 Russia and Ukraine were the world’s first and fifth biggest exporters of wheat, shipping 39m tonnes and 17m tonnes respectively—28% of the world market. They also grow a lot of grain used to feed animals, such as maize and barley, and are the number one (Ukraine) and number two (Russia) producers of sunflower seeds, which means they have 11.5% of the vegetable-oil market. All told, they provide almost an eighth of the calories traded worldwide.”, The Economist, May 19, 2022

Global, Regional & Local Travel Updates

“Tourism in Asia is bouncing back, but can the rebound survive a global recession? From Singapore and Malaysia to Indonesia, Thailand and Japan, inbound travel protocols are being relaxed and international visitors welcomed back. But the region’s tourism rebound risks being grounded by the combined effects of soaring food prices, runaway inflation and global supply chain disruptions. The sigh of relief was palpable across Asia as countries began lifting strict Covid-19 movement restrictions to allow in foreign travellers after two years of living in the shadow of the coronavirus.”, South China Morning Post, May 28, 2022

“Paris Tourism Rebounds as Europeans and Americans Return – Hotel prices in late April up 17% from 2019, according to MKG Jump comes as most Covid restrictions dropped, dollar rises. The city is the second-most sought-after destination worldwide this year, behind London, according to booking website aggregator Trivago. That has steadily pushed up hotel room rates and occupancy since the beginning of the year.”, Bloomberg, May 23, 2022

“Singapore Air Says Business Travel Is Climbing Its Way Back – Airline said Wednesday its net loss narrowed in second half Sees strong passenger growth this year as travel curbs eased. ‘Since April of this year, when Singapore fully opened its borders, we have seen a strong rebound in corporate travel,’ the carrier’s executive vice president of commercial operations, Lee Lik Hsin, said at a briefing Thursday.”, Bloomberg, May 19, 2022

Country & Regional Updates

Australia

“Unemployment rate falls to lowest level in 50 years – That is the lowest level since 1974 and the sixth consecutive monthly gain in employment. ‘In April, we saw employment rise by 4000 people and unemployment fall by 11,000 people,’ ABS head of labour statistics Bjorn Jarvis said on Thursday. ‘As a result, the unemployment rate decreased slightly in April, though remained level, in rounded terms, with the revised March rate of 3.9 per cent.’”, News.com.au, May 19, 2022

Canada

“Seismic reinvention of shopping malls accelerates in COVID’s wake – Reports of a ‘retail apocalypse’ don’t tell the whole story about what’s happening in Canadian shopping malls. The truth is more complex, with wins and losses leading to a revolution in retail. While e-commerce has been a catalyst for change, it hasn’t meant the end of retail stores. Customers are using malls for curbside pickups and inspirational window shopping to get ideas about what they want to buy online. And more online retailers could be opening return centres in retail complexes to make it more convenient for customers to send back merchandise.”, The Globe and Mail, May 17, 2022

China

“Shanghai will exit two months of COVID lockdowns on Wednesday. The hard part will be restarting the city’s economy. China’s economy is currently in a slump not seen since early 2020, with retail sales down 11% and industrial output down 3% in April compared to the same period last year. But the downturn in Shanghai, which implemented the strongest COVID controls of all Chinese cities battling Omicron outbreaks this year, is significantly greater.”, Fortune, May 30, 2022

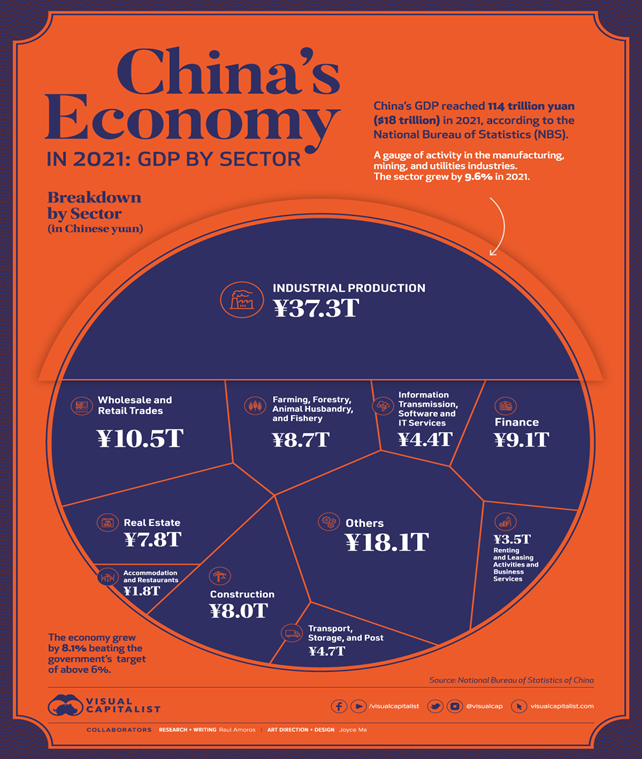

“Visualizing China’s $18 Trillion Economy in One Chart – China is the world’s second largest economy after the U.S., and it is expected to eventually climb into the number one position in the coming decades. While China’s economy has had a much rockier start this year due to zero-tolerance COVID-19 lockdowns and supply chain issues, our visualization covers a full year of data for 2021—a year in which most economies recovered after the initial chaos of the pandemic.”, Visual Capitalist and National Bureau of Statics of China, May 18, 2022

Germany

“German business morale rises in May on buoyant services sector – German business morale rose unexpectedly in May thanks to a pick up in the services sector in Europe’s largest economy that helped offset the impact of high inflation, supply chain problems and the war in Ukraine, a survey showed on Monday. ‘The German economy is showing resilience,’ Ifo economist Klaus Wohlrabe told Reuters, adding that service providers were benefiting from the easing of COVID-19 restrictions – especially in the tourism and hospitality sector. The situation in the industrial sector was more difficult.”, Reuters, May 23, 2022

India

“India Inflation Fight, Monsoon May Take Pressure Off RBI, Former Deputy Governor Says – Repo rate can rise 50 bps in June, and another 25 bps by March. Government-RBI steps may cool inflation within target of 6%. India’s coordinated fiscal and monetary efforts to tame inflation, plus a good agricultural production outlook, may take pressure off the central bank to aggressively raise interest rates later in the year, according to a former Reserve Bank of India official.”, Bloomberg, May 30, 2022

Mexico

“Mexico’s Economy Rebounded in First Quarter on US Demand – Output climbs 1% in first quarter, above initial 0.9% print Export-based economy relies on US demand, No. 1 trade partner. ‘It would be desirable for us to grow more, but it’s not bad growth,’ said Janneth Quiroz Zamora, vice president of economic research at Monex Casa de Bolsa. ‘There was an impact of Omicron, but it wasn’t as strong or as pronounced as was expected.’”, Bloomberg, May 25, 2022

Russia

“McDonald’s on Pushkinskaya will open under a new name on June 12 – Moscow Mayor Sergei Sobyanin said that after the name change, McDonald’s will remain the same menu. According to him, the authorities will support the resumption of the company under a new brand. The mayor noted that the departure of McDonald’s from Russia was discussed as “a huge loss and disaster”, but it turned out that 95-98% of the products used by the network are Russian.”, www.gazeta.ru, May 26, 2022. Compliments of Paul Jones, Jones & Co., Toronto

“Nike Is Reportedly Leaving Russia After Not Renewing Main Franchise Contract – U.S. sporting heavyweight Nike is exiting Russia after suspending operations in March, according to news reports on Wednesday, another symbolic departure of a major American brand as multinational firms including McDonald’s and Starbucks sever ties with Moscow for invading Ukraine.”, Forbes, May 25, 2022

“Starbucks joins McDonald’s in pulling out of Russia – The giant coffee chain, which had already suspended all business activity in Russia in March, said it had now decided ‘to exit and no longer have a brand presence in the market’. Starbucks does not have any cafés in Ukraine but in Russia it has 130 outlets that are wholly owned and operated by a licensed partner, Alshaya Group, of Kuwait, which has 2,000 so-called ‘green apron partners’.”, The Times of London, May 24, 200

Saudi Arabia

“Saudi Arabia steps into the Davos limelight – Flush with oil revenue, the kingdom and its Gulf neighbours are a rare economic bright spot. Despite a dire human rights record, the Gulf country wants the world to focus on its economic story: the world’s top oil exporter is one of the few bright spots in an otherwise shaky global economy wracked by Russia’s invasion of Ukraine, and surging inflation.”, The Financial Times, May 27, 2022

United Kingdom

“Food and drink sales in Britain’s cities back in growth as workers and visitors return – The Top Cities Vibrancy report reveals buoyant Spring sales for restaurants, pubs and bars as Bristol is ranked Britain’s most vibrant city, while northern hubs bounce back…… nine of the ten cities recorded higher sales over the four-week period than in the same period in 2019. Bristol tops the list of most vibrant cities, and sales growth was also above 8% in Manchester, Birmingham and Glasgow.:”, CGA Strategy, May 7, 2022

“Why chicken is getting more and more expensive – The price of chicks is up 14% in a year. Chicken feed is up 50% over 2 years. Packaging, diesel and wages are up double digits…..Prices from the farm gate have already risen by almost 50% in a year.”, BBC News, May 24, 2022

United States

“US Economic Data Signals Firmer Growth That May Ease by Yearend – Consumer spending off to a solid start early in second quarter. Manufacturing gauges soften, while housing market stumbles. Firmer consumer spending and a decisive narrowing of the merchandise trade deficit show the US economy is emerging in short order from a first-quarter pothole. Sustaining that momentum later this year is more of a question mark as manufacturing and housing soften along with employment and wage growth.”, Bloomberg, May 28, 2022

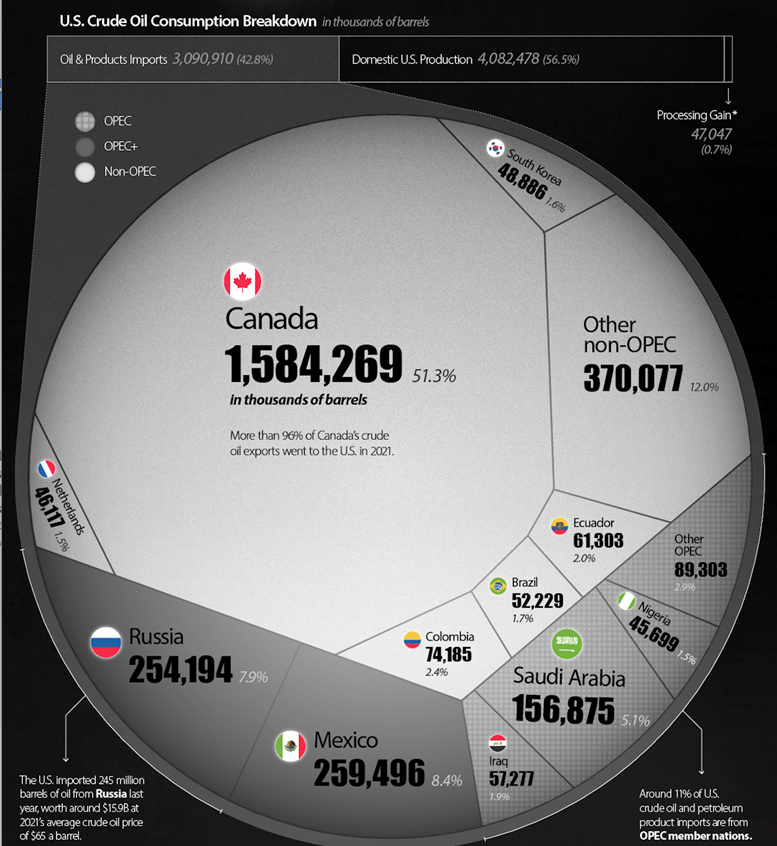

“Visualizing U.S. Crude Oil and Petroleum Product Imports in 2021 – Despite being the world’s largest oil producer, in 2021 the U.S. still imported more than 3 billion barrels of crude oil and petroleum products, equal to 43% of the country’s consumption. This visualization uses data from the Energy Information Administration (EIA) to compare U.S. crude oil and refined product imports with domestic crude oil production, and breaks down which countries the U.S. imported its oil from in 2021.”, Visual Capitalist, May 16, 2022

Brand News

“Focus Brands announces first (international) franchise operations support center – The center will see Focus Brands provide high-quality coaching to improve customer service. The Customer Experience Center of Excellence (CECE) will be located in Heredia, Costa Rica. CECE’s job will be to provide an affordable and effective means to deliver world-class customer service and ultimately, improve the performance of all franchisees.”, Global Franchise, May 24, 2022

“What McDonald’s In Other Countries Is Really Like – McDonald’s is in over 100 countries around the globe, practically all of which have adapted the menu to reflect local cultural tastes while still maintaining some of the signature American items that the restaurant is known for. But what are some of those differences? For those whose curiosity is piqued, this is what McDonald’s is like in other countries.”, Mashed, May 27, 2022

“One of America’s Favorite Burger Chains May Soon Have a New Owner – Wendy’s largest shareholder is exploring moves that would improve the chain’s shareholder value. Trian Fund Management, a majority shareholder of Wendy’s, announced Tuesday that it is looking into a potential acquisition of the burger chain, in hopes of making the company more profitable. A recent SEC filing confirms that Trian, which owns a 19.4% stake in Wendy’s, is currently ‘explor[ing]…a potential transaction…to enhance shareholder value’—one which could involve a third party, and include an acquisition, merger, or other deal that would transfer control of Wendy’s.”, Eat this. Not That!, May 25, 2022

Articles & Studies For Today And Tomorrow

“Did You Really Think We’d Stop Shaking Hands? Humans are meant to be together, especially when it comes to conducting business. We yearn to see each other’s faces in person. And we want to touch and shake hands. The act of shaking hands dates back to medieval times when the world was a more dangerous place. It was a way to ensure your arms were free of anything intended to harm another. Millenia later, the Covid pandemic hit and we found ourselves anxiously disinfecting everything in sight, from packages of potato chips to our own kids.”, Skift, May 13, 2022

“QR Codes Are More Than Digital Menus – Several trending articles over the last year have cropped up maligning the ubiquity of QR codes, most prominently by Erin Woo the New York Times….The little black punctuated squares almost seemed self-replicating with their proliferation in an era of pandemic and its accompanying collective aversion to fomites and non-sanitized contact surfaces. From restaurant menus to payment portals, they have become a mainstay, almost necessitating a smartphone for everyday interactions.”, Forbes, May 30, 2022

To receive our biweekly newsletter, sign up here: https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the world that impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ covers 43 countries and provides us with updates about what is happening in their specific countries. Please feel free to send us your input for the biweekly report. bedwards@edwardsglobal.com

To sign up for our biweekly newsletter click here: https://bit.ly/geowizardsignup

William (Bill) Edwards, Your Newsletter Editor, has a four-decade career successfully accelerating the international growth of more than 40 brands. With experience in the franchise, oil and gas, information technology and management consulting sectors, he has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East. He has lived in China, the Czech Republic, Hong Kong, Indonesia, Iran and Turkey and has worked on projects in over 50 countries.

Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. Our U.S. based executive team has experience living and working around the world. EGS has twice received the U.S. President’s Award for Export Excellence.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

For advice on doing business successfully across 40+ countries, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

EGS Biweekly Global Business Newsletter Issue 56, Tuesday, May 17, 2022

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

In 2022, our company is actively seeking international partners for our Clients in Australia, Canada, Egypt, Germany, Israel, Italy, Japan, Mexico, New Zealand, Spain, the United Arab Emirates and the United Kingdom. Getting back to pre-COVID activity!!!!

Prior to the pandemic, 60% of our business for the first 18 years of our company was in Asia. Most of Asia and the Americas remain either partially shutdown or do not have investors ready for new projects this year. 2023 will see Asia come back.

Since September 2021, I have been back on the road in Canada, Israel, Germany, Italy, Mexico, the Netherlands and the United Kingdom meeting and evaluating Client partners. Next are Australia and New Zealand. Then India, Mexico, the United Arab Emirates and the United Kingdom.

To receive our biweekly newsletter, click on this link: https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others

“Play by the rules, but be ferocious.”, Phil Knight, Founder and CEO of Nike

“Success usually comes to those who are too busy to be looking for it.”, Henry David Thoreau

One small positive thought can change your whole day.”, Zig Ziglar

Highlights in issue #56:

- Brand Global News Section: Chipotle®, Denny’s®, McDonald’s®, Papa John’s® and Wendy’s®

Interesting Data and Studies

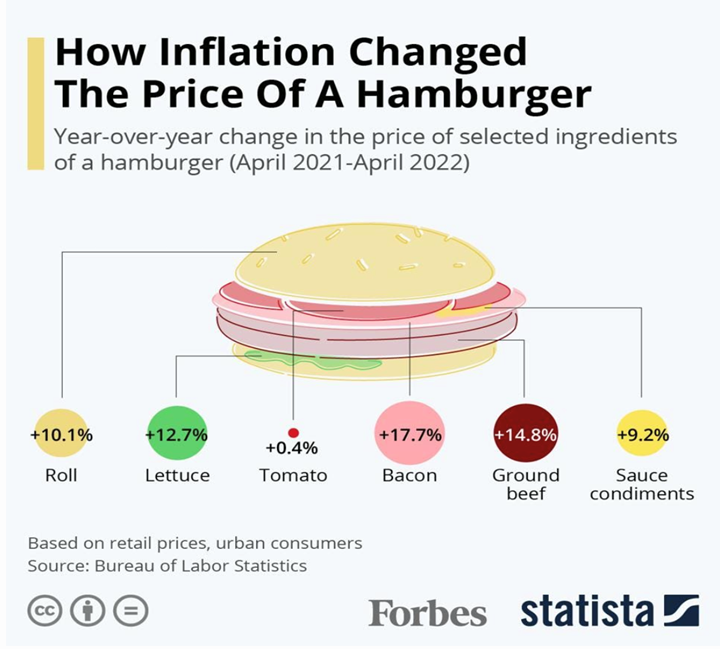

“How Inflation Changed The Price Of A Hamburger – Food and energy—the more volatile items in the Consumer Price Index—drove rising cost of living. Especially energy, in short supply following the Russian invasion of Ukraine and ensuing sanctions, was a major culprit. Costs rose by more than 30% since April 2021 independent of the base effect, as energy prices had already reached pre-pandemic levels one year ago. Food prices also took some significant steps up, as seen in the example of shopping for hamburger ingredients.”, Forbes, May 13, 2022

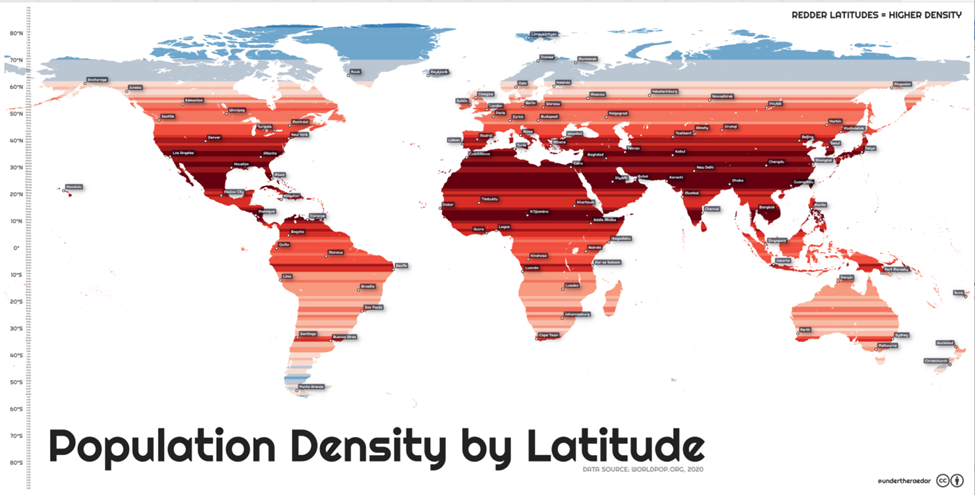

“The World’s Population Density by Latitude – When you think about areas with high population densities, certain regions spring to mind. This could be a populous part of Asia or a cluster of cities in North America or Europe. Usually density comparisons are made using cities or countries, but this map from Alasdair Rae provides another perspective. This world map depicts population density by latitude, going from the densest populated coordinates in deep red to the sparsest in light blue.”, Visual Capitalist / Worldpop.org, 2020

Global Energy

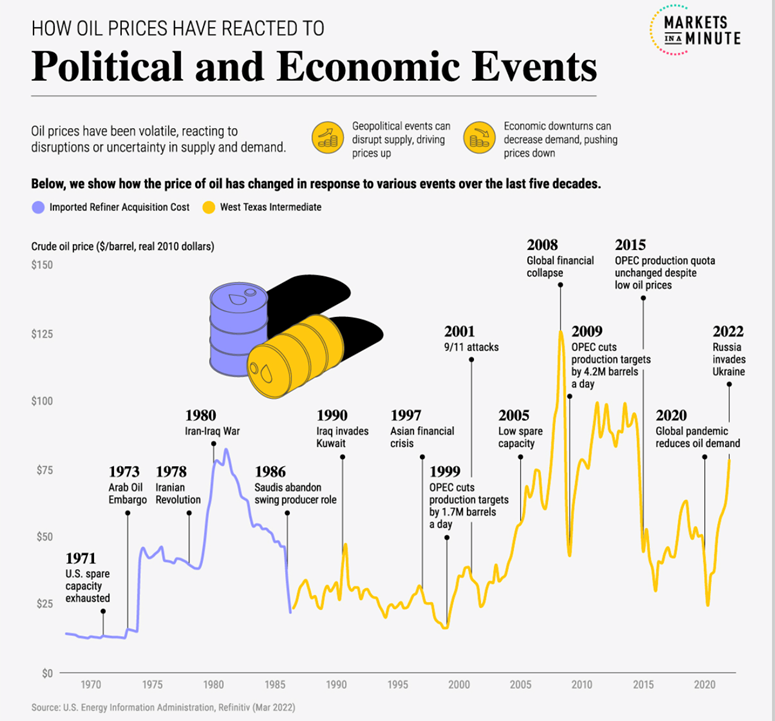

“Visualizing Historical Oil Prices (1968-2022) – Amid Russia’s invasion of Ukraine, the inflation-adjusted price of oil reached a seven-year high. Russia is one of the world’s largest producers of crude oil, and many countries have announced a ban on Russian oil imports amid the war. This has led to supply uncertainties and, therefore, rising prices.

How does the price increase compare to previous political and economic events? In this Markets in a Minute from New York Life Investments, we look at historical oil prices since 1968.”, Visual Capitalist / U.S.. Energy Information Administration, March 2022

Global Supply Chain & Trade Update

“Diversify global supply chains, don’t dismantle them, IMF says – The COVID-19 pandemic wreaked havoc on global supply chains but new International Monetary Fund research shows that more diversification of source countries and inputs can significantly reduce the economic drag from supply disruptions.

In an analytical chapter of its forthcoming World Economic Outlook, IMF researchers said that countries experienced larger declines of goods imports, and GDP, in the first half of 2020 when trading partners imposed strict COVID-19 lockdowns. ‘Dismantling global value chains is not the answer. More diversification, not less, improves resilience,’ the researchers wrote in a blog post accompanying the chapter.”, Reuters, April 12, 2022

Global, Regional & Local Travel Updates

“Business Travel CEOs Say the Sector is Back as Border Controls Evaporate – Fliers are spending big to get back in the air, and away from Zoom. Business travel, contrary to some expectations in the thick of the pandemic, is coming back. While bookings may not have reached pre-Covid levels, there’s mounting evidence of a rebound, the strength of which is taking some by surprise.”, Bloomberg, May 13, 2022

“European Union To Lift Airport And Airline Mask Requirements Next Week – The European Union says it will no longer require masks at airports and on planes starting next week throughout its 27-country bloc. The lifting of the mask mandate is in response to lowering COVID-19 cases throughout the EU, but officials say each member can decide for itself to reinstate the mask mandate should COVID-19 cases spike.”, Travel Awaits, May 13, 2022

Country & Regional Updates

China

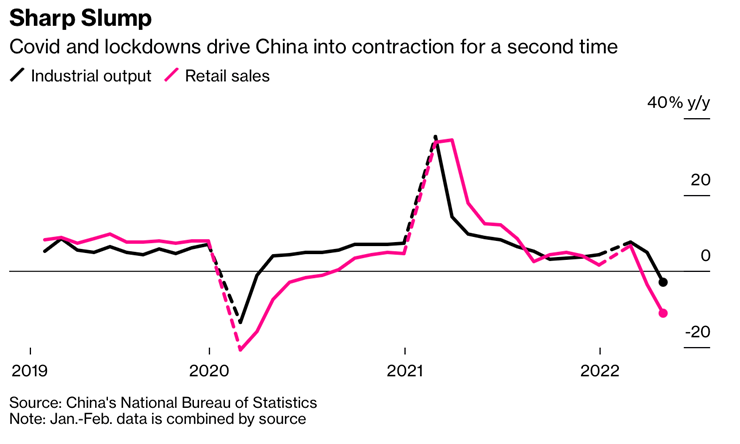

“China’s Economic Activity Collapses Under Xi’s Covid Zero Policy – Factory output, retail plunged in April; joblessness rose Economists say Covid restrictions mean slow recovery. China’s economy is paying the price for the nation’s Covid Zero policy, with industrial output and consumer spending sliding to the worst levels since the pandemic began and analysts warning of no quick recovery.

Industrial output unexpectedly fell 2.9% in April from a year ago, while retail sales contracted 11.1% in the period, weaker than a projected 6.6% drop. The unemployment rate climbed to 6.1% and the youth jobless rate hit a record. Investors responded by selling everything from Chinese shares to US index futures and oil.”, Bloomberg, May 15, 2022

“Small Businesses Suffer as Lockdowns Cut Revenue, Cash Flow – China’s small businesses are grappling with tighter cash flow and diminishing revenue as their costs rise and demand weakens, a survey shows.

The pressure on smaller companies’ liquidity reflects the impact of the country’s “zero-Covid” strategy, as extended lockdowns disrupt or altogether prevent activity and weaken sentiment going forward. In the first quarter, the polled micro and small businesses had enough cash flow to operate for 2.4 months on average, down 0.3 months for the fourth quarter of 2021, according to a survey jointly conducted by Peking University and fintech giant Ant Group Co. Ltd.”, Caixin Global, May 13, 2022

European Union

“The European Union has downgraded its growth forecasts as high energy and food costs caused by Russia’s invasion of Ukraine hit economies across Europe. GDP growth in both the EU and the eurozone is expected to be 2.7 per cent this year, down from its previous estimate of 4 per cent growth. Growth next year is forecast to slow to 2.3 per cent from 2.8 per cent (2.7 per cent in the eurozone) previously.

Inflation in the euro area, which hit 7.5 per cent in March, is projected to be 6.1 per cent this year, before falling to 2.7 per cent in 2023. This compares with the winter forecast of 3.5 per cent. For the EU, inflation is expected to increase to 6.8 per cent in 2022, up from 2.9 per cent in 2021, and fall back to 3.2 per cent in 2023.”, The Times of London, May 16, 2022

India

“Morgan Stanley cuts India growth forecasts on inflation, global slowdown – Gross domestic product growth will be 7.6% for fiscal 2023 and 6.7% for fiscal 2024, 30 basis points lower than the previous estimates, the brokerage said in a note dated Tuesday.

The cut reflects a pronounced economic impact from the Russia-Ukraine conflict that has driven up crude prices, pushing retail inflation in India – the world’s third-biggest oil importer – to its highest in 17 months.”, Reuters, May 11, 2022

New Zealand

“New Zealand March Visitor Arrivals Surged 517% as Kiwis Returned – Overseas arrivals surged 517%, to 28,600 from 4,640 a year earlier, Statistics New Zealand said Thursday in Wellington. The total is the most since July last year, when New Zealand closed a quarantine-free travel arrangement with Australia amid concerns about a fresh wave of Covid-19 infections. New Zealand tourist operators are hopeful the progressive reopening of the border will revive their industry, which has been decimated since the pandemic struck in March 2020.”, Bloomberg, May 11, 2022

The Philippines

“Philippines’ Outperforming Economy Boosts Case for Rate Hike – First quarter GDP growth at 8.3% versus 6.8% survey estimate. Gross domestic product in the three months through March grew 8.3% from a year ago, the Philippine Statistics Authority said Thursday, versus the median estimate for a 6.8% expansion in a Bloomberg survey. That compares with a revised 3.8% contraction in the same quarter in 2021.”, Bloomberg, May 12, 2022

Russia

“Almost 1,000 Companies Have Curtailed Operations in Russia—But Some Remain. Originally a simple “withdraw” vs. “remain” list, our list of companies now consists of five categories—graded on a school-style letter grade scale of A-F for the completeness of withdrawal.”, Jeffrey Sonnenfeld and his team of experts, research fellows, and students at the Yale Chief Executive Leadership Institute, May 16, 2022

United Kingdom

“UK Salaries Rise as Firms Face Growing Candidate Shortages – Fewer foreign workers, geopolitical uncertainty stoke scarcity REC report will fuel pressure on BOE for more rate increases. As candidate availability declined for the 14th straight month, starting-salary inflation held close to a record high, the Recruitment and Employment Confederation and KPMG said in a report published Thursday.”, Bloomberg, May 11, 2022

“The economy contracted in March as the war in Ukraine and rising prices hit confidence, according to the latest data from the Office for National Statistics (ONS). Month-on-month gross domestic product fell 0.1 per cent. City economists had forecast flat growth. In the three months to the end of March the economy grew 0.8 per cent, against expectations for 1 per cent growth.”, The Times of London, May 12, 2022

United States

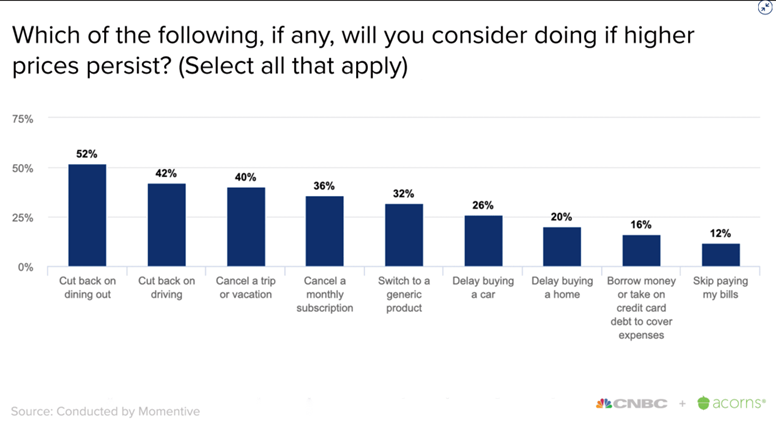

“Inflation remained near a 40-year high in April. Here’s where consumers plan to cut spending. If price pressure continues, more than 50% of adults say they’ll cut back spending on dining out and will consider reducing that further, according to the CNBC + Acorns Invest in You survey, conducted by Momentive. The online survey of nearly 4,000 adults was taken March 23-24.”, CNBC, May 11, 2022

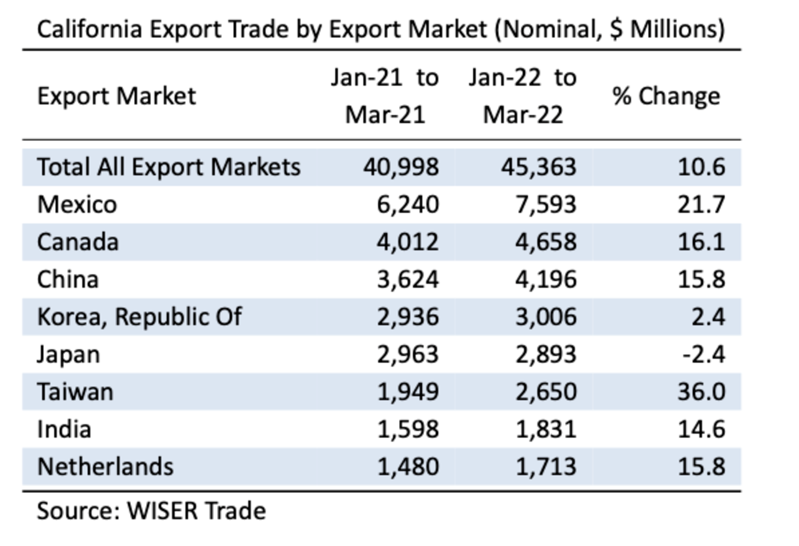

“Double-digit jump in California export value reflects growth and inflation”, Beacon Economic, May 4, 2022

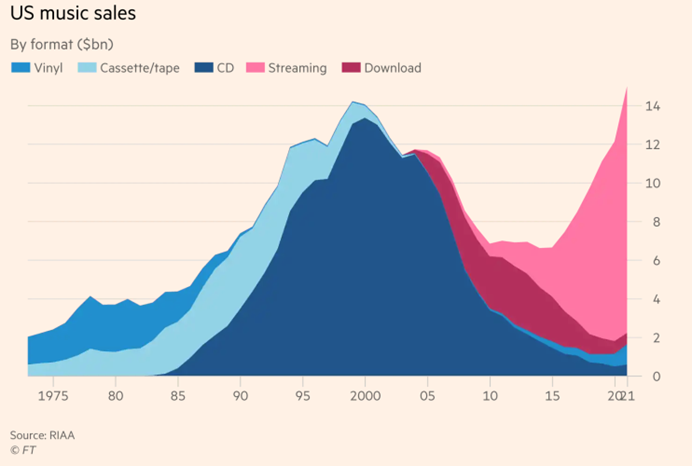

“iPod: technology’s ever changing beat – Enduring love of retro will ensure portable music device’s survival even as US tech group discontinues it. RIP iPod. Apple’s pioneering music-in-your-pocket has gone the way of the BlackBerry, the 244-year-old Encyclopedia Britannica and the dodo. The Cupertino-based tech group this week said it was discontinuing the iPod Touch, its last remaining portable music device.

At 20 years, the iPod had half as long a run as Sony’s Walkman, its clunkier predecessor. The Walkman allowed 1980s cool kids to listen to music cassettes while rollerblading or doing aerobics.”, The Financial Times, May 13, 2022

Brand News

“Denny’s preps for growth as it hires Kelli Valade as CEO – Denny’s has appointed Kelli Valade as CEO and president, effective June 13, the company announced Tuesday. Valade will succeed John Miller, who is retiring on Aug. 3, but will retain his position on the board of directors to help ensure a seamless transition. Valade brings 30 years of experience, and most recently served as CEO at Red Lobster for less than a year. Prior to that position, she was CEO at Black Box Intelligence from 2019 to 2021 and held various roles within Brinker International.”, Restaurant Dive, May 4, 2022

“McDonald’s To Exit from Russia – After more than 30 years of operations in the country, McDonald’s Corporation announced it will exit the Russian market and has initiated a process to sell its Russian business. This follows McDonald’s announcement on March 8, 2022, that it had temporarily closed restaurants in Russia and paused operations in the market. The humanitarian crisis caused by the war in Ukraine, and the precipitating unpredictable operating environment, have led McDonald’s to conclude that continued ownership of the business in Russia is no longer tenable, nor is it consistent with McDonald’s values.”, McDonald’s® press release, May 16, 2022

“McDonald’s Convenience of the Future digital orders offer 11 ways to get a meal – Ordering and eating a Big Mac and fries from a McDonald’s restaurant used to be a binary experience: you went up to the counter, placed your order with a member of the crew and either ate it on the premises or took it away with you.

No longer. A new-look restaurant, unveiled today under the fast-food operator’s £250 million Convenience of the Future investment programme, reflects customers’ increasingly diverse expectations, providing 11 ways of getting a meal. The revamp also reflects the fact that about half of sales are now made through digital channels. In addition to the traditional walk-in and drive-thru, a redesign of the kitchens and dining areas caters to the growth of digital sales channels such as self-order touchscreen terminals….”, The Times of London, May 16, 2022

“Papa Johns plans to open nearly 2,000 stores by the end of 2025 – The quick-service pizza restaurant chain announces big development plans after reporting a successful first quarter, ending with same-store sales up 1.9% in North America. In addition to the sales growth, the Louisville-based pizza chain is also planning an aggressive footprint expansion — especially in international markets — with plans for 1,400-1,800 new stores opening by the end of 2025, and 320 units opening in fiscal ’22, CEO Rob Lynch said.”, Nation’s Restaurant News, May 5, 2022

“Restaurants’ Virtual Stores Test Consumers’ Appetite for Metaverse Marketing

Wendy’s and Chipotle join a growing number of companies exploring the potential of virtual worlds – Fast-food chains Wendy’s Co. and Chipotle Mexican Grill Inc. are testing new experiences in virtual worlds as brands try to better understand the marketing potential of the metaverse. The metaverse is a term used to describe a virtual environment in which people can use digital avatars to work, play and shop. The concept has drawn attention particularly since the parent company of Facebook last year promised to spend heavily on building the metaverse and changed its name to Meta Platforms Inc.

Wendy’s last week opened a virtual restaurant in Horizon Worlds, the virtual reality game from Meta. Visitors cannot buy food there, virtual or otherwise, but they can play a basketball-themed game located near the restaurant.”, The Wall Street Journal, April 5, 2022

Articles & Studies For Today And Tomorrow

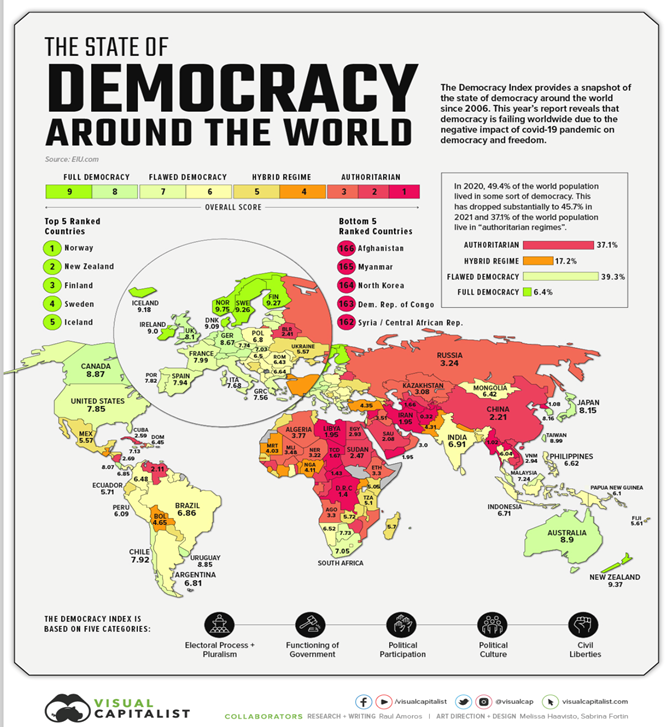

“The State of Global Democracy in 2022 – The world’s (almost) eight billion people live under a wide variety of political and cultural circumstances. In broad terms, those circumstances can be measured and presented on a sliding scale between “free” and “not free”—the subtext being that democracy lies on one end, and authoritarianism on the other.

According to EIU, the state of democracy is at its lowest point since the index began in 2006, blamed in part on the pandemic restrictions that saw many countries struggling to balance public health with personal freedom.”, Visual Capitalist, May 13, 2022

“IFA CEO on what’s ahead for franchise businesses – The past two years have presented unique challenges, with business owners managing the impact of the pandemic and, more recently, elevated inflation. Matthew Haller, president and CEO of the International Franchise Association, discusses the growth outlook for franchising, the group’s advocacy efforts and the advantages of franchised businesses.”, SmartBrief, May 12, 2022

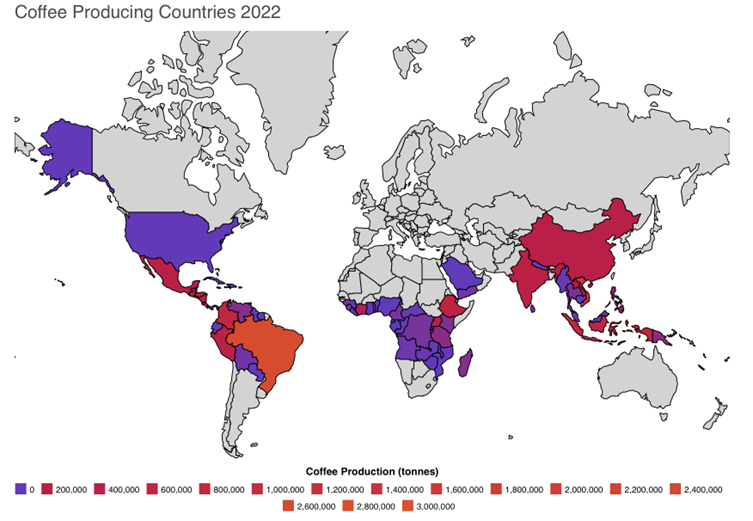

“Coffee Producing Countries 2022 – There’s a prime location for coffee growth and it is called the Bean Belt. This title refers to the area between 25° N and 30° S. Coffee thrives in warmer locations, so anywhere that is too extreme in relation to the northern and southern poles will not be substantial or feasible places to grow coffee. Coffee exportation, as well as coffee as imports, is most common in Africa, Asia, South America, and North America, with the exception of the country of Canada.”, World Population Review, May 13, 2022

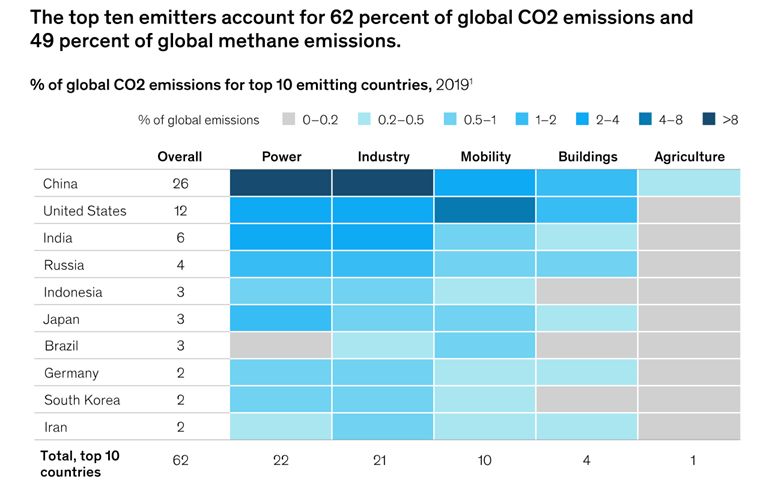

“Asia’s net-zero transition: Opportunity and risk amid climate action – Within just a few generations, life expectancy in Asia–Pacific has more than doubled, the infant mortality rate has fallen more than 70 percent and per capita GDP has risen nearly eighty-fold. People are living longer, healthier, and more prosperous lives. Yet, the environmental cost of human progress, in Asia and elsewhere, is now threatening the stability of the Earth’s climate.”, McKinsey, April 29, 2022

To receive our biweekly newsletter, sign up here: https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ covers 43 countries and provides us with updates about what is happening in their specific countries. Please feel free to send us your input for the biweekly report. bedwards@edwardsglobal.com

To sign up for our biweekly newsletter click here: https://bit.ly/geowizardsignup

William (Bill) Edwards, Your Newsletter Editor, has a four-decade career successfully accelerating the international growth of more than 40 brands. With experience in the franchise, oil and gas, information technology and management consulting sectors, he has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East. He has lived in China, the Czech Republic, Hong Kong, Indonesia, Iran and Turkey and has worked on projects in over 50 countries.

Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. Our U.S. based executive team has experience living and working around the world. EGS has twice received the U.S. President’s Award for Export Excellence.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country rankingFor advice on doing business successfully across 40+ countries, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

EGS Biweekly Global Business Newsletter Issue 55, Tuesday, May 3, 2022

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Trends in this issue:

In this issue: Did the U.S. economy really shrink in the 1st quarter of 2022? What will it cost the European Union to switch to clean energy by 2050? Did White Castle really sell 28 billion hamburgers? Australia and New Zealand are open for business! And China decides to jump start their COVID hampered economy.

To receive our biweekly newsletter, click on this link: https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others

“The future does not belong to the fainthearted, it belongs to the brave.”, President Ronald Regan” Space Shuttle Disaster Speech, January 28, 1986

“The secret of change is to focus all of your energy not on fighting the old, but on building the new.”, Socrates

“Every day the clock resets. Your wins don’t matter. Your failures don’t matter. Don’t stress on what was, fight for what could be.”, Sean Higgins

Highlights in issue #55:

- Brand Global News Section: Jack’s Café®, McDonald’s®, Sonic®, Unleashed Brands, White Castle® and WingStop®

Interesting Data and Studies

“Lessons from the Pandemic: How Covid is changing franchising – Which industries continued to experience franchise growth and, conversely, which shrank? How well did they perform, and how much “new” unit activity was there? In a typical year, we see about 300 new brands emerge. What about an atypical year like the one we just experienced? As you consider your next franchise investment opportunity, let’s shed some light on these questions.”, Franchising.com, April 2022

Global Energy

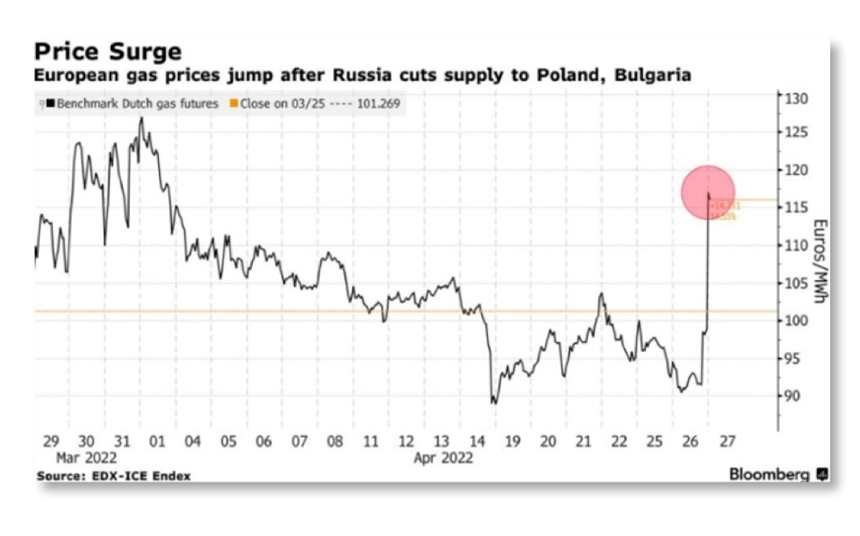

“Citing failure to pay in rubles, Russia halts gas supplies to NATO members Poland and Bulgaria. European gas prices rose roughly 20 percent after state-owned Gazprom announced it would stop supplying gas to Poland and Bulgaria—a move the European Commission President called ‘another attempt by Russia to use gas as an instrument of blackmail.’”, Exiger, April 2022 Supply Chain Report

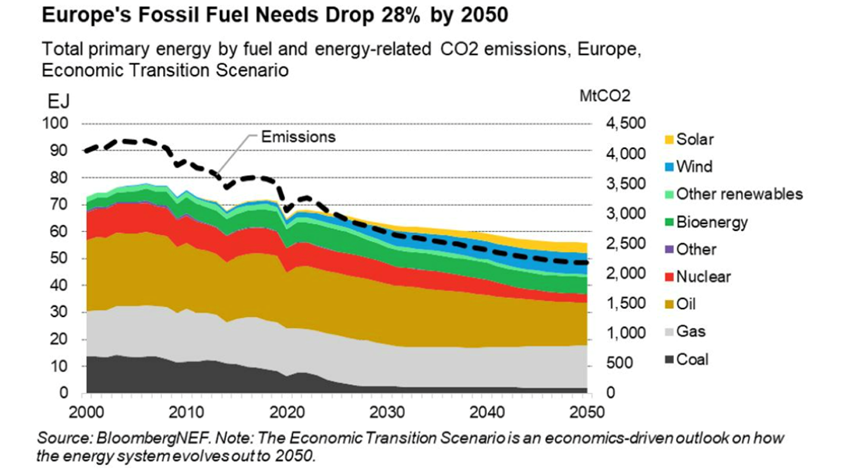

“How much will it cost Europe to switch to clean energy by 2050? Europe could free itself from fossil fuels by 2050, according to a new report from BloombergNEF. However, it will require $3.8 trillion of investment in mostly wind and solar projects. And another $1.5 trillion would need to be spent on green hydrogen developments.”, World Economic Forum, April 27, 2022

Global Supply Chain & Trade Update

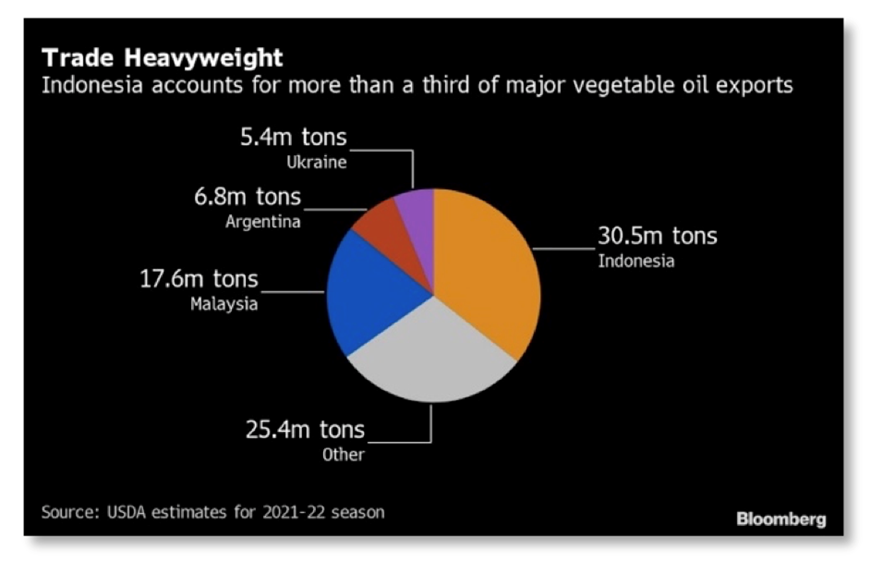

“Indonesia bans palm oil exports, including crude palm oil. The move comes as the price of crude palm oil rose sharply and after the country scrapped previous restrictions imposed in January. In 2020, Indonesia accounted for 46.8 percent of global crude palm oil exports and 52.4 percent of refined exports. Palm oil is the most widely consumed vegetable oil and has applications in other consumer products and biofuels.”, Exiger, April 2022 Supply Chain Report.

Global, Regional & Local Travel Updates

“Global airline capacity hits 2022 high as China demand rebounds – OAG – Global airline capacity has surged to its highest level in 2022 this week because of a rebound in Chinese domestic demand despite extended lockdowns in Asia’s biggest aviation market, travel data firm OAG said on Tuesday. Total global domestic and international airline capacity increased by 3.3% this week to 88.6 million seats, about 20% lower than in 2019.”, Reuters, April 26, 2022

“WH Smith (U.K.) back in black as travel restrictions ease – The stationery chain posted a headline pre-tax profit of £14 million for the six months to the end of February compared with a £19 million loss a year earlier and consensus forecast of £12.5 million. Statutory pre-tax profit came in at £18 million, against a £38 million loss a year ago, on the back of sales rising by 45 per cent to £608 million. Carl Cowling, 48, the chief executive, said the business had delivered a ‘good performance with a strong rebound in profitability. We have seen a recovery across all of our travel markets despite the impact of the Omicron variant.’”, The Times of London, April 28, 2022

Country & Regional Updates

Australia

“Australia set for small business boom, with younger and more diverse founders to start 3.5 million new businesses by 2031, with a massive influx of construction, professional services, and transportation firms helping to add $60 billion to the annual GDP in a decade’s time. A new report from accounting and business services software provider Xero, released Tuesday, states a pandemic-era boom in new business signups, technological progress, and a younger, more diverse class of entrepreneurs will support a million new jobs by 2031. Those new firms are slated to provide 3% to the national GDP in 2031, the report states.”, Smart Company AU, April 26, 2022

Chile

“Chile’s economic activity index bolstered by increase in services – Chile’s IMACEC economic activity index, a close proxy of gross domestic product (GDP), rose 7.2% in March from the same month last year, the country’s central bank said on Monday. That was above market expectations of a 6.3% rise, according to a Reuters poll of economists. In a statement, the central bank said the rise was ‘mainly explained by the increase in services activity.’ It said services, including transport and business services, rose 12.2%. Commerce also registered a 8.6% rise, boosted by retail sales, household equipment and automobile sales.”, Reuters, May 2, 2022

China

“China Puts Its Foot on the Gas to Spur a Faltering Economy – The State Council, China’s cabinet, issued sweeping guidelines Monday for bolstering economic activity after retail sales fell 3.5% year-on-year in March, the first contraction since August 2020. The guidelines call for greater assistance to businesses hit by the pandemic, including implementation of tax cuts, tax rebates and fee reductions to support manufacturing, small and micro companies, and sole proprietors. Caixing Global, April 27, 2022

“China to end regulatory storm over Big Tech and give sector bigger role in boosting slowing economy, sources say – The key message to tech companies is that the state wants them to grow and play a role in Beijing’s efforts to bolster an economy battered by Covid-19 controls, such as through the distribution of consumption vouchers, according to one source.”, South China Morning Post, April 29, 2022

Germany

“Germany Speeds Up Time Frame For Ending Russian Oil Dependence – Germany could end its reliance on Russian oil by the close of summer, the country’s Federal Ministry of Economics and Technology reportedly announced Sunday, stepping up its previous timeline by at least three months—barely three weeks after the European Union announced a ban on Russian coal imports. The ministry said a German oil embargo taking effect near the end of summer following “a sufficient transition period” would be manageable, according to a government report released Sunday and translated by Bloomberg.”, Forbes, May 1, 2022

New Zealand

“New Zealand welcomes first tourists in two years as Covid restrictions lifted – Tourists from more than 50 countries including the UK travelled to New Zealand for the first time in more than two years this week after the government dropped most of its pandemic border restrictions. Before the pandemic more than three million tourists visited each year, accounting for 20 per cent of New Zealand’s foreign income and more than 5 per cent of the overall economy.”, The Times of London, May 2, 2022

The Philippines

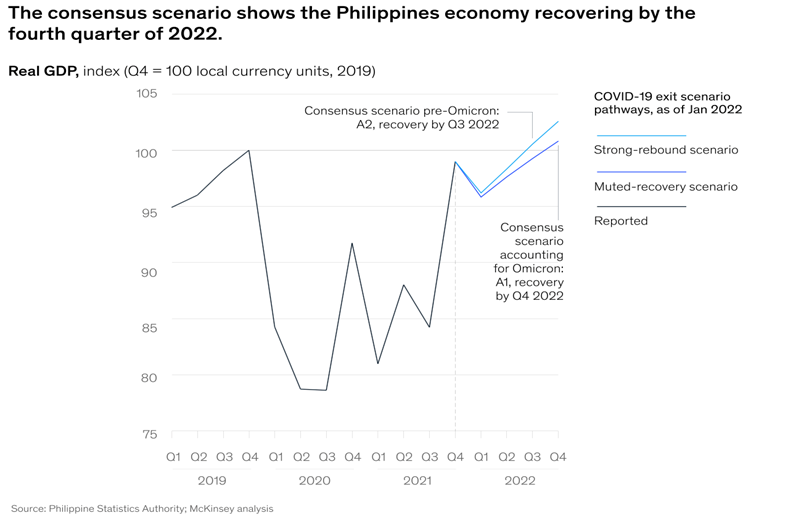

“Companies doing business in the Philippines are assessing the implications of COVID-19 on the country’s economy. They are likely to find that three shifts introduced during the pandemic will persist into the future: economic activity will be digitally enabled but also hyperlocal; the wealth gap is widening, and new consumer segments have emerged; and the pandemic is likely to result in a greener and more sustainable economy. Meanwhile, the consensus view shows the Philippines economy recovering by the fourth quarter of 2022 under a muted scenario, even taking the Omicron wave into account.”, McKinsey, April 26, 2022

Saudi Arabia

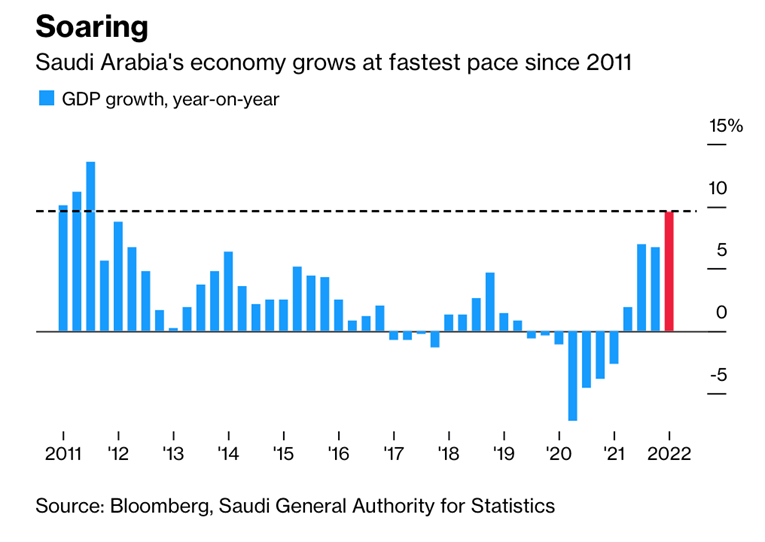

“Saudi Economy Grows at Fastest Pace in a Decade on Oil Boom – Kingdom’s GDP rose by 9.6% year-on-year in the first quarter. Economy benefiting as crude prices and production increase. Gross domestic production rose by 9.6% year-on-year, the Saudi General Authority for Statistics said. That’s the highest figure since the third quarter of 2011, according to data compiled by Bloomberg.”, Bloomberg, May 1, 2022

South Korea

“South Korea’s Recovery Eased Last Quarter Amid Omicron Wave – Gross domestic product expanded 0.7% from prior three months Policy makers aiming to support growth while curbing inflation. The result highlights the challenge for policy makers: supporting an economy that’s set to be buffeted by war in eastern Europe and widespread lockdowns in key trading partner China; yet also battling to stem inflationary pressure that’s mounting worldwide. The upshot is economists expect the Bank of Korea will raise interest rates further, having already hiked twice this year.”, Bloomberg, April 25, 2022

United Kingdom

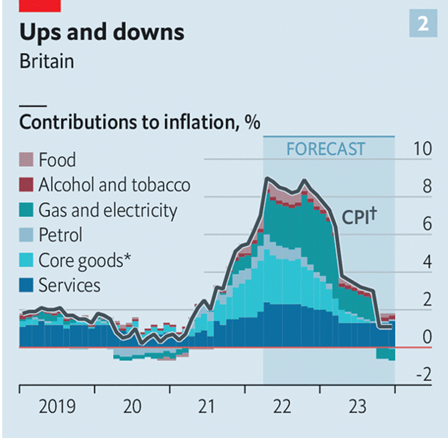

“A guide to Britain’s cost-of-living crunch – In March the rate of annual inflation in Britain reached 7%, the biggest such increase in 30 years. Energy bills are rising most sharply, but price increases are occurring across the board. The consequence will be a fall in living standards over the coming fiscal year of 2.2%, a drop not seen since records began in the 1950s. Energy prices have been rising dramatically for many months, but after Russia’s invasion of Ukraine some types saw a particular surge. The cost of heating oil, used by around 3% of Britons to heat their homes in winter, soared by 44% in March compared with the prior month.”, The Economist, April 23, 2022

United States

“Did the U.S. Economy Really Shrink in Early 2022? Is a Recession Near? No, and Here’s Why. Let’s start with the 1.4% drop in gross domestic product, the headline number that gets all the attention. GDP is the official scorecard of sorts for the economy. Most of the decline was tied to a record U.S. trade deficit, shrinking inventories and less government spending. Added altogether and these oft-volatile categories subtracted a whopping 4.5 points from GDP.

Strip out reduced U.S government spending and final sales to private customers—that is, households and businesses—rose an even stronger 3.7%. Looked at that way, the U.S. economy actually strengthened from January to March compared to the end of last year, when the headline GDP numbers were much higher. GDP rose at a 6.9% rate in the fourth quarter and 2.3% in the third quarter.”, Barron’s, April 28, 2022

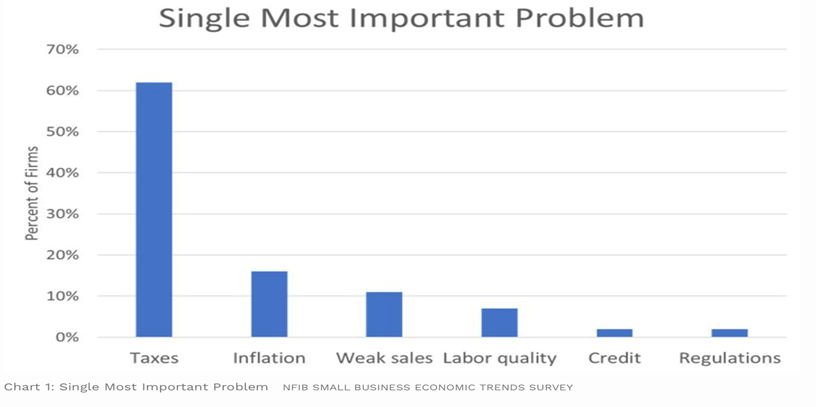

“Small Business’ Number One Problem – New small business owners face a myriad of challenges getting their business ideas up and running. Marketing, securing products, staffing, and establishing processes are just few challenges new owners might have to navigate. However, there is a whole other set of challenges that are often unexpected, the unwelcomed “partnership” with government, federal, state, and local. Likely aware of the tax law, what probably surprised them was the plethora of regulations, compliance costs, licensing, etc. associated with their new firm and location.”, Forbes, April 28, 2022

Brand News

“Cutting-edge technology is nothing new for Sonic – The concept owes its long run in no small part to recognizing a game-changing piece of equipment back when TV was a novelty. After seven decades in business, Sonic finds itself once again in alignment with the lifestyles of the times, President Claudia San Pedro commented while being honored last week as the 2022 Restaurant Leader of the Year.”, Restaurant Business Online, April 19, 2022

“Hungry Jack’s launches Jack’s Cafe across WA restaurants – Hungry Jack’s has launched its sister coffee chain Jack’s Cafe across its 65 restaurants in Western Australia. The state-wide launch is part of the business’ plan to roll out the beverage brand across all 450-plus locations by June.”, QSR Media AUS, April 20, 2022. Compliments of Jason

“McDonald’s lost $127m from shuttering restaurants in Russia and Ukraine – The fast-food giant said they’re losing about $55m a month in sales from their pull-out in Russia….CEO Chris Kempczinski noted that the company continues to pay the salaries of its 62,000 employees in Russia, as well as their Ukrainian staff, who similarly saw their 108 restaurants closed in the fallout from the ongoing conflict.”, Independent, April 30, 2022

“Unleashed Brands Acquires XP League Esports Franchise – XP League addresses the void between traditional youth athletics and competitive esports. (For the uninitiated, esports are multiplayer video game competitions that are played with spectators.) XP League, an esports league that’s structured like classic youth sports organizations, promotes development of sportsmanship, teamwork and other positive behaviors related to competition.”, FranchiseWire, April 28, 2022

“You Won’t Believe How Many Total Hamburgers White Castle Has Sold – century is a long time to do anything. How many living people have even existed for that long? But White Castle can boast that it’s a centenarian of the food business, selling its famous sliders for around 101 years……..White Castle has hit a major stat when it comes to sales. The company announced that it has sold more than 28 billion Original Sliders and Cheese sliders.”, Mashed, April 30, 2022

“Wingstop doubles its expansion plans in Indonesia – The wing chain on Wednesday said its franchisee will double its commitment in the Southeast Asian country, from 60 to 120 restaurants, by 2028. Wingstop has previously stated a goal to open more than 7,000 global locations, with at least 3,000 of them located outside the U.S. Wingstop ended 2021 with 1,731 restaurants worldwide, 197 of which were outside the U.S.”, Restaurant Business Online, April 27, 2022

To receive our biweekly newsletter, sign up here: https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the world that impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ covers 43 countries and provides us with updates about what is happening in their specific countries. Please feel free to send us your input for the biweekly report. bedwards@edwardsglobal.com

To sign up for our biweekly newsletter click here: https://bit.ly/geowizardsignup

William (Bill) Edwards, Your Newsletter Editor, has a four-decade career successfully accelerating the international growth of more than 40 brands. Bill Edwards has a four-decade career successfully accelerating the international growth of more than 40 brands. With experience in the franchise, oil and gas, information technology and management consulting sectors, he has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East. He has lived in China, the Czech Republic, Hong Kong, Indonesia, Iran and Turkey and has worked on projects in over 50 countries.

Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. Our U.S. based executive team has experience living and working around the world. EGS has twice received the U.S. President’s Award for Export Excellence.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

For advice on doing business successfully across 40+ countries, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.