EGS Biweekly Global Business Newsletter Issue 55, Tuesday, May 3, 2022

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Trends in this issue:

In this issue: Did the U.S. economy really shrink in the 1st quarter of 2022? What will it cost the European Union to switch to clean energy by 2050? Did White Castle really sell 28 billion hamburgers? Australia and New Zealand are open for business! And China decides to jump start their COVID hampered economy.

To receive our biweekly newsletter, click on this link: https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others

“The future does not belong to the fainthearted, it belongs to the brave.”, President Ronald Regan” Space Shuttle Disaster Speech, January 28, 1986

“The secret of change is to focus all of your energy not on fighting the old, but on building the new.”, Socrates

“Every day the clock resets. Your wins don’t matter. Your failures don’t matter. Don’t stress on what was, fight for what could be.”, Sean Higgins

Highlights in issue #55:

- Brand Global News Section: Jack’s Café®, McDonald’s®, Sonic®, Unleashed Brands, White Castle® and WingStop®

Interesting Data and Studies

“Lessons from the Pandemic: How Covid is changing franchising – Which industries continued to experience franchise growth and, conversely, which shrank? How well did they perform, and how much “new” unit activity was there? In a typical year, we see about 300 new brands emerge. What about an atypical year like the one we just experienced? As you consider your next franchise investment opportunity, let’s shed some light on these questions.”, Franchising.com, April 2022

Global Energy

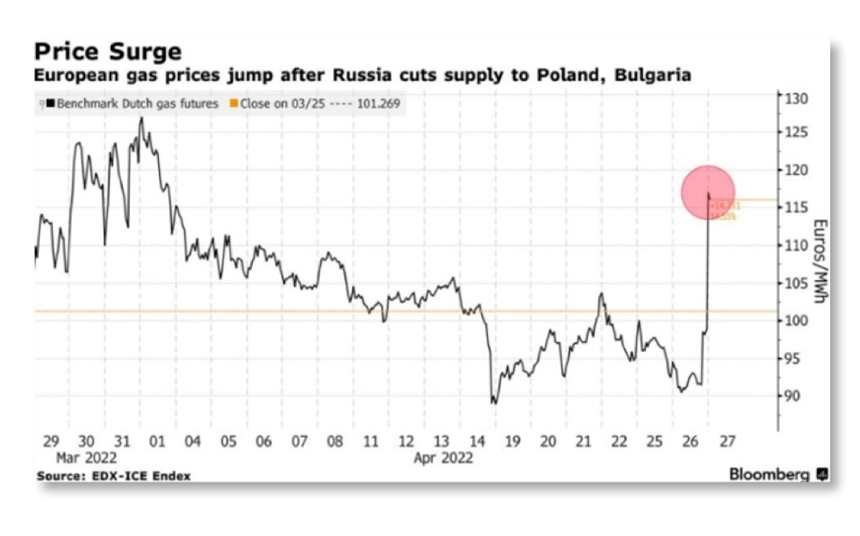

“Citing failure to pay in rubles, Russia halts gas supplies to NATO members Poland and Bulgaria. European gas prices rose roughly 20 percent after state-owned Gazprom announced it would stop supplying gas to Poland and Bulgaria—a move the European Commission President called ‘another attempt by Russia to use gas as an instrument of blackmail.’”, Exiger, April 2022 Supply Chain Report

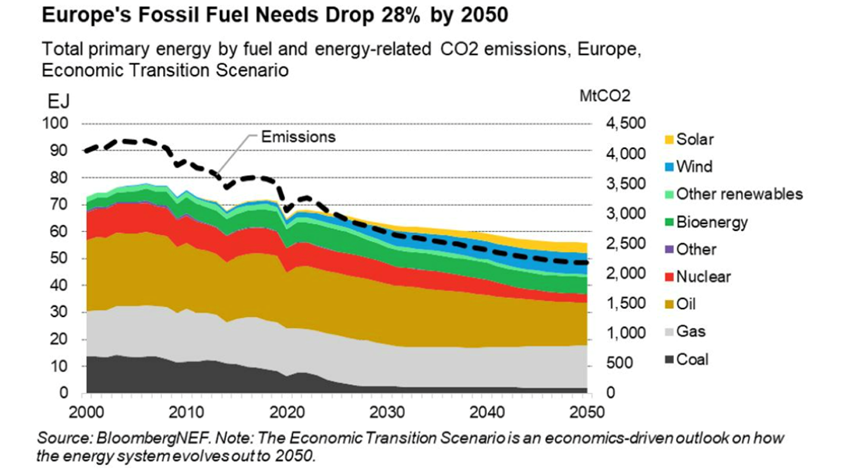

“How much will it cost Europe to switch to clean energy by 2050? Europe could free itself from fossil fuels by 2050, according to a new report from BloombergNEF. However, it will require $3.8 trillion of investment in mostly wind and solar projects. And another $1.5 trillion would need to be spent on green hydrogen developments.”, World Economic Forum, April 27, 2022

Global Supply Chain & Trade Update

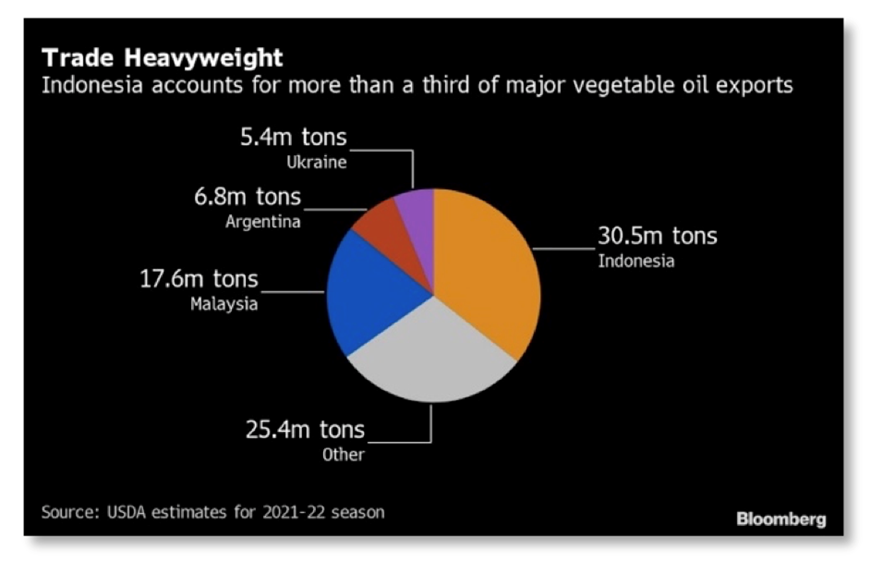

“Indonesia bans palm oil exports, including crude palm oil. The move comes as the price of crude palm oil rose sharply and after the country scrapped previous restrictions imposed in January. In 2020, Indonesia accounted for 46.8 percent of global crude palm oil exports and 52.4 percent of refined exports. Palm oil is the most widely consumed vegetable oil and has applications in other consumer products and biofuels.”, Exiger, April 2022 Supply Chain Report.

Global, Regional & Local Travel Updates

“Global airline capacity hits 2022 high as China demand rebounds – OAG – Global airline capacity has surged to its highest level in 2022 this week because of a rebound in Chinese domestic demand despite extended lockdowns in Asia’s biggest aviation market, travel data firm OAG said on Tuesday. Total global domestic and international airline capacity increased by 3.3% this week to 88.6 million seats, about 20% lower than in 2019.”, Reuters, April 26, 2022

“WH Smith (U.K.) back in black as travel restrictions ease – The stationery chain posted a headline pre-tax profit of £14 million for the six months to the end of February compared with a £19 million loss a year earlier and consensus forecast of £12.5 million. Statutory pre-tax profit came in at £18 million, against a £38 million loss a year ago, on the back of sales rising by 45 per cent to £608 million. Carl Cowling, 48, the chief executive, said the business had delivered a ‘good performance with a strong rebound in profitability. We have seen a recovery across all of our travel markets despite the impact of the Omicron variant.’”, The Times of London, April 28, 2022

Country & Regional Updates

Australia

“Australia set for small business boom, with younger and more diverse founders to start 3.5 million new businesses by 2031, with a massive influx of construction, professional services, and transportation firms helping to add $60 billion to the annual GDP in a decade’s time. A new report from accounting and business services software provider Xero, released Tuesday, states a pandemic-era boom in new business signups, technological progress, and a younger, more diverse class of entrepreneurs will support a million new jobs by 2031. Those new firms are slated to provide 3% to the national GDP in 2031, the report states.”, Smart Company AU, April 26, 2022

Chile

“Chile’s economic activity index bolstered by increase in services – Chile’s IMACEC economic activity index, a close proxy of gross domestic product (GDP), rose 7.2% in March from the same month last year, the country’s central bank said on Monday. That was above market expectations of a 6.3% rise, according to a Reuters poll of economists. In a statement, the central bank said the rise was ‘mainly explained by the increase in services activity.’ It said services, including transport and business services, rose 12.2%. Commerce also registered a 8.6% rise, boosted by retail sales, household equipment and automobile sales.”, Reuters, May 2, 2022

China

“China Puts Its Foot on the Gas to Spur a Faltering Economy – The State Council, China’s cabinet, issued sweeping guidelines Monday for bolstering economic activity after retail sales fell 3.5% year-on-year in March, the first contraction since August 2020. The guidelines call for greater assistance to businesses hit by the pandemic, including implementation of tax cuts, tax rebates and fee reductions to support manufacturing, small and micro companies, and sole proprietors. Caixing Global, April 27, 2022

“China to end regulatory storm over Big Tech and give sector bigger role in boosting slowing economy, sources say – The key message to tech companies is that the state wants them to grow and play a role in Beijing’s efforts to bolster an economy battered by Covid-19 controls, such as through the distribution of consumption vouchers, according to one source.”, South China Morning Post, April 29, 2022

Germany

“Germany Speeds Up Time Frame For Ending Russian Oil Dependence – Germany could end its reliance on Russian oil by the close of summer, the country’s Federal Ministry of Economics and Technology reportedly announced Sunday, stepping up its previous timeline by at least three months—barely three weeks after the European Union announced a ban on Russian coal imports. The ministry said a German oil embargo taking effect near the end of summer following “a sufficient transition period” would be manageable, according to a government report released Sunday and translated by Bloomberg.”, Forbes, May 1, 2022

New Zealand

“New Zealand welcomes first tourists in two years as Covid restrictions lifted – Tourists from more than 50 countries including the UK travelled to New Zealand for the first time in more than two years this week after the government dropped most of its pandemic border restrictions. Before the pandemic more than three million tourists visited each year, accounting for 20 per cent of New Zealand’s foreign income and more than 5 per cent of the overall economy.”, The Times of London, May 2, 2022

The Philippines

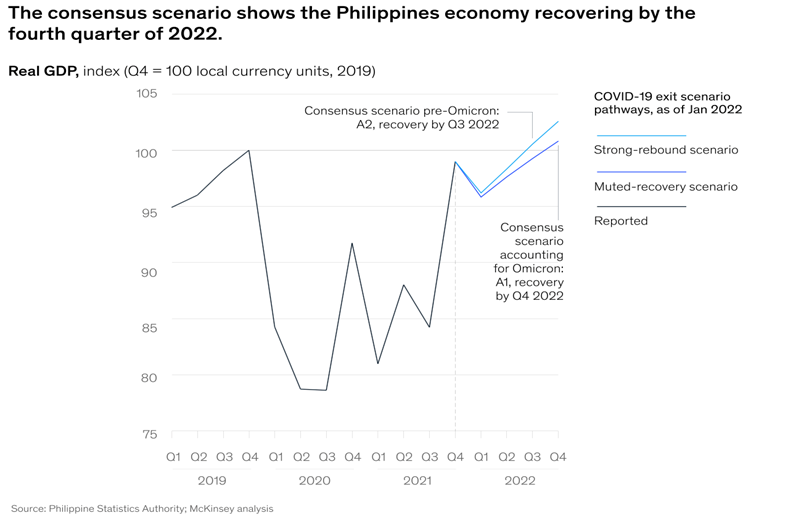

“Companies doing business in the Philippines are assessing the implications of COVID-19 on the country’s economy. They are likely to find that three shifts introduced during the pandemic will persist into the future: economic activity will be digitally enabled but also hyperlocal; the wealth gap is widening, and new consumer segments have emerged; and the pandemic is likely to result in a greener and more sustainable economy. Meanwhile, the consensus view shows the Philippines economy recovering by the fourth quarter of 2022 under a muted scenario, even taking the Omicron wave into account.”, McKinsey, April 26, 2022

Saudi Arabia

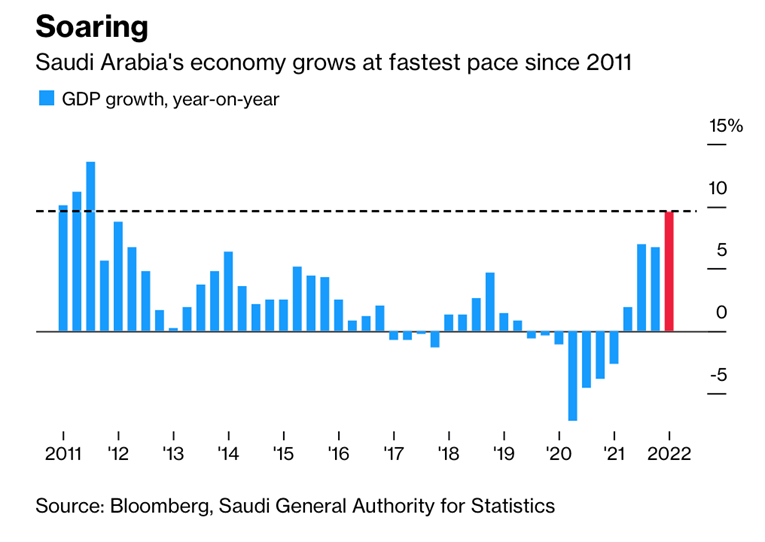

“Saudi Economy Grows at Fastest Pace in a Decade on Oil Boom – Kingdom’s GDP rose by 9.6% year-on-year in the first quarter. Economy benefiting as crude prices and production increase. Gross domestic production rose by 9.6% year-on-year, the Saudi General Authority for Statistics said. That’s the highest figure since the third quarter of 2011, according to data compiled by Bloomberg.”, Bloomberg, May 1, 2022

South Korea

“South Korea’s Recovery Eased Last Quarter Amid Omicron Wave – Gross domestic product expanded 0.7% from prior three months Policy makers aiming to support growth while curbing inflation. The result highlights the challenge for policy makers: supporting an economy that’s set to be buffeted by war in eastern Europe and widespread lockdowns in key trading partner China; yet also battling to stem inflationary pressure that’s mounting worldwide. The upshot is economists expect the Bank of Korea will raise interest rates further, having already hiked twice this year.”, Bloomberg, April 25, 2022

United Kingdom

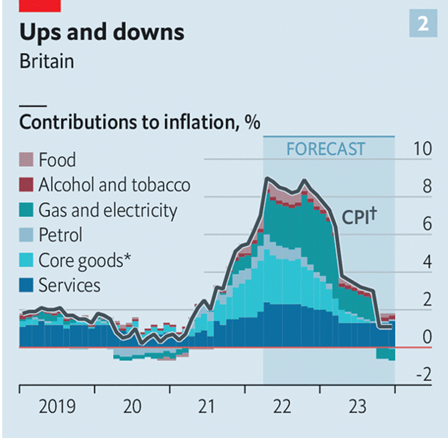

“A guide to Britain’s cost-of-living crunch – In March the rate of annual inflation in Britain reached 7%, the biggest such increase in 30 years. Energy bills are rising most sharply, but price increases are occurring across the board. The consequence will be a fall in living standards over the coming fiscal year of 2.2%, a drop not seen since records began in the 1950s. Energy prices have been rising dramatically for many months, but after Russia’s invasion of Ukraine some types saw a particular surge. The cost of heating oil, used by around 3% of Britons to heat their homes in winter, soared by 44% in March compared with the prior month.”, The Economist, April 23, 2022

United States

“Did the U.S. Economy Really Shrink in Early 2022? Is a Recession Near? No, and Here’s Why. Let’s start with the 1.4% drop in gross domestic product, the headline number that gets all the attention. GDP is the official scorecard of sorts for the economy. Most of the decline was tied to a record U.S. trade deficit, shrinking inventories and less government spending. Added altogether and these oft-volatile categories subtracted a whopping 4.5 points from GDP.

Strip out reduced U.S government spending and final sales to private customers—that is, households and businesses—rose an even stronger 3.7%. Looked at that way, the U.S. economy actually strengthened from January to March compared to the end of last year, when the headline GDP numbers were much higher. GDP rose at a 6.9% rate in the fourth quarter and 2.3% in the third quarter.”, Barron’s, April 28, 2022

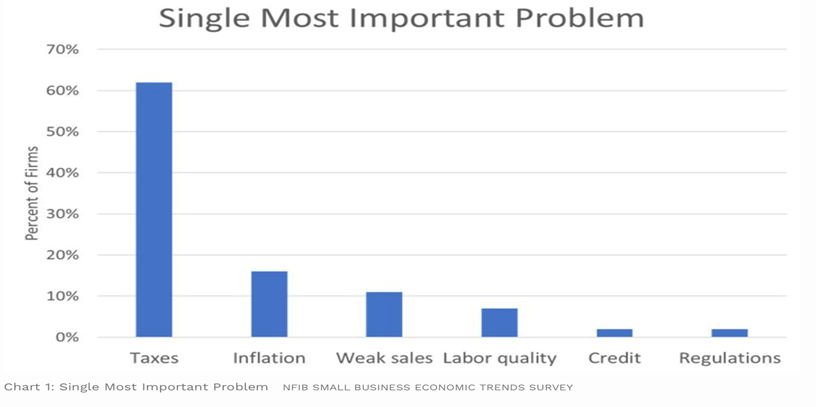

“Small Business’ Number One Problem – New small business owners face a myriad of challenges getting their business ideas up and running. Marketing, securing products, staffing, and establishing processes are just few challenges new owners might have to navigate. However, there is a whole other set of challenges that are often unexpected, the unwelcomed “partnership” with government, federal, state, and local. Likely aware of the tax law, what probably surprised them was the plethora of regulations, compliance costs, licensing, etc. associated with their new firm and location.”, Forbes, April 28, 2022

Brand News

“Cutting-edge technology is nothing new for Sonic – The concept owes its long run in no small part to recognizing a game-changing piece of equipment back when TV was a novelty. After seven decades in business, Sonic finds itself once again in alignment with the lifestyles of the times, President Claudia San Pedro commented while being honored last week as the 2022 Restaurant Leader of the Year.”, Restaurant Business Online, April 19, 2022

“Hungry Jack’s launches Jack’s Cafe across WA restaurants – Hungry Jack’s has launched its sister coffee chain Jack’s Cafe across its 65 restaurants in Western Australia. The state-wide launch is part of the business’ plan to roll out the beverage brand across all 450-plus locations by June.”, QSR Media AUS, April 20, 2022. Compliments of Jason

“McDonald’s lost $127m from shuttering restaurants in Russia and Ukraine – The fast-food giant said they’re losing about $55m a month in sales from their pull-out in Russia….CEO Chris Kempczinski noted that the company continues to pay the salaries of its 62,000 employees in Russia, as well as their Ukrainian staff, who similarly saw their 108 restaurants closed in the fallout from the ongoing conflict.”, Independent, April 30, 2022

“Unleashed Brands Acquires XP League Esports Franchise – XP League addresses the void between traditional youth athletics and competitive esports. (For the uninitiated, esports are multiplayer video game competitions that are played with spectators.) XP League, an esports league that’s structured like classic youth sports organizations, promotes development of sportsmanship, teamwork and other positive behaviors related to competition.”, FranchiseWire, April 28, 2022

“You Won’t Believe How Many Total Hamburgers White Castle Has Sold – century is a long time to do anything. How many living people have even existed for that long? But White Castle can boast that it’s a centenarian of the food business, selling its famous sliders for around 101 years……..White Castle has hit a major stat when it comes to sales. The company announced that it has sold more than 28 billion Original Sliders and Cheese sliders.”, Mashed, April 30, 2022

“Wingstop doubles its expansion plans in Indonesia – The wing chain on Wednesday said its franchisee will double its commitment in the Southeast Asian country, from 60 to 120 restaurants, by 2028. Wingstop has previously stated a goal to open more than 7,000 global locations, with at least 3,000 of them located outside the U.S. Wingstop ended 2021 with 1,731 restaurants worldwide, 197 of which were outside the U.S.”, Restaurant Business Online, April 27, 2022

To receive our biweekly newsletter, sign up here: https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the world that impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ covers 43 countries and provides us with updates about what is happening in their specific countries. Please feel free to send us your input for the biweekly report. bedwards@edwardsglobal.com

To sign up for our biweekly newsletter click here: https://bit.ly/geowizardsignup

William (Bill) Edwards, Your Newsletter Editor, has a four-decade career successfully accelerating the international growth of more than 40 brands. Bill Edwards has a four-decade career successfully accelerating the international growth of more than 40 brands. With experience in the franchise, oil and gas, information technology and management consulting sectors, he has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East. He has lived in China, the Czech Republic, Hong Kong, Indonesia, Iran and Turkey and has worked on projects in over 50 countries.

Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. Our U.S. based executive team has experience living and working around the world. EGS has twice received the U.S. President’s Award for Export Excellence.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

For advice on doing business successfully across 40+ countries, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.