EGS Biweekly Global Business Newsletter Issue 64, Tuesday, September 6, 2022

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

A new Prime Minister for the UK. A timely quote from Albert Einstein. There are up to 8,755 commercial flights in the air at any given time of day. Indonesia is a pleasant surprise among emerging markets. Japan turns back to nuclear power. Energy prices continue to rise to rise. And a must read 2022 Member survey from the U.S. China Business Council to know what is happening in China.

To receive this biweekly newsletter that is read by 1,450 people in 20 countries, click here : https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others

“The world as we have created it isa process of our thin king. It cannot be changed without changing our thinking.”, Albert Einstein

“The ones who are crazy enough to think that they can change the world are the ones who do.”, Steve Jobs.

“There’s no shortage of remarkable ideas, what’s missing is the will to execute them.” – Seth Godin

Highlights in issue #64:

- Brand Global News Section: Bonchon®, Denny’s®, Dominos®, Hardees®, Marco’s Pizza®, Pret A Manger®, Planet Smoothie® and Red Rooster®

NOTE: Bolded headlines in this newsletter are live links where the article is freely available

Interesting Data and Studies

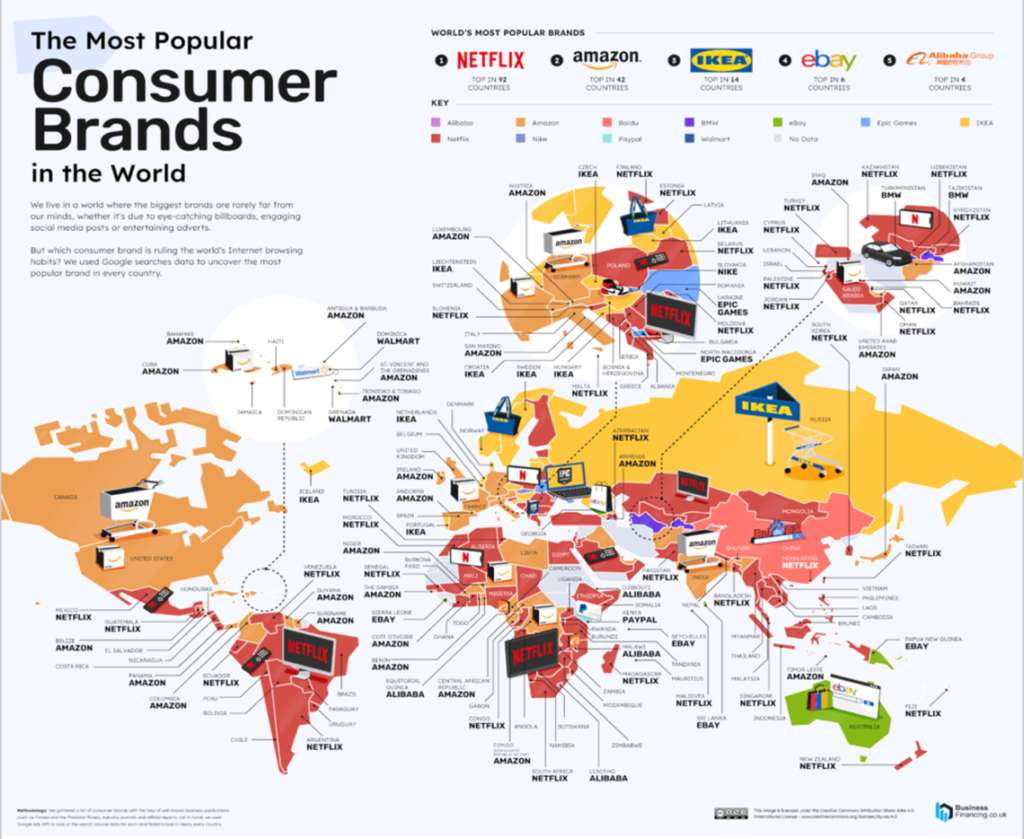

“The Most Searched Consumer Brands in 2022 – In today’s fast-paced world, a strong brand is a powerful asset that helps a business stand out in a sea of competition. What are some of the most popular brands around the world? One way to gauge this is by looking at Google searches to see what consumers are searching for online (and therefore, what brands they’re paying the most attention to). This graphic by BusinessFinancing.co.uk uses data from Google Keyword Planner to show the world’s most searched consumer brands in the twelve months leading up to March 2022.”, Visual Capitalist / Business/Finance, September 4, 2022

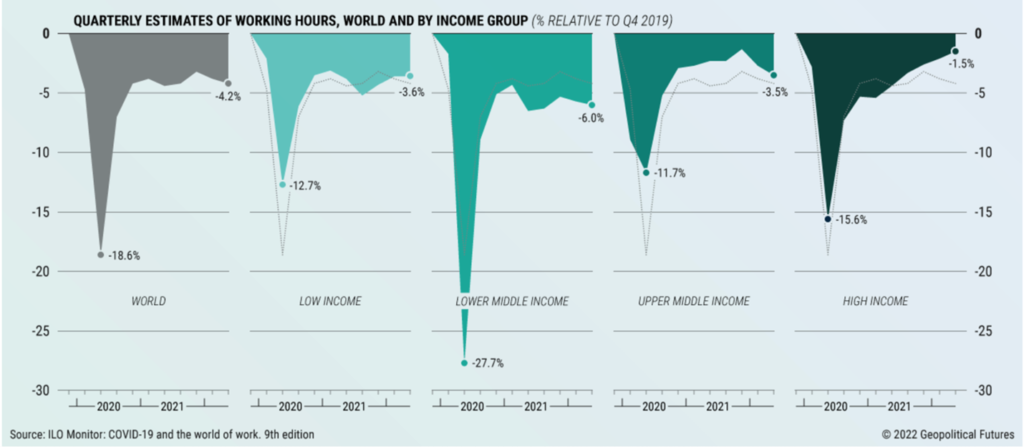

“How Work Has Changed Since COVID-19 – Labor markets everywhere are digging themselves out of a deep hole. The International Labor Organization predicts continued global labor market disruptions for at least the remainder of the year because of the war in Ukraine and China’s domestic economic problems. Predictably, problems are especially pronounced in low- and middle-income countries. When it comes to hours worked, high-income economies are again faring much better than the rest.”, Geopolitical Futures, August 26, 2022

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

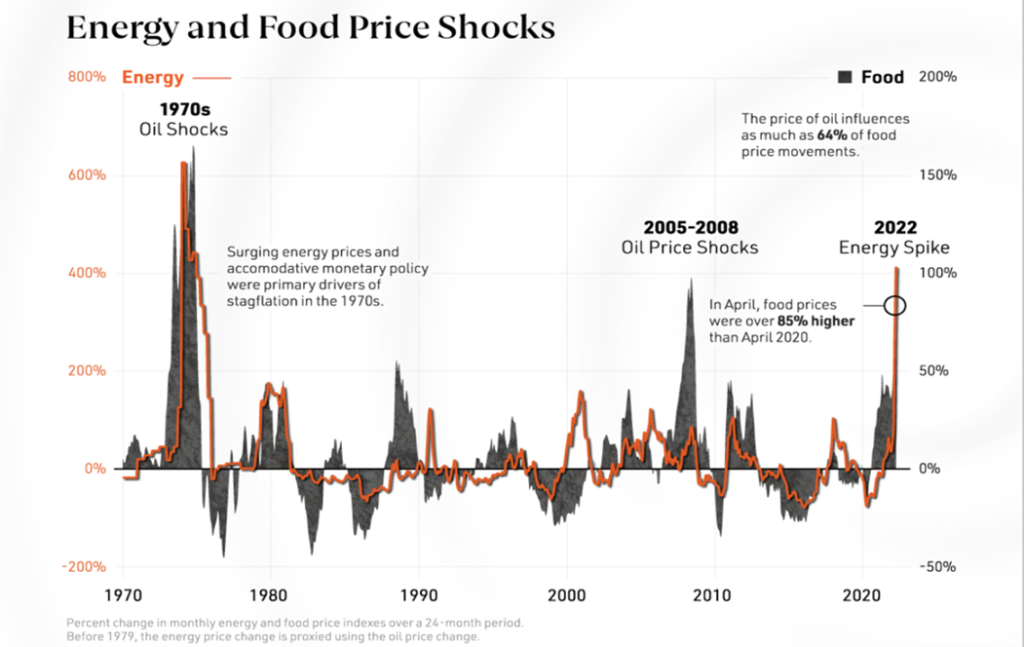

“How Rising Food and Energy Prices Impact the Economy – Since Russia’s invasion of Ukraine, the effects of energy supply disruptions are cascading across everything from food prices to electricity to consumer sentiment. In response to soaring prices, many OECD countries are tapping into their strategic petroleum reserves. In fact, since March, the U.S. has sold a record one million barrels of oil per day from these reserves. This, among other factors, has led gasoline prices to fall more recently—yet deficits could follow into 2023, causing prices to increase. With data from the World Bank, the above infographic charts energy shocks over the last half century and what this means for the global economy looking ahead.”, Visual Capitalist / World Bank, September 1, 2022

Global & Regional Travel Updates

“Ryanair passenger numbers hit new all-time high in August – Ryanair (RYA.I) in August flew a record number of passengers for the fourth month in a row as it continued to consolidate its position as Europe’s largest airline by passenger numbers. The Irish low-cost carrier, which unlike many airlines made a point of keeping its pilots and crew up-to-date with their flying hours during the pandemic, flew 16.9 million passengers in August compared to a pre-COVID peak of 14.9 million in August 2019.”, Reuters, September 1, 2022

“Mapping Airways: The World’s Flight Paths and Airports – There are up to 8,755 commercial flights in the air at any given time of day. These flights transport thousands of people (and millions of dollars worth of goods) around the world. But where are these people and goods headed? This map from Adam Symington uses historical data from OpenFlights to visualize the world’s flight paths. The graphic shows a comprehensive data set encompassing 67,663 different routes that connect 10,000 different airports across the globe. Visual Capitalist / OpenFlights, September 2, 2022

Country & Regional Updates

Asia

“Relief in sight for cheese lovers as Domino’s expands in Asia – Australia’s largest pizza chain, Domino’s Pizza Enterprises, says there are early signs that price pressures for key ingredients such as wheat and cheese are starting to flatten, but the company will still have to lift some product prices to combat inflation. The company also stepped up its expansion in Asia with the acquisition of 287 stores in Malaysia, Singapore and Cambodia in a deal with an upfront price of $214 million, in what is the biggest acquisition in the company’s history. It aims to grow to 600 stores in total across the three countries.”, The Australia Financial Review, August 24, 2022

China

“U.S.-China Business Council 2022 Member Survey – The US-China Business Council’s 2022 Member Survey was conducted in June 2022, shortly after a period of widespread COVID-19 lockdowns across China, most prominently in Shanghai. This report is based on responses from 117 member companies, a similar participation rate to past years. Most respondents are large, US-headquartered multinational companies that have operated in China for more than 20 years. China’s COVID-19 policies are the top challenge. Bilateral tensions continue to hurt American companies. Trajectory of commercial relations at another inflection point.”, U.S-China Business Council, August 29, 2022

“China Was One of the Best Places for Private Equity. Not Anymore. The number of Investments by U.S. PE and venture-capital firms in that country declined by about 31% in the second quarter this year, while their value plunged 79%, according to data from S&P Global Market Intelligence. Concerns about the country’s macroeconomic picture spurred the drop, S&P said.”, Barron’s, September 5, 2022

India

“India overtakes former colonial ruler UK to become 5th largest world economy – According to the calculation, based on US dollars, India overtook the U.K. in the final three months of 2021 and extended its lead into the first quarter. Nirmala Sitharaman, Minister of Finance and Corporate Affairs noted that a decade ago, India ranked 11th among the largest economies, while the U.K. was the 5th. The news came just after the country celebrated its 75th anniversary of independence from the U.K., which it achieved after nearly 100 years of direct rule. ”, Fox Business, September 4, 2022

Indonesia

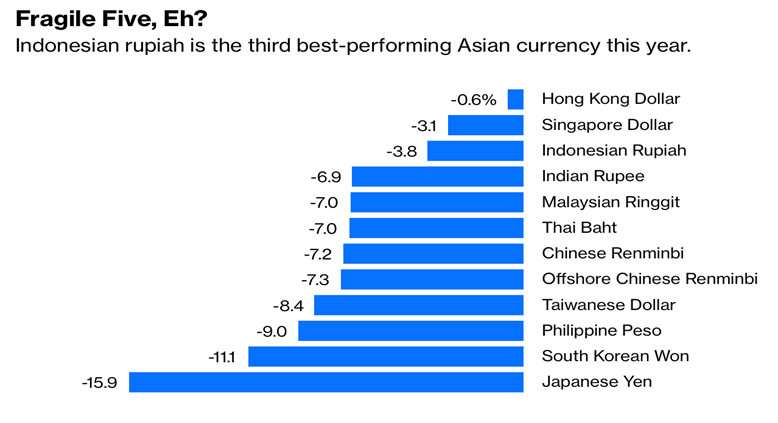

“A Surprise Winner as Emerging Markets Crumble – President Joko Widodo wants Indonesia to be more than a source of commodities, and investors are buying it. Developing nations are reeling from the double whammy of Federal Reserve interest-rate hikes and China’s economic slowdown. They are burning through foreign reserves at the fastest pace since the 2008, to defend their currencies and cover higher import bills for food and fuel. Indonesia, which was singled out as a Fragile Five less than a decade ago for its vulnerable currency and reliance on hot foreign money, has been a haven of relative calm.”, Bloomberg, August 25, 2022

Italy

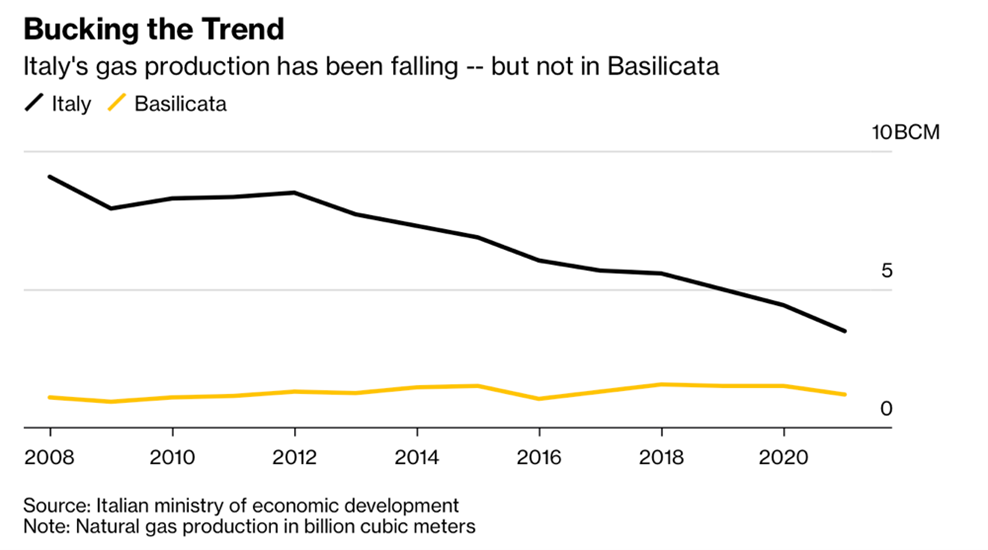

“An Italian Region Is Cutting Gas Bills as Prices Soar Elsewhere – Basilicata residents are due to get free gas from Shell, Eni – Southern region has bucked trend of reducing gas production. A small region in Italy’s impoverished south is about to enjoy a discount on gas bills of as much as 50% just as prices keep breaking records across Europe. Basilicata is reaping the benefits of a controversial decision to continue exploiting its vast gas reserves even as the rest of Italy reduced or halted production, largely over environmental concerns. Expanding domestic oil and gas production has become a divisive issue ahead of elections next month.”, Bloomberg, August 26, 2022

Japan

“Japan turns back to nuclear power in post-Fukushima shift – Prime minister says government will step up reactor restarts and study construction of new plants. (Prime Minister Fumio) Kishida’s decision to throw his political weight behind the nuclear power sector is intended to rein in soaring energy costs for households and companies and to support Japan’s nuclear technology manufacturers.”, The Financial Times, August 24, 2022

Nigeria

“Nigeria Pays Part of Airline Dues Amid Flight Suspension Threats – Nigeria released some funds owed to international air carriers to try and avert a crisis in the aviation sector amid warnings of flight suspensions from operators including Dubai’s Emirates Airline. The Central Bank of Nigeria released $265 million to settle ticket sales owed to airline operators, it said late on Friday. Nigeria — Africa’s biggest economy — owes carriers $464 million, the International Air Transport Association said this month.”, Bloomberg, August 27, 2022

Portugal

“Foreign tourism to Portugal surpasses pre-COVID levels in July – The number of foreign tourists visiting Portugal slightly surpassed pre-pandemic levels in July for the first time since the end of most COVID-19 restrictions, data from the National Statistics Institute (INE) showed on Wednesday. More than 1.8 million foreigners stayed in Portuguese hotels last month, up from around 600,000 a year ago, when the country still had some restrictions in place, and slightly above 1.78 million in July of 2019, which was a record year for tourism.”, Reuters, August 31, 2022

Singapore

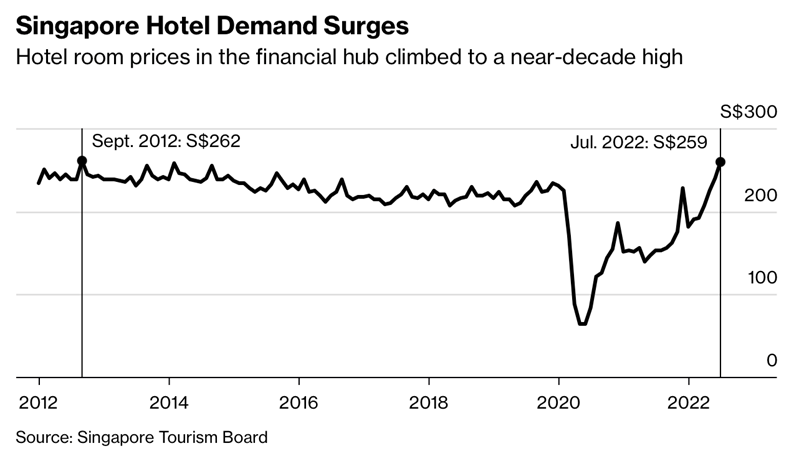

“Singapore Hotel Prices Hit 10-Year High as City Roars Back to Life – Arrivals accelerating as Covid-19 restrictions are eased. Pace expected to continue with F1 event, slew of concerts. Hotel rooms in Singapore are now the most expensive in almost a decade as the city-state seeks to position itself as the tourism and business destination in Asia with a slew of high-profile events lined up for the coming months.”, Bloomberg, September 4, 2022

United Kingdom

“Liz Truss vows to ‘deliver’ after winning race to be new prime minister – In her acceptance speech, Truss promised to cut taxes, deal with energy bills and fix the NHS, and appeared to rule out an early election, saying: ‘We will deliver a great victory for the Conservative Party in 2024’.”, The Time of London, September 5, 2022

“Britain heading for recession as business contracts – The likelihood of the British economy sliding into recession has risen after a closely-watched survey showed business activity contracted last month for the first time in a year and a half. The latest composite purchasing managers’ index (PMI), which encompasses the services and manufacturing sectors, has been revised down to 49.6 for August, from an initial flash reading of 50.9, S&P Global said. In a further sign of the faltering economy, the survey result for the services sector last month was also lowered from the preliminary flash reading of 52.5 to 50.9, which represented the weakest growth for 18 months.”, The Times of London, September 3, 2022

United States

“US Goods-Trade Gap Narrows to Least Since October as Imports Drop Again – (Value) of consumer-goods imports fell most since at least 1992 Overall imports declined 3.5% to $270 billion, Census says. The US merchandise-trade deficit narrowed in July to the smallest since October as imports fell for a fourth month, suggesting a tailwind for economic growth in the third quarter.”, Bloomberg, August 26, 2022

“KPMG to Cut Manhattan Office Space in Move to New U.S. Headquarters at Hudson Yards – Firm shrinking its New York office space by over 40% as it pursues hybrid-work strategy. The KPMG deal also highlights the harsh new reality for the office sector. Companies are still willing to spend big on modern office space with more amenities, outdoor space and energy efficiency. But they often want far less of it. That leaves landlords with increasingly large holes to fill, especially in older buildings.”, The Wall Street Journal, August 23, 2022

Vietnam

“Good morning Vietnam: the world’s new factory is emerging – Amid tensions with China, the nation’s manufacturing sector is booming. In 2021, Vietnam’s exports hit $336 billion (£282 billion) in value, up 19 per cent from 2020 despite the pandemic. Foreign-invested production dominates, with 73 per cent of last year’s export turnover generated by international firms.”, The Times Of London, August 28, 2022

Brand News

“American chain Planet Smoothie opens its first two Australian stores – Kahala Brands, the franchisor and owner of the Planet Smoothie brand, has collaborated with the Docklands-based Smoothie Group to expand into Australia. The company plans to open an additional location in the second quarter of next year.”, Insideretail.com.au, August 24, 2022. Compliments of Jason Gehrke, Franchise Advisory Centre, Brisbane

“Bonchon is Crunching the Competition with Record Sales Numbers – The Korean fried chicken brand is on fire and outperforming the industry average as it leads the fast-casual and casual dining segments, according to mid-year data from research firm Black Box Intelligence™. Bonchon has experienced a year-over-year sales increase of 12 percent and the brand’s AUV has increased by 24.7% to $1.57 million since VIG Partners invested in the company in 2018. It’s full-steam ahead for the second half of the year, with plans to grow by 20 percent before the end of the year.”, Franchising.com, September 5,l 2022

Denny’s hires presidents for both its brands – Denny’s has promoted John Dillon, chief brand officer, to president of Denny’s effective Sept. 1, the company announced Thursday. David Schmidt, who recently served as CFO at Red Lobster, has been hired as president for Keke’s Breakfast Cafe, effective Sept. 12. These appointments come a month after Denny’s closed its $82.5 million acquisition of Keke’s Breakfast Cafe, which will operate independently of Denny’s.”, Restaurant Dive, August 26, 2022

“Hardee’s Has Teamed Up With A Nashville Brewery To Create A Beer That Includes The Chain’s Signature Biscuits – Hardee’s announced today it is working with Nashville-based Southern Grist Brewing Co. to turn its famous biscuits into a Strawberry Biscuit Ale. Specifically, the brewer has figured out a way to infuse Hardee’s biscuits into a full-bodied, cream ale that incorporates hints of strawberry jam and buttermilk.”, Forbes, August 30, 2022

“Top Pizza Franchise Becomes Billion-Dollar Brand – Marco’s Pizza, the nation’s fastest-growing pizza brand*, recently crossing the $1B annual systemwide sales mark and opening its 1,100th store. Marco’s expects greater expansion of its geographic footprint with more than 230 stores currently in development. Multi-unit franchisees play a huge part in the continuous growth of the brand. In fact, nearly half of Marco’s current franchise network is made up of multi-unit operators……”, Franchising.com, September 5, 2022

“Overweight in the coffee market McDonald’s (China) plans to add about 1 000 McCafé stores in 2023 – On August 31, McCafé, a professional handcrafted coffee brand owned by McDonald’s, announced the launch of the “Milk Iron Series”. This product is a brand-new milk coffee product developed by McCafe on the basis of understanding the coffee taste of Chinese consumers. “Milk Iron” will be sold in nearly 2,500 McAfee stores nationwide as an exclusive star product of McAfee. As a result, McCafe also announced the latest plan. It is expected that about 1,000 new stores will be added in 2023, mainly in third-tier cities.”, Beijing Business Daily, September 2, 2022. Compliments of Paul Jones, Jones & Co., Toronto

“American chain Planet Smoothie opens its first two Australian stores – Kahala Brands, the franchisor and owner of the Planet Smoothie brand, has collaborated with the Docklands-based Smoothie Group to expand into Australia. The company plans to open an additional location in the second quarter of next year.”, Insideretail.com.au, August 24, 2022. Compliments of Jason Gehrke, Franchise Advisory Centre, Brisbane

“PRET-flation! How lunchtime and pub favourites have soared in price amid cost-of-living crisis – with Pret A Manger tuna sandwich up 50p to £3.80. It comes after fast-food chain McDonalds last month raised the price of its iconic – and once seemingly inflation-beating – 99p cheeseburger to £1.19. It was the first time the burger’s price had been increased in more than 14 years. It comes as all restaurants and grab and go spots face a double whammy of increasing costs. Ingredients such as flour and cooking oils have all gone up in price as a knock on from Russia’s invasion of Ukraine, while shops, cafes and restaurants are also feeling the pinch due to spiraling gas prices.”, DailyMail.com, September 3, 2022

“Red Rooster (Australia) celebrates 50 years of Red – Red Rooster is celebrating 50 years of serving as Australia’s chicken shop through promotions such as limited merchandise collection and a chance to win 50,000 Red Royalty Dollars. The chicken shop is ‘painting the town Red’ by offering various initiatives to more than 360 Red Rooster restaurants.”, Qsrmedia.com.au, August 22, 2022. Compliments of Jason Gehrke, Franchise Advisory Centre, Brisbane

Articles & Studies For Today And Tomorrow

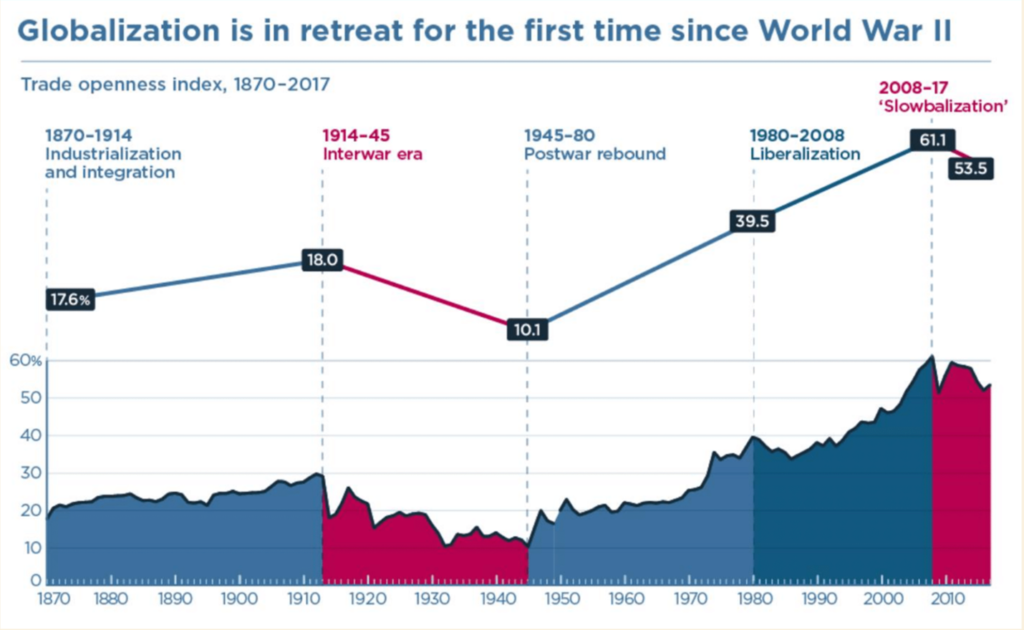

“Slowbalization – This chart is from “Globalization ’22 – What Will The Future Hold”, a presentation made by Team 4 in the Executive MBA 23 course at the University of Southern California, Irvine led by Dr. Leonard Lane. Bill Edwards was asked to monitor and contribute to the final course team presentations. https://bit.ly/3D2ba1y

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ covering 43 countries provides us with updates about what is happening in their specific countries.

To sign up for our biweekly newsletter click here: https://bit.ly/geowizardsignup

William (Bill) Edwards has a four-decade career successfully accelerating the international growth of more than 40 brands. He has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East and has lived in China, the Czech Republic, Hong Kong, Indonesia, Iran and Turkey. Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. EGS has twice received the U.S. President’s Award for Export Excellence. For advice on doing business successfully across 40+ countries, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link: