EGS Biweekly Global Business Newsletter Issue 69, Tuesday, November 15, 2022

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

China begins to loosen Zero COVID travel quarantine, coal not going away just yet, China and the USA have half the world’s wealth, India’s coming decade of growth, US back to pre-COVID air travel, coffee bean prices are falling, 2 billion trees to be planted in Brazil and the dominant global marketing trends for 2023.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here:

https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others

“Nothing is impossible, the word itself says ‘I’m possible’“., Audrey Hepburn

“Wisdom comes from experience. Experience is often a result of lack of wisdom.”, Terry Pratchett

“The pessimist sees difficulty in every opportunity. The optimist sees opportunity in every difficulty.”, Winston Churchill

Highlights in issue #69:

- Brand Global News Section: Dunkin®, Carl’s Jr.®, Jolibee®, Kinderdance®, Tim Hortons® and Wetzel’s Pretzels®

NOTE: Bolded headlines in this newsletter are live links where the article is available without a subscription.

Interesting Data and Studies

“Battle of the Biggest – Today we look at who really has the world’s biggest economy……..But how to measure comparative sizes when countries have different currencies? A popular way to get around fluctuating exchange rates is to use a method called purchasing power parity, which accounts for the cheaper prices of goods and services in poorer countries. PPP, as it’s known, accounts for the bigger punch that $1 packs in, say, Laos than it does in the US. It’s not unlike looking at “real” GDP, which strips out the impact of inflation to look at the underlying state of the economy.”, Bloomberg, November 8, 2022

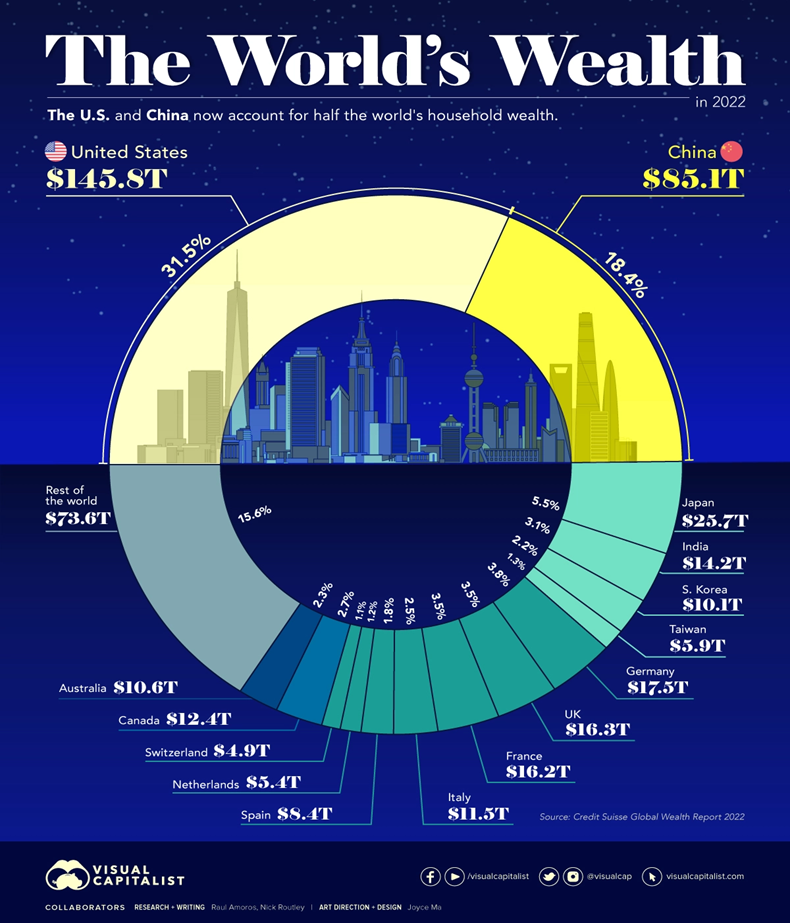

“The U.S. and China Account for Half the World’s Household Wealth – Measures like GDP are commonly used to understand the overall wealth and size of the economy. While looking at economic output on an annual basis is useful, there are other metrics to consider when evaluating the wealth of a nation. This visual utilizes data from Credit Suisse’s annual Global Wealth Report to break down the latest estimates for household wealth by country.”, Visual Capitalist / Credit Suisse, November 9, 2022

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

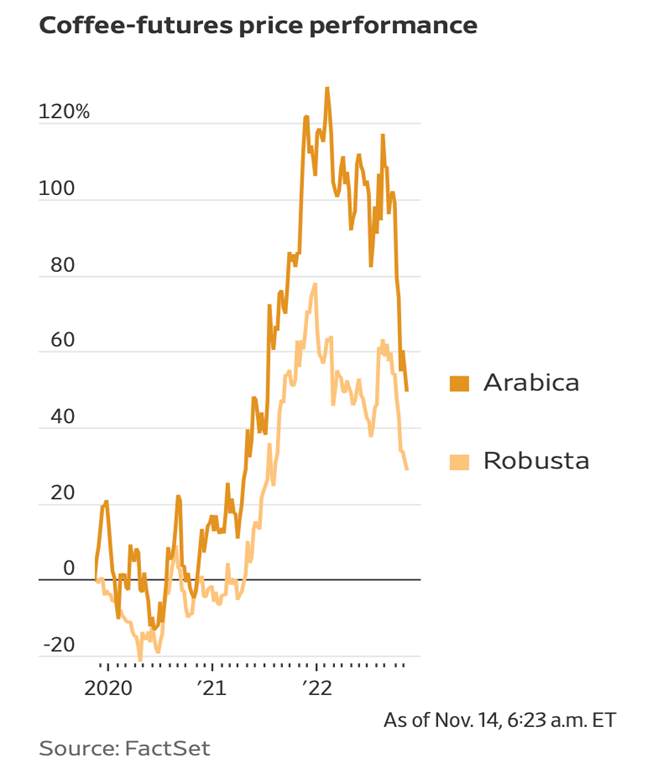

“Coffee Market Goes Cold as Brazilian Weather Normalizes – Futures prices have plunged since August, with coffee-growing conditions bouncing back from last season’s drought and frost. Wet weather in farming areas such as Brazil and Indonesia is raising the prospect of a good crop and bigger coffee supply, sending prices down. Arabica coffee futures have shed 22% in the past month.”, The Wall Street Journal, November 14, 2022

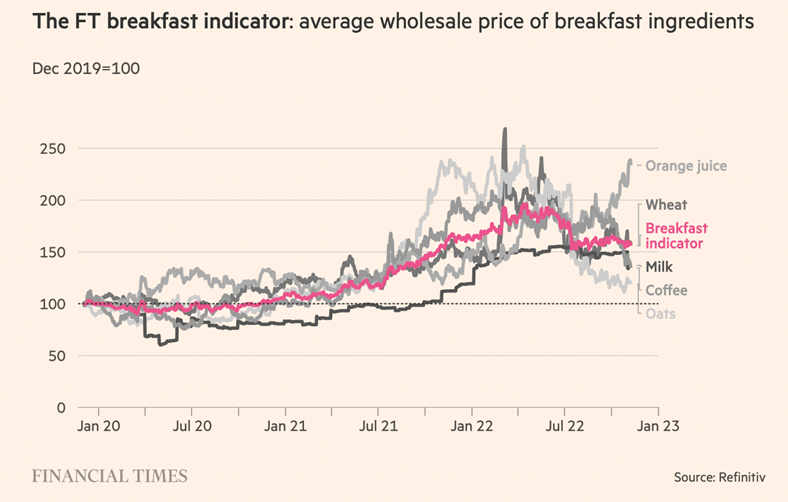

“Global inflation tracker: see how your country compares on rising prices –Russia’s invasion of Ukraine has increased prices for everything from energy to wheat, adding to the inflationary pressures affecting major economies of the world including the US, UK, Germany and France.”, The Financial Times, November 10, 2022

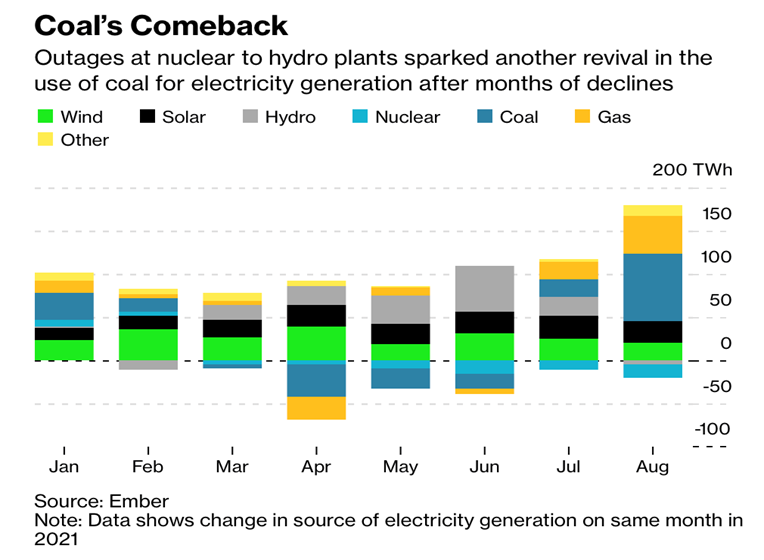

“Coal Was Meant to Be History. Instead, Its Use Is Soaring – The demise of the dirtiest fossil fuel has been delayed as power shortages and the war in Ukraine drive consumption, while China and India construct new plants. Prices of exported coal have skyrocketed to records and futures contracts suggest they’ll remain at historic highs for years to come.”, Bloomberg, November 4, 2022

Global & Regional Travel Updates

“These are the top 10 airlines in the world for 2022 – Airline-ranking company Skytrax ranked the world’s best carriers, and not a single U.S. airline made it to the top 10. Delta Airlines did rank in the 24th spot and earned the title of the best airline in North America—a result backed up by this year’s travelers satisfaction survey from The Points Guy.”, CNBC, November 10, 2022

“Americans Have Spent $11 Billion More on Domestic Flights This Year Than They Did in 2019 – Domestic flight prices in October alone were 24 percent higher than pre-pandemic levels. Through October 17, U.S. travelers spent a total of $76 billion on domestic flights, compared to $65 billion in 2019.”, Conde Nast Traveler, November 11, 2022

“WH Smith sales take off with return of global travel – WH Smith has reinstated dividend payments after reporting that the rebound in global travel had propelled it to the highest sales figures in 15 years. The group beat market expectations with a headline pre-tax profit of £61 million for the year to the end of August, against a £104 million loss last year, on sales of £1.4 billion. The company said it would pay a final dividend of 9.1p per share after suspending dividends during the pandemic.”, The Times of London, November 11, 2022

Country & Regional Updates

Brazil

“2 Billion New Trees (in Brazil): Suzano, Santander Launch Massive Planting Push in Brazil – An area the size of Switzerland, made of protected trees. The world’s largest pulp producer is among six companies aiming to plant millions of hectares of trees in Brazil, financed by the sale of carbon offsets.”, Bloomberg, November 12, 2022

China

“China Loosens ‘Zero-Covid’ Controls on Quarantine, Inbound Flights – China ended its “circuit breaker” mechanism for inbound flights and shortened the quarantine period for overseas travelers in an effort to “optimize” the country’s Covid-19 response, health authorities announced Friday. Travelers arriving in the country now must submit to five days of centralized quarantine plus three days of home confinement, rather than seven days of centralized isolation and three days of observation at home, according to the Joint Prevention and Control Mechanism of the State Council.”, Caixin Global, November 11, 2022

“Why Is China’s Youth Unemployment So High? This year’s cohort of college graduates has been facing China’s toughest job market in recent memory. Nearly one in every five young Chinese urbanites was unemployed in July, a record since data began to be released at the start of 2018. Their chances of finding a job have been hit by a perfect storm of economic disruption and uncertainty.”, Caixin Global, November 11, 2022

“Yum China Net profit in the third quarter increased by 98 percent to US 206 million with a total of 239 net new stores – In terms of the number of stores, a total of 239 new stores were added in the quarter, mainly driven by the development of the KFC and Pizza Hut brands, bringing the total number of stores to 12,409 as of September 30, 2022.”, Caijing Network, November 2, 2022. Compliments of Paul Jones, Jones & Co., Toronto

India

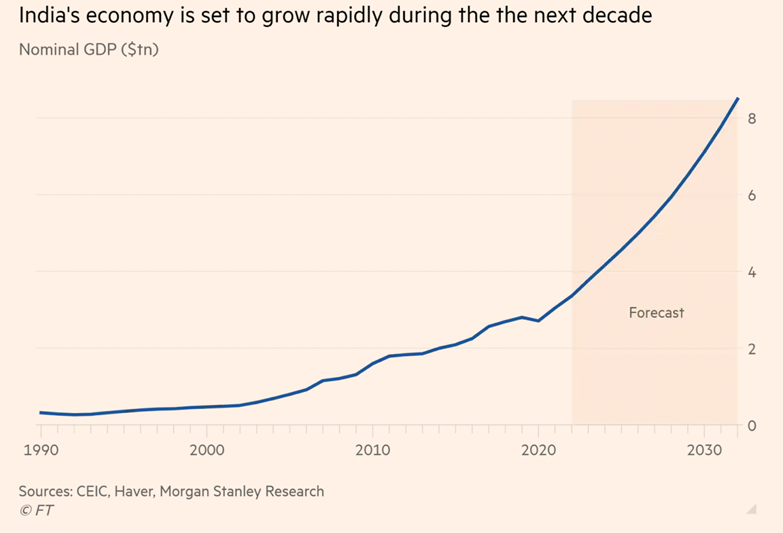

“India’s coming decade of outperformance – The country will provide a compelling opportunity in a world starved of growth. We forecast that India will be the third-largest economy by 2027, with its GDP more than doubling from the current $3.4tn to $8.5tn over the next 10 years. Incrementally, India will add more than $400bn to its GDP every year, a scale that is only surpassed by the US and China.”, The Financial Times, November 8, 2022

Malaysia

“Malaysia posts fastest economic growth in over a year, outlook clouded – Malaysia grows 14.2% y/y in Q3, beating forecasts. Central bank expects 2022 growth to surpass govt projections. Outlook clouded by risk of global slowdown.”, Reuters, November 11, 2022

The Philippines

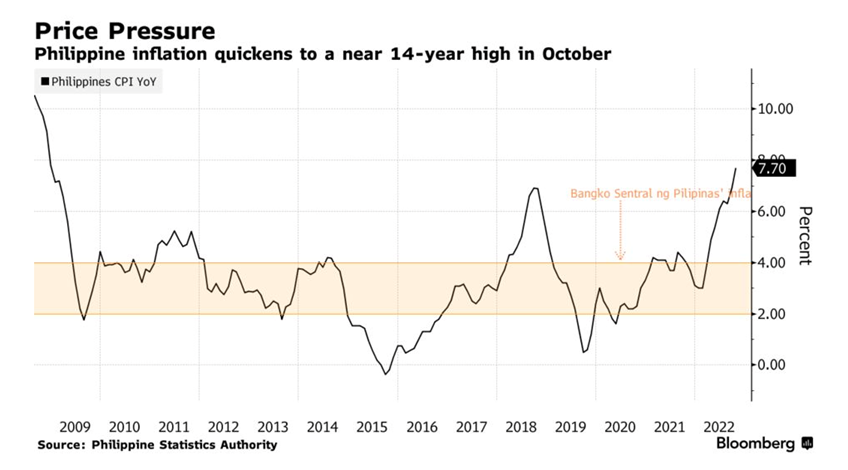

“Philippines Is Open to Matching More Fed Hikes to Tame Inflation – The Philippines central bank may keep on matching the Federal Reserve’s next rate increases should domestic inflation continue to quicken, according to Governor Felipe Medalla. Medalla’s comments came after the Philippines reported the fastest inflation in almost 14 years last month and a day after the governor announced that the monetary authority will match this week’s 75-basis-point hike at the Nov. 17 meeting.”, Bloomberg, November 4, 2022

United Kingdom

“Inflation ‘very possibly’ peaking – Is global inflation nearing its peak? Kristalina Georgieva, the head of the International Monetary Fund, has dared to say it might be. Georgieva believes the united action of central banks around the world to raise interest rates could be starting to push down on consumer price rises, which have surged to double-digit highs in the UK and elsewhere.”, The Times of London, November 7, 2022

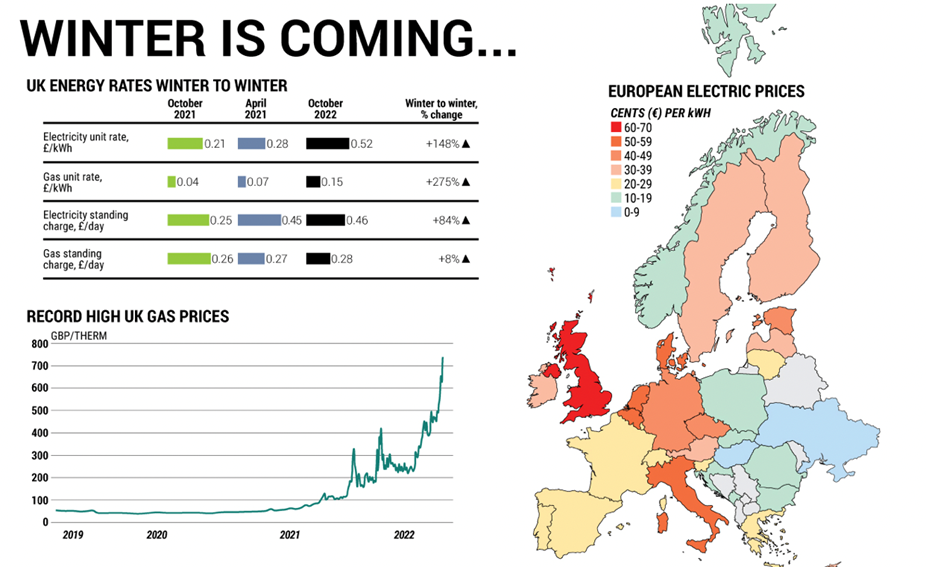

“UK Energy Costs Are Through the Roof – A price cap is set to expire in April. Following the downfall of another prime minister and the British pound’s collapse to its lowest level ever against the dollar, the U.K. urgently needs to tackle energy prices. In June, regulatory body Ofgem reported that more than 2.3 million British households are behind on their electricity bills and 1.9 million are behind on gas bills. Both figures are some 70 percent higher than at the end of 2020.”, Geopolitical Futures, October 28, 2022

United States

“US Air-Passenger Traffic Tops Pre-Pandemic Levels of 2019 – Just over 15 million people went through Transportation Security Administration security portals in the past seven days, about 39,000 more than in 2019, or an increase of less than 1%, according to TSA data. The uptick comes in a traditionally slack period for travel. The recent volume is still well below the 18 million people a week who flew during peaks in the summer of 2019.”, Bloomberg, November 1, 2022

“Visualizing America’s Most Popular Fast Food Chains – Fast food is big business in America. From national chains to regional specialties, the industry was worth $331.4 billion as of June 2022. Which fast food brands are currently dominating this space? This graphic by Truman Du uses data from Quick Service Restaurant (QSR) Magazine to show the most popular fast food chains across America.”, Visual Capitalist / QSR Magazine, October 28, 2022

Brand & Franchising News

“MUMBO-fication: Multi-branding grows across international borders – It is becoming increasingly common to find multi-brand franchisees of foreign brands worldwide. This may be at the local or regional level, country level, or even a multi-country level. This is a major trend we see in the U.S. and increasingly in EU countries. These franchisees are often referred to as MUMBOs: multi-unit, multi-brand operators.”, Franchising.com, November 13, 2022. This article is by William Edwards, Editor of this newsletter

“Boost Juice (Australia) and EFG (Cambodia) sign agreement to bring Boost to Cambodia – EFG is committed to open 20 Boost locations within five years in Cambodia. The agreement also covers future store openings in Laos and Myanmar. Stores are expected to be located in airports, shopping malls and gas stations tapping into Asian needs for Grab & Go, Convenience Retail and a healthy daily beverage trend.”, Franchising.com, November 13, 2022

“Carl’s Jr. Signs Deal to Grow in Switzerland – CKE Restaurants Holdings, Inc. announced a franchise agreement with Spycher Burger Gang AG to develop Carl’s Jr. restaurants in Switzerland. Spycher will open restaurants across Switzerland in key cities including Zurich, Basel, Bern, and Lucerne.”, QSR Magazine, November 9, 2022

“Jollibee And Dunkin’ Are Breaking Up Their Partnership Overseas – This partnership, between Dunkin’ and Jollibee Food Corp., planned to expand the donut empire within southeast Asia, with a focus on China. Jollibee hoped to open more than 1,500 Dunkin’ locations, per The Philippine Star, but unfortunately, this expansion proved to be more difficult than anyone expected. In early November 2022, Jollibee and Dunkin’ announced that they would be ending their partnership.”, Mashed, November 10, 2022

“Kinderdance® A Top Kids Franchise Soars In Romania – Franchise owner Dana Iancu and her team of instructors are offering Kinderdance programs to children in Romania. Kinderdance programs are designed to be an integral part of a child’s school day and afterschool schedule.”, Franchising.com, November 2, 2022

“The next generation of ghost kitchens is stepping out from the shadows – Ghost kitchens and virtual brands in a post-pandemic world will favor more flexible, transparent business models from industry veterans like Reef and Nextbite, to newcomers like Oomi and Meal Outpost.”, Nation’s Restaurant News, October 31, 2022

“Papa Murphy’s® Owner MTY Foods to Buy Wetzel’s Pretzels® – The Canadian brand collector continues its U.S. shopping spree with its second deal this year, following an earlier acquisition of Famous Dave’s. The Canadian brand collector, which made its name through the ownership of dozens of mall-based concepts north of the border, on Tuesday announced the acquisition of the 350-unit Wetzel’s Pretzels for $207 million in cash.”, Restaurant Business, November 2, 2022

“Restaurant Brands profit, sales gain as Tim Hortons® looks to expand lunch, dinner offerings – Tim Hortons® has been adding lunch and dinner items to its menu, such as wraps and bowls, and such items are now included in 10 per cent of its transactions, which helped to drive sales momentum for the chain in the third quarter.”, The Globe and Mail, November 3, 2022

Articles & Studies For Today And Tomorrow

The Dominant Global Marketing Trends of 2023 – The world around us continues to change rapidly and drastically. With this change comes new and exciting opportunities for brands to connect with their customers. Global marketing teams are bracing for leaner budgets going into 2023. As budgets are tightening, marketing teams everywhere are finding that they need to optimize the campaigns that they can run and ensure that every dollar spent can make the most impact.”, Marcom Central, September 19, 2022. Compliments of Steve Dobbins, Founder and CEO of the Dobbins Group

“Unilever to extend four-day working week trial to Australia – Move follows successful New Zealand pilot scheme during which company reported happier and more engaged staff. Unilever is to extend its trial of a four-day working week to 500 employees in Australia after a successful 18-month pilot in New Zealand, becoming the largest company yet to offer a vote of confidence in the shorter schedule. Placid Jover, chief talent officer at the UK-based maker of Dove soap and Hellmann’s mayonnaise, said positive results from paying about 80 staff full salaries for four rather than five-day weeks in New Zealand had prompted the extension.”, The Financial Times, November 1, 2022

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ covering 25+ countries provides us with updates about what is happening in their specific countries.

To sign up for our biweekly newsletter click here: https://bit.ly/geowizardsignup

William (Bill) Edwards has a four-decade career successfully accelerating the growth of more than 40 brands worldwide. He has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East and has lived in China, the Czech Republic, Hong Kong, Indonesia, Iran and Turkey. Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. EGS has twice received the U.S. President’s Award for Export Excellence. For advice on doing business successfully across 40+ countries, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link: