EGS Biweekly Global Business Newsletter Issue 72, Tuesday, December 27, 2022

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

The focus of this issue is looking forward into 2023 with a few updates on current events. McKinsey says resilience is essential in business today. Inflation may be abating in developed economies with some exception such as the price of eggs. International travel has exceeded 2019 as have fares. China will open its borders in January. And who knew how popular KFC® chicken is in Japan at Christmas time?

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here:

https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others

“Transitions are a time for reflection, and a time for looking forward.”, Roy Cooper

“I’m always interested in looking forward toward the future. Carving out new ways of looking at things.”, Herbie Hancock

“I believe you win the race by looking forward, not behind.”, Payal Kadakia

Highlights in issue #72:

- Brand Global News Section: KFC® and McDonald’s®

NOTE: Bolded headlines in this newsletter are live links where the article is available without a paid subscription.

Interesting Data and Studies

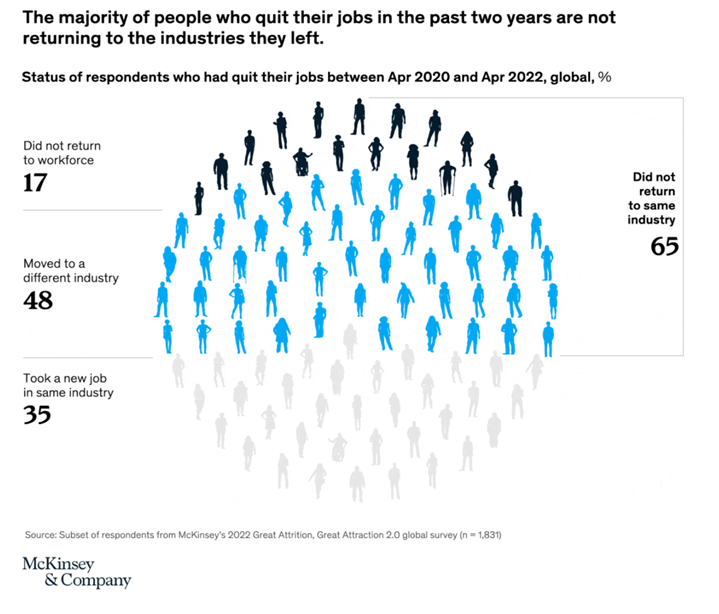

“Resilience becomes essential – Leaders continue to confront multiple crises: a geopolitical conflict, rising inflation, the lingering effects of the COVID-19 pandemic, and talent turnover. The challenges have called for broad resilience frameworks. As the Great Attrition went on unabated, with quit rates 25 percent higher than prepandemic levels, organizations found they couldn’t rely on old ways to attract and retain talent, as the same types of workers weren’t always available to fill those roles. Only 35 percent of people who left their jobs since the start of the pandemic took another one in the same industry. Companies that expand their talent-sourcing approach can expect better success for drawing different types of workers.”, McKinsey, December 9, 2022

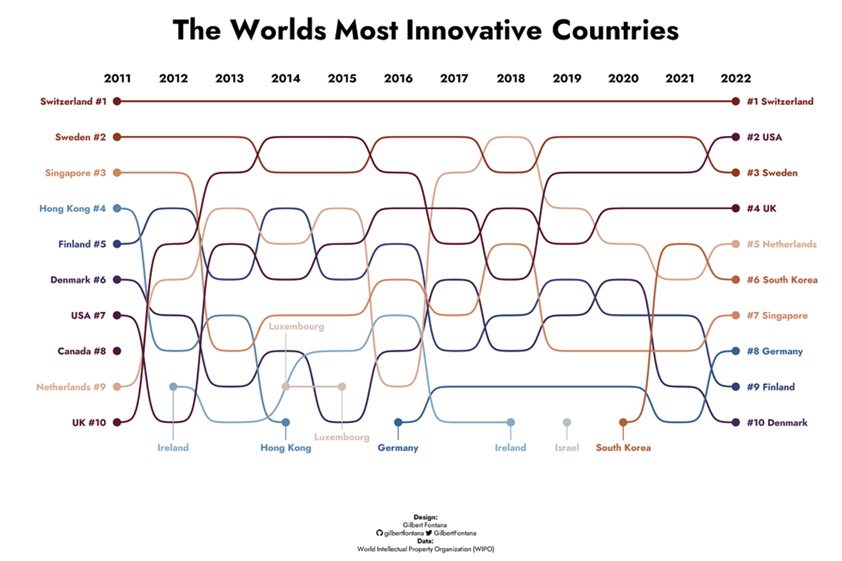

“12 Years of the World’s Top 10 Most Innovative Countries – Every year, the UN’s World Intellectual Property Organization (WIPO) scores countries on how innovative their economies are with the Global Innovation Index. The Index scores countries on indicators of a strong innovation economy. These include R&D spend, general market strength, patent systems and output, and local labor capital. And though a few countries consistently rank high, others are moving in and out of the top 10 rankings. This graphic from Gilbert Fontana details the top 10 most innovative countries in the UN’s WIPO Global Innovation Index from 2011-2022.”, Visual Capitalist, December 20, 2022

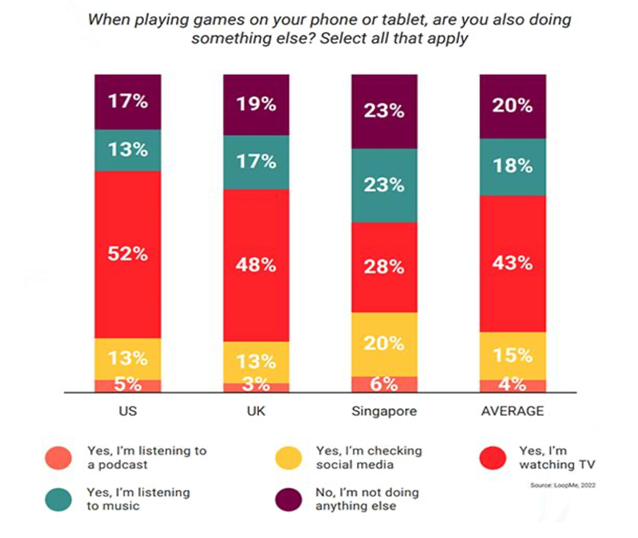

“62% Of Consumers Use Mobile To Play Games, 76% Play More Than 1 Hour Daily – Publishers, developers, and advertisers have a new opportunity to collaborate in 2023 when it comes to in-app gaming, according to data released this week from LoopMe. The tech company, which uses artificial intelligence (AI) to improve brand-advertising performance, aggregated responses from 5,468 consumers across the U.K., 6,192 consumers across the U.S., and 6,680 consumers across Singapore. The study was fielded between October 13 and October 17, 2022. According to eMarketer….time spent with mobile gaming is half the size of in-app social, yet the amount brands spend in social amounts to $56 billion, according to Statista, is 7-times that of the mobile gaming ad revenue projected for 2024, about $8 billion.”, Media Post, December 16, 2022

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

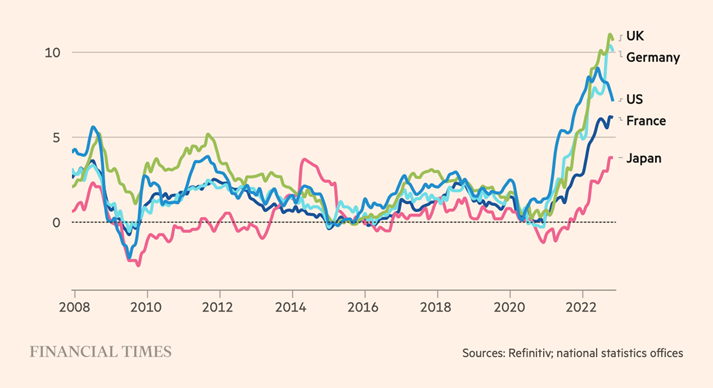

“Global inflation tracker – Inflationary pressures are beginning to wane. Inflation has started to show signs of easing from the multi-decade highs reached in many countries following Russia’s full-scale invasion of Ukraine. High inflation remains geographically broad-based, even if it is lower in many parts of Asia.”, The Financial Times, December 26, 2022

“U.S. poised to become net exporter of crude oil in 2023 – The United States has become a global crude oil exporting power over the last few years, but exports have not exceeded its imports since World War II. That could change next year. Sales of U.S. crude to other nations are now a record 3.4 million barrels per day (bpd), with exports of about 3 million bpd of refined products like gasoline and diesel fuel. The United States is also the leading liquefied natural gas (LNG) exporter, where growth is expected to soar in coming years.”, Reuters, December 19, 2022

“2023 Oil Outlook: China’s Reopening Signals Return Of Bull Market – Rising oil prices as 2022 draws to a close signal a return to bull market conditions next year, with oil expected to cost over $100 a barrel as China eases Covid-related restrictions and supply remains at risk due to Russian aggression against Ukraine. Concerns about the economy and the potential for a global recession continue to be a brake on prices, but the continued tightness of oil supplies trumps those worries. Current production numbers will be hard-pressed to keep up with consumption as the Chinese government – the world’s biggest oil importer – lifts its zero-Covid policy.”, Forbes, December 26, 2022

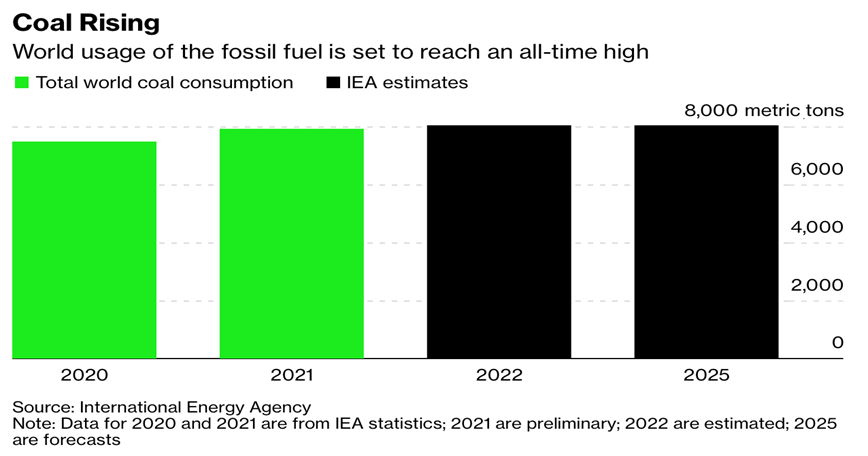

“World’s Coal Consumption Set to Breach New Record This Year – Usage of the dirty fuel is likely to increase by 1.2% in 2022 Europe fell back on coal after Russia squeezed gas supply. Coal usage looks likely to increase by 1.2% in 2022, surpassing 8 billion tons in a single year for the first time, according to an International Energy Agency report published Friday. It also said consumption will likely remain at that level until 2025, as declines in advanced economies are offset by demand in emerging Asian markets, such as China and India.”, Bloomberg, December 15, 2022

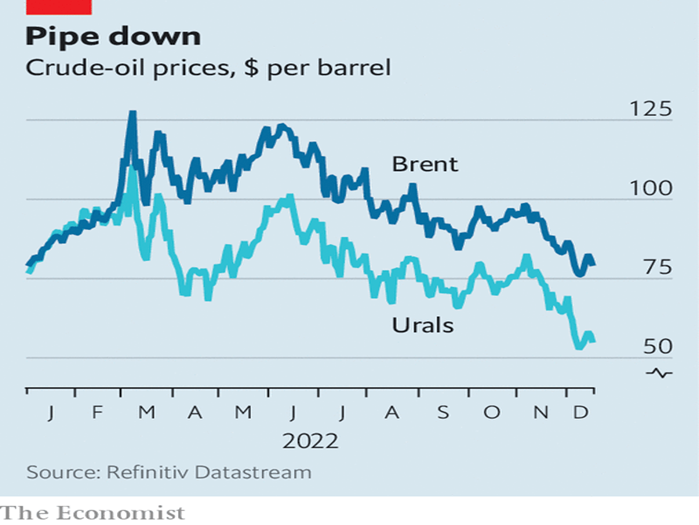

“2023 will bring the true test of the West’s oil-war tactics – Oil prices have sunk to pre-war levels. They are unlikely to remain there. By the second quarter of 2023 there may be another oil shortage. Industrial users in Europe are switching from natural gas to cheaper gasoil. Consumption in India and the Middle East is proving more resilient than expected. China’s reopening will probably fuel an economic rebound after cases peak.”, The Economist, December 20, 2022

Global & Regional Travel Updates

“Travel abroad is poised ‘for a big comeback’ in 2023 as Americans eye trips to Asia, Europe – Thirty-one percent of Americans are more interested in international than domestic travel, according to a recent poll by tourism market research firm Destination Analysts. That was a six-point increase from February and a year-to-date high, according to the survey, published in November. Meanwhile, 62% of 2023 flight searches in the first week of December were for international destinations, up from 55% the same time last year, according to a recent Hopper report.”, CNBC, December 25, 2022

Country & Regional Updates

Australia

“Workforce surges to record high, jobless rate steady – The number of people in the workforce surged to a record high in November with most going straight into jobs, prompting some economists to downplay a mooted interest rate pause in early-2023. Employment increased by a huge 64,000 people over the month – more than 50 per cent higher than average – while unemployment rose by a slim 7400, keeping the jobless rate steady at a 48-year low 3.4 per cent.”, Australia Financial Review, December 15, 2022

Canada

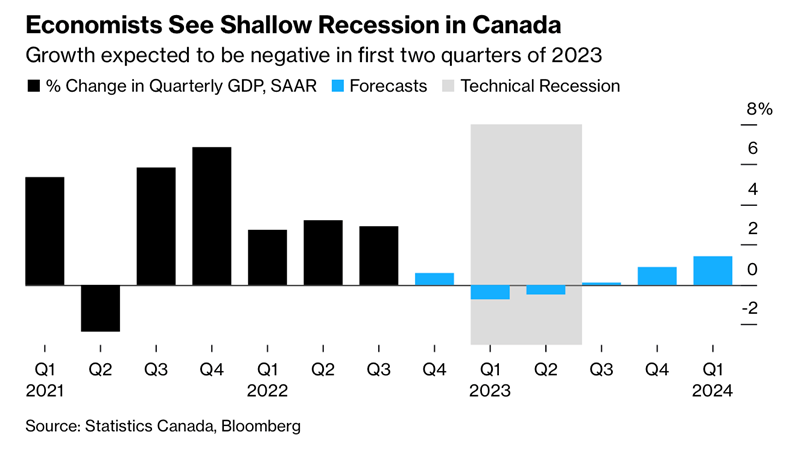

“Canada’s Economy Keeps Growing, Bolstering Case for More Hikes – GDP on track for 1.2% annualized growth in fourth quarter Data come on heels of inflation report showing sticky core CPI. Earlier this month, policymakers said future hikes would be guided by economic data, and underlying pressures and output numbers will play a key role in determining when interest rates will stop rising.”, Bloomberg, December 23, 2022

China

“China to reopen borders, drop Covid quarantine from January 8 – Local authorities will be stripped of the power to shut down entire communities from early next month. The decision is the last step in the country’s pivot to living with the virus. The Post understands from various sources that strict control measures including compulsory quarantine for travellers coming to China will also be removed after the downgrade, since it is no longer a compulsory requirement in the category B management.”, The South China Morning Post, December 26, 2022

“Beijing, Shanghai residents back to work as China limps towards living with COVID – Mask-wearing Beijing and Shanghai commuters crowded subway trains on Monday as China’s two biggest cities edged closer to living with COVID-19 even as frontline medical workers scrambled to cope with millions of new infections. Shanghai’s lively streets on Monday contrasted sharply with the atmosphere in April and May when hardly anyone went outside. An annual Christmas market held at the Bund, a commercial district in Shanghai, was popular with city residents over the weekend. Crowds thronged the winter festive season at Shanghai Disneyland and Beijing’s Universal Studios on Sunday, queuing up for rides in Christmas-themed outfits. The number of trips to scenic spots in the southern city of Guangzhou this weekend increased by 132% from last weekend, local newspaper The 21st Century Business Herald reported.”, Reuters, December 26, 2022

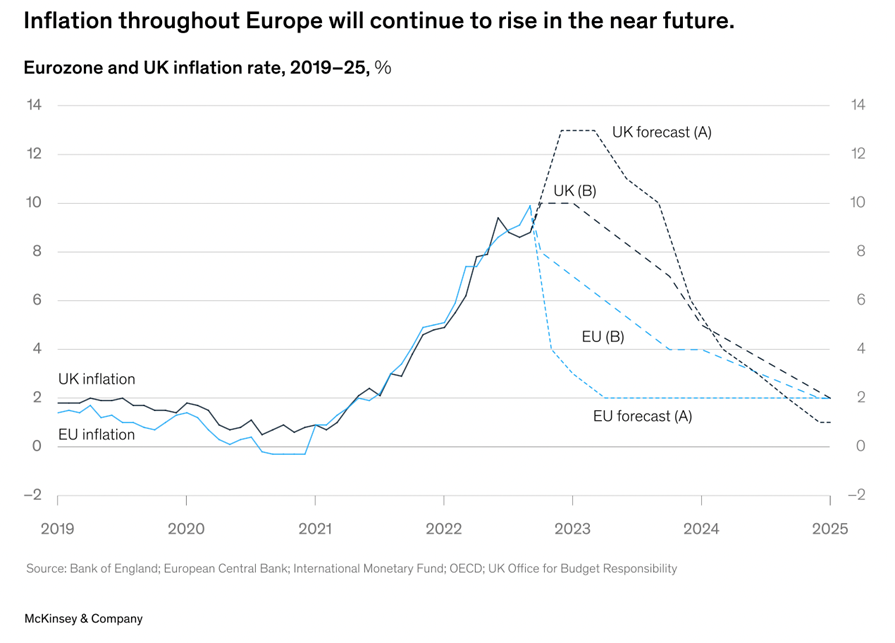

European Union

“Inflation will be tough for Europe – In 2023 the full economic impact of price rises—and the energy crunch largely responsible for them—will be felt across Europe. A recession is coming, followed by a painfully slow recovery. Though Europe added to its capacity to import liquefied natural gas after Russia slashed sales, global LNG supplies will not increase by much in 2023. That means energy will remain expensive, and it will keep prices high across the rest of the economy. Hard-hit consumers and businesses will start to hold back, curbing both spending and investment.”, The Economist, December 26, 2022

Finland

“Finland Unveils Grants to Help Households Pay High Power Bills – The subsidy will be 60% of monthly electricity bills in excess of 400 euros ($420), the government in Helsinki said on Tuesday. The maximum subsidy will be 660 euros per month from January through April, and it only applies to bills for one permanent residence, according to a statement.”, Bloomberg, December 20, 2022

India

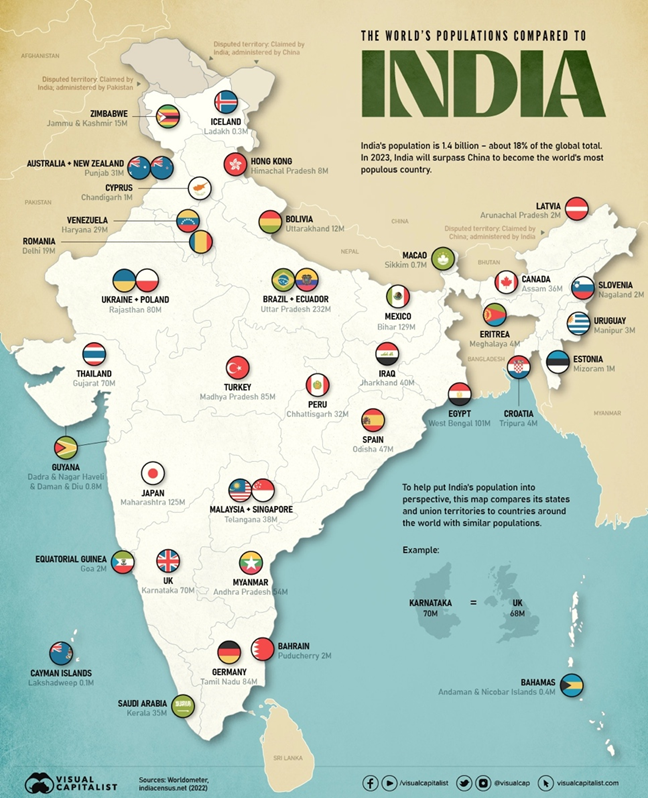

“The Population of India’s States Compared with Countries – According to United Nations projections, India is on track to become the most populous country in the world in 2023. While India’s population growth has slowed in recent years due to factors such as urbanization and increasing access to contraception, the country’s population is still expected to continue growing at a significant rate for the foreseeable future. Hypothetically, if India’s states were to all became countries today, they would take up half the spots in a ranking of the world’s top 20 most populous countries.”, Visual Capitalist, December 18, 2022

Indonesia

“Indonesia 2022 trade surplus to hit record, gap seen shrinking in 2023 – Indonesia’s 2022 trade surplus will likely be its biggest on record, but next year the gap is expected to narrow to about $38.3 billion to $38.5 billion, a trade ministry official said on Tuesday. Resource-rich Indonesia has seen an export boom this year, riding on high global commodity prices. It booked a $50.6 billion trade surplus in the January-November period, already bigger than the last record annual trade surplus in 2006.”, Reuters, December 19, 2022

Turkey

“Turkey Hikes Minimum Wage to Ease Sting of Inflation Before Vote – Turkey’s minimum wage will go up 55% in 2023 in a bid to help ease the burden of soaring living costs on millions of people just months ahead of elections. The latest hike is an attempt to cushion households from inflation that the central bank predicts will exceed 22% next year after ending 2022 at just over 65%.”, Bloomberg, December 22, 2022

United Kingdom

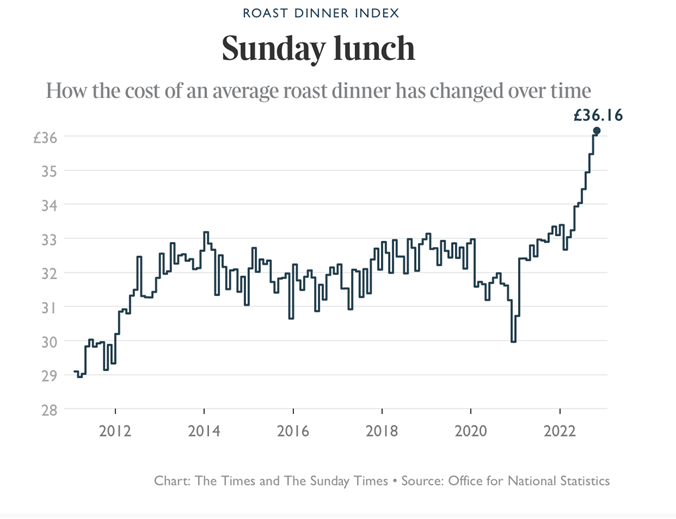

“How inflation has changed the price of a (U. K.) roast dinner – The cost of a home-cooked Sunday roast for a family of four has reached its highest level in over a decade. Our tracker uses data to show how much more expensive the weekend classic has become in the past decade. Sunday roast for a family of four now costs £36.16, up 8.5 per cent from the same time last year. The rise in the price of food and non-alcoholic drink was the second largest contributor to inflation this month after rises in the cost of household bills.”, The Times of London, December 14, 2022

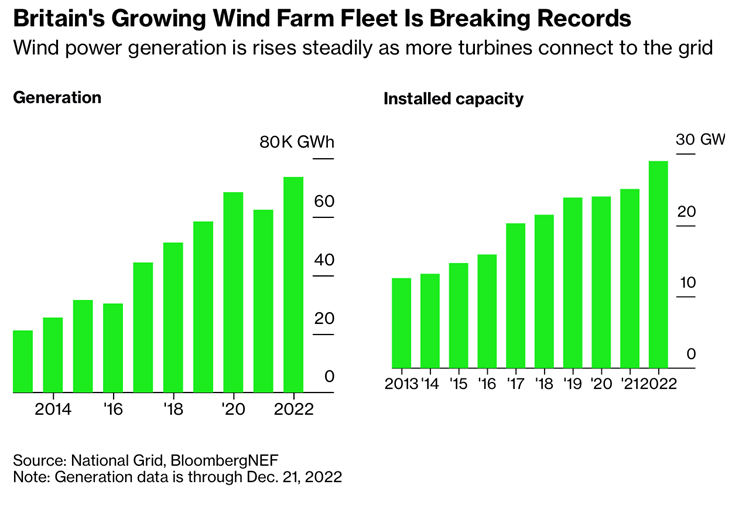

“The UK Produced a Record Amount of Wind Power in 2022, Easing Gas Crisis – Britain has some of Europe’s best conditions for wind power Wind is essential to easing gas crisis, reaching climate goals. The UK has some of Europe’s best wind conditions and the most turbines deployed at sea, where gusts tend to be stronger and more consistent. Britain’s wind farms produced nearly 74 terawatt hours so far this year, enough to power more than 19 million British homes, according to National Grid data.”, Bloomberg, December 21, 2022

“Retail sales lift the gloom — for now – Retailers benefited from an unexpected rebound in sales in the run-up to Christmas but are braced for it to be the last good news for a while, with sales expected to fall back in the new year, a survey shows. The survey of 138 companies, including 50 retailers, found that a net balance of 11 per cent of businesses said sales grew, up from -19 per cent in November.”, The Times of London, December 21, 2022

United States

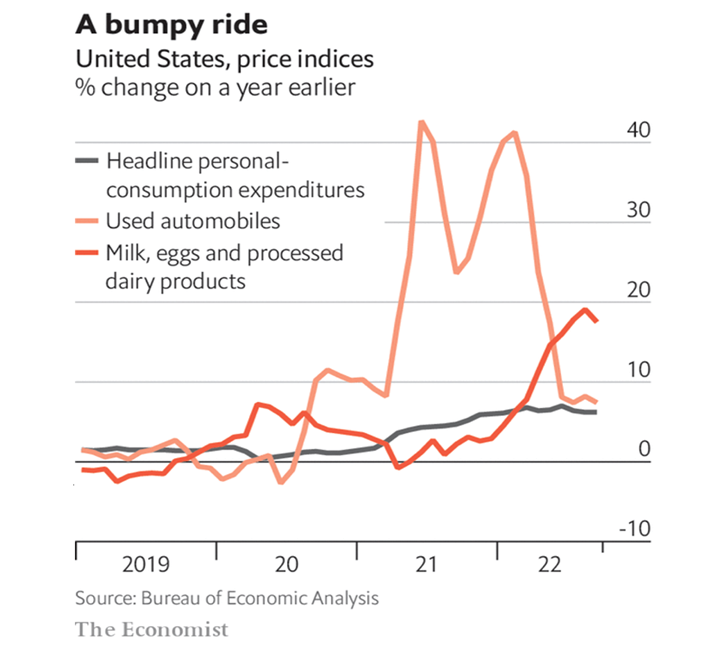

“Some unusual products have seen their prices soar and plunge – Everything from eggs to hot tubs to used cars. Higher energy prices mean that demand for hot tubs is tanking. In the year to September 2022 eggs jumped in price by 28%, having already increased by 11% in 2021. Milk also fared poorly, with a 20% rise since the start of 2021. Both prices depend heavily on the cost of livestock feed, which has been affected by the (Ukraine) war. Markets expect the Federal Reserve to raise its benchmark rate to 4.25-4.5% by June 2023. That spells bad news for cars and other durable goods that are often bought with borrowed money.”, The Economist, November 18, 2022

“Inflation and Rising Prices Impacting Small (US) Businesses – Small business operators typically rely on the holidays for key revenue but inflation could make that more difficult this holiday season, according to the quarterly MetLife and U.S. Chamber of Commerce Small Business Index. Inflation has been a top challenge for business owners for four straight quarters. More than half (53%) of small businesses now say inflation is the biggest challenge for small business owners, a 30-percentage point increase from this time last year. Four out of five (83%) say rising prices have had a significant impact on their business this year.”, Franchising.com. December 19, 2022

“U.S. retail sales grows 7.6% in holiday season – However, this year’s holiday retail sales growth is less than the 8.5% increase last year as decades-high inflation, rising interest rates and the threat of a recession turned consumers cautious. Retailers including Amazon.com Inc and Walmart Inc in the United States offered large discounts during the holiday season to get rid of excess stock and bring back inventories to normal levels. That led to strong demand for everything from toys to electronics during the five-day-long period between Thanksgiving and Cyber Monday.”, Reuters, December 26, 2022

Brand & Franchising News

“The Year In Franchising – Looking Back on 2022 and Building on the Anticipation for 2023. Throughout the year, we saw more franchise brands continuing to grow and returning to normalization. Some industries that exceled in franchising included fast causal restaurants, home improvement concepts, personal services, education, and pet related businesses. Although 2022 proved to be an impressive year for the franchising industry, struggles still remain. Some challenges include supply chain and distribution issues, rising cost of labor and the ability to find labor, and fighting rising rates and inflation. Despite that, the International Franchise Association (IFA) predicted that by the end of the year there would be a net gain of 17,000 new franchise establishments bringing the total count to 792,000 locations.”, Forbes, December 23, 2022

“Why is KFC so popular for Christmas dinner in Japan? Kentucky Fried Christmas! While you tuck into turkey, KFCs across Japan will be packed with diners who have ordered WEEKS in advance – Expats and tourists in Japan find it hard to get turkey at Christmas – KFC branches are booked up in advance prior to Christmas day celebrations. Quirky tradition started in 1974, when KFC advertised ‘Kentucky for Christmas’. People order weeks in advance and are prepared to queue for hours.”, The Daily Mail (UK), December 25, 2022

“McDonald’s unveils first automated location, social media worried it will cut ‘millions’ of jobs – Customers can fully avoid interacting with any humans during their order and pickup. McDonald’s opened its first automated restaurant, with machines handling everything from taking orders to delivering the food – and dividing opinions everywhere. The Fort Worth, Texas, location uses technology to minimize human interaction when ordering and picking up food. The restaurant features an “Order Ahead Lane” where customers can receive orders by conveyor belt, Newsweek reported.”, Fox Business, December 24, 2022

“(U. S.) Restaurant Staffers Are Returning to Work After Covid Flight – Employment nears prepandemic levels as pay and working conditions improve. This past month, restaurants and bars had nearly doubled the number of employees working at the pandemic low in April 2020, according to the Labor Department. The past month alone, restaurants and bars added 62,000 jobs. Restaurant owners and workers attribute the return to a combination of factors including pay increases, improving working conditions and fewer opportunities elsewhere as the economy weakens.”, The Wall Street Journal , December 26, 2022

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ covering 25+ countries provides us with updates about what is happening in their specific countries.

To sign up for our biweekly newsletter click here: https://bit.ly/geowizardsignup

During an extraordinary four-decades in international business, William (Bill) Edwards has played a leadership role in the global growth of more than 40 brands. He is widely recognized as an International Problem Solver, Strategist, Advisor and a specialist on global cultures. His career covers international operations, executive and entrepreneurial experience in the energy, technology, licensing, management consulting and retail sectors. He has been a technical specialist, manager, brand senior executive and country president.

Over the years, Bill has made or seen almost every mistake that companies can make when going global. He understands the global company world like few others. As a Global Advisor, he now shares his experiences and wisdom with senior executives to help them successfully navigate the complex international company growth landscape. To take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 71, Tuesday, December 13, 2022

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

The biggest news in global business for this issue is the very rapid dismantling of ‘zero Covid’ in China. After three years of shutdowns, personal monitoring by the government, constant PCR tests, monitoring apps and little intercity travel, China is rapidly opening back up. Stay tuned to future newsletters to see what happened to mainland China’s economy.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here:

https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others

“If you want the rainbow, you have to put up with the rain.”, Dolly Parton

“When creativity melds together with global issues, I believe you can bring the world together.”, Virgil Abloh

“A smooth sea never made a skilled sailor.”, Franklin Roosevelt

Highlights in issue #71:

- Brand Global News Section: Burger King®, Denny’s®, Dine Brands Global, Domino’s Pizza Enterprises (DPE), Empower Brands, McDonalds®, 9Round®, Wendy’s® and Xponential Brands®

NOTE: Bolded headlines in this newsletter are live links where the article is available without a subscription.

Interesting Data and Studies

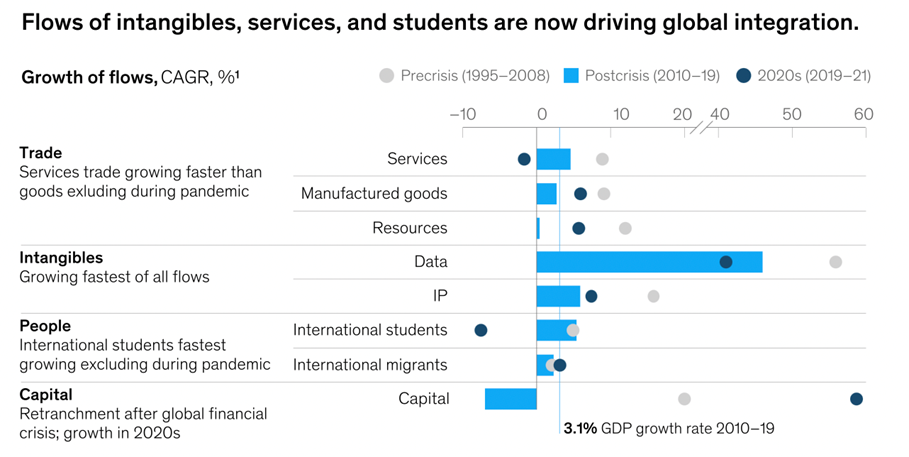

“Global flows: The ties that bind in an interconnected world – Economic and political turbulence have prompted speculation that the world is already deglobalizing. But the evidence suggests that global integration is here to stay, albeit with nuance. Ours is an interdependent world, connected by global flows of goods, services, capital, people, data, and ideas. Global value chains have been built on these flows, creating a more prosperous world. However, in light of the pandemic, Russia’s invasion of Ukraine, and years of rising tensions between the United States and China, some have speculated that the world is already deglobalizing. New MGI analysis finds a more nuanced reality.”, McKinsey, November 15, 2022

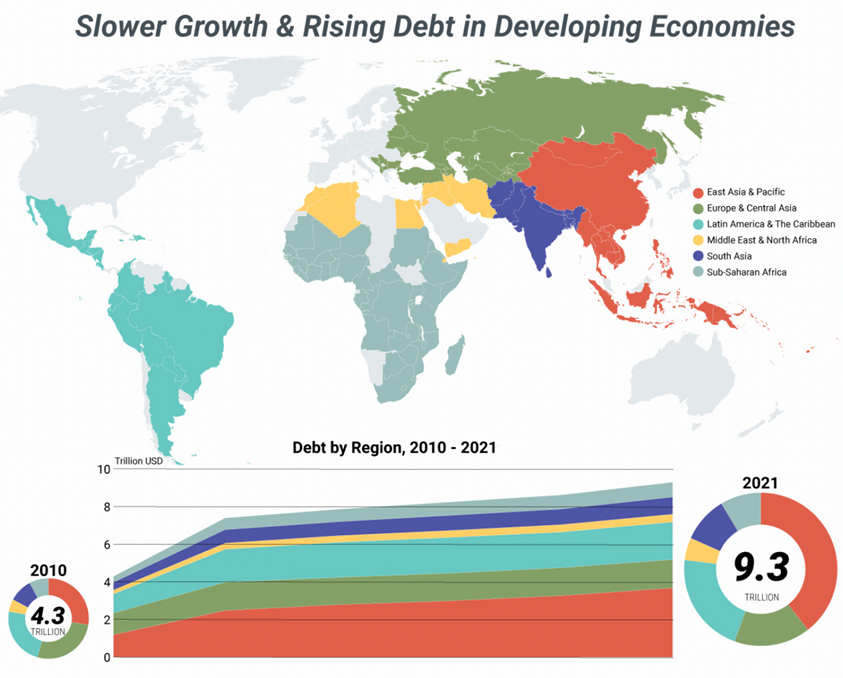

“Around the globe, spiraling debt in low- and middle-income countries is threatening their pursuit of sustainable development. Between 70 percent and 85 percent of developing nations’ debt is in a foreign currency. So far in 2022, around 90 percent of countries have seen their currencies depreciate against the U.S. dollar. Government debt levels as a share of gross domestic product have increased by about $2 trillion.”, Geopolitical Futures, December 9, 2022

“World’s oldest DNA reveals Ice Age ecosystem – Scientists harvested eDNA from sediment thawed from permafrost in northern Greenland. Unlike genetic material from one animal, eDNA is the microscopic spoor of many different species, including plants and micro-organisms. The 2m-year-old ecosystem was home to birch trees, geese, lemmings, reindeer and even mastodons, an extinct elephantine creature.”, The Economist, December 10, 2022

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

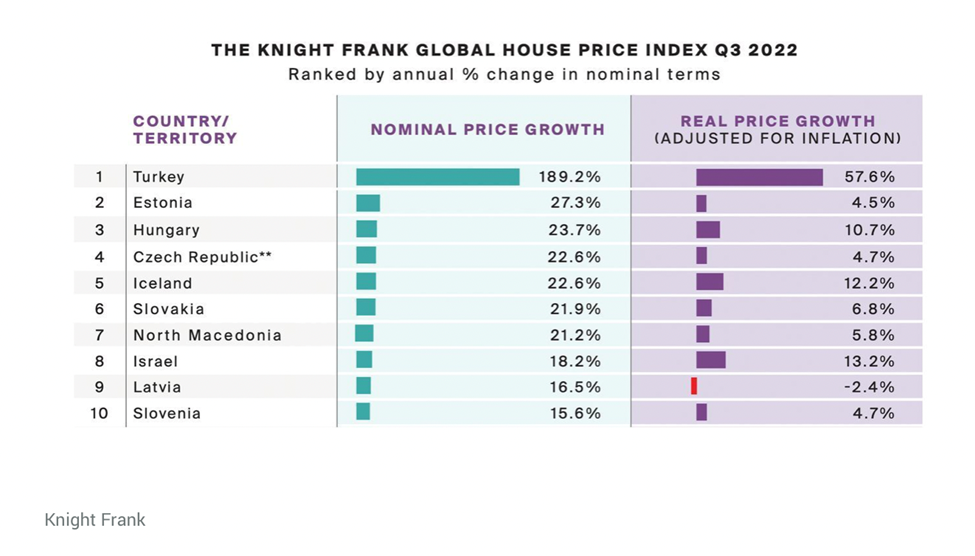

“Globally, Home Prices Climbed a Robust 8.8% in the Third Quarter Despite Rocky Economies – The third-quarter figure is in nominal terms—that is, not adjusted for inflation—and is down from its peak of close to 11% registered during the first quarter of 2022, the brokerage and property consultant said in its analysis of 56 countries and territories around the world. Property markets that are slipping down the table are those that have seen the most significant interest rate hikes, the report said. In the past three months, Canada has moved from 10th to 34th place in the rankings, and Australia from 28th to 47th.”, Barron’s, December 8th.

“Why the price of oil has dropped despite new constraints on Russian supply – Crude settles at lowest level of 2022 after European embargo and G7 price cap take effect. This week marked a pivotal moment in global geopolitics, as a European embargo and G7 price cap on Russian crude came into force. All of this would ordinarily have sent oil prices sharply higher, especially just weeks after the Opec+ cartel surprised the market by announcing deep new supply cuts. Yet on Thursday, the international oil benchmark Brent settled at $76.15 a barrel, a new low for 2022. What is going on? But the G7’s price cap plan aims to take the edge off.”, The Financial Times, December 8, 2022

“How retailers in Europe can navigate rising inflation – With inflation at record highs throughout Europe, retailers are under more pressure than ever. Those that act quickly and follow a holistic playbook can be well positioned to thrive. In this article, we examine the current state of inflation in Europe, take a quick dive into rapidly changing consumer behavior and sentiment, and draw lessons from previous periods of economic volatility. Finally, we describe a holistic approach that can help retailers think about how to simultaneously tackle inflationary challenges and build long-term resilience.”, McKinsey, December 7, 2022

Global & Regional Travel Updates

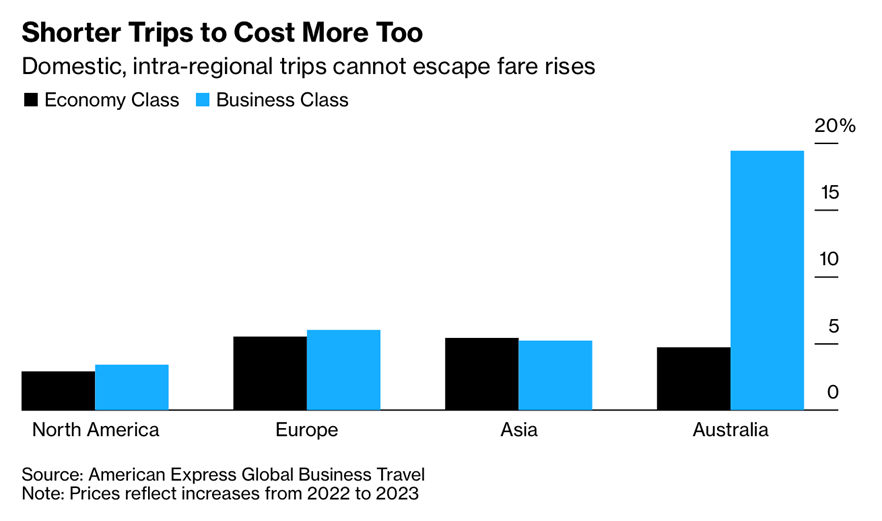

“Airfares Set for Big Jump Again in Business and Economy in 2023 – Airfares will increase around the world next year, by as much as 12% on Europe-Asia routes and 10% for North America-Asia flights, according to American Express Global Business Travel. Asia, which was slower to lift Covid travel curbs, is set for some of the biggest changes as demand swells, Amex GBT said in its Air Monitor 2023. The region’s relatively strong economic prospects could also push up prices, it said. With Europe also seeing a shortfall of airline capacity versus demand, intra-regional airfares are expected to climb 6% in business and 5.5% in economy next year, Amex GBT said.”, Bloomberg, December 8, 2022

“Delta Will Restart Service to Cuba Next Year — What to Know. Starting April 10, 2023, the airline will fly two daily nonstop flights from Miami International Airport. Delta joins JetBlue and American Airlines, which each received permission to service more flights to Cuba. The new service also comes months after the Biden administration started allowing commercial and charter flights to fly to cities beyond just Havana.”, Travel and Leisure magazine, December 12, 2022

Country & Regional Updates

Asia

Australia

“Soaring coal delivers Chalmers a Christmas miracle – Soaring iron ore, coal and natural gas prices are set to add $58 billion to tax revenue over four years and deliver Treasurer Jim Chalmers a Christmas miracle – a federal budget bottomline temporarily in balance. But while a boon for exporters, high commodity prices are driving domestic inflation, placing huge strain on household budgets, and forcing a major intervention in the energy market by the Albanese government.”, Australian Financial Review, December 4, 2022

China

“Chinese Cities Continue Shift From ‘Zero-Covid’ – Major cities across China including Beijing, Shanghai and Guangzhou, have further eased local Covid-19 restrictions on travel and quarantine after the country announced sweeping changes to its virus control regime. Following the announcement, searches containing the key word “air tickets” surged 160% on ctrip.com. Searches for the tickets on flights departing a few days before next month’s Lunar New Year soared to the highest level in three years on the online travel service platform.”, Caixin Global, December 8th, 2022

“Shanghai Disneyland Reopens as Businesses in China Welcome Covid-Control Easing – Cautious optimism spread among foreign companies over the rollback of some zero-Covid measures, though challenges remain…..Beijing on Wednesday announced the end of many measures, including requirements covering quarantine and testing as well as restrictions on domestic travel…The policies have damaged consumer sentiment, curtailed economic growth and brought heavy disruptions to foreign businesses with large operations in the world’s second-largest economy.”, The Wall Street Journal, December 8, 2022

“China Halts Location Tracking App as Covid Restrictions Fall – Some residents say they have seen a surge in Covid cases even as official daily tallies drop. China is pulling the plug on a nationwide mobile tracking app that collects data on users’ travel movements, dismantling a symbol of one of the world’s sternest and most durable Covid-19 containment regimes even as cases continue to surge across the country. Authorities said Monday that the mobile app, a cornerstone of Beijing’s technocentric approach to throttling the pandemic, would disappear by day’s end, part of China’s swift retreat from the “zero-Covid” approach that it has adhered to for the past three years.”, The Wall Street Journal, December 12, 2022

European Union

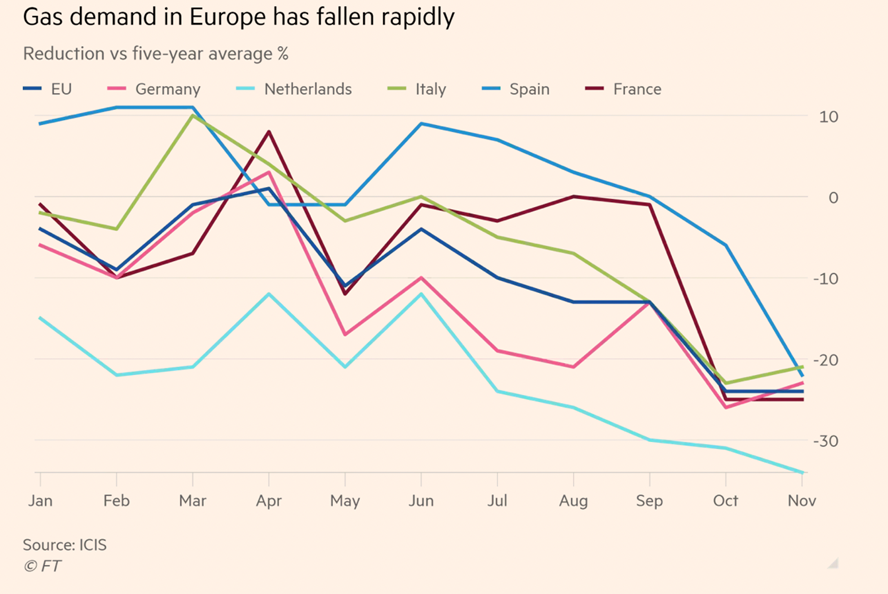

“Where next for Europe’s industry? More evidence that factories have weathered the energy crisis well. The impact of the energy crisis on European industry continues to be debated hotly. When I (Martin Sandbu) highlighted in last week’s Free Lunch how well the continent’s manufacturing has held up, the reactions varied from denial to surprised delight. Start with Europe’s impressive ability to adapt to higher natural gas prices. My colleague Shotaro Tani added to the evidence of this, reporting on Monday that European users cut consumption by one-quarter in both October and November, relative to five-year averages. This was largely accounted for by cuts in industry demand for gas.”, The Financial Times, December 8, 2022

India

“India’s Outlook Is Surprisingly Bright – Why investors might want to park their cash in the Asian country. India’s resilient economic growth—despite global weakness—gives India’s central bank leeway to tackle inflation without worrying about a steep slowdown, particularly with Brent oil down about $40 a barrel from its midsummer highs. India’s September quarter growth came in at 6.3%, significantly lower than the previous quarter’s but much better than developed markets and many emerging markets. The RBI expects India to grow 6.8% in the current fiscal year ending in March.”, The Wall Street Journal, December 8, 2022

Mexico

“Mexican state brings back mask mandate as COVID numbers rise – A northern Mexican state reintroduced the obligatory use of face masks in closed public spaces, officials said on Monday, in a bid to reduce rising COVID-19 infections, as well as the spread of other respiratory diseases. The health minister of Nuevo Leon state, home to Mexico’s third-biggest city Monterrey, highlighted the updated guidelines in a news conference, and said that the measure will go into effect immediately.”, Reuters, December 12, 2022

New Zealand

“Air New Zealand raises first half profit outlook on travel demand – The increased profit outlook follows a moderation in fuel prices in recent weeks and assumes that the airline will fly about 75% of its pre-COVID capacity levels across the network in December, according to Air New Zealand.”, Reuters, December 7, 2022

United Kingdom

“UK banking rules in biggest shake-up in more than 30 years – The government has announced what it describes as one of the biggest overhauls of financial regulation for more than three decades. It says the package of more than 30 reforms will “cut red tape” and “turbocharge growth”. Rules that forced banks to legally separate retail banking from riskier investment operations will be reviewed.”, Yahoo News, December 9, 2022

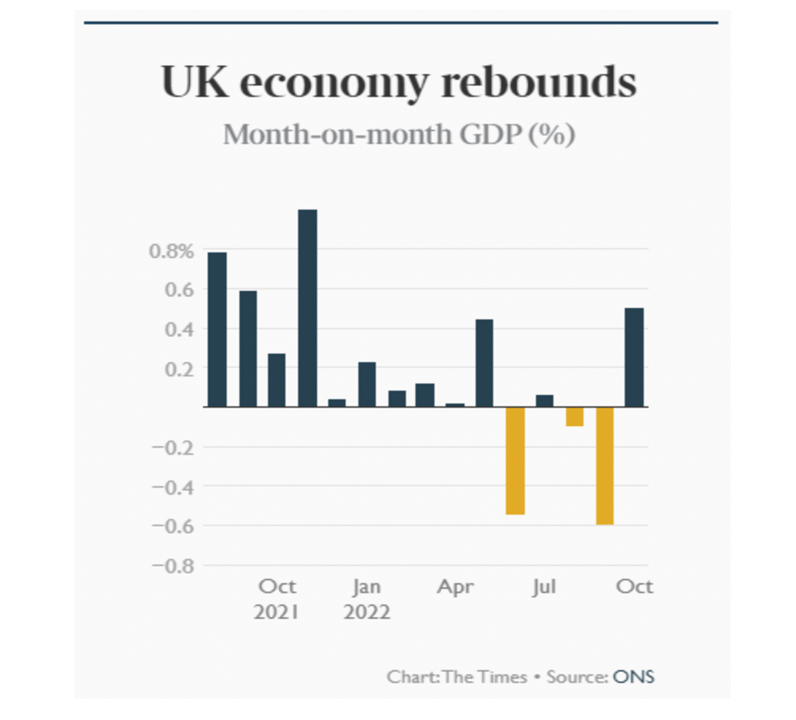

“UK Economy Rebounds – The UK economy returned to growth in October following a 0.6 per cent fall in September, according to the latest data released this morning by the Office for National Statistics. Month-on-month gross domestic product rose 0.5 per cent. City economists had forecast growth of 0.4 per cent. September’s fall was largely attributed to the extra Bank holiday for the Queen’s funeral. In the three months to the end of October the economy contracted 0.3 per cent.”, The Times of London, December 12, 2022

United States

“U.S. third-quarter productivity raised; labor costs still running high – U.S. worker productivity rebounded at a bit faster pace than initially thought in the third quarter, though the trend remained weak, keeping labor costs elevated. Nonfarm productivity, which measures hourly output per worker, rose at a 0.8% annualized rate last quarter. That was revised up from the 0.3% pace reported last month and ended two straight quarterly decreases.”, Reuters, December 7, 2022

“Economists think inflation has peaked. Main Street is preparing for more pain – More players in the stock market and among the ranks of professional economists have come around to the view that inflation has peaked or already is in decline, but small business owners on Main Street don’t expect a reprieve from high prices any time soon, according to a new CNBC poll.An overwhelming majority (78%) of America’s entrepreneurs say they expect inflation to continue to rise, according to the quarterly CNBC|SurveyMonkey Small Business Survey. That is effectively unchanged from last quarter when 77% said they expected inflation to continue to rise.”, CNBC, December 10, 2022

“The Next Career Move For Americans Looking For A Healthier Lifestyle: Working For Themselves – Even with a record number of traditional jobs available, the number of independent workers in the U.S. keep climbing, according to new research. There are now 64.6 million independent workers in the U.S., according to “Happier, Healthier Wealthier: The State of Independence in America,” issued by MBO Partners, a provider of back-office services to independent workers. The report found that the number of full-time independents—those working 15 hours a week or more—is 21.6 million, up from 15.3 million in 2019.”, Forbes, November 30, 2022

Brand & Franchising News

“Applebee’s owner to acquire Fuzzy’s Taco Shop for $80M – Dine Brands Global, which also operates IHOP, will get its long-desired growth concept in the 138-unit fast-casual brand. On Monday, the owner of Applebee’s and IHOP, which has been expressing a desire to acquire a third concept for years, finally pulled the trigger on one, agreeing to acquire Fuzzy’s Taco Shop from NRD Holding Co. for $80 million in cash. Dine believes this will give it a growth chain and its first limited-service concept.”, Restaurant Business, December 5, 2022

“Burger King Has Released A Winter Whopper In Japan – Earlier this year in August, (Wendy’s) Japan released an Icy Whopper with a layer of shaved ice in the burger. Thankfully, this latest edition of the Whopper won’t include any ice, which probably wouldn’t be the top meal choice on a chilly winter day. According to The Street, the Winter Whopper includes gouda cheese and a spicy hot sauce. Burger King Japan’s Twitter account posted a photo that reveals this burger will hit stores on Friday, December 9.”, Mashed.com, December 12, 2022

“Here’s how Denny’s fits into the evolving family-dining breakfast category – Denny’s CEO Kelli Valade discusses brand synergy with new acquisition Keke’s, the future of the 24-hour operations model, and how customers are evolving. Valade spoke about the evolution of family dining— including the brand’s new acquisition of Florida-based Keke’s Breakfast Café, labor challenges, and operations changes — during the last CREATE Live Digital Learning Session of 2022 with NRN Senior Editor Ron Ruggless.”, Nation’s Restaurant News, December 8, 2022

“Listed Australian pizza chain franchisor Domino’s Pizza Enterprises (DPE) is expanding its footprint in Asia and Europe with a completed acquisition and the launch of an equity capital raising, according to a media report. On November 30, Domino’s advised stakeholders that their acquisition of Domino’s Malaysia and Domino’s Singapore was complete. The company’s acquisition of Domino’s Cambodia is expected to be completed in Q1 of 2023, subject to regulatory approvals. Meanwhile, DPE is also seeking to raise a total of $165 million to buy out its business partner in the German market.”, Compliments of Jason Gerhrke, the Franchise Advisory Centre, Brisbane.

“Lynx Franchising and Outdoor Living Brands Rebrand as Empower Brands – The launch of Empower Brands comes following Lynx’s September 2021 acquisition of Outdoor Living Brands. After months of integrating the two organizations, Lynx Franchising and Outdoor Living Brands decided the best way to continue moving these brands forward was to combine forces under one, unified name. Together as Empower Brands, the team can provide more experience and an even stronger commitment to providing franchisees with a winning playbook and the right resources to pursue their long-term goals.”, Franchising.com, December 9, 2022

“9Round Finalizes Deal to Bring Facilities to South India – 9Round Franchising, LLC, has finalized a master franchise agreement to expand into South India. South India’s master franchisees Arun Bharathi, Balaji Jeyakumar and Sharmila Jayakumar will open the country’s first 9Round location in Chennai or Bangalore in early 2023. Balaji is an accomplished professional with more than nine years of experience in operations and supply chain management. Sharmila has experience in supply chain management, product development, and market research, as well as strategic planning.”, Franchising.com, December 9, 2022

“McDonald’s Careful Moves Pay Off – The fast-food leader introduces new store concepts, new menu items, and more. McDonald’s is possibly the most old-fashioned of all the big fast-food chains, rarely making major changes to its classic menu. That’s not to say Mickey D’s doesn’t embrace modernity in its own way, though. Its new test restaurant concept in Fort Worth, Texas, is smaller than its usual locations and introduces the Order Ahead lane, specifically designed for people who placed their orders using the McDonald’s app.”, The Street, December 12, 2022

“Wendy’s Is Now the Most Expensive Fast Food Restaurant in the U.S., New Data Says – Wendy’s earns the notorious title of the most expensive fast food chain this year, beating out last year’s “winner” Burger King. Wendy’s prices increased by an eyebrow-raising 35% this year, representing the largest increase in 2022 among analyzed chains (average price: $6.63).”, Eat This, Not That!, December 9, 2022

“Xponential Fitness Signs Master Franchise Agreement in Japan – The agreement was signed with Wellness X Asia, Xponential’s existing Master Franchise Partner in Japan for Club Pilates and CycleBar. Wellness X Asia (formerly Club Pilates Japan Co. Ltd.) will now be responsible for the country-wide development of Rumble and AKT, in addition to Club Pilates and CycleBar.”, Franchising.com, December 9, 2022

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the world that impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ covering 25+ countries provides us with updates about what is happening in their specific countries.

To sign up for our biweekly newsletter click here: https://bit.ly/geowizardsignup

During an extraordinary four-decades in international business, William (Bill) Edwards has played a leadership role in the global growth of more than 40 brands. He is widely recognized as an International Problem Solver, Strategist, Advisor and a specialist on global cultures. His career covers international operations, executive and entrepreneurial experience in the energy, technology, licensing, management consulting and retail sectors. He has been a technical specialist, manager, brand senior executive and country president.

Over the years, Bill has made or seen almost every mistake that companies can make when going global. He understands the global company world like few others. As a Global Advisor, he now shares his experiences and wisdom with senior executives to help them successfully navigate the complex international company growth landscape. For hard learned advice on taking your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking