EGS Biweekly Global Business Newsletter Issue 73, Tuesday, January 10, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

In this issue you will find more predictions on the global economy and consumer trends in 2023 as well as updates on global inflation, energy prices, the work week, air travel, 10 countries and 9 international brands. The history of McDonald’s® in Russia is an interesting case study for all companies taking their businesses global. And soon we will be able to use our cell phones during flights in Europe!

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here:

https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others

“Try not to become a man of success. Rather become a man of value.”, Albert Einstein

“When you change your thoughts, remember to also change your world.”, Norman Vincent Peale

“I’m a greater believer in luck, and I find the harder I work the more I have of it.” , Thomas Jefferson

Highlights in issue #73:

- Brand Global News Section: Burger King®, Chiplote®, Dominos®, Gelatissimo®, McDonald’s®, Popeyes®, Starbucks®, Wendy’s®, White Castle®

NOTE: Bolded headlines in this newsletter are live links where the article is available without a paid subscription.

Interesting Data and Studies

“5 Top Issues Our Columnists Are Watching in 2023 – (Foreign Policy ) FP columnists identify key trends and events to look out for in the coming year.Each December, we survey some of our experts for the most important issue they’ll be following in the coming year. Beyond the most obvious one—Russia’s ongoing war in Ukraine—here are five things Foreign Policy columnists are keeping an eye on in 2023.”, Foreign Policy magazine, January 2, 2023

“Global Consumer Trends 2023 Report: Rediscovering the Human Connection – ‘We spoke to more than 33,000 consumers in 29 countries around the world to find out what businesses need to do to win their loyalty. The answer? Act more human.’ That’s from the introduction to “2023 Global Consumer Trends,” a 31-page report from the Qualtrics XM Institute. As the pendulum continues to swing toward ever-greater use of technology, the report urges businesses seeking to improve their customer service to make 2023 the year they improve the balance of the human component in their customers’ experience.”, Franchising.com, January 1, 2023

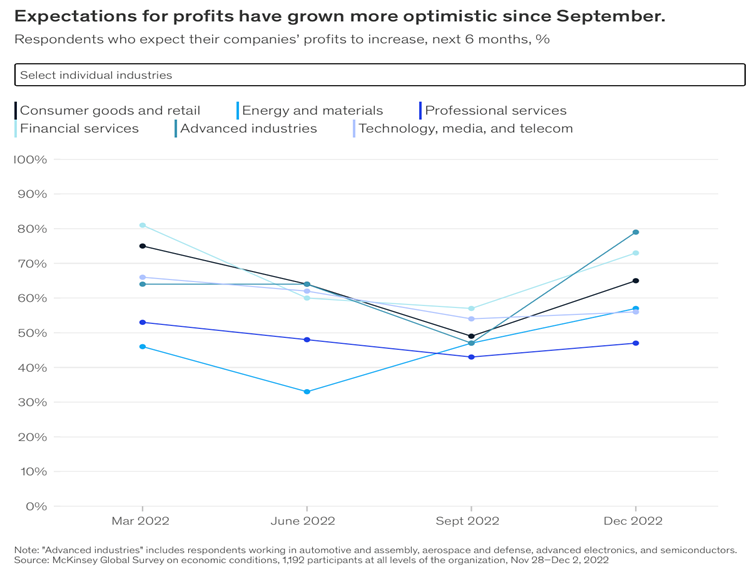

“(McKinsey) Survey results: Expectations for company performance – Compared with last quarter, respondents share more optimistic views for their companies’ future profits. However, expectations overall for company performance are more muted than at the start of 2022. Respondents are much more likely now, compared with the September survey, to expect profits to increase: 59 percent say their companies’ profits will grow in the next six months, up from 51 percent in the previous survey. We see optimism increasing in each industry.”, McKinsey, December 21, 2022

“Is the 4-Day Work Week the Future of Work? Where did the 5-day work week come from? Who invented it? It is right for 2023, or are there better alternatives? Could 4 days be the flexible future of our work week? Or is 35 hours a week the right number, with business leaders allowing employees the option of spreading those 35 hours over however many days a week they prefer? A 4-day work week trial has been running since January 2022 across several countries, where more than 70 firms are taking part in the scheme where employees get 100% pay for 80% of their normal hours worked. After six months, data shows that productivity has been maintained or improved at most firms.”, Franchising.com, January 2023

“The safest place in the world to live is across the ocean: This country ranks most peaceful – Iceland is the world’s most peaceful country, making it a top option for the safest place to live. The Woodlands, just outside of Houston, Texas, is ranked the best city to live in America. New England states dominate the charts of the safest states to live in the United States. The top ten most peaceful countries, according to the 2022 GPI (Global Peace Index):

- Iceland

- New Zealand

- Ireland

- Denmark

- Austria

- Portugal

- Slovenia

- Czech Republic

- Singapore

- Japan

From USA Today, January 1, 2023

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

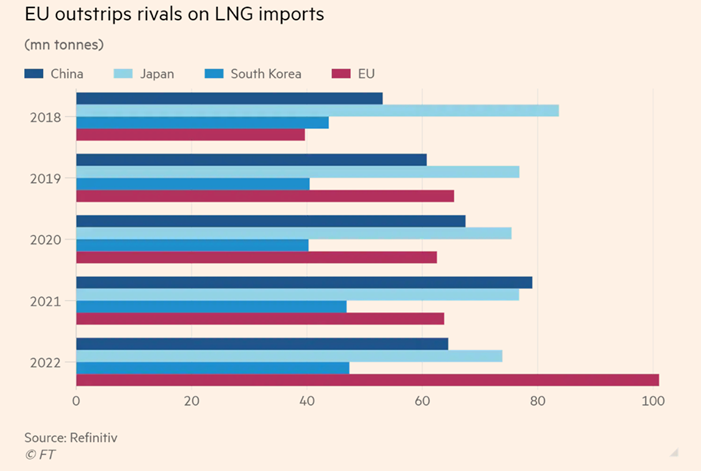

“Europe leads pack on LNG imports as global competition for fuel heats up – EU nations bought 101mn tonnes last year — 58% more than in all of 2021. Europe was the largest customer in the global liquefied natural gas market in 2022, with the region importing substantially higher volumes than rival buyers as it seeks to replace dwindling Russian pipeline gas supplies. In previous years, the EU lagged behind Japan and China on LNG imports, but Russia’s weaponisation of energy since its invasion of Ukraine has forced the bloc to seek alternative fuel supplies.”, The Financial Times, January 7. 2023

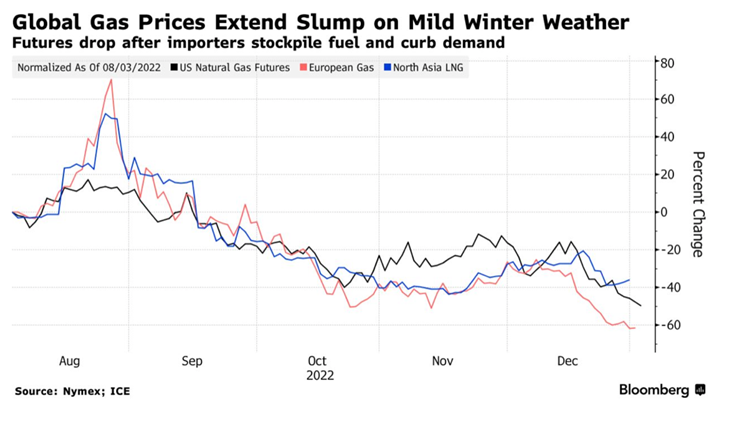

“Natural Gas Prices Are Plunging On a Warmer Start to Winter – Milder weather seen from Europe to China over next few weeks. Gas rationing unlikely as top importers have built stockpiles. A warmer-than-expected start to winter in large parts of the world that could linger for weeks — especially across the US — is easing fears of a natural gas crisis that had been predicted to trigger outages and add to power bills. Forecasts point to temperatures above seasonal norms for most of Europe and the US over the next several weeks. It’ll also be more mild across much of China — the world’s biggest gas importer — over the next 10 days, and Tokyo may see a temperature spike around mid-January.”, Bloomberg, January 2, 2023

“Lower energy prices put brakes on eurozone inflation – The sharp decline in CPI was driven by an easing in annual energy price inflation which rose by 25.7 per cent last month compared with the same period in 2021, down from the 35 per cent climb recorded in November. Despite the drop in headline inflation, a measure of core inflation which strips out volatile elements like energy, rose by 20 basis points to a fresh record high of 5.2 per cent last month. Services prices also rose from 4.2 per cent to 4.4 per cent, in a sign that underlying inflationary pressures remain strong.”, The Times of London, January 7, 2023

“Shipping Companies Face More Dangerous Shoals – A price war among shipping companies is looking more likely next year: Slowing growth amid high inflation and interest rates in the U.S. and an energy crisis in Europe may culminate in recession. And the demand cliff comes as the shipping industry is also preparing for a massive delivery of new vessels. Drewry expects 2023 will witness the largest ever addition of new ship capacity—about 2.5 million twenty-foot equivalent units (TEU), unless some deliveries are deferred. Shipping companies will struggle to manage a simultaneous decline in global trade and a surge in ship supply unless they can form alliances to curtail sailings, sell excess capacity and convince clients to sign on to long-term contracts.”, The Wall Street Journal, December 30, 2022

Global & Regional Travel Updates

“Flight Mode Off: EU To Allow Phone Use On Planes – The EU has agreed to allow phones to be used on airplanes without the need to turn phones to flight mode—a change that will make a lot of travelers very happy indeed. Thierry Breton, EU Commissioner for the Internal Market said in a statement that ‘the sky is no longer a limit when it comes to possibilities offered by super-fast, high-capacity connectivity.’ (5G) The European Commission passed the ruling although it is not yet clear when and how it will work—EU member states have been given the deadline of June 30, 2023 to enable 5G technology aboard all aircraft.”, Forbes, December 26, 2022

“Will 2023 Bring China’s Tourism Recovery? Chinese international travelers had been the world’s biggest tourism spenders for a while before the pandemic crashed international tourism markets. Chinese tourist won’t have to quarantine anymore upon returning to their home country starting January 8. As seen in data by the UN World Tourism Organization, expenditures of outbound travelers from China were still down 58 percent on average from 2019 as of June 2022.”, Statista, January 2, 2023

“Delta Air Lines to Offer Free Wi-Fi Starting Feb. 1 – Delta Chief Executive Ed Bastian said Thursday that about 80% of Delta’s U.S. domestic mainline fleet will be equipped to launch the free offering at the start of next month, with more aircraft being added weekly. The airline said free Wi-Fi will be available on more than 700 planes by the end of this year, with the service expanding to all of Delta’s international and regional planes by the end of next year.”, The Wall Street Journal, January 5, 2023

Country & Regional Updates

Australia

“Wine, Lobsters Could Be Next in China-Australia Trade Thaw – China’s trade restrictions on Australian wine, lobsters and other commodities could be the next to ease amid a warming of diplomatic ties and expectations that Beijing will soon resume imports of coal. Curbs on commodity imports will probably be eased gradually and in an unofficial manner, said Hans Hendrischke, professor of Chinese Business and Management at the University of Sydney. While there’s some confidence that restrictions will be lifted, there’s currently no indication of timing, he said.”, Bloomberg, January 5, 2023

Canada

“Small business outlook for year improves slightly, but still shows recession fears – The Canadian Federation of Independent Business says the outlook among entrepreneurs for the 12 months ahead improved slightly from last month but remains quite low. The group says its latest survey found its small business confidence indicator registered 50.9 index points in December, up 0.9 points over last month. It says that while an improvement, it remains at levels usually only seen around recession periods, while the short-term outlook dropped more than three points to 40.2.”, The Globe and Mail, December 29, 2022

China

“China Is Open Again. 13 Ways to Tap Into Its Recovery Right Now – Chinese stocks look poised to keep bouncing into the Year of the Rabbit. As authorities peel back some of the last Covid restrictions this weekend and policy makers prioritize reviving the world’s second largest economy, Chinese stocks stand to recoup some of the steep losses of the past two years.”, Barron’s, January 7, 2023

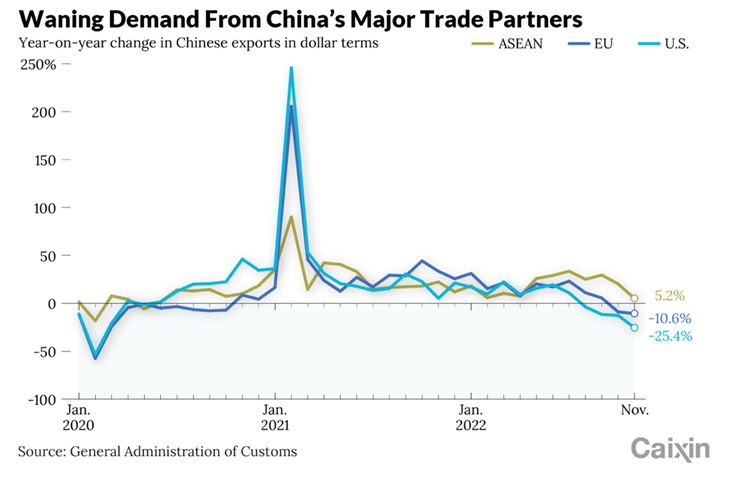

“China’s Struggle to Contain Covid Hits the Economy Hard – Faced with faltering demand at home and abroad, China’s GDP has been expanding well below target this year. Exports used to be a major driver of China’s economic recovery, but that has been tapering off. But since August this year, export growth has slowed or even slipped into negative territory, as demand from the world’s three largest importers of Chinese goods, the U.S., the EU and Southeast Asia, has weakened as high inflation has weighed on consumers’ purchasing power and inventories have piled up.”, Caixin Global, December 30, 2022

Germany

“Germany’s finance minister sees 2023 inflation at 7% – Germany’s finance minister expects inflation in Europe’s biggest economy to drop to 7% this year and to continue falling in 2024 and beyond, but believes high energy prices will become the new normal. Pushed by spiking energy prices following Russia’s invasion of Ukraine and falling Russian energy exports, Germany’s year-on-year inflation has slowed slightly in November to 11.3% from a high of 11.6% the month prior.”, Reuters, January 1, 2023

India

“India will become the world’s most populous country in 2023 – China is now suffering from a demographic slump. CHINA HAS been the world’s most populous country for hundreds of years. In 1750 it had an estimated 225m people, more than a quarter of the world’s total. India, not then a politically unified country, had roughly 200m, which ranked it second. In 2023 it will seize the crown. The UN guesses that India’s population will surpass that of China on April 14th. India’s population on the following day is projected to be 1,425,775,850.”, The Economist, November 14, 2023 (update from previous article)

“Indian economic growth to slow to 7% in 2022/23, govt forecasts – India’s government expects economic growth to slow in the financial year ending March, as pandemic-related distortions ease and pent-up demand for goods levels out going into 2023. Gross domestic product (GDP) will likely rise 7% this fiscal year, compared with 8.7% the previous year, the Ministry of Statistics said in its first estimate for the period that put manufacturing growth at just 1.6%.”, Reuters, January 6, 2023

Spain

“Spanish services activity expands again in December – Activity in the Spanish services sector expanded for the second consecutive month in December, supported by a marginally better demand environment amid slowing inflation, a survey showed on Wednesday. S&P Global’s Purchasing Managers’ Index (PMI) for Spain’s services sector, which accounts for around half of Spanish economic output, rose to 51.6 last month from 51.2 in November, above the 50.0 mark that separates growth from contraction.”, Reuters, January 4, 2023

Thailand

“Thailand’s GDP will increase by 3.2% in 2022 and 4.5% in 2023 (Fitch) – During its 2022 Thailand Sovereign and Bank Outlook Webinar, Fitch Ratings analysts said that Thailand’s economic recovery is improving, despite growing inflationary pressures and weaker global growth posing risks to the short-term comeback…..supported by steady improvements in tourism and domestic demand, while noting that higher inflation and slower global growth are downside risks to the forecast.”, Fitch, December 2022. Compliments of Sean Ngo, VF Franchising, Ho Chi Minh City

United Arab Emirates

“Dubai announces $8.7 trillion economic plan to boost trade, investment and global hub status – Dubai aims to double the size of its economy in the next decade and become one of the “top 3 economic cities around the world,” Sheikh Mohammed bin Rashid al Maktoum, the ruler of Dubai, tweeted. Recent years have seen Dubai roll out a flurry of reforms aimed at making it more attractive for foreigners and international companies to live and invest.”, CNBC, January 4, 2023

“Dubai scraps 30% alcohol tax and licence fee in apparent bid to boost tourism – It will also stop charging for personal alcohol licences – something residents who want to drink at home must have. Dubai has been relaxing laws for some time, allowing the sale of alcohol in daylight during Ramadan and approving home delivery during the pandemic. This latest move is thought to be an attempt to make the city more attractive to foreigners, in the face of competition from neighbours.”, BBC News, January 2, 2023

United Kingdom

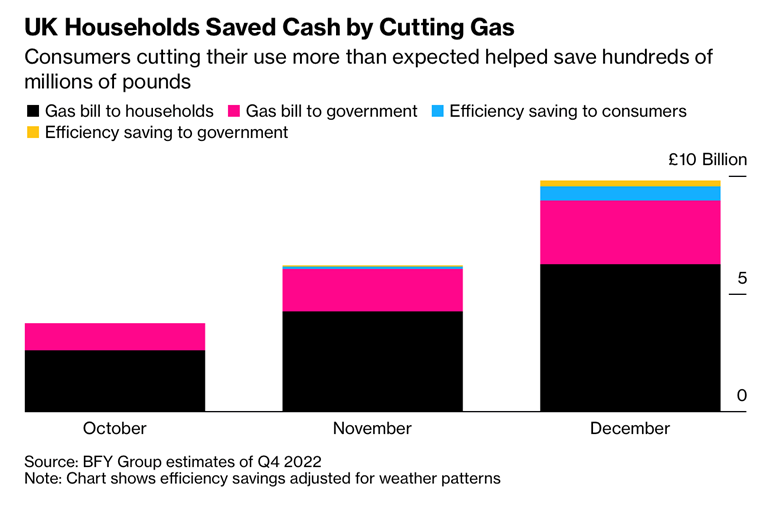

“British Households Dialed Down Winter Gas Use to Save Cash – Use in homes was 8.7% below expectations, says BFY Group Savings show consumers’ power to lift strain on energy system. The figures are some of the first signs of British consumers’ ability to find energy savings in their homes amid record-high prices for heating. Governments in Germany and France have been more proactive in encouraging energy saving than in the UK, which only launched a campaign for demand reduction in December.”, Bloomberg, January 6, 2023

“Bosses toast reasons to cheer in 2023 – The year ahead will make a bumpy start, but business chiefs hope for a rebound after a likely bumpy start. ‘We think inflation is likely to have peaked in the fourth quarter, the Bank rate will reach 4 per cent in early 2023 and GDP will contract by about 1 per cent next year,’ said Charlie Nunn, head of Lloyds Banking Group. Cyrus Kapadia, chief executive of Lazard’s UK financial advisory arm said: “Financial markets could rebound more quickly than some expect. Despite the current economic slowdown, balance sheets remain relatively strong.”, The Times of London, January 1, 2023

United States

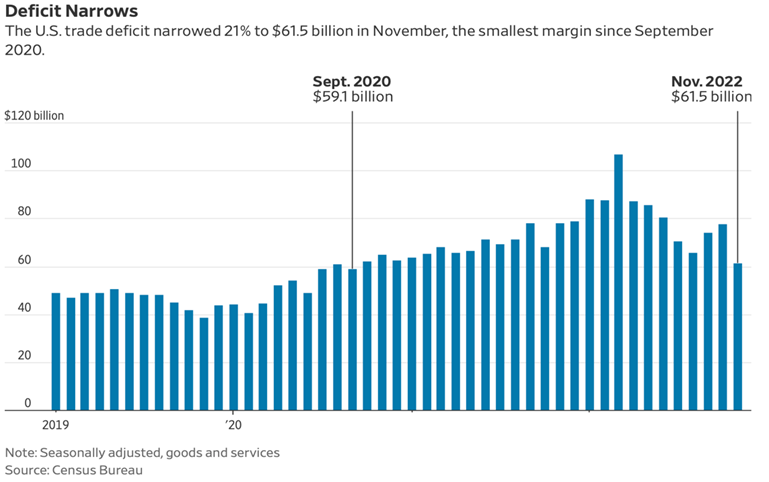

“U.S. Trade Deficit Narrowed Sharply in November as Global Demand Cooled – American imports fell more than exports amid high inflation and interest rates. U.S. commerce with the rest of the world declined significantly in November, shrinking the U.S. trade deficit by more than a fifth and adding to signs of a global economic slowdown through the holiday season. U.S. exports fell 2% in November from October, reflecting an ebbing appetite abroad for American products—including aircraft, food and telecommunications equipment—the Commerce Department reported Thursday.”, The Wall Street Journal, January 5, 2023

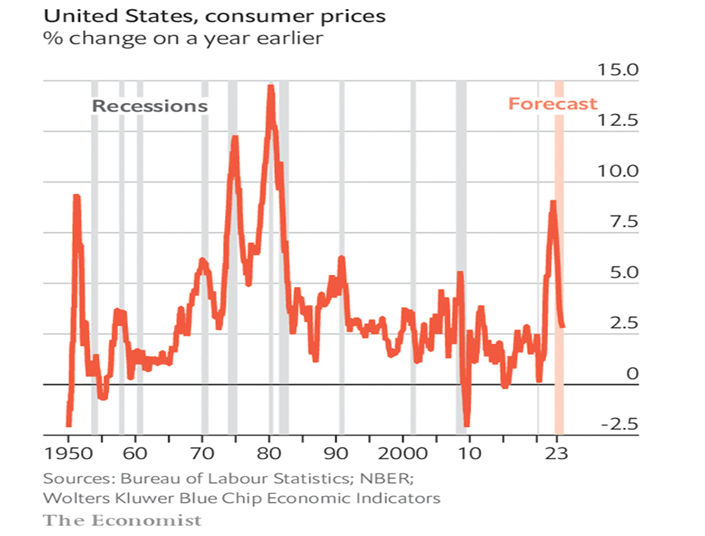

“The American economy is set for a downturn, not a crisis – The coming recession looks likely to be mild. America is heading for a recession in 2023. Over the past half-century, whenever inflation has reached an annual pace of more than 5%, it has always taken a recession to wring it out of the economy. But it will not be all gloom. There is reason to think that the coming recession will be mild. Throughout the past year the number of open jobs has far outstripped the number of available workers. Disinflation will eventually take hold, turning into outright month-on-month deflation when the recession strikes. That ought to spell the end of the Fed’s rate-increase cycle by the middle of the year, with the focus instead shifting to when it might start to loosen policy.”, The Economist, November 18, 2022

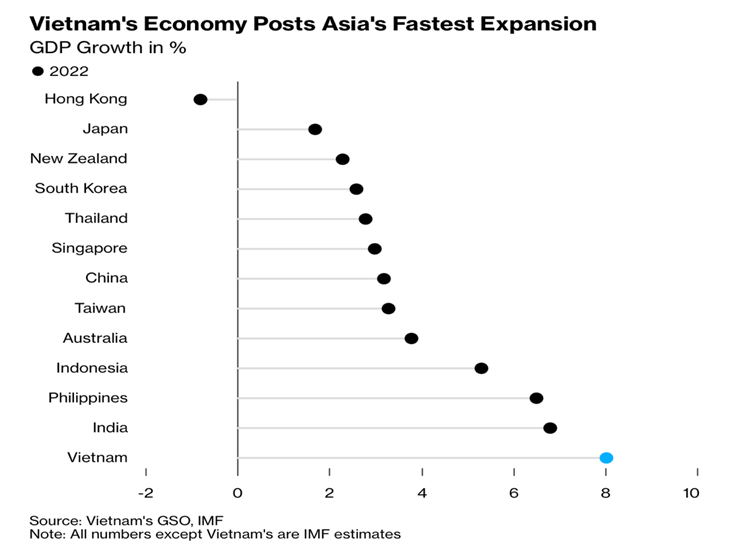

Vietnam

“Vietnam Pulls Off Asia’s Fastest Growth as Economy Powers On – GDP grows 8.02% in 2022 signaling momentum to recovery Growth beats government’s initial full-year target of 6%-6.5%. Vietnam’s economy grew at the fastest pace in Asia this year, signaling momentum just before risks from a global slowdown began to materialize.”, Bloomberg, December 28, 2022

Brand & Franchising News

“Chipotle and White Castle are spending hundreds of thousands a month on automation to combat labor shortages and rising food costs – but it is still cheaper than paying human workers. Fast-food chains are employing robots that flip burgers, brew espressos and greet customers. The move to automation is due to labor shortages and rising food costs. White Castle uses a burger-flipping, fry-making robot at 100 of its locations, each costing $3,000 a month. Chipotle has a robot that makes tortilla chips at one site – but refused to tell DailyMail.com how much it pays. The cost of these robots is cheaper than paying a human worker”, The Daily Mail (UK), January 3, 2023

“Domino’s franchisee opens 600th store in Dubai – Middle East-based Alamar Foods has opened its 600th Domino’s Pizza store in Dubai, according to a TradeArabia report. Alamar Foods in the master franchisee for Domino’s in the Middle East, North Africa and Pakistan.”, QSR Magazine, December 21, 2022

“Australian gelato franchise hits Hawaii – Gelatissimo, a 65-unit gelato concept based in Sydney, Australia, is offering American entrepreneurs a scoop of its multi-million-dollar franchise model as it rolls out its U.S. expansion plan. Opening a store in Hawaii next month at the Royal Hawaiian Center in Waikiki, the concept made its American debut earlier this year in Houston under the direction of franchisees Simon Stankevicius and Phanary Hok, who own several dessert concepts.”, Fast Causal, November 30, 2022. Compliments of Franchising.com

“How McDonald’s Won Russia—and Then Lost It All – For 30 years the fast-food icon turned meat, bread and potatoes into a display of capitalism that changed the way the country did business. Then Putin invaded Ukraine.” Bloomberg, January 3, 2023

“RBI signs master agreement to bring Popeyes, Burger King to Eastern Europe – Restaurant Brands International and McWin, a European franchisee, have signed a master agreement to bring Burger King and Popeyes to several countries in Eastern Europe. New restaurants are slated to open in 2023, according to a press release. McWin, through its newly established Rex Concepts CEE platform, is set to expand the Burger King brand in Czech Republic, Poland and Romania, and to bring the Popeyes to Czech Republic and Poland, with plans to open 600 restaurants throughout these countries over the next 10 years.”, QSR Web, November 30, 2022. Compliments of Franchising.com

“Starbucks commits to expanding in Việt Nam with 100th store plan – Starbucks is committed to expanding further in Việt Nam with its plan of opening the 100th store by the end of the second quarter this year – a decade after the first shop opened in HCM City in February 2013. Currently, the US coffee chain runs 87 outlets across seven cities and provinces nationwide with 50 in HCM City and 24 in Hà Nội and more than 1,000 employees (including 200 coffee masters).”, Vietnam News, January 6, 2023. Compliments of Paul Jones, Jones & Co., Toronto

“How Wendy’s Is Turning an All-American Chain Into a Brand for Brits – The brand’s signature sass has been adapted for UK audience. Since its U.K. relaunch in mid-2021, Wendy’s has opened 25 restaurants in the market, with sites in London, Sheffield and Brighton. Now, following a successful 18 months, it has ambitious plans to ramp things up with new spaces in Liverpool and Greater Manchester. The Ohio-founded chain’s most recent debut in the U.K. marked its third crack at the market following two previous unsuccessful forays.”, AdWeek, December 19, 2022

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ covering 25+ countries provides us with updates about what is happening in their specific countries.

To sign up for our biweekly newsletter click here: https://bit.ly/geowizardsignup

During an extraordinary four-decades in international business, William (Bill) Edwards has played a leadership role in the global growth of more than 40 brands. He is widely recognized as an International Problem Solver, Strategist, Advisor and a specialist on global cultures. His career covers international operations, executive and entrepreneurial experience in the energy, technology, licensing, management consulting and retail sectors. He has been a technical specialist, manager, brand senior executive and country president.

Over the years, Bill has made or seen almost every mistake that companies can make when going global. He understands the global company world like few others. As a Global Advisor, he now shares his experiences and wisdom with senior executives to help them successfully navigate the complex international company growth landscape. To take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link: