EGS Biweekly Global Business Newsletter Issue 76, Tuesday, February 21, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Introduction: This issue is eclectic! From falling inflation to employee ‘hoarding’ to phasing out gasoline cars (not really!) to air travel passing 2019 numbers to global gold demand soaring in 2022. Plus China’s falling inboard investment, Europe’s sources of electricity to Indonesia and India shining.

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here:

https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others

“There are no such things as limits to growth, because there are no limits on the human capacity for intelligence, imagination, and wonder.”, U.S. President Ronald Reagan

“The only place where success comes before work is in the dictionary.”, Vidal Sassoon

“Many of life’s failures are people who did not realize how close they were to success when they gave up.”, Thomas Edison

Highlights in issue #76:

- Brand Global News Section: Boost Juice®, Denny’s®, Dominos®, Taco Bell®, Texas Roadhouse®, Tim Horton’s, YUM® China

NOTE: Bolded headlines in this newsletter are live links where the article is available without a paid subscription.

Interesting Data and Studies

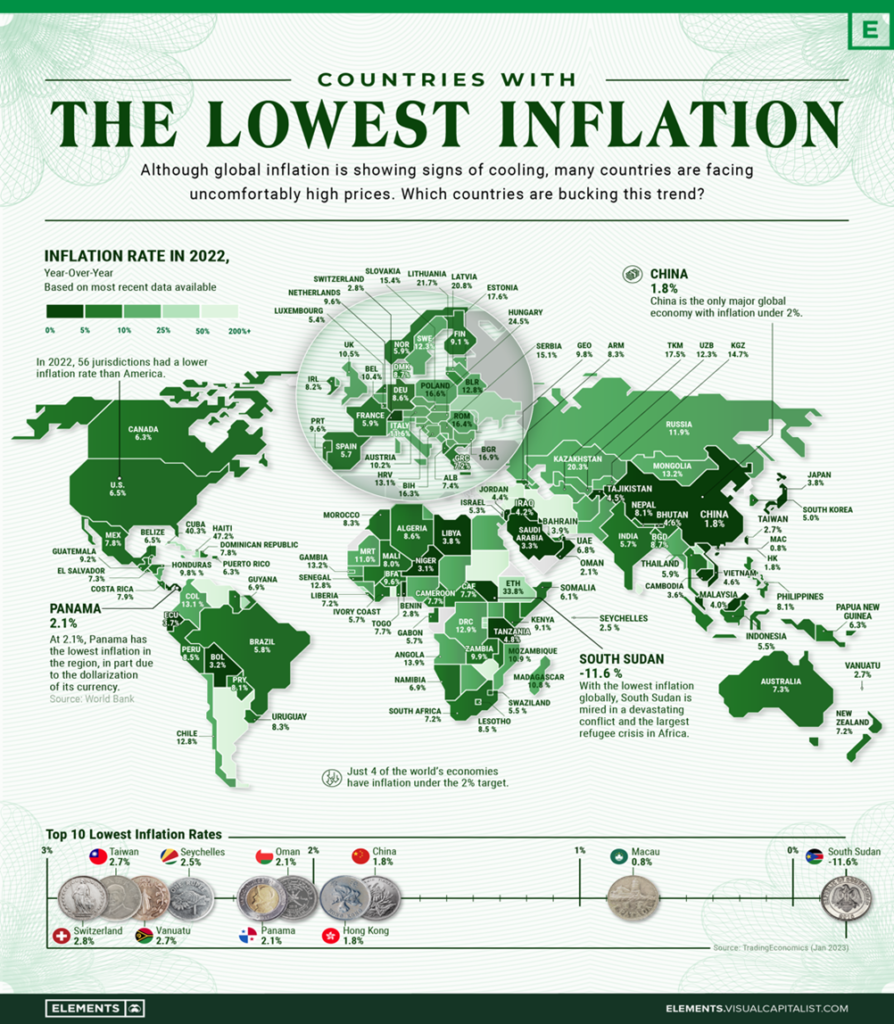

“Which Countries Have the Lowest Inflation? As price pressures rattle global markets, the above infographic maps inflation rates globally using data from Trading Economics, focusing in on the countries with the lowest inflation levels. Many of the lowest inflation rates around the world are located in Asia, including Macau, China, Hong Kong, and Taiwan. In this region, widespread lockdowns strained growth and consumer spending, lessening inflationary pressures. Last year, Chinese consumers saved $2.2 trillion in bank deposits during these restrictions which were lifted earlier this year.”, Visual Capitalist / Trading Economics, February 16, 2023

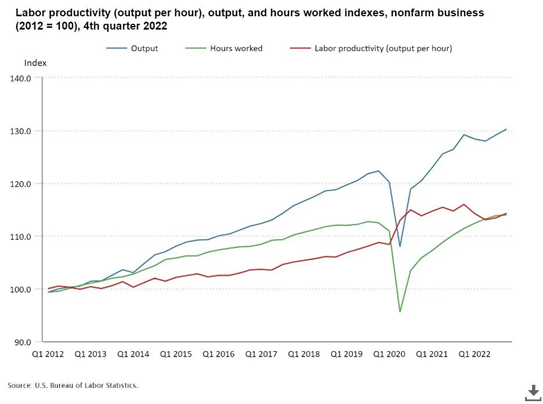

“The return to the office could be the real reason for the slump in productivity. Here’s the data to prove it. U.S. productivity jumped in the second quarter of 2020 as offices closed, and stayed at a heightened level through 2021. Then, when companies started mandating a return to the office in early 2022, productivity dropped sharply in Q1 and Q2 of that year. Productivity recovered slightly in Q3 and Q4 as the productivity loss associated with the return to office mandate was absorbed by companies–but it never got back to the period when remote-capable employees worked from home.”, Fortune, February 16, 2023

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

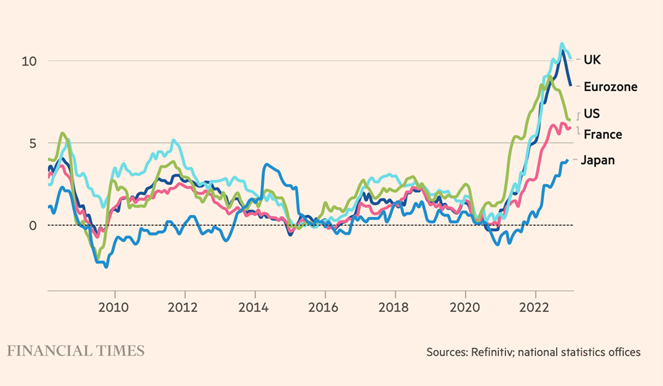

Data explorer: consumer price inflation – Annual % change in consumer price index

“Global inflation tracker – Inflation has started to show signs of easing from the multi-decade highs reached in many countries following Russia’s full-scale invasion of Ukraine. The latest figures for most of the world’s largest economies still make for worrying reading, with price pressures remaining high as the war in Ukraine continues to keep energy and food prices elevated. But in some countries pressures have eased and energy and food wholesale prices have declined. Economist and investors also expect inflationary levels to stabilise in the next few years. The Financial Times, February 15, 2023

“European natural gas prices fall to 18-month low as energy crisis ebbs – Mild weather boosts confidence that Europe will avoid shortages this winter and next. The benchmark gas price on Friday fell below €50 per megawatt hour for the first time in almost 18 months, down to €48.90/MWh, as traders report growing confidence that European countries will avoid shortages this winter and next. The gas benchmark peaked at more than €300/MWh in August 2022.”, The Financial Times, February 17, 2023

“Global Gold Demand Soars in 2022 Amid Search for Safe Havens – Global gold demand surged to an 11-year high in 2022, lifted by record buying by central banks and vigorous retail investment, sparked largely by a search for safe-haven assets during a year plagued by geopolitical shocks and rampant inflation. Annual demand for bullion — excluding over-the-counter trading — soared 18% year-on-year to 4,741 tons last year, hitting its highest level since 2011, according to a World Gold Council (WGC) report published Jan. 31.”, Caixin Global, February 9, 2023

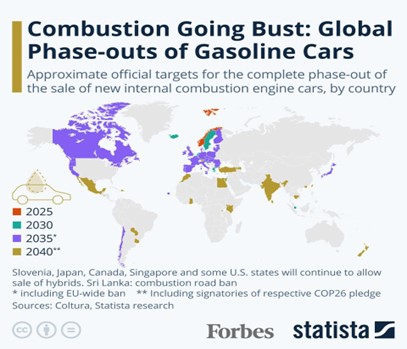

“Combustion Going Bust: Global Phase-Outs Of Gasoline Cars – When the European Union on Tuesday approved a law that will ban the sale of combustion engine cars in its member states from 2035, a whole list of countries received a deadline for how long new gasoline car will still be available from dealerships. California was the first state back in August to set a phase-out date for new combustion engine car sales, also for 2035. While there are 17 states that have tied their vehicle standards to California’s under the Federal Clean Air Act, several of them now want out as a full phase-out date has been set.”, Forbes, February 16, 2023

“The world won’t decarbonise fast enough unless renewables make real money – Governments must accept that green power is pricey. Last year global capital spending on wind and solar assets was greater than investment in new and existing oil and gas wells for the first time. Governments in America and Europe are spending billions on subsidies for clean tech over the next decade; China is offering juicy incentives, too.”, The Economist, February 16, 2023

Global & Regional Travel Updates

Air travel to surpass pre-Covid level demand this year – Air passenger demand in 2023 will rapidly recover to pre-pandemic levels on most routes by the first quarter and growth of around 3% on 2019 figures will be achieved by year end, according to the International Civil Aviation Organization (ICAO). ‘Assuring the safe, secure, and sustainable recovery of air services will be key to restoring aviation’s ability to act as a catalyst for sustainable development at the local, national and global levels, and will consequently be vital to countries’ recovery from the broader impacts of the Covid-19 pandemic, said ICAO Council President Salvatore Sciacchitano.”, Trade Arabia, February 16, 2023

“Travel Giant TUI Sees Summer Bookings Ahead of 2019 Levels – TUI AG said recent bookings for the upcoming summer are running ahead of pre-pandemic levels, the latest sign the travel sector is booming despite high inflation sapping consumer spending power. The world’s biggest tour operator said booking volumes since the start of the year exceeded 2019 levels, led by demand from travelers in the UK and Germany. Prices are also higher than pre-pandemic levels, the company said.”, Bloomberg, February 15, 2023

“The Safest Airlines In 2023 – Every airline offers something different—but aside from comfort, catering and service, safety has to be one of the most most important criteria for judging whether one is better than another. AirlineRatings.com have just announced the top 20 airlines for safety in 2023 after taking into consideration the following factors for all 385 airlines that it monitors: the number of crashes over the past five years; the number of serious incidents over the past two years, the audits from aviation’s governing bodies and lead associations, the age of the airline’s fleet, expert analysis of pilot training and Covid protocols.”, Forbes, February 8, 2023

Country & Regional Updates

Brazil

“Brazil’s economic activity rises 2.9% in 2022 – Brazil’s economic activity increased by 2.9% in 2022, according to a central bank index released on Thursday, boosted by the services sector and defying earlier predictions of mild growth, but with recent months’ performance showing loss of momentum. After starting the previous year with a forecast of a 0.3% expansion for the Brazilian economy in 2022, private economists surveyed weekly by the central bank now project 3% growth, on the back of resilient services activity and a stronger labor market.”, Reuters, February 16, 2023

Canada

“Canadian firms plan to increase salaries, hire while hedging against recession, surveys show – Canadian employers are looking to ramp up hiring as well as employee compensation through the first half of the year, while simultaneously taking measures to protect against a sudden change to the economic landscape.

With unemployment near a record low, the Canadian labour market remains historically competitive, despite widespread layoffs in the tech sector, inflation challenges, rising interest rates and fears of a looming recession. In response, businesses plan to increase spending on compensation to compete for talent in the first half of the year but are also leaving themselves some room to manoeuvre should economic circumstances change over the coming months.

A recent survey of 440 Canadian employers by HR consulting firm Normandin Beaudry found that half plan to increase their 2023 salary budgets for non-unionized workers by an average of 4.7 per cent.” The Globe and Mail, February 20, 2023

China

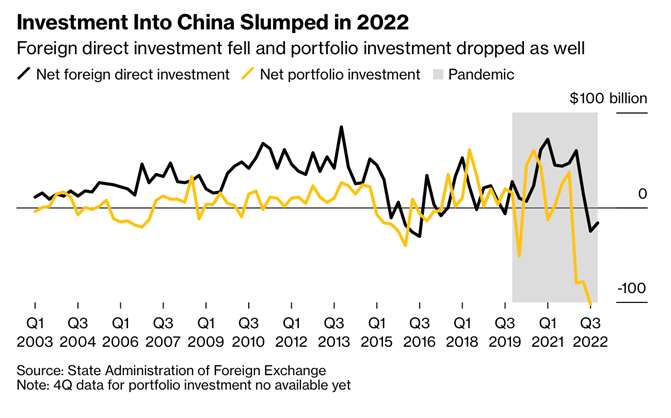

“Shanghai Must Lift Foreign Confidence After Covid – Foreign investment into China weak in 2022 as economy slowed China’s government is trying to attract more investment now. China should eliminate barriers to investment faced by foreign firms, as well as promote the yuan’s internationalization and strengthen financial support for smaller companies, the European Chamber of Commerce’s Shanghai chapter wrote in its biannual report published Tuesday.”, Bloomberg, February 13, 2023

“From Apple to VW, CEOs Gradually Returning to China After Its Reopening – Despite growing geopolitical tensions, companies pursue business opportunities. For many senior executives, it will be their first visit to the country since the Covid-19 pandemic began, after China—a top manufacturing hub and consumer market for many of the world’s largest companies—deepened its isolation for three years by slamming the door to international travel. As its economy struggles, Beijing is counting on such visits to attract investments from multinationals.”, The Wall Street Journal

Egypt

“Egypt Launches Privatization Drive as Economy Reels From Inflation – Government plans to sell stakes in 32 state companies, including three major banks and the country’s largest insurer. The country plans to sell the shares in the coming year either directly to investors or via the Egyptian Stock Exchange, Egyptian Prime Minister Mostafa Madbouly said Wednesday. Egypt’s economy has long been dominated by the state and increasingly by the military, creating less space for private firms to thrive.”, The Wall Street Journal, February 9, 2023

Eurozone & European Union Countries

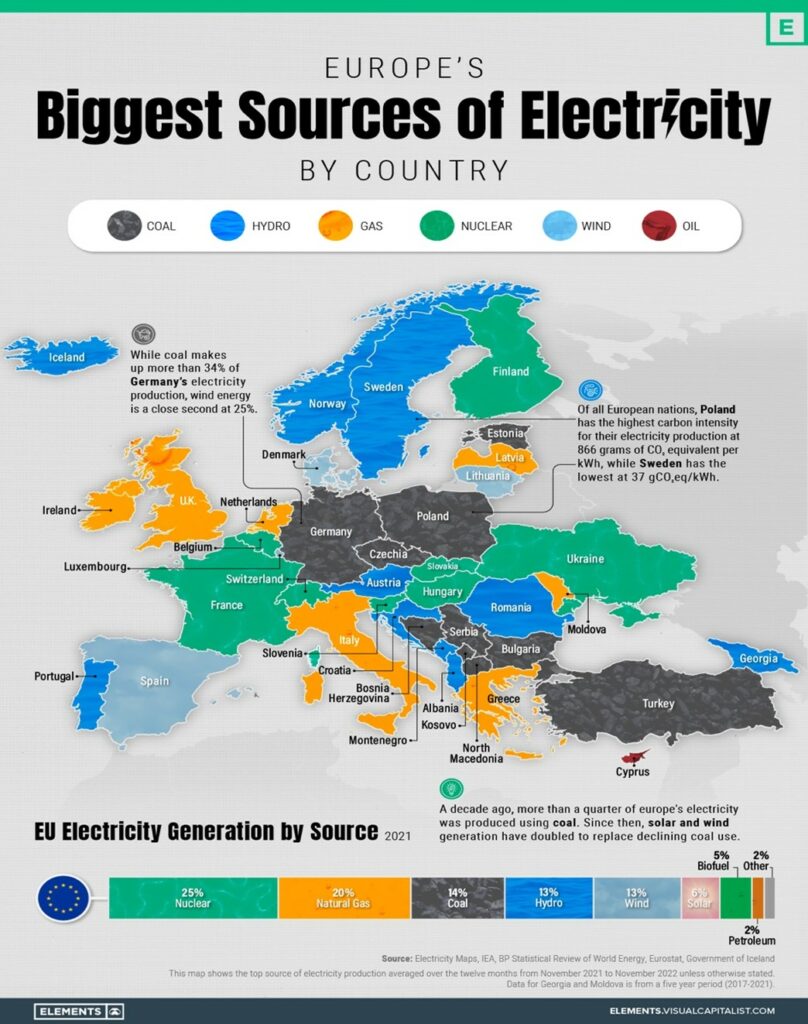

“Europe’s Biggest Sources of Electricity by Country – Energy and electricity supply have become vital for nearly every European nation over the past year, as the region shifts away from its dependence on Russian fuel imports. This graphic maps out European countries by their top source of electricity generation using data from Electricity Maps and the IEA, along with a breakdown of the EU’s overall electricity generation by source in 2021.”, Visual Capitalist, February 10, 2023

India

“Goldman Growth Fund Boosts Bets on India as China Interest Cools – Half of Goldman’s growth capital invested in Asia since 2003. Goldman Sachs Group Inc. is ramping up investing its clients money in India and developed markets in Asia-Pacific as interest in China cools amid political and economic friction. The New York-based bank is targeting to invest a quarter of its newly-raised $5.2 billion growth fund in the region, people familiar with the matter said, who asked not to be named discussing internal information.”, Bloomberg, February 15, 2023

Indonesia

“Indonesia Holds Key Rate as Inflation, Rupiah Pressures Subside – The central bank left its seven-day reverse repurchase rate unchanged at 5.75% on Thursday, as seen by 26 of 28 economists in a Bloomberg survey. It’s the central bank’s first hold since July, before it embarked on a 225 basis-points of rate hikes to get a grip on surging food and fuel prices. The outlook for Southeast Asia’s biggest economy has changed significantly since. Inflation dipped to a five-month low in January, aided by lower transport costs and an extensive government push to distribute food supplies across markets and villages.”, Bloomberg, February 15, 2023

Israel

“Israel economy grew 6.5% in 2022, seen near 3% in 2023 – On a per capita basis, Israel’s economy – which produced some $500 billion last year – grew 4.4% versus an OECD average of 2.6%. On a per capita basis, Israel’s economy – which produced some $500 billion last year – grew 4.4% versus an OECD average of 2.6%. Helped by a surge in immigration from former Soviet states and a decline in mortality, Israel’s population rose 2.2% last year and now stands at 9.66 million.”, Reuters, February 16, 2023

Japan

“Japan’s Economy Grows Slightly in Fourth Quarter – Revival in tourism helps GDP expand annualized 0.6% but inflation looms. The world’s third-largest economy after the U.S. and China grew 0.2% in the three months to December from the previous quarter and 0.6% on an annualized basis. For all of 2022, real growth was 1.1%, but the economy was still slightly smaller than it had been in the pre-Covid-19 years of 2017 through 2019 because of a big drop in 2020 caused by the pandemic.”, The Wall Street Journal, February 13, 2023

Mexico

“Border-Town Warehouses Are Booming as More Manufacturing Moves to Mexico – Real-estate investors add properties in cities like Tijuana, Mexico, and Laredo and El Paso, Texas. American and some foreign companies are shifting production and equipment to Mexico in pursuit of a manufacturing hub closer to the U.S. Many are relocating from Asia after a series of disruptions related to China during the pandemic, part of a burgeoning “nearshoring” trend.”, The Wall Street Journal, February 7, 2023

Thailand

“Thailand’s Fourth-Quarter GDP Growth Slowed to 1.4% – Thailand’s economic growth slowed in the final quarter of 2022 as private consumption moderated and exports of goods fell despite a continued recovery in tourism. Gross domestic product rose 1.4% from a year earlier, compared with 4.6% growth in the third quarter, the Office of the National Economic and Social Development Council said Friday. The quarterly growth figure fell short of the median forecast of 3.5% expansion in The Wall Street Journal’s poll of seven economists.”, The Wall Street Journal, February 16, 2023

United Kingdom

“Students Seeking Jobs Drive Record Net Increase in UK Workforce – Economic inactivity falls as students return to jobs market Figures ease concerns about labor shortage pushing up wages. Students are riding to the rescue of staff-starved British businesses by driving a record net increase in the number of people coming back into the workforce. The number of adults sitting on the sidelines of the jobs market — classed as economically inactive because they’re out of work and not looking for jobs fell by 113,000 in the three months to December, the Office for National Statistics said Tuesday.”, Bloomberg, February 14, 2023

“Heathrow sees busiest January since start of Covid – Heathrow Airport has recorded its busiest January since the start of the pandemic, with 5.4 million passengers travelling through it last month. The latest figures are still below the six million people that passed through in January 2020, but Heathrow boss John Holland-Kaye said it showed the airport was ‘back to its best’.”, BBC, February 13, 2023

“A view from London – Milder, and shorter it may be, but a recession is still on the cards.

For the first time in more than a year we are raising our forecast for UK growth. A recession is still on the cards, but a shorter, milder recession than had seemed likely. Better news on energy supply, inflation and the outlook for the economies of China, the US and the EU lie behind our upgrade.”, Deloitte, February 13, 2023

United States

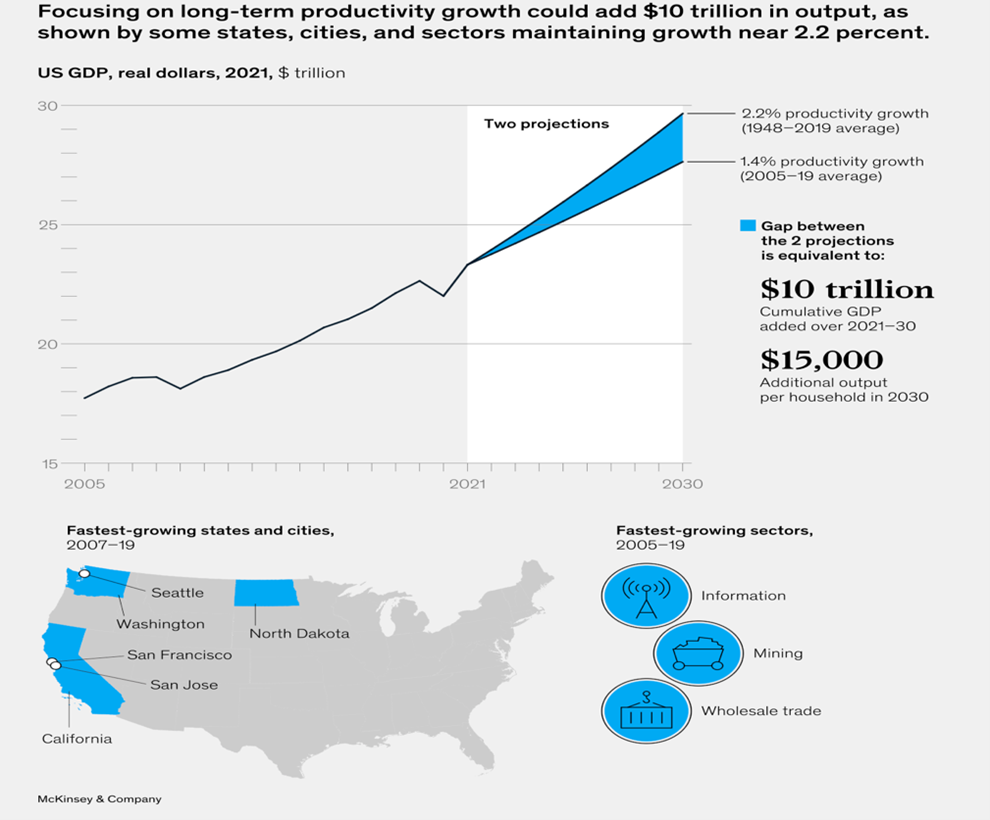

“Rekindling US productivity for a new era – Regaining historical rates of productivity growth would add $10 trillion to US GDP—a boost needed to confront workforce shortages, debt, inflation, and the energy transition. Achieving and equalizing productivity gains will require concerted action. Priorities include unlocking the power of existing technology, investing in intangibles, improving workforce reskilling and labor mobility, and implementing place-based approaches tuned to specific geographies.”, McKinsey, February 16, 2023

“Nearly 90% Of (U.S.) Small Businesses Are Labor Hoarding, New Study Finds – An Insight Global study reported that 77% of the American workforce planned to stay in their current jobs. And in a recent Skynova survey a whopping majority of 1,010 business owners (21% large, 22% medium and 57% small businesses) say they are labor hoarding. That means they are pumping up their investments in employees to keep the status quo and avoid a labor shortage.”, Forbes, February 11, 2023

Brand & Franchising News

“Adamantem to swoop on Boost Juice, Betty’s Burgers owner – Adamantem Capital has snapped up a majority stake in the Boost Juice and Betty’s Burgers chains in a deal valuing parent company Retail Zoo at around $350 million, becoming the third private owner in a decade. CEO Nishad Alani will remain running the business, which also owns Boost Juice. The firm has bought an estimated 70 per cent stake from Bain Capital. Other owners include Boost Juice founders Janine Allis and her husband Jeff, who are believed to have sold part of their stake to Adamantem.”, Australian Financial Review, February 6, 2023. Compliments of Jason Gehrke, The Franchise Advisory Centre, Brisbane

“Denny’s embraces new ways of broadening its customer base – The diner chain is trying a number of initiatives to keep its core business fresh and growing. Meanwhile, its parent is getting ready to expand Keke’s. With the installation of new kitchen equipment nearly done, Denny’s intends to stud its next core menu with more draws for diversifying its customer base, executives told investors Monday. They declined to specify what those products might be, but indicated the items were beyond the capabilities of the diner chain’s previous equipment array. Management has indicated before that the back-of-house revamp, now completed by about 98% of domestic units, will be particularly useful in appealing to a broader array of customers at dinner.”, Restaurant Business, February 14, 2023

“Domino’s (Australia) opened the most stores in 2022 – Domino’s opened 34 stores in 2022 increasing its network to 754 stores, the brand with the most opened stores amongst fast food and QSR brands in Australia, a report by cloud-based data intelligence platform GapMaps revealed. The focus of Domino’s growth has been within growth areas of major cities, as well as in cities with less than 20,000 residents.”, QSR Media Australia, February 3, 2023. Compliments of Jason Gehrke, The Franchise Advisory Centre, Brisbane

“Taco Bell opens first Cantina in Hollywood with digital tech and DJ parties – The first Taco Bell Cantina in Los Angeles will replace menu boards with five kiosks and will have event capabilities. The latest Cantina store is just one small step in Taco Bell’s larger growth journey. Last quarter, Taco Bell opened 253 gross new units, and it’s part of a wider strategy to expand Taco Bell’s footprint to be on-par with McDonald’s, Taco Bell CEO Mark King said during Yum Brands’ investor day in December.”, Nation’s Restaurant News, February 16, 2023

“A Newly Opened Texas Roadhouse Is Reportedly The Largest On Earth – Lubbock, Texas has had a Texas Roadhouse for more than two decades, but they’ve never had one like the location that just opened at 6101 Slide Road. Why? According to Everything Lubbock, it’s enormous, and at 12,000 square feet, is thought to be the biggest restaurant the steakhouse chain has ever operated. “It’s bigger than the one we had before, it’s frankly the largest Texas Roadhouse in the world right now,” noted Mike Smith, managing partner at Texas Roadhouse Lubbock, per Everything Lubbock.”, The Tasting Table, February 11, 2023

“Tim Hortons parent Restaurant Brands International replacing CEO – Toronto-based Restaurant Brands International Inc., which also owns Burger King, Popeyes Louisiana Kitchen and Firehouse Subs, announced Tuesday that chief operating officer Joshua Kobza will replace CEO Jose Cil, effective March 1. Mr. Cil will remain with the company as an adviser for one year. RBI’s board has made the change just a few months after it hired Patrick Doyle, who is known for leading a turnaround at Domino’s Pizza Inc., as its new executive chair.”, The Globe and Mail, February 14, 2023

“Yum China’s net profit in the fourth quarter of 2022 will drop by 90 percent – Executives say they will focus on boosting sales in 2023. For the full year of 2022, Yum China’s total revenue will be US$9.57 billion (approximately RMB 64.926 billion), a year-on-year decrease of 3%; net profit will be US$442 million (approximately RMB 2.999 billion), a year-on-year decrease of 55%. Same-store sales are an important indicator for chain restaurants. In the fourth quarter of 2022, Yum China’s same-store sales fell by 4% year-on-year, of which KFC and Pizza Hut fell by 3% and 8% respectively.”, Caixin, February 8, 2023. Compliments of Paul Jones, Jones & Co., Toronto

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

To sign up for our biweekly newsletter click here: https://bit.ly/geowizardsignup

Over 4 decades William (Bill) Edwards has steered more than 40 brands successfully through the complexities of Going Global. Problem-solver, strategist, visionary and trusted Global Advisor, Bill Edwards sees what others don’t. Now he’s sharing this unmatched experience and wisdom with select senior executives traversing the complex international growth landscape.

For a free 30 minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 75, Tuesday, February 7, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

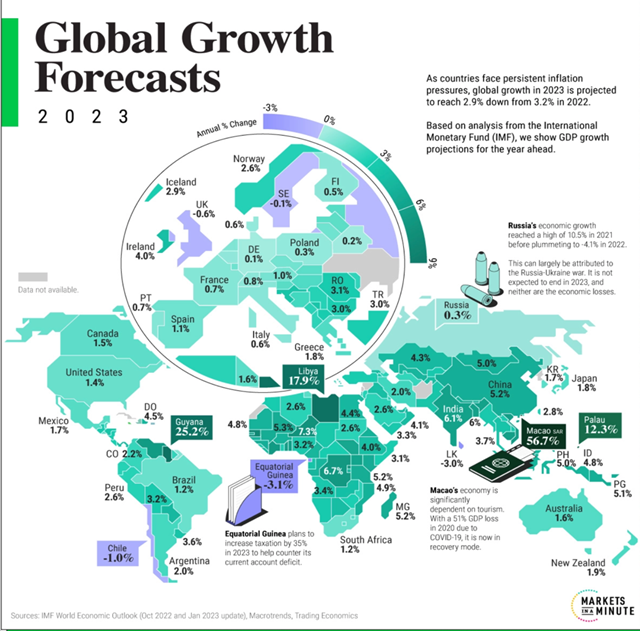

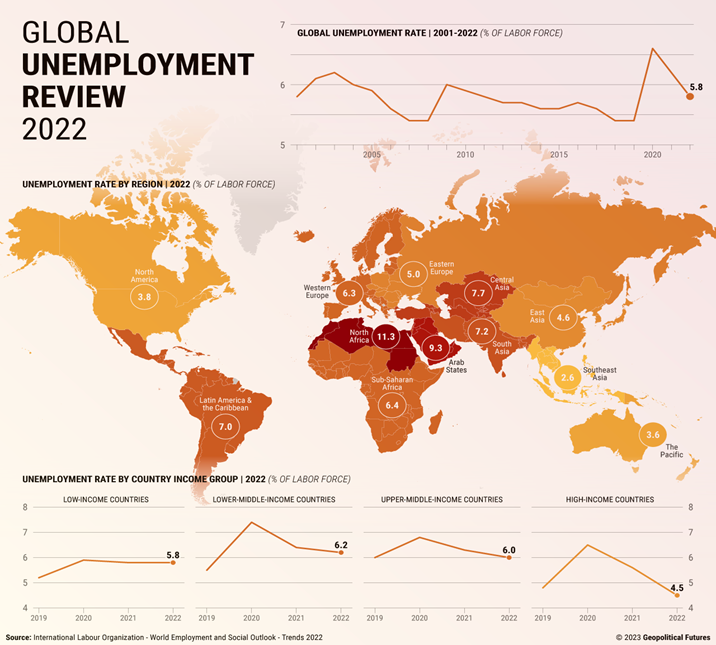

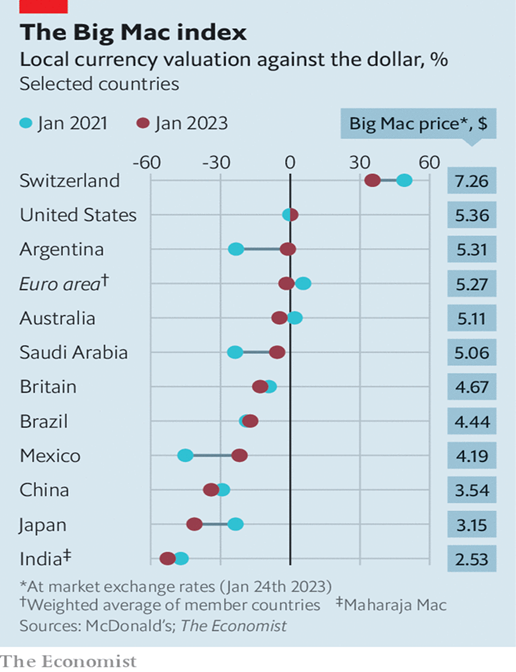

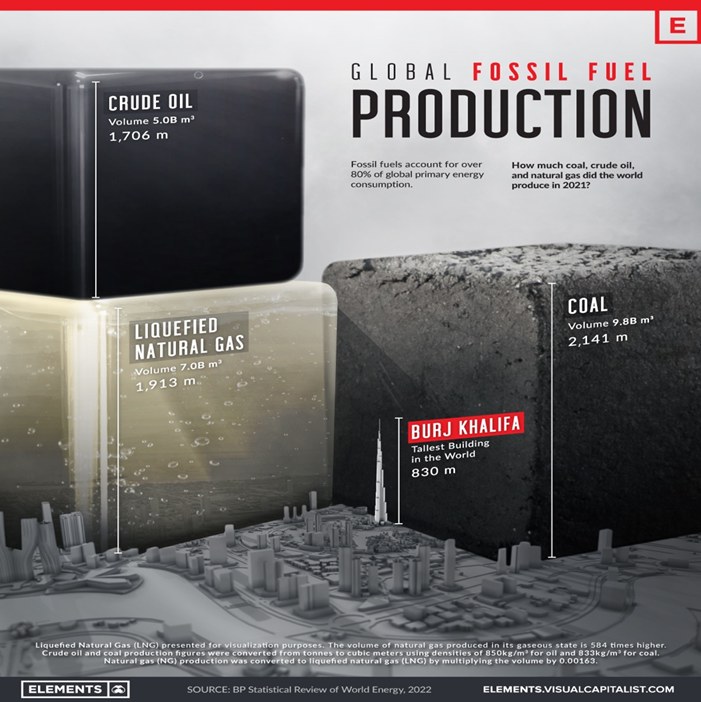

Introduction: This issue is one of our longest to date. In this issue we cover 10+ countries, the European Union and Eurozone, 2023 global GDP growth, unemployment and fossil fuel projections, the Big Mac Index, the most visited websites worldwide, the rise of the use of AI in corporations, the state of global democracy, global jet fuel use and the last 747 is built.

We want to pass along our very best wishes to the people of Turkey in these difficult times after two major earthquakes. My family and I lived in Turkey in the 1980s and have many Friends in this wonderful country.

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here:

https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others

“A journey of a thousand miles begins with a single step.”, Ancient Chinese proverb

“Happiness and freedom begin with one principle. Some things are within your control and some are not.”, Epictetus, 55-155 AD

“The desire for safety stands against every great and noble enterprise.”, Tacitus, 56-117 AD

Highlights in issue #75:

- Brand Global News Section: City Cave®, Starbuck®, Subway®

NOTE: Bolded headlines in this newsletter are live links where the article is available without a paid subscription.

Interesting Data and Studies

“IMF Boosts Global Growth Forecast, Saying a Recession Is Unlikely – The IMF upgraded its forecast for world growth to 2.9% from a previous prediction of 2.7% in October. It sees the expansion accelerating to 3.1% in 2024. In 2022, it estimates the world economy grew 3.4%. ‘The year ahead will still be challenging,’ said IMF Chief Economist Pierre-Olivier Gourinchas. ‘But it could well represent the turning point, with growth bottoming out and inflation declining.’”, Barron’s, February 3, 2023

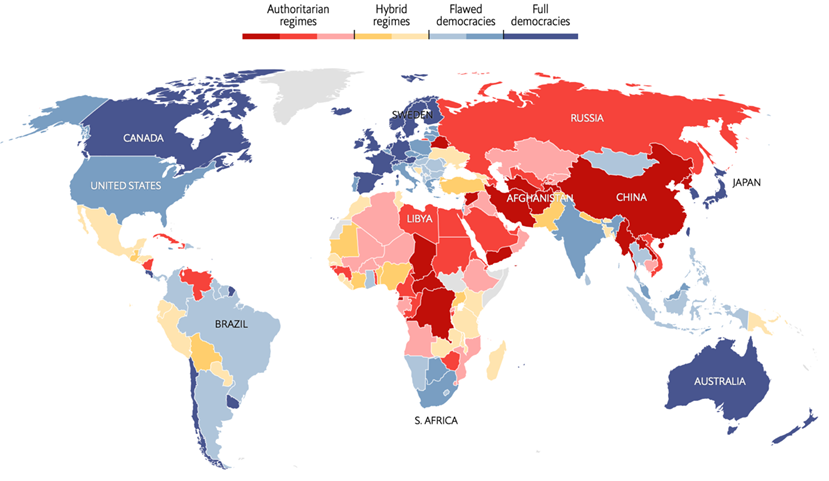

“The world’s most, and least, democratic countries in 2022 – The EIU’s global democracy index shows several authoritarian rulers tightened their grip. The annual survey rates the state of democracy across 167 countries on the basis of five measures with a maximum score of ten—electoral process and pluralism, the functioning of government, political participation, democratic political culture and civil liberties. The latest edition finds that almost half (45.3%) of the world’s population live in a democracy of some sort, while more than a third (36.9%) live under authoritarian rule.”, The Economist, February 1, 2023

“GDP Growth Forecasts by Country, in 2023 – Since Russia’s invasion of Ukraine early last year, talk of global recession has dominated the outlook for 2023. High inflation, spurred by rising energy costs, has tested GDP growth. Tightening monetary policy in the U.S., with interest rates jumping from roughly 0% to over 4% in 2022, has historically preceded a downturn about one to two years later. For European economies, energy prices are critical. The above infographic maps GDP growth forecasts by country for the year ahead, based on projections from the International Monetary Fund (IMF) October 2022 Outlook and January 2023 update.”, Visual Capitalist / Markets In A Minute, February 2, 2023

“Global Unemployment in 2022 – In poor countries, employment has increased but job quality remains low. The global economy is facing a potential recession in 2023 that threatens to undo the post-pandemic job recovery. Globally, employment has increased but job quality remains low, especially in lower-income countries where informal employment is prevalent. The volatility in markets and pessimistic economic climate are hindering investment and slowing productivity. Access to quality jobs with strong wages is becoming increasingly difficult.”, Geopolitical Futures, February 3, 2023

“2023 Business Predictions As AI And Automation Rise In Popularity – A Deloitte study recently found that over 50% of organizations are planning on incorporating the use of AI and automation technologies in 2023. While many top executives are worried about the risks of AI usage, other high-achieving organizations are adopting new tech-savvy operational processes. A survey of Global 500 companies found that leaders choosing to invest in AI and automation business tools and software solutions expect to see significant growth within the next few years. To help your business prepare for a successful year, here are some predictions of how business practices will evolve in 2023.”, Forbes, February 2, 2023

“The Top 50 Most Visited Websites in the World – Estimates vary, but there are upwards of two billion websites in existence in 2023. Topping the list of most-visited websites in the world is, of course, Google. With over 3.5 billion searches per day, Google has cemented its position as the go-to source for information on the internet. The company also owns YouTube, the second-most popular website in the world. Together, Google and YouTube have more traffic than the next 48 websites combined. The power of YouTube, in particular, is sometimes not fully understood. The video platform is the second largest search engine in the world after Google.”, Visual Capitalist, January 24, 2023

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

“What inflation means for the Big Mac index – The competitive advantage of fast-food nations. The iconic McDonald’s burger is an amalgam of rent, electricity and labour, as well as beef, bread and cheese. Its price is therefore indicative of broader inflationary pressures. And because the burger is basically the same wherever you are in the world, its price can also reveal how inflation has changed the relative costliness of different countries. The combination of rising prices and a rising currency threatens to move American prices out of whack with those elsewhere in the world. Two years ago, for example, the Big Mac was 26% cheaper in Japan than America. In principle, this suggests the yen was undervalued and should have risen against the dollar. A Big Mac is now more than 40% cheaper in Japan.”, The Economist, January 25, 2023

“Visualizing the Scale of Global Fossil Fuel Production – Fossil fuels have been our predominant source of energy for over a century, and the world still extracts and consumes a colossal amount of coal, oil, and gas every year. In 2021, the world produced around 8 billion tonnes of coal, 4 billion tonnes of oil, and over 4 trillion cubic meters of natural gas. Most of the coal is used to generate electricity for our homes and offices and has a key role in steel production. Similarly, natural gas is a large source of electricity and heat for industries and buildings. Oil is primarily used by the transportation sector, in addition to petrochemical manufacturing, heating, and other end uses.”, Visual Capitalist, January 31, 2023

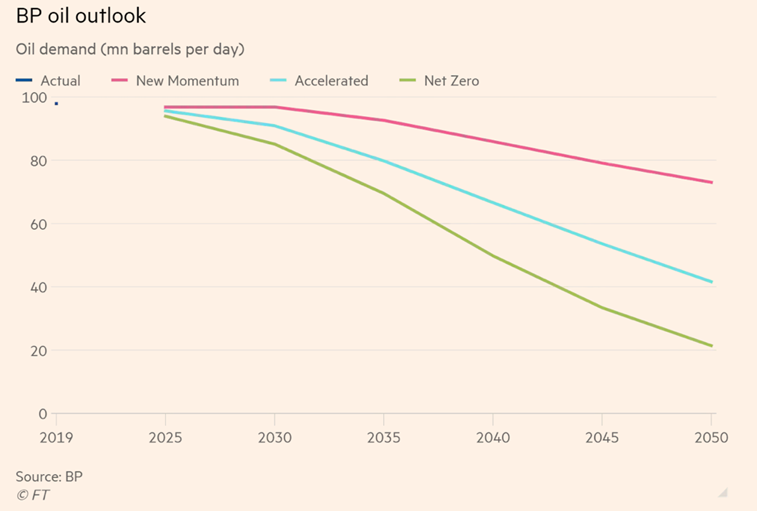

“BP cuts long-term forecast for oil and gas demand – Group’s latest annual outlook says energy security concerns will spur more investment in renewables. BP has trimmed its outlook for oil and gas demand in its latest annual forecast, arguing that the upheaval unleashed by Russia’s invasion of Ukraine will push countries to pursue greater energy security over the next decade by investing in renewables. As a result, global carbon emissions could peak earlier in the 2020s than it had previously suggested, BP (British Petroleum) said in its annual energy outlook on Monday.”, The Financial Times, January 29, 2023

Global & Regional Travel Updates

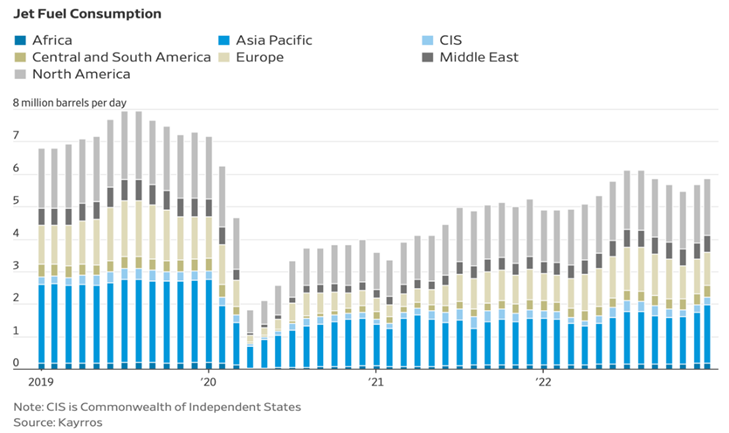

“Rising Jet-Fuel Costs Threaten to Send Airfares Higher – Prices have jumped, partly because of swelling travel demand as China eases its Covid restrictions. Prices for the kerosene-based product have been climbing since December, propelled by diminished supplies after winter storms shut down refineries. Swelling demand has also pushed up prices, as millions of Chinese travelers took to the skies to celebrate the Lunar New Year and newfound freedom from Covid restrictions. The global jet-fuel price index maintained by S&P Global is up 20% since Dec. 7, while prices on the U.S. East Coast are up about 77%.”, The Wall Street Journal, February 2, 2023

“Final Boeing 747 rolls off assembly line: “It’s not just another airplane”. The 747 was the world’s first jumbo jet. Twice as big as any other airliner when it first flew back in 1969. Pan-Am welcomed the first passengers on board a year later. Over more than 118 million flight hours and counting, the 747’s four engines have carried millions of passengers, six U.S. presidents and even the space shuttle across the country and around the world. After 1,574 of the 747s were built, this marks the end of the line for the Queen of the Skies at Boeing.”, CBS News, February 4, 2023

Country & Regional Updates

Canada

“As COVID-19 wanes and recession lurks, corporate profits boom – In spite of inflation, spiking interest rates and the threat of recession, 2022 was a great year for corporate Canada, with the biggest companies in the country having more than rebounded from COVID. A Globe and Mail study of the financial statements of more than 200 publicly traded companies shows that, in the first nine months of 2022, revenue was up 37 per cent and net income was up 40 per cent over the first nine months of 2019, the last “normal,” prepandemic year of business. The growth in corporate earnings – which can be seen across multiple measures of profitability – is outpacing workers’ wages and the Canadian economy as a whole.”, The Globe and Mail, February 6, 2023

China

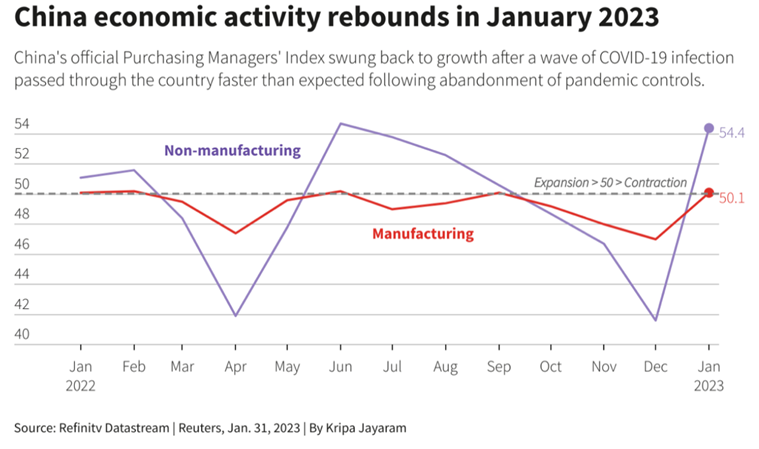

“China economic activity swings back to growth in January – The official purchasing managers’ index (PMI), which measures manufacturing activity, rose to 50.1 in January from 47.0 in December, the National Bureau of Statistics (NBS) said on Tuesday. Economists in a Reuters poll had predicted the PMI to come in at 48.0. Since the result was above 50.0, it implied growth. A rebound in non-manufacturing activity was more decisive than expected by economists – but helped by a seasonal surge in spending for the Lunar New Year holiday. That index, which covers services, leapt to 54.4, from 41.6 in December.”, Reuters, January 31, 2023

“Shanghai shopping malls poised for surge of new tenants chasing post-pandemic ‘revenge spending’ spree – At least 13 global chain-store operators have already set up or plan to open their first mainland Chinese shops in Shanghai this year. China’s exit from its zero-Covid strategy will unleash pent-up demand for packaged food and personal-care products, according to a study. “In 2023, a strong recovery of shopping activities will be seen from the second quarter,” said Sherril Sheng, research director for the residential sector at JLL China. “More lease agreements will be signed as new-energy vehicle, personal care brands, garment makers and outdoor sportswear companies look to open new stores.”, South China Morning Post, February 5, 2023

Eurozone & European Union Countries

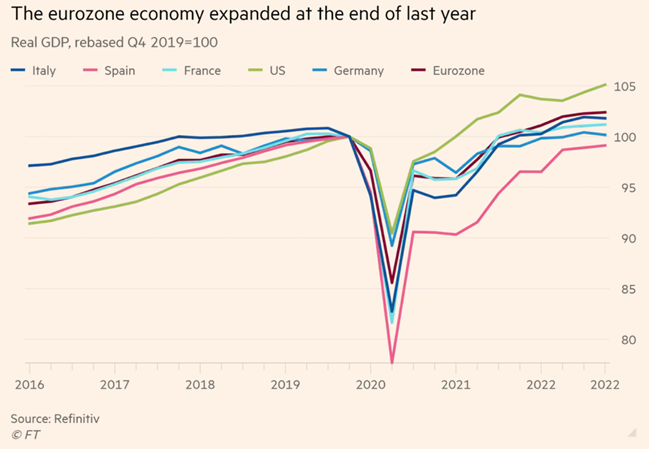

“Eurozone avoids recession as economy expands in fourth quarter – Mild weather and government support help region offset energy price rises triggered by Ukraine war. Bert Colijn, senior economist at ING, the bank, said the region’s economy was showing “incredible resilience” in the face of the energy crisis triggered by Russia’s invasion of Ukraine. Tuesday’s data means that the region managed to grow in each quarter of 2022 and by 3.5 per cent over the course of the year.”, The Financial Times, January 31, 2023

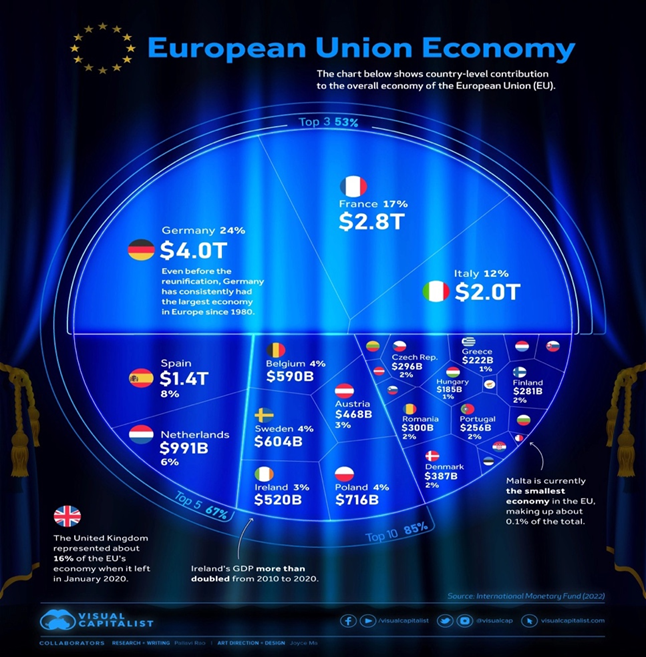

“The $16 Trillion European Union Economy – The European Union has the third-largest economy in the world, accounting for one-sixth of global trade. All together, 27 member countries make up one internal market allowing free movement of goods, services, capital and people. The modern version of the EU can trace its origin to 1993, with the adoption of the name, ‘the European Union,’ the birth of a single market, and the promise to use a single currency—the euro. Since then the EU has become an economic and political force to reckon with. Its combined gross domestic product (GDP) stood at $16.6 trillion in 2022, after the U.S. ($26 trillion) and China ($19 trillion.)”, Visual Capitalist, January 23, 2023

Germany

“German economy shrinks as soaring energy costs pinch demand – Unexpected fourth-quarter contraction shows how hard manufacturing has been hit. The German economy unexpectedly contracted by 0.2 per cent in the final quarter of 2022, as high gas prices squeezed demand and placed the eurozone’s manufacturing powerhouse on the brink of recession.”, The Financial Times, January 30, 2023

India

“India economic outlook, January 2023 – Healthy domestic drivers will help India post a strong growth of 6.5%–6.9% in FY2022–23, but global economic exigencies may cast their shadows on the outlook for the rest of 2023. Apart from the customary change in dates, very little in the new year feels different from the one gone by for the global economy. Geopolitical uncertainties continue unabated, a legacy of the last year, and there’s wide consensus among economists now that the global economy is on the verge of entering a phase of severe slowdown. It is unlikely that India will remain insulated from these developments. But here is a bit of good news as far as India’s economy goes—there are enough reasons to be optimistic about India’s economic outlook in 2023. In particular, healthy domestic drivers will likely help the country post reasonably strong growth this year.”, Deloitte, January 25, 2023

Japan

“Japan Inc strives to lure skilled workers as inflation, labour crunch bite – From inflation allowances to the reskilling of workers, firms in Japan are stepping up efforts to help employees fight rising prices and a labour crunch, even though some cannot afford pay hikes that do more than offset cost-push inflation. As annual “shunto” labour talks get into full swing, momentum from both labour and management is growing for firms to offer such hikes to cushion, even if not beat, consumer inflation, which hit a 41-year high of 4% in December.”, Reuters, January 30, 2023

Saudi Arabia

“Saudi Business Confidence Hits Two-Year High As Boom Continues – The Riyad Bank Saudi PMI rose to 58.2 from 56.9 in December, well above the 50-mark separating growth from contraction. Last month’s figure was the second-highest recorded since September 2021 after November’s more than seven-year high. It’s the latest sign that last year’s economic boom is continuing even as oil prices fall from recent highs. Overall growth was an estimated 8.7% last year, Saudi official projections showed, making it the fastest growing major economy.:, Bloomberg, February 5, 2023

South Korea

“China’s reopening stirs hopes that South Korea can turn around a record trade deficit – South Korea logged a US$12.69 billion trade deficit in January, with the total value of exports falling by 16.6 per cent from a year earlier. Exports to China decreased by 31.4 per cent in January year on year, due primarily to economic disruption from Covid outbreaks. Other factors included a seasonal increase in energy imports over winter amid high global costs and a sharp drop in semiconductor export prices. Semiconductors are the biggest export item for South Korea, making up 18.9 per cent of the country’s total export value last year.”, South China Morning Post, February 1, 2023

Spain

“Spain’s economy is recovering from the pandemic, but problems persist – In January 2022, an index by The Economist, ranking 23 countries’ recoveries from the pandemic, put Spain in last place. The government criticised the index, while the opposition was bound to jeer. A year later, a similar exercise put Spain in 4th place, and it was the government’s turn to strut. And the flattering numbers continue to appear. Annual inflation, running at 5.6% in December, is the lowest in the euro zone, in part because Spain consumes little Russian gas. The main share-price index has made up most of its losses. The unemployment rate is the lowest since 2008, when the financial crisis burst a construction bubble. Tourism rebounded strongly last year.”, The Economist, January 27, 2023

Turkey

“Turkey’s tourism gains in war-hit 2022 but trade deficit widens – Turkey’s tourism revenue hit a record $46.3 billion in 2022 even as its trade deficit swelled to more than $109 billion, as a fallout from war in nearby Ukraine brought a surge of Russian arrivals but also drove up energy-import costs. But even as arrivals at Turkey’s Mediterranean beaches and historical sites brought in forex, energy imports shot up by more than 90% to $96.55 billion in 2022, the official data showed. The overall foreign trade deficit surged 137% year-on-year to $109.54 billion in 2022, according to the general trade system, the data showed, while the December deficit increased 42% from a year earlier.”, Reuters, January 31, 2023

United Kingdom

“FTSE 100 defies gloom to close at record high after US jobs surprise – The FTSE 100 closed at a record high today after unexpectedly strong jobs figures from America buoyed the value of Britain’s biggest listed companies. The benchmark UK index reached its highest ever intra-day level of 7,906.58 — beating the 7,903.5 points set on May 22, 2018 — around an hour after the employment data was released. It closed at an all-time high of 7,901.8, up 1.04 per cent during the session, topping the previous peak closing figure of 7,877.45 set on the same day four-and-a-half years ago.”, The Times Of London, February 3, 2023

“Bank of England raises UK interest rates to 4% – Hike of 0.5 percentage points lifts rates to 14-year high, but BoE says shorter and shallower recession now more likely. Publishing an updated outlook for the economy alongside the rate decision, the Bank said that inflation “is likely to have peaked” and a recession would be less severe than previously predicted, but said Brexit was damaging the economy more quickly than it had anticipated.”, The Guardian, February 2, 2023

United States

“(U.S.) Jobs Growth Was Double the Forecast. It’s a Challenge for the Fed. – Nonfarm payrolls increased to 517,000 last month, up from 223,000 jobs in December. The latest reading was more than double the 185,000-job increase expected among economists surveyed by FactSet. The unemployment rate fell to 3.4% from 3.5%, rather than rising to 3.6% as economists had estimated.”, Barron’s, February 3, 2023

“Americans fear recession, but most believe their jobs are safe – Many Americans (73%) said they had a negative outlook on the economy, according to a recent survey by fintech company Achieve. However, 74% said they didn’t believe a downturn would impact their jobs. Additionally, 73% of respondents said they had no plans to leave their current employment, signaling that the Great Resignation trend, which saw droves of workers quit their jobs in the last two years, may be coming to an end, the survey said.”, Fox Business, January 30, 2023

Brand & Franchising News

“Former Subway CEO invests in Oz health chain – Suzanne Greco, the former international chief executive of sandwich chain, Subway International, has joined Brisbane-based wellness brand City Cave as a shareholder in the international expansion of the business, according to a post on LinkedIn. City Cave has approximately 50 outlets in Australia providing float therapy, massage and sauna services, and won the NextGen in Franchising Award at the 2019 International Franchise Association annual conference in Las Vegas, an annual competition which invites young entrepreneurs from around the world to submit innovative business ideas to grow via franchising.”, LinkedIn, January 2023. Compliments of Jason Gehrke, Managing Director, Franchise Advisory Center, Brisbane, Australia

“Starbucks Net profit in the first fiscal quarter increased by 4 8 percent year on year to US855 2 million, and the number of stores in China reached 6,090 – In terms of the number of stores, there were a net increase of 459 stores in the first quarter, and the total number of stores worldwide reached 36,170 at the end of the quarter. By the end of the first quarter, the number of stores in the United States and China accounted for 61% of the world, including 15,952 stores in the United States. In terms of the Chinese market, Starbucks also stated that in the first quarter, Starbucks China opened 69 new stores and entered 10 new cities. At the end of the quarter, the company had 6,090 stores in China, covering 240 cities.”, Caijing.com.cn, February 3, 2023. Compliments of Paul Jones, Jones & Co., Toronto

“Subway to Add Thousands of Restaurants Outside the US – The chain aims to increase its international locations to around 25,000 over 10 years from roughly 16,000 today, Mr. Chidsey said. The expansion is part of a plan to raise Milford, Conn.-based Subway’s sales to around $25 billion annually from its current $16 billion. Mr. Chidsey said that much of the company’s growth lies abroad, with sandwiches resonating well with many different dietary preferences and the chain facing much less competition. ‘The unit-growth story continues to be international,’ Mr. Chidsey said.”, The Wall Street Journal, February 2, 2023

“Why 2023 will be a year of weaker (US) sales and higher margins – Fitch Ratings expects modest restaurant growth this year. But recent price increases and an improving inflationary environment should help with profits. Low-price restaurants like Taco Bell can be expected to outperform full-service chains and those with higher prices. In 2022, restaurants watched their profits shrink even as their sales growth remained strong or even accelerated. This year should be the opposite, as last year’s price increases coupled with an improving inflationary environment lead to improved profits even as sales growth weakens.”, Restaurant Business, January 30, 2023

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

To sign up for our biweekly newsletter click here: https://bit.ly/geowizardsignup

Over 4 decades William (Bill) Edwards has played a leadership role in the global growth of more than 40 brands. He is widely recognized as an International Problem Solver, Strategist, Advisor and a specialist on global cultures. His career covers international operations, executive and entrepreneurial experience in the energy, technology, licensing, management consulting and retail sectors. As a Global Advisor, he now shares his experiences and wisdom with senior executives to help them successfully navigate the complex international company growth landscape.

For more information on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking