EGS Biweekly Global Business Newsletter Issue 80, Tuesday, April 18, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Introduction: In this issue, are we approaching the end of the central bank interest rate increases? There is a natural gas surplus due to increased U.S. LNG shipments and conservation post Ukraine invasion. Delta has already sold 75% of its seats for summer travel. Inflation continues to fall except for sugar. And the global future lies with electric cars ready or not!

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here:

First, A Few Words of Wisdom From Others

“Europe was created by history. America was created by philosophy.”, Margaret Thatcher

“To understand Europe, you have to be a genius – or French.”, Madeleine Albright

“You can’t go back and change the beginning, but you can start where you are and change the ending.”, C. S. Lewis

Highlights in issue #80:

- Brand Global News Section: Burger King®, Chick-Fil-A®, Papa Johns® and Subway

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data and Studies

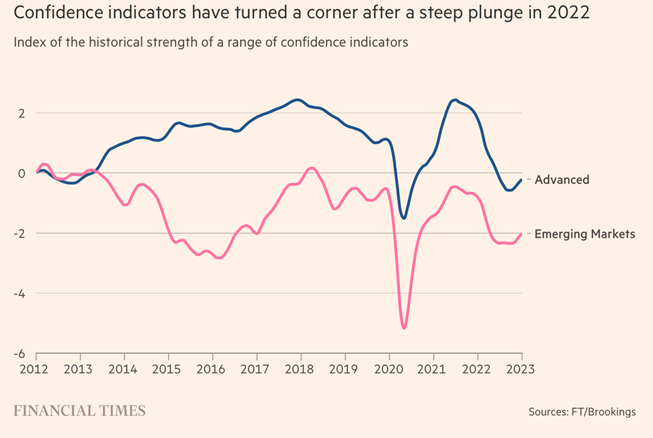

“Global economy fends off geopolitical and banking threats – China, US, eurozone, India and UK well-placed to avoid slowdown going into IMF-World Bank spring meetings. The world’s leading economies are showing surprising resilience despite facing a perilous moment, according to research for the Financial Times that suggests the global economy may avoid a sharp slowdown this year. China, the US, the eurozone, India and the UK are all growing faster than had been expected late last year, the latest edition of the twice-yearly Brookings-FT tracking index found, with consumer and business confidence rising after a rocky end to 2022.”, The Financial Times, April 9, 2023

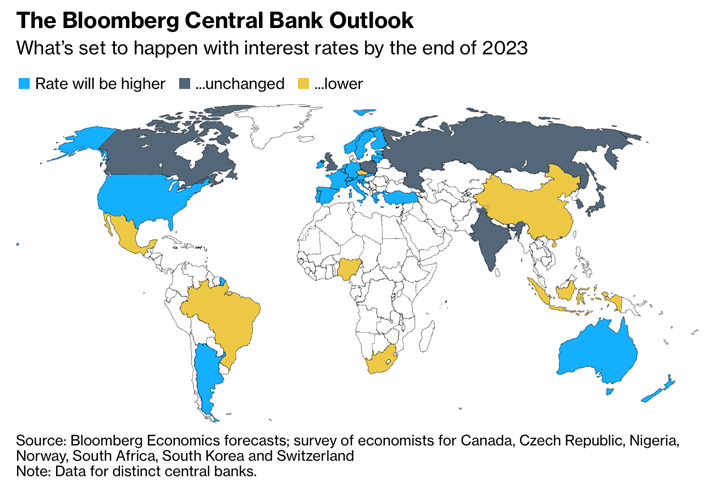

“End May Be in Sight for Global Rate-Hike Cycle as Fed Nears Peak – Quarterly outlook on what to expect from monetary policy. One more Fed hike and a pause could herald pivot by peers. Most global central banks may be either close to a peak or already done with interest-rate hiking, auguring a hiatus before possible monetary loosening comes into view.”, Bloomberg, April 9, 2023

“Intelligence for Sanctions Compliance – International sanctions and trade restrictions are growing in scope and complexity, not least in response to Russia’s invasion of Ukraine. Compliance with such laws can require insights into third-parties that cannot be achieved with automated screening or desktop research. For situations of heightened risk, an investigative approach that goes beyond the public record is recommended.”, Enquirisk, April 10, 2023

Editor’s Note: this site and company offer unusual insight into the all-important but often murky area of sanctions that companies need to know about when doing business on a global basis

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

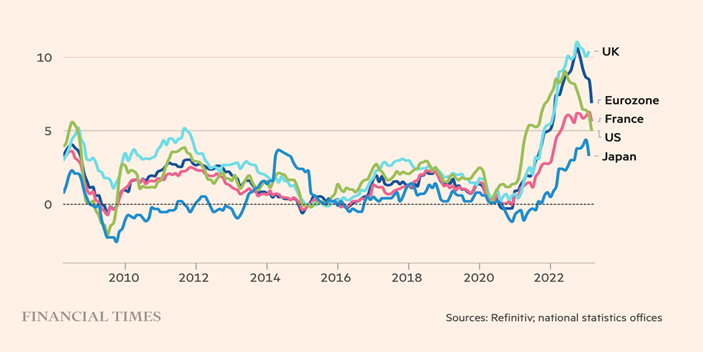

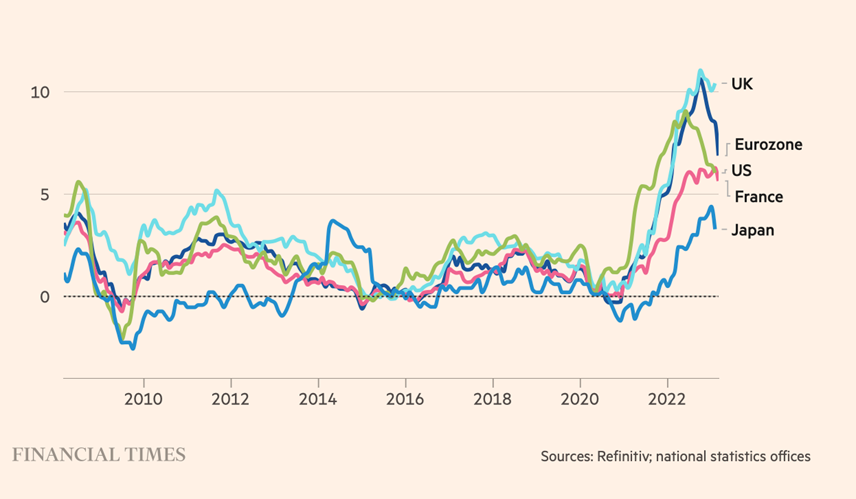

“Global inflation tracker – Inflation has started to show signs of easing from the multi-decade highs reached in many countries following Russia’s full-scale invasion of Ukraine. The latest figures for most of the world’s largest economies still make for worrying reading, with price pressures remaining high as the war in Ukraine continues to keep energy and food prices elevated. But in some countries pressures have eased and energy and food wholesale prices have declined. Economist and investors also expect inflationary levels to stabilise in the next few years.”, The Financial Times, April 12, 2023

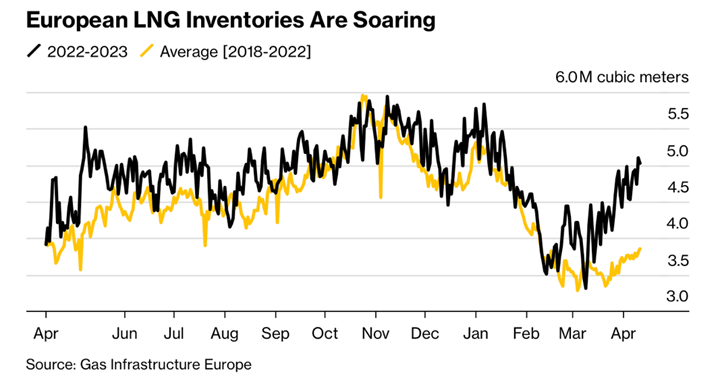

“World Gas Supply Shifts From Shortage to Glut With Demand Muted – Europe is reaching storage milestones weeks earlier than usual. Analysts uncertain over how long gas supply glut will last. The world is becoming awash with natural gas, pushing prices lower and creating an overabundance of the fuel in both Europe and Asia — at least for the next few weeks…… inventories are filling up from South Korea to Spain, a result of mostly mild winter weather and efforts to reduce consumption. Tankers filled with liquefied natural gas — a stopgap in replacing lost Russian pipeline flows — now often struggle to find a home, spending weeks idling at sea.”, Bloomberg, April 15, 2023

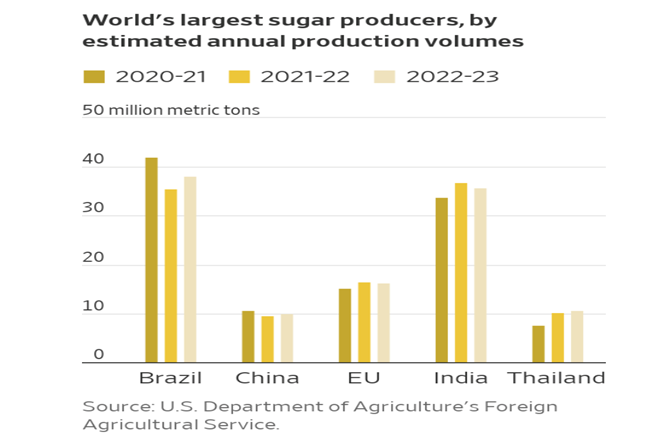

“Sugar Prices Bubble Up to Highest Since 2012 – The surge could lead to costlier sweet foods and drinks. Bad weather in India, China and Thailand has hit sugar production in all three countries, just as China’s economy has begun to reopen following the end of coronavirus lockdowns. Winners from the rally include Brazilian farmers, who are on track for a solid crop. Losers could include both food companies and consumers.”, The Wall Street Journal, April 14, 2023

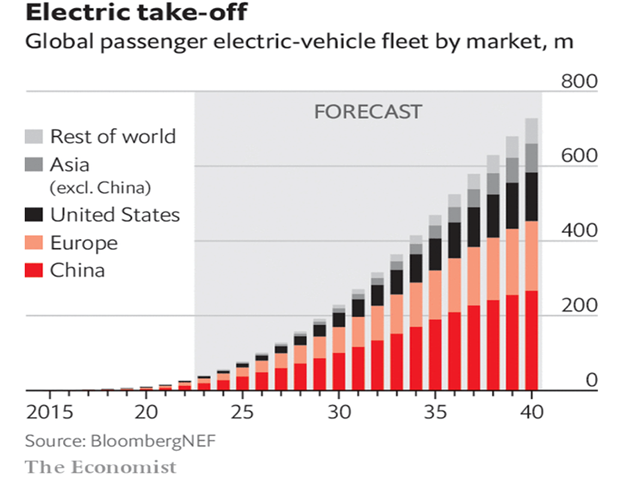

“The future lies with electric vehicles – The car industry is electrifying rapidly and irrevocably. A draft law approved by the European Union in February may mean a total ban on new ice cars by 2035 (though Germany has won an exception for cars using carbon-neutral synthetic fuels). Governments and cities are cracking down on carbon and other emissions that affect local air quality. China is demanding that 20% of cars must be (electric) by 2025.”, The Economist, April 14, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel Updates

“Delta’s International Flights Are Already 75% Booked for Summer Travel – Want to fly Delta this summer? The increased demand follows a record March in which consumer demand ‘was well ahead of pre-pandemic levels,’ Delta president Glen Hauenstein said in an earnings call this week reviewed by Travel + Leisure. As a result, Delta is growing its international capacity this summer, and flying its largest-ever Transatlantic summer schedule (including new flights to London, increased service to Paris, and beyond).”, Travel & Leisure, April 14, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Australia

“May rate rise on the cards after strong jobs numbers – Overall consumer spending appears to be coming off the boil following 10 Reserve Bank interest rate increases and the inflationary squeeze on household incomes. But the 53,000-strong job surge in March, reported yesterday, brings a May rate rise back onto the table, reported Michael Read, following the central bank’s pause this month. If so, that would come exactly a week before the May 9 federal budget. Amid the loss of tech and consulting jobs, the red-hot labour market has been one of the big surprises of the pandemic recovery.”, Australia Financial Review, April 13, 2023

Canada

“Companies turn to baristas, free food and socializing to lure employees back to the office – Manulife’s chief executive Roy Gori says a complete overhaul of the company’s nearly 100-year-old office building, as well as pro-actively listening to employee feedback on their hybrid arrangement, has already paid off. ‘We’re not seeing any decrease in productivity,’ Mr. Gori says over lunch in the company’s renovated second floor cafeteria. “If anything, I think we’re going to see – and probably already are seeing – productivity improve because people are now being more purposeful with their time.”, The Globe And Mail, April 11, 2023

China

“Chinese Exports Surge as Trade With Russia and Southeast Asia Jumps – Shipments to Russia more than doubled in March from a year earlier. Outbound shipments from China soared 14.8% in March from a year earlier, data from China’s customs bureau showed Thursday, reversing the 6.8% decline recorded during the first two months of 2023 and ending a nearly half-year string of such drops stretching back to October.”, The Wall Street Journal, April 13, 2023

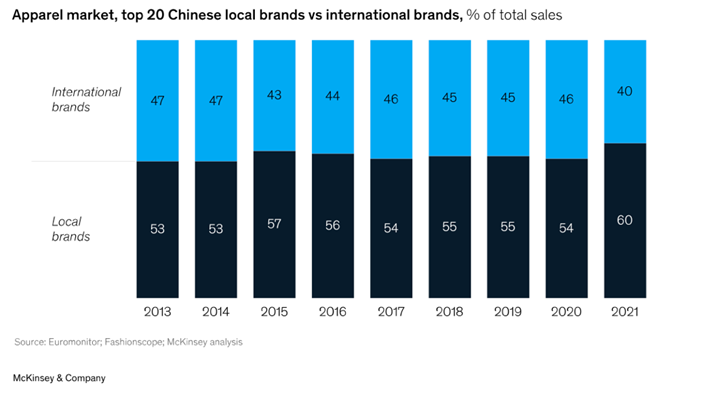

“Winning in China Top priorities for global apparel and fashion brands – The apparel, fashion, and luxury market in China continues to be one of the largest and most dynamic in the world. After a difficult 2022, the industry is likely to resume double-digit growth, fueled in part by a rising middle class. However, for multinational companies, doing business in China is getting harder. According to the National Bureau of Statistics, the China Consumer Confidence Index fell by 28 percent from October 2021 to October 2022, dampening consumer spending.2 Chinese champions are increasingly outpacing their global peers, and many are adopting a more agile operating model and supply chain to enable greater responsiveness to changing consumer preferences.”, McKinsey, March 30, 2023. Compliments of Paul Jones, Jones & Co., Toronto

India

“India’s plan to export its wildly successful digital payments system – After starting cross-border payments with Singapore, India is now setting up more international partnerships. The country’s biometric ID system, Aadhaar, already has takers in developing countries in Africa and Southeast Asia that are seeking digital sovereignty. With wider adoption of its unified payments interface, India’s digital stack is now positioned as a ‘benign’ alternative to international networks like Swift.”, Rest Of World, April 10, 2023

Japan

“Japan to Drop COVID-19 Testing, Vaccination Protocols Next Month — What to Know: ‘All border measures to prevent the spread of COVID-19 will be lifted on May 8, 2023,’ the Japan National Tourism Organization announced. Currently, all travelers heading to Japan are required to show either proof of three doses of a COVID-19 vaccine or proof of a negative test conducted within 72 hours of departure, according to the Japan National Tourism Organization.”, Travel & Leisure, April 7, 2023

Turkey

“Turkey to make inaugural deliveries from big Black Sea gas discovery – Turkish Petroleum, the state oil and gas company, will on Thursday flip the switch on the Sakarya gasfield development, roughly three years after making the find, according to its chief executive, Melih Han Bilgin.”, The Financial Times, April 16, 2023

United Kingdom

“Big firms a lot more confident about the future – Confidence among finance chiefs at the UK’s biggest companies has seen its sharpest rise since 2020. The Deloitte survey of chief financial officers showed sentiment rebounded as their concerns about energy prices and Brexit problems eased. There were 25% more chief financial officers feeling better about the future than worse, compared to 17% more feeling the opposite three months ago. Not since the Covid vaccine rollout has there been such a swing in confidence.”, BBC News, April 16, 2023

“No recession — but growth to be subdued, forecasters warn – The forecasting group expects the gross domestic product (GDP) measure of output to rise by 0.2 per cent. This reflects a significant upgrade from the 0.7 per cent decline expected in its January forecast. Output is then expected to rise by 1.9 per cent next year and 2.3 per cent in 2025. Inflation will begin to decline quickly because prices this year are compared with already high prices last year, and household bills are set to drop from July once households benefit from the sharp decline in natural gas prices over winter, the EY Item Club said.”, The Times of London, April 17, 2023

United States

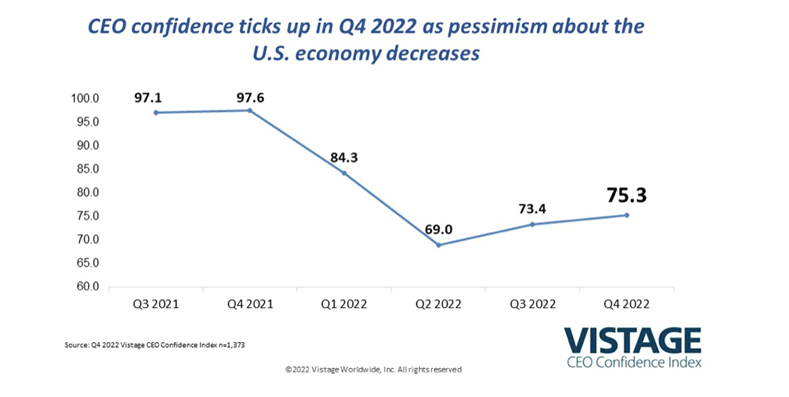

“The Q4 2022 Vistage CEO Confidence Index rose 1.9 points in Q4 to reach 75.3, which is the fourth lowest reading since the Great Recession. Looking across the six core components of the Index, the shifts in CEOs’ responses between improved, stayed the same and worsened largely offset each other. While plans for increased hiring in the year ahead rose, that improving sentiment was tempered by confidence in the economy remaining near historic lows.”, Vistage, January 5, 2023

“Homebuilder sentiment jumps to highest level since September – Confidence among builders in the U.S. housing market increased more than expected in April as declining mortgage rates and low inventory helped drive demand higher for new homes. The National Association of Home Builders/Wells Fargo Housing Market Index, which measures the pulse of the single-family housing market, rose one point to 45, the highest reading since September.”, Fox Business, April 17, 2023

“Small businesses are less optimistic about the future, survey finds – The National Federation of Independent Businesses released survey results showing their small business optimism index decreased in March, ‘marking the 15th consecutive month below the 49-year average of 98.’ “Small business owners are cynical about future economic conditions,” NFIB Chief Economist Bill Dunkelberg said. ‘Hiring plans fell to their lowest level since May 2020, but strong consumer spending has kept Main Street alive and supported strong labor demand.’”, Washington Examiner, April 12, 2023

Brand & Franchising News

“Burger King is selling more Whoppers than ever before in early days of its U.S. turnaround – Seven months after Burger King unveiled a strategy to revive its U.S. business, the chain is selling more Whoppers than ever before. Burger King U.S. President Tom Curtis told CNBC that preliminary improvements to restaurant operations and new marketing campaigns are already boosting sales and customer satisfaction, although it’s still early innings.”, CNBC, April 5, 2023

“Chick-fil-A Has the Country’s ‘Slowest Drive-Thru,’ But It’s Still Bringing in Major Profits – The chicken chain brought in $18.8 billion in U.S. sales last year, marking consistent upward growth since 2019, according to the brand’s Franchise Disclosure Document released earlier this week. But Chick-fil-A also ranked last for speed of service, according to The 2022 QSR Drive-Thru Report, with the average transaction taking 325.47 seconds (for reference, Taco Bell ranked number one at 221.99 seconds).”, Entrepreneur magazine, April 7, 2023

“Papa Johns Plots Global Domination – QSR Magazine reports that Papa Johns has announced, in partnership with PJP Investments Group, plans to open a whopping 650 new restaurants in India by 2033. That’s a lot of stores. According to Papa Johns’ filings, as of 2019 the chain consisted of 3,142 locations in the United States and 5,395 restaurants worldwide. The new locations in India would account for 11% of all Papa Johns units—which is wild, considering the restaurant operates in 49 other countries.”, The Takeout, April 4, 2023

“Subway Sale Process Heats Up as Bidders Head to Second Round – The first pool of bids were lodged in March, and several interested parties have already been thrown out by the company’s advisers for offering too little, the people said. Subway is aiming for a valuation of $10 billion or more. More than 10 possible suitors, including some big names in private equity, are conducting due diligence that should draw to a close by the end of this month, the people added. Final bids will likely be due around then and a buyer could emerge by the end of May, the people said.”, The Wall Street Journal, April 13, 2023

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

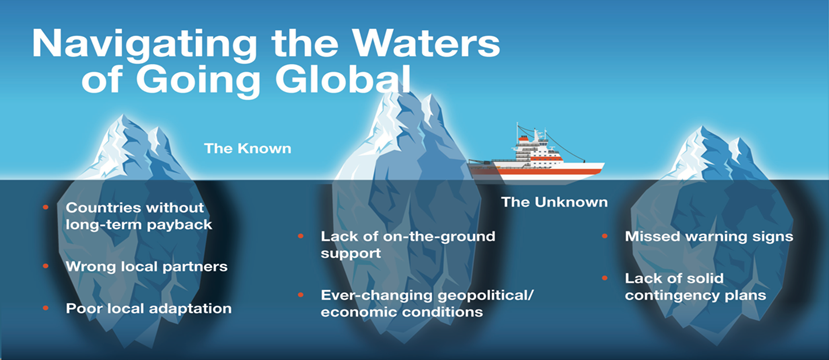

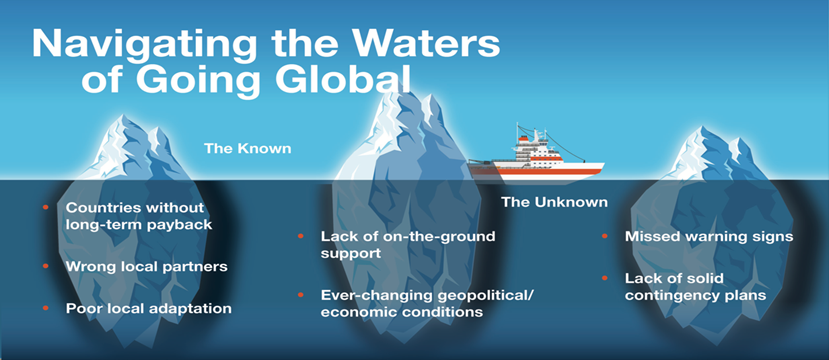

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global.

With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant taking 40 franchisors global.

For a complimentary 30 minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 79, Tuesday, April 4, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Introduction: In this issue, inflation falling around the world, AI spreading, EV adoption spreading, oil rising again, Middle East IPOs are up, UK house prices are down and post pandemic western food & beverage brands are once again on the rise in China as Chinese consumers are heading back to stores and restaurants.

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here:

https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others

“Take risks. Failure is a stepping stone to success.”, Arianna Huffington, co-founder of The Huffington Post

“If you always do what you’ve always done, you’ll always get what you’ve always got.”, Henry Ford, founder of the Ford Motor Company

“The road to success is always under construction.” , Lily Tomlin, actress and comedian

This issue’s quotes are compliments of Zyro.com

Highlights in issue #79:

- Brand Global News Section: BurgerFi®, Dominos®, Haidilao®, KX Pilates®, Popeyes® and Starbucks® China

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data and Studies

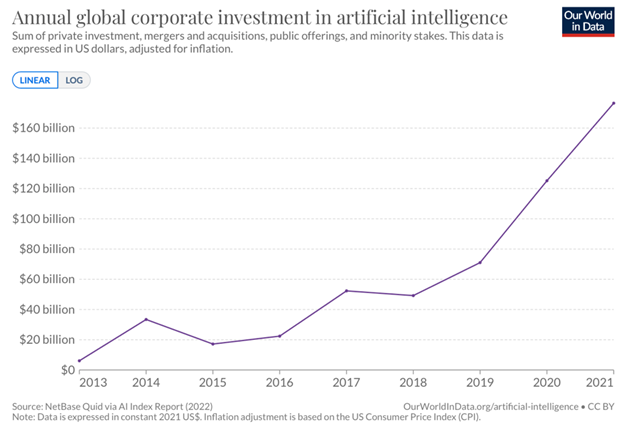

“Artificial intelligence has advanced despite having few resources dedicated to its development – now investments have increased substantially. In the past, relatively few researchers were working on AI technology and there was little commercial interest and funding. Now, the available resources have increased substantially. We should expect that the field continues to advance rapidly.”, Our World In Data, March 29, 2023

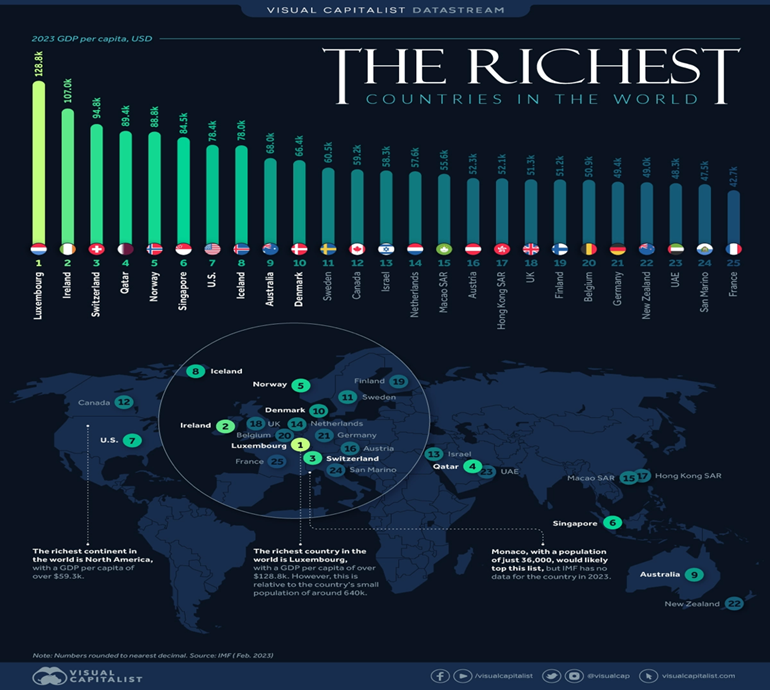

“The World’s 25 Richest Countries by GDP per Capita – Measuring GDP per capita is a common measure of the economic wealth on a per person basis. This article sorts countries according to the latest International Monetary Fund (IMF) projections on GDP per capita for 2023. Currently this metric is at $13,920 globally in 2023, up from $13,400 in 2022 and $11,160 in 2020, all nominal figures, not accounting for inflation.”, Visual Capitalist, March 29, 2023

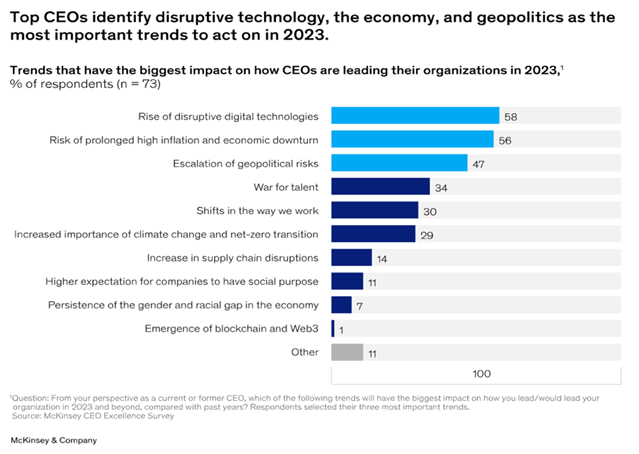

“Actions the best CEOs are taking in 2023 – Corporate leaders are addressing the risks while finding the opportunities in digital disruption, the economy, and geopolitical uncertainties. the torrent of trends, ideas, and information that leaders now face makes knowing what matters more difficult than ever…….McKinsey conducted its latest CEO Excellence Survey, to take the pulse of leading CEOs’ evolving priorities and the actions they’re taking in response. We started by asking a group of the world’s top-performing CEOs which trends will have the biggest impact on how they lead their business in 2023 compared with past years. Their answers suggest that three “true signals” matter most: digital disruption, the economy, and geopolitics.” McKinsey, March 15, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

“Global inflation tracker – Inflation has started to show signs of easing from the multi-decade highs reached in many countries following Russia’s full-scale invasion of Ukraine. High inflation remains geographically broad-based, even if it is lower in many parts of Asia.”, The Financial Times, March 31, 2023

“Oil Prices Jump as Saudi-Led Group Plans Output Cuts – Potential U.S. recession and China’s demand will help determine whether crude pushes even higher. Tallying up Sunday’s commitments by Saudi Arabia, Iraq and others, OPEC producers say they will cut daily output by more than 1.1 million barrels from May, according to Natasha Kaneva, head of commodities research at JPMorgan Chase.”, The Wall Street Journal, April 3, 2023

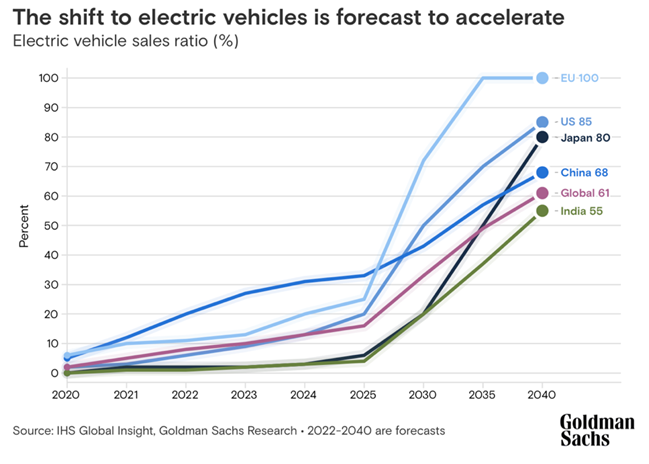

“Electric vehicles are forecast to be half of global car sales by 2035 – EV sales will soar to about 73 million units in 2040, up from around 2 million in 2020, according to forecasts by Goldman Sachs Research. The percentage of EVs in worldwide car sales, meanwhile, is expected to rise to 61% from 2% during that span. The share of EV sales is anticipated to be well over 80% in many developed countries.”, Goldman Sachs, February 10, 2023

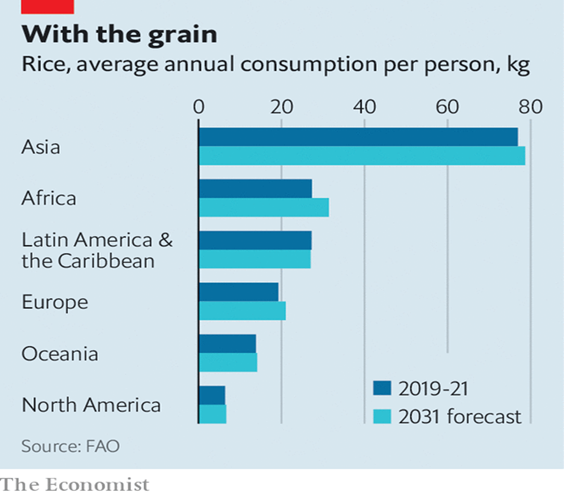

“The global rice crisis – Rice feeds more than half the world—but also fuels diabetes and climate change. Asia accounts for 90% of the world’s rice production and almost as much of its consumption. Asians get more than a quarter of their daily calories from rice. The un estimates that the average Asian consumes 77kg of rice a year—more than the average African, European and American combined. Hundreds of millions of Asian farmers depend on growing the crop, many with only tiny patches of land. Yet the world’s rice bowl is cracking.”, The Economist, March 28, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel Updates

“Flights at Cathay Pacific budget carrier HK Express ‘back to pre-pandemic levels by Friday – Airline seeks 500 staff as it ramps up services. Low-cost carrier took delivery of the first of 16 narrow-body Airbus A321neo aircraft on Wednesday… the carrier’s service frequency would return to pre-pandemic levels by the end of the month with more than 400 flights per week and 500 by the summer to around 22 destinations. HK Express is looking to expand network and aims to hire 180 pilots and more than 300 cabin crew by the end of the year.”, South China Morning Post, March 29, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Argentina

“IMF approves next tranche of emergency loans to Argentina – The $5.4 billion set for disbursement brings the total lent to the Latin American country under the Extended Fund Facility to $28.9 billion. Argentina is the target of the IMF’s largest assistance program. The International Monetary Fund’s executive board approved late on Friday the disbursement of $5.4 billion (approximately €4.97 billion) to Argentina, as part of a $44 billion loan program to the Latin American nation struggling with an ailing economy.”, Deutsche Welle, March 31, 2023

Canada

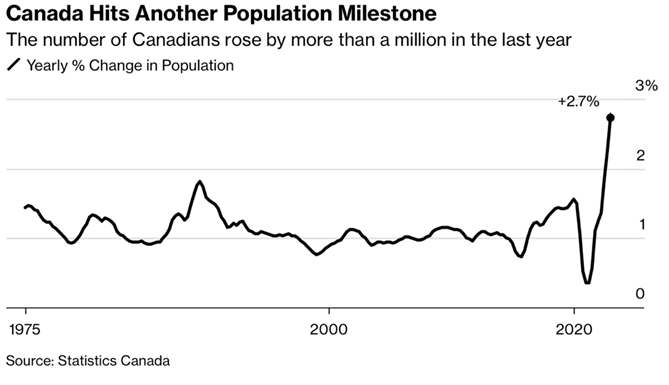

“Canada’s Population Grows by Over 1 Million for First Time – Annual expansion of 2.7% is fastest among advanced economies. Rush of newcomers strains housing market, health-care system. International migration accounted for 95.9% of the growth — a testament to Canada’s decision to counter the economic drag of an aging populace by throwing its doors open to newcomers.”, Bloomberg, March 27, 2023

China

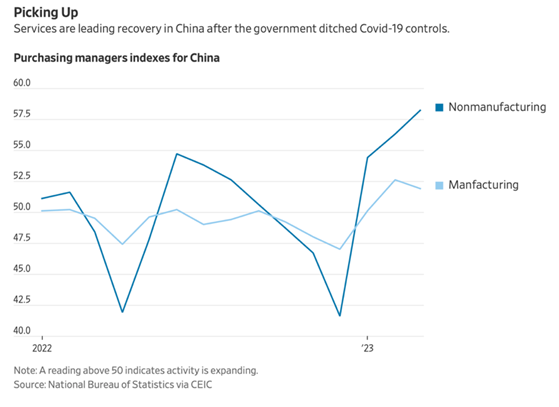

“China’s Consumers Extend Economic Rebound From Pandemic – A gauge of activity in China’s services sector reached its highest level in more than a decade in March, a sign that Chinese consumers are heading back to stores and restaurants, powering an economic recovery following the end of almost three years of strict Covid-19 controls.”, The Wall Street Journal, Mach 31, 2023

Eurozone & European Union Countries

“Eurozone inflation lower than expected, as energy costs drop – Inflation in the Eurozone slowed sharply to 6.9% in an unexpected turnaround after months of steady increases. The 20 countries that make up the Eurozone recorded slowed inflation rates, although food prices rose with energy prices falling official, European Union’s statistics agency revealed on Friday. -Consumer prices in the Eurozone rose by 6.9% in March, but that represented a decrease from 8.5% in February, the data showed.”, Deutsche Welle, March 31, 2023

India

“From fast food to autos, India’s digitally connected users lure investors – China saw a jump in consumption from 2006 when, as per World Bank data, its per capita gross domestic product (GDP) crossed $2,000. India crossed that threshold in 2021, according to the bank’s latest available data, which could put it on a similar growth trajectory even though weak job growth and income inequalities in the country pose a risk to this outcome.

With the cheapest mobile data rates in the world, thanks to intense competition among telecoms providers, and the explosive growth of social media and personal entertainment, Indian consumers are going digital at a breakneck pace.”, Reuters, April 2, 2023

“India Offers Rupee Trade Option to Nations Facing Dollar Crunch – New Delhi has been pushing to internationalize the rupee Central bank unveiled plans for rupee settlement last year. India will offer its currency as an alternative for trade to countries that are facing a shortage of dollars in the wake of the sharpest tightening in monetary policy by the US Federal Reserve in decades. Facilitating the rupee trade for countries facing currency risk will help “disaster proof” them, Commerce Secretary Sunil Barthwal said during an announcement on India’s foreign trade policy Friday in New Delhi.”, Bloomberg, March 31, 2023

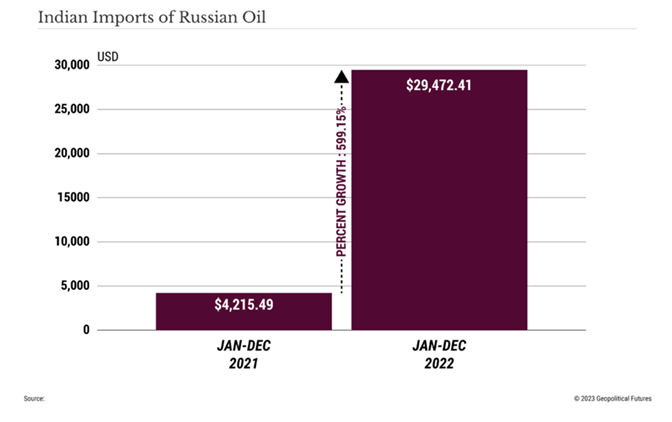

“India’s Emerging Foreign Policy – India’s economic rise has validated its historical efforts to maintain a diverse set of foreign relations. Russia’s war in Ukraine is both an opportunity and a challenge for New Delhi’s foreign policy approach. While managing pressures from Western governments to help isolate Moscow, the Indians have also been trying to assert themselves on the world stage. The South Asian powerhouse will not content itself with being merely an ally of the West and instead will maintain its policy independence, with implications for the U.S.-Chinese rivalry.”, Geopolitical Futures, March 29, 2023

Indonesia

“Nickel Revolution Has Indonesia Chasing Battery Riches Tinged With Risk – A wave of new supply from the Southeast Asian nation, key for climate goals, is challenging metal markets and a pristine environment. Within two years, Indonesia could supply 65% of the world’s nickel, up from 30% in 2020, Macquarie Group Ltd. estimates. With so much metal outside the London Metal Exchange and the Shanghai exchange, Indonesia threatens to upend even nickel pricing benchmarks.”, Bloomberg, March 28, 2023

Italy

“ChatGPT banned in Italy over privacy, data collection concerns – Calls have grown in the United States to stop development of the AI technology. The Italian Data Protection Authority said it is blocking OpenAI from processing the data from American users, and has opened an investigation into the organization. The order lasts until OpenAI respects the EU’s privacy law, the General Data Protection Regulation (GDPR).”, Fox Business, March 29, 2023

Japan

“Tokyo Inflation Slows Ahead of BOJ Leadership Change to Ueda – Production, retail sales improve in more positive sign Labor market worsens slightly in challenge for wages outlook. Consumer prices excluding fresh food in the capital rose 3.2% from a year ago, following a sharp deceleration in the previous month that was mainly driven by government subsidies for electricity costs, according to the ministry of internal affairs Friday.”, Bloomberg, March 30, 2023

South Korea

“Five trends that will define South Korean grocery in 2023 – South Korean consumers are increasingly shifting from cooking from scratch to eating out or more conveniently. What does “convenience” mean? According to our 2021 South Korea grocery survey,1 45 percent of consumers prefer prepackaged and partially cooked fresh meals that require some preparation (compared with 34 percent of the world), and 41 percent order prepared foods for delivery (versus 24 percent of the world).”, McKinsey, March 22, 2023

Mexico

“Mexico Sees Inflation Slowing to 4% in 2024 as Economy Grows 3% – Finance Ministry released preliminary budget plan for 2024 The country’s economy expected to grow 3% this year and next. Inflation in Latin America’s second-largest economy is expected to slow to 5% by the close of this year and reach 4% by the end of 2024, from the most recent level of 7.12% in early March.”, Bloomberg, March 31, 2023

Middle East Region

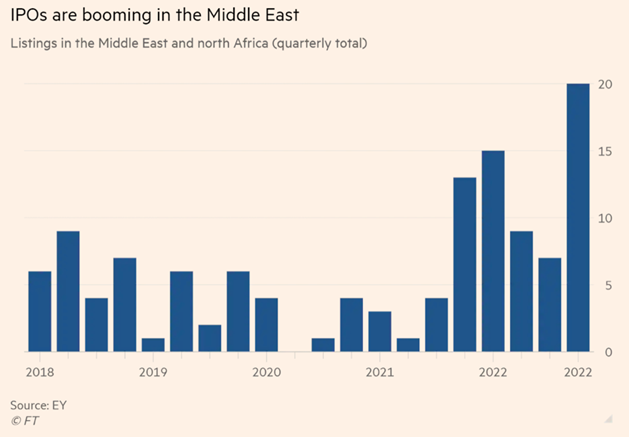

“Middle East on ‘radar’ of global investors as it enjoys IPO boom – Frenzy of activity across the region contrasts sharply with Europe’s moribund market. The 51 IPOs across the Middle East and north Africa last year was a record, according to EY. They raised $22bn, a 179 per cent increase on 2021, the advisory firm said, adding that this year’s market looked “healthy”. Financial regulatory reform, a privatisation push amid political stability and oil and gas prices that have risen significantly from their Covid-19 pandemic lows are driving both the IPO frenzy and private deals, bankers said.”, The Financial Times, March 27, 2023

United Kingdom

“Joining this trade partnership opens up a world of opportunity – The UK’s accession to the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) is a significant milestone for UK trade. This landmark deal will help the UK enhance its trading links in the Asia-Pacific region and strengthen its ties with some of the fastest-growing markets in the world. It is a marker of the UK’s strong position on the global stage that we are the first country from outside the Pacific Rim to join this bloc — and our presence will enhance its total value from 13 per cent of global GDP to 15 per cent, making it worth £11 trillion.”, The Times of London, April 1, 2023

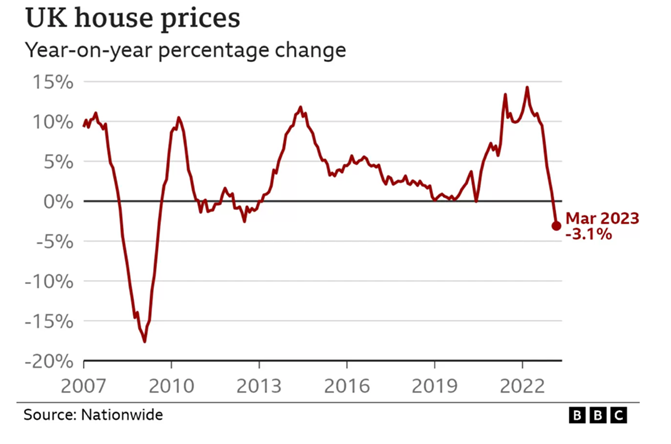

“House prices see biggest annual fall since 2009 – House prices fell in March at their fastest annual pace for 14 years, according to the latest figures from the Nationwide. The lender said prices were down 3.1% compared with a year earlier, the largest annual decline since July 2009. The Nationwide said the housing market reached a “turning point” last year, after the financial market turbulence which followed the mini-budget. Since then, “activity has remained subdued”, it added.”, BBC News, March 31, 2023

“Businesses in battle to find skilled staff – Most British businesses are struggling to plug gaps in their workforces amid a shortage of skilled talent. About 80 per cent of companies reported difficulty filling jobs, according to the latest talent shortage survey by ManpowerGroup, the American recruitment giant. That marks the highest percentage since 2006, while the proportion of businesses reporting difficulties with recruitment has jumped from 13 per cent a decade ago.”, The Sunday Times of London, March 27, 2023

United States

“Remote work gains momentum despite return-to-office mandates from high-profile CEOs – In some major US cities, the number of job postings for remote-friendly roles is hitting record levels — and trending up. That’s the latest finding of researchers including Stanford University’s Nicholas Bloom who’ve been gathering data on remote work since the early days of the pandemic. Data from security firm Kastle Systems show that office occupancy in major US cities is only about half of the pre-Covid level.”, Fortune, March 25, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“2023 Franchising Economic Outlook Predicts Industry Will Stay Strong – Despite economic uneasiness from ongoing inflation, labor shortages and supply chain problems, the franchise industry remained healthy last year and most sectors are expected to grow steadily in 2023, according to the 2023 Franchising Economic Outlook Report by FRANdata. In 2022, total franchised units grew 2% to a total of 790,492. The report projects that franchisee-owned businesses will increase by 15,000 units, to a total of roughly 805,000 this year. Franchising will grow by about 254,000 jobs, a 3% increase over 2022.”, FranchiseWire, March 22, 2023

“Study Finds 2 Out of 3 Restaurant Franchise Operators Feel Optimistic – Yet another survey has confirmed that restaurant operators are most concerned about inflation as they operate in 2023. But TD Bank’s Restaurant Franchise Finance Group’s new survey also finds people in the restaurant industry optimistic about the future and finding opportunities to invest. The poll surveyed 300 restaurant franchise operators and other finance professionals at the 2022 Restaurant Finance and Development Conference in Las Vegas, Nevada, to identify restaurant franchise finance trends.”, Franchising.com, March 30, 2023

“The Franchise in Spain 2023 Report Shows Post-Pandemic Resilience – The data shows that the turnover (revenue) figure grew by 2.9%, from €26,154 million at the end of 2019 to €26,929 million at year-end 2022. In 2022 franchising in Spain provided jobs for 303,595 people, compared with 294,231 employed in 2019, an increase of 3.18%. The number of networks that make up the country’s franchise system fell slightly, from 1,381 at the end of 2019 to 1,375 at year-end 2022, a decline of 0.5%. The number of open establishments also fell slightly (0.7%), from 77,819 operational premises at the end of 2019 to 77,426 at the end of 2022. Of Spain’s 1,375 franchise networks, 1,137 (82.6% ) are of national origin. The remaining 238 brands (17.4%) come from a total of 24 countries.”, Franchising.com, March 28, 2023

“BurgerFi Predicts Growth Despite Financial Woes And Closures – BurgerFi closed 15 stores in 2022 and 17 in 2021, on top of many other pandemic-related closures in 2020 (via QSR Magazine). As of 2022, the chain has 114 total remaining stores, all located exclusively in the U.S., 11 of which it opened in 2022. The chain cited the previous store closures as the result of staffing shortages, lack of capital, and inadequate operational knowledge. Looking forward, BurgerFi expects to opens 15 to 20 stores in 2023, including airport restaurants…..”, Tasting Table, March 25, 2023

“Chinese top hotpot chain’s overseas unit sees profit this year – The overseas unit of China’s biggest hotpot chain Haidilao expects to return to profit this year, after posting almost 80% year-on-year growth in revenue for 2022 late on Thursday. Originally founded in Sichuan Province of China in 1994, Haidilao now operates more than 1,300 stores across China……Haidilao currently has 114 stores overseas, including a new store opened in Dubai this month, its first venture into the Middle East market.”, Reuters, March 30, 2023

“Domino’s (China) Pizza Franchiser DPC Dash Looks to Tap Hong Kong IPO Market – The pizza chain operator has set a price range of HK$41.4 to HK$55.0 a share. The latest offering is higher than its earlier plan to raise up to HK$567.50 million. The Shanghai-headquartered company began managing Domino’s Pizza outlets in China in 2010, and now operates more than 450 of the restaurants in Beijing, Shanghai and eight other cities across the country.”, The Wall Street Journal, March 15, 2023

“KX Pilates (Australia) eyes global expansion as it celebrates 100 studios – Founded by fitness entrepreneur Aaron Smith, KX Pilates opened its first studio in Melbourne in 2010 and now spans across 100 studios in Australia and the broader Asia Pacific region, including New Zealand, Indonesia, China and Taiwan, and is soon to launch in Singapore. It counts six international studios and 94 Australian-based studios in its franchised network, with Noosa taking the title as the 100th location. In 2023, a further 15 new studios are on the cards, and 2024 is forecasted to be bigger than ever for the global business.”, Smart Company AU, March 14, 2023. Compliments of Jason Gehrke, Franchise Advisory Centre, Brisbane

“Popeyes to Accelerate Growth in China – Roughly $90 million is being poured into growth and development efforts. Tims China, the master franchisee rapidly growing Tim Hortons across mainland China, Hong Kong, and Macau, announced Thursday that it will spearhead growth for Popeyes as well. The company purchased PLKC International (Popeyes China), which holds exclusive rights to develop and sub-franchise Popeyes in mainland China and Macau.”, QSR Magazine. March 31, 2023. Compliments of Paul Jones, Jones & Co., Toronto

“Starbucks braced for price war in China as rivals pile into coffee market – Chains backed by private equity bet consumers will turn social pastime into daily routine. The US chain plans to open a store in China every nine hours to reach 9,000 locations by 2025, up from just over 6,000 currently. As with many consumer brands in China, Starbucks’s expectations of a big rebound rest on projections for a huge market opportunity, but they are tempered by increased competition from international and domestic rivals and often fickle consumer habits.”, The Financial Times, March 22, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

William “Bill” Edwards: Global Advisor – Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global.

With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant taking 40 franchisors global.

For a complimentary 30 minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking