EGS Biweekly Global Business Newsletter Issue 81, Tuesday, May 2, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Introduction: In this issue, inflation continues to fall for most developed economies. AI may give as many jobs as it takes away….over time. The numbers for China seem mixed. European consumer trends report. Some developing countries try to move away from the US$. And we track the interesting growth of gold production over 200 years.

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here:

First, A Few Words of Wisdom From Others

“To be successful, you must act big, think big and talk big.”, Aristotle Onassis

“Whenever you see a successful business, someone once made a courageous decision.”, Peter F. Drucker

The secret of getting ahead is getting started.”, Mark Twain

Highlights in issue #81:

- Brand Global News Section: Anytime Fitness®, Johnny Rockets, McDonalds®, Popeyes®, Shake Shack® and Subway®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

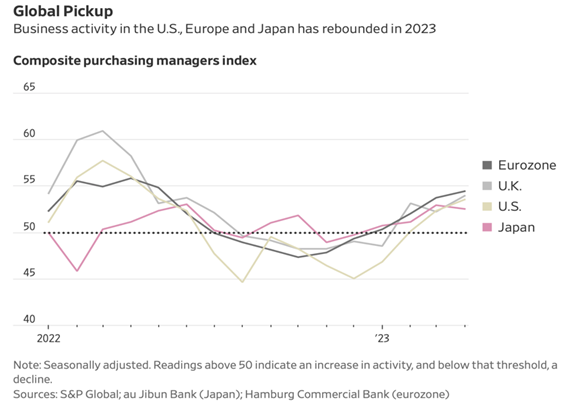

Interesting Data and Studies

“Global Economy Gets Boost but Inflation Worries Linger – U.S., European business activity accelerated in April, but price pressures picked up as central banks consider additional interest-rate increases. U.S. and European business activity rose in April at the fastest pace in about a year, a boost for the global economy but a potentially complicating factor for central banks working to reduce high inflation. Demand for services drove the growth, according to surveys by data firm S&P Global covering U.S., eurozone and U.K. businesses. That kept pressure on price increases in regions where inflation last year reached its highest level in decades.”, Wall Street Journal, April 21, 2023

“What is generative AI? Generative artificial intelligence (AI) describes algorithms (such as ChatGPT) that can be used to create new content, including audio, code, images, text, simulations, and videos. Recent breakthroughs in the field have the potential to drastically change the way we approach content creation. While many have reacted to ChatGPT (and AI and machine learning more broadly) with fear, machine learning clearly has the potential for good.”, McKinsey, January 19, 2023

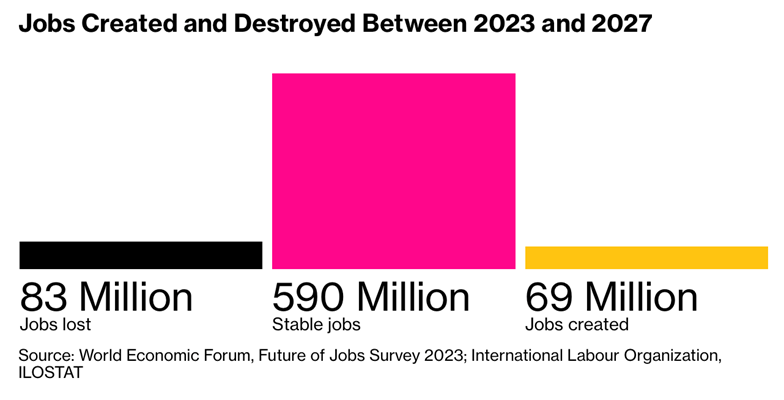

“Tech, AI Driving Job Changes for Nearly a Quarter of All Workers – Technology may eliminate 26 million jobs over next five years. Green transition will provide opportunities for job creation. Over the next five years, nearly a quarter of all jobs will change as a result of AI, digitization and other economic developments like the green energy transition and supply chain re-shoring, according to a report published by the World Economic Forum in Geneva on Monday. While the study expects AI to result in “significant labor-market disruption,” the net impact of most technologies will be positive over the next five years as big data analytics, management technologies and cybersecurity become the biggest drivers of employment growth.”, Bloomberg, April 30, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

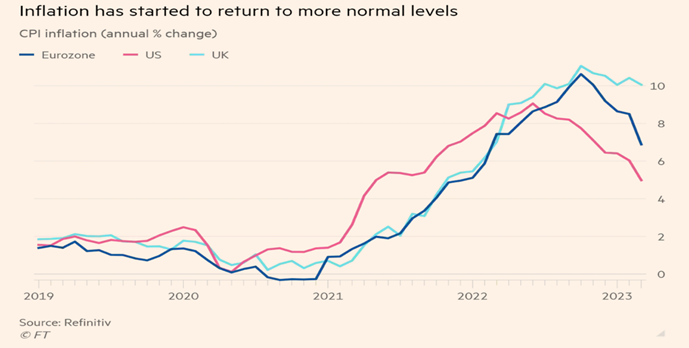

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

“The ECB’s inflation dilemma: can Lagarde silence her critics again? – The Financial Times has spoken to a dozen current and former members of the ECB’s rate-setting governing council in the past few weeks as well as several economists, financiers and analysts who follow the central bank closely. Most of them praise Lagarde for rebuilding unity among ECB monetary policymakers and preventing recent economic shocks from spiralling into a financial crisis. But critics complain she lacks economic expertise, was late to react to soaring inflation and should communicate more clearly.”, The Financial Times, April 30, 2023

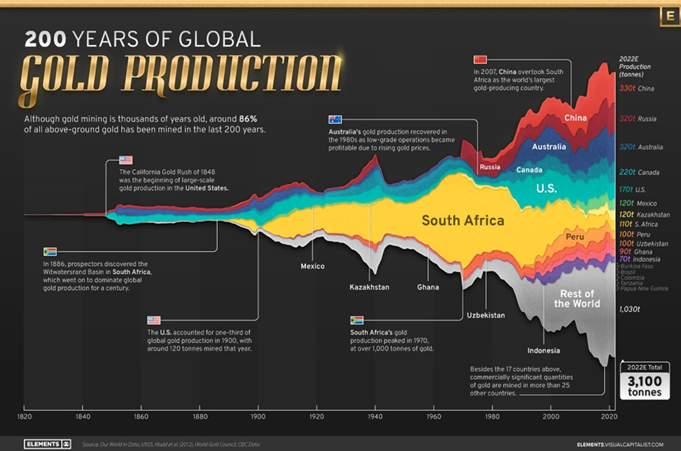

“Visualizing Global Gold Production Over 200 Years – Although the practice of gold mining has been around for thousands of years, it’s estimated that roughly 86% of all above-ground gold was extracted in the last 200 years. With modern mining techniques making large-scale production possible, global gold production has grown exponentially since the 1800s. The above infographic uses data from Our World in Data to visualize global gold production by country from 1820 to 2022, showing how gold mining has evolved to become increasingly global over time.”, Visual Capitalist / Our World In Data, April 26, 2023

“Here’s How Supply Chains Are Being Reshaped for a New Era of Global Trade –

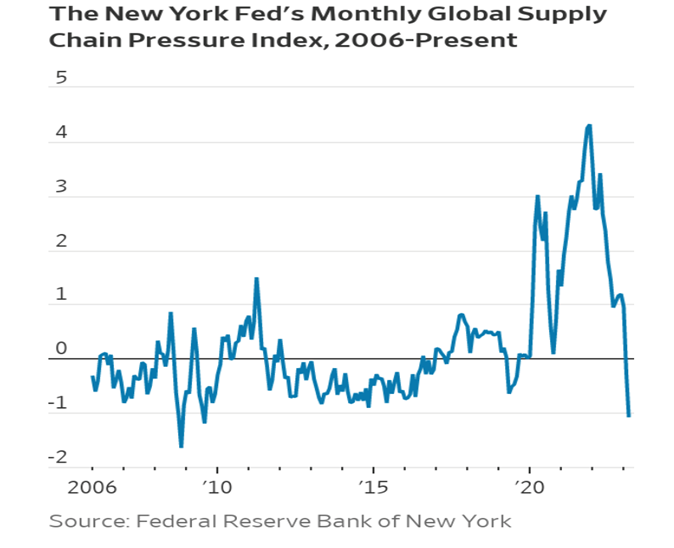

Nearshoring. Automation. Supplier diversification. Sustainability. Companies are adapting their operations to changing market pressures and geopolitics. When a measure of strains on global supply chains fell earlier this year to levels last seen before the Covid-19 pandemic, it signaled to some that the product shortages, port bottlenecks and shipping disruptions of the past three years were over and that a new era of stability was on the horizon.”, The Wall Street Journal, April 24, 2023

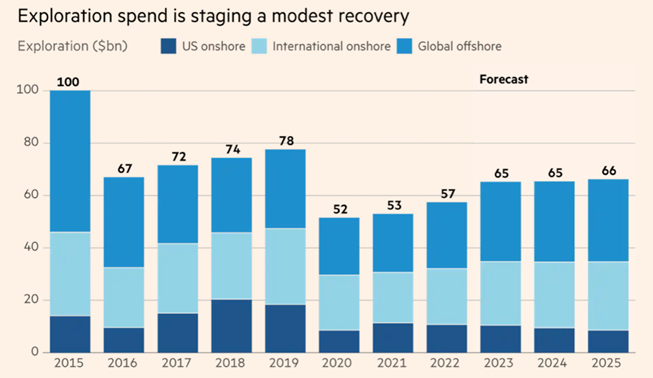

“Oil exploration: modest revival leaves majors ahead by a whisker – Total spend on exploration is set to rise to $65bn in 2023, from $57.5bn last year. It takes a brave oil and gas major to wager on wildcat wells, as risky drilling is termed. Most have taken an axe to budgets, believing the energy transition will stem demand for fossil fuels. Now there are inklings of excitement in exploration. That is good news for the likes of Shell, TotalEnergies and drilling services groups. But investors yearning for the return of roustabout rock ‘n’ roll in London stocks will be disappointed.”, The Financial Times, April 24, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel Updates

“American Airlines Sees Topping Profit Forecast as Global Demand Grows – Airline is boosting capacity for international flights. Ease of Covid restrictions is boon for overseas travel. The company, like its largest rivals, is seeing a rebound in flights outside the US after travelers pulled back on those trips last year when many Covid-related restrictions were still in place. The airline is devoting 80% of its capacity growth this quarter to long-haul international routes.”, Bloomberg, April 27, 2023

“These Airlines Are Using AI to Make Long-haul Flights More Efficient – The goal is to cut down on delays and cancellations. Airlines like Air New Zealand and Qantas are using AI-powered software to determine fuel-efficient routes in efforts to prevent having to stop to refuel, Bloomberg reported. (The former launched a 17.5-hour flight from New York City to Auckland, New Zealand. The latter plans to launch the longest flights in the world between Sydney to New York and London with its Project Sunrise.) The software, which is designed to get better the more it’s used, warns pilots about bad weather, helps them catch a tailwind, and more.”, Travel & Leisure magazine, April 24, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Canada

“Small businesses expect to grow in next 6 months despite economic challenges – 62% of small and medium-sized businesses anticipate growth. Business leaders of Canadian small and medium-sized companies are optimistic about the future, with 62 per cent expecting to grow in the next six months, according to a new report by Zoho Corp. More specifically, 38.2 per cent expect growth of one to 10 per cent, 15.4 per cent estimate growth of 10 to 20 per cent and 8.5 per cent forecast growth of above 20 per cent, the Zoho Canada SMB Outlook Report, which surveyed 1,016 Canadian business leaders in March, showed. However, 31.2 per cent are expecting zero growth and only 7.8 per cent are expecting declines.”, The Financial Post, April 21, 2023

China

“US firms’ confidence in China’s economy is rising, but so are fears over bilateral tensions – AmCham China poll finds a sharp increase in negative sentiment regarding the impact of souring relations between the world’s two largest economies. However, more business executives are visiting China, and more foreigners say they would consider moving to China. A total of 59 per cent of 109 respondents had a positive outlook on China’s economic recovery in AmCham’s latest “flash survey” conducted from April 18-20, marking a significant increase from 33 per cent in the previous survey results released in March after 319 respondents were polled in October, November and February. Yet, pessimistic views on bilateral relations have worsened, rising across the two surveys from 73 per cent to 87 per cent.”, South China Morning Post, April 26, 2023. Compliments of Paul Jones, Jones & Co., Toronto

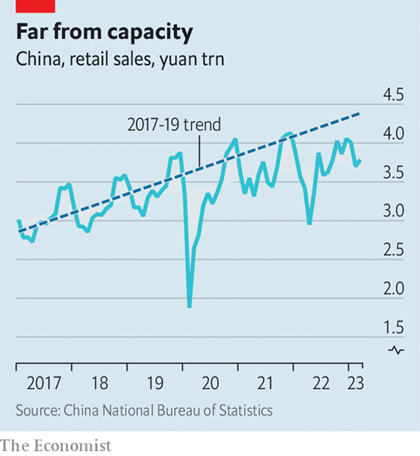

“If China’s growth is so strong, why is inflation so weak? This newspaper described China’s reopening as the biggest economic event of the year. So why has it had such a small effect on prices? Some suspect the recovery is weaker than the official statistics portray. Analysts at China Beige Book, which relies on independent surveys to track the country’s economy, told clients they were “snickering” at official figures showing that retail sales surged by 10.6% in March compared with the previous year.”, The Economist, April 27, 2023

Eurozone

“Eurozone returns to weak growth in first quarter – GDP fails to hit expectations as German stagnation weighs on outlook. The eurozone economy returned to growth in the first three months of the year as output expanded by 0.1 per cent. But the figure undershot economists’ expectations of stronger growth as stagnation in Germany, the region’s largest economy, offset expansions elsewhere in the bloc. The eurozone’s economy is now 1.3 per cent larger than in the first quarter of 2022. That compares with US growth of 1.6 per cent over the same period and a 4.5 per cent expansion of the Chinese economy in the same period.”, The Financial Times, April 28, 2023

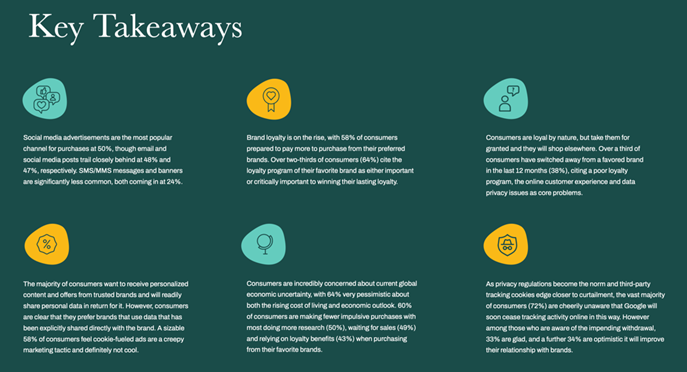

“2023 European Consumer Trends & Attitudes – Are European consumers different from consumers elsewhere in the world? Marigold, in conjunction with Econsultancy, asked 7,392 consumers across Europe (U.K., Germany, France, Spain, Denmark, Sweden, and the Benelux region) for their thoughts on 2023. Here’s some of what they found, all reported in the Europe Consumer Trends Index 2023. The 41-page report focuses on European consumer attitudes and trends in six areas: messaging, brand loyalty, privacy and personalization, the rising cost of living, and consumer sentiment by industry.”, Euroconsultancy, April 2023. Compliments of Eddy Goldberg, Franchising.com

India

“India Pushes Rupee Settlements With Trade Partners Amid Dollar Shortages. – New Delhi is boosting its efforts to expand the use of the Indian rupee (INR) in international trade, as it seeks to increase exports to nations facing a shortage of the U.S. dollar. The United Arab Emirates, a rising economy in the Middle East, is now set to join 18 other countries that are settling cross-border trade transactions with the rupee. India’s push to advance rupee transactions in global trade follows in the lines of similar efforts by other countries, notably China and Russia, to ditch the dollar as the world looks warily at the weaponization of the greenback by the United States.”, International Business Times, May 1, 2023

Japan

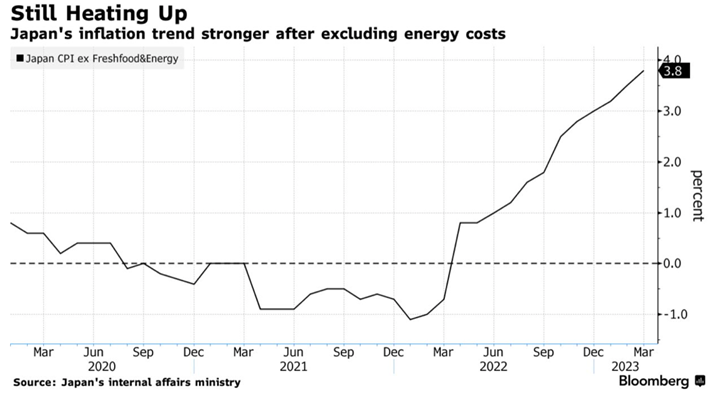

“Japan Inflation Outpaces Forecasts Again as BOJ Prepares to Meet – Gauge of underlying price trend at strongest since 1981. Consumer prices excluding fresh food rose 3.1% in March from a year ago, matching the pace of the previous month, the internal affairs ministry said Friday. Economists had expected the inflation measure to ease to 3%. A separate gauge of price growth that excludes both energy and fresh food also proved stronger than expected, climbing to 3.8% for its highest reading since 1981.”, Bloomberg, April 20, 2023

Spain

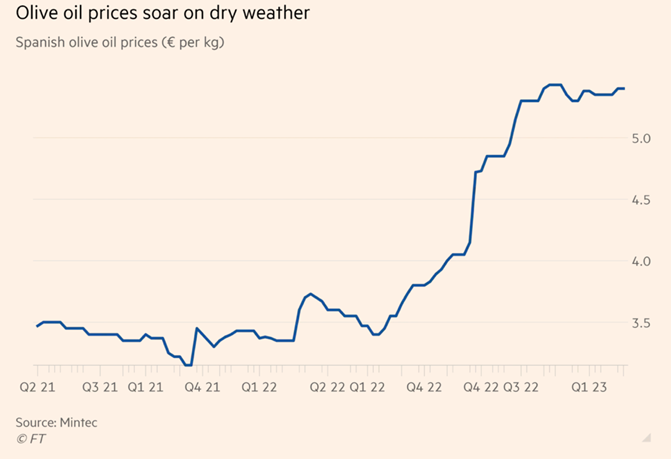

“No rain in Spain pushes olive oil prices to record levels – Continuing drought conditions leave traders and analysts worried about this year’s output. Olive oil prices have surged almost 60 per cent since June to roughly €5.4 per kilogramme, on the back of a severe drought in Europe that last year ruined olive crops across the continent. Spain, the largest olive oil producer, was hit particularly hard. The country’s farmers typically produce half of the world’s olive oil, though annual supplies have roughly halved to about 780,000 tonnes in the past 12 months.”, The Financial Times, April 23, 2023

United Kingdom

“Demand for services pushes private sector to 12-month high – The flash composite purchasing managers’ index (PMI), which is compiled by the Chartered Institute of Procurement and Supply and S&P Global, jumped by more than expected to hit 53.9 on the index this month, up from 52.2 in March. City economists had predicted that it would stay at 52.2. It is the third consecutive month in which there has been a rise in business activity, adding to signs that the wider economy is holding up despite the cost of living squeeze on households.”, The Times of London, April 21, 2023

United States

“US manufacturing contracts again in April, but pace slows – Manufacturing PMI rises to 47.1 in April New orders improve moderately; prices paid pick up. U.S. manufacturing pulled off a three-year low in April as new orders improved slightly and employment rebounded, but activity remained depressed amid higher borrowing costs and tighter credit, which have raised the risk of a recession this year.Despite the weakness in factory activity and demand for goods reported by the Institute for Supply Management (ISM) on Monday, there was a build-up of inflation pressures last month.”, Reuters, May 1, 2023

“US growth slowed sharply in first quarter as Fed pushed rates higher – GDP climbed 1.1% on annualised basis as consumers spent heavily in face of elevated inflation. The world’s largest economy grew 1.1 per cent on an annualised basis between January and March, according to preliminary data released by the commerce department on Thursday. The figures marked an abrupt deceleration from the 2.6 per cent pace registered in the final three months of 2022 and came in well below economists’ expectations of a 2 per cent increase.”, The Financial Times, April 27, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“Information statement for prospective franchisees – The Australian government has released a new version of the ‘Information statement for prospective franchisees. This document must be given to potential franchisees by a franchisor if they express an interest in a franchise. It must be given as soon as practicable, but not later than 7 days after interest is expressed. The information statement must be given to the potential franchisee before giving them any other documents. It is part of Australia’s Franchising Code of Conduct and is a legal requirement for every foreign or local franchisor to comply with if offering franchises in Australia.”, Australian Competition and Consumer Commission, April 2023. Compliments of Rod Young, Chairman, DC Strategy, Sydney

“Anytime Fitness has signed a master franchise deal for Austria with Manfred Mitterlehner, the fitness and personal training operator of Austria-based Mitterlehner Fitness. He will continue to operate Mitterlehner Training Physio brand locations separately and independently. Within the next 12 months, however, he will convert 9 existing Mitterlehner Fitness Clubs across Austria to Anytime Fitness clubs. He also plans to open two new Anytime Fitness clubs in Vöcklamarkt and Andorf in this autumn. With this deal, parent company Self Esteem Brands will have Anytime Fitness clubs operating in 40 countries and territories.”, Franchising.com, April 27, 2023

“Johnny Rockets Touches Down in India at Kempegowda International Airport – Classic Burger Chain Broadens International Presence with Newest Bengaluru Location. FAT Brands Inc. announces a new location in India at the Kempegowda International Airport in partnership with HMSHost. Located in Bengaluru, the capital city of Karnataka, the new Johnny Rockets serves the classic fare that put the brand on the map over 35 years ago, including juicy, made-to-order burgers and hand-spun shakes. ‘Expanding Johnny Rockets’ presence in non-traditional venues continues to be a key growth objective for the brand,’ said Jake Berchtold, COO of FAT Brands’ Fast Casual Division. ‘Strategically, we are pleased to spearhead this type of expansion in a country like India, where we see significant opportunity to build our footprint.’”, Franchising.com, April 27, 2023

“McDonald’s Restaurant Revamp Is Paying Off, CEO Says – Net income rises 63% in first quarter. McDonald’s Corp.’s efforts to improve operations across its U.S. restaurants are making orders faster and more accurate, its chief executive said, as the burger giant pursues a broader restructuring. McDonald’s said that restaurant staffing levels are improving, and that the chain is continuing to draw business from rival fast-food restaurants despite raising menu prices.”, The Wall Street Journal, April 25, 2023

“Popeyes (China) spreads its wings for a new operator – Tims China announced it would acquire the exclusive rights to develop and sub-franchise the fried chicken brand earlier this year. Tims China completed a transaction on March 30 to become the exclusive operator and developer of the Popeyes brand on the Chinese mainland. Under the transaction, Popeyes China would bring US$30 million in cash to Tims China and the latter will earmark an additional US$60 million to develop its Popeyes China business over the coming years.”, Shina.cn, April 24, 2023

“‘Too Many Seats, Too Few Butts’ Mean Changes at Your Favorite Restaurant – As eating out is replaced by ordering out, restaurant real estate gets a radical makeover. For most people, a meal at an upscale chain is about the ambience as much as the food. A surprisingly high 18% of sales at American fine dining establishments last year, surveyed by consulting firm Technomic, were to people for whom there is no place like home—except maybe their car. At the other end of the quality and price spectrum–fast food–about 60% of meals already were consumed off-premises in 2019. That rose to about three-fourths in the final quarter of 2022.”, The Wall Street Journal, April 29, 2023

“Restaurant Earnings Have Been Strong. Why Some Operators See Trouble Ahead – Menu prices are up across the board—but if the current spate of restaurant earnings are anything to go by, that hasn’t ruined people’s appetites for dining out. This week, McDonald’s, Domino’s Pizza, and Chipotle Mexican Grill all released first-quarter results—and beat analysts’ estimates. ‘Our base case does not include a recession, or certainly not a meaningful recession’, said John Hartung, Chipotle’s chief financial and administrative officer, in a call with analysts. BofA’s economics team has a different view, arguing that the report’s strength was thanks to a series of one-off boosts to spending, including an unseasonably warm January and an 8.7% increase to Social Security benefits. “The handoff to 2Q spending is soft and the outlook for the consumer over the rest of 2023 is murky,” the team wrote.”, Barron’s, April 28, 2023

“Shake Shack to Open in Israel in 2024 – Shake Shack will partner with Harel Wizel and Yarzin Sella Group to bring Shake Shack to Israel. Harel Wizel is the CEO of Fox Group, a fashion and lifestyle retail group with more than 1,000 global stores. Yarzin Sella Group is one of Israel’s leading culinary groups that owns and manages more than 30 restaurant concepts, and operates high-end corporate dining services in more than seven countries.” QSR Magazine, April 19, 2023

“Subway shed more U.S. sandwich shops in 2022 – Subway, which is exploring a potential $10 billion sale, further shrank last year in the United States as franchisees closed 2.7% of the brand’s sandwich shops, squeezing its royalties and fees. The chain shed another net 571 locations in 2022 after even steeper closings in previous years in the United States, its largest global market, according to the latest disclosure document it provides to franchisees who are interested in buying locations.”, Reuters, May 1, 2023

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

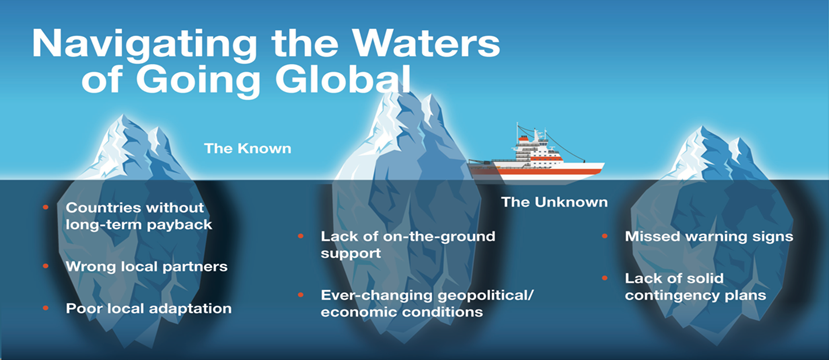

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global.

With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant taking 40 franchisors global.

For a complimentary 30 minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link: