EGS Biweekly Global Business Newsletter Issue 89, Tuesday, August 22, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Introduction: In this issue, Barbie on the menu in restaurants? A new McDonald’s® brand, Subway® sold? The world’s 50 most valuable companies, travel to be US$15 trillion by 2035, more flights to China soon, Latin American banks lowering interest rates, inflation remains high in the UK, Germany sees a slowdown while the US heads for 5%+ GDP growth (?).

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

NOTE: Some of the sources that we provide links to require a paid subscription to access. We subscribe to 40 international information sources to keep our readers up to date on the world’s business.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here:

First, A Few Words of Wisdom From Others

“The best way to predict the future is to create it.”, Abraham Lincoln

“You miss 100% of the shots you don’t take.”, Wayne Gretzky

“If you really look closely, most overnight successes took a long time.”, Steve Jobs

Highlights in issue #89:

- Brand Global News Section: CosMc®, Jollibee®, Marrybrown®, Potato Corner®, Rally’s & Checkers®, Subway®, Wendys®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data and Studies

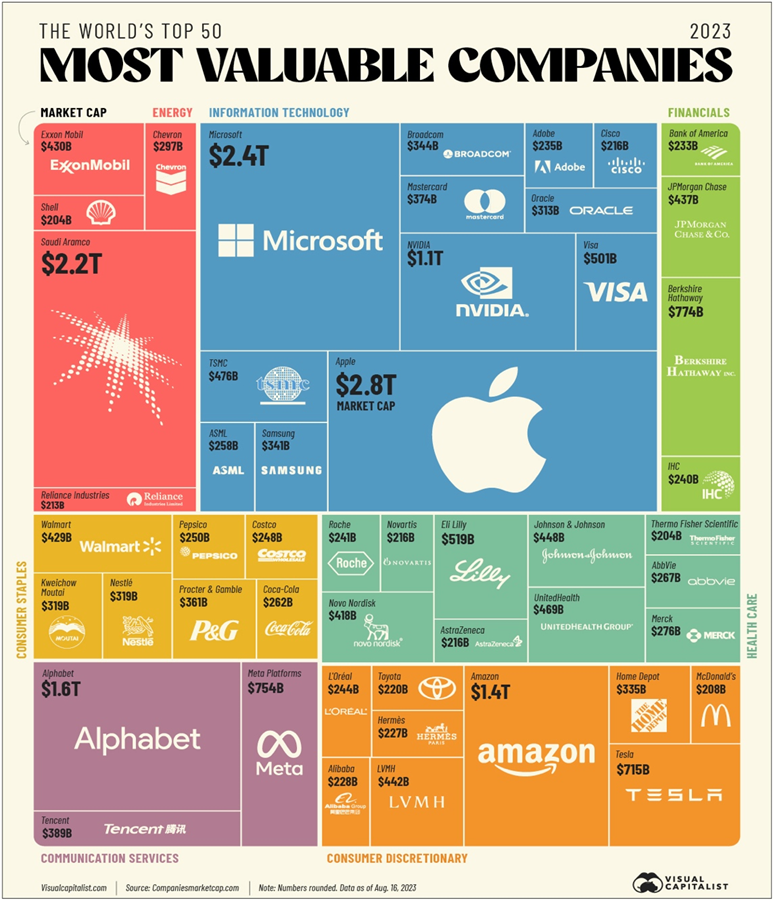

“The 50 Most Valuable Companies in the World in 2023 – Market capitalization, or market cap, is one measure of a company’s value as determined by the stock market. It is easily calculated by multiplying the company’s outstanding shares by its current share price. In this graphic, we present a treemap chart that visualizes the world’s top 50 publicly-traded companies by market cap, using data as of Aug. 16, 2023. Altogether, the 50 most valuable companies represent over $26.5 trillion in shareholder value. At a sector level, Information Technology is the most represented in the top 50, with $9.3 trillion in combined market cap. The next biggest sectors are Consumer Discretionary ($4.0 trillion) and Health Care ($3.3 trillion).”, Visual Capitalist, August 20, 2023

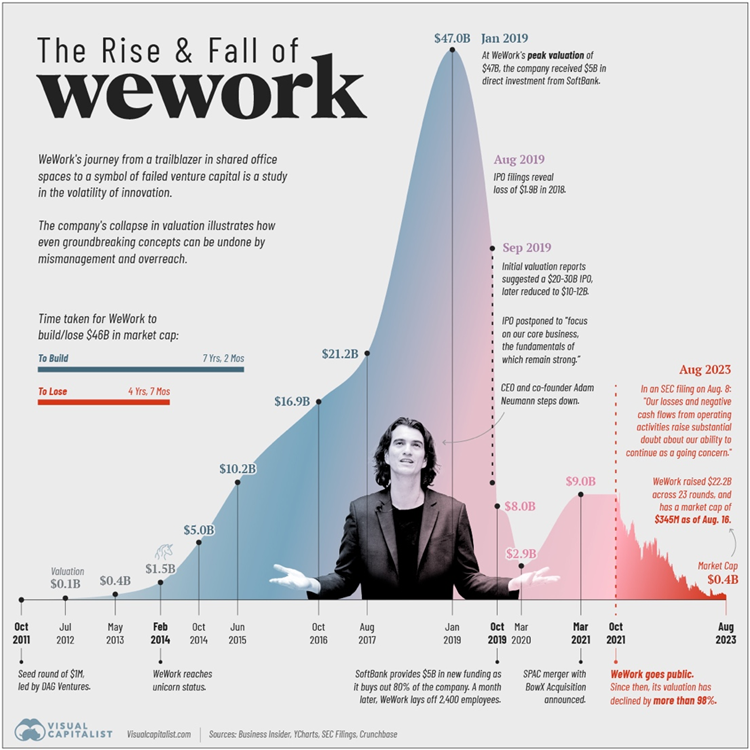

“The Rise and Fall of WeWork – Despite its recommitment to core business fundamentals in the last few years, WeWork’s management—which saw a shakeup in May 2023 when CEO Sandeep Mathrani departed—is setting off a signal flare about the company’s future. WeWork was founded in 2010 by Adam Neumann and Miguel McKelvey with the primary objective of providing shared workspaces catered to freelancers, startups, and companies seeking ‘flexible office solutions.’ The business model, which rested on renting space from developers long-term, renovating and parceling the property, and subsequently leasing it out to short-term clients, thrived in a decade of low interest rates.”, Visual Capitalist, August 16, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

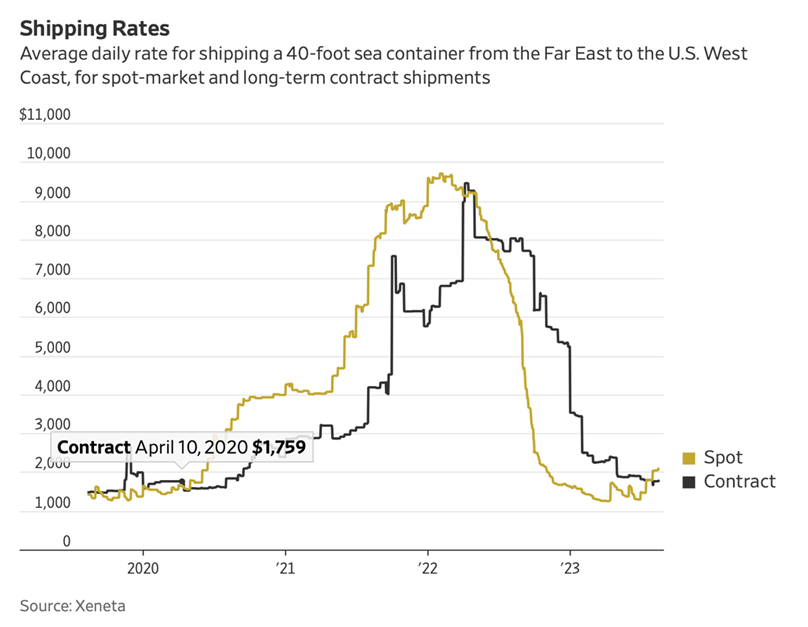

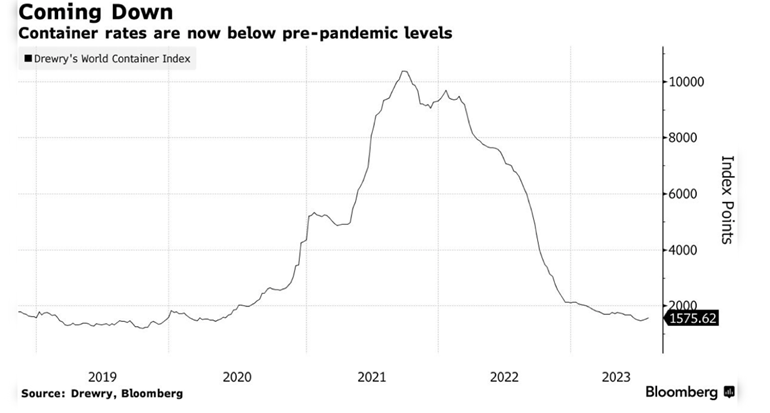

“U.S. Importers Are Absorbing Higher Shipping Costs This Summer – Container lines have reversed a big drop in freight rates this year, but experts say the price increases may be short-lived. Costs to ship goods from Asia to the U.S. are turning sharply upward, but American importers appear to be absorbing the higher prices after watching freight rates plummet this year from record highs. The average spot rate to ship a 40-foot container from China to the U.S. West Coast rose 61% during the six weeks through Aug. 15 to $2,075….”, The Wall Street Journal, August 16, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel Updates

“Travel Will Represent a $15.5 Trillion Economy by 2033 – Data from the World Travel & Tourism Council points to global tourism’s significant growth in the next decade. That includes the US, where travel will soon be worth $3 trillion. As a whole, the industry will employ up to 430 million people by 2033, compared with 334 million in 2019. That accounts for roughly 1 of every 9 jobs globally. In 2033, China’s travel sector is forecast to contribute $4 trillion and will make up 14.1% of the Chinese economy. By contrast, the US industry is projected to reach $3 trillion and will represent 10.1% of the US economy.”, Bloomberg, August 21, 2023

“Hilton bets on China’s middle class as it eyes about 730 hotels in next 10 years – The operator of Waldorf Astoria and Conrad hotels said its performance received a boost from Chinese travellers this year. Hilton said its properties in Asia-Pacific stood out in the second quarter, with revenue-per-room surging 79 per cent year on year. Hilton, which was previously majority owned by HNA Group until 2019 before the Chinese conglomerate fell into financial difficulties, currently manages 512 hotels in 170 destinations across China. It had closed 60 per cent of its properties across Asia-Pacific at the height of the pandemic that ravaged the industry for three years between 2020 and 2022.?, South China Morning Post, August 20, 2023

“Delta Air Lines to Expand China Flights For Winter Season – Delta Air Lines is gearing up for an extensive flight schedule expansion to China. The airline will introduce 10 weekly China flights to Shanghai-Pudong International Airport from its Seattle-Tacoma International Airport and Detroit Metropolitan Wayne County Airport hubs. These new services will kick off on Oct. 29, featuring daily flights from Seattle-Tacoma International Airport and three weekly flights from Detroit Metropolitan Wayne County Airport. Delta Air Lines is reinstating a four-times-weekly Shanghai Pudong International Airport route from its Los Angeles hub in March next year. In doing that, the company brings back a route that was last operational in February 2020.”, Travel Noire, August 19, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

China

“New Indicator Shows China’s Consumers Are Spending — on Services. Retail sales of services jumped 20.3% year-on-year in the January to July period compared with 7.3% growth for overall retail sales. Spending on services now accounts for more than 40% of the nationwide per capita consumption expenditure. The surge in retail sales from services this year was fueled by pent-up demand for culture, sports, health care and business services.”, Caixing Global, August 18, 2023

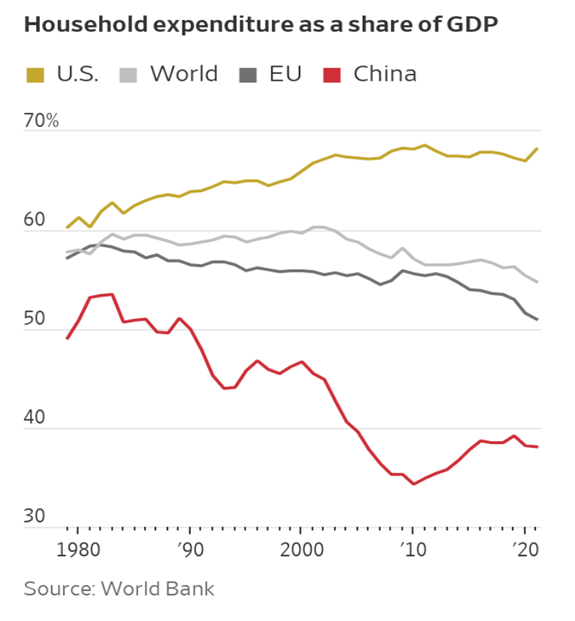

“China’s 40-Year Boom Is Over. What Comes Next? The economic model that took the country from poverty to great-power status seems broken, and everywhere are signs of distress. Economists now believe China is entering an era of much slower growth, made worse by unfavorable demographics and a widening divide with the U.S. and its allies, which is jeopardizing foreign investment and trade. The International Monetary Fund puts China’s GDP growth at below 4% in the coming years, less than half of its tally for most of the past four decades. Capital Economics, a London-based research firm, figures China’s trend growth has slowed to 3% from 5% in 2019, and will fall to around 2% in 2030.”, The Wall Street Journal, August 20, 2023

Germany

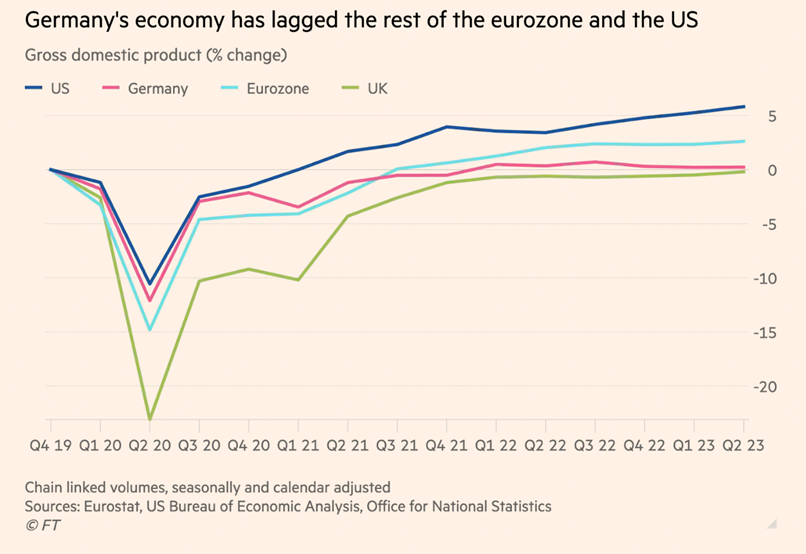

“Can Germany fix its economy? Ukraine war, higher rates and sluggish trade aggravate longstanding structural problems in EU powerhouse. The IMF and OECD both expect Germany to be the worst-performing leading economy in the world this year. A big reason is the global downturn in manufacturing, which hits Germany disproportionately hard as the sector contributes a fifth of its overall output — a similar level to Japan, but almost double that of the US, France and the UK.”, The Financial Times, August 20, 2023

Latin America

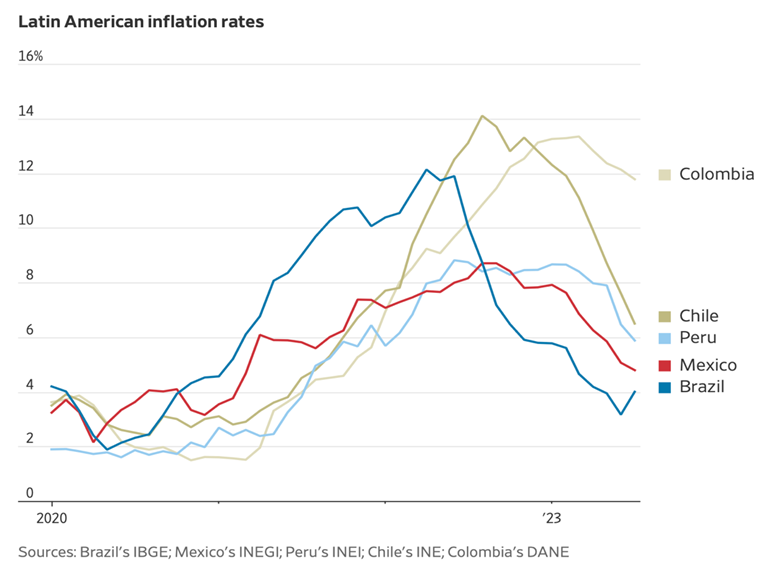

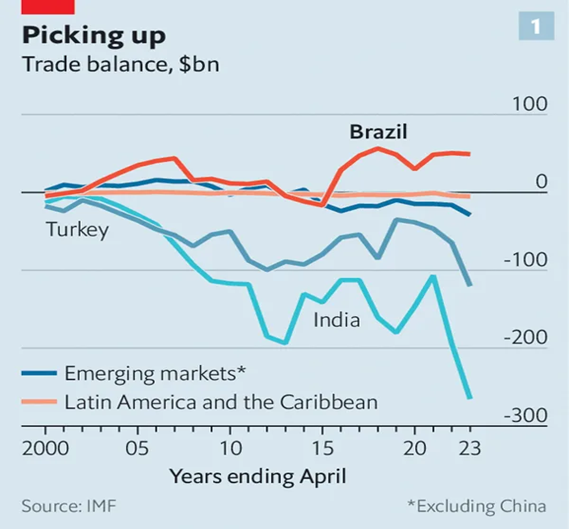

“Latin American Central Banks Take Lead in Cutting Rates as Inflation Cools – Recalling past hyperinflation, region’s central bankers raised rates before Federal Reserve acted. As inflation eased in Chile, the country became the first major emerging market to reduce interest rates during the current cycle. Latin America’s pivot to trim back high interest rates comes as a region rich in oil, copper and lithium struggles to rebound after posting some of the world’s biggest economic contractions during the pandemic. The easing of monetary policy doesn’t mean Latin American officials are anywhere close to reviving sluggish economies, according to analysts. Instead, they are gradually moving to what economists call neutral interest rates in line with countries’ typical inflation targets….”, The Wall Street Journal, August 17, 2023

Singapore

“Singapore workers are the world’s fastest in adopting AI skills, LinkedIn report says – Workers in Singapore are the world’s fastest when it comes to adopting artificial intelligence skills, according to LinkedIn’s latest Future of Work report.The report, which drew data from 25 countries, found that Singapore has the highest “diffusion rate” — the share of members adding AI skills to their profiles grew 20 times from January 2016. That’s significantly higher than the global average of eight times, LinkedIn told CNBC Make It.”, CNBC Make It, August 20, 2023

Thailand

“Thai economy likely grew 3.1% in Q2 on higher tourist arrivals – On a quarterly basis, gross domestic product (GDP) was forecast to have grown by a seasonally-adjusted 1.2%, a slowdown from the 1.9% growth in the preceding quarter, according to a smaller sample of forecasts in the Aug. 14-17 poll. While the country’s tourism-driven economy is expected to improve gradually, visitor numbers are still well below pre-pandemic levels. Thailand is predicted to receive 29 million tourists this year, down from 40 million visitors in 2019, the last full year before the COVID pandemic.”, Reuters, August 18, 2023

Turkey

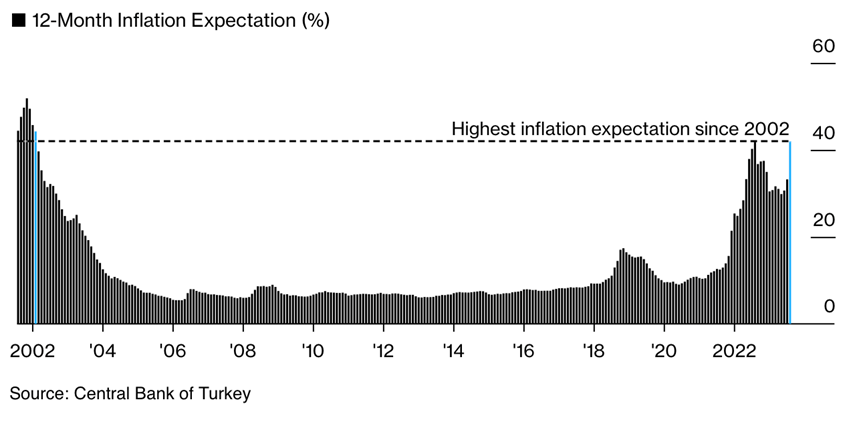

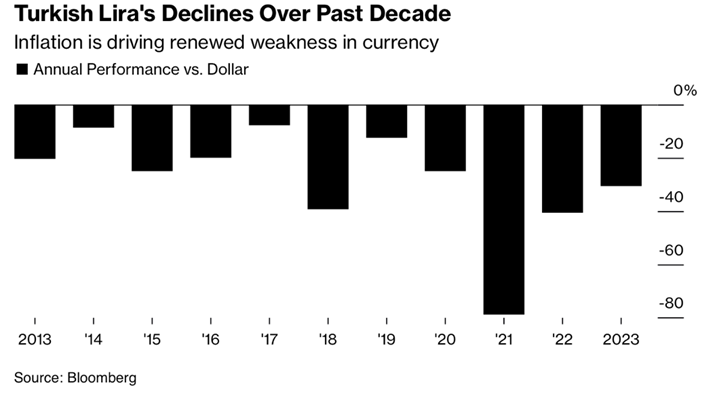

“Turkish Inflation Outlook at Its Worst in 21 Years on Weak Lira – Central bank survey puts year-ahead inflation estimate at 42%. Turkey finding it hard to curb prices after cheap money era. The lira is projected to lose more than 20% of its value against the dollar during the same period, fueling price increases, according to forecasts published by the central bank on Friday. The central bank expects inflation to decelerate after peaking in the second quarter of next year, as policymakers continue to gradually increase the cost of money.”, Bloomberg, August 18, 2023

United Kingdom

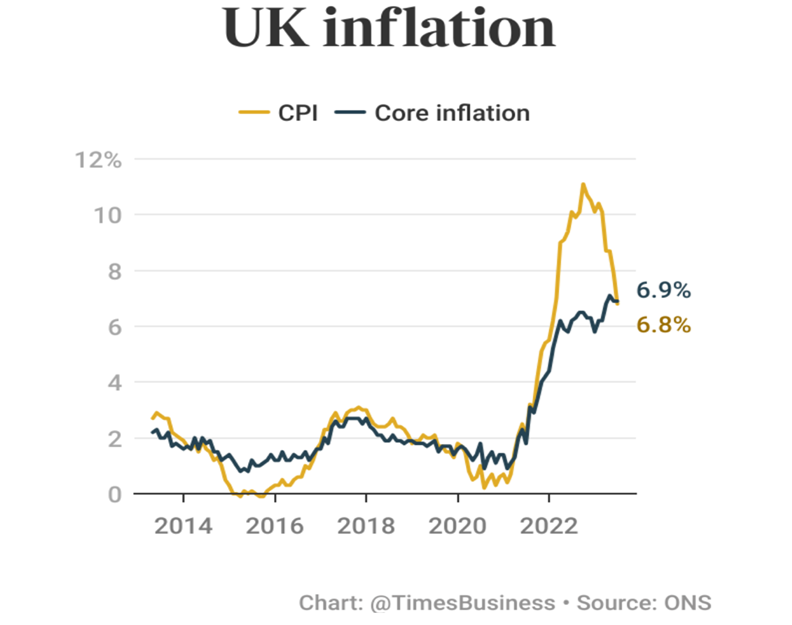

“UK inflation falls to 6.8% – Inflation fell to 6.8 per cent in the year to July, down from 7.9 per cent in the year to June. The consumer prices index reading from the Office for National Statistics was in line with expectations. It means that UK inflation has fallen to its lowest level since Russia’s invasion of Ukraine. Falling gas and electricity prices were the main reason that price growth fell. Food inflation, while still rising, has moderated, leading to an easing in the annual inflation rate. However, this was offset to some extent by upward pressure from the cost of hotels and air fares. The key measure is now surpassed by wage growth, which is running at a record 7.8 per cent.”, The Times of London, August 16, 2o23

United States

“This Fed GDP forecast has the U.S. growing 5.8% in the third quarter. Higher interest rates have not spawned a much predicted recession. Could the economy be growing even faster despite rising interest rates? Sure seems so. The Atlanta Federal Reserve’s GDPNow forecast for the third quarter was just raised to a heady 5.8% annual rate. The Atlanta Fed’s forecast was lifted from 5% after the government on Wednesday reported an increase in new house construction and industrial production in July. Most Americans who want a job can find one and lots of companies are still hiring. The unemployment rate sits near a 55-year low of 3.6% and wages are rising faster than inflation for the first time in a few years.

That’s kept consumer spending — the main engine of the economy — motoring ahead.”, MarketWatch, August 17, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“Buyout firm Roark Capital to buy Subway sandwich chain for US$9.6bn – The secretive private equity group, which specialises in buying restaurants, had been competing for months with Sycamore Partners and TDR, among others, for the fast-food chain. Subway’s board is expected to meet later this week to determine the auction winner, but Roark was the lead candidate as of Monday, said those informed about the talks.”, The Financial Times, August 21, 2022

“Barbie momentum expands beyond the box office and into restaurants – Some concepts that embraced Barbie-themed menu promotions are reporting new customers and double-digit sales lifts. Cold Stone Creamery, for instance, is offering an All That Glitters is Pink flavor, with pink cotton candy ice cream, graham cracker crust, dance party sprinkles and whipped topping, while Pinkberry launched a Barbie Land Berry Pink Swirl, featuring dragon fruit and strawberry flavors and topped with “dream sprinkles.” The Barbie Frappuccino – a secret menu item at Starbucks – proliferated on social media shortly before the movie’s release.”, Nation’s Restaurant News, August 17, 2023

“Beyond Borders — How Successful Franchises Thrive in Diverse Markets. Successful franchises can adapt and deliver their products and services in any corner of the world. Adaptability is Crucial: Whether it’s McDonald’s adjusting its menu to suit local tastes in India, Egypt, or Japan, or understanding regional preferences even within the United States, franchises that succeed globally recognize the importance of tailoring their offerings. The Brand isn’t Just the Product: While products might differ across countries, the underlying brand promise should remain consistent.”, Entrepreneur, August 14, 2023. From a book by Mark Siebert entitled, “The Multiplier Model”.

“Filipino Franchise Brands Aim For Rapid International Growth – Here in the UK, two Filipino franchise brands are starting to make their mark amongst British consumers. In the past few years, both fried chicken chain Jollibee and Potato Corner – famous for its flavoured fries – have established presences in various locations across the UK and have plans to expand further both this side of the pond and into other newly-developed international territories. It’s all part of a significant drive by the Philippine franchising industry to push their home grown brands out across the globe…..At present, around twenty Philippine-based franchises have an international reach, the majority in the fast food sector.”, Forbes, August 19, 2023

“Marrybrown – The Malaysian fast-food giant recently entered the Australian market – Marrybrown is ready to challenge the fast-food market in Australia and it isn’t planning on changing a thing on its menu. In a quick interview with QSR Media, Joshua Liew, CEO of Marrybrown, said that though he believes that localising the menu is very important, they do not currently plan on doing so in Australia. Marrybrown is currently in sixteen markets. Usually, 20% of their menu is localised. Their reason for localising is so that consumers won’t feel that Marrybrown is a foreign brand. However, recent consumer behaviour in some of their markets made them realise that this isn’t true 100% of the time.”, QSR Media AUS, August 3, 2023. Compliments of Jason Gehrke, The Franchise Advisory Centre, Brisbane

“Who on Earth is CosMc? B-list McDonald’s character gets name-checked in spinoff chain. McDonald’s announced during its second-quarter earnings call on Thursday that it will unveil a spinoff restaurant brand in 2024 that goes by the name of CosMc’s. “CosMc’s,” CEO Chris Kempczinski explained, ‘is a small-format concept with all the DNA of McDonald’s, but its own unique personality,’ adding that a ‘small handful of sites” would roll out “in a limited geography beginning early next year.’”, Fast Company, July 27, 2023

“Rally’s and Checkers are using AI chatbots for Spanish-language food orders – The not-yet-reliable automation is designed to cut down on labor costs. Checkers and Rally’s restaurants have launched the first Spanish ordering system that uses AI, Checkers restaurants announced. The system from a company called Hi Auto is already in use at 350 of those restaurants, following two months of beta testing at five locations. The system takes orders via a virtual assistant and detects the customer’s language spoken, automatically switching between English and Spanish.”, August 18, 2023

“Wendy’s to develop 200 restaurants in Australia – A new master franchise agreement for Australia has been announced by The Wendy’s Company and Flynn Restaurant Group, with the aim to open 200 restaurants in Australia by 2034. Flynn Restaurant Group is the largest restaurant franchise operator in the world and will serve as the exclusive master franchisee in Australia. It also operates restaurants for Applebee’s, Taco Bell, Panera, Arby’s and Pizza Hut throughout the US. ‘Wendy’s sees Australia as a high priority, strategic growth market and the collaboration with Flynn Restaurant Group showcases Wendy’s ambition to expand its international footprint using its franchising model,’ explained The Wendy’s Company.”, New Food Magazine, August 17, 2023

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

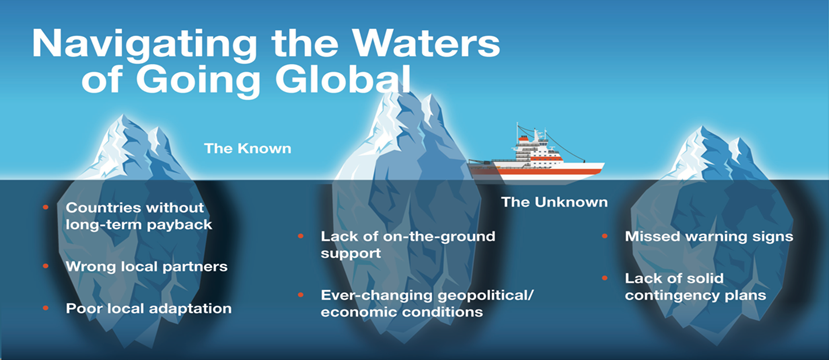

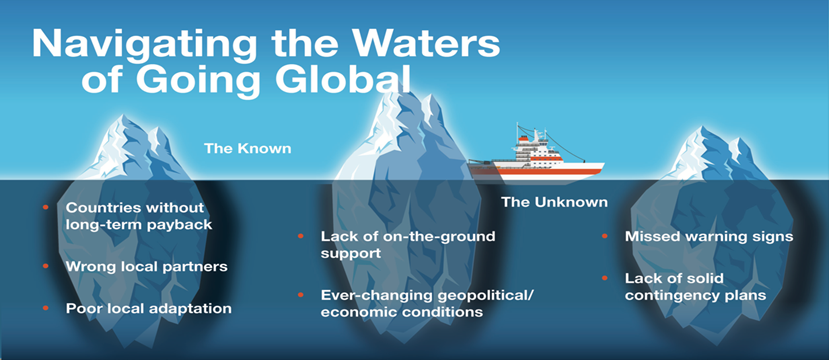

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant taking 40 franchisors global.

For a complimentary 30 minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 88, Tuesday, August 8, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Introduction: In this issue, AI driving employees back to the office, Zoom tells employees to come back to the office (?), investors once again positive about Brazil, global shipping up and down, Europe flights delays this summer but few visiting China yet, the latest ‘Economist’ Big Mac Index and an excellent report on franchising in Australia to download.

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

NOTE: Some of the sources that we provide links to require a paid subscription to access. We subscribe to 40 international information sources to keep our readers up to date on the world’s business.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here:

First, A Few Words of Wisdom From Others

“Don’t sit down and wait for the opportunities to come. Get up and make them.”, Madam C.J. Walker, first female self-made millionaire, 1905

“You have to be burning with an idea, or a problem, or a wrong that you want to right. If you’re not passionate enough from the start, you’ll never stick it out.” , Steve Jobs, CEO and co-founder of Apple Inc.

“Do what you love and success will follow. Passion is the fuel behind a successful career.”, Meg Whitman, CEO of Quibi

Highlights in issue #88:

Inflation Is Cooling. Food Inflation Could Get Worse

Global Shipping Costs Creep Higher After 16-Month Freefall

AI is driving the return to office

Zoom asks employees to return to office for first time since COVID-19 pandemic

Canada sheds jobs in July, unemployment ticks up to 5.5% as evidence of slowing economy mounts

McDonald’s Breakfast In Hong Kong Is Truly Deluxe

- Brand Global News Section: Applebee’s®, Chipotle®, Firehouse Subs®, IHOP®, McDonalds®, Outback®, Papa Johns®, Pollo Tropical®, Starbucks®, Subway® and Taco Bell®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data and Studies

“AI is driving the return to office – AI workers want to be in the office—and it just might solve the real-estate crisis. Artificial intelligence could be the savior of the office building. Unlike many tech companies that are actively downsizing office space and waffling on RTO timing and policies, AI companies are seeing the need for physical office space to do their suddenly desirable work. The real estate services firm JLL estimates that by the end of 2023, AI companies will occupy 17.2 million square feet of office space across the country. To put that number in perspective, it’s equivalent to more than half of the amount of office space that’s been leased or subleased between July 2022 and June 2023, according to JLL’s latest U.S. Office Outlook report.”, Fast Company, August 5, 2023

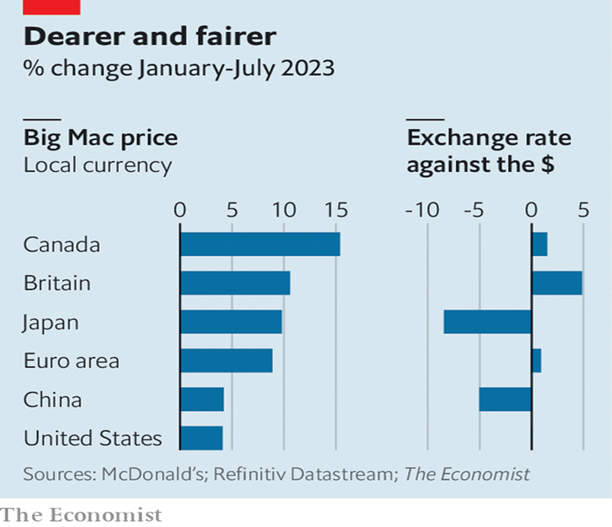

“The dollar is now better value, says the Big Mac index – But not against the Japanese yen. Since 1986 The Economist has tracked the price of a McDonald’s Big Mac around the world as a light-hearted guide to the fair value of currencies. Our index shows that the median price of the burger in its home market rose to $5.58 in July, an increase of over 4% since January and 8.3% compared with a year earlier. That is the beefiest rate of American McFlation recorded in our index since July 2012. Compared with the rest of the world, however, Americans have escaped lightly. From January to July the price of a Big Mac has risen more than twice as fast in the euro zone and Britain, and nearly four times as fast in Canada (see chart).”, The Economist, August 3, 2023

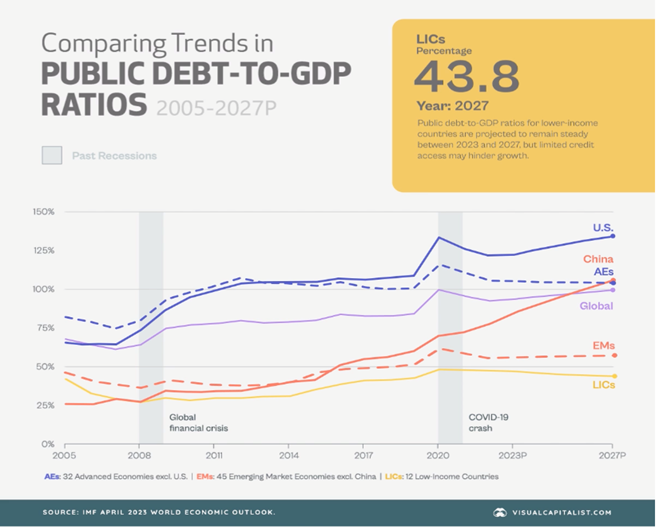

“Global Debt Projections (2005-2027) – Total global debt stands at nearly $305 trillion as of the first quarter of 2023. Over the next five years, it is projected to jump even further—raising concerns about government leverage in a high interest rate and slower growth environment. After rising steadily for years, government debt first ballooned to almost 100% of GDP in 2020. While this ratio has fallen amid an economic rebound and high inflation in 2021 and 2022, it is projected to regain ground and continue climbing. World government debt is now projected to rise to 99.5% of GDP by 2027. Here’s data going back to 2005, as well as the forecast for global public debt-to-GDP:” Visual Capitalist / IMF, August 1, 2023

“Zoom asks employees to return to office for first time since COVID-19 pandemic – Zoom has told its employees to return to the office for the first time since the coronavirus pandemic led employees to use video communications to speak with coworkers. Zoom is asking all employees within 50 miles of a company office to return for at least two days a week. ‘We’ll continue to leverage the entire Zoom platform to keep our employees and dispersed teams connected and working efficiently,’ the spokesperson said.”, Fox Business, August 6, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

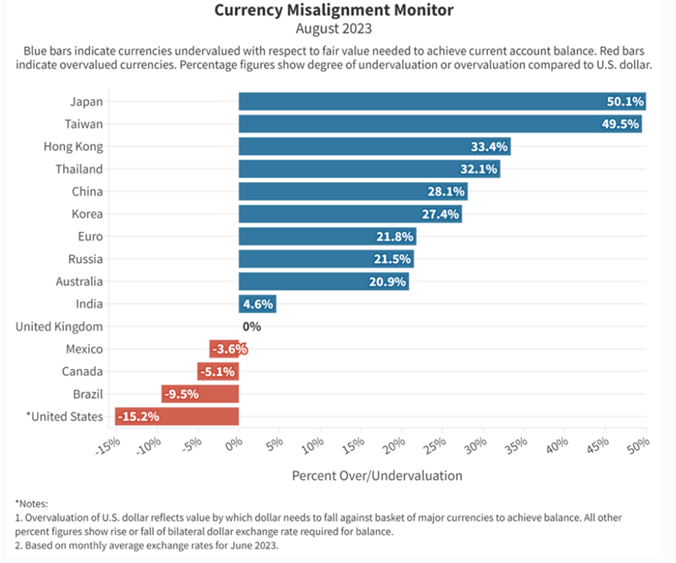

“The ‘Weak Dollar’ Is Overvalued By 15.2% – The ‘weak dollar’ is so strong it is estimated to be 15.2% overvalued against a basket of 34 currencies, according to economists at the Coalition for a Prosperous America and Blue Collar Dollar Institute. The two produce a monthly index on dollar valuation called the Currency Misalignment Monitor (CMM). The index is designed to provide a rough approximation of the degree of movement of exchange rates that would be required to bring the U.S. into a better trade balance with partner countries over a five-year stretch. Why is the dollar always overvalued against most currencies, including the second most used currency in world trade – the euro? Basically, it’s because of the securities market. Stocks and bonds (and real estate) are America’s most important product.”, Forbes, July 31, 2023

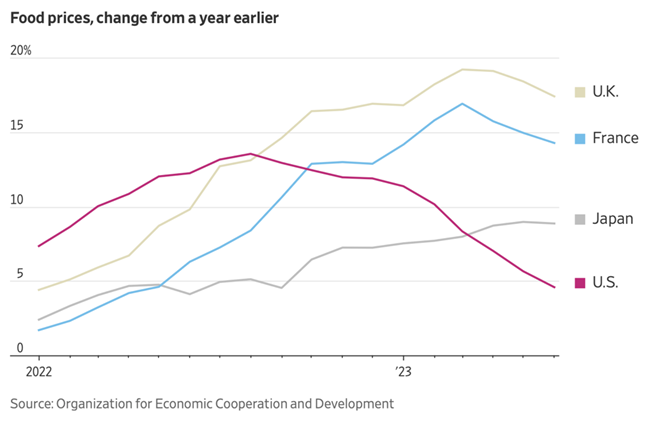

“Inflation Is Cooling. Food Inflation Could Get Worse – Food prices have been rising rapidly for longer than central bankers had expected, and recent setbacks may prolong the agony. A combination of disrupted exports, unusually hot weather and Russia’s continuing pounding of Ukraine, one of the world’s largest grain producers, is likely to add fresh momentum to the main source of global inflation. U.K. food prices rose 17.4% in the year through June, while Japanese prices were up 8.9% and French prices were up 14.3%. While food inflation has slowed slightly in the U.K. and France, it has picked up in Japan. The U.S. has fared better, with food prices up 4.6% from a year earlier in June, more than double the rate of inflation targeted by the Federal Reserve but well down on the August 2022 peak of 13.5%.”, The Wall Street Journal, August 4, 2023

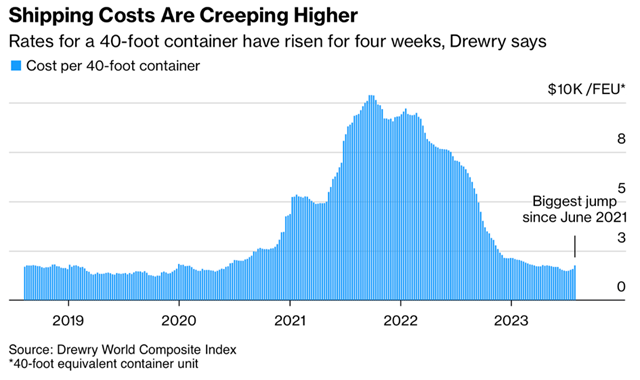

“Global Shipping Costs Creep Higher After 16-Month Freefall – Drewry world container index climbed for fourth week. Rates from Shanghai to LA, Rotterdam also increasing. Spot rates for shipping containers jumped by the most in more than two years, a sign that a 16-month slump in ocean-freight costs that helped ease the sting of goods inflation is over. The Drewry World Container Index composite increased 11.8% to $1,761 for a 40-foot container, the fourth straight advance and biggest week-on-week percentage gain since June 2021. The composite — which reflects short-term rates across eight trade routes connecting Asia, Europe and the US — had fallen in 15 of the 16 months through June.”, Bloomberg, August 3, 2023

“World Trade Forecast Cut as Maersk Flags Fears for Economy – Outlook signals supply shock has turned into demand decline. Maersk controls about one-sixth of world’s container trade. Shipping giant A.P. Moller-Maersk A/S, a bellwether for the world economy, lowered its estimate for global container trade, indicating that weak demand continues to hamper economic activity after years of supply shocks. Global container trade will probably contract as much as 4% this year, down from Maersk’s previous prediction of as much as 2.5%, the Copenhagen-based company said in a statement on Friday, as there are no substantial signs that volumes will recover this year.”, Bloomberg, August 3, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel Updates

“China’s Latest Problem: People Don’t Want to Go There – As geopolitical tensions rise, fewer visitors are traveling to the world’s No. 2 economy, widening the East-West divide. Half a year after China lifted Covid-19 restrictions and reopened its borders, few international travelers are coming—another sign of decoupling between China and the West that could have negative repercussions for a long time. Foreign travelers’ absence is particularly evident in major cities like Beijing and Shanghai, where the numbers of foreigners who visited in the first half of the year totaled less than a quarter of comparable figures in 2019, before the Covid pandemic. Nationwide, just 52,000 people arrived to mainland China from overseas on trips organized by travel agencies during the first quarter, the latest period for which national data is available, compared with 3.7 million in the first quarter of 2019.”, The Wall Street Journal, August 3, 2023

“Going to Europe This Summer? Brace for Flight Delays – Wildfires, air-traffic control shortages, strikes and the war in Ukraine have led to more delays than last year’s summer of disruption. Passengers traveling across the region have so far experienced more delayed flights this summer than a year ago, when the flying season was marred by long lines, lost baggage and regular cancellations as a rebound in demand overwhelmed airports. This summer airlines and airports are wrestling with an array of challenges. A shortage of air-traffic controllers has impacted the number of flights that can be handled during the day. The war in Ukraine has closed off airspace previously used regularly, and workers, including cabin crew and pilots, are striking across the region.”, The Wall Street Journal, August 7, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Australia

“Growth spurt ahead for small and micro businesses – Small business growth has rebounded to pre-pandemic levels despite significant issues such as labour shortages, according to the findings from the latest Quarterly Small and Micro Business Index. The index, compiled by the Council of Small Business Organisations Australia (COSBOA) and payment platform Square, shows a promising outlook for the business landscape despite the current economic climate. Growth rates at Australian businesses have returned to pre-pandemic levels.”, Kochie’s Business Builders, August 7, 2023

“Growth to slump as high rates smash households, RBA warns – The Reserve Bank downgraded its near-term growth forecasts on Friday as the economy cools in response to the fastest interest rate tightening cycle in decades. The central bank expects real gross domestic product to expand by just 0.9 per cent in the 12 months to December 2023 as a result of a weaker-than-expected March quarter national accounts, down from its previous forecast of 1.2 per cent and below the current rate of 2.3 per cent.”, Australian Financial Review, August 4, 2023

Brazil

“Investors are increasingly optimistic about Brazil’s economy – An efficient finance minister and the favourable international backdrop are helping. In a recent poll of 94 Brazilian fund managers and analysts, just 44% had an unfavourable view of the government, down from 90% in March. On July 26th Fitch, a ratings agency, upgraded Brazil’s long-term foreign-currency debt for the first time since it was downgraded in 2018.”, The Economist, August 2, 2023

Canada

“Canada sheds jobs in July, unemployment ticks up to 5.5% as evidence of slowing economy mounts – The Canadian economy unexpectedly shed jobs in July while the unemployment rate ticked higher for the third straight month, providing further evidence that the economy is losing momentum in the face of higher interest rates. The country lost a total of 6,400 jobs and the unemployment rate rose to 5.5 per cent, up from 5.4 per cent in the previous month, Statistics Canada reported Friday. Bay Street analysts were expecting a gain of around 21,000 jobs in July, according to Reuters polling.”, The Globe and Mail, August 5, 2023

China

“China’s Private Sector Is Losing Ground. The State Is Gobbling Market Share – Private companies, which enjoyed a 40-year explosion as a proportion of China’s economy, are now ceding market share to the dinosaurs of state enterprises. Among the 100 largest listed companies, measured by market capitalization, the share of companies that are majority-owned by the Chinese state rose to 61% from 57.2% in the first half of 2023, according to the institute. The share of the private sector, defined as firms with less than 10% state ownership, in the same period dropped below 40% for the first time since the end of 2019.”, Barron’s, August 6, 2023

“China eases entry visa and hukou rules in all-out push to save the economy – More businesspeople will be able to get visas on landing and more rural residents should qualify for urban residency. The changes unveiled by the Ministry of Public Security are meant to foster freer movement of people and data. In addition, the ministry will make it easier for overseas business travellers to apply for landing visas, including those wanting to visit China for business meetings, exhibitions or investment but are unable to secure the permission before their trip.”, South China Morning Post, August 4, 2023

Turkey

“Deutsche, HSBC See Turkish Lira Diving to New Lows on Inflation – Annual price increases have accelerated to almost 50%. Central bank is keeping to “gradual” tightening cycle. The Turkish central bank, under new Governor Hafize Gaye Erkan, recently acknowledged price pressures and significantly revised up its inflation forecast to 58% by year-end, peaking at 60% in the second quarter of 2024. Deutsche Bank analysts cited the trajectory of price increases and the “challenges confronting policymakers in returning inflation to a more sustainable path” for its revisions. It also said it sees the lira sliding further to 35 per dollar at the end of 2024.”, Bloomberg, August 4, 2023

United Arab Emirates

“Dubai Tourist Arrivals Top Pre-Pandemic Levels, Room Rates Surge – Dubai reported a record number of tourist arrivals in the first half of the year, topping levels last seen before the Covid-19 pandemic took hold and helping push hotel room rates to a fresh high. The city reported 8.55 million international overnight visitors, up 20% from the first half of last year and more than the 8.36 million tourists who visited during the same period in 2019. Average daily hotel rates came in at 534 dirhams ($145.40), up by a fifth from 2019 levels.”, Bloomberg, August 6, 2023

United Kingdom

“First-time buyers flee London for more affordable mortgages – In the pandemic, young Londoners moved out of the city in search of space and freedom. Now they are being forced out by rising mortgage costs, according to research. First-time buyers made up 30 per cent of Londoners buying homes outside the capital in the first half of this year, the highest proportion recorded by Hamptons estate agency since it started collecting the data in 2007. Unaffordability is the driving force.”, The Times Of London, August 6, 2023

United States

“Restaurant employment levels inch back up in July – After losing jobs in June for the first time in nearly two and a half years, the restaurant and bar sector gained over 13,000 positions in July. The restaurant workforce remains below pre-pandemic levels by about 64,000 jobs, or 0.5%. In a statement, National Restaurant Association Chief Economist Bruce Grindy said, ‘restaurant operators who are looking to boost staffing levels may find a somewhat less competitive recruiting environment in the months ahead. Job growth in the industry remained in July but remained well below the gains registered during the early months of the year.’”, Nation’s Restaurant New, August 6, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“Applebee’s Is Shrinking & Closing Dozens of Restaurants This Year – The chain has closed hundreds of restaurants in recent years. The casual dining chain announced this week that it expects to end the year with 25 to 35 fewer restaurants than it had at the start. This will be an even bigger decrease than the 10 to 20 net closures that Applebee’s initially expected to see in 2023. Applebee’s net unit count hasn’t taken such a major hit since 2020, when it ended the year with 67 fewer restaurants, according to Restaurant Business Magazine.”, Eat This! Not That, August 4, 2023

“State of (Australia) Franchise Report – Franchise Council of Australia – Despite the multiple challenges of recent times, our 2023 State of Franchise Report shows the ongoing benefits of the resilience and flexibility of franchising in Australia. Our members are predominantly small businesses with fewer than 20 employees. With more than 94,000 franchise outlets across Australia employing almost 600,000 Australians and generating $174 Billion into Australia’s economy.”, Franchise Council of Australia, August 2023

“Outback Steakhouse Is Investing In New Tech To Improve Its Food And Dining Experience – Outback Steakhouse has implemented new tableside technology in all 691 of its U.S.-based restaurants and continues to install new “advanced” grills and ovens in its kitchens this quarter. The purpose? According to Bloomin’ Brands CEO Dave Deno on the second-quarter earnings call on August 1, ‘improved product quality and overall meal pacing.’ And profit growth, of course.”, The Daily Meal, August 4, 2023

“McDonald’s Breakfast In Hong Kong Is Truly Deluxe – McDonald’s offers a fairly extensive breakfast menu in the U.S., but most of these tend to be grab-and-go a la carte items like its signature Egg McMuffins or McGriddles. Perhaps this is because its two Big Breakfast platters may not do so well with the drive-thru customers who could be the chain’s wheelhouse, as it were, since such orders can make up 70% of the chain’s sales in certain markets. McDonald’s in Hong Kong, however, goes all-in on platters when it comes to breakfast. It offers two deluxe versions, one with eggs, English muffins, sausage, and hash browns and the other with pancakes (aka hotcakes), sausage, and hash browns. There’s also a jumbo breakfast featuring all of the aforementioned items.”, Mashed, August 1, 2023

“Papa Johns franchisees see comparable-store sales dip – Papa Johns will provide guidance to franchisees after North American comparable-store sales declined 1.4% in the second quarter ended June 25. Comparable sales increased 2.2% in domestic company-owned restaurants but fell 2.3% in North American franchises restaurants. International comparable-store sales were down 1%, largely attributable to inflation in the United Kingdom, although international comparable-store sales improved 5% from the first quarter.”, Food Business News, August 7, 2023

“Pollo Tropical Restaurant Chain to Be Sold – Authentic Restaurant Brands to buy Fiesta Restaurant Group for $225 million. The Dallas company owned and operated 137 Pollo Tropical restaurants, plus 30 that are franchised, across the U.S., Puerto Rico, Panama, Guyana and the Bahamas as of April 2, according to securities filings. Miami-based Pollo Tropical is known for serving heaping portions of Latin American-inspired cuisine, including marinated and grilled chicken, rice and black beans.”, The Wall Street Journal, August 6, 2023

“Starbucks Q3 revenue increased by 12% to US$9.2 billion, and the Chinese market achieved a growth rate of 60% – Global same-store sales increased by 10%, mainly driven by a 5% increase in same-store transaction volume and a 4% increase in average order value. Among them, same-store sales in North America and the United States increased by 7%, driven by a 1% increase in same-store transaction volume and a 6% increase in average customer price. In terms of regions, the net revenue in the Chinese market reached US$821.9 million, an increase of 60% year-on-year (excluding the impact of exchange rate changes), and an increase of 10% from the previous quarter. Same-store sales increased by 46% , same-store transaction volume increased by 48% , and average customer unit price decreased by 1%, which was a significant increase compared to the second quarter.”, Caijing.com.cn, August 2, 2023. Article and translation compliments of Paul Jones, Jones & Co., Toronto

“Subway’s $10 Billion Price Tag Is Tough to Swallow – The sandwich chain’s growth-at-any-cost strategy didn’t work so well, and now it’s having a hard time selling itself. At a time when the value of an increasing number US companies are exceeding the once unthinkable $1 trillion mark, it feels odd to ask whether businesses can be too big to be profitable. And yet that’s the very question sandwich chain Subway Restaurants Inc. is asking itself right now — and it may not like the answer. Subway doesn’t own any of its outlets, which means that to increase profits it either has to add new franchisees or raise fees charged to those franchisees.”, Bloomberg, August 4, 2023

“Taco Bell’s Digital Sales Got A Sizable Boost From In-Store Kiosks – Taco Bell is reaping the return on its investment, and we aren’t just talking about those favorite Mexican pizzas. The Yum! brand food chain recently announced that its digital sales have not only seen a 35% growth, but the chain can back it with the swagger that 100% of its quick service eateries have kiosks, according to QSR Magazine.”, Tasting Table, August 5, 2023

“Here’s what it’s like eating at an AI-generated restaurant: ‘Almost dreamlike’ – When you hear of an AI-generated restaurant, you would probably think of a clean, sterile environment which two bites of food served by robot waiters. But Luminary by RAFI, Australia’s first-ever AI-generated restaurant, is anything but. Luminary, a pop-up restaurant being held for one week only at RAFI in North Sydney, from July 29 to August 5, was first conceptualised with the help of artificial intelligence.”, Honey Kitchen (Australia), August 2, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant taking 40 franchisors global.

For a complimentary 30 minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking