EGS Biweekly Global Business Newsletter Issue 91, Tuesday, September 19, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Introduction: In this issue, problems brewing for Europe’s coffee supply, China seems to be turning a corner if the data is real, the French government is selling fuel at a loss (?), rice supply is having a bad year, Germany’s EVs are having trouble competing, the Middle East is an ATM, Japan is old, the UK is inactive, Mexico’s airlines appear safe again and the USA continues to have lots of job openings.

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

NOTE: Some of the sources that we provide links to require a paid subscription to access. We subscribe to 40 international information sources to keep our readers up to date on the world’s business.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here:

First, A Few Words of Wisdom From Others

“Opportunities don’t happen. You create them.” – Chris Grosser

“The best way to predict the future is to create it.” – Peter Drucker

“In the middle of every difficulty lies opportunity.” – Albert Einstein

Highlights in issue #91:

- Brand Global News Section: Chick-fil-A®, Church’s Chicken®, Paradies Lagardère and Twisted by Wetzel’s®,

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

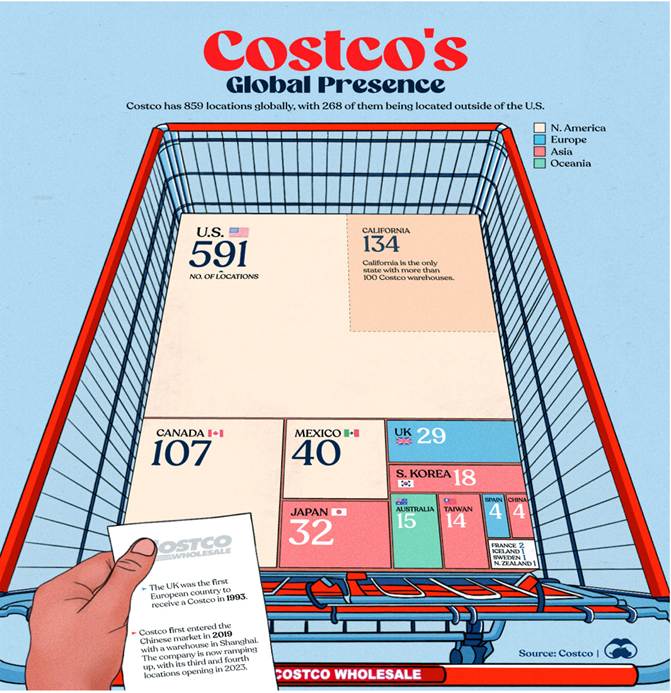

Interesting Data and Studies

“Visualizing Costco’s Global Presence – Costco is a membership-based retail chain founded in 1983 in Seattle, Washington. Best known for its unique warehouse stores and high-quality products, Costco offers everything from electronics to groceries. Since its founding, Costco has become a major retailer in the U.S., while also greatly expanding its international presence. As of August 2023, the company has 859 locations globally, with a split of 69% domestic (591 stores) and 31% international (268 stores).”, Visual Capitalist, September 8, 2023

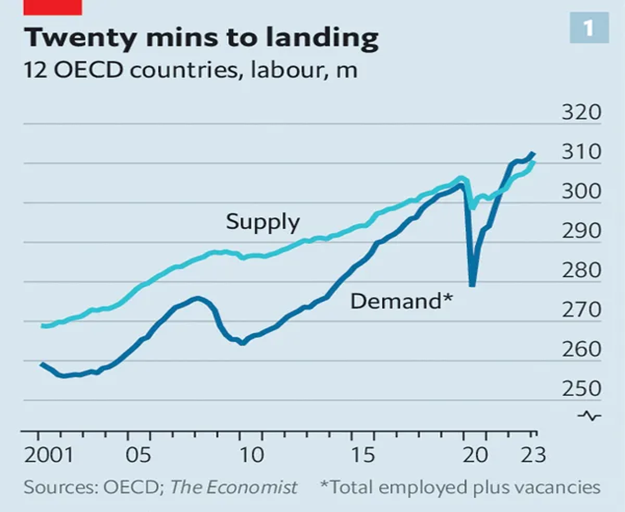

“Why aren’t more people being sacked? – How inflation has fallen without mass job casualties. If central bankers are to defeat inflation, they must cool the labour market. For two years rich-world wage growth has added to corporate costs, sending prices relentlessly upwards. But as they began raising interest rates to slow the economy, policymakers hoped for an even rosier outcome. They wanted to achieve a “soft landing”, which involves both bringing down inflation, and doing so without mass job losses. It is a lot to ask of a tool as blunt as monetary policy. Are they succeeding? And so far the evidence suggests that—against widespread expectations—labour markets from San Francisco to Sydney are co-operating.”, The Economist, September 17, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

“Peak Oil Demand ‘Wilting Under Scrutiny,’ Aramco CEO Says – Nasser sees 2030 crude usage of 110 million barrels per day – CEO’s pared-back forecast still outstrips IEA projections. Last week, OPEC projected global oil markets would face a supply shortfall of more than 3 million barrels a day next quarter — potentially the biggest deficit in more than a decade. The IEA’s (International Energy Agency) prediction that oil consumption will peak this decade and grow at a slower rate in the near term as the energy transition gathers pace has been proven to be unrealistic, Nasser said Monday.”, Bloomberg, September 18, 2023

“Shipping giant Maersk is seeing tentative signs of a bounce back in global trade – Consumers in the U.S. and Europe have been key drivers in the demand uptick, Vincent Clerc (CEO of shipping titan Maersk) told CNBC’s Silvia Amaro, and those markets have continued to ‘surprise on the upside.’ The upcoming pickup would be fueled by consumption, he said, rather than the “inventory correction” which has featured heavily in 2023. ‘Barring any negative surprises, we would hope for a slow pickup as we get into 2024, a pickup that will not be a boom like what we have known in the past few years, but certainly … a demand that is a bit more in line with with what we see in terms of consumption, and not so much an inventory correction.’”, CNBC, September 15, 2023

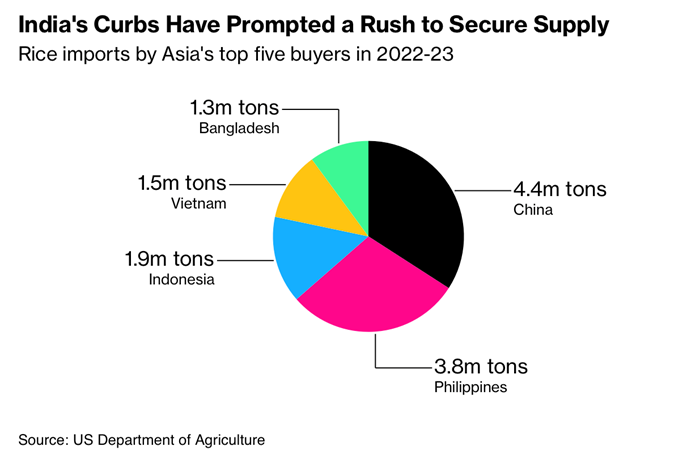

“Rice Crisis in the Philippines Sounds a Global Inflation Alarm – Indonesia agrees on first deal with Cambodia in over a decade Malaysia implements purchase limit, starts enforcement checks. Rice inflation in the Southeast Asian nation increased at the fastest pace in almost five years in August, reviving memories of a 2018 shock that led to the end of a two-decade-old limit on imports. India’s restrictions have upended the market and prompted worried nations to secure supply as they try and contain the rising cost of rice, which is a vital part of the diets of billions of people across Asia and Africa.”, Bloomberg, September 8, 2023

“What ‘Friend-Shoring’ Means for the Future of Trade – Over the past few years, the world has experienced an escalating series of trade disruptions: the US-China trade war, the Covid-19 pandemic and its supply chain disruptions, Russia’s invasion of Ukraine and the sanctions and export controls that followed. Their cumulative impact has called into question the vision of a globalized economy. In response, some US officials pushed “friend-shoring” — a happy-sounding name for a policy that would lead to a world divided between free-market democracies and countries that align with the authoritarian regimes of China or Russia. It’s a world in which supply chains could be more robust and less subject to economic blackmail. It’s also likely a world that’s poorer and less productive.

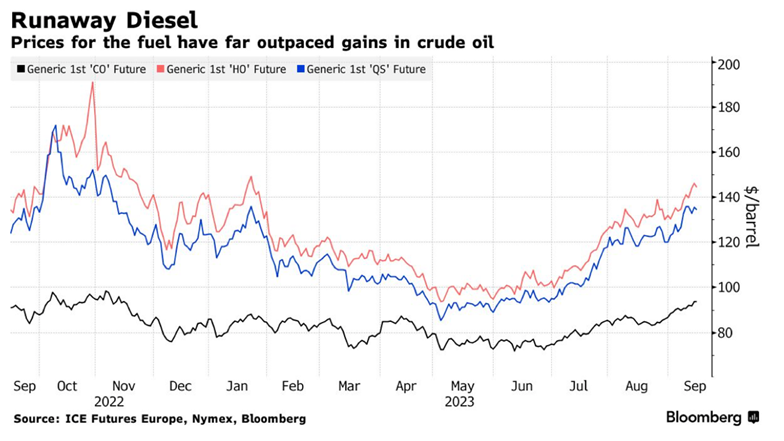

“The World Is Struggling to Make Enough Diesel – Crude production cuts have been detrimental to diesel supply – Refineries have sought to satisfy demand surge for other fuels. While oil futures are rocketing — on Friday they were just below $95 a barrel in London — the rally pales in comparison with the surge in diesel. US prices jumped above $140 to the highest ever for this time of year on Thursday. Europe’s equivalent soared 60% since summer.”, Bloomberg, September 17, 2023

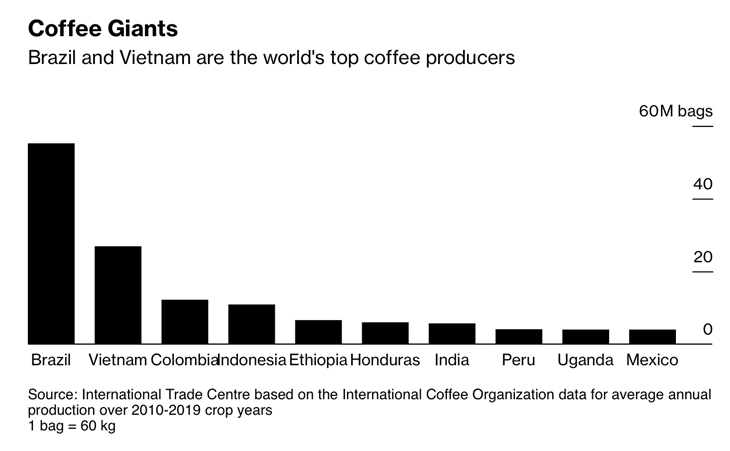

“Coffee Storm Is Brewing: Proving a Latte’s Sustainable Journey From Farms – How do you trace a journey of beans from millions of farms around the world all the way to cappuccinos and lattes sipped in cafes from Vienna to Rome? That’s the conundrum the coffee industry faces as it scrambles to get ready for Europe’s ground-breaking sustainability rules. Coffee is grown in about 70 countries, with five of them — including Brazil and Vietnam — making up about 85% of the world’s output. The rest comes from some 9.6 million growers in smaller producers, who often lack the resources to meet sustainability standards, according to Ethos.”, Bloomberg, September 15, 2023

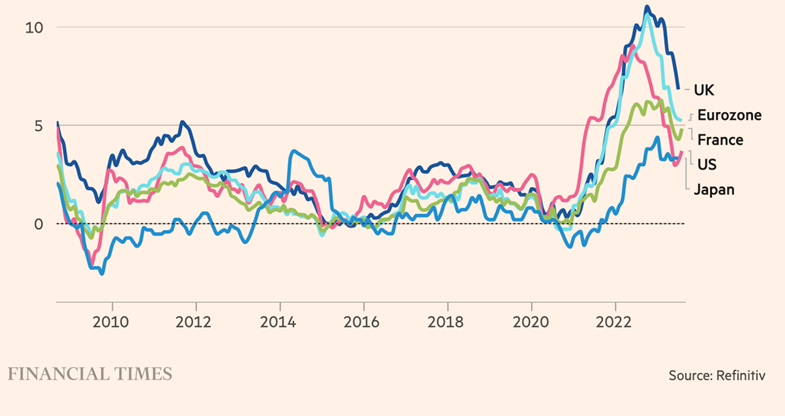

Annual % change in consumer price index

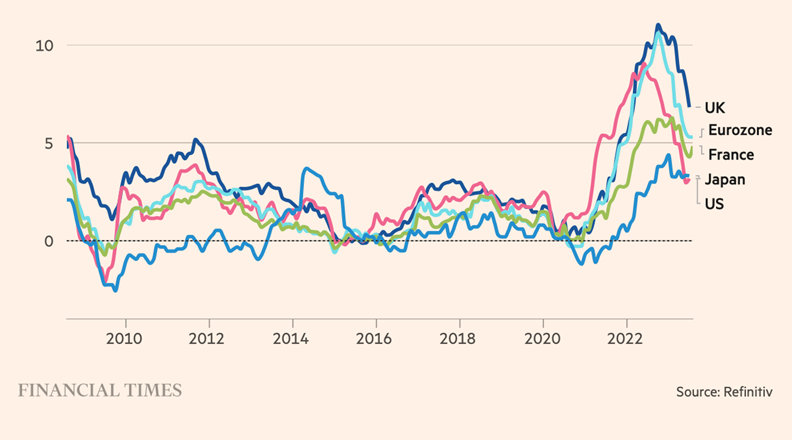

“Global inflation tracker – Inflation is easing from the multi-decade highs reached in many countries following Russia’s full-scale invasion of Ukraine. The latest figures for most of the world’s largest economies show the wholesale food and energy prices that soared during 2022 are now falling back.”, The Financial Times, September 14, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel Updates

“US raises Mexico air safety rating in boost for country’s airlines – US raises Mexico air safety rating in boost for country’s airlines. The Federal Aviation Administration (FAA) said on Thursday it has upgraded Mexico’s air safety rating, a move that will allow Mexican carriers to expand U.S. routes and add new service. Mexico was downgraded by the U.S. regulator in May 2021 after the agency found the country did not meet safety standards. The downgrade was a major blow to Mexico carriers, as U.S. airlines were able to scoop up market share.”, Reuters, September 14, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

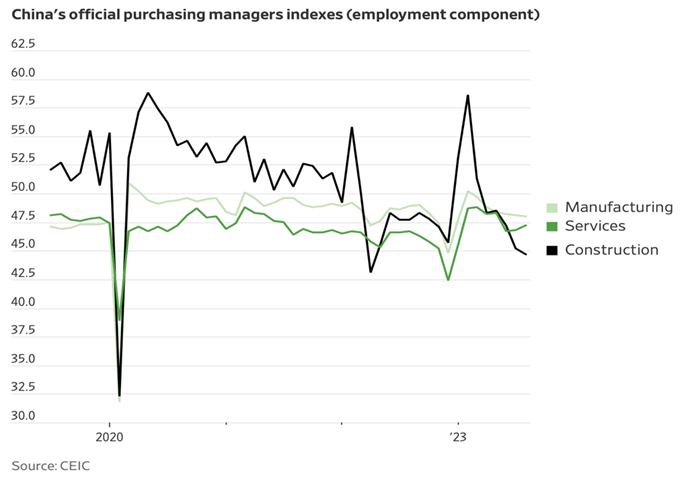

China

“China May Dodge Deflation, After All – But it will probably be a near miss, and economic data still hints at a bottom rather than a strong rebound. After a grim June and July, China’s main August economic data, released Friday, contained clear hints of improvement. The news from the critical housing sector, which is mired in a protracted slump, was less encouraging: Price falls accelerated in lower-tier cities. But growth in retail sales accelerated to 4.6% from a year earlier, from just 2.5% in July. Unemployment ticked down marginally.”, The Wall Street Journal, September 15, 2023

“China expects ‘golden week’ holiday journeys to beat pre-pandemic figures – China Railway said it had recorded a record single day’s sales, with 22.9 million tickets being bought in one day. Airline tickets are also selling well as the National Day holiday coincides with Mid-Autumn Festival. That is roughly double the 72 million trips made during the same holiday last year and well above the 138 million trips made in 2019 before the Covid pandemic.”, South China Morning Post, September 17, 2023

“Beijing “Has Plenty Of Dry Powder” – Can Manage Economic Stresses: U.S-China Business Forum. China’s economy is facing two sources of stress at the same time – cyclical and structural, yet the government ‘has plenty of dry powder’ and is ‘able to manage this situation,’ U.S.-China Business Council President Craig Allen said in a recent interview in New York. Authorities recognize ‘the problems that they face and are working on those problems in an incremental manner — (through) incremental stimulus and incremental reform,’ Allen said. ‘But it’s slow and steady and not as dramatic as many people would like to see.’”, Forbes, September 13, 2023

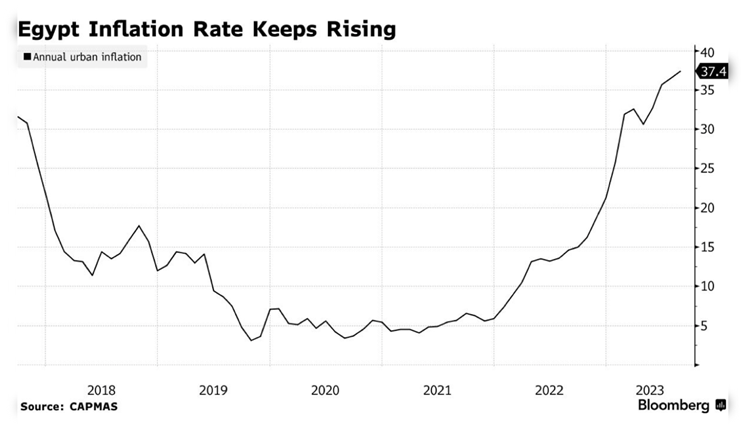

Egypt

“Egypt Inflation Soars as Higher Food Costs Add to Currency Angst – Egyptian inflation soared to a fresh record, with consumer costs now increasingly at the mercy of whether authorities will allow the pound to weaken again. Price growth in urban parts of the country accelerated to an annual 37.4% in August from 36.5% the previous month, according to figures released Sunday by the state-run CAPMAS statistics agency. On a monthly basis, inflation was 1.6%, compared with 1.9% in July. A 71.4% increase in the cost of food and beverages, the largest single component of the inflation basket, was a major contributor to last month’s price pickup.”, Bloomberg, September 9, 2023

France

“France to Allow Selling Fuel at Loss to Curb Inflation – Prime Minister Borne announces plan in Le Parisien Newspaper. The French government plans to allow gas stations to sell fuel at a loss, overriding a law from 1963, as it struggles to find new ways of containing inflation without adding to vast sums of public money already spent. Such a move would in theory allow greater competition between distributors, who could cut prices below costs and aim to make up lost margin with sales of other products and services.”, Bloomberg, September 17, 2023

“France’s Carrefour puts up ‘shrinkflation’ warning signs – French supermarket Carrefour has put stickers on its shelves this week warning shoppers of “shrinkflation” – where packet contents are getting smaller while prices are not. Lipton Iced Tea, Lindt chocolate and Viennetta ice cream are among the products being named and shamed. Shoppers are being told if bottles are smaller or pack contents lighter. Carrefour has identified 26 products that have shrunk, without a price reduction to match, made by food giants including Nestle, PepsiCo and Unilever.”, BBC News, September 14, 2023

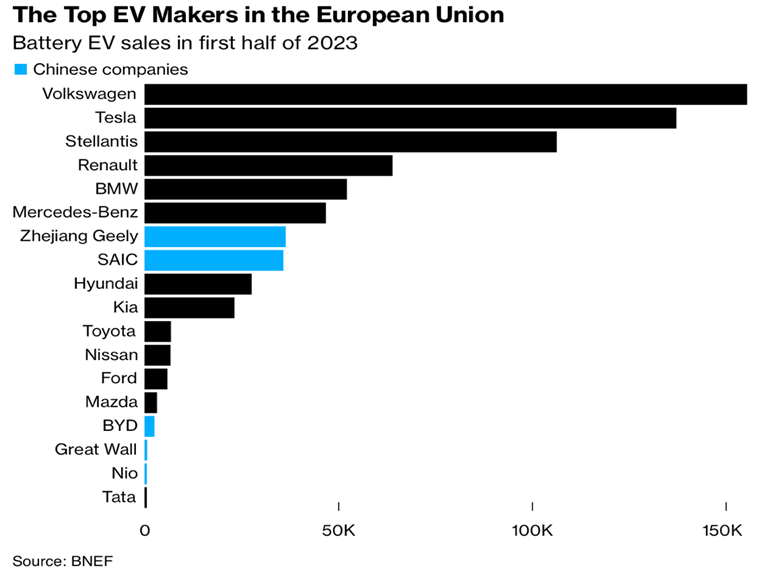

Germany

“VW Lays Off Workers at Key EV Factory Over Cratering Demand – Volkswagen is having a tough time selling enough mostly made-in-Germany electric cars to challenge Tesla Inc.’s global dominance. Lackluster economic growth as well as higher energy, living and borrowing costs in Europe have weighed on demand for its ID fleet of EVs.”, Bloomberg, September 14, 2023

India

“Apple to Sell Made-in-India iPhones on Launch Day for First Time – Devices from India to debut at same time as China-made ones IPhone 15 marks a milestone for India’s electronics ambitions. It would also underscore India’s growing production prowess and reflect a significant departure from Apple’s previous strategy of selling mostly Chinese-made new devices to frenzied customers across the world.”, Bloomberg, September 12, 2023

Japan

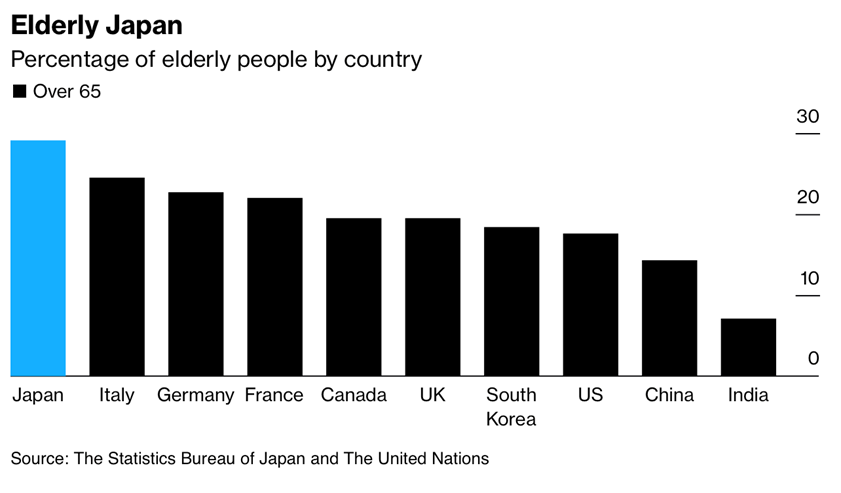

“One in 10 Japanese Now Aged Over 80, Population Report Shows – Japan’s persistently low birthrate and long lifespans have made it the oldest country in the world in terms of the proportion of people aged over 65, which this year hit a record of 29.1%. Ballooning social security spending has added to Japan’s massive debt and the shortage of young people has left many industries short of labor — not least carers for the elderly.”, Bloomberg, September 17, 2023

The Middle East

“The Middle East Becomes the World’s ATM – Flush with cash from an energy boom, Saudi Arabia and other Gulf monarchies have a moment on the world’s financial stage. Middle East monarchies eager for global influence are having a moment on the world’s financial stage. They are flush with cash from an energy boom at the very time traditional Western financiers—hampered by rising interest rates—have retreated from deal making and private investing. The region’s sovereign-wealth funds have become the en vogue ATM for private equity, venture capital and real-estate funds struggling to raise money elsewhere.”, The Wall Street Journal, September 7, 2023

Saudi Arabia

“Why Saudi Arabia is the Future Frontier for Global Entrepreneurs – The Saudi horizon is vast, and it’s gleaming with golden opportunities for the discerning entrepreneur. Saudi Arabia’s Vision 2030 is a clarion call for diversification. The nation is proactively steering away from its oil-dependent past, investing heavily in entertainment, tourism, technology and sports sectors. For budding entrepreneurs, this evolution translates into a broader spectrum of business avenues, a more varied market and an ever-evolving consumer base. Recent years have witnessed a startup explosion, with young Saudis taking the entrepreneurial plunge, driven by passion and the promise of a supportive ecosystem. But perhaps the most heartening aspect of this entrepreneurial surge is the rise of female founders and business leaders.”, Entrepreneur, September 7, 2023

Sweden

“Sweden is the No. 1 country for affordability, safety and overall quality of life – To rank the 87 countries listed, U.S. News and World Report, WPP and the Wharton School of the University of Pennsylvania surveyed more than 17,000 people worldwide. According to Numbeo, the cost of living in Sweden is, on average, 20.9% lower than in the United States, while renting is 57.5% lower. Sweden’s people boast one of the longest life expectancies, with an average age of 82.8 years, according to the CIA World Factbook.”, CNBC, September 17, 2023

United Kingdom

“Remote working to require ‘total rewiring of UK – The shift means people drove 19 billion fewer miles last year as the pandemic continued to redraw how Britons live. Last year cars travelled a total of 244 billion miles, according to the Department for Transport. While this is higher than the pandemic years of 2020 and 2021, it remains 7 per cent lower than the 263 billion miles driven in 2019. It is the lowest non-pandemic year for almost a decade. Data also shows a shift from traffic peaks before 9am on weekdays, to later in the day and at weekends. Bloom said the changes brought in by the pandemic had now been “baked in”, and companies that tried to force a return to the office full-time would struggle to recruit and retain workers.”, The Times of London, September 13, 2023

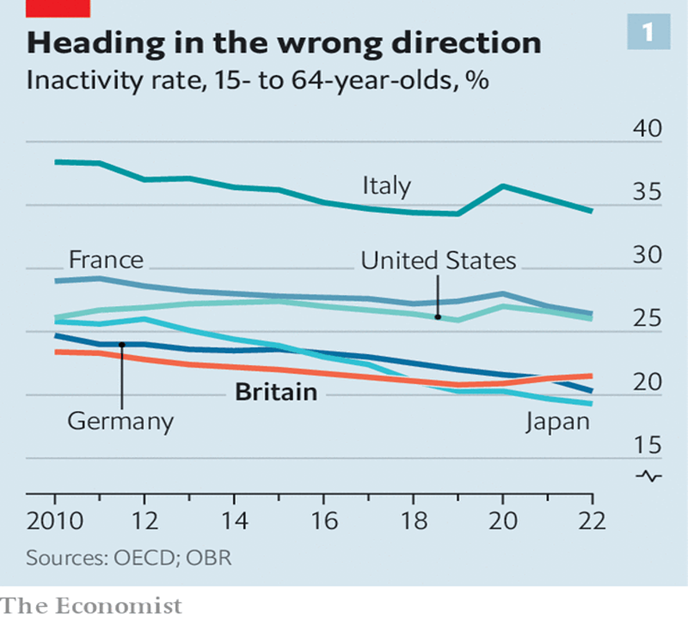

“Why Britain has a unique problem with economic inactivity – A series of policy blunders is to blame. In contrast to most other rich countries, benefits for those of working age were rather stingy. Meanwhile, rates of labour-force participation were admirably high. The inactivity rate—the proportion of working-age people not working or actively seeking a job—was among the lowest internationally and on a downward path from the mid-1990s until 2019.’, The Economist, September 14, 2023

United States

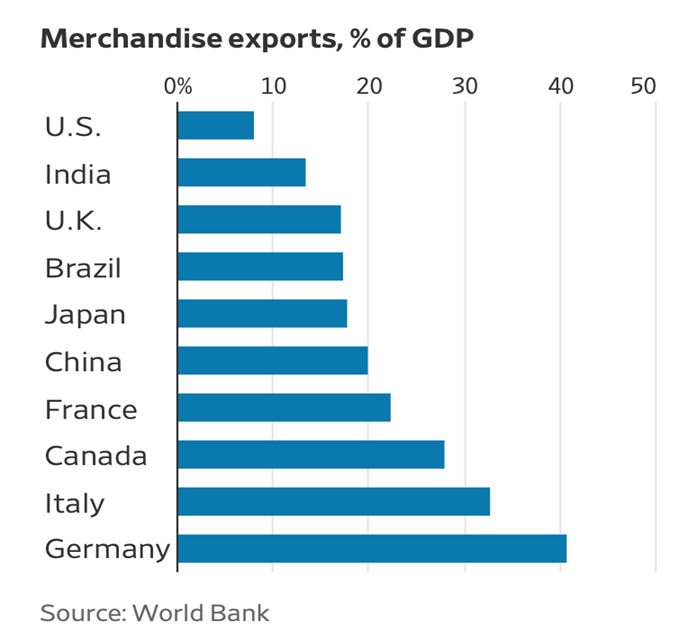

“The U.S. economy is chugging along while the rest of the world falls behind – Driving the division among the world’s most powerful economies: a slowdown in trade that is hurting some much more than others. At the losing end are “extroverted” economies that have traditionally recorded trade surpluses and are now seeing their growth lag behind those of the U.S. and India, for instance, vast markets that have historically relied more on domestic demand for growth relative to their peers. “Global trade will be less global” in the future, with exchanges occurring more within regional blocs, said Holger Schmieding, chief economist at Berenberg Bank. It will also shift away from goods and toward services, he added, providing a boost to economies like the U.S. and India that specialize in IT and other services at the expense of manufacturing powerhouses like Germany and China.”, The Wall Street Journal, September 9, 2023

“Leisure and Hospitality Job Openings Remain Disproportionately High – Job openings for the leisure and hospitality segment of the U.S. economy remain disproportionately high compared to other industries, which could slow the travel industry’s growth as the country considers its future following its post-pandemic recovery period. While employment in this country is at its lowest level since March 2021, the U.S. Bureau of Labor Statistics finds that employment in leisure and hospitality is 1.7 percent lower now than it was in February of 2020, before the pandemic. That’s a lack of 290,000 people, but the disparity deepens when you consider the number of hotels and resorts in the U.S. continues to grow at a fast pace.”, Travel Pulse, September 12, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“6 Shifting Consumer Trends Affecting Quick-Service Restaurants – According to industry data, food spending is expected to rebound through 2024 and into 2025. Consumers’ preferences are shifting like never before, due to a variety of societal and economic dynamics. How can quick-service restaurants adjust to maintain—and potentially increase—foot traffic during these transformative times? The good news is that consumers aren’t trading out of foodservice; however, many are trading down within the segment. According to industry data, food spending is expected to rebound through 2024 and into 2025 as the country moves into a recovery phase following a mild recession.”, QSR Magazine, September 15, 2023

“Chick-fil-A to re-enter UK market – Chick-fil-A, the American fast-food brand, is renewing its attempt to enter the UK market, four years after its debut pop-up closed amid a row over its ties to anti-gay beliefs. The first restaurants will open in early 2025, the first permanent outlets outside North America. The 55-year-old family-owned business runs more than 2,800 restaurants across the US, Canada and Puerto Rico. It is aiming to open five restaurants in the UK in the first two years of launch, creating between 80 and 120 jobs per branch.”, The Times of London, September 15, 2023

“Paradies Lagardère Swoops On Airport Dining Specialist Tastes On The Fly – The French parent company of North American travel retailer Paradies Lagardère has signed an agreement to acquire airport restaurateur Tastes on the Fly. Tastes on the Fly operates about 25 concepts across five major airports, including San Francisco, Denver, New York’s JFK, Boston, and Vancouver in Canada. Added to Paradies’ existing portfolio, Tastes on the Fly’s addition takes the number of F&B brands to more than 100, ranging from full-service to fast-casual and quick-serve.”, Forbes, September 7, 2023

“Southlake man couldn’t get job at Church’s Chicken years ago. Now he owns 140 locations – Aslam Khan’s life story is often described as rags to riches. Which he finds ironic because he was actually wearing a suit and tie when he was turned away from his first job interview with Church’s Chicken nearly four decades ago. He thinks it might have been because he was overdressed. It was for a fast-food restaurant, after all, he said. Now, at 69, he is the largest franchisee in the organization of the fast-food restaurant with his company, Falcon Holdings, operating over 140 stores.”, Star Telegram, September 14, 2023

“How Twisted by Wetzel’s is planning to disrupt the snack category – The streetside restaurant concept is bigger than a traditional Wetzel’s and features a broader, more creative menu. In the spring, Wetzel’s Pretzels opened a new concept called Twisted by Wetzel’s that is quite different from anything the company has done in its nearly-30-year history. The company describes Twisted as a ‘street concept that takes Wetzel’s fun-loving brand and timeless menu and elevates it to a whole new level.’”, Nation’s Restaurant News, September 15, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

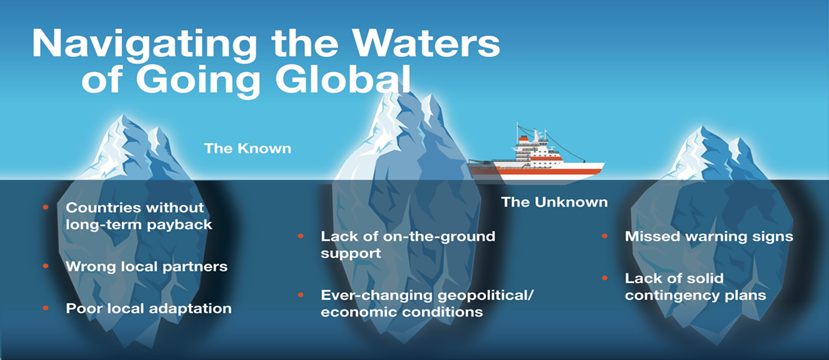

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant taking 40 franchisors global.

For a complimentary 30-minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 90, Tuesday, September 5, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Introduction: In this issue, The BRICs countries ‘proposed’ expansion, a history of franchising, the state of AI in 2023, no more plastic water bottles at LAX. Updates the economy in Brasil, Indonesia, the Philippines, Turkey, the United Kingdom, and the USA. Krispy Kreme® and Popeyes® celebrate news. Popeyes tries to justify the almost US$10 billion sale price. And China’s grain problem. Finland issues digital passports.

This is one of the longest issues so far. Perhaps partly due to my having excellent Internet access on my 13-and-a-half-hour flight back from Sydney, Australia this past weekend. I spent almost a week in both Australia and New Zealand on business on this trip. In New Zealand I gave a keynote talk on the state of global franchising covering 20 countries. In Australia, I found the new investment climate strong.

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

NOTE: Some of the sources that we provide links to require a paid subscription to access. We subscribe to 40 international information sources to keep our readers up to date on the world’s business.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here:

First, A Few Words of Wisdom From Others

“If knowledge is power, knowing what we don’t know is wisdom.” – Adam Grant

“However difficult life may seem, there is always something you can do and succeed at.” – Stephen Hawking

“People begin to become successful the minute they decide to be.” – Harvey MacKay

Highlights in issue #90:

- Brand Global News Section: Body Fit Training (BFT), Krispy Kreme®, Pizza Hut®, Popeyes® and Subway®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data and Studies

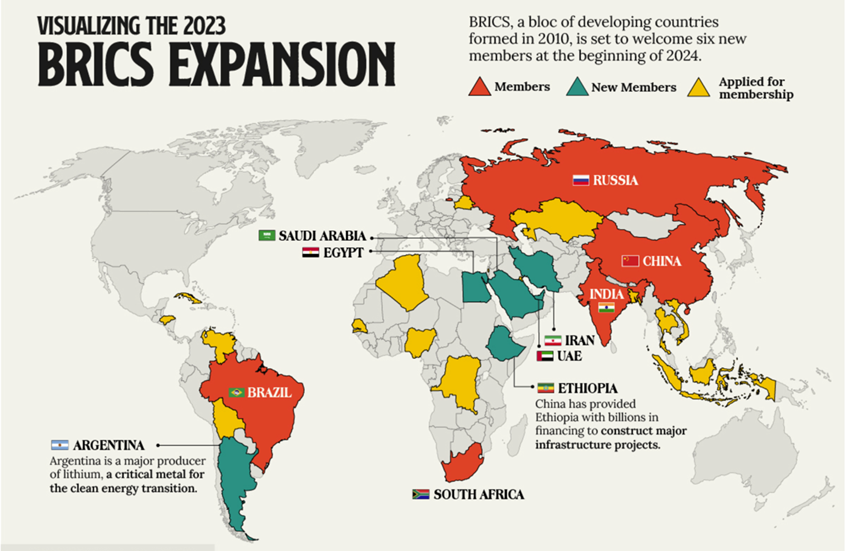

“Visualizing the BRICS Expansion – BRICS is an association of five major countries including Brazil, Russia, India, China, and South Africa. Distinguished by their emerging economies, the group has sought to improve diplomatic coordination, reform global financial institutions, and ultimately serve as a counterbalance to Western hegemony. On Aug. 24, 2023, BRICS announced that it would formally accept six new members at the start of 2024: Saudi Arabia, Iran, Ethiopia, Egypt, Argentina, and the United Arab Emirates (UAE).”, Visual Capitalist, August 24, 2023

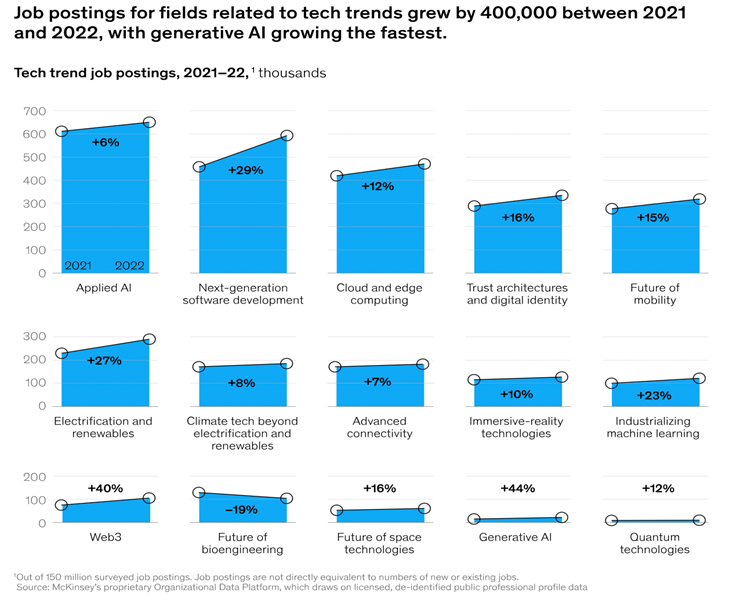

“McKinsey Technology Trends Outlook 2023 – Which technology trends matter most for companies in 2023? New analysis by the McKinsey Technology Council highlights the development, possible uses, and industry effects of advanced technologies. After a tumultuous 2022 for technology investment and talent, the first half of 2023 has seen a resurgence of enthusiasm about technology’s potential to catalyze progress in business and society. Generative AI deserves much of the credit for ushering in this revival, but it stands as just one of many advances on the horizon that could drive sustainable, inclusive growth and solve complex global challenges. To help executives track the latest developments, the McKinsey Technology Council has once again identified and interpreted the most significant technology trends unfolding today.”, McKinsey & Co., July 20, 2023

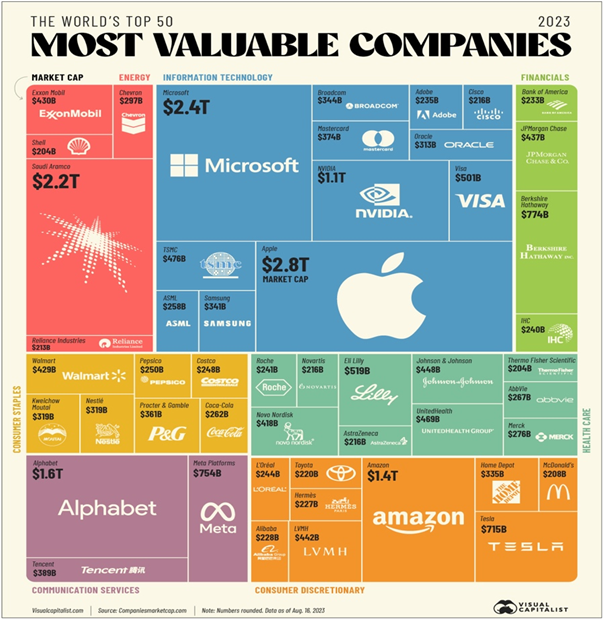

“The 50 Most Valuable Companies in the World – Market capitalization, or market cap, is one measure of a company’s value as determined by the stock market. It is easily calculated by multiplying the company’s outstanding shares by its current share price…..as of Aug. 16, 2023. From this data, we can see that there are only a handful of trillion dollar companies in the world, including Apple, Microsoft, Saudi Aramco, Amazon, Alphabet, and Nvidia. Altogether, the 50 most valuable companies represent over $26.5 trillion in shareholder value. Visual Capitalist, August 20, 2023

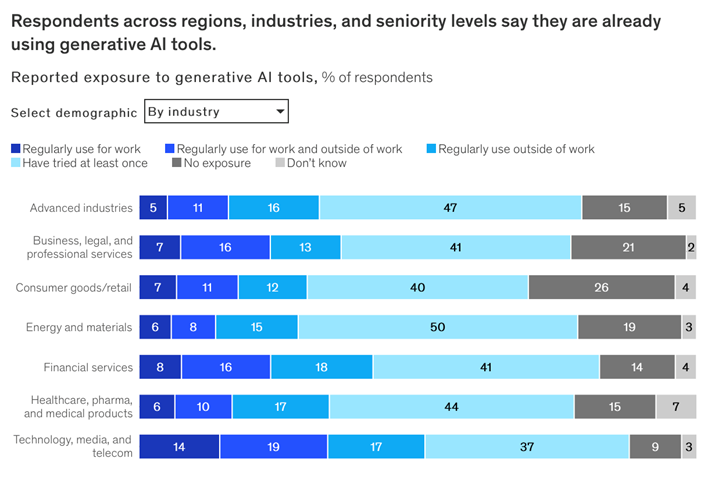

“The state of AI in 2023: Generative AI’s breakout year – As organizations rapidly deploy generative AI tools, survey respondents expect significant effects on their industries and workforces. Less than a year after many of these tools debuted, one-third of our survey respondents say their organizations are using gen AI regularly in at least one business function. Amid recent advances, AI has risen from a topic relegated to tech employees to a focus of company leaders: nearly one-quarter of surveyed C-suite executives say they are personally using gen AI tools for work, and more than one-quarter of respondents from companies using AI say gen AI is already on their boards’ agendas.”, McKinsey & Co., August 1, 2023

“Friday is just a dead day’: how a summer perk became a year-round staple. More white-collar employees are clearing the decks at the end of the week after pandemic upended in-office work. Corporate America’s working rhythms have been evolving since the start of the pandemic. In late 2020, as employers started pushing for a return to the office, some insisted on workers showing up in-person on Fridays to avoid a slide into effective three-day weekends, said Nick Bloom, a Stanford economics professor who studies workplace data. But as a labour shortage shifted the balance of power towards workers, some employees have been able to negotiate working from home on Fridays in particular, and increasingly giving themselves more flexible working hours on that day.”, The Financial Times, August 31, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

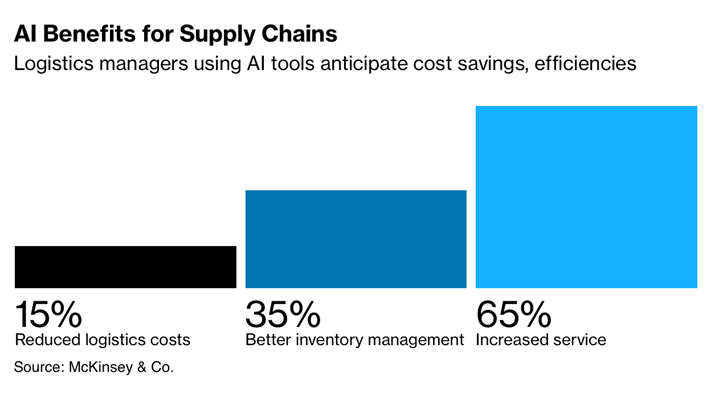

“AI Fused With Trade Data May Finally Smooth Clunky Supply Chains – AI models may help make trade more transparent, predictable. The dawn of artificial intelligence tools like ChatGPT may revolutionize the way both the public and private sector use data to ferret out risks and opportunities in the $32 trillion global trading system…..AI tools are helping many organizations simplify trade-data analysis in ways that may help smooth cross-border commerce — a notoriously labor-, spreadsheet- and carbon-intensive engine of the world economy.”, Bloomberg, September 2, 2023

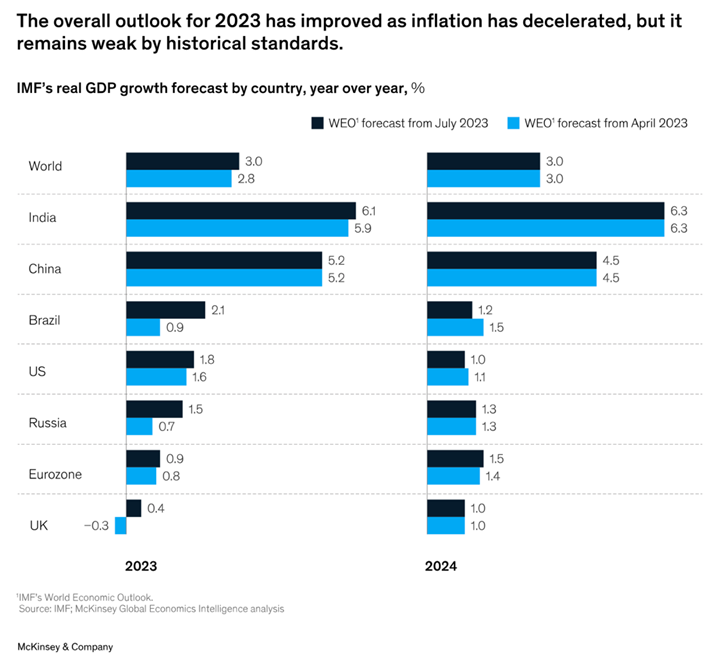

“Global Economics Intelligence executive summary – Mixed economic picture with patchy positives; consumers cautious but confidence rising; inflation in developed economies decelerates, while producer prices decline; trade volumes down. July’s World Economic Outlook Update from the IMF projects global growth to fall from an estimated 3.5% in 2022 to 3.0% in both 2023 and 2024. Meanwhile, the IMF expects global headline inflation to fall from 8.7% in 2022 to 6.8% in 2023 and 5.2% in 2024. It anticipates that underlying (core) inflation will decline more gradually, with forecasts for inflation in 2024 revised upward.”, McKinsey & Co., August 21, 2023

“Global inflation tracker – Inflation is easing from the multi-decade highs reached in many countries following Russia’s full-scale invasion of Ukraine. The latest figures for most of the world’s largest economies show the wholesale food and energy prices that soared during 2022 are now falling back. Investors’ expectations of where inflation will be five years from now have declined from their recent peaks.”, The Financial Times, August 31, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel Updates

“Tourists’ slow return to China post-Covid causing headaches for travel industry – China recorded a 70 per cent drop in international travellers in the first half of this year compared with pre-Covid levels. Lasting damage of the pandemic as well as China’s negative image amid geopolitical tensions have been blamed for the poor recovery. Analysts and industry figures attributed the poor figures to the lasting damage from the pandemic as well as China’s negative global image and loss of business confidence amid geopolitical tensions.”, South China Morning Post, September 3, 2023

“Los Angeles Airport Has Now Banned This Common Item – You’re going to have to figure out a new way to hydrate at LAX – In security queues at airports, there are signs asking passengers to get rid of their water bottles. Los Angeles World Airports (LAWA) has banned single-use plastic bottles at the Los Angeles International Airport and the non-commercial Van Nuys Airport. All restaurants, vendors, lounges, and vending machines are required to eliminate plastic bottles, but they will still be available on flights.”, Fodor’s, September 2, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Australia

“School’s in: Sam Kerr to launch her own Australian academy for future Matildas and Socceroos – Just days after the Matildas finished their Cup campaign, Kerr will unveil her own academy for the next batch of players – complete with her signature backflip celebration as part of its branding. The program will be fronted by Australia’s record goalscorer and include opportunities for business people to buy a Sam Kerr Football franchise, as well as allowing coaches to lend their expertise. Having spoken about wanting to leave a legacy after the Matildas finished fourth in a home World Cup – the highest finish for an Australian men’s or women’s team – Kerr has opted to set up her own development pathway.”, The Sydney Morning Herald, August 23, 2023. Compliments of Jason Gehrke, Franchise Advisory Centre, Brisbane

Brazil

“An economic evaluation for Lula – Brazil welcomed higher-than-expected growth figures on Friday. The economy expanded 0.9% in the second quarter, more than forecast, thanks to a bullish domestic market. The news follows a 1.9% rise in the first quarter, driven by a bumper harvest. That is good news for Luiz Inácio Lula da Silva, Brazil’s president. Lula took office in January amid fears of a spending spree like the one that characterised his party’s last stint in government (which ended in a recession in 2016). Instead, the economy looks rosier than before. The inflation rate, which hit 12% in 2022, is at 3.99%. Unemployment, at 7.9%, is at its lowest level since 2014. But analysts remain sceptical about the longer term. Predictions for GDP growth for 2024 and 2025 remain stuck below 2%.”, The Economist, September 1, 2023

China

“Why is China’s economy slowing down and could it get worse? China’s economic growth is slowing down as policymakers try to fix a property market downturn, with troubles at major developer Country Garden in focus. Concerns are mounting over whether the world’s second-largest economy is coming closer to a crunch point. Unlike consumers in the West, Chinese people were left largely to fend for themselves during the COVID-19 pandemic and the revenge spending spree that some economists expected after China re-opened never took place. Moreover, demand for Chinese exports has been softening as key trading partners have been grappling with rising living costs. And with 70% of Chinese household wealth tied up in real estate, a big slowdown in the sector is trickling through to other parts of the economy.”, Reuters, August 31, 2023

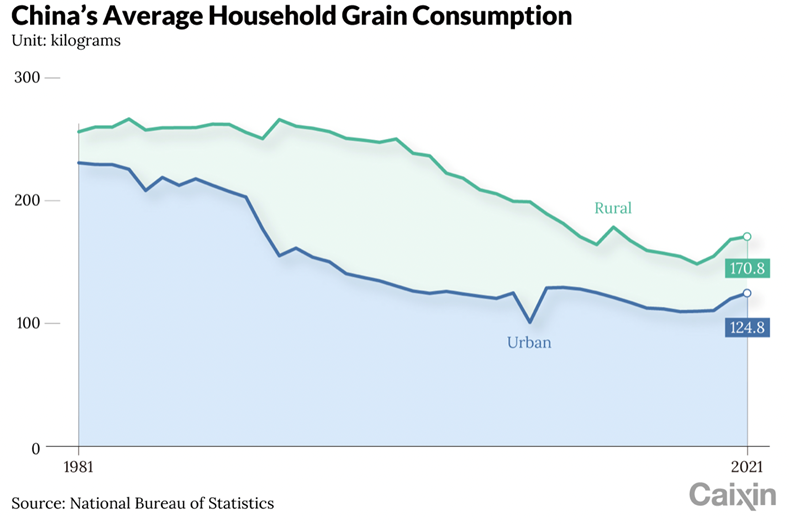

“China’s Richer Diet Is Straining the Agricultural Industry – For years China had more than enough wheat and rice to feed its 1.4 billion people. But since the nation grew richer and diets shifted to more meat and dairy, the world’s second-most populous country is running out of enough arable land to keep up with the demand for high-protein food. As household incomes increase, average Chinese meat consumption is expected to rise 38% from the current 55 kilograms per year to 76 kilograms in 2035. As production of animal products such as meat, eggs and milk requires a large amount of grain as feed, the rising consumption of such foods means that China will have to produce more grain for animal feed — or expand imports.”, Caixin Global, August 30, 2023

Finland

“This Country Just Became the First to Introduce Digital Passports – Could physical passports soon be replaced by an app? This pilot program aims to find out. Finland is changing the way it handles border security—specifically by doing away with physical passports. During the trial period, which runs until February 2024, the digital passport will only work on Finnair flights between Finland’s Helsinki Airport and three U.K. airports: Edinburgh, London, and Manchester.”, AFAR, September 1, 2023

Indonesia

“Indonesia Introduces Golden Visa to Draw Foreign Investors – Five year visa requires investment of at least $350,000. Government is targeting quality investors. Indonesia will issue so-called golden visas allowing foreigners who make substantial investments to remain for between five and 10 years, in an effort to boost the country’s economic development. Last year, the Southeast Asian nation rolled out a second home visa for wealthy tourists with at least 2 billion rupiah ($130,000) in their bank account.”, Bloomberg, September 3, 2023

“PepsiCo returns to Indonesia, breaks ground for snack factory – U.S. food and beverage maker PepsiCo (PEP.O) began building a snack factory in Indonesia’s West Java on Wednesday, marking its return to Southeast Asia’s largest economy after splitting with a local partner two years ago. The factory, part of PepsiCo’s $200 million commitment to invest in Indonesia over a 10-year period, is expected to start producing snacks by 2025. Building the new factory without a local partner, PepsiCo pledged to source most raw materials for its snacks, including corn and palm oil, from sustainable sources and to use renewable power sources.”, Reuters, August 29, 2023

The Philippines

“The promise of the Philippines: A retail success story – Retail in the Philippines has been showing great promise, with players encouraged by its high growth rate across various retail categories. This is particularly true in luxury goods, with the Philippines set to be the fast-growing market in Southeast Asia for this sector, a 30 percent increase from 2021 to 2022. In addition, retail e-commerce growth rates in the Philippines are set to surpass all other markets in the region. This retail success is driven primarily by increased supply chains and distribution, leading to greater accessibility to consumer products and services. Affluence translates into higher consumer spending. Beauty and personal care also offers opportunities in the Philippines.”, Retail Asia, late July 2023

Switzerland

“UBS breaks record with $29bn profit after Credit Suisse deal – Swiss bank plans to complete integration and make $10bn of cost cuts by 2026. The Swiss lender announced the figures on Thursday as it said it would press ahead with absorbing Credit Suisse’s domestic business despite local and political opposition to a deal that is expected to result in thousands of job cuts and branch closures. UBS agreed to rescue its ailing rival five months ago and its record $29bn pre-tax profit was almost entirely thanks to the accounting gain it recorded on the $3.4bn takeover.”, The Financial Times, September 1, 2023

Turkey

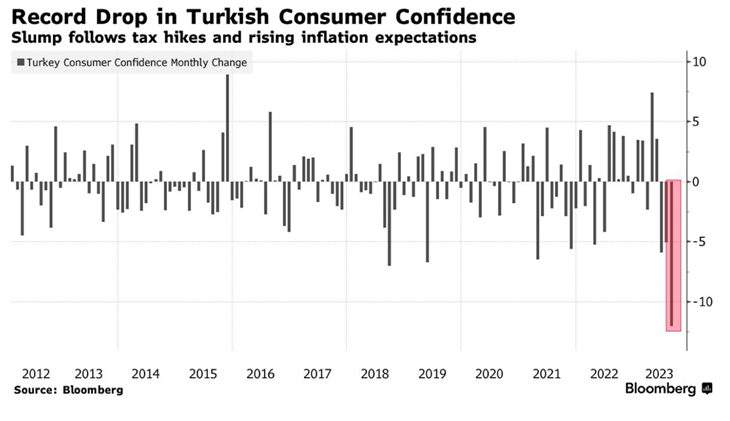

“Turkish Consumers Suffer Biggest Confidence Drop of Erdogan Era – The consumer confidence index plummeted to 68 points in August from 80.1 a month earlier, according to the Turkish Statistical Institute. That’s the biggest drop since records began in 2004, months after Erdogan first became prime minster. The precipitous slump follows a series of tax hikes, several increases in interest rates and a sharp upward revision in official inflation expectations for the year. The central bank’s new governor, Hafize Gaye Erkan, and Treasury and Finance Minister Mehmet Simsek are orchestrating a return to orthodox policy after years of growth-at-all-costs measures.”, Bloomberg, August 23, 2023

United Kingdom

“UK economy bigger than before Covid, revised ONS figures show – Official data has revealed that the recovery from the pandemic was far faster than thought. It means the economy is no longer the worst performer among the world’s richest nations as the growth rate is likely to have surpassed Germany’s. Analysts said that the perception of the UK as the G7’s laggard was ‘no longer valid’. Jeremy Hunt, the chancellor, welcomed the data, which he said was more evidence that those talking down the British economy ‘have been proved wrong’. GDP performed much better than initially thought during the Covid-19 crisis and was 0.6 per cent larger in the final three months of 2021 than before the onset.”, The Times Of London, September 1, 2023

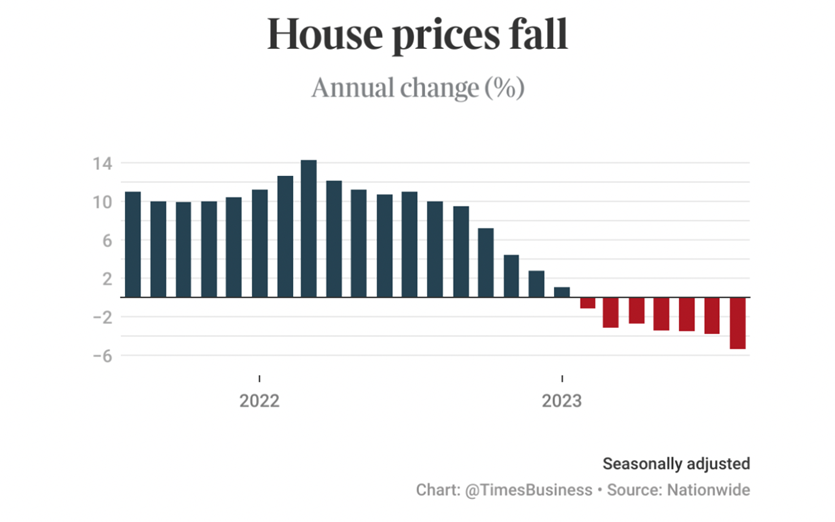

“The fall in house prices accelerated in August – House prices fell by a larger than expected 5.3 per cent year-on-year in August, accelerating from the 3.8 per cent fall recorded in July. It was the biggest annual decline since July 2009 and the seventh consecutive annual drop reported by Nationwide. City economists had forecast a 4.7 per cent fall. Month-on-month house prices fell by 0.8 per cent. The average house price is now £259,153 (US$327,546), down from £260,828 in July.”, The Times of London, September 1, 2023

United States

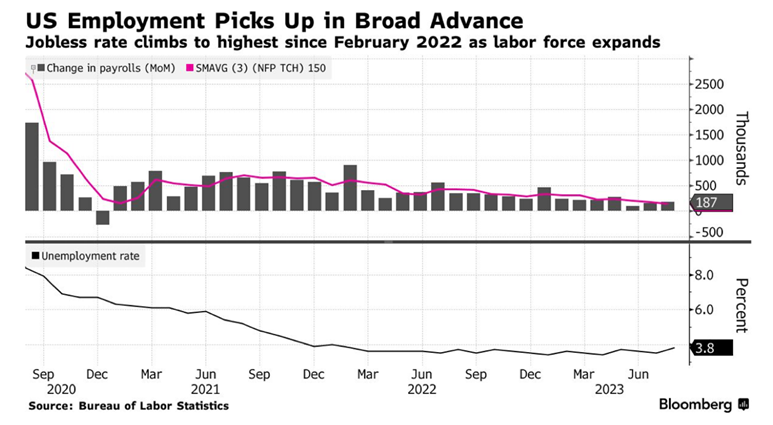

“US Jobs Report Signals Smooth Downshift in Labor Market – Still-solid hiring, slower wage growth gives Fed room to pause More people returned to the labor force but couldn’t find jobs. The latest US job data showed a labor market undergoing a controlled cooling, illustrated by solid hiring, slower earnings growth and more people returning to the workforce. Employers in August added 187,000 jobs in a broad-based advance, following downward revisions to payrolls in the prior two months, government figures showed Friday. Hundreds of thousands more joined the labor force, though a growing number was unable to find work right away.”, Bloomberg, September 1, 2023

“Study Finds Consumers Remain Concerned About Economy – 59% of consumers have a high level of concern regarding the economy, up from July. 65% of consumers feel as though the country is in an economic recession, and the same amount think the US economy will worsen in the next few months. 76% think inflation will increase in the next few months. Over the next few months, 38% of consumers say their primary concern will most likely be personal finances. 77% of consumers say rising prices on essential goods and services is their main economic concern (+5 points from July), followed by rising prices on gas/fuel (70%, +9 points from July).”, Franchising.com, August 31, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“A History of Franchising – From a Founding Father’s Printing Press to Fast Food Chains In honor of Franchise Appreciation Day on September 2, we look at the history of franchising. Benjamin Franklin is often credited as one of the pioneers of franchising in America, having established the first franchise-like agreement in 1731 through a printing business partnership. Martha Matilda Harper, who, in 1891, introduced the Harper Method Shops, including standardized training, proprietary branded products, and advertising support, was another franchising trailblazer. The decades following World War II witnessed a franchising boom, giving birth to legendary brands like McDonald’s, KFC, and Dunkin’ Donuts.”, Entrepreneur magazine, September 1, 2023

“Franchise Opportunities In An Unconventional Economy – The current economy is characterized by an interesting mix of optimism and anxiety. Franchises are a significant segment of the economy and despite a challenging economy, growth is expected to continue. For example, the International Franchise Association forecasted that franchises in the U.S. would grow by 3.0% in 2023, adding 254,000 jobs, reaching a total of 8.7 million employees. But while growth among franchisors is expected to continue, rising interest rates are impacting their growth and expansion outlook according to a confidence survey just released in Franchise Times by financial technology company Boefly.”, Forbes, August 30, 2023

“Australia’s BFT expands across South-East Asia and Spain as gym chains face an economic workout – The chain opened its first Hong Kong franchise this month and has recently sold its first two franchises in Malaysia, plus an additional two franchises across Madrid and Barcelona. The additions will complement BFT’s 175 Australian studios, and an additional 75 spread across New Zealand, the US, Canada, England, and Singapore. BFT’s franchise expansion comes in a difficult economic environment for many gym businesses, which are balancing the post-lockdown return to group physical activity against mounting operating costs.”, Smart Company (Australia), August 22, 2023

“Krispy Kreme celebrate 20 years in Australia with free doughnuts – To celebrate 20 years since they opened their first Aussie store in Penrith in 2003, Krispy Kreme will be slinging one of their famous glazed doughnuts to anyone that has the courage to shout the iconic Aussie birthday chant “Hip Hip Hooray” in store during their birthday weekend, from September 7 to 10.”, Kitchen Nine, September 1, 2023

“Will Pizza Hut be next giant to disappear from the (UK) High Street? Future of restaurant in doubt after 50 years in the UK with soaring prices pushing it further into losses. The UK franchise of the fast-food chain admitted that they were heavily affected by the pandemic, which limited the demand for people dining in their restaurants. And this has only been worsened by the war in Ukraine, which caused prices of energy, food and transportation to rocket. The chain was founded in the US state of Kansas in 1958 and the first UK outlet opened in Islington, north London, in 1972. Since then, Pizza Hut has soared in popularity and at its peak employed 10,000 workers in more than 260 restaurants up and down the country, serving three million guests a month.”, The Daily Mail, August 28, 2023

“Popeyes Announces Major Plans For Reopening In China – The popular chicken conglomerate, which last year announced plans to build locations across North America, has now added China to its list once again. As of Monday, Popeyes is planning the opening of 1,700 outposts across China, at least 10 of which will be in Shanghai. The expansion announcement comes on the heels of the chain’s purchase by Tims China, owner of Canada’s beloved Tim Hortons, which made the acquisition in March.”, The Tasting Table, August 22, 2023. Compliments of Paul Jones, Jones & Co., Toronto

“Restaurant Brands appoints Arif Khan as permanent CEO – Khan has been acting group CEO since April and had spent several years in management at the business in his early career. In 2018, he returned to oversee the Restaurant Brands New Zealand business as CEO after serving as global chief operating officer from November to April of last year. Restaurant Brands is a corporate franchisee that manages multi-location branded food retail franchises. It operates the KFC and Taco Bell chains in Australia and KFC, Pizza Hut, Taco Bell and Carl’s Jr in New Zealand.”, Inside Retail (Australia), September 1, 2023

“Subway’s New Owner Faces Tough Decisions on Sandwich Chain’s Massive Size in US – Company still has about 20,000 locations in the US alone Sandwich chain says existing management will stay in place. Subway’s restaurant count currently stands at nearly 37,000 worldwide, with around 20,000 in the US. That’s even after the company aggressively pared back in recent years amid fierce competition and locations in close proximity to each other that cannibalized sales and squeezed franchisees. Management shuttered more than 6,500 US locations between 2015 and 2022, according to food-service research firm Technomic. But per-store sales still trail rivals’, the data show.”, Bloomberg, Aufust 24, 2023

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant taking 40 franchisors global.

For a complimentary 30-minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking