EGS Biweekly Global Business Newsletter Issue 91, Tuesday, September 19, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Introduction: In this issue, problems brewing for Europe’s coffee supply, China seems to be turning a corner if the data is real, the French government is selling fuel at a loss (?), rice supply is having a bad year, Germany’s EVs are having trouble competing, the Middle East is an ATM, Japan is old, the UK is inactive, Mexico’s airlines appear safe again and the USA continues to have lots of job openings.

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

NOTE: Some of the sources that we provide links to require a paid subscription to access. We subscribe to 40 international information sources to keep our readers up to date on the world’s business.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here:

First, A Few Words of Wisdom From Others

“Opportunities don’t happen. You create them.” – Chris Grosser

“The best way to predict the future is to create it.” – Peter Drucker

“In the middle of every difficulty lies opportunity.” – Albert Einstein

Highlights in issue #91:

- Brand Global News Section: Chick-fil-A®, Church’s Chicken®, Paradies Lagardère and Twisted by Wetzel’s®,

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

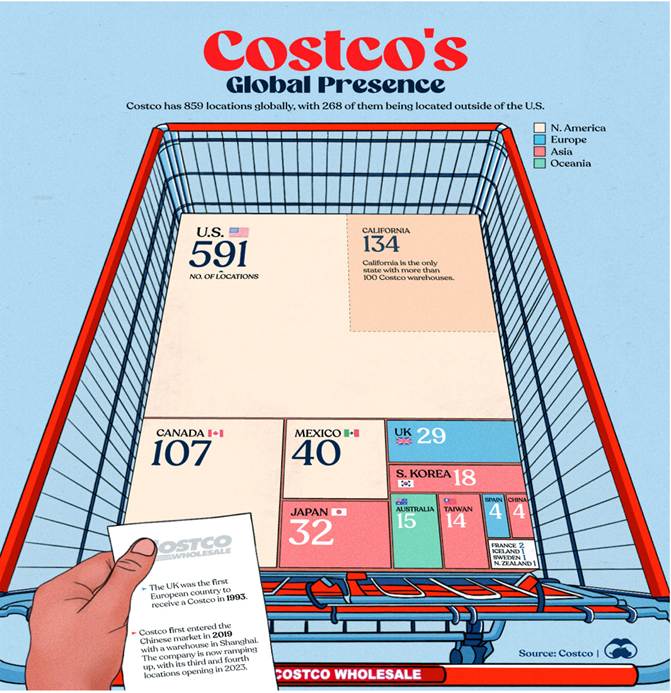

Interesting Data and Studies

“Visualizing Costco’s Global Presence – Costco is a membership-based retail chain founded in 1983 in Seattle, Washington. Best known for its unique warehouse stores and high-quality products, Costco offers everything from electronics to groceries. Since its founding, Costco has become a major retailer in the U.S., while also greatly expanding its international presence. As of August 2023, the company has 859 locations globally, with a split of 69% domestic (591 stores) and 31% international (268 stores).”, Visual Capitalist, September 8, 2023

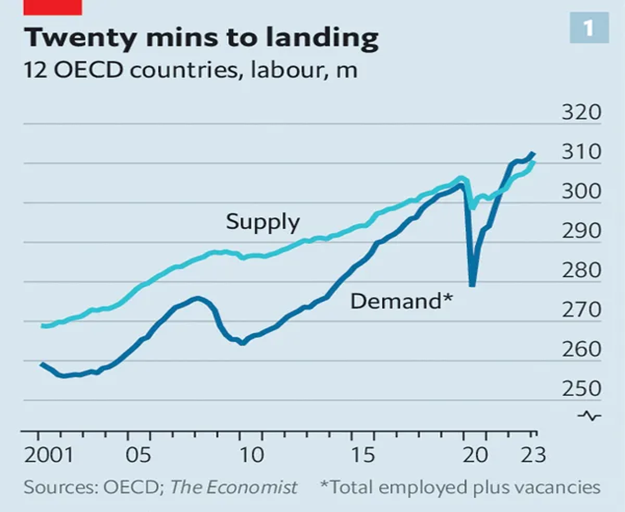

“Why aren’t more people being sacked? – How inflation has fallen without mass job casualties. If central bankers are to defeat inflation, they must cool the labour market. For two years rich-world wage growth has added to corporate costs, sending prices relentlessly upwards. But as they began raising interest rates to slow the economy, policymakers hoped for an even rosier outcome. They wanted to achieve a “soft landing”, which involves both bringing down inflation, and doing so without mass job losses. It is a lot to ask of a tool as blunt as monetary policy. Are they succeeding? And so far the evidence suggests that—against widespread expectations—labour markets from San Francisco to Sydney are co-operating.”, The Economist, September 17, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

“Peak Oil Demand ‘Wilting Under Scrutiny,’ Aramco CEO Says – Nasser sees 2030 crude usage of 110 million barrels per day – CEO’s pared-back forecast still outstrips IEA projections. Last week, OPEC projected global oil markets would face a supply shortfall of more than 3 million barrels a day next quarter — potentially the biggest deficit in more than a decade. The IEA’s (International Energy Agency) prediction that oil consumption will peak this decade and grow at a slower rate in the near term as the energy transition gathers pace has been proven to be unrealistic, Nasser said Monday.”, Bloomberg, September 18, 2023

“Shipping giant Maersk is seeing tentative signs of a bounce back in global trade – Consumers in the U.S. and Europe have been key drivers in the demand uptick, Vincent Clerc (CEO of shipping titan Maersk) told CNBC’s Silvia Amaro, and those markets have continued to ‘surprise on the upside.’ The upcoming pickup would be fueled by consumption, he said, rather than the “inventory correction” which has featured heavily in 2023. ‘Barring any negative surprises, we would hope for a slow pickup as we get into 2024, a pickup that will not be a boom like what we have known in the past few years, but certainly … a demand that is a bit more in line with with what we see in terms of consumption, and not so much an inventory correction.’”, CNBC, September 15, 2023

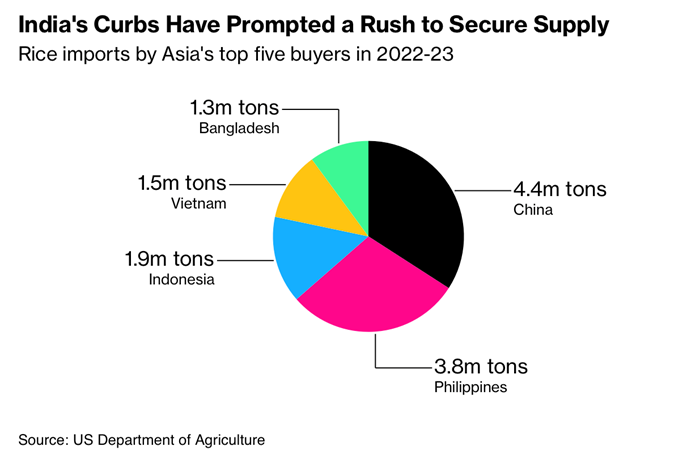

“Rice Crisis in the Philippines Sounds a Global Inflation Alarm – Indonesia agrees on first deal with Cambodia in over a decade Malaysia implements purchase limit, starts enforcement checks. Rice inflation in the Southeast Asian nation increased at the fastest pace in almost five years in August, reviving memories of a 2018 shock that led to the end of a two-decade-old limit on imports. India’s restrictions have upended the market and prompted worried nations to secure supply as they try and contain the rising cost of rice, which is a vital part of the diets of billions of people across Asia and Africa.”, Bloomberg, September 8, 2023

“What ‘Friend-Shoring’ Means for the Future of Trade – Over the past few years, the world has experienced an escalating series of trade disruptions: the US-China trade war, the Covid-19 pandemic and its supply chain disruptions, Russia’s invasion of Ukraine and the sanctions and export controls that followed. Their cumulative impact has called into question the vision of a globalized economy. In response, some US officials pushed “friend-shoring” — a happy-sounding name for a policy that would lead to a world divided between free-market democracies and countries that align with the authoritarian regimes of China or Russia. It’s a world in which supply chains could be more robust and less subject to economic blackmail. It’s also likely a world that’s poorer and less productive.

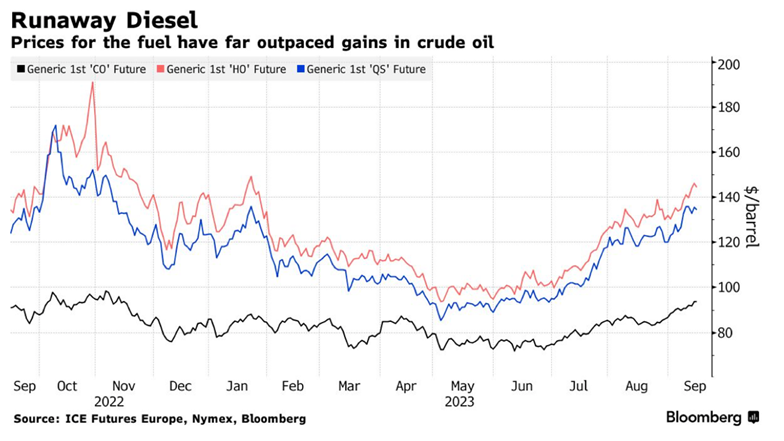

“The World Is Struggling to Make Enough Diesel – Crude production cuts have been detrimental to diesel supply – Refineries have sought to satisfy demand surge for other fuels. While oil futures are rocketing — on Friday they were just below $95 a barrel in London — the rally pales in comparison with the surge in diesel. US prices jumped above $140 to the highest ever for this time of year on Thursday. Europe’s equivalent soared 60% since summer.”, Bloomberg, September 17, 2023

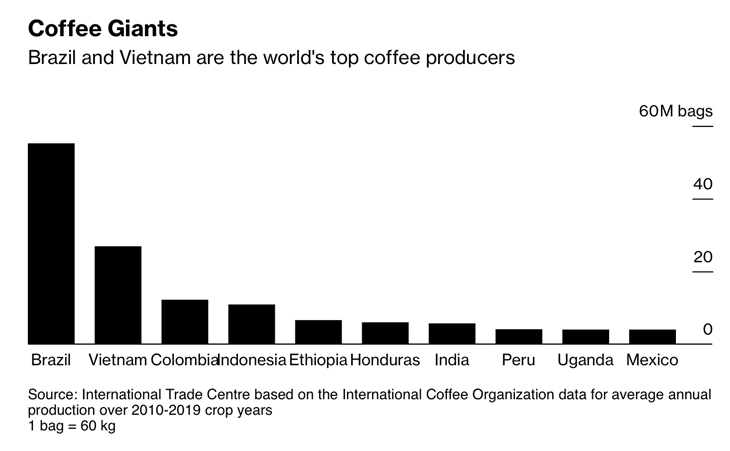

“Coffee Storm Is Brewing: Proving a Latte’s Sustainable Journey From Farms – How do you trace a journey of beans from millions of farms around the world all the way to cappuccinos and lattes sipped in cafes from Vienna to Rome? That’s the conundrum the coffee industry faces as it scrambles to get ready for Europe’s ground-breaking sustainability rules. Coffee is grown in about 70 countries, with five of them — including Brazil and Vietnam — making up about 85% of the world’s output. The rest comes from some 9.6 million growers in smaller producers, who often lack the resources to meet sustainability standards, according to Ethos.”, Bloomberg, September 15, 2023

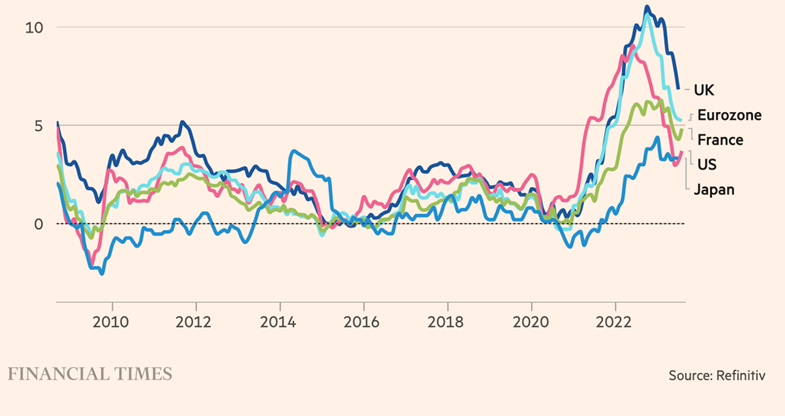

Annual % change in consumer price index

“Global inflation tracker – Inflation is easing from the multi-decade highs reached in many countries following Russia’s full-scale invasion of Ukraine. The latest figures for most of the world’s largest economies show the wholesale food and energy prices that soared during 2022 are now falling back.”, The Financial Times, September 14, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel Updates

“US raises Mexico air safety rating in boost for country’s airlines – US raises Mexico air safety rating in boost for country’s airlines. The Federal Aviation Administration (FAA) said on Thursday it has upgraded Mexico’s air safety rating, a move that will allow Mexican carriers to expand U.S. routes and add new service. Mexico was downgraded by the U.S. regulator in May 2021 after the agency found the country did not meet safety standards. The downgrade was a major blow to Mexico carriers, as U.S. airlines were able to scoop up market share.”, Reuters, September 14, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

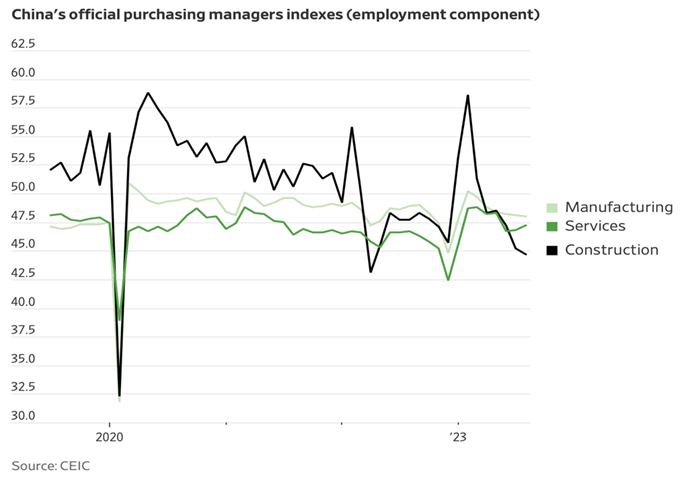

China

“China May Dodge Deflation, After All – But it will probably be a near miss, and economic data still hints at a bottom rather than a strong rebound. After a grim June and July, China’s main August economic data, released Friday, contained clear hints of improvement. The news from the critical housing sector, which is mired in a protracted slump, was less encouraging: Price falls accelerated in lower-tier cities. But growth in retail sales accelerated to 4.6% from a year earlier, from just 2.5% in July. Unemployment ticked down marginally.”, The Wall Street Journal, September 15, 2023

“China expects ‘golden week’ holiday journeys to beat pre-pandemic figures – China Railway said it had recorded a record single day’s sales, with 22.9 million tickets being bought in one day. Airline tickets are also selling well as the National Day holiday coincides with Mid-Autumn Festival. That is roughly double the 72 million trips made during the same holiday last year and well above the 138 million trips made in 2019 before the Covid pandemic.”, South China Morning Post, September 17, 2023

“Beijing “Has Plenty Of Dry Powder” – Can Manage Economic Stresses: U.S-China Business Forum. China’s economy is facing two sources of stress at the same time – cyclical and structural, yet the government ‘has plenty of dry powder’ and is ‘able to manage this situation,’ U.S.-China Business Council President Craig Allen said in a recent interview in New York. Authorities recognize ‘the problems that they face and are working on those problems in an incremental manner — (through) incremental stimulus and incremental reform,’ Allen said. ‘But it’s slow and steady and not as dramatic as many people would like to see.’”, Forbes, September 13, 2023

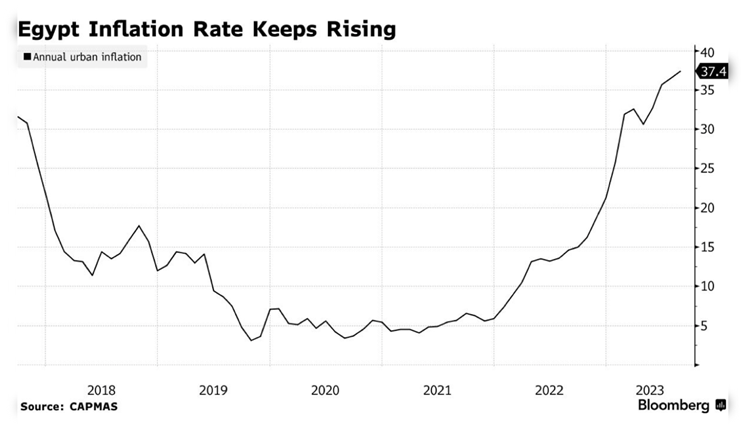

Egypt

“Egypt Inflation Soars as Higher Food Costs Add to Currency Angst – Egyptian inflation soared to a fresh record, with consumer costs now increasingly at the mercy of whether authorities will allow the pound to weaken again. Price growth in urban parts of the country accelerated to an annual 37.4% in August from 36.5% the previous month, according to figures released Sunday by the state-run CAPMAS statistics agency. On a monthly basis, inflation was 1.6%, compared with 1.9% in July. A 71.4% increase in the cost of food and beverages, the largest single component of the inflation basket, was a major contributor to last month’s price pickup.”, Bloomberg, September 9, 2023

France

“France to Allow Selling Fuel at Loss to Curb Inflation – Prime Minister Borne announces plan in Le Parisien Newspaper. The French government plans to allow gas stations to sell fuel at a loss, overriding a law from 1963, as it struggles to find new ways of containing inflation without adding to vast sums of public money already spent. Such a move would in theory allow greater competition between distributors, who could cut prices below costs and aim to make up lost margin with sales of other products and services.”, Bloomberg, September 17, 2023

“France’s Carrefour puts up ‘shrinkflation’ warning signs – French supermarket Carrefour has put stickers on its shelves this week warning shoppers of “shrinkflation” – where packet contents are getting smaller while prices are not. Lipton Iced Tea, Lindt chocolate and Viennetta ice cream are among the products being named and shamed. Shoppers are being told if bottles are smaller or pack contents lighter. Carrefour has identified 26 products that have shrunk, without a price reduction to match, made by food giants including Nestle, PepsiCo and Unilever.”, BBC News, September 14, 2023

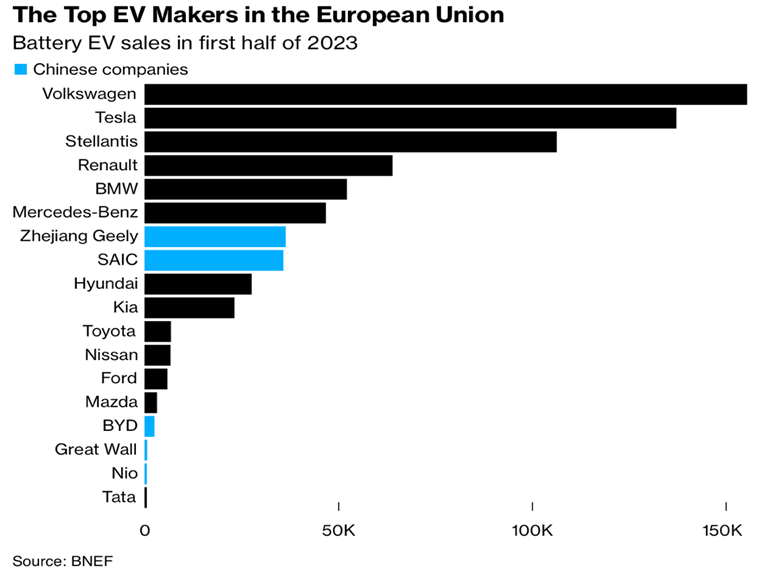

Germany

“VW Lays Off Workers at Key EV Factory Over Cratering Demand – Volkswagen is having a tough time selling enough mostly made-in-Germany electric cars to challenge Tesla Inc.’s global dominance. Lackluster economic growth as well as higher energy, living and borrowing costs in Europe have weighed on demand for its ID fleet of EVs.”, Bloomberg, September 14, 2023

India

“Apple to Sell Made-in-India iPhones on Launch Day for First Time – Devices from India to debut at same time as China-made ones IPhone 15 marks a milestone for India’s electronics ambitions. It would also underscore India’s growing production prowess and reflect a significant departure from Apple’s previous strategy of selling mostly Chinese-made new devices to frenzied customers across the world.”, Bloomberg, September 12, 2023

Japan

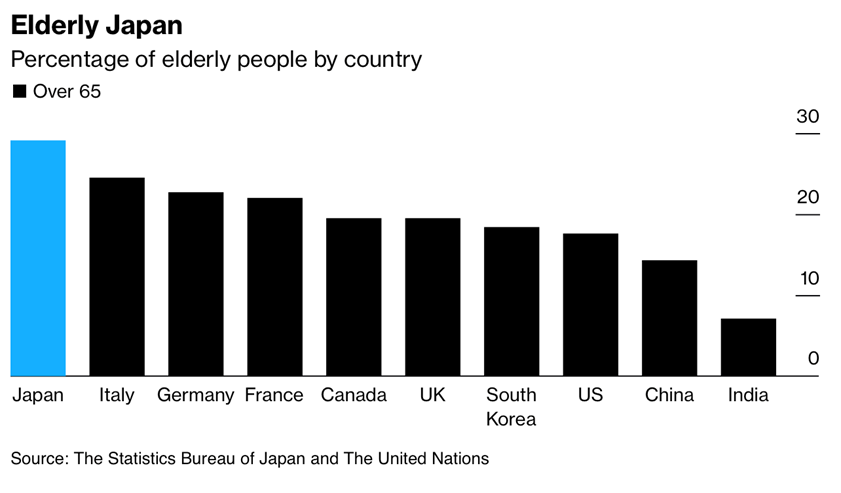

“One in 10 Japanese Now Aged Over 80, Population Report Shows – Japan’s persistently low birthrate and long lifespans have made it the oldest country in the world in terms of the proportion of people aged over 65, which this year hit a record of 29.1%. Ballooning social security spending has added to Japan’s massive debt and the shortage of young people has left many industries short of labor — not least carers for the elderly.”, Bloomberg, September 17, 2023

The Middle East

“The Middle East Becomes the World’s ATM – Flush with cash from an energy boom, Saudi Arabia and other Gulf monarchies have a moment on the world’s financial stage. Middle East monarchies eager for global influence are having a moment on the world’s financial stage. They are flush with cash from an energy boom at the very time traditional Western financiers—hampered by rising interest rates—have retreated from deal making and private investing. The region’s sovereign-wealth funds have become the en vogue ATM for private equity, venture capital and real-estate funds struggling to raise money elsewhere.”, The Wall Street Journal, September 7, 2023

Saudi Arabia

“Why Saudi Arabia is the Future Frontier for Global Entrepreneurs – The Saudi horizon is vast, and it’s gleaming with golden opportunities for the discerning entrepreneur. Saudi Arabia’s Vision 2030 is a clarion call for diversification. The nation is proactively steering away from its oil-dependent past, investing heavily in entertainment, tourism, technology and sports sectors. For budding entrepreneurs, this evolution translates into a broader spectrum of business avenues, a more varied market and an ever-evolving consumer base. Recent years have witnessed a startup explosion, with young Saudis taking the entrepreneurial plunge, driven by passion and the promise of a supportive ecosystem. But perhaps the most heartening aspect of this entrepreneurial surge is the rise of female founders and business leaders.”, Entrepreneur, September 7, 2023

Sweden

“Sweden is the No. 1 country for affordability, safety and overall quality of life – To rank the 87 countries listed, U.S. News and World Report, WPP and the Wharton School of the University of Pennsylvania surveyed more than 17,000 people worldwide. According to Numbeo, the cost of living in Sweden is, on average, 20.9% lower than in the United States, while renting is 57.5% lower. Sweden’s people boast one of the longest life expectancies, with an average age of 82.8 years, according to the CIA World Factbook.”, CNBC, September 17, 2023

United Kingdom

“Remote working to require ‘total rewiring of UK – The shift means people drove 19 billion fewer miles last year as the pandemic continued to redraw how Britons live. Last year cars travelled a total of 244 billion miles, according to the Department for Transport. While this is higher than the pandemic years of 2020 and 2021, it remains 7 per cent lower than the 263 billion miles driven in 2019. It is the lowest non-pandemic year for almost a decade. Data also shows a shift from traffic peaks before 9am on weekdays, to later in the day and at weekends. Bloom said the changes brought in by the pandemic had now been “baked in”, and companies that tried to force a return to the office full-time would struggle to recruit and retain workers.”, The Times of London, September 13, 2023

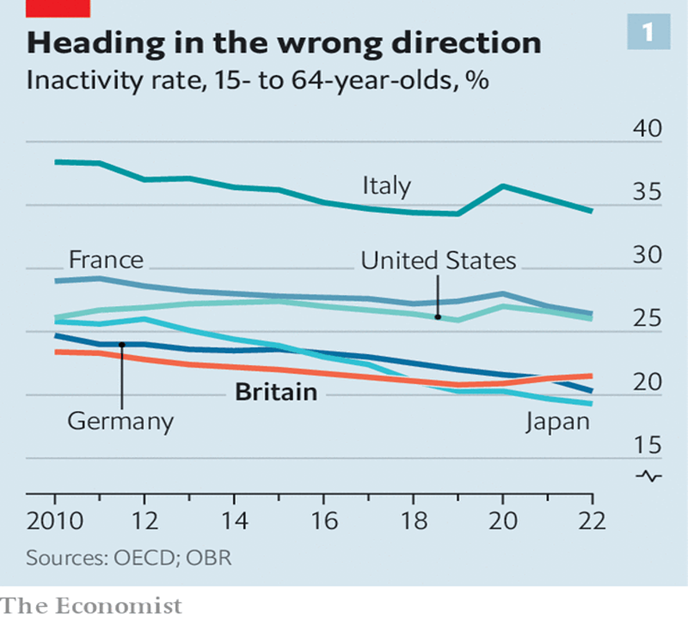

“Why Britain has a unique problem with economic inactivity – A series of policy blunders is to blame. In contrast to most other rich countries, benefits for those of working age were rather stingy. Meanwhile, rates of labour-force participation were admirably high. The inactivity rate—the proportion of working-age people not working or actively seeking a job—was among the lowest internationally and on a downward path from the mid-1990s until 2019.’, The Economist, September 14, 2023

United States

“The U.S. economy is chugging along while the rest of the world falls behind – Driving the division among the world’s most powerful economies: a slowdown in trade that is hurting some much more than others. At the losing end are “extroverted” economies that have traditionally recorded trade surpluses and are now seeing their growth lag behind those of the U.S. and India, for instance, vast markets that have historically relied more on domestic demand for growth relative to their peers. “Global trade will be less global” in the future, with exchanges occurring more within regional blocs, said Holger Schmieding, chief economist at Berenberg Bank. It will also shift away from goods and toward services, he added, providing a boost to economies like the U.S. and India that specialize in IT and other services at the expense of manufacturing powerhouses like Germany and China.”, The Wall Street Journal, September 9, 2023

“Leisure and Hospitality Job Openings Remain Disproportionately High – Job openings for the leisure and hospitality segment of the U.S. economy remain disproportionately high compared to other industries, which could slow the travel industry’s growth as the country considers its future following its post-pandemic recovery period. While employment in this country is at its lowest level since March 2021, the U.S. Bureau of Labor Statistics finds that employment in leisure and hospitality is 1.7 percent lower now than it was in February of 2020, before the pandemic. That’s a lack of 290,000 people, but the disparity deepens when you consider the number of hotels and resorts in the U.S. continues to grow at a fast pace.”, Travel Pulse, September 12, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“6 Shifting Consumer Trends Affecting Quick-Service Restaurants – According to industry data, food spending is expected to rebound through 2024 and into 2025. Consumers’ preferences are shifting like never before, due to a variety of societal and economic dynamics. How can quick-service restaurants adjust to maintain—and potentially increase—foot traffic during these transformative times? The good news is that consumers aren’t trading out of foodservice; however, many are trading down within the segment. According to industry data, food spending is expected to rebound through 2024 and into 2025 as the country moves into a recovery phase following a mild recession.”, QSR Magazine, September 15, 2023

“Chick-fil-A to re-enter UK market – Chick-fil-A, the American fast-food brand, is renewing its attempt to enter the UK market, four years after its debut pop-up closed amid a row over its ties to anti-gay beliefs. The first restaurants will open in early 2025, the first permanent outlets outside North America. The 55-year-old family-owned business runs more than 2,800 restaurants across the US, Canada and Puerto Rico. It is aiming to open five restaurants in the UK in the first two years of launch, creating between 80 and 120 jobs per branch.”, The Times of London, September 15, 2023

“Paradies Lagardère Swoops On Airport Dining Specialist Tastes On The Fly – The French parent company of North American travel retailer Paradies Lagardère has signed an agreement to acquire airport restaurateur Tastes on the Fly. Tastes on the Fly operates about 25 concepts across five major airports, including San Francisco, Denver, New York’s JFK, Boston, and Vancouver in Canada. Added to Paradies’ existing portfolio, Tastes on the Fly’s addition takes the number of F&B brands to more than 100, ranging from full-service to fast-casual and quick-serve.”, Forbes, September 7, 2023

“Southlake man couldn’t get job at Church’s Chicken years ago. Now he owns 140 locations – Aslam Khan’s life story is often described as rags to riches. Which he finds ironic because he was actually wearing a suit and tie when he was turned away from his first job interview with Church’s Chicken nearly four decades ago. He thinks it might have been because he was overdressed. It was for a fast-food restaurant, after all, he said. Now, at 69, he is the largest franchisee in the organization of the fast-food restaurant with his company, Falcon Holdings, operating over 140 stores.”, Star Telegram, September 14, 2023

“How Twisted by Wetzel’s is planning to disrupt the snack category – The streetside restaurant concept is bigger than a traditional Wetzel’s and features a broader, more creative menu. In the spring, Wetzel’s Pretzels opened a new concept called Twisted by Wetzel’s that is quite different from anything the company has done in its nearly-30-year history. The company describes Twisted as a ‘street concept that takes Wetzel’s fun-loving brand and timeless menu and elevates it to a whole new level.’”, Nation’s Restaurant News, September 15, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

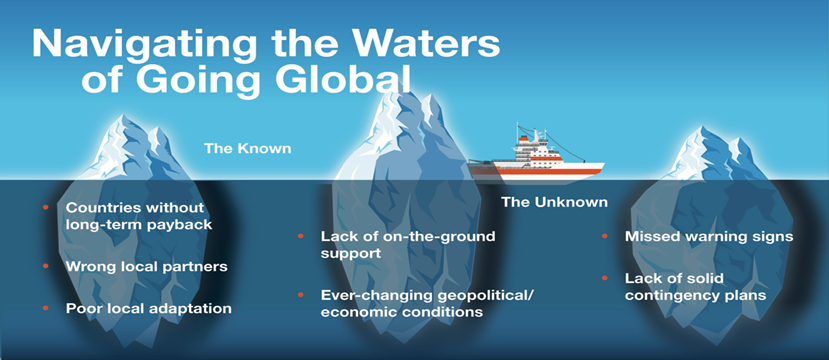

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant taking 40 franchisors global.

For a complimentary 30-minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link: