EGS Biweekly Global Business Newsletter Issue 92, Tuesday, October 3, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Introduction: In this issue, Japan’s stock market soars, the European Union will need US LNG for decades, McDonalds® raises its franchisee royalty rate for the first time in 30 years, Singapore’s Changi airport to go passport free, Indonesia bans sales on social media, and Eurozone country’s inflation is at a 2 year low.

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

NOTE: Some of the sources that we provide links to require a paid subscription to access. We subscribe to 40 international information sources to keep our readers up to date on the world’s business.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here:

First, A Few Words of Wisdom From Others

“Tough times never last, but tough people do.” – Robert H. Schuller

“Out of difficulties grow miracles.” – Jean de La Bruyère

“The secret of change is to focus all of your energy not on fighting the old, but on building the new.” – Socrates

Highlights in issue #92:

The $109 Trillion Global Stock Market in One Chart

The Lack Of Travelers To The U.S. Is Hurting American Retailers

Top EU energy official says US gas will be needed for decades

McDonald’s Is Raising (US) Royalty Fees on New Franchises for the First Time in 30 Years

Four Small States That Show Leadership

A breakout year for Japanese stocks

Brand Global News Section: Coffee Berry®, Guzman y Gomez®, KFC®, McDonalds®, Starbucks®, Subway® and Tim Hortons®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data and Studies

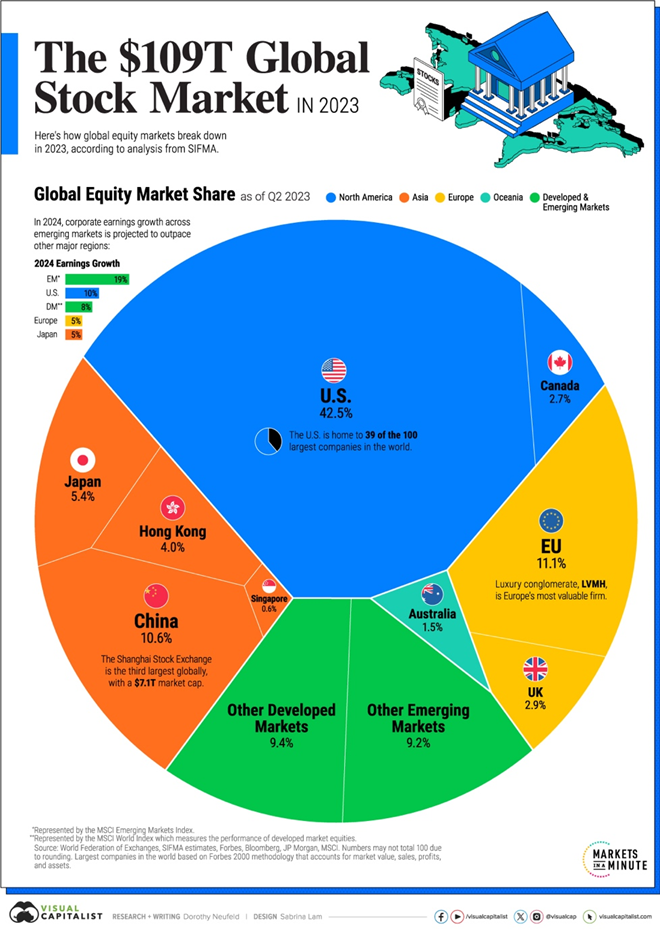

“The $109 Trillion Global Stock Market in One Chart – Over the last several decades, the growth in money supply and ultra-low interest rates have underpinned rising asset values across economies. With the world’s deepest capital markets, the U.S. makes up 42.5% of global equity market capitalization, outpacing the next closest economy, the European Union by a significant margin.”, Visual Capitalist, September 27, 2023

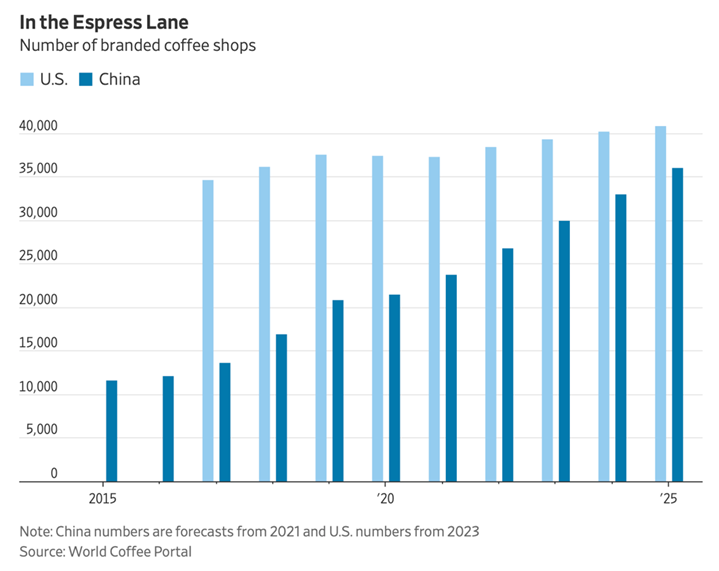

“The Furious Race for the Future of Coffee – Starbucks is making a big push in China. Other chains are pushing even harder. It turns out that selling foamy brown water at an 80% markup is really profitable. Back in 2013, the chief financial officer of what was then called Dunkin’ Donuts dubbed beverages ‘the holy grail of profitability.’, The Wall Street Journal. September 22, 2023

“The Latest On Returning To Offices – As corporate and urban centers around the world continue to resume a more familiar pace, leaders seek the “right” balance between in-person and remote work, as well as between mandates and persuasion. A recent WTW survey reports that leaders expect more than half of their employees (55%) to work either fully remotely or hybrid in three years, compared with 15% before the pandemic. Effective leaders take six actions as employees return to offices.”, Forbes, September 29, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

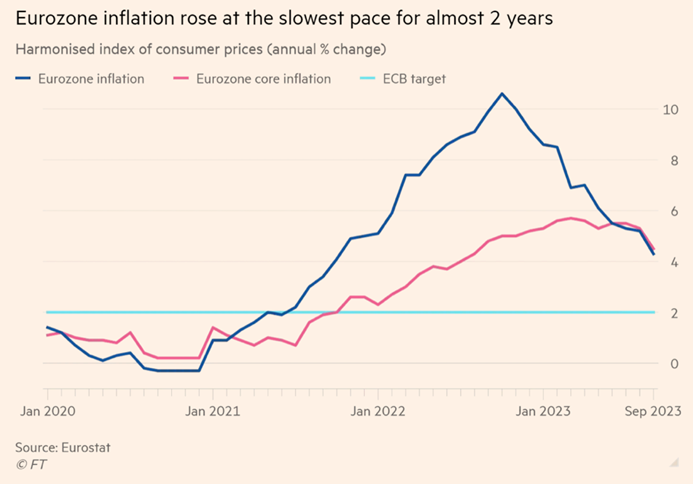

“Eurozone inflation hits 2-year low as US price pressures ease – Data helps steady bond markets and signals prospect of end to interest rate rises on both sides of Atlantic. The last time inflation was lower was in October 2021. US data also bolstered hopes that the biggest surge in consumer prices for a generation is fading fast. ‘The main takeaway is that the tightening cycle is coming to an end,’ said Seema Shah, chief global strategist at Principal Asset Management.”, The Financial Times, September 29, 2023

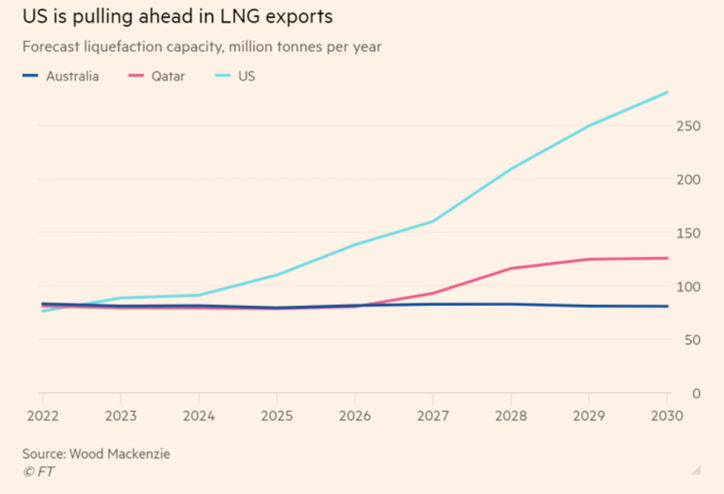

“Top EU energy official says US gas will be needed for decades – Europe will have to rely on US fossil fuels for decades to come as it races to diversify from Russian natural gas and scale up its renewables sector to boost energy security, the EU’s top energy official has said. ‘We will need some fossil molecules in the system over the coming couple of decades. And in that context, there will be a need for American energy,’ said Jørgensen, director-general for energy in the European Commission, in an interview in New York.”, The Financial Times, September 24, 2023

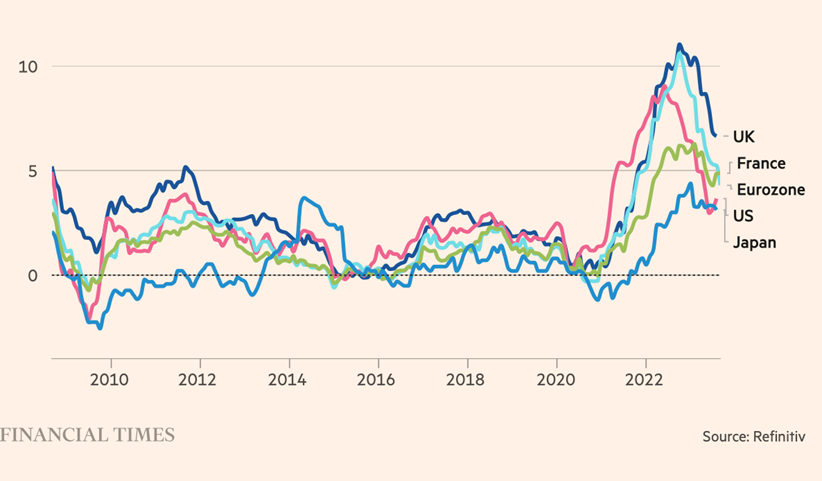

Annual % change in consumer price index

“Global inflation tracker – Inflation is easing from the multi-decade highs reached in many countries following Russia’s full-scale invasion of Ukraine. The latest figures for most of the world’s largest economies show the wholesale food and energy prices that soared during 2022 are now falling back.”, The Financial Times, September 29, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel Updates

“The Lack Of Travelers To The U.S. Is Hurting American Retailers – Due to the global pandemic, the United States saw a drop in international visitors. While travel has been picking up, one industry that isn’t recovering as quickly is the retail industry. In 2023, overseas travel is only nearly 75 percent recovered, which is estimated to cost retailers over $6 billion.”, Forbes, September 29, 2023

“This Airport Is About to Go Passport Free – Soon you’ll only need your face to travel through Singapore’s Changi Airport. Starting sometime in the first half of 2024, you won’t need to show your passport if you’re traveling through Singapore. All you’ll need to pass through security and immigration is your face—the airport is switching to biometric technology and facial recognition technology instead of having agents physically check travel documents to move travelers through the airport more quickly.”, AFAR, September 27, 2023

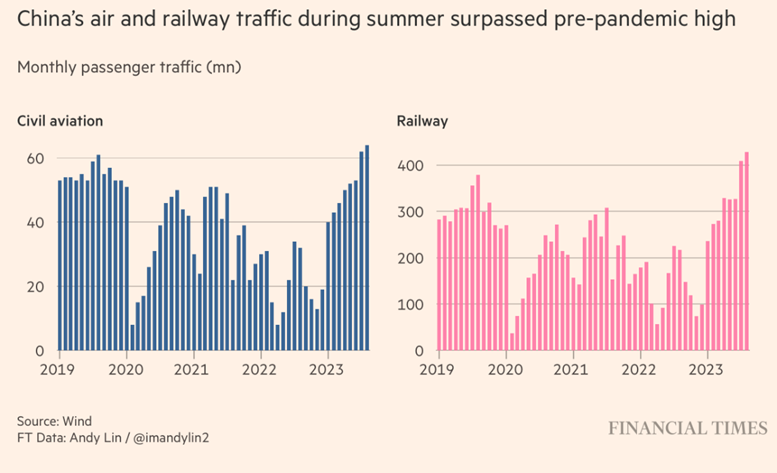

“More direct China-US flights on the horizon, but return to 2019 traffic far more distant – Direct flights between two countries set to increase in October, a fraction of pre-pandemic routings. Both Chinese and US airlines will expand their schedules, but politics and structural demand shifts may blunt enthusiasm for total resumption. Frequency of flights will increase in October, when US airlines expand their list of direct routes. The US Department of Transportation announced in August that the number of Chinese passenger flights permitted to fly to the US would increase by six in October, up to 24 per week. ‘However, it is important to note that this is still significantly less than the pre-Covid-19 period when there were more than 300 round trips per week,’ said Herman Tse, valuations manager at Cirium Ascend consultancy.”, South China Morning Post, September 25, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Asia

“Asia faces one of worst economic outlooks in half a century, World Bank warns – Sluggish post-pandemic recovery, China’s property crisis and US trade policies expected to hinder growth next year. The gloomier 2024 forecasts from the bank underline the mounting concern over China’s slowdown and how it will spill into Asia. China’s policymakers have already set one of the lowest growth targets in decades for 2023, of about 5 per cent. It also downgraded its 2024 forecast for gross domestic product growth for developing economies in east Asia and the Pacific, which includes China, to 4.5 per cent, from a prediction in April of 4.8 per cent and trailing the 5 per cent rate expected this year.”, The Financial Times, October 1, 2023

Estonia, New Zealand, Qatar and Singapore

“Four Small States That Show Leadership – While most geopolitical commentators focus on the new duo-polar world with the rise of China or even a multi-polar world of many eastern and western players, the influence of smaller countries is often overlooked. It’s clear there’s an important – even critical – role to play for sophisticated nations to punch above their weight on the regional and world stage, despite the small size of their populations and the power of their much larger neighbours. Four examples show just how it isn’t size but strategy that makes a country successful.”, Forbes, October, 2, 2023

China

“China hopes Golden Week holiday will deliver economic boost – Surge in consumer spending could spill over into fourth quarter and help ailing property sector. Economists will be watching in particular whether Chinese consumers will use the eight-day break, which combines the October 1 National Day and the mid-Autumn festival holidays, to spend not only on restaurants and outings but also on bigger ticket items, particularly property.”, The Financial Times, September 29, 2023

“Chinese consumers much more inclined to buy from foreign brands than last year – With borders opening and Chinese travelling and seeing the world again – either in person or vicariously through their network’s social media, consumers are reminded of many great attributes of foreign countries, lifestyles and brands that has been absent in propaganda. This appeal is reflected in PWCs Global Consumer Insights Survey which polled 18,155 global participants over the past two years, of whom more than 1,276 consumers were from Chinese mainland and Hong Kong. There has been a slight improvement in the perception of foreign brands, with 30% having a preference to buy foreign brands in 2023 versus 28% last year. However the biggest shift is the 15% who are ‘much more’ inclined to buy foreign brands, almost double the 8% last year.”, China Skinny, September 22, 2023. Compliments of Paul Jones, Jones & Co., Toronto

“AmCham report: US firms upbeat on China business prospects – American companies remain generally optimistic about business prospects in China, according to the latest 2023 China Business Report by AmCham Shanghai. It revealed that the end of the pandemic has brought stability to revenue expectations, with an increasing number of companies planning to ramp up their investments in China this year compared with 2022. The report, based on the results of AmCham Shanghai’s 2023 China Business Survey, indicated that 52 percent of companies expect greater revenue in 2023 than in the previous year, among which retail firms are the most optimistic, with 74 percent anticipating higher revenues. This positive outlook emphasizes the resilience and potential of China’s market.”, Shine.cn, September 27, 2023. Compliments of Paul Jones, Jones & Co., Toronto

Germany

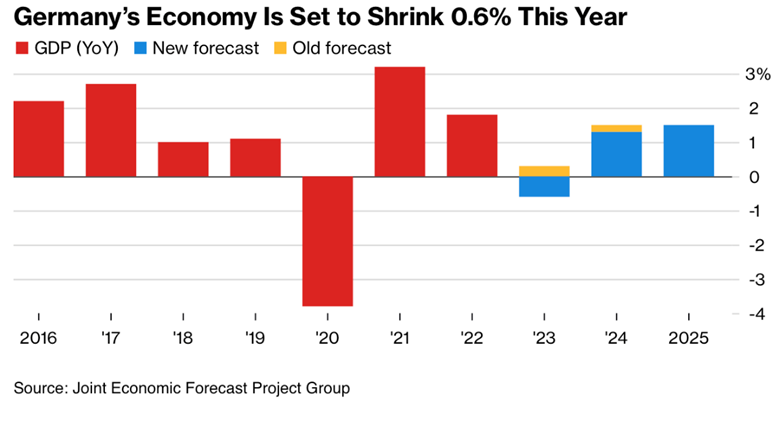

“German Economy to Shrink 0.6% in 2023 Before Wages Drive Rebound – Purchasing power to fuel 1.3% growth next year, institutes say Inflation expected to slow to 2.6% in 2024, 1.9% in 2025. Germany’s economy is on course for its first full year of contraction since the pandemic, new forecasts showed, though rebounding consumption should spur a recovery in 2024.”, Bloomberg, September 28, 2023

India

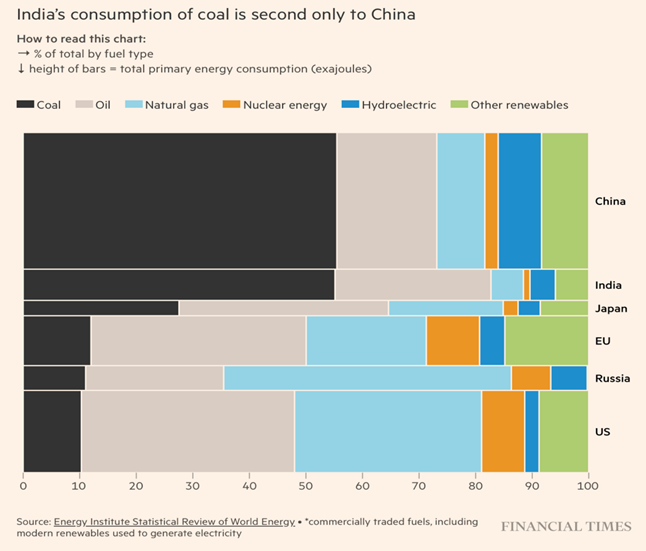

“India’s dream of green energy runs into the reality of coal – The fossil fuel accounts for around three-quarters of power generation and demand is expected to grow, despite an ambitious renewables plan. Prime Minister Narendra Modi has laid out an ambitious target to build 500 gigawatts of non-fossil fuel capacity by 2030. India has also announced billions in subsidies to manufacture clean-energy technology and wants to become a leading green hydrogen exporter. Yet India’s energy transition is complicated by intractable problems, from the difficulty of acquiring land for solar and wind farms to deep financial distress in its power system, which slows new investment. While demand is surging, millions still lack access to reliable electricity. Authorities see the expansion of polluting industries like steel and cement as essential to creating jobs and economic growth.”, The Financial Times, September 24, 2023

Indonesia

“Indonesia bans purchases on social media, in a blow to TikTok’s e-commerce ambitions – Indonesia’s ministry of trade said Tuesday it is working to further regulate e-commerce, adding that the country does not allow transactions on social media platforms. ‘One of the things that is regulated is that the government only allows social media to be used to facilitate promotions, not for transactions,’ the ministry said in an official release. This means that users in Indonesia cannot buy or sell products and services on TikTok and Facebook.”, CNBC, September 27, 2023

Japan

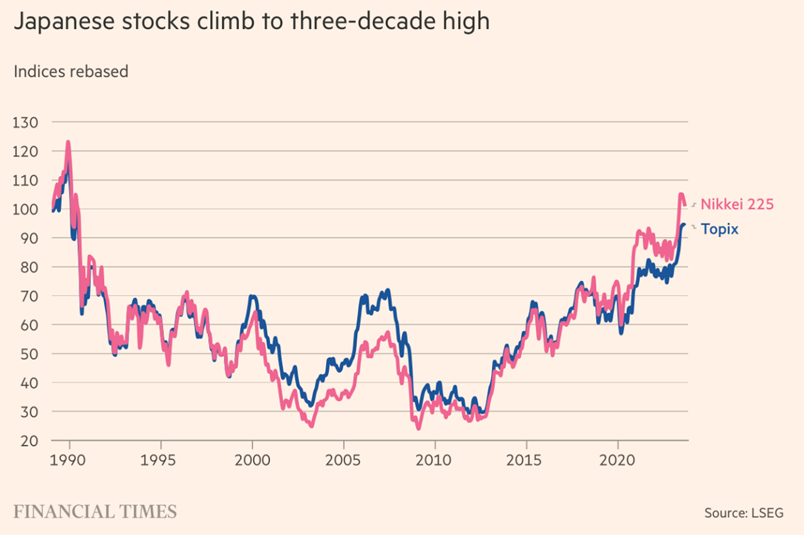

“A breakout year for Japanese stocks – After a series of false dawns, investors sense a long-awaited shift in the Tokyo market. But everything has come together this year, despite the very clear consensus that 2023 would be similarly drab. The Topix and Nikkei 225 are both up more than 20 per cent so far this year. That drops in to single figures in dollar terms but this remains a breakout year.”, The Financial Times, September 29, 2023

Singapore

“Singapore’s population grows 5% as foreign workers return post-pandemic – There were 5.9 million people in Singapore as of June, up from 5.6 million in June last year. Of these, 61% were Singaporeans, 9% were permanent residents and 30% were foreigners working or studying in the country. The bulk of the population increase came from foreign employment, with 162,000 foreign workers coming to Singapore from June 2022 to June this year. The National Population and Talent Division said the largest increase came from workers in the construction, marine shipyard and process sectors as contractors hired more workers for projects that were delayed by the pandemic.”, Reuters, September 29, 2023

“Singapore is now the world’s freest economy, displacing Hong Kong after 53 years – For the first time since the Economic Freedom of the World Index started in 1970, Hong Kong has slipped from its number one position to second place — and its score is about to drop even further. New regulatory barriers to entry, increasing cost of business, and limits on employing foreign labor dented Hong Kong’s ranking, the report stated.”, CNBC, September 21, 2023

United Kingdom

“UK GDP: Economy grew faster than Germany and France after Covid – Gross domestic product is now estimated to be 1.8 per cent larger compared with the final months of 2019, just before the pandemic swept through the country, according to the Office for National Statistics (ONS). The revised figures mean that the economy has added about an extra £10 billion in output since the final quarter of 2019. Under its initial estimates, the statistics agency thought the economy was 0.2 per cent below its pre-pandemic levels. The Times of London, September 29, 2023

United States

“US GDP growth unrevised at 2.1% in second quarter as economy shows resilience – The U.S. economy maintained a fairly solid pace of growth in the second quarter and activity appears to have accelerated this quarter, but a looming government shutdown and an ongoing strike by auto workers are dimming the outlook for the rest of 2023. Inflation also remains elevated and tight labor market conditions continue to prevail, with the number of Americans filing new claims for unemployment benefits rising slightly last week, the reports showed on Thursday.”, Reuters, September 28, 2023

“50% of U.S. Small Business Say Interest Rates Have Hurt Their Businesses – Further, 66% of the poll respondents in this group believe economic issues will persist even if the Federal Reserve doesn’t raise rates further. In fact, 38% of those struggling say that the interest rate must be reduced by at least 3 points before they envision rebounding again. These are just a few findings emerging from a poll of 7,396 randomly selected small-business owners surveyed from August 5 to September 18, 2023.”, Franchising.com, September 22, 2023

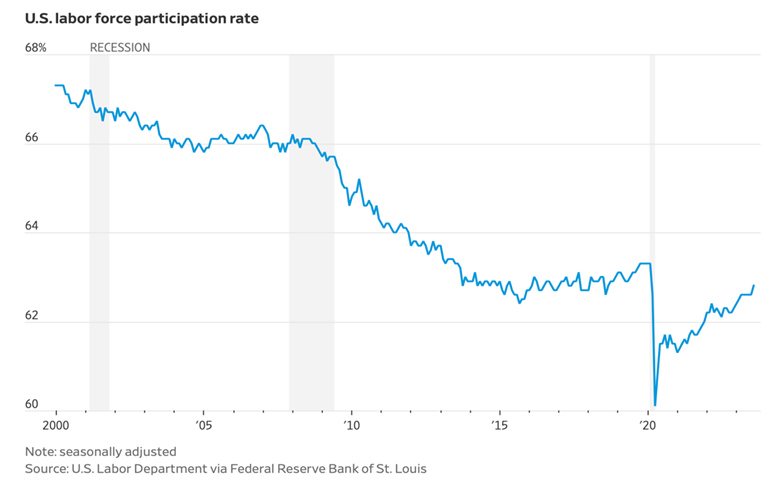

“Why America Has a Long-Term Labor Crisis, In 6 Charts – Participation hasn’t fully recovered from pandemic-era losses, though there have been signs of growth for prime-age workers—those between ages 25 and 54. The overall participation rate is expected to drop to 60.4% in 2032, according to the Labor Department, mainly because of baby boomer retirements. Wages reflect supply and demand. They shot up during the pandemic recovery and have recently outpaced inflation, which gives workers more spending power. Long-term labor shortages could lead to a faster pace of wage growth for the foreseeable future.”, The Wall Street Journal, September 25, 2023

Vietnam

“Boosting Vietnam’s manufacturing sector: From low cost to high productivity – In the past decade, manufacturing in Vietnam has been at the epicenter of the country’s high growth. This sector contributed more than 20 percent to the country’s GDP1 and has been an anchor in Vietnam’s trade balance, helping to attract foreign direct investment (FDI). It played a significant role in the remarkable resilience that Vietnam’s economy demonstrated in the face of global upheaval, which maintained a positive GDP growth rate of 2.6 percent in 2021, even amid the COVID-19 pandemic, and sustained an 8 percent growth rate in 2022.”, McKinsey & Co., September 25, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“After KFC store went cashless, what are the other fast food giants in Australia planning? A spokesperson from McDonald’s told 9News that the global burger brand had ‘no plans to go cashless at this stage’. Competing chicken brand Red Rooster said they had “no intention of going cashless in the near future,” despite the move by KFC. Domino’s told 9News that going cashless was ‘not currently something we are looking at doing’”. 9News, September 27, 2023

“Coffee Berry, a Greek coffee chain, debuts in Saudi Arabia – Greece’s renowned coffee chain, Coffee Berry, has made its inaugural entry into the Saudi Arabian market by unveiling its first store at the Hayat Mall in Riyadh. This significant move marks Coffee Berry’s fourth international venture, showcasing its growing global presence. In 2022, Coffee Berry, headquartered in Athens and boasting an impressive 210-store count, inked a franchise agreement that paved the way for its Saudi Arabian expansion. The company’s strategic vision includes the establishment of a network comprising a minimum of 20 outlets across the kingdom within the coming years.”, Franchise Talk, September 25, 2023

“Burritos on the bourse: Guzman y Gomez boss preparing to say hola to ASX – Burrito chain Guzman y Gomez could make its debut on the Australian stock exchange as early as next year, founder Steven Marks says, even as the hunt for his own replacement continues. Australia’s fastest-growing Mexican food franchise sold $759 million worth of burritos, tacos, bowls and more in the 2023 financial year, a 32 per cent rise from the year before. Underlying earnings jumped 56 per cent to $32 million.”, Brisbane Times, September 11, 2023. Compliments of Jason Gehrke, Franchise Advisory Centre, Brisbane

“McDonald’s Is Raising (US) Royalty Fees on New Franchises for the First Time in 30 Years – The change, to 5% from 4%, applies in limited scenarios, McDonald’s said, including when an operator opens a new restaurant or purchases one the company owns. The move is aimed to help McDonald’s maintain its competitive edge, the company said, as many other franchise businesses have royalties that exceed 5%. Indeed, the royalty rate is currently at 5% across McDonald’s markets other than the U.S. and Canada, the company said in an internal memo reviewed by Barron’s.”, Barron’s, September 22, 2023

“A moment of dependable zen on a helter-skelter day’: Grace Dent on the joy of (UK) chain restaurants – They may never dazzle, but your favourite fast food chain never really burns its bridges. Come as you are, come dishevelled, hungover, heartbroken, alone or with a rabble. We’re not going on a culinary journey; rather, this is a culinary cul-de-sac where you’ve been doing a three-point turn for the past 20 years. In fact, I’m fairly sure that, at a moment’s notice, I could step in for the 2pm-10pm shift at Wagamama, say, because I’ve been eating its yaki udon since about 1995; my order rarely deviates and my love never dwindles.”, The Guardian, September 29, 2023

“Subway Is Forcing Franchisees To Accept Mobile App Discounts – According to Subway franchisees, all Subway locations will be required to accept all mobile app discounts as of December 28, 2023. In correspondence with Restaurant Business, franchise operators stated that Subway corporate announced the hard deadline to franchisees on September 26. Unfortunately, food costs and ongoing inflation have had more than a few franchisees opt out of accepting coupons that they couldn’t afford to honor.”, The Tasting Table, October 1, 2023

“Tim Hortons Launches New UK Franchise Model To Fuel Expansion Plans – Since launching its first UK location in 2017, Canadian coffee and donut chain Tim Hortons has become an increasingly familiar name across British towns and cities over recent years. The brand first opened its doors and started serving its signature coffees and baked goods to British customers from its first unit this side of the pond in Glasgow, and now has 75 locations in the UK, all of which are currently company-owned. With its eyes now firmly on rapid UK growth, Tim Hortons this week announced the launch of a franchise model following what it calls a five year ‘test and learn phase’”, Forbes, September 19, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

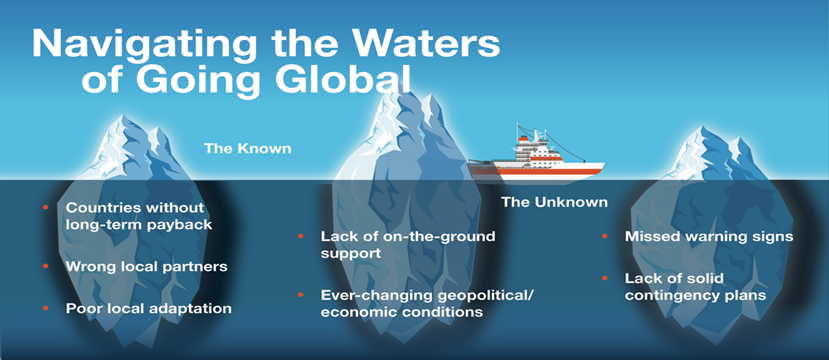

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant taking 40 franchisors global.

For a complimentary 30-minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link: