EGS Biweekly Global Business Newsletter Issue 93, Tuesday, October 17, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Introduction: In this issue, global trade and inflation are improving while country investment risks are not. 1 in 8 people in the USA worked at McDonalds®! No more paper passports in the future? Asian countries economies are on track to improve in 2024. India’s stock markets pass those in China which is seeing births at the lowest level since 1949.

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

NOTE: Some of the sources that we provide links to require a paid subscription to access. We subscribe to 40 international information sources to keep our readers up to date on the world’s business.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here:

First, A Few Words of Wisdom From Others

“There are no such things as limits to growth, because there are no limits on the human capacity for intelligence, imagination, and wonder.’, President Ronald Regan

“Challenges make life interesting, however, overcoming them is what makes life meaningful.”, Mark Twain

“Success is not final, failure is not fatal: It is the courage to continue that counts.”, Winston Churchill

Highlights in issue #93:

- Brand Global News Section: Burger King®, Jack In The Box®, Mathnasium®, McDonalds® and Texas Roadhouse®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data and Studies

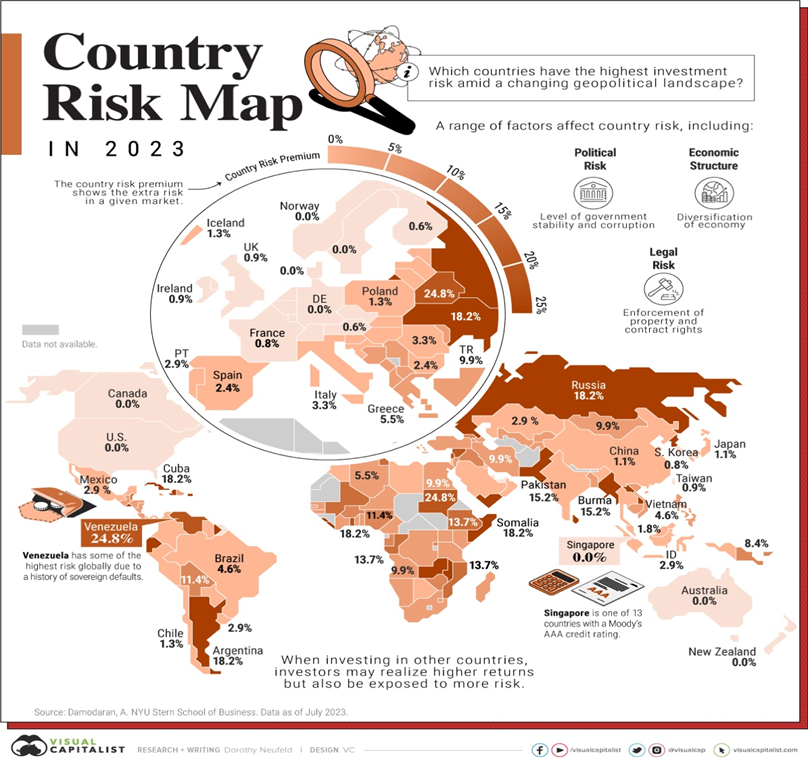

“Which Countries Have the Highest Investment Risk? Given the rapid growth of emerging economies, and the opportunities this may present to investors, it raises the question: does investment exposure abroad come with risk, and how can that risk be analyzed? This graphic shows country risk around the world, based on analysis from Aswath Damodaran at New York University’s Stern School of Business. To get a clearer picture of country risk, Damodaran analyzed the following broad factors: Political risk: Type of regime, corruption, level of conflict; Legal risk: Property rights protections, contract rights; and Economic risk: Diversification of economy.”, Visual Capitalist, October 9, 2023

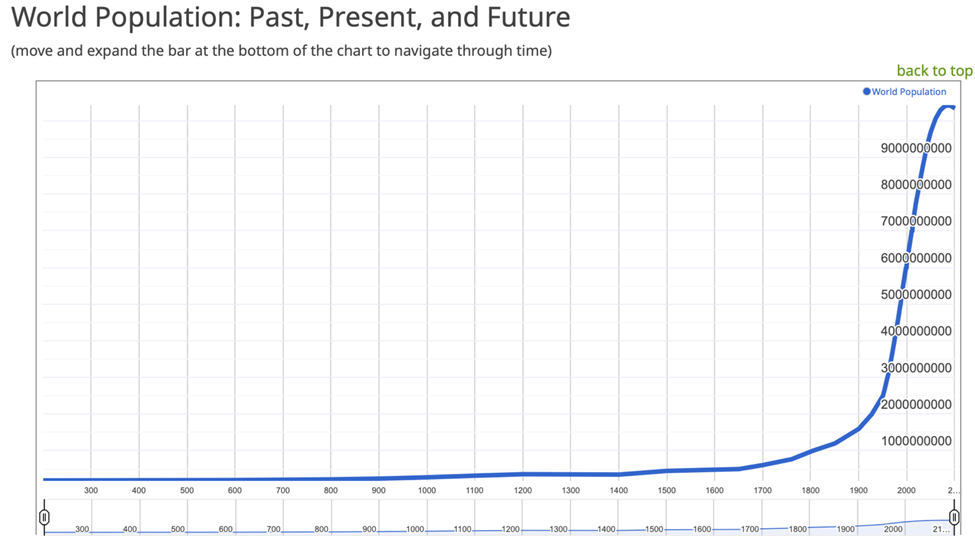

“2023 World Population – The World Population in 2023 is 8,045,311,447 (at mid-year, according to U.N. estimates a 0.88% increase (70,206,291 people) from 2022, when the population was 7,975,105,156, a 0.83% increase (65,810,005 people) from 2021, when the world population was 7,909,295,151. During the 20th century alone, the population in the world has grown from 1.65 billion to 6 billion. In 1970, there were roughly half as many people in the world as there are now. Because of declining growth rates, it will now take over 200 years to double again.”, Worldometer, July 16, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

“Global Trade Poised to Turn a Corner – Bloomberg’s Trade Tracker shows only four out of 10 gauges sat in below-normal range in early October, compared to six in August. It’s the surest sign yet of recovery since the start of 2023, when as many as nine out of 10 indicators were deep in the red. Consumer demand, though nascent, appears to be firming up. Shipping volumes improved in key ports like Los Angeles, while early export data out of South Korea showed a rare annual increase.”, Bloomberg, October 8, 2023

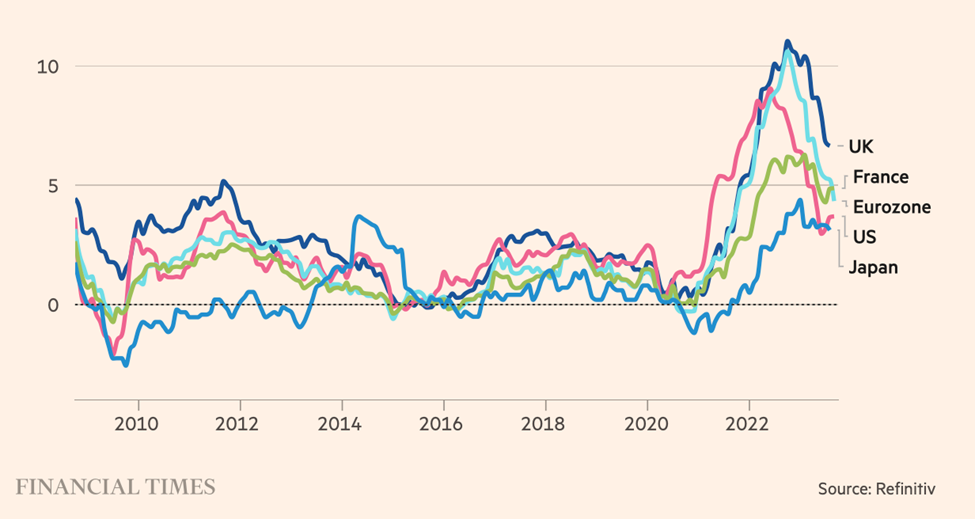

Annual % change in consumer price index

“Global inflation tracker – Inflation is easing from the multi-decade highs reached in many countries following Russia’s full-scale invasion of Ukraine. The latest figures for most of the world’s largest economies show the wholesale food and energy prices that soared during 2022 are now falling back.”, The Financial Times, October 11, 2023

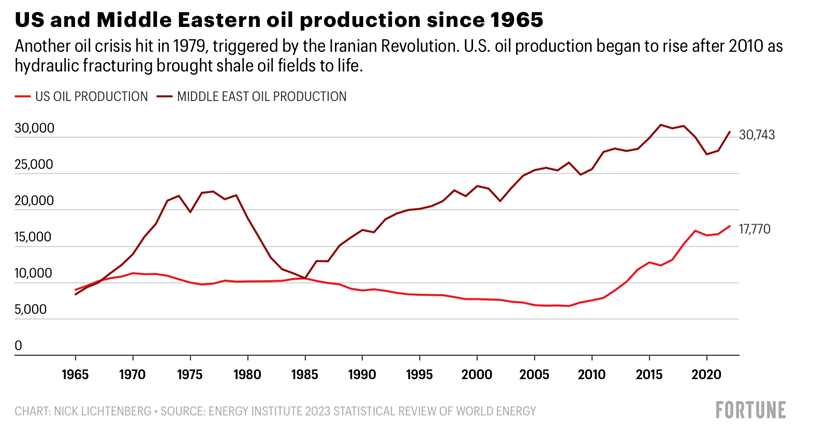

“3 stunning charts show how the world of gas-guzzling has changed—and hasn’t—since the trauma of the 1973 oil embargo – Fifty years ago, a secret deal among Arab governments triggered one of the most traumatic economic crises to afflict the United States and other big oil importers. Fifty years on, markets have changed. But oil continues to be the world’s dominant energy source. On one hand, crude oil use has grown dramatically. Global supply has risen from less than 60 million barrels per day in 1973 to nearly 94 million barrels per day in 2022. On the other hand, OPEC’s importance – and oil’s share of the global energy mix – has declined.”, Fortune, October 12, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel Updates

“The Future of International Travel Is Passport-Free – Biometric technology is replacing the need for passports at the world’s most modern airports. Travelers at some of the best airports in the world no longer need to show passports, thanks to new technology that is making airport immigration smoother than ever. From travelers’ perspectives, an overwhelming majority are in favor of using biometrics to ease airport processes. According to a November 2022 survey from aviation trade group IATA, “75% of passengers want to use biometric data instead of passports and boarding passes.”, Conde Nast Traveler, October 16, 2023

“Despite Record Passenger Volumes, North American Airports Earn Higher Marks for Traveler Satisfaction – Overall customer satisfaction with North American airports increases 3 points to 780 this year, despite record passenger volume, crowded terminals and a barrage of delays and cancellations. Top-performing airports in the study all saw substantial gains in terminal facilities; food and beverage and retail service; and baggage claim. There is a direct correlation between overall passenger satisfaction and spending at the airport.”, J. D. Power, September 20, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Asia

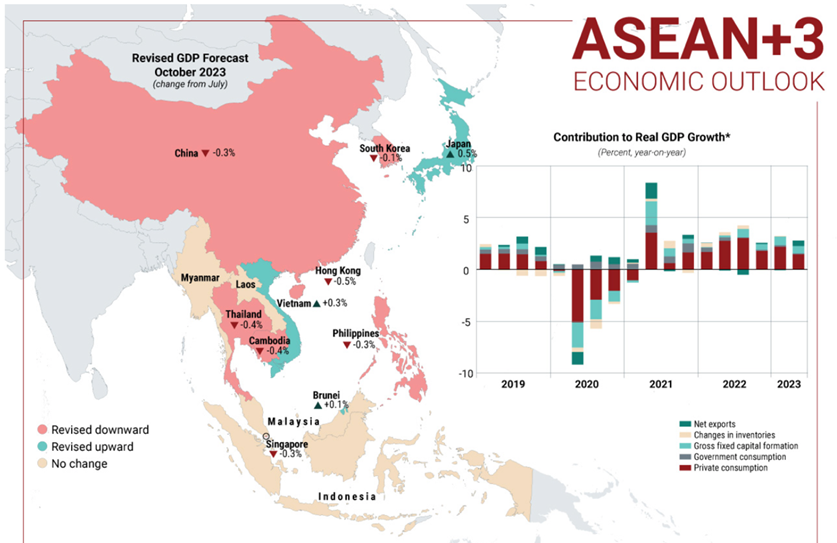

“Asia’s Economic Outlook – Growth prospects may improve next year – Amid China’s weaker-than-expected economic performance, the ASEAN+3 Macroeconomic Research Office cut its 2023 growth forecast for the region to 4.3 percent from July’s projection of 4.6 percent. Given that China is by far the largest economy in the grouping – which comprises the 10 states of the Association of Southeast Asian Nations as well as China, Japan and South Korea – it is natural that its downturn will affect the others’ economic growth prospects. Still, the long-term outlook for the grouping is far from bleak. In China, manufacturing investment is holding up and consumer spending is starting to rise – two factors that will support regional growth.”, Geopolitical Futures, October 13, 2023

“India, Indonesia Risk Biggest Fallout From Geopolitical Shocks – High energy costs, surging dollar, global tensions test Asia Malaysia may be a beneficiary due to status as energy exporter. A triumvirate of high oil prices, a surging dollar and geopolitical instability are set to weigh on India and Indonesia among Asia’s emerging markets, while energy exporter Malaysia may prove a rare beneficiary.”, Bloomberg, October 15, 2023

Canada

“Most small (Canadian) businesses optimistic about future despite economic uncertainty – Still, the top priority for most businesses is to cut costs wherever possible. According to a Scotiabank survey of nearly 1,700 Canadian small businesses with revenue between $50,000 and $5 million, two thirds (66 per cent) say they are very or extremely optimistic about the future of their business. The positive sentiment is even higher in Atlantic provinces (83 per cent) and in Saskatchewan and Manitoba (82 per cent).”, Yahoo Finance, October 12, 2023

China

“Births in China slide 10% to hit their lowest on record – China had just 9.56 million births in 2022, according to a report published by the National Health Commission. It was the lowest figure since records began in 1949. The high costs of childcare and education, growing unemployment and job insecurity as well as gender discrimination have all helped to deter many young couples from having more than one child or even having children at all. Last year, the country’s population also fell for the first time in six decades, dropping to 1.41 billion people.”, Reuters, October 12, 2023

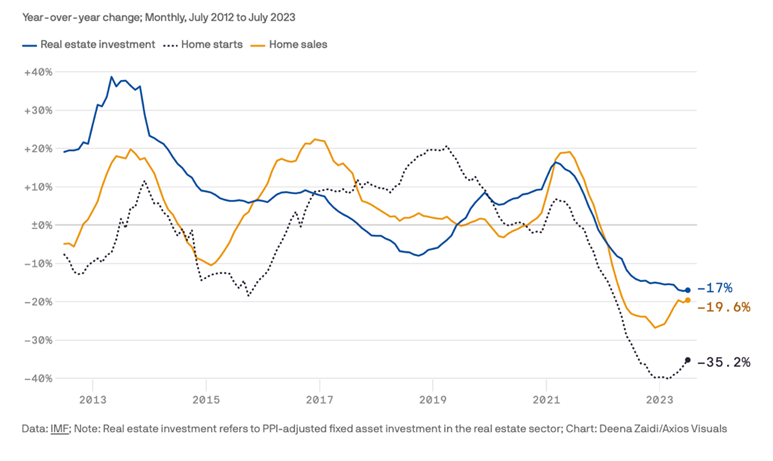

“China’s real estate struggles could threaten global economic growth – At its peak, China’s residential property sector was thought to contribute an estimated 25%-30% of the country’s GDP. Its ongoing struggles present a challenge to economic growth in China that will ripple out to other nations — as China has been the largest single source of growth for the world economy in recent decades. Property developers face severe funding constraints, preventing them from completing pre-sold homes … real estate investment and housing prices continue to decline, putting pressure on local governments’ revenues from land sales and threatening already fragile public finances.”, Axios, October 11, 2023

Germany

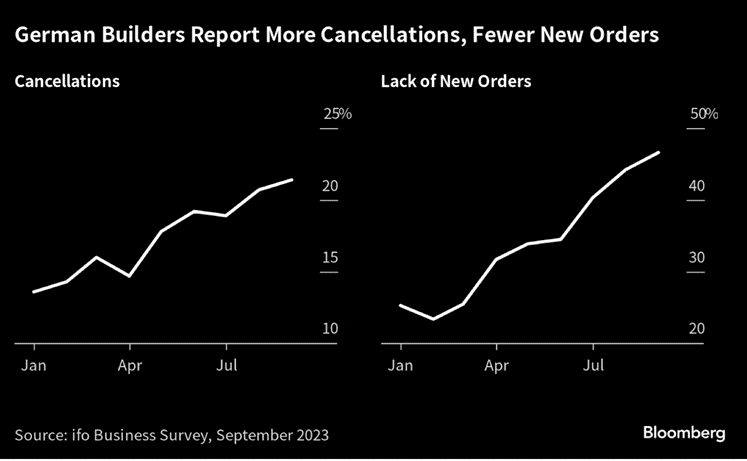

“German Housing Crisis Deepens on Record Building Cancellations – Monthly Ifo survey shows deteriorating conditons for builders Business confidence also slumps to all-time low in September. In September, 21.4% of residential builders said they were affected by construction projects being called off, according to a survey by the Munich-based Ifo Institute. That was the highest level since records began in 1991 and worse than August’s 20.7%.”, Bloomberg, October 16, 2023

India

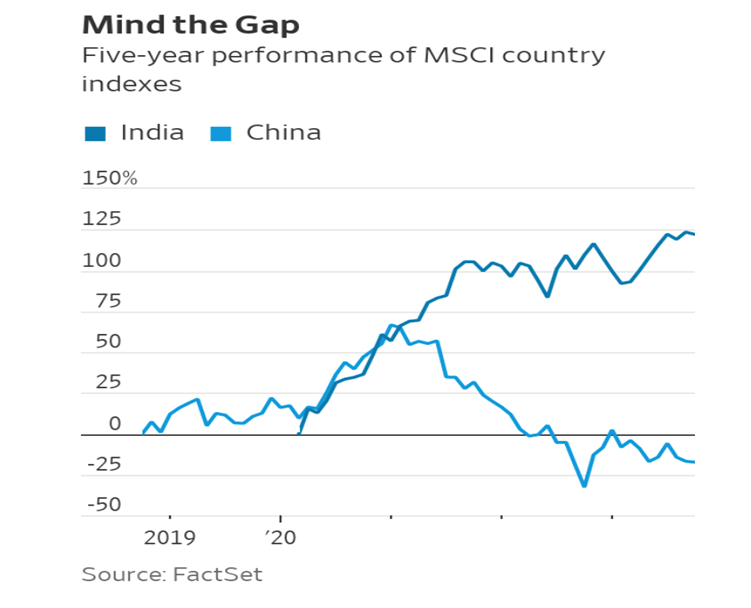

“India’s Booming Stock Market Is Leaving China in the Dust – The South Asian nation’s market has been a quiet outperformer for a decade. Now foreign investors are starting to pay attention. The MSCI India index has gained more than 7% this year, pulled higher by a rally in the shares of banks and automakers. The MSCI China index has lost almost 11% of its value, while a wider emerging-market index is down 2%. India’s stock market has outperformed China’s for the past three years, partly the result of China’s strict effort to combat Covid-19, which caused economic pain that the country hasn’t fully recovered from.”, The Wall Street Journal, October 9, 2023

Turkey

“Turkey’s republic enters its second century – Legacies of Kemal Atatürk era resonate in the age of strongman Recep Tayyip Erdoğan. Preparations are in full swing in Turkey for the 100th anniversary of the modern republic, proclaimed on October 29 1923. The republic was founded on the ashes of the Ottoman Empire by Mustafa Kemal Atatürk, a hero in the eyes of millions of Turks for having led the nation to independence and embarking on an extensive, rapid modernisation of state and society. Yet Atatürk’s legacy is by no means uncontested.”, The Financial Times, October 14, 2023

United Kingdom

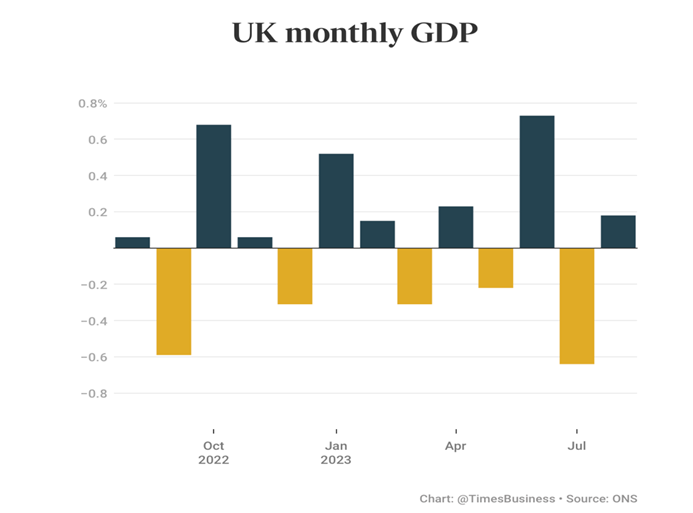

“UK economy grows 0.2% in August despite drag from higher interest rates – Britain’s economy has outperformed analysts’ expectations this year, dodging a much-touted recession, but GDP is growing at a historically slow rate, leading to fears that the country is in the early stages of a prolonged period of stagnant economic activity. Services businesses, which generate about £2 in every £3 of Britain’s GDP, were the main contributors to the economy’s summer turnaround, providing growth in the sector of 0.4 per cent. Construction output, plagued by a reduction in house building in response to the Bank of England raising interest rates aggressively, contracted 0.5 per cent in August. Industrial production was also weaker as it was drawn into a weak global manufacturing cycle.”, The Times of London, October 12, 2023

United States

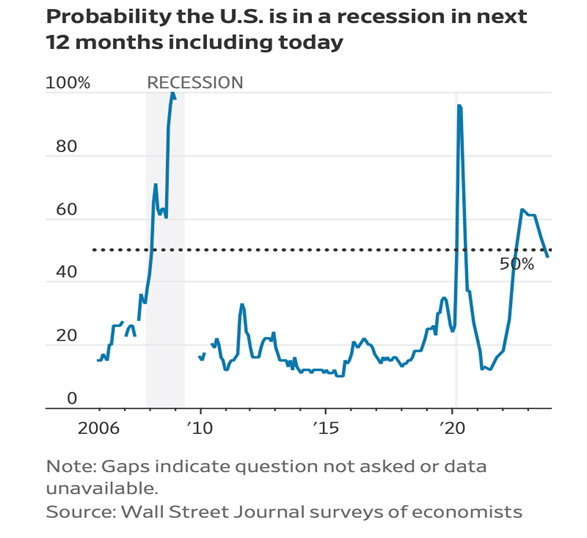

“A (US) Recession Is No Longer the Consensus – In WSJ survey, economists lower recession probability below 50% and say Fed is finished raising interest rates. Economists are turning optimistic on the U.S. economy. They now think it will skirt a recession, the Federal Reserve is done raising interest rates and inflation will continue to ease. In the latest quarterly survey by The Wall Street Journal, business and academic economists lowered the probability of a recession within the next year, from 54% on average in July to a more optimistic 48%. That is the first time they have put the probability below 50% since the middle of last year.”, The Wall Street Journal, October 15, 2023

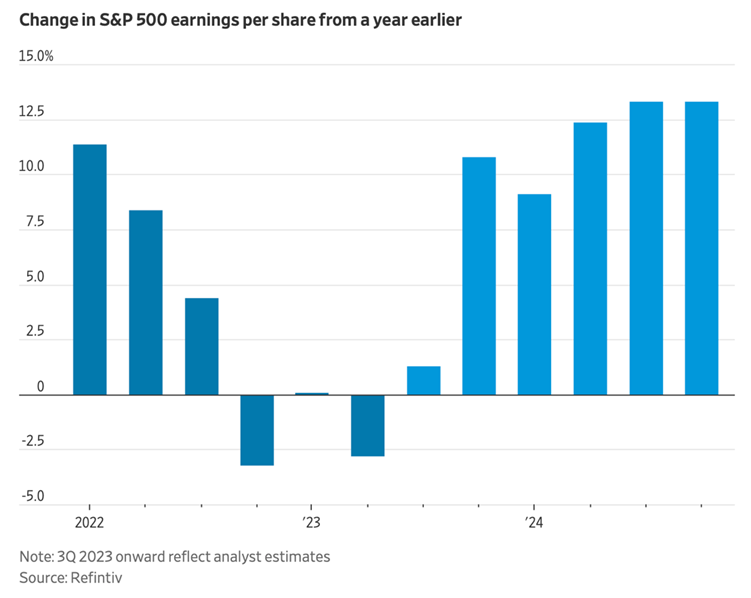

“(US) Profits Are Making a Comeback – Despite challenges including rising labor costs and high interest rates, U.S. corporate earnings are on an upswing. Industry estimates indicate that members of the S&P 500 will report earnings per share were 1.3% higher than a year earlier—a nice improvement from the second quarter’s decline of 2.8%. Finally, analysts reckon that profit growth in the fourth quarter will be substantially better, with estimates pointing to S&P 500 earnings up 10.8% from a year earlier.”, The Wall Street Journal, October 11, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“Turkish Burger King Operator Seeks to Sell Shares in Istanbul IPO – TAB Gida operates about 1,500 fast food restaurants in Turkey, Northern Cyprus, North Macedonia and Georgia, including more than 700 Burger King outlets. Its other operations include Arby’s, Popeyes, Sbarro and Subway, as well as a number of domestic brands. Its revenue jumped 125% in 2022 to 8.62 billion liras, while net income was 361.8 million liras, according to the company prospectus.”, Bloomberg, October 13, 2023

“The Rise, Fall, And Resurgence Of Jack In The Box – Emerging from a small San Diego drive-in chain in the 1940s, Jack in the Box evolved into one of the most visible and lucrative of the fast-food brands. Jack in the Box helped popularize the drive-through. After many ups and downs over the decades, It’s in the middle of a big expansion plan.”, Mashed, October 16, 2023

“Mathnasium Announces Renewed Franchise Agreement in Vietnam, Set to Double in Size – Mathnasium Learning Centers announces they have renewed the master franchise agreement in Vietnam with Mr. Phan Tan Nghia for an additional ten years. The renewed agreement confirms a commitment to open an additional 25 centers. Mr. Nghia originally joined Mathnasium in 2013 and has since grown his portfolio to 28 locations across Vietnam. He’s grown his Mathnasium Center’s student-base per center to the highest level in the Mathnasium system.”, Franchising.com, October 4, 2023

“1 out of 8 Americans have worked at the Golden Arches, McDonald’s says – McDonald’s, with its more than 13,000 locations in the U.S. alone, is known for being the first job many teens have, with many folks keeping the Golden Arches as their place of employment well into adulthood. McDonald’s confirmed to TODAY.com that it surveyed a representative sample of American adults and found that 1 in 8 (just over, actually, at 13.7%) reported that they currently or formerly worked at a McDonald’s restaurant. According to the U.S. Census, the population in 2022 was more than 333,287,000 people, meaning that walking among us are more than 41,000,000 current or past McDonald’s employees.”, Today.com. October 11, 2023

“Texas Roadhouse Is America’s Most Beloved Sit-Down Restaurant Chain – Market research company Savanta just released a new report on the most beloved restaurant brands among diners in the US in 2023. The report was based on insights collected from more than 72,000 people through Savanta’s marketing intelligence platform, BrandVue Eating Out. Fast-food chains Chick-fil-A, Starbucks, and McDonald’s ended up receiving the first, second, and third highest brand love scores in the ranking, respectively. Meanwhile, Texas Roadhouse received the fourth-highest score, making it the highest-ranked sit-down chain in the new report.”, Eat This, Not That!, October 12, 2023

“Wagamama owner backs £700m takeover by Apollo – The restaurant operator behind the Wagamama chain has agreed to a £700 million takeover bid from the private equity firm Apollo Global Management after coming under intense pressure from activist investors. TRG has about 380 restaurants and pubs, a concessions business and a 20 per cent stake in a joint venture operating seven Wagamama noodle bars in America. It also has about 60 franchises around the world.”, The Times of London, October 13, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

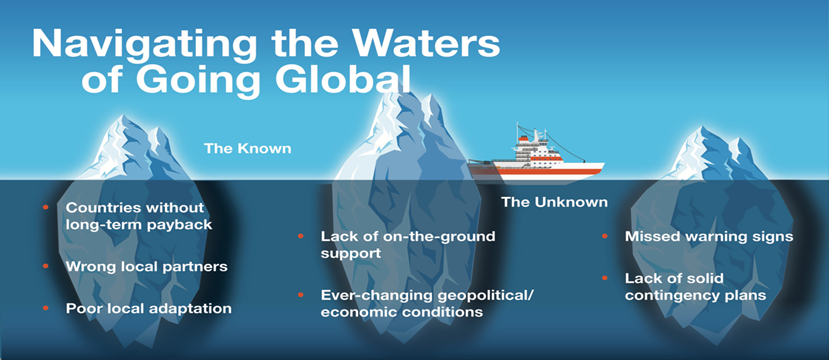

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant taking 40 franchisors global.

For a complimentary 30-minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link: