EGS Biweekly Global Business Newsletter Issue 94, Tuesday, October 31, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

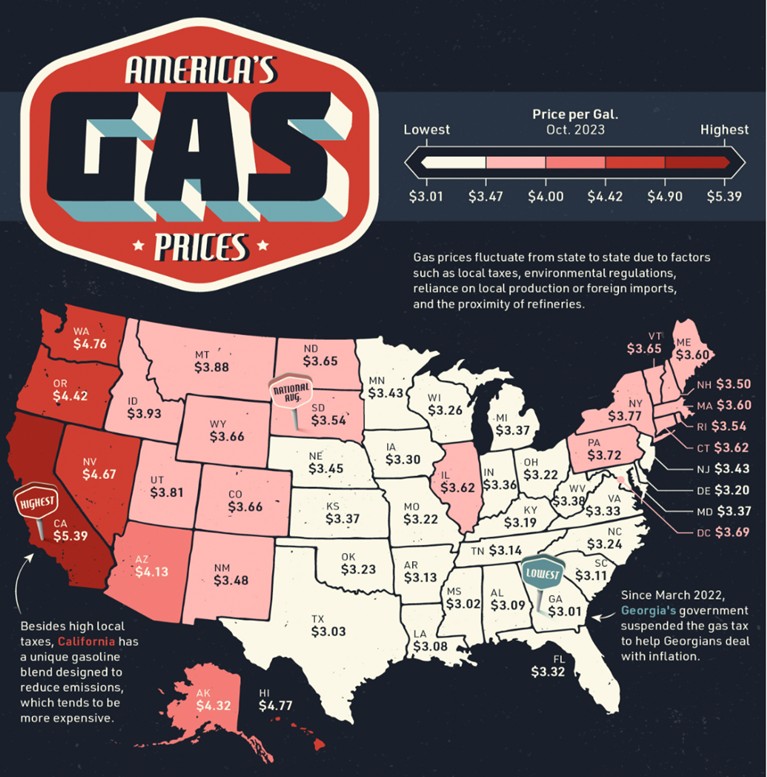

Introduction: In this issue, as we get towards the end of another year there are lots of economic projections coming out. Look at the cost of a gallon of gas in California versus the US Midwest. Overall, global consumer confidence remains broadly stable with some exceptions. And why McDonalds® menu are better in other countries….really.

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

NOTE: Some of the sources that we provide links to require a paid subscription to access. We subscribe to 40 international information sources to keep our readers up to date on the world’s business.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here:

First, A Few Words of Wisdom From Others

“The price of greatness is responsibility.”, Winston Churchill

“You cannot escape the responsibility of tomorrow by evading it today.”, U.S. President Abraham Lincoln

“Management is doing things right; leadership is doing the right things.”, Peter Drucker

Highlights in issue #94:

- Brand Global News Section: Cici’s Pizza®, McDonalds®, Pizza Express®, Popeyes®, Pret-A-Manger, Shake Shack® and Tim Hortons®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data and Studies

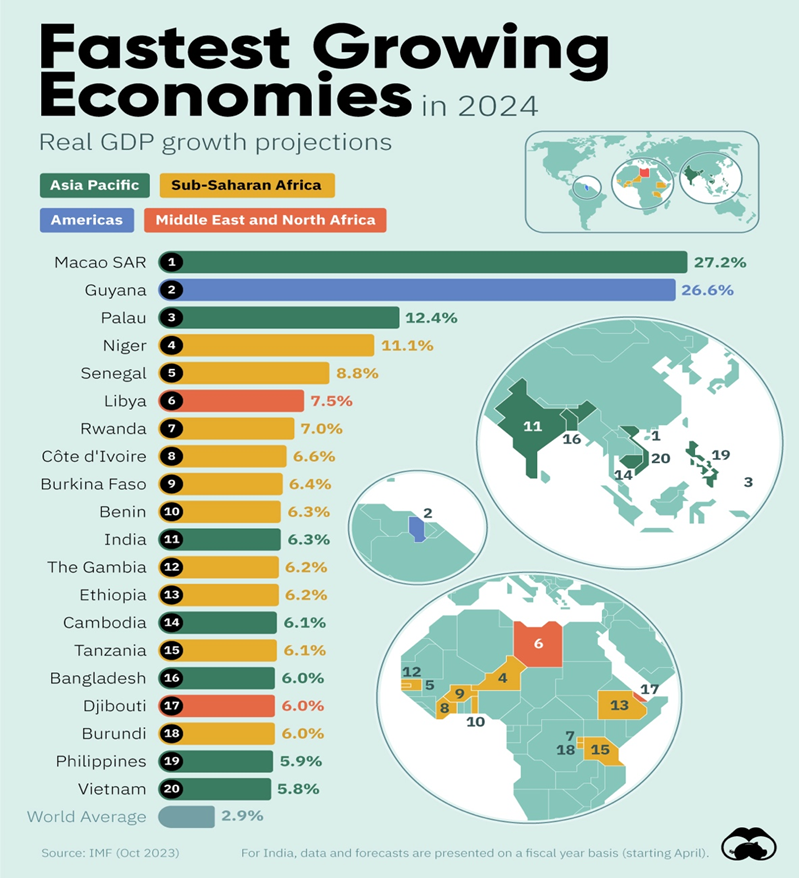

“IMF Projections: The Fastest Growing Economies in 2024 – Which countries will see the most economic growth in 2024? To answer this question, we’ve visualized GDP growth forecasts from the IMF’s October 2023 World Economic Outlook. Unsurprisingly, many of these countries are located in Asia and Sub-Saharan Africa—two of the world’s fastest growing regions.”, IMF and Visual Capitalist, October 24, 2023

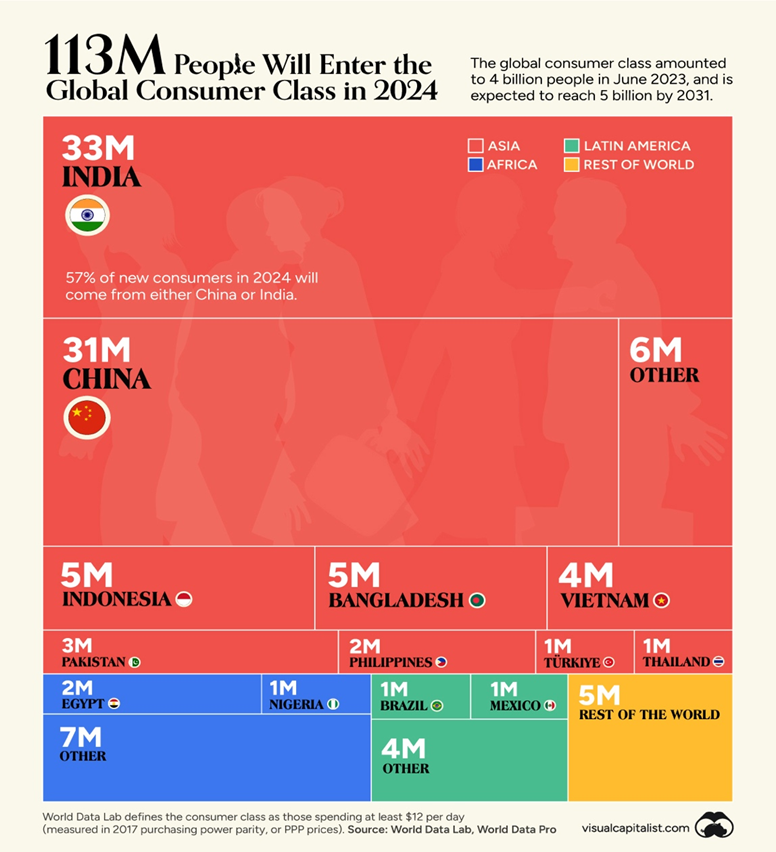

“113 Million People Will Join the Global Middle Class in 2024 – Defined by the World Data Lab as someone who spends at least $12 per day (measured in 2017 purchasing power parity), these individuals are typically rising up in developing regions like Asia and Africa. In this graphic, we’ve created a treemap diagram that shows where the new entrants to this consumer class in 2024 will originate from.”, Visual Capitalist, October 19, 2023

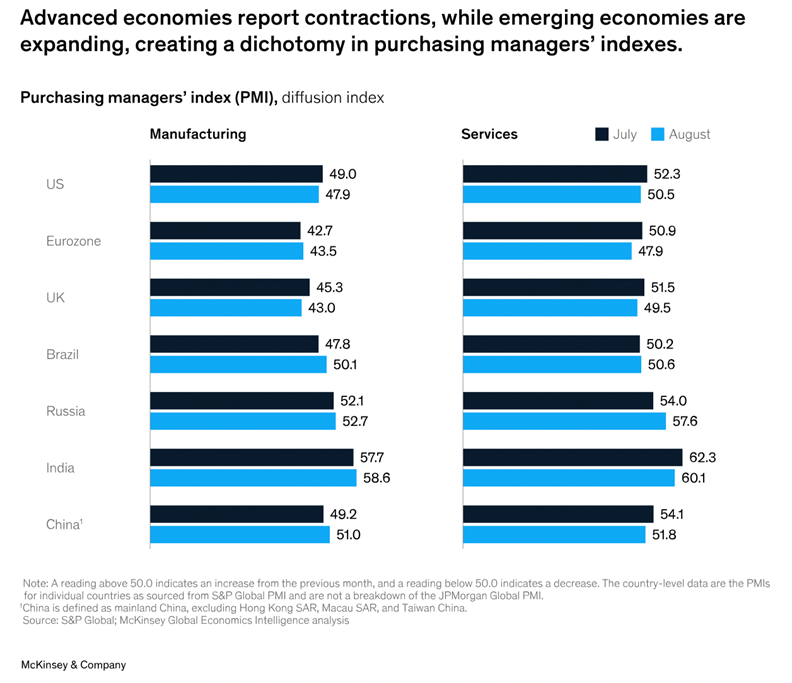

“Global Economics Intelligence executive summary, September 2023 – Some leading indicators improved, though outlook still fragile; confidence stable but consumers lean toward saving; inflation and trade volumes continue downward trend. Overall, consumer confidence remained broadly stable across our surveyed countries but still leaned toward saving rather than spending—although confidence dipped in China. In Brazil, consumer confidence rose to 96.8 in August, up from 94.8 in July—the highest reading since February 2014.”, McKinsey, October 20, 2023

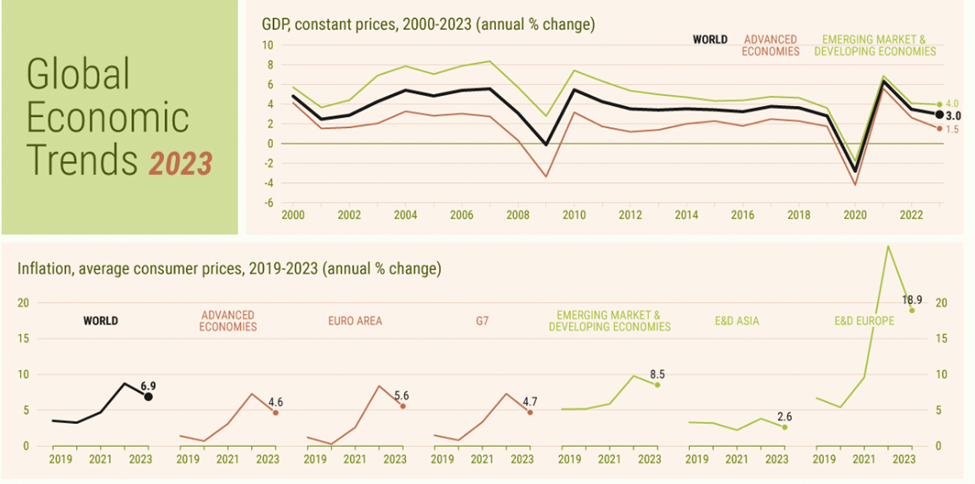

“Global Economic Trends, 2023 – According to a report recently published by the International Monetary Fund, global economic growth will be significantly slower in 2023 and 2024 than the average annual rate over the past two decades. The IMF projects that global gross domestic product growth will be 3 percent in 2023 and 2.9 percent in 2024, lower than the average of 3.8 percent from 2000 to 2019. Meanwhile, inflation is projected to decline this year and next year due to tighter monetary policies in many countries around the world, but it will remain at an elevated level. Overall, global economic growth will be slow and uneven, as it continues its recovery from the pandemic, Russia’s invasion of Ukraine and increases in global commodity prices.”, Geopolitical Futures, October 23, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

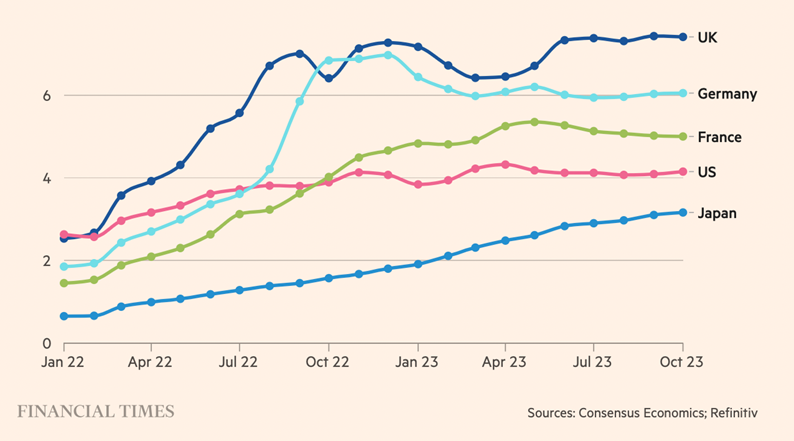

Annual % change in consumer price index, by date of forecast

“Global inflation tracker – Inflation is easing from the multi-decade highs reached in many countries following Russia’s full-scale invasion of Ukraine. The latest figures for most of the world’s largest economies show the wholesale food and energy prices that soared during 2022 are now falling back.”, The Financial Times, October 29, 2023

“World needs 80 million more kilometres of new power lines by 2040, IEA finds – The agency said that grid investment needs to double to more than $600bn (£495bn) a year by 2030, or electrical grids could become a barrier to the deployment of renewables and electric transport options – risking climate catastrophe and frequent blackouts. The report found that 80 million kilometres (49.7 million miles) of transmission lines will be needed by 2040 in order for countries to meet their climate goals and energy demands. This is roughly equivalent to the total number of miles of electrical grid that currently exist in the world, according to the IEA.”, Engineering & Technology, October 19, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel Updates

“Saudi Arabia expects nearly 100 million tourist visits this year, minister says – Travel and tourism to contribute 6% to kingdom’s gross domestic product this year, up from 3% in 2019. The country will close the year with about 30 million international tourists, which is nearly half of its goal of 70 million overseas visitors by 2030, Saudi Arabia’s Tourism Minister Ahmed Al Khateeb told the Future Investment Initiative in Riyadh this week. Saudi Arabia has also revised upwards its 2030 target for total annual tourist trips – a figure that entails both domestic and international travellers – to 150 million from 100 million, the minister said.”, The National News, October 25, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Australia

“Australia under more mortgage stress than any other nation, IMF says – Cost of repaying loans is 15% of income and likely to be higher after this year’s rate hikes, as fund predicts GDP growth of 1.2% next year. The increased cost of borrowing has left Australia at the top of the league for debt with Canada second followed by Norway and the Netherlands.”, The Guardian, October 10, 2023. Compliments of Jason Gehrke, The Franchise Advisory Centre, Brisbane

Canada

“Bank of Canada holds rate steady, trims growth forecast as inflation risks rise – The Bank of Canada held its benchmark interest rate steady on Wednesday but left the door open to further increases, as its latest forecast showed a thorny combination of weaker economic growth and more-persistent inflation. After 10 rate hikes since March, 2022, including two over the summer, higher borrowing costs are having their intended effect. Canadian consumers are pulling back on spending, unemployment is up and economic growth has slowed to a crawl.”, The Globe and Mail, October 26, 2023

“Small business confidence hits lowest level since COVID-19 onset – The CFIB found in its latest business barometer from this month that more business owners are feeling less confident going into the holiday season. The 12-month small business confidence index dropped 1.5 points to 47.2, the lowest reading since April 2020 and the third lowest reading in nearly 15 years. The CFIB says an index level of around 65 normally indicates that the economy is growing at its full potential.”, Yahoo! Finance Canada, October 26, 2023

China

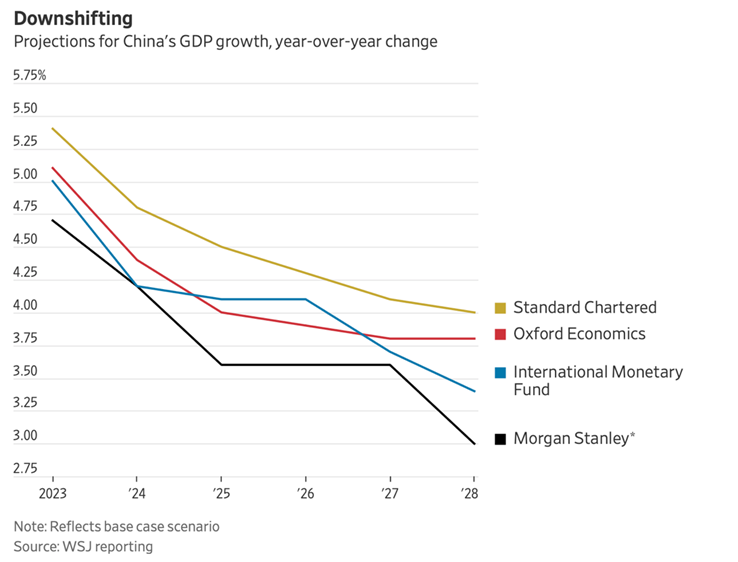

“China’s Economy Faces Deepening Troubles in Years Ahead – The country’s growth is showing signs of emerging from a soft patch, but its long-term prospects are darkening. economists warn China’s economy remains fragile and its long-term prospects are darkening. In recent weeks, a bevy of economists have lowered their forecasts for China’s longer-term growth trajectories, even as they raised their shorter-term predictions. The International Monetary Fund this month lowered its forecast for China’s growth next year to 4.2%, down from 4.5%.”, The Wall Street Journal, October 18, 2023

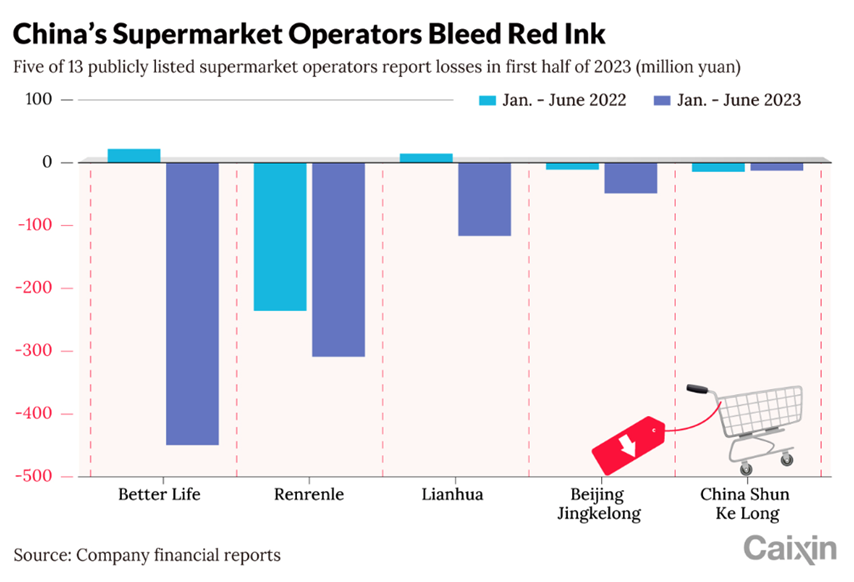

“The Struggle Facing Big-Box Supermarkets in China – Carrefour China, once the country’s largest foreign supermarket chain with nearly 260 stores in 2017, had less than 150 stores remaining at the end of last year. Financial trouble is also reflected in the first-half results of China’s 13 publicly traded supermarket operators, among which five reported year-on-year losses while three posted revenue declines despite making a profit, according to their earnings reports.”, Caixin Global, October 20, 2023

United Kingdom

“Federation of Small Businesses finds companies regaining confidence – Martin McTague, chairman of the federation, said: ‘After the economic turmoil wrought by the cost of doing business crisis over the past year and a half, [there are] signs of stabilisation in small firms’ performance. We need to beware that stabilisation does not turn into stagnation and that intentions to invest and grow are not thwarted by economic circumstances.’”, The Times of London, October 30, 2023

United States

“Gas Prices in Every U.S. State – Gas prices fluctuate from state to state due to factors such as local taxes, environmental regulations, reliance on local production or imports, and the proximity of refineries. In this infographic, we use data from the American Automobile Association (AAA) to illustrate the cost of fueling a vehicle in each U.S. state.

According to the AAA, the national average price of regular unleaded gas was $3.54 per gallon as of October 25, 2023.”, Visual Capitalist, October 25, 2023

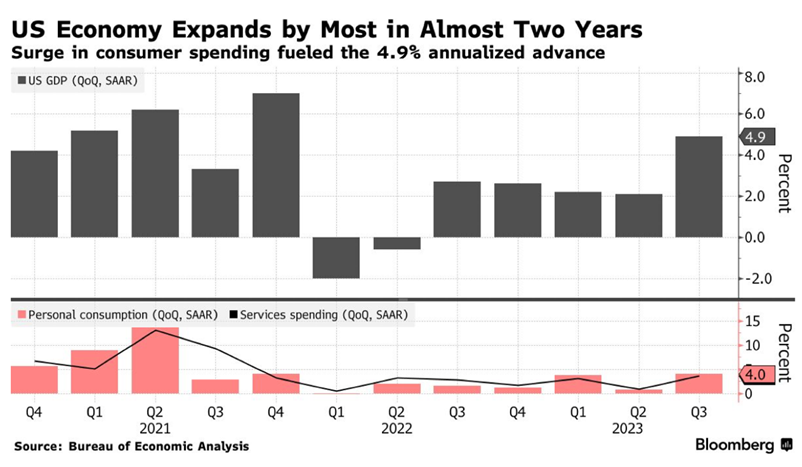

“US Economy Grew at a 4.9% Pace Last Quarter, Fastest Since 2021 – Consumer spending jumped at 4% rate, also the most since 2021 Core PCE price index increased a less-than-forecast 2.4%. The economy’s main growth engine — personal spending — jumped 4%, also the most since 2021. The primary driver of that resilience is the enduring strength of the job market, which continues to fuel household demand.”, Bloomberg, October 26, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“How Cicis Pulled Itself Out Of Restaurant Ruin – Declining sales and changing dining habits pulled it all the way down into bankruptcy in 2021, but it miraculously rose like a phoenix from the ashes. A restaurant that once seemed on the brink of death now stands as a bold testament to the power of innovation and adaptability in the change-or-die restaurant landscape. CiCi’s reinvented itself with wise innovations and marketing strategies, and the transformation was nothing short of extraordinary.”, Mashed, October 21, 2023

“AI set to transform the restaurant industry – Domino’s announced it has partnered with Microsoft to use the advanced AI to streamline pizza preparation, assist with quality control, inventory management and simplify the ordering process. Customers can expect to see noticeable changes to ordering processes at restaurants that integrate AI into their systems….AI will eventually be integrated across all restaurant operations, playing a pivotal roll at the front of the house by making ordering and payment processes more efficient. He said in the back of the house, AI can be used to provide accurate forecasting, tackle food waste by predicting usage patterns and even streamline employee management and scheduling.”, Fox Business, October 20, 2023

“The Reason McDonald’s International Menus Are Way Better Than The US – Thanks to the nature of the internet and social media sites like TikTok, customers in the United States are acutely aware that they’re missing out on some of McDonald’s bolder offerings. In fact, there’s an entire list of international food items we wish McDonald’s had in the U.S. It seems to be a common discussion point among McDonald’s customers over whether international McDonald’s tastes better than the chain’s domestic offerings.”, The Daily Meal, October 21, 2023

“U.K. pizza franchise PizzaExpress entering the Canadian market – U.K. casual dining pizza restaurant brand, PizzaExpress, has launched its international franchise program into Canada. PizzaExpress has been serving pizza in the UK since it was founded in 1965 in London’s Soho. From urban and suburban casual dining restaurants, quick service kiosks, and express locations, all the way up to its live music venues. PizzaExpress has more than 450 locations in 12 international markets.”, Canada Franchise, October 19, 2023

“Popeyes’ Journey from Cult-Favorite to the Mainstream – When RBI (Restaurant Brands International) acquired the brand on March 27, 2017, for $1.8 billion, there were about 2,600 locations in the U.S. and 25 countries globally. From acquisition to 2020, RBI posted cumulative net restaurant growth of 27 percent at Popeyes. Fast forward and Popeyes finished Q1 2023 with 4,178 restaurants globally—2,947 in the U.S. and 1,231 internationally. There were more than 200 North America debuts in 2022, featuring the loftiest figure of new franchisees and the largest percentage of freestanding single or double drive-thru locations in five years.”, QSR Magazine, October 18, 2023

“Pret adds growth to menu with US venture – Pret A Manger has handed the majority of its American operation to a franchiser, creating a joint venture that will take operational control of 50 stores in New York, Pennsylvania and Washington. The deal gives Dallas Holdings exclusive rights to open new shops in the three markets, with formats including drive-through outlets and a menu with slightly different ingredients and portion sizes. The operation, which comprises 58 stores in total, will be majority-owned by Dallas, which will hold 70 per cent of the joint vehicle.”, The Times of London, October 21, 2023

“Shake Shack® Malaysia: What can you expect to pay for a burger when it arrives next month – The Shake Shack branch in Malaysia is operated by SGP Group, the same group that is handling the brand in South Korea and Singapore. The ShackBurger cost in other countries: United States: USD 6.89 (about RM 32.90), South Korea: 6,900 Won (about RM 24.30) and Singapore: SGD 9.70 (about RM 33.80). If we take the pricing of both the South Korean market and the Singapore market, and we average it, we will get RM 29.05. We may see a slight increase in price due to taxes and raw material availability here. So, we can round up the price to about RM 30 for a basic ShackBurger here in Malaysia.”, Soyacincau, October 27, 2023

“Tim Hortons surpasses 300 stores milestone in the GCC and India – Tim Hortons, a beacon of Canadian coffee culture, has firmly entrenched itself in the Middle East with an impressive 285 outlets and further solidified its presence in India with 22 locations. India, with its vibrant and diverse palate, has warmly embraced Tim Hortons, evident in the growing store count: Delhi NCR boasts 10 stores, Punjab has 7, Mumbai proudly hosts 3, and Bangalore has opened 2.”, The Franchise Talk, October 16, 2023

“Running a franchise business like fast food is getting more expensive – Franchise fees have gone up with inflation, but the economics may get more expensive even as inflation falls, driven by technology costs and wage pressures in the labor market. Royalty fees could continue to rise. Pending changes in (US) federal labor law could upend franchise economics. CNBC, October 20, 2023

“New (U.S.) Labor Rule Could Make it Easier for Franchises Like McDonald’s to Unionize – The revised joint-employer rule was announced by the National Labor Relations Board and applies to workers’ rights to join unions, bargain collectively, and protest work-related conditions under federal law. The new standard replaces a Trump-era regulation on joint-employer status, adopted in 2020, which said a business needed to have “substantial direct and immediate control” over job conditions to be considered a joint employer. Under the new rule, a business could be considered a joint employer whether it has direct or indirect control over one or more “essential” working conditions. Those conditions could include wages, scheduling, assignment of duties, and the safety and health of workers.”, Barron’s, October 27, 2023

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

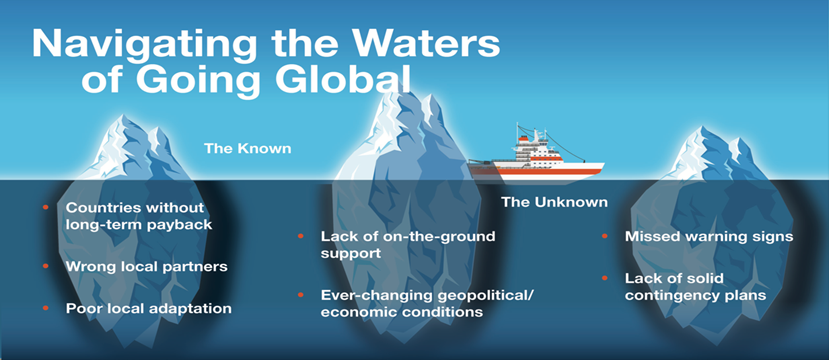

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant taking 40 franchisors global.

For a complimentary 30-minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link: