EGS Biweekly Global Business Newsletter Issue 95, Tuesday, November 14, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Introduction: In this issue, as we get towards the end of another year there are lots of economic projections coming out. Look at the cost of a gallon of gas in California versus the US Midwest. Overall, global consumer confidence remains broadly stable with some exceptions. And why McDonalds® menu are better in other countries….really.

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

NOTE: Some of the sources that we provide links to require a paid subscription to access. We subscribe to 40 international information sources to keep our readers up to date on the world’s business.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here: https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others For These Times

“The people who are crazy enough to think they can change the world are the ones who do.”, Steve Jobs’

“Find the pathway to win, not the excuse to fail.”, Byron Ashley

“Develop success from failures. Discouragement and failure are two of the surest stepping stones to success.”, Dale Carnegie

Highlights in issue #95:

- Brand Global News Section: Planet Fitness®, Popeyes®, and Subway®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data and Studies

“Technology trends for 2024 and beyond – As we look forward to 2024, our technology narrative has been consumed by AI. However, we must remember that AI is only a component of a broader digital revolution that includes blockchain, quantum computing, nanotechnology, synthetic biology, robotics, 3D printing, AR/VR, and other emerging innovations. Technology revolutions create more jobs than they destroy. However, history has proven that the period following the rapid deployment of technological innovation arrests wages for unskilled workers (known as Engle’s Pause). In the short term, those who control capital often benefit from technological progress.”, Vistage, October 30, 2023

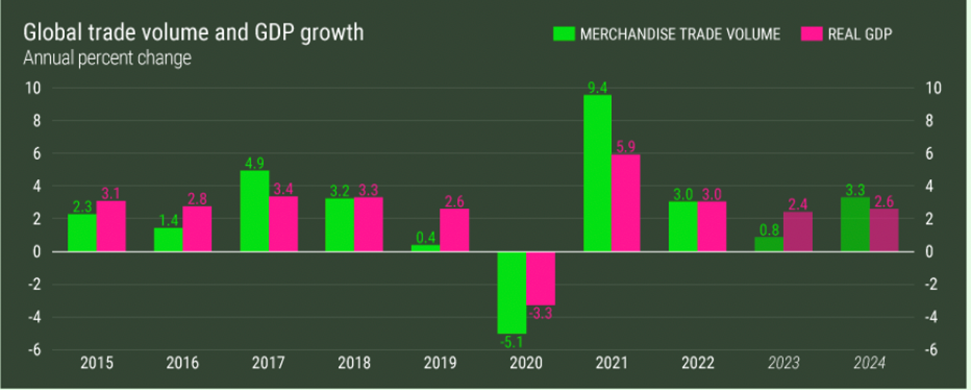

“WTO Downgrades Global Trade Forecast – Last month, the World Trade Organization published its updated Global Trade Outlook in which it downgraded its projection for trade growth this year to just 0.8 percent from 1.7 percent in April. The shift is a result of a number of factors – inflation, high interest rates, China’s underwhelming recovery, a high U.S. dollar and geopolitical tensions – and has affected a broad range of countries and sectors. The WTO’s outlook for 2024 remained relatively unchanged, declining only slightly from 3.3 percent to 3.2 percent. Two key variables, however, could upend this forecast: a weak Chinese economy and high inflation rates in developed economies.”, Geopolitical Futures, November 10, 2023

“World’s population has passed 8 billion, says US Census Bureau – The world population growth, however, continues a long-term trend of slowing down. The human species has topped 8 billion, with longer lifespans offsetting fewer births, but world population growth continues a long-term trend of slowing down. The United Nations estimated the number was passed 10 months earlier, having declared 22 November 2022, the “Day of 8 Billion”, the Census Bureau pointed out in a statement.”, The Independent, November 10, 2023

“These Five Countries Are Key Economic ‘Connectors’ in a Fragmenting World – Vietnam, Poland, Mexico, Morocco and Indonesia are benefiting from the reshuffling of supply chains in response to US-China tensions. As a group, these countries logged $4 trillion in economic output in 2022—more than India and almost as much as Germany or Japan. Despite their very different politics and pasts, they share an opportunistic desire to seize the economic windfall to be had by positioning themselves as new links between the US and China—or China, Europe and other Asian economies. They represent 4% of global gross domestic product, yet they’ve attracted slightly over 10%, or $550 billion, of all so-called greenfield investment since 2017.”, Bloomberg, November 2, 2023

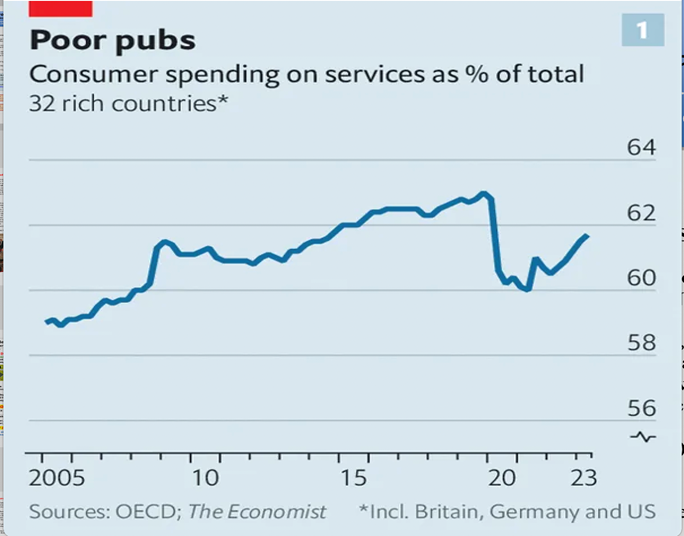

“Welcome to the age of the hermit consumer – The world economy is witnessing a $600bn-a-year shift in behaviour. Before covid, the share of consumer spending devoted to services was rising steadily. As societies became richer, they sought more luxury experiences, health care and financial planning. Then in 2020 spending on services, from hotel stays to hair cuts, collapsed. With people spending more time at home, demand for goods jumped, with a rush for computer equipment and exercise bikes. Three years on, the share of spending devoted to services remains below its pre-covid level. Rich-world consumers are spending around $600bn a year less on services than you might have expected in 2019. In particular, people are less interested in leisure activities that take place outside the home, including hospitality and recreation. Money is being redirected to goods, ranging from durables like chairs and fridges, to things such as clothes, food and wine.”, The Economist, October 22, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

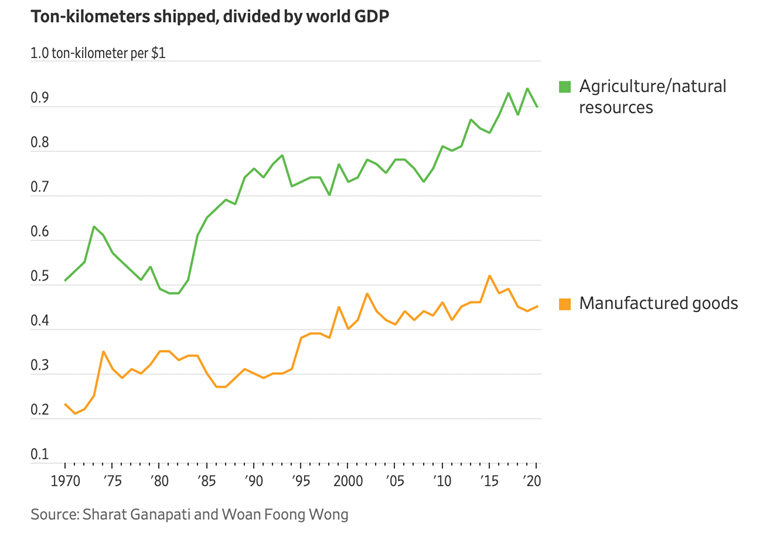

“Is Globalization in Decline? A New Number Contradicts the Consensus – Instead of looking at the dollar value of trade, focus on how many tons of stuff get shipped how far. Over the past 15 years, a consensus has developed that globalization has run its course and gone into decline. One popular number supporting this argument: Trade as a share of global output peaked in 2008 at the cusp of the global financial crisis and has never recovered. How can the value of trade be down, if the tonnage and distance are up? The obvious way this could happen is if the items being shipped are getting cheaper per ton. More goods are traveling greater distances than ever before. Shipping has increased for raw materials such as agricultural goods and natural resources, but has stagnated for manufactured goods”, The Wall Street Journal, November 3, 2023

“Ole! Mexico becomes biggest U.S. importer amid tensions with China – Businesses seek cheaper suppliers closer to U.S. Clothes, iPhones and TVs made in China have long made the Asian giant the biggest supplier of foreign-made goods to American consumers. No longer. A steady increase in imports from Mexico during the past decade have made the southern border the biggest hotspot in global trade. Mexico has doubled its imports to the U.S. since 2010, and this year, it’s on track to surpass China as the nation’s biggest supplier of foreign-made goods and services. China held that unofficial title since 2008.”, Market Watch, November 7, 2023

Annual % change in consumer price index, by date of forecast

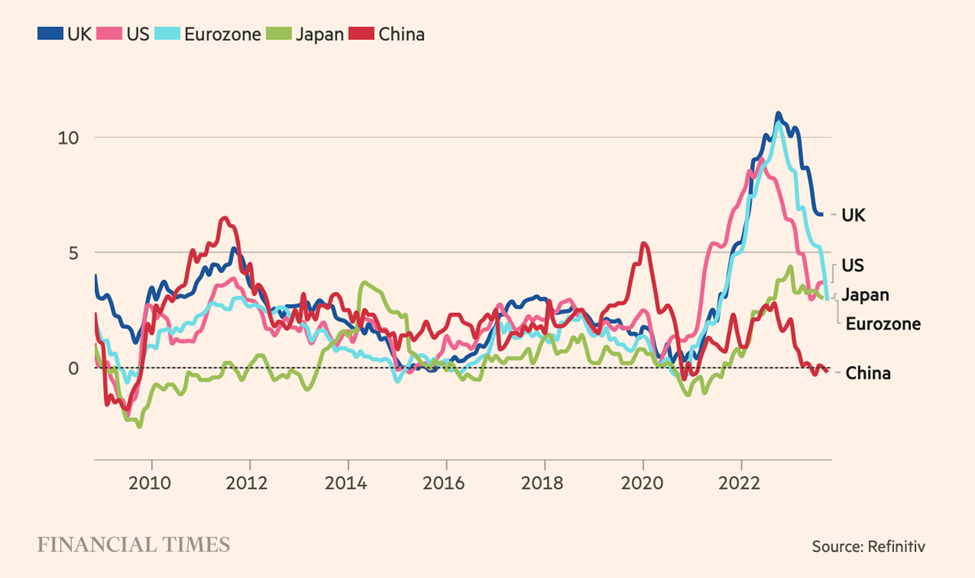

“Global inflation tracker – Inflation is easing from the multi-decade highs reached in many countries following Russia’s full-scale invasion of Ukraine. The latest figures for most of the world’s largest economies show the wholesale food and energy prices that soared during 2022 are now falling back.”, The Financial Times, November 9, 2023

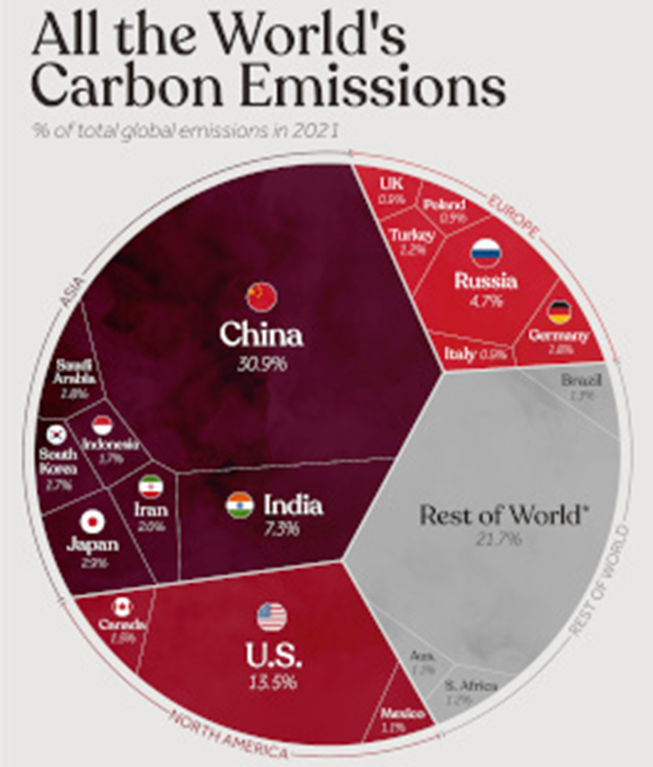

“Visualizing All the World’s Carbon Emissions by Country – The greenhouse effect, essential for sustaining Earth’s life-friendly temperatures, has been intensified by burning fossil fuels. This amplification of the natural greenhouse effect has led to significant alterations to the planet’s climate system. The graphic above uses data from the Global Carbon Atlas to explore which countries contribute the most to CO₂ emissions.”, Visual Capitalist, November 8, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel Updates

“International travel demand falls after onset of Israel-Hamas conflict – International flight bookings around the world have fallen since the onset of the Israel-Hamas conflict especially in the Americas as people cancel trips to the Middle East and around the world, according to travel analysis firm ForwardKeys. International flight bookings from the Americas dropped 10% in the three weeks after the Oct. 7th attack, when compared to the number of tickets issued three weeks before the attack, according to flight ticketing data from ForwardKeys.”, Reuters, November 9, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Canada

“Bank of Canada holds rate steady, trims growth forecast as inflation risks rise – Bank Governor Tiff Macklem and his team kept the policy rate at 5 per cent, the highest level in more than two decades. The decision was widely expected by analysts. It marked the second straight rate announcement in which the bank has remained on the sidelines. After 10 rate hikes since March, 2022, including two over the summer, higher borrowing costs are having their intended effect. Canadian consumers are pulling back on spending, unemployment is up and economic growth has slowed to a crawl.”, The Globe and Mail, October 26, 2023

China

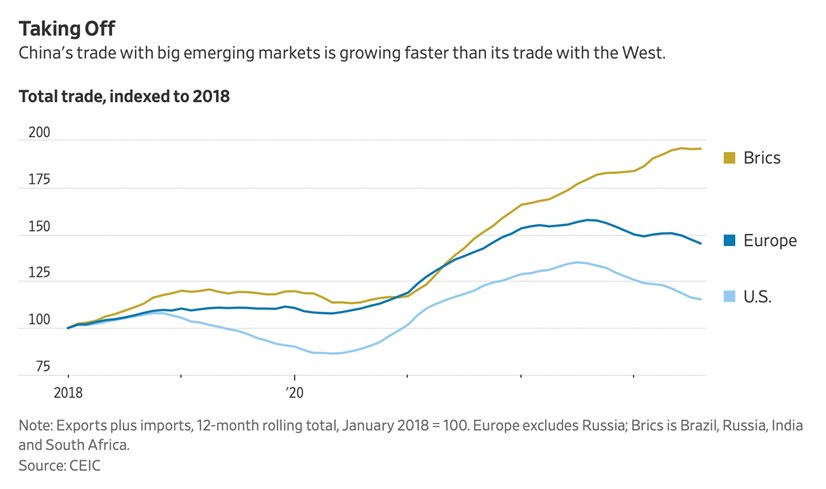

“It’s U.S. vs. China in an Increasingly Divided World Economy – Trade and investment flows settle into new patterns around two rival power centers—with major risks. China passed a significant milestone last fall: For the first time since its economic opening more than four decades ago, it traded more with developing countries than the U.S., Europe and Japan combined. It was one of the clearest signs yet that China and the West are going in different directions as tensions increase over trade, technology, security and other thorny issues.”, The Wall Street Journal, November 3, 2023

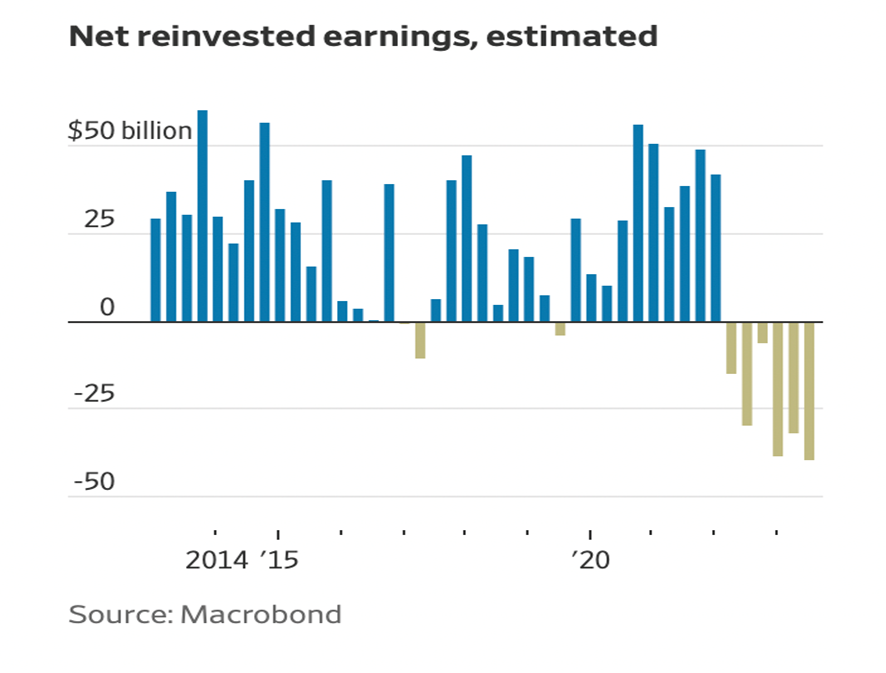

“Foreign Firms Pull Billions in Earnings Out of China – The outflows show interest rates, U.S. tensions and a weak economy are sapping China’s investment appeal. For years, foreign companies plowed the profits they made in China back into China, using the cash to finance new hiring and investment as its giant economy expanded rapidly. Now, as growth slows and tensions between Beijing and Washington rise, they are pulling those profits out.”, The Wall Street Journal, November 6, 2023

“China Is Making Too Much Stuff—and Other Countries Are Worried – Factories lack customers and are pushing exports harder, raising trade tensions. Some Chinese factories, saddled with overcapacity in a struggling economy, are trying to export their way out of trouble and stoking new trade tensions in the process. The tensions are most acute in Europe, where European Union regulators in September unveiled an antisubsidy probe, reflecting concern that China is flooding the region with low-cost electric vehicles. India is investigating whether China dumped a range of goods, from chemicals to furniture parts, into the country at unfair prices. Vietnam in September started examining whether wind towers imported from China have hurt domestic manufacturers.”, The Waal Street Journal, November 10, 2023

European Union

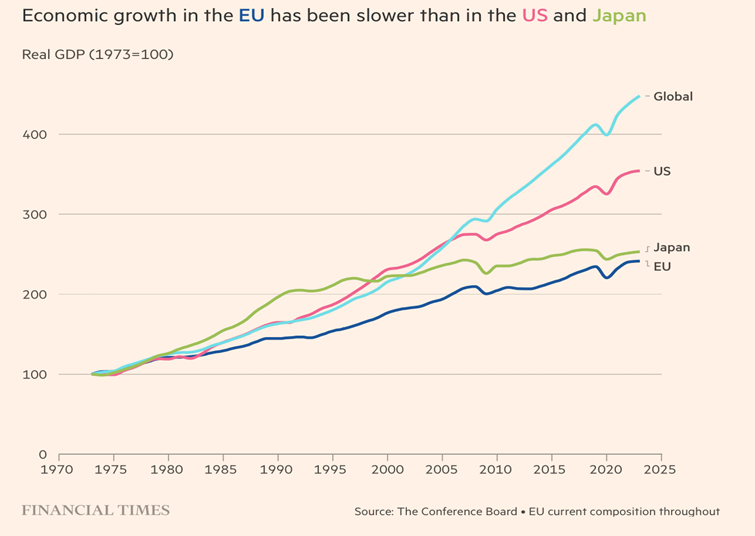

“The EU’s plan to regain its competitive edge – Brussels is trying to devise another new strategy amid fears of being left even further behind the US and China. When the heads of cabinets of the EU’s 27 commissioners huddled in the Belgian countryside in late August for their back-to-work retreat, all were invited to talk about what they thought should be the priority for the autumn. Everyone, over and over again, kept on coming back to competitiveness, and fixing the state of the EU’s economy. The EU economy, in dollar terms, is 65 per cent of the size of the US economy. That’s down from 91 per cent in 2013. Per capita, US gross domestic product is more than twice the size of the EU’s, and the gap is increasing.”, The Financial Times, November 5, 2023

Germany

“Coalition Government Agrees to Reduce Electricity Prices for Industry – The package of measures will lower the electricity tax until at least 2025 and expand and extend existing subsidy schemes for energy-intensive manufacturers. Although electricity prices in Germany have dropped significantly from the record highs seen at the height of the energy crisis, they remain much higher for many energy-intensive manufacturers compared with those faced by their international competitors.”, RANE WorldView, November 9, 2023

India

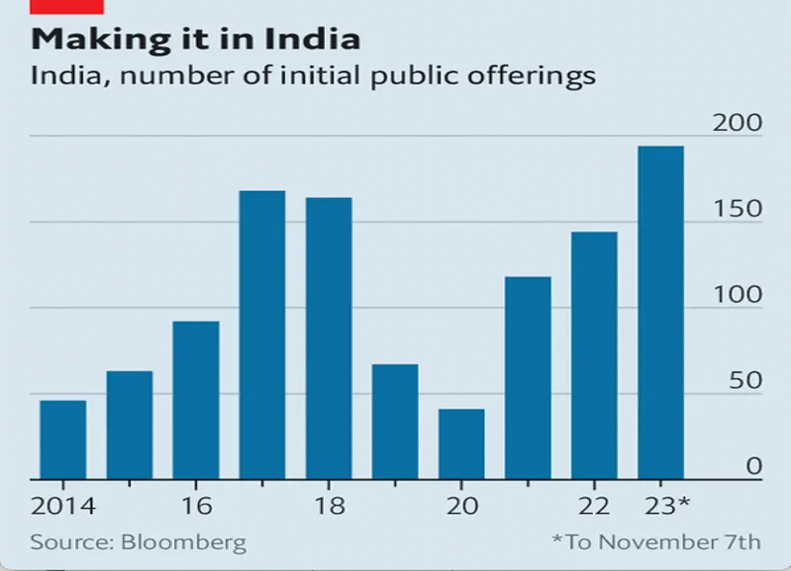

“India is in the midst of an unusual IPO boom – Extraordinary economic growth makes even ordinary companies look good. Beginning late last year, valuations in India’s private markets collapsed as investors lost patience with loss-making startups such as oyo, a hotel chain, and Byju’s, an online-learning business. Public markets sagged, too. The first hint of a shift in mood came in April with the listing of Mankind Pharma, a manufacturer of condoms and pregnancy tests. It quickly became apparent that attractive opportunities abounded in ordinary areas of an economy experiencing extraordinary growth. A flood of listings followed. As of early November, 194 companies had gone public this year, up from 144 for all of 2022.”, The Economist, November 9, 2023

Turkey

“High Court Clash Will Likely Hinder Foreign Investment – Turkey’s top appeals court filed criminal complaints against Constitutional Court judges after they issued a ruling in October calling for the release of Can Atalay, an opposition figure who was elected to the National Assembly in May, from prison on grounds of parliamentary immunity, Reuters reported on Nov. 8. This clash between Turkey’s top courts may cause a judicial crisis and a lack of standardized interpretations of regulations. Without uniform regulations, foreign capital is unlikely to increase, despite Ankara’s efforts to increase foreign investment to boost its economy amid economic turmoil.”, RANE WorldView, November 9, 2023

United States

“Houston overtakes Miami as best place for foreign businesses in annual FT-Nikkei ranking – Texas cities dominate top 10 amid surge of foreign investment in auto and tech sectors. Houston has taken the top slot as the best US city for foreign multinationals to do business in the second annual ranking compiled by the Financial Times and Nikkei. It gained the top spot by offering business friendly policies, excellent logistics, affordable cost of living, and a diverse community for overseas companies. To learn more about how Houston finished on tThe FT-Nikkei Investing in America ranking showcases the top US cities for international business. The ranking measures cities across more than four dozen metrics important to foreign investors.”, The Financial Times, November 8, 2023

Vietnam

“Intel Suspends Factory Expansion Amid Power Grid Limitations, Red Tape – Intel’s decision was based on concerns about Vietnam’s unreliable power grid and overbearing bureaucracy. The reasons for Intel’s suspension demonstrate that Vietnam lacks the capacity to power the many new or expanded factories and fabrication plants streaming into the country. Meanwhile, the country’s ongoing anti-graft campaign has created bureaucratic bottlenecks because officials are wary of signing off on projects. These same issues have constrained Vietnam’s efforts to upskill its workforce while drawing investment and reshoring companies from China.”, RANE WorldView, November 7, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“Planet Fitness shares surge as company raises revenue outlook – The gym chain also boosted its revenue outlook for the year. Revenue jumped nearly 14% to $277.6 million. The company said it now expects to post 14% revenue growth for the year, up from its previous guidance of 12% and higher than analysts’ expectations of 11.6%. New and existing franchise owners received updated agreement details in mid-October that included key changes to the business structure, including: an increased franchise agreement from 10 years to 12 years to eliminate the initial $20,000 franchise fees, shortening grace periods for franchisees from 12 to six months and reequip periods extended to free up capital and reduce store spending.”, CNBC, November 7, 2023

“How America fell back in love with the drive-thru – A taste for tech and dislike of face-to-face interaction among young diners has shifted eating habits. When Harry Snyder opened the first In-N-Out hamburger stand close to Route 66 in 1948, he helped to consummate the love affair between two of America’s favourite things — the car and fast food. Fast-food chains including McDonald’s and Taco Bell are building ever larger drive-thrus to accommodate the growing demand. The biggest, a Chick-fil-A due to open next year in Atlanta, Georgia, will be able to handle 75 cars at a time across four lanes.”, The Times of London, November 11, 2023

NZ Franchise Awards 2023 Results – BATTLE OF THE BRANDS – This year’s Westpac New Zealand Franchise Awards were among the most hotly-contested ever, and it was fitting that there were two new names on the Supreme trophies from franchise brands that had never stood on the top step before. In their 28th year, the Westpac New Zealand Franchise Awards once again celebrated true excellence and achievement, and demonstrated the spirit of support and friendship that makes franchising such a successful business model.”, Franchise New Zealand, November 11, 2023

“Cartesian Capital Plots Rapid Popeyes® Growth in China – When Popeyes made its China debut in August, it “smashed the record” for opening-day transactions with more than 1,760, said Greg Armstrong, a partner at Cartesian Capital, the global private equity firm that’s behind the launch of Popeyes in China with plans to open more than 1,700 restaurants across the country in the next decade. It’s an ambitious development push that might appear overly so, but not for Tims China, said Armstrong. That’s the Cartesian-owned exclusive operator and master franchisee of Tim Hortons in China, which is on track to have more than 1,000 Tims stores open by the end of the year and is the same group behind the Popeyes expansion. Both brands are part of Restaurant Brands International.”, Franchise Times, October 30, 2023. Compliments of Paul Jones, Jones & Co., Toronto

“Subway opens largest Asian store in Shanghai’s West Bund – The new eatery has a submarine-shaped design, the first of its kind in the world, reflecting the signature freshly-made sandwich that allows customers to choose different types of meat, cheese, and other toppings. Covering over 300 square meters (3,230 square feet) of space, it features an interactive menu ordering device, and decorative drawings are in place to offer a more immersive dining experience. Earlier this year, Subway reached a deal with master franchisee Shanghai Fu-Rui-Shi Corporate Development Co to open nearly 4,000 new sandwich shops across mainland China over the next 20 years.”, Shine.com, November 11, 2023.

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

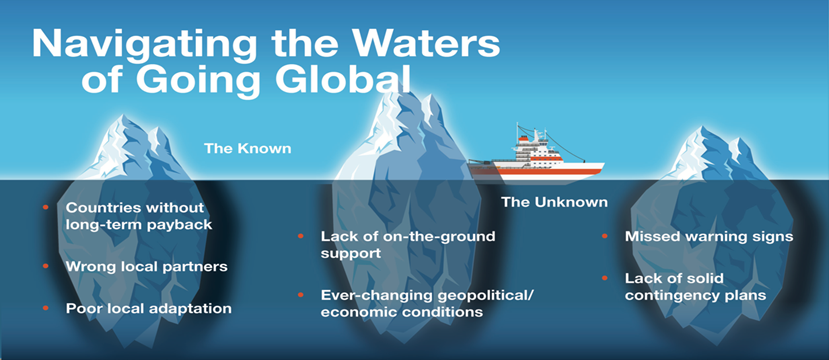

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant taking 40 franchisors global.

For a complimentary 30-minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link: