EGS Biweekly Global Business Newsletter Issue 96, Tuesday, November 28, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

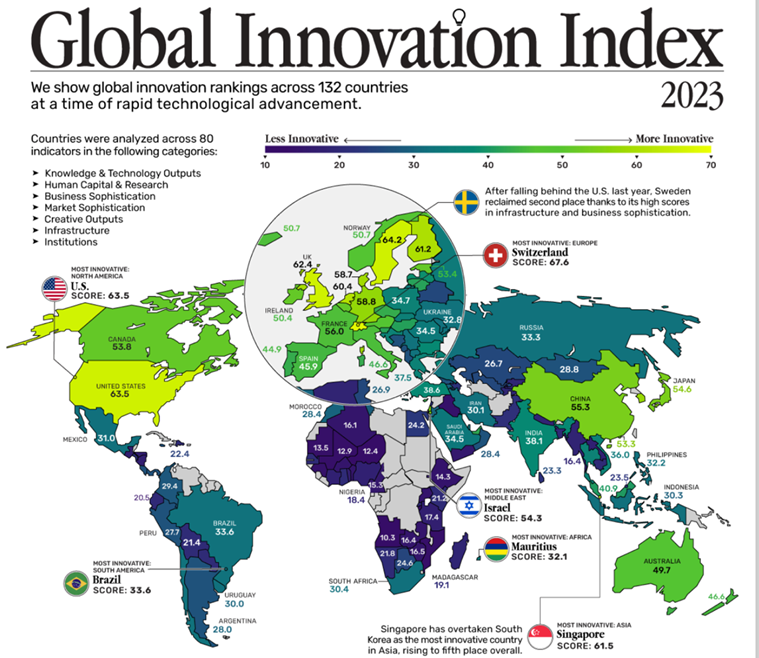

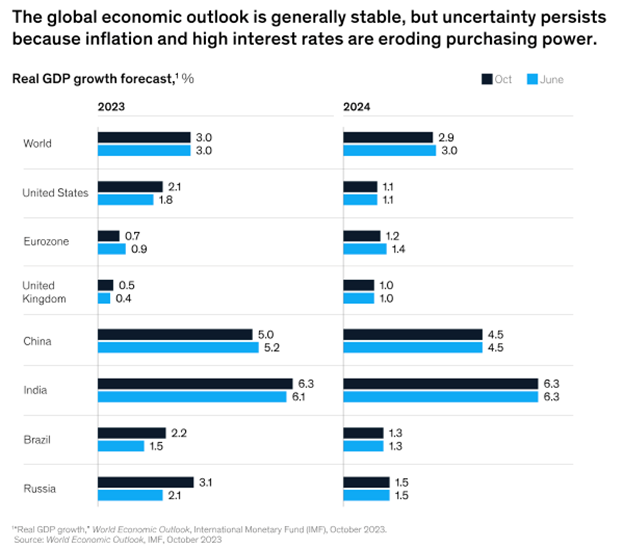

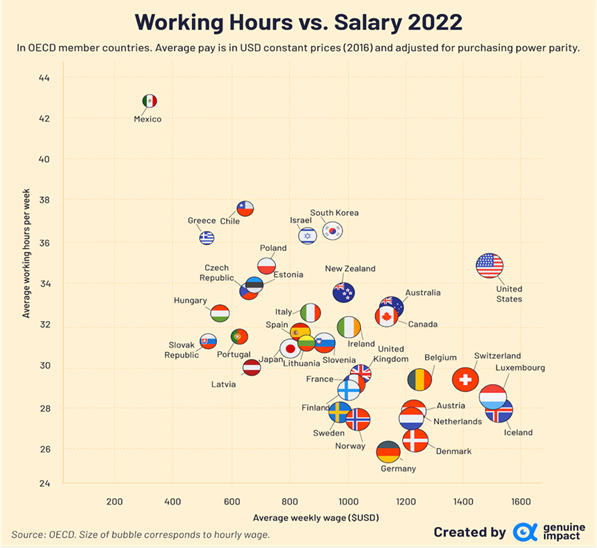

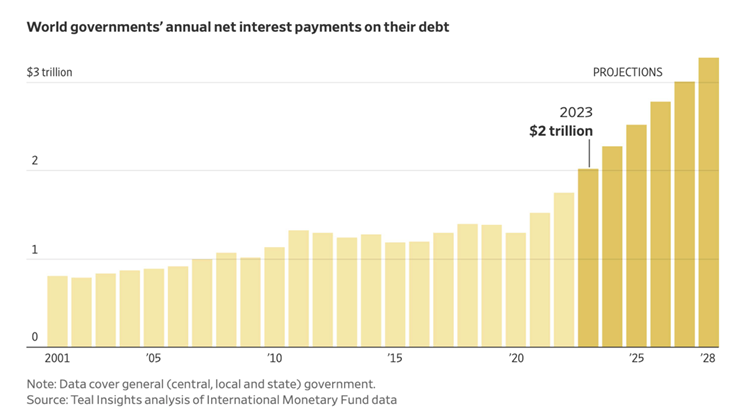

Introduction: In this issue, each day 70 million people visit McDonald’s 40,000 restaurants worldwide. The hours we work each week vary widely by country. Switzerland, Sweden, the United States, the United Kingdom, and Singapore lead the Global Innovation Index this year. And governments are expected to spend $2 trillion on interest on their debt this year.

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

NOTE: Some of the sources that we provide links to require a paid subscription to access. We subscribe to 40 international information sources to keep our readers up to date on the world’s business.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here: https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others For These Times

“Every problem is a gift — without problems we would not grow.”, Tony Robbins, motivational speaker and writer

“Only those who will risk going too far can possibly find out how far one can go.”, T.S. Eliot

“The journey of a thousand miles begins with a single step.”, Lao Tzu, Chinese Taoist philosopher

Highlights in issue #96:

- Brand Global News Section: McDonalds®, Pizza Hut® and Jim’s Beauty®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data and Studies

“The Most Innovative Countries in the World in 2023 – Which countries are the global innovation powerhouses? In many ways, the past year has represented an inflection point in technological advancement. Almost overnight, OpenAI’s large language model ChatGPT became a household name and AI was within reach to the masses. Yet looking under the surface, innovation is influenced by several unseen factors, from the institutional environment and high-tech exports to research talent and entrepreneurship culture. This graphic shows the most innovative countries in the world, based on the 2023 Global Innovation Index (GII) put together by the World Intellectual Property Organization.”, Visual Capitalist, November 14, 2023

“The global outlook is unchanged despite weaker readings in trade, consumer confidence, and business activity. Still-elevated inflation and interest rates are acting as headwinds to economic growth. According to theInternational Monetary Fund’s (IMF) October World Economic Outlook, global growth is forecast to slow from 3.5% in 2022 to 3.0% in 2023 and 2.9% in 2024. There are mixed signals from global trade. Overall consumer confidence declined, primarily due to elevated interest rates.”, McKinsey & Co., November 20, 2023

“Comparing Weekly Work Hours and Salaries in OECD Countries – The Organization for Economic Co-operation and Development (OECD) is generally regarded as a collection of highly developed, high income countries. However with 38 member states from across the globe, economic prosperity can still vary widely between these nations.To illustrate this, Truman Du from Genuine Impact charts the average weekly work hours and salaries across the OECD in 2022.”, Visual Capitalist, November 18, 2023

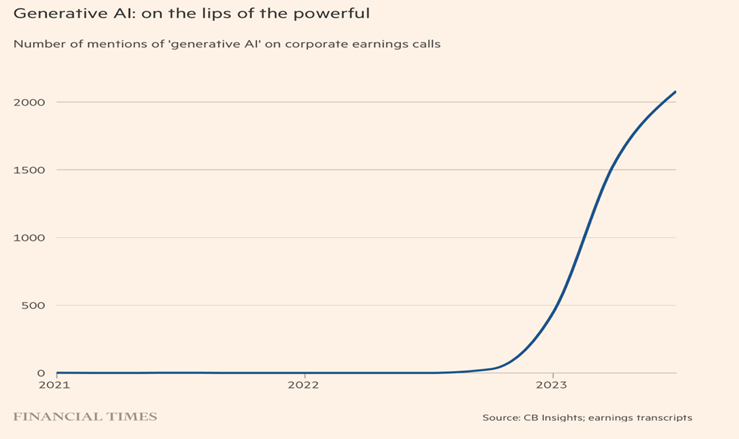

“OpenAI and the rift at the heart of Silicon Valley – The tech industry is divided over how best to develop AI, and whether it’s possible to balance safety with the pursuit of profits. OpenAI was launched as a research firm dedicated to building safe AI for the benefit of all humanity. But the drama of recent days suggests it has failed to deal with the outsized success that has flowed from its own technical advances. It has also thrown the question of how to control AI into sharp relief: was the crisis caused by a flaw in the company’s design, meaning that it has little bearing on the prospects for other attempts to balance AI safety and the pursuit of profits? Or is it a glimpse into a wider rift in the industry with serious implications for its future — and ours?”, The Financial Times, November 24, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

“The $2 Trillion Interest Bill That’s Hitting Governments – Debt-servicing costs complicate plans in many countries for more military, climate spending. Governments are expected to spend a net $2 trillion paying interest on their debt this year as higher interest rates make borrowing more expensive, up more than 10% from 2022, according to an analysis of International Monetary Fund data by research consulting firm Teal Insights and a separate analysis by Fitch Ratings. By 2027, it could top $3 trillion, according to Teal Insights.”, The Wall Street Journal, November 15, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel Updates

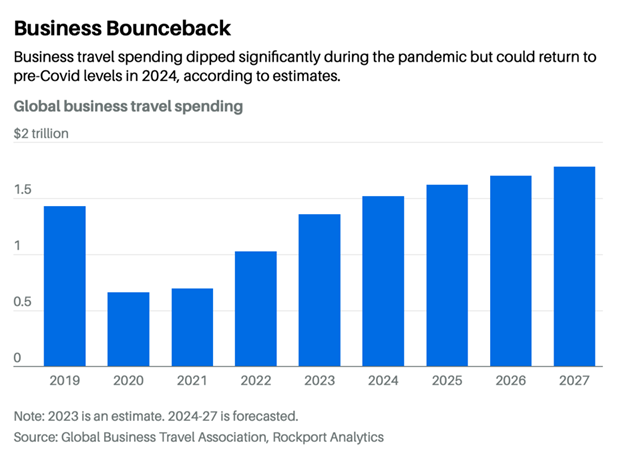

“Business Travel Is About to Pick Up – Corporate travel may finally be back in business, unlocking higher profit margins for airlines and hotel companies and a much-needed revenue boost for the next few months, typically a slow season for leisure travel. Travel manager surveys, anecdotal evidence from airlines, hotel company earnings, and the end of the Hollywood and auto makers’ strikes all signal a long-awaited uptick after a slow postpandemic recovery. The key for investors is that there looks to be more upside ahead.”, Barron’s, November 23, 2023

“China offers visa-free entry for citizens of France, Germany, Italy – China will temporarily exempt citizens of France, Germany, Italy, the Netherlands, Spain and Malaysia from needing visas to visit the world’s second-largest economy in a bid to give a boost to post-pandemic tourism.From Dec. 1 to Nov. 30 next year, citizens of those countries entering China for business, tourism, visiting relatives and friends, or transiting for no more than 15 days, will not need a visa, a foreign ministry spokesperson said on Friday.China has been taking steps in recent months – including restoring international flight routes – to revive its tourism sector following three years of strict COVID-19 measures that largely shut its borders to the outside world.”, Reuters, November 24, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Argentina

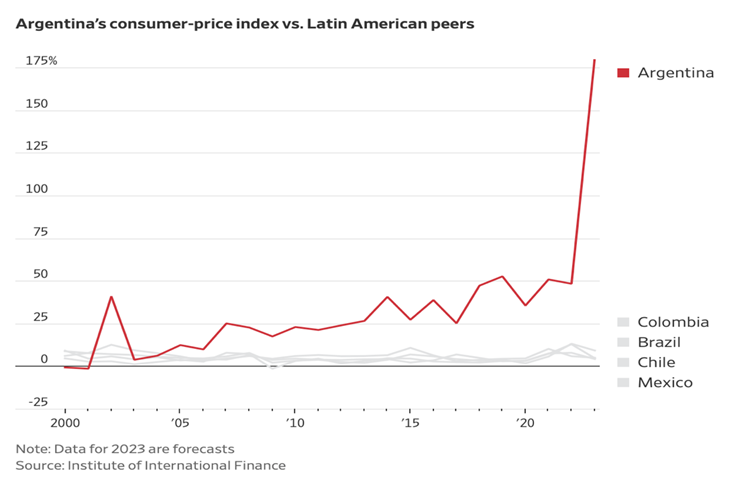

“Argentina’s Economic Turmoil Is Getting Worse – Argentina has long been trapped in recurring cycles of deep and destructive economic contractions brought on by policies that force governments to routinely spend more than they collect through taxes and other income, economists say. President-elect Javier Milei will take office in early December with the task of reversing unsustainable spending policies that have depleted government coffers and caused inflation and interest rates to soar.”, The Wall Street Journal, November 20, 2023

China

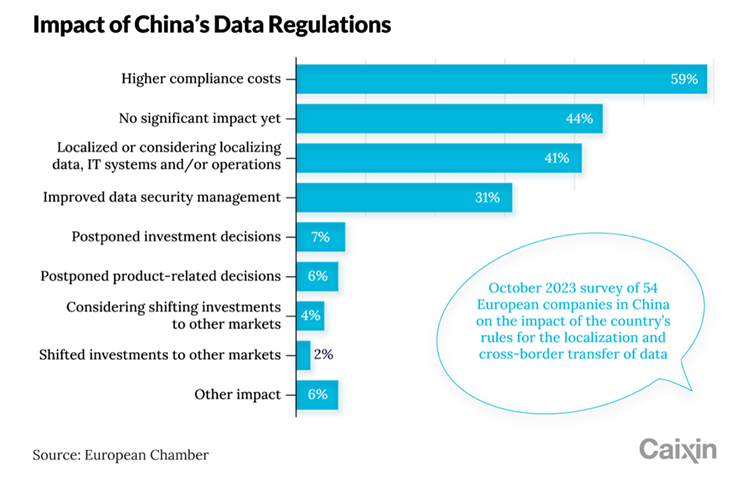

“European Firms Want Clarity on China’s Data Transfer Rules Seen as Raising Costs – A European business group has called on Beijing to clarify cross-border data transfer regulations it considers too vague or too strict, as they have created challenges such as higher costs for companies doing business in China. More than 80% of the respondents want Beijing to further clarify what “important data” encompasses, while 59% and 39% would like to see clearer definitions of “personal information” and “critical information infrastructure,” respectively, according to the survey.”, Caixin Global, November 16, 2023

“China’s shoppers are gloomy and picky – They want to spend on pets and sports, not makeup or perfume. Although the unemployment rate in China’s cities is only 5%, many households are not optimistic about their pay or their job prospects. According to the latest central-bank survey, more people expect their income to fall in the near future than to rise. Consumer confidence collapsed during the pandemic-related lockdowns of 2022. It has yet to recover. The gloom is making customers picky and cost-conscious.”, The Economist, November 16, 2023

European Union

“New car sales in Europe pop as EVs record 36% increase and hybrids account for nearly 3 in 10 vehicles sold – The ACEA said fully electric cars made up 14.2% of sales in October, overtaking sales of diesel cars for the third time. As recently as 2015, diesel models accounted for more than 50% of cars sold in the EU, but they accounted for just 12% of sales in October. For the ten months through October, sales of fully electric cars were up 53.1%. Electrified vehicles – either fully electric models, plug-in hybrids or full hybrids – accounted for over 47% of all new passenger car registrations in the EU between January and October 2023, up from 42% in the same period last year, the ACEA said.”, Fortune magazine, November 22, 2023

India

“India is seeing a massive aviation boom – New airports, hundreds of aircraft and millions of new passengers are on their way. The country’s entire aviation industry is growing at an astonishing clip. Four new airports and four new terminals have opened in the past 12 months. That gives India 149 operational civil airports, twice the number it had a decade ago. Nine additional airports have been approved and many more are planned. Domestic passenger numbers rose from 98m in 2012-13 to 202m in 2019-20. Already the third-biggest domestic aviation market by volume, India is projected to be the third-largest overall by 2026, according to the International Air Transport Association, an industry body.”, The Economist, November 23, 2023

Japan

“Is Japan’s economy at a turning point? Wage and price inflation is coinciding with an exciting corporate renewal. After years of deflation or low inflation, Japan is seeing its fastest price growth in more than 30 years. Wages, long stagnant, are rising faster than at any time since the 1990s. Both increases are driven largely by global supply shocks. But they are not the only changes afoot. As Aoki predicted, gradual institutional and generational shifts are bearing fruit and changing Japan Inc from within.”, The London Economist, November 16, 2023

Mexico

“The city where Mexico’s nearshoring hype is becoming reality – Optimism infects business leaders in Monterrey as manufacturers shift operations close to the US. Industrial real estate is expanding, yet at the same time vacancy rates are below 2 per cent. Developers are even building a physical symbol of the hubris: a skyscraper taller than the Empire State Building. ‘A week doesn’t go by for us without meeting Chinese, Korean, Japanese executives, looking to open offices or a plant,’ said Lorenzo Barrera Segovia, chief executive of Banco Base, a bank based in the city.”, The Financial Times, November 27, 2023

Turkey

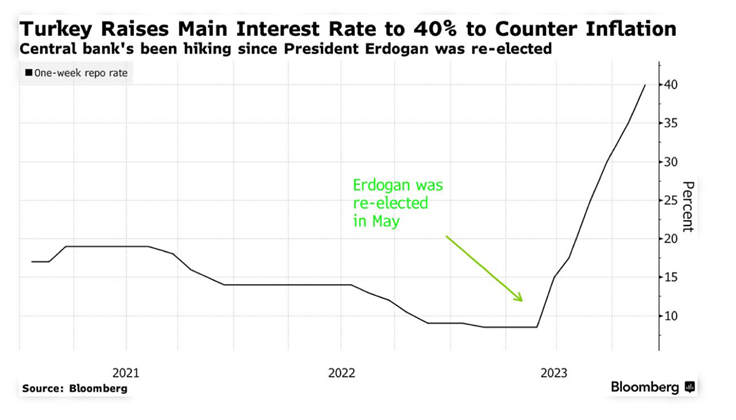

“Turkey Central Bank Hikes Rate by Double the Forecast to 40% – The monetary authority delivers a bigger-than-expected hike Real rates now above zero relative to an inflation gauge. The MPC, led by Governor Hafize Gaye Erkan, signaled it would slow the pace of tightening from now. It’s lifted rates by more than 30 percentage points since President Recep Tayyip Erdogan was re-elected in May, reversing years of loose fiscal and monetary policies that were blamed for enabling inflation to soar and scaring foreign investors away.”, Bloomberg, November 23, 2023

United Kingdom

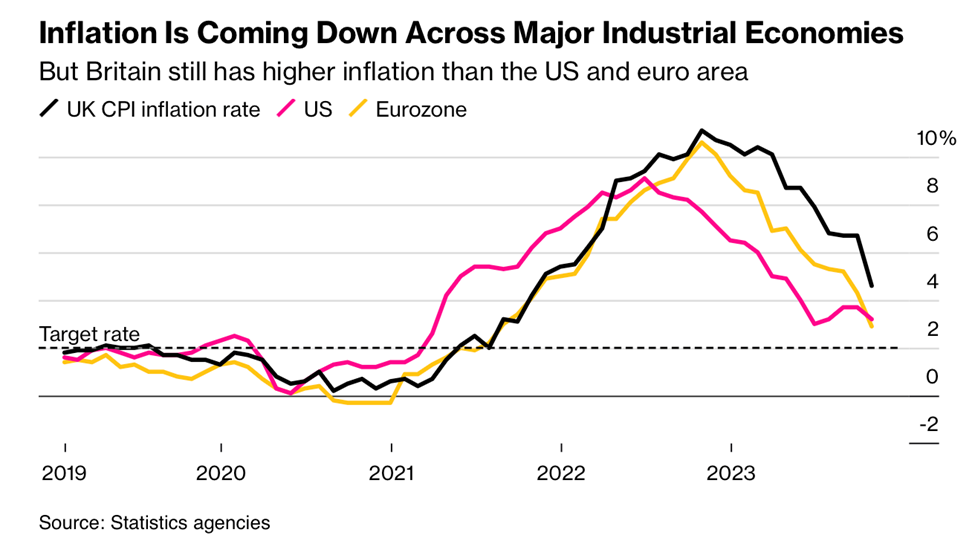

“UK Inflation Slows to Two-Year Low, Bolstering Rate Cut Bets – UK inflation tumbled to the lowest level in two years, firming up bets that the Bank of England will be able to cut rates as early as the middle of next year. Consumer prices rose 4.6% from a year earlier in October, down sharply from 6.7% in September and the slowest pace since 2021 as energy prices fell, the Office for National Statistics said Wednesday.”, Bloomberg, November 15, 2023

“The UK Economy Continues to Beat Expectations – That’s mostly good news, unless you’re hoping for imminent interest rate cuts. Consumer confidence headed higher this month. It’s still negative, but it’s going in the right direction….the latest snapshot of business activity in the UK (courtesy of S&P Global/CIPS) showed expansion for the first time since July. This was led by the services sector, with manufacturing still in contraction.”, Bloomberg, November 24, 2023

United States

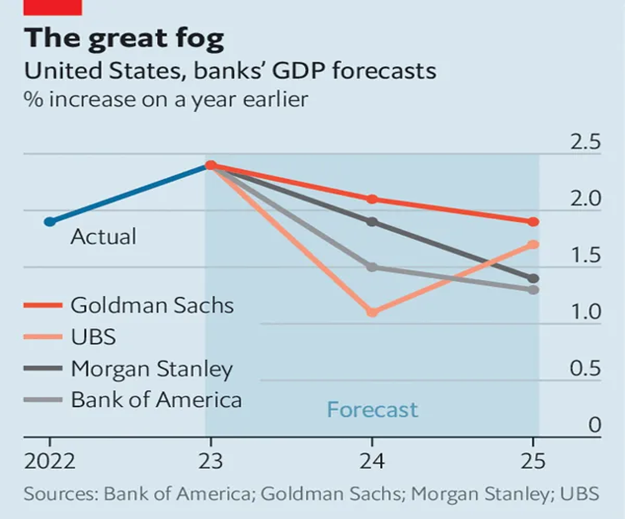

“How will America’s economy fare in 2024? Don’t ask a forecaster – The consensus is that there is no consensus. Goldman Sachs expects growth in America to be robust, at 2.1%, around double the level that economists at ubs foresee. Some banks see inflation falling by half in 2024. Others think it will remain sticky, only dropping to around 3%, still well above the Federal Reserve’s target. Expectations for what the Fed will end up doing with interest rates range, accordingly, from basically nothing to 2.75 percentage points of rate cuts.”, The London Economist, November 23, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“‘Big Jack’: McDonald’s loses legal food fight over Australian rival’s choice of burger name – Court rules Hungry Jack’s had not infringed on trademark but had misled consumers over ‘25% more Aussie beef’ claim. McDonald’s has lost a three-year trademark battle over the sale of “Big Jack” burgers sold by its rival, Hungry Jack’s. But McDonald’s succeeded on a separate consumer law claim. The court found Hungry Jack’s had misled consumers by advertising that its Big Jack burger contained ‘25% more Aussie beef’ than its Big Mac counterpart.”, The Guardian, November 15, 2023. Compliments of Jason Gehrke, The Franchise Advisory Centre, Brisbane

“McDonalds Global will acquire Carlyle Group s equity in McDonalds China business increasing its shareholding ratio to 48% – McDonald’s Global and Carlyle Group announced that McDonald’s Global agreed to acquire Carlyle’s minority stake in McDonald’s strategic cooperation companies in mainland China, Hong Kong and Macau. The CITIC Consortium, dominated by CITIC Capital, will maintain its controlling position. After the transaction is completed, CITIC Consortium will continue to hold 52% of the shares, and McDonald’s Global, as a minority shareholder, will increase its shareholding ratio from 20% to 48%. It is reported that since September 2019, McDonald’s China has achieved system sales growth of more than 30%.”, Caixin.com.cn, November 21, 2023. Compliments of Paul Jones, Jones & Co., Toronto

“The Number Of People Who Eat McDonald’s Daily Is Enough To Populate A Country – With over 40,275 restaurant locations worldwide, McDonald’s has long reigned as one of the most successful fast food chains on the planet. From South Carolina to the South of France, you can count on finding a McDonald’s no matter where you are (save a few exceptions, of course, such as Iceland and Bolivia). According to statistics from 2021, approximately 70 million people visit a McDonald’s location every day. That is more than the population of France or the United Kingdom…”, The Daily Meal, November 21, 2023

“Pizza Hut set for 400 store Aussie expansion – A fast food battle is looming in Australia with Pizza Hut unveiling aggressive new expansion plans as it aims to take on Domino’s. It currently has about 10 per cent of the Australian pizza market, compared to Domino’s’ 50 per cent market share. In June, US-based Flynn Restaurant Group bought the master licence for Pizza Hut in Australia from private equity firm Allegro Funds. There are currently 260 Pizza Hut stores in Australia…..Pizza Hut Australia CEO Phil Reed added that the company had identified 400 sites across Australian where it could open a store.”, News.com.au, November 27, 2023

“Jim’s Beauty opens offering customers at home beauty treatments – Jim’s Group is renowned for having a long list of franchises, including Jim’s Mowing, Jim’s Cleaning and Jim’s Painting. . Now, Aussies in the beauty industry are being offered the chance to start their own business and join the Jim’s Beauty franchise. The mobile services can be done in the customer’s home or even the franchisee’s house and salon if the customer prefers.”, News.com.au, November 13, 2023. Compliments of Jason Gehrke, The Franchise Advisory Centre, Brisbane

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

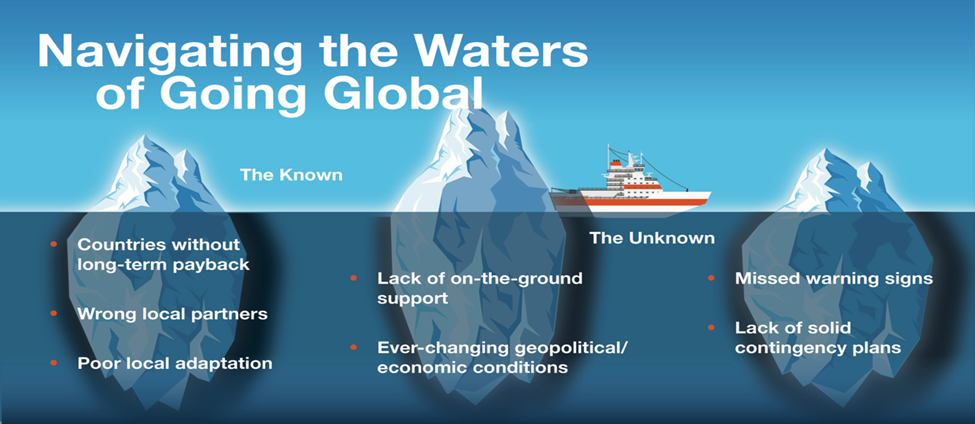

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant taking 40 franchisors global.

For a complimentary 30-minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

And download our latest chart ranking 40+ countries as places to do business at this link: