EGS Biweekly Global Business Newsletter Issue 97, Tuesday, December 12, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Introduction: In this issue, global government debt is at $97 trillion. Analysts are mixed in how they see economies in 2024. The European Union proposes the first government rules for AI. Global airfares are expected to stabilize in 2024. And McDonalds® plans to open 9,000 more restaurants worldwide. And dairies take 1st steps to tackle planet-warming cow burps.

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

NOTE: Some of the sources that we provide links to require a paid subscription to access. We subscribe to 40 international information sources to keep our readers up to date on the world’s business.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here: https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others For These Times

“No one who achieves success does so without acknowledging the help of others.” – Alfred North Whitehead.

“Accept challenges so that you may feel the exhilaration of victory.” – General George S. Patten.

“You must do the things you think you cannot do.” – Eleanor Roosevelt

Highlights in issue #97:

- Brand Global News Section: 7-Eleven®, Joe and the Juice®, KFC® and McDonalds®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data and Studies

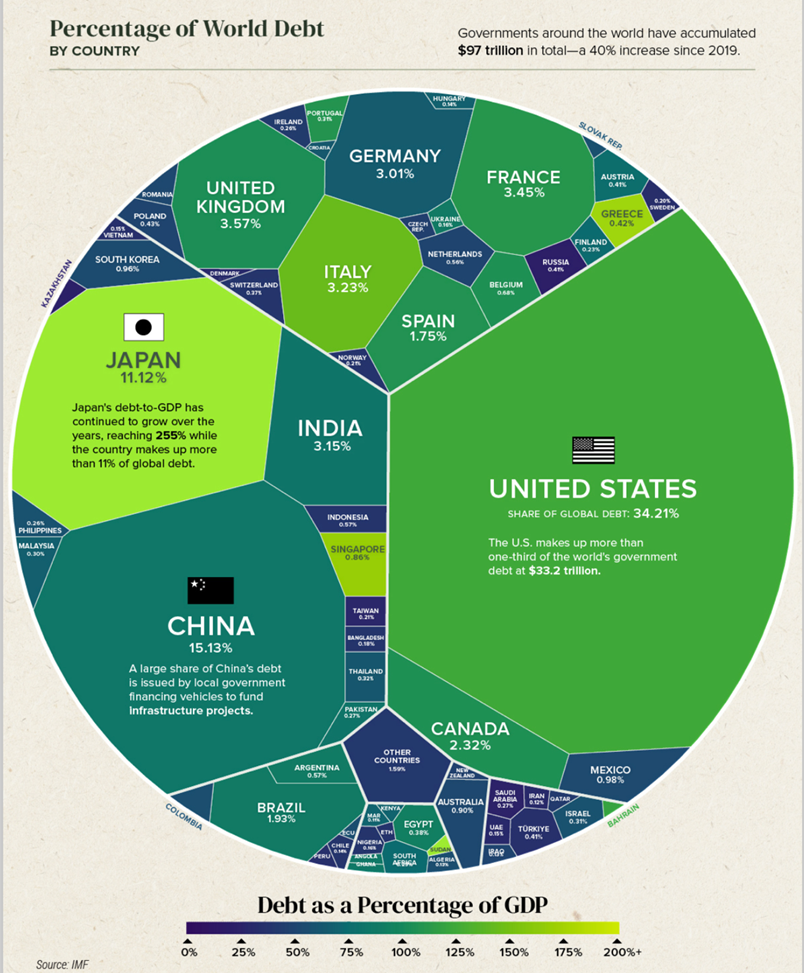

“Global government debt is projected to hit $97.1 trillion this year, a 40% increase since 2019 – During the COVID-19 pandemic, governments introduced sweeping financial measures to support the job market and prevent a wave of bankruptcies. However, this has exposed vulnerabilities as higher interest rates are amplifying borrowing costs. This graphic shows global debt by country in 2023, based on projections from the International Monetary Fund (IMF).”, Visual Capitalist, December 5, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

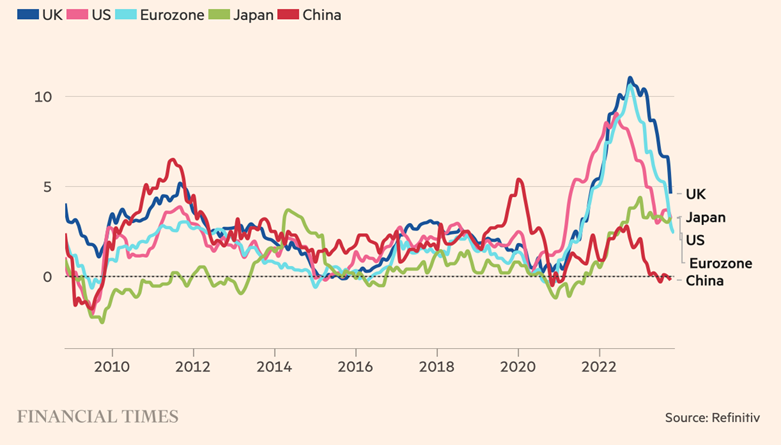

Annual % change in consumer price index

“Global Inflation Tracker – Inflation is easing from the multi-decade highs reached in many countries following Russia’s full-scale invasion of Ukraine. The latest figures for most of the world’s largest economies show the wholesale food and energy prices that soared during 2022 are now falling back.”, The Financial Times, December 11, 2023

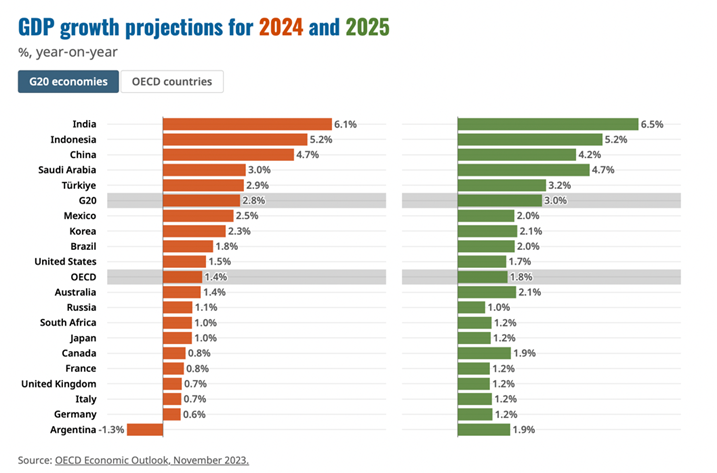

“Restoring Growth – OECD Economic Outlook November 2023 – The global economy continues to confront the challenges of inflation and low growth prospects. GDP growth has been stronger than expected so far in 2023, but is now moderating on the back of tighter financial conditions, weak trade growth and lower business and consumer confidence. Global growth is projected to be 2.9% in 2023, and weaken to 2.7% in 2024. As inflation abates further and real incomes strengthen, the world economy is projected to grow by 3% in 2025. Global growth remains highly dependent on fast-growing Asian economies. On the upside, growth could also be stronger if households spend more of the excess savings accumulated during the pandemic.”, OECD, November 2023

“Global trade to contract by 5% in 2023, UN body says – Global trade is set to contract by 5% in 2023 compared to last year, the United Nations trade body said on Monday, with an overall pessimistic forecast for 2024. In its Global Trade Update, the United Nations Conference on Trade and Development (UNCTAD) projected that commerce this year would amount to approximately $30.7 trillion. Trade in goods is expected to contract by nearly $2 trillion in 2023, or 8%, but services trade should increase by about $500 billion, or 7%, according to the U.N. body.”, Reuters, December 11, 2023

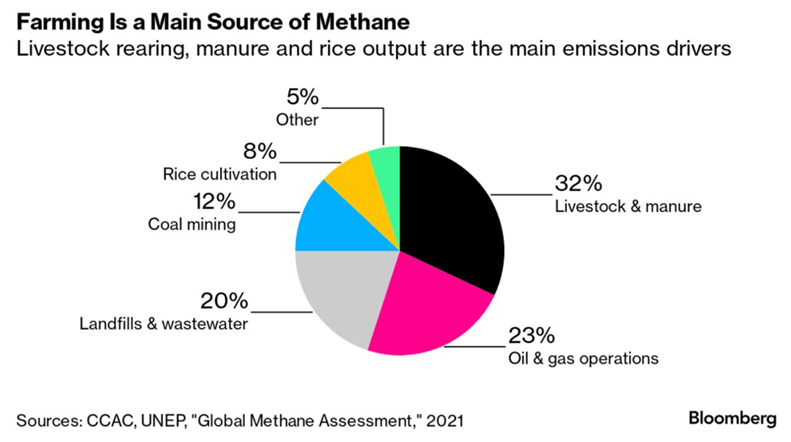

“Dairy Giants Take First Steps to Tackle Planet-Warming Cow Burps – Six of the world’s biggest dairy producers pledged to publicly say how much methane they emit as part of efforts to address livestock’s huge environmental footprint. Agriculture emits about 40% of all methane, a potent gas with 80 times the warming power of carbon dioxide. The majority of that comes from livestock, whether belched from the stomach or through manure. While the focus has been on tackling the problem in the energy sector — such as leaks from oil wells — addressing it in farming has so far proven elusive.”, Bloomberg, December 8, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel Updates

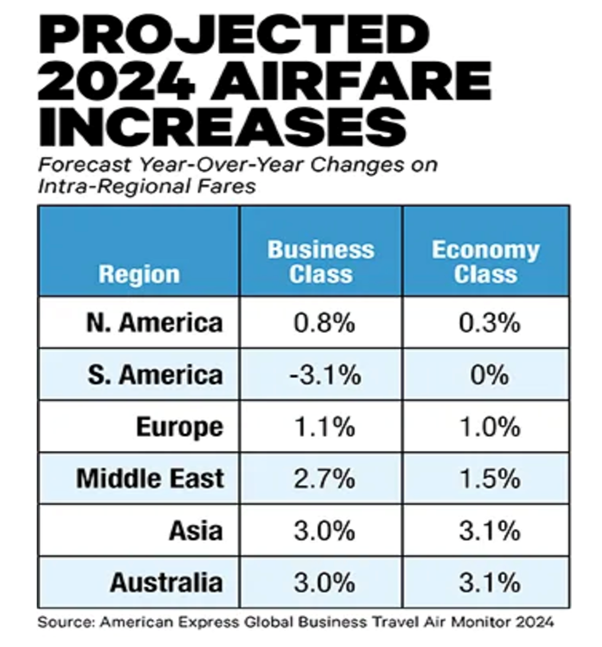

“Amex GBT Projects 2024 Global Airfares to Stabilize – 2024 economy- and business-class airfares throughout the world are projected to stabilize, “with prices falling on some routes,” according to a new American Express Global Business Travel forecast, released Wednesday. Business-class fare projections from North America to other regions are mixed….. Most economy-class fares from North America are expected to decline.”, Business Travel News, December 6, 2023

“Indonesia eyes visa waivers for 20 countries, including US, China, India – The government will finalise the list of countries included in the provision within one month, according to a statement. Minister Sandiaga Uno said the president had instructed the government to consider the visa waiver as a means of boosting the economy, tourism visits and investment.”, Reuters, December 7, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Argentina

“Argentina prepares for Milei to start shock therapy – Argentina’s financial markets were on tenterhooks on Monday to see if new President Javier Milei would immediately launch into his promised economic shock therapy by devaluing the peso. The radical economist took office on Sunday with a warning in his inaugural speech that he had no alternative to a sharp, painful fiscal shock to fix the country’s “titanic” challenges. Milei has promised deep cuts to public spending but his task looks daunting, with inflation nearing 200%, recession looming and payments ramping up while Argentina’s reserves are depleted.”, Reuters, December 11, 2023

China

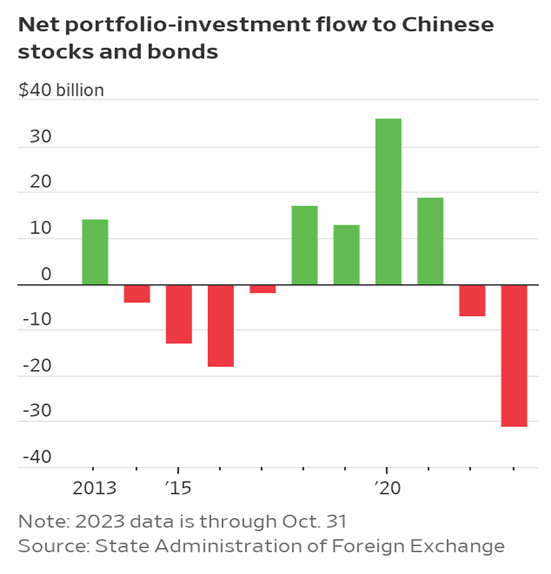

“Wall Street Puts a ‘Sell’ on Its China Holdings – Institutional investments in the nation have plunged as its economy slows and property market craters; ‘a bit of an awakening’. The amount of money that institutional investors have in Chinese stocks and bonds has declined by more than $31 billion this year, through October, the biggest net outflow since China joined the World Trade Organization in 2001, official Chinese data show.”, The Wall Street Journal, December 7, 2023

“China’s deflation worsens as economic pressures mount – Consumer price data comes after policymakers pledge to step up fiscal and monetary support. China’s consumer prices fell 0.5 per cent year on year in November, the sharpest decline in three years as the world’s second-largest economy grapples with worsening deflation. Consumer prices dropped by more than the 0.2 per cent decline forecast by a Bloomberg survey of economists and exceeded October’s fall of 0.2 per cent. Producer prices, which are measured at factory gates and heavily driven by the cost of commodities and raw materials, dropped by 3 per cent and have remained in negative territory for the past year.”, The Financial Times, December 9, 2023

European Union

“Europe seals world’s first set of rules regulating artificial intelligence – The deal requires ChatGPT and general purpose AI systems (GPAI) to comply with transparency obligations before they are put on the market. The proposals lay the groundwork for the Artificial Intelligence Act, which will be voted on by the European Parliament and Council next year and will come into effect in 2025. The legislation, if passed, would be the world’s first comprehensive rules to regulate the use of artificial intelligence, paving the way for legal oversight of AI technology.”, Fox Business, December 9, 2023

India

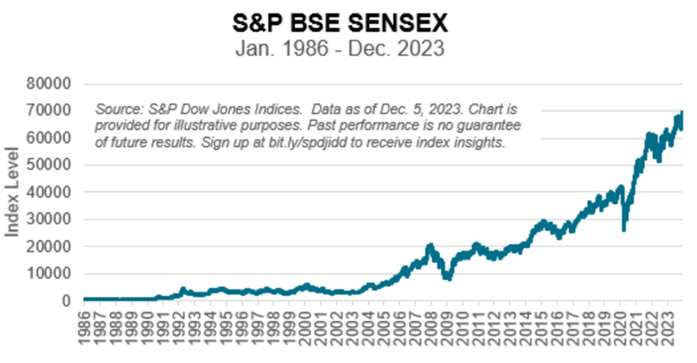

“India’s stock market tops $4 trillion in value as investors buy into world’s fastest growing big economy – The S&P BSE Sensex, India’s benchmark equity index, is up more than 7% in just the past month and has gained 14.3% for the year-to-date as investors seek exposure to the world’s most populous nation and fifth biggest economy. The MSCI China index, in dollar terms, has dropped 13.6%, while the MSCI World Index is up 16.1% over the same period, boosted by an 18.5% gain for the S&P 500 in the U.S. ‘It’s been a fantastic decade for Indian blue chips, with the Sensex hitting a new all-time high in 9 of the past 10 years, for a cumulative total of 243 times,’ noted Benedek Vörös, director, index investment strategy at S&P Dow Jones Indices.”, Market Watch, December 7, 2023

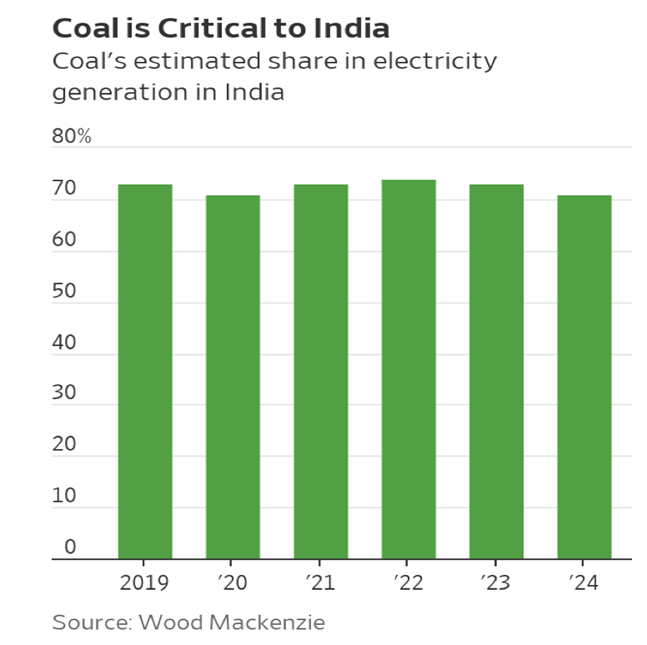

“What India Needs to Ditch Coal – India, along with China, has opted out of the Global Renewables and Energy Efficiency pledge at the COP28 climate conference in Dubai—which included a commitment to curtail investment in new coal power. Coal currently meets nearly three-quarters of India’s growing energy needs. Moreover higher electricity capacity will, ironically, be key to survival in its increasingly hot weather as air conditioning needs rise. So what does India really need to shift decisively toward low carbon power? For one, money—much of it from the developed world.”, The Wall Street Journal. December 11, 2023

The Philippines

“Peso Set to Ride Remittance Wave on Philippine Holiday Spending – The Philippine peso has outperformed its Asian peers this year and a seasonal pick-up in overseas remittances ahead of Christmas will likely extend the gains.

Remittances are a key pillar of the nation’s economy, which typically receives the highest cash transfers in the last month of the year as workers send money home for holiday spending. The inflows have helped strengthen the currency in all but three Decembers in the last 10 years, data compiled by Bloomberg show.”, Bloomberg, December 10, 2023

Turkey

“Türkiye logs 5.9% Q3 GDP growth, sets eye on disinflation – Türkiye’s economy expanded by a more-than-expected 5.9% year-over-year in the third quarter, driven primarily by solid household spending, the official data showed Thursday. The country’s gross domestic product (GDP) thus grew slightly above the market expectations, hovering around 5.6%, data by the Turkish Statistical Institute (TurkStat) showed. ‘As envisaged in our program, we are moving toward a more balanced composition in growth,’ Treasury and Finance Minister Mehmet Şimşek said as he commented on the figures.”, Daily Sabah, November 30, 2023

United Kingdom

“Interest rates won’t be cut until 2026, predicts CBI – Business lobby group forecast based on inflation not hitting Bank of England’s 2% target until second half of 2025. In its latest outlook on the UK economy, the CBI said the base rate will stay at 5.25 per cent for at least two more years, despite rising market speculation that rates will be cut next year. The forecast is based on projections showing that consumer price inflation will not reach the Bank’s 2 per cent target until the third quarter of 2025. Rate-setters on the monetary policy committee — including Andrew Bailey, the Bank’s governor — have pushed back against traders’ expectations and warned that no monetary easing is imminent, despite inflation falling to a two-year low of 4.6 per cent in October. The Times of London, December 8, 2023

“UK economy showing ‘signs of life’ as eurozone heads towards recession – A closely watched index of private sector activity in the UK returned to growth in November after three months of decline. But in the single currency bloc business continued to struggle – leaving it on the brink of recession. The updates came as an influential ‘hawk’ at the European Central Bank said she believes further interest rate hikes can be taken off the table following the ‘remarkable’ fall in inflation. Isabel Schnabel fuelled speculation that rates in Europe and the UK will be cut in the first half of next year.”, The Daily Mail, December 5, 2023

United States

“(U.S.) Stock analysts who got it wrong last year predict a soft landing in 2024 – What a difference a year makes. Heading into 2023, stock forecasters were predicting an imminent recession triggered by high interests would torpedo financial markets. As we head into 2024, by contrast, Wall Street expects a soft landing for the U.S. economy to power the market to record highs. Most strategists also expect the Federal Reserve to turn the page on its rate-hiking offensive and for the S&P 500 to grind higher in the new year. Like most New Year’s resolutions, however, stock forecasts often end up bowing to reality. That imminent recession analysts predicted last year? It never materialized. Instead, the economy continues to grow; inflation is easing and equities are cruising toward year-end having booked double-digit gains.”, CBS News, December 8, 2023

“Market pros are all over the map when it comes to 2024 forecasts – Investment banks and asset managers have wildly varying stock market and currency calls for 2024, reflecting deep division over whether the U.S. economy will enter a long-heralded recession and drag the world with it. The lack of consensus among forecasters is a stark contrast to a year ago, when most predicted a U.S. recession and rapid rate cuts that failed to materialize. The world’s largest economy expanded by 5.2 per cent in the third quarter of this year.”, The Globe and Mail, December 8, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“From one 7-Eleven store to a $1.71 billion payday – The 7-Eleven Australia convenience store business, which began with one store in the Melbourne suburb of Oakleigh in 1977, has been sold by the Withers and Barlow families in a $1.71 billion payday. It has been acquired by the Japanese parent group Seven-Eleven Japan, which plans to step up expansion in Australia of a business with 752 outlets selling snacks, drinks, coffee and fuel. It has a market share of about 32 per cent in convenience store merchandise. The new owners are aiming to open around 35 stores annually. The Japanese group owns the 7-Eleven global licence and already collects licence fees from the Australian business, which has been owned by the two families since 1976.”, Australian Financial Review, November 30, 2023

“Private Equity Firm to Acquire Majority Ownership in Joe & the Juice – The 360-unit beverage chain wants to expand worldwide, including a new franchise program. Private equity firm General Atlantic announced Monday that it will acquire a majority interest in Joe & the Juice, a growing beverage chain with stores around the world. General Atlantic, which initially made a minority investment in October 2016, has three priorities for Joe & the Juice: accelerate expansion in international markets, capitalize on customer demand, and build digital channels.”, QSR Magazine, November 14, 2023

“Retail Food Group acquires Beefy’s Pies in major business deal – An Aussie award winning pie company has been sold to a major food and beverage group for $10 million. With stores in Gympie, Brisbane and on the Sunshine Coast, Beefy’s Famous Aussie Pies is an institution for many visitors to the southeast Queensland region. RFG CEO Matt Marshall said there was a number of appealing factors for acquiring Beefy’s, including its loyal customer base and its ability to foster a passionate business model since it opened its first store in 1997.”, News.com.au, November 30, 2023. Compliments of Jason Gehrke, The Franchise Advisory Centre, Brisbane

“Yum’s KFC division agrees to acquire more than 200 KFC restaurants in the UK and Ireland from franchisee EG Group – The deal “represents a significant opportunity to accelerate KFC’s growth strategy in the large and growing UK and Ireland chicken market, with high average unit volumes and robust margins,” the companies said in a joint statement. No financial terms were disclosed, but the deal is expected to close by the end of the first half of 2024.”, Market Watch, December 6, 2023

“McDonald’s Targets 50,000 Restaurants in Expansion Blitz – Most new stores will be in international licensed markets. The chain currently has more than 41,000 restaurants and already committed to opening an extra 2,000 by the end of this year. The new target highlights the burger giant’s stepped-up ambitions as it looks for its next leg of growth.”, Bloomberg, December 6, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

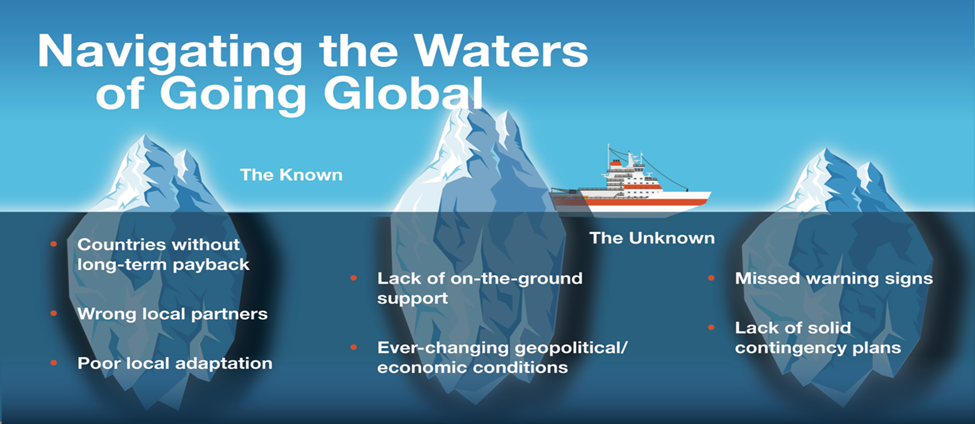

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant taking 40 franchisors global.

For a complimentary 30-minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

And download our latest chart ranking 40+ countries as places to do business at this link: