EGS Biweekly Global Business Newsletter Issue 99, Tuesday, January 9, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Introduction: In this issue, we look back at 2023 and forward with lots of different projections for 2024. Global shipping disrupted. Global markets had their best year since before the pandemic. Where will the Chinese economy go in 2024. U.S. oil and gas exports fuel the world’s demand. India continues to grow at a high level. The U.S. dollar finished 2023 down. The U.S. economy leads other developed countries in 2023.

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

NOTE: Some of the sources that we provide links to require a paid subscription to access. We subscribe to 40 international information sources to keep our readers up to date on the world’s business.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here: https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others For These Times

“Every time you tear a leaf off a calendar, you present a new place for new ideas.”, Charles Kettering

“The new year stands before us, like a chapter in a book, waiting to be written.”, Melody Beattie

““Be at war with your vices, at peace with your neighbors, and let every new year find you a better man.”, Benjamin Franklin

Highlights in issue #99:

- Brand Global News Section: Chick Fil A®, Dominos® and McDonalds®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

“These Are the Five Potential Trouble Spots That Could Knock the Global Economy Off Course. US unemployment claims in the US, business confidence in Germany, bond yields in Japan. What investors and executives need to be watching in 2024. The global economy was tested in 2023 as it rarely has been before: inflation and the most aggressive monetary tightening campaign in decades, wars in Europe and the Middle East, a festering real estate crisis in China and the deepening rivalry between Washington and Beijing, which is forcing companies to rethink supply chains and security. The International Monetary Fund forecasts global growth of 2.9% in 2024, a whisker below last year. With two wars raging and some 40 national elections on the calendar, political developments will shape the year, especially as Donald Trump makes a go at winning back the presidency. But crucial economic stress points could upend the benign outlook.”, Bloomberg, January 3, 2024

“Six things to watch in 2024 global economy, from tax cuts to AI – The Israel-Hamas war could broaden, and many developing countries are on a path to crisis. Six things to watch in 2024 global economy, from tax cuts to AI. The Israel-Hamas war could broaden, and many developing countries are on a path to crisis. Central banks start to cut interest rates. A developing-country debt crisis. Pre-election tax cuts. A deepening US-China cold war. The unstoppable rise of generative AI. Rising oil prices.”, The Guardian, January 2, 2024

“Ten business trends for 2024, and forecasts for 15 industries – Geopolitics will again loom large in 2024, as us-China tensions mount and the wars in Ukraine and Gaza rumble on. Inflation will fall and interest rates level off; supply-chain kinks will ease, along with commodity prices. But global gdp will grow by only 2.2% amid lacklustre expansions in rich countries. Developing economies will do better, though China will lose corporate investment to competitors. Companies will face new environmental rules and perhaps a global minimum tax rate.”, The Economist, November 13, 2024

“Global stock markets record best year since 2019 – S&P 500 ends 2023 just shy of record as investors bet interest rates have peaked. The MSCI World index, a broad gauge of global developed market equities, has surged by 16 per cent since late October and is up 22 per cent this year — its best performance for four years. That has largely been fuelled by Wall Street’s benchmark S&P 500 index, which has risen 14 per cent since October and 24 per cent on the year, ending the last trading day of 2023 just shy of its all-time record. The gains have been driven by a dramatic shift in interest rate expectations following a slew of recent data showing inflation falling faster than expected in western economies.”, The Financial Times, December 30, 2024

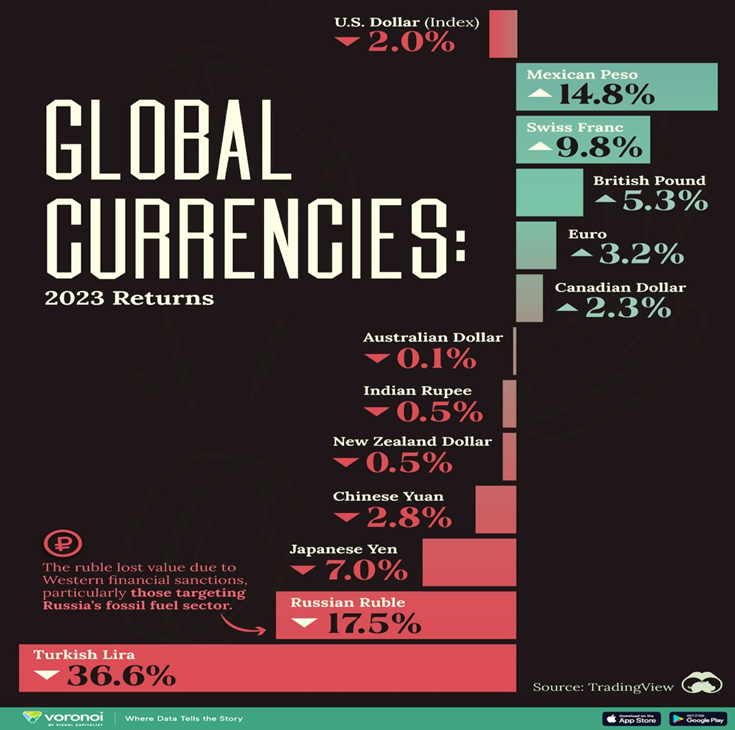

“How Major Currencies Performed in 2023 – The U.S. Dollar Index peaked in fall 2022, the highest it had been in nearly two decades, rising in response to aggressive interest rate hikes. The index measures the value of the U.S. dollar against a basket of major currencies from six countries. A gain indicates the dollar is appreciating against the basket and vice-versa. The euro is the biggest component on the index and thus sways the index value and return.”, Visual Capitalist, January 4, 2024

“The top tech trends to watch in 2024 – CES, the consumer electronics show in Las Vegas, will offer a first look at the ways our relationship with tech could change this year. If the last two years proved that generative artificial intelligence and large language models aren’t going anywhere, 2024 will be year they get embedded into products you may actually want to buy. CES, one of the largest technology trade shows in the world, will host thousands of engineers, entrepreneurs, dealmakers and tech companies in Nevada, all eager to share their visions of what’s next. And yes, AI looms larger over the show than ever before — though it’s not the only thing attendees will be talking about.”, The Washington Post, January 8, 2024

“Will AI enable a three-day workweek? Certain billionaires think so, but some experts disagree. Some of the world’s most successful business leaders, including Bill Gates and Jamie Dimon, have recently suggested that advancements in artificial intelligence will cut the workweek down to just three or three and a half days. Others aren’t so convinced. In a November episode of the What Now? With Trevor Noah podcast the former Microsoft chief executive described a world where machines do most of the labour, while humans earn a comfortable living working three days a week.”, The Globe and Mail, January 8, 2024

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

“2024 Supply Chain Risk Report – Which geopolitical instability should you be watching? What materials will supply chain managers be fighting over? And what is the top risk your supply network will 100% guaranteed face in 2024. Everstream’s 2024 outlook is based on our comprehensive database of supply chain disruptions and how those impact our clients. The report includes a countdown, risk scores, and extensive data for each of 2024’s Top 5 most likely events.”, Evergreen Analytics, January 4, 2024

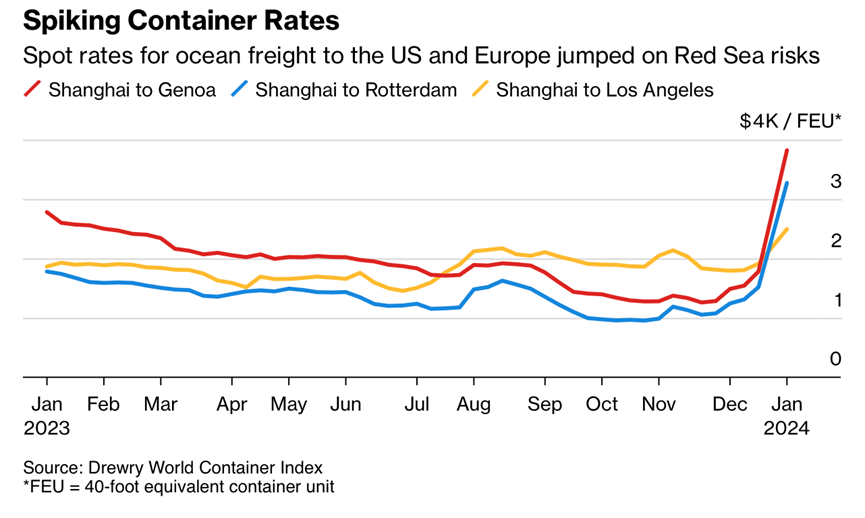

“Spot Container Shipping Rates Soar 173% on Red Sea Threats – Suez traffic is down 28% in past 10 days, IMF PortWatch says Risk of congestion rises heading into Chinese Lunar New Year. The spot rate for shipping goods in a 40-foot container from Asia to northern Europe now tops $4,000, a 173% jump from just before the diversions started in mid-December, Freightos.com, a cargo booking and payment platform, said late Wednesday. The cost for goods from Asia to the Mediterranean increased to $5,175, Freightos said, adding that some carriers have announced prices above $6,000 for this route starting in mid-January. Rates from Asia to North America’s East Coast have risen 55% to $3,900 for a 40-foot container.”, Bloomberg, January 4, 2024

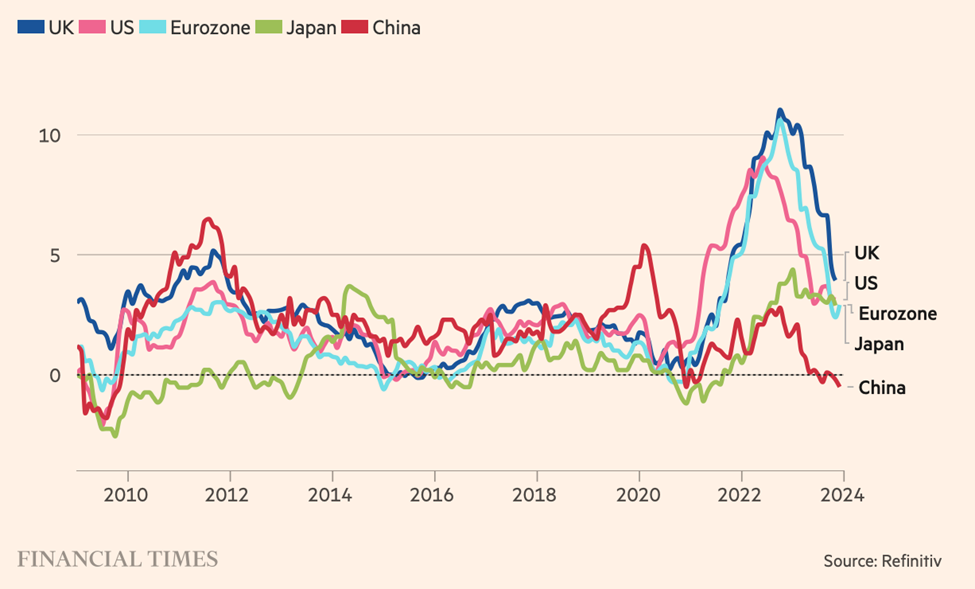

Annual % change in consumer price index

“Global Inflation Tracker – Inflation is easing from the multi-decade highs reached in many countries following Russia’s full-scale invasion of Ukraine. The rise in energy prices was the main driver of inflation in many countries, even before Russia invaded Ukraine. Daily data show how the pressure has intensified on the back of a conflict that has forced Europe to search for alternative gas supplies. However, wholesale prices continue to ease as a result of weakening global demand and European gas storage facilities being filled close to capacity.”, The Financial Times, January 5, 2-24

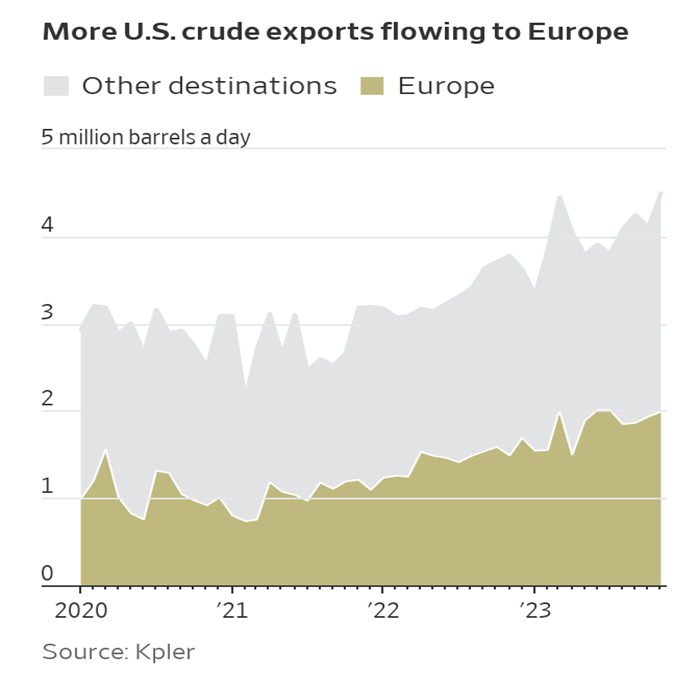

“(U,S.) Shale Is Keeping the World Awash With Oil as Conflicts Abound – The shipping crisis in the Red Sea is expected to raise consumer prices. But it has had little impact on energy prices, largely because of surging supplies from U.S. frackers. That is largely because of record production of U.S. fossil fuels. Shippers in November moved more oil out of the U.S. than what was produced in Iraq, OPEC’s second-largest member, at a record 4.5 million barrels a day. Likewise, U.S. exports of liquefied natural gas, or LNG, are set to hit a record in December, according to market intelligence firm Kpler.”, The Wall Street Journal, January 1, 2024

Global & Regional Travel Updates

“SAFEST PLACES TO TRAVEL 2024 – What makes a safe place to travel?It sounds like an easy question, but the definition of a safe destination has changed over time. According to our research, a safe place was originally a place that’s largely free from terrorist activity. Then it became a place that was safe from disease outbreaks. Now it’s a place where all types of people can move about freely without discrimination or harassment. As definitions of a safe destination have evolved, so too have the world’s safest places. Are there places where people can move about freely, stay disease-free, and be sheltered from severe weather events?”, Berkshire Hathaway Travel Protection, September 2024

“The World’s Most On-Time Airlines in 2023 – Aviation analytics firm Cirium ranked the punctuality of different airlines around the world—and the winner may surprise you. The list, derived from over 600 real-time flight information sources, features the expected names, to be sure (Delta received Cirium’s Platinum Award for global operational excellence for the third year in a row), but reveals some wild card winners as well. Avianca Airlines, a low-cost carrier based in Colombia, was ranked the most punctual global airline of 2023 with 85.73% of its flights arriving within 15 minutes of its scheduled gate arrival.”, CNN Traveler, January 2, 2024

Country & Regional Updates

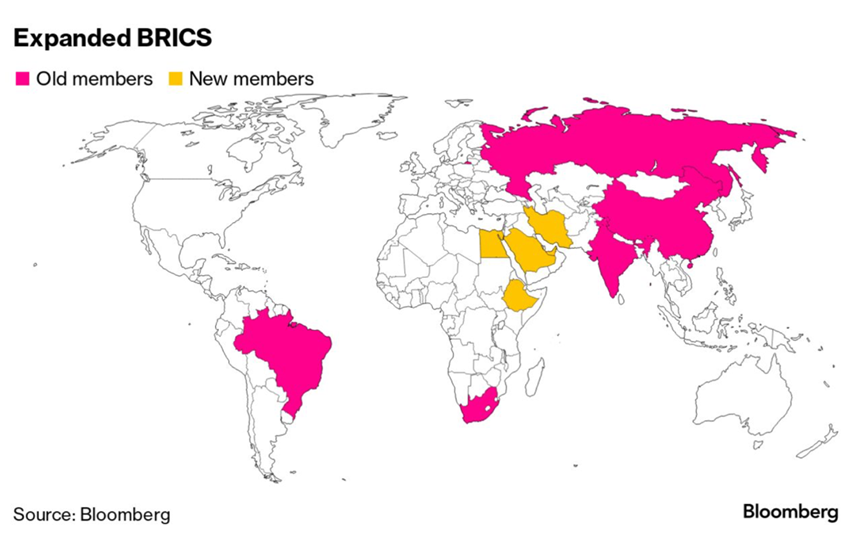

BRICS Countries

“How BRICS Doubled in Size – The BRICS group of emerging-market nations — the acronym stands for Brazil, Russia, India, China and South Africa — has gone from a slogan dreamed up at an investment bank two decades ago to a real-world club that controls a multilateral lender. It doubled in size at the start of 2024, pairing some of the planet’s largest energy producers with some of the biggest consumers among developing countries and potentially enhancing the group’s economic clout in a US-dominated world. Saudi Arabia, Iran, the United Arab Emirates, Ethiopia and Egypt accepted invitations to join starting on Jan. 1.”, Bloomberg, January 4, 2024

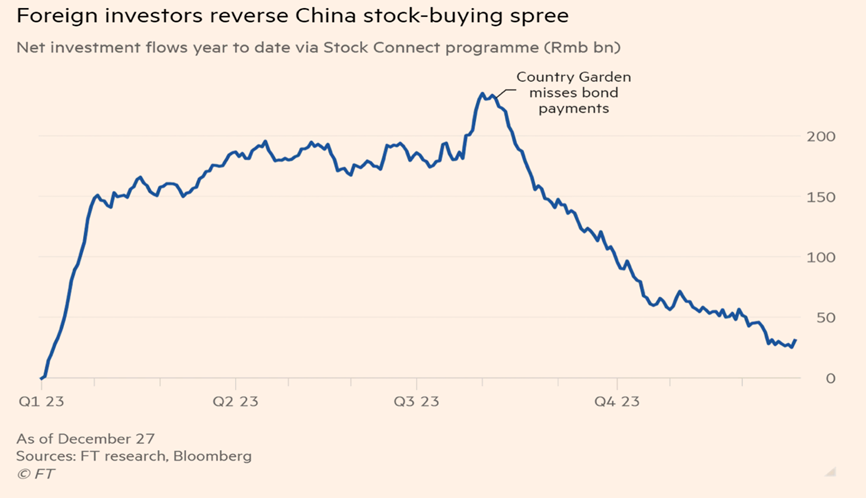

China

“Foreign investors unwind $33bn bet on China growth rebound – Almost 90% of money that flowed into Chinese stocks in 2023 has left amid concern about economy. Since peaking at Rmb235bn ($33bn) in August, net foreign investment in China-listed shares this year has dropped 87 per cent to just Rmb30.7bn, according to Financial Times calculations based on data from Hong Kong’s Stock Connect trading scheme. ‘The confidence issue goes beyond real estate, although real estate is key,’ said Wang Qi, chief investment officer for wealth management at UOB Kay Hian in Hong Kong. ‘I’m referring to consumer confidence, business confidence and investor confidence — both from domestic and foreign investors.’”, The Financial Times, December 27, 2023

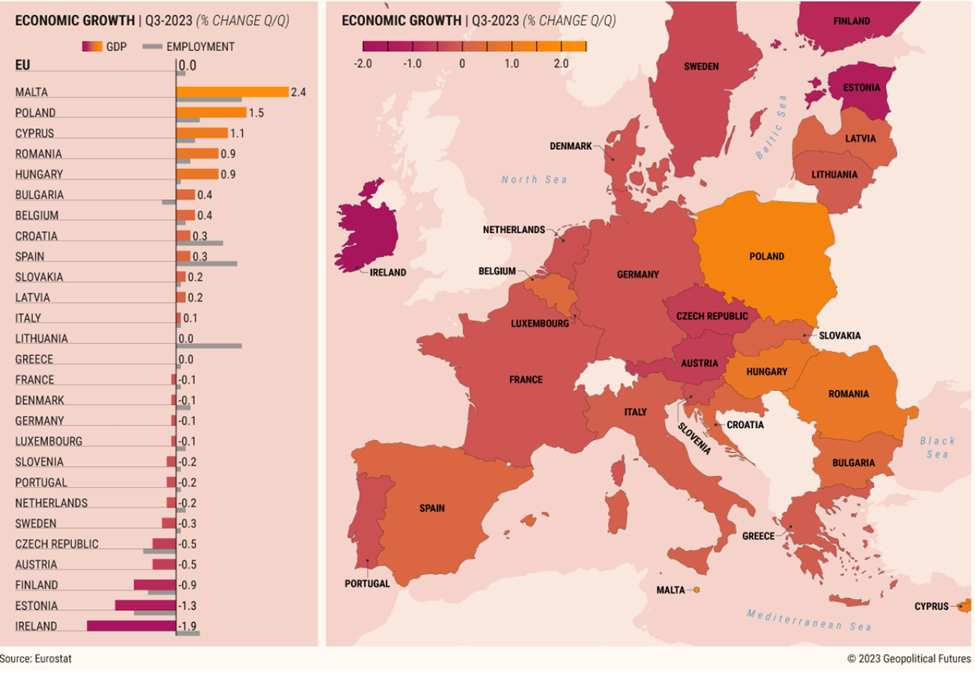

European Union & Eurozone

“EU Economy Is Stable but Stagnant – High and volatile energy costs continue to hold back growth. In the third quarter of 2023, seasonally adjusted gross domestic product remained stable in the European Union compared with the previous quarter, and employment ticked up slightly. Stabilization aside, the EU still faces growth challenges. European industry is unlikely to reach pre-pandemic growth rates anytime soon, as volatile energy prices continue to restrain industrial activity and create distributional conflicts within countries and the bloc as a whole.”, Geopolitical Futures, December 29, 2024

Germany

“German inflation rises to 3.8% in blow to rate-cut hopes – Energy subsidy phaseout pushes up prices in EU’s largest economy ahead of closely watched eurozone figures. The reduction of government subsidies on gas, electricity and food that began last year has triggered a re-acceleration of annual inflation in much of Europe. German energy prices rose 4.1 per cent in the year to December, a reversal from a 4.5 per cent annual decline a month earlier.”, The Financial Times, January 4, 2024

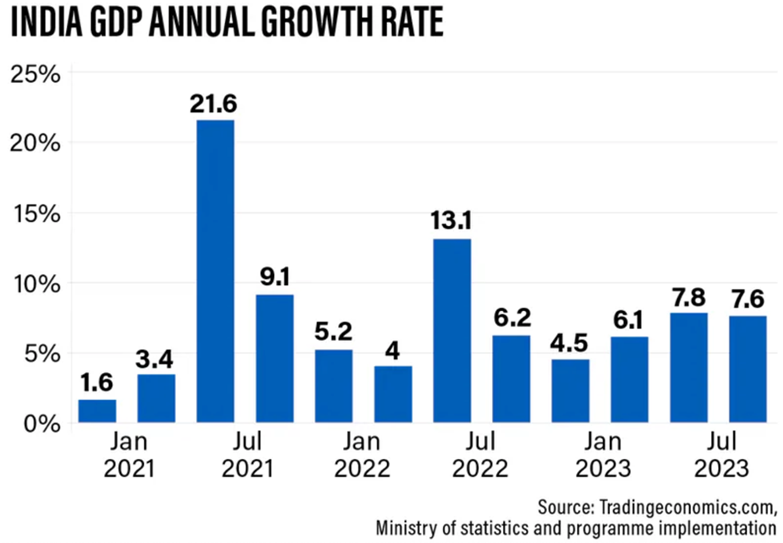

India

“Will India emerge as a global economic powerhouse in 2024? – While there is overall optimism, some economists are sounding a note of caution on the world’s fifth largest economy. Against a backdrop of global economic volatility, coupled with food and oil supply shocks keeping inflation elevated, some may wonder whether India’s growth momentum will continue in 2024. The country, which overtook China to become the world’s most populous nation in 2023 with more than 1.4 billion people, is set to benefit from its young demographic and rising middle class incomes, economists say.”, The National news, December 31, 2024

South Korea

“South Korea Unveils Steps Aimed at Suppressing Inflation Quickly – Authorities to prevent price rigging, freeze utility costs Inflation fight comes ahead of parliamentary elections. The government plans to freeze public utility charges, bolster monitoring of potential price rigging and make it mandatory for businesses to disclose if they are reducing packaged volumes of their products during the first six months of 2024, according to a statement Thursday from the Finance Ministry. The government will also provide about 11 trillion won ($8.4 billion) in support for energy vouchers, food discounts and other programs that could help lower consumer prices, it said.”, Bloomberg, January 3, 2024

Turkey

“Turkish inflation climbs to nearly 65%, with more rises expected – Inflation in the country rose to 64.8% on an annual basis in December, an acceleration from 62% in November. This was slightly below expectations of economists polled by Reuters of 65.1%. Month-on-month inflation cooled to 2.9% from 3.3%. Inflation has been back on the rise since June, but market watchers say this cycle should hit its peak by mid-2024. Murat Ulgen, HSBC’s global head of emerging markets research, said Turkish bonds are in favor among EM investors who see a peak in inflation and stabilizing currency ahead.”, CNBC, January 3, 2024

United Kingdom

“Eight reasons to be cheerful about UK economy – Deutsche Bank predicts falling inflation will mean tax cuts before election. The chancellor is set to benefit from lower inflation, the possibility of interest rate cuts and a reduction in the Bank of England’s bond holdings, all of which will help to reduce the estimated borrowing bill compared with forecasts made by the Office for Budget Responsibility in November.”, The Times of London, January 2, 2024

United States

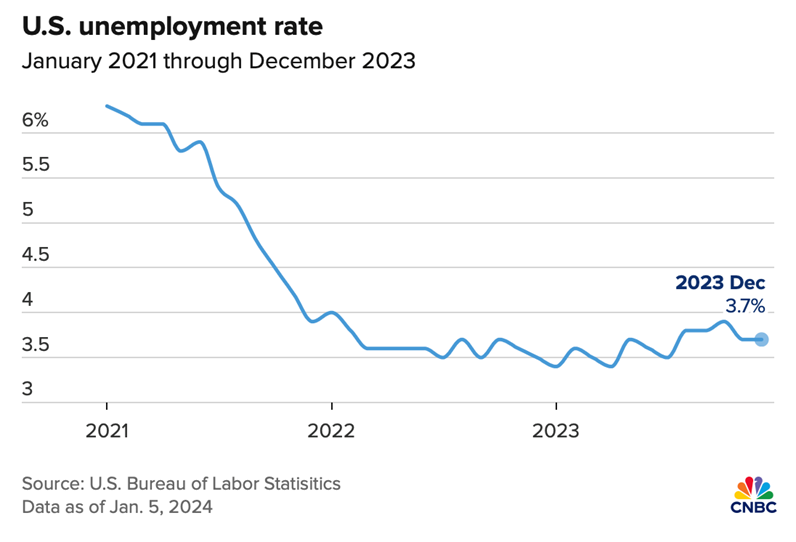

“The 2023 U.S. economy, in a dozen charts – The U.S. labor market ended the year strong, creating more than 200,000 jobs in the last month of the year and nearly 2.7 million jobs in all of 2023, when seasonally adjusted. Consumer spending remained robust throughout the year, with bright spots in travel and entertainment. There were some trouble areas for consumers, however, with mortgage rates high and existing home sales low.”, CNBC, January 7, 2024

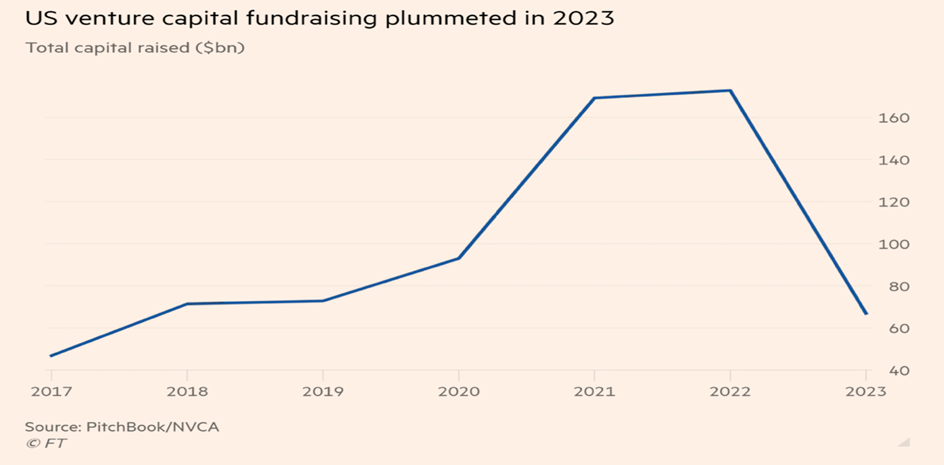

“US venture capital fundraising hits a 6-year low – A 60% decline in 2023 from the year before sends a gloomy signal to funders and the start-ups that rely on them. Globally, in 2023 venture investors raised the lowest level of capital since 2015. The sharp decline ratchets up pressure on start-ups, which have endured a funding drought over the past 18 months.”, The Financial Times, January 5, 2024

Brand & Franchising News

“Chick-fil-A prices surge in recent years, report says – Chick-fil-A prices up 21% in the last two years, data shows. Newsweek compiled data from Food Truck Empire, which said the chicken chain first increased prices for its classic chicken sandwich by 15% in 2022, and a menu-wide 6% increase in January 2023. So what is the cause? Rising costs of ingredients, packaging and transportation due to inflation added to supply disruptions, Aaron Anderson, the CEO and founder of franchise consulting firm Axxeum Partners, told Newsweek.”, Fox Business, January 3, 2024

“Domino’s Pizza expands China franchise with 10 new stores – DPC Dash reaches a milestone with openings in Xiamen, Yangzhou, and other mainland cities. DPC Dash Ltd., Domino’s Pizza’s exclusive franchise operator in China, Hong Kong and Macau, has opened 10 new stores in eight new cities as part of its strategy for expansion. Currently, DPC Dash has opened a combined 175 new stores, leading to over 761 stores in over 29 cities in the Chinese mainland.”, Retail Asia, January 2, 2024

“McDonalds China and Cainiao partner on RFID chips to improve supply chain efficiencies. A trial project of the RFID technology helped reduce the time needed for stocktaking each day from 1 hour to 15 minutes for restaurants. The deal between McDonald’s China and Cainiao comes as the logistics firm prepares for an initial public offering in Hong Kong. Apart from deploying RFID technology to improve efficiency in inventory and logistics, McDonald’s and Cainiao will also explore digitisation and automation technologies in the supply chain, Cainiao said.”, South China Morning Post, January 5, 2024. Compliments of Paul Jones, Jones & Co., Toronto

“Why McDonald’s Ultimately Flopped In Bolivia – If you’ve recently visited the Tibet of the Americas, then you may have noticed there are no golden arches to be seen. That’s because McDonald’s pulled out of Bolivia in 2002, only a few years after it tried to launch in the country. McDonald’s withdrawal from the region marked a rare failure for the company. Locals were going to the thousands of street vendors — largely made up of indigenous women – for their fix of burgers rather than the fast food chain. This led to poor year-on-year sales that caused the restaurant to shut its doors in the country. Part of the blame can be placed on a move away from American influence in the early 2000s to focus on Bolivia’s marginalized natives.”, The Daily Meal, December 30, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

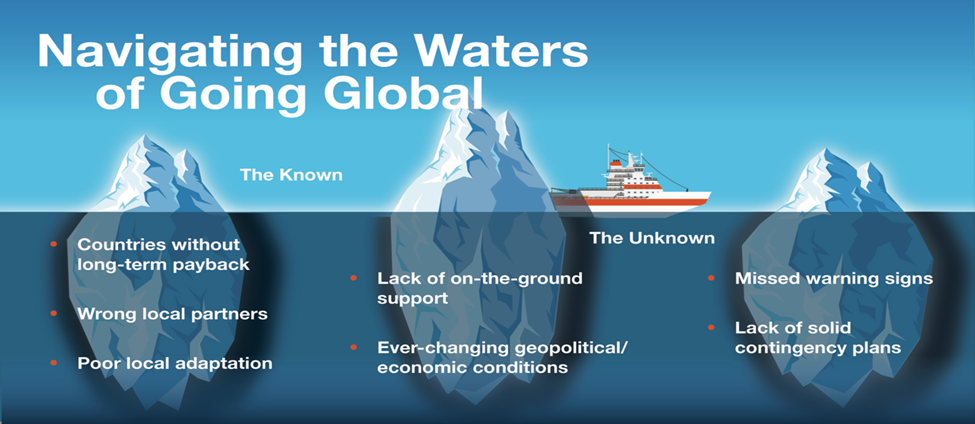

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant taking 40 franchisors global.

For a complimentary 30-minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

And download our latest chart ranking 40+ countries as places to do business at this link: