Biweekly Global Business Newsletter Issue 117, Tuesday, September, 2024

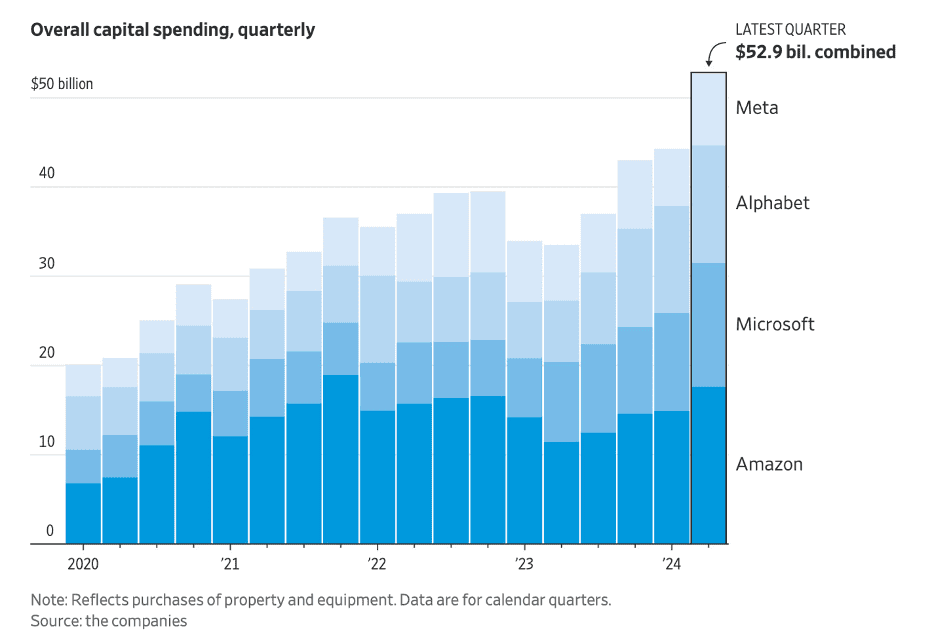

Commentary about the 117th Issue: In some countries people spend more per year on their pets than their kids! Amazon calls almost everyone back to work in offices. Four companies spent US$52.9 billion last quarter alone on property and equipment. Take a look at which countries have minable reserves of the chemicals needed for the switch to renewable energy.

The business book to read now is How the World Ran Out of Everything: Inside the Global Supply Chain” by Peter S. Goodman. The use of coal for energy continues to rise, just ask China. The top 14 largest countries in the Americas by population size have all seen nearly 40% population growth between 1990–2023. US consumer sentiment is rising. And countries are moving up and down in the latest GlobalVue™ country ranking as places to do business.Editor’s Note: You will see small ads in each edition for carefully vetted companies that serve international businesses. Please click on the ads or use the QR code to see what each of our carefully chosen advertisers can do to make doing global business easier.

==========================================================================================

Edited and curated by: William (Bill) Edwards, CEO & Global Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA. Contact Bill with any questions, comments and we welcome contributions.

https://www.linkedin.com/in/williamedwards/

+1 949 375 1896

========================================================================================

The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business. Some of the information sources that we provide links to require a paid subscription for our readers to access.

======================================================================================

First, A Few Words of Wisdom From Others For These Times

“Earth is the cradle of humanity, but one cannot live in a cradle forever.”, Konstantin Tsiolkovsky

“We’d never have got a chance to go outside and look at the earth if it hadn’t been for space exploration and NASA.”, James Lovelock

“The best and most beautiful things in the world cannot be seen or even touched – they must be felt with the heart.”, Helen Keller

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Highlights in issue #117:

- Brand Global News Section: Dominos®, Franchise Update Media, International Franchise Association and Toridoll®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

B2B Payments Platform For Global Businesses

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

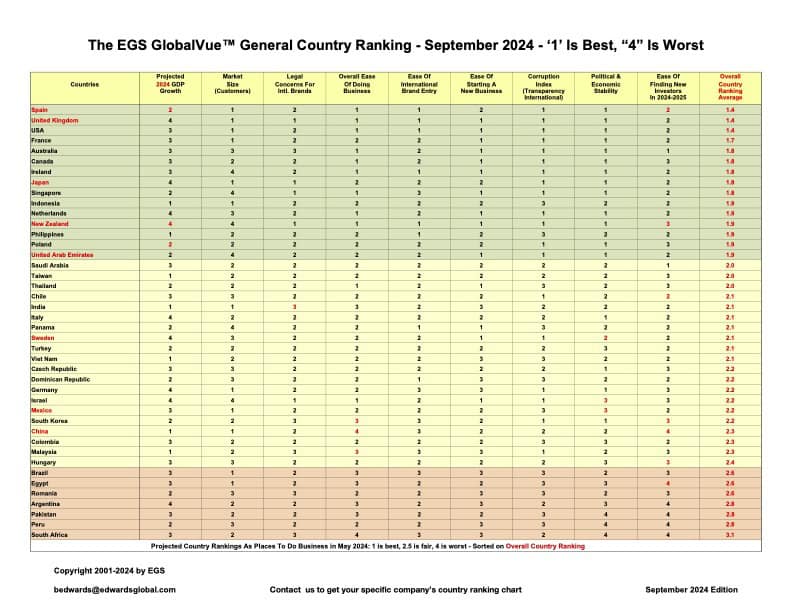

GlobalVue™ – The latest quarterly 40 country ranking as places to do business chart can be downloaded on readable format at: https://edwardsglobal.com/globalvue/. The ranking of countries in red have change substantially since May.

=========================================================================================

“Amazon CEO Vows Leaner Teams Amid Bloat, Ends Work From Home – Company is targeting bureaucracy after ballooning in size Jassy acknowledges RTO policy will require ‘adjustments’. The shakeup, announced in a memo to employees on Monday, echoed what some company veterans have been whispering for years: It’s become harder to get things done at Amazon. Stories of endless deliberation, unnecessary meetings and layers of approval have become commonplace at a company that fashions itself as a collection of teams charged with operating like startups., Bloomberg, September 16, 2024

============================================================================================

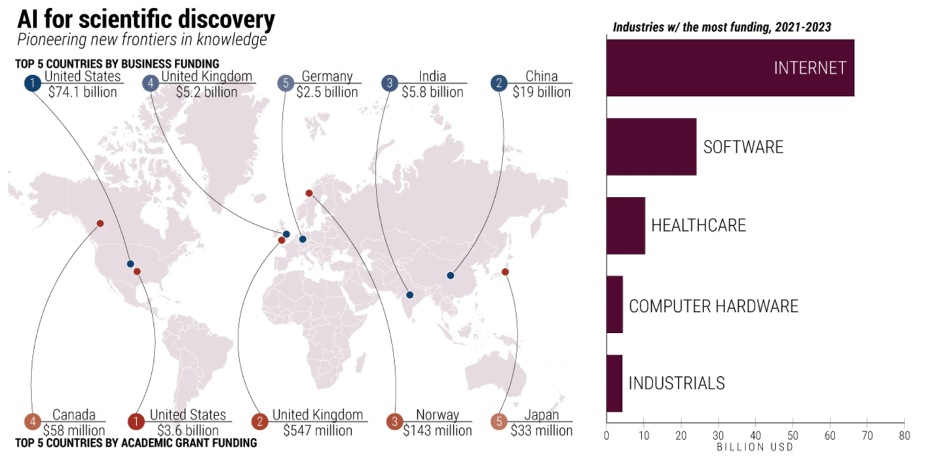

“Emerging Technologies – From the wheel to the internal combustion engine, new technologies have, for better or worse, fundamentally transformed our society. The emerging technologies listed have the potential to do the same. How and when they change the world, however, will depend on the geopolitical competition around their development and execution. Artificial intelligence breakthroughs like deep learning, generative AI and foundation models enable scientists to achieve previously unthinkable discoveries and accelerate scientific progress. Access to massive datasets, particularly via AI, will almost certainly expedite research, discovery and innovation. The biggest players here are the United States, the United Kingdom, Germany, India and China.”, Geopolitical Futures, September 13, 2024

============================================================================================

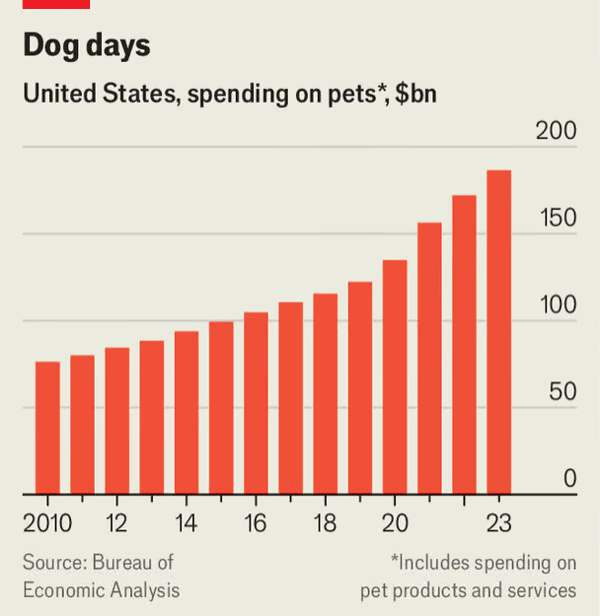

“People are splurging like never before on their pets – Would you buy your furry companion a cologne? There is little, it seems, that people won’t do for their pets. Americans spent $186bn on them last year, according to the Bureau of Economic Analysis, covering everything from food and vet visits to toys and grooming. That is more than they spent on childcare. Spending on pets rocketed through the covid-19 pandemic, as lonely people adopted animals then splurged on them. Between 2019 and 2023 pet spending grew by a compound annual rate of 11%, in nominal terms, compared with 6% for consumer spending overall and 5% for pet spending over the preceding decade. Plenty more growth is yet to come.”, The Economist, September 12, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

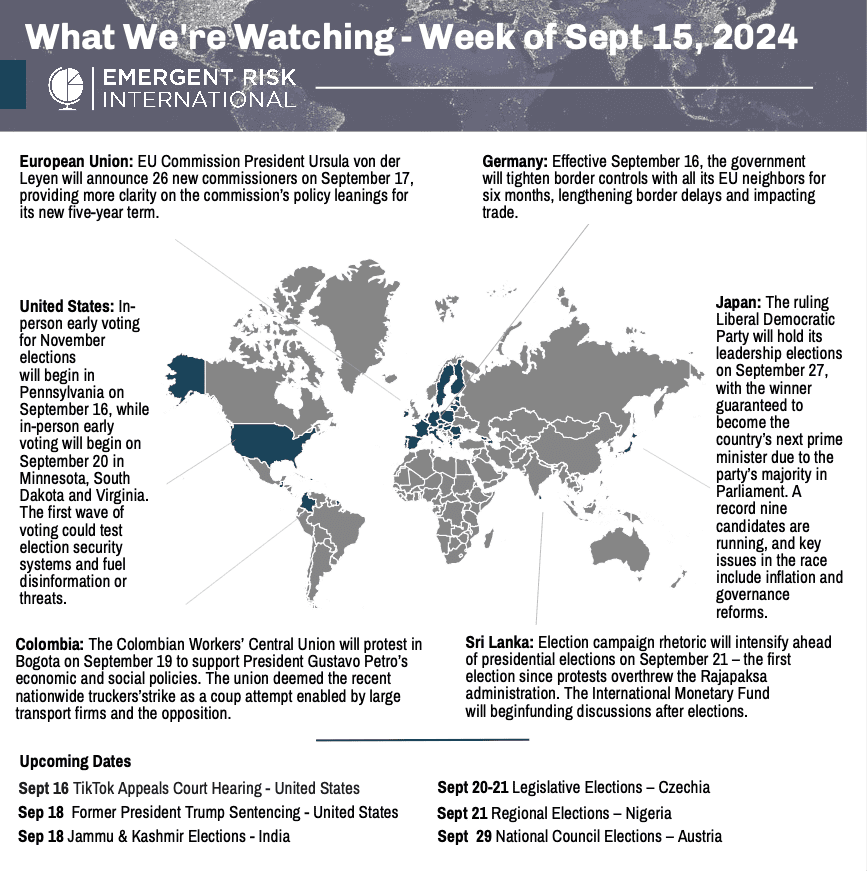

Emergent Risk International – What We’re Watching – Week of Sept 15, 2024. This is an amazing weekly look at global ‘hotspots’ that we recommend subscribing to. Meredith Wilson, Chief Executive Officer & Founder, started Emergent Risk International in 2014. It is one of the most timely sources of trusted global information today.

==============================================================================================

Taking Businesses Global Profitably

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation, Taxes & Trade Issues

“The AI Spending Spree, in Charts – Tech giants and investors are shoveling cash into artificial intelligence amid questions about whether it will pay off. Generative artificial intelligence has sparked one of the biggest spending booms in modern American history, as companies and investors bet hundreds of billions of dollars that the technology will revolutionize the global economy and one day lead to massive profits. The question is when, and even whether, all those investments will pay off. “The risk of underinvesting is dramatically greater than the risk of overinvesting,” Sundar Pichai, chief executive of Google parent Alphabet, said on an earnings call in July. Venture capitalists are similarly betting that at least a few AI startups could one day be worth billions or even trillions, even though most currently aren’t profitable.”, The Wall Street Journal, September 11, 2024

=================================================================================================

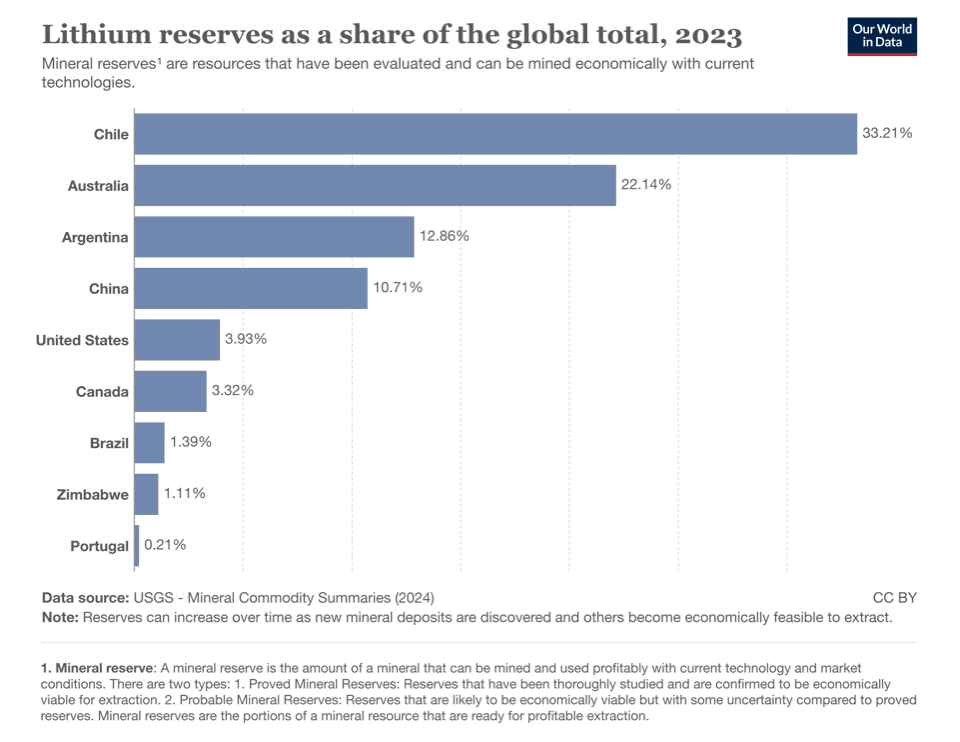

“Which countries have the critical minerals needed for the energy transition? An overview of the distribution of critical minerals for clean energy. The world’s energy system today is mainly powered by fossil fuels. The transition to a low-carbon one will shift its underpinnings away from coal, oil, and gas to the minerals needed for solar, wind, nuclear, batteries, and other technologies. The dynamics of the energy system will shift dramatically. Who currently produces critical minerals such as cobalt, lithium, nickel, and copper? Which countries have reserves that can be mined in the future?”, Our World In Data, September 16, 2024

=============================================================================================

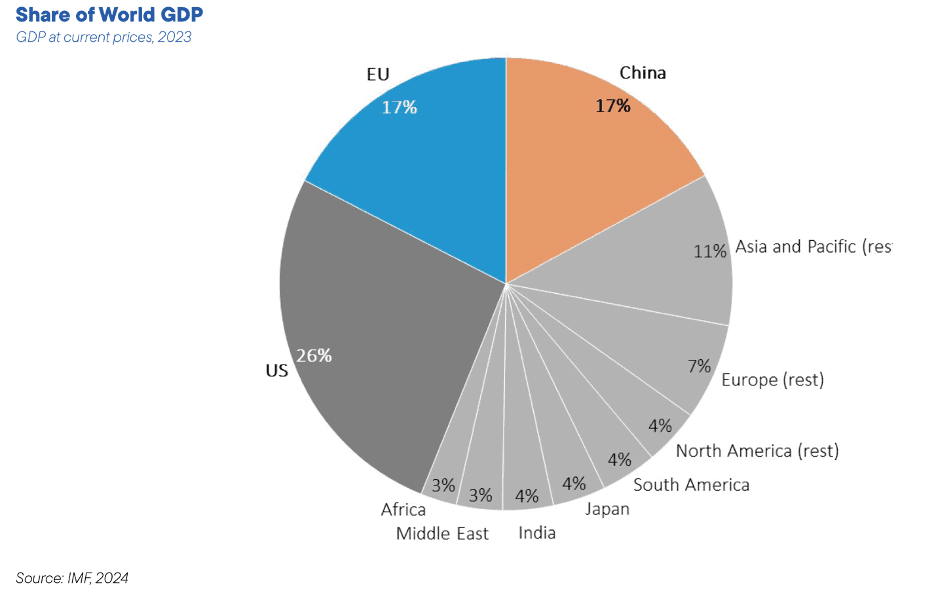

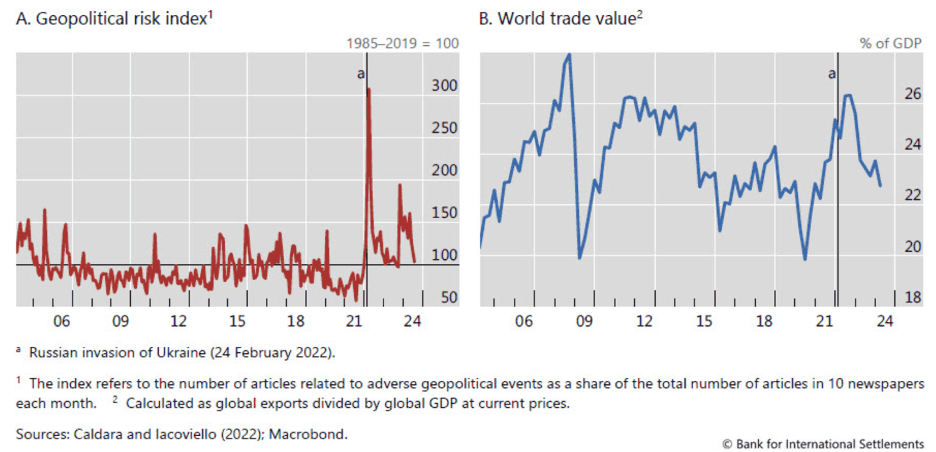

“Deconstructing global trade: the role of geopolitical alignment – The slowdown in global trade, which intensified following Russia’s invasion of Ukraine, has highlighted threats to globalisation. Since the end of the Second World War, the global economy has become increasingly integrated, with trade playing a central role. Increasing integration has been an engine of economic growth, allowing countries to specialise in the goods and services in which they have a comparative advantage. However, rising geopolitical tensions have fuelled concerns about a possible retreat from globalisation, sometimes called “deglobalisation”. As an illustration, a popular measure of geopolitical risk based on press articles displays a noticeable spike around the time of the Russian invasion of Ukraine and has remained elevated thereafter. Meanwhile, the total value of global trade as a share of global GDP peaked soon after the invasion and has declined since.”, Bank of International Settlements, September 16, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Simple, secure currency transfers

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Book Review

One of the key international business books released in 2024 is “How the World Ran Out of Everything: Inside the Global Supply Chain” by Peter S. Goodman. This book provides an in-depth exploration of the vulnerabilities and complexities in global supply chains, particularly in light of recent disruptions, such as the COVID-19 pandemic.

Goodman highlights the intricate paths that products take from factories in Asia to consumers worldwide, revealing the ruthless business practices and financial interests that have left many communities vulnerable. This is an essential read for understanding the fragility and future of global supply chains. By the New York Times’s Global Economics Correspondent, an extraordinary journey to understand the worldwide supply chain—exposing both the fascinating pathways of manufacturing and transportation that bring products to your doorstep, and the ruthless business logic that has left local communities at the mercy of a complex and fragile network for their basic necessities. (Extracted from various sources).

==========================================================================================

Country & Regional Updates

China

“China is suffering from a crisis of confidence – Can anything perk up its economy? According to the National Bureau of Statistics, consumer confidence collapsed in April 2022 when Shanghai and other big cities were locked down to fight the covid-19 pandemic (see chart 1). It has yet to recover. Indeed, confidence declined again in July, according to the latest survey. The figure is so bad it is a wonder the government still releases it. Gloom is not confined to consumers. Foreign companies have long complained about unfair or unpredictable policymaking. Some have declared China “uninvestible” as a consequence. Now their money is running along with their mouths. Foreign direct investment (fdi) in the country slumped to minus $14.8bn in the second quarter of this year, the worst figure on record. Any dollars ploughed in were comfortably outweighed by foreign investors selling stakes, collecting loan repayments or repatriating earnings.”, The Economist, September 5, 2024

==========================================================================================

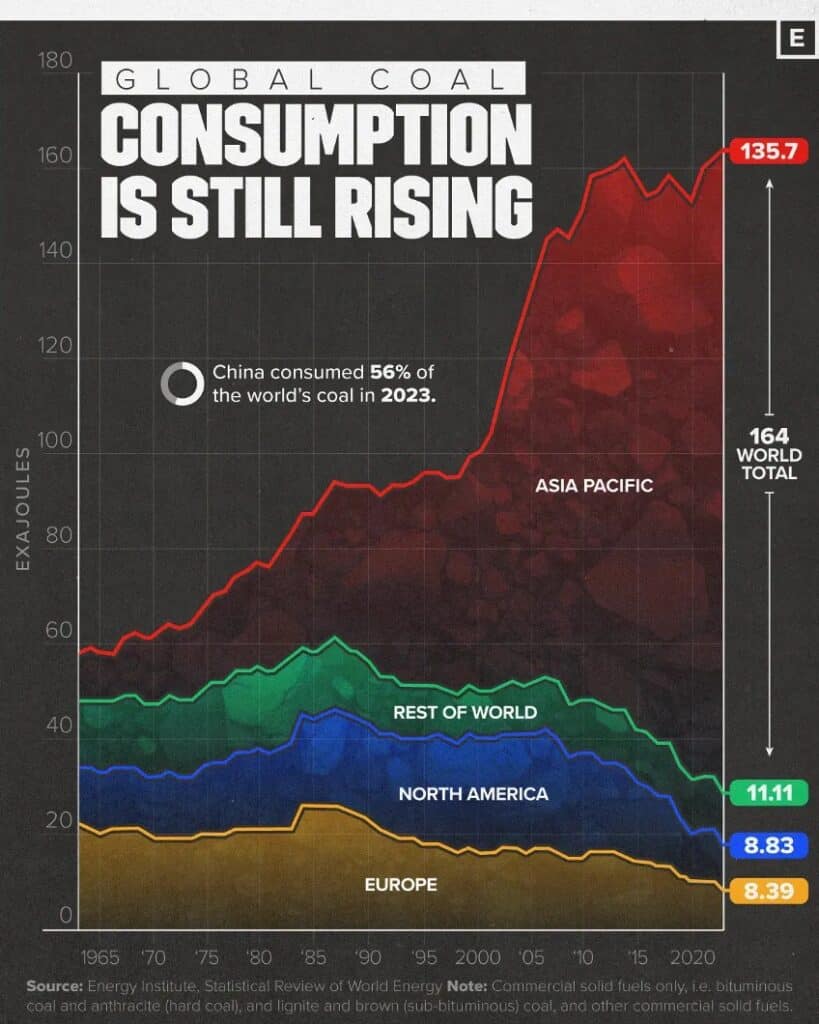

“China’s Energy Needs Keep on Rising – Beginning in the 1990s, rapid industrialization in China led to increased electricity demand for factories and infrastructure. Mass migration to cities and improved living conditions is pushing demand even higher. According to estimates by China’s national statistics department, a 1% increase in the urbanization rate increases total energy consumption by at least 60 million tons of coal.”, Visual Capitalist, August 20, 2024

================================================================================================

European Union Countries

“The Future Of European Competitiveness – Europe has been worrying about slowing growth since the start of this century. Various strategies to raise growth rates have come and gone, but the trend has remained unchanged. On a per capita basis, real disposable income has grown almost twice as much in the US as in the EU since 2000. For most of this period, slowing growth has been seen as an inconvenience but not a calamity. Europe’s exporters managed to capture market shares in faster growing parts of the world, especially Asia. Many more women entered the workforce, lifting the labour contribution to growth. And, after the crises of 2008 to 2012, unemployment steadily fell across Europe, helping to reduce inequality and maintain social welfare. The EU also benefitted from a favourable global environment. World trade burgeoned under multilateral rules. The safety of the US security umbrella freed up defence budgets to spend on other priorities. In a world of stable geopolitics, we had no reason to be concerned about rising dependencies on countries we expected to remain our friends. But the foundations on which we built are now being shaken.”, European Commission, September 2024

==================================================================================================

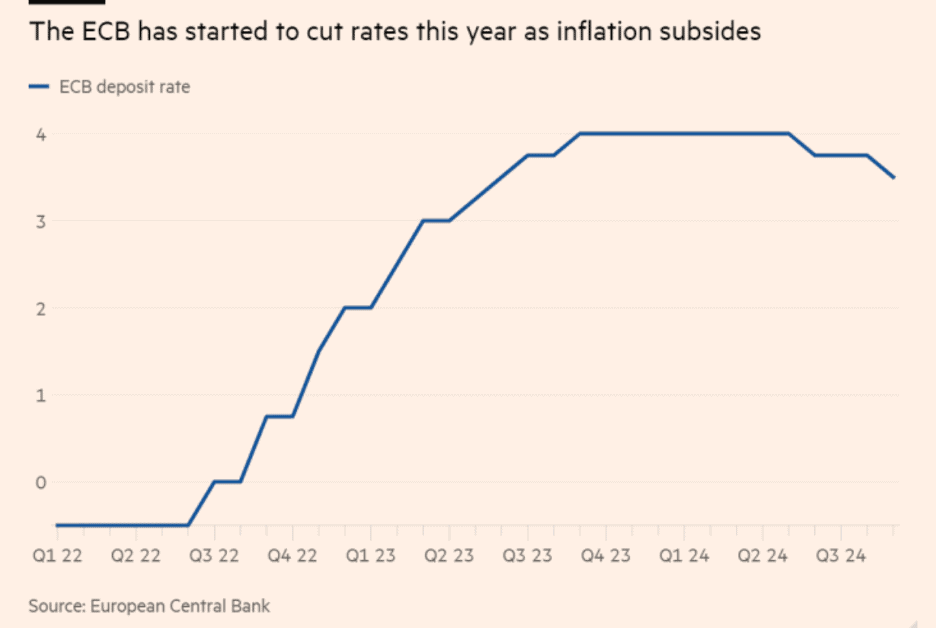

“ECB cuts interest rates to 3.5% – Christine Lagarde says policymakers decided ‘unanimously’ on this year’s second quarter-point reduction. ECB (European Central Bank) president Christine Lagarde said Thursday’s decision to lower the benchmark deposit rate for the second time this year was “unanimously decided” — unlike the previous cut in June, when Austria’s central bank head Robert Holzmann dissented. Major central banks are now lowering rates in response to indications that the biggest inflationary surge for a generation has faded, with the US Federal Reserve expected to start cutting borrowing costs next week. Referring to the ECB’s 2 per cent inflation goal, Lagarde said recent data ‘comforts us in our confidence that we are heading towards our target’.”, The Financial Times, September 12, 2024

=====================================================================================================

Latin America

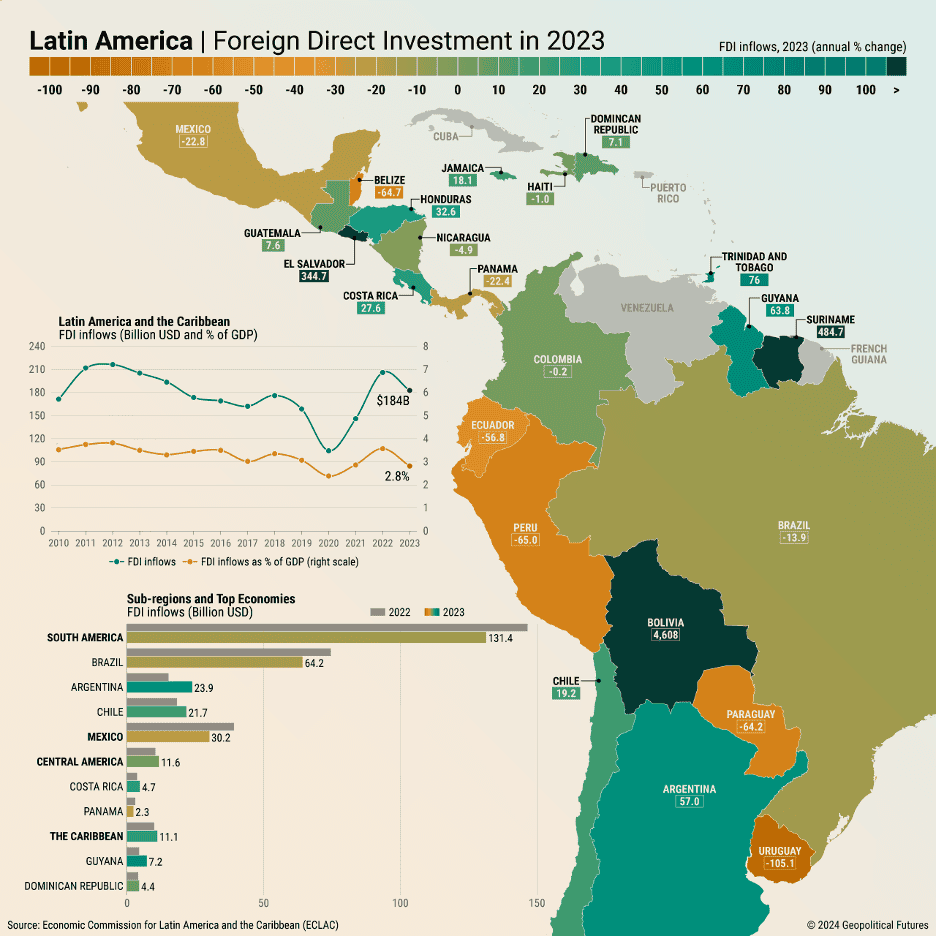

“Foreign Investment Trends in Latin America – Latin American countries remain trapped in a low-growth environment, hindered by economic volatility, high inequality and ineffective governance. As a result, many governments in the region are turning to foreign direct investment to spur growth. However, FDI fell by 9.9 percent last year to $184.3 billion. While mergers and acquisitions increased by 15 percent, their total value decreased by 13 percent. FDI is concentrated in a few countries. Brazil attracted 35 percent of the region’s FDI last year, followed by Mexico with 16 percent. Argentina, boosted by the new government of President Javier Milei, came in third with 13 percent, while Chile and Colombia secured 12 percent and 9 percent, respectively. The U.S. remains the largest investor in the region, with the European Union driving mergers and acquisitions. The EU showed the largest increase in FDI from 2022 to 2023, followed by Canada. China remains active but has diminished its investment role compared to a decade ago.”, Geopolitical Futures, September 6, 2024

===================================================================================================

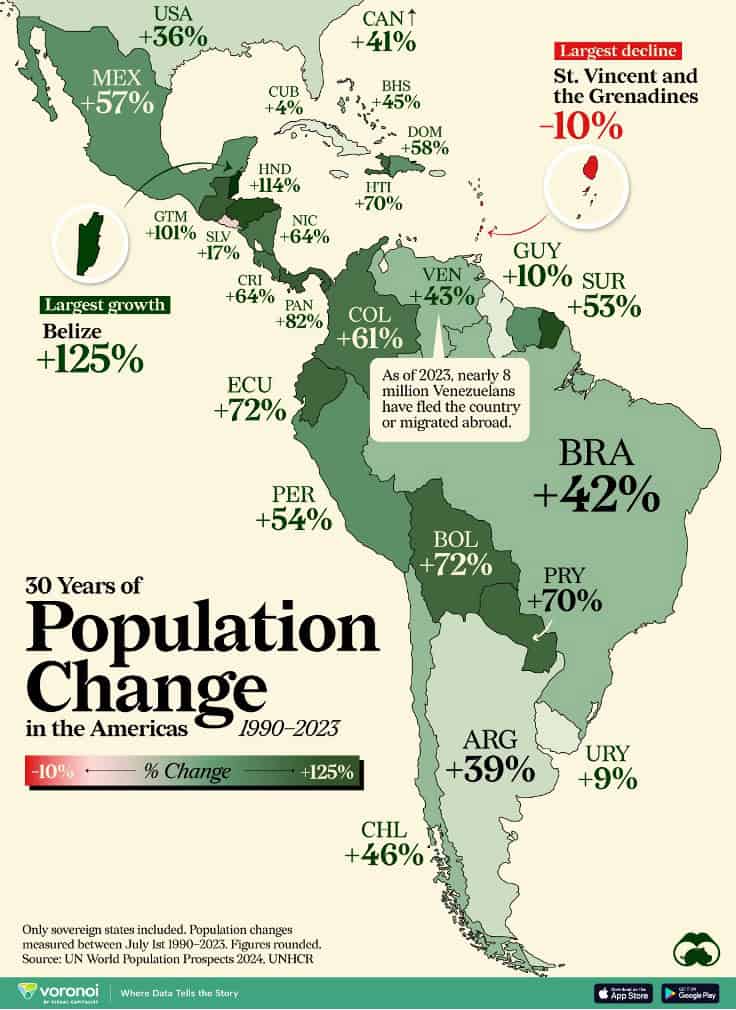

“How Populations Have Changed in the Americas (1990-2023) – Currently more than one billion people live in the Americas, an area with 35 countries and many overseas territories and dependencies. This color-coded map shows population changes by country in the Americas from 1990 to 2023. Data was sourced from the 2024 World Population Prospects from the UN. The top 14 largest countries in the Americas by population size have all seen nearly 40% population growth between 1990–2023.”, Visual Capitalist, September 5, 2024

=====================================================================================================

Southeast Asia

“As cheap Chinese imports flood Southeast Asia, industries struggle to stay afloat – Local industries – from Thailand’s truckers to Malaysia’s retailers – are feeling the squeeze from low-cost Chinese goods. Half of the ceramics factories in Thailand’s northern Lampang province have closed. In Indonesia, thousands of textile workers have lost their jobs. Malaysia’s manufacturers, meanwhile, say the government’s attempt at stemming the tide – a meagre 10 per cent tax on e-commerce – has done little to shield them from the deluge. The flood of Chinese goods has been aided by the world’s largest e-commerce market, as well as new railways and upgraded ports that streamline logistics. An intricate web of free trade agreements – from the Asean Free Trade Area to the Regional Comprehensive Economic Partnership – further paves the way for Chinese products to penetrate local markets.”, South China Morning Post, September 7, 2024

============================================================================================

United States

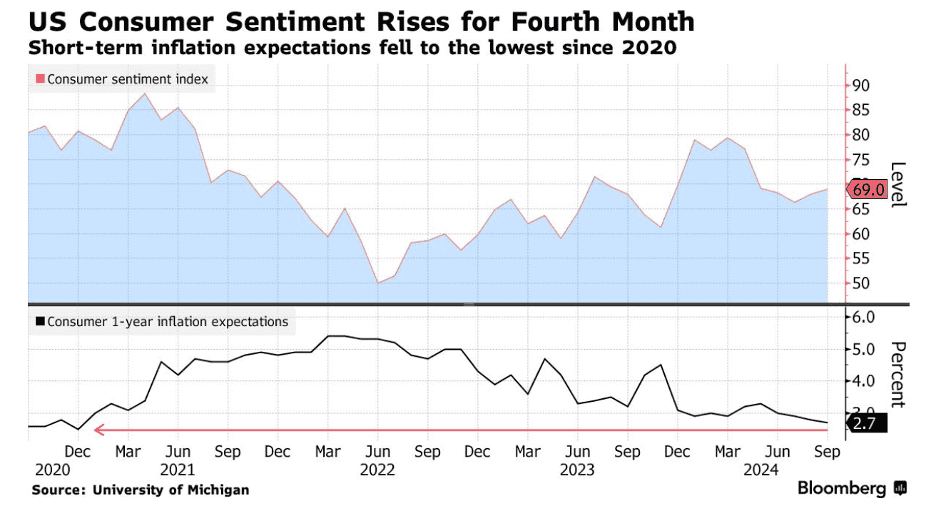

“US Consumer Sentiment Rises as Inflation Expectations Retreat – University of Michigan sentiment index increased to 69 Short-term inflation views fell to 2.7%, lowest since 2020. US consumer sentiment rose to a four-month high in early September, helped by the tamest short-term inflation expectations since the end of 2020 and prospects for lower borrowing costs. Consumers expect prices to rise at an annual rate of 2.7% over the next year compared with the 2.8% expected a month earlier. That represented a fourth month of declining short-term inflation expectations.”, Bloomberg, September 13, 2024

================================================================================================

The Franchise Consortium’s Franchise Supplier Accreditation Is Coming

===============================================================================================

Brand & Franchising News

“Domino’s announces plans to hire 5,000 workers ahead of the festive season in Britain and Ireland – Domino’s plans to hire new staff in a variety roles from new delivery drivers to in-store team members and pizza makers. Over Christmas the company sees a marked increase in demand and the period represents a crucial trading period for companies like Domino’s Pizza. The driving force to ramp up staffing to ensure smooth service for customers.”, The Daily Mail, September 15, 2024

=============================================================================================

“IFA to Acquire Multi-Unit Franchising Conference Owner Franchise Update Media – The International Franchise Association will expand its events and media holdings with the acquisition of Franchise Update Media. In a deal set to close by the end of the year, the purchase will put the Multi-Unit Franchising Conference and Multi-Unit Franchisee Magazine, along with numerous franchise education, franchise opportunity and market resource products, under the IFA umbrella. ‘We’re trying to grow as an organization, and this is a lot better way to grow than starting something new and competing with what’s already established,’ said IFA President and CEO Matt Haller as he noted the association is in a strong financial position to make the investment.”, Franchise Times, September 13, 2024

============================================================================================

“Meet The Japanese Noodle Billionaire Taking On McDonald’s And KFC – Takaya Awata parlayed a tiny local diner into quick-service giant Toridoll Holdings. Now he wants to taste global success. When Takaya Awata used his meager savings to open a small restaurant in Kakogawa, a coastal city off Japan’s Seto Inland Sea, the then-23-year-old named it Toridoll Sanban-kan, or Toridoll store No. 3. It was a promise to himself that stores number one and two were only a matter of time and he would soon achieve his modest goal of owning three restaurants. Four decades later, Awata’s Tokyo-listed Toridoll Holdings has a network of nearly 2,000 quick-service restaurants across 28 countries and regions covering 21 brands. The flagship is Marugame Seimen, Japan’s largest udon noodle chain by both revenue and store count. The entrepreneur’s fast-food success has made him a billionaire and honed his ambitions.”, Forbes, September 8, 2024 per cent to $7.9 million and US network sales surged 81.8 per cent to $10.8 million.”, Inside Retail AU, August 27, 2024

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive our biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com

================================================================================================

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing business environment. And our GlobalTeam™ on the ground covering 25+ countries provide us with updates about what is actually happening in their specific countries. We do not get involved in or report on politics!

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe, and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant since 2001 taking 40+ franchisors global.

| To receive this biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com ++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++ |

Our latest GlobalVue™ 40 country ranking

For a complimentary 30-minute consultation on how to take your business into new countries and make money doing it. For a complimentary call with Bill Edwards click on the QR code or contact Bill at bedwards@edwardsglobal.com and +1 949 375 1896