Biweekly Global Business Newsletter Issue 118, Tuesday, October 1, 2024

How Hello Kitty Took Over The World – 50 Years Ago!

Commentary about the 118th Issue: China releases a ‘shock and awe’ economic package. Chick-fil-a® reenters the United Kingdom and Slim Chickens® enters Germany. The world’s superpower(s)? Inflation continues to fall in European countries. The immense energy needs to train a new AI bot. Wisdom from Abraham Lincoln, Jeff Bezos and Vidal Sassion (really!). Nearshoring in Central Europe. G7 government debt projections.

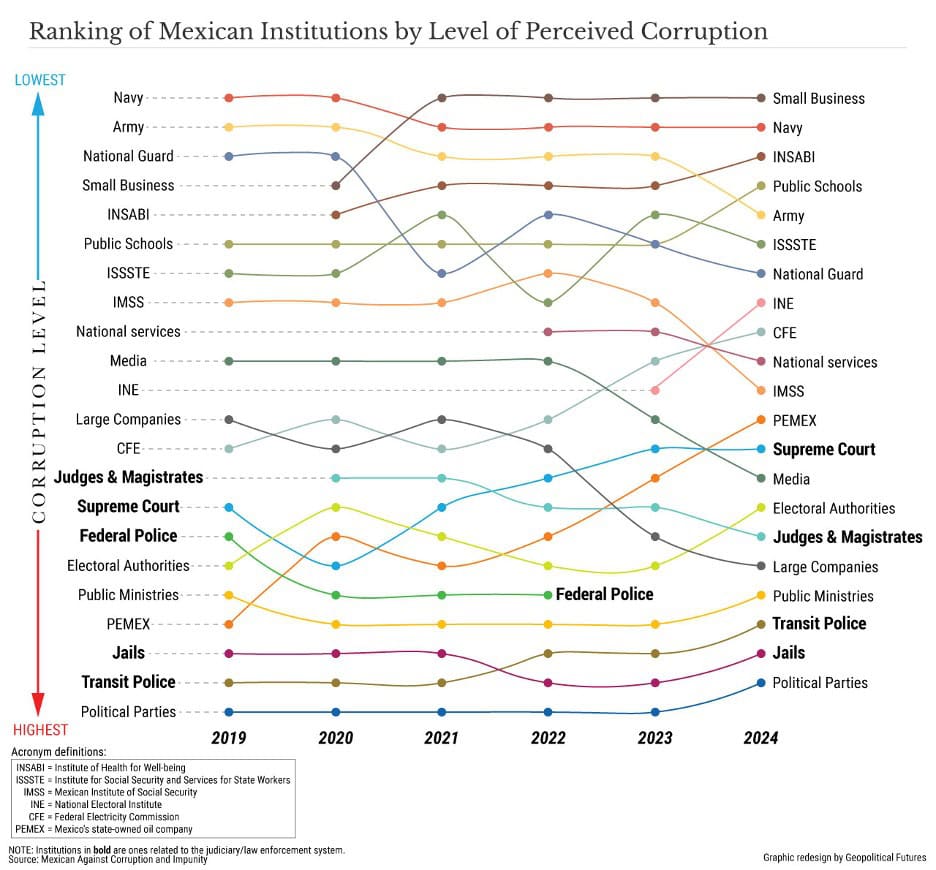

An amazing chart showing the progression of corruption in Mexican companies and institutions is in this edition. In 2022, China’s population shrank for the first time since 1961. How Hello Kitty Took Over the World 50 years ago! And…..women are beginning to leave men behind.

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Editor’s Note: You will see small ads in each edition for carefully vetted companies that serve international businesses. These small, focused, vetted ads are in place of charging subscriptions to our readers. Please click on the ads or use the QR code to see what each of our carefully chosen advertisers can do to make doing global business easier.

===========================================================================================

Edited and curated by: William (Bill) Edwards, CEO & Global Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA. Contact Bill with any questions, comments and we welcome contributions.

https://www.linkedin.com/in/williamedwards/

+1 949 375 1896

========================================================================================

The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business. Some of the information sources that we provide links to require a paid subscription for our readers to access.

======================================================================================

First, A Few Words of Wisdom From Others For These Times

“Whatever you are, be a good one.”, Abraham Lincoln

“If you can’t feed a team with two pizzas, it’s too large.”, Jeff Bezos

“The only place where success comes before work is in the dictionary.”, Vidal Sassoon

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Highlights in issue #118:

- Brand Global News Section: Chick-fil-a®, Hello Kitty® and Slim Chickens®

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

B2B Payments Platform For Global Businesses

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

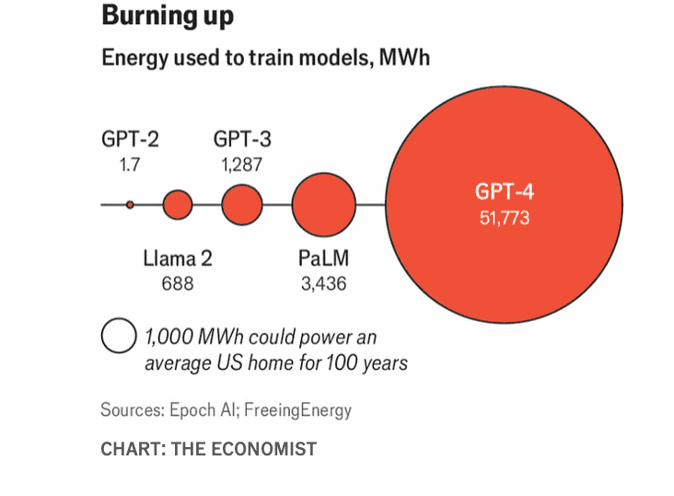

Interesting Data, Articles and Studies

“The end of Moore’s law will not slow the pace of change – Semiconductors are likely to continue their transformational role. In the past 50 years, processors have come to operate tens of thousands of times faster and store a million times more data in the same area. The cost of a transistor has also fallen by a factor of a billion, making technology a global deflationary force. They are also ubiquitous: semiconductors are now the third-most traded commodity in the world by value, after oil and cars. A single Blackwell chip, Nvidia’s latest, runs five times faster than its predecessor, but uses 70% more power in the process. Data centres lash hundreds or thousands of these power-hungry chips together to run large artificial-intelligence (ai) models. By some estimates, Openai, maker of Chatgpt, guzzled more than 50 gigawatt-hours of electricity to train its latest model (see chart). The International Energy Agency calculates that in 2022 data centres consumed 460 terawatt-hours, or almost 2% of global electricity demand. The agency expects this figure to double by 2026.”, The Economist, September 16, 2024

==========================================================================================

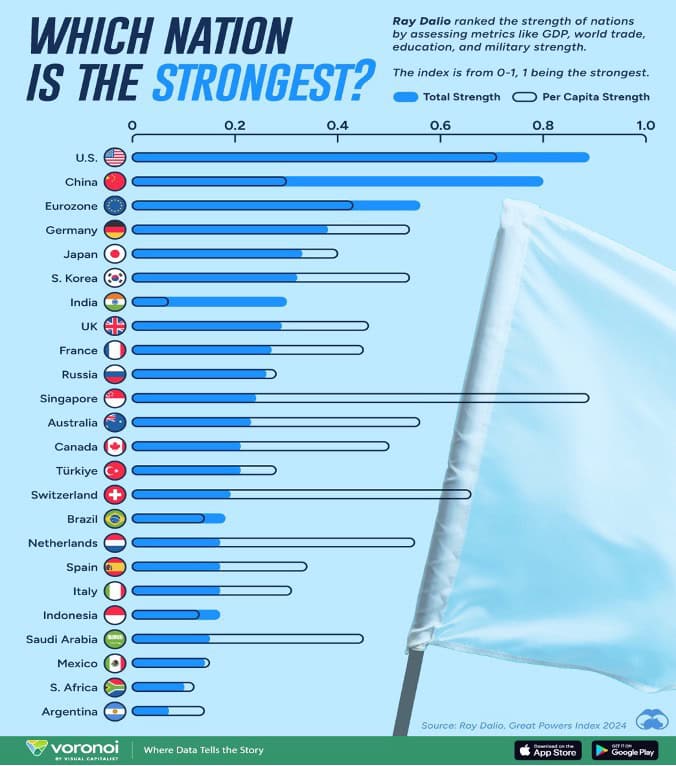

“World’s Biggest Superpowers in 2024 – The global economic order is stitched together by trade and economic collaboration, but these show signs of fraying. With nationalism on the rise and cross-border trade flows stagnating, economies are growing more protectionist. At the same time, demographic shifts are driving economic growth and productivity in India and Asia, which could shift the global power balance. This graphic ranks world superpowers in 2024, based on analysis from Ray Dalio’s Great Powers Index 2024. (This chart shows) the total strength of world superpowers, based on a wide range of metrics including economic output, military strength, and trade. Additionally, we show per capita strength, indicating a country’s efficiency relative to its population. Visual Capitalist & Ray Dalio, September 24, 2024

============================================================================================

“We spent nearly a year building a generative AI tool. These are the 5 (hard) lessons we learned. McKinsey built an AI tool called Lilli to bring sources and capabilities into one platform to improve workflows. Say hello to “Lilli,” the gen AI tool launched in August 2023. Named after Lillian Dombrowski, the first professional woman hired by McKinsey in 1945, our goal was to aggregate McKinsey’s 40-plus sources and capabilities into a single platform. This would allow teams around the world to readily access McKinsey’s knowledge, generate insights, and thus help clients. Technological change is inherently difficult. For any organization, incorporating gen AI will probably feature such difficulties. That said, it is possible to benefit from experience. Looking back on our 11-month effort, here are five principles we learned—sometimes the hard way.”, Fast Company, June 11, 2024

===========================================================================================

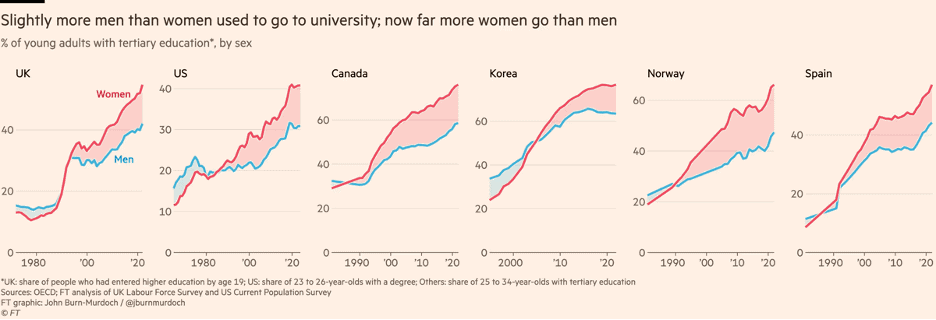

“Young women are starting to leave men behind – Men’s education deficit is increasingly becoming an employment, earnings and outcomes gap, with significant repercussions. Across the developed world, girls and young women have been pulling ahead of boys and young men in education for several decades, with much larger proportions going on to attend university than their male counterparts. Much less appreciated than the widening tertiary education gap is the fact that in several rich countries young women are now more likely to be in work than young men.”, The Financial Times, September 19, 2024

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Simple, secure currency transfers

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation, Taxes & Trade Issues

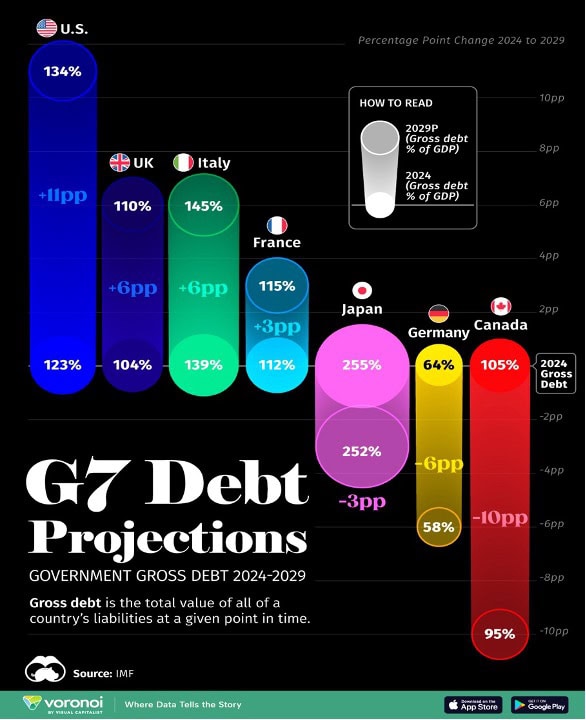

“Government Debt Projections for G7 Countries (2024-2029F) – This graphic uses data from the International Monetary Fund’s (IMF) April 2024 edition of the World Economic Outlook to show how the U.S. stacks up against its G7 counterparts in terms of projected gross debt as a percentage of GDP in 2024, and how debt is forecasted to change by 2029. Gross debt is the total value of all of a country’s liabilities at a given point in time. Net debt is gross debt less a country’s financial assets, including cash reserves or investments. The debt figures in this infographic are of government debt, and don’t include public sector debt from provincial or state-level debt. While this reduction in rates will help reduce debt-servicing costs, the U.S. is still projected to see the biggest increase in its gross debt of all G7 nations over the next five years.” Visual Capitalist & IMF, September 25, 2024

=================================================================================================

“The hard stuff: Navigating the physical realities of the energy transition – The energy transition is in its early stages, with about 10 percent of required deployment of low-emissions technologies by 2050 achieved in most areas. What challenges lie ahead? About half of energy-related CO2 emissions reduction depends on addressing the most demanding physical challenges. For all its advantages, today’s system also has critical flaws. About two-thirds of energy is currently wasted. And the system generates more than 85 percent of global emissions of carbon dioxide (CO2).”, McKinsey, August 14, 2024

Editor’s Note: This article by McKinsey is very dense but very detailed about the challenges faced by many industries and countries to make the transition to renewable energy worldwide.

=========================================================================================

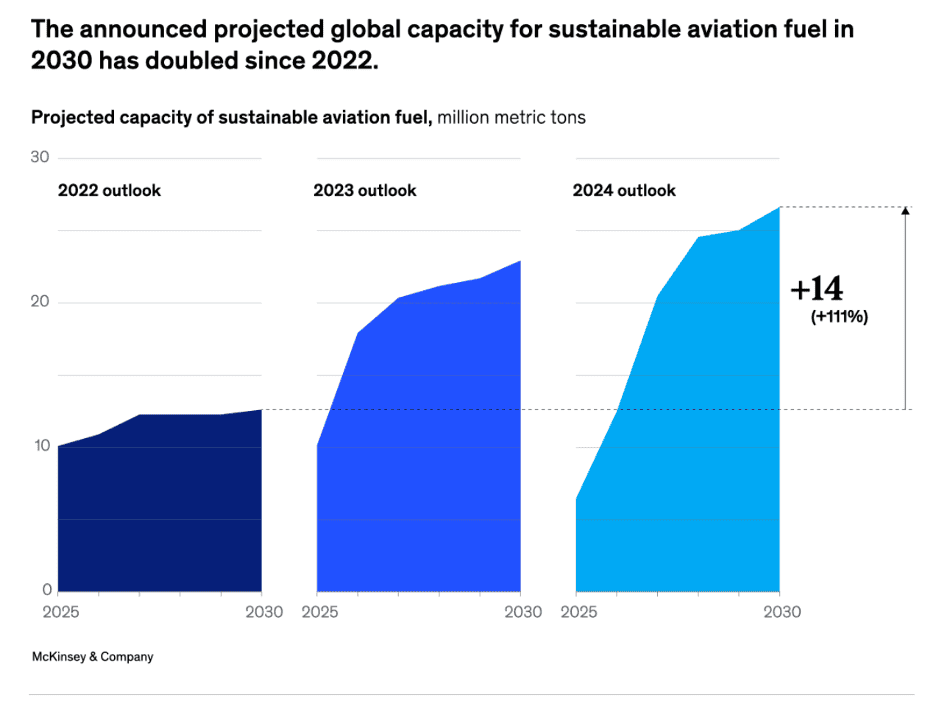

“Sustainable fuel flies higher – Global projections for sustainable aviation fuel capacity in 2030 have increased significantly since 2022. According to partner Axel Esqué and coauthors, the projected 2030 volume has doubled, from seven million metric tons in 2022 to 14 million metric tons this year. Although the 2030 projection is now higher, the amount of fuel expected to be available in the near future has decreased since last year’s projection.”, McKinsey, September 26, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel

“Everything you need to know about EES, the new EU visa scheme – With the new Entry/Exit System (EES) launching in November, following by the long-delayed visa waiver next year, we take a look at what it means for travellers. It will mean anyone travelling to and from most European countries without an EU passport will need to have their biometrics — fingerprints and photograph — captured and then checked on every visit. There are fears of queues in terminals and at ports as the rules come into force. It will add two to three minutes of processing time per passenger, up from about 45 seconds at present. The scheme will be adopted by 29 countries, including all EU members bar Cyprus and Ireland. It will also be in force in Iceland, Liechtenstein, Norway and Switzerland. People with passports issued by any of these countries — including Cyprus and Ireland — will be exempt.”, National Geographic Traveler, September 20, 2024

==============================================================================================

Book Review

“Generative AI in Practice” by Bernard Marr (2024) is a timely and accessible guide for professionals and business leaders looking to understand how generative AI can be applied across various industries. Marr does an excellent job of breaking down complex AI concepts into practical insights that are easy to grasp, even for those without a technical background. One of the key strengths of this book is its real-world examples, which provide readers with concrete illustrations of how generative AI can drive business innovation. Whether it’s automating creative processes like writing and design or improving product development through AI-generated simulations, Marr shows how AI is more than just a trend—it’s reshaping industries.

Marr doesn’t shy away from discussing the risks of generative AI, such as job displacement, biased outputs, and the potential for misuse. He emphasizes the need for responsible AI implementation, making this book not just a technical guide but also a thoughtful exploration of the societal impact of AI.

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Keith Gerson and Bill Edwards Join Forces To Offer Trusted Suppliers To The Franchise Community

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Central & Eastern Europe (CEE)

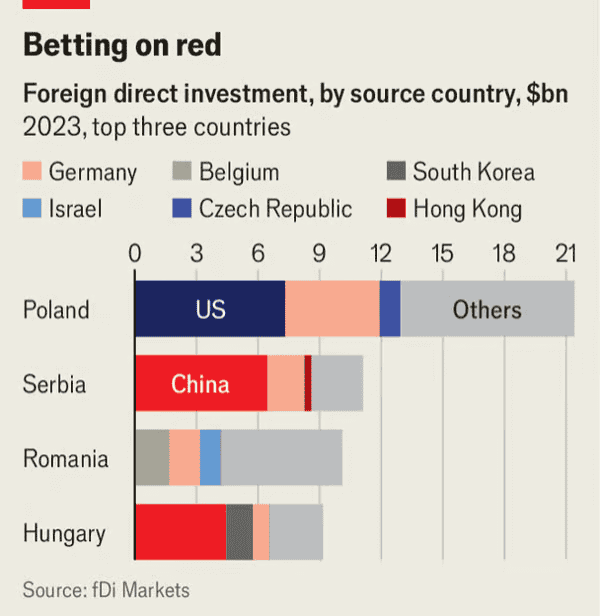

“Near-shoring is turning eastern Europe into the new China – With firms moving production closer to market, CEE is the place to be. cee countries are benefiting from firms shifting production closer to the European market (near-shoring) or to places considered politically reliable (friend-shoring), as well as old-fashioned offshoring for lower costs. There are three reasons to expect more investment into the region. The first is the global transition to climate neutrality. The second reason is Chinese overcapacity. Finally, tension between America and China, with Europe in between, can disrupt supply chains. This is why firms have started to bring production closer to markets (near-shoring).”, The Economist, September 19, 2024

=============================================================================================

China

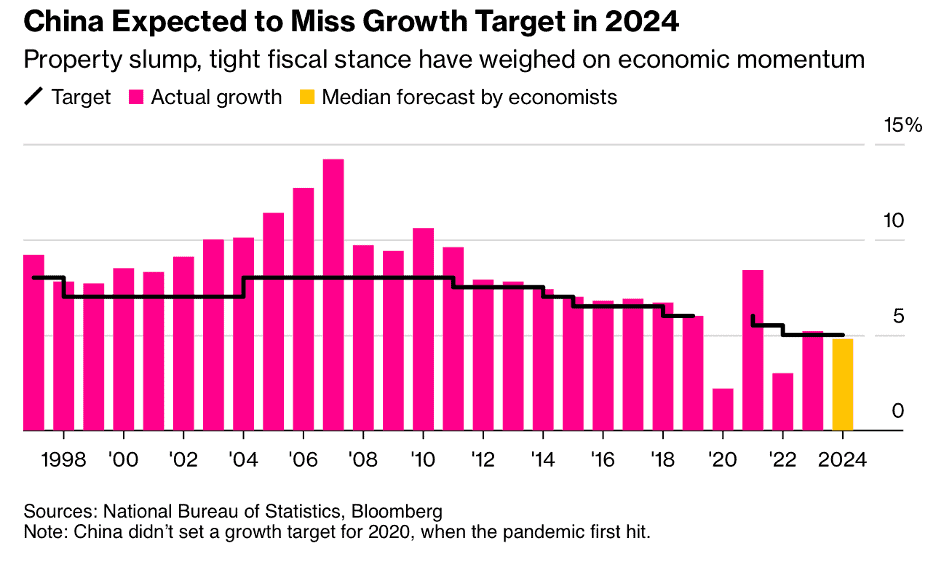

“China’s Shock-and-Awe Package Misses Key Element: Fiscal Policy – It probably says more about China’s lack of policy stimulus to date that the package of monetary measures announced Tuesday amounted to the strongest set of steps seen in years. The production “speaks to the urgency felt in Beijing to head off deflationary risks and get growth on track for the 5% target” for 2024, Chang Shu and Eric Zhu of Bloomberg Economics wrote. The team’s SHOK model indicates a boost of as much as about 1% of GDP over the coming year. But at the end of the day it’s a “growth boost,” not an “economy fix,” Shu and Zhu wrote.”, Bloomberg, September 25, 2024

=========================================================================================

“China’s Silver Economy Is Thriving as Birthrate Plunges – The shrinking population poses threats to growth but has opened opportunities for businesses that serve seniors. Schools for children have been turned into education centers offering activities for seniors like singing, dancing and art classes. China’s aging society is expected to deplete the vigor and vitality of the world’s second-largest economy in the coming decades. But the adverse effects of demographic change are already apparent for Chinese businesses that cater to children. Dairy companies that produced formula for China’s infants are now developing powdered milks for seniors. Proprietors of preschools and kindergartens are closing those facilities to start senior care centers. A technology firm that made devices for parents to track their young children is now designing products allowing grown children to keep tabs on their aging mothers and fathers.

In 2022, China’s population shrank for the first time since 1961. Deaths outnumbered births again last year, and the number of 60-year-olds topped 290 million, or one in every five Chinese people.”, The New York Times, September 20, 2024. Compliments of Paul Jones, Jones & Co., Toronto

==============================================================================================

Europe & European Union Countries

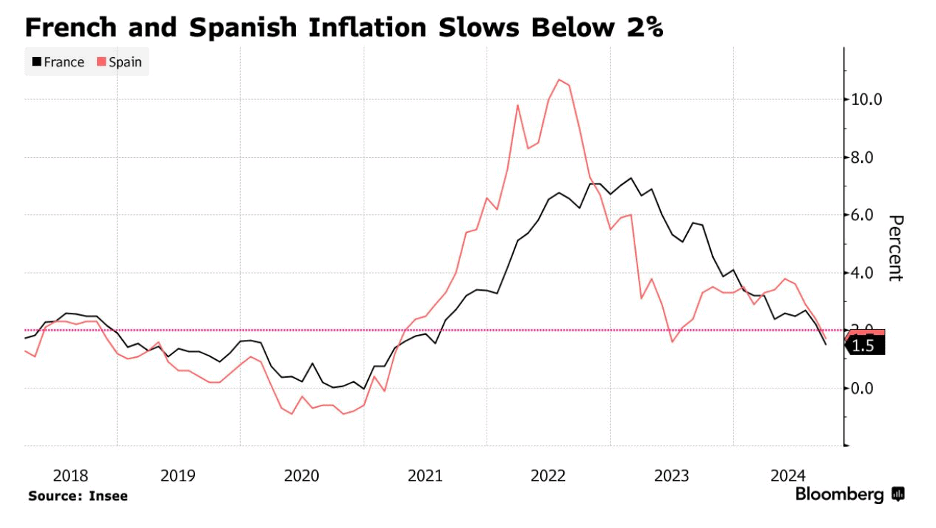

“ECB Rate-Cut Bets Jump as France, Spain Inflation Sinks Below 2% – Prices rose 1.5% in France in September, 1.7% in Spain. Markets now see 80% chance of rates being lowered in October. Inflation in France and Spain plunged below 2% — fueling predictions by investors and economists that the European Central Bank will speed up the pace of interest-rate cuts.”, Bloomberg, September 26, 2024

==========================================================================================

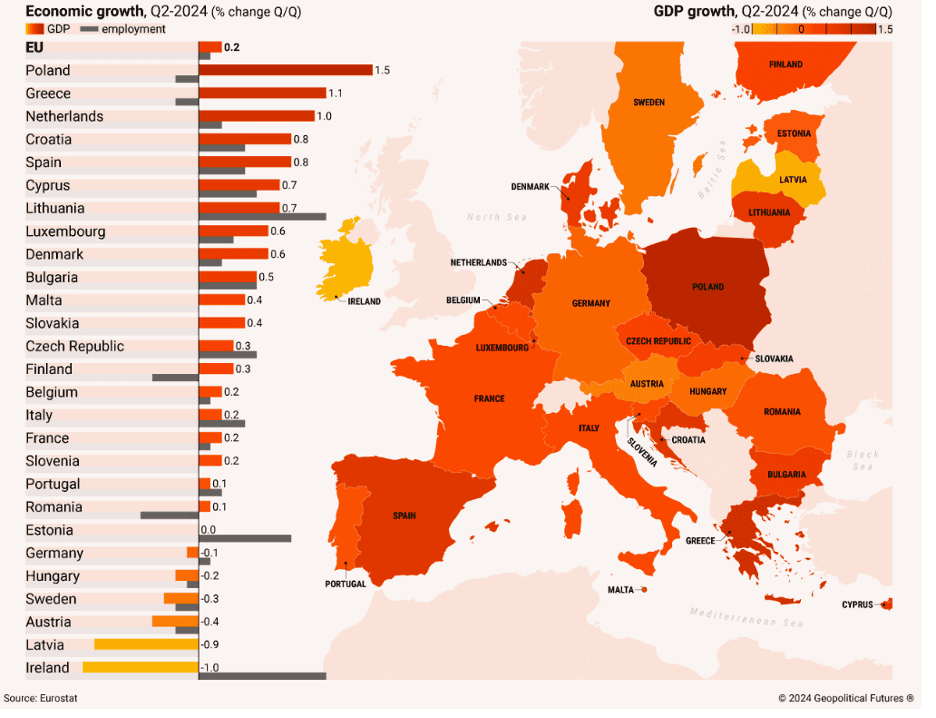

“No End in Sight for Europe’s Sluggish Economy – The European Union’s economic growth rate slowed in the second quarter, though the bloc’s gross domestic product was 0.2 percent higher compared with the previous three-month period. The EU’s largest economies showed very modest growth, with Germany, traditionally the region’s economic driver, even posting negative figures. This confirms a stable trend of slower economic growth amid ongoing domestic and foreign policy challenges. The war in Ukraine has become a money pit for all sides, while the loss of Russia as a supplier of cheap energy and a buyer of European goods continues to drag on the EU economy.

Other factors, including a stronger emphasis on fiscal discipline, further hinder Europe’s economic acceleration, especially compared with the U.S., where GDP grew by 0.7 percent on a quarterly basis over the same period. Although the European Central Bank has started to lower interest rates as inflation cools, a sudden turnaround in growth is unlikely.”, Geopolitical Futures, September 27, 2024

===============================================================================================

Germany

“German inflation drops below 2% for first time since early 2021 – Softer price pressure and weak economic activity increase chances of ECB rate cut in October. Inflation in Germany is now at its lowest level since February 2021, when it stood at 1.6 per cent. It had surged to 11.6 per cent by October 2023, driven by higher energy prices, pent-up demand after the Covid-19 pandemic and shortages in the wake of global supply chain disruptions.”, The Financial Times, September 30, 2024

==============================================================================================

Indonesia

“Indonesia formally requests to join Trans-Pacific trade pact – Indonesia has formally requested to join the Trans-Pacific trade pact to widen its export markets, its chief economic minister said on Wednesday, according to a report by state news agency Antara. Jakarta announced its intention to join the free trade agreement that already groups 12 countries in May, hoping to attract investment by widening export market access. CPTPP members are Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore, the United Kingdom and Vietnam.”, Reuters, September 25, 2024

===============================================================================================

Japan

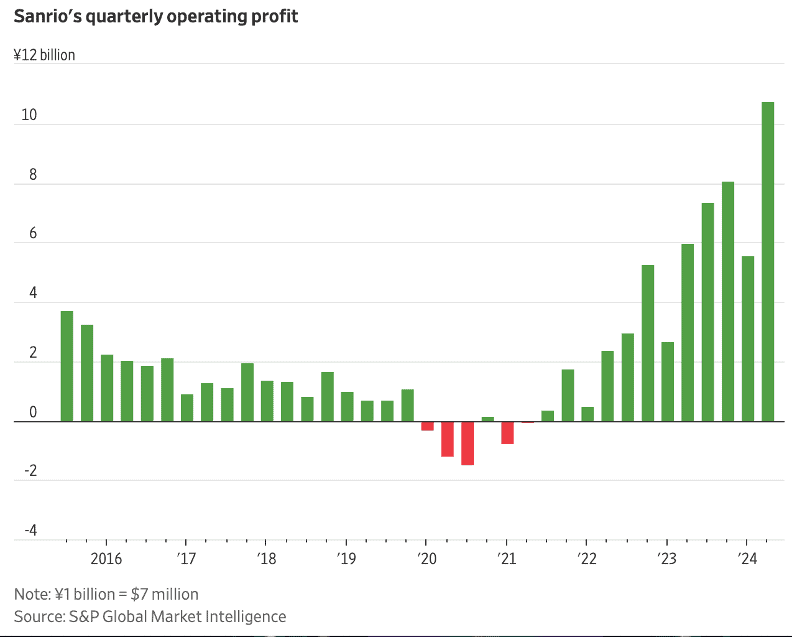

“How Hello Kitty Took Over the World – Investors in Sanrio have made 10 times their money as the iconic Japanese brand expands digitally. Hello Kitty is celebrating her 50th birthday this year. Sanrio the Japanese company behind the iconic character, has much to cheer about too. Sanrio’s share price is at a record high after surging 10-fold from its trough in 2020. The company is delivering record profits with strong revenue growth. Operating profit last quarter rose 80% from a year earlier……Sanrio’s business outside of Japan is booming, particularly in China and the U.S. Its profit contribution from abroad, including royalties payment from overseas subsidiaries to the parent company, nearly doubled year on year in the June quarter. Sanrio struck a deal with China’s e-commerce giant Alibabain 2022 to license its characters in the country. But the U.S. is among its fastest-growing markets: Sales in the Americas grew 141% year on year last quarter. The younger generation is increasingly familiar with Sanrio’s characters given the company’s strong presence on social media.”, The Wall Street Journal, September 25, 2024

============================================================================================

Mexico

“Mexico’s Audacious Judicial Overhaul – Just weeks away from leaving office, Mexican President Andres Manuel Lopez Obrador ushered legacy-defining judicial reforms through Congress, sparking concern among opponents and international businesses. Mexican governments have restructured the court system several times over the past 30 years, but institutional weaknesses have persisted. Whether the latest reforms will do what they’re intended to do remains an open question, but the deep-rooted problems that undermine public confidence in the courts are likely to endure. The implications for the economy could be severe. Critics worry that the new judiciary, reflecting the politics of Morena, could favor protectionist policies and adopt a more nationalistic regulatory approach. The reforms pave the way for changes to regulatory bodies overseeing economic competition, telecommunications, and oil and gas, potentially undermining Mexico’s commitments under the U.S.-Mexico-Canada trade agreement. Other opponents say the reforms could undermine labor, environmental and trade standards required by the agreement or jeopardize dispute resolution procedures involving judges.”, Geopolitical Futures, September 24, 2024

==============================================================================================

United States

“(U.S.) Consumer Confidence Drops in August – The August Consumer Confidence Score was 55.9 (-0.5 vs. July), which is an average of how consumers feel about the job market, their household finances, and their spending comfort levels. The August Financial Outlook Score was 50.8 (+0.1), indicating that consumers feel neutral about their household finances. Thinking about one year from now, 25% think their finances will be better than they are now, 51% think they’ll be the same, and 24% think they’ll be worse.”, Franchising.com, September 23, 2024

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Taking Brands Global Successfully For 5 Decades

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“Chick-fil-A shares ‘first phase’ of U.K. expansion plans – The chain’s initial entry in the market includes restaurants in Belfast, Leeds, Liverpool, and London. That stage is expected to take two years, while the company plans to invest over $100 million to expand there within the next 10 years. In addition to the U.K., the company is eyeing ambitious international growth in stores across Europe and Asia supported by a $1 billion investment. Plans currently call for five international markets by 2030, with the U.K. housing the first permanent store outside of North America.”, Nation’s Restaurant News, September 26, 2024

===========================================================================================

“Inflation Threatens 87% of (U.S.) Franchisees — Here Are the Ways They’re Fighting Back From soaring labor costs to escalating supply prices, franchise owners are facing significant economic challenges, mostly due to inflation. Industries such as food and personal services, where profit margins are already slim, are feeling the inflationary squeeze more acutely. Franchisees across the country are feeling the squeeze of rising costs, with 87% reporting that inflation is impacting their bottom line, according to the 2024 IFA Annual Franchisee Survey. From soaring labor costs to escalating supply prices, franchise owners face significant economic issues.”, Entrepreneur, September 23, 2024

=============================================================================================

“Slim Chickens Opens First Location in Germany – Slim Chickens announced today its first restaurant in Berlin, Germany. The brand has opened locations across the United States, Turkey, and the United Kingdom.”, Franchising.com, September 10, 2024

=============================================================================================

“2024 Top Global Franchises Ranking – Click here to see the list of this year’s top 200 global – not U.S. – franchise brands across 12 different business sectors. From small to very large and from food to senior care, these franchise brands are making history across the globe.

==============================================================================================

To receive this biweekly newsletter in your email every other Tuesday, click here https://insider.edwardsglobal.com

===========================================================================================

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing business environment. And our GlobalTeam™ on the ground covering 25+ countries provide us with updates about what is actually happening in their specific countries. We do not get involved in or report on politics!

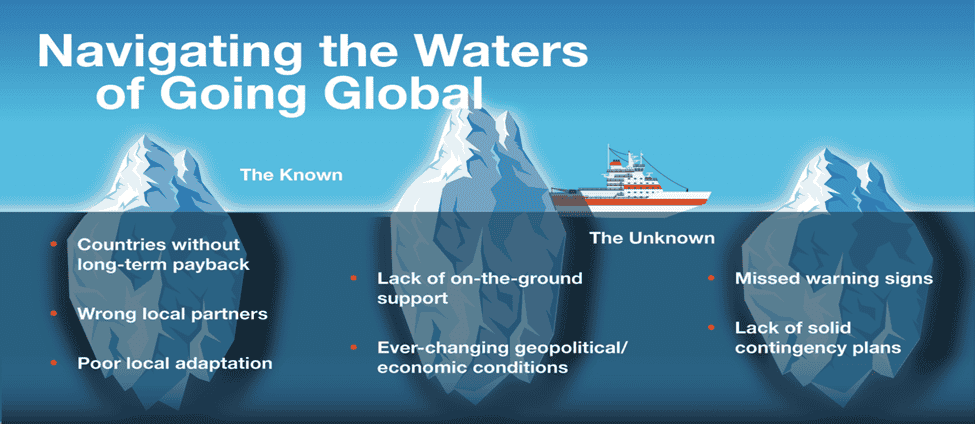

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe, and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant since 2001 taking 40+ franchisors global.

| To receive this biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com +++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++ |

Our latest GlobalVue™ 40 country ranking

For a complimentary 30-minute consultation on how to take your business into new countries and make money doing it. For a complimentary call with Bill Edwards click on the QR code or contact Bill at bedwards@edwardsglobal.com and +1 949 375 1896