Biweekly Global Business Newsletter Issue 127, Tuesday, February 18, 2025

The Global Price Of Gas, More Tariffs, China and Franchising

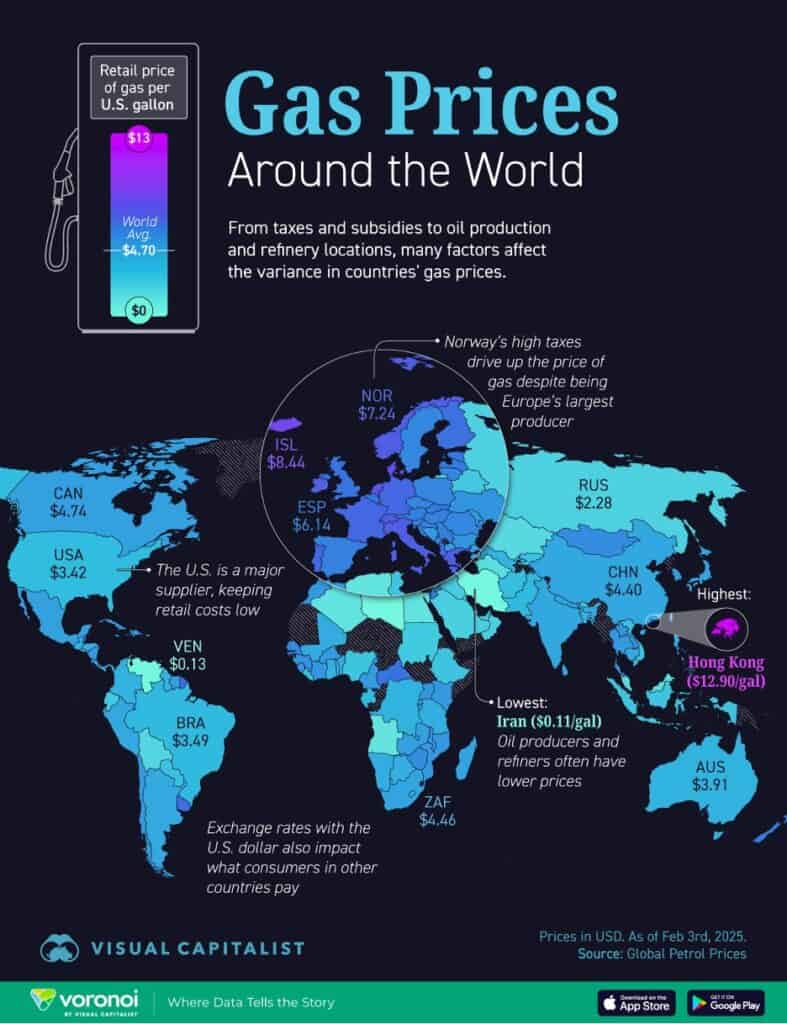

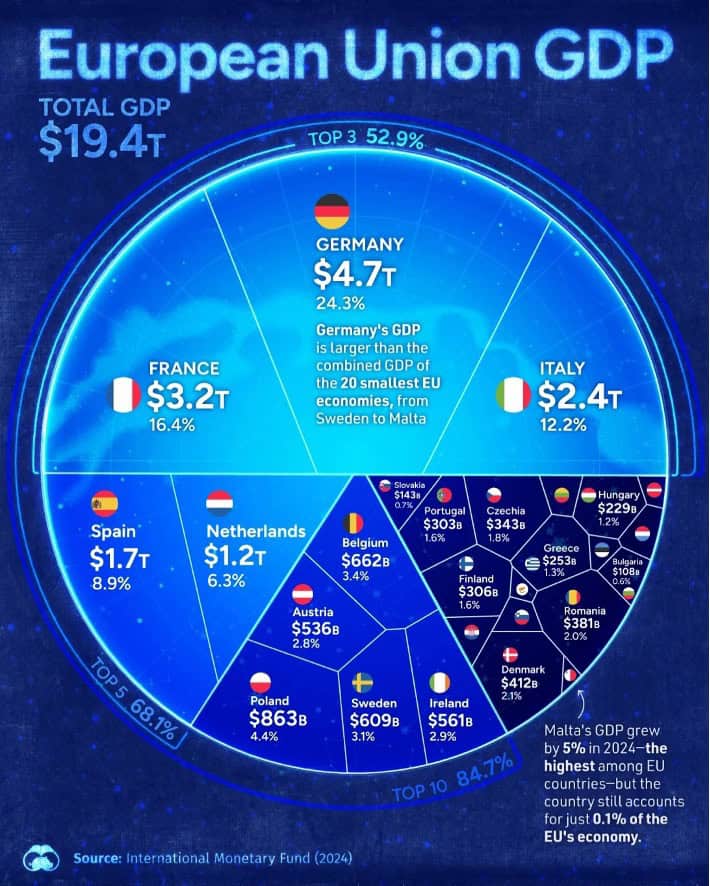

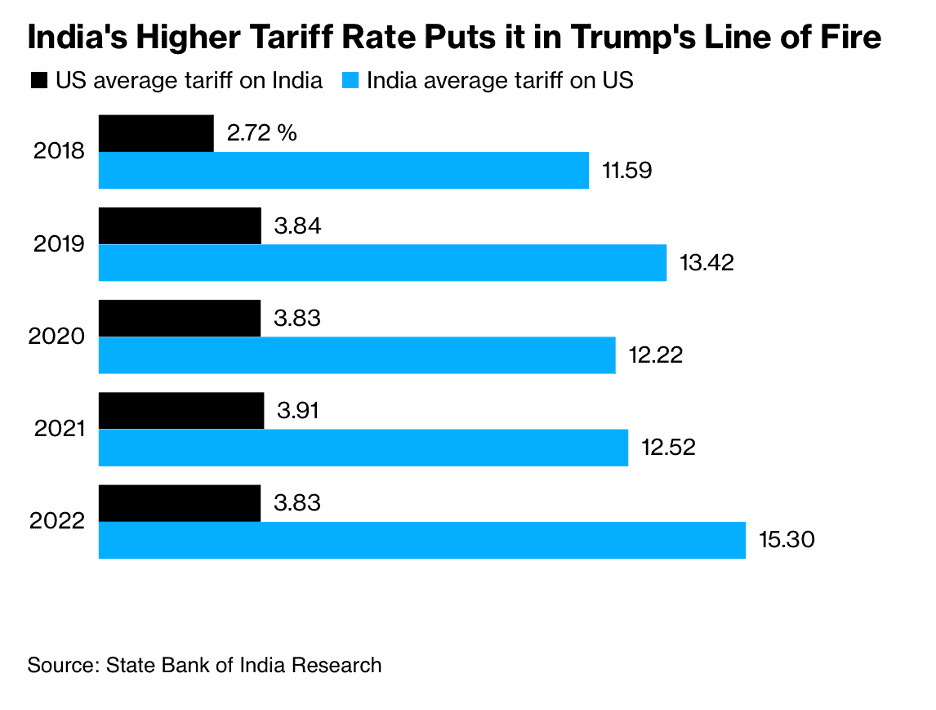

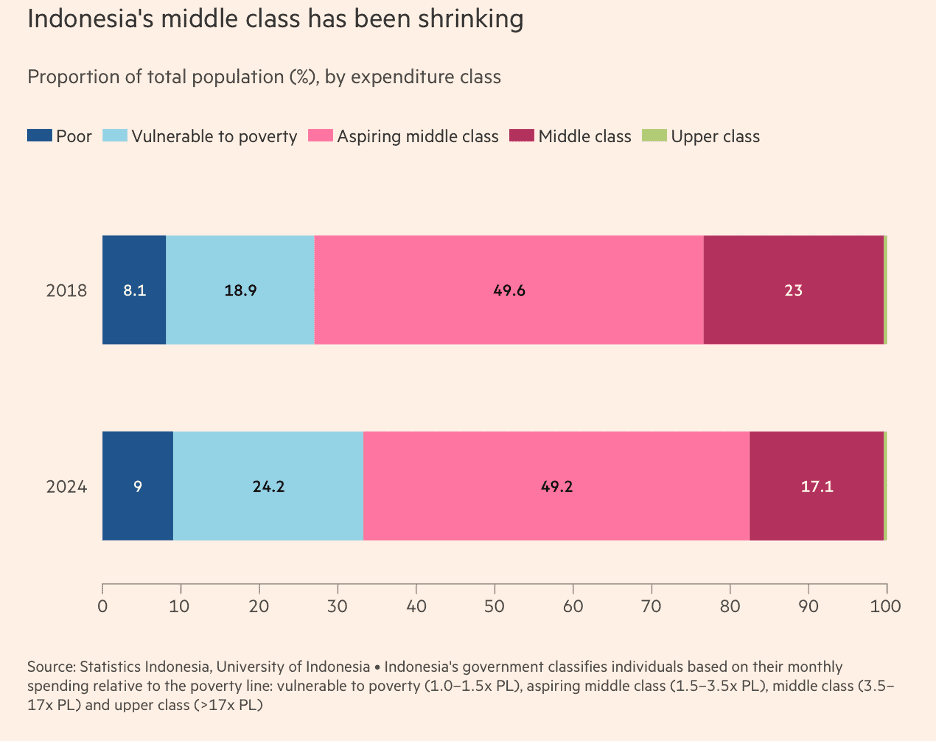

Commentary about the 128th Issue: In the USA the average price of a gallon of gas is US$3.42. In Iran it is 11¢ and in Hong Kong it is US$13. This issue has comparisons of tariffs countries charge each other and how each region of the world depends on cross border trade. India has a big tariff problem with the USA. Global unemployment is the lowest ever recorded but jobless rates are climbing again in both low- and high-income countries. Despite all its challenges, the European Union has a US$19 trillion economy. Long touted as an emerging country with a fast-growing middle class, Indonesia is now losing this key demographic. China continues to export more than other countries want it to.

One More Thing: In this issue’s brand section, various reports indicate 2025 will be a major growth year for the franchise business sector that will probably end 2025 with 9 million employees in over 800,000 individual businesses that collectively are approaching 5% of the USA’s gross domestic product (GDP).

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business.

PLEASE NOTE: Some of the information sources that we provide links to in our newsletter require a paid subscription to directly access them. Clicking on a link may not give the reader access to the content.

Edited and curated by: William (Bill) Edwards, CEO & Global Business Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA. Contact Bill with questions, comments and contributions. Bedwards@edwardsglobal.com, +1 949 375 1896

https://www.linkedin.com/in/williamedwards/ +1 949 375 1896

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

First, A Few Words of Wisdom From Others For These Times

“I’ve learned that people will forget what you said, people will forget what you did, but people will never forget how you made them feel.”, Maya Angelou

“Happiness depends more upon the internal frame of a person’s own mind, than on the externals of the world.”, George Washington

“People do not buy goods and services. They buy relations, stories, and magic.”, Seth Godin

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Highlights in issue #128:

How Much Each Country Pays for Gas in 2025

The $19 Trillion European Union Economy

Why 2025 Will be a Big Year For Franchising — And How to Capitalize

The restaurant industry is projected to reach US$1.5 trillion in sales this year

India Plans More Tariff Changes to Curb Trump’s Trade Threats

Brand Global News Section: Hilton®, Jollibee®, Pizza Hut®, YUM China

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

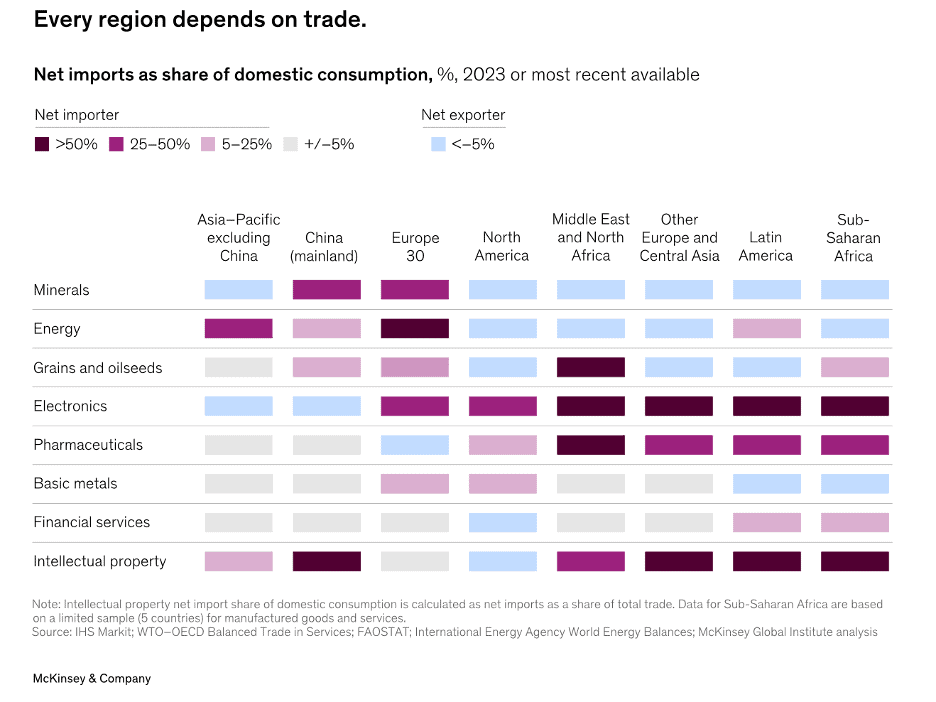

Interesting Data, Articles and Studies

“Geopolitics and the geometry of global trade: 2025 update – Trade relationships are continuing to reconfigure, and changing geopolitics is a major reason. The United States has continued to shift trade away from China and toward other economies such as Mexico and Vietnam. In some cases, this is due to these economies forming an intermediate step in trade flows between China and the United States. European economies have moved away from trade with Russia and increased trade with other partners, notably the United States. Developing economies, rather than advanced ones, now account for the majority of China’s imports and exports. Economies such as the Association of Southeast Asian Nations (ASEAN), Brazil, and India continue to strengthen trade ties across the geopolitical spectrum.”, McKinsey & Co., January 27, 2025

=============================================================================================

“Singapore, Japan To Remain Property Hot Spots As Global Investors Diversify: JLL CEO – The real estate markets of Australia, Japan, Korea and Singapore will remain hot spots in the next few years as global investors seek to diversify their portfolios with demand for real estate in China and Europe continues to be soft, according to Christian Ulbrich, global CEO and president of property consultancy JLL. Real estate investments in the Asia Pacific climbed 23% to $131 billion in 2024, led by gains in Australia, India, Japan, Korea and Singapore, according to the capital tracker report published by JLL in January. Singapore—which has been attracting scores of billionaires and high-net worth individuals setting up family offices in the island nation—posted the strongest growth across the region, with global investors pouring over $11.5 billion in the Lion City, up 60% from the previous year.”, Forbes, February 17, 2025

============================================================================================

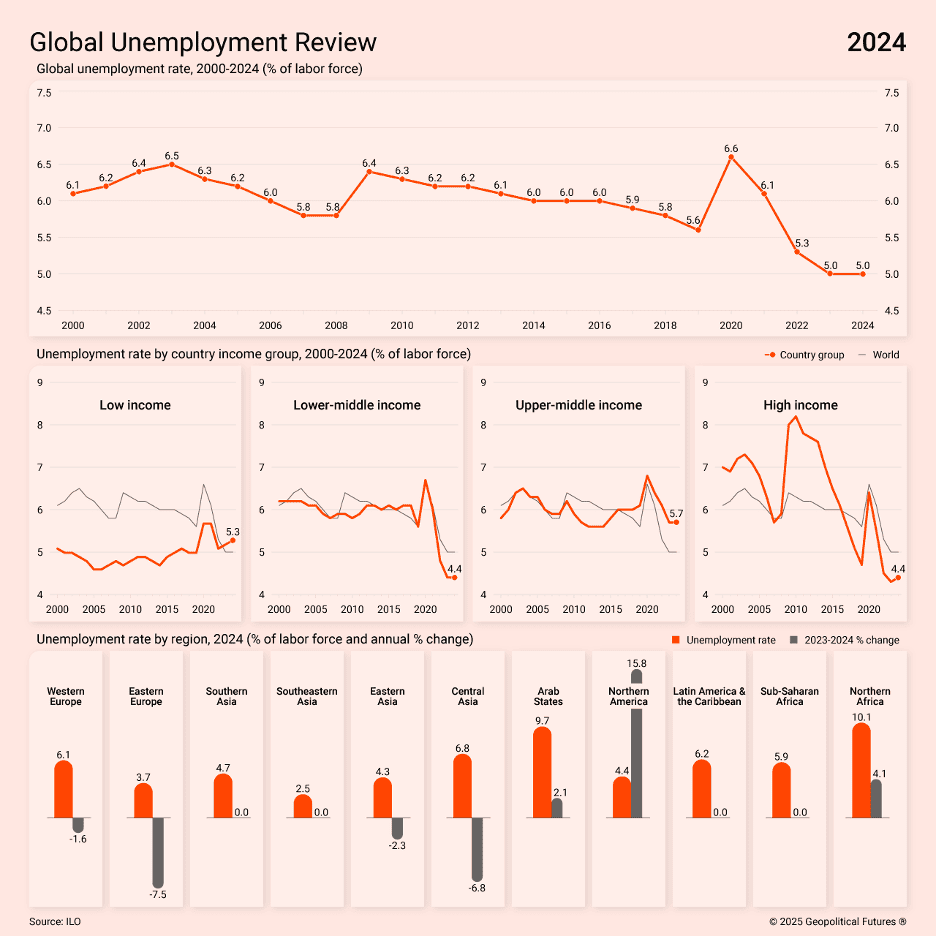

“Low Global Unemployment Won’t Last – Jobless rates are climbing again in both low- and high-income countries. In 2024, conflicts in Ukraine and the Middle East and tight monetary policies contributed to a slowing global economy. Yet, global unemployment remained stable at 5 percent, its lowest level in decades. In Europe and East Asia, jobless rates fell as economies continued recovering from the pandemic and adjusted to trade restrictions and sanctions on Russia. This decline offset a sharp rise in U.S. unemployment, driven by the Federal Reserve’s high base rate, weak demand and slower hiring. The International Labor Organization does not expect unemployment to stay this low. An upward trend has already emerged in both low- and high-income countries. Meanwhile, despite job growth, real wages have declined in many nations due to persistently high inflation. The ILO sees no immediate factors that could mitigate future labor market risks.”, Geopolitical Futures, February 14, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation, Taxes & Trade Issues

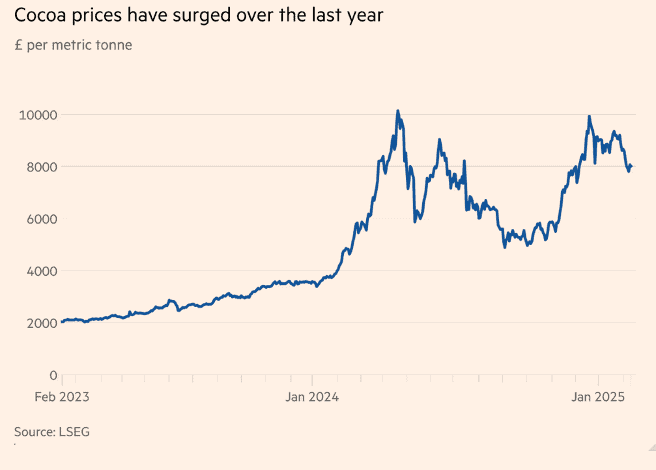

“Cocoa stockpiles plunge to record low – Chocolate makers grab available reserves to counter acute global shortage. Stocks of cocoa in London and New York have plunged to all-time lows in the latest sign of a shortage that has forced chocolate makers desperate to meet Valentine’s Day demand to seek alternative ingredients. Traders and chocolate manufacturers have withdrawn most of the lower-quality surpluses at the world’s largest commodity exchanges as the market struggles to cope with years of poor global harvests.”, The Financial Times, February 13, 2025

=============================================================================================

“How Much Each Country Pays for Gas in 2025 – This map tracks the retail price of gas in 169 countries and territories around the world. Data is sourced from Global Petrol Prices, as of Feb 3rd, 2025. Gas is more commonly known as petrol, and also priced per liter in many places. The equivalent cost has been included in the table in the next section. Even amongst the cluster of countries with cheap gas in the Middle East, pump prices in Iran are astonishingly low. On average, Iranians paid 11 cents per gallon in the week of February 3rd.On the other hand, people in Hong Kong paid close to $13/gallon in the same time period.”, Visual Capitalist &Global Petrol Prices, February 12, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global, Regional & Country Travel

“Hilton Expects Leisure, Business-Travel Demand to Continue to Grow in 2025 Despite Political Challenges – System-wide top-line growth of 2% to 3% for 2025 expected, CEO says. The company is taking a more positive view on economic and geopolitical conditions as well. Business confidence has been shaken some by Trump’s proposed tariffs, though, forcing companies to scramble to adjust their operations.”, The Wall Street Journal, February 6, 2025

==================================================================================================

“Travel agents say Canadians are cancelling U.S. trips amid tariff threats – U.S. President Donald Trump has threatened punishing tariffs, mused about making Canada the 51st state. The threats of a trade war have led to an upswing in Canadian pride, with sports fans booing the U.S. national anthem and polls suggesting Canadian patriotism is on the rise. Now, Canadian travel agents say they’re seeing more customers cancel their U.S. trips and book vacations elsewhere, in wh’t could prove to be an impactful way of voting with their wallets.”, CBC, February 11, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Book Review

In “The AI-Driven Leader: Harnessing AI to Make Faster, Smarter Decisions,” Geoff Woods provides a comprehensive guide for executives aiming to integrate artificial intelligence into their strategic decision-making processes. Drawing from his tenure as Chief Growth Officer at Jindal Steel & Power, where he facilitated a market cap increase from $750 million to over $12 billion in four years, Woods emphasizes the transformative potential of AI when used as a strategic thought partner. Woods introduces practical tools, including effective AI prompting techniques, to enhance strategic clarity and accelerate data-driven decisions. By presenting real-world examples and prompt libraries, he equips leaders with the means to harness AI effectively, thereby amplifying employee impact and maintaining a competitive edge in an AI-driven landscape.

Five Key Takeaways:

1. AI as a Thought Partner: Leaders should view AI not merely as a tool but as a strategic collaborator to enhance decision-making.

2. Overcoming Operational Overwhelm: Implementing AI can automate routine tasks, allowing leaders to focus on strategic initiatives.

3. Effective AI Communication: Crafting precise prompts and providing context are essential for obtaining valuable AI-generated insights.

4. Accelerated Data-to-Decision Process: AI enables faster analysis and interpretation of data, leading to quicker, informed decisions.

5. Amplifying Employee Impact: Utilizing AI can significantly enhance individual and team productivity, leading to exponential organizational growth.

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The Accredited Franchise Supplier certification

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Asia

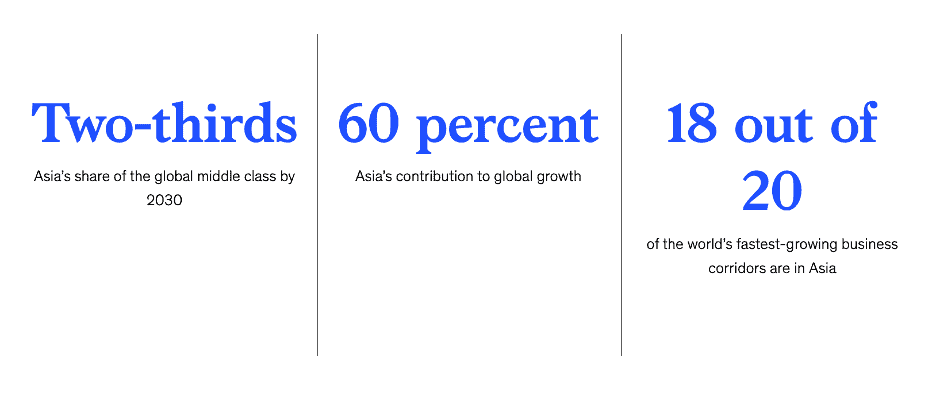

“Asia’s emerging business corridors: New highways to growth – As geopolitical shifts affect global business corridors, opportunities are opening for companies. Asia is positioned at the epicenter to lead the way in reshaping trade and investment patterns. During this period of transition and uncertainty, Asia remains the key to global connectivity. The newly emerging and fast-growing business corridors are evidence of this. The growth of new corridors in technology, services, and green business will likely be accompanied by opportunities arising from the redirection of established business corridors. These include entrenched but nascent bilateral relations.”, McKinsey & Co., January 20, 2025

==============================================================================================

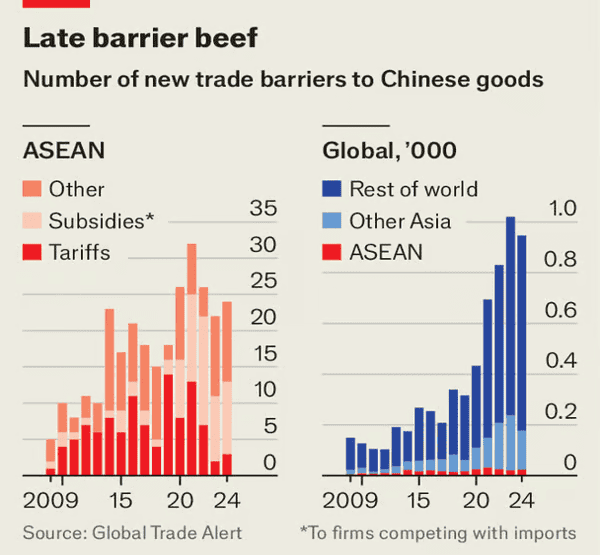

“South-East Asian producers are being hammered by Chinese imports – Deep ties with China stymie a protectionist response. The phenomenon begins in China. Because of a property slump, dispirited consumers and the state’s resistance to large fiscal stimulus, demand is weak. In search of new drivers of growth, China has doubled down on manufacturing. Much of this is bound for export markets: in 2024 China’s net exports made up almost a third of gdp growth, the highest share since 1997. Since the start of 2021, Asean has introduced 104 new trade restrictions on Chinese goods, including both tariffs and subsidies to offset import competition….Governments taking a more protectionist response would result in higher costs for price-sensitive South-East Asian consumers.”, The Economist, February 13, 2025

==============================================================================================

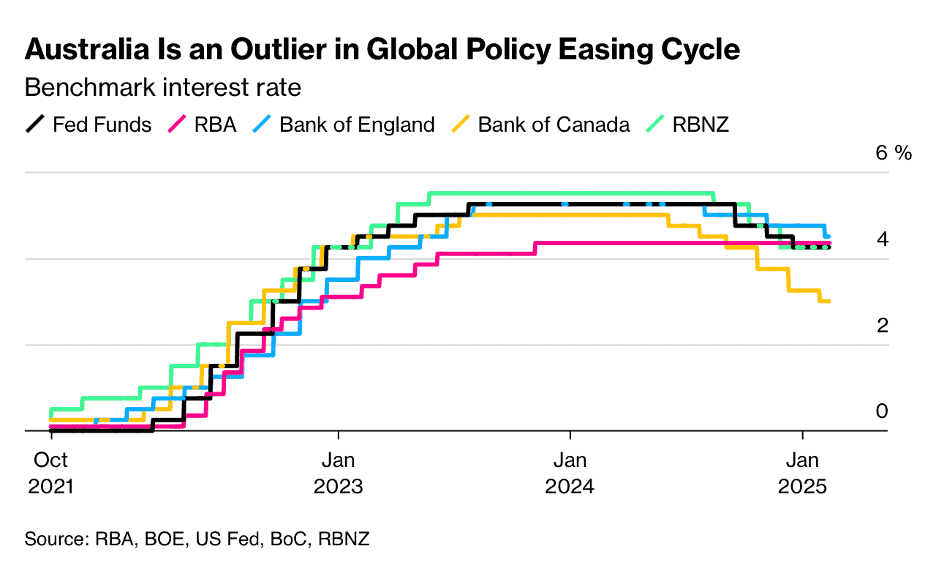

Australia

“RBA Poised to Deliver First Rate Cut in Four Years – A majority of economists in a Bloomberg News survey as well traders expect the RBA to finally begin easing tomorrow with a 25 basis-point reduction in the cash rate to 4.1%. A cut may provide a shot in the arm for Prime Minister Anthony Albanese.”, Bloomberg, February 16, 2025

(RBA – Reserve Bank of Australia)

==============================================================================================

China

“Cheap coffee and smaller pizzas help Yum China survive an uncertain consumer market – China’s economy still can’t shake its consumption slump. Retail sales in China grew by 3.5% in 2024, lower than the headline growth rate of 5% for the year, according to data from the National Bureau of Statistics. Yet Yum China, which operates over 16,000 stores, including Chinese outlets of Kentucky Fried Chicken and Pizza Hut outlets, is finding growth in a tougher market. The company, No. 368 on the Fortune 500, managed to grow sales across both its directly owned and franchised outlets by 5% in 2024, ahead of the broader industry. Yum China launched Pizza Hut WOW in May, which offers smaller, more affordable servings for thrifty diners, including a pepperoni pizza for just 29 yuan ($4). “This kind of store is more for individuals, like a small plate of tapas,” a spokesperson told Reuters in early September. The company now has over 200 WOW outlets across China.”, Fortune, February 7, 2025

============================================================================================

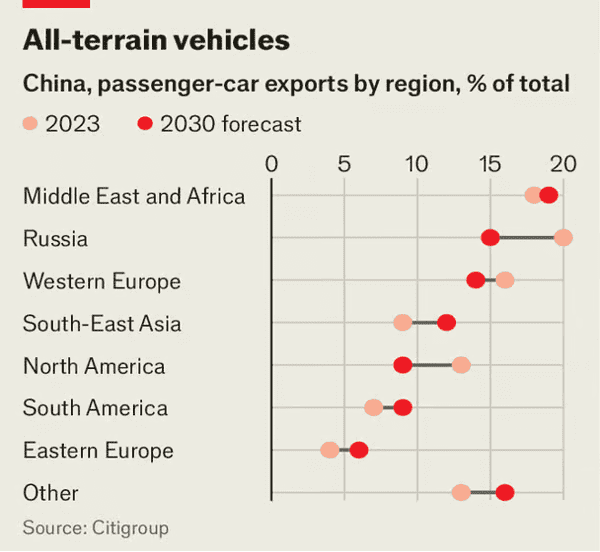

“Chinese cars are taking over the global south – Petrol (gas) engines, not batteries, are powering their growth. China has taken a decisive lead as the world’s biggest manufacturer of cars. The number of cars shipped abroad from China reached 4.7m last year, triple the amount three years earlier, according to Citigroup (around a third of these came from multinational brands with factories in the country). The surge is set to continue—in 2030 the bank reckons sales abroad will hit 7.3m. Car-carrying vessels are departing China’s ports in ever greater numbers in part because the domestic market, where 23m passenger vehicles were sold last year, is neither as fast-growing nor as profitable as in the past.”, The Economist, February 13, 2025

=============================================================================================

European Union

“The $19 Trillion European Union Economy – Europe’s Economic Giants Hold Their Ground. Germany, France, and Italy have long been the EU’s largest economies, driven by industrial strength, financial hubs, and manufacturing power. Together, they account around 53% of the EU’s $19.4 trillion GDP, with Germany alone surpassing the combined output of the 20 smallest EU economies. However, these top three economies saw stagnating or negative growth last year. Spain and the Netherlands round out the top five, bringing their collective share to 68%. Meanwhile, Malta posted the highest GDP growth at 5% in 2024 but remains the EU’s smallest economy at just 0.1% of the total.”, Visual Capitalist & The International Monetary Fund, February 8, 2025

===============================================================================================

India

“India Plans More Tariff Changes to Curb Trump’s Trade Threats – India’s top officials said they will continue to cut import taxes as the government looks to work around US President Donald Trump’s plan to impose reciprocal tariffs on trading partners. Weeks after she unveiled sweeping cuts to duties on imports from textiles to motorcycles, India’s finance minister said that she will carry on the process of reforming the nation’s tariff regime. Economists said India’s higher tariff rate and a $41 billion trade surplus with the US makes the South Asian nation among the most exposed to risks if Trump follows through with plans to impose like-for-like tariffs. Analysts from Mitsubishi UFJ Financial Group Inc said US tariffs on India could rise to above 15%, from around 3% currently, ‘if full reciprocity were enforced in theory.’”, Bloomberg, February 17, 2025

==============================================================================================

Indonesia

“Indonesia’s shrinking middle class rattles businesses betting on a boom – People are falling behind as commodities giant fails to deliver well-paid jobs. Pizza Hut’s Indonesian franchisee pinned its hopes on the middle class’s expansion in the world’s fourth-most populous country. But its decision to shut 20 stores and reduce its workforce offers a warning for those betting on a consumer boom in south-east Asia’s largest economy. Businesses selling everything from pizzas to cars have been hit by Indonesia’s shrinking middle class. The number of people considered to be middle class by the government has declined 20 per cent over the past six years, a risk to the commodity giant’s growth plans and a warning for potential investors such as Apple. Economists said the decline had been triggered by a lack of formal employment, a shortage of investment in higher-income industries and overreliance on a commodities sector that has produced poorly paid work — pressures that have been exacerbated by the Covid-19 pandemic.”, The Financial Times, February 16, 2025

================================================================================================

The Philippines

“Jollibee Jumps Most Since 2020 as Foreign Ownership Cap Scrapped – Move could make stock more attractive for foreign funds. The fast-food chain, known for dishes like fried chicken and sweet spaghetti, said the Philippine Stock Exchange has approved its request which is in line with changes in its articles of incorporation that removes its ability to own, acquire or mortgage land. Apart from expanding its Jollibee brand outlets, the company has made acquisitions in recent years. It took over South Korea’s Compose Coffee for $340 million in July, following investments in a Taiwan milk tea brand in 2021 and the $350 million purchase of Los Angeles-based Coffee Bean and Tea Leaf in 2019.”, Bloomberg, February 12, 2025

=============================================================================================

United States

“The restaurant industry is projected to reach US$1.5 trillion in sales this year – 80% of operators are optimistic their sales will be either higher than or the same as they were in 2024, according to the National Restaurant Association’s 2025 State of the Restaurant Industry report. This trajectory is driven by more than just pricing, however. The report indicates that consumers have plenty of pent-up demand, with about 80% stating they would use restaurants more frequently if they had the money (including 81% for table service restaurants, 76% for quick-service, snack, deli, and coffee concepts, and 82% for delivery). Some recent trends suggest consumers may be feeling a bit more confident with their financial status.”, Nation’s Restaurant News, February 6, 2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Taking Brands Global Successfully For 5 Decades

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“The International Franchise Association (IFA) today released its annual Franchising Economic Outlook showing that franchise growth exceeded projections for 2024, even in the face of ongoing economic uncertainty and policy headwinds. On top of the 2.2% growth experienced in 2024, which exceeded the 1.9% projection, the report forecasts that franchises will grow an additional 2.4% in 2025, a faster rate than the 1.9% projected for the broader economy by the Congressional Budget Office (CBO).

The full report, conducted by FRANdata, is available here.

“The resilience of the franchise business model not only helped the sector survive the uncertainty of recent years, but thrive in the face of challenging economic conditions,” said Matt Haller, IFA President and CEO. “A more favorable economic and regulatory climate have created new optimism and confidence for the year ahead.

=============================================================================================

“Why 2025 Will be a Big Year For Franchising — And How to Capitalize. Franchising is an excellent choice for the business owner who wants to join an established brand that enjoys widespread name recognition, has built customer loyalty and offers reliable, time-tested systems and processes. With a business-friendly environment and strong industry momentum, 2025 presents major opportunities for franchise expansion. AI, automation, and customer-focused strategies will drive franchise success in the coming year. Business services, sustainable brands, and fast-casual food franchises are among the most promising investments for new franchisees.

This article is by Ray Titus, CEO of United Franchise Group (UFG), the global leader for entrepreneurs. With over three decades in the franchising industry and more than 1,800 franchisees throughout the world, UFG offers unprecedented leadership and solid business opportunities for entrepreneurs.”, Entrepreneur magazine, February 13, 2025

==============================================================================================

“5 Trends to Watch: 2025 Franchising – Franchise Brokers Face Greater Scrutiny; Increased Regulatory Uncertainty; Restaurant Chain Challenges Expected to Continue; Continued Consolidation of Franchisees; and Increased Focus on Junk Fees.”, by Greenberg Traurig in Lexology, February 10, 2025

==================================================================================================

“Franchising Trends in Canada: Here’s What To Expect in 2025 – In 2025, franchising will continue to be a thriving and dynamic sector of Canada’s economy. However, the landscape is evolving, with shifts driven by economic trends, technology, and consumer preferences. Here are some of the key franchising trends that may define Canada’s franchise industry in 2025.”, Franchising.com, February 2025 from an article by Kevin Winters, the franchise development manager with Little Caesars Canada.

To receive our biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing business environment. And our GlobalTeam™ on the ground covering 25+ countries provide us with updates about what is actually happening in their specific countries. We do not get involved in or report on politics!

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe, and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant since 2001 taking 40+ franchisors global.

| To receive this biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com +++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++ |

Our latest GlobalVue™ 40 country ranking

For a complimentary 30-minute consultation on how to take your business into new countries and make money doing it. For a complimentary call with Bill Edwards click on the QR code or contact Bill at bedwards@edwardsglobal.com and +1 949 375 1896

Biweekly Global Business Newsletter Issue 127, Tuesday, February 4, 2025

Tariffs, Tariffs, Tariffs, Tariffs, Tariffs and More

Commentary about the 127th Issue: In 2025, success in international business isn’t just about crossing borders—it’s about bridging cultures, leveraging technology, and adapting to rapid economic and geopolitical shifts.

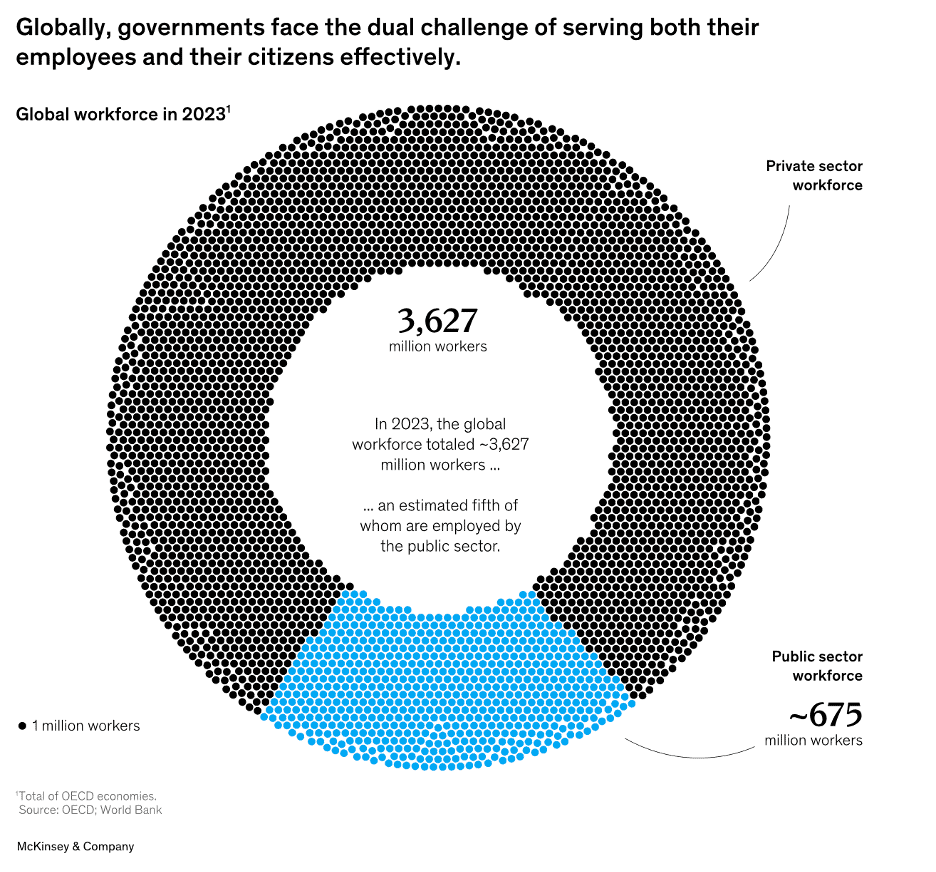

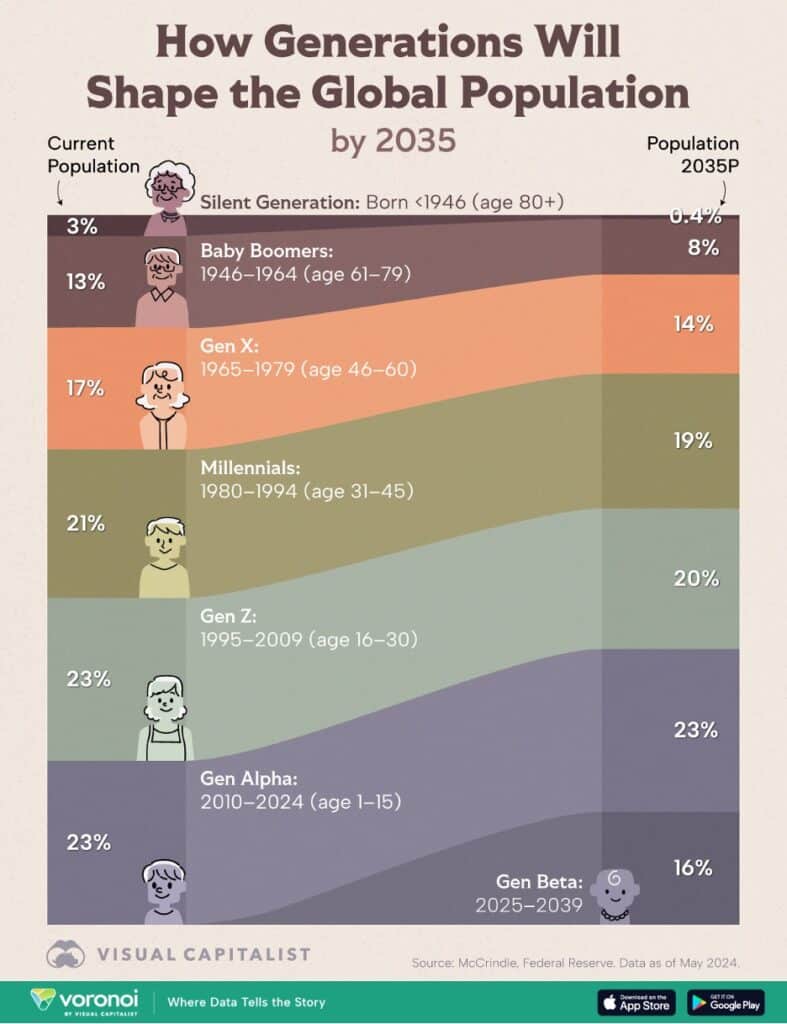

As this edition goes to press, the U.S. President has announced tariffs on goods coming into the USA from Canada, China and Mexico. The situation is changing almost hourly! This issue also looks at DeepSeek, the world’s projected population growth by generations including the newest generation, Generation Beta. And the ‘massive’ global work force of 3.67 billion workers of which almost 20% are government workers.

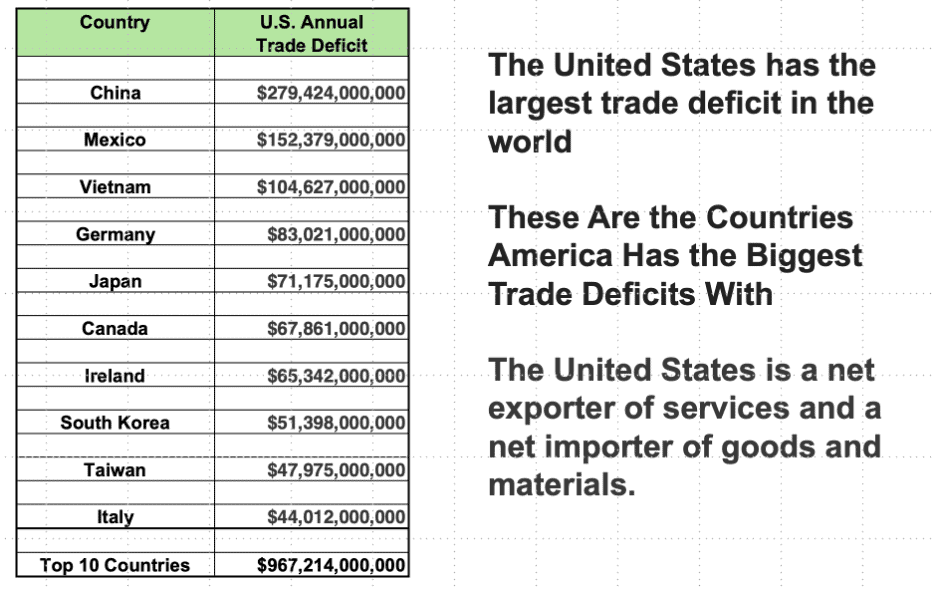

One More Thing: The United States has the largest trade deficit of any country in the world. Last year it was almost US$1 Trillion from just the top ten countries the USA has a trade deficit with.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business.

PLEASE NOTE: Some of the information sources that we provide links to in our newsletter require a paid subscription to directly access them. Clicking on a link may not give the reader access to the content.

Edited and curated by: William (Bill) Edwards, CEO & Global Business Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA. Contact Bill with questions, comments and contributions. Bedwards@edwardsglobal.com, +1 949 375 1896

https://www.linkedin.com/in/williamedwards/ +1 949 375 1896

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

First, A Few Words of Wisdom From Others For These Times

“In an era of shifting trade policies and technological disruption, the best global strategy is flexibility and a deep understanding of local markets.”, Richard Branson

“The companies that will thrive in global markets by 2025 are those that embrace digital trade, sustainability, and the agility to pivot amid geopolitical uncertainty.”, Christine Lagarde

“International business in 2025 will be defined by resilience: the ability to manage supply chain disruptions, regulatory changes, and new consumer expectations in a hyperconnected world.”, Klaus Schwab

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Highlights in issue #127:

What the Experts See Coming in 2025

Powering the World: A Look at Global Electricity Generation in 2023

Visualizing the Global Population in 2035, by Generation

These Were the Busiest Airports in 2024

Foreign Investment in Africa Reaches Record $94bn in 2024

Brand Global News Section: Chili’s® and Luckin Coffee®

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

Tariff, Tariffs, Tariffs – The U.S. President over the weekend announced 25% tariffs on most goods coming into the USA from Canada and Mexico, 10% on oil and gas coming from Canada and 10% on almost everything coming into the USA from China. As of late on Monday, February 3rd, the US President had calls with the President of Mexico and the Prime Minister of Canada and all agreed to hold off implementing tariffs for at least one month during which they would have talks to try resolve this issue.

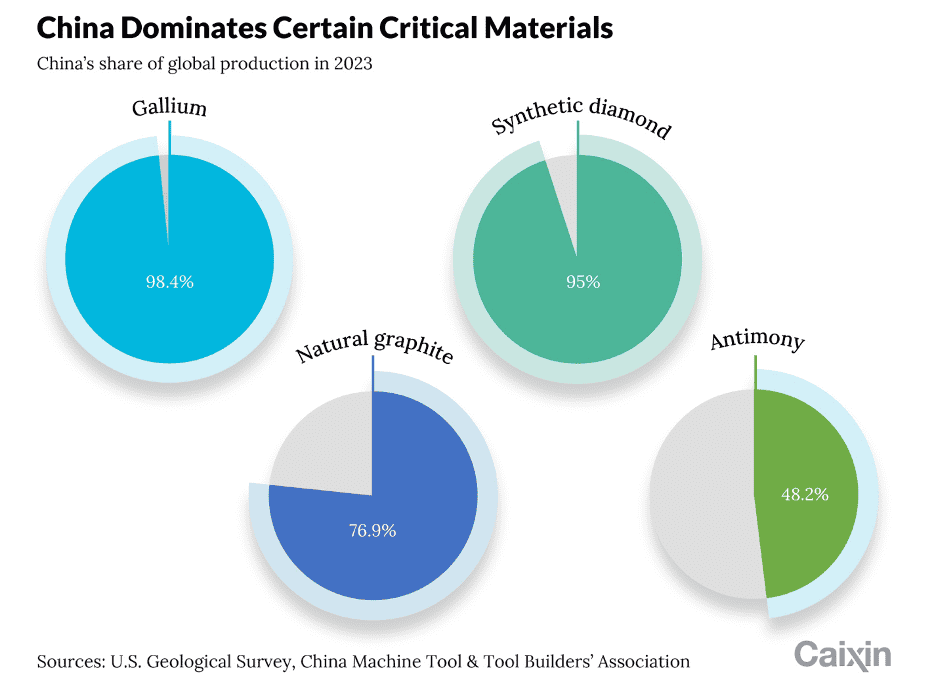

Meanwhile, China plans to bring the new USA 10% tariffs to the World Trade Organization (WTO) for discussion. Up till now, China has either imposed or proposed tariffs on $110 billion of U.S. goods, representing most of its imports of American products. And then there is the ban on shipments from China to the USA of certain critical minerals (see below).

Needless to say, the tariff situation is very fluid. Perhaps by our newsletter on February 28 we will have more details on the actual tariffs. Or maybe not……..

============================================================================================

The new U.S. President issued a new America First Trade Policy on January 20. The links below are the full policy and a January 29th analysis of the policy.

CalChamber Analysis by Susanne T. Stirling, Senior Vice President, International Affairs

============================================================================================

For our Artificial Intelligence section in this issue, we will briefly look at DeepSeek which has been in the news recently. Here are some interesting articles from a variety of sources about this new AI tool that speak for themselves.

“Six things DeepSeek won’t tell you about — but ChatGPT will”, The Times of London, January 28, 2025

The DeepSeek Wake-Up Call, The Atlantic, January 30, 2025

Inside Microsoft’s quick embrace of DeepSeek The Verge, January 30, 2025

Meta CEO Mark Zuckerberg says DeepSeek will ‘benefit’ the company and the future of its AI business: The Business Insider, January 30, 2025

Is the DeepSeek Panic Overblown?: Time, January 30, 2025

DeepSeek, Stargate, and the new AI arms race, AP News, January 28, 2025

OpenAI says it has proof DeepSeek used its technology to develop its AI model, The New York Post, January 29, 2025

“The DeepSeek controversy: Authorities ask where does the data come from and how safe is it?”, Malwarebytes.com, January 30, 2025

“How small Chinese AI start-up DeepSeek shocked Silicon Valley”, The Financial Time, January 24, 2025

=======================================================================================

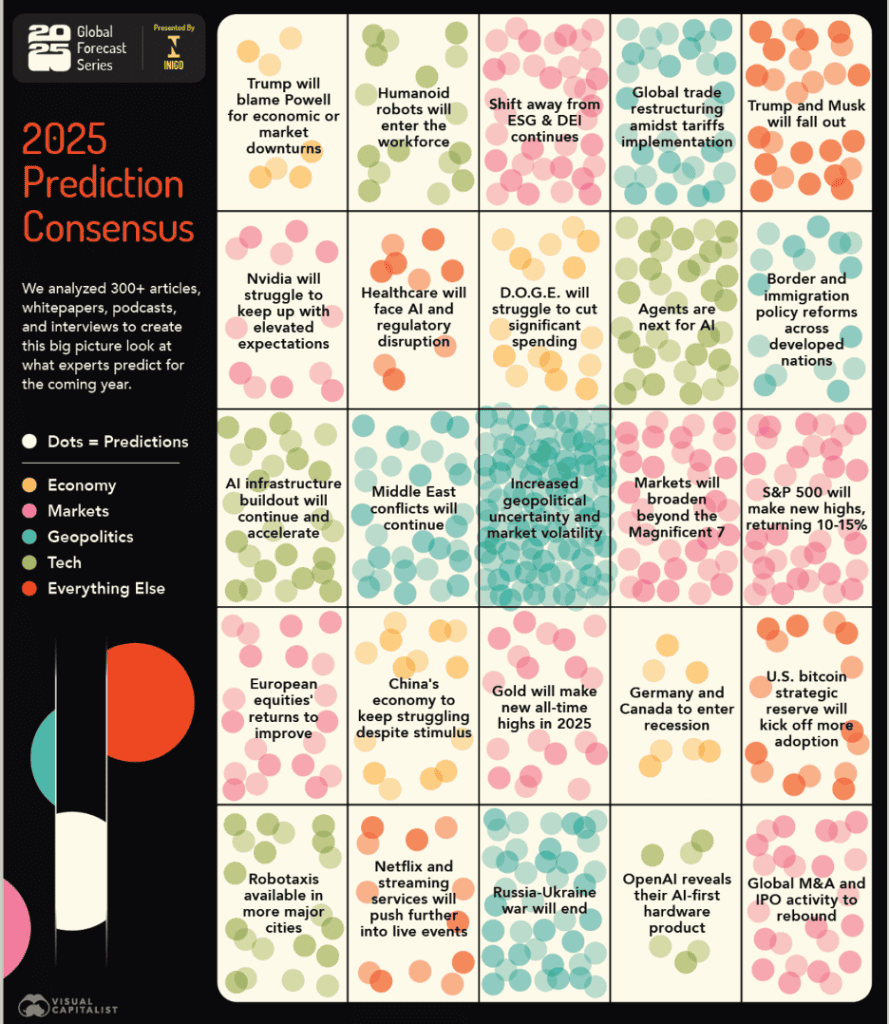

“What the Experts See Coming in 2025 – In this now sixth year of our Prediction Consensus (part of our comprehensive 2025 Global Forecast Series presented by Inigo Insurance), we’ve summarized the most common predictions and forecasts by experts into a single visual of what they expect to happen in 2025. Drawing from our predictions database of over 800 forecasts compiled from reports, interviews, podcasts, and more, the Prediction Consensus “bingo card” and this article offer an overview of the most cited trends and opportunities that experts are watching for the rest of the year.”, Visual Capitalist, January 26, 2025

Editor’s Note: This chart is, of course, already out of date but it combines input from over 800 forecasts compiled from reports, interviews, podcasts.

==============================================================================================

“A massive global workforce – In 2023, the global workforce consisted of 3.627 billion workers. Approximately one-fifth of these people, or 675 million, were employed in the public sector……. Governments must serve their constituents and take care of their employees, including their professional development and job security. This dual mission can be challenging, given constraints such as public scrutiny, competing priorities and stakeholders, politics, budget, and citizen dissatisfaction with government.”, McKinsey & Co., January 30, 2025

===========================================================================================

“Visualizing the Global Population in 2035, by Generation – The year 2025 marks the start of Generation Beta. This graphic compares the current population share of each generation with the projected share in 2035, based on data from McCrindle as of May 2024. Generation Beta will be born from 2025 to 2039. They will be the children of younger Gen Ys (Millennials) and older Gen Zs, and many will live to see the 22nd century. By 2035, this group is expected to make up at least 16% of the global population.”, Visual Capitalist and The Federal Reserve, January 17, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation, Taxes & Trade Issues

“Powering the World: A Look at Global Electricity Generation in 2023 – In 2023, the world relied heavily on a mix of sources to power our homes, businesses, and industries. The data from 2023 paints a picture of a world in transition. While fossil fuels still hold a strong grip, generating a combined 60.7% or 17,943.4 TWh of the world’s electricity, the increasing adoption of renewable energy sources is a clear sign of a shift towards a cleaner, more sustainable future. Clean energy sources collectively generated 39.3% or 11,619.5 TWh of the world’s electricity in 2023. While the world is transitioning to cleaner energy sources, fossil fuels still dominate global electricity generation. In 2023, coal remained a major player, accounting for a substantial 35.4% of the world’s power, generating a massive 10,460.4 Terawatt-hours (TWh). Natural gas also played a crucial role, contributing 22.6% or 6,668.7 TWh, often favored as a cleaner-burning alternative to coal.”, Visual Capitalist & Ember Electricity Data Explorer, January 18, 2025

=============================================================================================

“Beijing’s Ban on Mineral Exports to U.S. Leaves Traders Scrambling – On Dec. 3 (2024), the commerce ministry banned shipments of gallium, germanium, antimony and superhard materials to the U.S., and tightened the rules on graphite exports, based on China’s Export Control Law and related regulations. China maintains a dominant position in the global production of gallium, germanium and antimony. According to estimates from the U.S. Geological Survey (USGS), China supplied 98% of the world’s primary low-purity gallium, 60% of germanium, and 48% of antimony in 2023.”, Caixing Global, January 24, 2025

=============================================================================================

This chart is based on data from a 27/7 Wall Street article on December 20, 2024 and gives us a glance at the U.S. trade deficit. Almost a trillion dollars each year from just the top 10 countries we trade with.

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global, Regional & Country Travel

“These Were the Busiest Airports in 2024 – If your flight is departing from an airport on this list, be sure to build in some extra time (and patience). By calculating the airline capacity (the total number of seats), for international and domestic flights in airports across North America, Europe, Asia, and the Middle East, (global travel statistics provider) OAG has determined which airports truly are the world’s most frenetic. Holding firm in first place is Atlanta Hartsfield-Jackson International Airport (ATL). This won’t come as a surprise—the Georgia airport has been named the world’s busiest for 23 of the 24 years the report has been published.”, Conde Nast Traveler, January 21, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Book Review

In Build Your Cultural Agility, Paula Caligiuri provides a practical guide for professionals navigating the complexities of global business. The investment in global collaboration technology now exceeds US$45 billion. Professionals who work across cultures face some of the most cognitively, psychologically and emotionally difficult challenges, regardless of whether they work virtually or in person. And they often face these challenges without the help of a corporate guide. Build Your Cultural Agility is that guide. 5 Key Takeaways:

1. Adaptability is Critical – Successful global professionals must quickly adjust to new cultural norms and business practices.

2. Emotional Resilience Enhances Performance – Managing stress and ambiguity is essential when working in unfamiliar environments.

3. Curiosity Drives Cultural Learning – Being open-minded and eager to learn improves cross-cultural interactions.

4. Building Trust Across Cultures is Key – Effective communication and respect for local customs foster strong global relationships.

5. Cultural Agility is a Learnable Skill – Through experience, training, and exposure, professionals can improve their ability to work across cultures.

Caligiuri’s book is a must-read for those looking to expand their global mindset and succeed in international business.borders.

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The Accredited Franchise Supplier certification

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Africa

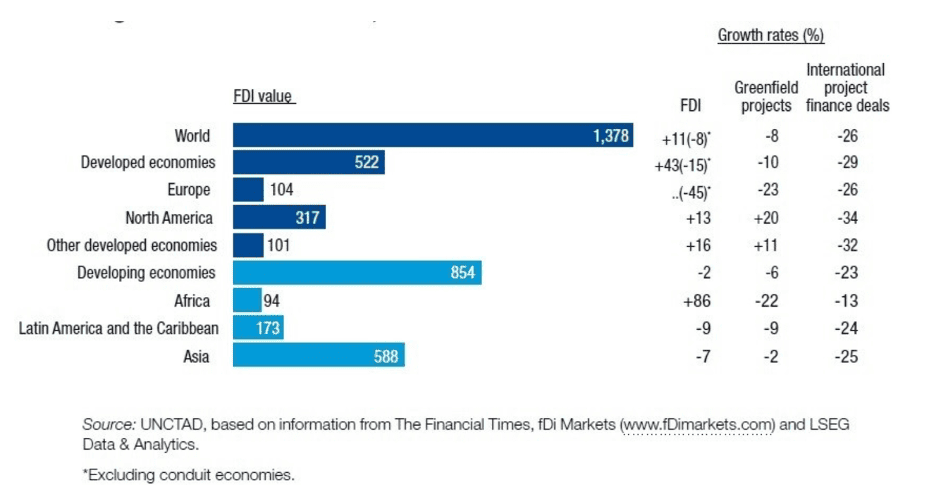

“Foreign Investment in Africa Reaches Record $94bn in 2024 – Despite a global decline in foreign investment, Africa saw a significant boost last year, largely driven by a single major urban and tourism project in Egypt. Even without this mega-project, Africa saw a 23% increase in FDI inflows in 2024, totaling $50 billion. The gains came despite a tough economic climate marked by rising interest rates, mounting public debt, and persistent political and security challenges across the continent. Asia, traditionally the largest recipient of FDI among developing regions, saw inflows shrink by 7%, while Latin America and the Caribbean experienced a 9% decline. UN Trade and Development predicts moderate FDI growth in 2025, supported by better financial conditions and a recovery in mergers and acquisitions. However, risks such as geopolitical tensions and global economic instability remain significant challenges for both developing and developed countries.”, Ecofina Agency, January 23, 2025. Compliments of Africa Alert, a regional newsletter published by colin smith.

============================================================================================

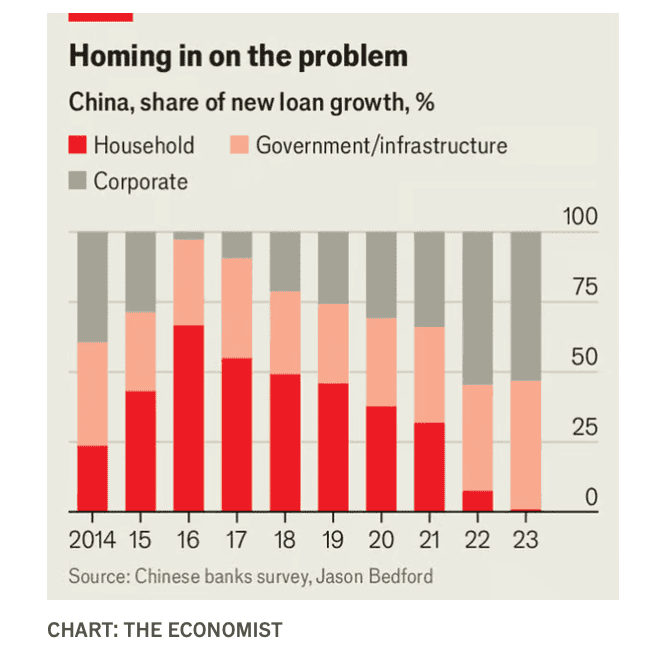

China

“China’s financial system is under brutal pressure – When will something break? “Short essays” appear to be causing big problems in China’s bond market. Over the past year the term has been used to refer to rumours swirling around financial hubs, which often originate with brief posts on social media that attempt to explain the inner workings of the system. One such rumour claims that the central bank is hunting down speculators who have made “illegal transactions” on the bond market. Another implies the China Financial Futures Exchange, where bond futures are bought and sold, has ratcheted up fees in order to discourage trading…..Falling (home) prices will please first-time homebuyers, but not banks. They use unsold flats and the land reserves of property developers as collateral against loans.”, The Economist, January 23, 2025

==============================================================================================

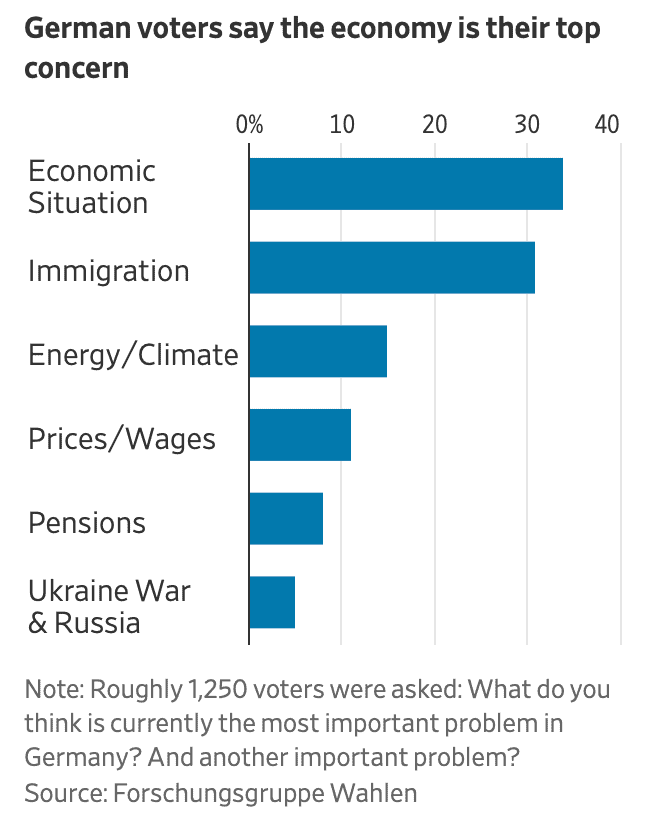

Germany

“Germany’s Economic Model Is Broken, and No One Has a Plan B – The country is focused on exports, but China is slowing imports and U.S. tariff threats are growing. Politicians are offering few alternatives. Gross domestic product has roughly flatlined since 2019, before the start of the Covid-19 pandemic—the longest period of stagnation since the end of World War II. Most economists expect it will stagnate again this year. Most politicians are focusing on how to tweak and improve the current export-reliant, manufacturing-heavy economic model. New ideas to encourage investment and consumption, boost trade inside Europe or open up to fast-growing tech or services sectors are virtually absent.”, The Wall Street Journal, January 26, 2025

==============================================================================================

India

“WeWork’s India franchisee files for Mumbai IPO – WeWork India has an aggregate leaseable area of 602,012 square metres (6.48 million square feet). The offer will consist of the sale of 33 million equity shares by Indian real estate firm Embassy Group (EMBA.NS) and 10.3 million equity shares by 1 Ariel Way Tenant. WeWork India is controlled by real estate tycoon Jitu Virwani and son Karan Virwani who own Bengaluru-based developer Embassy Group. Karan Virwani is CEO of WeWork India.”, Reuters, February 2, 2025

=============================================================================================

Japan

“Bank of Japan raises interest rates to highest level in 17 years – Central bank signals more increases to come if wage and price growth hit forecasts. The Bank of Japan has raised short-term interest rates to “around 0.5 per cent”, the highest level in 17 years, as the central bank said that economic activity and wage and price inflation were at targets to justify its push to “normalise” monetary policy. The BoJ’s decision, by an 8-1 vote, raised the policy rate from 0.25 per cent to its highest level since the 2008 global financial crisis. The central bank is targeting a stable inflation rate of about 2 per cent.”, The Financial Times, January 24, 2025

===============================================================================================

United Kingdom

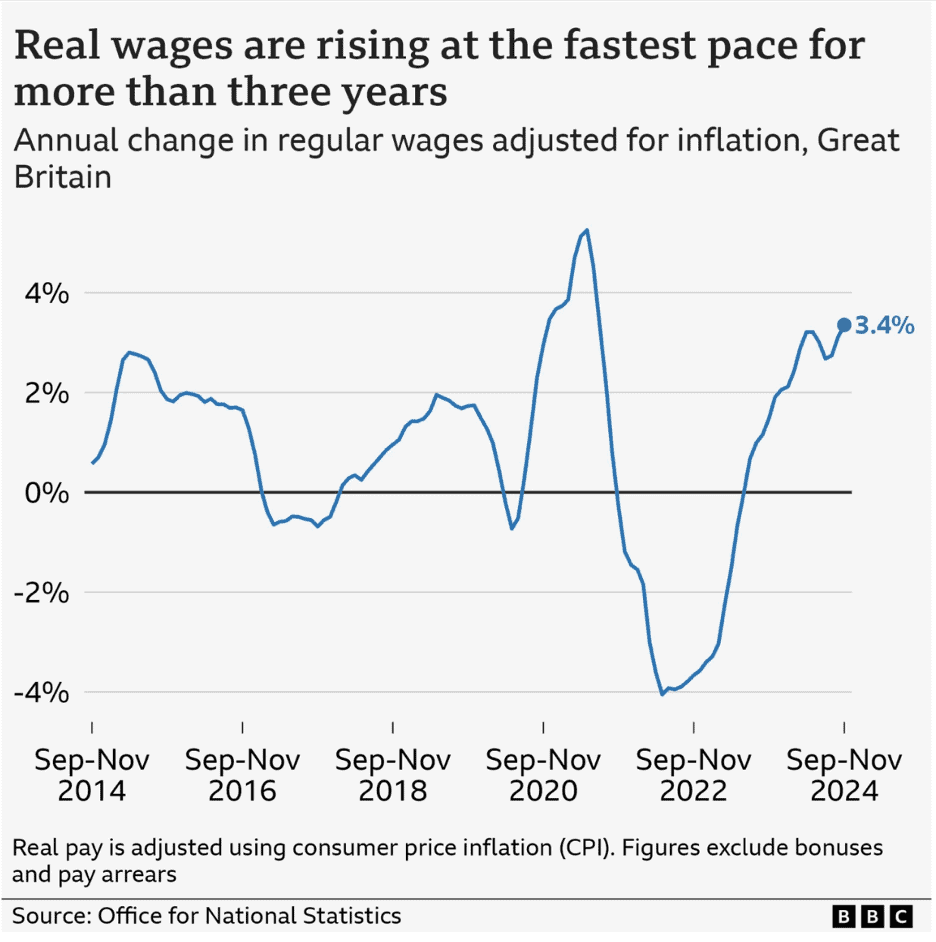

“(UK) Pay after inflation rises at fastest rate since 2021 – UK pay after inflation has risen at its fastest rate for more than three years, driven by strong wage growth in the private sector. Pay packets increased on average by 3.4% between September and November compared with the same period a year ago after taking into account the impact of price rises, according to the Office for National Statistics (ONS). Growth in private sector earnings was stronger than for public sector jobs.”, BBC, January 21, 202

================================================================================================

United States

“Sales of Electric Heavy-Duty Trucks Are Hitting a Regulatory Wall – Commercial prospects for the vehicles face shifting and contradictory mandates, leaving dealers in limbo. Heavy-duty truck manufacturers and dealers are caught in a swirl of shifting and conflicting rules over zero-emissions big rigs as the changing regulatory landscape undercuts the commercial prospects of the vehicles. Trucking industry officials broadly welcomed California’s move because of battery-electric trucks’ limited driving range compared with diesel and because of the scarcity of electric-charging infrastructure across the state.”, The Wall Street Journal, January 29, 2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Taking Brands Global Successfully For 5 Decades

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“This Iconic Chain’s Shocking Comeback Is Outpacing Olive Garden and Texas Roadhouse – Ever since the pandemic, sit-down chains have been struggling to stay afloat. From inflation forcing the price of dining out to the healthy eating trend, fewer people have been spending their money at their local Chili’s, Outback, or Olive Garden. However, little by little, the bigger chains are building their customer bases once again. According to stats, Brinker International’s (EAT) Chili’s experienced nearly a 15 percent growth in 2024. Jefferies analyst Andy Barish called the chain ‘the most extreme example of being able to hit a value promotion at exactly the right time and then be able to support it with an incredible amount of social media spending and influencers.’”, Eat This, February 2, 2025

==============================================================================================

“Luckin Coffee beat Starbucks in China. It’s now taking its playbook overseas to markets like Malaysia– The chain is expected to copy its successful China playbook of promotions and steep discounts in Malaysia. To commemorate the launch, Luckin priced its beverages as low as 2.99 Malaysian ringgit ($0.67). A Starbucks Americano costs about 11 ringgit ($2.50). The chain’s revenue overtook Starbucks’ Chinese revenue by the following year. Luckin also started its overseas expansion in 2023 with its first Singapore outlet; it now has 45 stores in the city-state, according to its latest quarterly filing. The chain reportedly plans to continue its expansion in Southeast Asia and even to launch in the U.S., aiming for cities with large Chinese student and tourist populations like New York.”, Fortune, January 23, 2025++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive our biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing business environment. And our GlobalTeam™ on the ground covering 25+ countries provide us with updates about what is actually happening in their specific countries. We do not get involved in or report on politics!

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe, and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant since 2001 taking 40+ franchisors global.

| To receive this biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com +++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++ |

Our latest GlobalVue™ 40 country ranking

For a complimentary 30-minute consultation on how to take your business into new countries and make money doing it. For a complimentary call with Bill Edwards click on the QR code or contact Bill at bedwards@edwardsglobal.com and +1 949 375 1896