Biweekly Global Business Newsletter Issue 131, Tuesday, April 1, 2025

Happiest Countries, Global Uncertainty and TGI Friday’s Is Back!

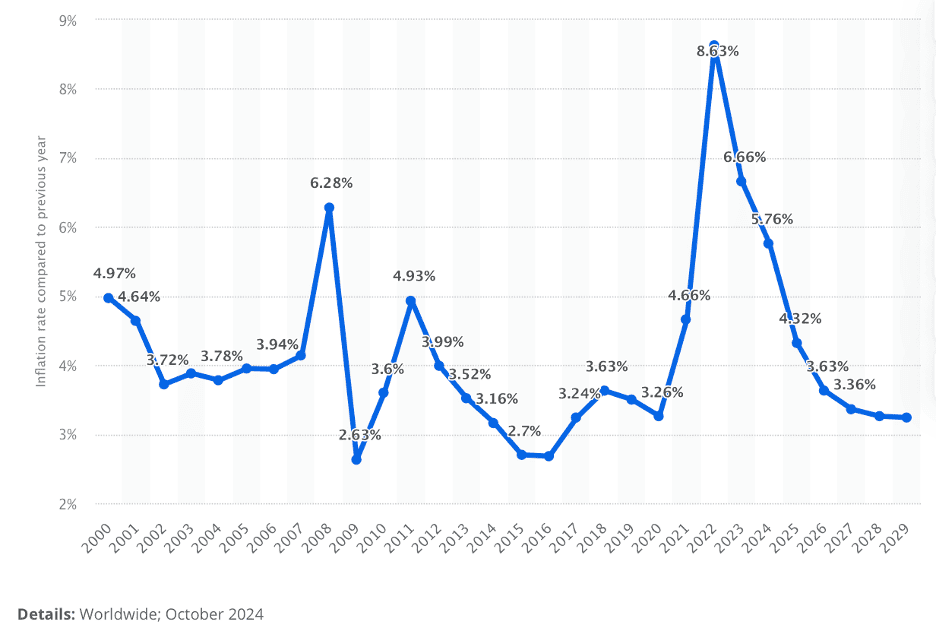

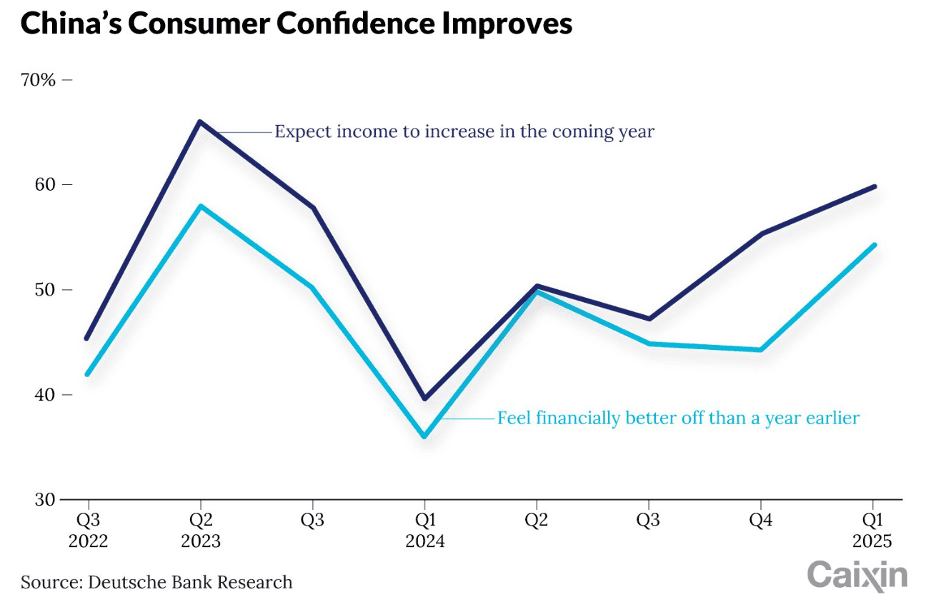

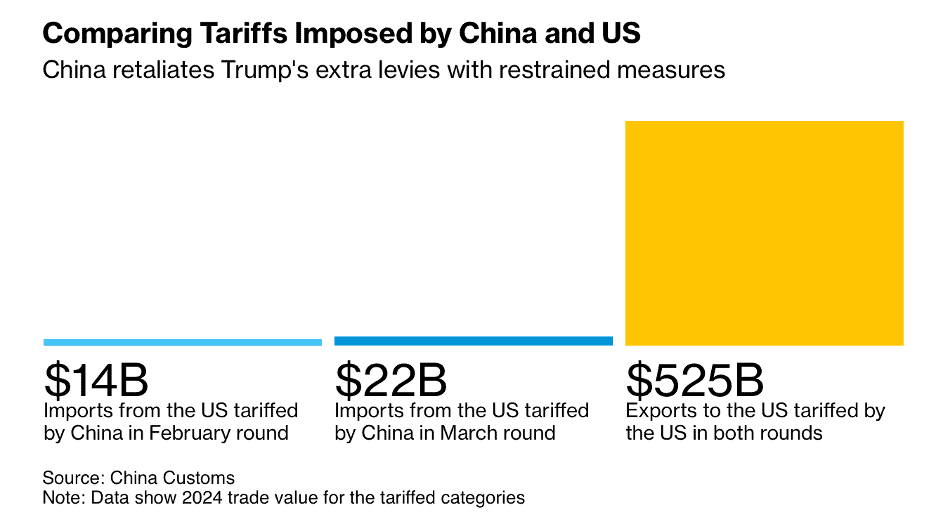

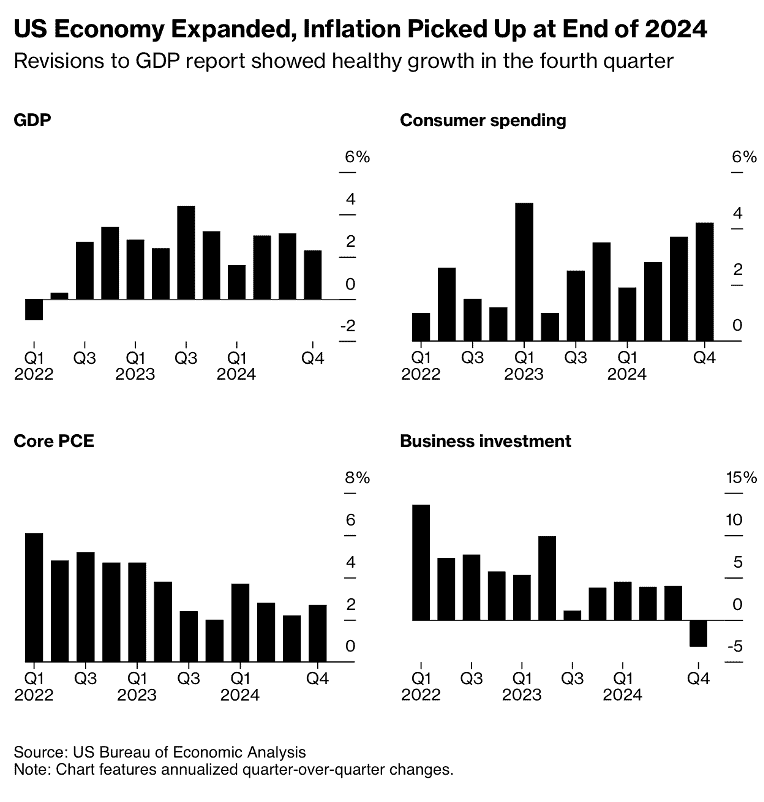

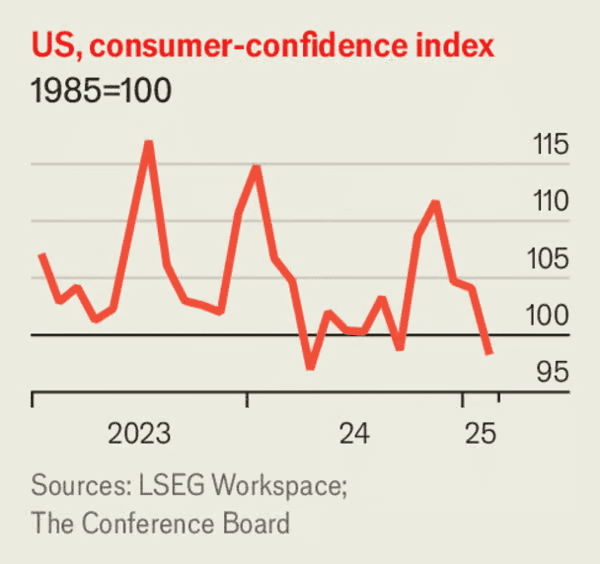

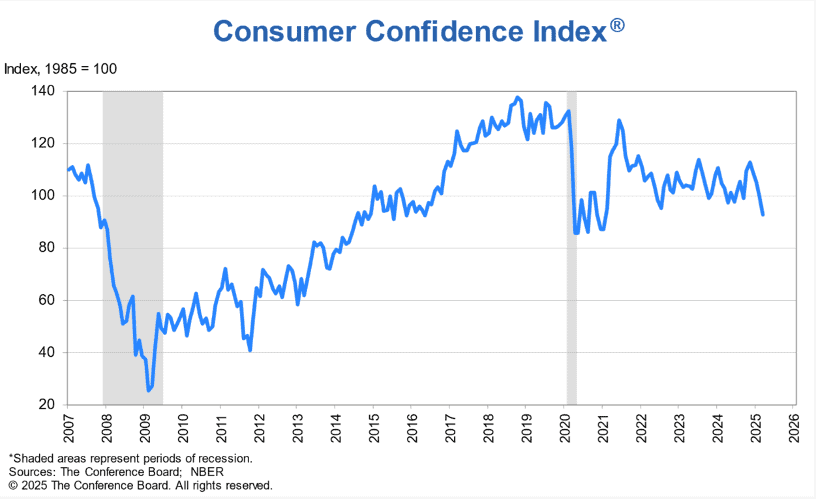

Commentary about the 131th Issue: This is one of our biggest newsletters to date as there is lots of ‘stuff’ going on around the world today! As we approach ‘T-Day” on April 2nd (maybe) in the USA, other countries are pushing back against doing business with US companies and brands. America accounts for just 13 percent of global goods imports — down from close to 20 percent two decades ago. Global inflation is projected to drop from over 5% in 2024 to just over 3% by 2029. Walmart, the US’s 10th most valuable company is a full $300 billion more valuable than Tencent, China’s most valuable company. Chinese consumer confidence is up while consumer confidence tumbled this month partially due to concern about the impact tariffs will have on prices at stores. Going forward, it is predicted that economic growth will depend on electricity, not oil as the supply and price of electricity become as politically potent as that of gasoline. And several high tourist countries are putting ‘overtourism’ policies in place. Oh, and you can see the predictions for all 12 zodiac signs in the Year of the Snake!!!!!!

One More Thing: The “Opportunities don’t happen. You create them” quote in this issue by Chris Grosser is especially relevant for entrepreneurs and franchise leaders expanding into new international markets like the companies Edwards Global Services, Inc. helps Go Global successfully with their brands.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

But First……The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business.

PLEASE NOTE: Some of the information sources that we provide links to in our newsletter require a paid subscription to directly access them. Clicking on a link may not give the reader access to the content.

Edited and curated by: William (Bill) Edwards, CEO & Global Business Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA. Contact Bill with questions, comments and contributions. Bedwards@edwardsglobal.com, +1 949 375 1896

Link to our current and past newsletters: https://edwardsglobal.com/geowizard/

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

First, A Few Words of Wisdom From Others For These Times

“Tough times never last, but tough people do.”, Robert H. Schuller

“Believe you can and you’re halfway there.”, Theodore Roosevelt

“Opportunities don’t happen. You create them.”, Chris Grosser.

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Highlights in issue #131:

McDonald’s passes Starbucks as the world’s most valuable restaurant brand

The World’s Happiest Countries Over Time (2019–2024)

Is Year of the Snake’s month 3 lucky for you?

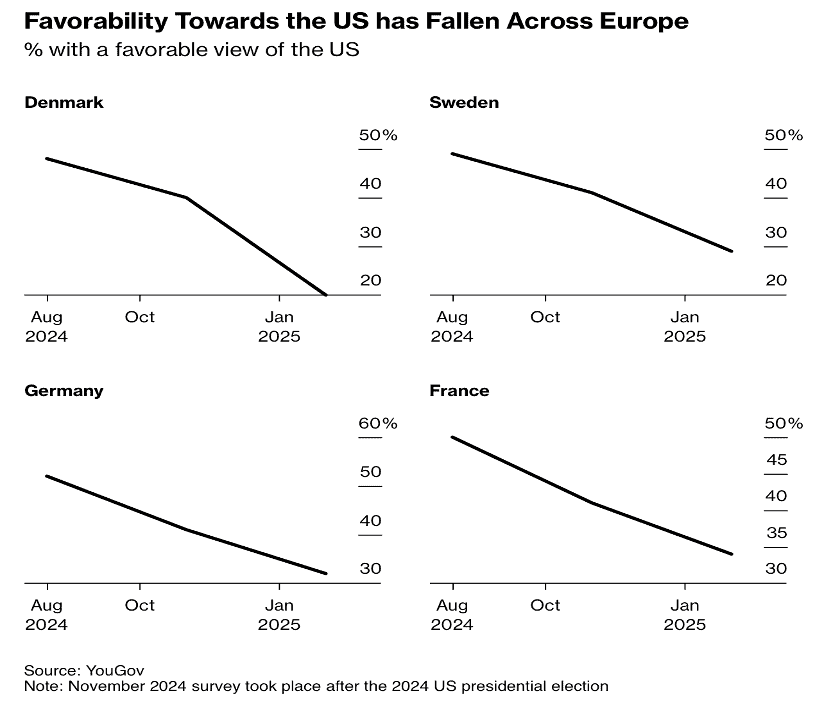

Anti-American Sentiment Rises in Europe as Trump Fuels Anger

US Consumer Confidence tumbled again in March

Destinations Making Changes to Combat Overtourism

Brand Global News Section: Chagee®, Dave’s Hot Chicken®, Haidilao®, Off Burger®, McDonalds® and TGI Fridays®

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

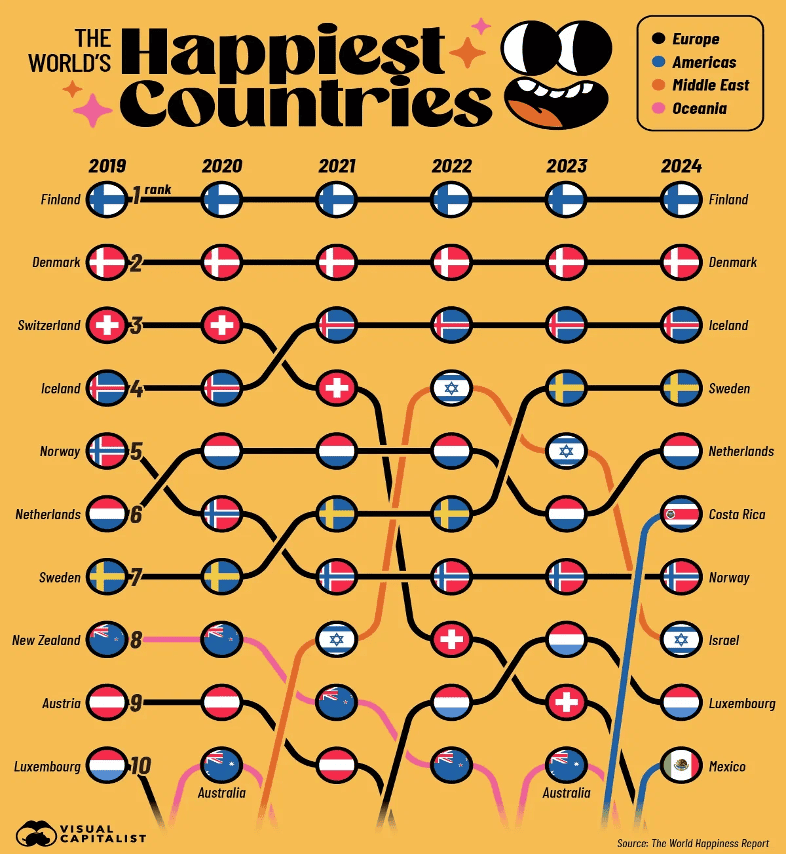

“The World’s Happiest Countries Over Time (2019–2024) – The World Happiness Report is an annual publication that ranks global happiness based on life evaluations, social support, freedom, GDP per capita, and other well-being indicators, using data from the Gallup World Poll and additional sources. Finland and Denmark have been the world’s two happiest countries for six years in a row, respectively. Overall, Nordic countries have consistently been among the top 10, with Iceland and Sweden climbing up the rankings. Costa Rica has seen a steady climb from the 15th spot in 2019 to 6th in 2024. Meanwhile, Switzerland dropped from 3rd to 13th over the same period. Among the top 10, Mexico has seen the biggest jump from 25th in 2023 to number 10 in 2024. Israel has seen a turbulent shift in happiness rankings, rising from 14th in 2019 to 4th in 2022, before dropping to 8th in 2024. However, it remains among the happiest countries in the world.”, Visual Capitalist & World Happiness Report, March 28, 2025

Editor’s Note: Canada ranks 18th, The United Kingdom 23rd and the United States 24th.

============================================================================================

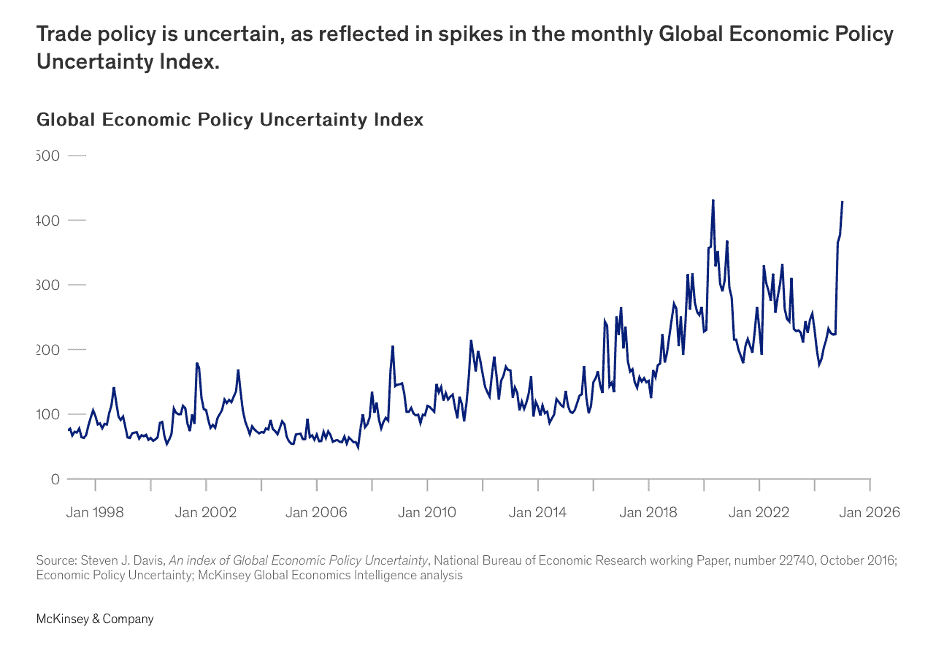

“Global Economics Intelligence executive summary – Geopolitical and trade uncertainty stayed elevated in February, with inflation back in focus as consumers and producers expect higher prices; industry sentiment is still positive despite slow growth. Trade policy is notably uncertain, with both the monthly Global Economic Policy Uncertainty Index and the Trade Policy Uncertainty Index spiking. Across economies, consumer confidence has dipped as inflation expectations have risen. The US consumer confidence index (Conference Board) declined in January to 104.1, from a revised 109.5 in December. In Brazil, consumer confidence has been lingering below the neutral 100 mark and fell to 86.2 in January (91.3 in December) to reach its lowest level since February 2023, with elevated borrowing costs a likely factor in denting confidence.”, McKinsey & Co., March 21, 2025

=============================================================================================

“10 Largest Companies in the U.S., Europe, and China – This chart ranks the 10 largest companies in the U.S., EU (including the UK), and China by their market capitalizations. Data is……current up to February 10th, 2025. The top nine American companies by market cap are all worth more than a trillion dollars. And the 10th largest—Walmart—is a full $300 billion more valuable than Tencent, China’s most valuable company.”, Visual Capitalist & Companiesmarketcap.com & Yahoo Finance, February 24, 2025

=============================================================================================

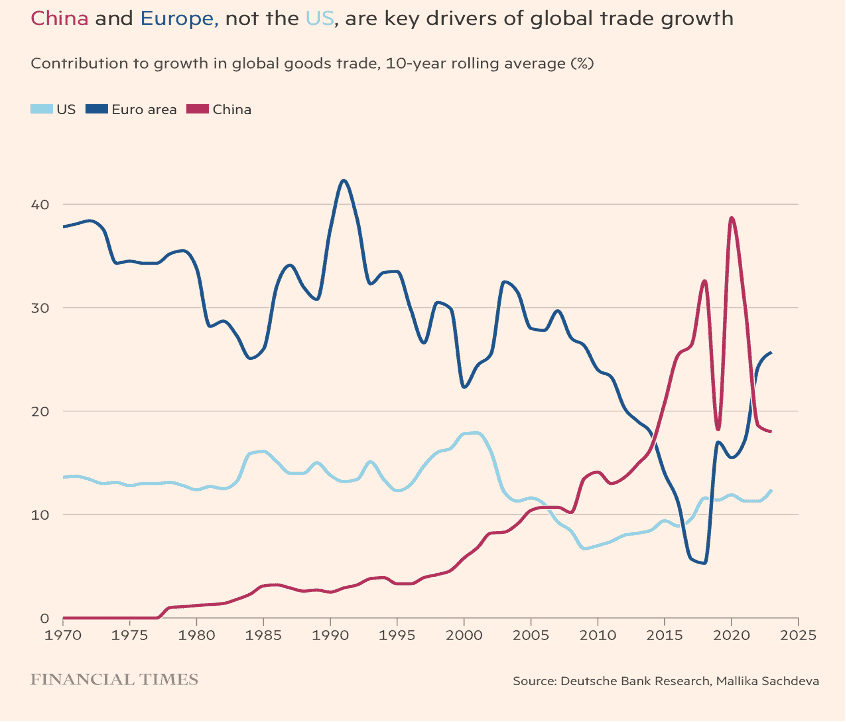

“Globalisation will triumph over Donald Trump – Economic incentives outweigh politics in the long run. Fear of a deglobalising world is high. With the global goods trade slowing and national security doctrine in vogue, many worry that Trump’s tariffs could be the straw that breaks globalisation’s back……….the importance of the US to global trade can be overstated, since it is the world’s largest economy. America accounts for just 13 per cent of global goods imports — down from close to one-fifth two decades ago. That makes it the largest importer and a notable influence on trade patterns, but not sufficient to reverse globalisation on its own. The US isn’t the main driver of global trade growth. Europe — and more recently China — are bigger contributors. ‘As the US retreats from the global stage, other governments will want to lean in to offset potential sales and import losses with new deals,’ said Scott Lincicome, a vice-president at the Cato Institute.”, The Financial Times, March 29, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation, Taxes & Trade Issues

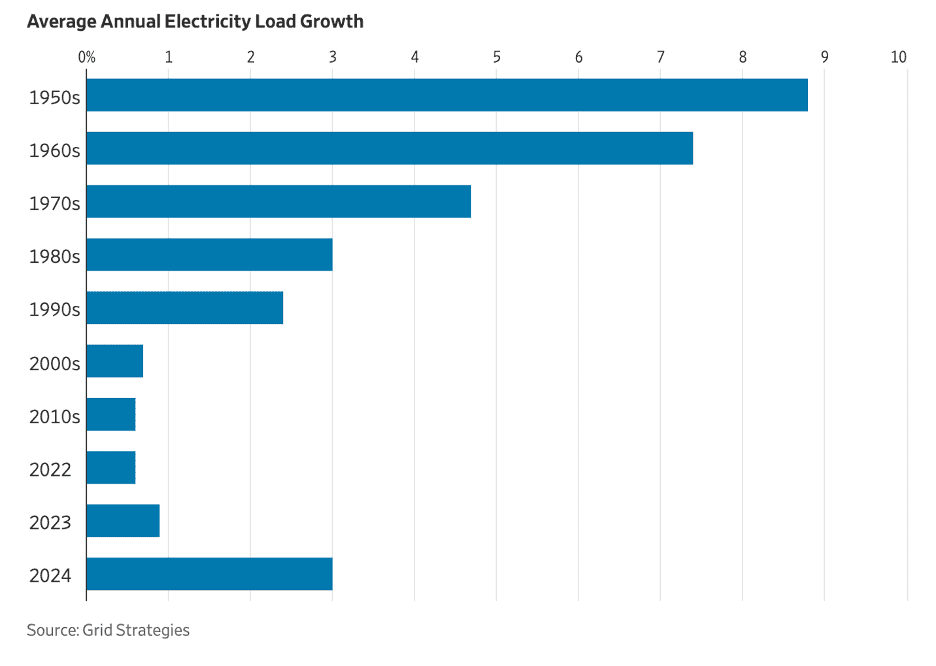

“Economic Growth Now Depends on Electricity, Not Oil – Americans have long equated energy security with oil. The country wanted as much as possible because of the havoc an interruption to supply—from wars, disasters and political convulsions—can cause. In coming years, though, energy security will mean electricity. Power demand, stagnant for decades, is now growing rapidly, for data centers to run artificial intelligence and other digital services and, in time, transportation and buildings. An economy dependent on electricity will be different from one dependent on oil. It will require mammoth investment in generation, distribution and transmission. It will challenge regulators and political leaders, as the supply and price of electricity become as politically potent as that of gasoline.”, The Wall Street Journal, March 29, 2025

=============================================================================================

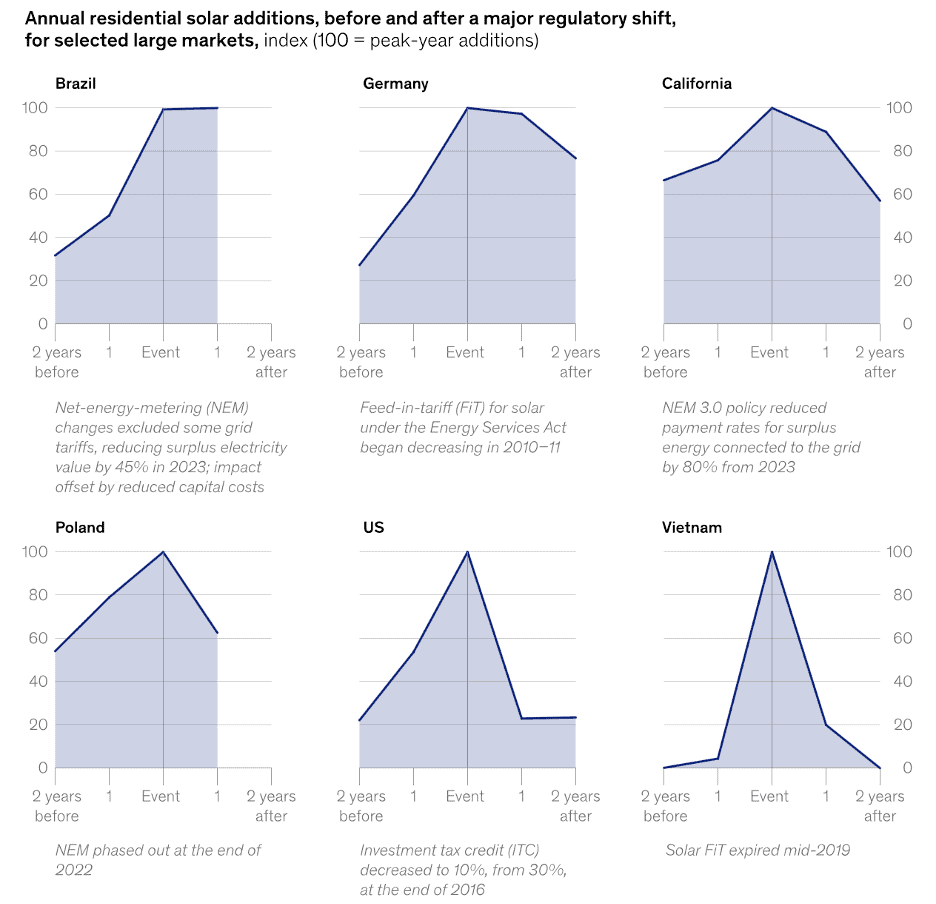

“Solar installation swings with policy shifts – Regulatory changes significantly affect residential solar projects. Policy shifts, such as the addition or removal of compensation mechanisms like net-energy metering or feed-in tariffs, can cause dramatic year-over-year increases or decreases in the installation of residential solar projects in markets worldwide…..Significant policy changes can bring dramatic swings in year over year solar installation.”, McKinsey & Co., March 11, 2025

============================================================================================

“Global inflation rate from 2000 to 2022, with forecasts until 2029 – Inflation is generally defined as the continued increase in the average prices of goods and services in a given region. Following the extremely high global inflation experienced in the 1980s and 1990s, global inflation has been relatively stable since the turn of the millennium, usually hovering between three and five percent per year. There was a sharp increase in 2008 due to the global financial crisis now known as the Great Recession, but inflation was fairly stable throughout the 2010s, before the current inflation crisis began in 2021.”, Adapted from Statista, published by Aaron O’Neill, January 10, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel News

“Destinations Making Changes to Combat Overtourism – Overtourism is a big theme in the travel world, and it has been growing since the pandemic. Destinations that received large numbers of tourists enjoyed a well-deserved break from the congestion during lockdowns and travel bans. Then, they suddenly experienced large waves of tourists returning once the world reopened. Amsterdam is one of the significant destinations creating the most laws restricting or curbing overtourism in recent years. Barcelona hopes to ban short-term rentals by 2028. Alicante is banning new short-term rentals for the next two years. The Czech Republic cracked down on unregistered short-term vacation rentals in major cities like Prague in September 2024. Venice implemented a day trip tax for travelers who don’t stay the night during high-tourist days and later added a size limit for tour groups, so groups can only be 25 people maximum. Rome is also considering restricting access to the Trevi Fountain due to large crowds.”, Travel Pulse, March 21, 2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Book Review

“The Measure of Progress: Counting What Really Matters” by Diane Coyle, critically examines the adequacy of traditional economic metrics in capturing the complexities of today’s digital and global economy. Coyle argues that economic indicators developed in the mid-20th century, such as Gross Domestic Product (GDP), are outdated and insufficient for assessing contemporary economic realities. She contends that these metrics fail to account for factors like environmental sustainability, digital innovation, and intangible assets, which are increasingly central to economic progress. The book advocates for a new statistical framework that better reflects the current economic landscape.

In regard to doing global business, Coyle’s insights underscore the necessity of adopting more comprehensive and nuanced measures of economic performance. Relying solely on traditional metrics like GDP can lead to misinformed strategies and policies that overlook critical elements such as digital transformation, environmental impact, and social well-being. Embracing a broader set of indicators can enhance decision-making processes, promote sustainable practices, and provide a more accurate assessment of market potentials and risks.

Five Key Takeaways

Limitations of Traditional Metrics: Standard economic measures like GDP are inadequate for capturing the full scope of modern economic activities and challenges.

Need for a New Framework: There is a pressing need to develop and implement statistical frameworks that incorporate contemporary factors such as digital assets, environmental costs, and intangible values.

Importance of Comprehensive Data: Accurate and inclusive data collection is essential for understanding and responding to current economic dynamics effectively.

Policy Implications: Policymakers must recognize the shortcomings of existing economic indicators and work towards integrating more holistic measures to guide economic policies.

Adaptation to Modern Challenges: The evolving nature of the global economy, marked by digitalization and environmental concerns, necessitates a reevaluation of how progress is measured to ensure sustainable and equitable growth.

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The Accredited Franchise Supplier certification

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Argentina

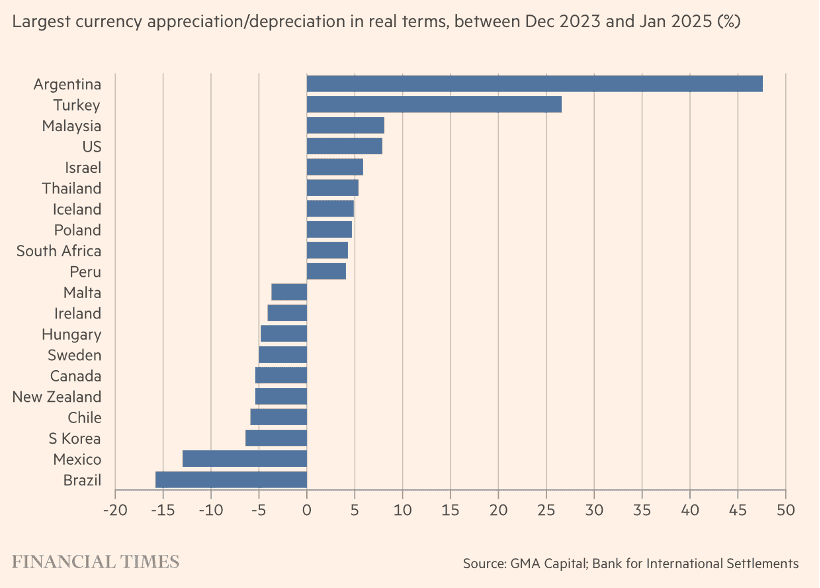

“Argentines snap up foreign goods as Javier Milei strengthens peso – Chinese solar panels and Uruguayan butter arrive as president tackles inflation by easing import restrictions. Argentina’s peso has strengthened more in real terms than any other currency since December 2023. As Argentina recovered from a recession that depressed imports and Milei began opening up the protectionist economy, the country’s inbound trade surged 30 per cent in the past six months compared with the previous period on a seasonally adjusted basis, according to the national statistics agency. Italian pasta, Brazilian bread and Uruguayan butter have become increasingly visible on supermarket shelves after retailers almost doubled food imports in the first two months of 2025 from a year earlier. Solar-cell imports grew tenfold, while farmers quadrupled overseas tractor purchases.”, The Financial Times, March 22, 2025

==============================================================================================

Australia

“Industrial Relations Reforms Causing (Australian) Small Business Headaches – Australian businesses are feeling the squeeze from ongoing industrial relations (IR) changes, with new research revealing that nearly two-thirds of business owners believe the reforms have made running their business harder. The survey by Small Business Loans Australia, found that a large number of businesses have been negatively impacted by the government’s IR reforms. Wage increases, limits on fixed-term contracts, multi-employer bargaining, and changes designed to improve worker protections are damaging small businesses. 64 per cent of businesses say IR changes have made running their business harder. Minimum wage increases have had the most negative impact on more than a quarter of businesses. Half of large businesses are struggling with multi-employer bargaining. The most common pain point was the 2022 increase to the minimum wage, which saw pay packets rise by 5.2 per cent. More than a quarter (28 per cent) of business owners identified this change as a major burden.”, Business Builders, March 20, 2025

===============================================================================================

Canada

“Canada’s corrugated industry works to untangle from U.S. as tariffs loom – It can take less than 24 hours for a shipment of 3.5 tonne paper rolls to travel from a mill in Washington State to corrugated sheet manufacturer CanCorr in Surrey, B.C. But in the past two months, Baha Naemi, co-founder and managing partner of CanCorr, has paused orders from the U.S., instead waiting at least 10 days for the same shipment to arrive from Eastern Canada. Or even longer from Europe. It’s no secret that he’s losing money over the decision, but he says it’s worth it to send a message to his U.S. counterparts and smooth out any kinks in a changing supply chain. ‘We all agree that Canada needs to become self-reliant, whether it’s in the packaging industry or any other industry,’ Mr. Naemi said.”, The Globe and Mail, March 26, 2025

===============================================================================================

China

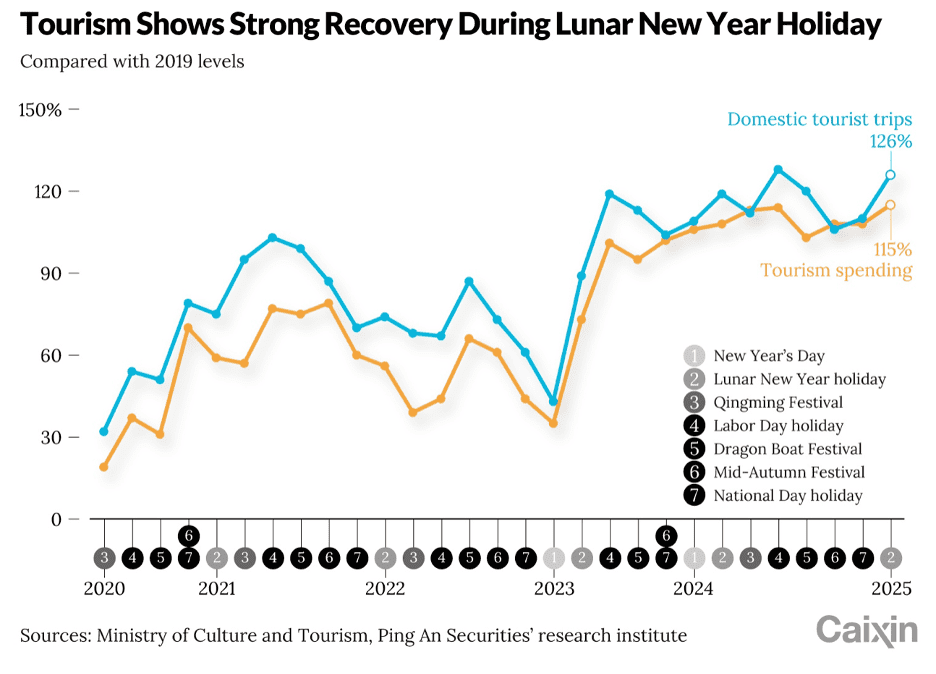

“Chinese Consumers Are More Confident and Willing to Spend, Survey Shows – Confidence among consumers in China’s large and midsize cities is returning and willingness to spend is increasing, with more people feeling financially better off and expecting higher incomes this year, a new survey shows, suggesting government stimulus measures that started in September are having an impact. However, while attitudes on income and spending have improved, more survey respondents said prices have been rising over the past few months and sentiment toward the property market remains weak….The survey was conducted during the first quarter among individuals aged 18 to 65 in first- and second-tier cities.”, Caixin Global, March 20, 2025

==============================================================================================

“Is Year of the Snake’s month 3 lucky for you? Predictions for all 12 zodiac signs – Work pressures increase for many Chinese zodiac signs in the third lunar month of the Year of the Snake, which starts on March 29, while budgeting and windfalls are common themes as well. Health seems stable for most signs, with a couple of outliers who must watch out for accidents and take preventive measures. Read on to discover feng shui master Andrew Kwan’s predictions about what your Chinese zodiac sign brings.” South China Morning Post, March 29, 2025

===============================================================================================

Europe

“Anti-American Sentiment Rises in Europe as Trump Fuels Anger – Trump’s threats to impose punitive tariffs on Europe, seize territories and pull military support in the region — including his handling of the war in Ukraine — have irked European consumers, fueling campaigns to boycott US products. There’s currently no country in Europe where more than half of the population has a positive attitude toward the US, according to a YouGov poll published March 4. Facebook groups urging the boycott of US goods have sprung up and amassed thousands of followers.”, Bloomberg, March 30, 2025

=============================================================================================

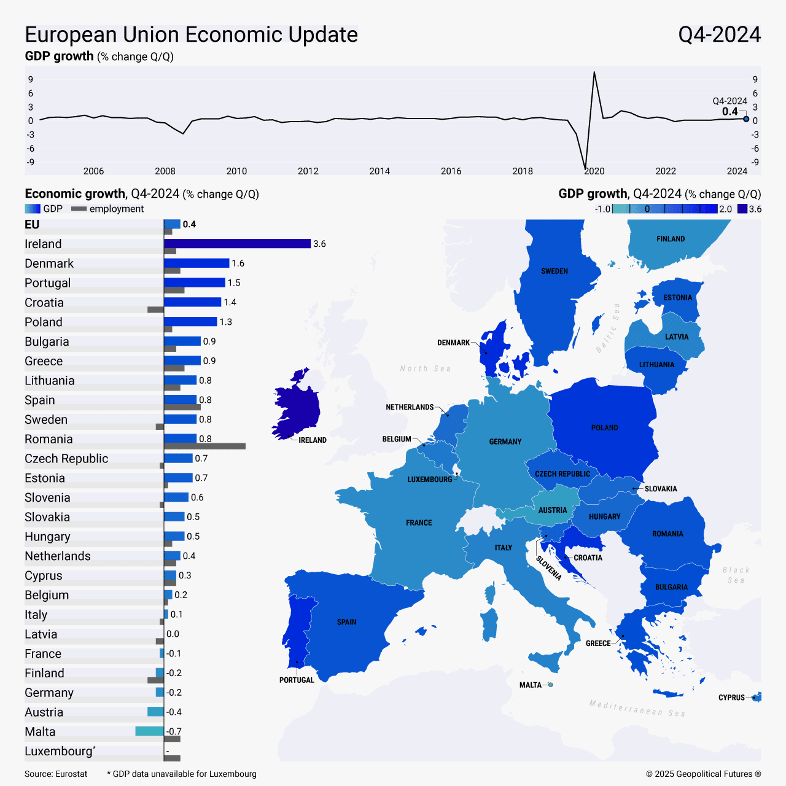

Germany

“Germany Weighs Down European Growth – Germany’s economic trajectory remains Europe’s central challenge. The euro area posted modest economic growth in the last quarter of 2024, with seasonally adjusted gross domestic product rising 0.2 percent from the previous quarter. The broader EU outpaced it slightly, growing by 0.4 percent. Employment also increased, up 0.1 percent in the euro area and 0.3 percent in the EU. Germany, however, remains a weak link. Its GDP contracted by 0.2 percent in the fourth quarter, reversing the 0.1 percent growth in the previous quarter. The primary driver was a sharp 2.2 percent drop in exports – the steepest decline since mid-2020.”, Geopolitical Futures, March 28, 2025

==============================================================================================

India

“US officials begin trade talks in Delhi as tariff deadline nears – A US delegation, led by Assistant Trade Representative for South and Central Asia Brendan Lynch, arrived in the city on Tuesday for the talks. ‘This visit reflects the United States’ continued commitment to advancing a productive and balanced trade relationship with India,’ a US Embassy statement said. The countries have been engaged in hectic negotiations since Trump came into office. Trump and Modi had set a target to more than double it to $500bn (£400bn). The two sides also committed to negotiating the first phase of a trade agreement by autumn 2025. India’s average tariffs of around 12% are also significantly higher than the US’s 2%.”, BBC News, March 25, 2025

==============================================================================================

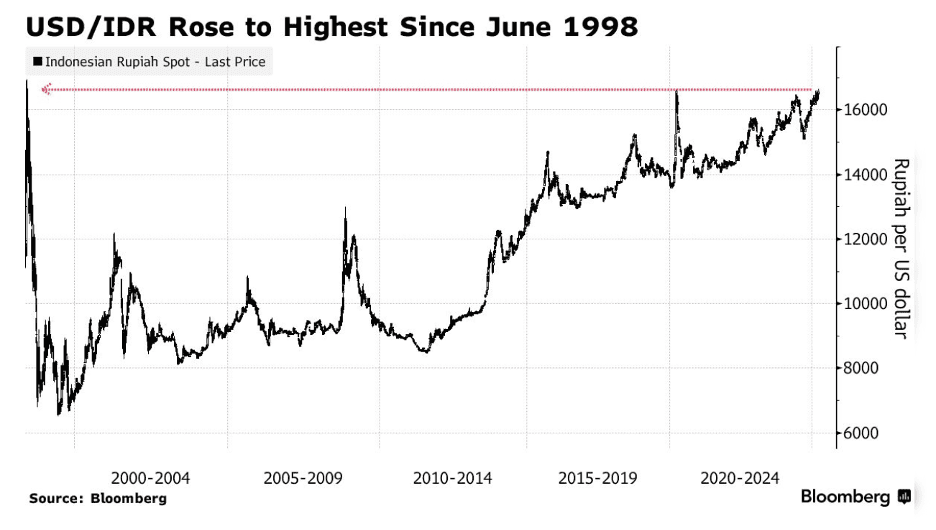

Indonesia

“Indonesian Rupiah Tumbles to Lowest Since Asian Financial Crisis – The currency has slumped more than 3% this year, making it one of the worst performers in emerging markets. The rupiah’s weakening is mainly due to global uncertainties, including Donald Trump’s tariffs and a potentially more hawkish Federal Reserve…… Indonesia, one of the region’s favorite markets just a year ago, has quickly lost its appeal with global investors as concerns grow over the sustainability of the nation’s economic policies.”, Bloomberg, March 25, 2025

==============================================================================================

The Philippines

“Philippine Finance Chief Sees 7% Growth Despite Political Noise – The Philippine economy can grow as much as 7% this year, aided by interest-rate cuts that will support investment and consumption, according to Finance Secretary Ralph Recto who also brushed aside concerns over political stability. The Philippine currency has risen 1.6% in the past month, the best performance among Asia’s most-active currencies. The Philippines, one of Asia’s growth stars, could see its economic momentum slow amid elevated borrowing costs, sluggish stock market and mounting political risks.”, Bloomberg, March 18, 2025

===============================================================================================

United States

“US Consumer Confidence tumbled again in March – Consumers’ expectations for the future at a 12-year low. The Conference Board Consumer Confidence Index® fell by 7.2 points in March to 92.9 (1985=100). The Present Situation Index—based on consumers’ assessment of current business and labor market conditions—decreased 3.6 points to 134.5. The Expectations Index—based on consumers’ short-term outlook for income, business, and labor market conditions—dropped 9.6 points to 65.2, the lowest level in 12 years and well below the threshold of 80 that usually signals a recession ahead. The cutoff date for preliminary results was March 19, 2025. ‘Consumer confidence declined for a fourth consecutive month in March, falling below the relatively narrow range that had prevailed since 2022,’ said Stephanie Guichard, Senior Economist, Global Indicators at The Conference Board.”, The Conference Board, March 25, 2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Taking Brands Global Successfully For 5 Decades

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Brand & Franchise Sector News

McDonald’s passes Starbucks as the world’s most valuable restaurant brand – Chick-fil-A has jumped into the top 10 with a 43% increase in brand value, according to valuation consultancy Brand Finance. After a challenging 2024 that included four straight quarters of same-store sales declines, Starbucks is no longer the world’s most valuable restaurant brand, according to a new “Restaurants 25 2025” report from valuation consultancy Brand Finance. The coffee giant has ceded the top spot to McDonald’s, which experienced a 7% increase in value to $40.5 billion. It’s the first time McDonald’s has held the top spot since 2016.”, Nation’s Restaurant News, March 24, 2025

Editor’s Note: Here are the top 10 most valuable food & beverage brands in 2025: McDonald’s®, Starbucks®, KFC®, Subway®, Taco Bell®, Tim Horton’s®, Dominos®, Chick fil A®, Wendy’s® and Pizza Hut®.

===============================================================================================

‘Hot Chicken’ Is On The Menu With Dave’s Billion Dollar Buyout – Dave’s Hot Chicken has signed a deal with Roark Capital to sell its trendy fried chicken franchise to the Atlanta-based private equity firm for a cool $1 billion. Dave’s is a fast-casual restaurant chain with a colorful, artsy, graffiti aesthetic that started as a pop-up in Los Angeles in 2017 and has grown like wildfire (too soon?) with nearly 300 locations around the country and annual sales reaching $1 billion. Roark Capital, a private equity fund with $37 billion in assets under management, is no stranger to food and franchises, and owns iconic brands such as Dunkin’ Donuts, Baskin Robbins, Subway, Buffalo Wild Wings, Jimmy John’s, Jamba Juice, Auntie Anne’s Pretzels, Cinnabon, Moe’s Southwest Grill and Sonic (among others).”, Forbes, March 21, 2025

============================================================================================

“Chinese tea chain Chagee reveals revenue surge in US IPO filing – Net revenue nearly tripled to US$1.71 billion in 2024, company says as it prepares for Nasdaq listing. Founded in 2017, Chagee is a premium tea brand. As of December 31, its network comprised 6,440 teahouses, including 6,284 in mainland China, the company said. Chagee’s net revenue jumped to 12.41 billion yuan (US$1.71 billion) in 2024, from 4.64 billion yuan a year ago. Net income increased 213 per cent to 2.51 billion yuan over the same period. The Chinese tea chain plans to use the offering’s proceeds to expand its network in China and abroad, along with other corporate purposes.”, South China Morning Post, March 25, 2025. Compliments of Paul Jones, Jones & Co., Toronto

===============================================================================================

“TGI Fridays CEO says the brand is ready to grow again post-bankruptcy – Ray Blanchette returned to the restaurant chain earlier this year and will help lead future growth, menu innovation and franchising. ‘Over the past decade, our business, and the category-at-large, has faced challenges,’ Blanchette said. ‘Yet, the essence of Fridays — our culture, values, and people — remains strong……With 391 locations across 41 countries, making the right strategic decisions to secure our brand’s future for me is more than a job — it’s a calling……… With TGI Fridays now operating under a debt-free structure, franchisees fully own and manage their locations, allowing them to focus on what matters most — delivering exceptional guest experiences.’”, Restaurant Dive, March 25, 2025

===============================================================================================

“Odd Burger halts US expansion plans over US Canada political tensions – The Ontario-based vegan burger restaurant said its U.S. development is being put on pause ‘given the global tariff uncertainty’. This is a swift turnaround from the burger chain’s U.S. expansion plan funded by a $2 million private placement announced two weeks ago. Instead, Odd Burger is planning to use the private investment funds to invest in its Canadian manufacturing and franchise operations. With U.S. tariffs on Canadian imports set to go into effect on April 2, Odd Burger stated that it wants to help Canadian companies transition from U.S.-based vegan products to Canadian companies selling plant-based products, like Odd Burger.”, Nation’s Restaurant News, March 24, 2025. Compliments of Paul Jones, Jones & Co., Toronto

==============================================================================================

“Haidilao’s core operating profit increased by 18 7 percent last year – It will strategically seek to acquire high-quality assets. On March 25, Haidilao released its 2024 financial report. It disclosed that the company’s revenue last year was 42.755 billion yuan, up 3.1% year-on-year; net profit was 4.700 billion yuan, up 4.6% year-on-year. The core operating profit was 6.230 billion yuan, up 18.7% year-on-year. By the end of 2024, Haidilao will operate 1,368 restaurants, including 1,332 self-operated restaurants in mainland China, 23 in Hong Kong, Macao and Taiwan, and 13 franchised restaurants. Haidilao maintains a relatively steady pace of expansion while continuing to adjust and optimize its stores. In 2024, Haidilao received a total of 415 million customers, with an average daily customer flow of over 1.1 million, an increase of 4.5% over the previous year, and an average turnover rate of 4.1 times per day.”, Caijing, March 25, 2025. Compliments of Paul Jones, Jones & Co., Toronto

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive our biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing business environment. And our GlobalTeam™ on the ground covering 25+ countries provide us with updates about what is actually happening in their specific countries. We do not get involved in or report on politics!

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe, and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant since 2001 taking 40+ companies global.

| To receive this biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com +++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++ |

Our latest GlobalVue™ 40 country ranking

For a complimentary 30-minute consultation on how to take your business into new countries and make money doing it. For a complimentary call with Bill Edwards click on the QR code or contact Bill at bedwards@edwardsglobal.com and +1 949 375 1896

Biweekly Global Business Newsletter Issue 130, Tuesday, March 18, 2025

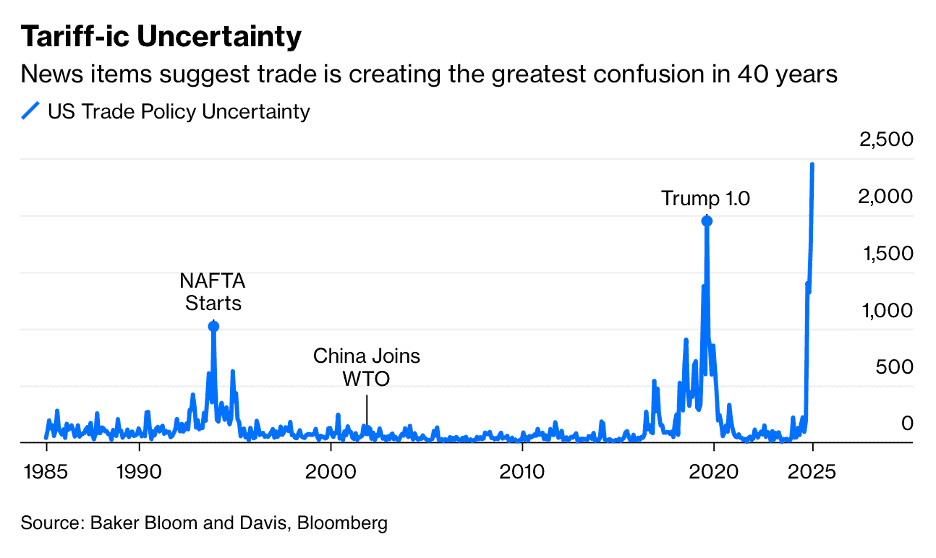

‘Tariff-ic Uncertainty’ Has Arrived, Global Growth To Slow

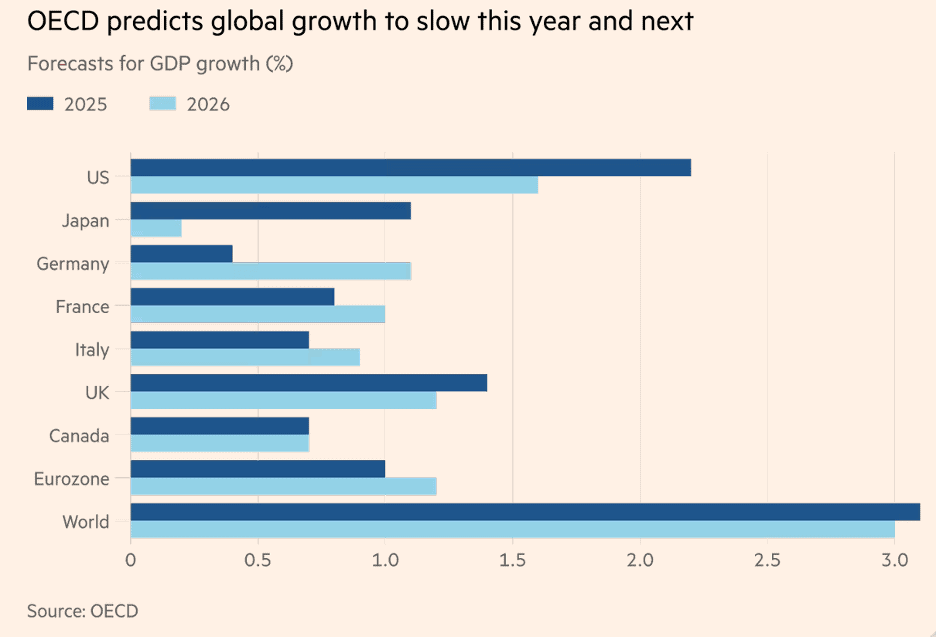

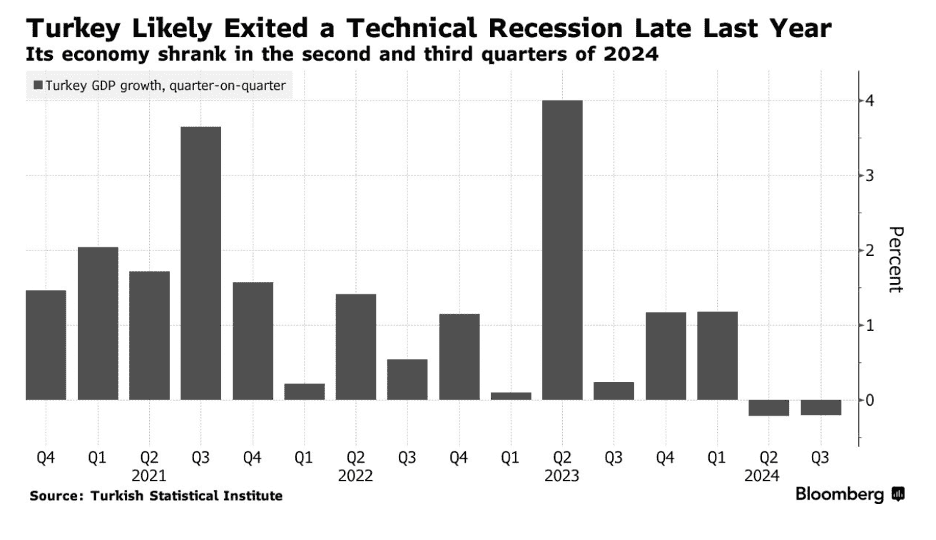

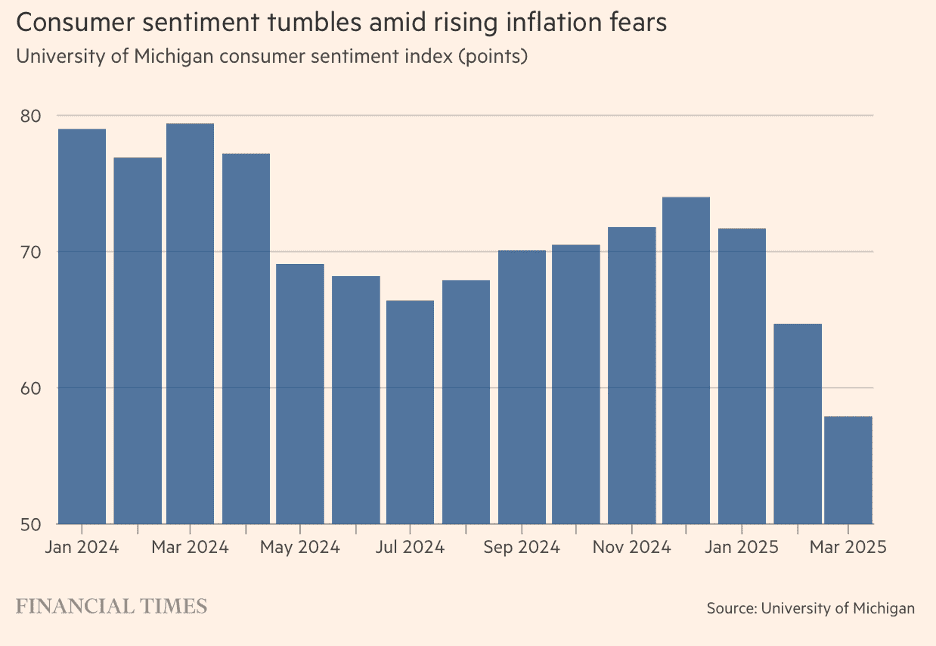

Commentary about the 130th Issue: To our readers: some issues are more positive than others. This issue highlights the upcoming impact of tariffs on our lives and on doing global business while addressing the uncertainty of what the tariffs will be, where they will be applied, when and by whom. As the Economist magazine says, “One thing is certain so far about Trumponomics: no one is sure where it is heading, with radically different possibilities.” Bloomberg says, “forecasting is maddeningly difficult because US policy is so inconsistent.” Tariffs could push Canada into a recession. The OECD says that “Global growth will slow this year and next, from 3.2 per cent last year to 3.1 per cent and 3 per cent in 2025 and 2026.” U.S. airlines expect higher costs from tariffs, supply chain disruptions, and weakened travel demand due to a slowing economy, leading to lower profit forecasts, stock declines, and cautious financial outlooks for 2025. And a little bit about NATO…….The University of Michigan’s consumer sentiment index fell to a preliminary reading of 57.9 in March, the third consecutive monthly drop and the lowest reading since November 2022.

One More Thing: Today “King Dollar: The Past and Future of the World’s Dominant Currency” by Paul Blustein is being published today and offers a very timely and insightful analysis of the U.S. dollar’s enduring supremacy in global finance. He examines historical and contemporary challenges to the dollar, including economic sanctions and emerging digital currencies, concluding that the dollar’s preeminence is likely to persist barring significant policy errors by the United States.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

But First……The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business.

PLEASE NOTE: Some of the information sources that we provide links to in our newsletter require a paid subscription to directly access them. Clicking on a link may not give the reader access to the content.

Edited and curated by: William (Bill) Edwards, CEO & Global Business Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA. Contact Bill with questions, comments and contributions. Bedwards@edwardsglobal.com, +1 949 375 1896

https://www.linkedin.com/in/williamedwards/ +1 949 375 1896

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

First, A Few Words of Wisdom From Others For These Times

“Your time is limited, don’t waste it living someone else’s life.” – Steve Jobs

“It always seems impossible until it’s done.” – Nelson Mandela

“If you want to achieve greatness, stop asking for permission.” – Anonymous

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Highlights in issue #130:

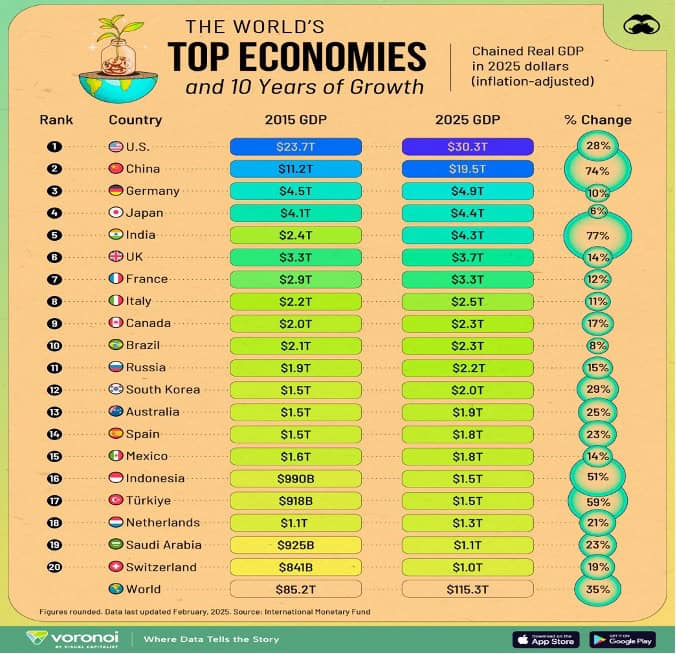

The World’s Top 20 Economies by GDP Growth (2015-2025)

“(Canadian) Employers begin layoffs as Canada-U.S. trade war intensifies

Major U.S. airlines warn consumers aren’t spending

How to use AI as a ‘force multiplier’ to start a business

Maintaining Brand Identity While Adapting to International Markets

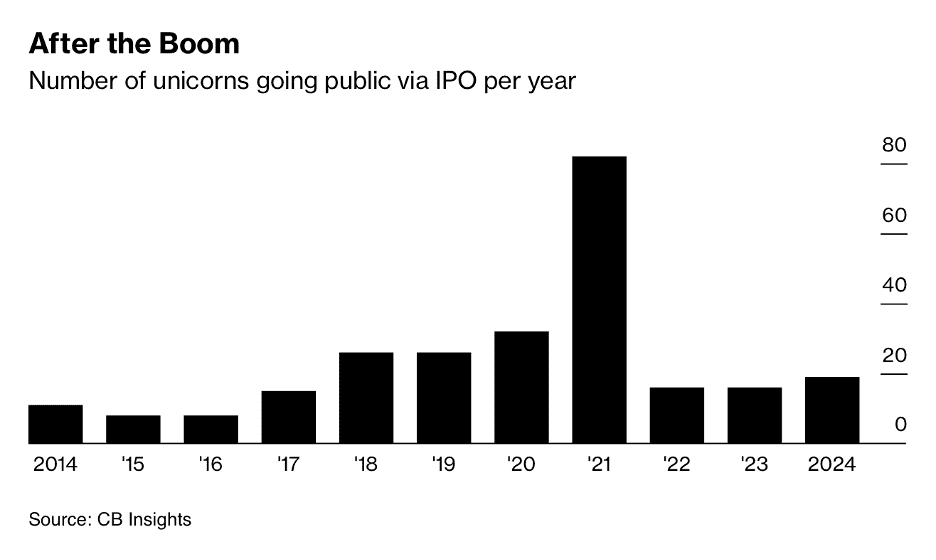

The Unicorn Boom Is Over, and Startups Are Getting Desperate

A Slowdown in Saudi Arabia Is Roiling the Consulting Market

Brand Global News Section: Crunch Fitness® and Gong Cha®

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

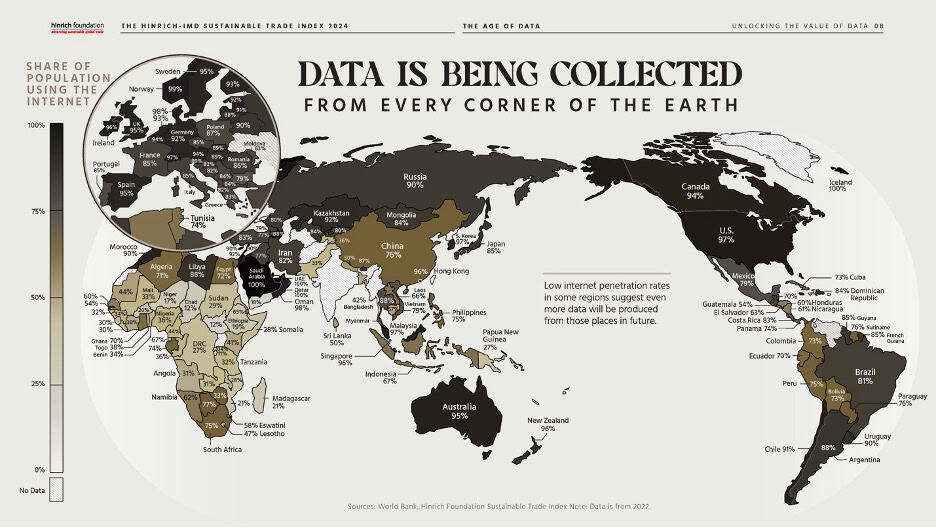

“The Age of Data – Data’s emergence as a resource more valuable than oil tells a story of how economics and technology changed in the last 50 years and converged with geopolitics and AI in a race for global power. Ever more essential by the day, data pulses through cables under our oceans and satellites over our skies. Visual Capitalist takes a deep dive into the age of data. It is a thoroughly modern irony that the world’s most abundant resource is now also its most critical asset. In the age of data, ever-increasing amounts of the resource are being generated, collected, traded, analyzed, and weaponized to make decisions that change the way we live, do business, and the very course of history. The ability to amass and manipulate data has compounded our control over the development of AI and the direction of geopolitics, placing data as a commodity squarely at the convergence of an increasingly frantic race between nations for global power.”, Visual Capitalist, March 11, 2025

=============================================================================================

“The World’s Top 20 Economies by GDP Growth (2015-2025) – This graphic ranks countries by their forecasted gross domestic product (GDP) in 2025, and visualizes their inflation-adjusted growth since 2015. The 2015 figure was calculated by reversing the effects of real GDP growth for every intervening year. All figures are in 2025 dollars. Data for this chart is sourced from the International Monetary Fund.”, Visual Capitalist and the International Monetary Fund, March 3, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

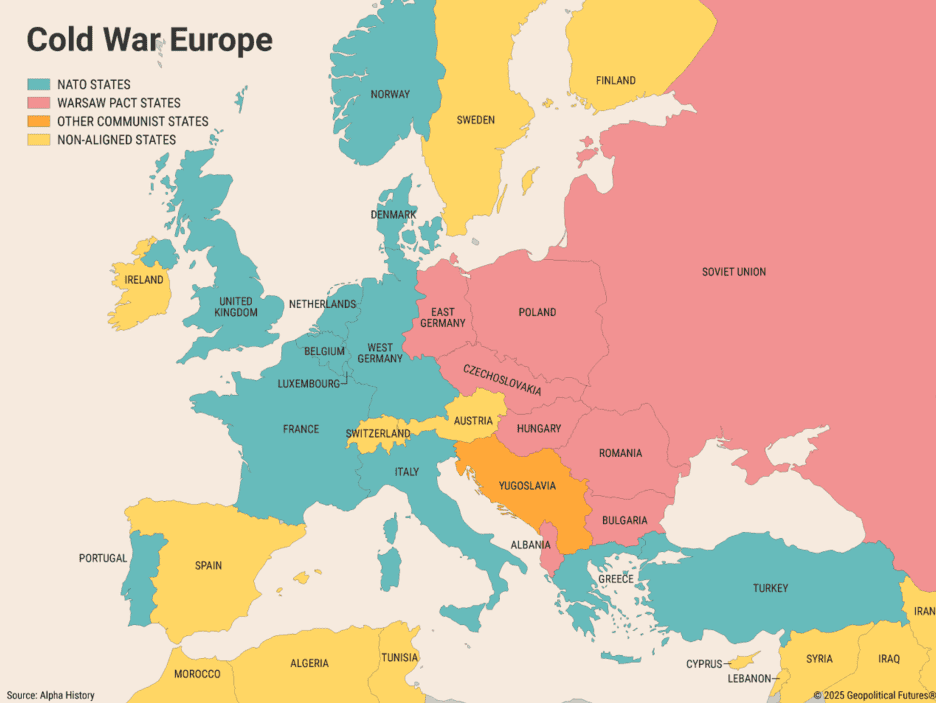

“The Evolution of NATO – New realities have forced new positions. For the past 75 years, NATO has been the de facto defender of Europe. Virtually every country on the Continent has its own armed forces, of course, and the alliance includes countries like the United States and Canada that are not, in fact, European. But when it comes to external threats against the whole, NATO has been the first and last name in collective defense. More explicitly, NATO was created as a U.S.-secured bulwark against the Soviet Union. Indeed, the entire alliance was arrayed against the threat from Moscow. So when the Soviet Union collapsed, NATO reconfigured itself as a broader cooperative security organization – only it did so without a common enemy, leaving its 32 members more or less independent to decide for themselves what is and is not a threat to their interests. This has pulled the alliance into multiple directions by nations, or blocs of nations, that disagree on what NATO’s role should be going forward. To be sure, many members still see Russia as the primary threat to their security. Others, however, believe the organization should shift its focus to places like the Arctic, the Middle East and the Asia-Pacific, where its members often share economic and political interests.”, Geopolitical Futures, March 14, 2025

=============================================================================================

“How to use AI as a ‘force multiplier’ to start a business – If you’re thinking of starting a new business and need advice on what to do, your first move should be turning to an artificial intelligence chatbot tool, like OpenAI’s ChatGPT or Anthropic’s Claude. That’s according to Steve Blank, who has written four books on the subject of entrepreneurship. He helped build eight different tech startups, of which he co-founded four, before retiring over two decades ago. His final startup, business software company Epiphany, sold to SSA Global Technologies for $329 million in 2005. Blank is currently an adjunct professor at Stanford University, where he teaches courses on innovation and his Lean Startup method. ‘AI [is] a force multiplier to everything you do,’ Blank tells CNBC Make It. ‘AI could help you figure out where to get outside, probably faster than anything else. If you have a business idea, [ask] something like ChatGPT: ‘I have Idea X, has anybody done it? Why hasn’t [it] worked? Where should I best do this?’””, CNBC Make It, March 17, 2025

=============================================================================================

“The Unicorn Boom Is Over, and Startups Are Getting Desperate – The billion-dollar startup bubble is deflating, and more than $1 trillion in value is locked up in companies with dwindling prospects. By the time the Covid-era tech boom crested in 2021, well over 1,000 venture capital-backed startups had reached valuations above $1 billion, including fake meat purveyor Impossible Foods Inc., home maintenance marketplace Thumbtack and online-class platform MasterClass. Then came a squeeze sparked by rising interest rates, a slowing initial public offering market and the feeling that any startup not focused on AI was yesterday’s news. In 2021 more than 354 companies received billion-dollar valuations, thus achieving unicorn status. Only six of them have since held IPOs, says Ilya Strebulaev, a professor at Stanford Graduate School of Business. Four others have gone public through SPACs, and another 10 have been acquired, several for less than $1 billion. Others, such as the indoor farming company Bowery Farming and AI health-care startup Forward Health, have gone under.”, Bloomberg, February 14, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

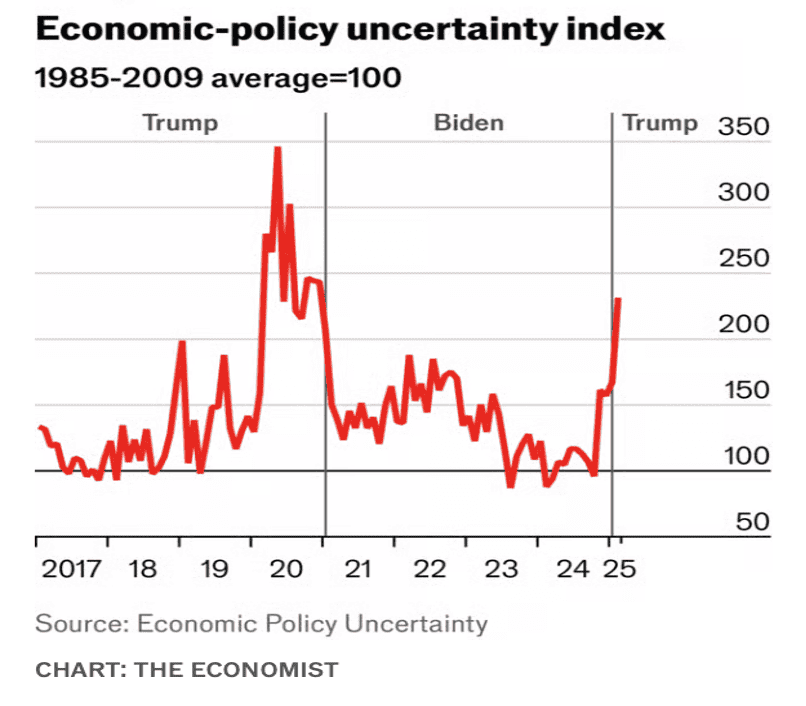

“Ten indicators explain what’s going on with America’s economy – One thing is certain so far about Trumponomics: no one is sure where it is heading, with radically different possibilities. Detractors point to all the disruption from tariffs. Supporters buy into Mr Trump’s pledge that he will bring about a new “golden age” for the American economy, fuelled by tax cuts and deregulation. One way of measuring all of this uncertainty is the Economic Policy Uncertainty index, devised by three American economists. The index tracks media coverage, tax policies and disagreements among economic forecasters. It spiked at the height of covid before falling below its long-term average under Mr Biden. Now it is once again soaring. Uncertainty can be a problem in and of itself, acting as an impediment for both businesses and consumers who face tough decisions. It is hard to commit to a large purchase or investment if the next few months, let alone the next few years, are so hard to predict.”, The Economist, March 14, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation, Taxes & Trade Issues

“Tariff Anxiety and the Dilemma of Forecasting – Investors want clarity. Will the Trump administration stand up to the market? Tariffs on Mexico are off again, for another month; tariff uncertainty remains and it’s damaging. Paraphrasing FDR, there is an argument that we have nothing to fear from tariffs, save tariff fear itself. There are arguments that the cost might not be that high, but forecasting is maddeningly difficult because US policy is so inconsistent.”, Bloomberg, March 6, 2025

==================================================================================================

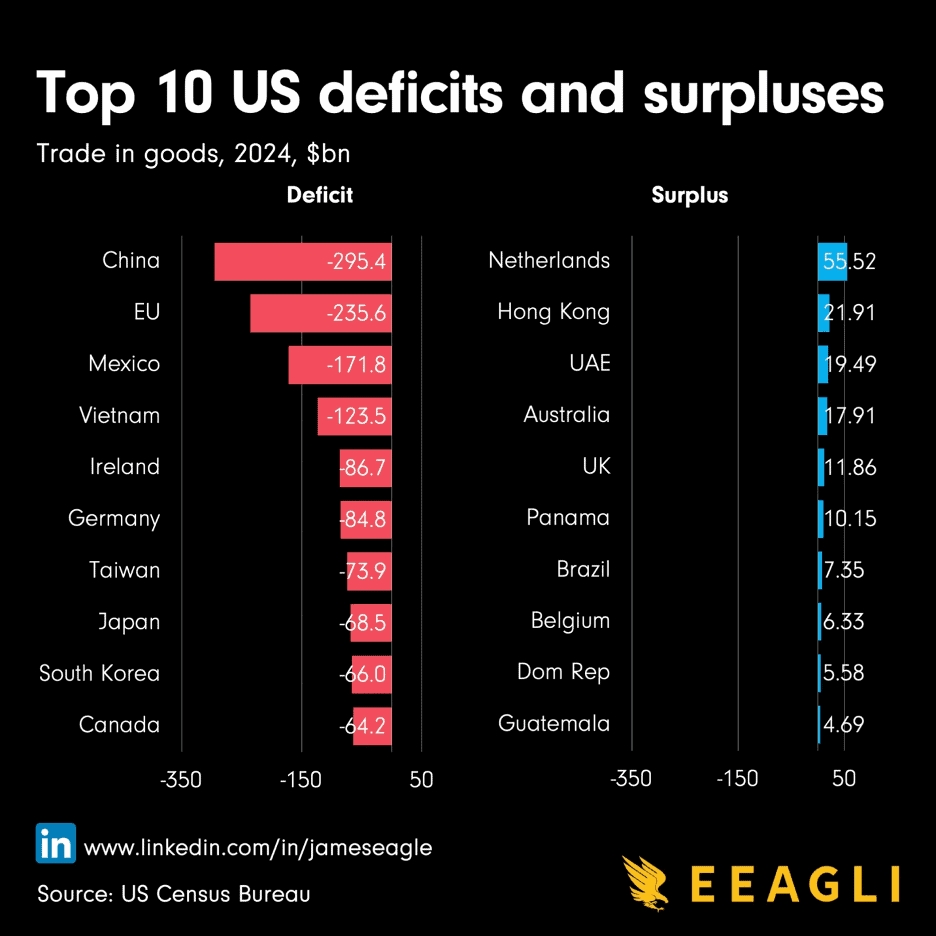

“Top 10 US deficits and surpluses – What the headlines miss: The US dollar is the world’s reserve currency, which means foreign governments and institutions hold large amounts of it. When they hold non-interest-bearing dollars (such as physical currency or certain reserve balances), it effectively serves as an interest-free loan to the United States. The US Treasury market is the largest, most liquid government bond market globally. Foreign entities don’t just sell the US goods – they turn around and invest those dollars into the US market, funding American innovation and growth. The US is a service-based economy, but the US trade deficits we currently hear about in the media are goods only. The US runs significant surpluses in services (think: tech, finance, entertainment, education) that aren’t reflected here. The dollar itself is the US’ greatest export. When other countries use USD for transactions, they’re effectively paying us for the privilege through seigniorage. US consumer benefits are enormous. Americans enjoy lower-priced goods that improve living standards across income levels.”, Voronoi, March 16, 2025

=================================================================================================

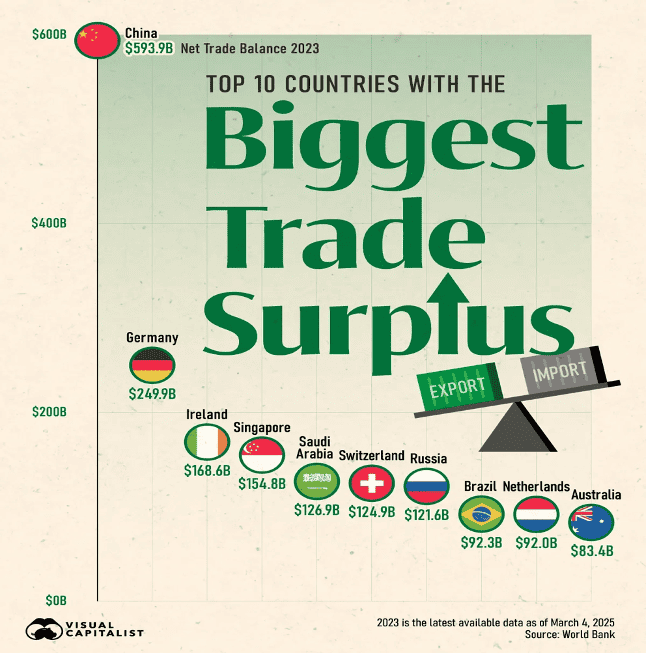

“The Top 10 Countries With the Biggest Trade Surplus – Fueled by an export boom, China’s trade surplus is the largest globally at $593.9 billion in 2023, skyrocketing from $33.7 billion in 20 years. Germany ranks in second, driven by exports of cars ($174 billion) and vehicle parts ($69.4 billion). The country’s top export destination was America, receiving 10% of its exports. Five of the world’s largest trade surpluses are in Europe, followed by two in Asia based on data from the World Bank as of March 4, 2025. In 2023, China’s trade surplus was greater than the next three countries combined, standing as the top trading partner to 60 countries globally. Since the pandemic, China’s merchandise exports have ballooned by $1 trillion, with the country increasingly exporting to Southeast Asian countries amid growing trade tensions with America and other nations. At a time of sluggish GDP growth and weak domestic demand, China has particularly focused on manufacturing as an engine of economic growth.”, Voronoi, March 16, 2025

=================================================================================================

“Donald Trump’s trade war will damage global growth, OECD warns – Forecasts downgraded for a dozen G20 economies and alarm sounded on ‘ratcheting up’ of trade barriers. Global growth will slow this year and next, from 3.2 per cent last year to 3.1 per cent and 3 per cent in 2025 and 2026 respectively, while inflation will be stickier than previously expected, the Paris-based OECD said in its interim outlook as it urged countries to avoid a “ratcheting up of retaliatory trade barriers”. GDP growth in the US will decelerate from 2.8 per cent last year to 2.2 per cent this year and 1.6 per cent in 2026, the OECD said. Higher trade barriers will contribute to persistent inflation, leading the Federal Reserve to keep interest rates unchanged until the middle of 2026, it predicted.”, The Financial Times, March 17, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global, Regional & Country Travel

“Major U.S. airlines warn consumers aren’t spending – Three of the largest U.S. airlines have cut their revenue or earnings forecasts since Monday’s market close, with all citing weakening consumer demand. Why it matters: Indications are piling up, almost by the hour, that consumers — the engine of the U.S. economy — are losing their nerve amid tariff uncertainty and rising recession fears. Delta, Southwest and American all warned Monday night and Tuesday morning that their first-quarter results will disappoint.”, Axios, March 11, 2025

=================================================================================================

“Half of European buyers fear higher US travel costs – The poll of 115 corporate travel and procurement professionals found that 48 per cent thought that travel costs to the US would go up and 35 per cent said it would also become “more difficult” to travel to and from the US under the new Republican government. The survey also revealed a high level of familiarity (83 per cent) among buyers about the UK’s Electronic Travel Authorisation (ETA) system, which opened for applications from European travellers earlier this month, and the EU’s much-delayed ETIAS scheme – now scheduled for introduction in late 2026.”, BTN Europe, March 17, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Book Review

“King Dollar: The Past and Future of the World’s Dominant Currency” by Paul Blustein offers an insightful analysis of the U.S. dollar’s enduring supremacy in global finance. Despite recurring forecasts of its decline, Blustein argues that the dollar’s dominance remains resilient, attributing this to the lack of viable alternatives and the inherent strengths of the U.S. financial system. He examines historical and contemporary challenges to the dollar, including economic sanctions and emerging digital currencies, concluding that the dollar’s preeminence is likely to persist barring significant policy errors by the United States. This book is being published today, March 18, 2025

Five Major Takeaways from “King Dollar”:

1. Persistent Dominance: The U.S. dollar continues to hold a central position in global finance, with its dominance proving durable over time.

2. Geopolitical Leverage: The United States effectively utilizes the dollar’s global status to impose economic sanctions, thereby exerting geopolitical influence.

3. Challengers’ Limitations: Alternative currencies, including digital ones, currently lack the necessary infrastructure and trust to supplant the dollar’s role.

4. Responsibility of Dominance: The U.S. must exercise prudent policies to maintain the dollar’s status, as mismanagement could erode its global position.

5. Global Stability: The dollar’s supremacy contributes to international financial stability, serving as a reliable reserve currency and medium of exchange.

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The Accredited Franchise Supplier certification

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Argentina

“Argentina’s Milei Signs Decree To Clear the Way for a New IMF Deal – A new IMF deal would improve Argentina’s short- and medium-term economic and financial outlook in the face of limited international financial market access and negative foreign exchange reserves, and open the door to the lifting of capital controls. Argentina is seeking to secure a new IMF deal as it faces significant external financing requirements and limited access to international capital markets.”, RANE Worldview, March 13, 2025

=================================================================================================

Canada

“(Canadian) Employers begin layoffs as Canada-U.S. trade war intensifies – Multiple employers are laying off workers as the impact of the U.S.-Canada trade war seeps into the labour force, while other companies are scaling back their hiring plans because of the upheaval. Over the past three weeks, numerous businesses from furniture manufacturers to steel producers have announced layoffs to cope with the uncertainties brought about by U.S. tariffs on Canadian exports, and subsequently, Canada’s retaliatory tariffs on some American imports. The Canadian unemployment rate held steady at 6.6 per cent in February, but economists are cautioning that the unpredictability of U.S. President Donald Trump’s tariff actions could force businesses to cut costs. A recent report from TD Bank economists warned that a flare-up in “tit-for-tat” tariffs between the U.S. and Canada could push the Canadian economy into recession and cause the unemployment rate to spike by 2 per cent.”, The Globe and Mail, March 13, 2025

===================================================================================================

China

“China’s latest plan to boost consumption is ‘most comprehensive’ since 1970s – The 30-point strategy to drive up consumer spending tackles a slew of underlying issues, from low wages to the real estate crisis. From increasing workers’ incomes to improving the consumption environment, the policy strategy released on Sunday covers a slew of underlying issues that will need to be addressed if China is to shift its economy onto a consumption-driven growth model. The plan also included measures to stabilise the stock and property markets.”, The South China Morning Post, March 17, 2025

==================================================================================================

“How China’s slowing consumer spending is affecting the recovery of F&B firms – Analysts warn that targeted measures are needed to revive the industry, as companies like Nayuki and Xiabu Xiabu report losses and closures. Tepid consumer spending and escalating competition are weighing on the performance of China’s food and beverage (F&B) chains, with analysts warning that chances of a sustained recovery remain slim in the absence of policy support targeted at the sector. Mainland fresh drinks maker Nayuki is expecting an adjusted net loss of up to 970 million yuan (US$134 million) for 2024, compared with a profit of 20.9 million yuan the previous year, according to a filing to the Hong Kong stock exchange this week. Hotpot restaurant chain Xiabu Xiabu said in a filing to the Hong Kong exchange this week that it could record a 20 per cent decline in revenue to about 4.8 billion yuan for 2024, alongside a net loss of up to 410 million yuan. It specifically noted that a consumption downgrade continues to put pressure on its mid-to-high-end brand, Coucou.”, The South China Morning Post, March 14, 2025

=================================================================================================

Egypt

“Easing food inflation brings relief for struggling Egyptians – Cost of essentials has stabilised, bringing joy at Ramadan, but subsidy cuts loom on fuel and electricity. Inflation fell dramatically in February to 12.8 per cent, down by half compared to the previous month. Though it remains high, it is a far cry from the all-time peak of 38 per cent recorded in September 2023. Shortages in food supplies have also eased. However, Egyptians remain wary about the future with further austerity measures on the horizon. Other essential goods have also seen significant price drops in recent weeks. Rice, which peaked at 32 Egyptian pounds per kilo last Ramadan, is now selling at 16 pounds.”, The National News, March 17, 2025

=============================================================================================

Latin America and The Caribbean

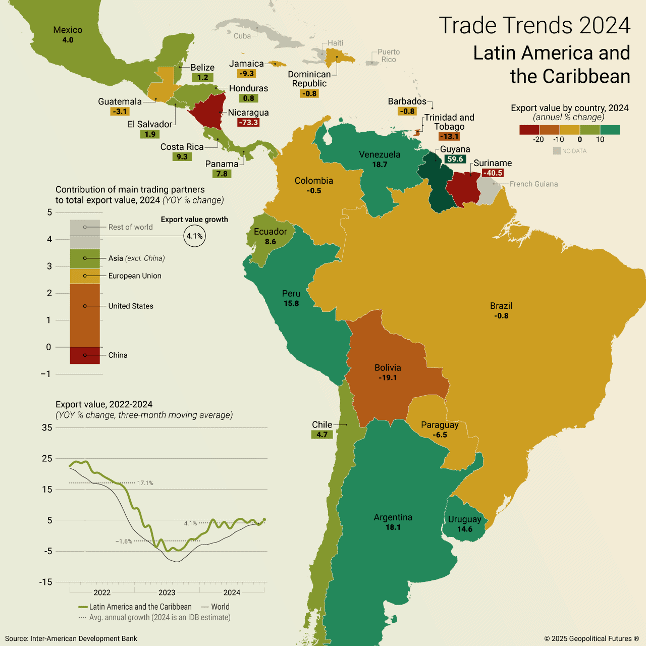

“Trade Trends in Latin America and the Caribbean – Argentina experienced an 18.1 percent increase over the previous year, due in part to economic reforms. Since taking office in 2023, President Javier Milei has introduced significant changes meant to revitalize the economy by deregulating certain sectors, cutting subsidies, privatizing state companies and relaxing labor laws. Guyana saw the biggest bump in exports (59.6 percent), driven by rising oil output. In Peru, the rising global demand for minerals, which the country produces in abundance, helped propel 15.8 percent growth in exports. Meanwhile, Venezuela’s recovering oil sector drove an 18.7 percent rise in exports. Nicaragua’s exports declined by 73.3 percent, amid growing U.S. economic pressure over human rights concerns. The United States remained the region’s top trade partner, while countries that have strained relations with Washington (including Nicaragua, Suriname and Bolivia) saw declining exports.”, Geopolitical Futures, March 7, 2025

===============================================================================================

Mexico

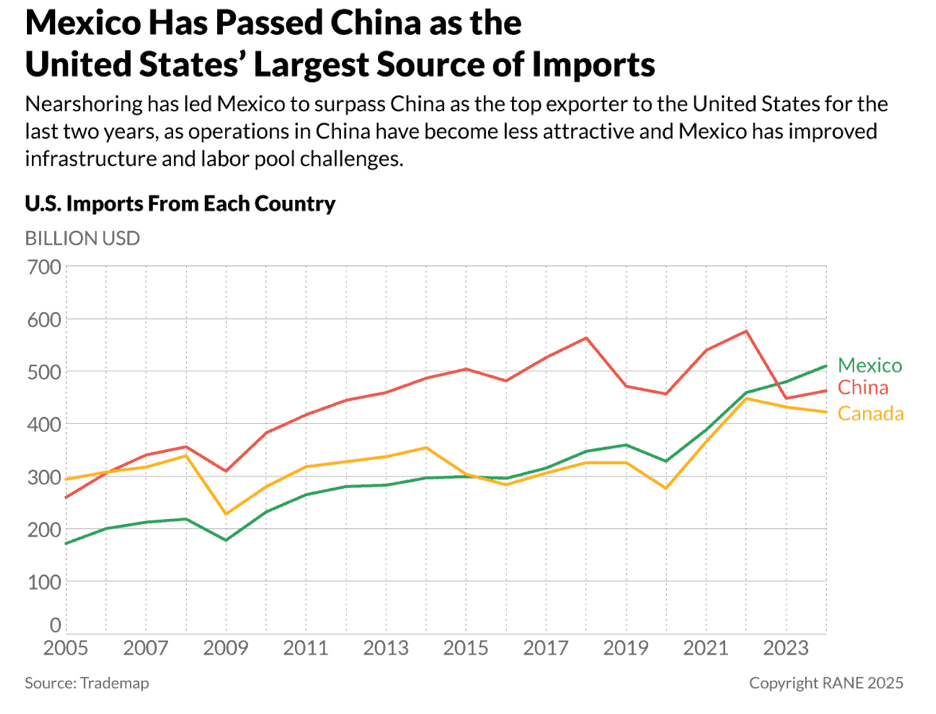

“Rising Threats to Nearshoring in the Americas – Trump administration policies will create new challenges for nearshoring manufacturing closer to the United States, but a reversal that substantially damages major manufacturing countries’ attractiveness for nearshoring is unlikely. In 2023, Mexico surpassed China as the top exporter to the United States for the first time in decades, a position Mexico held for the second year in a row in 2024. Canada, for its part, is the largest recipient of U.S. exports (though China exports a larger amount to the United States), illustrating the deep interconnectivity of North American supply chains and, amid broader shifts in global trade, pointing to an ongoing uptick in manufacturing in parts of the Western Hemisphere to supply the U.S. market. Multiple factors have driven nearshoring closer to the United States, including rising manufacturing costs in Asia (especially China), the growing attractiveness of operations in the Americas (especially Mexico), and Washington’s expanding push for more resilient and secure supply chains.”, RANE Worldview, March 11, 2025

============================================================================================

Saudi Arabia

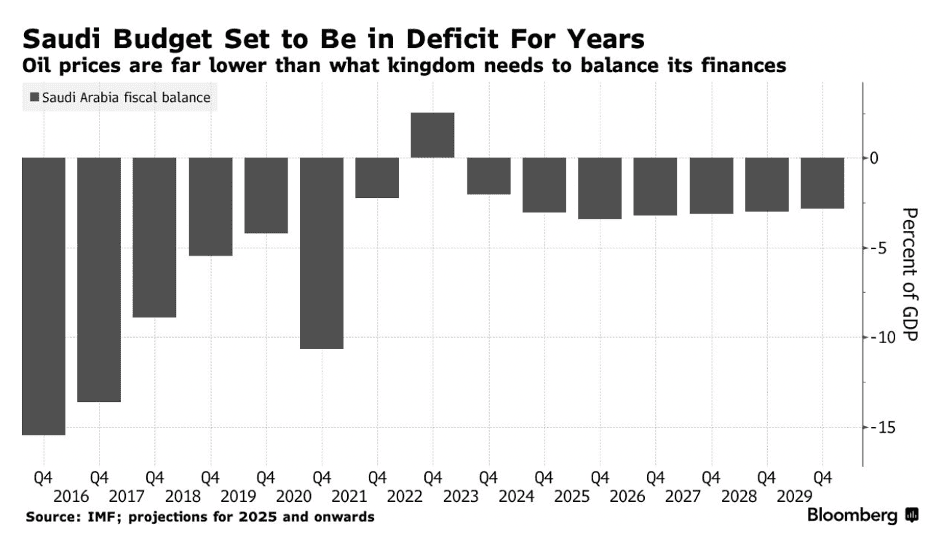

“A Slowdown in Saudi Arabia Is Roiling the Consulting Market – For years, Saudi Arabia has leaned on advisory firms to drive an expensive overhaul of its economy. But the kingdom’s once insatiable appetite for foreign consultants is dimming, adding pressure on an industry already buffeted by pressures worldwide. While the country remains one of the biggest markets for consultants in the world, the pace of contract awards has started to slow, according to people familiar with the matter. It’s also led to some firms moving staffers to other locations, including Doha, one of the people said, declining to be identified as the information is private. The government relies on the global network and expertise of major consulting firms to execute on mega projects and initiatives under the Vision 2030 strategy, according to Access KSA, a Saudi Arabia-based business adviser that works to bring foreign companies and investment to the country.”, Bloomberg, March 14, 2025

================================================================================================

United States

“US consumer sentiment tumbles as long-term inflation expectations hit 32-year high – Worse than expected data comes days ahead of Federal Reserve’s next meeting on interest rates. The University of Michigan’s consumer sentiment index fell to a preliminary reading of 57.9 in March, the third consecutive monthly drop and the lowest reading since November 2022. Economists expected a smaller fall to 63.1 from 64.7 in February. Inflation expectations one year ahead jumped to 4.9 per cent, their highest level since November 2022. Longer-term inflation expectations leapt to 3.9 per cent from 3.5 per cent, bringing them to their highest level since 1993, according to Bloomberg data. ‘The drumbeat of bad news around the stock market and lay-offs among federal workers is clearly not sitting well with consumers,’ said Ryan Sweet, chief US economist at Oxford Economics. Unemployment fears among consumers polled by the University of Michigan also surged to levels last seen in the 2008 financial crisis.”, The Financial Times, March 14, 2025

===============================================================================================

Vietnam

“US Tells Vietnam to Improve Trade Balance Amid Tariff Risks – The US ran a $123.5 billion trade deficit with Vietnam in 2024, according to the Office of the USTR. The trade deficit is the third highest gap for the US, behind China and Mexico. Some of it comes down to re-routing, with Chinese companies setting up shop elsewhere to skirt tariffs. Vietnam overtook Japan as China’s third-largest export destination for the first time in 2024, putting the country at the forefront of the economic conflict between the two superpowers.”, Bloomberg, March 13, 2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Taking Brands Global Successfully For 5 Decades

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Franchise Sector Update

“Gong Cha: Bubble tea chain plans huge UK expansion and 2,000 new jobs – Bubble tea chain Gong Cha has revealed plans to open more than 225 stores across the UK and create nearly 2,000 jobs after signing a franchise agreement with a Costa Coffee giant. The London-headquartered business, which was founded in Taiwan in 2006, said the deal with Jinziex forms part of its wider strategy to reach 10,000 locations across the world by 2032. Jinziex is a new company led by Diljit Brar, CEO of Goldex; Azha Rehman, founder and CEO of Kaspa’s Desserts; and Steve Falle, managing director of WY&SF Ltd. Gong Cha currently operates more than 2,100 locations across 28 countries. In the UK, Gong Cha currently runs 13 stores.”, City AM, March 14, 2025

===============================================================================================

“What Franchisors and Franchisees Need to Know About the New Tariffs – A set of new U.S. tariffs took effect on March 4, imposing a 25 percent tariff on imports from Canada and Mexico and a 10 percent tariff on imports from China. Energy imports from Canada face a reduced 10 percent tariff. These tariffs, implemented by President Donald Trump under the International Emergency Economic Powers Act (IEEPA), were justified on grounds of illegal immigration and fentanyl trafficking. Earlier in February, the U.S. also expanded Section 232 tariffs on steel and aluminum, increasing tariffs on aluminum imports from 10 to 25 percent, effective March 12. In response, Mexico, China, and Canada have imposed retaliatory tariffs on U.S. goods, further complicating trade relations. A day after the March 4, IIEPA tariffs went into effect, dissatisfied U.S. automakers put pressure on President Trump, who then temporarily granted a one-month exemption on auto tariffs on Mexico and Canada. President Trump also suspended tariffs on all imports that are compliant with the United States-Mexico-Canada Agreement (USMCA) until April 2. There are several different ways these tariffs impact franchising……..”, Franchising.com, March 2025. An article by Joyce Mazero and Josh Goldberg, Polsinelli.

================================================================================================

“Maintaining Brand Identity While Adapting to International Markets – Expanding a franchise internationally is an exciting opportunity, but it comes with significant challenges. The key to success lies in maintaining your brand identity while being flexible enough to adapt to local markets, and to know which markets are a good fit for your brand. Having developed in 52 countries and visited 132 for consideration, I’ve seen firsthand how brands can thrive, or fail, when entering new territories. Before franchise brands go global there are some critical boxes to be checked.:, Franchising.com, March 17, 2025. This is an article by Hair Parra, the SVP of international operations and development with Captain D’s.

================================================================================================

“Crunch Fitness Announces Major Franchise Expansion into India, Marking South Asian Physical Location Debut – Crunch Fitness, a globally-recognized high-value, multi-amenity gym franchise, today announced the signing of a Master Franchise Agreement for India – a development which will bring a minimum of 75 Crunch Fitness brick-and-mortar gyms to the country in the coming years. The new development marks the brand’s continued international expansion into South Asia alongside Crunch+, the company’s extensive fitness offering, which has been available online for years to Indian consumers. The Indian development will be led by Nikhil Kakkar, former COO of Gold’s Gym India, and business partner Dr. Umesh Kansal, M.D., CEO of several well-established companies in the fitness industry, financial services and global apparel business.”, PR Newswire, February 26, 2025Franchising.com, March 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive our biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing business environment. And our GlobalTeam™ on the ground covering 25+ countries provide us with updates about what is actually happening in their specific countries. We do not get involved in or report on politics!

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe, and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant since 2001 taking 40+ companies global.

| To receive this biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com +++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++ |

Our latest GlobalVue™ 40 country ranking

For a complimentary 30-minute consultation on how to take your business into new countries and make money doing it. For a complimentary call with Bill Edwards click on the QR code or contact Bill at bedwards@edwardsglobal.com and +1 949 375 1896

Biweekly Global Business Newsletter Issue 129, Tuesday, March 4, 2025

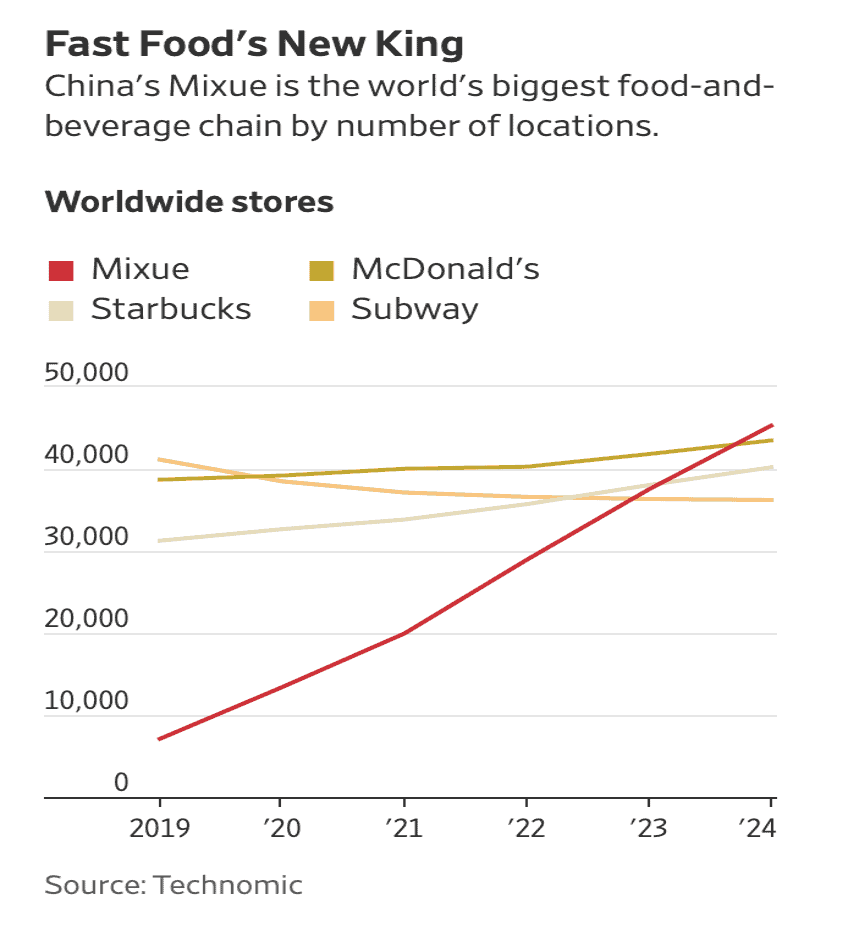

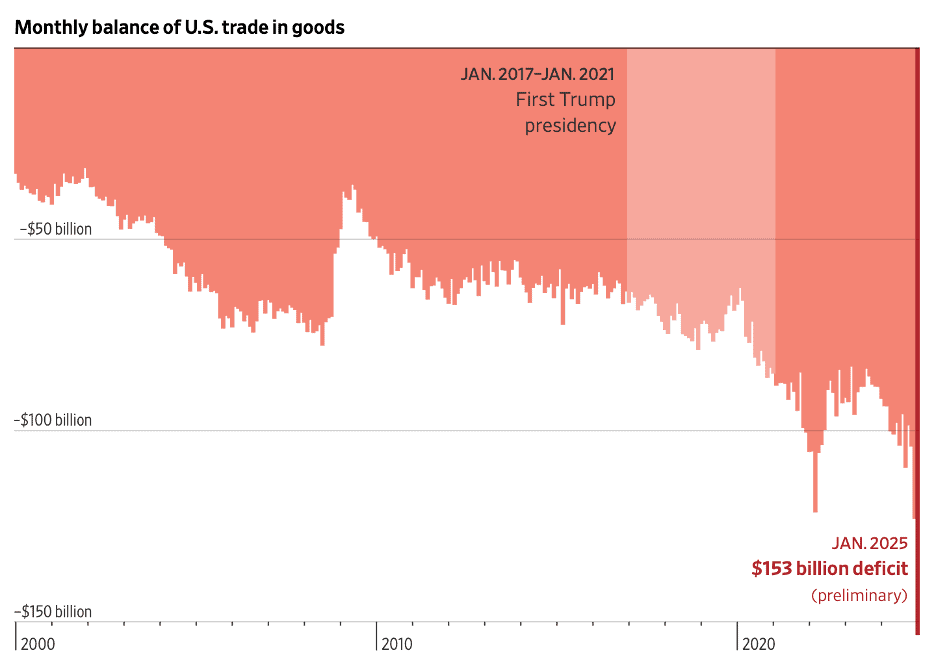

The Impact Of Trade Imbalances And The Resulting Broad Tariffs

Commentary about the 129th Issue: Much of this issue is about tariffs being put on a wide range of products first by the USA and then by its trading partners We also look at the massive trade imbalance between what the USA exports and what its main trading partners import from the USA. AI infrastructure spending continues to rocket up. A look at shipbuilding which also have a massive difference between the USA and other countries and what this means to global trade. Which countries are the most corrupt and which are not. And advice on doing business in the Middle East during Ramadan. McDonalds® is no longer the largest fast food chain in the world!!

One More Thing: The price of eggs in the USA and how restaurants are adapting to what appear to be increasing food prices…….again. Even Turkey is involved in supplying eggs to the USA.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

But First……The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business.

PLEASE NOTE: Some of the information sources that we provide links to in our newsletter require a paid subscription to directly access them. Clicking on a link may not give the reader access to the content.

Edited and curated by: William (Bill) Edwards, CEO & Global Business Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA. Contact Bill with questions, comments and contributions. Bedwards@edwardsglobal.com, +1 949 375 1896

https://www.linkedin.com/in/williamedwards/ +1 949 375 1896

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

First, A Few Words of Wisdom From Others For These Times

“Most people, companies, and teams fail because they do the wrong thing, they fail because they did the right thing for too long.”, Rajeev Kapur

“Whether you think you can, or think you can’t – you’re right.”, Henry Ford

“Difficulties mastered are opportunities won.”, Winston Churchill

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Highlights in issue #129:

China and Canada Hit Back as Trump’s Tariffs Kick In

The True Cost of U.S. Tariffs on Canada

Navigating Tariffs and Trade Uncertainty: South Korea’s Next Moves

The Chicken and The Egg Headlines

Forget McDonalds This Chinese Fast Food Chain Is Now the World’s Biggest.

Navigating Gulf Business during the Holy Month

Which Countries Are The Most Corrupt?

Brand Global News Section: Mixue®, McDonalds®

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

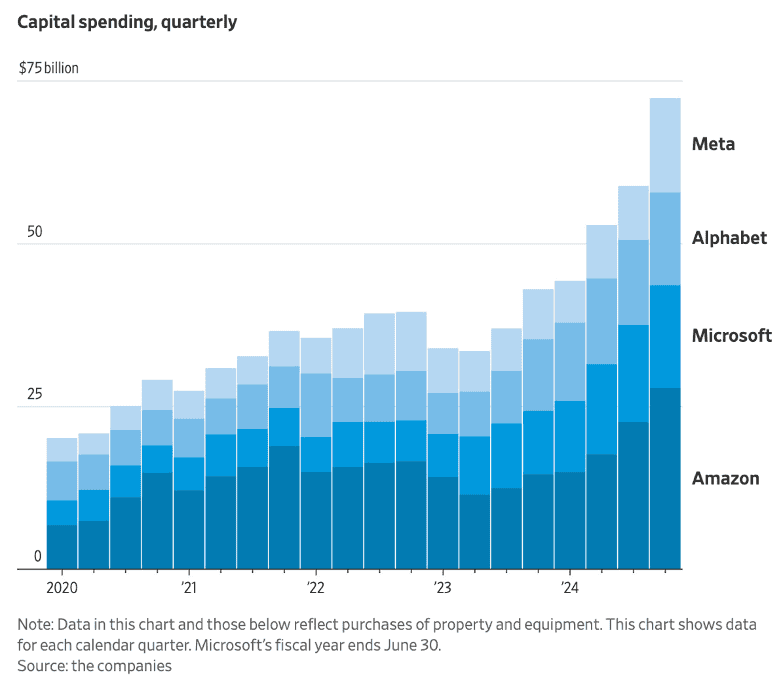

“Why AI Spending Isn’t Slowing Down – Soaring demand for reasoning models will consume electricity, microchips and data-center real estate for the foreseeable future. Despite a brief period of investor doubt, money is pouring into artificial intelligence from big tech companies, national governments and venture capitalists at unprecedented levels. The technology is shifting away from conventional large language models and toward reasoning models and AI agents. Owing to their enhanced capabilities, these reasoning systems will likely soon become the default way that people use AI for many tasks.”, The Wall Street Journal, February 21, 2025

=============================================================================================

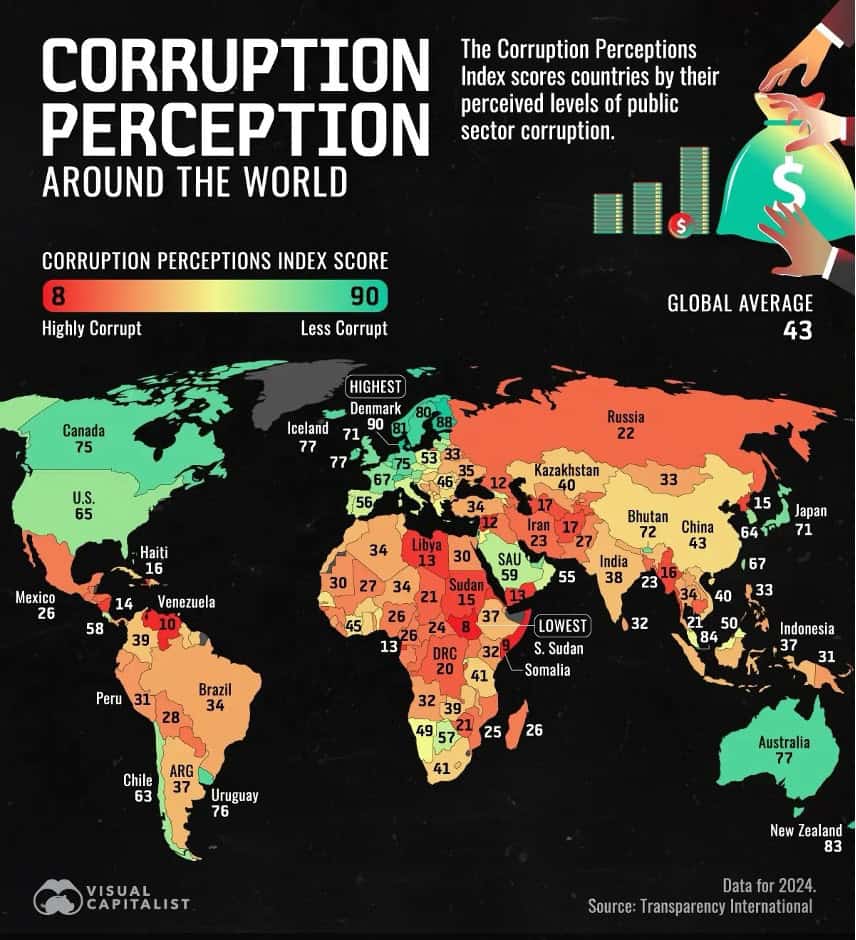

“Which Countries Are The Most Corrupt? The Corruption Perceptions Index (CPI) of 180 countries and territories. The CPI ranks countries and territories worldwide by their perceived levels of public sector corruption. Data is for 2024 and comes from Transparency International. CPI scores are calculated through a combination of at least 3 data sources drawn from 13 different corruption surveys and assessments, answered by experts and business executives. Sub-Saharan Africa had the lowest regional CPI score in 2024, with an average of 33. South Sudan had the lowest CPI score out of all countries surveyed, followed by Somalia which had a CPI score of 9. Nordic countries ranked the highest, with Denmark coming in first–for the seventh year in a row–with a score of 90, followed by Finland at 88.”, Visual Capitalist & Transparency International, March 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation, Taxes & Trade Issues

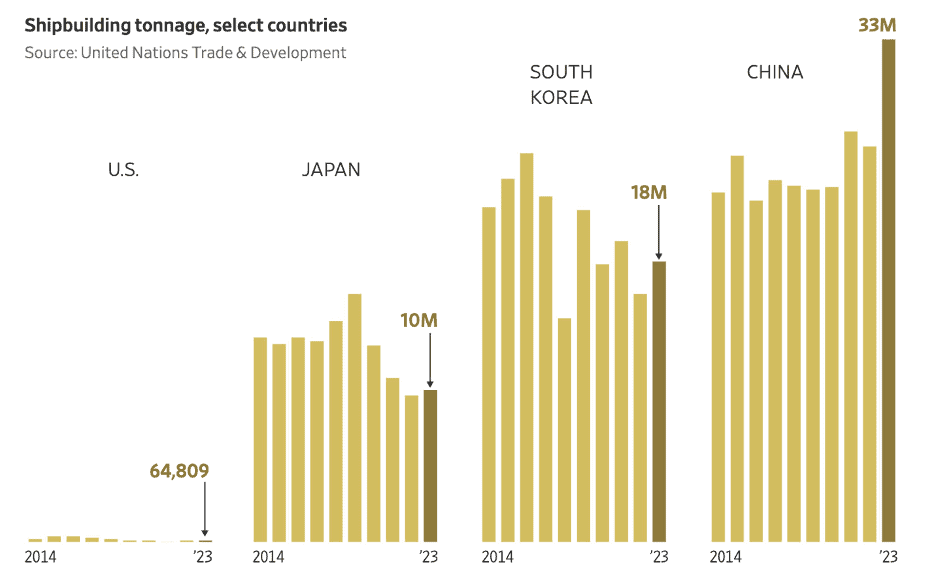

“In Shipbuilding, the U.S. Is Tiny and Rusty – Asian shipyards churn out hundreds of big boxships and oil tankers a year. The U.S. is lucky if it can finish more than one each year. It has been that way for decades. Few major American shipyards remain and they now mostly build or repair vessels for the U.S. Navy. Those that do produce new commercial ships mostly make small vessels for U.S. companies operating on domestic routes, not the giant containerships and ocean vessels that underpin global trade. hina now dominates the shipbuilding industry, accounting for more than half of world tonnage in 2023 and 74% of orders for new ships last year. The biggest shipping lines, such as MSC, Maersk and CMA CGM, now rely on hundreds of Chinese built ships to move goods around the world.”, The Wall Street Journal, March 2, 2025

=============================================================================================

“The Countries Driving America’s $1.2 Trillion Trade Deficit in Goods – Growing gaps with Mexico and Vietnam add to the biggest imbalance the U.S. faces—with China. The U.S. had a record $1.2 trillion goods trade deficit in 2024, driven by its largest trading partners. The U.S. runs goods trade deficits with most European countries, with the exceptions including the Netherlands and the U.K. The goods deficit with India has doubled since the first year of Donald Trump’s first term. The U.S. imported $1.2 trillion more in goods in 2024 than it exported, a record annual deficit and a major economic irritant for President Trump. On Feb. 13, the president announced that his administration would evaluate tariffs and other trade barriers imposed on U.S. exports by other nations and match them with “reciprocal” tariffs. Those deficits were mitigated only slightly by surpluses the U.S. had in 2024 with Hong Kong, Australia and Singapore.”, The Wall Street Journal, March 1, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

“China and Canada Hit Back as Trump’s Tariffs Kick In – China hit back as Donald Trump’s new tariffs came into effect. It imposed levies of up to 15% on American agricultural goods and banned exports to some defense companies, escalating a trade warbetween the world’s two largest economies. Canada also retaliated, putting tariffs on $107 billion of US products. The first stage is 25% tariffs on about C$30 billion ($20.6 billion) worth of goods from US exporters, and will go into effect at 12:01 a.m. New York time unless the US drops its tariffs, Trudeau said. A second round of tariffs at the same rate will be placed on C$125 billion of products in three weeks — a list that will include big-ticket items like cars, trucks, steel and aluminum.”, Bloomberg, March 4, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global, Regional & Country Travel

“(U.S.) Federal government layoffs affect official and leisure travel – Travel advisors are feeling the impact as mass layoffs of the federal workforce chill travel plans for current and former employees and government contractors. The Trump administration’s Department of Government Efficiency (DOGE), formed in January, initiated a sweeping campaign to streamline the federal government and slash spending, which has included eliminating thousands of jobs. Further, a Feb. 27 executive order took aim at federal employee travel, directing government agencies to prohibit travel without written and approved justification for the trip. The directive also requires that federal agencies, with assistance from DOGE, build a system that records approval for federally funded travel for conferences and other nonessential purposes.”, Travel Weekly, March 3, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Book Review

I

A Brief History of Intelligence: Evolution, AI, and the Five Breakthroughs That Made Our Brains by Max S. Bennett provides valuable insights for business leaders, particularly in decision-making, innovation, and AI adoption.

This book helps business leaders better understand AI, adaptability, and decision-making, offering valuable perspectives for navigating the future of business and technology. Here’s how the book impacts business strategy:

Understanding Intelligence & Adaptation – Just as intelligence evolved through key breakthroughs, businesses must adapt and evolve in response to changing markets, technology, and consumer behavior. Companies that fail to innovate risk becoming obsolete.

AI & Business Strategy – The book highlights how human intelligence shaped AI. Business leaders can better integrate AI into operations, ensuring human-AI collaboration rather than just automation.

Data-Driven Decision Making – Mental simulation and learning from past experiences mirror predictive analytics in business. Understanding how intelligence evolved helps leaders make more strategic, forward-thinking decisions.

Social Cognition & Leadership – Business success depends on team dynamics, collaboration, and emotional intelligence—all crucial aspects of human intelligence that AI has yet to master.

Communication & Market Influence – Language shaped human progress; in business, effective communication, storytelling, and brand messaging are critical for market leadership.

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The Accredited Franchise Supplier certification

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Canada

“The True Cost of U.S. Tariffs on Canada – The Canada-U.S. trading relationship is at an inflection point, and how we meet this moment will affect North American economic security and competitiveness for decades to come. By trading essential goods at competitive prices, Canada and the United States make life more affordable for millions of people in both countries. But tariffs threaten this mutually beneficial partnership. While they’ll hit Canadian exporters hardest, the true cost will be felt far more widely, including by U.S. companies, workers and consumers. In a trade war, there are no winners. Potential tariffs on Canadian exports could take effect as early as March 4, including 25% on goods and 10% on energy.”, Advocacy – CalChamber, February 25, 2025

=============================================================================================

China

“Holiday Spending Gives Chinese Consumption a Needed Boost – The average daily sales of the country’s consumption industries grew by 10.8% compared with last year’s holiday, according to the State Taxation Administration, based on value-added tax data. Consumption of goods rose 9.9% and services 12.3%. Wu Chaoming, chief economist at Hunan province-based investment firm Chasing Financial, attributed the growth to consumer preferences for activities that bring joy and emotional value, as well as local governments’ efforts to stimulate spending through vouchers for tourism, dining and movies. Despite the holiday-driven rebound, there are signs that many Chinese consumers remain reluctant to splurge, suggesting the recovery may be short-lived.”, Caixing Global, February 21, 2025

==============================================================================================

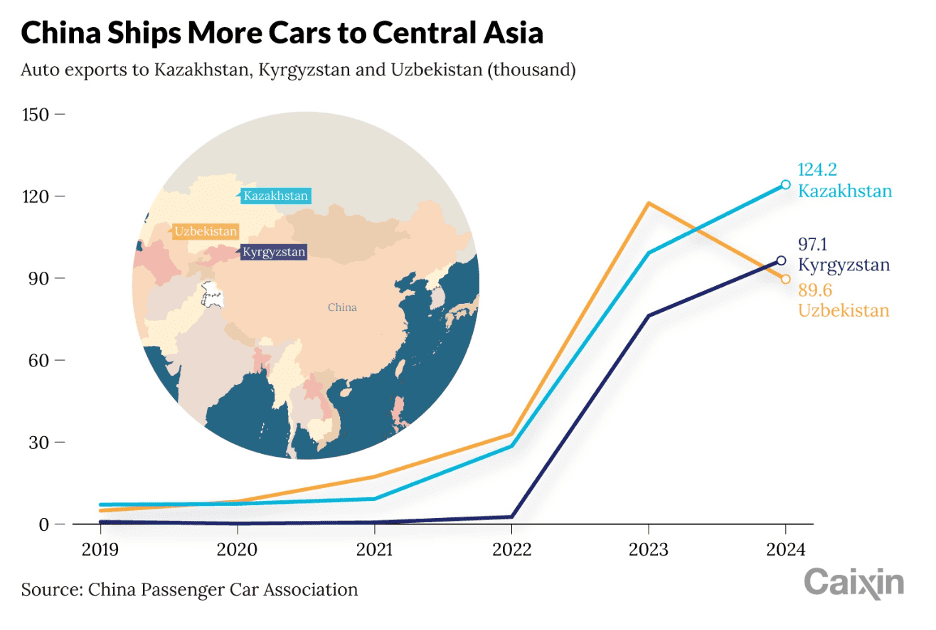

“Chinese Carmakers Expand Into Growing Central Asian Markets – Chinese automakers are pushing deeper into Central Asian markets through exports and manufacturing localization after Russia’s crackdown on a lucrative loophole that allowed re-exports of vehicles through Eurasian Economic Union (EAEU) member states. Last year, China-made cars accounted for 39% of the 205,111 vehicles sold in Kazakhstan, the region’s largest economy. That’s up from 10% in 2021, according to a recent report by Kazinform News Agency. Market observers attributed the growing popularity of Chinese car brands to their lower prices, product diversification and promotions by local dealerships, the report said.’, Caixing Global, February 20, 2025

===============================================================================================

The Middle East

“Ramadan Etiquette for Westerners: Navigating Gulf Business during the Holy Month – As Ramadan approaches, Western professionals engaging in business in the Gulf region must adapt their practices to align with this sacred month of reflection, community, and tradition. Understanding and respecting Ramadan etiquette is crucial for maintaining strong relationships and demonstrating cultural sensitivity. Let’s explore how Ramadan influences business in the Gulf and provide essential tips for navigating this period with respect and success.”, Star Kat, February 23, 2025. Compliments of Corina Goetz.

==============================================================================================

South Korea