Biweekly Global Business Newsletter Issue 137, Tuesday, June 24, 2025

“Think global, act local.”, Patrick Geddes

Welcome to Edition #137 of the Edwards Biweekly Global Business Update, your trusted biweekly briefing on the complex and fast-moving developments shaping global trade, investment, and franchising. This edition provides curated insights across several sectors—from energy strategy shifts in Canada to etiquette nuances in the Gulf—and is designed to help executives anticipate risks and spot new global opportunities.

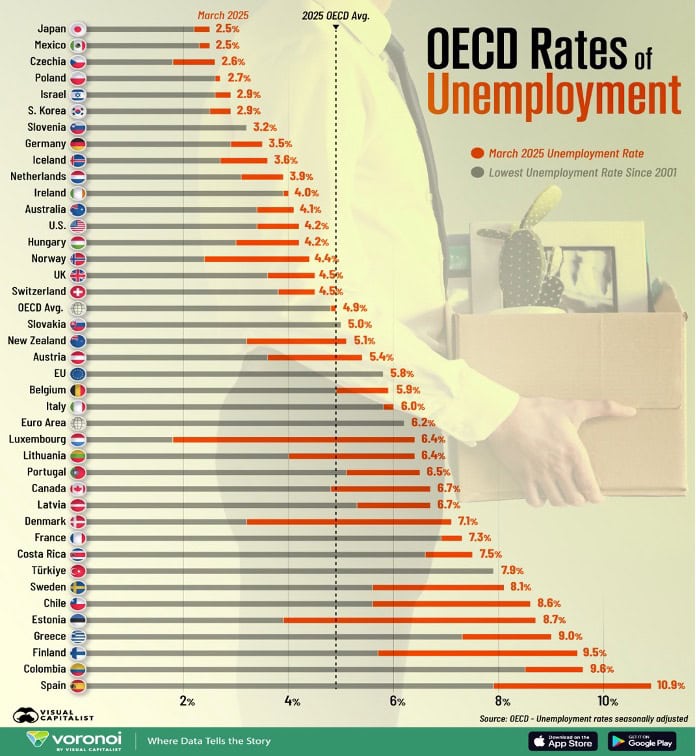

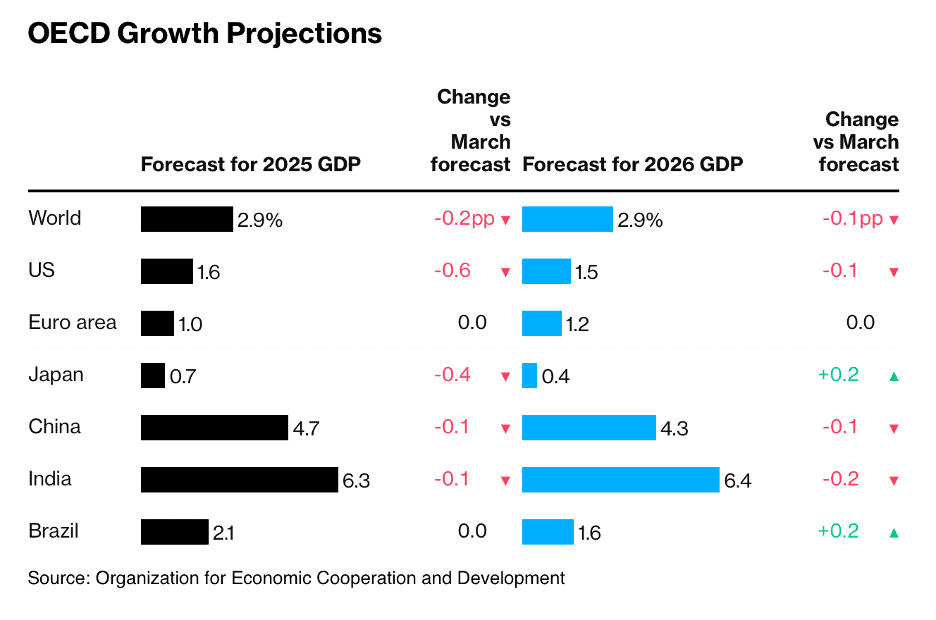

This issue captures a world in continuing flux. The OECD has revised its inflation forecasts upward for 2025 and 2026, highlighting how persistent trade barriers and geopolitical instability are reshaping economic expectations. At the same time, global unemployment trends paint a mixed picture—some nations are hitting record lows, while others like Spain are now struggling with double-digit jobless rates.

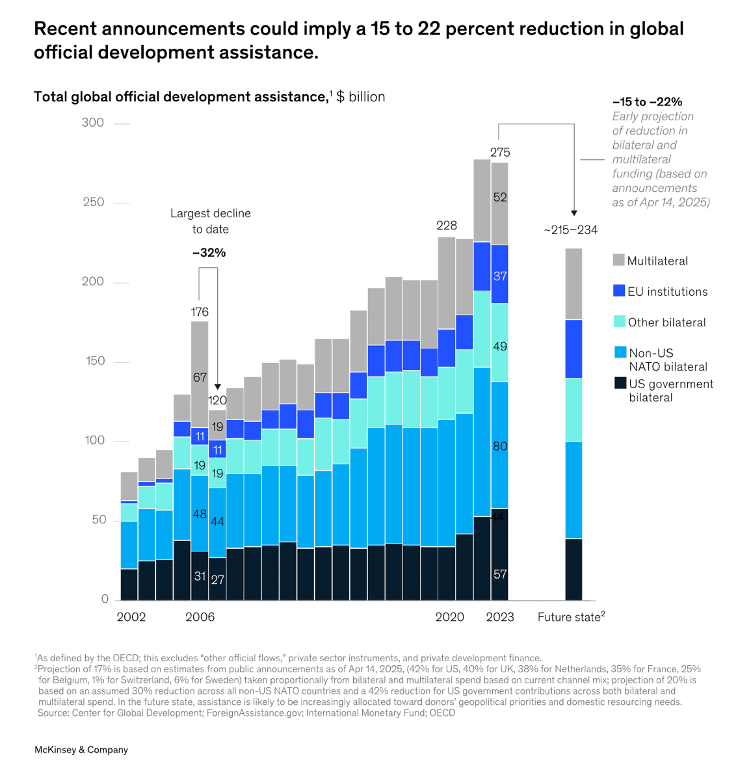

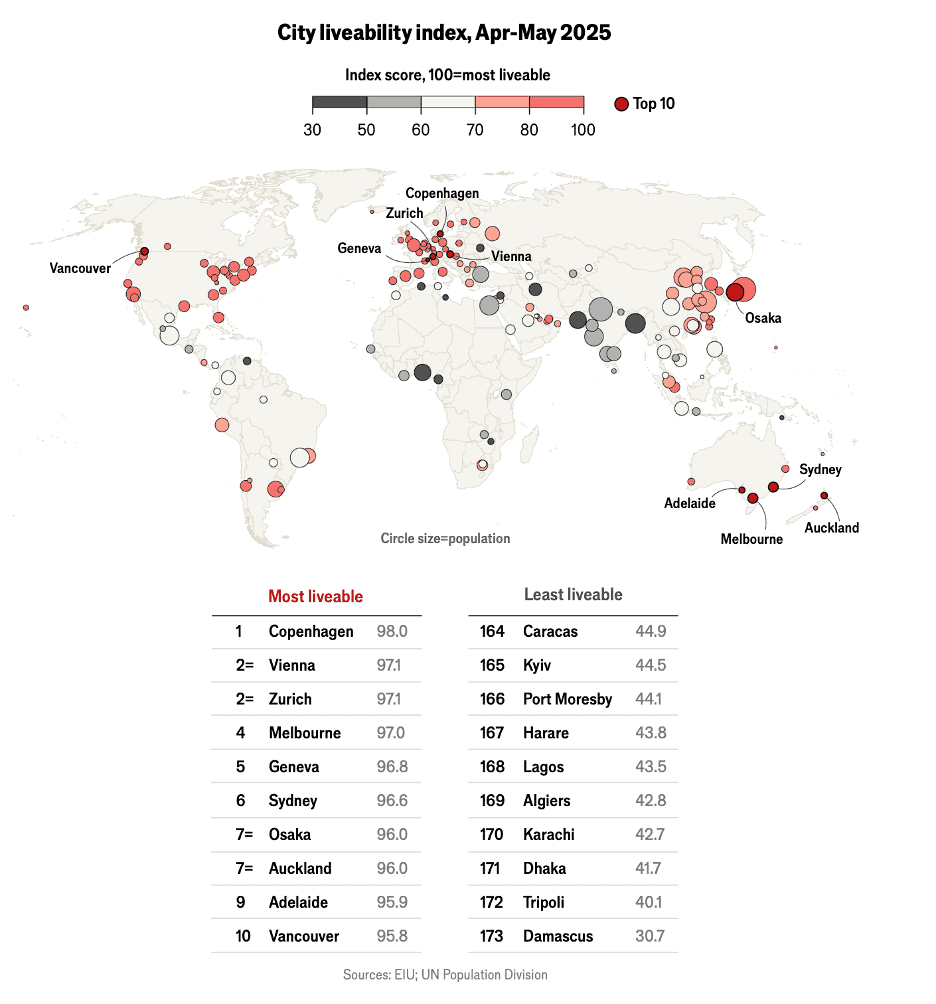

In the realm of global aid, major donor countries are pulling back. With official development assistance projected to drop by up to $60 billion, there’s growing concern over the future of global health, education, and infrastructure initiatives. Meanwhile, cities once known for stability—like Vienna—have seen their reputations shaken, underscoring how safety and security increasingly influence global livability and business decisions.

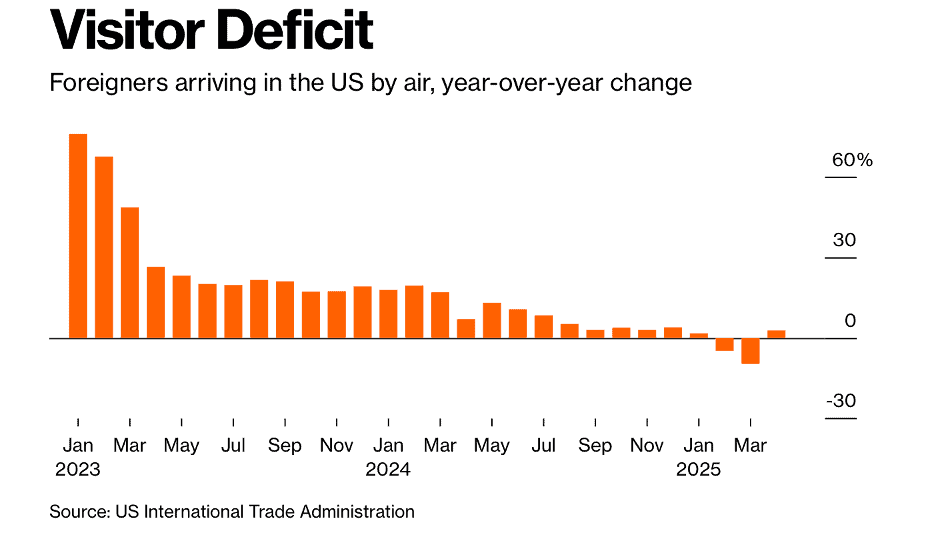

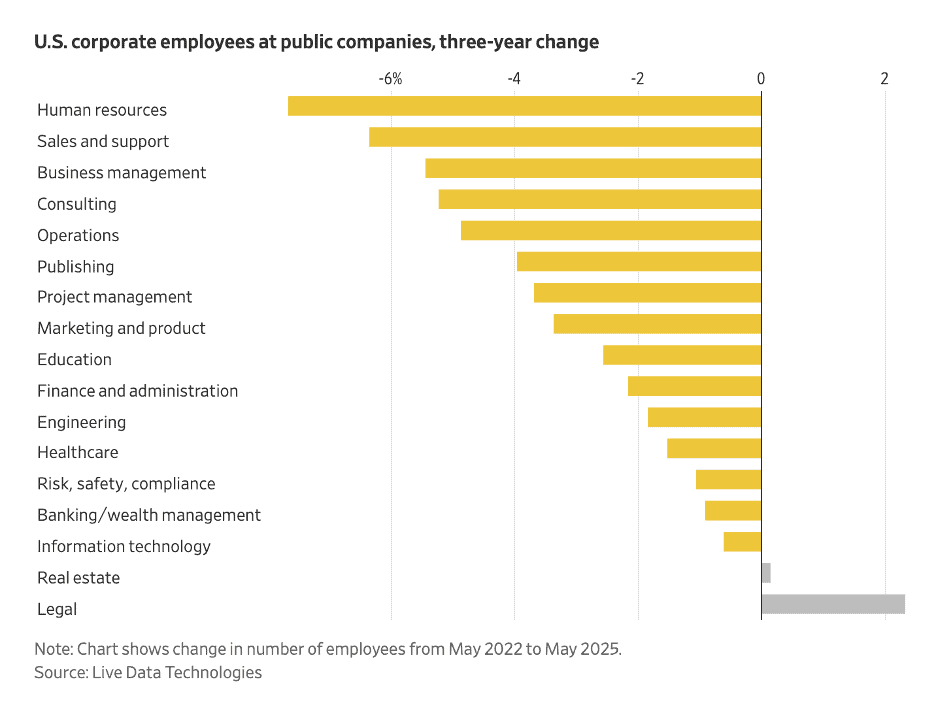

Trade and tourism are also under pressure. President Trump’s second-term policies, including new travel bans and protectionist tariffs, may have wiped out $12.5 billion in U.S. tourism revenue this year and triggered retaliatory moves in regions like Southeast Asia. Meanwhile the biggest companies across America are cutting their workforces.

On the franchise front, innovation continues. From Yum China’s rollout of an AI assistant for KFC store managers to U.S. Congressional recognition of June 11 as the first-ever World Franchise Day, we see both technological and political forces validating the growing relevance and success of the franchise model worldwide. And some casual-dining franchise chains are staging a comeback.

In this issue’s book, Marketcrafters: The 100-Year Struggle to Shape the American Economy, Chris Hughes, Co-Founder of Facebook, presents a compelling historical narrative that challenges the myth of the “free market” as a natural phenomenon. Instead, he argues that markets are deliberately created and continuously shaped by policymakers, economists, and corporate interests—a process he calls “marketcraft.” Covering a century of U.S. economic history, from New Deal reforms to Big Tech’s modern dominance, Hughes reveals how intentional rule-making has defined winners and losers in the American economy.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

But First……The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business.

PLEASE NOTE: Some of the information sources that we provide links to in our newsletter require a paid subscription to directly access them. Clicking on a link may not give the reader access to the content.

Edited and curated by: William (Bill) Edwards, CEO & Global Business Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA. Contact Bill with questions, comments and contributions. Bedwards@edwardsglobal.com, +1 949 375 1896

Link to our current and past newsletters: https://edwardsglobal.com/geowizard/

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

First, A Few Words of Wisdom From Others For These Times

“Choose lazy people to do difficult jobs, they always find ways to do it easily.”, Bill Gates

“The future belongs to those who believe in the beauty of their dreams.”, Eleanor Roosevelt

“We must ensure that the global market is embedded in broadly shared values and practices that reflect global social needs, and that all the world’s people share the benefits of globalization.”, Kofi Annan

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Highlights in issue #137:

Global Inflation Projections in 2025 and 2026

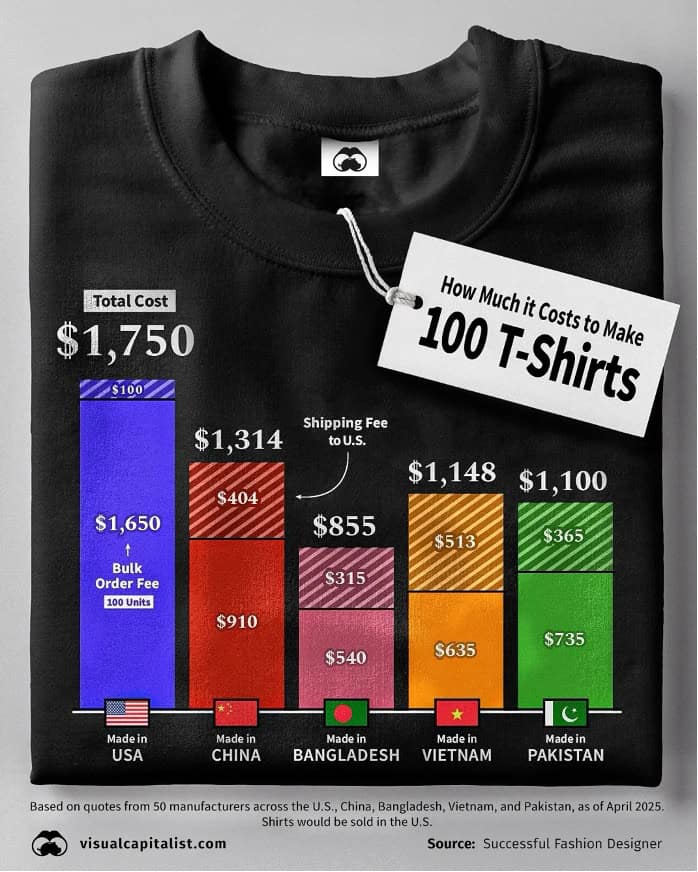

How Much it Costs to Make 100 T-Shirts

Yum China is testing an AI assistant for store managers

Unemployment Rates in OECD Countries in 2025

How Weight-Loss Drugs Blew Out the U.S. Trade Deficit

Trump’s $12 Billion Tourism Wipeout

Brand Global News Section: Chili’s®, Honeymoon Dessert® and YUM China

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Please sign up for this amazing future looking August 6th event at the Beall Center for Innovation and Entrepreneurship at the University of California, Irvine at this kink: www.enpinstitute.com/events

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

“Global Inflation Projections in 2025 and 2026 – Average headline inflation across the OECD is projected to be 4.2% in 2025, and 3.2% in 2026. The OECD’s previous inflation projections have been revised upwards due to escalating trade barriers. After a global spike in inflation following the COVID-19 pandemic and Russia’s invasion of Ukraine, central banks have worked to cool price growth. This visualization shows the OECD’s latest inflation projections through 2026, highlighting where price pressures are easing—and where they are still stubbornly high.”, OECD Economic Outlook, June 2025

==================================================================================================

“Global aid at a crossroads – Global aid faces a pivotal moment. After years of official development assistance increasing, major foreign donors have announced significant reductions. As a result, a 15 to 22 percent reduction in funds is expected, for an estimated loss of $41 billion to $60 billion, according to McKinsey & Co. Senior Partner Tania Holt and coauthors. Stakeholders can consider several levers to combat these challenges, including mobilizing additional resources and reprioritizing investments and programs.”, McKinsey & Co., June 11, 2025

============================================================================================

“Unemployment Rates in OECD Countries in 2025 – Japan and Mexico have the lowest unemployment rates at 2.5%. Spain’s unemployment rate of 10.9% is the highest of all OECD countries. Unemployment rates in Türkiye, Slovenia, and Slovakia are at their lowest levels since 2001. As of March 2025, the average unemployment rate across OECD countries stood at 4.9%, nearly in line with its lowest level since 2001. However, behind that average lies a wide spectrum, ranging from countries at near-record unemployment lows to others grappling with high joblessness.”, OECD & Visual Capitalist, June 20, 2025

============================================================================================

“The world’s most liveable cities in 2025 – Vienna has lost its crown. Instability threatens living standards everywhere. Vienna is a case in point. The Austrian capital was the world’s most liveable city from 2022 to 2024. But this year it lost its place because two foiled terrorist attacks—on a Taylor Swift concert and on a train station—brought down its stability score, which quantifies the threat of military conflict, civil unrest and terrorism. Smaller places generally do well on the index. Only three cities in the top 20 have more than 6m residents. London and New York are in 54th and 69th place respectively.”, The Economist, June 16, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation, Taxes & Trade Issues

“How Much it Costs to Make 100 T-Shirts – This graphic breaks down the cost to produce 100 T-shirts from manufacturers in various countries. Bangladesh offers the lowest total cost and cost per shirt. Shipping costs significantly impact the total cost, with locations like Ho Chi Minh and Guangdong showing higher shipping fees. Manufacturing in the USA is the most expensive option, with the highest bulk order fee and cost per shirt, despite lower shipping costs. Based on quotes from 50 manufacturers across the U.S., China, Bangladesh, Vietnam, and Pakistan, as of April 2025.”, Successful Fashion Designer, June 9, 2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel News

“Trump’s $12 Billion Tourism Wipeout – Four months into the president’s second term, his policies are upending tourism worldwide. Nine charts show the toll on global travel. US President Donald Trump’s “America First” policies have cut into travel worldwide. The simmering trade war, the crackdown at the border and the rollback of LGBTQ rights—capped by a ban on visitors from a dozen countries announced on June 4—have led to tens of thousands of canceled trips. With travelers choosing alternate destinations, the American economy will lose out on $12.5 billion this year, according to the World Travel & Tourism Council—which will widen the trade deficit, because economists count spending by visitors to the country as an export.”, Bloomberg, June 5, 2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Book Review

In Marketcrafters: The 100-Year Struggle to Shape the American Economy, Chris Hughes presents a compelling historical narrative that challenges the myth of the “free market” as a natural phenomenon. Instead, he argues that markets are deliberately created and continuously shaped by policymakers, economists, and corporate interests—a process he calls “marketcraft.” Covering a century of U.S. economic history, from New Deal reforms to Big Tech’s modern dominance, Hughes reveals how intentional rule-making has defined winners and losers in the American economy.

Hughes draws from his background in politics and technology to show how power, not just policy, influences economic outcomes. The book is rigorously researched yet highly readable, offering both historical insight and a call to action for more democratic participation in market design. For global business leaders, Marketcrafters is a timely reminder that markets are not immutable—they’re built, and they can be rebuilt for broader prosperity.

Top 5 Takeaways for Global Businesspeople

Markets Are Engineered, Not Natural – Policies, institutions, and legal frameworks actively shape economic systems.

Power Determines Outcomes – Market structures often reflect the interests of those with influence, not pure efficiency.

Globalization is a Policy Choice – Trade liberalization, labor flows, and tech regulation are outcomes of crafted decisions, not inevitabilities.

Economic Fairness Requires Deliberate Design – Equity and competition don’t emerge on their own—they must be built into market rules.

Business Leaders Are Market Participants and Market Shapers – Executives must recognize their role in shaping fair and functional systems, not just operating within them.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Canada

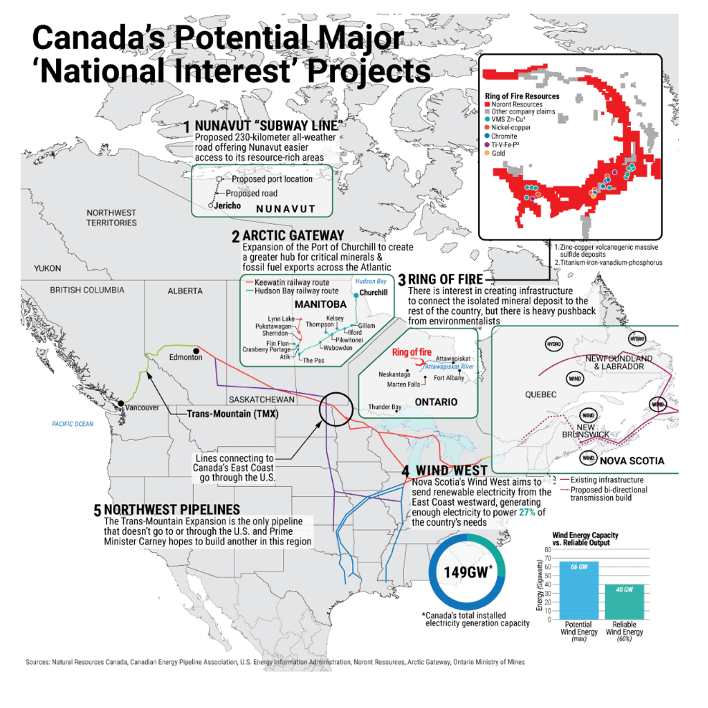

“Strategic Projects Under Consideration in Canada – Ottawa has ambitions to become an energy superpower. The Canadian government is making a strong push to improve the country’s strategic independence. The government of Prime Minister Mark Carney has rallied provincial and business leaders to fast-track infrastructure projects that will make Canada more self-reliant, improve national security and support long-term economic growth. The country wants to become an energy superpower (both for internal consumption and export), improve its export infrastructure, build a strong Arctic presence and boost development of critical mineral resources. Tensions with the U.S. are accelerating these efforts, but the projects address longstanding needs that will persist long after the Trump administration.”, Geopolitical Futures, June 13, 2025

===============================================================================================

China

“China’s Top 100 Chain Stores in 2024 Released – Based on the results of the 2024 industry basic situation survey, the China Chain Store & Franchise Association (CCFA) released the “Top 100 Chinese Chains in 2024”. In 2024, the sales volume of the top 100 chain enterprises will be 2.13 trillion yuan, and the total number of stores will be 257,200, an increase of 4.9% and 13.5% respectively over the previous year’s top 100 chain enterprises. Among the top 100 chain enterprises, there are 46 comprehensive retailers, 23 supermarkets, 13 convenience stores, and 18 specialty stores. Among them, comprehensive retail enterprises face the greatest growth pressure, with 19 enterprises experiencing year-on-year sales growth, and 9 enterprises achieving year-on-year double growth in sales and number of stores.”, China Chain Store & Franchise Association, June 18, 2025. Compliments of Paul Jones, Jones & Co., Toronto

================================================================================================

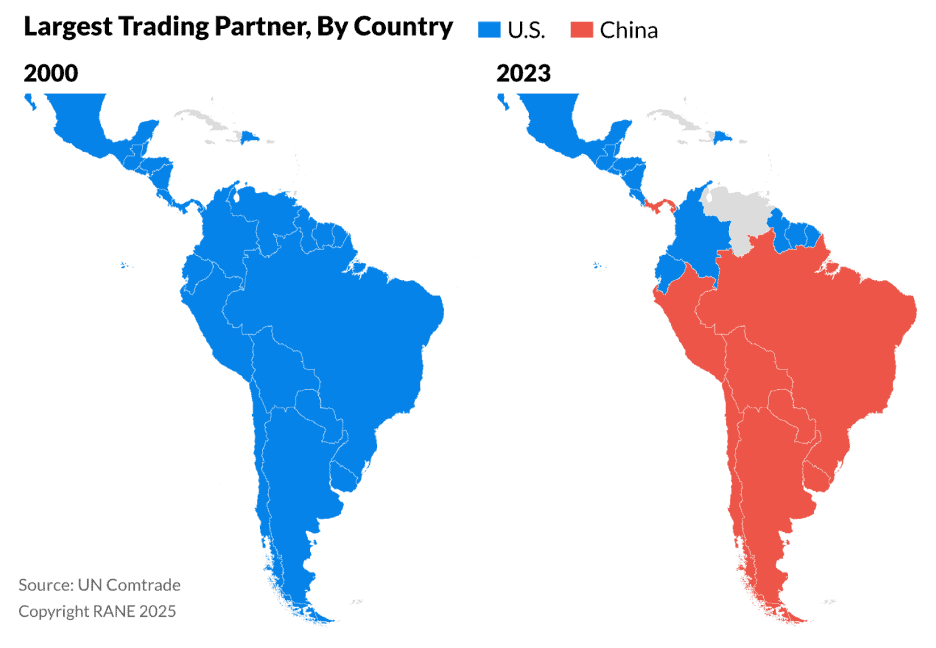

“Despite Stronger Trade Ties, China’s Influence in Latin America Will Remain Limited – In 2000, the United States was the main trade partner of countries across the Western Hemisphere. However, China soon became the largest trading partner of most regional countries, especially in South America, after joining the World Trade Organization in 2001 and expanding commerce with the region. In the coming years, China will diversify and expand trade and investment in Latin America and the Caribbean amid U.S. protectionism, but Beijing’s influence will likely remain limited due to its declining financial capacity and the region’s enduring ties with the West.”, RANE Worldview, June 11, 2025

=============================================================================================

Middle East

“Same Gulf? Different Rules: The Saudi vs UAE Etiquette You Can NOT Ignore – When most Western professionals think of the Gulf region, they tend to paint it with the same brush: conservative, wealthy, hierarchical, and relationship-driven. And while there is truth to that, each country has its own unwritten rules that can make or break a deal. One of the biggest mistakes expats make is assuming the Gulf is culturally identical. Many think a smooth pitch in Dubai guarantees success in Riyadh. In reality, copying your UAE approach in Saudi can damage trust overnight. Nowhere is this more apparent than in the subtle but important differences between Saudi Arabia and the United Arab Emirates (UAE).”, Star Katz, June 22, 2025. Compliments of Corina Goertz.

============================================================================================

United States

“The Biggest Companies Across America Are Cutting Their Workforces – It isn’t just Amazon. There’s a growing belief that having too many employees will slow a company down—and that anyone still on the payroll could be working harder. U.S. public companies have reduced their white-collar workforces by a collective 3.5% over the past three years, according to employment data-provider Live Data Technologies. Over the past decade, one in five companies in the S&P 500 have shrunk. New technologies like generative artificial intelligence are allowing companies to do more with less. The message from many bosses: Anyone still on the payroll could be working harder.”, The Wall Street Journal, June 18, 2025

=================================================================================================

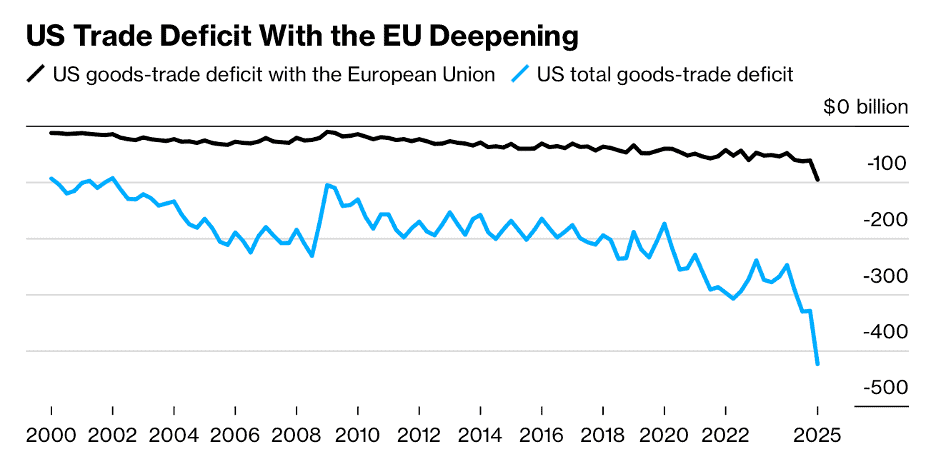

“How big trade deficit drop as tariffs hit imports is playing out inside U.S. supply chain and economy – The U.S. trade deficit has plunged as imports surged and then plummeted as a result of President Trump’s trade war and tariffs. The impact of rapid global economic shifts can be seen in the supply chain activity across the U.S., from warehouses to freight orders and inventory. The data points to greater pain for small businesses. The U.S. trade deficit fell by the largest amount on record in April as imports fell by over 16% after a surge in orders to beat President Trump’s tariffs, but there’s a worrying flip side for the consumer. As the trade war whipsaws global economic activity, supply chain data shows that the retail inventory crunch could be next and small business across the country are bearing the brunt of the pain. From freight orders to inventory and warehousing, the latest logistics data shows the inability of many importers to make business decisions related to inventory levels.”, CNBC, June 5, 2025

=============================================================================================

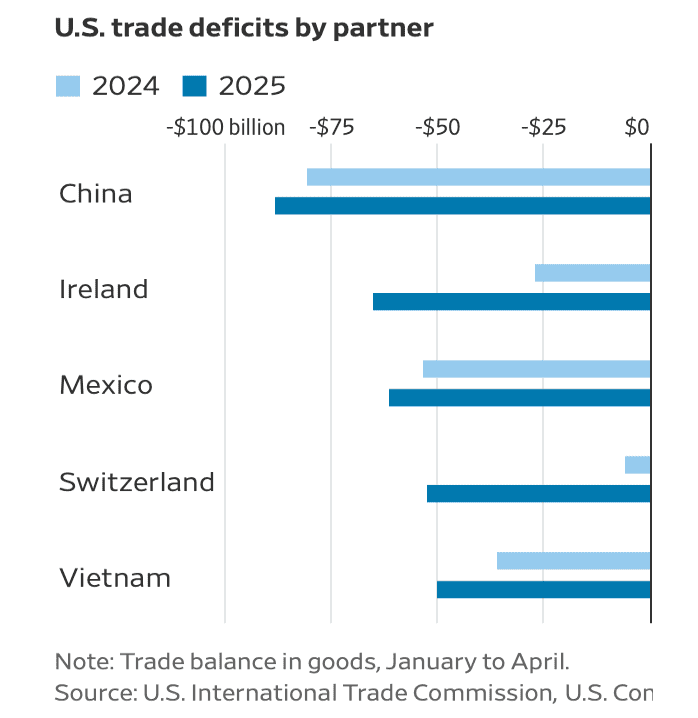

“How Weight-Loss Drugs Blew Out the U.S. Trade Deficit – Shipments have propelled Ireland, a country of 5.4 million, to the second-largest goods-trade imbalance with the U.S., behind China. Planes have been jetting from Ireland to the U.S. this year carrying something more valuable than gold: $36 billion worth of hormones for popular obesity and diabetes drugs. Fit into temperature-controlled air-cargo containers, the pharmaceutical ingredients have had a huge impact on the U.S. trade imbalance. The shipments have propelled Ireland, a country of only 5.4 million people, to the second-largest goods-trade imbalance with the U.S., trailing only China. They accounted for roughly half of the $71 billion in goods the U.S. imported from the country in the first four months of the year.”, The Wall Street Journal, June 20, 2025.

=============================================================================================

Vietnam

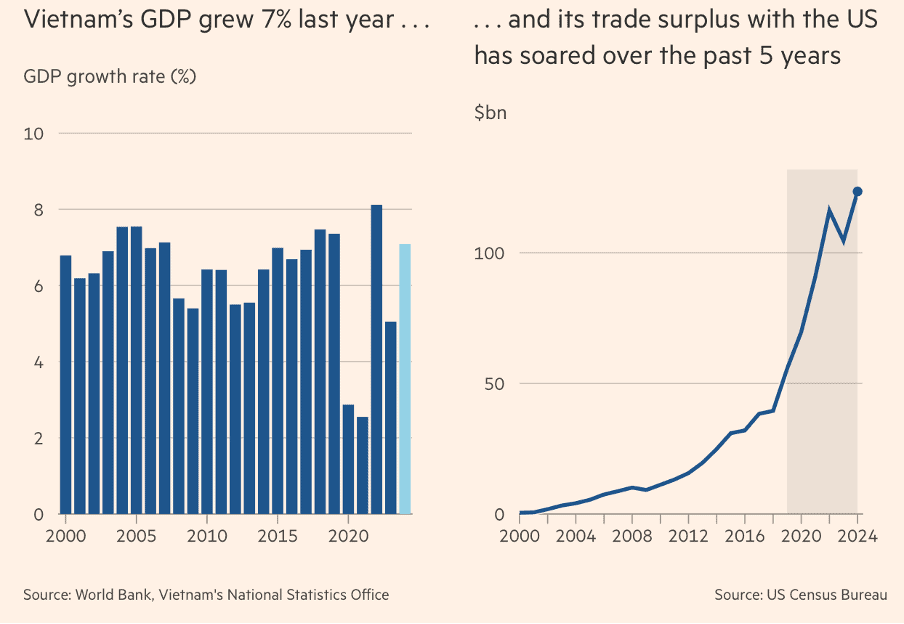

“Vietnam risks being the trade war’s biggest loser. Does it have a plan B? The south-east Asian country benefited hugely from US-China tensions, but the Trump tariffs strike at the heart of its economy. On Trump’s so-called “liberation day”, he announced Vietnam would face a 46 per cent tariff rate, one of the highest in the world. For A&M and its 120 employees, new orders from American clients slowed to a trickle. Like thousands of companies across Vietnam, it is now frantically trying to figure out its future. The country’s recent economic success — with GDP growth at 7 per cent last year — has been driven primarily by exports to the US and surging investments from companies fleeing China.”, The Financial Times, June 12, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The Accredited Franchise Supplier certification

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Brand & Franchise Sector News

“(U.S.) Congressional Leaders Introduce Resolution Recognizing First-Ever World Franchise Day – A bipartisan and bicameral group of lawmakers today introduced a historic congressional resolution recognizing June 11 as the first-ever World Franchise Day, honoring the franchise business model’s impact on job creation, entrepreneurship, and economic development across the United States and the world. The resolution is being led in the U.S. Senate by U.S. Sens. Markwayne Mullin (R-OK) and Chris Coons (D-DE), and in the U.S. House by Representatives by U.S. Reps. Kevin Hern (R-OK), Troy Carter (D-LA), Hillary Scholten (D-MI), and Beth Van Duyne (R-TX). The House resolution has 12 bipartisan original cosponsors. ‘World Franchise Day is a powerful reminder of the franchise model’s unparalleled ability to create opportunity for aspiring entrepreneurs of all backgrounds and walks of life,’ said Matt Haller, IFA President and CEO.”, The International Franchise Association, June 11, 2025

===============================================================================================

“Yum China is testing an AI assistant for store managers – The company began incorporating similar tools as early as 2019. Yum China today announced the pilot launch of “Q-Smart,” an artificial intelligence-enabled assistant for restaurant managers, at select KFC restaurants. According to the company, Q-Smart helps with labor scheduling, inventory management, and food quality and safety inspection. Managers can interact with the system using wearable devices such as wireless earphones and smart watches, creating a hands-free experience rather than having to rely on touchscreens or PCs to complete tasks. An example of Q-Smart’s application is its ability to monitor a restaurant’s inventory and compare it with upcoming sales forecasting, reminding managers to make timely ordering decisions. Q-Smart can also understand and respond to managers’ voice commands, helping them to conduct equipment inspections and inventory counts. Further, the system can provide real-time support and solutions for managers to handle urgent operational issues.”, NRN, June 20, 2025

================================================================================================

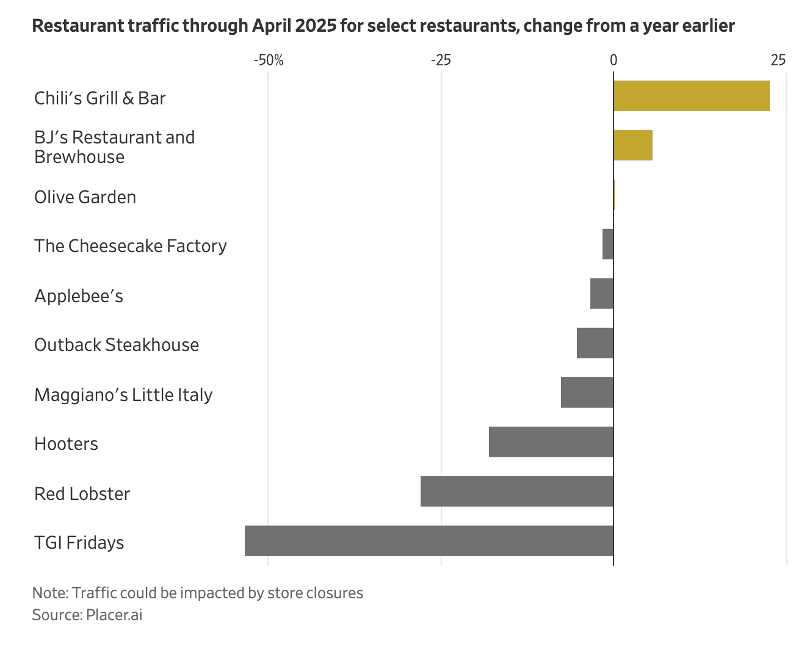

“After a Bruising Year, Casual-Dining Chains Try to Stage a Comeback – Vintage restaurant brands aim for overhauls without scaring loyal customers; ‘No one is getting drunk at Cracker Barrel’. Restaurants like Cracker Barrel and Red Lobster are working to stage a comeback by spending millions to update menus and dining rooms. Red Lobster is recovering from bankruptcy with new leadership, menu updates and improved customer sentiment. Chains like Chili’s and Texas Roadhouse have focused on offering high service levels and good prices. U.S. restaurant bankruptcies last year hit the highest level in decades excluding 2020, when the Covid-19 pandemic upended the industry. TGI Fridays, Rubio’s Coastal Grill and Red Lobster were among chains that filed for Chapter 11, closing hundreds of restaurants……the shakeout in casual dining continues as brands such as Denny’s, Applebee’s and Hooters close locations in efforts to improve profitability. Restaurant locations run by the largest casual-dining chains dropped 1.2% last year, the first unit decline since 2020, according to market-research firm Technomic.”, The Wall Street Journal, June 20, 2025

==============================================================================================

“Honeymoon Dessert launches global partner program – The dessert industry seeks new support points through self service model and overseas expansion. Honeymoon Dessert, which is sandwiched between the forces of new tea drinks, has launched a global partner program while fine-tuning and adjusting its business model, emphasizing its determination to expand overseas. Honeymoon Dessert “has now arrived in Southeast Asia, North America, Europe and other places”, and a new store in Thailand is about to open. After 30 years, Honeymoon Desserts is not only exploring the old business of stores.”, Caijing.com.cn, June 17, 2025. Compliments of Paul Jones, Jones & Co., Toronto.

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive our biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing business environment. And our GlobalTeam™ on the ground covering 25+ countries provide us with updates about what is actually happening in their specific countries. We do not get involved in or report on politics!

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe, and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant since 2001 taking 40+ companies global.

| To receive this biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com +++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++ |

Our latest GlobalVue™ 40 country ranking

For a complimentary 30-minute consultation on how to take your business into new countries and make money doing it. For a complimentary call with Bill Edwards click on the QR code or contact Bill at bedwards@edwardsglobal.com and +1 949 375 1896

Biweekly Global Business Newsletter Issue 13, Tuesday, June 10, 2025

“In the midst of every crisis, lies great opportunity.”, Albert Einstein

Welcome to Issue #136 of the Global Business Update – As we hit the midpoint of 2025, the global economy is sending mixed—and at times, conflicting—signals. In this issue, we cover everything from rising gold prices to sinking tourist numbers, from trade skirmishes to surprising growth pockets.

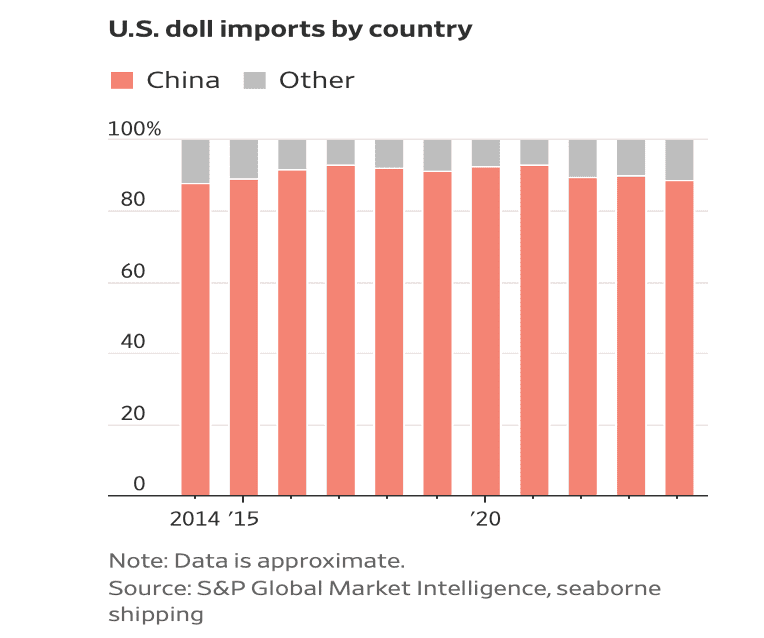

The global economy sputters as new tariffs return under Trump, intensifying trade tensions now hitting on three fronts. We’re seeing ripple effects: jobs at the Port of Los Angeles are down by half, international tourist arrivals to the U.S. continue to decline, and tariffs are already making dolls more expensive for American families. Yet, in a twist, AmCham reports no polled U.S. firms in China are planning to reshore to the USA.

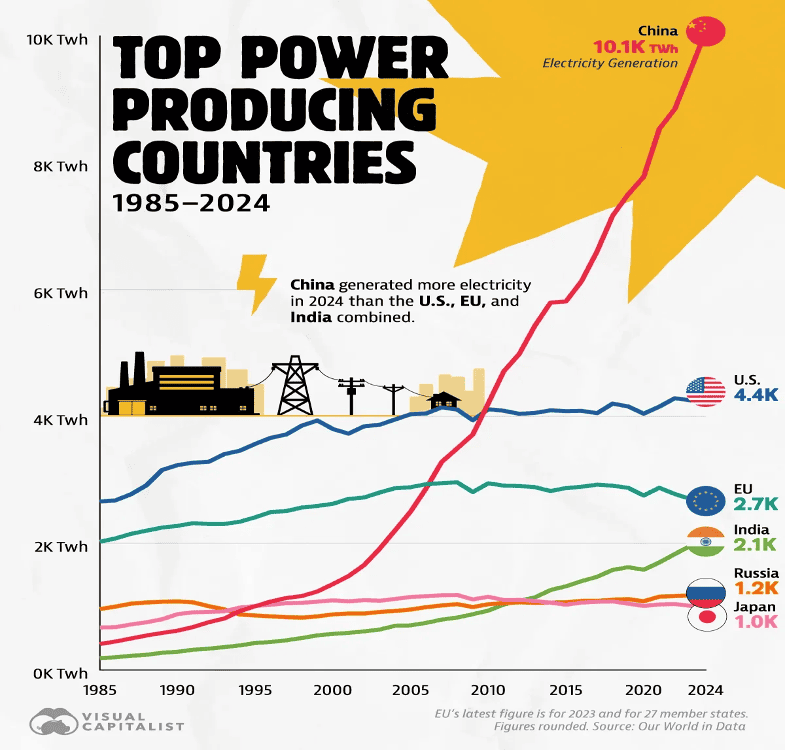

Meanwhile, China generated more electricity in 2024 than the U.S., EU, and India combined, and Starbucks is cutting prices in China as competition grows. Vietnam emerges as a high-growth market, while Canada pushes for faster project approvals and freer trade. Europe quietly doubles its growth pace, attracting investor attention.

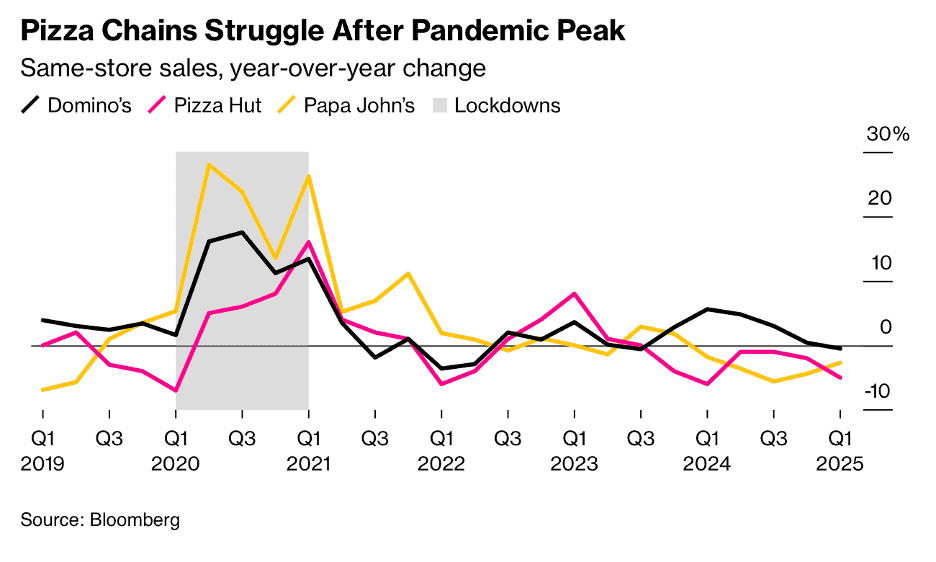

This issue also features a deep dive into life expectancy by country, a timely look at The Art of Uncertainty, and what America’s Pizza Economy says about the real one. But despite the tariff challenges, Freddies® is opening its first restaurant in Canada!

One More Thing… In this issue’s book, The Art of Uncertainty: How to Navigate Chance, Ignorance, Risk and Luck, global strategist and philosopher Dennis Shirshikov challenges conventional views on control and prediction in business. This thought-provoking book argues that embracing uncertainty—not avoiding it—is the most powerful way to succeed in today’s complex and volatile global environment.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

But First……The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business.

PLEASE NOTE: Some of the information sources that we provide links to in our newsletter require a paid subscription to directly access them. Clicking on a link may not give the reader access to the content.

Edited and curated by: William (Bill) Edwards, CEO & Global Business Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA. Contact Bill with questions, comments and contributions. Bedwards@edwardsglobal.com, +1 949 375 1896

Link to our current and past newsletters: https://edwardsglobal.com/geowizard/

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

First, A Few Words of Wisdom From Others For These Times

“Uncertainty is the new norm. Leaders must rely on their ‘muscle memory’—past experience and foundational knowledge—to navigate challenges like trade policy shifts, fluctuating markets, AI integration, and evolving workforce dynamics.”, Janet Truncale – Global Chair & CEO, Ernst & Young (EY)

“Never to let one’s self be beaten down by persons or by events.”, Marie Curie

“Commitment is what transforms a promise into reality.”, Abraham Lincoln

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Highlights in issue #136:

How Long People Live, by Country

Global Economy Sputters as Trump Inks New Tariff

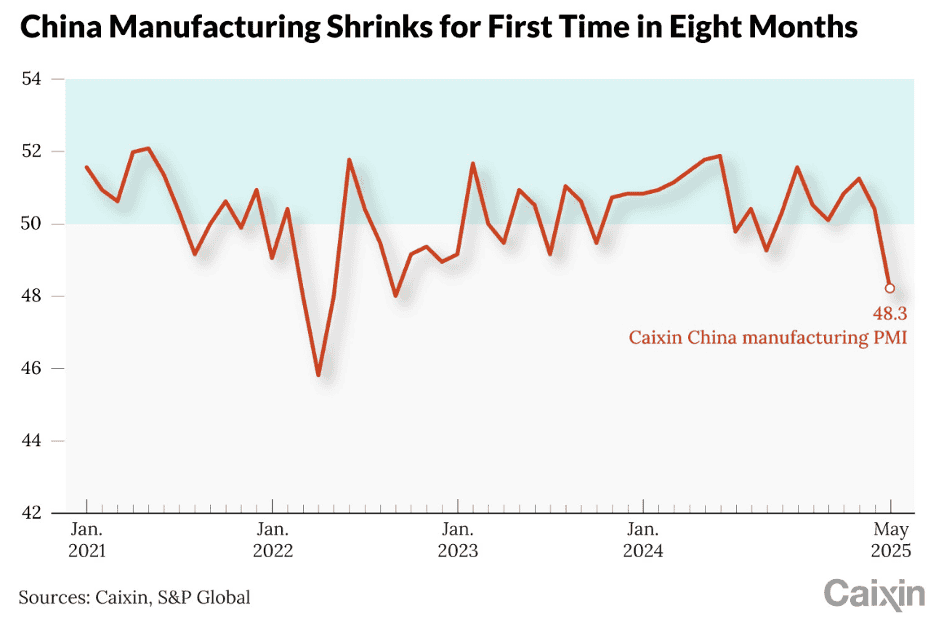

Plunge in Overseas Demand Hits China Manufacturing, Caixin PMI Shows

Jobs at the Port of Los Angeles are down by half, executive director says

Fewer international tourists are visiting the U.S.

What America’s Pizza Economy Is Telling Us About the Real One

Euro Economies Doubling Growth Grabs Investor Attention –

Brand Global News Section: Dave’s Hot Chicken®, Freddies®, Little Cesars® and Starbucks®

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

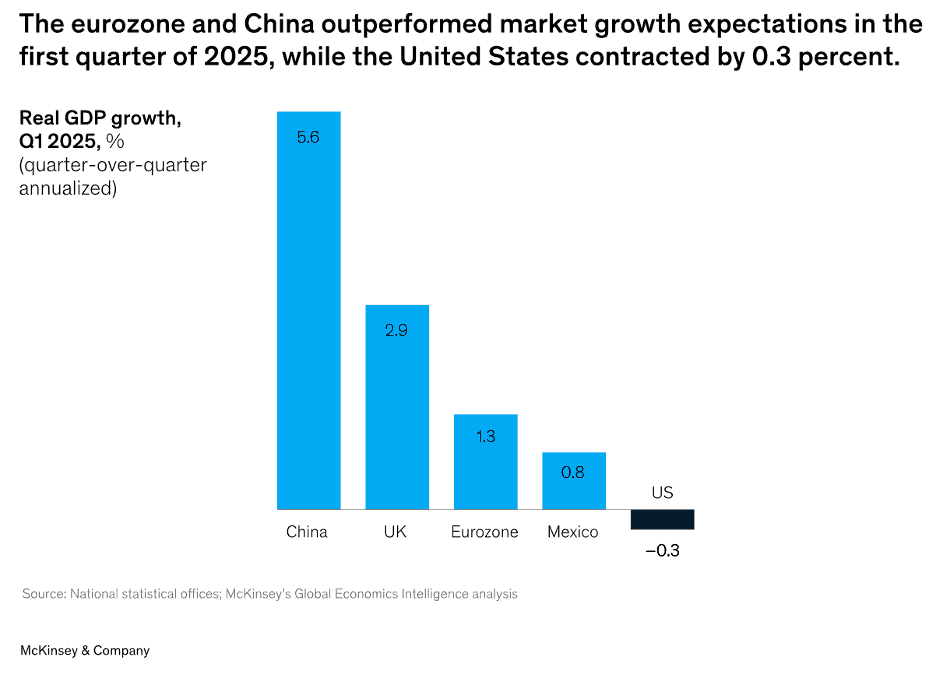

Interesting Data, Articles and Studies

“Global Economics Intelligence executive summary, April 2025 – Markets fluctuate but return to early April levels; first-quarter US GDP data indicates consumer spending and investment growth despite 0.3% contraction, while China and Europe outpace expectations. Persistent high consumer prices and elevated levels of uncertainty continue to affect households, leading to low levels of overall consumer confidence in the US and beyond. Despite the uncertainty, leading indicators were above long-term trends across the main economies during March. Economies are continuing to reduce interest rates, except Russia and Brazil, which have been raising rates to combat high inflation.”, McKinsey & Co., May 29, 2025

==================================================================================================

“Global Economy Sputters as Trump Inks New Tariff – Despite promised blowback from Europe, Donald Trump formally raised steel and aluminum tariffs to 50% from 25% on Tuesday. The move by the president raises trade tensions at a time when the US is locked in negotiations with numerous trading partners over his so-called “reciprocal” duties before a July 9 deadline. While those tariffs have been deemed by US courts to likely be illegal, they remain in place as litigation over them proceeds. The steel levies aren’t implicated by the rulings.”, Bloomberg, June 3, 2025

============================================================================================

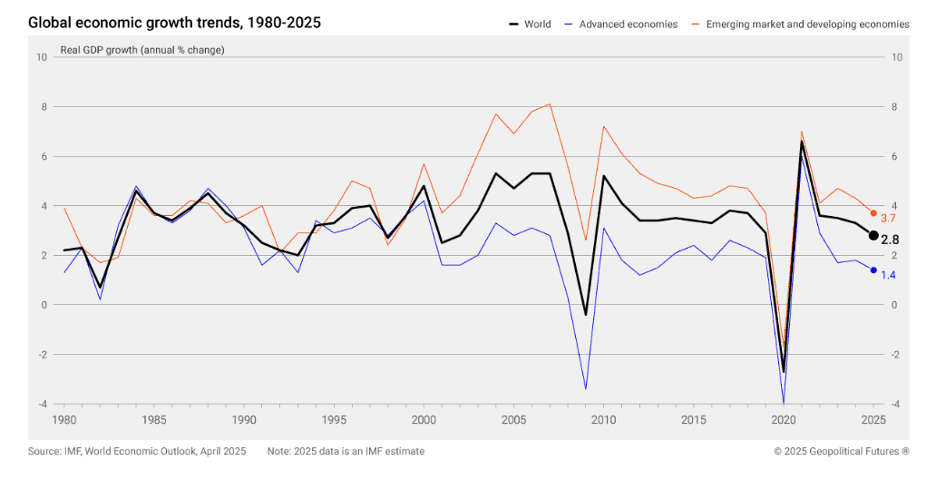

“A New Era for the Global Economy – Established economic and trade rules are being eroded, without a clear replacement emerging. Over the past two decades, the global economy has endured significant shocks – most notably the 2008 financial crisis and the economic fallout from pandemic-related lockdowns. These events severely hindered real GDP growth. Despite these disruptions, the primary indicator of economic activity has remained resilient. Growth rebounded quickly after the pandemic, surpassing 3 percent for many countries. Still, the IMF expresses caution. It does not expect strong economic growth to continue into the coming year, although it does forecast positive growth overall. Ongoing instability – especially in trade relationships and global conflicts – poses serious risks. These factors threaten supply chains and the flow of goods, shifting economic risks to the downside. For example, new tariffs imposed by the United States, along with retaliatory measures by its trading partners, prompted the IMF to lower its global growth forecast in the January 2025 World Economic Outlook update to 2.8 percent for the year.”, Geopolitical Futures, May 28, 2025

============================================================================================

“How Long People Live, by Country – How long you live depends a lot on where you’re born. For example, Western European countries have an 80+ life expectancy at birth. However, several African countries have a below 60 life expectancy, a lifespan that is a full 20 years shorter. Parts of already Africa battle a perfect storm of difficult living conditions: poor nutrition, not enough clean water, and violence. However, the biggest difference between life expectancies of Africans and residents of high-income regions are for those before the age of 5 and after 60.”, Visual Capitalist and UN World Population Prospects 2024, May 22, 2025

================================================================================================

“China Generated More Electricity in 2024 Than the U.S., EU, & India Combined – China generated over 10,000 TWh (terawatt-hour) of electricity in 2024. That’s more than the combined output of the U.S., EU, and India—the next three biggest producers.”, Our World In Data, June 1, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

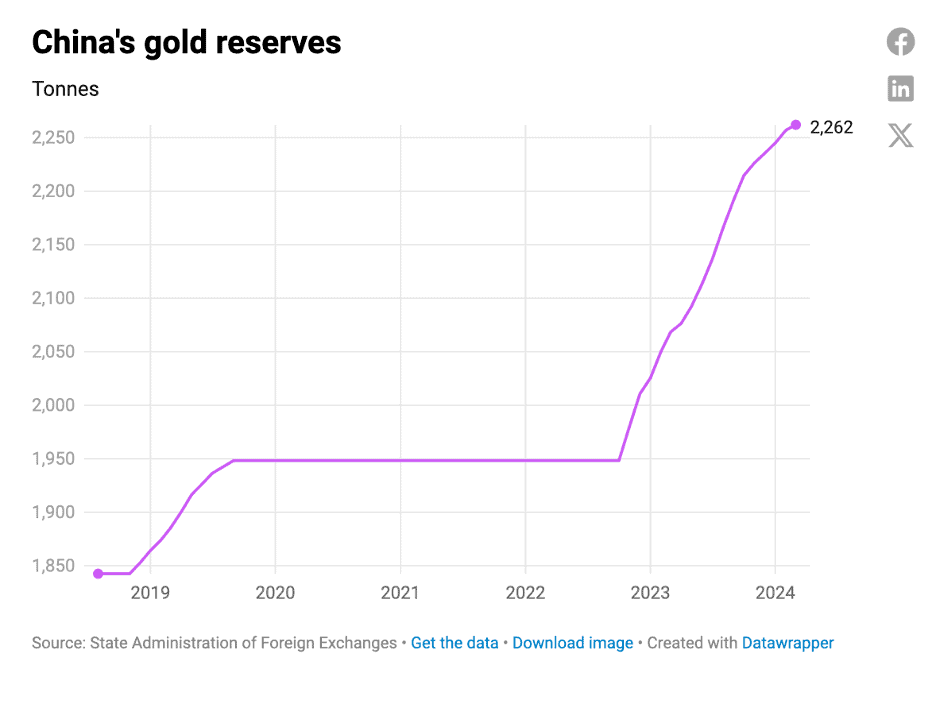

“Why central banks are playing a big role in pushing up gold prices – Governments are buying up gold as they see it as a safe investment – and, in some cases, a tool for evading Western sanctions. Gold prices have surged this year as investors seek safe investments amid a spike in economic uncertainty unleashed by US President Donald Trump’s tariff policies. Countries are increasingly experimenting with creating gold-backed digital assets and trading systems that bypass the dollar-denominated financial system, according to an article by Kimberly Donovan and Maia Nikoladze of the Atlantic Council’s Economic Statecraft Initiative published earlier this month.”, South China Morning Post, May 27, 2025

=============================================================================================

Global & Regional Travel News

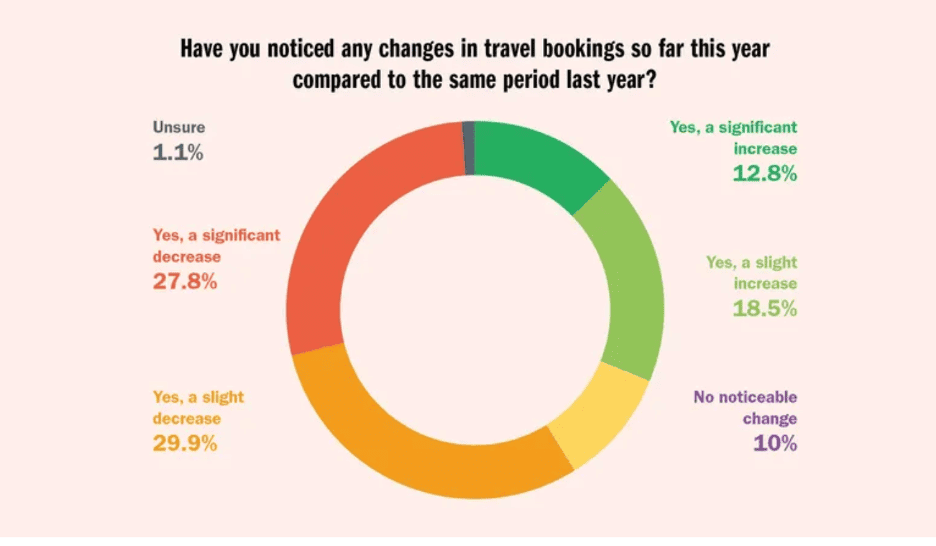

“Travel advisor survey shows bookings decline, but not across the board – A majority of travel advisors say that bookings are down this year compared to last, with the economy, consumer confidence and price sensitivity all playing roles. A Travel Weekly survey fielded last month found that 27.8% of respondents reported a significant decrease in bookings so far in 2025, while 29.9% reported a slight decrease. That adds up to 57.7% who are reporting some kind of decrease. Ten percent reported no change in bookings, 18.5% reported a slight increase, and 12.8% reported a significant increase.”, Travel Weekly, June 2, 2025

==============================================================================================

“Fewer international tourists are visiting the U.S. — economic losses could be ‘staggering,’ researchers estimate. Spending among international visitors to the U.S. is poised to fall $8.5 billion this year, according to Oxford Economics. Tourists are avoiding the U.S. as a destination amid tensions tied to Trump administration policy related to trade and the border, experts said. A relatively strong dollar and weak global growth prospects are also playing a role, they said. Spending from foreign visitors to the U.S. is poised to fall by $8.5 billion this year as negative perceptions tied to trade and immigration policy lead overseas tourists to look elsewhere, according to a research note published by Oxford Economics. The spending decline, which works out to a drop of about 5% relative to last year, is a result of less foot traffic. International arrivals to the U.S. are expected to fall about 9% this year, Aran Ryan, director of industry studies at Tourism Economics, part of Oxford Economics, wrote in a research note last week.”, CNBC, May 28, 2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Book Review

In The Art of Uncertainty: How to Navigate Chance, Ignorance, Risk and Luck, global strategist and philosopher Dennis Shirshikov challenges conventional views on control and prediction in business. This thought-provoking book argues that embracing uncertainty—not avoiding it—is the most powerful way to succeed in today’s complex and volatile global environment. For professionals in international business, Shirshikov’s insights are particularly resonant.

Through compelling case studies and psychological insights, the book explores how successful decision-makers don’t eliminate risk; instead, they learn to work with randomness, incomplete information, and ambiguity. This mindset is essential in international markets, where variables such as cultural nuance, regulatory shifts, economic volatility, and geopolitical tension can disrupt even the most well-planned strategies.

Shirshikov emphasizes agility, scenario thinking, and the use of probabilistic models to guide choices—not for perfect forecasts, but to build resilience and adaptability. His discussion of “productive ignorance” is especially valuable for global business leaders, reminding us that humility and curiosity often yield better long-term outcomes than false confidence.

Ultimately, The Art of Uncertainty offers a compelling toolkit for thriving amid global ambiguity. For entrepreneurs, executives, and strategists operating across borders, this book is not only timely—it’s indispensable.

5 Key Takeaways for International Businesspeople

1. Embrace Uncertainty as a Strategic Asset: Use uncertainty to identify opportunities and drive innovation in unpredictable markets.

2. Make Decisions with Incomplete Information: Take action using probabilities and patterns, essential for navigating new territories.

3. Leverage “Productive Ignorance”: Recognize gaps in knowledge to ask better questions and build stronger local partnerships.

4. Design Flexible, Resilient Strategies: Use scenario planning and optionality to adapt to shifting global conditions.

5. Differentiate Luck from Skill: Understand the role of timing and luck to remain humble and prepared for change.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Africa

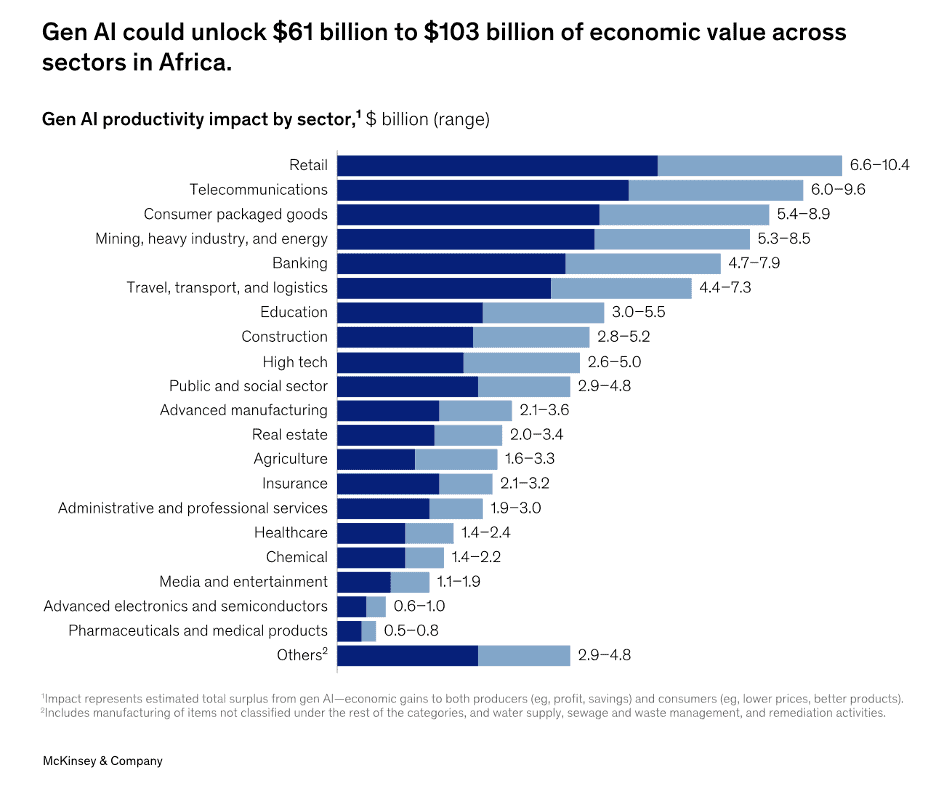

“Africa’s gen AI potential – Africa has embraced gen AI with remarkable speed, and its institutions are quickly catching up with and in some instances leading global developments. However, the continent’s progress so far with both gen AI and AI more broadly is only the tip of the iceberg, say Partner Mayowa Kuyoro and coauthors. Gen AI adoption varies widely by sector, with digitally mature sectors such as technology, telecommunications, and financial services leading the way. The authors estimate that at-scale deployment of gen AI could lead to $61 billion to $103 billion of additional economic value across Africa.”, McKinsey & Co., May 29, 2025

==============================================================================================

Canada

“Geography has made us neighbors. History has made us friends. Economics has made us partners. And necessity has made us allies”., President Kennedy, Ottawa in 1961.

==============================================================================================

“Canada Introduces Bill to Speed Up Project Approval, Dismantle Trade Barriers – Officials say removing internal trade barriers and expediting approval of major infrastructure and resource projects would help maximize Canada’s economic potential. Canada introduced legislation on Friday that aims to accelerate approval of resource and infrastructure projects, and knock down internal trade barriers that analysts estimate cost the domestic economy tens of billions of dollars in growth. As for internal trade barriers, this marks the federal government’s boldest effort yet to get the country’s 10 provinces and three territories to mutually recognize their rules and regulations. For instance, provinces have different rules regarding how long truckers can work, and minimum energy efficiency requirements in appliances like washing machines. Wine made in one province can’t be directly sold to customers in another. Further, labor mobility is hampered as provinces have differing rules on who is qualified to work in the trades.”, The Wall Street Journal, June 6, 2025

===============================================================================================

China

“Plunge in Overseas Demand Hits China Manufacturing, Caixin PMI Shows – China’s manufacturing shrank in May at the fastest pace since September 2022, with overseas demand falling at a quicker pace, a Caixin-sponsored survey showed Tuesday. The Caixin China General Manufacturing Purchasing Managers’ Index (PMI), which gives an independent snapshot of the country’s manufacturing sector, came in at 48.3, down from 50.4 in April. A reading above 50 indicates an expansion in activity, while a number below that signals a contraction. The Caixin PMI is one of the earliest available monthly indicators of activity in the world’s second-largest economy. Manufacturing accounted for around 26% of China’s GDP in the first quarter, according to government data.”, Caixin Global, June 3, 2025

=============================================================================================

“China Tariffs Already Mean Fewer, More Expensive Dolls for American Kids – Toy makers are raising prices and are cautious about producing more amid uncertainty over tariff levels. Trump’s tariffs on China are hurting U.S. toy makers, who face higher costs and reduced assortment. A federal trade court ruling on tariffs was put on hold, adding to uncertainty for businesses. Smaller toy makers struggle to fulfill orders as Chinese factories prioritize larger customers. Trump’s China tariffs have been hurting low-margin industries such as toy makers, where companies say there are few alternatives to raising prices. As a result, these businesses expect American shoppers to face a smaller assortment of goods this Christmas—and at a higher cost.”, Wall Street Journal, June 7, 2025

=============================================================================================

“No polled US firms in China shifting production back to US, AmCham survey finds – ‘Instead, they are localising operations or shifting some production to third countries,’ the American Chamber of Commerce says after poll of 112 member companies in China. “Tariffs are an added challenge for our member companies at a time when operating in China is already becoming more complex,” said Alvin Liu, AmCham China chair. Despite the challenges, however, most companies are not planning to exit China, the survey found. None report shifting production back to the US.”, South China Morning Post, June 6, 2025. Compliments of Paul Jones, Jones & Co., Toronto

=============================================================================================

European Union & The Euro Zone

“Trump’s Trade Fight Now a War on Three Fronts – The European Union is preparing for another round of trade talks with the US, but it’s also warning that it may speed up retaliatory measures if President Donald Trump follows through on his latest threat: a 50% levy on steel and aluminum imports. The European Commission, which handles trade matters for the EU, said Monday it “strongly” regrets the tariff hike—up from an originally planned 25%—and said the move is undermining efforts to reach a solution to the trade conflict.”, Bloomberg, June 2, 2025

================================================================================================

“Euro Economies Doubling Growth Grabs Investor Attention – Eurozone economies led by Ireland and Germany expanded twice as much as previously reported to begin the year, with exports surging in anticipation of US tariffs. Eurostat’s upward revision to 0.6% growth caught most economists by surprise and capture a currency union that’s so far proving resilient. For all the Sturm und Drang hurled by the Trump administration, Europe’s macro-economic picture still shows light on the horizon. Private equity investors have a new-found love for Germany and are prowling for deals. Defense technology stocks are booming as investors pour into meeting EU security requirements. The reassessment of European fortunes takes place as jitters spread among investors eyeing what’s taking place on the other side of the Atlantic. The US has ceased to be a secure destination because of risks stemming from Trump’s tax and spending bills, according to the chief economist at French asset manager Carmignac.”, Bloomberg, June 6, 2025

============================================================================================

Middle East

“Etiquette Is Not Fluff: It is Strategy in the Gulf Market – When Western companies think about business expansion into the Gulf, their minds often jump straight to legal structures, market size, product fit, and perhaps even localisation. And yes, they are important. But one area often dangerously overlooked is this: Etiquette! Not as a nice-to-have. Not as an afterthought. Not to be googled as quick fix. But as a strategic imperative.

In the Gulf region — comprising countries like Saudi Arabia, the UAE, Qatar, Kuwait, Bahrain, and Oman — Etiquette is not just about saying the right thing or offering the correct greeting. It’s about showing respect, building trust, and signalling that you understand the invisible rules of the game. If you don’t understand these rules, you are not just being seen as impolite. You are being seen as untrustworthy, incompetent, or simply not ready for serious business.”, Star Kat – Middle East Sunday Pages, May 25, 2025. Compliments of Corina Goetz

============================================================================================

United States

“Jobs at the Port of Los Angeles are down by half, executive director says – Job opportunities at the Port of Los Angeles are dwindling as President Trump’s steep tariffs take a hit on global trade and a major economic engine for the regional economy. Nearly half of the longshoremen who support operations at the port went without work over the last two weeks, Gene Seroka, executive director of the Port of Los Angeles, said in an interview. The port processed 25% less cargo than forecast for the month of May, he said.”, The Los Angeles Times, June 7, 2025

==================================================================

“How big trade deficit drop as tariffs hit imports is playing out inside U.S. supply chain and economy – The U.S. trade deficit has plunged as imports surged and then plummeted as a result of President Trump’s trade war and tariffs. The impact of rapid global economic shifts can be seen in the supply chain activity across the U.S., from warehouses to freight orders and inventory. The data points to greater pain for small businesses. The U.S. trade deficit fell by the largest amount on record in April as imports fell by over 16% after a surge in orders to beat President Trump’s tariffs, but there’s a worrying flip side for the consumer. As the trade war whipsaws global economic activity, supply chain data shows that the retail inventory crunch could be next and small business across the country are bearing the brunt of the pain. From freight orders to inventory and warehousing, the latest logistics data shows the inability of many importers to make business decisions related to inventory levels.”, CNBC, June 5, 2025

============================================================================================

Vietnam

“Vietnam: a high-growth market going cheap – It has been 50 years since Vietnam was reunited after a 25-year war that devastated the country………..in the late 1980s, the government performed a sharp U-turn and turned Vietnam into a very capitalist country under autocratic rule. Since then, GDP per capita has risen from $270 a year to $4,300 in an economy that has grown from $6.3 billion to $430 billion, notes Tod Davis of brokers Deutsche Numis. Wider signs of social progress are equally impressive: the population has increased from 44 million to 100 million, male life expectancy at birth has risen from 61 to 75, literacy has risen from 57% to 96%, and the poverty rate has fallen from 78% to around 3%. With the economy growing at 6% per annum, ‘Vietnam is likely to become a high income nation similar to Taiwan and South Korea, with a GDP per capita of $12,500 within 20 years’, says Brook Taylor, chief executive of VinaCapital. The threat of tariffs is the current worry (America’s trade deficit with Vietnam is its third-largest), but this may be exaggerated. VinaCapital expects the US to settle for a 20% tariff in the end, probably with a high-tech exemption. This would reduce GDP growth from 7% to about 6% for 2025.”, Money Week, June 6, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The Accredited Franchise Supplier certification

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Brand & Franchise Sector News

“Starbucks to cut prices in China – Consumer businesses under pressure from weaker economic backdrop and intense competition. Starbucks will cut the prices of several iced and tea-based drinks in China, as the coffee chain grapples with heated competition in its second-biggest market. The Seattle-based company said in a social media post on Monday it would reduce the prices of products, including tea lattes and frappucinos, by an average of Rmb5, taking the price of certain drinks to Rmb23 ($3.20). Businesses in Chinese consumer sectors from cars to food and beverage have been under pressure to lower prices amid a weaker economic backdrop and intense competition.”, The Financial Times, June 9, 2025

Editor’s Note: The Shanghai price is the same as it is in Southern California!!

===============================================================================================

Roark Capital Investment Adds Sizzle to Dave’s Hot Chicken’s Explosive Growth Plans –With the private equity firm now a majority owner, the fast casual plans to become a worldwide sensation, with 155-165 stores opening this year. Dave’s Hot Chicken president Jim Bitticks remembers visiting restaurants five years ago and asking cofounder Dave Kopushyan what he thinks the brand will be someday. His answer? ‘We won’t sell until it’s a billion.’ Dave’s, founded in 2017 by childhood friends Kopushyan, Arman Oganesyan, and Tommy Rubenyan, started with $900 and a parking lot pop-up in East Hollywood. The brand became an instant sensation, and a couple of years later, it brought on Phelps—the former CEO of Wetzel’s Pretzels and Blaze Pizza—to begin franchising.

Since then, Dave’s has grown swiftly. After opening roughly 80 stores each in 2023 and 2024, the plan is to open 155 to 165 locations this year and around the same in 2026. The fast casual is working through a pipeline of over 1,000 franchise locations across the U.S., the Middle East, and Canada.”, QSR Magazine, June 2, 2025

================================================================================================

“What America’s Pizza Economy Is Telling Us About the Real One – Higher-end pies are still selling, but for lower-income consumers even frozen pizza is becoming a luxury. For the longest time, pizza has been the go-to dinner order for anyone looking to feed a family fast and on the cheap. What’s often touted as America’s favorite food took on another attribute during the pandemic: safe. Domino’s Pizza Inc., the largest of the delivery chains, and its smaller rival Papa John’s International Inc. each registered double-digit year-over-year same-store sales increases in the US and North America, respectively, in 2020, helped by Covid-19 lockdowns. Four years on, though, it looks as if low-income consumers are being priced out of pizza. Those same-store sales were down at all three pizza chains in the first quarter of 2025, declining 5% at Pizza Hut, 2.7% at Papa John’s and 0.5% at Domino’s. Domino’s did have one metric to celebrate, at least: Takeout ticked up 1%, because, as Chief Financial Officer Sandeep Reddy explained in an earnings call, it costs less than delivery.”, Bloomberg, June 6, 2025

==============================================================================================

“Little Caesars makes India debut with NCR outlet plan – Harnessing Harvest to lead franchise push. Little Caesars, the world’s third-largest pizza chain by global presence, is set to enter India this month by opening its first outlet in the Delhi-NCR region, the company said on Friday. This will be the brand’s 30th global market. The Detroit-based brand, known for its ‘hot-n-ready’ pizzas and Crazy Bread, has partnered with Harnessing Harvest as its India franchisee. ‘Launching in India marks an exciting milestone for Little Caesars as we expand into our 30th country,’ said Paula Vissing, President, Global Retail at Little Caesars Pizza, in a statement. The company’s foray into India is part of a wider global expansion that recently included markets like Cambodia and Kuwait, PTI reported.”, The Times Of India, June 7, 2025

=============================================================================================

“Freddy’s to open first Canadian restaurant – The Winnipeg unit is the first outside the U.S. for the growing burger chain, which is building out a significant store pipeline. The fast-growing burger brand is developing its Canadian footprint through a master franchise agreement with North 49 Frozen Custard and Steakburgers, and the first unit has been in the works for some time. Freddy’s has grown rapidly since its 2021 acquisition by Thompson Street Capital, according to its franchise disclosure document. In 2022, the brand said it was targeting a total unit count of about 1,000.”, Restaurant Dive, June 2, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive our biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing business environment. And our GlobalTeam™ on the ground covering 25+ countries provide us with updates about what is actually happening in their specific countries. We do not get involved in or report on politics!

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe, and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant since 2001 taking 40+ companies global.

| To receive this biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com +++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++ |

Our latest GlobalVue™ 40 country ranking

For a complimentary 30-minute consultation on how to take your business into new countries and make money doing it. For a complimentary call with Bill Edwards click on the QR code or contact Bill at bedwards@edwardsglobal.com and +1 949 375 1896