Biweekly Global Business Newsletter Issue 141, Tuesday, August 19, 2025

“World trade isn’t grinding to a halt—it’s changing shape.”

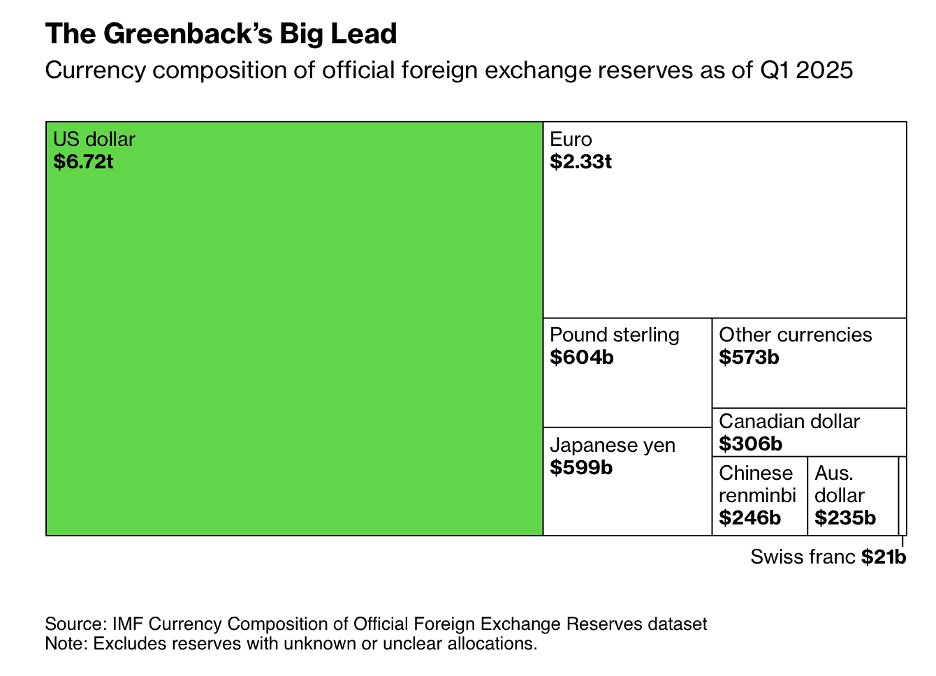

Welcome to the 141st Edition of the Global Business Update – Tariff policies and shifting alliances are reshaping global trade. The U.S. dollar’s dominance faces renewed challenges as governments and investors diversify into other currencies. Meanwhile, U.S. small businesses are bearing the brunt of tariffs—an estimated $202 billion annually, or $856,000 per importer—straining competitiveness.

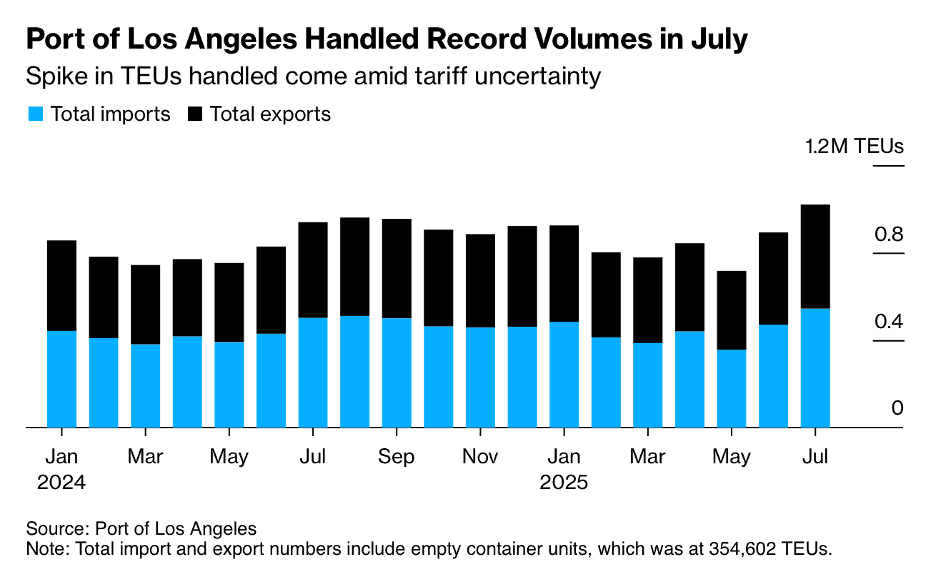

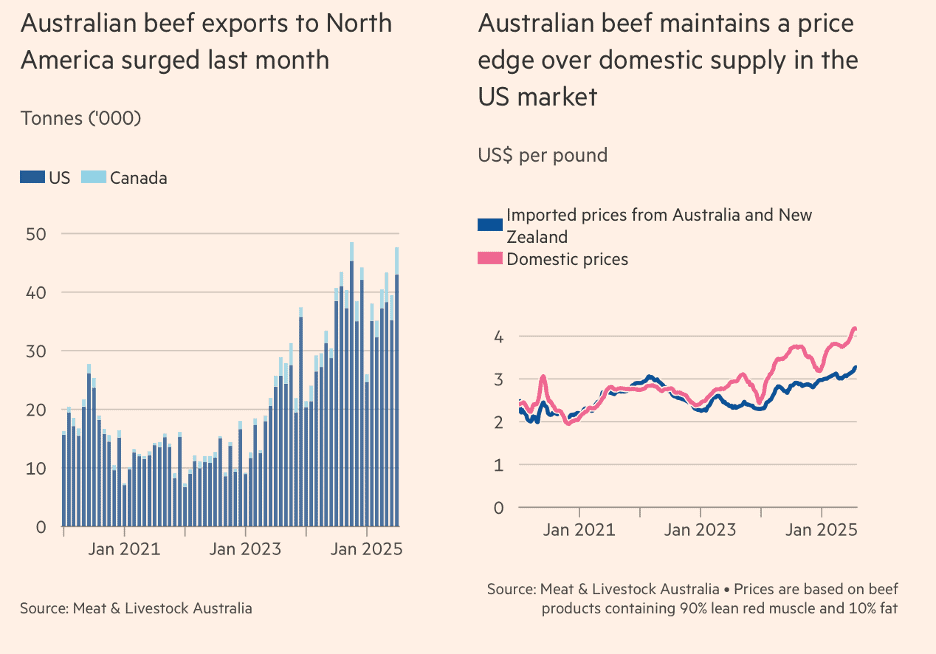

Uncertainty around duties has driven record cargo through the Port of Los Angeles as shippers rush goods before increases. The International Energy Agency warns of a record oil glut by 2026, while agriculture trade is already shifting: U.S. tariffs on Brazil are boosting Australian beef exports (+12% in July), and China has hit Canada with nearly 76% tariffs on canola.

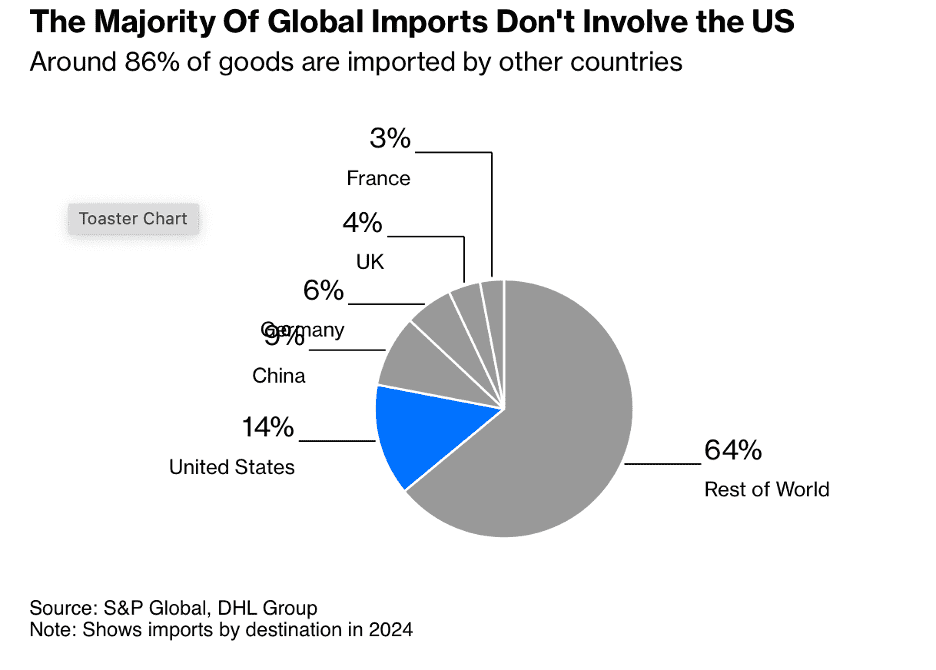

Despite tensions, globalization is adapting, not collapsing. DHL reports growth in shipments to Asia, the Middle East, and Africa, with Asian exporters gaining market share despite U.S. barriers. And dealmakers stared down volatility, leading to higher global M&A activity in the first half of this year. Pus we have some travel trips for you global flyers!

Countries highlighted: Australia, Brazil, Cambodia, Canada, China, India, Indonesia, Ireland, Japan, Saudi Arabia, Switzerland, Thailand, United States, Vietnam.

Tariff implications: Higher costs for U.S. firms, disrupted exports for Canada and Brazil, competitive gains for Australia, and persistent global supply chain shifts.

Franchise Watch: Expansion continues—Taco Bell enters Ireland and Chili’s stays red hot as same-store sales surge 24%. Plus, Benjamin Simon tells us about Franchising Across Borders: The Five Essentials for International Expansion.

This issue’s book is: “Space to Grow: Unlocking the Final Economic Frontier” by Matthew Weinzierl and Brendan Rosseau. Space to Grow examines the rapid shift from government-dominated space exploration to a vibrant, competitive private-sector arena. Drawing on research from Harvard Business School, Weinzierl and Rosseau chart how companies like SpaceX, Blue Origin, and Rocket Lab have transformed space from a realm of national prestige to a commercially viable industry.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business. We do not get involved with or report on politics!

PLEASE NOTE: Some of the information sources that we provide links to in our newsletter require a paid subscription to directly access them. Clicking on a link may not give the reader access to the content.

Edited and curated by: William (Bill) Edwards, CEO & Global Business Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA. Contact Bill with questions, comments and contributions. Bedwards@edwardsglobal.com, +1 949 375 1896

Link to our current and past newsletters: https://edwardsglobal.com/geowizard/

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

First, A Few Words of Wisdom From Others For These Times

“World trade isn’t grinding to a halt—it’s changing shape.”, Georges Elhedery, CEO of HSBC

“Customer obsession remains the single biggest driver of our success.”, Andy Jassy – CEO, Amazon

“In economics, things take longer to happen than you think they will, and then they happen faster than you thought they could.”, Rudiger Dornbusch, German Economist. Compliments of Beth Adkisson, the Greatest Vistage Chair Ever

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Highlights in issue #141:

Globalization Can Survive the US Trade War

The Dollar Still Rules, But US Policy Is Making It Less Special

Dealmakers deliver strong first-half results in M&A

Trading on Thin Ice: Mapping Partner Dependence on the U.S. Market

Small US Firms Paying Trump Tariffs Face a $202 Billion Hit

What Declining Cardboard Box Sales Tell Us About the US Economy

Ford’s Answer to China: A Completely New Way of Making Cars

Brand Global News Section: Chili’s® and Taco Bell®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

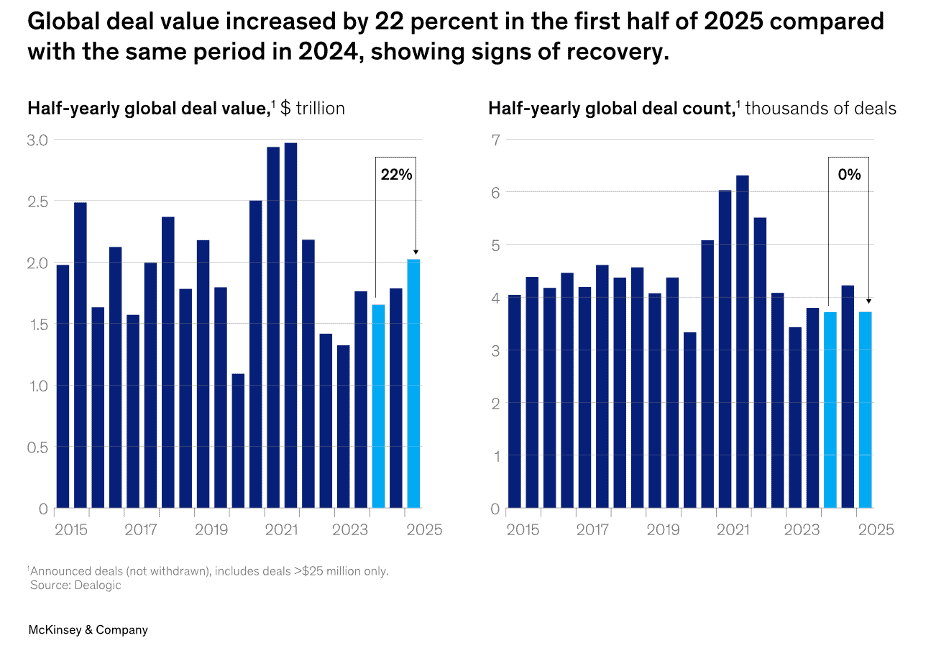

“Dealmakers deliver strong first-half results in M&A – For the first half of the year, ending June 30, the value of deals over $25 million increased 22 percent globally to $2 trillion, from $1.7 trillion a year earlier (exhibit). While volume was flat at slightly over 3,700 deals, a surge in megadeals pushed activity higher. Meanwhile, average deal size reached $544 million globally—the highest level in five years. This was especially impressive since the earlier period included the heady times following the end of pandemic-era lockdowns—a development which lifted moods and spending and created a euphoric blip in M&A.”, McKinsey & Co., August 7, 2025

=============================================================================================

“The Dollar Still Rules, But US Policy Is Making It Less Special – America will have less geopolitical and economic leverage if investors and central banks hold more kinds of currency. The dollar’s role as the world’s reserve currency is being challenged due to President Donald Trump’s push to redesign the global economic order in favor of the US. Trust in the dollar is faltering, with the US dollar index tumbling more than 10% in the first six months of the year, its worst first-half performance since 1973, and some of Asia’s richest families cutting exposure to US assets. According to Josh Lipsky, senior director of the GeoEconomics Center at the Atlantic Council, the US may have to give up some benefits of the strong-dollar regime, including lower interest rates, as the dollar faces more competition in a multicurrency world. Banks and brokers are seeing rising demand for currency products that bypass the dollar, and some of Asia’s richest families are cutting exposure to US assets, saying Trump’s tariffs have made the country much less predictable.”, Bloomberg, August 11, 2025

============================================================================================

“Globalization Can Survive the US Trade War – The prosperity gains from interaction are too great for the rest of the world to turn more protectionist. ‘Despite all the talk of deglobalization, if you just look at the numbers, what we are seeing in the last two and a half years is an acceleration of globalization on the back of a huge commercial success from Chinese companies taking market share on the global stage,’ Vincent Clerc, the chief executive officer of A. P. Moller-Maersk A/S, told investors last week. German logistics giant DHL Group is seeing similar shifts in demand, with time-definite US express shipments with a guaranteed delivery date plunging 31% in the second-quarter, while its deliveries to Asia rose 2% and those to the Middle East and Africa jumped 8%.”, Bloomberg, August 13, 2025

============================================================================================

“Where ChatGPT is Banned in 2025 – ChatGPT is banned or unavailable in 20 countries due to government censorship or privacy laws. Some regions are excluded not by government action, but because OpenAI does not support accounts there. Governments around the world are taking different stances on artificial intelligence tools like ChatGPT. While some embrace the technology, others have restricted or outright banned access due to political, cultural, or security concerns. In 2025, ChatGPT remains unavailable in 20 countries. In this visualization, we highlight where ChatGPT is banned, as well as places where OpenAI does not offer service.”, Visual Capitalist, August 13, 2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation, Taxes & Trade Issues

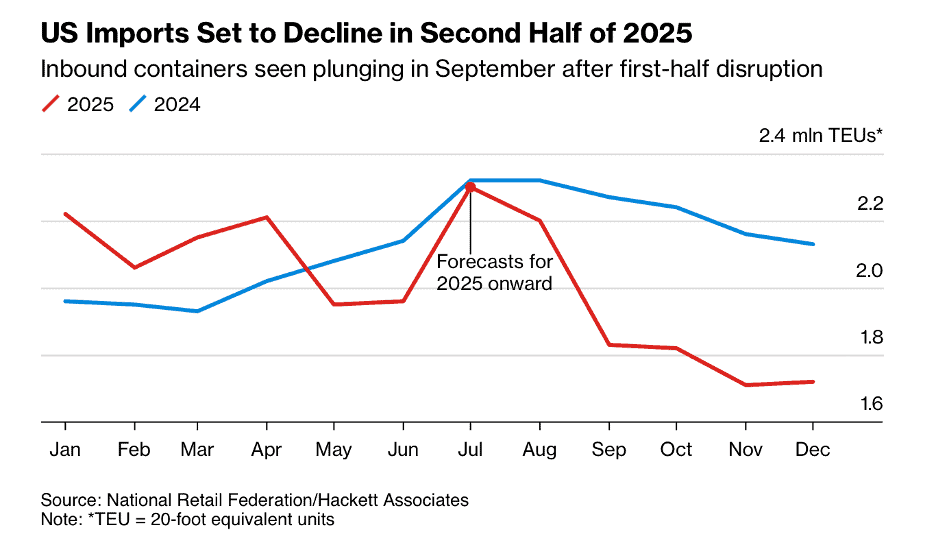

“Small US Firms Paying Trump Tariffs Face a $202 Billion Hit – Small US companies are struggling to comply with President Donald Trump’s new tariffs and cope with growing financial strains from higher import costs, according to Erin Williamson, vice president of US customs brokerage at Geodis. The US Chamber of Commerce estimated that the combined annual tariff hit to small-business importers is $202 billion, which works out to about $856,000 per firm a year, based on an estimate before Trump’s duties took effect. The National Retail Federation and other groups are echoing concerns that small businesses are grappling with the ability to stay in business due to the tariffs, with NRF Vice President Jonathan Gold saying “small businesses especially are grappling with the ability to stay in business”., Bloomberg, August 11, 2025

============================================================================================

“Global Oil Markets Face Record Supply Glut Next Year, IEA Says – Global oil markets are on track for a record surplus next year as demand growth slows and supplies swell, the International Energy Agency said. Oil inventories will accumulate at a rate of 2.96 million barrels a day, surpassing even the average buildup during the pandemic year of 2020, data from the IEA’s monthly report showed. The IEA said “Oil-market balances look ever more bloated as forecast supply far eclipses demand towards year-end and in 2026,” and noted ‘It is clear that something will have to give for the market to balance.’ Oil inventories will accumulate at a rate of 2.96 million barrels a day, surpassing even the average buildup during the pandemic year of 2020, data from the IEA’s monthly report showed. World oil demand this year and next is growing at less than half the pace seen in 2023.”, Bloomberg, August 13, 2025

============================================================================================

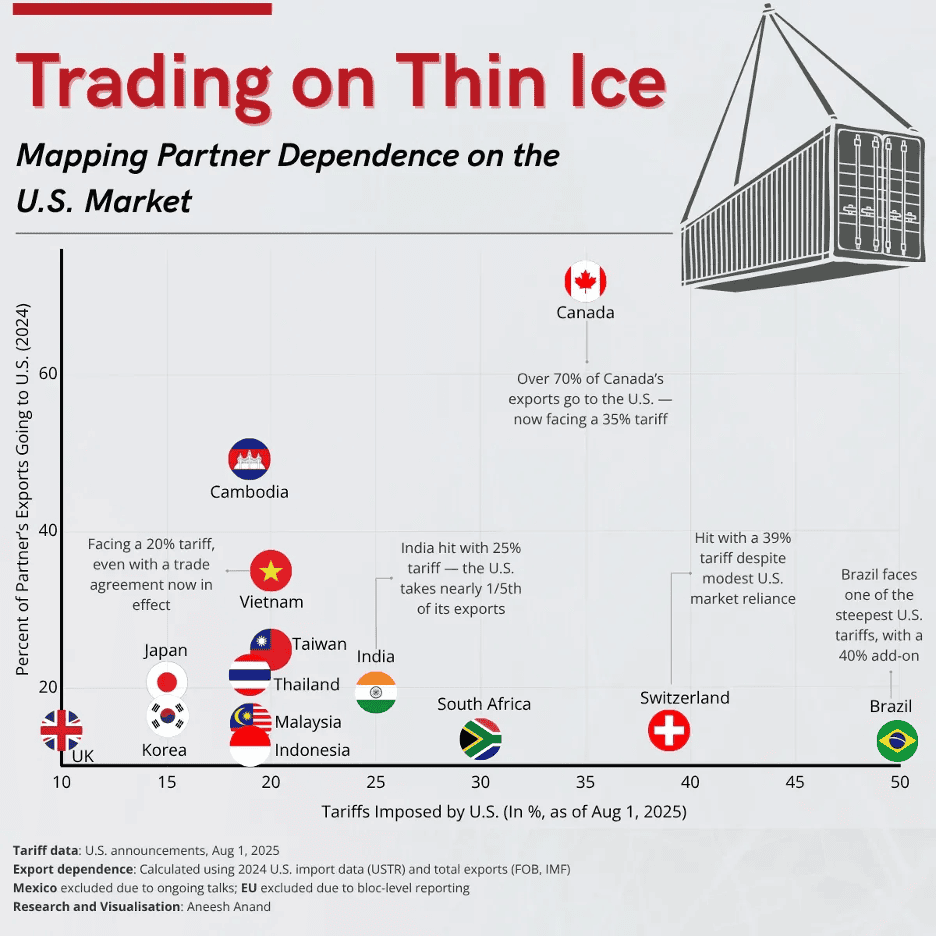

“Trading on Thin Ice: Mapping Partner Dependence on the U.S. Market – Canada: Over 70% of its exports are U.S.-bound, making it America’s most tightly integrated trading partner — and its biggest source of foreign oil. Now faces a 35% tariff. India: Hit with a 25% tariff, despite the U.S. accounting for nearly one-fifth of its exports — reflecting deeper trade and services linkages. Cambodia: Sends nearly half of its exports to the U.S. and now sees a revised 19% tariff after a ceasefire along its border. Thailand: Like Cambodia, its tariff was adjusted to 19% following de-escalation at its frontier — but its U.S. trade exposure remains material. Vietnam: Faces a 20% base tariff — plus an additional 40% levy on Chinese-origin goods rerouted through its ports, aimed at curbing transshipment. Switzerland: Now subject to a 39% tariff, even though the U.S. accounts for just one-sixth of its total exports — largely in pharma and high-end goods. Brazil: Faces one of the steepest tariff packages globally, including a 40% add-on — a move seen as politically driven, despite the U.S. running a goods surplus against it.”, Visual Capitalist, August 4, 2025

=============================================================================================

“Tariff Confusion Drives Record Volumes at Los Angeles Port – The Port of Los Angeles said it handled the highest container volume in its 117-year history last month, as uncertainty over President Donald Trump’s tariffs drives shippers to front-load cargoes. Already the busiest port in the country, LA moved more than 1 million twenty-foot equivalent units (TEUs) in July, an 8.5% increase from a year ago, the operator said on Wednesday. That includes containers entering and exiting its terminals, with loaded imports rising by a similar percentage to nearly 544,000 TEUs. The total volume handled was 14.2% higher than in June. The spike was due to traders rushing to front-load their cargo to be able to reach US stores before Trump’s import duties take effect, said the port’s Executive Director Gene Seroka.”, Bloomberg, August 14, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel News

“16 Golden Rules That Business Travelers Swear By – People who constantly hit the road for work share what they wish they’d known from the jump. Business travelers are made, not born. And almost everyone who travels frequently for work can list off at least a few things they wish they’d known when they first got into the game. To gather the rules of the road, we chatted with highly-seasoned business travelers about what they wish someone wiser had told them at the start of it all. It’s exciting when work sends you to far-flung places that you’ve always wanted to visit—but don’t let the novelty trick you into thinking you’re getting a vacation.”, Conde Nast Traveler, August 6, 2025

==============================================================================================

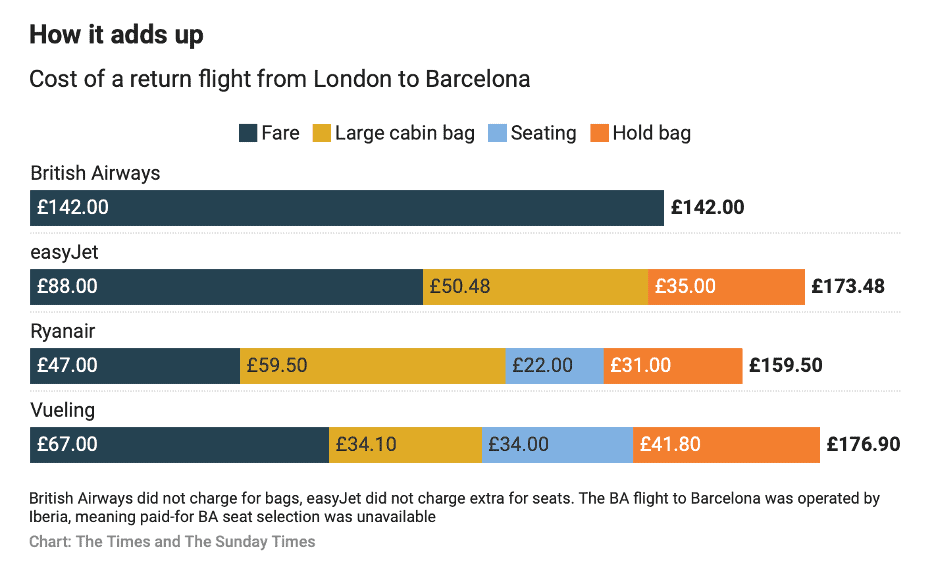

“The five airport rip-offs to avoid this summer – Don’t bother with duty-free, swerve the fast-track security lane and whatever you do, check in online before you get to the airport. Airlines are raking in cash from these charges for seats. There is no consistency on baggage allowances between airlines. While checking in online beforehand is free, Wizz Air charges £36.50 and Ryanair £55 for checking in at the airport, which they claim covers the cost of servicing airport check-ins.”, The Times of London, August 16, 2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Book Review

“Space to Grow: Unlocking the Final Economic Frontier” by Matthew Weinzierl and Brendan Rosseau.Space to Grow examines the rapid shift from government-dominated space exploration to a vibrant, competitive private-sector arena. Drawing on research from Harvard Business School, Weinzierl and Rosseau chart how companies like SpaceX, Blue Origin, and Rocket Lab have transformed space from a realm of national prestige to a commercially viable industry.

The authors argue that this transformation isn’t just about rockets and satellites—it’s the birth of a new economic frontier. Innovations in launch technology, manufacturing, and supply chains are driving costs down and making space access scalable. This, in turn, is enabling entirely new markets, from orbital tourism to asteroid mining and off-planet manufacturing.

They explore how private companies are partnering with—and sometimes competing against—national space agencies, creating complex governance questions about safety, property rights, and environmental stewardship in space. The book also discusses the economic ripple effects on Earth: new industries, global talent competition, and the opportunity for nations and entrepreneurs to secure early-mover advantages in space-related sectors.

For business leaders, Space to Grow is both an industry playbook and a strategic wake-up call: frontier markets may open faster than expected, and the rules are still being written. Those who understand the ecosystem early could shape its future.

Five Key Takeaways for Businesspeople

Ethical and environmental standards are still forming—stakeholders can influence them now.

First-mover advantage in space industries could yield long-term economic dominance.

Falling launch costs open opportunities for smaller nations and companies.

Public–private partnerships will define early governance and market access.

Space commercialization will have ripple effects across Earth-based industries.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Australia

“US appetite for Australian beef poised to grow on tariff advantage – Australia’s cattle ranchers say higher levies on rival producers such as Brazil will further boost exports. US demand for Australian “trim” beef — which is blended with fattier American meat to make hamburger patties and mince — has boomed in recent years, as the American cattle industry has been unable to keep pace with consumption. Exports of beef to the US rose 12 per cent in July on the year before to 43,000 tonnes, according to data from Meat & Livestock Australia, helping boost overall shipments last month to an all-time high. Constrained domestic supply owing to years of drought has driven US meat prices to record levels this year and further increased appetite for imports.”, The Financial Times, August 11, 2025

=============================================================================================

Canada

“China to Hit Canadian Canola With Nearly 76% Tariff as Trade Row Escalates – This new Chinese tariff significantly broadens existing levies in place as of March on certain canola imports. The levy would be a blow for Canada’s agricultural sector, as canola represents the biggest cash crop for farmers. China said a probe by the country’s commerce department concluded that a surge of Canadian canola shipments had harmed China’s domestic rapeseed business.”, The Wall Street Journal, August 12, 2025

=============================================================================================

China

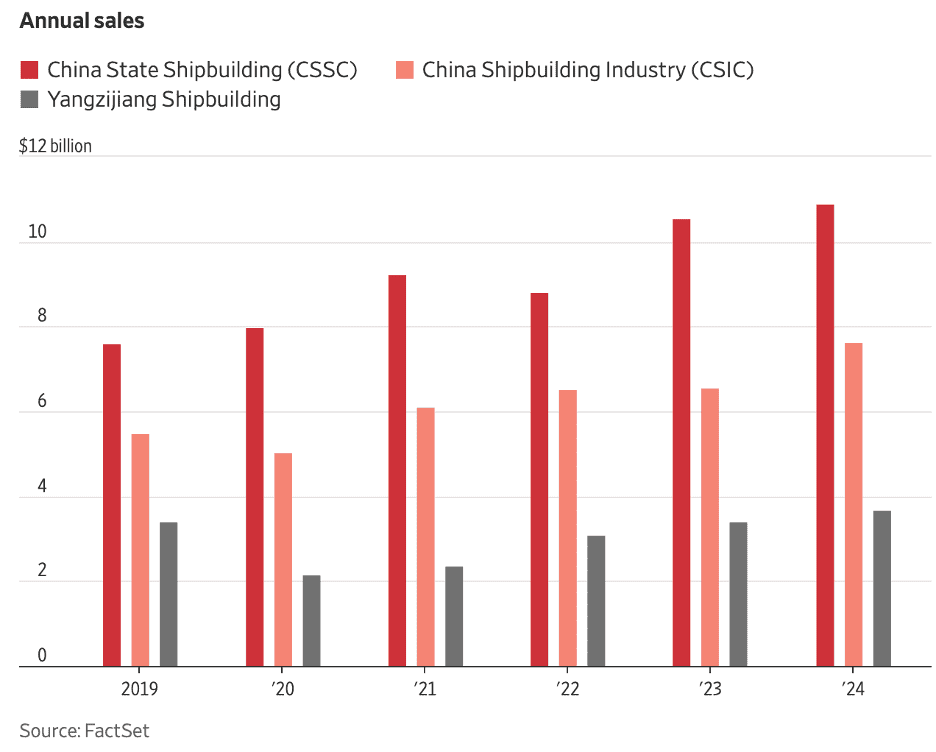

“China Creates World’s No. 1 Shipbuilder, Driven by Rivalry With U.S. – In $16 billion deal, Beijing looks to counter Trump’s moves to rebuild American shipyards. China-built ships accounted for about 55% of global tonnage last year, compared with less than 0.05% for the U.S., data from the United Nations show. China possesses 232 times the shipbuilding capacity of the U.S., according to the U.S. Navy. But recent data suggest China is facing rougher times because the prospect of U.S. port fees on Chinese-made ships has prompted owners to look at non-Chinese shipyards. In addition, Trump’s tariffs and countries’ focus on domestic supply chains have raised the specter of less global trade overall, meaning fewer ships would be needed to carry goods.”, The Wall Street Journal, August 11, 2025

==============================================================================================

India

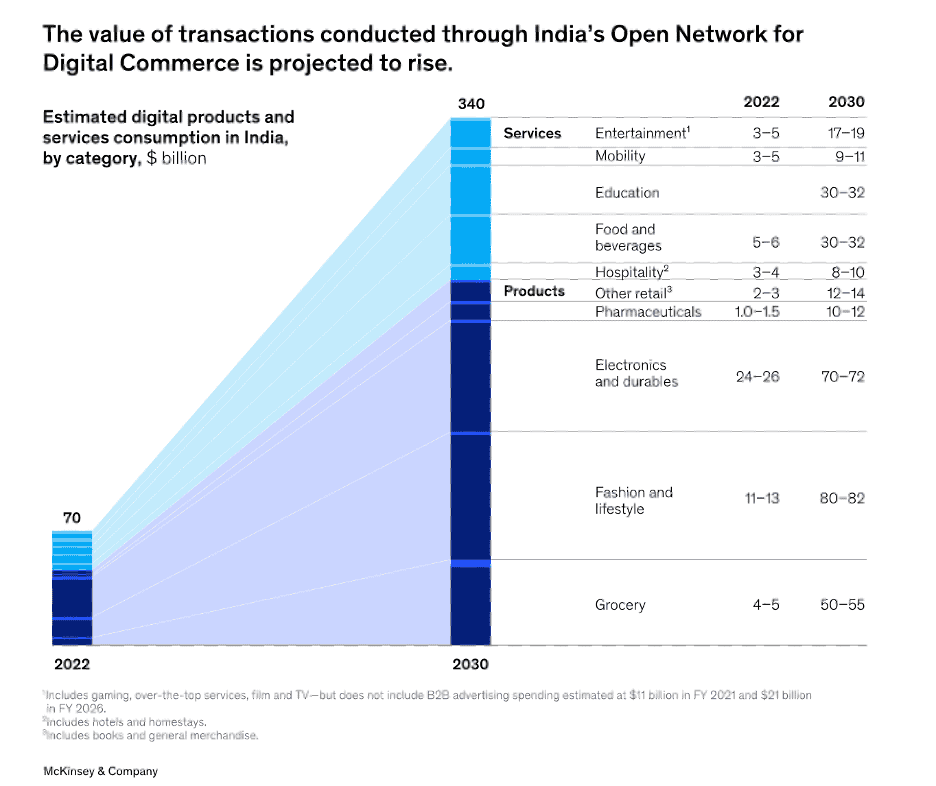

“India: The promise and possibilities for global companies – India is drawing attention as a global business hub. With a strong talent base, a large pool of consumers, and continuously improving infrastructure, the country offers many opportunities for multinational companies over the next decade. According to one estimate, India could gain up to $0.8 trillion to $1.2 trillion from trade-flow shifts by 2030 and boost the country’s GDP share for manufacturing from 16 percent in 2023 to 25 percent by 2030. While the country’s government has strong pro-business policies, companies may need to grapple with complex regulations, labor strikes, and red tape. India’s vast consumer base, with its huge variations in product preferences and spending power, could also present hurdles for marketing and sales. Some multinational companies have thrived in India despite these obstacles, but others have reduced, or even ceased, local operations.”, McKinsey & Co., April 10, 2025

=============================================================================================

Indonesia

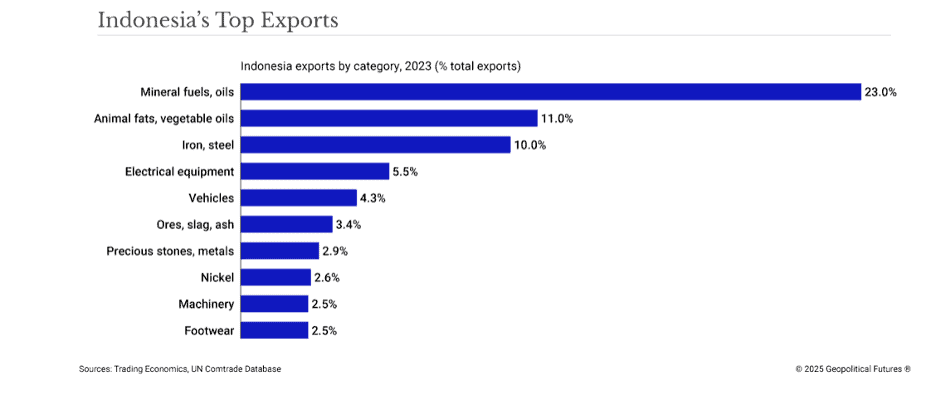

“Indonesia’s Strategy in the Tariff War – Like many countries, it must balance between the U.S. and China. After U.S. President Donald Trump announced that the United States would impose tariffs on much of the world, Indonesia was among the first countries to strike a reciprocal agreement. According to the agreement, Indonesia would face a 19 percent tariff rate instead of the original 32 percent starting Aug. 7. In return, it pledged to purchase 50 Boeing aircraft, mainly from the 777 series, and the government in Jakarta would import $15 billion of U.S. energy commodities and $4.5 billion worth of agricultural products. Despite public praise of the deal from Indonesia’s president, reports indicate that Jakarta is still in talks with Washington to secure lower rates for certain products.”, Geopolitical Futures, August 12, 2025

=============================================================================================

Japan

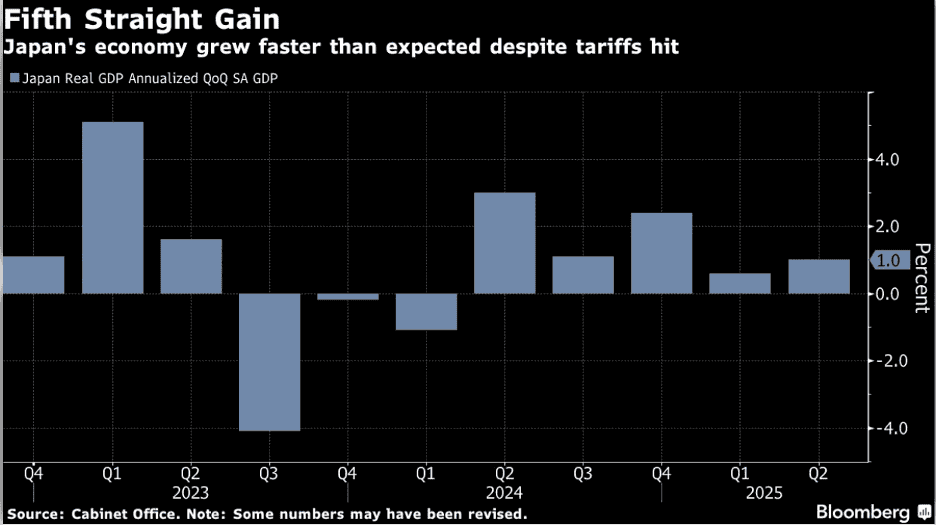

“Japan Growth Beats Forecasts, Boosting Rate-Hike Case for BOJ – Japan’s economy expanded faster than expected last quarter led by solid domestic demand, boosting the case for the Bank of Japan to raise its benchmark rate again this year while giving embattled Prime Minister Shigeru Ishiba some rare good news. Gross domestic product grew at an annualized pace of 1% in the three months through June from the prior period, surpassing economists’ forecast of a 0.4% gain, the Cabinet Office reported Friday. Authorities revised the previous quarter’s results to 0.6% growth, reversing from a preliminary contraction. Gains were led by business investment, which rose 1.3% from the previous quarter, surpassing the consensus estimate of 0.7% growth. Private consumption nudged 0.2% higher.”, Bloomberg, August 15, 2025

============================================================================================

Saudi Arabia

“Saudi Arabia’s PIF makes (US)$8bn writedown on value of flagship megaprojects – Developments such as futuristic Neom hit by budget overruns and lower oil prices. ‘There were impairments to certain projects primarily relating to global economic market conditions, changes to operational plans and increases in budgeted costs,’ said a person familiar with the matter. The PIF owns five so-called gigaprojects, including Neom, which is designed to include a linear city inspired by science fiction. While there has been robust growth in other sectors in recent years, the kingdom still relies on oil exports for more than 60 per cent of its revenue.”, The Financial Times, August 14, 2025

=============================================================================================

United Kingdom

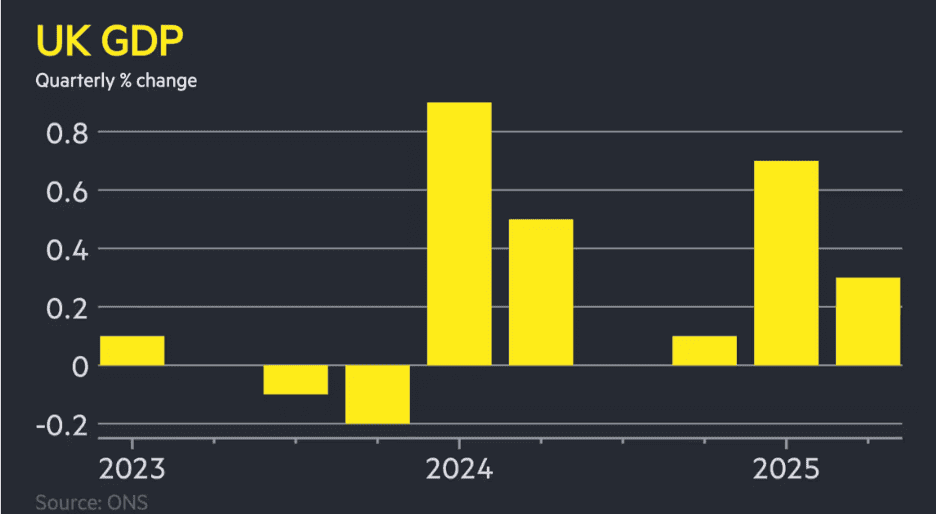

“UK economic growth slows to 0.3% in second quarter – GDP figure comes as chancellor Rachel Reeves prepares for a tough Autumn Budget. The UK economy expanded 0.3 per cent in the second quarter, surpassing expectations but underlining the challenges facing chancellor Rachel Reeves as she attempts to boost growth and repair the public finances. Thursday’s GDP figure for the April-to-June period was above the 0.1 per cent forecast by economists but marked a sharp slowdown from the 0.7 per cent growth in the first three months of the year. The services, construction and manufacturing sectors underpinned growth in the second quarter, according to the Office for National Statistics, with the economy expanding by a faster than expected 0.4 per cent in June following declines in April and May.”, The Financial Times, August 14, 2025

============================================================================================

United States

“U.S. Small Businesses Brush Off Tariff Fears – The main drivers of July’s better sentiment were respondents reporting improved business conditions and willingness to invest to expand. The National Federation of Independent Business said Tuesday that its optimism index, a gauge of sentiment among small firms, improved to 100.3 in July from 98.6 in June, taking it further above the 98 point that marks the index’s long-term average. The main drivers of July’s better sentiment were respondents reporting improved business conditions and willingness to invest to expand, a good sign for the country’s economic prospects ahead.”, The Wall Street Journal, August 12, 2025

============================================================================================

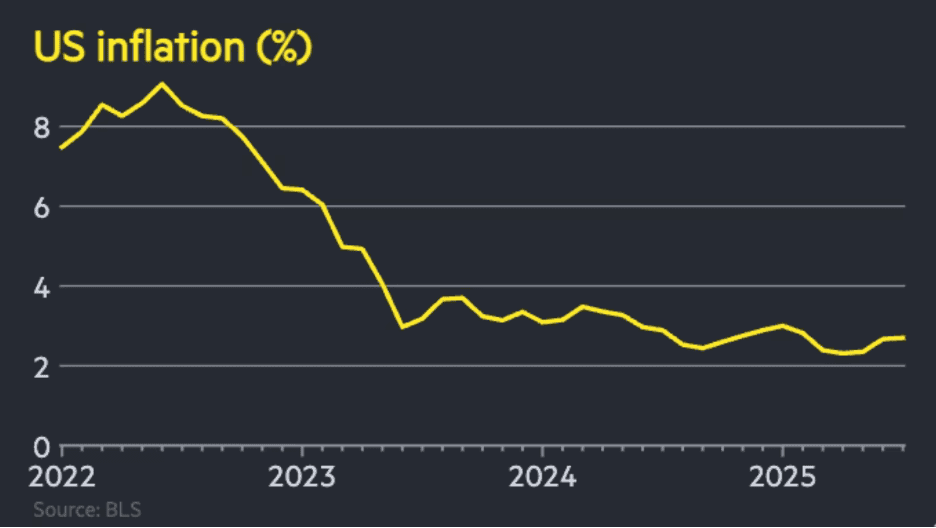

“US stocks hit record high as inflation holds steady at 2.7% in July despite Trump’s tariffs – The consumer price index reading came despite concerns from some economists that the aggressive tariffs US President Donald Trump announced over recent months would push inflation higher. The July CPI figure was weighed down by weaker fuel prices, with the index for petrol down 9.5 per cent over the past 12 months. Core inflation, which strips out volatile food and energy prices, rose to 3.1 per cent, surpassing expectations of a smaller rise to 3 per cent from June’s 2.9 per cent.”, The Financial Times, August 12, 2025

=============================================================================================

“What Declining Cardboard Box Sales Tell Us About the US Economy – Box demand touches nearly every industry, from flat-screen TVs to packaged food, all of which see sales fluctuate based on how flush shoppers feel. Sales of corrugated cardboard used to make boxes are slumping, signaling that retail demand across industries may be due for a correction. US box shipments fell to the lowest second-quarter reading since 2015, with companies like International Paper Co. and Smurfit Westrock Plc reporting drops in box shipments. The drop in packaging demand appears to be tied to President Donald Trump’s mixed messaging on tariffs, with companies not stocking up on packaging while they wait to find out how the levies will affect costs and demand. The box slump marks a big turnaround from the early days of Covid-19, when demand for packaging was so high that some North American paper mills started churning out cardboard instead of the thinner stuff, triggering a brief paper shortage.”, Bloomberg, August 14, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The Accredited Franchise Supplier certification

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Brand & Franchise Sector News

“Chili’s stays red hot as same-store sales surge 24% – The casual-dining chain has now posted five straight quarters of double-digit growth fueled by value and marketing and improved operations. It is not taking its foot off the gas. It was the chain’s fifth straight quarter of double-digit same-store sales growth, continuing an astounding turnaround at the Dallas-based brand that has been fueled by value, marketing and social media as well as improved operations and food. Its same-store sales growth outpaced the rest of casual dining by a whopping 1,890 basis points, Brinker International CEO Kevin Hochman said Wednesday. Restaurant Business, August 13, 2025

==============================================================================================

“Franchising Across Borders: The Five Essentials for International Expansion – International expansion is one of the most strategic growth levers a franchise brand can pull, but only if it’s done with the right foundation in place. Entering a new country isn’t just a matter of translating materials or securing a newly signed franchise agreement. It requires operational maturity, cultural fluency, and a long-term mindset. A concept that works domestically may not translate unless there’s strong, localized demand for what the brand offers. Successful global franchises are built on a clear identity, one that can flex for localization, but not fracture. Franchisors must invest time in due diligence, alignment conversations, and partner enablement.”, Franchising.com, August 8, 2025. Extracted from an article by Benjamin Simon.

=============================================================================================

Legendary US fast food chain to open first restaurant in Ireland next month with location revealed – Another popular US chain is set to open ten restaurants in Ireland this year. Applegreen will open Ireland’s first Taco Bell this September. The restaurant will be part of a new €15 million motorway service area at Junction 6 on the M3 in Dunshaughlin, Co Meath. The Dunshaughlin service hub will include other well-known brands. These will include an M&S Food shop, a Burger King, a Braeburn Coffee Café and Applegreen’s new deli counter brand Crafted.”, The Irish Sun, August 13, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive our biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing business environment. And our GlobalTeam™ on the ground covering 25+ countries provide us with updates about what is actually happening in their specific countries. We do not get involved in or report on politics!

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe, and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant since 2001 taking 40+ companies global.

For a complimentary 30-minute consultation on how to take your business into new countries and make money doing it. For a complimentary call with Bill Edwards click on the QR code or contact Bill at bedwards@edwardsglobal.com and +1 949 375 1896