Biweekly Global Business Newsletter Issue 142, Tuesday, September 2, 2025

“The old maps no longer apply. We need new compasses

and the courage to use them.”

Welcome to the 142nd Edition of the Global Business Update – Global business activity this period reflects both persistent headwinds and major structural shifts. U.S. food companies are pressing for relief from new tariffs, arguing that sectors dependent on imported seafood and produce cannot source substitutes domestically. In Europe, Brussels has struck a deal with Washington to scrap tariffs on U.S. industrial goods in exchange for moderating auto levies, underscoring the delicate balance in transatlantic trade.

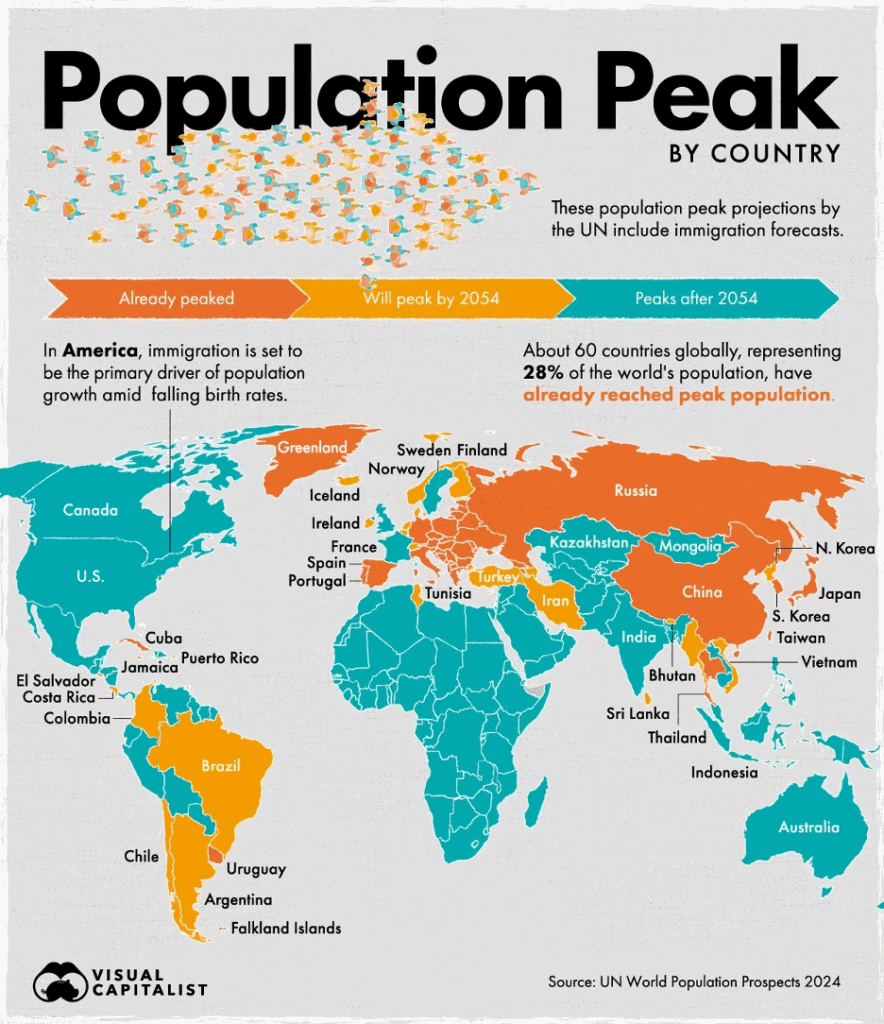

Demographics remain another powerful theme: more than 60 countries, including China, Japan, and Germany, have already peaked in population, while India, Nigeria, and the U.S. will continue to expand, driven by immigration and younger age profiles. On the energy front, 2025 marks a milestone, with global renewable investment forecast to hit $780 billion—well above oil spending.

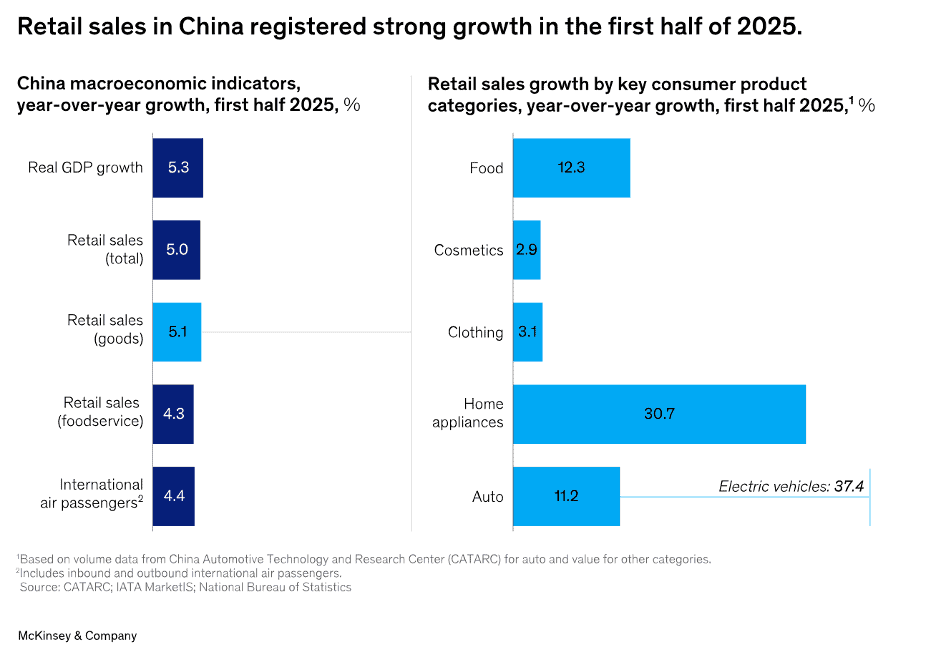

China presents a mixed picture: consumer confidence is subdued, and property challenges persist, yet retail categories are growing, auto exports are surging, and Hangzhou has become the first city to mandate AI education, a signal of the country’s long-term priorities, energy, and technology are converging to redefine business strategy globally.

The global franchise sector remains dynamic. Papa John’s is re-entering India with plans for 650 stores, while Chick-fil-A is preparing its first locations in the UK and Singapore. Dave’s Hot Chicken is accelerating across Europe with a deal for 180 restaurants following its viral UK success. Meanwhile, U.S. restaurants still face profitability pressures, Burger King has closed nearly all outlets in Hong Kong, and regulatory changes in Indonesia are complicating market entry. By contrast, Tims China has passed 1,000 outlets, reflecting strong consumer appetite and the continued resilience of franchise growth globally. More global franchise updates than usual this edition. Lots going on in the global franchise world!!!!

“Ports, Politics, & The Price Of Trade: A Frontline Economic View” – this webinar that I did on August 22nd is now on YouTube and brings you up to date on these key subjects.

This issue’s book is: Peak Human: What We Can Learn From History’s Greatest Civilizations, by Johan Norberg who argues that peak performance comes not from longer hours but from aligning energy, recovery, and purpose. Drawing lessons from neuroscience, psychology, and history’s great civilizations, the book offers practical strategies for leaders to foster resilience, deep focus, and trust-based cultures that multiply both individual and organizational success.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business. We do not get involved with or report on politics!

PLEASE NOTE: Some of the information sources that we provide links to in our newsletter require a paid subscription to directly access them. Clicking on a link may not give the reader access to the content.

Edited and curated by: William (Bill) Edwards, CEO & Global Business Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA. Contact Bill with questions, comments and contributions. Bedwards@edwardsglobal.com, +1 949 375 1896

Link to our current and past newsletters: https://edwardsglobal.com/geowizard/

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

First, A Few Words of Wisdom From Others For These Times

“The old maps no longer apply. We need new compasses and the courage to use them.”, Kearney CEO Retreat 2025

“Economic globalization remains irreversible.”, Li Qiang – China

“The entrepreneur always searches for change, responds to it, and exploits it as an opportunity.” – Peter Drucker

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Highlights in issue #142:

63 Countries Have Already Reached Peak Population

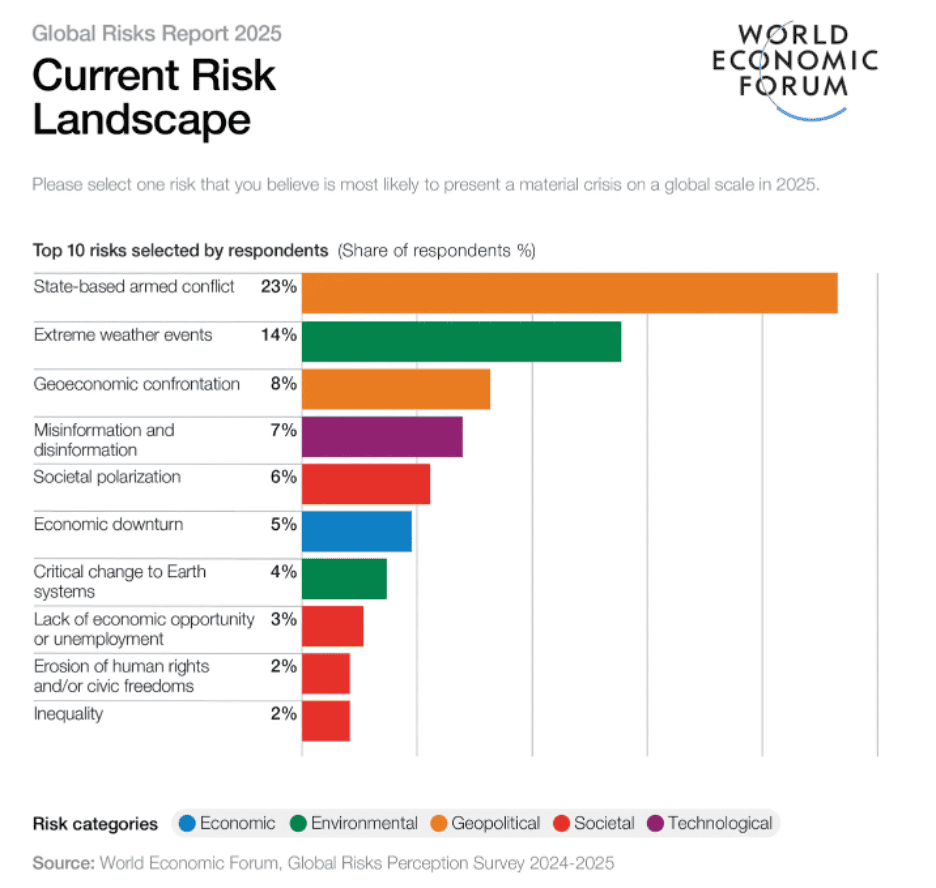

Why every company now needs a Chief Geopolitical Officer –

Restaurant profitability has taken a hit since the pandemic

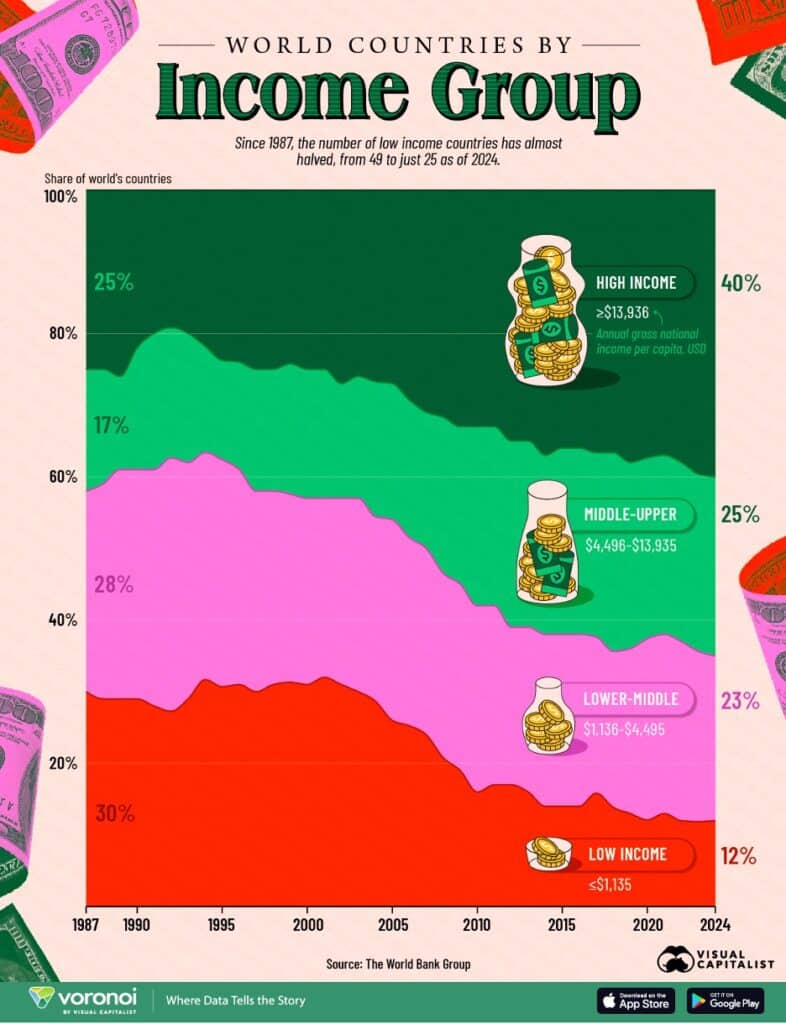

Share of the World’s Countries by Income (1987-2024)

New $250 visa fee risks deepening US travel slump

Brand Global News Section: Americana, Burger King®, Chick-fil-A®, Cracker Barrel®, Dave’s Hot Chicken, Dominos®, Papa John’s®, TH International and Tim Hortons®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

“Ports, Politics, & The Price Of Trade: A Frontline Economic View” – This current affairs webinar, hosted by the World Affairs Council of Orange County, featured presentations by Ferdinando (Nando) Guerra and William (Bill) Edwards (Your Editor!!). The discussion focused on the critical role of the Port of Long Beach and the Port of Los Angeles in the U.S. and in today’s global economy, the impact of tariffs and trade policy, as well as the broader challenges facing international businesspeople today. Click on the link to go to the YouTube webinar.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

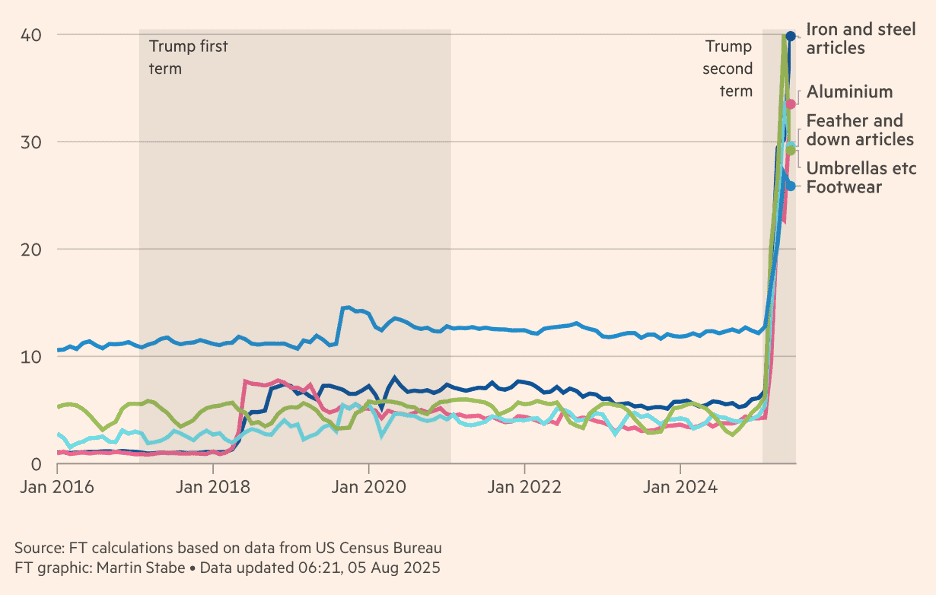

“US food groups plead for relief from Donald Trump’s tariffs – Piecemeal approach leaves seafood and produce sectors fighting to win individual carve-outs. Industry groups warn that the food sector is uniquely vulnerable to tariffs because some affected countries grow ingredients that will never be produced in quantity in the US. But lobby groups are taking a piecemeal approach by pleading for exemptions rather than attacking tariffs overall. Most food consumed in the US is produced domestically by its vast farm sector. But about a fifth is imported, according to the US agriculture department.”, The Financial Times, August 24, 2025

Editor’s Note: The left axis of this chart is the effective US tariff rate (%) as of the time of this article.

=============================================================================================

“Share of the World’s Countries by Income (1987-2024) – The number of low-income countries has almost halved, with their global share dropping from 30% in 1987 (49 countries) to 12% in 2024 (25 countries).Middle-income is now the plurality. Upper-middle (25%) and lower-middle (23%) income groups together account for almost half of the world’s countries in 2024, underscoring a broad shift out of extreme poverty but not yet into the richest tier. The world’s income landscape has shifted dramatically over the last four decades.From 1987 to 2024, more of the world’s countries have steadily risen out of the low-income category, reshaping the global distribution of prosperity.”, Visual Capitalist and the World Bank, August 27, 2025

============================================================================================

“Why every company now needs a Chief Geopolitical Officer – With governments and international institutions acknowledging the fragmenting global order, the creation of a Chief Geopolitical Officer role is an urgent priority for business. The CGO role is designed to integrate sophisticated geopolitical intelligence into core business decision-making. When both governments and international institutions are explicitly warning businesses about geopolitical risks, traditional corporate approaches to navigating international relations are no longer sufficient. The solution isn’t merely better government relations or enhanced risk management; it’s the emergence of an entirely new C-suite role: the Chief Geopolitical Officer (CGO). While the CGO title is new and rare, the function isn’t. Meta’s Vice President of Global Affairs – held until recently by former British Deputy Prime Minister Nick Clegg – is a role that has existed for over 10 years in the company. His experience was sought as the tech giant needed to navigate the intricate web of EU privacy regulations, US content moderation demands, and other challenges of entering complex markets.”, World Economic Forum, July 16, 2025

============================================================================================

“63 Countries Have Already Reached Peak Population – China, Germany, and Japan have all reached peak population by 2024. Across 48 countries, populations are projected to peak between 2025 and 2054, representing 10% of the world population. Meanwhile, 126 countries are forecast to grow through 2054, including India, Pakistan, Nigeria, and America. Countries are growing (or declining) at different levels due to factors like fertility rates, mortality, and immigration. The UN’s latest population prospects finds that more than a quarter of the global population live in countries that are shrinking in population size. On the other hand, immigration will be a primary driver of population growth in countries like the U.S. and Canada, while high fertility rates and younger demographics are set to propel growth in Angola, Somalia, and Niger.”, Visual Capitalist & UN World Population Prospects 2024, August 25, 2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation, Taxes & Trade Issues

“The Shift in Global Energy Investment (2015-2025) – In 2025, global renewable energy investment is projected to hit $780 billion, outpacing oil investment by $237 billion. Over the past decade, investment in renewables has surged 109%. Global energy investment has shifted dramatically in the last decade. As the world transitions to cleaner sources, capital is flowing into technologies that support electrification and decarbonization. Bolstering this trend are rapidly declining costs across solar and wind power, in particular.”, Visual Capitalist and the IEA, August 26, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel News

“New $250 visa fee risks deepening US travel slump – Fee impacts travelers from non-visa waiver countries like Mexico, India, China. Travel from Mexico, Argentina, Brazil sees growth despite overall decline. Visa fee raises total cost to $442, among highest globally. Overseas travel to the U.S. fell 3.1% year-on-year in July to 19.2 million visitors, according to U.S. government data. It was the fifth month of decline this year, defying expectations that 2025 would see annual inbound visitors finally surpass the pre-pandemic level of 79.4 million.”, Reuters, August 30, 2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Book Review

“Peak Human: What We Can Learn From History’s Greatest Civilizations, by Johan Norberg – Peak Human explores how individuals and organizations can unlock their highest levels of performance by aligning biology, mindset, and systems. Drawing from neuroscience, psychology, and leadership research, the book argues that sustainable success comes from optimizing not just productivity but also energy, recovery, and purpose.

The author emphasizes that today’s workplace rewards agility, resilience, and creativity more than sheer output. Leaders must therefore reframe success away from constant busyness toward intentional performance cycles that balance stress with renewal. Practical strategies include leveraging daily rituals, cultivating deep focus, and building resilience through recovery practices like sleep and mindfulness.

The book also highlights how social and organizational environments shape performance. Leaders who create cultures of trust, connection, and psychological safety unleash far greater discretionary effort. Ultimately, *Peak Human* is both a manual for personal mastery and a guide for building high-performing, human-centered organizations.

5 Key Takeaways for Businesspeople

Energy > Time – Performance is not about managing hours but about managing physical, emotional, and mental energy. Business leaders should design work rhythms that sustain energy, not deplete it.

Stress + Recovery = Growth – Like elite athletes, professionals grow when cycles of challenge are paired with proper recovery. Burnout happens when recovery is neglected.

Deep Work Drives Value – In an age of distraction, the ability to focus deeply on high-impact tasks is a competitive advantage. Leaders should protect and prioritize time for such work.

Culture Multiplies Individual Effort – Trust, connection, and a sense of belonging enable teams to perform beyond the sum of their parts. Leaders must model empathy and authenticity.

Purpose Fuels Resilience – When individuals tie their work to a meaningful purpose, they access higher levels of motivation, adaptability, and perseverance—critical in uncertain markets.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Australia

“An 83-Year-Old Pizza Tycoon Fights to Save 3,500 Domino’s – Billionaire Jack Cowin built a fast-food empire by bringing fried chicken to 1960s Australia. Now, at 83, he’s back to attempt a turnaround of the biggest Domino’s Pizza franchisee outside the US. Cowin is the largest shareholder of Sydney-listed Domino’s Pizza Enterprises Ltd., which has more than 3,500 stores from Australia to Europe. The stock has plunged 91% from its peak four years ago as rising costs and competition eroded its market share. The US-listed Domino’s Pizza Inc. has slid just about 10% over the same period. The octogenarian has much to gain from reviving the pizza chain. His near 25% stake in the firm is part of his $3.2 billion fortune, which the Bloomberg Billionaires Index has calculated for the first time. Domino’s Pizza Enterprises said Wednesday it swung to loss of A$3.7 million ($2.4 million) in the year ended June 29 from a profit of A$96 million a year earlier.”, Bloomberg, August 26, 2025

=============================================================================================

China

“Five surprises from China’s consumer market – Although macro indicators remain mixed and headwinds persist, several lesser-known developments are signaling deeper shifts in how China consumes, innovates, and competes both at home and on the global stage. China’s economy in the first half of 2025 presents a complex and often contradictory picture. Consumer confidence remains low, the property market is under sustained stress, and households continue to save at historically high levels. Retail sales are climbing in key categories, air travel has surpassed 2019 levels, auto exports have risen to the top globally, and Chinese pop culture is gaining an international foothold. Despite the return of growth in several sectors, China’s Consumer Confidence Index (CCI) remains near historic lows and has only gradually been recovering. Concerns about employment, economic stability, and especially the ongoing property downturn are still top of mind.”, McKinsey & Co., August 13, 2025

=============================================================================================

“China’s Hangzhou makes AI classes compulsory in schools amid nationwide push – Local governments are beginning to take action after Beijing said it wants all primary and secondary students to study the advanced tech. Hangzhou, in China’s Zhejiang province, will introduce mandatory artificial intelligence (AI) courses for primary and secondary schools starting in the new semester – part of a nationwide strategy to nurture talent in the rapidly growing sector. The initiative seeks to build a talent pipeline while improving educators’ ability to use smart tools and protect data, covering both student and teacher training, according to two documents released by the city’s education bureau.Schools will have flexibility in how they deliver the lessons – either by concentrating them within a single week or integrating AI content into subjects like information technology and science.”, The South China Morning Post, August 26, 2025

==============================================================================================

European Union

“E.U. to Scrap Duties on U.S. Industrial Goods as It Scrambles to Soften Auto Tariff Blow – Brussels and Washington agreed to cut levies on European autos to 15% from a provisional rate of 27.5%. The European Union will move to eliminate all tariffs on U.S. industrial imports and expand access for American farm products, part of an effort to shield European automakers from steeper duties on their exports to the U.S. The proposals follow a joint statement last week in which Brussels and Washington agreed to cut levies on European autos to 15% from a provisional rate of 27.5%. In return, the EU committed to lowering tariffs on a range of U.S. goods. Under the EU’s proposal, tariffs on U.S. industrial goods would be scrapped entirely, while American seafood and certain non-sensitive agricultural products would receive preferential access to the European market. A separate proposal would extend tariff-free treatment for U.S. lobster, including processed varieties of the shellfish. The measures will now go to other EU institutions for approval.”, The Wall Street Journal, August 28, 2025

===========================================================================================

Middle East

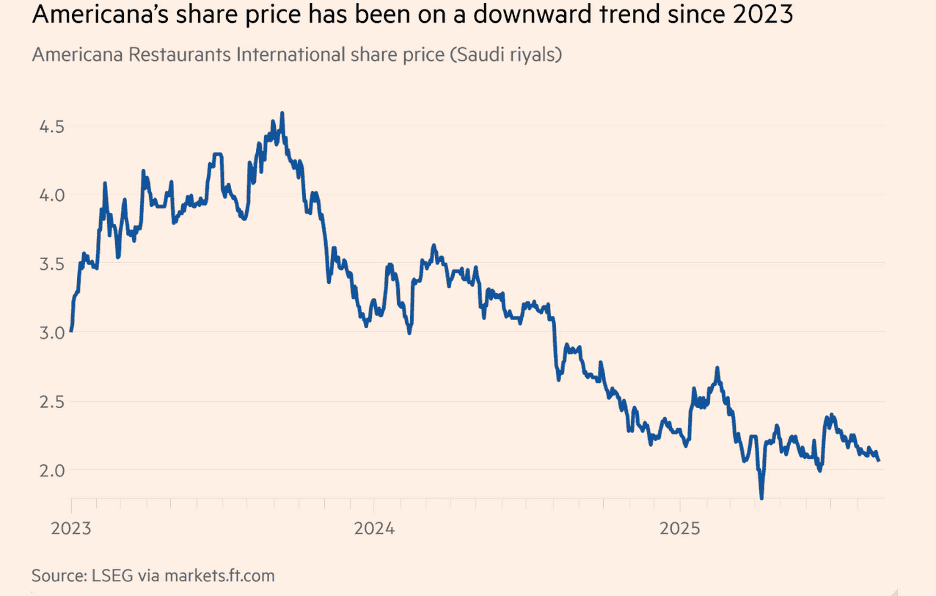

“Middle East KFC operator Americana to diversify into local brands after Gaza boycott – Sales at fast-food franchise operator tumbled when consumers turned on western outlets over American support for Israel. Americana, the Middle East’s biggest fast-food franchise operator, is planning to diversify away from US brands after profits generated from the likes of KFC and Krispy Kreme were hit by local boycotts. Full-year net profits at the company fell nearly 40 per cent to $159mn last year, as consumers in the region rejected US-linked eateries and products over Washington’s support for Israel during the war in Gaza. The Middle East and north Africa’s fast-food market is worth about $33bn, according to data analytics company Euromonitor International, with average annual growth of nearly 9 per cent since 2020. McDonald’s was among the fast-food chains that had been hit by the consumer boycott but said in February that its Middle East business had picked up again.”, The Financial Times, August 29, 2025

=============================================================================================

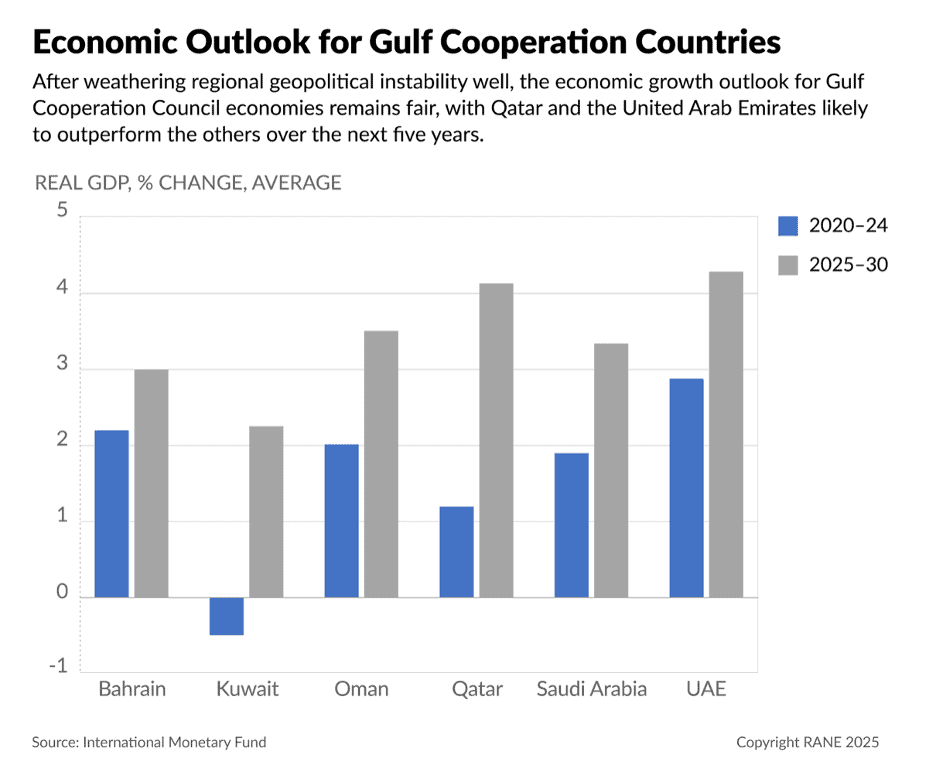

“Solid Fundamentals Shield GCC Economies From Global Volatility – Gulf Arab states’ solid macroeconomic and financial fundamentals will keep the region resilient in the face of global economic uncertainty, including a potential sustained drop in oil prices over the next few quarters. According to the International Monetary Fund (IMF), the members of the Gulf Cooperation Council (GCC) are expected to sustain solid economic growth over the next five years against the backdrop of low inflation and strong current account and external financial positions. Oil prices and production levels, particularly in the case of swing producers like Saudi Arabia and the United Arab Emirates, will continue to strongly contribute to economic growth, despite Gulf states’ decades-long and ongoing efforts to diversify away from oil and gas production.”, RANE Worldview, August 19, 2025

=============================================================================================

Poland

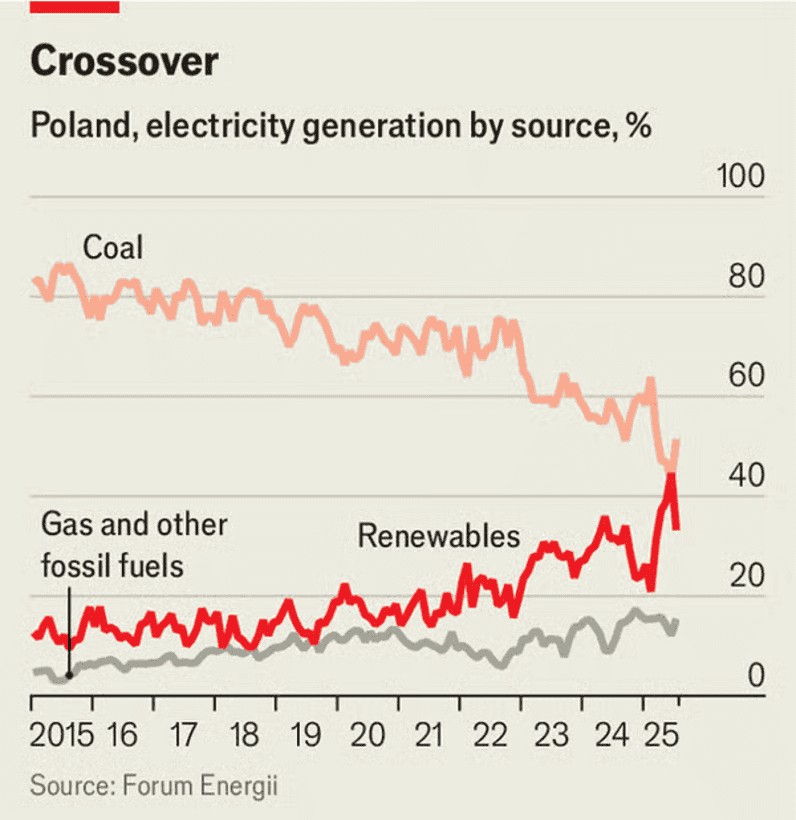

“Why Poland is becoming less central European and more Baltic – Thanks to energy and security concerns, its centre of gravity is shifting north. Poland’s south, home to most of its coal mines and heavy industry, has long been the country’s engine room. That is changing. Poland plans to phase out coal by 2049, so as to align with euclean-energy targets. Increasing mining costs are also helping the economy go green. In June of this year, Poland’s renewables generated more power than coal for the first time. Energy is leading the way.Poland plans to phase out coal by 2049, so as to align with euclean-energy targets. Increasing mining costs are also helping the economy go green. In June of this year, Poland’s renewables generated more power than coal for the first time. Poland is increasingly looking to the Baltic coast to meet its energy needs. The country has already boosted capacity at its only lng(liquefied natural gas) terminal, in Swinoujscie, to 8.3bn cubic metres (bcm) per year, and plans to open a second one, capable of handing another 6.1bcm, in Gdansk in 2028. A pipeline stretching from Norway through Denmark, launched in 2022, can provide up to 10bcm more gas. Wind power, which now accounts for 14.7% of Poland’s energy mix, up from 0.3% two decades ago, is also moving north, and offshore.”, The Economist, August 28, 2025

============================================================================================

United States

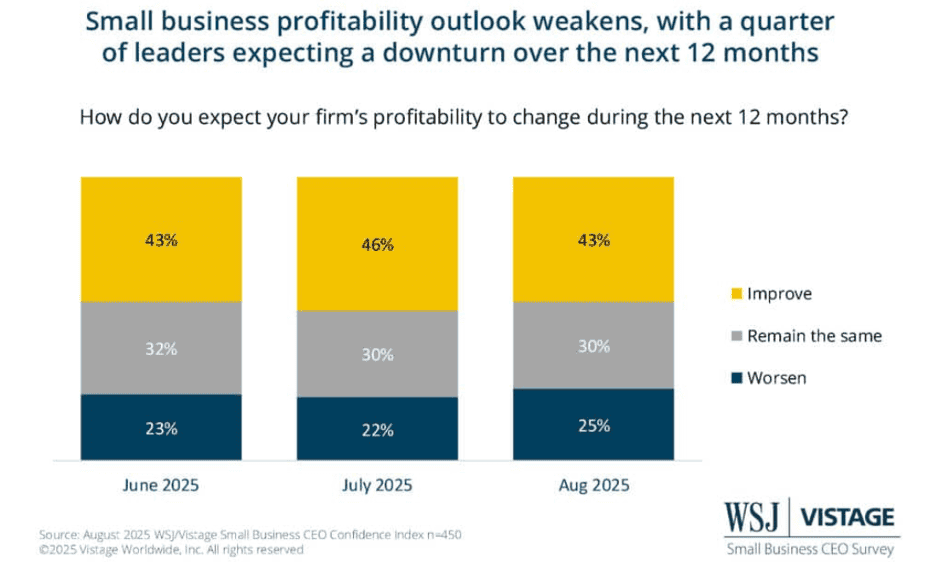

“Uncertainty Rises, Small Business CEO Confidence Stalls – After July’s modest boost in confidence, the WSJ/Vistage Small Business CEO Confidence Index dropped slightly in August to 85.0. Beneath this relative stability, however, lies a growing undercurrent of uncertainty, driven by shifting policy signals and unanswered questions about the recently passed One Big Beautiful Bill Act (OBBBA). Nearly half of small business leaders report that their economic uncertainty has grown in the last few months. Simply scanning headlines of tariffs, trade, and other legislation reveals plenty of unknowns. Even the OBBBA, with its major tax provisions, has been slow to gain positive traction.”, The Wall Street Journal & Vistage, August 2025 Survey

============================================================================================

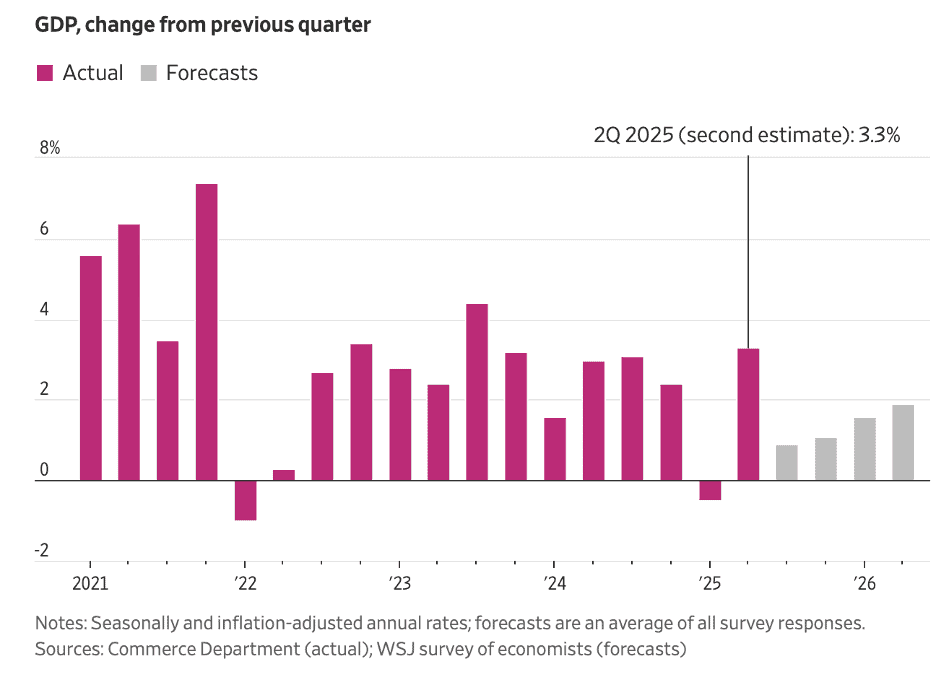

“U.S. Economy Grew Faster in Second Quarter, New Estimate Shows – Consumer spending, growth in AI added to GDP revision. Gross domestic product expanded at a seasonally and inflation-adjusted annual rate of 3.3% in the quarter, the Commerce Department said in an updated estimate Thursday. The department had previously said the economy grew by 3%. The economy’s growth reflected in part a drop in imported goods after companies front-loaded purchases earlier in the year to get ahead of new tariffs. Trade can cause swings in quarterly growth because of the way GDP is calculated.

The latest estimate changed because of revisions to investment and consumer spending, the department said. Investments in intellectual property, light trucks and commercial and healthcare structures were all revised upward. With the latest estimate, the U.S. economy grew at an annualized average of 1.4% in the first half of the year. That is still a significant slowdown from the pace of growth in recent years. In 2024, GDP grew by an average pace of 2.5%.”, The Wall Street Journal, August 28, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The Accredited Franchise Supplier certification

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Brand & Franchise Sector News

“Restaurant profitability has taken a hit since the pandemic – According to the National Restaurant Association, median profitability at all restaurants remains lower than it was before the pandemic, despite historic increases in menu prices. According to the National Restaurant Association’s latest data abstract, median income before taxes at full-service restaurants is just 2.8% of revenues, compared with 4% in 2019. The weakened profitability has come despite historically high increases in menu prices, which has turned off a certain segment of the U.S. consumer. Yet those increases haven’t been enough to offset restaurant profits.”, Restaurant Business By Jonathan Maze on Aug. 28, 2025

==============================================================================================

“The Impact of Recent Franchise Regulation Changes in Indonesia – Indonesia’s current regulations on franchises, as stipulated under Government Regulation No. 35/2024 on Franchising and its implementing regulation, Ministry of Trade (MOT) Regulation No. 71/2019 regarding Implementation of Franchising, highlight fundamental changes in franchise registration. These changes have introduced additional complexities and challenges in the franchise registration procedure, making it more difficult for franchise owners to navigate the process.”, Lexology – Tilleke & Gibbins, August 25, 2025

============================================================================================

“Following days of uproar, Cracker Barrel switches back to its old logo – The family-dining chain said it heard its customers’ concerns about the new logo and has reinstated the “old timer” and his barrel. Its stock spiked in after-hours trading. In a statement Tuesday evening, the family-dining chain thanked its customers for making their voices heard. “We said we would listen, and we have,” the company said. ‘Our new logo is going away and our ‘Old Timer’ will remain.’ The criticism enflamed a simmering backlash against Cracker Barrel’s ongoing rebrand, which includes a more modern restaurant design as well as updates to the menu and marketing.”, Restaurant Business, August 26, 2025

==============================================================================================

“Papa John’s to re-enter India with plan for 650 pizza stores by 2035 – U.S. pizza chain Papa John’s International (PZZA.O), opens new tab plans to return to India by October, said a master franchisee executive, aiming to open 650 stores over the next decade in a market where fast-food chains have been struggling to sustain sales growth. The world’s third-largest pizza delivery company, which exited India in 2017 citing underperformance, follows U.S. rival Little Caesars, which opened in India earlier this year with a target of 100 stores by the decade-end. The pizza chain had revealed plans in April 2023 to re-enter the ‘complex market’. Its return comes as fast-food chains grapple with weakening sales in the country, as cash-strapped urban consumers – the key customer base – cut back due to slow wage growth and as rising competition bites.”, Reuters, August 25, 2025

============================================================================================

“Chick-fil-A expanding to UK, Singapore – Chick-fil-A Inc. announced plans to open its first permanent locations in the United Kingdom and Singapore in 2025. The quick-service restaurant chain stated the operations would be led by local owner-operators who were born and raised in the countries where they will be serving customers. During the fall, Chick-fil-A plans to open its first restaurant in Leeds, United Kingdom, as part of a strategy to open five restaurants in the next two years. The company anticipates investing more than $100 million in the United Kingdom over the next decade. For Singapore, the first Chick-fil-A restaurant is set to open later this year, backed by a $75 million, 10-year investment.”, Meat + Poultry, August 29, 2025

=============================================================================================

“TH International Grows Franchise Stores – Since launching its targeted franchisee program in December 2023, TH International received more than 8,100 franchise applications and successfully transitioned over 400 stores to subfranchisee status by the end of the second quarter. The number of franchised stores increased from 333 as of June 30, 2023, to 449 as of June 30, 2024, and management is targeting approximately 200 new franchise stores on a gross basis in 2025. Management is targeting approximately 200 new gross franchise store openings in 2025, with 200 to 300 new store openings anticipated annually over the next few years.”, The Motley Fool, August 26, 2025

==============================================================================================

“Tims China s Q2 revenue reached 349 million yuan with 1 015 stores nationwide – As of June 30, 2025, the total number of Tims (Tim Hortons) franchise stores in China has increased to 449, a 35% year-on-year increase from 333 stores in the second quarter of last year. With this, the total number of Tims stores in China has reached 1,015 nationwide, covering 90 cities. Tims China is reportedly further expanding its dedicated channel network, expanding into more high-speed rail stations, airports, and highway service areas, while also increasing its coverage of dedicated channel stores in hospitals, schools, and banks. It is reported that 18 new dedicated channel stores were added this quarter.”, Caijing.com, August 26, 2025. Compliments of Paul Jones, Jones & Co., Toronto

==============================================================================================

“Dave’s Hot Chicken to open 180 restaurants in Europe – The celebrity-backed fried chicken chain has exceeded UK performance forecasts since opening in London in December. Dave’s Hot Chicken, which went viral after hordes flocked to the opening of its first UK restaurant in London in December, has struck a deal with Azzurri Group to open 180 restaurants across ten European countries including Portugal, Spain and Germany. Azzurri, the restaurant group behind the Italian chains ASK and Zizzi as well as the Boojum Mexican restaurant chain, owns the main franchise in the UK and Ireland for Dave’s Hot Chicken. The 180-restaurant target is on top of Azzurri’s plans to open 60 Dave’s restaurants in Britain.”, The Tomes of London, September 1, 2025

=============================================================================================

“Burger King closes all Hong Kong locations, except airport outlet – According to Sing Tao Daily, the closure was confirmed by SSP Hong Kong, the franchise operator. It follows earlier shutdowns of locations in Wan Chai, Tsim Sha Tsui, Yau Ma Tei, Wong Tai Sin, and Tseung Kwan O. Burger King first entered Hong Kong in the 1980s, exited in the 1990s, and re-entered in 2003. The brand once operated more than 20 stores across the city. The latest closure reflects years of mounting operational, financial, and competitive challenges. Burger King reportedly has struggled to maintain market share against dominant players like McDonald’s, which operates around 260 outlets, and KFC, with more than 60 stores citywide.”, Inside Asia Retail, August 14, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive our biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing business environment. And our GlobalTeam™ on the ground covering 25+ countries provide us with updates about what is actually happening in their specific countries. We do not get involved in or report on politics!

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe, and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant since 2001 taking 40+ companies global.

For a complimentary 30-minute consultation on how to take your business into new countries and make money doing it. For a complimentary call with Bill Edwards click on the QR code or contact Bill at bedwards@edwardsglobal.com and +1 949 375 1896