Biweekly Global Business Newsletter Issue 144, Tuesday, September 30, 2025

“Plans cannot keep pace with change.” — Chinese Proverb

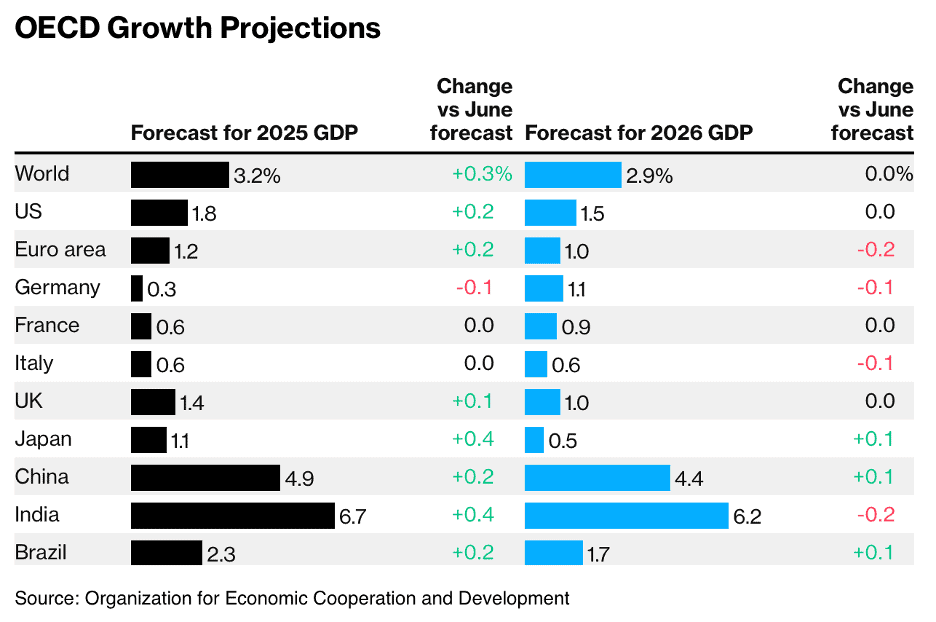

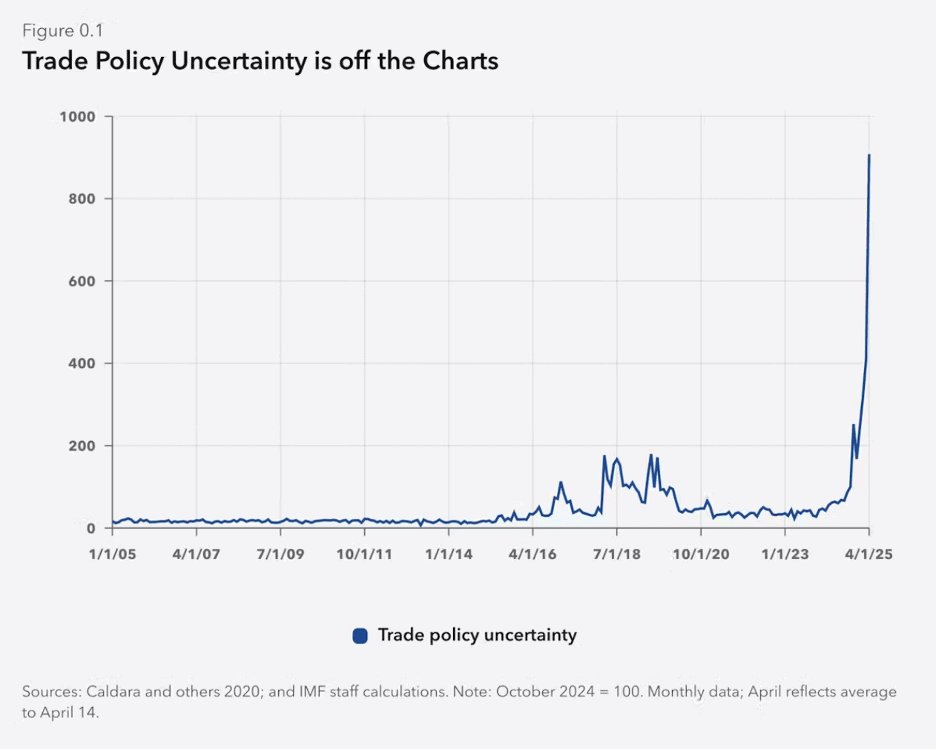

Welcome to the 144th Edition of the Global Business Update – This issue comes at a time when resilience and uncertainty are colliding in the global economy. The OECD has raised its growth outlook for 2025, noting that economies are performing better than expected—but also warned that new tariffs set for 2026 could slow global expansion to 2.9% from 3.2%. But trade policy uncertainty is at is highest level in at least 20 years. The message is clear: businesses must adapt quickly, because plans made today may not hold up tomorrow.

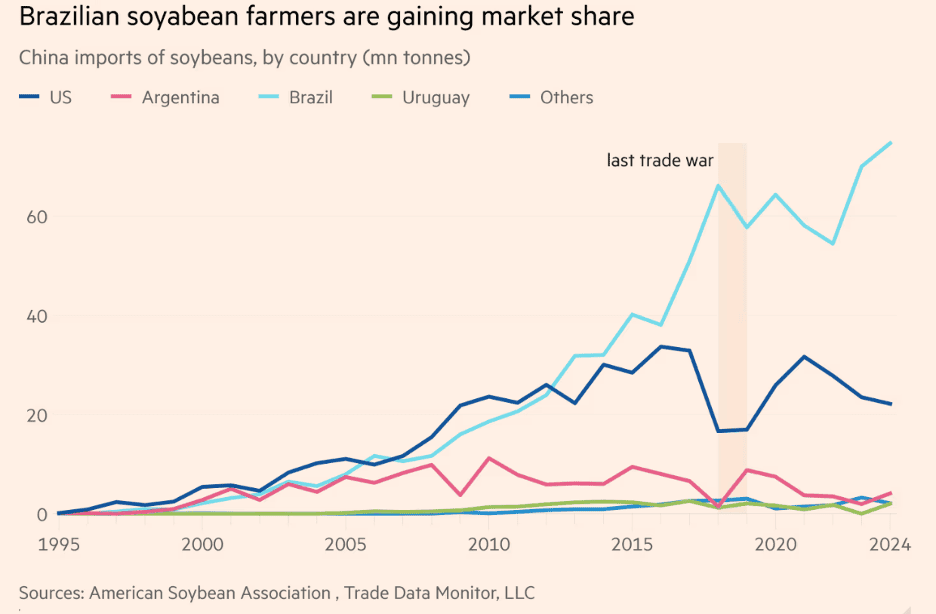

Trade disruptions are already reshaping supply chains. U.S. soybean exports to China have collapsed, with Beijing turning instead to Brazil, leaving American farmers squeezed. Meanwhile, Canada is bracing for an economic rebound in 2026, while simultaneously deepening its trade ties to Asia, with record cargo volumes at the Port of Vancouver.

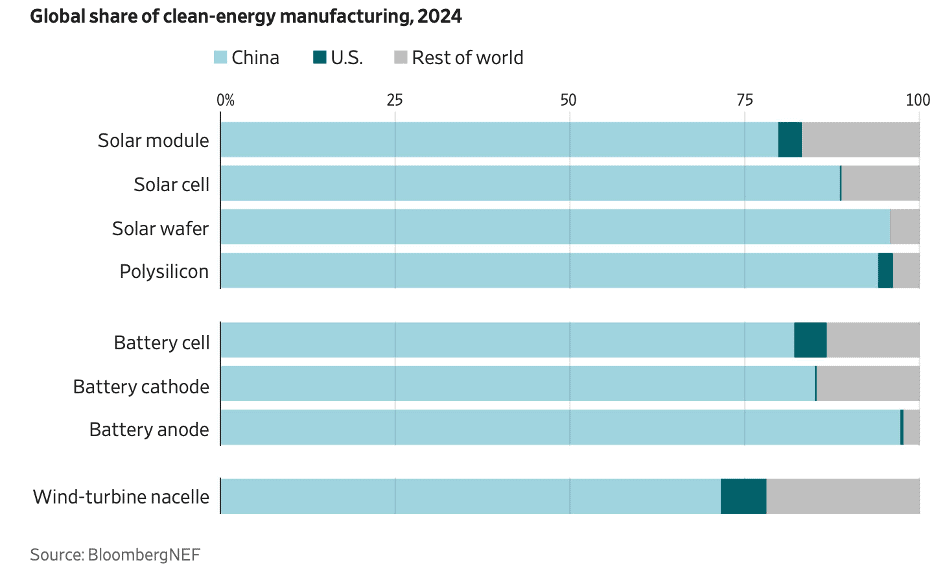

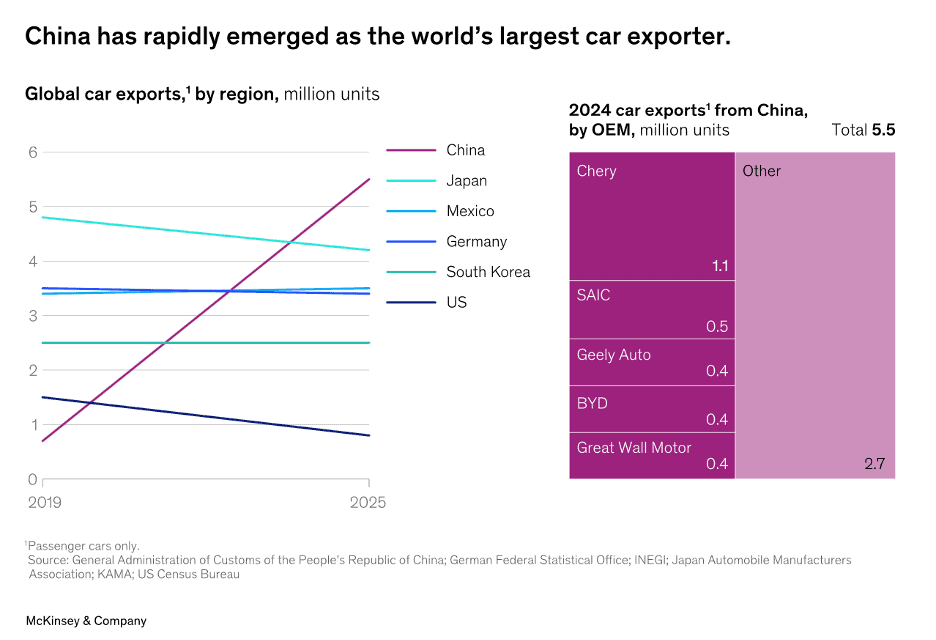

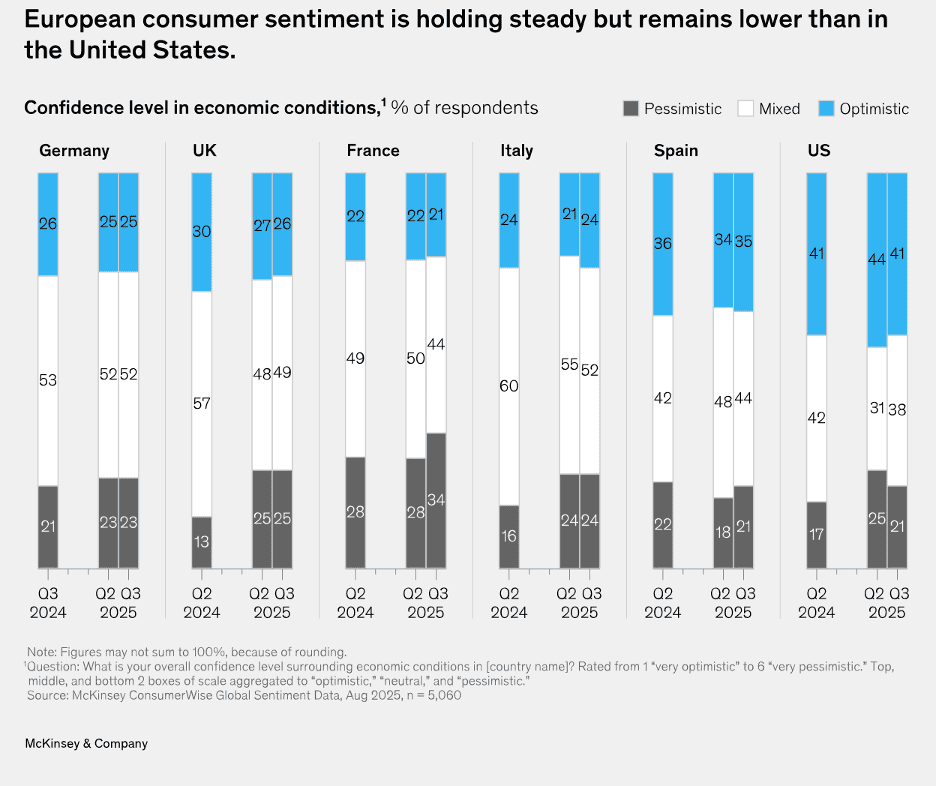

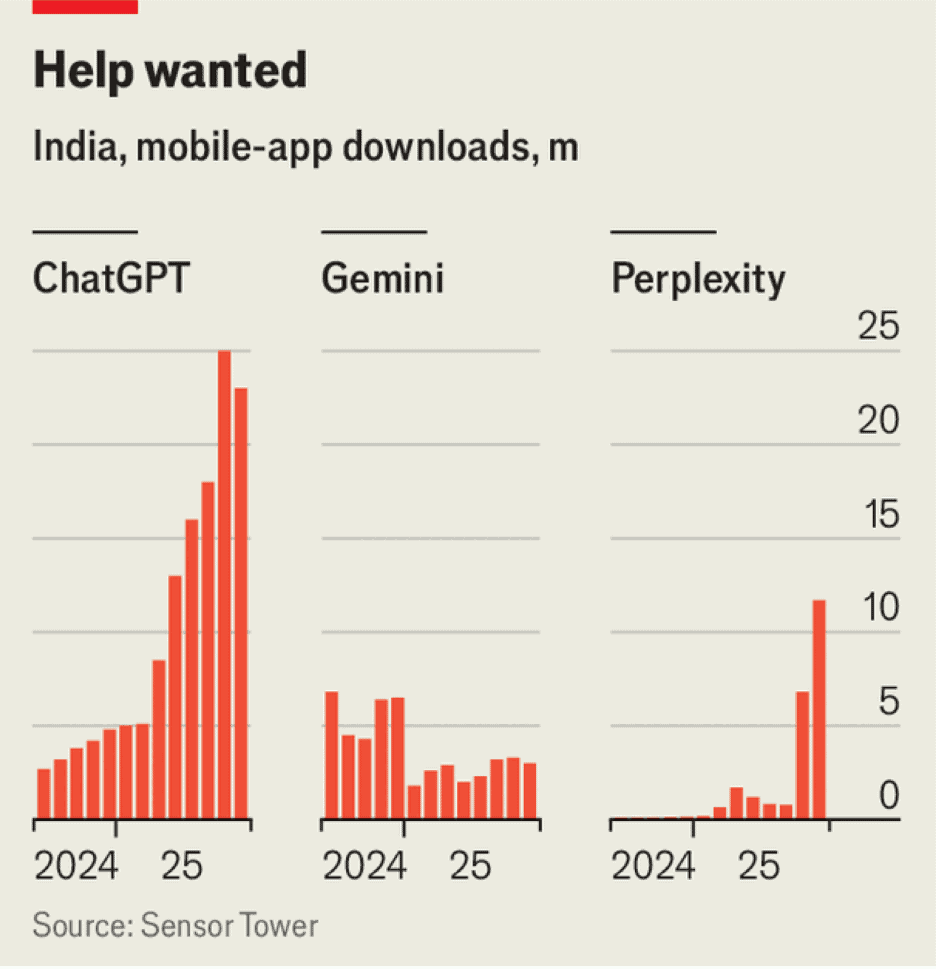

China’s role continues to expand—installing more renewable power in seven months than the U.S. projects for the entire year and overtaking Japan and Germany as the world’s largest car exporter. Europe shows a split picture: Spain has become the continent’s standout growth economy, while consumer sentiment across the EU remains cautious. And AI is truly erupting in India!

Starbucks is restructuring, Shake Shack is opening in Vietnam, Guzman y Gomez is growing, and Elegant Hoopoe® is pioneering AI-driven wellness franchising with global ambitions. And McDonalds China will invest US$56 million to train 10,000 employees in 2025.

The stories in edition 144 illustrate both the risks and the opportunities for companies seeking growth abroad. As this edition makes clear, success in today’s global economy will not come from rigid plans but from adaptability, resilience, and a willingness to see change as opportunity.

This issue’s book review highlights “What Matters Next: A Leader’s Guide to Making Human-Friendly Tech Decisions in a World That’s Moving Too Fast by Kate O’Neill, a timely new book on how leaders can make technology decisions that are fast yet human-friendly. In a world where global business moves at breakneck speed, O’Neill offers practical tools for balancing urgency with foresight, and efficiency with humanity. It’s a framework that resonates strongly with today’s global challenges. As global business leaders, we can’t slow the pace of change—but we can choose to guide it responsibly. Ultimately, the book is a playbook to help leaders make tech-enabled change that is not only efficient but human‑friendly.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business. We do not get involved with or report on politics!

PLEASE NOTE: Some of the information sources that we provide links to in our newsletter require a paid subscription to directly access them. Clicking on a link may not give the reader access to the content.

Edited and curated by: William (Bill) Edwards, CEO & Global Business Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA. Contact Bill with questions, comments and contributions. Bedwards@edwardsglobal.com, +1 949 375 1896

Link to our current and past newsletters: https://edwardsglobal.com/geowizard/

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

First, A Few Words of Wisdom From Others For These Times

“Plans cannot keep pace with change.” — Chinese Proverb

“In a fragmented world, the future belongs to those who build bridges, not walls.”, Inspired by Óscar Arias

“When you have exhausted all possibilities, remember this—you haven’t.”, Thomas Alva Edison

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Highlights in issue #144:

Resilient World Economy Set for Tariff Hit in 2026, OECD Says

Are You Ready To Spend 29 Hours On The World’s Longest Flight?

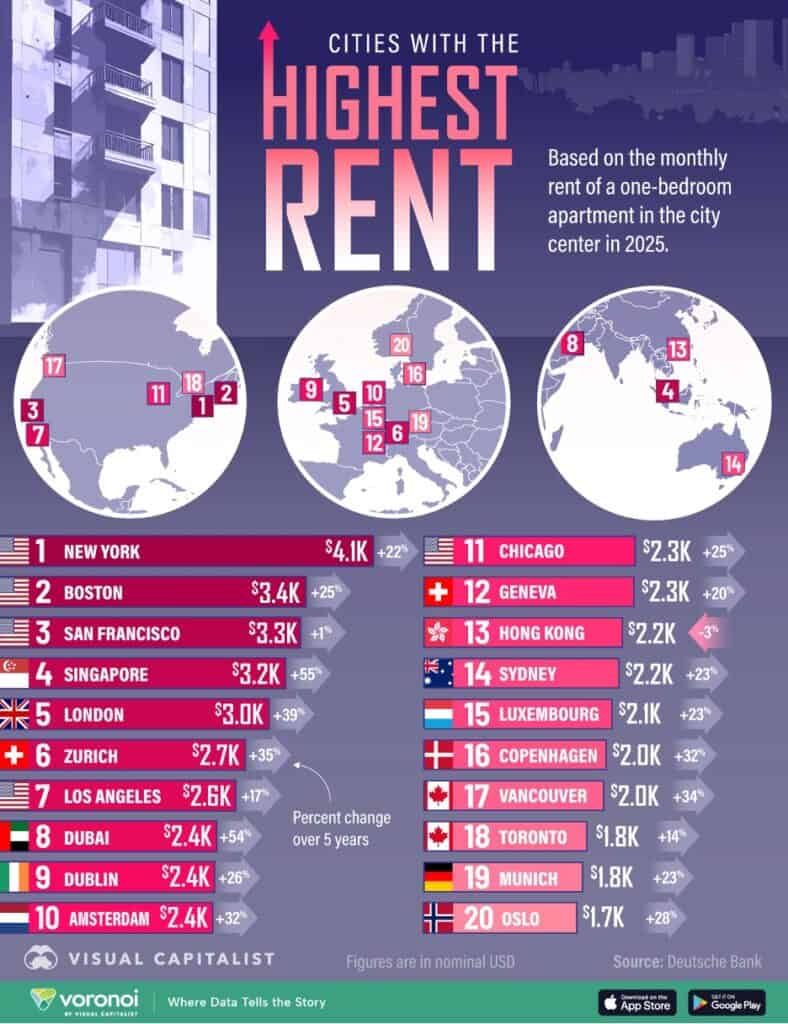

Which Cities Have the Most Expensive Rent in the World in 2025?

Canadian economy poised for upturn in 2026, but risks abound, Deloitte says in fall outlook

Why so many US fast food chains are expanding fast in Britain

Brand Global News Section: Elegant Hoopoe®, Guzman y Gomez®, McDonalds® China, Shake Shack® and Starbucks®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

“Resilient World Economy Set for Tariff Hit in 2026, OECD Says – The OECD said the global economy is still on course for a substantial blow from Donald Trump’s trade measures despite showing greater resilience than expected in recent months. The OECD raised its 2025 outlook for world growth and most individual economies, citing the impact of front-loading in anticipation of higher tariffs. The OECD expects global growth to drop to 2.9% from 3.2% in 2026 amid higher import duties and elevated uncertainty, with the full impact of the trade measures yet to be felt. In new forecasts published on Tuesday, the Paris-based organization raised its 2025 outlook for world growth and most individual economies, citing the impact of front-loading in anticipation of higher tariffs. The US also saw strong investment in artificial intelligence, while China benefited from fiscal support.”, Bloomberg, September 25, 2025

=============================================================================================

“IMF 2025 Annual Report: Getting to Growth in an Age of Uncertainty – The global economy faces exceptional levels of uncertainty. The 2025 IMF Annual Report shows that low-income countries in particular, already strained by past shocks, risk falling further behind. Growth is the central challenge for all. And achieving it will require bold reforms at home and collaboration to address imbalances between countries.”, International Monetary Fund, LinkedIn, September 26, 2025

============================================================================================

“Which Cities Have the Most Expensive Rent in the World in 2025? Across major cities worldwide, the cost of rent has climbed sharply in recent years. Record-high housing prices, paired with a wave of remote workers moving into new markets, are reshaping rental dynamics. At the same time, limited supply is tightening conditions even further, compounding challenges for renters in countless regions. New York has the highest rental costs globally, averaging $4,100 in 2025. Over the past five years, rent has surged across European cities, sparking protests. Singapore has the highest rent in Asia, at $3,300 per month, given its role as a financial hub.”, Visual Capitalist & Deutsche Bank, September 19, 2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation, Taxes, Tariffs & Trade Issues

“The U.S. Is Forfeiting the Clean-Energy Race to China – As President Trump doubles down on fossil fuels, the U.S. and China offer competing visions for the future of energy. The U.S. renewables retreat goes far beyond the tax bill that is winding down more than $400 billion in estimated subsidies. Federal agencies have tightened rules for new development. The rapid pace of EV adoption in China and elsewhere casts a long shadow over oil demand. Natural gas will be burned for decades, but increasingly competitive solar panels and batteries might sap how much of it the world will need. China installed 277 gigawatts of wind and solar capacity in the first seven months of the year, quadruple the utility-scale additions federal analysts in the U.S. project across all power sources for 2025.”, The Wall Street Journal, September 21, 2025

===============================================================================================

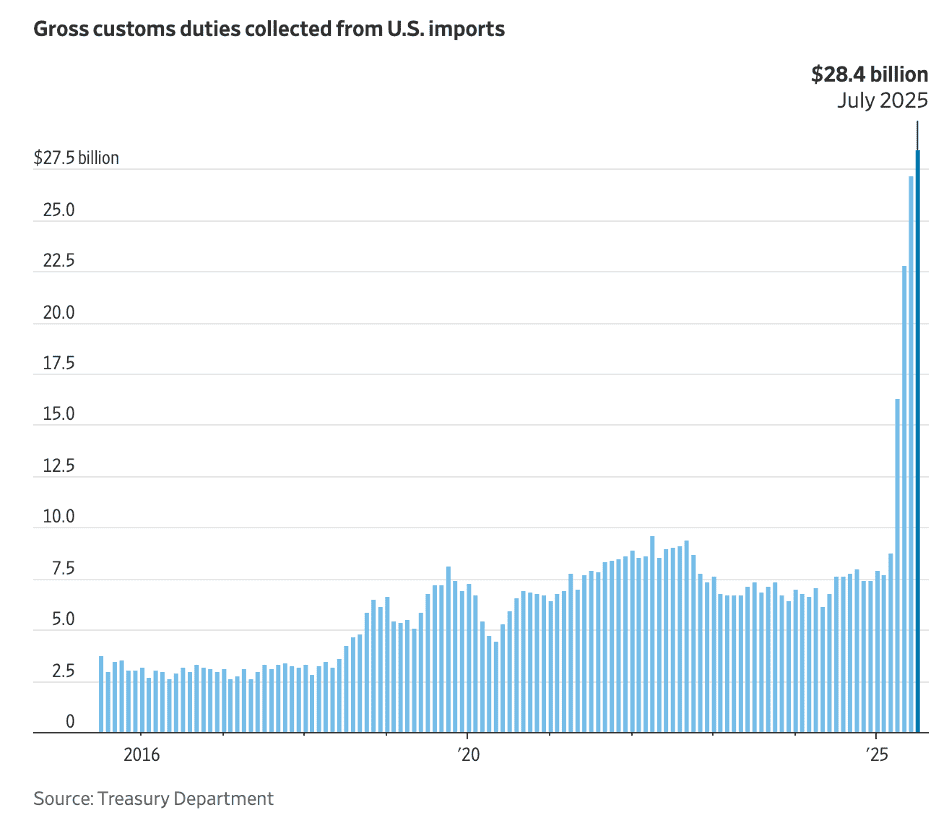

“U.S. Importers Eye Refund Options as Tariff Fight Goes to Supreme Court – Uncertainty over the fate of President Trump’s duties spurs firms to see whether they could claw back billions of dollars. The Trump administration on Wednesday asked the Supreme Court to quickly hear its appeal of last week’s lower court ruling. The courts are weighing the legality of 10% baseline tariffs the Trump administration imposed this year on most trading partners, as well as steeper tariffs on China, Mexico and Canada.”, The Wall Street Journal, September 6, 2025

===============================================================================================

“US soyabean farmers squeezed as China blocks imports and stockpiles rise – Overseas sales of top US export crop plummet as trade talks between Washington and Beijing stall. The new export season for soyabeans has opened with no sales or shipments to China, government data shows — a sharp break from a year ago, when it had already booked 6.5mn tons. For decades, more than half of all US soyabeans went to China, the world’s biggest buyer. But this year, as trade talks between Washington and Beijing stall, not a single American soyabean has headed east, leaving farmers struggling to stay afloat as bins fill and prices sag while China turns to record supplies from Brazil.”, The Financial Times, September 26, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel News

“US Travel Association Warns Government Shutdown Could Cost Industry Billions – With a government shutdown looming, the U.S. Travel Association is calling on lawmakers to avert the crisis, which could have ramifications for the travel economy and the traveling public. ‘A shutdown is a wholly preventable blow to America’s travel economy—costing $1 billion every week—and affecting millions of travelers and businesses while placing unnecessary strain on an already overextended federal travel workforce’. 60 percent of Americans said they would cancel or avoid trips by air in the event of a shutdown.”, Travel Pulse, September 25, 2025

===============================================================================================

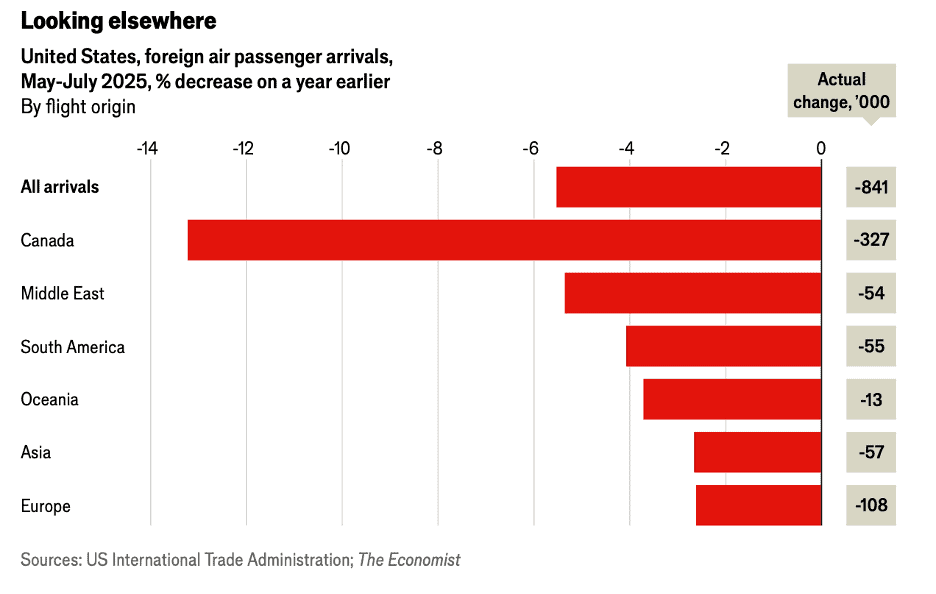

“Have foreign tourists really avoided America this year? Using monthly data on arrivals at all airports from America’s International Trade Administration, a government agency, The Economist finds that foreign arrivals at American airports are down by 3.8% compared with 2024, or 1.3m fewer people. The slump was steepest between May and July, when arrivals fell by 5.5% year on year. That bucked the global trend as tourism finally recovered to pre-pandemic levels. Travel and tourism make up around 3% of America’s gdp. But so far hotel operators have reported that higher spending by well-off domestic travellers has softened the blow.”, The Economist, August 26, 2025

==================================================================================================

“Are You Ready To Spend 29 Hours On The World’s Longest Flight? China Eastern Airlines is launching twice-a-week service from Shanghai to Buenos Aires, with Boeing 777-300ER widebody aircraft. As today’s airliners are not capable of flying the full 12,299 mile distance without refueling, the direct flight will have a “technical stop” in Auckland, New Zealand. China Eastern described “The Shanghai Pudong-Auckland-Buenos Aires route.. as an important measure to build a new ‘Air Silk Road’ channel between Asia-Pacific and South America.” The flight will be “the world’s first commercial route connecting antipodal cities,” as Shanghai and Buenos Aires are literally on opposite sides of the earth. The southerly flight path will skirt Antarctica, flying over vast empty expanses of ocean.”, Forbes, September 27, 2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Book Review

What Matters Next: A Leader’s Guide to Making Human‑Friendly Tech Decisions in a World That’s Moving Too Fast by Kate O’Neill addresses the tensions leaders face in an era of rapid technological change: how to move decisively without abandoning human values. O’Neill argues that many tech decisions fail because they are made either too hastily (with unintended harmful consequences) or too slowly (letting opportunity slip or compounding risk). She introduces a conceptual framework to help navigate this balancing act.

Central to her approach is the Now‑Next Continuum, which treats decisions as part of a temporal spectrum rather than binary between “now” and “future.” Leaders are encouraged to shift from asking immediate “how” questions toward cultivating deeper insights and bankable foresights—that is, plausible projections grounded in evidence that can guide future actions. She also emphasizes through‑line thinking: tracing how current decisions connect to future outcomes, so that seemingly small choices aren’t disconnected from long‑term purpose.

O’Neill further explores the “Harms of Action vs. Harms of Inaction,” showing that both false starts and delays carry costs. Her idea of ethical acceleration encourages leaders to accelerate responsibly—moving neither recklessly nor inertly—by embedding human-centric values into innovation. She weaves in case examples, decision heuristics, and leadership mindset shifts that allow organizations to embed humanity (meaning, dignity, context) into technology strategies. Ultimately, the book is a playbook to help leaders make tech-enabled change that is not only efficient but human‑friendly.

5 Key Takeaways

Balance urgency with deliberation: Acting too quickly risks unintended consequences; waiting too long means missed opportunity. The sweet spot lies in “ethical acceleration,” where speed is tempered by foresight and values.

Think in continuums rather than binaries: The Now‑Next Continuum helps leaders avoid false dichotomies (e.g. “do now vs. wait”) by seeing decisions as nodes in a continuous trajectory.

Shift from “how” to “insight → foresight”: Rather than jumping to execution, begin with framing better questions, seeking insights, then developing “bankable foresights” that anchor future actions.

Trace through‑lines to connect decisions across time: Through‑line thinking ensures that short-term tech choices align with longer-term purpose, reducing disjointed or contradictory strategies.

Embed humanity in technology strategy: Use human values (meaning, dignity, context) as guardrails. For example: design systems that preserve agency, context, privacy, and human judgment rather than fully automating away human roles.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Africa

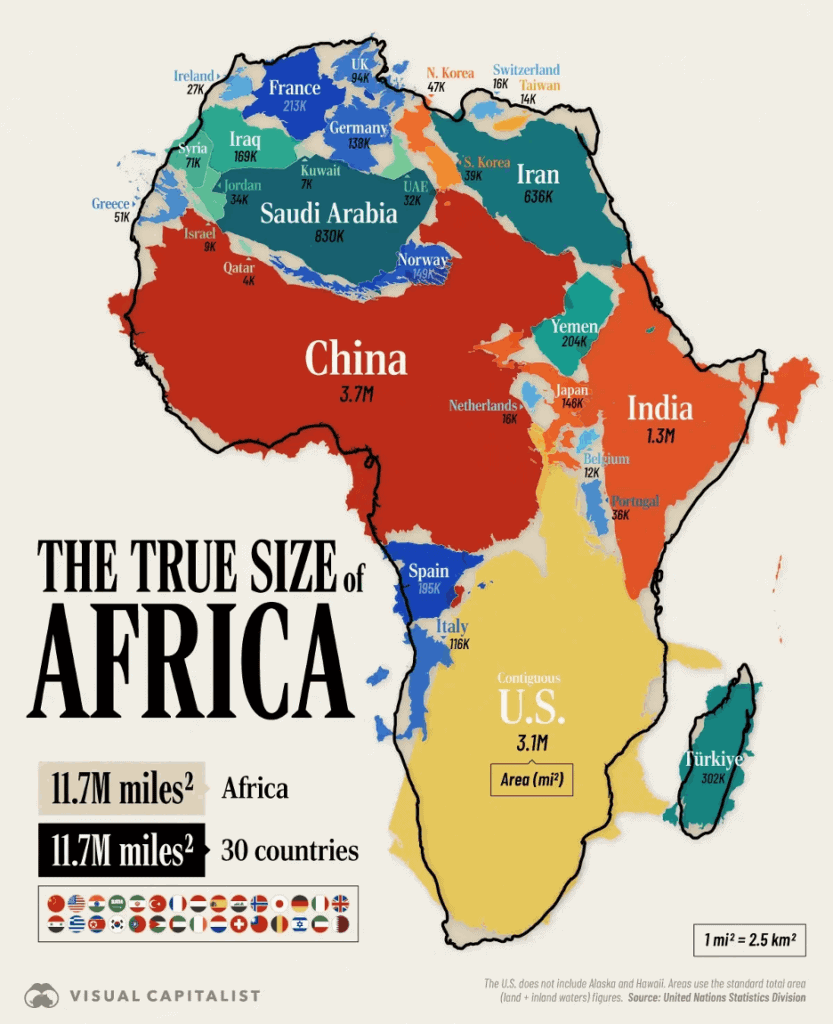

“How Many Countries Fit in Africa? Visualizing the Continent’s True Size – The continent of Africa covers 11.7 million mi² (30.4 million km²), roughly equal to the size of 30 countries. These 30 include some of the world’s largest countries like the (contiguous) U.S., China, and India. However, the most common map projection, called the Mercator projection, makes Africa appear smaller than it actually is. For reference, Africa is the second-largest continent, both by size and population (1.6 billion people).”, Visual Capitalist & United Nations Statistics Division, September 20, 2025

==============================================================================================

Canada

“Canadian economy poised for upturn in 2026, but risks abound, Deloitte says in fall outlook – After months of sluggish activity under U.S. tariffs, the economy is expected to rebound in 2026 as lower interest rates and federal spending take hold – provided the carve-outs that keep most exports tariff-free survive, a new economic outlook from Deloitte Canada shows. The country’s gross domestic product will grow 1.1 per cent in 2025 and 1.6 per cent next year, gaining momentum from falling borrowing costs, infrastructure spending and rising business investment, according to projections from Deloitte’s fall economic outlook.”, The Globe and Mail, September 29, 2025

============================================================================================

“Port of Vancouver handles record volumes as Canadian trade shifts toward Asia – The Port of Vancouver’s cargo volumes rose 13 per cent to set a record level of activity for the first six months this year as data show a trend toward Canada trading more with Asia and reducing reliance on the United States. The port’s midyear statistics show that it handled a record 85.4 million tonnes of cargo in the first six months of 2025, compared with 75.7 million tonnes for the same period last year. China is by far the largest trading partner with Canada at the West Coast port. China accounted for 25.4 million tonnes of exported and imported cargo in this year’s first half, up 25 per cent from the year-earlier period.”, The Globe and Mail, September 26, 2025

===============================================================================================

China

“China drives to the top – China has rapidly become the world’s largest car exporter, fueled in part by a surge in electric vehicle (EV) sales, positioning China as a key global player. In 2019, the country exported 0.7 million cars, but by 2024, that number had risen to 5.5 million, surpassing Japan, Mexico, and Germany. EVs composed nearly 40 percent of China’s passenger vehicle exports in 2024 and nearly half in the first half of 2025.McKinsey & Co., September 23, 2025

=============================================================================================

European Union

“An update on European consumer sentiment: Cautious, but gearing up for the holidays – Despite geopolitical and economic uncertainty, European consumer sentiment is holding steady heading into the holiday season—with spending intentions remaining in line with last year’s levels. Inflation remains the top concern for consumers, but its gradual stabilization in the eurozone has allowed many shoppers to maintain their holiday budgets. Across EU-5 nations, net consumer sentiment—the difference between optimism and pessimism—remains relatively unchanged compared to previous surveys. Stable inflation rates and a resilient job market are likely strong drivers for this trend. However, France stands out as the exception, experiencing a significant uptick in pessimism with minimal corresponding movement in optimism. In contrast, sentiment in the United States has been more volatile, though it remains higher than European levels.”, McKinsey & Co., September 5, 2025

=============================================================================================

India

“AI is erupting in India – American firms are piling on users—and sucking up mountains of data. Sam altman is bullish about India. The co-founder of Openai, the firm behind Chatgpt, says the country’s adoption of artificial intelligence (ai) has been “unmatched anywhere in the world”. India is already Openai’s second-largest market by number of users and could soon be its biggest. For Indians, the battle promises cutting-edge ai tools at extremely low cost. For ai firms, the payoff may lie less in revenue than in reach: the chance to lock in hundreds of millions of users, and the torrents of data they create. The opportunities in India are staggering. The country has around 900m internet users; only China has more. But unlike China, India is open to American tech firms.”, The Economist, September 17, 2025

===========================================================================================

Spain

“Spain has become Europe’s standout economy – But it must combine immigration-led growth with productivity improvements. Since the start of 2024, the Spanish economy has grown at an average annual rate of 3 per cent, compared with just over 1 per cent for the Eurozone as a whole. In recent weeks, S&P Global Ratings has upgraded its credit rating, and the Bank of Spain raised its 2025 growth forecast to 2.6 per cent — underscoring the nation’s position as Europe’s fastest-growing major economy, and one of the strongest in the advanced world. Tourism has recovered from the pandemic. The government has been spending grants from the EU’s Next Generation EU fund on improving infrastructure….Cheap renewable energy has also attracted foreign direct investment. Earlier reforms, including an initiative in 2021 to boost the stability of employment, have helped too. But Spain’s biggest motor has been immigration. While other European nations have been keen to tighten their borders, Spain has adopted a more liberal approach.”, The Financial Times, September 28, 2025

=============================================================================================

United States

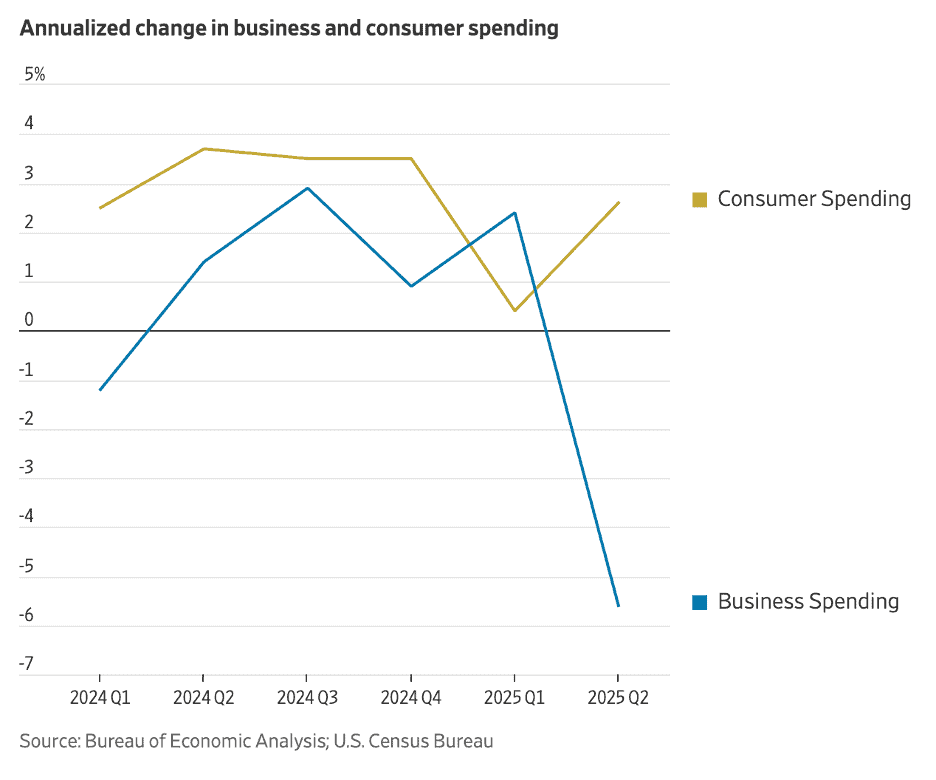

“Beneath the GDP, a Recession Warning – Business spending dropped sharply in the second quarter. Blame the trade war. Buried in last week’s BEA report is a much more reliable measure of the economy—gross output, or GO. It measures spending at all stages of production, totaling an estimated $63 trillion this year—more than twice GDP of $30 trillion. GO revealed that economic growth is slowing to a crawl, ahead only 1.2% in real terms. If you include all transactions in wholesale and retail trade, the adjusted GO is up only 0.3%. More important, overall business spending fell sharply, by an annualized 5.6% in real terms. These results are much more consistent with the weak labor-market data.”, The Wall Street Journal, September 28, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The Accredited Franchise Supplier certification

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Brand & Franchise Sector News

Starbucks to close stores, lay off workers in $1 billion restructuring plan – Starbucks announced a $1 billion restructuring plan Thursday that involves closing some of its North American coffeehouses and laying off more workers. Approximately 900 non-retail employees will be laid off, Starbucks said. This is the second round of layoffs in Niccol’s tenure, after 1,100 corporate workers were let go earlier this year. The number of company-operated stores in North America will decline by about 1% in fiscal 2025, accounting for both openings and closures, the company said in a Securities and Exchange Commission filing. That figure translates to roughly 500 gross closures, according to TD Cowen estimates.”, CNBC, September 25, 2025

=============================================================================================

“Shake Shack plans first restaurant in Vietnam for next year – It is expanding its partnership with licensee Maxim’s Caterers Limited, which already operates 52 Shake Shack locations in China, including Hong Kong and Macau, and Thailand. Maxim’s has a total of 2,000 outlets globally throughout China and Southeast Asia. Those include many concepts exclusive to Asia, but also The Cheesecake Factory and Lawry’s The Prime Rib, as well as Starbucks, of which it has coffeehouses in Hong Kong, Macau, Vietnam, Cambodia, Singapore, Thailand, and Laos, according to its web site.”, Nation’s Restaurant News, August 12, 2025

=============================================================================================

“McDonalds China Hamburger University will invest 400 million yuan (US$56 million) in talent development over the next three years revealing its plan to train 10,000 people annually – As of now, there are 11 Hamburg universities around the world. Each year, nearly 10,000 trainees at McDonald’s China complete training at Hamburger University, and over 200,000 employees learn online. ‘When Hamburger University was founded in 2010, we had more than 1,000 restaurants across China. Today, we have over 7,400 restaurants, serving over 1.3 billion customers annually,’ said Zhang Jiayin, CEO of McDonald’s China.”, Yical, September 24, 2025. English translation and article compliments of Paul Jones, Jones & Co., Toronto

=============================================================================================

“Why so many US fast food chains are expanding fast in Britain – It’s not just McDonald’s: brands like Chick-fil-A, Denny’s and Chuck E Cheese plan to open more than a thousand outlets this year. What’s behind their appetite? Ten American firms with little or no presence in the UK have revealed plans for hundreds of outlets, on top of the 700 new diners announced by established brands such as McDonald’s and KFC. US companies have long seen the UK as the obvious first step in their plans for global expansion, in part because of Britain’s familiarity with American film and television.”, The Tines of London, September 21, 2025

=============================================================================================

“Guzman y Gomez to open a dozen new stores by year’s end – Fast-growing Mexican food chain Guzman y Gomez plans to deliver on 40 per cent of its new store openings planned this financial year within the last three months of 2025 alone, with 12 new locations planned across VIC, NSW, QLD and the ACT. The company has revealed 12 of these will be between October and December, of which five will be corporate run and seven will be franchised as GYG welcomes five new franchisees. This compares to 11 new openings for the same period in 2024, as the group works towards a rhythm of 40 new store openings annually in Australia while it strives to hit a footprint of 1,000 locations over the long term. The current store count is more than 250.”, Business news Australia, September 23, 2025

==============================================================================================

“Elegant Hoopoe unveils AI-powered wellness franchise targeting $1.5 trillion global wellness market with expansion to over 200 clinics – Hoopoe Holding, the first AI-powered, IP-protected wellness franchise, is rapidly progressing toward its ambitious global expansion targeting 200+ clinics worldwide under its elegant hoopoe brand, positioning itself to capture a significant share of the $1.5 trillion global wellness economy. The UK has been identified as the primary European launch market, with advanced discussions underway with capital partners and operators across the USA, Canada, France, Germany, Switzerland, and Italy.”, TMC Net News, September 23, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive our biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing business environment. And our GlobalTeam™ on the ground covering 25+ countries provide us with updates about what is actually happening in their specific countries. We do not get involved in or report on politics!

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

William “Bill” Edwards: CEO & Global Trade Advisor “Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global”. With five decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe, and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service global management consultant since 2001 helping 40+ franchisors expand into new countries. Bill knows how to turn the challenges in taking a brand global into opportunities.

For a complimentary 30-minute consultation on how to take your business into new countries successfully. For a complimentary call with Bill Edwards click on the QR code or contact Bill at bedwards@edwardsglobal.com and +1 949 375 1896

And download our latest chart ranking 40+ countries as places to do business, used by many companies for strategic planning, at this link: