Biweekly Global Business Newsletter Issue 146, Tuesday, October 28, 2025

The most dangerous phrase in business is:

‘We’ve always done it this way.’

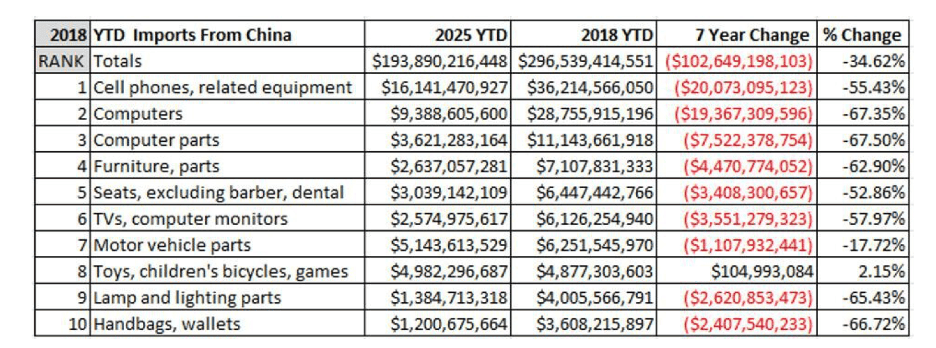

Welcome to the 146th Edition of the Global Business Update – As 2025 closes, business leaders face a world defined by economic recalibration and geopolitical realignment. The global economy continues to expand—though unevenly—as nations adapt to persistent inflation, rising borrowing costs, and shifting supply-chain dependencies. Emerging markets are proving surprisingly resilient, powered by domestic demand, digital adoption, and regional trade initiatives that are gradually replacing the old globalization model with something more balanced and diversified. Eight Of Top 10 U.S. Imports From China In 2018 Down More Than 50% Now

At the same time, non-tariff barriers and regulatory nationalism continue to challenge exporters and investors alike. Governments are becoming more assertive in protecting domestic industries, setting new environmental and labor standards, and regulating data flows and market access. These policies are reshaping how companies think about risk and market entry. Success today requires agility, partnerships built on trust, and a long-term commitment to local compliance and cultural understanding.

The global energy transition, rapid advances in AI, and demographic shifts are also influencing business decisions in profound ways. Many corporations are investing in technology and sustainability not only to meet shareholder expectations but to secure their license to operate in a world that values accountability and resilience.

This edition includes our regular look at global economic indicators, corporate expansion trends, and the latest developments in international trade and investment. We close with a focus on global franchising, one of the most consistently successful models for taking U.S. concepts abroad. The franchise section highlights new markets opening for brands and the evolving legal and operational frameworks shaping this dynamic sector.

This edition’s book review highlights: The Corporation in the Twenty-First Century: Why (Almost) Everything We Are Told About Business Is Wrong by John Kay (2025) challenges decades of assumptions about what corporations are, how they create value, and what their true purpose should be. Kay argues that most of the models we still teach and follow were built for an industrial economy that no longer exists. In that world, success was measured by control of physical assets, vertical integration, and economies of scale.

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive our biweekly newsletter by email every other Tuesday, click here https://insider.edwardsglobal.com

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business. We do not get involved with or report on politics!

PLEASE NOTE: Some of the information sources that we provide links to in our newsletter require a paid subscription to directly access them. Clicking on a link may not give the reader access to the content.

Edited and curated by: William (Bill) Edwards, CEO & Global Business Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA. Contact Bill with questions, comments and contributions. Bedwards@edwardsglobal.com, +1 949 375 1896

Link to our current and past newsletters: https://edwardsglobal.com/geowizard/

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

First, A Few Words of Wisdom From Others For These Times

“The most dangerous phrase in business is: ‘We’ve always done it this way.’”, Grace Hopper, Computer Scientist and U.S. Navy Rear Admiral

“The companies that survive are the ones that work out what they uniquely can give to the world.”, Simon Sinek, Author and Speaker

“Leadership today means connecting the dots between cultures, not just markets.”, Satya Nadella, CEO, Microsoft

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Highlights in issue #146:

Global trade has flourished even as U.S. tariffs rocked American trade

Eight Of Top 10 U.S. Imports From China In 2018 Down More Than 50% Now

Gen Alpha Purchasing Power Tops $28 Billion

Understanding Decision-making in Korean Business Culture

Brand Global News Section: Burger King®, German Doner Kebab® Pizza Hut UK and Wingsup®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

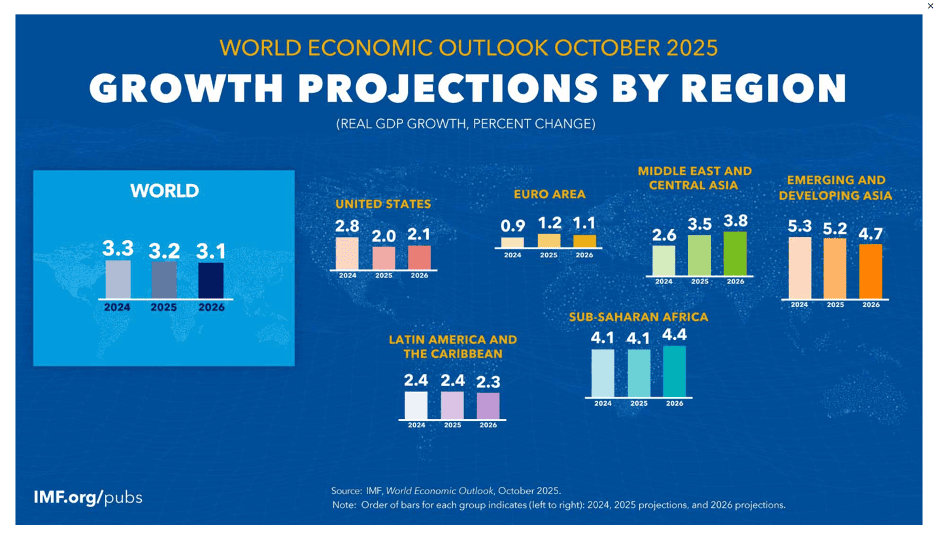

“Global Economy in Flux, Prospects Remain Dim – The global economy is adjusting to a landscape reshaped by new policy measures. Some extremes of higher tariffs were tempered, thanks to subsequent deals and resets. But the overall environment remains volatile, and temporary factors that supported activity in the first half of 2025—such as front-loading—are fading. As a result, global growth projections in the latest World Economic Outlook (WEO) are revised upward relative to the April 2025 WEO but continue to mark a downward revision relative to the pre-policy-shift forecasts. Global growth is projected to slow from 3.3 percent in 2024 to 3.2 percent in 2025 and 3.1 percent in 2026, with advanced economies growing around 1.5 percent and emerging market and developing economies just above 4 percent. Risks are tilted to the downside. Prolonged uncertainty, more protectionism, and labor supply shocks could reduce growth.”, The International Monetary Fund, October 2025

=============================================================================================

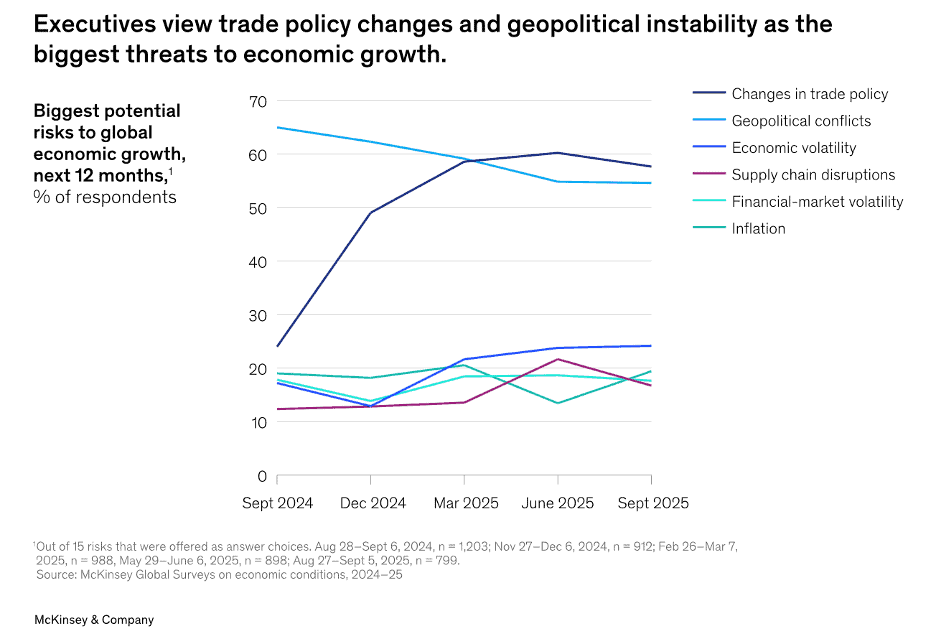

“Upgrading corporate affairs for a new geopolitical era – Geopolitical tensions and economic competition are raising the demands on corporate-affairs teams. Geopolitical turmoilis shifting the ground beneath business leaders’ feet. Executives are navigating waves of new tariffs, fallout from conflicts in Europe and the Middle East, escalating tensions in Asia, and an expanding web of policy measures through which governments seek to secure economic and strategic advantages. At a time when rules governing global trade and business change rapidly and perceived geopolitical affiliations can reverse a company’s fortunes, defining the corporate narrative and deftly managing relations with governments, regulators, and other geopolitical influencers are crucial to success.”, Geopolitical Futures, October 8, 2025

Editor’s Note: There is the emergence of a new ‘C’ level executive in several large corporations– the Geopolitical Risk Officer (GRO) who is responsible for identifying, analyzing, and mitigating risks to the company’s operations, supply chains, and investments arising from global political, economic, and security developments. A Geopolitical Risk Officer monitors and manages the impact of international political, economic, and security events on a company’s global strategy, operations, and reputation.

=================================================================================================

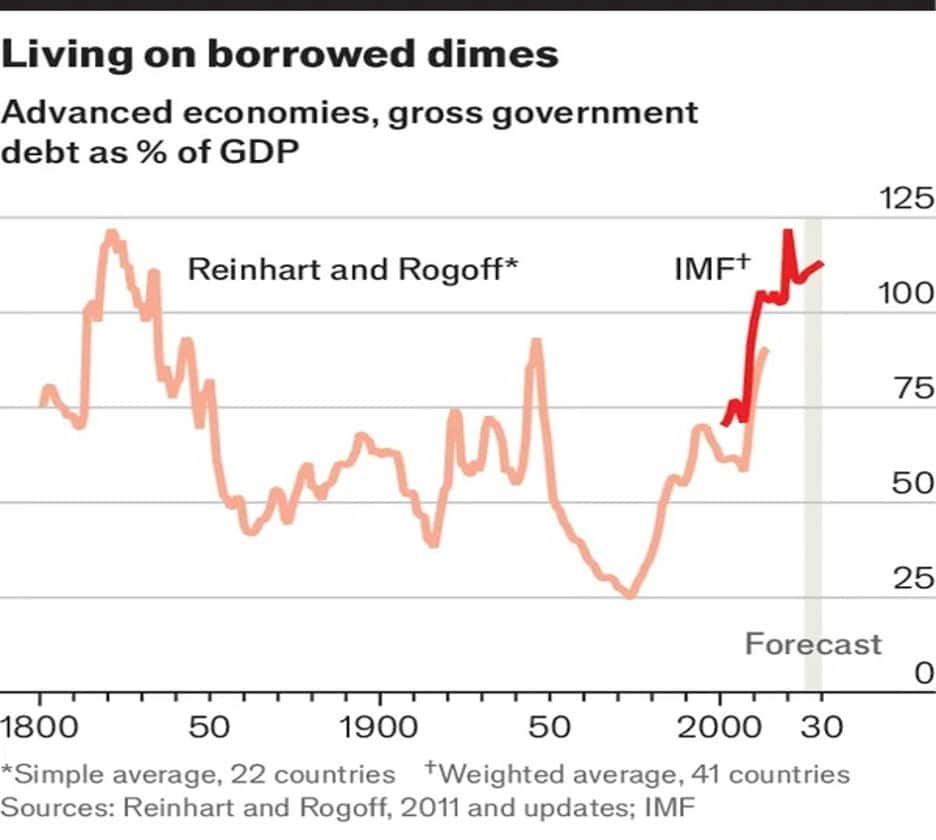

“Across the rich world, fiscal crises loom – Gross public debt as a share of gdp in advanced economies stands near 110%, close to an all-time high. A rise in interest rates since 2022—initiated by central bankers to control inflation that was caused in part by government spending sprees—has made debts far more burdensome. Rich countries as a whole now spend half as much again on interest as they do on national defence. The prospect investors must worry about is not just—or even mainly—that of default. There is another weapon that can hurt them over long horizons: inflation. Debts are typically fixed in nominal terms, meaning higher prices can erode their real value. The irony of the world’s fiscal mess is that economic conditions are benign. No major economy is in a recession. Public debts have fallen slightly in real terms since their pandemic peak (due to inflation). And though interest rates have risen, in many countries they remain below the rate of economic growth.”, The Economist, October 13, 2025

===============================================================================================

“The 20 happiest cities in the world in 2025, according to locals – We quizzed more than 18,000 urbanites on how joyful their city makes them feel – here’s what they had to say. Our happiness metric was based on the percentage of positive responses to five statements: My city makes me happy; I feel happier in my city than other places I’ve visited or lived; The people in my city seem happy; I find joy in the everyday experiences my city offers; The sense of happiness in my city has grown a lot recently. Here are the “Top 20” happiest cities in the world in 2025: 1. Abu Dhabi, UAE, 2. Medellín, Colombia, 3. Cape Town, South Africa, 4. Mexico City, Mexico, 5. Mumbai, India, 6. Beijing, China, 7. Shanghai, China. 8. Chicago, US, 9. Seville, Spain, 10. Melbourne, Australia, 11. Brighton, UK, 12. Porto, Portugal, 13. Sydney, Australia, 14. Chiang Mai, Thailand, 15. Marrakech, Morocco, 16. Dubai, UAE, 17. Hanoi, Vietnam, 18. Jakarta, Indonesia; 19. Valencia, Spain and 20. Glasgow, UK.”, Time Out, October 10, 2025

============================================================================================

“1 in 4 European workplaces make decisions with algorithms and AI that impact employee working life– As artificial intelligence (AI) and algorithmic management tools trickle into Europe’s workplaces, labour professionals are urging the European Union to introduce a new directive to safeguard workers’ rights. A joint report from the Commission and the International Labour Organisation (ILO) found that the French logistics sector uses AI-powered route planning tools to give drivers information like road traffic and delivery locations in real time, but this can lead to ‘extensive monitoring and surveillance of drivers’. Algorithmic management can decide an employee’s working conditions, such as the hours that people work, wages, shifts, and performance assessment.”, Euro News, October 27, 2025

=============================================================================================

“Gen Alpha Purchasing Power Tops $28 Billion – 66% of Gen Alpha parents say their child prefers shopping in-store with the top reasons being family time outside the home (47%) and the sense that shopping trips are fun (45%). 53% of Gen Alpha parents report giving some sort of allowance to their children with the average weekly allowance being $22 for personal spending and saving. Gen Alpha uses their allowance dollars to purchase snacks (59%), toys (55%), entertainment (34%), electronics (31%), and beverages (31%). Gen Alpha consumer behavior is also clear in their quick-service restaurant preferences. Gen Alpha parents say their kids like McDonald’s best overall (34%), especially among 1–5-year-olds (40%) and 6–10-year-olds (39%), thanks to kid-friendly menus and cultural staying power. Chick-fil-A ranks second at 17%, maintaining steady appeal across all groups. But by ages 11–14, choices diversify: McDonald’s slips to 25% while Starbucks (10%) and Taco Bell (9%) rise in popularity. Gen Alpha is the first truly digital-native generation, and social media is central to how they discover products. Among 11–14-year-olds, 48% learn about new products from influencers and internet personalities, a rate that now rivals in-store discovery.”, Franchising.com, October 22, 2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation, Taxes, Tariffs & Trade Issues

“Global trade has flourished even as U.S. tariffs rocked American trade – Waves of American tariffs may have rocked freight flows with the country’s closest partners, but worldwide trade continued largely unabated, according to a study from parcel and logistics firm DHL and New York University’s Stern School of Business. In fact, global trade grew faster in the first half of 2025 than in any half-year since 2010, excluding the pandemic rebound, the researchers said. One reason why trade can continue growing even as the U.S. raises tariffs is that only 13% of global goods imports went to the U.S. in 2024 and only 9% of exports came from the U.S. Another reason is that most countries have not followed the U.S. in implementing broad tariff increases, DHL said.”, Supply Chain Xchange, October 14, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel News

“6 Ways Travel Is About to Get More Expensive—And Why – Groaning at the cost of your latest rental, flight, or hotel stay? Get used to it, because global events are turning. These are the travel-related costs that are most likely to increase in the near future. According to the Global Business Travel Association (GBTA), hotel rates are expected to increase globally by 4% over the next few years. This is partly due to demand outstripping supply in certain places, especially popular business hubs…… In 2025, Hartsfield-Jackson Atlanta International Airport tripled its hourly parking rates, Denver International Airport increased usage fees that are tacked onto airfare so it can fund infrastructure improvements, and Richmond International Airport jacked up parking charges as a direct response to its own rising operational costs. Starting in 2027, airlines in 126 member states will be required offset growth in CO2 emissions. Some airlines, including Lufthansa, have already started raising the price you pay to offset these costs, adding what they’re referring to as ‘environmental cost surcharges’”., Frommers, October 14, 2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Book Review

The Corporation in the Twenty-First Century: Why (Almost) Everything We Are Told About Business Is Wrong by John Kay (2025) challenges decades of assumptions about what corporations are, how they create value, and what their true purpose should be. Kay argues that most of the models we still teach and follow were built for an industrial economy that no longer exists. In that world, success was measured by control of physical assets, vertical integration, and economies of scale.

Today’s leading companies, he explains, thrive not by owning machinery or real estate, but by orchestrating networks of people, partners, technology, and ideas. The modern corporation’s true strength lies in coordination — the ability to align talent, innovation, and purpose across a complex ecosystem.

He also dismantles the long-standing notion that the primary goal of business is to maximize shareholder value. According to Kay, this thinking has led to short-term decision-making, fragile supply chains, and declining trust. Instead, he calls for a renewed focus on corporate purpose — building organizations that create sustainable value for customers, employees, and societies over time.

In essence, Kay reframes the modern corporation as a living system — one that must continually learn, adapt, and evolve. It’s not just about financial engineering or scale, but about cultivating capabilities that competitors cannot easily copy. His message is especially relevant for global business leaders: those who succeed in the 21st century will be the ones who build resilient, people-centered organizations capable of thriving amid constant technological and geopolitical disruption.

Five Takeaways for Global Business Leaders

Prioritize capabilities over assets – Competitive advantage today comes from talent, brand, and partnerships, not factory ownership.

Redefine corporate purpose – Profit follows from delivering sustained value to customers and society, not from chasing shareholder returns.

Build adaptive networks – Global success depends on orchestrating people, suppliers, and knowledge across borders.

Think long-term – Resist short-term financial targets that erode innovation and resilience.

Lead with trust and purpose – Transparency, responsibility, and shared goals now define durable global enterprises

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Africa

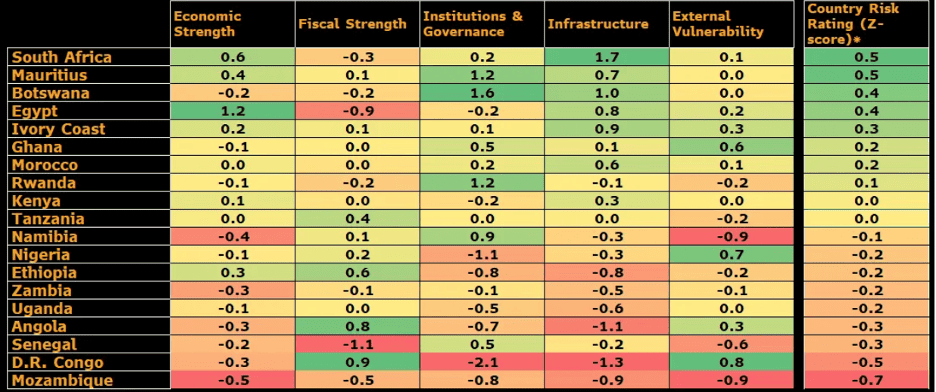

“Africa Attracts Billions as Tariffs Redraw Global Trade Map – As US tariffs redraw traditional trade routes, investors are plowing tens of billions of dollars into the continent’s farms, railways, renewable energy, and data hubs, betting that Africa will be the next big supply-chain link in a fractured world economy. With the African Continental Free Trade Area promising a $3.4 trillion common market by 2035, the region with the world’s youngest population is becoming a magnet for both capital and competition. But opportunity brings risk. The continent faces an infrastructure gap of as much as $108 billion a year, patchy governance and rising debt burdens.”, Bloomberg, October 23, 2025

===============================================================================================

Canada

“Why more Canadian small businesses are embracing AI to build for the future – According to a recent report from Statistics Canada, 12.2 per cent of businesses surveyed in the second quarter of 2025 reported using AI to produce goods or deliver services in the previous 12 months, an increase of 6.1 per cent from the same period in 2024. A separate study from the Business Development Bank of Canada (BDC) found ‘a staggering 97 per cent of SMEs (small- and medium-sized enterprises) using AI reported tangible benefits, including increased efficiency, reduced costs, higher sales, improved customer service, and better management of sales, production or inventory.’, The Globe and Mail, October 21, 2025

============================================================================================

China

“Eight Of Top 10 U.S. Imports From China In 2018 Down More Than 50% Now – The U.S. deficit with China is down 52.94% from 2018 to today, when comparing the latest year-to-date Census data, which is through July. The deficit has fallen, in that seven-month window, from $296.54 billion to $194.98 billion. Part of that is because overall imports from China have fallen 34.62% from the same seven-month period in 2018. U.S. exports to China are down 12.01%, which I discuss in this post. There are other signs. The U.S. deficit with China, more than five times as great as that with any other country in 2018, is little more than 12% larger than the U.S. deficit with Mexico today. While the U.S. trade deficit with China declined, the U.S. deficit with the world hit $809.29 billion, the first time ever above $800 billion through July. The U.S. deficit with the world today is 29.71% greater than it was in the summer of 2018.”, Forbes, October 21, 2025

=============================================================================================

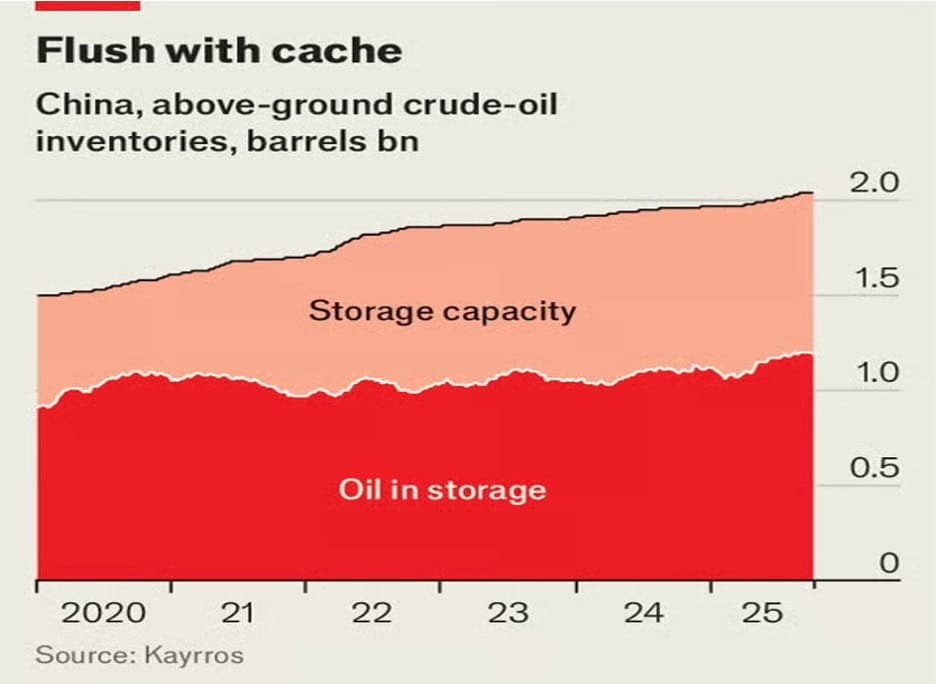

“China’s secret stockpiles have been a great success—so far – Since early 2024, when it became clear that President Donald Trump might return to the White House, officials have stockpiled fuel, food and metals to limit exposure to sanctions and tariffs. Those measures accelerated, and broadened, after Mr Trump slapped high duties on Chinese goods in the spring. China does have reason to fret about its energy supply. Despite booming electric-vehicle sales, it will continue to need 16m or so oil barrels a day (b/d) for years—three-quarters of which it must import. Its purchases of natural gas have tripled in the past ten years as urban heating and fertiliser plants demand more. And it imports half a billion tonnes a year of coal, which remains the fuel for 60% of its power. Although the country is one of the world’s mineral refining centres, it imports 85% of the iron it bakes into steel; is short of bauxite, the underlying ore for aluminium; and its smelters ship in 88% of their raw copper. It buys four-fifths of the 100m-120m tonnes of soyabeans it feeds to its 430m hogs and 70% of the edible oil it blends into processed food.”, The Economist, October 26, 2025

=============================================================================================

India

“Amazon says India’s e-commerce exports top $20 billion, despite US tariffs – U.S. tariffs pose short-term challenge; long-term outlook firm. Seller base hits 200,000 across 200 cities; small towns surge. Sets $80 bln export goal for 2030 as reforms boost e-commerce. Thousands of Indian artisans and small businesses were affected after the U.S. doubled tariffs on certain goods to 50% starting on August 27. The tariffs were a response to India’s purchases of Russian oil. Amazon’s Global Selling programme, unveiled in 2015, enables Indian small- and medium-sized enterprises to sell to customers in 18 global markets, including the U.S., Britain, Germany, Canada and the United Arab Emirates.”, Reuters, October 27, 2025

=============================================================================================

South Korea

“Understanding Decision-making in Korean Business Culture – In most Korean companies, leadership makes decisions on direction and major issues. Your role as part of the local or working team is to gather and prepare the necessary information. Once approved, you’ll report back to headquarters on implementation and progress. If you’re hoping to propose a new idea, service, or program, understand this: your local Korean management’s role is to collect your information and share it with the appropriate senior team members—often back in Korea. Your local opinion is valued, but the final approval? That always comes from Korea.”, Bridging Culture Worldwide, October 2025. Compliments of Don Southerton.

Editor’s Note: This is one of our author focus additions to the Geowizard newsletter. Don has more than 20 years of direct business experience in South Korea. His insights will help anyone considering doing business in this interesting but often challenging market.

============================================================================================

Spain

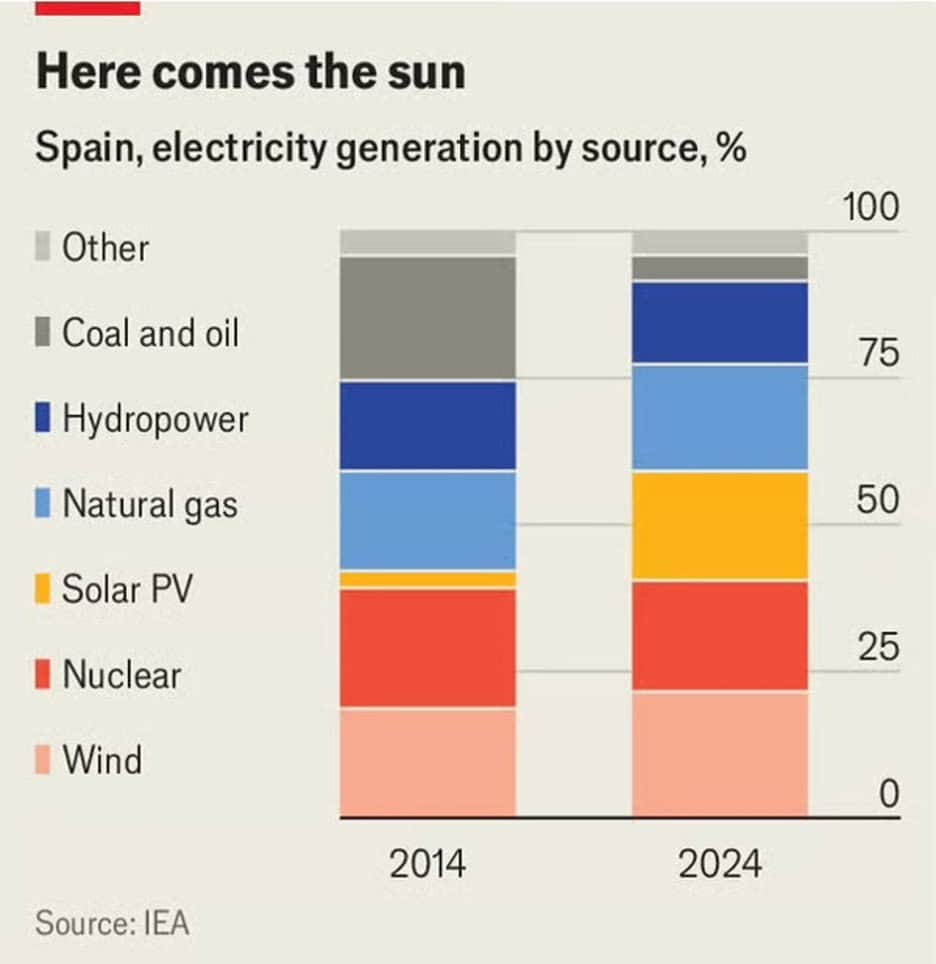

“The high costs of Spain’s renewables revolution – It is a country with almost no oil or gas of its own, which until recently was a disadvantage. But in a decade Spain has transformed its energy matrix. Wind and solar now account for more than 40% of the total electricity supply. In a land of abundant sunshine, the share of solar is set to rise further. Not only has Spain become a world leader in the energy transition but renewables have driven down the cost of generation. Industry experts say there are two main problems. First, electricity supply has grown much faster than demand……. The second problem is that the supply of solar power, which tends to be highest in the middle of the day when demand is lower, has not gone hand in hand with sufficient investment in storage and stabilisation technologies, such as batteries.”, The Economist, October 16, 2025

==========================================================================================

United Kingdom

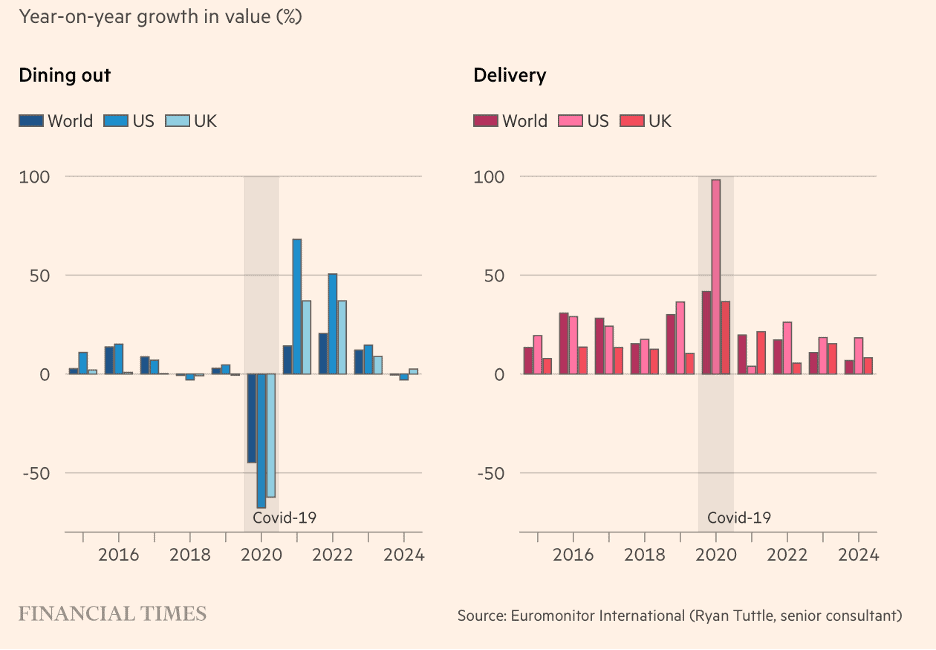

“The rise of the eat-at-home economy – Consumers are increasingly shunning the restaurant experience for the comfort and cost savings of their living rooms. After Covid’s disruption, dining out rose sharply — but that has fallen back as food delivery resumes its steady growth. The trend is fuelling a growing “eat at home” economy, where consumers are shunning the dining out experience for the comfort, convenience and cost savings of their living rooms. It represents a new kind of competition for restaurants, which are already facing off against the popular convenience of delivery services, as they grapple with rising food and labour inflation, particularly in the UK.

As restaurants have struggled, delivery providers have also flourished. Between 2023 and 2024, the value of the UK’s delivery market grew 8.2 per cent, far outstripping a 2.5 per cent rise for eat-in restaurants, according to Euromonitor. This shift was even more pronounced in the US, where the delivery market expanded 18 per cent last year, while the eat-in restaurant market actually contracted.”, The Financial Times, October 24, 2025

==============================================================================================

United States

“Why Employers Aren’t Hiring Anymore – The U.S. economy is adding far fewer jobs than it used to, raising the question of what factors are holding back hiring. An analysis by Goldman Sachs economists found President Donald Trump’s immigration restrictions were the biggest factor. Other reasons include economic uncertainty about about tariffs and layoffs of federal workers, as well as artificial intelligence. The biggest factor in the slowdown in recent months is Trump’s crackdown on immigration…….Trump’s cutbacks to the federal workforce have also slowed things down, reducing government hiring by 30,000. Additionally, Goldman noted that a reduction in spending on federal contracts is weighing on the labor market.”, Investopedia, October 23, 2025

==============================================================================================

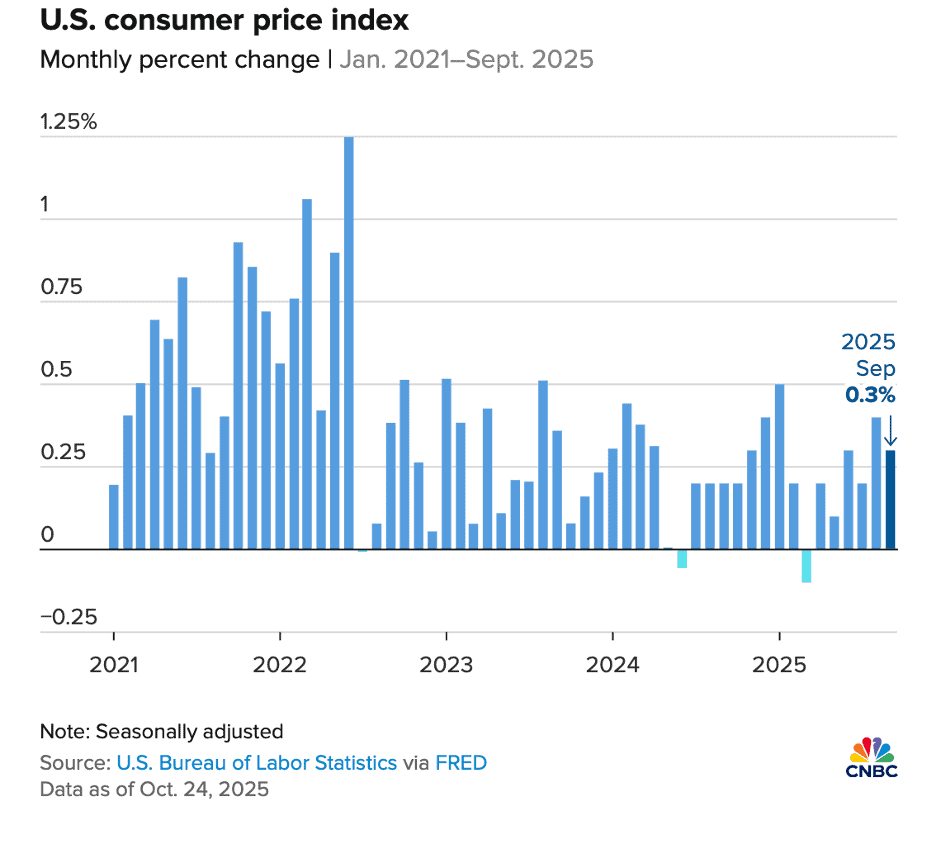

“Here’s the (U.S.) inflation breakdown for September 2025 – The consumer price index rose 3% on an annual basis in September 2025. Economists said the Trump administration’s tariff agenda could raise consumer prices more in the months ahead. Without any other economic data, the report provides a look at the state of the U.S. economy ahead of next week’s Federal Reserve meeting. “Core” commodities — which exclude volatile food and energy prices — also rose 3% in September from a year earlier. The CPI tracks how quickly prices rise or fall for a basket of consumer goods and services, from coffee and bananas to club memberships and concert tickets.”, CNBC, October 24, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The Accredited Franchise Supplier certification

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Brand & Franchise Sector News

“German Doner Kebab signs franchise agreement for India, 450 sites to open over next 15 years – GDK’s first India restaurant is set to open in early 2026. The launch follows a milestone year for GDK, having opened its 150th UK restaurant, in Leeds, this month and the imminent debut of its first Ireland location in Dublin. GDK has more than 170 restaurants across the UK, Ireland, Sweden, North America, and the Middle East. The brand has grown at pace through a franchise model, cementing its presence in UK high streets, travel hubs, and shopping centres, and is now accelerating its international footprint.”, Propel Info, October 27, 2025

=============================================================================================

“Pizza Hut UK acquires Pizza Hut’s dine-in operations, 74 restaurants closing with loss of more than 1,700 jobs – The business has now been acquired by Pizza Hut UK. A spokesperson said: “Today, Pizza Hut UK announces the acquisition of the Pizza Hut dine-in operations through a pre-packaged administration, after FTI was announced as administrators of DC London Pie, a franchisee of Pizza Hut dine-in restaurants. We are pleased to secure the continuation of 64 sites to safeguard our guest experience and protect the associated jobs. Approximately 1,277 team members will transfer to the new Yum! equity business under UK TUPE legislation, including above-restaurant leaders and support teams.”, Propel Info, October 20, 2025

==============================================================================================

“Who Owns Burger King? The Answer Isn’t As Straightforward As You’d Think. Outlets of most ubiquitous fast food brands look the same no matter where you are. This consistent appearance and experience you get makes every outlet feel like it’s a part of a monolithic whole — owned and managed by the same entity. So, whether you walk into a Burger King in the United States, Europe, or Japan, you probably think it’s owned by the same company. However, this isn’t the case. In fact, over 90% of Burger King’s 19,000-odd locations are actually owned by small companies and individuals, and not by the brand’s actual parent company, Restaurant Brands International Inc. (RBI). This difference in ownership is what makes Burger King a franchise and not a chain restaurant. As it turns out, RBI owns the Burger King brand as well as Popeyes, Tim Horton’s, and Firehouse Subs — which cover over 30,000 restaurants across more than a hundred countries.”, Chowhound, October 25, 2025

===============================================================================================

“Burger King Owner Is Said to Shortlist CPE and HSG for China Stake – Chinese private equity firms HSG and CPE are vying for a controlling stake in Burger King’s China business, according to people familiar with the situation. Burger King isn’t the only well-known Western brand adapting to changes in the China market, with others including Starbucks Corp. working to bring in investors for their businesses in the country, Bloomberg News has reported. RBI, which also owns the Tim Hortons, Popeyes and Firehouse Subs chains, bought out its Burger King China joint venture partner for about $151 million in February, and assumed roughly $178 million of outstanding debt, its quarterly report shows. The company said in the report it was trying to find a new controlling shareholder that aligned with its strategy of partnering with experienced local operators while maintaining a primarily franchised business.”, Bloomberg, October 27, 2025

==============================================================================================

“How Canadian Concept WingsUp! Plans to Stand Out in America’s Crowded Chicken Market – The legacy chain is targeting Texas, Georgia, and Florida, and should open some store within the next 12 months. WingsUp is jumping head first into its U.S. growth. It’s opening a corporate office in Dallas so that it can begin expansion in Texas, Florida, and Georgia—all states with strong sports fandom, a demographic that correlates strongly with eating chicken wings. On the company’s franchising website, it points out Jacksonville, Orlando, Tampa, and Miami as key markets in Florida, and El Paso, Dallas-Fort Worth, Austin, San Antonio, and Houston in Texas.”, QSR Magazine, October 24, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive our biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing business environment. And our GlobalTeam™ on the ground covering 25+ countries provide us with updates about what is actually happening in their specific countries. We do not get involved in or report on politics!

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

William “Bill” Edwards: CEO & Global Trade Advisor “Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global”. With five decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe, and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service global management consultant since 2001 helping 40+ franchisors expand into new countries. Bill knows how to turn the challenges in taking a brand global into opportunities.

For a complimentary 30-minute consultation on how to take your business into new countries successfully. For a complimentary call with Bill Edwards click on the QR code or contact Bill at bedwards@edwardsglobal.com and +1 949 375 1896

And download our latest chart ranking 40+ countries as places to do business, used by many companies for strategic planning, at this link:

Our latest GlobalVue™ 40 country ranking

Biweekly Global Business Newsletter Issue 145, Tuesday, October 14, 2025

“History is who we are and why we are the way we are.”

Welcome to the 145th Edition of the Global Business Update – The world is changing faster than our assumptions — but opportunity remains for those who adapt with clarity. As we enter the final quarter of 2025, global business is defined by contrasts—momentum in some markets and fragility in others. The World Trade Organization reports stronger-than-expected trade growth this year, driven by AI-related demand, even as tariffs and political headwinds reshape supply chains. Emerging markets are surging back, marking their biggest rally in 15 years, while developed markets face slower growth and rising caution.

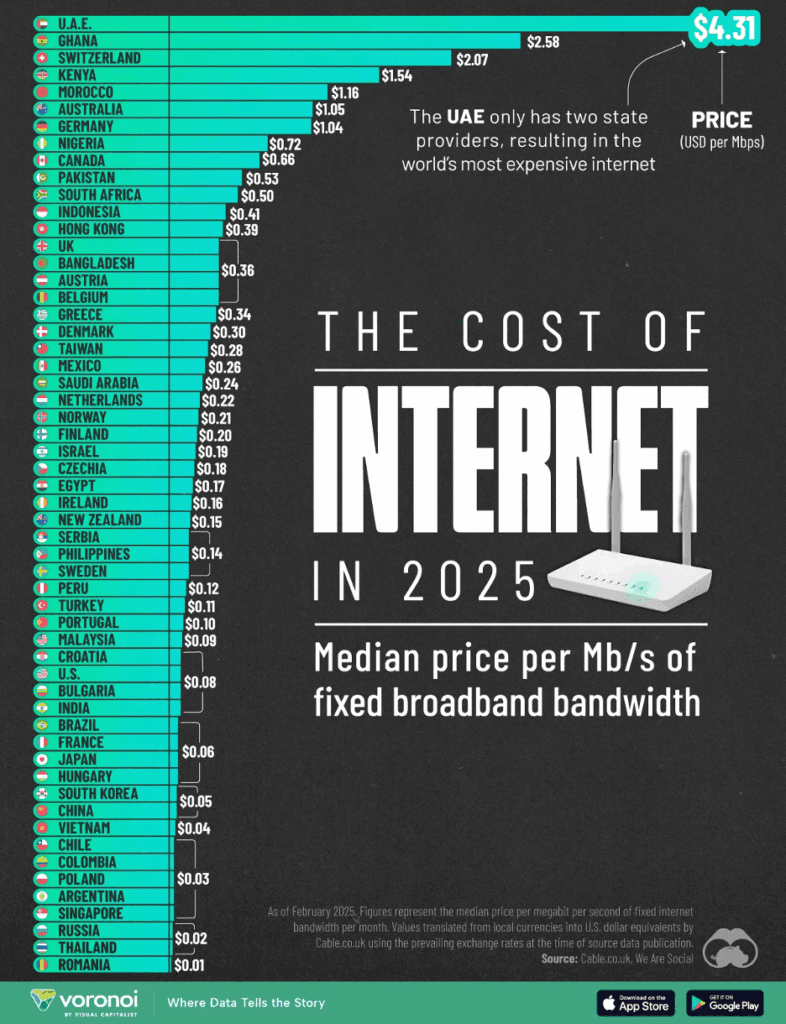

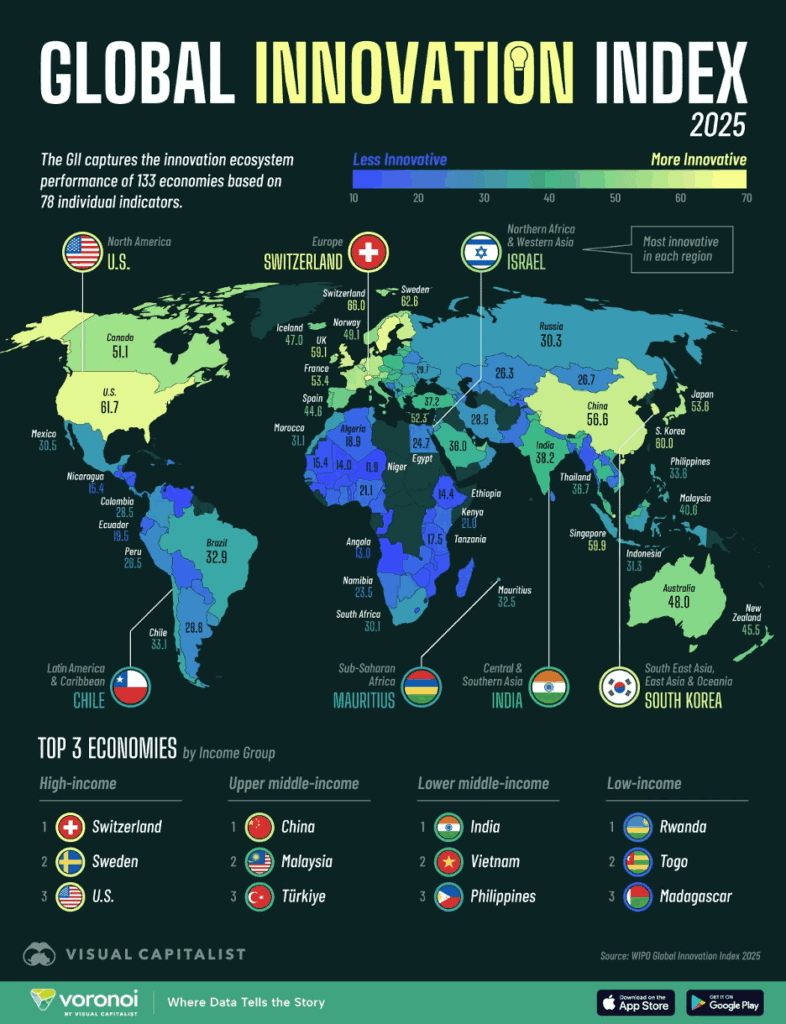

Innovation continues to redraw the global landscape: China enters the top ten of the Global Innovation Index for the first time, and South Korea reaches new heights in R&D-driven competitiveness. Yet these shifts occur amid widening gaps in access and cost—such as internet prices ranging from $0.01 per Mbps in Romania to over $4 in the UAE.

From Australia’s search for a post-China growth model to Brazil’s rise as an energy powerhouse and Vietnam’s new status as an emerging-market leader, nations are redefining their global roles. Meanwhile, Europe’s gradual digital border rollout, India’s billion-dollar IPO wave, and the Middle East’s growing appeal to Chinese travelers signal an era of recalibration rather than retreat.

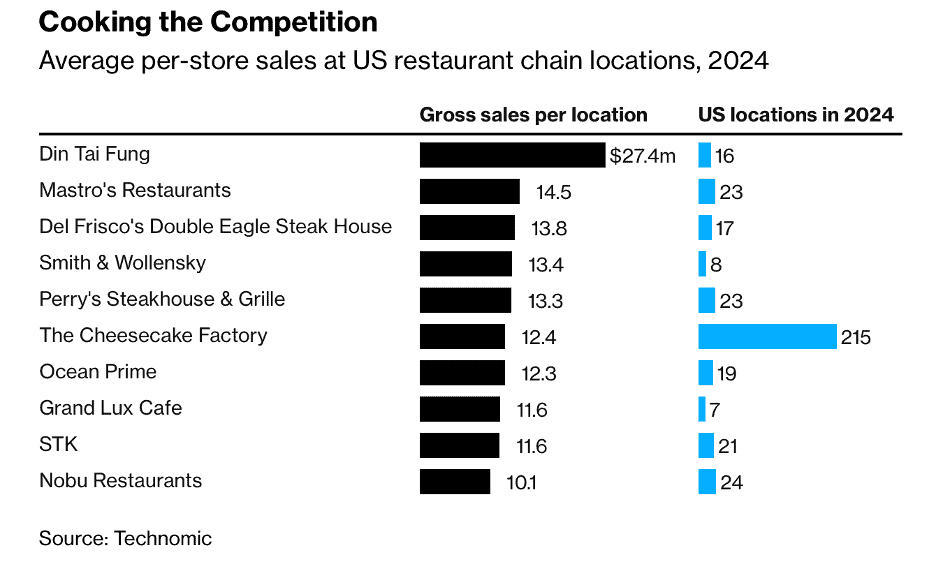

In franchising and consumer brands, staying power is the new currency of success. Dave’s Hot Chicken’s billion-dollar acquisition, Din Tai Fung’s global momentum, and Pizza 4P’s expansion to New York highlight how authentic concepts cross borders when backed by operational discipline and cultural adaptability.

This edition’s book review highlights: History Matters by David McCullough, one of America’s most respected historians, is best known for his Pulitzer Prize–winning biographies and accessible storytelling. In History Matters: Reflections on History and the American Experience, McCullough gathers speeches and essays delivered over several decades. While brief in form, the collection packs enduring insights on why history is not simply about the past—it is about how we live, lead, and make choices in the present.

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive our biweekly newsletter by email every other Tuesday, click here https://insider.edwardsglobal.com

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business. We do not get involved with or report on politics!

PLEASE NOTE: Some of the information sources that we provide links to in our newsletter require a paid subscription to directly access them. Clicking on a link may not give the reader access to the content.

Edited and curated by: William (Bill) Edwards, CEO & Global Business Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA. Contact Bill with questions, comments and contributions. Bedwards@edwardsglobal.com, +1 949 375 1896

Link to our current and past newsletters: https://edwardsglobal.com/geowizard/

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

First, A Few Words of Wisdom From Others For These Times

“History is who we are and why we are the way we are.”, David McCullough

“The future belongs to those who can see connections where others see walls.”, Madeleine Albright, Former U.S. Secretary of State

“In the business world, the rearview mirror is always clearer than the windshield.”, Warren Buffett

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Highlights in issue #145:

Internet Costs by Country in 2025

The World’s Most Innovative Countries in 2025

EU begins gradual rollout of digital border system

Which Chinese regions are being hit hardest by US tariffs?

Brand Global News Section: Dave’s Hot Chicken®, Din Tai Fung®, Dominos®, Pizza 4Ps®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

“Internet Costs by Country in 2025 – UAE has the world’s most expensive fixed internet at $4.31 per Mbps. Eastern Europe leads affordability, with Romania as low as $0.01 per Mbps. In a world more connected than ever, internet access has become essential infrastructure. But the price people pay for that access varies dramatically around the globe. This graphic compares the cost of fixed broadband internet per megabit per second (Mbps) across 60+ countries in 2025. At the top of the list, the United Arab Emirates stands out with an average cost of $4.31 per Mbps—nearly double that of the second-most expensive, Ghana ($2.58). These high prices are often due to limited competition, infrastructure challenges, and regulatory factors. Switzerland, Kenya, and Morocco also rank high on the list, all exceeding $1.00 per Mbps.”, Visual Capitalist & We Are Social, October 2, 2025

=============================================================================================

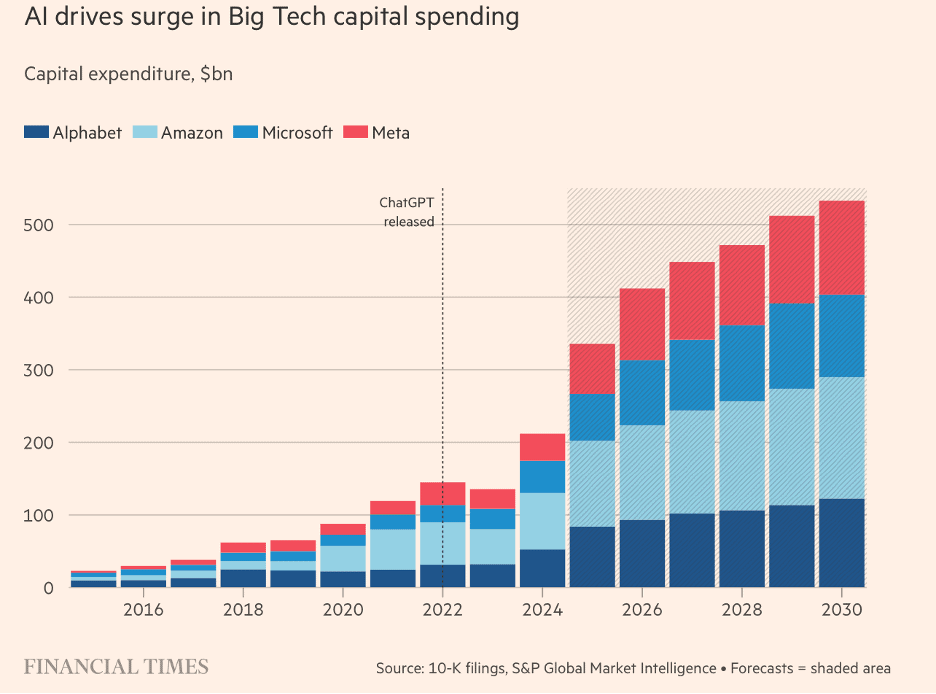

“The AI capex endgame is approaching – The rapid building of excess capacity both extends bubbles and ultimately bursts them. The dramatic rise in AI capital expenditure by so-called hyperscalers of the technology and the stock concentration in US equities are classic peak bubble signals. But history shows that a bust triggered by this over-investment may hold the key to the positive long-run potential of AI. AI stocks have exhibited bubble characteristics for a while. Share prices have skyrocketed, driving excessive index concentration. The good news is that the aggressive AI capex build-out almost guarantees AI’s future ubiquity. The bad news is that this will probably only come after a period of Schumpeterian creative destruction.”, The Financial Times, October 2, 2025

=================================================================================================

“The World’s Most Innovative Countries in 2025 – This graphic maps the main results of the Global Innovation Index (GII) 2025, which captures the innovation ecosystem performance of 139 economies. China has entered the GII’s top 10 for the first time, while South Korea climbed to fourth (its highest position to date). Innovation is often viewed as the backbone of economic competitiveness. In this graphic, we’ve visualized the results of the annual Global Innovation Index (GII), which ranks countries on their ability to foster research and entrepreneurship. In our map, lower scores are shown as darker shades of blue, transitioning to green and then yellow as score increases.”, Visual Capitalist & WIPO Global Innovation Index, October 2, 2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation, Taxes, Tariffs & Trade Issues

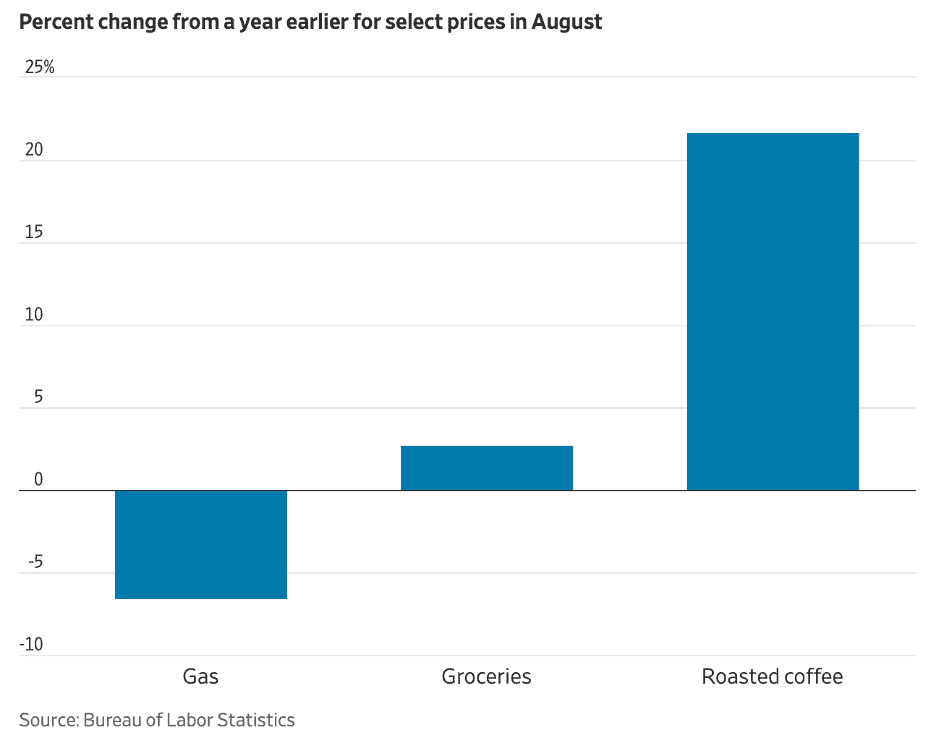

“Hell Hath No Fury Like a Coffee Drinker in 2025 – Prices are driving people to expletive-laden rants, but few are quitting caffeine; ‘I cannot function without that coffee.’ Roasted coffee prices at the grocery store are up 22% in the past year, more than any other item tracked by the government. The price increases are due to bad weather in the world’s coffee-growing regions and the Trump Administration’s tariffs.”, The Wall Street Journal, October 3, 2025

===============================================================================================

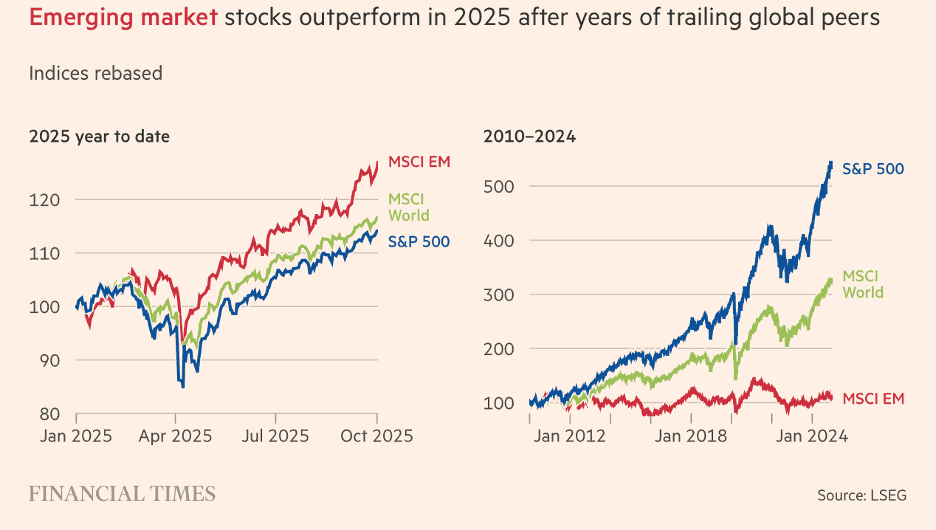

“Emerging markets roar back with biggest stock rally in 15 years – ‘Stars are finally aligning’ for EM assets, as weakening US dollar sends investors in search of yield. An MSCI benchmark index of emerging-market stocks has risen 28 per cent so far this year, its biggest gain over the same period since 2009, while a JPMorgan index of government bonds sold by developing countries in their own currencies is up 16 per cent, in a growing comeback from a “lost decade” in the shadow of US markets. The rally in emerging market stocks has far outpaced gains in advanced economies — an MSCI index of developed market stocks is up less than 17 per cent so far this year.”, The Financial Times, October 6, 2025

=============================================================================================

“Global Trade Growth to Be Stronger Than Expected, WTO Says – Cites artificial intelligence surge and a buildup in inventories in the U.S. that softens the impact of higher tariffs. Global trade is projected to increase by 2.4% in 2025, a significant rise from earlier forecasts due to AI-related purchases and U.S. inventory buildup. Trade in AI-related products, including semiconductors and servers, surged by 20% in the first half of 2025, accounting for 42% of total trade growth. The WTO lowered its 2026 trade growth forecast to 0.5% from 1.8%, anticipating the full impact of tariffs and the depletion of built-up inventories. Global trade in goods will increase more rapidly than previously expected this year as purchases of goods related to artificial intelligence surge and a buildup in inventories in the U.S. softens the impact of higher tariffs, the World Trade Organization said Tuesday.”, The Wall Street Journal, October 7, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel News

“Travel Forecast – The U.S. Travel Fall 2025 update projects slower growth for travel in 2025, but higher growth rates in 2026 and beyond. Spending is buoyed by continued growth in domestic leisure travel despite economic concerns. International inbound travel is projected to decrease in 2025 for the first time since 2020, but to resume growth in 2026 driven by U.S. hosted events such as the FIFA World Cup and America 250 celebrations. Travel to the United States is projected to reverse course and fall to just 85% of 2019 levels in 2025.”, U.S. Travel Association, October 1, 2025

===============================================================================================

“Middle East gains ground with Chinese tourists during Golden Week – The Middle East has traditionally not ranked among the top destinations for Chinese travelers, but that appears to be changing fast. During this year’s extended Golden Week holiday — which runs Oct. 1–8 — Chinese travel reservations to Doha surged 441% from a year earlier, while bookings to Abu Dhabi rose 229%, according to Trip.com. Meanwhile, Dubai saw a 27% increase, placing it among the top 10 destinations outside Asia, according to travel data analytics firm ForwardKeys, which counted international departures from China between Sept. 27 and Oct. 12.”, CNBC, October 11, 2025

===============================================================================================

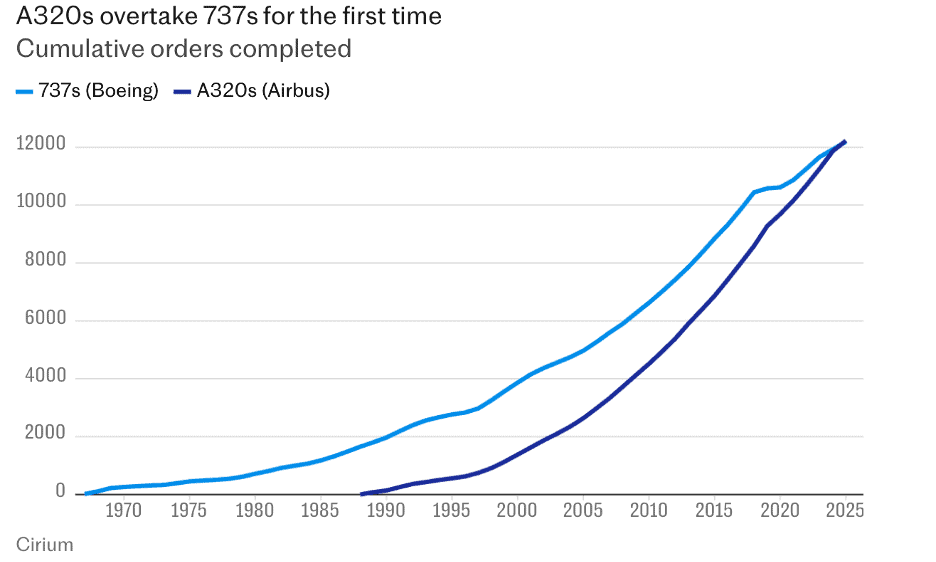

“Boeing 737 loses status as world’s most popular jet – First introduced in 1967, Boeing’s 737 was developed as an industry workhorse to run on high-frequency routes between cities within the US and Europe. A 737 takes off or lands every 1.5 seconds and the global fleet has carried more than 31 billion passengers – or four flights for everyone on the planet. Airbus, based in Toulouse, France, introduced the A320 in 1988 – giving Boeing’s 737 a 19-year head start on orders. However, the arrival of the re-engined A320neo model in 2020 saw Airbus gain an advantage and it has been steadily gaining ground since.”, The London Telegraph, October 7, 2025

Editor’s Note: During my first career in the international oil & gas sector, I flew on a 737 in the Persian Gulf at 130 degrees F and 100% humidity and on the North Slope of Alaska in -77 degrees F and 0% humidity. This airplane has had the widest operating range ever.

================================================================================================

“EU begins gradual rollout of digital border system – EU Entry/Exit System to be rolled out over six months. Passport stamping to be replaced by digital records. EU seeks tighter border controls amid immigration pressures. European Union member countries began rolling out a new entry and exit system on Sunday at the bloc’s external borders, electronically registering non-EU nationals’ data. The Entry/Exit System (EES), an automated system that requires travellers to register at the border by scanning their passport and having their fingerprints and photograph taken, will be introduced over six months. The move is aimed at detecting overstayers, tackling identity fraud and preventing illegal migration amid political pressure in some EU countries to take a tougher stance.”, Reuters, October 11, 2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Book Review

History Matters by David McCullough, one of America’s most respected historians, is best known for his Pulitzer Prize–winning biographies and accessible storytelling. In History Matters: Reflections on History and the American Experience, McCullough gathers speeches and essays delivered over several decades. While brief in form, the collection packs enduring insights on why history is not simply about the past—it is about how we live, lead, and make choices in the present.

McCullough insists that history is more than facts and dates. It is a narrative of people—leaders, innovators, citizens—facing uncertainty, overcoming obstacles, and often reshaping the world in ways they themselves could not fully see. That perspective resonates deeply for business leaders navigating today’s volatile global environment. The stories McCullough shares remind us that resilience, values, and the willingness to adapt are the threads connecting successful endeavors across time.

Another recurring theme is humility. McCullough urges readers not to view history as inevitable but as contingent—a series of decisions made by fallible human beings. For executives and boards, this is a powerful reminder: success is not guaranteed, and the decisions you make today will become tomorrow’s history. Just as past leaders faced wars, depressions, or technological disruption, modern executives face geopolitical risks, regulatory uncertainty, and fast-moving innovation. Learning from history is not optional; it is essential preparation.

McCullough also highlights the role of storytelling. Nations, organizations, and leaders who tell compelling stories about their mission inspire trust, attract talent, and build resilience. For global franchisors and executives, this insight underscores the importance of shaping a brand narrative that both honors its roots and adapts to new markets.

5 Takeaways for Global Business

Context matters – Decisions without historical perspective risk repeating past mistakes.

Resilience is timeless – Every era has crises; thriving requires persistence and adaptability.

Leadership is human – Imperfection is universal; great leaders learn and adjust.

Culture is strategic – Shared values sustain both nations and companies during uncertainty.

The past inspires the future – Stories of innovation and courage motivate bold action today

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Australia

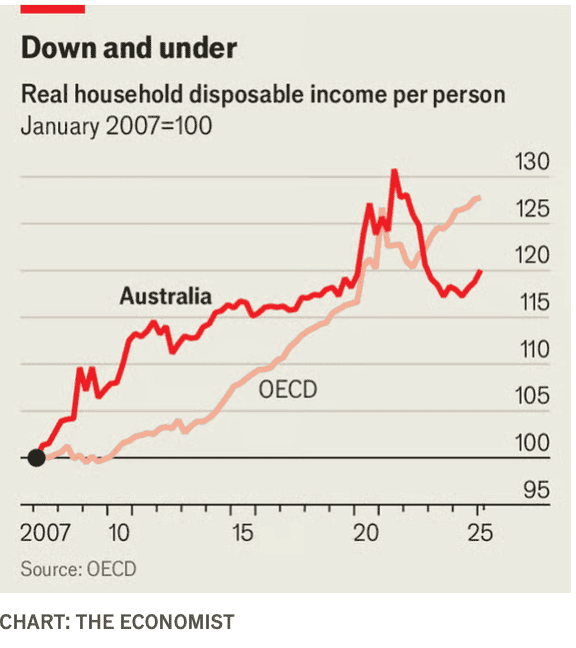

“Australia’s post-China hangover – The country grew rich on Chinese demand. Now it must find a new model for growth. or years Australia benefited from a booming Chinese economy. Ships full of iron ore and coal streamed out of the country. They not only earned Australia foreign exchange but also held up wages, swelled tax revenues and brought a run of budget surpluses. Yet now those good times are over. China’s economy is slowing; commodity prices are falling. The numbers are bleak. Productivity growth slumped between 2019 and 2024: Australia now ranks second-last, ahead only of Mexico, according to the oecd, a club mostly of rich countries.”, The Economist, October 2, 2025

Brazil

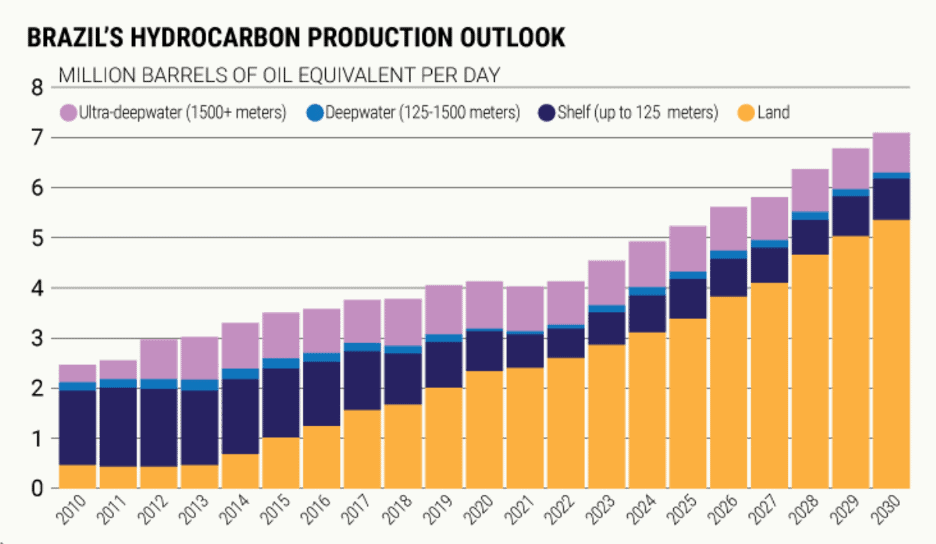

“New Highs for Brazil’s Oil Production – Offshore oil discoveries bode well for its plans to become a top producer. According to data from Brazil’s hydrocarbon regulator, Brazil extracted an average of 4.9 million barrels of oil equivalent per day in June. This is the largest volume of hydrocarbons that Brazil, Latin America’s top oil producer, has ever pumped. Crude oil output also reached a new record of 3.8 million bpd. Oil discoveries in ultra-deep waters off Brazil’s coast bode well for its plans to become a top-five global oil producer. Brazil also expects to attract more than $120 billion in investment by 2029, primarily in its pre-salt oil fields, where the average breakeven cost is below $40 per barrel.”, Geopolitical Futures, October 3, 2025

================================================================================================

Canada

“Canada’s economy added 60,000 jobs in September, rebounding from two months of losses – The Canadian labour market snapped out of a funk in September, partially unwinding a spate of job losses over the summer. Employment prospects have been dinged by the U.S.-driven trade war, resulting in job losses in certain export industries and a cautious approach to hiring from employers.”, The Globe and Mail, October 10, 2025

============================================================================================

China

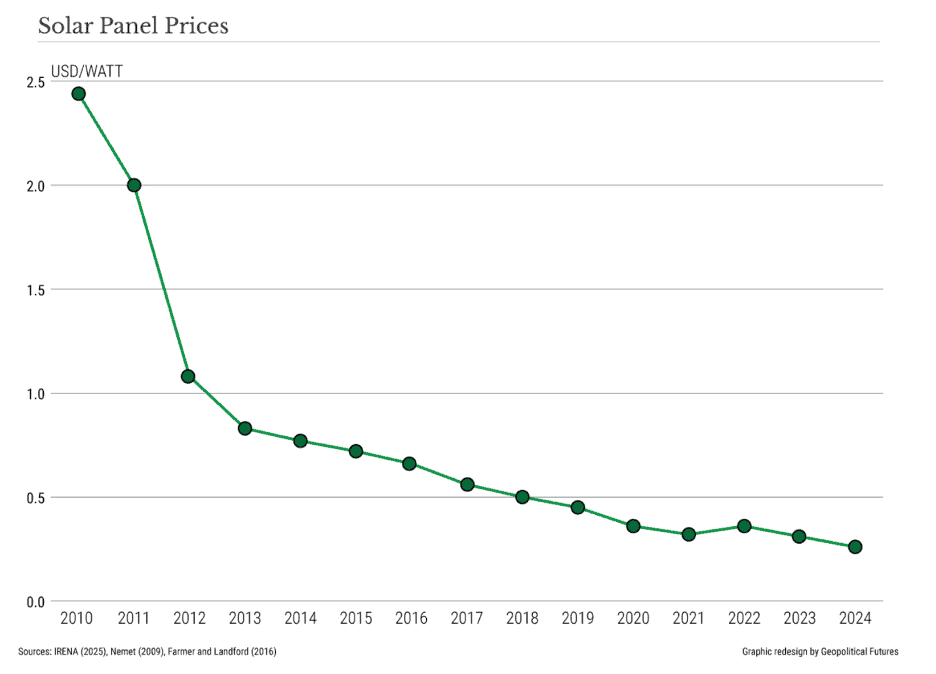

“China’s Green Push for the Global South – Domestic overproduction of green technologies means new markets need to be found. China’s focus on renewable energy is not driven by ideology but by economic interest and strategic competition. China has massively expanded its output of solar panels, batteries and wind turbines. Despite rapid domestic uptake, production outstrips demand at home, forcing Beijing to seek out new markets for export. By flooding global markets with cheap green hardware and pairing exports with financing, Beijing is turning the energy transition into a strategic export industry.”, Geopolitical Futures, October 10, 2025

=============================================================================================

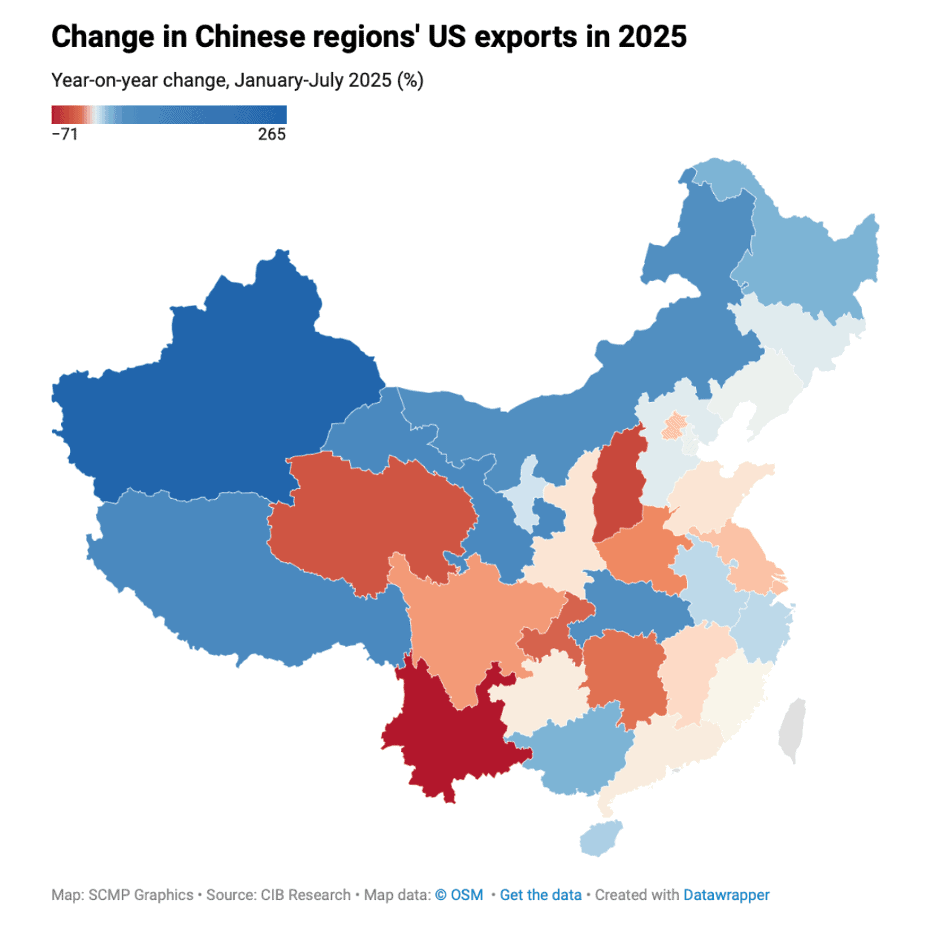

“Which Chinese regions are being hit hardest by US tariffs? Some Chinese provinces have recorded sharp drops in US exports amid the trade war. Others have seen shipments soar as much as 265%. As the trade war between the world’s two largest economies drags on, the impact is already showing: China’s exports to the United States were down 15.5 per cent year on year in the first eight months of 2025. But US tariffs are not affecting China equally. The country is made up of more than 30 provincial-level regions, and there is a wide divergence between these areas both in terms of their exposure to the US market and the effect of the trade war. China’s export hubs on the country’s eastern coastline dominate trade with the United States. Six coastal regions – Guangdong, Zhejiang, Jiangsu, Shanghai, Shandong and Fujian – together accounted for nearly 80 per cent of China’s exports to the US in value terms during the first seven months of 2025, according to CIB Research.”, South China Morning Post, September 19, 2025

=============================================================================================

European Union

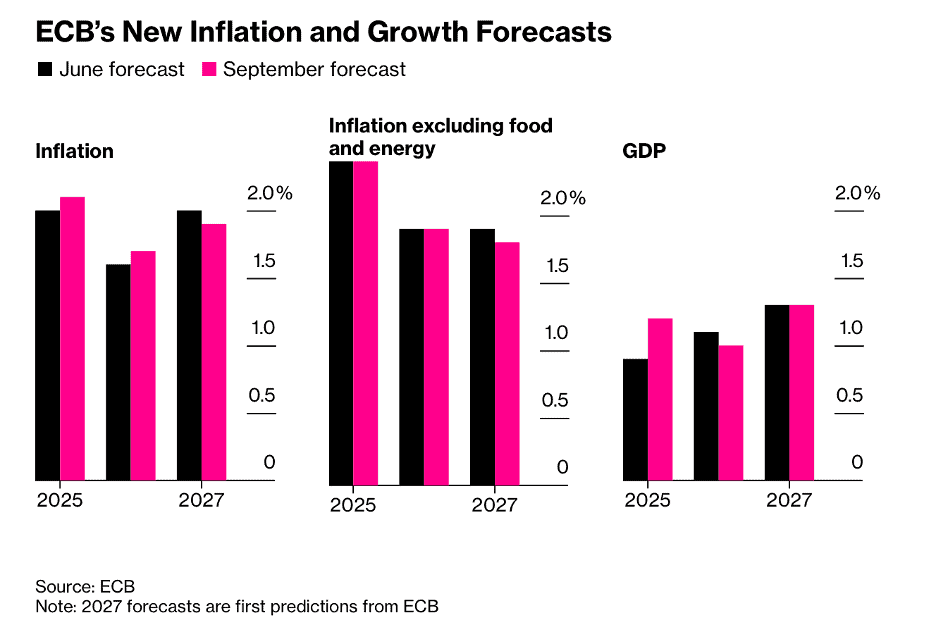

“Lagarde Sees ECB on Target With Growth Headwinds Fading Soon – Christine Lagarde said inflation remains close to the European Central Bank’s 2% target and expects the economy to pick up in 2026. Lagarde stated that sluggish export performance is expected to hold growth back for the remainder of the year, but the effect of these headwinds should fade next year. The ECB president suggested that the euro can become a global anchor of trust and raised the prospect of common EU debt, such as joint financing of public goods like defense. Addressing told European Union lawmakers in Strasbourg, she said that ‘sluggish export performance, driven by higher tariffs, a stronger euro and increased global competition, is expected to hold growth back for the remainder of the year.’”, Bloomberg, October 6, 2025

=============================================================================================

India

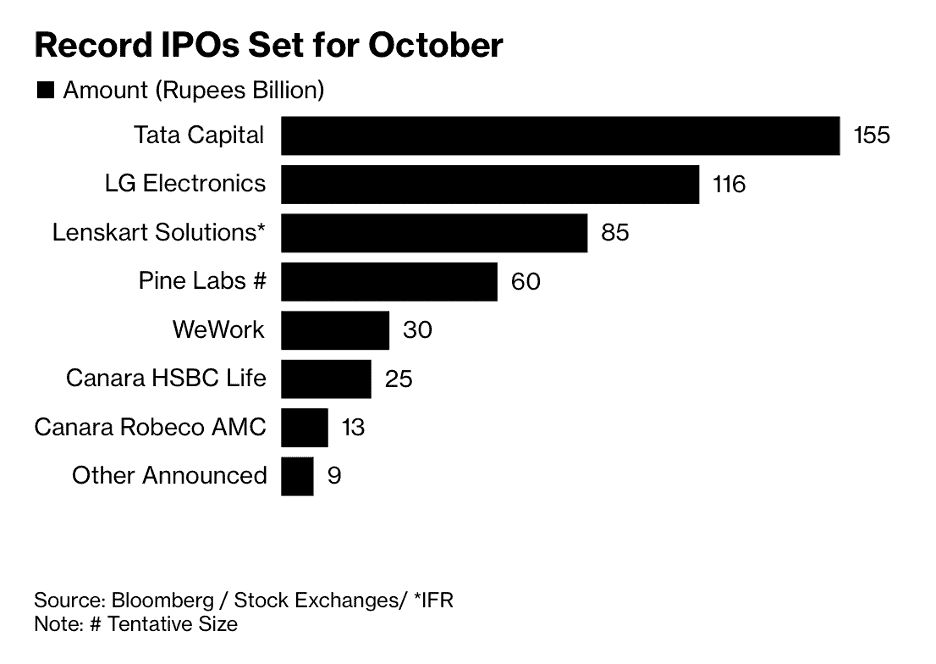

“Two Billion-Dollar Debuts Test Strength of Hot India IPO Market – Tata Capital Ltd. and LG Electronics India Ltd. will begin trading in Mumbai after concluding two of the nation’s biggest initial public offerings this year. The two listings will test the strength of India’s equity capital market and underscore the country’s growing status as a global fundraising hub. The success of these offerings could set the tone for hundreds of firms waiting to go public in India and fuel optimism that proceeds from new Indian listings in 2025 could exceed last year’s record haul. The two listings underscore India’s growing status as a global fundraising hub, powered by deep domestic liquidity and an expanding retail investor base.”, Bloomberg, October 11, 2025

=============================================================================================

United States

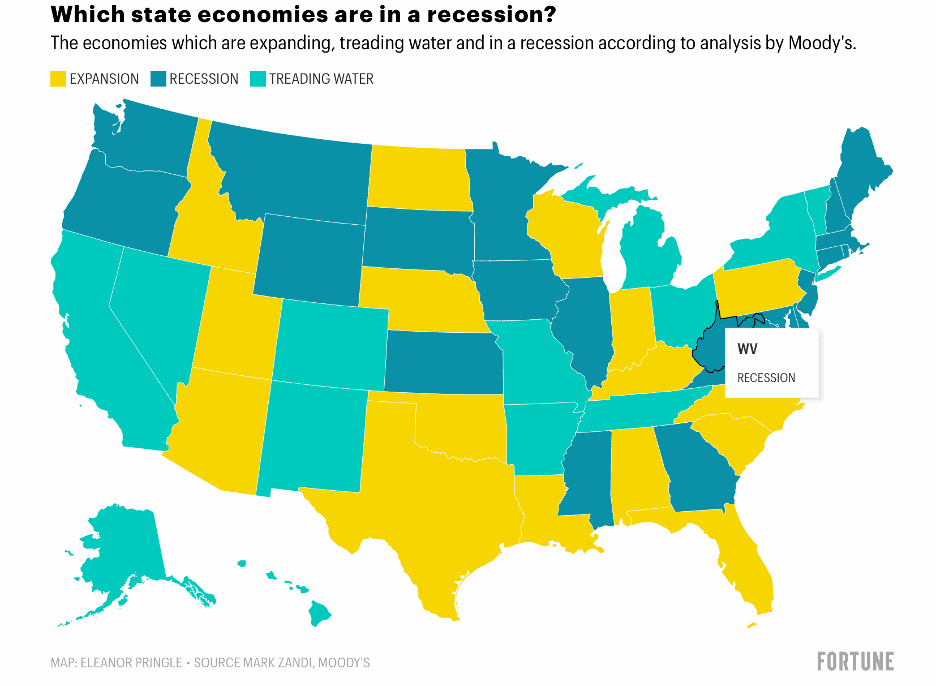

“Roughly half of U.S. states are effectively in a recession and ‘hanging on by their fingertips’ – Despite strong national figures—3.8% GDP growth and 4.3% unemployment—large parts of the U.S. are effectively in recession, according to Moody’s Analytics. Chief economist Mark Zandi exclusively told Fortune that 22 states are contracting and many lower- and middle-income households are “hanging on by their fingertips,” struggling with debt and slowing wage growth despite steady employment. Private data during the federal shutdown shows weakening consumer confidence, particularly among those earning under $35,000.”, Fortune, October 9, 2025

==============================================================================================

Vietnam

“Vietnam Wins Emerging-Market Status From FTSE, Drawing Investor Optimism – The upgrade from frontier status puts Vietnam alongside peers such as China, Indonesia and India. Index provider FTSE Russell reclassified the Southeast Asian nation as a secondary emerging market, citing reforms that have brought its capital markets more in line with international standards. “The upgrade affirms that Vietnam has reached a key milestone in its development,’ Julius Baer equity research analyst Jen-Ai Chua said in a note. ‘This should drive more reforms.” DBS senior economist Chua Han Teng expects the change to help attract stronger foreign inflows.”, The Wall Street Journal, October 8, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The Accredited Franchise Supplier certification

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Brand & Franchise Sector News

“Establishing Staying Power: Five Steps To Consider When Expanding Internationally – Expanding into international markets can be one of the most rewarding and strategic moves a franchise brand makes, but success isn’t measured at the ribbon-cutting. It’s measured in staying power. Sustained success abroad requires more than a strong launch. It demands deep local insight (primarily guided by your franchisee), long-term thinking (from both franchisor and franchisee), and the operational discipline to scale with consistency (franchisor to instill standards, then monitoring and supporting franchisee).”, Franchising.com, October 10, 2025. Article by Benjamin Simon is the regional vice president of international at Mathnasium.

==============================================================================================

“Vietnam’s Pizza 4P’s to launch in New York City – Vietnamese restaurant chain Pizza 4P’s is set to make its US debut with a flagship location in Brooklyn, New York, marking a significant milestone in the company’s ongoing international expansion. Known for its farm-to-table philosophy and house-made cheese, the fast-growing restaurant group will take a distinctive blend of Japanese Omotenashi hospitality and artisanal pizza to one of the world’s most competitive dining markets. The Brooklyn opening will be Pizza 4P’s fifth international location, joining its presence in Japan, Cambodia, Indonesia, and India.”, Inside Retail Asia, October 2, 2025. Compliments of Jim Mayfield.

=============================================================================================

“How Din Tai Fung Became America’s Top-Earning Restaurant Chain – The dumpling restaurant was started in Taiwan half a century ago. Now there are 17 always-packed locations in the US, including one in Disneyland. Din Tai Fung, a staple of international and California dining that arrived on America’s East Coast just over a year ago, generates an annual average of $27.4 million per US location, according to industry researcher Technomic—almost triple what high-end restaurant group Nobu pulls in. Headquartered in Taipei, Din Tai Fung is undeniably a global brand, with more than 165 locations worldwide and a cult following on multiple continents. In 2024 the chain opened restaurants in Singapore, Dubai, Phuket in Thailand, Manila, and one at Disneyland in Anaheim, California, in addition to an East Coast flagship in Manhattan. This year it added more than a dozen, including North American locations in Vancouver and Santa Monica, California.”, Bloomberg, October 6, 2025

===============================================================================================

“Meet the finance duo behind Dave’s Hot Chicken’s $1 billion deal as Gen Z flocks to the brand – Fast-casual restaurant Dave’s Hot Chicken began as a $900 pop-up in a Los Angeles parking lot in 2017. Eight years later, the brand has expanded to over 345 stores worldwide—a remarkable rise from seven locations in early 2020. Known for its Nashville-style hot chicken, Dave’s attracted Atlanta-based private equity firm Roark Capital, which specializes in franchised businesses and acquired Subway in 2023. Roark owns two major restaurant holding companies: Inspire Brands (Dunkin’, Buffalo Wild Wings, Sonic) and GoTo Foods (Auntie Anne’s, Carvel, Cinnabon). Dave’s Hot Chicken was acquired by Roark this past summer for $1 billion and expects to reach 400 stores this year.”, Fortune, October 6, 2025

===============================================================================================

“Dunkin’ Sells $900 Million of Bonds Backed By Franchise Fees – Dunkin’ Brands Group Inc. sold $900 million of bonds backed by the fees it gets from franchising its restaurants. The company will use the proceeds from the sale to repay the Class A-2-II portion of a similar bond it sold in 2019 and the outstanding amount of Class A-1 of a variable funding note in 2023. There have been 10 whole-business securitization sales this year, totaling about $7.4 billion, according to data compiled by Bloomberg.”, Bloomberg, October 9, 2025

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive our biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing business environment. And our GlobalTeam™ on the ground covering 25+ countries provide us with updates about what is actually happening in their specific countries. We do not get involved in or report on politics!

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

William “Bill” Edwards: CEO & Global Trade Advisor “Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global”. With five decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe, and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service global management consultant since 2001 helping 40+ franchisors expand into new countries. Bill knows how to turn the challenges in taking a brand global into opportunities.

For a complimentary 30-minute consultation on how to take your business into new countries successfully. For a complimentary call with Bill Edwards click on the QR code or contact Bill at bedwards@edwardsglobal.com and +1 949 375 1896

And download our latest chart ranking 40+ countries as places to do business, used by many companies for strategic planning, at this link:

Our latest GlobalVue™ 40 country ranking